As filed with the Securities and Exchange Commission on May 9, 2023

Registration No. 333-269753

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter) |

| 8071 |

| ||

(State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cloud Peak Law Group, P.C.

1095 Sugar View Dr, Ste 100 Sheridan, Wyoming 82801, USA

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William S. Rosenstadt, Esq. Mengyi “Jason” Ye, Esq. Ortoli Rosenstadt LLP 366 Madison Avenue, 3rd Floor New York, NY 10017 +1-212-588-0022 - telephone +1-212-826-9307 - facsimile |

| Fang Liu, Esq. VCL Law LLP 1945 Old Gallows Road, Suite 630 Vienna, VA 22182 +1 (703) 919-7285 |

Approximate date of proposed sale to the public

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

| SUBJECT TO COMPLETION, DATED MAY 9, 2023 |

BIONEXUS GENE LAB CORP.

1,875,000 Shares of Common Stock

We are offering up to an aggregate of 1,875,000 shares of our common stock, no par value per share, of BioNexus Gene Lab Corp, a Wyoming corporation, on a firm commitment basis.

We expect the offering price of our common stock will be $[●] per share. Prior to this offering, our common stock was quoted on the OTCQB under the symbol “BGLC.” As of the date of this prospectus, the trading price for our common stock, as reported on the OTCQB, was $[●] per share ($[●] on a post-reverse split basis). We have applied to list our common stock under the symbol “BGLC” on the Nasdaq Capital Market (“Nasdaq”). However, there is no assurance that the offering will close and that our common stock will be trading on Nasdaq. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our common stock will be approved for listing on Nasdaq.

The share and per share information in this prospectus reflects, other than in our Financial Statements and the Notes thereto, our proposed reverse stock split of the outstanding common stock of 12 for 1 to occur immediately upon our common stock’s listing on Nasdaq.

We are both an “emerging growth company” and a “smaller reporting company” under the federal securities laws and have elected to comply with certain reduced public company reporting requirements available to each. See “Prospectus Summary—Implications of Being an Emerging Growth Company” and “Prospectus Summary—Implications of Smaller Reporting Company.”

|

| Per Share |

|

| Total Without Over- Allotment Option |

|

| Total With Full Over- Allotment Option |

| |||||||||

Public offering price |

| US$ |

|

|

|

|

| US$ |

|

|

|

|

| US$ |

|

|

|

|

Underwriting discount (1) |

| US$ |

|

|

|

|

| US$ |

|

|

|

|

| US$ |

|

|

|

|

Proceeds to us, before expenses (2) |

| US$ |

|

|

|

|

| US$ |

|

|

|

|

| US$ |

|

|

|

|

(1) We have agreed to give the Underwriter a discount equal to eight percent (8%) of the gross proceeds of this offering. See “Underwriting” beginning on page 85 for additional information regarding the Underwriter’s compensation.

(2) We estimate the total expenses of this offering will be approximately $[418,851].

This offering is being conducted on a firm commitment basis. The Underwriter is obligated to take and pay for all of the shares offered pursuant to this offering if any such shares are taken by the Underwriter. We have also granted the Underwriter an option to purchase up to an additional 281,250 shares of common stock from us at the public offering price, less underwriting discounts, within 45 days from the date on which this registration statement is declared effective by the Securities and Exchange Commission to cover over-allotments, if any. If the Underwriter exercises the option in full, the total underwriting discounts payable will be $690,000, and the total proceeds to us, before expenses, will be $[●].

If we complete this offering, net proceeds will be delivered to us on the closing date.

The Underwriter expects to deliver the common stock against payment in U.S. dollars to purchasers on or about [●], 2023.

Investing in our common stock and warrants (collectively, “Securities”) involves a high degree of risk. See “Risk Factors” beginning on page 14 of this prospectus for a discussion of information that should be considered in connection with an investment in our Securities.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 9, 2023

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

| 2 |

TABLE OF CONTENTS

|

| Page |

|

| 4 |

| |

| 14 |

| |

| 35 |

| |

| 35 |

| |

| 36 |

| |

| 37 |

| |

| 37 |

| |

| 39 |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 40 |

|

| 51 |

| |

| 66 |

| |

| 70 |

| |

| 74 |

| |

| 76 |

| |

| 77 |

| |

| 77 |

| |

Market for Registrant’s Common Equity and Related Stockholder Matters |

| 78 |

|

| 79 |

| |

| 80 |

| |

| 84 |

| |

| 85 |

| |

| 89 |

| |

| 89 |

| |

| 89 |

| |

| F-1 |

|

Neither the underwriter nor we have authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell shares of our common stock and seeking offers to buy shares of our common stock, only in jurisdictions where such offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market, and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data, and other industry data and forecasts are reliable, we have not independently verified the data.

For investors outside of the United States: neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and observe any restrictions relating to this offering and the distribution of this prospectus.

| 3 |

| Table of Contents |

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in one share of common stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Prospectus Conventions

Except where the context otherwise requires and for purposes of this prospectus only, any references to “BioNexus” and “BGLC” are to BioNexus Gene Lab Corp., a Wyoming company, and any references to “we,” “our,” “the Company,” “our company” and “us” are to BioNexus Gene Lab Corp. and its subsidiaries. Unless otherwise indicated, in this prospectus, references to: | ||

|

|

|

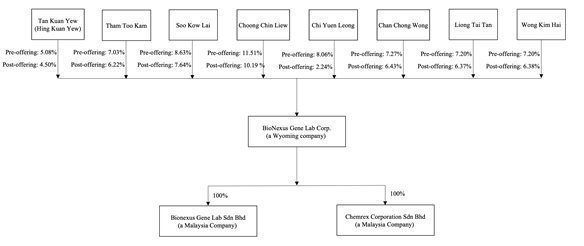

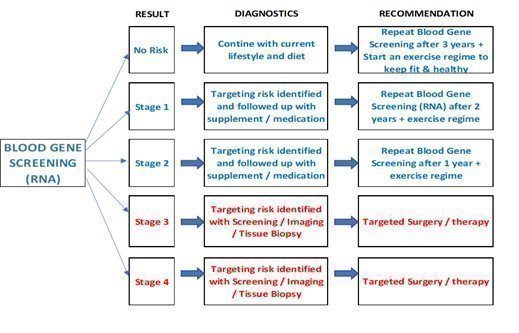

| · | “BGL” or “BioNexus Malaysia” refers to BioNexus Gene Lab Sdn Bhd, a Malaysian corporation and a wholly owned subsidiary of BioNexus. |

|

|

|

| · | “Chemrex” refers to Chemrex Corporation Sdn Bhd., a Malaysian corporation and a wholly owned subsidiary of BioNexus. |

