UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

c/o Cambium Networks, Inc. |

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

The aggregate market value of the ordinary shares held by non-affiliates on June 30, 2022 (the last business day of the registrant’s most recently completed second fiscal quarter), based on the last sale price of the common shares on that date of $14.65 was $

As of February 23, 2023 there were

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

|

|

Page |

PART I |

|

|

Item 1. |

4 |

|

Item 1A. |

14 |

|

Item 1B. |

38 |

|

Item 2. |

39 |

|

Item 3. |

39 |

|

Item 4. |

39 |

|

|

|

|

PART II |

|

|

Item 5. |

40 |

|

Item 6. |

41 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

42 |

Item 7A. |

52 |

|

Item 8. |

53 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

53 |

Item 9A. |

53 |

|

Item 9B. |

53 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspection |

53 |

|

|

|

PART III |

|

|

Item 10. |

54 |

|

Item 11. |

54 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

54 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

54 |

Item 14. |

54 |

|

|

|

|

PART IV |

|

|

Item 15. |

55 |

|

Item 16 |

55 |

i

Note regarding forward-looking statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws. All statements other than statements of historical fact contained in this Annual Report on Form 10-K, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, forward-looking statements may be identified by terms such as “may,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Annual Report on Form 10-K are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this report and are subject to a number of risks, uncertainties and assumptions described in Item 1A, “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, they should not be relied upon as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Annual Report on Form 10-K.

1

Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events or otherwise.

Summary Risk Factors

The following is a summary of the principal risks described below in Part I, Item 1A “Risk Factors” in this Annual Report on Form 10-K. We believe that the risks described in the “Risk Factors” section are material to investors, but other factors not presently known to us or that we currently believe are immaterial may also adversely affect us. The following summary should not be considered an exhaustive summary of the material risks facing us, and it should be read in conjunction with the “Risk Factors” section and the other information contained in this Annual Report on Form 10-K.

2

Trademarks and Service Marks

“Cambium”, “Cambium Networks”, “cnPilot”, “cnMaestro”, ‘cnMedusa”, “cnArcher”, “cnReach”, “cnHeat”, “cnRanger”, “cnWave”, “cnVision”, “LinkPlanner”, “Xirrus”, "Canopy" and "cnMatrix", the Cambium and Xirrus logos and other trademarks or service marks of Cambium Networks, Ltd. appearing in this Annual Report are the property of Cambium Networks Corporation. This Annual Report contains additional trade names, trademarks and service marks, which are the property of their respective owners.

3

PART I

Item 1. Business.

Business Overview

What we do

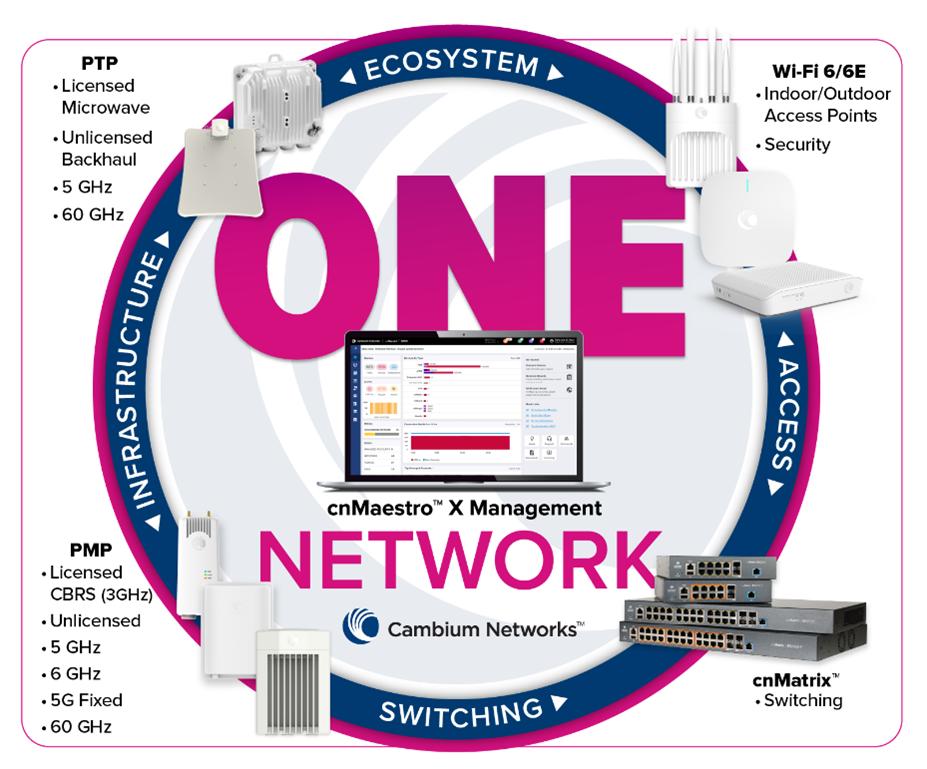

Cambium Networks is a global technology company that designs, develops, and manufactures wireless broadband and Wi-Fi networking infrastructure solutions for a wide range of applications, including broadband access, wireless backhaul, Industrial Internet of Things (IIoT), public safety communications and Wi-Fi access. Our products are used by businesses, governments, and service providers to build, expand and upgrade broadband networks. Our product lines fall into three broad, interrelated categories: Fixed Wireless Broadband (FWB), Enterprise networking, and Subscription and Services. The FWB portfolio spans point-to-point (PTP) and point-to-multi-point (PMP) architectures over multiple standards, including IEEE 802.11 and 3GPP (Third Generation Partnership Program), and frequency bands, including licensed, unlicensed and lightly licensed spectrum. The Enterprise portfolio includes Wi-Fi access points, wireless aware switches, and other networking devices.

The Subscription and Services portfolio includes network planning and design as well as cloud or on-premises network management and control. The latter capability, delivered through subscription to cnMaestro™ X, forms the foundation of our ONE Network, a cloud-based network management architecture that allows users to remotely configure, monitor, and manage their wireless network. It provides a single, centralized view of all network devices, including both FWB and Enterprise, as well as real-time performance and usage data, and allows users to make changes to the network configuration and settings. Advanced services offered in conjunction with this platform include application visibility and control which is used to optimize end user experiences; integrated security gateway and SD-WAN for small and medium business; and automated and intelligent network optimization.

Our strategy

Our strategy is to enable our customers to build broadband and internet access networks that deliver exceptional digital experiences at an affordable total cost of ownership. The foundation of our strategy is the Cambium ONE Network which brings integration and automation to our entire portfolio. It removes a great deal of complexity, making it easier to plan, deploy and operate a broadband network from core to edge, using a wide range of wireless technologies, standards, and radio frequency (RF) spectrum.

