UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to _________________

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|||

|

☒ |

|

Smaller reporting company |

|

||

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of November 5, 2021, the registrant had

Summary Risk Factors

A summary of certain risk factors affecting our business and prospects is included below. You should carefully consider the risks described below together with all of the other information in this Quarterly Report on Form 10-Q, including our financial statements and the related notes and the information included the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as the “Risk Factors” included in item 1A in this Quarterly Report on From 10-Q and our Annual Report on Form 10-K for the fiscal year ended December 31, 2020. If any of the events described below actually occurs, our business, results of operations, financial conditions, cash flows or prospects could be harmed. If that were to happen, you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business.

i

ii

Table of Contents

|

|

Page |

PART I. |

1 |

|

Item 1. |

1 |

|

|

1 |

|

|

2 |

|

|

3 |

|

|

5 |

|

|

Notes to Unaudited Condensed Consolidated Financial Statements |

6 |

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 |

Item 3. |

28 |

|

Item 4. |

28 |

|

PART II. |

29 |

|

Item 1. |

29 |

|

Item 1A. |

29 |

|

Item 2. |

47 |

|

Item 3. |

47 |

|

Item 4. |

47 |

|

Item 5. |

47 |

|

Item 6. |

47 |

|

48 |

||

iii

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Compass Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except per share data)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2021 |

|

|

2020 |

|

||

Assets |

|

(Unaudited) |

|

|

(Note 1) |

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

|

|

$ |

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

|

||

Total current assets |

|

|

|

|

|

|

||

Property and equipment, net |

|

|

|

|

|

|

||

Restricted cash |

|

|

|

|

|

|

||

Operating lease, right-of-use ("ROU") asset |

|

|

|

|

|

|

||

Other assets |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

|

|

$ |

|

||

Accrued expenses |

|

|

|

|

|

|

||

Operating lease obligations, current portion |

|

|

|

|

|

|

||

Current portion of long-term debt |

|

|

|

|

|

|

||

Total current liabilities |

|

|

|

|

|

|

||

Long-term debt, net of current portion |

|

|

|

|

|

|

||

Operating lease obligations, long-term portion |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Stockholders' equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Additional paid-in-capital |

|

|

|

|

|

|

||

Accumulated deficit |

|

|

( |

) |

|

|

( |

) |

Total stockholders' equity |

|

|

|

|

|

|

||

Total liabilities and stockholders' equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

1

Compass Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations (Unaudited)

(In thousands, except per share data)

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

General and administrative |

|

|

|

|

|

|

|

|

|

|

|

||||

In-process R&D |

|

|

|

|

|

|

|

|

|

|

|

||||

Total operating expenses |

|

|

|

|

|

|

|

|

|

|

|

||||

Loss from operations |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Other expense, net |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Loss before income tax expense |

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Income tax expense |

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

||

Net loss |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Net loss per share - basic and diluted |

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

Basic and diluted weighted average shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

Compass Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Convertible Preferred Stock and Stockholders’ Equity (Deficit) (Unaudited)

(In thousands)

|

Convertible |

|

|

Common Stock |

|

|

Additional |

|

|

Accumulated |

|

|

Total |

|

|||||||||||||

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity |

|

|||||||

Balance at December 31, 2020 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at March 31, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||||

Common shares issued for Trigr acquisition |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||||

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at September 30, 2021 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Convertible |

|

|

Common Stock |

|

|

Additional |

|

|

Accumulated |

|

|

Total |

|

|||||||||||||

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Equity (Deficit) |

|

|||||||

Balance at December 31, 2019 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

( |

) |

|||||

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at March 31, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|||||

Common shares issued to former shareholders |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Conversion of Compass preferred into common shares |

|

( |

) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Common shares issued, net of issuance costs of $ |

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

||||

Payment to non-participating Compass Therapeutics LLC members |

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at June 30, 2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||||||

Adj. to costs related to June 2020 private placement |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Vesting of share-based awards |

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Stock-based compensation |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

||

Net loss |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Balance at September 30, 2020 |

|

|

|

$ |

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

||||||

3

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Compass Therapeutics, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

|

|

For the Nine Months |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

( |

) |

|

$ |

( |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Loss (gain) on disposal of equipment |

|

|

( |

) |

|

|

|

|

Noncash interest expense |

|

|

|

|

|

|

||

Share-based compensation |

|

|

|

|

|

|

||

Write-off of in-process R&D |

|

|

|

|

|

|

||

Change in fair value of derivative liability |

|

|

|

|

|

|

||

ROU asset amortization |

|

|

|

|

|

|

||

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Prepaid expenses and other current assets |

|

|

|

|

|

( |

) |

|

Other long-term assets |

|

|

|

|

|

|

||

Accounts payable |

|

|

( |

) |

|

|

|

|

Accrued expenses |

|

|

|

|

|

( |

) |

|

Operating lease liability |

|

|

( |

) |

|

|

|

|

Settlement of derivative liability |

|

|

|

|

|

( |

) |

|

Net cash used in operating activities |

|

|

( |

) |

|

|

( |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

( |

) |

|

|

( |

) |

Asset acquisition costs |

|

|

( |

) |

|

|

|

|

Proceeds from sale of equipment |

|

|

|

|

|

|

||

Net cash (used in) provided by investing activities |

|

|

( |

) |

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from issuance of common stock |

|

|

|

|

|

|

||

Issuance costs from issuance of common stock |

|

|

|

|

|

( |

) |

|

Repayment of borrowings under loan |

|

|

( |

) |

|

|

( |

) |

Net cash (used in) provided by financing activities |

|

|

( |

) |

|

|

|

|

Net change in cash, cash equivalents and restricted cash |

|

|

( |

) |

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

|

||

Cash, cash equivalents and restricted cash at end of period |

|

$ |

|

|

$ |

|

||

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

|

|

|

|

||

Supplemental disclosure of financing activities |

|

|

|

|

|

|

||

Deferred offering costs included in accrued expenses |

|

$ |

|

|

$ |

( |

) |

|

Conversion of preferred units |

|

$ |

|

|

$ |

|

||

Payment to non-participating Compass LLC investors, within accrued expenses |

|

$ |

|

|

$ |

( |

) |

|

ROU asset acquired through operating leases |

|

$ |

|

|

$ |

|

||

Acquisition of Trigr Therapeutics, Inc. |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Compass Therapeutics, Inc. and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