|

|

|

| · | “Dollar,” “USD,” “US$,” or “$” are to U.S. dollars. |

|

|

|

| · | “FRP” refers to fibre-reinforced polymer. |

|

|

|

| · | “FY” refers to financial year. |

|

|

|

| · | “RNA” refers to ribonucleic acid. |

|

|

|

| · | “R&D” refers to research and development. |

|

|

|

| · | “RM” and “Ringgit” refer to the legal currency of Malaysia. |

|

|

|

| · | “Underwriter” refers to Network 1 Financial Securities, Inc. |

Overview

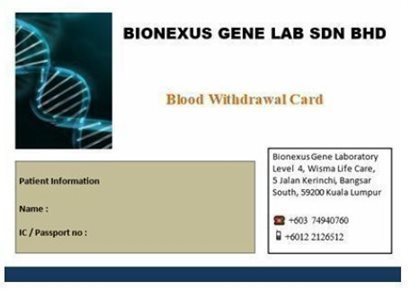

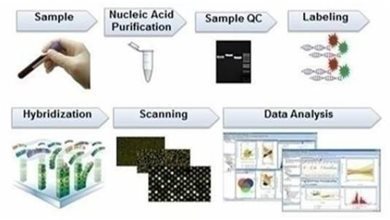

BioNexus Gene Lab Corp., through our wholly owned subsidiary BioNexus Gene Lab Sdn Bhd, is in the business of developing and providing safe, effective, and non-invasive liquid biopsy tests for the early detection of disease risks derived from evidence-based research to minimize treatment costs and improve patient management on his current health status. Our non-invasive blood tests provide analysis of changes in RNA to detect the potential risk of 11 different diseases.

Furthermore, through our wholly owned subsidiary Chemrex Corporation Sdn Bhd., we focus on the sale of chemical raw materials for the manufacture of industrial, medical, appliance, aero, automotive, mechanical, and electronic industries in the Southeast Asia region. These countries include Malaysia, Indonesia, Vietnam, and other countries in Southeast Asia.

| ||

| 4 |

| Table of Contents |

Our Products

Non-invasive Blood Tests

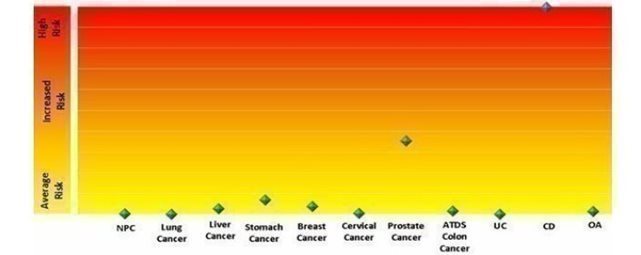

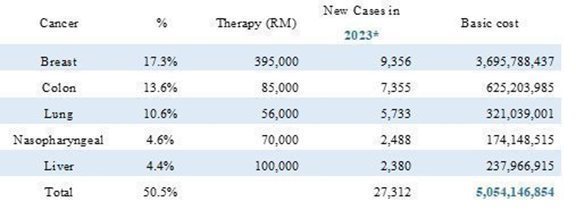

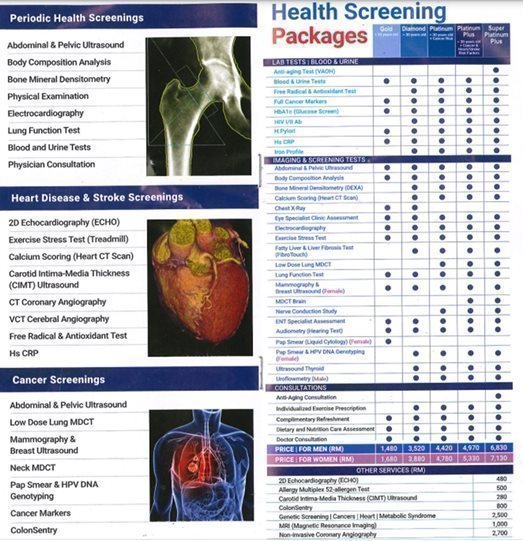

Through our wholly owned subsidiary BGL, we provide non-invasive blood tests to analyze changes in RNA to detect the potential risk of 11 different diseases by biomarkers in Malaysia. These diseases include eight cancers (nasopharyngeal, lung, liver, stomach, breast, cervical, prostate and colon), two bowel diseases (colitis and Crohn’s) and osteoarthritis.

As of December 31, 2022 and December 31, 2021, respectively, 0.9% and 10% of our revenue was from the sales of non-invasive blood tests. Since August 2022, we had proposed to the Chief Secretary of the Health Ministry of Malaysia a nationwide RNA screening on 0.2% of the population aged 40 and above. The Deputy Director General from Public Health scheduled a meeting on January 17, 2023 to examine the cost effectiveness of our RNA screening. Meanwhile, we had presented our technology and expansion plan nationally and globally to the Minister of Science and Technology. We received favorable response and we are advised to submit for a technology grant for the continuation of research, commercialization and expansion.

Chemical Raw Material Products

Through our wholly owned subsidiary Chemrex, we focus on chemical raw material products. We purchase raw chemical materials, mostly FRP, from domestic and international manufacturers and sell them to customers in Southeast Asia Maldives Islands, Sri Lanka, Bangladesh, and Africa. The FRP and other raw materials we offer are used to produce a wide variety of goods, including handrails, bench tops, automotive and aero parts, cleanroom panels, and covers for various instruments used in manufacturing.

As of December 31, 2022, and December 31, 2021, respectively, 99.1% and 88.67%, of our revenue are from the sales of FRP and other raw materials.

Our Strategies | ||

|

| BGL |

|

|

|

| · | Continue to leverage our relationships with healthcare providers. To date, we have relied upon the efforts of management and their relationships with healthcare providers to create continued interest in our blood-based genomic screening. These relationships have been located primarily in the Klang Valley market. We will continue to use our relationships with providers in the Klang Valley market and elsewhere in Malaysia to increase sales and product awareness. |

|

|

|

| · | Continue to collaborate with local hospitals on our research and development. Continue with our research on Cardiovascular Disease, Stroke, Pancreas Cancer, Alzheimer, Mental Disorders (Depression, Obsessive Compulsive Disorder and Schizophrenia) for the next few years. To date, we have collaborative partnerships with these local hospitals such as National Heart Centre, University Malaya Medical Centre, National University Hospital and Monash University, Australia. |

|

|

|

| · | Allocate more capital resources to our marketing efforts. Apart from sales through existing relationships with healthcare providers, we intend to allocate more capital to marketing and promotion. As part of these efforts, we have appointed two commission-based marketing companies, Gloco and Yakin Healthcare, to bring awareness of our services in Malaysia. |

|

|

|

| · | Increase focus on corporate clients. To date, we have entered arrangements with six corporate clients to provide our 11 diseases/disorders screening services to their employees. In addition, we intend to solicit more corporate clients in the Klang Valley and major cities in Malaysia. We commenced these efforts last year and will continue in 2023. Our officers and the Marketing Companies will undertake these efforts. |

|

|

|

| · | Expand to other regions in Malaysia. We intend to expand to other large cities in Malaysia, such as Penang, Ipoh, Seremban, Melaka, Johor Bahru, and Kuantan.