Our software and other tools enable network services that address a primary operating cost and constraint to growth faced by most network operators. Our approach is to simplify and automate the design, deployment, optimization, and management of broadband and Wi-Fi access networks through intelligent automation. For example, the policy-based automation feature on our cnMatrix switches enables the establishment of policies for each end-point device type and then automatically propagates those policies across all switch ports in the network, regardless of the actual port each device is plugged into.

Managing operating expenses, such as energy consumption, is increasingly of importance to network operators. Our solutions can aid in the reduction of energy consumption costs by requiring fewer devices to operate the network to achieve a given coverage and capacity. Our portfolio does not have the overhead required for mobile infrastructure that can contribute to energy consumption. For example, where electricity is unreliable or not available, our purpose-built FWB products have been successfully deployed using only solar and battery power.

In our product development we strive to minimize capital outlays required by end users of our products. First, we innovate on top of industry standard technologies to optimize the performance per dollar invested in the network. Second, our software-defined radios, with their ease of remote configuration via cnMaestro, together with our commitment to backward compatibility, extends the life of our products, while also minimizing truck-rolls otherwise needed by the end user to configure and install new products.

Increasingly, performance and cost are important metrics for most network operators. A key differentiation between network products and services providers for most network operators will be the availability of integrated services layered on top of the network. We enable our end users to customize networks with bespoke or third-party services provided by or enabled by us.

Meeting new trends

The post-COVID era has redefined the workspace in the midst of a rebalancing between the enterprise and home. Businesses and individuals both expect seamless, secure communication and connectivity, whether from the conference room or the living room. The number of applications and devices on the network - from gaming, streaming media, and home automation, to enterprise applications running in the cloud, as well as applications that enhance automation and security, will continue to increase on a global basis. Some applications need more bandwidth. Other applications need lower latency.

As a result of continuing of labor shortages across industries, businesses are leveraging IIoT devices in digital transformation initiatives. Increasingly, wireless broadband is being chosen over fiber or CAT5 to economically connect security cameras. Simultaneously, networking technologies and standards continue to iterate, providing new capabilities and choice points for network

4

operators. The result is a network edge that has evolved from a static connection to a highly complex, constantly evolving platform supporting a growing array of services.

Our FWB and Wi-Fi access, switching technologies, and software are designed to be cost-efficient and deliver high-quality digital experiences and device connectivity around the world. Our goal is to enable edge-of-the-network intelligence and the ability to adapt and respond to change. We are building and enabling a suite of services, deployed at scale with minimal human intervention, that will enable the network to be dynamic.

Expanding our addressable markets

Today, fierce competition to provide broadband access in rural, suburban, and urban markets is driving down subscription prices while simultaneously driving up performance requirements. We expect to respond to growing trends such as the following:

5

Our technology and products

Our ONE Network strategy takes advantage of advances in wireless standards, software defined radios and open Application Programming Interfaces (APIs) to enable the centralized management of a range of network technologies. Our products and services enable network operators to build a platform using heterogeneous wireless technologies without requiring a separate management platform for each one. Our addition of intelligent automation improves operational performance and efficiency in networks that include our products’ ability to optimize the network at the application layer, enabling our products to enhance network performance.

Point-to-Point (PTP) fixed wireless backhaul

Our PTP solutions are typically connected to high-speed, high-bandwidth wireline or fiber networks, and provide wireless broadband backhaul to a facility, a networked device, or to a PMP access point. Our PTP solutions can be deployed throughout a network over distances of more than 100 kilometers and provide speeds greater than 5 Gbps.

We offer PTP solutions that are designed to operate in unlicensed spectrum from 220 MHz to 5.9 GHz and 57 to 66 GHz, and in licensed spectrum from 6-38 and 71-86 GHz. In addition, our PTP 700 operates in NATO Band IV from 4.4-5.9 GHz, as well as in the 7 GHz and 8 GHz bands, and meets stringent federal operating, performance, and security standards. The mainstay of our backhaul offering is the PTP 670 for commercial applications and PTP 700 for defense and national security applications. In addition, our PTP 820 and 850 series offers carrier-grade microwave backhaul in licensed spectrum, and our PTP 550 offers price-performance leadership in spectral efficiency in sub-6 GHz unlicensed spectrum.

In addition to dedicated point-to-point platforms, as technology has evolved, solutions have developed that while principally supporting point-to-multi-point architectures, also support point-to-point applications, including the recently introduced 60 GHz cnWave V3000 and the ePMP Force 425. Revenues from these products are included in the PMP product category in our revenues by product category reporting, as that is their primary application.

Point-to-Multipoint (PMP) fixed wireless

Our PMP solutions extend wireless broadband access from tower mounted FWB access points to customer premise equipment (CPE) providing broadband access to residences and enterprises covering wide areas with a range of 10 to 30 kilometers. Our PMP solutions are increasingly used to backhaul video surveillance systems and public Wi-Fi.

Our PMP portfolio ranges from our PMP 450 series to our ePMP solutions for network operators that need to optimize for both price and performance to our cnReach family of narrow-bandwidth connectivity products for industrial communications. The PMP 450 series is optimized for performance in high-density and demanding physical environments, and includes the PMP 450m with integrated cnMedusa massive multi-user multiple input/multiple output, or MU-MIMO, technology. The PMP 450 product line also supports the FCC’s Citizen Broadband Radio Service, or CBRS. The FCC completed the auction of CBRS Priority Access Licenses, or PAL, in the third quarter of 2020, complementing the existing availability of General Authorized Access, or GAA, licenses. Network operators are adopting the PMP 450 solution to exercise both PAL and GAA licenses.

6

For less demanding environments, ePMP provides a high-quality platform at a more affordable price. The ePMP 3000 supports 4x4 MU-MIMO and is complemented by a broad portfolio of ePMP Force 300 subscriber radios. In December 2022, we commenced commercial shipment of the ePMP 4600 series, which utilizes the 6 GHz band, expected to be commercially released by the FCC and other regulatory bodies around the world in 2023.

cnRanger, our Fixed LTE solution, operated in the 2 GHz (Bands 38, 40, 41) and 3 GHz (Bands 42, 43, 48). Like the PMP 450 platform, the 3 GHz cnRanger solution supports the CBRS service, while the 2 GHz bands support the FCC’s Educational Broadband Service, or EBS, classification.

Our cnReach IIoT solutions offer connectivity for distributed sensors and controls across industrial deployments, delivering real-time monitoring, measurement and analytics to optimize system performance. Our products can be deployed in a variety of industrial verticals such as oil and gas, electrical utilities, water management, rail and transportation operations and smart cities. cnReach focuses on SCADA systems for process control and monitoring, providing affordable, narrowband wireless connectivity, operating below 1 GHz, to support distribution automation, substation switches, circuit control and telemetry.

