UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________________________________________________________

FORM

____________________________________________________________________________________________________

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to _____________________.

Commission file number:

____________________________________________________________________________________________________

WISeKey INTERNATIONAL HOLDING AG

(Exact name of Registrant as specified in its charter)

____________________________________________________________________________________________________

(Translation of Registrant's name into English)

____________________________________________________________________________________________________

(Jurisdiction of incorporation or organization)

CH-

(Address of principal executive offices) ____________________________________________________________________________________________________

Chief Financial Officer

WISeKey International Holding AG

CH-

Tel: +

Fax: +

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Herman H. Raspé, Esq.

Patterson Belknap Webb & Tyler LLP

1133 Avenue of the Americas

New York, New York 10036

Tel: (212) 336-2000

____________________________________________________________________________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbols | Name of each exchange and on which registered | ||

|

Class B Shares, par value CHF 2.50 per share* |

____________________

* Not for trading, but only in connection with the registration of the American Depositary Shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: Class A Shares and Class B Shares.

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or (15)(d) of the

Securities Exchange Act of 1934. Yes ☐

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the

preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "accelerated filer," "large accelerated filer" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ☐ | Accelerated Filer ☐ |

| ||

|

Emerging Growth Company |

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use

the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section

13(a) of the Exchange Act.

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 o

If this is an annual

report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

i

| Item 14. | Material Modifications to The Rights of Security Holders and Use of Proceeds | 163 | |

| Item 15. | Controls and Procedures | 163 | |

| Item 16. | [RESERVED] | 163 | |

| Item 16A. | Audit Committee Financial Expert | 163 | |

| Item 16B. | Code of Ethics | 163 | |

| Item 16C. | Principal Accounting Fees and Services | 163 | |

| Item 16D. | Exemptions from the Listing Standards for Audit Committees | 164 | |

| Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 164 | |

| Item 16F. | Change in Registrant's Certifying Accountant | 164 | |

| Item 16G. | Corporate Governance | 164 | |

| Item 16H. | Mine Safety Disclosure | 164 | |

| Item 16I. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 164 | |

| Item 16J. | Insider trading policies | 164 | |

| Item 16K. | Cybersecurity | 164 | |

| Item 17. | Financial Statements | 167 | |

| Item 18. | Financial Statements | 167 | |

| Item 19. | Exhibits | 167 | |

| Index to Exhibits | 167 | ||

| SIGNATURES | 171 | ||

ii

INTRODUCTION AND USE OF CERTAIN TERMS

We were formed in 2015 as a holding company to incorporate, acquire, hold, and dispose of interests in national and international entities, in particular entities active in the area of security technology and related areas. Our Class B Shares, as defined below, have been listed on the Swiss Exchange (SIX) since 2016 and our American Depositary Shares ("ADSs") have been listed on the Nasdaq Stock Market LLC under the symbol "WKEY" since December 4, 2019. The Bank of New York Mellon, acting as depositary, registers and delivers our ADSs, each of which represents one-half of one of our Class B Shares.

We have prepared this annual report using a number of conventions, which you should consider when reading the information contained herein. In this annual report, "we," "us," "our Company," "the Group," "WISeKey," "the WISeKey Group," "WISeKey International Holding Ltd", “WIHN”, and "our" shall refer to WISeKey International Holding AG and its subsidiaries, affiliates, and predecessor entities. Additionally, this annual report uses the following conventions:

| · | "CHF" and "Swiss francs" refer to the legal currency of Switzerland |

| · | "Class A Shares" and “WIHN Class A Shares” refer to our Class A Shares, par value CHF 0.25 per share |

| · | "Class B Shares" and “WIHN Class B Shares” refer to our Class B Shares, par value CHF 2.50 per share |

| · | "Code” refers to the U.S. Internal revenue Code of 1986, as amended |

| · | "IC” refers to integrated circuits |

| · | "IoT" refers to Internet of Things |

| · | “IRS” refers to the U.S. Internal Revenue Service |

| · | “Jobs Act” refers to the U.S. Jumpstart Our Business Startups Act of 2012 |

| · | "NASDAQ" refers to the Nasdaq Stock Market LLC |

| · | "PKI" refers to Public Key Infrastructure |

| · | "$," "US $," "USD" and "U.S. dollars" refer to the legal currency of the United States |

| · | “SaaS” refers to Software as a Service |

| · | "Sarbanes Oxley Act” refers to the U.S. Sarbanes-Oxley Act of 2002 |

| · | “SEC” refers to the U.S. Securities and Exchange Commission |

| · | “Securities Act” refers to the U.S. Securities Act of 1933, as amended |

| · | “Securities Exchange Act” and “Exchange Act” refers to the U.S. Securities and Exchange Act of 1934, as amended |

| · | "SIX" refers to the Swiss Exchange (SIX) |

| · | "Switzerland" refers to the Swiss Confederation |

3

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This annual report contains forward-looking statements. These forward-looking statements include information about possible or assumed future results of our operations or our performance. Some of these forward-looking statements can be identified by terms and phrases such as "anticipate," "should," "likely," "foresee," "forecast," "believe," "estimate," "expect," "intend," "continue," "could," "may," "plan," "project," "predict," "will," and similar expressions, as they relate to us, our management or third parties. Forward-looking statements include statements regarding our business strategy, financial performance, results of operations, market data, events or developments that we expect or anticipate will occur in the future, as well as any other statements which are not historical facts. Although we believe that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and contingencies, many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements appear in a number of places in this annual report and include, but are not limited to, statements contained in the sections entitled "Item 3. Key Information," "Item 4. Information on the Company" and "Item 5. Operating and Financial Review and Prospects".

These forward-looking statements include, but are not limited to, statements relating to:

| · | Our anticipated goals, growth strategies and profitability; |

| · | Future operating or financial results; |

| · | Our planned capital expenditure program for additional production lines to be added to our supply chain; |