|

|

|

Chemrex

|

| · | Continue to leverage our relationships with suppliers and customers. Most suppliers and customers have been doing business with Chemrex for more than 10 years. Chemrex’s mission is to supply innovative chemical raw material for the composite industry. We have reach across Southeast Asia, the Maldives Islands, Sri Lanka, Bangladesh and Africa. Given, our decade of experience in the composite industry and our long-standing relationship with several leading name in the fiberglass manufacturing, we pledged to offer consistently superior grade products.

|

| · | Online and off-line marketing. Most of the new customers are reviewing Chemrex products online before visiting the sales office for further discussion and finalization of orders. They may start with one product and ended up ordering a combination of four to six products instead of sourcing from few other suppliers in view of the competitive quantity discount |

|

|

|

| · | Reduce logistics costs and optimize inventory capacity. Space optimizing with cross docking from manufacturers/suppliers to customers to cut down logistic and warehousing costs. Automate the stock arrangement and speedy stock retrieval for existing warehouses and new regional warehouses where the revenues increase to $5m or more. |

| 5 |

| Table of Contents |

Our Competitive Strengths | ||

|

|

|

|

| BGL

|

| · | Our screening (a simple blood draw) is less invasive, unlike tissue biopsies. A tissue biopsy is a procedure in which a physician removes a piece of tissue or a sample of cells from a patient’s body to be analyzed in a laboratory. If a patient experiences certain signs and symptoms or the physician has identified an area of concern, he may undergo a biopsy to determine whether the patient has cancer or another ailment. While biopsies can have higher accuracy, it is a more invasive procedure that is difficult to repeat and thus impractical for periodic monitoring. BGL’s screening tests are a form of liquid biopsy which utilizes RNA biomarkers. Broadly speaking, a liquid biopsy is the collection of a blood sample to test for relevant biomarkers to inform patient management, most applied to the collection of peripheral blood for analysis of cell-free circulating tumor ribonucleic acids (RNA). Since liquid biopsies are performed on peripheral blood, which is easy to access, it allows for more widespread use, particularly in patients who cannot have surgery. As a result, liquid biopsies can reduce the time to treatment, improve the efficiency of medical staff and resources, and be used to screen more diseases. |

|

|

|

| · | Non-DNA blood tests for diseases like cancer are not dispositive. There currently exist various examinations to detect diseases in patients. For example, abnormally high or low levels of certain substances in your body can be a sign of disease. Testing of blood, urine or other body fluids that measure these substances can help doctors make a diagnosis. However, abnormal lab results are not a sure sign of disease. Lab conventional blood tests are an important tool but are not always reliable because of low sensitivity, specificity, and predictive value. |

|

|

|

| · | Other Conventional tests could require a longer turnaround time. Imaging is a procedure in which physicians utilize pictures of areas inside the body that help the doctor see whether a disease is present. These images can be taken in several ways, including a CT scan, Nuclear Scan, MRI, PET Scan, and Ultrasound. Imaging is useful in providing physicians with real-time images to assist with diagnosis. However, imaging techniques can have longer turnaround times, the information provided can be limited, and the patient may be exposed to radiation. |

|

|

|

| · | Our screening provides a predictive risk assessment for developing the 11 diseases. Most other screening procedures detect diseases only when they are already present in the body and most cases, in the final stages of the disease, making it difficult to treat or reverse. Our screening can detect the 11 diseases at an earlier stage before any symptoms even appear. Early detection and targeted medical intervention could be crucial in saving patients’ lives and financial resources. |

|

|

|

| · | Our screening measures the current risk of specific individuals. DNA tests measure a specific individual’s lifetime risk based on their DNA. However, since DNA does not change with external factors, it cannot quantify an individual’s specific risk of the disease materializing. However, our RNA-based test is highly specific since RNA expression changes with lifestyle and other external factors. Hence, at-risk patients can make timely adjustments to their lifestyles to reduce the potentiality of these diseases. Lifestyle adjustments may include reduction or changes to food, tobacco, and alcohol intake, change of working environment, and the implementation of exercise programs, among other changes. |

|

|

|

|

| Chemrex |

|

|

|

| · | Technical Expertise: Our technical staff, comprising two chemists and one engineer, are highly competent and familiar with the technical advancements in the FRP industry. They provide technical know-how on mixing various products and offer product suggestions or modifications to our customers, which may involve strengthening or enhancing existing products sold by our customers. |

|

|

|

| · | Pricing Advantage: As a prominent reseller of FRP products in the domestic market with significant market share, we distribute our products at a relatively higher volume than our competitors. Hence, we enjoy the discounts we order from our suppliers in bulk which we then pass on to our customers. As a result, prospective customers could incur higher prices if they purchase from our competitors who do not transact at such a high volume. |

|

|

|

| · | Convenience: We provide a wide variety of over 100 FRP products from different suppliers and manufacturers. In contrast, some of our competitors might have a smaller product range. In addition, prospective customers could incur higher logistics if they purchase from many different sellers instead of relying on us as a one stop shop for all their business needs. |

|

|

|

| · | Sourcing New Raw Materials for product development: We source a broad range of raw materials worldwide. This global reach greatly expands our potential customers and provides more opportunities for our customers to develop new products from a greater variety of raw materials. |

| 6 |

| Table of Contents |

Sales and Marketing | ||

|

|

|

| · | Online Promotion. We market our product offerings through our website www.chemrex.com.my. We utilize Google’s search engine optimization to drive traffic to our website. Additionally, we also engage the services of PanPages, an internet marketing company to further market our products to new consumers over the internet. New prospective customers can forward their inquiries via phone or our website. Our marketing and technical representatives will then contact the prospective customer and discuss how we can fulfill their order and accommodate any specific requests. |

|

|

|

| · | Product Display. We invite current and potential customers to examine our product range at our warehouse; thus, customers may get a more comprehensive assessment of our product’s quality. |

|

|

|

| · | Marketing Personnel. Our product sales and marketing are performed by our Managing Director Mr. Tham Too Kam, our Executive Director Mr. Tan Liong Tai, and our Marketing Manager Mr. Chan Kwan Wah, together with three marketing and technical representatives. |

|

|

|

| · | Business Introduction from Suppliers. We meet our suppliers regularly. From time to time, our suppliers will also provide us with the contact details of new potential customers we can provide our products to and our marketing personnel will follow up on these new sales leads. |

|

|

|

Summary of Risks

Investing in our common stock involves risks. The risks summarized below are qualified by reference to “Risk Factors” beginning on page 11 of this prospectus, which you should carefully consider before deciding to purchase our shares of common stock. If any of these risks occurs, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our shares of common stock would likely decline, and you may lose all or part of your investment.