In the fourth quarter of 2020, we began shipping our 60 GHz solution, cnWave, which enables Gbps networking using the 60 GHz band and a distributed architecture that enables scaled networks with dynamic routing for reliability and resiliency.

In 2022, we commenced commercial shipments of 28 GHz cnWave 5G Fixed, which operates in the 3GPP n257 (26.50 – 29.50 GHz), n258 (24.25 – 27.50 GHz), and n261 (27.50 – 28.35 GHz) bands. The platform incorporates both uplink and downlink MU-MIMO to optimize data rate to the CPE for residential and enterprise customers.

Enterprise solutions

Our Enterprise portfolio includes our cloud-managed Wi-Fi solutions, our cnMatrix cloud-managed wireless-aware switching solution, our Xirrus Wi-Fi solutions, and our Wi-Fi 6 portfolio of Wi-Fi 6 access points which support both cnMaestro and Xirrus XMS management.

Our enterprise-grade Wi-Fi 6/6E solutions provide distributed access to individual users or devices in indoor settings, such as office complexes, and outdoor settings, such as private spaces and outdoor public Wi-Fi hotspots, over distances from two meters to 1 kilometer with high capacity. Our Wi-Fi access point portfolio includes solutions enterprise, government, education, small business and home applications and offers a range of Wi-Fi access points and RF technology that enable network optimization based on desired geographic coverage and user density.

In June 2020, we introduced our first Wi-Fi 6 access point, the XV3-8, which supports both cnPilot and Xirrus solutions. In 2021 and 2022 we continued to extend our Wi-Fi 6/6E portfolio, including the addition of the XE5-8, a five-radio Wi-Fi 6/6E 8×8/4×4 access point (AP) designed to deliver high-density, future-proof performance for building next generation wireless networks. With five user servicing radios, the XE5-8 delivers the highest density Wi-Fi 6 solution in the industry. Wi-Fi 6E support extends the capacity of Wi-Fi into the 6 GHz band, more than tripling the wireless spectrum available. In 2022, we also introduced the XV2-22H Wi-Fi 6 Wall Plate Access Point. The XV2-22H indoor Wi-Fi 6 AP offers 2.97 Gbps of bandwidth and an integrated switch. Ideal for hospitality, MDU, education, and small/medium business applications.

The following table shows a summary of our product portfolio:

Cambium Networks Product Portfolio Summary |

||||||||||||||

Network Management |

|

cnMaestro X - Cloud-Based Management Software |

||||||||||||

Network Services |

|

QoE and NSE 3000 Advance Services Platforms |

||||||||||||

Wired Interface |

|

cnMatrix - Wireless Aware Switching |

||||||||||||

Product Platform |

|

PTP 820/850 |

|

PTP 550/670/700 |

|

PMP 450 |

|

ePMP |

|

cnWave |

|

Wi-Fi 6/6E |

|

cnReach |

Design Focus |

|

Licensed Microwave Backhaul |

|

Industry Leading Sub-6 GHz Backhaul Performance |

|

Unparalleled Scalability for Multipoint networks |

|

Price/Performance PTP and PMP Leadership |

|

Gb to the Edge for Urban, high-density Suburban, and Rural markets |

|

Software Defined Radios, Cloud Managed, High Performance |

|

Licensed Narrowband in rugged I/O rich package |

Throughput |

|

2+ Gbps |

|

450 - 1400 Mbps |

|

1.4 Gbps/Sector |

|

1.2 Gbps/ Sector |

|

15 Gbps/DN |

|

1+ Gbps/AP |

|

KB to MB |

Spectrum (GHz except as noted) |

|

6 - 38 |

|

4.400 - 5.925 |

|

900 MHz, |

|

2.4, |

|

24.25 - 29.50 |

|

2.4, 5, 6 |

|

220, 450, 700, |

7

Ethernet Switches

Our cnMatrix Ethernet enterprise switching solutions simplify network deployment and operation. cnMatrix provides the intelligent interface between wireless and wired networks. cnMatrix’s policy-based automation (PBA) accelerates network deployment, mitigates human error, increases security, and improves reliability. When deployed with Cambium Networks Wi-Fi access points and the cnMaestro management system, network operators have an affordable, feature-rich, high-quality unified wired/wireless enterprise grade network. In the first quarter of 2021, we introduced and began shipping the cnMatrix TX 2020R-P. The TX 2020R-P is the first of a series of switches designed specifically to support PMP and PTP fixed wireless broadband networks, incorporating the cnMatrix enterprise-class feature set and incorporating additional features and services pertinent to network operators deploying fixed wireless broadband networks. The TX 2012R-P was introduced in April 2021 and is the second platform in the TX series.

Network Management Platform

Our cloud-based cnMaestro and cnMaestro X network management platform provide users with an integrated, intelligent, easy to use tool for end-to-end network management of our portfolio from the network operating center to be managed to the edge of the network by an individual CPE. cnMaestro’s interface allows users to easily onboard large numbers of new devices, configure existing devices, monitor the entire network and troubleshoot.

We have recently introduced two subscription services that complement and rely on cnMaestro: Network Service Edge (NSE 3000), and Quality of Experience (QoE). Network Service Edge delivers advanced security, network, and SD-WAN services for small and medium enterprise networks. These services are integrated into Cambium’s ONE Network solution that enables organizations to deploy and manage security policies across the wireless and wired network, all fully managed and controlled as part of a single framework.

Our QoE solution is hardware agnostic, operating across both wireless and fiber networks, and offers a range of services to network operators utilizing our networking solutions as well as third-party competitive offerings. The subscription-based solution includes granular application shaping, dynamic queue-based rate limiting, congestion management and application insights, which provides broadband service providers immediate access to the information and controls to optimize end user experiences and be the service provider of choice.

Our network planning tools include cnHeat and LINKPlanner. cnHeat is a network planning subscription service that provides a heat map coverage model display of locations that are available for FWB connectivity that aids in network planning. cnHeat utilizes LiDAR or equivalent geospatial data to accurately model the geography being evaluated, coupled with highly accurate RF modeling, to render a visual and quantitative assessment of anticipated RF coverage and performance. cnHeat allows network operators to optimize site selection for coverage, supporting their total cost of ownership and return on investment. LINKPlanner is a comprehensive tool, developed over the past 12 years, used to plan PTP and PMP networks. LINKPlanner allows users to visualize and analyze hypothetical network deployment scenarios to evaluate performance and reliability allowing for cost-effective expansion and deployment of their networks. cnArcher is a smartphone app that accelerates installation and deployment of our fixed wireless products by field technicians.

