UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

For the fiscal year ended:

or

For the transition period from ________ to ________

Commission File Number:

(Exact name of registrant as specified in its charter) |

| ||

(State or Other Jurisdiction of Incorporation or Organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

| ||

(Address of Principal Executive Offices) |

| (Zip Code) |

+

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☐ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. At June 30, 2021, the aggregate market value of shares held by non-affiliates of the registrant was $

As of March 30, 2022 there were

| 2 |

| Table of Contents |

FORWARD-LOOKING STATEMENTS

Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Company’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Company. Although the Company believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the objectives and plans of the Company will be achieved.

Unless stated otherwise, the words “we,” “us,” “our,” “the Company” or “BioNexus” in this Annual Report collectively refers to BioNexus Gene Lab Corp., a Wyoming corporation and our wholly owned subsidiaries, BioNexus Gene Lab Sdn. Bhd. (“BGL” or BioNexus Malaysia”) and Chemrex Corporation Sdn. Bhd. (“CCSB” or “Chemrex”), both Malaysian companies (“Subsidiaries”).

We acquired Chemrex on December 31, 2020 pursuant to a Share Exchange Agreement (“Agreement”) with Chemrex its shareholders. We acquired all of the issued and outstanding shares of capital stock of Chemrex from the Chemrex shareholders in exchange for 68,487,261 shares of common stock of the Company issued to the Chemrex shareholders.

Our principal corporate office is Unit 02, Level 10, Tower B Vertical Business Suite, Bangsar South, No. 8 Jalan Kerinchi, Kuala Lumpur, Malaysia, the BioNexus Malaysia lab is located at Lab 353, Chemical Science Centre, University Science Malaysia, George Town, Penang, Malaysia and it also has a blood collection center located at 1st floor, Lifecare Medical Centre, Kuala Lumpur, Malaysia. Chemrex offices and supply hub is located at 4 Jalan CJ 1/6 Kawasan Perusahaan Cheras Jaya, Selangor, Malaysia.

Our corporate and BioNexus Malaysia telephone number is (+60) 1221-26512 and its website is www.bionexusgenelab.com. Chemrex’s telephone number is (+60) 1922-23815 and its website is www.chemrex.com.my.

| 3 |

| Table of Contents |

Item 1. Business.

BUSINESS DESCRIPTION

Company Overview

BioNexus Gene Lab Corp., a Wyoming corporation, was incorporated on May 12, 2017.

On August 23, 2017, we acquired all of the outstanding capital stock of Bionexus Gene Lab Sdn. Bhd., a Malaysian corporation (“BGL” or “BioNexus Malaysia”). BioNexus Malaysia was incorporated in Malaysia on April 7, 2015.

On December 31, 2020, we acquired all of the outstanding capital stock of Chemrex Corporation Sdn. Bhd. (“CCSB” or “Chemrex”). Chemrex was incorporated in Malaysia on September 29, 2004.

Our corporate structure is depicted below:

The corporate structure as at December 31, 2021 is depicted below:

|

| BioNexus Gene Lab Corp. a Wyoming company |

|

| |

|

|

|

|

|

|

|

|

|

| ||

100% owned |

|

| 100% owned | ||

Bionexus Gene Lab Sdn. Bhd., a Malaysian company |

|

| Chemrex Corporation Sdn. Bhd., a Malaysian Company | ||

BioNexus Malaysia

BioNexus Malaysia is an emerging molecular diagnostics company focused on the application of functional genomics to enable early diagnosis and personalized health management. Our focus is on developing and marketing safe, effective and non-invasive blood tests for early detection of diseases in order to minimize treatment cost and improve patient management. Our non-invasive blood tests analyze changes in ribonucleic acid (or RNA) to detect the risk potentiality of 11 different diseases. These diseases include eight cancers (nasopharyngeal, lung, liver, stomach, breast, cervical, prostate and colon), two bowel diseases (colitis and Crohn) and osteoarthritis. This unique blood based genomic biomarker approach is based on the scientific observation that circulating blood reflects, in a detectable way, what is occurring throughout the body currently.

The Company believes that its blood based genomic screening protocol for the risk of disease detection can be utilized in conjunction with other medical procedures for disease detection including blood tests, imaging and biopsies. We market our blood based genomic screening process to health care providers, such as doctors, laboratories and hospitals, which began in July 2017.