Risk Factors Related to Our Financial Prospects and Capitalization | ||

|

|

|

| · | BioNexus’ limited operating history may make it difficult to evaluate our current business and this makes predictions about our future success or viability subject to significant uncertainty. (on page 11). |

|

|

|

| · | BioNexus’ growth (organic and inorganic) may require substantial capital and long-term investments (on page 11). |

|

|

|

| · | BioNexus may incur net losses in the near future (on page 12). |

|

|

|

| · | Any additional capital BioNexus raises may not be available on satisfactory terms and may adversely affect stockholders’ holdings or rights (on page 12). |

|

|

|

| · | Raising additional capital may lead to dilution of shareholdings by BioNexus’ existing shareholders, restrict BioNexus’ operations, and may further result in fair value loss adversely affecting BioNexus’ financial results (on page 12). |

| 7 |

| Table of Contents |

| Risk Factors Related to Our Business and Industry

| |

| · | Global economic conditions could materially adversely impact demand for BioNexus’ products and services (on page 13). |

|

|

|

| · | Business disruptions could seriously harm BioNexus’ future revenue and financial condition and increase its costs and expenses (on page 14). |

|

|

|

| · | BGL’s financial prospects depend substantially upon the successful commercialization of the company’s services and products in the future, which may fail or experience significant delays (on page 15). |

|

|

|

| · | The marketing, sale and use of BGL’s products and services could result in substantial damages arising from products or service liability or professional liability claims, that exceed BGL’s resources (on page 17). |

|

|

|

| · | BGL may face technology transfer challenges and expenses in adding new tests to its portfolio and in expanding its reach into new geographical areas (on page 18). |

|

|

|

| · | BGL’s biomarkers have undergone limited clinical trials (on page 18). |

|

|

|

| · | BGL’s use both “open source” and proprietary software could subject its proprietary software to general release, adversely affect its ability to sell its tests and subject the company to possible litigation (on page 21). |

|

|

|

| · | BGL may face competition from other biotechnology competitors and its operating results will suffer if BGL fail to compete effectively (on page 21). |

|

|

|

| · | The chemical raw material industry is cyclical and both recessions and prolonged periods of slow economic growth could have an adverse effect on Chemrex’s business (on page 22). |

|

|

|

| · | The results of Chemrex’s operations are sensitive to volatility in the cost of raw materials, particularly fibre reinforced plastics (on page 22). |

|

|

|

| · | Disruptions in the supply of chemicals that we distribute or in the operations of our customers could adversely affect our business (on page 23). |

|

|

|

| · | We have non-written contracts with suppliers and customers, which are generally terminable upon notice, and the termination of our relationships with suppliers and customers contracts could negatively affect our business (on page 23). |

| 8 |

| Table of Contents |

| Risks Related to Its Operations | |

|

|

|

| · | BioNexus’ officers and directors may in future have outside business activities. As a result, there may be potential conflicts of interest and negatively impact the amount of time they will be able to dedicate to the company (on page 24). |

|

|

|

| · | BioNexus may be subject to intellectual property claims, which are extremely costly to defend, could require us to pay significant damages and could limit the company’s ability to use certain technologies in the future (on page 25). |

|

|

|

| · | BioNexus may pursue collaborations, in-licensing or out-license arrangements, joint ventures, strategic alliances, partnerships or other strategic investments or arrangements, which may fail to produce anticipated benefits and adversely affect the company’s operations (on page 25). |

|

|

|

| Risks Related to Doing Business in the Southeast Asia Region | |

|

|

|

| · | Changes in policies in Malaysia and other Southeast Asian countries could have a significant impact upon BioNexus’s ability to operate profitably in Malaysia and the Southeast Asia region (on page 26). |

|

|

|

| · | Developments in the social, political, regulatory and economic environment in Malaysia may have a material adverse impact on us (on page 27). |

|

|

|

| · | You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing actions in Malaysia against the BioNexus or its management named in the prospectus based on foreign laws, and the ability of U.S. authorities to bring actions in Malaysia may also be limited (on page 27). |

|

|

|

| Risks Related to This Offering

| |

| · | The offering price for the securities offered under this prospectus may not accurately reflect the value of your investment. Price movement could be affected by the industry market trend and announcement (on page 28). |

|

|

|

| · | BioNexus may experience periods of being a “thinly traded” stock. As a result, if BioNexus’ shareholders sell a large number of shares, the market price of its shares may decline due to the downward pressure (on page 28). |

|

|

|

| · | BioNexus does not intend to pay dividends on BioNexus’ common stock, so any returns on your investment in the company’s common stock will be limited to appreciation in the value of BioNexus’ stock (on page 29). |

|

|

|

| · | The price of BioNexus’ common stock may be volatile, and you could lose all or part of your investment (on page 30). |

|

|

|

| · | You may experience extreme stock price volatility, including any stock-run up, unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our common stock (on page 30). |

|

|

|

| · | You will experience immediate and substantial dilution in the net tangible book value of our common stock purchased (on page 30). |

|

|

|

| · | If securities or industry analysts do not publish research or reports about our business, or if the publish a negative report regarding our common stock, the price of our common stock and trading volume could decline (on page 30). |

| 9 |

| Table of Contents |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company.

Following this offering, we will continue to qualify as an emerging growth company until the earliest to occur of (1) the last day of the fiscal year during which we had total annual gross revenues of at least $1.235 billion (as indexed for inflation), (2) the last day of the fiscal year following the fifth anniversary of the date of our public offering under this prospectus, (3) the date on which we have, during the previous three-year period, issued more than $1.235 billion in non-convertible debt and (4) the date on which we are deemed to be a “large accelerated filer,” as defined under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”). We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain scaled disclosure available to smaller reporting companies.

|

| 10 |

| Table of Contents |

Corporate History

BioNexus Gene Lab Corp was incorporated in the State of Wyoming on May 12, 2017.

On August 23, 2017, BioNexus acquired all the outstanding capital stock of BioNexus Gene Lab Sdn. Bhd. (which we refer to as “BGL” and is formerly known as BGS Lab Sdn. Bhd.), a Malaysian corporation incorporated in Malaysia on April 7, 2015.

On December 31, 2020, the Company consummated a Share Exchange Agreement with Chemrex Corporation Sdn Bhd. (“Chemrex”) and the Chemrex shareholders pursuant to which we acquired all the issued and outstanding shares of capital stock of Chemrex, which as incorporated in Malaysia on September 29, 2004, from the Chemrex shareholders in exchange for 68,487,261 shares of common stock of BioNexus issued to the Chemrex shareholders.

Corporate Information

The address of BioNexus’s principal office is unit 02, Level 10, Tower B, Avenue 3, The Vertical Business Suite II, Bangsar South, No. 8 Jalan Kerinchi, Kuala Lumpur, Malaysia. Our lab is located at Lab 353, Chemical Science Centre, University Science Malaysia, George Town, Penang, Malaysia, and we have a blood collection center located at 1st floor, Lifecare Medical Centre, Kuala Lumpur, Malaysia. Our telephone number is (+60) 1221-26512, and our website is www.bionexusgenelab.com.

Chemrex’s distribution center and warehouse is located at 4 Jalan CJ 1/6 Kawasan Perusahaan Cheras Jaya, Selangor, Malaysia. Chemrex’s phone number is (+60) 1922-23815, and its website is www.chemrex.com.my.

