UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT UNDER SECTION 13 or 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

Commission file number 001-38661

Elanco Animal Health Incorporated

(Exact name of Registrant as specified in its charter)

| INDIANA | 82-5497352 | |||||||

| (State or other jurisdiction of | (I.R.S. Employer | |||||||

| incorporation or organization) | Identification No.) | |||||||

2500 INNOVATION WAY, GREENFIELD, INDIANA 46140

(Address of principal executive offices)

Registrant’s telephone number, including area code (877) 352-6261

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, no par value | ELAN | New York Stock Exchange | ||||||||||||

| 5.00% Tangible Equity Units | ELAT | New York Stock Exchange | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ý No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ý No o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of a “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ý | Accelerated filer o | |||||||||||||||||||

Non-accelerated filer o | Smaller reporting company o | |||||||||||||||||||

Emerging growth company o | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

Aggregate market value of the common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of June 30, 2019, the last business day of the Registrant’s most recently completed second fiscal quarter, was approximately $12.4 billion. The registrant has no non-voting common stock.

The number of shares of common stock outstanding as of February 25, 2020 were 398,532,256

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy materials for its 2020 Annual Meeting of shareholders are incorporated by reference into Part III hereof.

Elanco Animal Health Incorporated

Form 10-K

For the Year Ended December 31, 2019

Table of Contents

Part I | ||||||||||||||

Item 1. | Business | |||||||||||||

Item 1A. | Risk Factors | |||||||||||||

Item 1B. | Unresolved Staff Comments | |||||||||||||

Item 2. | Properties | |||||||||||||

Item 3. | Legal Proceedings | |||||||||||||

Item 4. | Mine Safety Disclosures | |||||||||||||

Part II | ||||||||||||||

Item 5. | Market for the Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |||||||||||||

Item 6. | Selected Financial Data | |||||||||||||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |||||||||||||

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||||||||||

Item 8. | Financial Statements and Supplementary Data | |||||||||||||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||||||||||

Item 9A. | Controls and Procedures | |||||||||||||

Item 9B. | Other Information | |||||||||||||

Part III | ||||||||||||||

Item 10. | Directors, Executive Officers, and Corporate Governance | |||||||||||||

Item 11. | Executive Compensation | |||||||||||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||||||||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||||||||

Item 14. | Principal Accountant Fees and Services | |||||||||||||

| Part IV | ||||||||||||||

Item 15. | Exhibits and Financial Statement Schedules | |||||||||||||

Item 16. | Form 10-K Summary | |||||||||||||

3

Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of the federal securities laws. This annual report contains forward-looking statements, including, without limitation, statements concerning our acquisition of the animal health business of Bayer Aktiengesellschaft (Bayer) and our estimated "stand up" costs as a result of our separation from Eli Lilly & Co. (Lilly), our estimated interest expense, our industry and our operations, performance and financial condition, including in particular, statements relating to our business, growth strategies, product development efforts and future expenses.

Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, our actual results may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national, or global political, economic, business, competitive, market, and regulatory conditions, including but not limited to the following:

•heightened competition, including from innovation or generics;

•the impact of disruptive innovations and advances in veterinary medical practices, animal health technologies and alternatives to animal-derived protein;

•changes in regulatory restrictions on the use of antibiotics in food animals;

•our ability to implement our business strategies or achieve targeted cost efficiencies and gross margin improvements;

•consolidation of our customers and distributors;

•an outbreak of infectious disease carried by food animals;

•the success of our research and development (R&D) and licensing efforts;

•our ability to complete acquisitions and successfully integrate the businesses we acquire, including the animal health business of Bayer;

•misuse, off-label or counterfeiting use of our products;

•unanticipated safety, quality or efficacy concerns associated with our products;

•the impact of weather conditions and the availability of natural resources;

•disruption in our supply chain due to manufacturing issues experienced by our contract manufacturers;

•the impact of increased or decreased sales to our channel distributors resulting in higher or lower inventory levels held by them in advance of or trailing actual customer demand, which could lead to variations in quarterly revenue results;

•risks related to our presence in emerging markets;

•changes in United States (U.S.) foreign trade policy, imposition of tariffs or trade disputes;

•the impact of global macroeconomic conditions; and

•the effect on our business resulting from our separation from Lilly, including the various costs associated with transition to a standalone entity, including the ability to stand up our enterprise resource planning (ERP) system and other information technology systems.

See "Risk Factors" in Part I, Item 1A of this Annual Report on Form 10-K for a further description of these and other factors. Although we have attempted to identify important risk factors, there may be other risk factors not presently known to us or that we presently believe are not material that could cause actual results and developments to differ materially from those made in or suggested by the forward-looking statements contained in this annual report. If any of these risks materialize, or if any of the above assumptions underlying forward-looking statements prove incorrect, actual results and developments may differ materially from those made in or suggested by the forward-looking statements contained in this annual report. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this annual report. Any forward-looking statement made by us in this annual report speaks only as of the date hereof. Factors or events that could cause our actual results to differ

4

may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update or to revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should be viewed as historical data.

Part I

Item 1. Business

Overview

Founded in 1954 as part of Lilly, Elanco Animal Health Incorporated (Elanco Parent) and its subsidiaries (collectively, Elanco, the Company, we, us, or our) is a premier animal health company that innovates, develops, manufactures and markets products for companion and food animals. Headquartered in Greenfield, Indiana, we are the fourth largest animal health company in the world, with revenue of $3.1 billion for the year ended December 31, 2019. Globally, we are #1 in medicinal feed additives, #2 in poultry, and #3 in other pharmaceuticals, which are mainly companion animal therapeutics, measured by 2018 revenue, according to Vetnosis. We also have one of the broadest portfolios of pet parasiticides in the companion animal sector. We offer a diverse portfolio of more than 125 brands that make us a trusted partner to veterinarians and food animal producers in more than 90 countries.

Elanco Parent was formed in 2018, as a wholly-owned subsidiary of Lilly, to serve as the ultimate parent company of substantially all of the animal health businesses of Lilly.

On September 20, 2018, our common stock began trading on the New York Stock Exchange (NYSE) under the symbol “ELAN.” On September 24, 2018, Elanco Parent completed an initial public offering (IPO), resulting in the issuance of 72.3 million shares of its common stock (including shares issued pursuant to the underwriters' option to purchase additional shares), which represented 19.8% of the outstanding shares, at $24.00 per share resulting in total net proceeds after underwriting discounts and commissions, of $1.7 billion. In connection with the completion of the IPO through a series of equity and other transactions, Lilly transferred to Elanco Parent the animal health businesses that form its business. In exchange, Elanco Parent has paid to Lilly approximately $4.2 billion, which included the net proceeds from the IPO, the net proceeds from the debt offering completed by Elanco Parent in August 2018 and the term loan entered into by Elanco Parent in September 2018 (see Note 9: Debt to our consolidated and combined financial statements). These transactions are collectively referred to herein as the "Separation."

On February 8, 2019, Lilly announced an exchange offer whereby Lilly shareholders could exchange all or a portion of Lilly common stock for shares of Elanco common stock owned by Lilly. The disposition of Elanco shares was completed on March 11, 2019, and resulted in the full separation of Elanco along with the disposal of Lilly's entire ownership and voting interest in Elanco.

We operate our business in a single segment directed at fulfilling our vision of enriching the lives of people through food, making protein more accessible and affordable, and through pet companionship, helping pets live longer, healthier lives. We advance our vision by offering products in four primary categories:

Companion Animal Disease Prevention (CA Disease Prevention): We have one of the broadest parasiticide portfolios in the companion animal sector based on indications, species and formulations, with products that protect pets from worms, fleas and ticks. Combining our parasiticide portfolio with our vaccines presence, we are a leader in the U.S. in the disease prevention category based on share of revenue.