Our principal office address is Unit 02, Level 10, Tower B, Avenue 3, The Vertical Business Suite II, Bangsar South, No. 8 Jalan Kerinchi, Kuala Lumpur, Malaysia, our lab is located at Lab 353, Chemical Science Centre, University Science Malaysia, George Town, Penang, Malaysia, and we have a blood collection center located at 1st Floor, Lifecare Medical Centre, Kuala Lumpur, Malaysia. Our telephone number is (+60) 1221-26512 and web-site is www.bionexusgenelab.com

| 4 |

| Table of Contents |

Acquisition of BGS Lab Sdn. Bhd.

On August 23, 2017, BioNexus Gene Lab Corp., a Wyoming company, acquired all of the capital stock of Bionexus Gene Lab Sdn. Bhd., a Malaysian company (“BioNexus Malaysia”), from its then existing shareholders. In connection with the transaction, the following shareholders of BioNexus Malaysia received the corresponding number of shares of our common stock; Soo Kow Lai, our Chairman, received 10,000,000 shares; Chi Yuen Leong, our President received 10,000,000 shares; Mr. Chan Chong Wong, our Chief Executive Officer received 10,000,000 shares; and late Dr. Choong Chin Liew, our Scientific Adviser received 20,000,000 shares. In exchange, we received certain software, equipment, know-how, related inventory and technology relating to blood based genomic analysis and screening developed by Dr. Liew which had enabled us to conduct our current operations. The technology and related assets were previously acquired by the BioNexus Malaysia from Dr. Liew in June 2017 in exchange for Dr. Liew receiving 40% of the equity of BioNexus Malaysia and the obligation to pay Dr. Liew the sum of approximately $354,930. The Company paid Dr. Liew the sum of $83,664 on January 23, 2018 and on February 15, 2018, Dr. Liew agreed to waive the remaining balance due to him by the Company which amounted to $271,266.

Development of the Blood Analysis Process.

Our company’s major shareholder, Dr. Liew, developed and tested a novel approach in blood based genomic analysis and screening by identifying biomarkers in RNA as opposed to deoxyribonucleic acid (or DNA) analysis. Through his extensive research and clinical trials, he had determined that communication occurs between cells in blood and tissue as blood circulates throughout the body and subtle changes occur in cells over time due to injury or disease. These cell-cell interactions induce changes in blood gene expression. Profiling these changes enables the Company to identify unique molecular signatures reflecting disease activity which can then be used to develop disease-specific molecular diagnostic assays. The Company uses disease-specific blood-based biomarkers as the basis for molecular diagnostics tests and to enable personalized health management through the development of systems biology tools and algorithms.

The Company focuses on developing and commercializing proprietary molecular diagnostic tests for early detection of diseases and personalized health management, with a primary focus on cardiovascular, diabetes and cancer-related indications. There is a constant and dynamic interaction of blood with cells, tissues and organs of the human body. Many clinical studies performed by Dr. Liew and others have demonstrated that blood gene expression profiles can be used to develop personalized signatures capable of differentiating patients with cancer from healthy patients across a broad spectrum of pathologies interaction between tumor cells and the immune system that has been referred to as immunoediting. Immunoediting is the response of the immune system to a tumor and comprises three stages: elimination (in which the immune system identifies cancerous and/or precancerous cells and attempts to eradicate them), equilibrium (in which the surviving tumor cells begin mutating rapidly), and escape (in which tumor cells proliferate uncontrollably, leading to tumor progression). Each of these stages induces leukocyte gene expression changes that constitute a unique, detectable molecular signature.

Dr. Liew began his research in 1962 and has published numerous articles in medical and peer review journals. His publications include the following;

Peripheral Blood Transcriptome Dynamically Reflects System-wide Biology: A Potential Diagnostic Tool. Liew CC, Ma J, Tang HC, Zheng R, Dempsey AA. Journal of Laboratory and Clinical Medicine (March 2006).

The Peripheral Blood Transcriptome: New Insights into Disease and Risk Assessment. Mohr, S Liew CC. Trends in Molecular Medicine (October 2007).

| 5 |

| Table of Contents |

DNA and RNA each consist of a single molecule and both are present in the blood. DNA is the carrier of human genetic information and is passed down from generation to generation. At conception, a person receives DNA from both parents. All of the cells in our bodies, except red blood cells, contain a copy of our DNA. Humans share about 99% of the same genetic code. However, it is the 1% of the genetic code that makes us all very distinct individuals. Historically, the study of DNA has been used to detect ancestry and inherited characteristics, including certain inherited diseases like Huntington Disease, Cystic Fibrosis and Down Syndrome, among others. It also is believed there is a genetic (DNA) pre-disposition to certain cancers, like breast cancer, colon cancer and gastric cancer.