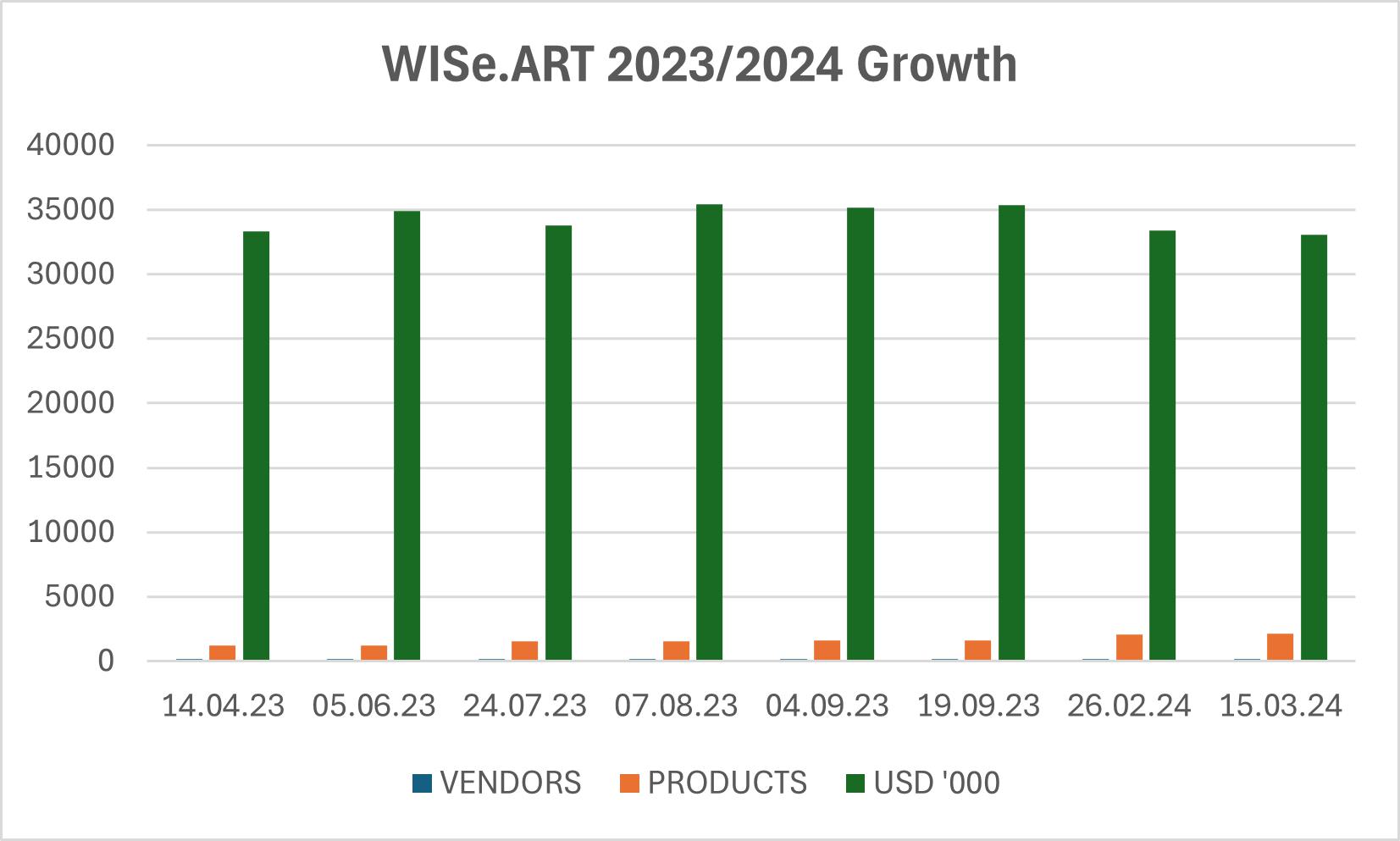

| · | Our intention to make investments in sales and marketing operations including R&D of new products, such as post-quantum cryptography, WISe.ART, and WISeSat.Space; |

| · | Our plans for global customer base expansion; |

| · | Our intention to establish a Design Center, OSAT and Personalization project; |

| · | Our expansion of the WISeSat.Space project; |

| · | Our expectation about the development of markets for the WISeSat.Space Low |

| · | Earth Orbit satellites; |

| · | Our development and tokenization of WISe.ART; |

| · | Our plan to evolve the WISeID platform to include Web 3.0 capabilities, such as Distributed Identity; |

| · | Our timeline related to the deployment of SEALCOIN; |

| · | Our anticipated pipe growth in 2024; |

| · | Our belief that the products resulting from our R&D will create additional opportunities for growth; |

| · | Our expectation about the development of the markets for WISeKey, including expanding the role of Metaverse, increase in cyber threats and growth of secure hardware market, growing demand for IoT solutions, increase in cybersecurity spending based on the recent regulations and legislations; |

| · | Our intent to invest heavily in the ongoing development of our products and technology; |

| · | Whether or not we are or will be a PFIC; |

| · | Assumptions underlying or related to any of the foregoing. |

4

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us and are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Those factors include, in addition to those set forth in "Item 3D. Risk Factors" and those included elsewhere in this report, among others, the following:

| · | The inability to realize estimated financial position, results of operations or cash flows; |

| · | The inherent uncertainty associated with financial projections and valuation techniques; |

| · | Our ability to anticipate market needs and opportunities; |

| · | Our ability to attract new customers and retain existing customer base; |

| · | Our ability to foster innovation, to develop new products and enhancements to our existing products; |

| · | The demand for our products or for the goods into which our products are incorporated; |

| · | Our expectation that order commitments and non-cancellable orders we received are properly executed; |

| · | The sufficiency of our cash and cash equivalents to meet our liquidity needs; |

| · | The impact of any supply chain disruption that we may experience; |

| · | Our dependency on the timely supply of equipment and materials from our third-party suppliers; |

| · | Our ability to protect our intellectual property rights; |

| · | Our ability to keep pace with technical advances in cryptography and semiconductor design; |

| · | Our ability to raise funds for investment by cash flow from operating activities, advance payments from a key customer, and grants and other available subsidies from funding agencies; |

| · | Our ability to reduce our cost structure and general and administrative costs; |

| · | Our ability to attract and retain qualified employees and key personnel; |

| · | Our ability to attract new customers and retain and expand within our existing customer base; |

| · | Our ability to foster innovation, to develop new products and enhancements to our existing products; |

| · | The potential impact of the COVID-19 pandemic, other pandemics or health emergencies affecting our clients’ ability and willingness to spend money in security applications and our supplier’s ability to source key components and material; |

| · | The future growth of the information technology and cybersecurity industry; |

| · | Risks relating to WISeKey’s ability to implement its growth strategies and its Group’s restructuring; |

| · | Our ability to achieve some or all of the expected benefits from the spin-off of SEALSQ Corp; |

| · | Our ability to successfully hire and retain qualified employees and key personnel; |

5

| · | Our ability to prevent security breaches and unauthorized access to confidential customer information; |

| · | Our ability to comply with modified or new laws and regulations relating to our industries; |

| · | The activities of our competitors and the introduction of competing products by our competitors; |

| · | Market demand and semiconductor industry conditions; |

| · | Our ability to successfully introduce new technologies and products; |

| · | Uncertain negative effect of the COVID-19 pandemic and its effect on the supply chain; |

| · | The cyclical nature of the semiconductor industry; |

| · | An economic downturn in the semiconductor industry; |

| · | Our ability to comply with U.S. and other applicable international laws and regulations; |

| · | Changes in our overall tax position as a result of changes in tax laws or tax rates, new or revised legislation, the outcome of tax audits or changes in international tax treaties which may impact our results of operations as well as our ability to accurately estimate tax credits, benefits, deductions and provisions and to realize deferred tax assets; |

| · | Fluctuations in the exchange rates between the U.S. dollar and the other major currencies we use for our operations; |

| · | Our ability to collect accounts receivable; |

| · | Changes in certain commodities used as raw material, which may affect our gross margin; |

| · | How long we will qualify as an emerging growth company or a foreign private issuer. |

Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement included in this annual report should not be construed as exhaustive. You should read this annual report, and each of the documents filed as exhibits to the annual report, completely, with this cautionary note in mind, and with the understanding that our actual future results may be materially different from what we expect.