Companion Animal Therapeutics (CA Therapeutics): We have a broad pain and osteoarthritis portfolio across species, modes of action, indications and disease stages. Pet owners are increasingly treating osteoarthritis in their pets, and our Galliprant product is one of the fastest growing osteoarthritis treatments in the U.S. We also have treatments for otitis (ear infections), as well as cardiovascular and dermatology indications.

Food Animal Future Protein & Health (FA Future Protein & Health): Our portfolio in this category, which includes vaccines, nutritional enzymes and animal-only antibiotics, serves the growing demand for protein and includes innovative products in poultry and aquaculture production, where demand for animal health products

5

is outpacing overall industry growth. We are focused on developing functional nutritional health products that promote food animal health, including enzymes, probiotics and prebiotics. We are a leader in providing vaccines as alternatives to antibiotics to promote animal health based on share of revenue.

Food Animal Ruminants & Swine (FA Ruminants & Swine): We have developed a range of food animal products used extensively in ruminant (e.g., cattle, sheep and goats) and swine production.

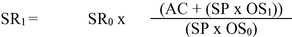

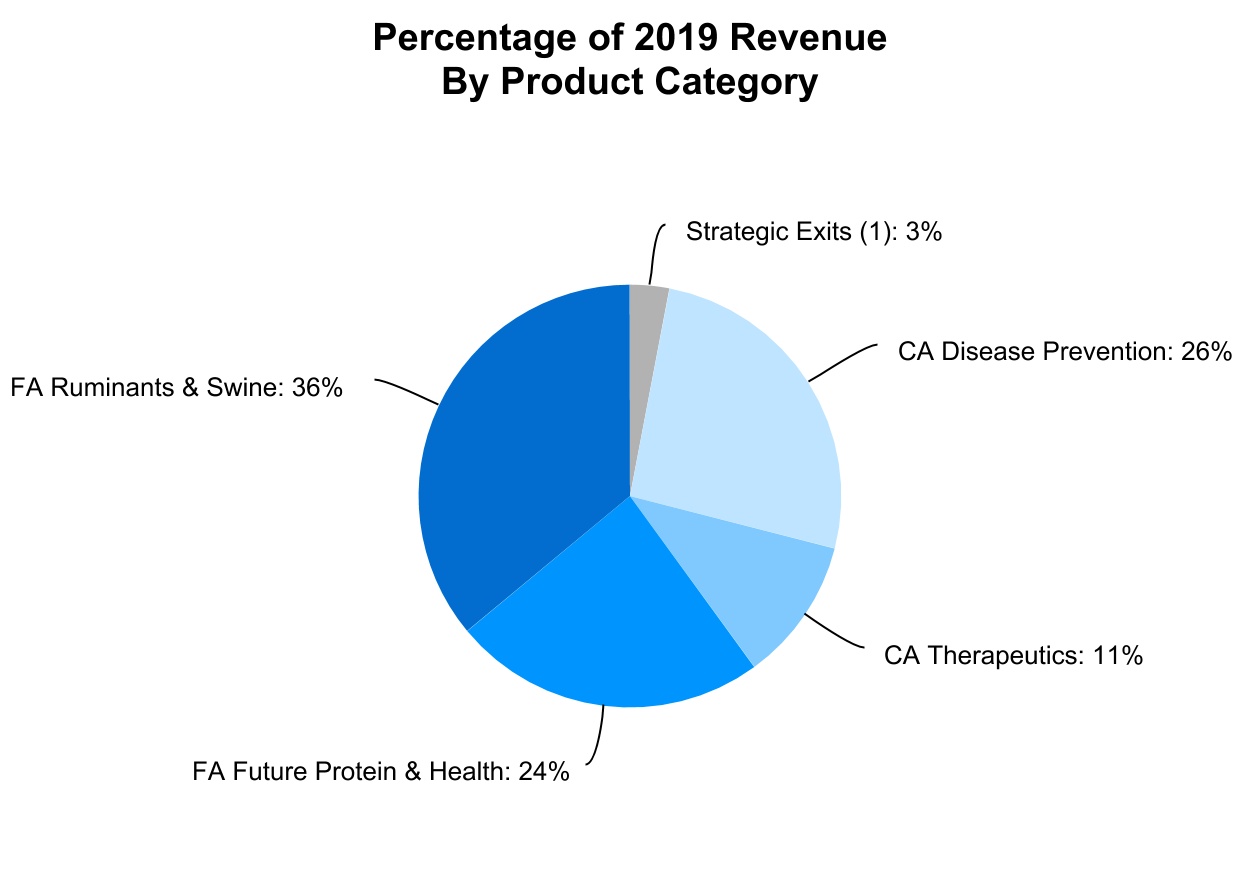

We have a top four presence in all four key industry geographic regions: North America (NA); Europe, the Middle East and Africa (EMEA); Latin America (LATAM); and Asia-Pacific (APAC), as measured by 2018 revenue, according to Vetnosis. The following graphs demonstrate our revenue for the year ended December 31, 2019 by product category and geography:

(1) Strategic Exits includes revenue from third-party manufacturing, distribution and other contractual arrangements, as well as products not core to our business, which we made the decision to exit.

6

(1) LATAM includes aquaculture in all regions

Through our global sales force of approximately 1,425 sales representatives, our veterinary consultants and our key distributors, we seek to build strong customer relationships and fulfill demand for our food animal products primarily with food animal producers, veterinarians and nutritionists, and for our companion animal products primarily with veterinarians and, in some markets, pet owners. We are also expanding into retail channels in order to meet pet owners where they want to purchase.

Our inclusive approach to sourcing innovation helps us identify, attract, fund and develop new ideas that enhance our pipeline and reduce risk as compared to an in-house only approach. Through this process we have launched or acquired 14 new products since 2015, including the additions of Entyce™, Nocita™ and Tanovea™ in 2019, that delivered $439.2 million of revenue in 2019.

We believe we have an experienced leadership team that fosters an adaptive, purpose-driven culture among approximately 6,080 employees worldwide as of December 31, 2019 and that our employees share a deep conviction for achieving our vision of food and companionship enriching life.

For the years ended December 31, 2019 and 2018, our revenue was $3.1 billion, and for the year ended December 31, 2017, our revenue was $2.9 billion. For the years ended December 31, 2019, 2018 and 2017, our net income (loss) was $67.9 million, $86.5 million and $(310.7) million, respectively.

Products

We have a diverse portfolio of products marketed under more than 125 brands, including products for both food animals and companion animals.

Our food animal products are designed to enable producers to keep animals healthy and deliver more food while using fewer resources. Our antibacterials, anticoccidials, vaccines and parasiticides aim to make food safer by preventing and controlling disease. We offer products and support to enhance the integrity of the food supply, while our productivity enhancers help make food more affordable and abundant by increasing the amount of meat or milk an animal can supply. Furthermore, our expertise and data analytics help our customers improve production efficiency and business performance. Food animal products represented approximately 60% of our revenue for the year ended December 31, 2019.

Our companion animal products help veterinarians better care for pets. We partner with pet owners and veterinarians for the purpose of providing a consistent flow of innovative and effective products and support. Our R&D focuses on products that prevent and treat disease, improve and extend quality of life and improve the type of care received by pets. We also partner closely with veterinarians to provide technical support and case

7

management for our products. Companion animal products represented approximately 37% of our revenue for the year ended December 31, 2019.

We group our products into four principal categories:

CA Disease Prevention: includes parasiticides and vaccine products for canines and felines.

CA Therapeutics: includes products for the treatment of pain, osteoarthritis, otitis, cardiovascular and dermatology indications in canines and felines.

FA Future Protein & Health: includes vaccines, antibiotics, parasiticides and other products used in poultry and aquaculture production, as well as functional nutritional health products, including enzymes, probiotics and prebiotics.

FA Ruminants & Swine: includes vaccines, antibiotics, implants, parasiticides and other products used in ruminants and swine production, as well as certain other food animal products.