1. Nature of Business and Basis of Presentation

Compass Therapeutics, Inc. (“Compass” or the “Company”) is a clinical-stage, oncology-focused biopharmaceutical company developing proprietary antibody-based therapeutics to treat multiple human diseases. Our scientific focus is on the relationship between angiogenesis and the immune system. Our pipeline includes novel product candidates that leverage our understanding of the tumor microenvironment, including both angiogenesis-targeted agents and immune-oncology focused agents. These product candidates are designed to optimize critical components required for an effective anti-tumor response to cancer. These include modulation of the microvasculature via angiogenesis-targeted agents; induction of a potent immune response via activators on effector cells in the tumor microenvironment; and alleviation of immunosuppressive mechanisms used by tumors to evade immune surveillance. We plan to advance our product candidates through clinical development as both standalone therapies and in combination with our proprietary drug candidates as long as their continued development is supported by clinical and nonclinical data. References to Compass or the Company herein include Compass Therapeutics, Inc. and its wholly-owned subsidiaries. The Company was incorporated as Olivia Ventures, Inc. (“Olivia”) in the State of Delaware on

The Company is subject to risks and uncertainties common to companies in the biotechnology and pharmaceutical industries. There can be no assurance that the Company’s research and development will be successfully completed, that adequate protection for the Company’s technology will be obtained, that any products developed will obtain necessary government regulatory approval or that any approved products will be commercially viable. The Company operates in an environment of rapid change in technology and substantial competition from pharmaceutical and biotechnology companies. In addition, the Company is dependent upon the services of its employees and consultants.

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all normal and recurring adjustments (which consist primarily of accruals, estimates and assumptions that impact the financial statements) considered necessary to present fairly the Company’s financial position as of September 30, 2021 and its results of operations and changes in convertible preferred stock and stockholders’ equity (deficit) for the three and nine months ended September 30, 2021 and 2020 and cash flows for the nine months ended September 30, 2021 and 2020. Operating results for the nine months ended September 30, 2021 are not necessarily indicative of the results that may be expected for the year ending December 31, 2021.

The unaudited condensed consolidated financial statements include the accounts of Compass Therapeutics, Inc. and its subsidiaries, and have been prepared by the Company in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial statements. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. The condensed consolidated balance sheet at December 31, 2020 has been derived from the audited consolidated financial statements at that date, but does not include all of the information and footnotes required by GAAP for complete financial statements. Accordingly, these condensed consolidated financial statements should be read in conjunction with the Company’s audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”).

Liquidity

Since our inception, we have devoted substantially all of our efforts to organizing and staffing our Company, business planning, raising capital, research and development activities, building our intellectual property portfolio and providing general and administrative support for these operations. To date, we have funded our operations primarily with proceeds from the sale of our equity securities and borrowings from debt arrangements. Through September 30, 2021, we have received $

6

development plans, we expect that such cash resources will enable us to fund our operating expenses and capital expenditure requirements through the fourth quarter of 2024.

COVID-19 Update

We have been carefully monitoring the COVID-19 pandemic and its potential impact on our business and have taken important steps to help ensure the safety of our employees and to reduce the spread of COVID-19 community-wide. We are ensuring that essential staffing levels at our operations remain in place, including maintaining key personnel in our laboratory facilities. We have implemented stringent safety measures designed to create a safe and clean environment for our employees as we continue to comply with applicable federal, state and local guidelines instituted in response to the COVID-19 pandemic.

We have been able to continue to pursue patient dosing and monitoring of our Phase 1 clinical trial of CTX-471 without significant delays. However, we have experienced increased delays in patient enrollment in several of our trial sites. In order to address the reduction in patient enrollment, we have added additional sites. In addition, there have been delays in sourcing of selected supplies required for the manufacturing of material to be used in our future clinical trials, and these delays have impacted and may continue to impact the timing of our future clinical trials. We expect that COVID-19 may continue to directly or indirectly impact (i) our employees and business operations or personnel at third-party suppliers and other vendors in the U.S. and other countries; (ii) the availability, cost or supply of materials; and (iii) the timeline for our ongoing clinical trial and potential future trials. We are continuing to assess the potential impact of the COVID-19 pandemic on our current and future business and operations, including our expenses and clinical trials, as well as on our industry and the healthcare system.

2. Summary of Significant Accounting Policies

There have been no material changes to the significant accounting policies previously disclosed in the Company’s Annual Report, except as noted below.

Recently Adopted Accounting Pronouncements

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016‑02, Leases, which requires a lessee to record a right‑of‑use asset and a corresponding lease liability on the balance sheet for all leases with terms longer than 12 months. A modified retrospective transition approach is required, applying the new standard to all leases existing at the date of initial application. An entity may choose to use either (1) its effective date or (2) the beginning of the earliest comparative period presented in the condensed consolidated financial statements as its date of initial application. If an entity chooses the second option, the transition requirements for existing leases also apply to leases entered into between the date of initial application and the effective date. The Company adopted this standard on January 1, 2021. See Note 7 for additional details on the Company’s accounting for leases.

Recent Accounting Pronouncements

7

3. Fair Value Measurements

The following tables present information about the Company’s financial assets and liabilities that are measured at fair value on a recurring basis and indicate the level of the fair value hierarchy utilized to determine such fair values (in thousands):

|

|

Fair Value Measurements as of September 30, 2021 Using: |

|

|||||||||||||

|

|

Quoted Prices |

|

|

Significant |

|

|

Significant |

|

|

Fair Value |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash equivalents - money market |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Total assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

Fair Value Measurements as of December 31, 2020 Using: |

|

|||||||||||||

|

|

Quoted Prices |

|

|

Significant |

|

|

Significant |

|

|

Fair Value |

|

||||

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash equivalents - money market |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Total assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