Sales and marketing

We sell our products primarily through a network of distributors who sell to other channel partners, including value-added resellers, system integrators, and end customers (end users), as well as through our direct sales force. End users include public or private network operators, including broadband and/or wireless LAN managed service providers; broadband internet service providers; mobile network operators; mid-market enterprises, such as education, hospitality, multi-dwelling units, and retail; state and local government; industrial, including energy, mining, rail operators and utilities; and military agencies. Channel partners may work directly with end users to identify their networking needs and they may also provide installation, configuration, and ongoing support services. As of December 31, 2022, we had over 12,600 channel partners, which includes over 160 distributors.

Our sales organization typically engages directly with large Internet service providers and enterprise managed service providers and certain enterprises even though product fulfillment generally is provided by our channel partners. We also engage in joint selling and marketing with our service provider, system integrator, and reseller channel partners to their customers’ end users. Our sales organization includes field and inside sales personnel, as well as regional technical managers with deep technical expertise who are responsible for pre-sales technical support and solutions engineering for internet service providers, enterprise networking managed service providers, systems integrators and resellers. As of December 31, 2022, we had 134 sales personnel located in 20 countries.

Our distributors play a central role by promoting and distributing our products in target vertical markets, providing value-added support to the service providers and reseller channels by bringing core strengths in technical support and professional services. This is in addition to logistics, and sales and marketing support. Our distributors typically stock and manage inventory of our products.

We typically work with channel partners through our Connected Partner program, which is a structured program designed to support and enable partners to sell and support our products. The program includes training and education, marketing support,

8

technical support, and other resources such as product discounts, deal registration, demonstration equipment, virtual and in-person events, and promotions to help channel partners succeed in selling and supporting our products.

Our marketing activities can be Cambium Networks led as well as distributor or channel partner led. Our marketing activities are focused on building brand awareness and generating leads with our target market segments of service providers, enterprise, industrial, and government. In addition, we work with our distributors and other channel partners to enable joint marketing that targets the enterprise end users. We leverage a broad mix of communications platforms including website and social media presence, public relations, webinars, trade shows and private events.

Customer support

We provide multiple layers of support: technical support, information-sharing with an experienced community of users, software downloads, warranty services, and repair. We support our enterprise class solutions with a range of flexible service plans and optional 24/7 availability that provide assurance to network operators that their always-on, mission critical communications requirements will be met. With every product purchase, we provide technical support on a best-effort basis. Hardware issues are diagnosed via joint troubleshooting with the end user, and the issue will be addressed according to standard warranty status and the root cause of the issue. This may be sufficient for some customers who can largely manage and operate their network without assistance and hold adequate spares. For others, we provide three support programs staffed by our skilled technical support team and product support engineers to keep the network operating smoothly and efficiently and may provide 24x7x365 technical support and premium warranty support and allow network operators to select the service level that best meets their needs. Our support organization both supports channel partners in supporting their direct customers and provides first-line support to our direct customers. Technical support is also available on-line via chat and automated ticketing systems.

Training

We provide a wide range of training and educational material, from comprehensive user guides and installation guides, to self-directed interactive training, to in-person instructor-led immersion courses to ensure our end-users and channel partners are familiar with the design, implementation, usage, and management of our products. The training and certification system is administered through a learning management system that provides the user a record of course work, exam results, certifications and access to on-demand self-directed training resources that complement instructor-led sessions scheduled frequently around the world.

Cambium Community Forum

The Cambium Networks Community Forum is a platform for users of our solutions to connect with each other, ask questions, and share information and experiences. It is a place where users can find help and support, as well the latest developments and features of Cambium Networks products. The forum is also a place where users can share their own tips and best practices for using our products, and where they can stay up to date with the latest news and updates from us.

Our Community Forum is moderated by our staff with direct and active engagement by our development engineering and product management personnel. Leveraging the Community Forum, we collect network operator and channel partner feedback on potential product improvements and new product ideas, including through the administration of beta testing on our products. As of December 31, 2022, there were approximately 46,000 registered forum members on our Community Forum.

Manufacturing and supply

We rely on third-party contract manufacturers and original design manufacturers for our manufacturing requirements. Our global sourcing strategy emphasizes the procurement of materials and product manufacturing in competitive geographies. For some of our products, we do substantially all of the design work; for other products, we outsource both the design (in whole or in part) and the manufacture of the product; and for several products we distribute and sell a product designed and manufactured by a third party under our name on a white label basis. We generally require that the manufacturing processes and procedures are certified to International Organization for Standardization (“ISO”) 9001 standards.

Our third-party manufacturers typically procure the components needed to build our products based on our demand forecasts. These forecasts represent our estimates of future demand for our products based on historical trends and analyses from our sales and product management functions as adjusted for overall market conditions. Generally, for our primary third-party manufacturers, we update these forecasts monthly. This allows us to leverage the purchasing power of our third-party manufacturers. Our products rely on key components, purchased from a limited number of suppliers, including certain sole source providers. Lead times for materials and components vary significantly, and depend on factors such as the specific supplier, complexity, contract terms, demand and availability of a component at a given time. From time to time, we may experience price volatility or supply constraints for certain components that are not available from multiple qualified sources or where our suppliers are geographically concentrated. We, like the rest of our industry, have experienced shortages in semiconductors and other key components used for our hardware, which have driven increased costs for components and shipping. To alleviate shortages, we have and may continue to purchase certain scarce components directly on the open market. We may also acquire component inventory in anticipation of supply constraints and enter

9

into longer-term pricing commitments with vendors to improve the priority, price and availability of supply. In periods of shortages, we have in the past and may in the future need to build inventory of select components.

We outsource the warehousing and delivery of our products at these fulfillment facilities to a third-party logistics provider for worldwide fulfillment. Our direct fulfillment facilities are in Louisville, Kentucky, Venlo, Netherlands and Shanghai, China from where we ship to our distributor partners and network operators.

Research and development

Our research and development organization is located primarily in San Jose and Thousand Oaks, California, Rolling Meadows, Illinois, Ashburton, United Kingdom and Bangalore, India. We also work with contract engineers in various locations globally. Our research and development team has deep expertise and experience in wireless technology, antenna design and network architecture and operation. We expect to continue to expand our product offerings and solutions capabilities in the future and to invest significantly in continued research and development efforts.

Intellectual property

Our success depends in part on our ability to protect our core technology and innovations. We rely on federal, state, common law and international rights, as well as contractual restrictions, to protect our intellectual property. We control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with third parties, such as Internet service providers, vendors, individuals and entities that may be exploring a business relationship with us. In addition to these contractual arrangements, we also rely on a combination of trade secrets, copyrights, patents, trademarks, service marks and domain names to protect our intellectual property. We pursue the registration of our trademarks, service marks and domain names in the United States and England and in certain other locations outside of these jurisdictions. These laws, procedures and restrictions provide only limited protection and the legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain and still evolving. Furthermore, effective patent, trademark, copyright and trade secret protection may not be available in every country in which our products are available.