We pursue the development of new chemical and biological molecules through our innovation strategy. Since 2015, we have launched or acquired the following 14 products:

In CA Disease Prevention, Credelio™ and Interceptor™ Plus.

In CA Therapeutics, Galliprant, Osurnia™, Tanovea, Entyce and Nocita.

In FA Future Protein & Health, Inteprity™, Imvixa™, Clynav™ and Correlink™.

In FA Ruminants & Swine, Imrestor™, Kavault™ and Prevacent™.

In the second quarter of 2018, we suspended commercialization of Imrestor and plan to pursue additional indications. In addition, as part of our antitrust strategy in connection with the acquisition of the animal health business of Bayer, we announced in January 2020 our plan to divest Osurnia and the U.S. rights to Capstar™ and in February 2020 our plan to divest Vecoxan™.

In 2016, we announced the creation of our Nutritional Health organization, which focuses on functional nutrition products, including enzymes, probiotics and prebiotics, which impact animal microbiomes and other dietary factors to reduce disease incidence, improve gut health and enhance feed digestibility. We first focused on nutritional health in 2012, with the acquisition of ChemGen and the Hemicell™ brand. In 2016, we entered into an agreement with Agro Biosciences, Inc. to commercialize Correlink - a novel direct-fed microbial (probiotic) product outside the U.S. In early 2018, we announced a new global, exclusive in-licensing agreement with Ab E Discovery to further develop and bring to the market an in feed antibody product focused on reducing and controlling coccidiosis. In late 2018, we entered into an R&D collaboration with Novozymes to develop nutritional health products in beef and dairy cattle. In 2019, we entered into an R&D collaboration agreement with AgBiome, Inc. to develop nutritional health products for swine.

Rumensin™, our top selling product, contributed approximately 10%, 11%, and 10% of our revenue in 2019, 2018, and 2017, respectively. No other product contributed 10% or more of our revenue. Our top five selling products, Rumensin, Trifexis™, Maxiban™, Interceptor Plus and Denagard™, collectively contributed approximately 31% of our 2019 revenue. Our top 10 products collectively contributed 43% of our 2019 revenue.

Set forth below is information regarding our principal products.

CA Disease Prevention Products

| Primary | ||||||||

| Product | Description | Species | ||||||

Bronchi Shield™ III and Bronchi Shield Oral (vaccines) | Bronchi Shield III - To protect against adenovirus, parainfluenza and Bordetella bronchiseptica (Bb) in dogs. Bronchi Shield Oral - To protect against Bb in dogs. | Dogs | ||||||

Comfortis™ (spinosad) | To kill fleas and prevent and treat flea infestations (Ctenocephalides felis) in cats 14 weeks of age or older and weighing at least 4.1 lbs. and dogs 14 weeks of age or older and weighing at least 5.0 lbs. | Cats, Dogs | ||||||

8

Credelio (lotilaner) | To kill adult fleas and to treat flea infestations (Ctenocephalides felis) and treat and control tick infestations (Amblyomma americanum (lone star tick), Dermacentor variabilis (American dog tick), Ixodes scapularis (black‑legged tick) and Rhipicephalus sanguineus (brown dog tick)) for one month in dogs and puppies 8 weeks of age or older and weighing at least 4.4 lbs. | Dogs | ||||||

Duramune™ (vaccines) | Includes multiple products that collectively protect against distemper, adenovirus, parvovirus, corona, parainfluenza, leptospira canicola, and other diseases in dogs. | Dogs | ||||||

Rabvac™ (vaccines) | To protect against rabies, includes a 1-year and 3-year shot. | Cats, Dogs | ||||||

Fel-O-Vax™ (vaccines) | Includes multiple products that collectively protect against leukemia, rhinovirus, calicivirus, panleukopenia, and chlamydia in cats. | Cats | ||||||

Fel-O-Guard™ (vaccines) | Includes multiple products that collectively protect against leukemia, rhinovirus, calicivirus, panleukopenia, and chlamydia in cats. | Cats | ||||||

Interceptor Plus (milbemycin oxime/praziquantel) | To prevent heartworm disease caused by Dirofilaria immitis and for the treatment and control of adult roundworm (Toxocara canis and Toxascaris leonina), adult hookworm (Ancylostoma caninum), adult whipworm (Trichuris vulpis), and adult tapeworm (Taenia pisiformis, Echinococcus multilocularis, and Echinococcus granulosus) infections in dogs and puppies weighing at least 2 lbs. and 6 weeks of age or older. Interceptor Plus is a relaunch of a previously approved formula. | Dogs | ||||||

Milbemax™ (milbemycin oxime + praziquantel) | To treat and control parasitic infections due to adult hookworm, adult roundworm and adult tapeworm and to prevent heartworm disease caused by Dirofilaria immitis in cats and dogs. | Cats, Dogs | ||||||

Trifexis (spinosad + milbemycin oxime) | To prevent heartworm disease (Dirofilaria immitis) and to kill fleas. Trifexis is indicated for the prevention and treatment of flea infestations (Ctenocephalides felis), and the treatment and control of adult hookworm (Ancylostoma caninum), adult roundworm (Toxocara canis and Toxascaris leonina) and adult whipworm (Trichuris vulpis) infections in dogs and puppies 8 weeks of age or older and weighing at least 5 lbs. | Dogs | ||||||

9

CA Therapeutics Products

| Primary | ||||||||

| Product | Description | Species | ||||||

Atopica™ (cyclosporine A) | To control atopic dermatitis in dogs weighing at least 4 lbs. | Dogs | ||||||

Fortekor Plus™ (benazepril + pimobendan) | To treat congestive heart failure due to atrioventricular valve insufficiency or dilated cardiomyopathy in dogs. | Dogs | ||||||

Galliprant (grapiprant) | To control pain and inflammation associated with osteoarthritis in dogs. | Dogs | ||||||

Onsior™ (robenacoxib) | To control postoperative pain and inflammation associated with soft tissue surgery in dogs weighing at least 5.5 lbs. and 4 months of age or older and control postoperative pain and inflammation associated with orthopedic surgery, ovariohysterectomy and castration in cats weighing at least 5.5 lbs. and 6 months of age or older; for up to a maximum of 3 days. | Cats, Dogs | ||||||

Osurnia(1) (terbinafine + florfenicol + betamethasone acetate) | To treat otitis externa in dogs associated with susceptible strains of bacteria (Staphylococcus pseudintermedius) and yeast (Malassezia pachydermatis). | Dogs | ||||||

Entyce (capromorelin) | To stimulate appetite in dogs. | Dogs | ||||||

Nocita (bupivacaine liposome) | Local anesthetic to provide up to 72 hours of post-operative pain relief following cranial cruciate ligament surgery in dogs and onychectomy in cats. | Cats, Dogs | ||||||

(1) In January 2020, we announced our plan to divest Osurnia in connection with the pending acquisition of the animal health business of Bayer. | ||||||||

10

FA Future Protein & Health

| Primary | ||||||||

| Product | Description | Species | ||||||

AviPro™ (vaccines) | Includes multiple products that collectively protect against Newcastle disease, infectious bronchitis, fowl cholera, paramyxovirus Type 3, Bursal Disease, other diseases and foodborne pathogens like Salmonella in poultry. | Poultry | ||||||

Clynav (plasmid deoxyribonucleic acid vaccine) | To immunize Atlantic salmon to reduce impaired daily weight gain, and reduce mortality, and cardiac, pancreatic and skeletal muscle lesions caused by pancreas disease following infection with salmonid alphavirus subtype 3 (SAV3). | Fish (Salmon) | ||||||