6

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

| A. | RESERVED |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary of Risk Factors

Investing in our Class B Shares and ADSs may expose you to a number of risks, including risks relating to our business and industry, financial risks, legal risks, and risks relating to our Class B Shares and ADSs. The following summarizes part, but not all, of these risks. Please carefully consider all of the information discussed in Item 3. Key Information—D. Risk Factors and elsewhere in this annual report which contains a more thorough description of risks relating to investing in us.

| · | The semiconductor industry is highly cyclical and highly competitive. If we fail to introduce new technologies and products in a timely manner, this could adversely affect our business. |

| · | Significantly increased volatility and instability and unfavorable economic conditions may adversely affect our business. |

| · | The demand for our products depends to a significant degree on the demand for our customers’ end products. |

| · | The semiconductor industry is characterized by continued price erosion, especially after a product has been on the market. |

| · | Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition. |

| · | We face competition from companies that are larger and better known, and we may lack sufficient financial or other resources to maintain or improve our competitive position. |

| · | Our research and development efforts may not produce successful products or enhancements to our security solutions that result in significant revenue or other benefits in the near future, if at all. |

| · | We are dependent on the timely supply of equipment and materials from various sub-contractors and if any one of these suppliers fails to meet or delays their committed delivery schedules, we can suffer with lower or lost revenues. |

| · | Changes in regulations or citizen concerns regarding privacy and protection of citizen data, or any failure or appearance of failure to comply with such laws, could diminish the value of our services and cause us to lose customers and revenue. |

7

| · | If our security systems are breached, we may face civil liability, and public perception of our security measures could be diminished, either of which would negatively affect our ability to attract and retain customers. |

| · | Our business model consists in promoting trust and security, and it depends on trust in our brand. Negative media coverage could adversely affect our brand and any failure to maintain, protect, and enhance our brand would hurt our ability to retain or expand our customer base. |

| · | We depend on our customers’ ability to sell their products, which may pose challenges for our ability to forecast or optimize our inventory and sales. |

| · | We may need to discontinue products and services. During the ramp-down of such products and services, we may experience a negative impact on our sales. |

| · | We are a holding company with no direct cash generating operations and rely on our subsidiaries to provide us with funds necessary to pay dividends to shareholders. |

| · | We may not achieve some or all of the expected benefits from the partial Spin-Off of SEALSQ Corp, and failure to achieve such benefits may adversely affect our business. |

| · | We derive a significant amount of our revenues each year from a limited number of significant customers. |

| · | Claims, litigation, government investigations, and other proceedings may adversely affect our business and results of operations. |

| · | Employment laws in some of the countries in which we operate are relatively stringent. |

| · | A change in tax laws, treaties or regulations, or their interpretation, of any country in which we operate, including tax rules limiting the deductibility of interest expense, could result in a higher tax rate on our earnings, which could result in a significant negative impact on our earnings and cash flows from operations. |

| · | As a “foreign private issuer” (within the meaning of the U.S. Securities Act) we are entitled to claim exemptions from certain Nasdaq corporate governance standards, and, if we elected to rely on these exemptions, you may not have the same protections afforded to stockholders of companies that are subject to all of the Nasdaq corporate governance requirements. |

| · | We may lose our foreign private issuer status, which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur significant legal, accounting and other expenses. |

| · | We have never paid dividends on our share capital, and we do not anticipate paying cash dividends in the foreseeable future. |

Risks Related to Our Business and Industry

We are currently operating in a period of economic uncertainty and capital markets disruption, which has been significantly impacted by geopolitical instability due to the ongoing military conflict between Russia and Ukraine, and more recently, the Israel-Hamas war. Our business, financial condition and results of operations may be materially adversely affected by any negative impact on the global economy and capital markets resulting from the conflict in Ukraine or any other geopolitical tensions.

U.S. and global markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict between Russia and Ukraine.

8

In February 2022, a full-scale military invasion of Ukraine by Russian troops was reported. Although the length and impact of the ongoing military conflict is highly unpredictable, the conflict in Ukraine could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions. We are continuing to monitor the situation in Ukraine and globally and assessing its potential impact on our business. Additionally, Russia’s prior annexation of Crimea, recent recognition of two separatist republics in the Donetsk and Luhansk regions of Ukraine and subsequent military interventions in Ukraine have led to sanctions and other penalties being levied by the United States, the European Union and other countries against Russia, Belarus, the Crimea Region of Ukraine, the so-called Donetsk People’s Republic, and the so-called Luhansk People’s Republic, including agreement to remove certain Russian financial institutions from the Society for Worldwide Interbank Financial Telecommunication, or SWIFT, payment system, expansive ban on imports and exports of products to and from Russia and ban on exportation of U.S. denominated bank notes to Russia or persons located there. Additional potential sanctions and penalties have also been proposed and/or threatened. Russian military actions and the resulting sanctions could adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets.

Additionally, on October 7, 2023, Hamas, a U.S. designated terrorist organization, launched a series of coordinated attacks from the Gaza Strip onto Israel. On October 8, 2023, Israel formally declared war on Hamas, and the armed conflict is ongoing as of the date of this filing.

Although our operations have not experienced material and adverse impact on supply chain, cybersecurity or other aspects of our business from the ongoing conflict between Russia and Ukraine, or from the war between Israel and Hamas, nor from any associated event such as the Red Sea shipping crisis, there is no assurance that such conflicts and events would not develop or escalate in a way that could materially and adversely affect our business, financial condition, and results of operations in the future.

We face many risks associated with our international expansion, including geopolitical tensions, trade barriers, payment delays and currency failures.

We are continuing to expand our operations into additional international markets. The expansion into international markets may cause difficulties because of distance, as well as language and cultural differences. Other risks related to international operations include fluctuations in currency exchange rates, difficulties arising from staffing and managing foreign operations, legal and regulatory requirements of different countries, and overlapping or differing tax laws. Management cannot assure that it will be able to market and operate WISeKey’s services successfully in foreign markets, select appropriate markets to enter, open new offices efficiently or manage new offices profitably.

Offering our services in a new geographical area also poses geopolitical risks. For example, export and import of cryptographic technologies is subject to sanctions, and national import and export restrictions. Changes in these restrictions due to geopolitical tensions may significantly harm our business.