4. Property and Equipment

Property and equipment consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

Equipment |

|

$ |

|

|

$ |

|

||

Software |

|

|

|

|

|

|

||

Leasehold improvements |

|

|

|

|

|

|

||

Furniture and fixtures |

|

|

|

|

|

|

||

Total property and equipment–at cost |

|

|

|

|

|

|

||

Less: Accumulated depreciation |

|

|

( |

) |

|

|

( |

) |

Property and equipment, net |

|

$ |

|

|

$ |

|

||

8

5. Accrued Expenses

Accrued expenses consist of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2021 |

|

|

2020 |

|

||

Compensation and benefits |

|

$ |

|

|

$ |

|

||

Research and development expenses |

|

|

|

|

|

|

||

Leasehold improvements |

|

|

|

|

|

|

||

Legal and professional fees |

|

|

|

|

|

|

||

Other |

|

|

|

|

|

|

||

Total accrued expenses |

|

$ |

|

|

$ |

|

||

6. Debt

The aggregate principal amount of debt outstanding consisted of the following (in thousands):

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2021 |

|

|

2020 |

|

||

Current portion of debt |

|

$ |

|

|

$ |

|

||

Less: unamortized debt discount |

|

|

( |

) |

|

|

( |

) |

Current portion of debt, net of debt |

|

$ |

|

|

$ |

|

||

Long-term debt, net of current portion |

|

$ |

|

|

$ |

|

||

Less: unamortized debt discount |

|

|

|

|

|

( |

) |

|

Long-term debt, net of current portion |

|

$ |

|

|

$ |

|

||

The Company entered into, and subsequently amended, a term loan facility with Pacific Western Bank, Inc. (the “Credit Facility”), and received $

The Credit Facility agreement contains a provision whereby the Company was obligated to pay a success fee of $

The Credit Facility contains a negative pledge on the Company’s intellectual property and also contains customary indemnification obligations and customary events of default, including, among other things, (i) non‑payment, (ii) breach of warranty, (iii) non‑performance of covenants and obligations, (iv) default on other indebtedness, (v) judgments, (iv) change of control, (vii) bankruptcy and insolvency, (viii) impairment of security, (ix) key permit events, (x) key person event, (xi) regulatory matters, and (xii) key contracts. In addition, the Company must maintain a minimum cash balance of $

The borrowings are collateralized by substantially all of the Company’s assets, excluding intellectual property, and contains affirmative and negative covenants including restrictions on the Company’s ability to incur additional indebtedness, pay dividends, encumber its property, or engage in certain fundamental business transactions, such as mergers or acquisitions of other businesses. The Company was in compliance with its covenants as of September 30, 2021.

The Company recognized interest expense of $

9

As of September 30, 2021, the aggregate minimum future principal payments due in connection with the Credit Facility, as amended, are as follows (in thousands):

Year Ending December 31, |

|

|

|

|

2021 |

|

$ |

|

|

2022 |

|

|

|

|

Total |

|

$ |

|

|

7. Leases

The Company adopted ASU 2016-02, Leases (Topic 842), or ASU 2016-02, effective January 1, 2021, using the modified retrospective transition method, in which the new standard is applied as of the date of initial adoption. The Company recognized and measured agreements executed prior to the date of initial adoption that were considered leases on January 1, 2021. No cumulative effect adjustment of initially applying the standard to the opening balance of retained earnings was made upon adoption. The Company elected the package of practical expedients permitted under the transition guidance that will retain the lease classification and initial direct costs for any leases that exist prior to adoption of the standard. In addition, the Company elected the accounting policy of not recording short-term leases with a lease term at the commencement date of 12 months or less on the condensed consolidated balance sheet as permitted by the new standard.

The Company has evaluated its leases and determined that it has one lease that is classified as an operating lease. The classification of this lease is consistent with the Company’s determination under the previous accounting standard.

When available, the Company will use the rate implicit in the lease to discount lease payments to present value; however, the Company’s current lease does not provide an implicit rate. Therefore, the Company used its incremental borrowing rate to discount the lease payments based on the date of the lease commencement.

The Company has

The table below presents the undiscounted cash flows for the lease term. The undiscounted cash flows are reconciled to the operating lease liabilities recorded on the condensed consolidated balance sheet:

|

|

(000's) |

|

|

Remainder of 2021 |

|

$ |

|

|

Years ending December 31, |

|

|

|

|

2022 |

|

|

|

|

2023 |

|

|

|

|

2024 |

|

|

|

|

2025 |

|

|

|

|

Total minimum lease payments |

|

|

|

|

Less: amount of lease payments representing interest |

|

|

( |

) |

Present value of future minimum lease payments |

|

|

|

|

Less: operating lease obligations, current portion |

|

|

( |

) |

Operating lease obligations, long-term portion |

|

$ |

|

|

10

8. Stock-Based Compensation

In June 2020, the Company’s board of directors adopted the 2020 Stock Option and Incentive Plan (the “2020 Plan”) and reserved

The 2020 Plan authorizes the board of directors or a committee of the board to grant incentive stock options, nonqualified stock options and restricted stock awards to eligible officers, employees, consultants and directors of the Company. Options generally vest over a period of

Stock-based compensation expense for the nine months ended September 30, 2021 and 2020 was classified in the condensed consolidated statement of operations as follows:

|

|

Nine Months Ended September 30, |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

|

|

(000’s) |

|

|||||

|

|

|

|

|

|

|

||

Research and development |

|

$ |

|

|

$ |

|

||

General and administrative |

|

|

|

|

|

|

||

Total |

|

$ |

|

|

$ |

|

||

As of September 30, 2021, remaining unrecognized compensation cost related to options and restricted stock awards to be recognized in future periods totaled $

Restricted Stock

Prior to the adoption of the 2020 Plan, the Company issued restricted stock.

|

|

Shares |

|

|

Fair Value |

|

||

Weighted Average Fair Value |

|

(000’s) |

|

|

Per Share |

|

||

Unvested, December 31, 2020 |

|

|

|

|

$ |

|

||

Granted |

|

|

|

|

$ |

|

||

Vested |

|

|

( |

) |

|

$ |

|

|

Forfeited or canceled |

|

|

( |

) |

|

$ |

|

|

Unvested, September 30, 2021 |

|

|

|

|

$ |

|

||

As of September 30, 2021, the total unrecognized compensation cost related to stock compensation expense for restricted stock is $