Coban™ / Elancoban™ (monensin) | To aid in the prevention of coccidiosis in broiler and replacement chickens (caused by Eimeria necatrix, E. tenella, E. acervulina, E. brunetti, E. mivati, and E. maxima), in turkeys (caused by Eimeria adenoeides, E. meleagrimitis and E. gallopavonis) and in growing Bobwhite quail (caused by Eimeria dispersa and E. lettyae). Coban/Elancoban is an animal-only antibiotic and an ionophore. | Poultry | ||||||

Hemicell (endo-1, 4-â-mannanase) | Enzyme supplement for poultry and swine feeds that contain a source of â-mannanase, which hydrolyses the â-mannans present in soybean and corn meal. | Poultry, Swine | ||||||

Imvixa (lufenuron) | To prevent and control infestation caused by sea lice, Caligus reogercresseyi, in farmed salmon. | Fish (Salmon) | ||||||

Maxiban (narasin + nicarbazin) | To prevent coccidiosis in broiler chickens caused by Eimeria necatrix, E. tenella, E. acervulina, E. brunetti, E. mivati and E. maxima. Maxiban is an animal-only antibiotic and an ionophore. | Poultry | ||||||

Monteban™ (narasin) | To prevent coccidiosis in broiler chickens caused by Eimeria necatrix, E. tenella, E. acervulina, E. brunetti, E. mivati and E. maxima. Monteban is an animal-only antibiotic and an ionophore. | Poultry | ||||||

Surmax™ / Maxus™ / Inteprity (avilamycin) | To prevent mortality caused by necrotic enteritis associated with Clostridium perfringens in broiler chickens. Surmax, Maxis and Inteprity are animal-only antibiotics. | Poultry | ||||||

11

FA Ruminants & Swine

| Primary | ||||||||

| Product | Description | Species | ||||||

Denagard (tiamulin) | To treat Swine Dysentery associated with Serpulina hyodysenteriae susceptible to tiamulin and for treatment of swine bacterial enteritis caused by Escherichia coli and Salmonella choleraesuis sensitive to chlortetracycline and treatment of bacterial pneumonia caused by Pasteurella multocida sensitive to chlortetracycline. Denagard is a shared-class antibiotic. | Swine | ||||||

Pulmotil™ (tilmicosin) | For swine: To control swine respiratory disease associated with Actinobacillus pleuropneumoniae and Pasteurella multocida. For cattle: To control bovine respiratory disease (BRD) associated with Mannheimia haemolytica, Pasteurella multocida and Histophilus somni in groups of beef and non-lactating dairy cattle, where active BRD has been diagnosed in at least 10% of the animals in the group. Pulmotil is a shared-class antibiotic. | Cattle, Swine | ||||||

Rumensin (monensin) | For cattle fed in confinement for slaughter: To improve feed efficiency and prevent and control coccidiosis due to Eimeria bovis and Eimeria zuernii. For dairy cows: To increase milk production efficiency (production of marketable solids-corrected milk per unit of feed intake). | Cattle | ||||||

For growing cattle on pasture or in dry lot (stocker and feeder and dairy and beef replacement heifers): To increase rate of weight gain and to prevent and control coccidiosis due to Eimeria bovis and Eimeria zuernii. For mature reproducing beef cows: To improve feed efficiency when receiving supplemental feed and to prevent and control coccidiosis due to Eimeria bovis and Eimeria zuernii. For goats: To prevent coccidiosis due to Eimeria crandallis, Eimeria christenseni and Eimeria ninakohlyakimovae in goats maintained in confinement. For calves (excluding veal calves): To prevent and control coccidiosis due to Eimeria bovis and Eimeria zuernii. Rumensin is an animal-only antibiotic and an ionophore. | ||||||||

Tylan™ Premix (tylosin phosphate) | To control porcine proliferative enteropathies associated with Lawsonia intracellularis and to control porcine proliferative enteropathies associated with Lawsonia intracellularis immediately after medicating with Tylan Soluble (tylosin tartrate) in drinking water. Tylan Premix is a shared-class antibiotic. | Swine, Cattle, Poultry | ||||||

Vira Shield™ (vaccines) | Includes multiple products that protect against infection, bovine rhinotracheitis, bovine viral diarrhea, bovine respiratory syncytial virus, bovine respiratory disease, leptospira canicola and other diseases in cattle. | Cattle | ||||||

Antibiotics

Antimicrobial resistance in humans, or the risk that bacterial pathogens that cause infectious disease in humans evolve or otherwise emerge that are resistant to antibiotics or other antimicrobials, is a significant health concern, and animal agriculture can play a role in mitigating this risk. As a company dedicated to the health and well-being of animals, we seek to help veterinarians and farmers responsibly use antibiotics when treating animals. In our efforts to address antibiotic resistance while protecting animal health, we introduced a global antibiotic stewardship plan focused on increasing responsible antibiotic use; reducing the need for shared-class antibiotics; and replacing

12

antibiotics with alternatives to help livestock producers treat and prevent animal disease. Antibiotics, used responsibly, along with good animal care practices, help enhance food safety and animal well-being.

There are two classes of antibiotics used in animal health:

Animal-only antibiotics and ionophores: Not all pathogens that cause disease in animals are infectious in humans, and accordingly animal-only antibiotics are not used in human medicine (i.e., not medically important). Ionophores are a special class of animal-only antimicrobials uniquely developed only for use in animals. In Europe and certain other jurisdictions, ionophores are not currently classified as antibiotics. Because of their animal-only designation, mode of action, and spectrum of activity, their use is not considered to create the same risk of resistance in human pathogens.

Shared-class antibiotics: These are used in both humans and animals. Some antibiotics are used to treat infectious disease caused by pathogens that occur in both humans and animals. Of the 18 major antibiotic resistance threats that the Centers for Disease Control and Prevention tracks, two are associated with infectious disease in animals. As part of our global antibiotic stewardship plan and in compliance with the U.S. Food & Drug Administration (FDA) guidance, shared-class antibiotics are labeled only for the treatment of an established need in animals and only with veterinarian oversight.

We have intentionally shifted away from shared-class antibiotics, and are focusing on animal-only antibiotics, as well as antibiotic-free solutions. In 2019, 11% of our revenue was from products classified as shared-class antibiotics (4% from sales in the U.S. and 7% from sales outside the U.S.), which is down from 16% in 2015. Revenue from animal-only antibiotics and ionophores represented 24% of our total revenue in 2019 (21% from ionophores), which is up from 23% in 2015. Through our policies and efforts in this area, we seek to protect the benefits of antibiotics in human medicine, while responsibly protecting the health of food animals and the safety of our food supply.

Sales and Marketing

Our sales organization includes sales representatives, veterinary consultants and other value added specialists. In markets where we do not have a direct commercial presence, we generally contract with distributors that provide logistics and sales and marketing support for our products.

Our sales representatives visit our customers, including consultants, veterinarians, food animal producers, and resellers, to inform, promote and sell our products and to support customers. Our veterinary consultants are available to provide scientific consulting focused on disease management and herd management, training and education on diverse topics, including responsible product use, and generally have advanced degrees in veterinary medicine, veterinary nutrition or other agriculture-related fields. These direct relationships with customers allow us to understand their needs. Additionally, our sales representatives and veterinary consultants focus on collaborating with our customers to educate and support them on topics such as local disease awareness and to help them adopt new and more sophisticated animal health solutions, including through the use of our products. As a result of these relationships, our sales and consulting visits provide us with access to customer decision makers. In addition, our sales and marketing organization provides enhanced value by providing support to food animal producers to help maximize their yields and reduce costs. Our analytics help customers analyze large amounts of health and production data. As of December 31, 2019, we had approximately 1,425 sales representatives.