As a result of these obstacles, we may find it impossible or prohibitively expensive to enter additional markets, or our entry into foreign markets could be delayed, which could hinder our ability to grow our business.

Business practices in the global markets that we serve may differ and may require us to include non-standard terms in customer contracts, such as extended payment or warranty terms. To the extent that we enter into customer contracts that include non-standard terms related to payment, warranties or performance obligations, our results of operations may be adversely impacted.

Additionally, our global sales and operations are subject to a number of risks, including the following:

| · | difficulty in enforcing contracts and managing collections, as well as long collection periods; |

| · | costs of doing business globally, including costs incurred in maintaining office space, securing adequate staffing and localizing our contracts; |

| · | management communication and integration problems resulting from cultural and geographic dispersion; |

| · | risk of unexpected changes in regulatory practices, tariffs, tax laws and treaties; |

9

| · | compliance with anti-bribery laws; |

| · | heightened risk of unfair or corrupt business practices in certain geographies and of improper or fraudulent sales arrangements that may impact financial results, and give rise to restatements of, or irregularities in, financial statements; |

| · | social, economic and political instability, terrorist attacks and security concerns in general; |

| · | reduced or uncertain protection of intellectual property rights in some countries; and |

| · | potentially adverse tax consequences. |

These factors could harm our ability to generate future global revenues and, consequently, materially impact our business, results of operations and financial condition.

Global inflationary pressure may have an adverse impact on our gross margins and our business.

As of December 31, 2023, global inflationary pressure has not materially affected our gross margins and our business. Our suppliers, which are all based in Asia, have not been impacted by the price inflation for energy that Europe and other geographies have experienced, nor from some raw material price inflation which might impact other industries. For fiscal year 2024, we are likely to incur payroll cost increases for some of our employees in order to retain and hire engineers given the strong local demand for experienced software and hardware engineers. While we believe that these costs will be balanced by the US Dollar to Euro exchange rate evolution which has absorbed the extra costs caused by the salary increase, there is no assurance that this cost balance will continue. Accordingly, continued inflationary pressure may have an adverse impact on our gross margins and could have a material adverse effect on our business, financial condition, results of operations or cash flows.

The future growth of the information technology and cybersecurity industry is uncertain.

Information (including cybersecurity) technology companies are generally subject to the following risks: rapidly changing technologies; short product life cycles; fierce competition; aggressive pricing and narrow profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; and frequent new product introductions. Technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, especially those which are Internet related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance.

We depend on our ability to keep pace with technical advances in cryptography and semiconductor design.

WISeKey needs to keep pace with changing technologies in order to provide effective identification and authentication solutions. In addition, we need to continue adjacent and inorganic growth in order to broaden and strengthen the portfolio of products and stay ahead of the technology changes and risks in order to be successful.

WISeKey needs to anticipate, and quickly react to, rapid changes occurring in security and communications technologies and to the development of new and improved devices, services, semiconductors and software that result from these changes. WISeKey must also continue to move vertically up the value chain with its customers in order to secure future business and substantiate growth. If WISeKey is unable to respond quickly and cost-effectively to changing communications technologies, hardware and software technologies and evolving industry standards, the existing offering could become non-competitive and WISeKey may lose market share. WISeKey's success will depend, in part, on its ability to effectively use leading technologies critical to the business, enhance its existing solutions, find appropriate technology partners, and continue to develop new solutions and technology that address the increasingly sophisticated and varied needs of its current and prospective clients and their customers and its ability to influence and respond to technological advances, emerging industry and regulatory standards and practices and competitive service offerings. WISeKey's ability to remain technologically competitive may require substantial expenditures and lead-time and the integration of newly acquired technologies will also take time. If WISeKey is unable to adapt and integrate in a timely manner to changing market conditions or customer requirements, its business, financial condition and results of operations could be seriously harmed.

10

WISeKey faces intense competition from companies that are larger and better known than we are, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

The digital security market space in which we operate face intense competition, constant innovation and evolving security threats. There are several global security companies with strong presence in this market, including VeriSign, Inc., DigiCert Inc., Entrust Datacard, Let's Encrypt, Symantec Corporation, FireEye, Inc., Red Hat Software, VASCO Data Security International, Inc., Zix Corp, NXP Semiconductors, Infineon Technologies, STMicroelectronics and Samsung Electronics. As we integrate and move into the knowledge automation space there are also related data lake and automation companies with strong foundations including Palantir and Snowflake.

Some of our competitors are large companies that have the technical and financial resources and broad customer bases needed to bring competitive solutions to the market and already have existing relationships as a trusted vendor for other products. Such companies may use these advantages to offer products and services that are perceived to be as effective as ours at a lower price or for free as part of a larger product package or solely in consideration for maintenance and services fees. They may also develop different products to compete with our current security solutions and respond more quickly and effectively than we do to new or changing opportunities, technologies, standards or client requirements. Additionally, we may compete with smaller regional vendors that offer products with a more limited range of capabilities that purport to perform functions similar to our security solutions. Such companies may enjoy stronger sales and service capabilities in their particular regions.

WISeKey's competitors may have competitive advantages, such as:

| · | greater name recognition, a longer operating history and a larger customer base; |

| · | larger sales and marketing budgets and resources; |

| · | broader distribution and established relationships with distribution partners and customers; |

| · | greater customer care and support resources; |

| · | broader supply chains; |

| · | greater resources to make acquisitions; |

| · | larger intellectual property portfolios; and |

| · | greater financial, technical and other resources. |

Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources. Current or potential competitors may be acquired by third parties with access to greater available resources. As a result of such acquisitions, our current or potential competitors may be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their products and services, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their product and service offerings more quickly than we do. Larger competitors with more diverse product offerings may reduce the price of products that compete with ours in order to promote the sale of other products or may bundle them with other products, which would lead to increased pricing pressure on our products and could cause the average sales prices for our products to decline.

If WISeKey does not successfully anticipate market needs and enhance existing products or develop new products that meet those needs on a timely basis, WISeKey may not be able to compete effectively and WISeKey's ability to generate revenues will suffer.

Many of our customers operate in markets characterized by rapidly changing technologies and business plans, which require them to adapt to increasingly complex digital security infrastructures to protect internal and external corporate communications. As our customers' technologies and business plans grow more complex, we expect them to face new and increasingly sophisticated threats of security breach or counterfeiting. WISeKey faces significant challenges in ensuring that our security solutions effectively protect identities of individual customers, company information and their brands in addition to driving efficient operations through automated decision making. As a result, we must continually modify and improve our products in response to changes in our customers' technology infrastructures.

11

WISeKey may not be able to successfully anticipate or adapt to changing technology or customer requirements on a timely basis or at all. If we fail to keep up with technological changes or to convince our customers and potential customers of the value of our security and automation solutions even in light of new technologies and integration, our business, results of operations and financial condition could be materially and adversely affected.