11

Stock Options

The following table summarizes the stock option activity for the 2020 Plan:

|

|

|

|

|

Weighted |

|

|

Weighted |

|

|||

|

|

Number of |

|

|

Average |

|

|

Average |

|

|||

|

|

Unvested |

|

|

Exercise |

|

|

Remaining |

|

|||

|

|

Options |

|

|

Price |

|

|

Contractual |

|

|||

|

|

(000’s) |

|

|

Per Share |

|

|

Life (in years) |

|

|||

Outstanding at December 31, 2020 |

|

|

|

|

$ |

|

|

|

|

|||

Granted |

|

|

|

|

$ |

|

|

|

|

|||

Exercise |

|

|

|

|

$ |

|

|

|

— |

|

||

Forfeited/cancelled |

|

|

( |

) |

|

$ |

|

|

|

— |

|

|

Outstanding at September 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|||

Vested at September 30, 2021 |

|

|

|

|

$ |

|

|

|

|

|||

For the nine months ended September 30, 2021, the weighted average grant date fair value for options granted was $

For the nine months ended September 30, 2020, the weighted average grant date fair value for options granted was $

The weighted average assumptions used in the Black-Scholes pricing model to determine the fair value of stock options granted during the nine months ended September 30, 2021 and 2020 were as follows:

|

Nine Months Ended |

|

|||||

|

September 30, |

|

|||||

|

2021 |

|

|

2020 |

|

||

Expected term (in years) |

|

|

|

|

|

||

Risk-free rate |

|

% |

|

|

% |

||

Expected volatility |

|

% |

|

|

% |

||

12

9. Merger Transaction

On

To determine whether the transaction meets the definition of a business acquisition or an asset acquisition in accordance with ASC 805-10-55, we had to assess the nature of the transaction and the fair value of the assets acquired in the transaction. Our assessment suggest that the fair value of the transaction is substantially concentrated in a license to a single identifiable asset, CTX-009, and a potential financial interest (in the form of royalties) in an additional set of early-stage similar assets. The guidance further requires a business acquisition to include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs. Because all asset acquisitions include inputs, the existence of a substantive process is what distinguishes a business acquisition from an asset acquisition. Our assessment is that there is no process or outputs that are being acquired with the TRIGR acquisition. As a result, the TRIGR acquisition is considered to fall under the guidance of an asset acquisition rather than a business acquisition. Accordingly, the Company allocated the $

10. Related Parties and Related-Party Transactions

On October 16, 2014, the Company entered into a collaboration agreement with Adimab, LLC. The Company’s co-founder has a direct ownership interest in Adimab, LLC. The Company recorded

In connection with the acquisition of TRIGR and upon consummation of the merger agreement on June 25, 2021, Miranda Toledano, who previously served as the Chief Financial Officer and Chief Operating Officer of TRIGR, was appointed to Compass Board of Directors as an independent director. Additionally, to facilitate the transition of CTX-009 from TRIGR, the Company entered into a consulting agreement with Ms. Toledano on June 25, 2021 for a period of six months.

13

11. Other Expense

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

||||

|

|

(000's) |

|

|

(000's) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest income |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Interest expense |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Change in fair value of derivative liability |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

Other income (expenses) |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Total other income (expenses) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

|

$ |

( |

) |

12. License, Research and Collaboration Agreements

Collaboration Agreements

ABL Bio Corporation ("ABL Bio") Agreements

In November 2018, the Company's wholly owned subsidiary TRIGR and ABL Bio, a South Korean biotechnology company, entered into an exclusive global (excluding South Korea) license agreement (the “TRIGR License Agreement”) which granted TRIGR a license to ABL001, ABL Bio’s bispecific antibody targeting DLL4 and VEGF-A (renamed CTX-009). Under the terms of the agreement, ABL Bio and TRIGR would jointly develop CTX-009, with ABL Bio responsible for development of CTX-009 throughout the end of Phase 1 clinical trials and TRIGR responsible for the development of CTX-009 from Phase 2 and onward. ABL Bio received a $

In May 2021, TRIGR and ABL Bio terminated license agreements to several preclinical assets. As a result of the return of these assets to ABL Bio and termination of the license agreements, the Company is eligible to receive royalty payments if ABL Bio develops or licensees two bispecific antibodies (ABL101 and ABL103) that were previously licensed to TRIGR.

Adimab Agreement

The Company entered into a collaboration agreement with Adimab, LLC on

Other License and Research Agreements

FUJIFILM Diosynth Biotechnologies ("Fujifilm") Agreement

The Company entered into a scope of work (“SOW”) under a master services agreement with Fujifilm on July 20, 2020. The Company made cash payments of $

14

13. Subsequent events

On November 1, 2021, the Company announced that it priced an underwritten public offering (the "Offering") to sell

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of the financial condition and results of operations of Compass Therapeutics, Inc. should be read in conjunction with the financial statements and the notes to those statements included in this Quarterly Report on Form 10-Q for the period ended September 30, 2021. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risk, uncertainties and assumptions. You should read the “Risk Factors” section of this Quarterly Report on Form 10-Q and the “Risk Factors” section included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Overview

We are a clinical-stage, oncology-focused biopharmaceutical company developing proprietary antibody-based therapeutics to treat multiple human diseases. Our scientific focus is on the relationship between angiogenesis, the immune system, and tumor growth. Our pipeline of novel product candidates is designed to target multiple critical biological pathways required for an effective anti-tumor response. These include modulation of the microvasculature via angiogenesis-targeted agents, induction of a potent immune response via activators on effector cells in the tumor microenvironment, and alleviation of immunosuppressive mechanisms used by tumors to evade immune surveillance. We plan to advance our product candidates through clinical development as both standalone therapies and in combination with proprietary pipeline antibodies based on supportive clinical and nonclinical data.

On June 25, 2021, we consummated a definitive merger agreement (the “Merger Agreement”) with Trigr Therapeutics, Inc. (“TRIGR”), a private biotechnology company, . Pursuant to the Merger Agreement, through our wholly owned subsidiaries and a two-step merger structure, we acquired all of the outstanding shares of TRIGR (the “TRIGR Merger”). Consideration payable to TRIGR shareholders at closing totaled an aggregate of 10,265,133 shares of our common stock (after giving effect to elimination of fractional shares that would otherwise be issued). In addition, TRIGR shareholders are eligible to receive up to $9 million, representing earnout payments which are dependent on certain events, including $5 million which is dependent on biologics license application approval of a product candidate acquired in the transaction, renamed CTX-009.