Customers

We primarily sell our food animal products to third-party distributors and directly to a diverse set of food animal producers, including beef and dairy farmers as well as pork, poultry and aquaculture operations. We primarily sell our companion animal products to third-party distributors, as well as directly to veterinarians that typically then sell our products to pet owners. We are also expanding into retail channels in order to meet pet owners where they want to purchase. Our largest customer, an affiliate of AmerisourceBergen Corp., is a third-party veterinary distributor and represented approximately 13% of our revenue for the year ended December 31, 2019. Our next two largest customers represented approximately 7% and 6% of our revenue for the year ended December 31, 2019. No other customer represented more than 5% of our revenue for the same period.

13

Research and Development

Our R&D organization is comprised of internal research, global development, global regulatory and external innovation collaborations and venture investing. As of December 31, 2019, we employed approximately 765 employees in our global R&D and Regulatory Affairs organizations. Our R&D headquarters is located in Greenfield, Indiana. We have R&D facilities in Basel, Switzerland; and Yarrandoo, Australia and R&D facilities co-located with manufacturing sites in Fort Dodge, Iowa; and Cuxhaven, Germany. Additional R&D operations are located in Sao Paulo, Brazil; Shanghai, China; and Bangalore, India. We incurred R&D expenses of $270.1 million in 2019, $246.6 million in 2018 and $251.7 million in 2017.

New product innovation is a core part of our business strategy. Our R&D investment is focused on projects that target novel product introductions, as well as new indications, presentations, combinations and species expansion. Our approach is a build, buy, or ally strategy to develop compelling targets and concepts that originate from our scientists and innovators, academia, agribusiness, or human pharmaceutical and biotechnology at all stages of R&D. The ability to source our concepts from different areas allows us to create a pipeline that can be competitive in the categories in which we have chosen to compete, while reducing our risk by not owning and funding all aspects of our R&D projects.

We seek to concentrate our resources in areas where we believe the science and our capabilities best match the opportunities in the animal health market. Specifically, our R&D focuses on six areas across companion animals and food animals. For companion animals, we have R&D activities in therapeutics, vaccines and parasiticides, while in food animals we are pursuing pharmaceuticals, vaccines and nutritional health.

Our R&D efforts consist of more than 100 active programs balanced across species and technology platforms. For both food animals and companion animals, we apply both large and small molecule approaches. In vaccines, our efforts encompass a full range of modified live, inactivated and nucleic acid strategies. In nutritional health, we focus on products based on enzymes, probiotics, prebiotics and other approaches that modulate biological activity in the animal digestive tract. Additionally, we employ various delivery strategies for products including in-feed, injectable, oral and topical formulations developed in conjunction with our manufacturing team to assure production that maximizes the capabilities within our internal and external manufacturing network.

We engage in licensing and business development to acquire assets for our pipeline and new R&D platforms and to establish strategic R&D collaborations. We make and maintain capital investments in venture capital vehicles that focus on agribusiness and animal health, and we engage in risk sharing collaborations to expand our external capital sources to augment internal investments. To support collaborations with innovation sources focused on human health we have developed capabilities to conduct translational comparative medical research trials in animals with naturally occurring conditions in animals that mimic a human disease or disorder. This type of collaboration de-risks unproven or less well-validated human hypotheses while potentially defining a clinically validated new approach in veterinary medicine.

Our R&D and commercial leadership allocate R&D investment annually with the goal of aligning near and long-term strategic opportunities and objectives. Portfolio investment decisions are made based on the probability of technical success and regulatory approval, timing of approval/launch and earlier milestones, feasibility and cost of development and manufacturing, intellectual property protection and market attractiveness/commercial forecast. R&D projects are supported by pharmaceutical project management approaches and we aim for all of our supporting R&D functional capabilities and capacities to be managed and matched to the evolving demands of the pipeline. We believe this overall R&D management system has enabled us to consistently gain product approvals while maintaining clear visibility to pipeline breadth and depth to support sustained launches into the future.

Manufacturing and Supply Chain

Prior to the separation, our products were manufactured at both sites operated by us and sites operated by third-party contract manufacturing organizations (CMOs).

14

We own and operate 12 internal manufacturing sites, four of which focus on vaccines, six of which focus on other animal health products and two of which are regional sites that focus on packaging:

| Site | Location | Site | Location | |||||||||||||||||

| Clinton | Indiana, U.S. | Prince Edward Island | Canada | |||||||||||||||||

| Speke | Liverpool, U.K. | Winslow | Maine, U.S. | |||||||||||||||||

| Kansas City | Kansas, U.S. | Fort Dodge | Iowa, U.S. | |||||||||||||||||

| Huningue | France | Cuxhaven | Germany | |||||||||||||||||

| Wusi | China | Chungli | Taiwan | |||||||||||||||||

| Terre Haute | Indiana, U.S. | Barueri | Brazil | |||||||||||||||||

We will continue to manufacture one product, human growth hormone, for Lilly at one of these sites until the end of 2020.

Our global manufacturing and supply chain is also supported by a network of CMOs. As of December 31, 2019, this network was comprised of approximately 90 CMOs. Our external manufacturing network centrally governs our global CMO relationships and provides oversight to these CMOs through four hubs.

We select CMOs based on several factors: (i) their ability to reliably supply products or materials that meet our quality standards at an optimized cost; (ii) their access to specialty products and technologies; (iii) capacity; and (iv) financial analyses. Our External Manufacturing Network seeks to ensure that all of the CMOs we use adhere to our standards of manufacturing quality.

We purchase certain raw materials necessary for the commercial production of our products from a variety of third-party suppliers. We utilize logistics service providers as a part of our global supply chain, primarily for shipping and logistics support.

We intend to continue our efficiency improvement programs in our manufacturing and supply chain organization. We have strong globally managed and coordinated quality control and quality assurance programs in place at all internal manufacturing sites and external manufacturing hubs, and we regularly inspect and audit our internal sites and CMO locations.

Competition

We face intense competition in the sectors and regions on which we focus. Principal methods of competition vary depending on the particular region, species, product category, or individual product. Some of these methods include new product development, quality, price, service and promotion.

Our primary competitors include animal health medicines and vaccines companies such as Zoetis Inc.; Boehringer Ingelheim Vetmedica, Inc., the animal health division of Boehringer Ingelheim GmbH; Merck Animal Health, the animal health division of Merck & Co., Inc.; and the animal health business of Bayer. In August 2019, we entered into an agreement to acquire the animal health business of Bayer (see Note 6: Acquisitions to our consolidated and combined financial statements). We also face competition globally from manufacturers of generic drugs, as well as from producers of nutritional health products, such as DSM Nutritional Products AG and Danisco Animal Nutrition, the animal health division of E.I. du Pont de Nemours and Company, a subsidiary of DowDuPont, Inc. There are also several new start-up companies working in the animal health area. In addition, we compete with numerous other producers of animal health products throughout the world.

Intellectual Property

Our technology, brands and other intellectual property are important elements of our business. We rely on patent, trademark, copyright and trade secret laws, as well as regulatory exclusivity periods and non-disclosure agreements to protect our intellectual property rights. Our policy is to vigorously protect, enforce and defend our rights to our intellectual property, as appropriate.

15

Our product portfolio and certain product candidates enjoy the protection of approximately 3,000 patents and applications, filed in over 50 countries, with concentration in our major market countries as well as other countries with strong patent systems, such as Australia, Brazil, Canada, Europe, Japan and the U.S. Many of the patents and patent applications in our portfolio are the result of our own work, while other patents and patent applications in our portfolio were at least partially developed, and licensed to us, by third parties. A subset of our current products or product candidates are covered by patents and patent applications in our portfolio.

Patents for individual products expire at different times based on the date of the patent filing (or sometimes the date of patent grant) and the legal term of patents in the countries where such patents are obtained. For example, Galliprant’s active ingredient, grapiprant, is encompassed by both compound and physical form patents in the U.S., Europe, Canada and other key markets, with terms that expire between October 2021 and March 2026. Various formulation and method of use patents encompass the spinosad pesticide products, Comfortis and Trifexis. The Comfortis formulation patent extends through August 2020 in the U.S., Canada and Australia, and, upon grant of applicable supplementing protection certificate (SPC), through August 2025 in Europe. The Trifexis formulation and method of use patents extend through September 2021 in the U.S., Canada and Australia, and, upon grant of applicable SPC, through September 2026 in Europe. We typically maintain all of our patents and assert our patent rights against third parties as appropriate.