WISeKey cannot guarantee that it will be able to anticipate future market needs and opportunities or be able to develop product enhancements or new products to meet such needs or opportunities in a timely manner, if at all. Even if we are able to anticipate, develop and commercially introduce enhancements and new products, there can be no assurance that enhancements or new products will achieve widespread market acceptance.

Our product enhancements or new products could fail to attain sufficient market acceptance for many reasons, including:

| · | delays in releasing product enhancements or new products; |

| · | failure to accurately predict market demand and to supply products that meet this demand in a timely fashion; |

| · | failure to accurately price products and solutions; |

| · | inability to interoperate effectively with the existing or newly introduced technologies, systems or applications of our existing and prospective customers; |

| · | defects in our products; |

| · | inability to integrate security and automation; |

| · | negative publicity about the performance or effectiveness of our products; |

| · | introduction or anticipated introduction of competing products by our competitors; and |

| · | installation, configuration or usage errors by our customers. |

If WISeKey fails to anticipate market requirements or fails to develop and introduce product enhancements or new products to meet those needs in a timely manner, that could cause us to lose existing customers and prevent us from gaining new customers, which would significantly harm our business, financial condition and results of operations.

The demand for our semiconductors products depends to a significant degree on the demand for our customers’ end products.

The vast majority of our IoT revenue is derived from sales to manufacturers in the IT infrastructure (Network Servers, Switch, Home boxes, PC Keyboards, etc.), utilities distribution edge infrastructure (Smart Meters) and Access Control modules. Demand in these markets fluctuates significantly, driven by consumer spending, consumer preferences, the development of new technologies and prevailing economic conditions. In addition, the specific products in which our semiconductors are incorporated may not be successful or may experience price erosion or other competitive factors that affect the price manufacturers are willing to pay us. Such customers have in the past, and may in the future, vary order levels significantly from period to period, request postponements to scheduled delivery dates, modify their orders or reduce lead times. This is particularly common during periods of low demand. This can make managing our business difficult, as it limits the predictability of future revenue. It can also affect the accuracy of our financial forecasts. Furthermore, developing industry trends, including customers’ use of outsourcing and new and revised supply chain models, may affect our revenue, costs and working capital requirements.

12

If customers do not purchase products made specifically for them, we may not be able to resell such products to other customers or may not be able to require the customers who have ordered these products to pay a cancellation fee. The foregoing risks could have a material adverse effect on our business, financial condition and results of operations.

Sometimes it will be necessary to make a product or product line obsolete and there may be negative impacts to sales or disruption to the customer base during the ramp down of that product.

All products have a natural lifecycle that includes the inevitable end-of-life (“EOL”) process. During the ramping down of a product, or product family, there are many ways that our business operations can be challenged. Last time buys are a typical way for customers to deal with the EOL of a product that is still critical to one of their end products. These kinds of orders show an increase in short term sales but result in the abrupt drop off of revenue from that customer, for that product, after the last time buy is delivered. Discontinuing a product also comes with the risk that we may lose that customer for good if we do not have a replacement for the product or if they decide to look at alternative suppliers because of the change in supply.

WISeKey is subject to a number of risks associated with global sales and operations.

Business practices in the global markets that we serve may differ and may require us to include non-standard terms in customer contracts, such as extended payment or warranty terms. To the extent that we enter into customer contracts that include non-standard terms related to payment, warranties or performance obligations, our results of operations may be adversely impacted.

Additionally, our global sales and operations are subject to a number of risks, including the following:

| · | difficulty in enforcing contracts and managing collections, as well as long collection periods; |

| · | costs of doing business globally, including costs incurred in maintaining office space, securing adequate staffing and localizing our contracts; |

| · | management communication and integration problems resulting from cultural and geographic dispersion; |

| · | risks associated with trade restrictions and foreign legal requirements; |

| · | risk of unexpected changes in regulatory practices, tariffs, tax laws and treaties; |

| · | compliance with anti-bribery laws; |

| · | heightened risk of unfair or corrupt business practices in certain geographies and of improper or fraudulent sales arrangements that may impact financial results and result in restatements of, or irregularities in, financial statements; |

| · | social, economic and political instability, terrorist attacks and security concerns in general; |

| · | reduced or uncertain protection of intellectual property rights in some countries; and |

| · | potentially adverse tax consequences. |

These factors could harm our ability to generate future global revenues and, consequently, materially impact our business, results of operations and financial condition.

Some of our larger opportunities depend on our customers’ ability to be awarded significant regional or national contracts in order to fulfill the volume predictions that were used in the pricing negotiations and forecasts.

The design of many industrial devices comes with the risk that the product may not see the demand that was expected in that market, or the high-volume contracts may be awarded to competing suppliers. Our customers may be bidding against several other suppliers to win a government contract and if they lose the bid, we will not see the results that were originally expected during the forecasting of the opportunity size and profitability.

13

The shift into knowledge automation and artificial intelligence is unknown and unproven on a global scale.

The automation market has been moving forward with Robotic Process Automation (“RPA”) for years and market demand for the next evolution of such technology remains unknown. Our potential customers need to accept to move forward from their current business process automation and RPA implementations in order for WISeKey to be successful. The ability for WISeKey to predict the market and conditions is yet to be proven and the customer reaction remains unknown. In addition, the complex implementation in this sphere requires focused delivery resources and clear plans with the customers. Customer input and knowledge is critical to the success of knowledge automation and therefore some of WISeKey’s potential success will be reliant on its customers’ belief in the WISeKey value proposition and their ability to support the implementation.

Our research and development efforts may not produce successful products or enhancements to our security solutions that result in significant revenue or other benefits in the near future, if at all.

Investing in research and development personnel, developing new products and enhancing existing products is expensive and time consuming, and there is no assurance that such activities will result in significant new marketable products or enhancements to our products, design improvements, cost savings, revenues or other expected benefits. If we spend significant time and effort on research and development and are unable to generate an adequate return on our investment, our business and results of operations may be adversely affected. This is expected to be exacerbated in the coming year with the required integration of newly acquired knowledge automation assets which is expected to result in a more complex research and development program.

Any decline in demand for our products from our clients could have a material adverse effect on the Company’s business, results of operations and financial condition.

Our business is at risk of our clients delaying or withdrawing purchase orders for items where we already committed to the production of these pieces. In these situations, and when sufficient notice is given, we are usually able to adjust our production schedules such that the production can be transferred to alternative clients thereby limiting our exposure. However, there can be a short-term impact upon the levels of stock that we hold at any given point in time. As our products have a lengthy development cycle, often being in the region of 18 to 24 months from design-win to delivering the first batch of finished goods, we are not susceptible to losing clients without a lengthy notice period, so there is a very limited risk that we find ourselves holding material amounts of stocks of finished goods that will not be eventually delivered to our clients. The greatest risk is that a client might reduce their production allocations with the Company and, in this instance, we would be required to adapt our purchase requirements accordingly. Most of our raw materials (in particular our wafers) can be redirected to alternative products and so the risk is limited to finished goods. In the event that a client was to significantly reduce demand with a limited lead-time and not place new orders for that product at a later stage, this could lead to some finished goods becoming obsolete, but this risk is considered remote by management. The main risk arising from a decline in demand for our products from one of our top ten clients is that we would need to find new sources of revenue to replace the departing clients.