The information on our websites is not part of this prospectus. We have included our website address as a factual reference and do not intend it to be an active link to our website. The information contained in or connected to our website is not incorporated by reference into, and should not be considered part of, this prospectus. The trade names, trademarks, and service marks of other companies appearing in this prospectus are the property of the respective holders.

Corporate Structure

The following diagram illustrates our corporate structure as of the date of this prospectus and upon closing of this offering:

|

| 11 |

| Table of Contents |

The Offering | ||

|

|

|

Common stock offered: |

| 1,875,000 shares of common stock (excluding the over-allotment discussed below). |

|

|

|

Common stock outstanding prior to completion of the offering: |

| 14,476,513 shares of common stock (assuming the completion of our proposed reverse stock split of the outstanding common stock of 12 for 1 immediately upon our common stock’s listing on Nasdaq). |

|

|

|

Common stock outstanding immediately after the offering: |

| 16,351,513 shares of common stock (or 16,632,763 shares of common stock if the Underwriter exercises its over-allotment option in full), excluding shares of common stock underlying the Underwriter Warrants. |

|

|

|

Assumed offering price: |

| $[●] per share of common stock. |

|

|

|

Gross proceeds before expenses to us: |

| US$[●], excluding proceeds from the exercise of the Underwriter’s over-allotment option. |

|

|

|

Listing: |

| Presently, our common stock trades on the OTCQB. As of the date of this prospectus, our common stock was trading at a price of $[●] ($[●] on a post-reverse split basis). In connection with this offering, we have applied to list our common stock on the Nasdaq Capital Market. The closing of this offering is conditioned upon Nasdaq’s final approval of our listing application, and there is no guarantee or assurance that our common stock will be approved for listing on Nasdaq.

|

Ticker symbols: |

| BGLC. |

|

|

|

Over-allotment: |

| We have granted a 45-day option to the Underwriter to purchase up to an additional 281,250 shares of common stock, which is 15% of the total number of shares of common stock to be offered by us in the offering, to cover over-allotments, if any, at the public offering price, less underwriting discounts and commissions on the same terms as set forth in this prospectus.

|

Underwriter Warrants: |

| We will issue to the Underwriter warrants to purchase a number of shares of common stock equal to eight percent (8%) of the common stock offered in this offering, including any over-allotment shares (the “Underwriter Warrants”). The Underwriter Warrants will be exercisable at any time, and from time to time, in whole or in part, for a period of five years from the closings of the offering. The Underwriter Warrants are exercisable at a per share price of $[●], which is 110% of the public offering price.

|

Transfer Agent: |

| Securities Transfer Corporation |

|

|

|

Use of Proceeds |

| We intend to use the proceeds from this offering for research and development, working capital and general corporate purposes. See “Use of Proceeds” for more information. |

|

|

|

Lock-up: |

| We and each of our officers and directors and existing stockholders holding in excess of 1% of the shares outstanding have agreed with the Underwriter, subject to certain exceptions, not to sell, transfer or otherwise dispose of any shares of common stock or similar securities for a period of 180 days after the date of this prospectus. See “Shares Eligible for Future Sale” and “Underwriting” for more information. |

|

|

|

Risk factors: |

| Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our shares of common stock. |

|

|

|

Dividend Policy: |

| We have no present plans to declare dividends and plan to retain our earnings to continue to grow our business. |

| 12 |

| Table of Contents |

Summary of Financial Information

The following table summarizes selected historical financial data regarding our business and should be read in conjunction with our consolidated financial statements, and related notes contained elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary consolidated balance sheet and statement of operations for the fiscal years ended December 31, 2022 and 2021 respectively and the consolidated financial statements are derived from the audited consolidated financial statements of BioNexus Gene Lab Corp., a Wyoming corporation, included elsewhere in this prospectus. We derived our summary consolidated financial data for the year ended December 31, 2022 and 2021. These financials include all adjustments, consisting of normal recurring adjustments, that our management considers necessary for a fair presentation of our financial position and results of operations as of the dates and for the periods presented. The results of operations for past accounting periods are not necessarily indicative of the results to be expected for any future accounting period.

Consolidated Statements of Operations Data |

|

| Year ended |

| |||||

|

| December 31, |

| |||||

|

| 2022 |

|

| 2021 |

| ||

|

|

|

|

|

|

| ||

REVENUE |

| $ | 10,928,707 |

|

| $ | 13,362,567 |

|

|

|

|

|

|

|

|

|

|

COST OF REVENUE |

|

| (9,669,678 | ) |

|

| (11,095,626 | ) |

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

| 1,259,029 |

|

|

| 2,266,941 |

|

|

|

|

|

|

|

|

|

|

OTHER INCOME |

|

| 179,283 |

|

|

| 66,491 |

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

General and administrative |

|

| (1,729,489 | ) |

|

| (1,277,605 | ) |

|

|

|

|

|

|

|

|

|

(LOSS)/PROFIT FROM OPERATIONS |

|

| (291,177 | ) |

|

| 1,055,827 |

|

|

|

|

|

|

|

|

|

|

FINANCE COSTS |

|

| (12,479 | ) |

|

| (12,973 | ) |

|

|

|

|

|

|

|

|

|

(LOSS)/PROFIT BEFORE TAX |

|

| (303,656 | ) |

|

| 1,042,854 |

|

|

|

|

|

|

|

|

|

|

Tax expense: |

|

|

|

|

|

|

|

|

Deferred tax |

|

| (3,898 | ) |

|

| (26,736 | ) |

Income tax |

|

| (48,412 | ) |

|

| (264,547 | ) |

Total tax expense |

|

| (52,310 | ) |

|

| (291,283 | ) |

|

|

|

|

|

|

|

|

|

NET (LOSS)/PROFIT |

| $ | (355,966 | ) |

| $ | 751,571 |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income: |

|

|

|

|

|

|

|

|

Foreign currency translation loss |

|

| (308,800 | ) |

|

| (233,946 | ) |

|

|

|

|

|

|

|

|

|

COMPREHENSIVE (LOSS)/INCOME |

| $ | (664,766 | ) |

| $ | 517,625 |

|

|

|

|

|

|

|

|

|

|

Earnings per share - Basic and diluted |

|

| (0.002 | ) |

|

| 0.004 |

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding – Basic and diluted |

|

| 172,916,782 |

|

|

| 171,218,152 |

|

Consolidated Balance Sheets Data

|

| As of |

|

| As of |

| ||

|

| December 31, |

|

| December 31, |

| ||

|

| 2022 |

|

| 2021 |

| ||

|

| (Audited) |

|

| (Audited) |

| ||

Current assets |

| $ | 6,021,826 |

|

| $ | 7,149,855 |

|

Total assets |

| $ | 8,740,162 |

|

| $ | 9,574,390 |

|

Current liabilities |

| $ | 2,004,077 |

|

| $ | 2,328,755 |

|

Total liabilities |

| $ | 2,075,149 |

|

| $ | 2,394,611 |

|

Total equity |

| $ | 6,665,013 |

|

| $ | 7,179,779 |

|

| 13 |

| Table of Contents |

RISK FACTORS

An investment in one share of common stock involves a high degree of risk. Before deciding whether to invest in one share of common stock, you should consider carefully the risks described below, together with all the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of one share of common stock to decline, resulting in a loss of all or part of your investment. The risks described below and in the sections referenced above are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in one share of common stock if you can bear the risk of loss of your entire investment.