Additionally, many of our vaccine products, including the Duramune family of vaccines, are based on proprietary or patented master seeds and formulations. We actively seek to protect our proprietary information, including our trade secrets and proprietary know-how, through a variety of means including by seeking to require our employees, consultants, advisors and partners to enter into confidentiality agreements and other arrangements upon the commencement of their employment or engagement.

In order to facilitate the Separation and allow Lilly's and our operations to continue with minimal interruption, Lilly licensed to us the right to use certain intellectual property rights in the animal health field. In addition, Lilly granted us a transitional license to use certain of Lilly’s trademarks for a period of time following the IPO.

We seek to file and maintain trademarks around the world based on commercial activities in most regions where we have, or desire to have, a business presence for a particular product. We currently maintain more than 9,000 trademark applications and registrations in major regions, primarily identifying products dedicated to the care of livestock and companion animals.

Regulatory

The sale of animal health products is governed by the laws and regulations specific to each country in which we sell our products. To maintain compliance with these regulatory requirements, we have established processes, systems and dedicated resources with end-to-end involvement from product concept to launch and maintenance in the market. Our regulatory function actively seeks to engage in dialogue with various global agencies regarding their policies that relate to animal health products. In the majority of our markets, the relevant health authority is separate from those governing human medicinal products.

United States

U.S. Food and Drug Administration. The regulatory body that is responsible for the regulation of animal health pharmaceuticals in the U.S. is the Center for Veterinary Medicine (CVM), a division of the FDA. All manufacturers of animal health pharmaceuticals must demonstrate their products to be safe, effective and produced by a consistent method of manufacture as defined under the Federal Food, Drug and Cosmetic Act (FFDCA). The FDA’s basis for approving a new animal drug application is documented in a Freedom of Information Summary. Post-approval monitoring of products is required by law, with reports being provided to the CVM’s Office of Surveillance and Compliance. Reports of product quality defects, adverse events or unexpected results are maintained and submitted in accordance with the law. Additionally, as part of the drug experience report, we are required to submit all new information pertaining to the safety or effectiveness of a product, regardless of the source.

U.S. Department of Agriculture. The regulatory body in the U.S. for veterinary biologicals is the U.S. Department of Agriculture (USDA). The Center for Veterinary Biologics within the Animal and Plant Health Inspection Service in the USDA is responsible for the regulation of animal health biologicals, which includes but is not limited to vaccines, bacterins, allergens, antibodies, antitoxins, toxoids, immunostimulants, certain cytokines, antigenic or immunizing components of live microorganisms, and diagnostic components of natural or synthetic origin, or that are derived

16

from synthesizing or altering various substances or components of substances such as microorganisms, genes or genetic sequences, carbohydrates, proteins, antigens, allergens or antibodies. All manufacturers of animal health biologicals must show their products to be pure, safe, effective and produced by a consistent method of manufacture as defined under the Virus Serum Toxin Act. Post-approval monitoring of products is required. Reports of product quality defects, adverse events or unexpected results are maintained and submitted in accordance with the agency requirements.

Environmental Protection Agency. The main regulatory body in the U.S. for veterinary pesticides is the Environmental Protection Agency (EPA). The EPA’s Office of Pesticide Programs is responsible for the regulation of most pesticide products applied to animals in accordance with a memorandum of understanding between the FDA and EPA for products that are subject to regulation under both the FFDCA and the Federal Insecticide, Fungicide and Rodenticide Act. All manufacturers of animal health pesticides must show their products will not cause unreasonable adverse effects to man or the environment as stated in the act. Within the U.S., individual state pesticide authorities must, before distribution in that state, also approve pesticide products that are approved by the EPA. Post-approval monitoring of products is required, with reports provided to the EPA and some state regulatory agencies.

Food Safety Inspection Service. The FDA is authorized to determine the safety of substances (including “generally recognized as safe” substances, food additives and color additives), as well as prescribe their safe conditions of use. However, although the FDA has the responsibility for determining the safety of substances, the Food Safety and Inspection Service, the public health agency in the USDA, still retains, under the tenets of the Federal Meat Inspection Act and the Poultry Products Inspection Act and their implementing regulations, the authority to determine that new substances and new uses of previously approved substances are suitable for use in meat and poultry products.

The Foreign Corrupt Practices Act (FCPA) prohibits U.S. corporations and their representatives from offering, promising, authorizing or making payments to any foreign government official, government staff member, political party or political candidate in an attempt to obtain or retain business abroad. The scope of the FCPA includes interactions with certain healthcare professionals in many countries. Other countries have enacted similar anti-corruption laws and/or regulations. In some countries in which we operate, the pharmaceutical and life sciences industries are exposed to a high risk of corruption associated with sales to healthcare professionals and institutions.

Outside of the United States

European Union (EU). We are governed by the following EU regulatory bodies:

The European Medicines Agency (EMA) is a centralized agency of the EU responsible for the scientific evaluation of Veterinary Medicinal Products (VMP) developed by pharmaceutical companies for use in the EU. The agency has a veterinary review section distinct from the medical review section for human products. The Committee for Veterinary Medicinal Products (CVMP) is responsible for scientific review of the submissions for VMP and Immunological Veterinary Medicinal Products. If the CVMP concludes that all requirements for quality, safety and efficacy are met, it issues a positive opinion that is forwarded to the European Commission, who takes the final decision following the European comitology procedure. The centralized marketing authorization (commission decision) of the European Commission is valid in all of the EU. All countries that are not part of the EU but belong to the European Economic Area (EEA), i.e., Norway, Iceland and Liechtenstein, have been part of the scientific assessment done by the CVMP. These countries issue a national marketing approval in accordance with the Commission decision. A series of regulations, directives, guidelines, EU Pharmacopeia Monographs and other legislation provide the requirements for approval in the EU. In general, these requirements are similar to those in the U.S., requiring demonstrated evidence of purity, safety, efficacy and consistency of manufacturing processes.

If approval is sought for products that either cannot or do not need to follow the centralized procedure, approval can also be achieved by national approval in an EEA country agency. This national authorization can be mutually recognized by other EEA countries/EU member states (Mutual Recognition Procedure). In addition, national and mutual recognition can be done in a combined procedure (Decentralized Procedure).

The European Food Safety Authority (EFSA) is the agency of the EU that provides scientific advice and communicates with respect to existing and emerging risks associated with the food chain. Based on EFSA’s mandate, the agency evaluates applications for feed additives, including enzymes and several nutritionals for animals.

17

The European Chemical Agency (ECHA) is the agency of the EU for the safe use of chemicals. Based on the ECHA’s mandate, the agency conducts the evaluation of biocides for the EU.

In regard to Brexit, the UK formally left the EU on January 31, 2020. A transition period is in effect from February 1, 2020 until December 31, 2020, during which the UK and the EU will negotiate a trade agreement. Post-separation, the UK has indicated it will look to continue working closely with the EMA, and that existing agreements between the EMA and other countries such as Switzerland, the U.S. and Canada provide a precedent on which the UK could build.