If WISeKey is unable to attract new customers, our future revenues and operating results will be harmed.

Our success depends in large part on our ability to attract new customers. The number of customers that WISeKey adds in a given period impacts both our short-term and long-term revenues. If WISeKey is unable to successfully attract a sufficient number of new customers, we may be unable to generate revenue growth.

A large amount of investment in sales and marketing and support personnel is required to attract new customers. If we are unable to convince these potential new customers of a need for our products or if we are unable to persuade them of our products' efficacy, we may be unable to achieve growth and there may be a meaningful negative impact on future revenues and operating results.

14

If we experience software errors and non-compliance, this may affect our reputation and our financial results.

WISeKey's software applications are complex, the addition of newly acquired assets increases this complexity and there is a risk that defects or errors could arise, particularly where new versions or enhancements are released. Similarly, regulatory and industry requirements are continuously evolving and we may not be able to keep up with them. This could result in adverse consequences for us, such as lost revenue, a delay in market acceptance or customer claims.

If we experience security breaches, we could be exposed to liability and our reputation and business could suffer.

We operate sensitive public key infrastructure ("PKI") platforms, retain certain confidential customer information in our secure data centers and registration systems, and our digital certificates and electronic signatures may be used by customers in mission critical applications. It is critical to our business strategy that our facilities and infrastructure remain secure and are perceived by the marketplace to be secure. We may have to expend significant time and money to maintain or increase the security of our facilities and infrastructure. Despite our security measures, our infrastructure may be vulnerable to physical break-ins, computer viruses, attacks by hackers or similar disruptive problems. It is possible that we may have to expend additional financial and other resources to address such problems. In the event of a security breach, we could face significant liability, customers could be reluctant to use our services and we could be at risk for loss of various compliance certifications needed for the operation of our businesses.

WISeKey's reputation and business could be harmed based on real or perceived shortcomings, defects or vulnerabilities in our security solutions or the failure of our security solutions to meet customers' expectations.

Organizations are facing increasingly sophisticated digital security threats and threats of counterfeiting. If WISeKey fails to identify and respond to new and increasingly complex methods of counterfeiting products or hacking personal and corporate digital accounts, our business and reputation will suffer. In particular, WISeKey may suffer significant adverse publicity and reputational harm if any of our products fail to perform as advertised. An actual or perceived breach of our customers' sensitive business data, regardless of whether the breach is attributable to the failure of our products, could adversely affect the market's perception of the efficacy of our security solutions and current or potential customers may look to our competitors for alternatives to our security solutions. Similarly, an actual or perceived failure of our products to prevent counterfeit products from being detected, regardless of whether such failure is attributable to our products, could adversely affect the market's perception of the efficacy of our authentication solutions and could encourage current or potential customers to look to our competitors for an alternative to our products. The failure of our products may also subject us to product liability lawsuits and financial losses stemming from indemnification of our partners and other third parties, as well as the expenditure of significant financial resources to analyze, correct or eliminate any vulnerability. It could also cause us to suffer reputational harm, lose existing customers or deter them from purchasing additional products and services and prevent new customers from purchasing our security solutions.

We depend on highly skilled key personnel to operate our business, and if we are unable to attract, retain, and motivate qualified personnel, our business could be harmed.

We believe that our future success is highly dependent on the talents and contributions of our senior management, including Carlos Moreira, founder and Chief Executive Officer of WISeKey, members of our executive team, and other key employees, such as key engineering, finance, research and development, marketing, and sales personnel. Our future success depends on our continuing ability to attract, develop, motivate, and retain highly qualified and skilled employees. All of our employees, including our senior management, are free to terminate their employment relationship with us at any time, and their knowledge of our business and industry may be difficult to replace.

Furthermore, our performance depends on favorable labor relations with our employees and compliance with labor laws in the countries where we have employees and plans to hire new employees. Any deterioration of current relations or increase in labor costs due to our compliance with labor laws could adversely affect our business.

15

Qualified individuals are in high demand, particularly in the digital industry, and we may incur significant costs to attract them. If we are unable to attract and retain our senior management and key employees, we may not be able to achieve our strategic objectives, and our business could be harmed. In addition, we believe that our senior management have developed highly successful and effective working relationships. We cannot ensure that we will be able to retain the services of any members of our senior management or other key employees. If one or more of these individuals leave, we may not be able to fully integrate new senior management or replicate the current dynamic and working relationships that have developed among our senior management and other key personnel, and our operations could suffer.

The tight global labor market has created an incredibly intense hiring environment. Since we require a highly skilled workforce in order to successfully compete in an increasingly competitive cybersecurity market, we have experienced and may continue to experience difficulty in hiring, high employee turnover, and considerable costs and productivity as well as time to market losses. In addition, to the extent we hire personnel from competitors, we may be subject to allegations that they have been improperly solicited or have divulged proprietary or other confidential information. Further, the training and integration of new employees requires allocation of a significant amount of internal resources and, even if we make this investment, there is no guarantee that existing or new personnel will remain or become productive members of our team. Our inability to attract or retain qualified personnel, or delays in hiring required personnel, particularly in sales & marketing and research & development, may seriously harm our business, financial condition and results of operations.

Dependence on key personnel and loss of such key personnel may have a negative impact on the operations and profitability of WISeKey.

Our future success depends in part on the continued service of our key personnel, particularly, the members of our senior management. We have employment agreements with our key personnel, but these do not prevent such personnel from choosing to leave the Company.

One of the cryptographic rootkeys used by WISeKey is owned by the Organisation Internationale pour la Sécurité des Transactions Electroniques OISTE. The Organisation Internationale pour la Sécurité des Transactions Electroniques OISTE has granted us a perpetual license to exclusively use the cryptographic rootkey. A termination of the license agreement would present a threat to WISeKey's existing business model.

The cryptographic rootkey used by WISeKey is owned by the Organisation Internationale pour la Sécurité des Transactions Electroniques OISTE ("OISTE") acting as a trusted third party and not-for-profit entity in charge of ensuring that the Root of Trust (the "RoT") remains neutral and trusted. The name of the RoT is OISTE/WISeKey, as shown in all major current browsers that embed the rootkey. A member of the two-member foundation board of OISTE is a WISeKey board member. Members of the foundation board of OISTE are appointed by a policy authorizing authority (the "Policy Authorizing Authority" or "PAA"), whose members are international organizations, governments and large corporations that use the OISTE/WISeKey RoT. OISTE has granted us a perpetual license to exclusively use the cryptographic rootkey and develop technologies and processes based on OISTE's trust model. The perpetual license agreement can only be terminated under limited circumstances, including if WISeKey were to move from the trust model developed by OISTE and/or changing the location of the RoT from Switzerland to another country. A termination of the license agreement would present a threat to WISeKey's current trust model.