We currently have three product candidates, two of which are in clinical development:

CTX-009 (a.k.a. ABL001) - anti-DLL4 x VEGF-A bispecific antibody

CTX-009 is an investigational bispecific antibody that simultaneously blocks Delta-like ligand 4/Notch ("DLL4") and vascular endothelial growth factor A ("VEGF-A") signaling pathways, which are critical to angiogenesis and tumor vascularization. We have licensed exclusive global rights to CTX-009, outside of South Korea, from ABL Bio, Inc. (“ABL Bio”), a South Korea-based clinical-stage company focused on developing antibody therapeutics. South Korean rights are held by Handok Pharmaceuticals, Inc. (“Handok”) and China rights which were out-licensed from the Company to Elpiscience Biopharmaceuticals Co., Limited (“Elpiscience”).

CTX-009 is undergoing clinical development in patients with advanced solid tumors in South Korea. A Phase 1 dose escalation and dose expansion monotherapy study has been completed and a Phase 1b combination study of CTX-009 in combination with chemotherapy is ongoing in South Korea. In the first quarter of 2021, Handok commenced a Phase 2a study of CTX-009 in combination with paclitaxel in patients with biliary tract cancers (“BTC” or “cholangiocarcinoma”) in South Korea.

On October 8, 2021, we, along with ABL Bio, presented clinical trial data from the CTX-009 Phase 1a/1b dose-escalation and dose expansion study at a plenary oral session during the AACR-NCI-EORTC International Conference on Molecular Targets and Cancer Therapeutics (Abstract Number: 4749; Session title: Plenary Session 2: New Drugs on the Horizon I). The significant findings presented are as follows:

16

Phase 1: Monotherapy Clinical Trial of CTX-009

An open-label, Phase 1 dose-escalation and expansion study designed to identify the optimal dose and to evaluate the safety, tolerability, pharmacokinetics, pharmacodynamics and the anti-tumor activity of CTX-009 in patients with advanced solid tumors after failure of standard of care treatment was conducted by ABL Bio in South Korea. This trial consisted of a Phase 1a monotherapy dose escalation arm and a Phase 1b dose expansion arm. The study was initiated in September 2017 and enrollment was completed in February 2021.

The dose escalation portion of the study followed a traditional 3+3 dosing scheme where CTX-009 was administered by intravenous infusion across nine dose cohorts ranging from 0.3 to 17.5 mg/kg biweekly. Patients were enrolled in two arms: a Phase 1a dose-escalation arm and a Phase 1b dose expansion arm. The expansion cohorts were 7.5, 10, 12.5 and 15 mg/kg. Patient tumor volumes were measured using CT scans at baseline and then every eight weeks.

A total of 40 out of the 45 patients enrolled in the study are evaluable for the purpose of determination of anti-tumor activity of CTX-009 since five patients did not reach their first scan at week eight due to progressive disease or for other reasons. Sixteen of the 40 evaluable patients were dosed at the 10 or 12.5 mg/kg dose levels and represent what we project to be the efficacious dose levels. Among those 16 patients, there were three PRs confirmed by RECIST 1.1 with an ORR of 18.8% and eight patients with stable disease (“SD”), with a CBR of 68.8%. Two of the three PRs were in advanced colorectal patients and one of the three PRs was in an advanced gastric cancer patient. In addition, one of the patients with gastric cancer had a 35% decline in tumor mass relative to baseline; however, that regression was not confirmed upon a second CT scan, and hence not included in the ORR and the best response of this patient included in the data set is stable disease.

Phase 1b: Combination Clinical Trial of CTX-009 in South Korea

An open-label, combination Phase 1b clinical trial to evaluate the safety, pharmacokinetics, anti-tumor activity and the RP2D of CTX-009 in combination with paclitaxel or irinotecan chemotherapy is currently being conducted by ABL Bio and Handok in South Korea. This study was initiated in June 2020 and enrollment was completed in December 2020 (clinicaltrials.gov identifier NCT04492033).

The study includes two cohorts, each of which is divided into two groups. The first cohort was administered 10 or 12.5 mg/kg of CTX-009 on a biweekly basis, in combination with 80 mg/m2 paclitaxel administered weekly. The second cohort was administered 10 or 12.5 mg/kg of CTX-009 in combination with 150 mg/m2 irinotecan on a biweekly basis.

Of the 17 patients enrolled, there have been four PRs, including three PRs that were confirmed by RECIST 1.1. and one PR which is unconfirmed, representing a 23.5% ORR and nine patients with SD, representing a CBR of 76.5%. The unconfirmed PR was in a patient with NSCLC who has been on the study for over a year and as of October 5, 2021 remains on the study. Of the four patients with advanced cholangiocarcinoma enrolled in the study, there were two PRs confirmed by RECIST 1.1 with 41% and 62% declines in tumor burden, respectively, representing an ORR in cholangiocarcinoma of 50%. A third patient with cholangiocarcinoma had a stable disease with 28% decline in such patient’s tumor burden, and therefore the CBR observed in cholangiocarcinoma is three out of four, or 75%. The responses in cholangiocarcinoma were particularly durable with a median duration of response ("DOR") of 9.7 months as of October 5, 2021.

The observed ORR of CTX-009 at the 10 and 12.5 mg/kg doses are 18.8% (3/16) as a monotherapy and 23.5% (4/17) in combination with chemotherapy. The CBR of CTX-009 at the 10 and 12.5 mg/kg is 68.8% (11/16) as a monotherapy and 76.5% (13/17) in combination with chemotherapy.

17

Phase 2a: Interim Data from Combination Clinical Trial of CTX-009 in BTC in South Korea

A Phase 2a study of CTX-009 in combination with paclitaxel was initiated by Handok in the first quarter of 2021 in patients with BTC. The study has been enrolling patients with unresectable advanced, metastatic, or relapsed BTCs and have received one or two prior systemic therapies.