Brazil. The Ministry of Agriculture, Livestock Production and Supply (MAPA) is the regulatory body in Brazil that is responsible for the regulation and control of pharmaceuticals, biologicals and medicinal feed additives for animal use. MAPA’s regulatory activities are conducted through the Secretary of Agricultural Defense and its Livestock Products Inspection Department. In addition, regulatory activities are conducted at a local level through the Federal Agriculture Superintendence. These activities include the inspection and licensing of both manufacturing and commercial establishments for veterinary products, as well as the submission, review and approval of pharmaceuticals, biologicals and medicinal feed additives. MAPA is one of the most active regulatory agencies in Latin America, having permanent seats at several international animal health forums, such as Codex Alimentarius, World Organization for Animal Health and Committee of Veterinary Medicines for the Americas. MAPA was also recently invited to be a Latin American representative at International Cooperation on Harmonisation of Technical Requirements for Registration of Veterinary Medicinal Products (VICH) meetings. Several normative instructions issued by MAPA have set regulatory trends in Latin America.

Japan. The Ministry of Agriculture, Forestry and Fishery (MAFF) is the regulatory body in Japan that is responsible for the regulation and control of pharmaceuticals (including biologicals and pesticide/disinfectant) and feed additive/feed for animal use. MAFF’s regulatory activities are conducted through the Livestock & Aquaculture Product Safety Control Division under Consumer Safety Bureau. The animal drug reviews and approvals, reexamination reviews, GxP compliance checks, GxP site inspections and product assay checks (including vaccine national assays) are done by National Veterinary Assay Laboratory (NVAL). MAFF coordinates with other agencies such as Ministry of Health, Labor and Welfare (MHLW) and Food Safety Commission (FSC) to perform various license compliance checks (e.g. marketing authorization holder, manufacturer and oversea site accreditation) and ensure good promotional activities. Routine inspections, antimicrobial feed additive national assays and manufacturing inspections are done by the Food & Agriculture Material Inspection Center. For food animal products, animal drug review is done by NVAL but the human food safety review is done by FSC (ADI establishment and antimicrobial risk assessment) and MHLW (MRL establishment). These three agencies (NVAL, FSC and MHLW) work together to approve food animal products. In addition to those central government agencies, various licenses are delegated to the local municipal government, such as animal drug wholesaler and retailer licenses and feed additive distributor licenses.

China. The Ministry of Agriculture (MOA) is the regulatory body that is responsible for the regulation and control of pharmaceuticals, biologicals, disinfectants, medicinal feed additives, pesticide and feed/feed additives for animal use. There are three organizations under the MOA that regulate animal health:

The Institute of Veterinary Drug Control is responsible for the evaluation of new applications, renewals, variations, manufacturers, quality methods and tissue residue methods for pharmaceuticals, biologicals, disinfectants and medicinal feed additives.

The feed/feed additive office is responsible for the registration and renewal of feed and feed additives.

The pesticide bureau is responsible for the registration and renewal of pesticide products.

Australia. The Australian Pesticides and Veterinary Medicines Authority (APVMA) is an Australian government statutory authority established in 1993 to centralize the registration of all agricultural and veterinary products into the Australian marketplace. Previously, each state and territory government had its own system of registration. The APVMA assesses applications from companies and individuals seeking registration so they can supply their product to the marketplace. Applications undergo rigorous assessment using the expertise of the APVMA’s scientific staff and drawing on the technical knowledge of other relevant scientific organizations, Commonwealth government departments and state agriculture departments. If the product works as intended and the scientific data confirms that when used as directed on the product label it will have no harmful or unintended effects on people, animals, the environment or international trade, the APVMA will register the product. As well as registering new agricultural and veterinary products, the APVMA reviews older products that have been on the market for a substantial period of

18

time to ensure they still do the job users expect and are safe to use. The APVMA also reviews registered products when particular concerns are raised about their safety and effectiveness. The review of a product may result in confirmation of its registration or it may see registration continue with some changes to the way the product can be used. In some cases, the review may result in the registration of a product being cancelled and the product taken off the market.

Rest of world. Country-specific regulatory laws typically have provisions that include requirements for certain labeling, safety, efficacy and manufacturers’ quality control procedures (to assure the consistency of the products), as well as company records and reports. Other countries’ regulatory agencies typically either refer to the FDA, USDA, EU and other international animal health entities, including the World Organization for Animal Health, Codex Alimentarius or VICH (see below), in establishing standards and regulations for veterinary pharmaceuticals and vaccines, or review the quality, safety and effectiveness of the products themselves according to their own national requirements.

Global policy and guidance

Joint FAO/WHO Expert Committee on Food Additives. The Joint FAO/WHO Expert Committee on Food Additives is an international expert scientific committee that is administered jointly by the Food and Agriculture Organization of the United Nations (FAO) and the World Health Organization (WHO). They provide a risk assessment/safety evaluation of residues of veterinary drugs in animal products, exposure and residue definition and maximum residue limit proposals for veterinary drugs. Similarly, the Joint FAO/WHO Meeting on Pesticide Residues (JMPR) is an international expert scientific group administered jointly by the FAO and WHO. JMPR reviews residues and analytical aspects of the pesticides, estimate the maximum residue levels, review toxicological data and estimate acceptable daily intakes for humans of the pesticides under consideration. Elanco works with these committees to establish acceptable safe levels of residual product in food-producing animals after treatment with veterinary drugs or pesticides. This in turn enables the calculation of appropriate withdrawal times for our products prior to an animal entering the food chain.

Advertising and promotion review. Promotion of ethical animal health products is controlled by regulations in many countries. These rules generally restrict advertising and promotion to those claims and uses that have been reviewed and endorsed by the applicable agency. We conduct a review of promotion material for compliance with the local and regional requirements in the markets where we sell animal health products.

Import and Export of Products. The importation and exportation of animal health products is controlled by regulations in many countries. In some jurisdictions this may include obtaining separate permits or licenses by product or by company or filing notices with applicable regulatory agencies prior to import or export of product. We ensure compliance with local and global regulations in the markets where we import/export our animal health products.

International Cooperation on Harmonization of Technical Requirements for Registration of Veterinary Medicinal Products. VICH is a trilateral (EU-Japan-USA) program launched in 1996 aimed at harmonizing technical requirements for veterinary product registration. Several other countries have obtained observer status, for example, Canada, New Zealand, Australia and South Africa, or are linked to VICH on basis of the VICH Outreach Forum, a VICH initiative with the main objective of providing a basis for wider international harmonization of technical requirements. In addition, the World Organization for Animal Health is an associate member of VICH.

The objectives of the VICH are as follows:

Establish and implement harmonized technical requirements for the registration of veterinary medicinal products in the VICH regions, which meet high quality, safety and efficacy standards and minimize the use of test animals and costs of product development.

Provide a basis for wider international harmonization of registration requirements through the VICH Outreach Forum.

Monitor and maintain existing VICH guidelines, taking particular note of the ICH work program and, where necessary, update these VICH guidelines.

Ensure efficient processes for maintaining and monitoring consistent interpretation of data requirements following the implementation of VICH guidelines.

19

By means of a constructive dialogue between regulatory authorities and industry, provide technical guidance enabling response to significant emerging global issues and science that impact regulatory requirements within the VICH regions.

Employees

As of December 31, 2019, we employed approximately 5,760 full time employees. In addition, we employed approximately 320 fixed-duration employees, which are individuals hired for a pre-defined length of time (one to four years). Together, they total approximately 6,080 worldwide. Of the 6,080 employees globally, approximately 2,560 are U.S.-based and approximately 3,520 are employed in other jurisdictions. Some of these employees are members of unions, works councils, trade associations or are otherwise subject to collective bargaining agreements, including approximately 150 union employees in the U.S. located at our Fort Dodge, Iowa manufacturing/R&D facility. Approximately 40% of our global population is in customer-facing roles, including but not limited to, traditional sales roles, technical consultants, account managers and commercial and general managers.

Environmental, Health and Safety

We are subject to various federal, state, local and foreign environmental, health and safety (EHS) laws and regulations. These laws and regulations govern matters such as the emission and discharge of hazardous materials into the ground, air or water; the generation, use, storage, handling, treatment, packaging, transportation, exposure to, and disposal of hazardous and biological materials, including recordkeeping, reporting and registration requirements; and the health and safety of our employees. Due to our operations, these laws and regulations also require us to obtain, and comply with, permits, registrations or other authorizations issued by governmental authorities. These authorities can modify or revoke our permits, registrations or other authorizations and can enforce compliance through fines and injunctions.