Services offered by our PKI business rely on the continued integrity of public key cryptography technology and algorithms that may be compromised or proven obsolete over time.

Our services and products are relying heavily on cryptography, in particular, services offered by our PKI business are based on public key cryptography technology. With public key cryptography technology, a user possesses a public key and a private key, both of which are required to perform encryption and decryption operations. The security afforded by this technology depends on the integrity of a user's private key and ensuring that it is not lost, stolen or otherwise compromised. Advances in attacks on cryptographic algorithms and technology may weaken their effectiveness, and significant new technology requirements may be imposed by root distribution programs that require us to make significant modifications to our systems or to reissue digital certificates to some or all of our customers, which could damage our reputation or otherwise harm our business. Severe attacks on public key cryptography could render PKI services in general obsolete or unmarketable.

16

Quantum computing may threaten the resilience of current cryptography against attacks during the current lifespan of hardware. This is certainly the case for our secure modules embedded in larger systems and/or deployed on remote locations, such as for smart meter and satellite deployments.

WISeKey cannot guarantee that its services and products will still offer sufficient protection against attacks executed with quantum computers.

We are dependent on the timely supply of equipment and materials from various sub-contractors and if any one of these suppliers fails to meet, or delays, their committed delivery schedules due to supply chain disruptions or other reasons, we can suffer with lower or lost revenues.

We use various suppliers for silicon manufacturing and testing our parts. Any one of these suppliers could not meet their commitments for on-time delivery of our products. The market supply of such products has seen and continues to see difficulties in meeting demand and these kinds of supply disruptions can happen due to global shortages of silicon wafers or chemicals used in the processing of the silicon packaging, or shortages in the labor force due to unrest or sicknesses. During the latter half of 2021 and 2022, we had to manage our delivery schedule carefully as a result of the global shortage of semiconductors material. During this period, the Company was receiving greater volumes of orders than it was capable of delivering due to such shortages, so we had to program the orders based upon the allocations of materials and production capacity available to us. While we were able to grow our revenue during this time though careful negotiation with our suppliers, we believe that our revenues would have been higher had there not been such supply disruption. Further, our business and operating conditions can be at risk if we cannot deliver on our product demand as committed in our customer contracts. The global shortage was alleviated in 2023 meaning that the same constraints were no longer applicable during that year and currently, we do not have issues around supply allocations.

Failure of our third-party suppliers to handle increased volume for their services could impact our ability to take advantage of upside business opportunities.

We outsource several critical functions in our supply chain to third-party suppliers such as the manufacture of our semiconductors. They all have a number of risks that are present in their businesses that could limit their ability to meet increased demands if we see increased orders from our customers. If our suppliers cannot satisfy our demand, we may not be able to meet our customer demands. Also, if our suppliers add higher costs to cover their increased volume, we may see drops in our gross profit margins. Many of these costs are not fixed, even though there may be contracts in place, and may be at the discretion of the third-party vendor.

If WISeKey does not include post-quantum crypto libraries in its semiconductors, WISeKey may fail to offer its customers sufficient protection against attacks executed with quantum computers.

Quantum computing may threaten the resilience of current cryptography against attacks during the current lifespan of hardware, especially in case our secure modules are embedded in larger systems and/or deployed on remote locations, such as smart meters and satellite deployments. WISeKey cannot guarantee that its secure modules will still offer sufficient protection against attacks executed with quantum computers. To mitigate this risk, WISeKey has launched an R&D program for assessing the portability and resistance of 2 of the algorithms shortlisted by the National Institute of Standards & Technology (NIST) as part of its post-quantum algorithms selection contest. This program is carried in partnership with l’Ecole des Mines (a very prestigious French engineering university).

If WISeKey does not respond to the trend of embedding secure modules on central processing units, WISeKey may lose the market of separate secure module chips.

The processor industry is rapidly changing with ARM-based processors that extend central processing units with ancillary functions such as graphics processing, neural processing and secure modules. WISeKey cannot guarantee that its secure modules will still be needed as separate tamper-proof chip. To mitigate this risk, WISeKey has launched an R&D program for building a “secure enclave”, which will complement its secure modules offer.

17

The semiconductor industry is highly cyclical.

Historically, the relationship between supply and demand in the semiconductor industry has caused a high degree of cyclicality in the semiconductor market. Semiconductor supply is partly driven by manufacturing capacity, which in the past has demonstrated alternating periods of substantial capacity additions and periods in which no or limited capacity was added. As a general matter, semiconductor companies are more likely to add capacity in periods when current or expected future demand is strong and margins are, or are expected to be, high. Investments in new capacity can result in overcapacity, which can lead to a reduction in prices and margins. In response, companies typically limit further capacity additions, eventually causing the market to be relatively undersupplied. In addition, demand for semiconductors varies, which can exacerbate the effect of supply fluctuations. As a result of this cyclicality, the semiconductor industry has, in the past, experienced significant downturns, such as in 1997/1998, 2001/2002 and in 2008/2009, often in connection with, or in anticipation of, maturing life cycles of semiconductor companies’ products and declines in general economic conditions. These downturns have been characterized by diminishing demand for end-user products, high inventory levels, under-utilization of manufacturing capacity and accelerated erosion of average selling prices. The foregoing risks have historically had, and may continue to have, a material adverse effect on our business, financial condition and results of operations.

Significantly increased volatility and instability, and unfavorable economic conditions may adversely affect our semiconductor business.

It is difficult for us, our semiconductor customers and suppliers to forecast demand trends. We may be unable to accurately predict the extent or duration of cycles or their effect on our financial condition or result of operations, and can give no assurance as to the timing, extent or duration of the current or future semiconductor business cycles generally, or specific to the markets in which we participate. In the event of a future decline in global economic conditions, our business, financial condition and results of operations could be materially adversely affected, and the resulting economic decline might disproportionately affect the markets in which we participate, further exacerbating a decline in our results of operations. The COVID-19 global pandemic, for example, created a period of significant instability in the global economy, including amongst our semiconductor clients and suppliers. The restrictions imposed upon people and businesses around the world served, in the short run, to reduce demand for our semiconductor products as many companies reduced or paused their operations. While this has since served to benefit WISeKey through the increased demand for IT network infrastructure amongst other examples, this may not always be the situation.

The semiconductor industry is highly competitive. If we fail to introduce new technologies and products in a timely manner, this could adversely affect our business.