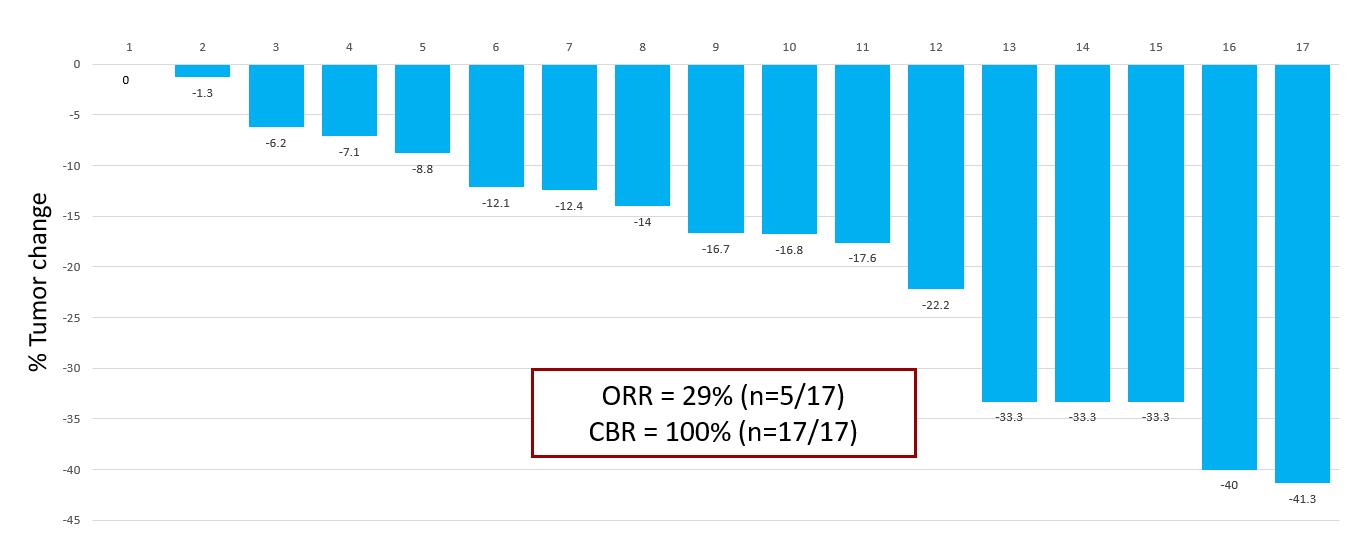

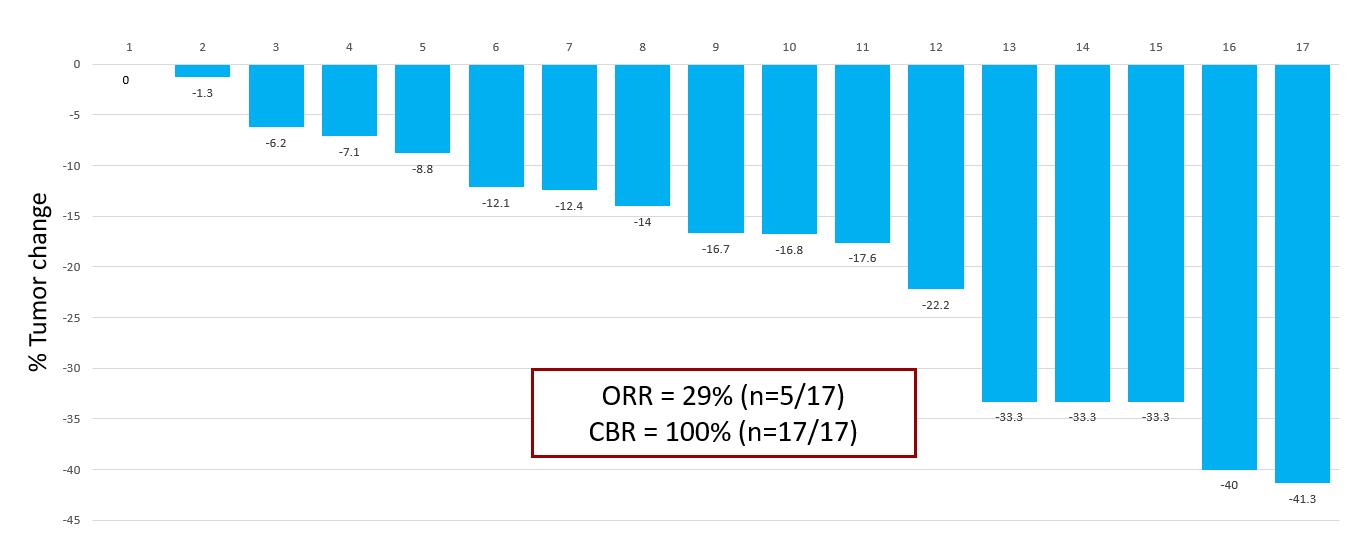

The Phase 2a study utilizes a Simon Two-Stage adaptive design where the criteria to advance to the second stage of the study is three PRs observed in 21 patients. Based on the Simon Two-Stage design, when the criteria for the first Stage is met, the study progresses to the second stage, where 45 additional patients will be enrolled. As of October 5, 2021, there had been five PRs observed among the first 17 patients evaluated (ORR=29%), and accordingly, the criteria to advance to the second part of the study has already been met. The study is being conducted at four leading medical centers in South Korea.

As of October 5, 2021, no formal safety data analysis had been completed, but CTX-009 was observed to be generally well-tolerated. AEs that were determined to be probably or possibly related to CTX-009 treatment included Grade 3 hypertension observed in 2 patients (8%). Other AEs observed were Grade 3 neutropenia (46%), Grade 3 thrombocytopenia (4%) and Grade 3 anemia (13%), which were all attributed to the concomitant chemotherapy agent (paclitaxel).

The table below depicts a preliminary summary of the drug-related AEs in 24 patients as of October 5, 2021:

|

Drug-related adverse events observed in >1 patient (preliminary as of |

Total |

Total |

Grade 3 |

Grade 3 |

10/5/2021) |

(n) |

(%) |

(n) |

(%) |

|

Neutropenia* |

11 |

46 |

11 |

46 |

|

Hypertension |

9 |

38 |

2 |

8 |

|

Thrombocytopenia* |

4 |

17 |

1 |

4 |

|

Anemia* |

3 |

13 |

3 |

13 |

|

Dyspnea |

3 |

13 |

0 |

0 |

|

General weakness |

3 |

13 |

1 |

4 |

|

Headache |

3 |

13 |

0 |

0 |

|

Hoarseness |

3 |

13 |

0 |

0 |

|

Edema, Fatigue, Fever, Pneumonia, Proteinuria |

2 each |

8 |

1 |

1** |

|

|

* Labeled Grade 3/4 cytopenia events with paclitaxel:52% neutropenia, 16% anemia, 7% thrombocytopenia ** One Grade5 pneumonia |

|

|

|

|

The study has enrolled 24 patients and 17 of those patients have reached their first CT scan and are considered evaluable. Five PRs confirmed by RECIST 1.1 have been observed among the first 17 evaluable patients, leading to a preliminary ORR of 29%, and all patients evaluated have had stable disease or better with a decline in tumor burden observed in 16 of the 17 patients leading to a CBR of 100%.