We seek patent protection for certain of our key innovations, protocols, processes and other inventions. As of December 31, 2022, we had 42 issued U.S. patents and 149 patents issued in various foreign jurisdictions as well as 9 U.S. and 41 foreign patent applications pending. We file patent applications in the United States and other countries where we believe there to be a strategic technological or business reason to do so. Although we actively attempt to utilize patents to protect our technologies, we believe that none of our patents, individually, are material to our business.

Competition

The markets for FWB and Enterprise solutions are highly competitive and subject to rapid technological change. We compete in a wide range of related categories, each with its set of competitors worldwide that vary in size and in the products and solutions offered. We expect competition to persist, intensify and increase in the future. We review our competitive situation as follows:

10

As our target markets continue to develop and expand, and as the technology for wireless broadband and enterprise networking continues to evolve, we expect competition to increase from both established and emerging market participants.

The market for our products and solutions is influenced by a variety of factors, including the following:

We believe we compete favorably on each of these factors.

Regulatory requirements

In addition to regulations of general application to global businesses, we are subject to a number of regulatory requirements specific to our industry, including, without limitation:

The applicable regulatory agencies in each jurisdiction adopt regulations to manage spectrum use, establish and enforce priorities among competing uses, limit harmful radio frequency interference and promote policy goals such as broadband deployment. These spectrum regulations regulate allocation, licensing, and equipment authorizations. Since our customers purchase devices to operate in specific spectrum bands allocated by the regulatory authorities, our products must meet the technical requirements set forth for such spectrum allocation(s).

In some bands, the operator, such as our customer, must seek prior regulatory authority to operate using specified frequencies, and the resulting spectrum license authorizes the licensee, for a limited term, to operate in a spectrum consistent with licensed technical parameters within a specified geographic area. We must design and manufacture our products to comply with these technical parameters.

Our products generally are subject to compliance testing prior to approval, and, as a condition of authority in each jurisdiction, we must ensure that our products have the proper labels and documentation specifying such authority. We generally use

11

telecommunications certification bodies to obtain certification for our devices in each jurisdiction in which we intend to market and sell our products.

We are also subject to rules, regulations and laws that involve a variety of matters including privacy, data protection and personal information, tax, trade, encryption technology, environmental sustainability (including climate change), human rights, product certification, and national security. Rules governing our use of personal data, such as the General Data Protection Regulation in the European Union, the California Consumer Privacy Act, and other applicable regulations in the United States and around the world continue to evolve and increase, together with current and proposed e-privacy and direct marketing rules governing direct and email marketing. These rules govern how we use personal data of our employees, customers and others with whom we might do business, including in our marketing activities.

A failure, or alleged failure, by us to comply with regulations or laws could have a material adverse effect on our business, operating results, or financial condition. For additional information about government regulation and laws applicable to our business, see “Item 1A. Risk Factors,” including the risk factor entitled “New regulations or standards or changes in existing regulations or standards in the United States or internationally related to our products may result in unanticipated costs or liabilities, which could have a material adverse effect on our business, results of operations and future sales,” “If we fail to comply with environmental requirements, our business, financial condition, operating results and reputation could be adversely affected” and "Our business, operating results and financial condition could be materially harmed by regulatory uncertainty applicable to our products and services.”

Environmental matters

We are subject to various environmental and other regulations governing product safety, materials usage, packaging and other environmental impacts in the United States and in various countries where our products are manufactured and sold. We are also subject to regulatory developments, including SEC disclosure regulations relating to "conflict minerals," relating to ethically responsible sourcing of the components and materials used in our products. To date, compliance with federal, state, local, and foreign laws enacted for the protection of the environment has had no material effect on our capital expenditures, earnings, or competitive position.

We maintain compliance with various regulations related to the environment, including the Waste Electrical and Electronic Equipment and the Restriction of the Use of Certain Hazardous Substances in Electrical and Electronic Equipment regulations adopted by the European Union. To date, our compliance efforts with various United States and foreign regulations related to the environment has not had a material effect on our operating results.

Human capital management

We pride ourselves on developing and maintaining a strong reputation for innovation and integrity and conduct our business affairs honestly and in an ethical manner. We are proud to be named by Built In Chicago as one of the 100 best large companies to work for in Chicago in 2022. We expect our corporate culture to embody trust and respect for individuals, teamwork and innovation; Cambium is a place where employees are proud to work, and where customers, suppliers and partners want to work with us. One of

12

our most valuable assets is our integrity. We are guided by our core values of growth and profitability; outstanding global teamwork; relentless innovation and edge; making and meeting commitments; respecting and developing our people; and serving our community.

We are focused on hiring, training, and retaining exceptional talent. As of December 31, 2022, we had approximately 650 full-time employees, of whom 419 are located outside the United States. None of our U.S. employees are subject to a collective bargaining agreement. In certain foreign jurisdictions, where required by local law or custom, some of our employees are represented by local workers’ councils and/or industry collective bargaining agreements. We have not experienced any work stoppages, and we consider our relationship with our employees to be good. We have a broad base of diverse talent in more than 20 countries and we believe that attracting, developing and retaining the best talent is critical to our success and achievement of our strategic objectives.

We appreciate one another’s differences and strengths and are proud that our workforce comprises employees with a diversity of backgrounds and perspectives. Diversity, inclusion and belonging have long been a part of our culture, and we work to continually expand our diversity, inclusion and belonging initiatives and to conform to the principles of equal opportunity. We do not discriminate based on race, religion, national origin, disability, medical condition, marital status, sex, gender, age, military or veteran status, sexual orientation or any other protected characteristic as established by federal, state or local laws. Further, we have policies in place that prohibit harassment of all kinds and we prohibit retaliation in all forms and are committed to encouraging a culture where employees can freely ask questions and raise concerns.

Although we are working in both remote and hybrid environments as a result of the COVID-19 pandemic, we work collaboratively, without hierarchy, and our management team is readily available to all employees, with additional quarterly global town hall events that allow for open question and answer dialogue.