Risk Factors Related to Our Financial Prospects and Capitalization

BioNexus’ limited operating history may make it difficult to evaluate our current business and this makes predictions about our future success or viability subject to significant uncertainty.

BioNexus’ limited operating history may make it difficult to evaluate our current business and this makes predictions about our future success or viability subject to significant uncertainty. In combination with other anticipated increased operating expenses in connection with becoming a public company, these anticipated changes in our operating expenses may make it difficult to evaluate our current business, assess our future performance relative to prior performance and accurately predict BioNexus’ future performance.

BioNexus will continue to encounter risks and difficulties frequently experienced by early commercial-stage companies, including those associated with increasing the size of BioNexus’ organization and the prioritization of BioNexus’ commercial, research and business development activities. If BioNexus does not address these risks successfully, BioNexus’ business could suffer.

BioNexus’ growth (organic and inorganic) may require substantial capital and long-term investments.

BioNexus’ competitiveness and growth depend on our ability to fund our capital expenditures. BioNexus cannot assure you that it will be able to fund our capital expenditures at reasonable costs due to adverse macroeconomic conditions, our performance or other external factors.

In the future, BioNexus expects to incur significant costs in connection with its operations. BioNexus intends to expand BioNexus’ business through increased marketing efforts of BioNexus Malaysia and Chemrex. These development activities generally require a substantial investment before BioNexus can determine commercial viability, and the proceeds of this offering will not be sufficient to fully fund these activities. BioNexus expects to need to raise additional funds through public or private equity or debt financings, collaborations or licensing arrangements to continue to fund or expand BioNexus’ operations.

BioNexus’ actual liquidity and capital funding requirements will depend on numerous factors, including:

| • | the scope and duration of and expenditures associated with BGL’ discovery efforts and research and development programs; |

| • | the costs to fund BGL’ commercialization strategies for any product candidates for which BioNexus receive marketing authorization or otherwise launch and to prepare for potential product marketing authorizations, as required; |

| • | the costs of any acquisitions of complementary businesses or technologies that BioNexus may pursue; |

| 14 |

| Table of Contents |

| • | potential licensing or partnering transactions, if any; |

| • | BioNexus’ facilities expenses, which will vary depending on the time and terms of any facility lease or sublease BioNexus may enter into, and other operating expenses; |

| • | the scope and extent of the expansion of BioNexus’ sales and marketing efforts; |

| • | the settlement of the government investigation described below, potential and pending litigation, potential pay or recoupments of reimbursement amounts, and other contingencies; |

| • | the commercial success of BioNexus’ products; |

| • | BioNexus’ ability to obtain more extensive coverage and reimbursement for BGL’ tests and therapeutic products, if any, including in the general, average-risk patient population; and |

| • | BioNexus’ ability to collect its accounts receivable. |

The availability of additional capital, whether from private capital sources (including banks) or the public capital markets, fluctuates as BioNexus’ financial condition and market conditions in general change. There may be times when the private capital sources and the public capital markets lack sufficient liquidity or when BioNexus’ securities cannot be sold at attractive prices or at all, in which case BioNexus would not be able to access capital from these sources. In addition, a weakening of BioNexus’ financial condition or deterioration in its credit ratings could adversely affect BioNexus’ ability to obtain necessary funds. Even if available, additional financing could be costly or have adverse consequences.

BioNexus may incur net losses in the near future.

BioNexus has devoted substantial resources to the development and commercialization of the products of BioNexus Malaysia and Chemrex. BioNexus might not remain profitable for any period. BioNexus’ failure to achieve profitability would negatively affect BioNexus’ business, financial condition, results of operations, and cash flows. If BioNexus is unable to execute BioNexus’ sales and marketing strategy and BioNexus’ products are unable to gain sufficient acceptance in the market, BioNexus may be unable to generate sufficient revenues to sustain BioNexus’ business.

Any additional capital BioNexus raises may not be available on satisfactory terms and may adversely affect stockholders’ holdings or rights.

Additional capital, if needed, may not be available on satisfactory terms or at all. In addition, the terms of any financing may adversely affect stockholders’ holdings or rights. Debt financing, if available, may include restrictive covenants. To the extent that BioNexus raises additional funds through collaborations and licensing arrangements, it may be necessary to relinquish some rights to BioNexus’ technologies or grant licenses on terms that may not be favorable to us.

If BioNexus is not able to obtain adequate funding when needed, BioNexus may be required to delay development programs or sales and marketing initiatives. If BioNexus is unable to raise additional capital in sufficient amounts or on satisfactory terms, BioNexus may have to make reductions in BioNexus’ workforce and may be prevented from continuing BioNexus’ discovery, development, and commercialization efforts and exploiting other corporate opportunities. In addition, it may be necessary to work with a partner on one or more of BioNexus’ tests or products under development, which could lower the economic value of those products to us. Each of the foregoing may harm BioNexus’ business, operating results, and financial condition and may impact BioNexus’ ability to continue as a going concern.

Raising additional capital may lead to dilution of shareholdings by BioNexus’ existing shareholders, restrict BioNexus’ operations, and may further result in fair value loss, adversely affecting BioNexus’ financial results.

BioNexus may seek additional funding through a combination of equity and debt financings and collaborations. To the extent that BioNexus raises additional capital through the sale of equity or convertible debt securities, the ownership interest of existing holders of BioNexus’ shares will be diluted, and the terms may include liquidation or other preferences that adversely affect the rights of BioNexus’ existing shareholders.

| 15 |

| Table of Contents |

The incurrence of additional indebtedness or the issuance of certain equity securities could result in increased fixed payment obligations and could also result in certain additional restrictive covenants, such as limitations on BioNexus’ ability to incur additional debt or issue additional equity, limitations on BioNexus’ ability to acquire or license IP rights and other operating restrictions that could adversely impact BioNexus’ ability to conduct its business.

Risk Factors Related to Our Business and Industry

General Business and Industry Risks

BioNexus is unable to predict the duration of current economic conditions.

Economic downturns, prolonged slow growth or stagnation in the economy have materially adversely affected BioNexus’ 2022 business. For 2023, results of operations, financial condition and cash flows could be affected as long as current economic conditions persist.

Global economic conditions could materially adversely impact demand for BioNexus’ products and services.