18

The interim waterfall plot below depicts the best response for each of the 17 patients evaluated in the study as of September 28, 2021:

We plan to submit an Investigational New Drug (“IND”) application to the U.S. Food and Drug Administration (“FDA”) in the fourth quarter of 2021 and subject to the IND going into effect with the FDA, to initiate a Phase 2 study of CTX-009 in combination with paclitaxel in patients with cholangiocarcinoma in the second quarter of 2022.

The second clinical study for which we plan to submit an IND is a Phase 2/3 monotherapy clinical trial of CTX-009 in the third line setting in colorectal cancer. We believe we can advance CTX-009 into a Phase 2/3 study in the third line setting in colorectal cancer with ORR and DOR as potential endpoints for accelerated approval. We plan to submit an IND supplement to the FDA in the first half of 2022 and subject to the IND going into effect with the FDA, to initiate a Phase 2 study in patients with colorectal cancer in the second half of 2022. We have not yet discussed this plan with regulatory agencies, including the FDA.

The timing of the initiation of the clinical trials in the United States depends, among other things, on the availability of clinical drug product for the studies, communications with the FDA and FDA allowance for each of the proposed studies to proceed.

CTX-471 - a monoclonal antibody agonist of CD137, a key co-stimulatory receptor on immune cells

In July 2019, we initiated a Phase 1 trial evaluating the safety and tolerability of CTX-471 as a monotherapy in oncology patients who were previously treated with PD-1 or PD-L1 immune checkpoint inhibitors and subsequently relapsed or progressed after a period of stable disease. The design of this trial includes a dose escalation stage (Phase 1a) followed by a dose expansion stage (Phase 1b). The dose-escalation stage of the Phase 1a trial has been completed and CTX-471 was observed to be generally well-tolerated.

The dose expansion stage of the trial is currently ongoing and nearing completion. As of October 21, 2021, 36 patients have been enrolled in the study and 25 of those patients are evaluable. Of the 25 evaluable patients, 2 patients had a PR, one of which has been confirmed by RECIST 1.1 and the other PR has been seen at the first tumor evaluation at Week 9, and 11 patients have reached stable disease, leading to a preliminary ORR of 8.0% and a CBR of 52%.

The first PR observed in the study was in a patient with advanced small cell lung cancer who had a PR at week 17 and this response has been confirmed at week 25. This patient has now been dosed with CTX-471 for more than one year with a durable PR. In October 2021, a second PR was observed in a patient with metastatic melanoma who was previously treated with nivolumab and progressed on nivolumab. There has been one treatment-related serious adverse event (“SAE”) in the Phase 1b dose expansion stage of the trial. We expect to complete the Phase 1b stage of this trial during the first half of 2022. The next step for development of CTX-471 is the initiation of a Phase 1b combination study with a PD-1 or PD-L1 blocker in the first half of 2022.

19

CTX-8371 - a bispecific antibody that simultaneously targets both PD-1 and PD-L1

CTX-8371 is a bispecific antibody that simultaneously targets both PD-1 and PD-L1, the targets of well-known and widely used checkpoint inhibitor antibodies. IND-enabling studies with CTX-8371 were initiated in August 2020 and are generally progressing well except that over the last six months, our contract development manufacturing organization, Fujifilm Diosynth Biotechnologies (see Note 12 to the financial statements contained in this Form 10-Q for further description of Fujifilm agreement) has been experiencing delays with its supply chain management, leading to a delay in the GMP manufacturing campaign of CTX-8371. Based on the new timeline provided by Fujifilm for the GMP manufacturing campaign, we are currently targeting an IND submission for CTX-8371 in the second half of 2022.

We have funded our operations primarily with proceeds from the sale of our equity securities and borrowings from debt arrangements. Through September 30, 2021, we have received $132.0 million in gross proceeds from the sale of equity securities, $15.0 million in term loan borrowings under a credit facility with Pacific Western Bank ("the Credit Facility") and $60.5 million in gross proceeds from the sale of our common stock in a private placement in June 2020. In November 2021, we completed an underwritten public offering in which we received net proceeds of approximately $117.3 million after underwriting and offering expenses (See Note 13 to the financial statements contained in this Form 10-Q for further description of this transaction).

We have incurred significant operating losses since inception and have not generated any revenue from the sale of products and we do not expect to generate any revenue from the sale of products in the near future, if at all. Our ability to generate product revenue sufficient to achieve profitability will depend heavily on the successful development and eventual commercialization of our treatments and any future product candidates. Our net losses were $6.0 million and $9.2 million for the three months ended September 30, 2021 and 2020, respectively, and $69.2 million and $21.1 million for the nine months ended September 30, 2021 and 2020, respectively. The losses for the nine months ended September 30, 2021 include $50.6 million of in-process R&D expense related to the TRIGR merger, which was a stock only transaction. We had an accumulated deficit of $220.6 million at September 30, 2021. We expect to continue to incur significant expenses for at least the next several years as we advance through clinical development, develop additional product candidates and seek regulatory approval of any product candidates that complete clinical development. In addition, if we obtain marketing approval for any product candidates, we expect to incur significant commercialization expenses related to product manufacturing, marketing, sales and distribution. We may also incur expenses in connection with the in-licensing or acquisition of additional product candidates.

Until such time as we can generate significant revenue from product sales, if ever, we expect to finance our operations through equity and debt financings, or other capital sources, which may include collaborations with other companies or other strategic transactions. As of September 30, 2021, we had $25.5 million in cash and cash equivalents. With the proceeds from the underwritten offering in November 2021, and based on our research and development plans, we expect that such cash resources will enable us to fund our operating expenses and capital expenditure requirements through the fourth quarter of 2024.