Certain environmental laws impose joint and several liability, without regard to fault, for cleanup costs on persons who have disposed of or released hazardous substances into the environment, including at third-party sites or offsite disposal locations, or that currently own or operate (or formerly owned or operated) sites where such a release occurred. We could be subject to liability for the investigation and remediation of legacy environmental contamination caused by historical industrial activity at sites that we own or on which we operate. In addition to clean-up actions brought by federal, state, local and foreign governmental entities, private parties could raise personal injury or other claims against us due to the presence of, or exposure to, hazardous materials on, from or otherwise relating to such a property.

We have made, and intend to continue to make, necessary expenditures for compliance with applicable EHS laws and regulations. We are also monitoring and investigating environmental contamination from past industrial activity at certain sites. As a result, we incurred capital and operational expenditures in 2019 for environmental compliance purposes and for the clean-up of certain past industrial activities. Environmental-related capital expenditures and other environmental-related expenditures were $0.0 million and $0.2 million in 2019, respectively.

In connection with past divestitures, we have undertaken certain indemnification obligations that may require us in the future, to conduct or finance environmental cleanups at sites that we no longer own or operate. In connection with certain of our acquisitions, we have also entered into indemnification agreements pursuant which we are or may be indemnified for various environmental cleanups; however, such indemnities are limited in both time and scope and may be further limited in the presence of new information, or may not be available at all.

Legal Proceedings

We are from time to time subject to claims and litigation arising in the ordinary course of business. These claims and litigation may include, among other things, allegations of violation of U.S. and foreign competition law, labor laws, consumer protection laws and environmental laws and regulations, as well as claims or litigation relating to product liability, intellectual property, securities, breach of contract and tort. We operate in multiple jurisdictions and, as a result, a claim in one jurisdiction may lead to claims or regulatory penalties in other jurisdictions. We intend to vigorously defend against any pending or future claims and litigation, as appropriate.

At this time, in the opinion of our management, the likelihood is remote that the impact of any such proceedings, either individually or in the aggregate, would have a material adverse effect on our consolidated results of operations, financial condition or cash flows. However, one or more unfavorable outcomes in any claim or litigation

20

against us could have a material adverse effect for the period in which they are resolved. In addition, regardless of their merits or their ultimate outcomes, such matters are costly, divert management’s attention and may materially adversely affect our reputation, even if resolved in our favor.

Available Information

Our website address is www.elanco.com. On our website, we make available, free of charge, our annual, quarterly and current reports, including amendments to such reports, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC.

Information relating to corporate governance at Elanco, including our Corporate Governance Guidelines, Code of Conduct, Financial Code of Ethics, Articles of Incorporation, Bylaws, Committee Charters; information concerning our executive officers and members of our board of directors; and ways to communicate are available on our website. We will provide any of the foregoing information without charge upon written request to Elanco’s Corporate Secretary, Elanco, 2500 Innovation Way, Greenfield, Indiana 46140. Information relating to shareholder services is also available on our website.

Information contained on our website is not part of, or incorporated by reference, in this Annual Report on Form 10-K.

21

Item 1A. Risk Factors

Our business, financial condition and results of operations are subject to various risks, including but not limited to the risks described below. If any of such risks actually materializes, our business, financial condition and results of operations could be materially adversely affected.

Risks Related to Elanco

The animal health industry is highly competitive.

The animal health industry is highly competitive. Our competitors include standalone animal health businesses, the animal health businesses of large pharmaceutical companies, specialty animal health businesses and companies that mainly produce generic products. We believe many of our competitors are conducting R&D activities in areas served by our products and in areas in which we are developing products. Several new start-up companies also compete in the animal health industry. We also face competition from manufacturers of drugs globally, as well as producers of nutritional health products. These competitors may have access to greater financial, marketing, technical and other resources. As a result, they may be able to devote more resources to developing, manufacturing, marketing and selling their products, initiating or withstanding substantial price competition or more readily taking advantage of acquisitions or other opportunities. Further, consolidation in the animal health industry could result in existing competitors realizing additional efficiencies or improving portfolio bundling opportunities, thereby potentially increasing their market share and pricing power, which could lead to a decrease in our revenue and profitability and an increase in competition. For example, many of our competitors have relationships with key distributors and, because of their size, the ability to offer attractive pricing incentives, which may negatively impact or hinder our relationships with these distributors. In addition to competition from established market participants, new entrants to the animal health medicines and vaccines industry could substantially reduce our market share, render our products obsolete or disrupt our business model.

To the extent that any of our competitors are more successful with respect to any key competitive factor, or we are forced to reduce, or are unable to raise, the price of any of our products in order to remain competitive, our business, financial condition and results of operations could be materially adversely affected. Competitive pressure could arise from, among other things, more favorable safety and efficacy product profiles, limited demand growth or a significant number of additional competitive products being introduced into a particular market, price reductions by competitors, the ability of competitors to capitalize on their economies of scale, the ability of competitors to produce or otherwise procure animal health products at lower costs than us and the ability of competitors to access more or newer technology than us.

Disruptive innovation and advances in veterinary medical practices, animal health technologies and alternatives to animal-derived protein, could negatively affect the market for our products.

The markets for our products are regularly impacted by the introduction and/or broad market acceptance of newly-developed or alternative products that address the diseases and conditions for which we sell products, including “green” or “holistic” health products, specially bred disease-resistant animals or replacements for meat, milk, eggs or fish from alternative natural or synthetic sources. For example, the market for our companion animal therapeutics has been particularly affected by innovation in new molecules and delivery formulations in recent years. Technological breakthroughs by others may render obsolete our products and reduce or eliminate the market for our products. Introduction or acceptance of competing animal health products and innovation or disruptive protein alternatives could materially adversely affect our business, financial condition and results of operations.

Regulatory restrictions and bans on the use of antibiotics and productivity products in food animals, as well as changing market demand, may continue to negatively affect demand for certain of our food animal products.

Over the past few years, our operational results have been, and will continue to be, affected by regulations and changing market demand. In certain markets, including the U.S., sales of certain of our food animal products have been negatively affected by an increase in consumer sentiment for proteins and dairy products produced without the use of antibiotics or other products intended to increase animal production.

22

There are two classes of antibiotics used in animal health: shared-class, or medically important, antibiotics, which are used to treat infectious disease caused by pathogens that occur in both humans and animals; and animal-only antibiotics, which are used to treat infectious disease caused by pathogens that occur in animals only. See “Business of Elanco - Products - Antibiotics.” Concerns that the use of antibiotics in food animal production may lead to increased antibiotic resistance of human pathogens have resulted in increased regulation and changing market demand. In December 2013, the FDA announced final guidance establishing procedures for the voluntary phase-out in the U.S. over a three-year period of the use of shared-class antibiotics in animal feed or water for growth promotion in food animal production. The guidance allows for continued use of shared-class antibiotics in food-producing animals under the supervision of a veterinarian for treatment, control and, under certain circumstances, for prevention of disease. The FDA indicated that it took this action to help preserve the efficacy of shared-class antibiotics to treat infections in humans. As part of those efforts, stricter guidelines governing the administration of shared-class antibiotics have recently come into effect. As of January 1, 2017, under the FDA’s guidance and the related rule known as the Veterinary Feed Directive, the use of shared-class antibiotics in the water or feed of food-producing animals requires written authorization by a licensed veterinarian. In addition, other countries in which we sell or plan to sell our products, such as France and Vietnam, have passed restrictions or bans on antibiotic use. Other countries have placed restrictions or bans on the use of specific antibiotics in certain food-producing animals, regardless of the route of administration (in feed or injectable).