We offer what we believe is a competitive compensation package, tailored to the job function and geography of each employee. Our team is global, and we offer competitive and meaningful compensation and benefits programs that meet the diverse needs of our employees, while also reflecting local market practices. Our U.S. benefits plan includes health benefits, life and disability insurance, various voluntary insurances, flexible time off and leave programs, an employee assistance plan, an educational assistance policy, and a 401(k) plan with a competitive employer match. Our international benefits plans are competitive locally and generally provide similar benefits. We believe our compensation structure aligns with our shareholders’ long-term interests by balancing profitability and growth, as well as current market practices, and reflects our commitment to pay for performance. Competition for qualified personnel in the technology space is intense, and our success depends in large part on our ability to recruit, develop and retain a productive and engaged workforce. Accordingly, investing in our employees and their well-being, offering competitive compensation and benefits, promoting diversity and inclusion, adopting progressive human capital management practices and community outreach constitute core elements of our corporate strategy. In addition to competitive salaries and bonuses or sales commissions, we offer a robust employment total rewards package that promotes employee well-being and includes health care, extended parental leave, and paid time off, including extended leave for new parents (moms, dads and partners) to care for a newborn or newly adopted child.

We also offer rewards and recognition programs to our employees, including peer-led recognition of employees who best exemplify our values. We believe that these recognition programs help drive strong employee performance. We conduct annual employee performance reviews, where each employee is evaluated by their manager as well as a self-assessment. Employee performance is assessed based on a variety of key performance metrics, including the achievement of corporate objectives and objectives specific to the employee’s department or role.

We grant equity-based compensation to many of our employees and have extended the opportunity for equity ownership through our employee share purchase plan in the United States, the United Kingdom and India. Additionally, we offer benefits to support our employees’ physical and mental health by providing tools and resources to help them improve or maintain their health and encourage healthy behaviors and facilitate a number of employee support groups.

Available information

Our Internet address is www.cambiumnetworks.com and our investor relations website is located at http://investors.cambiumnetworks.com. We make available free of charge on our investor relations website under the sub-heading “Financials” our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after such materials are electronically filed with (or furnished to) the SEC. Information contained on our websites is not incorporated by reference into this Annual Report on Form 10-K. In addition, the public may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site, www.sec.gov, that includes filings of and information about issuers that file electronically with the SEC.

13

Item 1A. Risk Factors.

This Report contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, the risk factors set forth below. These risks and uncertainties are not the only ones we face. Our business, financial condition, results of operations or prospects could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material. If any of the risks actually occur, our business, financial condition, results of operations and prospects could be adversely affected.

Risks related to our business

Our operating results can be difficult to predict and may fluctuate significantly, which could result in a failure to meet investor expectations or our guidance and a decline in the trading price of our shares.

Our quarterly and annual operating results have fluctuated in the past and may fluctuate significantly in the future. In particular, the timing and size of our sales of our products are difficult to predict and can result in significant fluctuations in our revenues from period to period. For instance, we have historically received and fulfilled a substantial portion of sales orders and generated a substantial portion of revenues during the last few weeks of each quarter. In addition, we generally recognize all product revenues in the same period in which the related products are sold. Because our operating results are relatively fixed in the short term, any failure to meet expectations regarding sales could have an immediate and material effect on our earnings. If our revenues or operating results fall below the expectations of investors or securities analysts or below any estimates we may provide to the market, the trading price of our shares would likely decline, which could have a material and adverse impact on investor confidence and employee retention.

Our operating results may fluctuate due to a variety of factors, many of which are outside of our control, and which we may not foresee. In addition to other risks listed in this “Risks Factors” section, factors that may affect our operating results include:

14

The effects of these or other factors individually or in combination could result in fluctuations and unpredictability in our operating results, our ability to forecast those results and the trading price of our shares. As a result, our past results should not be relied upon as an indication of our future performance.

The introduction of new products and technology is key to our success, and if we fail to predict and respond to emerging technological trends and network operators’ changing needs, we may be unable to remain competitive.

The wireless broadband market is generally characterized by rapidly changing technology, changing needs of network operators, evolving regulations and industry standards and frequent introductions of new products and services. Historically, new product introductions have been a key driver of our revenue growth. To succeed, we must effectively anticipate and adapt in a timely manner to network operator requirements and changing standards and regulatory requirements and continue to develop or acquire new products and features that meet market demands, technology trends and evolving regulatory requirements and industry standards. Our new product development may also be driven by component shortages that may require us to redesign our products. Our ability to keep pace with technological developments, satisfy increasing network operator requirements, and achieve product acceptance depends upon our ability to enhance our current products and develop and introduce or otherwise acquire the rights to new products on a timely basis and at competitive prices. The process of developing new technology is complex and uncertain, and can take time to develop as well as to perfect once released. The development of new products and enhancements typically requires significant upfront investment, which may not result in material improvements to existing products or result in marketable new products or cost savings or revenues for an extended period of time, if at all. Network operators have delayed, and may in the future delay, purchases of our products while awaiting release of new products or product enhancements. In addition, the introduction of new or enhanced products requires that we carefully manage the transition from older products to minimize disruption in channel partner ordering practices. If we fail to anticipate industry trends and evolving regulations by developing or acquiring rights to new products or product enhancements and timely and effectively introducing such new products and enhancements, or network operators do not perceive our products to have compelling technological advantages, our business would be adversely affected.

Terrorism, war, and other events may harm our business, operating results and financial condition.

The continued threat of terrorism and heightened security and military action in response thereto, or any other current or future acts of terrorism, war (such as the on-going Russia and Ukraine war), and other events (such as economic sanctions and trade restrictions, including those related to the on-going Russia and Ukraine war) may cause further disruptions to the economies of the United States and other countries and create further uncertainties or could otherwise negatively impact our business, operating results, and financial condition. The Russia-Ukraine conflict, other areas of geopolitical tension around the world, or the worsening of that conflict or tensions, and the related challenging macroeconomic conditions globally and in various countries in which we and our customers operate may materially adversely affect our customers, vendors, and partners, and the duration and extent to which these factors may impact our future business and operations, results of operations, financial condition, and cash flows remain uncertain. Likewise, events such as loss of infrastructure and utilities services such as energy, transportation, or telecommunications could have similar negative impacts. To the extent that such disruptions or uncertainties result in delays or cancellations of customer orders or the manufacture or shipment of our products, our business, operating results, and financial condition could be materially and adversely affected.

Competitive pressures may harm our business, revenues, growth rates and market share.

The markets for FWB and Enterprise solutions are highly competitive and subject to rapid technological change. We compete in a wide range of related categories, each with its set of competitors worldwide that vary in size and in the products and solutions offered. We expect competition to persist, intensify and increase in the future.

In all our markets, we compete with a number of wireless equipment providers worldwide that vary in size and in the products and solutions offered. Some of the competitors in our markets include the following:

15

As our target markets continue to develop and expand, and as the technology for wireless broadband continues to evolve, we expect competition to increase.

Demand for our solutions versus those of our competitors is influenced by a variety of factors, including the following:

We expect increased competition from our current competitors, as well as emerging companies and established companies that may enter our markets. Further, we have in the past and may again experience price competition from lower cost vendors selling to network operators that have lower budget or less demanding applications than our products have been designed to serve. We also expect that even higher cost competitors may engage in price competition to establish greater market share, which may adversely affect our ability to grow our revenues and profitability. Competition could result in loss of market share, increased pricing pressure, reduced profit margins, or increased sales and marketing expense, any of which would likely cause serious harm to our business, operating results or financial condition.