BioNexus’ operations and performance depend significantly on economic conditions. Global financial conditions continue to be subject to volatility arising from international geopolitical developments and global economic phenomenon, as well as general financial market turbulence and natural phenomena such as the COVID-19 pandemic. Uncertainty about global economic conditions could result in

| • | customers postponing purchases of its products and services in response to tighter credit, unemployment, negative financial news and/or declines in income or asset values and other macroeconomic factors, which could have a material negative effect on demand for its products and services; and |

|

|

|

| • | third-party suppliers being unable to produce devices for its products or raw materials in the same quantity or on the same timeline or being unable to deliver such parts and components as quickly as before or subject to price fluctuations, which could have a material adverse effect on the services and products provided by BGL; and accordingly, on its business, results of operations or financial condition. |

Access to public financing and credit can be negatively affected by the effect of these events on Malaysian, U.S. and global credit markets. The health of the global financing and credit markets may affect its ability to obtain equity or debt financing in the future and the terms at which financing or credit is available to us. These instances of volatility and market turmoil could adversely affect its operations and the trading price of its common stock.

BioNexus’ risk management programs, processes, or procedures for identifying and addressing risks in BGL’s business may not be adequate or effectively applied, and this may adversely impact its businesses.

BGL relies on a combination of technical and human factors to protect us against risks. BGL policies, procedures and practices are used to identify, monitor and control a variety of risks, including risks related to human error and hardware and software errors. The administration and results of each test are reviewed by a physician and a scientist in Malaysia before the results are released to the patient. The Company’s standard of operations has been developed internally primarily by Dr. Liew. These risk-management methods may not adequately prevent losses and may not protect us against all risks, in which case BioNexus’ business, economic conditions, operations and cash flows may be materially adversely affected.

BioNexus has risk-management policies, control systems and compliance manuals in place; however, there is no guarantee that such policies, systems, and manuals will be effectively applied in every circumstance by BioNexus’ staff. For example, employees could override the system technology and theoretically waive requirements, thereby exposing the company accurately conduct its quality control, reporting, payment or stock movement.

| 16 |

| Table of Contents |

BioNexus may be adversely impacted by changes in laws and regulations, or in their application.

Currently, there are no governmental regulations that materially restrict BioNexus’s screening and chemical distribution business in Malaysia. BGL’s laboratory in Malaysia was established through an invitation by the Malaysian Health Minister alongside a government grant of $1,250,000. BGL’s screening tests have gone through preclinical and clinical trials involving private hospitals and government agencies including the Institute of Medical Research (IMR), Malaysian Biotechnology Corporation (BiotechCorp) and the Clinical Research Centre (CRC). The findings of the preclinical and clinical trials are published in peer reviewed journals such as the Journal of Molecular and Cellular Cardiology, and Physiological Genomics. Once published, BGL would do confirmational tests before applying for commercialization. BGL’s Malaysian lab is currently national operating under an operating license granted by the city of Kuala Lumpur.

The Malaysian government passed the Pathology Laboratory Bill of 2007 (“Pathology Act”). However, since 2007, the government has not implemented the regulations underlying the legislation nor has the government enforced the Pathology Act. Any such regulations could establish criteria for the various classes and specialties of laboratories, the organization and management system of the laboratory, the qualification and experience of the person-in-charge, the qualification and competence of pathologists, scientific and technical staff engaged to conduct tests, and the standards of laboratory practice. BGL cannot predict whether it would be able to comply with the Pathology Act and its regulations, if implemented. In addition, there also is a risk that the regulations arising from the Pathology Act or new legislation or regulations could increase BGL’ costs of doing business or otherwise prevent BioNexus from carrying out the expansion of its business. Accordingly, BioNexus’ business may be harmed if BioNexus is not able to comply with any future governmental legislation or regulations, including the Pathology Act.

BGL and Chemrex are currently operating under an operating license granted by the City Hall of Kuala Lumpur and Kajang, Malaysia respectively. Under Malaysian and local laws, Chemrex may continue to operate under its current operating license alongside fire insurance, which Chemrex currently has. BioNexus cannot predict whether there will be future regulations which may impact its ability to conduct its business.

Currently, there are no governmental regulations that affecting the business of BGL and Chemrex in Malaysia. Future legislation or regulations could increase BGL and Chemrex’s costs of doing business or otherwise prevent BioNexus from carrying out the expansion of its business.

Business disruptions could seriously harm BioNexus’ future revenue and financial condition and increase its costs and expenses.

BioNexus’ operations could be subject to power shortages, telecommunications failures, wildfires, water shortages, floods, earthquakes, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics and other natural or man-made disasters or business interruptions. The occurrence of any of these business disruptions could seriously harm BGL’ operations and financial condition and increase BGL’ costs and expenses. Unfavorable global economic conditions could adversely affect BioNexus’ business, financial condition, or results of operations.

BioNexus do not carry insurance for all categories of risk that BioNexus’ business may encounter. Although BGL intend to obtain some form of business interruption insurance in the future, there can be no assurance that BioNexus will secure adequate insurance coverage or that any such insurance coverage will be sufficient to protect BioNexus operations to significant potential liability in the future. Any significant uninsured liability may require us to pay substantial amounts, which would adversely affect BioNexus’ financial position and results of operations.

Our lack of insurance could expose us to significant costs and business disruption.

We currently do not have any product liability or disruption insurance to cover our operations in Malaysia or overseas. We have determined that the costs of insuring for these risks and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. If we suffer any losses, damages or liabilities in the course of our business operations, we may not have adequate insurance coverage to provide sufficient funds to cover any such losses, damages or product claim liabilities. Therefore, there may be instances when we will sustain losses, damages and liabilities because of our lack of insurance coverage, which may in turn materially and adversely affect our financial condition and results of operations.

| 17 |

| Table of Contents |

Our internal controls are progressively improved with additional independent directors coming on board and audit committee appointed which could cause our financial reporting to be reasonably reliable.

Our management, including our chief executive officer and chief financial officer, is responsible for establishing and maintaining adequate internal control over our financial reporting. As defined in Exchange Act Rule 13a-15(f), internal control over financial reporting is a process designed by, or under the supervision of, the principal executive and principal financial officer and effected by the board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles in the United States of America and includes those policies and procedures that: pertain to the maintenance of records in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company; provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and/or directors of the Company; and provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

In connection with the audits of our consolidated financial statements as of December 31, 2021 and 2020, we identified these “material weaknesses,” were rectified with independent directors and audit committee be included in 2022 significant improvement in our internal control over financial reporting.

| • | We maintained segregation of duties within our business operations and reliance on several individuals fulfilling the role of officers and directors; |

|

|

|

| • | A functioning audit committee and a majority of independent members and outside directors on our Board of Directors, resulting in better oversight in the establishment and monitoring of required internal control and procedures; |

We will expand our current board of directors to include additional individuals from US public company in the near term due to our limited financial resources. Until such remedial actions can be fully realized, we will continue to rely on the advice of outside professionals and consultants.

As a public company, we may become subject to the Section 404 of the Sarbanes-Oxley Act, or SOX 404, which requires that we include a report from management on the effectiveness of our internal control over financial reporting in our annual report on Form 10-K and in our quarterly report on Form 10-Q if we are qualified as an accelerated filer.