Because of the numerous risks and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when, or if, we will be able to achieve or maintain profitability. Even if we are able to generate product sales, we may not become profitable. If we fail to become profitable or are unable to sustain profitability on a continuing basis, then we may be unable to continue our operations at planned levels and be forced to reduce or terminate our operations. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty.

20

COVID-19 Update

We have been carefully monitoring the COVID-19 pandemic and its potential impact on our business and have taken important steps to help ensure the safety of our employees and to reduce the spread of COVID-19 community-wide. We are ensuring that essential staffing levels at our operations remain in place, including maintaining key personnel in our laboratory facilities. We have implemented stringent safety measures designed to create a safe and clean environment for our employees as we continue to comply with applicable federal, state and local guidelines instituted in response to the COVID-19 pandemic.

We have been able to continue to pursue patient dosing and monitoring of our Phase 1 clinical trial of CTX-471 without significant delays. However, we have experienced increased delays in patient enrollment in several of our trial sites. In order to address the reduction in patient enrollment, we have added additional sites. In addition, there have been delays in sourcing of selected supplies required for the manufacturing of material to be used in our future clinical trials, and these delays have impacted and may continue to impact the timing of our future clinical trials. We expect that COVID-19 may continue to directly or indirectly impact (i) our employees and business operations or personnel at third-party suppliers and other vendors in the U.S. and other countries; (ii) the availability, cost or supply of materials; and (iii) the timeline for our ongoing clinical trial and potential future trials. We are continuing to assess the potential impact of the COVID-19 pandemic on our current and future business and operations, including our expenses and clinical trials, as well as on our industry and the healthcare system.

Components of Results of Operations

Research and Development

Research and development expenses consist primarily of costs incurred in connection with the development of our product candidates, CTX-471, CTX-8371 and CTX-009, as well as unrelated discovery program expenses. We expense research and development costs as incurred. These expenses include:

Advance payments that we make for goods or services to be received in the future for use in research and development activities are recorded as prepaid expenses. Such amounts are recognized as an expense as the goods are delivered or the related services are performed, or until it is no longer expected that the goods will be delivered or the services rendered.

Product candidates in later stages of clinical development generally have higher development costs than those in earlier stages of clinical development, primarily due to the increased size and duration of later-stage clinical trials. We expect that our research and development expenses will increase substantially in connection with our planned clinical development activities in the future. At this time, we cannot accurately estimate or know the nature, timing and costs of the efforts that will be necessary to complete the clinical development of any future product candidates.

The successful development and commercialization of product candidates is highly uncertain. This is due to the numerous risks and uncertainties associated with product development and commercialization.

21

In-Process R&D

In-process R&D expenses consists of the acquisition of Trigr Therapeutics, Inc., whose primary asset is CTX-009, an anti-DLL4 x VEGF-A bispecific antibody. As we expense research and development costs as incurred, the cost of this acquisition was expensed. See Note 9 to the financial statements contained in this Form 10-Q for further description of the accounting of this transaction.

General and Administrative Expenses

General and administrative expenses consist primarily of salaries and related costs for personnel in executive, finance, corporate and business development, and administrative functions. General and administrative expenses also include legal fees relating to patent and corporate matters; professional fees for accounting, auditing, tax and administrative consulting services; insurance costs; administrative travel expenses; marketing expenses and other operating costs.

We anticipate that our general and administrative expenses will increase in the future as we increase our headcount to support our business operations.

Other Expense, Net

Other expense consists of interest expense, interest income and realized losses on sales of furniture and equipment.

Interest expense consists primarily of cash interest under our Credit Facility that we entered into in March 2018 and the related non-cash interest attributable to the amortization of deferred financing costs incurred in connection with this facility.

Results of Operations

Comparison of the Three Months Ended September 30, 2021 and 2020

The following table summarizes our results of operations for the three months ended September 30, 2021 and 2020:

|

|

Three Months Ended September 30, |

|

|||||||||

|

|

2021 |

|

|

2020 |

|

|

Change |

|

|||

|

|

|

|

|

(000’s) |

|

|

|

|

|||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|||

Research and development |

|

$ |

3,154 |

|

|

$ |

3,670 |

|

|

$ |

(516 |

) |

General and administrative |

|

|

2,700 |

|

|

|

5,291 |

|

|

|

(2,591 |

) |

Total operating expenses |

|

|

5,854 |

|

|

|

8,961 |

|

|

|

(3,107 |

) |

Loss from operations |

|

|

(5,854 |

) |

|

|

(8,961 |

) |

|

|

3,107 |

|

Other expense, net |

|

|

(121 |

) |

|

|

(189 |

) |

|

|

68 |

|

Loss before income tax expense |

|

|

(5,975 |

) |

|

|

(9,150 |

) |

|

|

3,175 |

|

Income tax expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

$ |

(5,975 |

) |

|

$ |

(9,150 |

) |

|

$ |

3,175 |

|

|

|

|

|

|

|

|

|

|

|

|||

Research and Development Expenses

Research and development expenses decreased by $0.5 million for the three months ended September 30, 2021 compared to the three months ended September 30, 2020. We incurred $0.3 million less in depreciation expense and $0.2 million less in program related expenses (clinical and manufacturing expense related to CTX-471 and CTX-8371, respectively) as compared to the same period in 2020.

22

We track outsourced development, outsourced personnel costs and other research and development costs of specific programs. In 2021, we began tracking our internal personnel costs on a program-by-program basis. Research and development expenses are summarized by program in the table below:

|

|

Three Months Ended September 30, |

|

|||||

|

|

2021 |

|

|

2020 |

|

||

|

|

(000’s) |

|

|||||

|

|

|

|

|

|

|

||

CTX-471 |

|

$ |

1,067 |

|

|

$ |

438 |

|

CTX-8371 |

|

|

274 |

|

|

|

599 |

|

CTX-009 |

|

|

177 |

|

|

|

— |

|

Unallocated research and development expenses |

|

|

1,636 |

|

|

|

2,633 |

|

Total research and development expenses |

|

$ |

3,154 |

|

|

$ |

3,670 |

|

General and Administrative Expenses