A number of our current or potential competitors have longer operating histories, greater name recognition, significantly larger customer bases and sales channels and significantly greater financial, technical, sales, marketing and other resources than we do. Our competitors may be able to anticipate, influence or adapt more quickly to new or emerging technologies and changes in network operator requirements, devote greater resources to the promotion and sale of their products and services, initiate or withstand substantial price competition, bundle similar products to compete, take advantage of acquisitions or other opportunities more readily, and develop and expand their product and service offerings more quickly than we can.

Some of our competitors have been acquired or entered into partnerships or other strategic relationships to offer a more comprehensive solution than they had previously offered. We expect this trend to continue. The companies resulting from such consolidation may create more compelling products and be able to offer greater pricing flexibility, making it more difficult for us to compete effectively. In addition, continued industry consolidation might adversely affect network operators’ perceptions of the viability of smaller and even medium-sized wireless broadband equipment providers and, consequently, their willingness to purchase from those companies.

Additionally, the markets for development, distribution and sale of our products are rapidly evolving. New entrants seeking to gain market share by introducing new technology and new products may make it more difficult for us to sell our products, and could create increased pricing pressure, reduced profit margins due to increased expenditure on sales and marketing, or the loss of market share or expected market share, any of which may significantly harm our business, operating results and financial condition. Competitive pressures may also result from increased political tensions globally, and our ability to manufacture products meeting country of origin or country of manufacture requirements increasingly imposed by countries or end users. We may be unable to easily meet these location of manufacture requirements, which may adversely impact our ability to compete with other competitors who can. The success of new products depends on several factors, including appropriate new product definition, component costs, timely completion and introduction of products, differentiation of new products from those of our competitors and market acceptance of these products. We may not be able to successfully anticipate or adapt to changing technology on a timely basis, or at all. New technologies could render our existing products less attractive and if such technologies are widely adopted as the industry standard for wireless Internet service providers, our business financial condition, results of operations and prospects could be materially adversely affected.

16

We face risks related to actual or threatened health epidemics and other outbreaks, which could significantly disrupt our manufacturing, sales and other operations.

The global spread of COVID-19 created significant volatility, uncertainty and economic disruption. The restrictions imposed to prevent the spread of COVID-19 disrupted economic activity, resulting in reduced commercial and consumer confidence and spending, increased unemployment, closure or restricted operating conditions for businesses, volatility in the global capital markets, instability in the credit and financial markets, labor shortages, regulatory relief for impacted consumers and disruption in supply chains. While COVID-19 vaccines mitigated mortality risk, new COVID-19 variants proved to remain a threat. The lifting of lockdowns in certain areas started a slow economic recovery. The resulting increase in consumer demand has created significant challenges for supply chains as a result of labor and raw material shortages, which could lead to reduced earnings for many industries. In addition, due to the ongoing pandemic and global semiconductor chip shortage, we have experienced disruption and delays in our supply chain and significant price increases with certain of our manufacturing partners, and those disruptions, delays and price increases may continue. For example, in the second half of 2021, our results of operations were negatively impacted by increased expenses resulting from supply chain disruptions. There are also restrictions and delays on logistics, such as air and ocean cargo carriers, as well as increased logistics costs due to limited capacity and high demands for freight forwarders. If our supply chain operations are affected or are curtailed by the outbreak of diseases such as COVID-19, our supply chain, manufacturing and product shipments will be delayed, which could adversely affect our business, operations and customer relationships. We may need to seek alternate sources of supply which may be more expensive, unavailable or may result in delays in shipments to us from our supply chain and subsequently to our customers. Further, if our distributors’ or end user customers’ businesses are similarly affected, they might delay or reduce purchases from us, which could adversely affect our results of operations.

In addition, freight and logistics constraints caused in part by restrictions imposed by governments to combat the COVID-19 pandemic and additionally due to container and carriage shortages, have resulted in increased costs and constrained available transport, for us and our channel partners, all at a time when global demand has increased. If our supply chain operations continue to be affected or are curtailed by the outbreak of diseases such as COVID-19, our supply chain, manufacturing and product shipments will be delayed, which could adversely affect our business, operations and customer relationships. We have sought and may continue to seek alternate sources of supply which may be more expensive, unavailable or may result in delays in shipments to us and from our supply chain and subsequently to our customers.

Any alterations or modifications that we are required to make as a result of a global pandemic has in the past and may in the future, adversely impact our business, our customers and prospects, or our financial results.

The extent to which a global pandemic will impact our business and financial results will be dependent on future developments such as the length and severity of the crisis, the potential resurgence of COVID-19 or other pandemic and its variants in the future, future government actions in response to the crisis, the acceptance and effectiveness of vaccines to address the pandemic, and the overall impact of the pandemic on the global economy and capital markets, among many other factors, all of which are highly uncertain and unpredictable. There can be no assurance that any global pandemic or other health crisis will not have a material and adverse effect on our business, financial results and financial condition.

We rely on third-party manufacturers, which subjects us to risks of product delivery delays and reduced control over product costs and quality.

We outsource the manufacturing of our products to third-party manufacturers pursuant to which the third parties manufacture and supply our products subject to orders from us often based on our demand forecasts. Our reliance on third-party manufacturers reduces our control over the manufacturing process, including reduced control over quality, product costs and product supply and timing. From time to time, we have experienced and may in the future experience delays in shipments or issues concerning product quality from our third-party manufacturers. If any of our third-party manufacturers suffer interruptions, delays or disruptions in supplying our products, including by natural disasters or work stoppages or capacity constraints, our ability to ship products to distributors and network operators would be delayed. Additionally, if any of our third-party manufacturers experience quality control problems in their manufacturing operations and our products do not meet network operators’ requirements, we could be required to cover the repair or replacement of any defective products. These delays or product quality issues could have an immediate and material adverse effect on our ability to fulfill orders and could have a negative impact on our operating results. In addition, such delays or issues with product quality could harm our reputation and our relationship with our channel partners.