We are currently a “smaller reporting company”, meaning that we are not an investment company, an asset- backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and annual revenues of less than $50.0 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company,” at such time as we cease being an “emerging growth company,” we will be required to provide additional disclosure in our SEC filings. However, similar to an “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

| 18 |

| Table of Contents |

Our independent registered public accounting firm may be required to attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. In addition, after we become a public company, our reporting obligations may place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We may be unable to timely complete our evaluation testing and any required remediation.

During the course of documenting and testing our internal control procedures, in order to satisfy the requirements of SOX 404, we may identify other weaknesses and deficiencies in our internal control over financial reporting. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with SOX 404. If we fail to achieve and maintain an effective internal control environment, we could suffer material misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could in turn limit our access to capital markets, harm our results of operations, and lead to a decline in the trading price of our shares. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the stock exchange on which we list, regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

Fluctuations in foreign currency exchange rates could have a material adverse effect on our financial results.

We earn revenues, pay expenses, own assets and incur liabilities in countries using Malaysian Ringgit other than the U.S. dollar. Since our consolidated financial statements are presented in U.S. dollars, we must translate revenues, income and expenses, as well as assets and liabilities, into U.S. dollars at exchange rates in effect during or at the end of each reporting period. Therefore, increases or decreases in the value of the U.S. dollar against Malaysian currency affect our net operating revenues, operating income and the value of balance sheet items denominated in foreign currencies. We cannot assure you that fluctuations in foreign currencies exchange rates, particularly the strengthening or weakening of the U.S. dollar against Malaysian currency would not materially affect our financial results.

Risk Related to BGL’s Business and Industry

Exponential growth and competition in biotechnology.

Biotechnology is a rapidly changing field that continues to transform both in scope and impact. Well-funded established molecular labs are gathering big data on health records, genomics, lifestyle information that led to new health solutions. Digitization is revolutionizing health care, allowing for patient reported symptoms, health outcome to be captured as mineable data. BGL could lose out to its competitors’ exponential growth if we unable to establish network with medical centers, pharmaceutical groups and other molecular laboratories synergistically in sharing customers and big data.

If BGL grows too quickly without adequate planning and management, BGL’s future business could be harmed.

BGL expects to continue to add personnel in the areas of sales and marketing, research & development, laboratory operations, finance, quality assurance and compliance. As BGL builds its commercialization efforts and expands research and development activities, operating expenses and capital requirements will increase, and BGL expects that such costs will continue to increase significantly. BGL’s ability to manage its rapid expansion effectively requires us to forecast expenses accurately, and to properly prepare and expand operational and testing facilities, if necessary, to expend funds to improve our operational, financial and management controls, reporting systems and procedures. As BGL moves forward in marketing our tests and developing our test portfolio, the company will also need to effectively manage its recent established strategic alliances with Health Ministry, Medical Tourism Board, Science & Technology Ministry and Finance Ministry at the Federal and State levels to service their hospitals, insurance, government linked corporations, small and medium enterprises.. If BGL is unable to allocate adequate resources to keep pace with its rapidly expanding business requirements, BGL’s future business could be hindered.

| 19 |

| Table of Contents |

BGL’s financial prospects depend substantially upon the successful commercialization of the Company’s services and products in the future, which may fail or experience significant delays.

BGL’s future success depends upon BGL’s ability to continuously develop technologies and successfully market its existing cancer genetic offerings to customers within Malaysia and expand overseas. BGL’s ability to generate significant revenue in the next several years will depend primarily on the successes of each key stage of its business, including pre-clinical research and development, clinical trials, regulatory approval, marketing and commercialization of its services and products, which is subject to significant uncertainty. BGL’s ability to generate sales revenue from its products and services and its future profitability depends on several factors, including its ability to:

| • | obtain regulatory approvals and marketing authorizations for BGL’s services and products; |

|

|

|

| • | obtain market acceptance by patients, hospitals, clinicians, biopharmaceutical companies and others in the medical community; |

| • | establish sufficient testing capacity and commercial capabilities, either by expanding BGL’s current facility or making arrangements with third parties; |

| • | develop and maintain BGL’s sales network to launch and commercialize its new cancer genomic testing services and products; |

| • | set appropriate and favorable prices for BGL’s genomic testing services and products and obtaining adequate reimbursement from third-party payers; |

| • | maintain commercially viable supply relationships with third parties and maintaining sufficient research and development capabilities and infrastructure; |

| • | address any competing technological and market developments; and |

| • | maintain, protect, and expand BGL’s portfolio of intellectual property rights including trade secrets and know-how. |

The marketing, sale and use of BGL’s products and services could result in substantial damages arising from products or service liability or professional liability claims, that exceed BGL’s resources.

Due to the nature of BGL’s business, it may face claims for products or service liability. These claims may arise from the inaccurate or erroneous diagnosis of patient information or the mix-up of patient information whereby a patient receives the wrong diagnostic information. While the company feels confident in its quality control measures to ensure the safeguard of patient and client information, it cannot provide assurances that products or service liability claims will arise in the future.

Moreover, litigation or adverse publicity resulting from these allegations could materially and adversely affect BGL’s business, regardless of whether the allegations are valid or whether the company is liable. Currently BGL has no products and service liability insurance coverage, and even if there was such coverage, such coverage might not be sufficient to properly protect BGL. Further, claims of this type, whether substantiated or not, may divert BGL’s financial and management resources from revenue generating activities and the business operation.

| 20 |

| Table of Contents |

BGL may face technology transfer challenges and expenses in adding new tests to its portfolio and in expanding its reach into new geographical areas.

BGL’s plan for expanding its business includes developing and acquiring additional tests or additional biomarkers that can be transferred into its current and future diagnostic product portfolio and distributed in target markets. Due to differences in the hardware and software platforms available at different laboratories for running molecular tests, BGL’s may need to adjust the configuration of the reagents and there may be changes to the related software in order for the tests to be performed on particular hardware platforms. Making any such adjustments could take a considerable amount of time and expense, and BGL’s might not will succeed in running its tests on the hardware and software that it may encounter in different laboratories. To manage this issue, BGL’s may license or acquire additional instruments and software from another company that will be compatible with its tests. This may include additional licenses and license fees needed for reagents or components required hereto as well.

BGL’s biomarkers have undergone limited clinical trial.

As there are no governmental regulations that materially restrict our screening business in Malaysia, BGL has conducted limited clinical trials on its biomarkers. While BGL believes that its tests help detect the potential risk of different diseases, the specificity and sensitivity of those tests have been determined in limited clinical trials let alone those that may not meet the scope or standards of clinical trials that would satisfy regulators in the United States or the European Union. If BGL were to conduct extensive clinical trials, the results might prove to be less successful than we anticipate, and such tests might not be approved for sale in markets that require such clinical trials.

BGL currently receives and expects to continue to receive a significant portion of its revenues from its genomic screening products, and if its efforts to further increase the use and adoption of these products fail, its business will be harmed.