The semiconductor industry is highly competitive and characterized by constant and rapid technological change, short product lifecycles, significant price erosion and evolving standards. Accordingly, the success of our IoT segment business depends to a significant extent on our ability to develop new technologies and products that are ultimately successful in the market. The costs related to the research and development necessary to develop new technologies and products are significant and any reduction of our research and development budget could harm our competitiveness. Meeting evolving industry requirements and introducing new products to the market in a timely manner and at prices that are acceptable to our customers are significant factors in determining our competitiveness and success. Commitments to develop new products must be made well in advance of any resulting sales, and technologies and standards may change during development, potentially rendering our products outdated or noncompetitive before their introduction. If we are unable to successfully develop new products, our revenue may decline substantially. Moreover, some of our competitors are well-established entities, are larger than us and have greater resources than we do. If these competitors increase the resources they devote to developing and marketing their products, we may not be able to compete effectively. Any consolidation among our competitors could enhance their product offerings and financial resources, further strengthening their competitive position. In addition, some of our competitors operate in narrow business areas relative to us, allowing them to concentrate their research and development efforts directly on products and services for those areas, which may give them a competitive advantage. As a result of these competitive pressures, we may face declining sales volumes or lower prevailing prices for our products, and we may not be able to reduce our total costs in line with this declining revenue. If any of these risks materialize, they could have a material adverse effect on our business, financial condition and results of operations.

18

The demand for our semiconductor products depends to a significant degree on the demand for our customers’ end products.

The vast majority of our IoT segment revenue is derived from sales to manufacturers in the IT infrastructure (Network Servers, Switch, Home boxes, PC Keyboards, etc.), utilities distribution edge infrastructure (Smart Meters) and Access Control modules. Demand in these markets fluctuates significantly, driven by consumer spending, consumer preferences, the development of new technologies and prevailing economic conditions. In addition, the specific products in which our semiconductors are incorporated may not be successful or may experience price erosion or other competitive factors that affect the price manufacturers are willing to pay us. Such customers have in the past, and may in the future, vary order levels significantly from period to period, request postponements to scheduled delivery dates, modify their orders or reduce lead times. This is particularly common during periods of low demand. This can make managing our semiconductor business difficult, as it limits the predictability of future revenue. It can also affect the accuracy of our financial forecasts. Furthermore, developing industry trends, including customers’ use of outsourcing and new and revised supply chain models, may affect our revenue, costs and working capital requirements.

If semiconductor customers do not purchase products made specifically for them, we may not be able to resell such products to other customers or may not be able to require the customers who have ordered these products to pay a cancellation fee. The foregoing risks could have a material adverse effect on our business, financial condition and results of operations.

The semiconductor industry is characterized by continued price erosion, especially after a product has been on the market.

One of the results of the rapid innovation in the semiconductor industry is that pricing pressure, especially on products containing older technology, can be intense. Product life cycles are relatively short and, as a result, products tend to be replaced by more technologically advanced substitutes on a regular basis.

In turn, demand for older technology falls, causing the price at which such products can be sold to drop, in some cases precipitously. In order to continue profitably supplying these products, we must reduce our production costs in line with the lower revenue we can expect to generate per unit. Usually, this must be accomplished through improvements in process technology and production efficiencies. If we cannot advance our process technologies or improve our production efficiencies to a degree sufficient to maintain required margins, we will no longer be able to make a profit from the sale of these products. Moreover, we may not be able to cease production of such products, either due to contractual obligations or for customer relationship reasons, and as a result may be required to bear a loss on such products. We cannot guarantee that competition in our core product markets will not lead to price erosion, lower revenue or lower margins in the future. Should reductions in our manufacturing costs fail to keep pace with reductions in market prices for the products we sell, this could have a material adverse effect on our business, financial condition and results of operations.

Our ability to forecast our future results of operations and plan for and model future growth is limited and subject to a number of uncertainties due to recent changes in our context as well as in our own sales organization and go-to-market strategies.

Even though our heritage started before 2000, much of our business has changed in recent periods. Macro changes impacting our market, particularly the digital transformation induced by the Covid pandemic, competitors suffering supply chain shortages, and the increased use of Internet of Things (IoT) resulted in growing demand for our products.

To address this demand, we made substantial investments in our sales force. Additionally, we have also recently begun to focus on building relationships with potential distribution partners, to utilize their sales force resources to reach new customers. As a result of these recent changes in our market, sales organization and go-to-market strategies, and with our limited operating history, our ability to forecast our future results of operations and plan for and model future growth is limited and subject to a number of uncertainties.

We have encountered and will continue to encounter risks and uncertainties in developing markets. If our assumptions regarding these risks and uncertainties are incorrect or change in response to developments in the security market, our results of operations and financial results could differ materially from our plans and forecasts. If we are unable to achieve our key objectives, our business and results of operations will be adversely affected, and the fair market value of our common stock could decline.

Our growth prospects and revenue will be adversely affected if our efforts to attract prospective customers and to retain existing customers are not successful.

Our ability to grow our business and generate revenue depends on retaining and expanding our total customer base and increasing services revenue by effectively monetizing value added. We must convince prospective customers of the benefits of our solutions and our existing customers of the continuing value of our solutions. Our ability to attract new customers, retain existing customers, and reach out to new markets depends in large part on our ability to continue to offer leading technologies and products, superior security and trust, and integration capabilities. For instance, in our IoT segment, some of our semiconductor competitors, including Infineon, Microchip, NXP and STMicroelectronics, have developed, and are continuing to develop, secure elements, which puts us at a significant competitive disadvantage.

19

Additionally, management expects 2024 to be a transition year where the focus of customer demand will shift to the next generation of products, which is likely to impair WISeKey’s growth in its core business relating to our existing solutions. Our continued growth is therefore heavily dependent upon the successful attraction of prospective customers in new markets, both geographic and product, such as with secure transport of goods through the global, real-time tracking and tracing capabilities in conjunction with WISeSat.

Failure to protect our intellectual property could substantially harm our business, operating results, and financial condition.

The success of our business depends on our ability to protect and enforce our patents, trade secrets, trademarks, copyrights, and all of our other intellectual property rights, including the silicon intellectual property rights of our semiconductors.

We attempt to protect our intellectual property under patent, trade secret, trademark, and copyright law through a combination of employee, third-party assignment and nondisclosure agreements, other contractual restrictions, technological measures, and other methods. These afford only limited protection and we are still early in the process of securing our intellectual property rights. Despite our efforts to protect our intellectual property rights and trade secrets, unauthorized parties may attempt to copy aspects of our technology, or obtain and use our trade secrets and other confidential information. Moreover, policing our intellectual property rights is difficult and time consuming. We cannot assure you that we would have adequate resources to protect and police our intellectual property rights, and we cannot assure you that the steps we take to do so will always be effective.