Our agreements do not typically obligate our third-party manufacturers to supply products to us in specific quantities or for an extended term, which could result in short notice to us of supply shortages and increases in the prices we are charged for manufacturing services. We believe that our orders may not represent a material portion of the total orders of our primary third-party manufacturers, and, as a result, fulfilling our orders may not be prioritized in the event they are constrained in their abilities or resources to fulfill all of their customer obligations in a timely manner. Although we provide demand forecasts to some of our third-party manufacturers, some of our third-party manufacturers may assess charges, or we may have liabilities for excess inventory if we overestimate our demand, each of which could negatively affect our gross margins. During the normal course of business, in order to manage manufacturing lead times and help ensure adequate component supply, we enter into agreements with contract manufacturers and suppliers that allow them to procure inventory based upon criteria as defined by us, such as forecasted demand. We may be liable

17

to purchase excess product or aged material from our suppliers following reasonable mitigation efforts. Conversely, because lead times for required materials and components vary significantly and depend on factors such as the specific supplier, contract terms and the demand for each component at a given time, if we underestimate our requirements, our third-party manufacturer may have inadequate materials and components required to produce our products. This could result in an interruption of the manufacturing of our products, delays in shipments and deferral or loss of revenues. For example, as a result of increased global demand for some components used in our products, particularly semiconductor-related components, foundries have experienced capacity shortages and have responded by allocating existing supply among their customers, including us. This capacity shortage coupled with an increase in demand for our affected products, due in part to a global increase in demand for bandwidth has resulted in supply shortages that have caused increased lead times for some of our products. We may suffer delays introducing new products to the market and in sales of existing products as a result of parts unavailability or shortages, resulting in loss or delay of revenue.

If our third-party manufacturers experience financial, operational, manufacturing capacity or other difficulties, or experience or continue to experience shortages in required components, or if they are otherwise unable or unwilling to continue to manufacture our products in required volumes or at all, our supply may be disrupted, we may be required to seek alternate manufacturers and we may be required to re-design our products. It would be time-consuming and costly, and could be impracticable, to begin to use new manufacturers and designs and such changes could cause significant interruptions in supply and could have an adverse impact on our ability to meet our scheduled product deliveries and may subsequently lead to the loss of sales, delayed revenues or an increase in our costs, which could materially and adversely affect our business and operating results.

We require third-party components, including components from limited or sole source suppliers, to build our products. The unavailability of these components could substantially disrupt our ability to manufacture our products and fulfill sales orders.

We rely on third-party components to build our products, and we generally rely on our third-party manufacturers to obtain the components necessary for the manufacture of our products. We use our forecast of expected demand to determine our material requirements. Lead times for materials and components we order vary significantly, and depend on factors such as the specific supplier, contract terms and demand for a component at a given time. If forecasts exceed orders, we may have excess and/or obsolete inventory, which could have a material adverse effect on our business, operating results and financial condition. If orders exceed forecasts, or available supply, we may have inadequate supplies of certain materials and components, which could have a material adverse effect on our ability to meet customer delivery requirements and to recognize revenue. If we underestimate our requirements or our third-party suppliers are not able to timely deliver components, our third-party manufacturers may have inadequate materials and components required to produce our products. This could result in an interruption in the manufacture of our products, delays in shipments and fulfillment of customer orders, and deferral or loss of revenues. Our third-party manufacturers may not be able to secure sufficient components at reasonable prices or of acceptable quality to build our products in a timely manner, adversely impacting our ability to meet demand for our products. In addition, if our component suppliers cease manufacturing needed components, we could be required to redesign our products to incorporate components from alternative sources or designs, a process which could cause significant delays in the manufacture and delivery of our products. Unpredictable price increases for such components may also occur. The unavailability of these components could substantially disrupt our ability to manufacture our products and fulfill sales orders.

In addition, we currently depend on a limited number of suppliers for several critical components for our products, and in some instances, we use sole or single source suppliers for our components to simplify design and fulfillment logistics. Neither we nor our third-party manufacturers carry substantial inventory of our product components. Many of these components are also widely used in other product types. Shortages are possible and our ability to predict the availability of such components may be limited. In the event of a shortage or supply interruption from our component suppliers, we or our third-party manufacturers may not be able to develop alternate or second sources in a timely manner, on commercially reasonable terms or at all, and the development of alternate sources may be time-consuming, difficult and costly. Any resulting failure or delay in shipping products could result in lost revenues and a material and adverse effect on our operating results. If we are unable to pass component price increases along to our end customers or maintain stable pricing, our gross margins could be adversely affected and our business, financial condition, results of operations and prospects could suffer.

Supply shortages for key components in our products may result in extended lead times or supply changes, which could disrupt or delay our scheduled product deliveries to our end customers and may result in the loss of sales and end customers.

Our ability to manage our supply chain may be adversely affected by factors including shortages of, and extended lead times for, components used to manufacture our products, a reduction or interruption of supply, prioritization of component shipments to other vendors, cessation of manufacturing of such components by our suppliers and geopolitical conditions such as the U.S. trade war with China and the impact of public health epidemics like the COVID-19 pandemic. Insufficient component supply, or any increases in the time required to manufacture our products, have and may continue to lead to inventory shortages that could result in increased customer lead times for our products, delayed revenue or loss of sales opportunities altogether as potential end customers turn to competitors’ products that are more readily available. Shortages in the supply of components or other supply disruptions, including, without limitations, due to reductions in supply as a result of COVID-19 or as a result of the current global shortage of chipsets and other semiconductor components, may not be predicted in time to design-in different components or qualify other suppliers.

18

Qualifying new suppliers to compensate for such shortages may be time-consuming and costly and may increase the likelihood of errors in design or production. Similar delays may occur in the future.

In order to reduce manufacturing lead times and plan for adequate component supply, from time to time, we may issue purchase orders for components and products that are non-cancelable and non-returnable. In addition, we may purchase components and products that have extended lead teams to ensure adequate supply to support long-term customer demand and mitigate the impact of supply disruptions. If we are unable to use all of the components we have purchased, we may have excess inventory or obsolescence, or increased inventory or carrying costs, which could have an adverse impact on our results of operation or financial condition.

Governmental regulations may also impact our ability to procure required components, such as regulations enacted by the U.S. limiting the ability to procure certain components from China. If we are unable to procure required components from sources outside of jurisdictions restricted by government regulation, we may be unable to produce and sell products that we are able to sell to customers in regions subject to such restrictions.

We may face increased costs or other logistics challenges in the shipment of our products, which may increase cost of revenues or result in a delay of shipments to customers.

Logistics challenges have and may continue to impact our operations, as a result of container shortages which have and may continue to lengthen availability of containers and increased carriage costs, resulting in increases in relevant freight costs, all at a time when global demand has increased. Ports have and may continue to experience increasing lead times with delays in the container freight market as port delays, worker shortages and the impact of any global pandemic impact the ability to import and export goods, particularly from China, resulting in an increase in logistics and freight costs. These logistics and freight challenges and increasing costs could have a material adverse effect on our ability to meet customer delivery requirements, result in increased costs and adversely affect our business, financial condition, results of operations and prospects.

We outsource manufacturing to third-party manufacturers operating outside of the U.S., subjecting us to risks of international operations.