While DNA is relatively static, RNA conversely is subject to change and is affected by an individual’s lifestyle, such as diet, alcohol, tobacco and/or drug use, excessive or ongoing stress from work/family and exercise, along with exposure to environmental influences, such as pollutants and chemicals.

The distinctions between the characteristics of RNA and DNA are illustrated in the below table.

· Static | · Dynamic |

|

|

· Measures lifetime risk | · Measure current risk |

|

|

· Repeated test does not provide different result | · Repeated test provides different result |

|

|

· DNA does not change with external factors | · Lifestyle and external factors affect RNA expression |

The Collection and Analysis Process.

Our process involves a simple blood draw. A nurse or technician of the health care provider draws 2.5 ml of blood from the patient using a Paxgene blood tube. The blood and a completed company form are couriered to our lab located at 353, Chemical Science Centre, USM, George Town. All blood samples are labelled with name and personal identity number and laboratory reference number on the tube where the blood sample is maintained for safekeeping.

| 6 |

| Table of Contents |

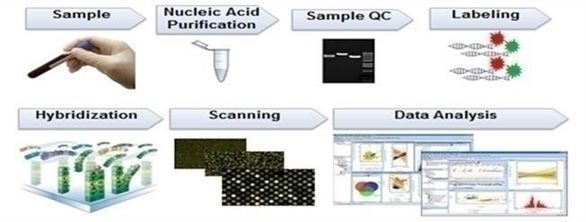

At our lab, RNA is extracted in biosafety cabinet followed by microcentrifuge and spectrophotometer to check spectrophotometric concentration and quality of the extracted RNA. The RNA then is purified (Biotinylated RNA will be mixed with purification beads and transferred to a U-bottom 96-well plate. Then, the plate will be placed onto a magnetic ring stand. Labeled cRNA will be captured when placed on the magnetic stand. The remaining solution will be removed and the captured pellet will be cleaned-up to obtain cRNA with high purity. Then, purified cRNA will be fragmented for hybridization) and hybridized onto a genechip (GeneChip 3’ IVT PLUS Reagent Kit will be used for preparing biotinylated target from purified total RNA samples suitable for hybridization to GeneChip arrays. Double-stranded cDNA will be synthesized from the total RNA using reverse transcriptase and oligo-dT primers. An in-vitro transcription (IVT) reaction is then done to produce biotin-labeled cRNA from the cDNA in 16 hours incubation) and scanned through the affymetrix station (Once the overnight hybridization is completed, the Genechips will be washed with dedicated buffers and solutions to remove excess cRNAs and hybridization solutions. Washed chips will be stained with staining buffers to illuminate attached cRNAs. All these processes will be conducted in the fluidic station by following the given instructions. Specific experimental information is defined using AMDS software on a PC-compatible workstation. Stained chips are ready for scanning. The chips will be transferred into the scanner. The scan is automatically completed and the image is processed into data files. The data collected from microarray analysis is analysed using our propriety software and algorithm calculation to generate the disease risk score report for the individual patient. A report is generated by our software and is forwarded to the health care provider for further consultation with the patient. This report can be used by patient and physician to plan future tests and therapies.

The process for effectuating RNA analysis depicted in the below pictures.

| 7 |

| Table of Contents |

The raw data obtained will be analyzed and quality control processed by our lab in Malaysia using our proprietary software to calculate the risk analysis of 11 different diseases. We simplify the result into a graph which is contained in the patient booklet provided to the health care professional. A sample graph is depicted below.

In the above chart, NPC is Nasopharyngeal Cancer, ATDS is Ascending, Transverse, Descending and Sigmoid Colon Cancer, and OA is Osteoarthritis. |

The following cautionary text in contained in the results booklet which the Company provides to each patient:

This report/screening is not intended or implied to be substitute for professional medical advice, diagnostics or treatment. The content, including text, graphics and information in the report illustrate the risk score only. Bionexus Gene Lab Sdn Bhd makes no representation and assumes no responsibility for the accuracy of the information as such information and contents are subject to change without notice. You are encouraged to review any medical condition or treatment with your doctor.

The key proprietary aspect of our process is our proprietary algorithm software and the RNA extraction, preservation, quality control, hybridization, data analysis processes which was developed by Dr. Liew. We acquired the software and the technological processes in June 2017. The gene expression from a reference population representing a specific disease condition is filtered according to a quality assurance process based on repeatability data. This collected data is then analyzed by our proprietary algorithm software and processes checked by the laboratory manager to ensure all the steps are followed in the deriving predictive model for each disease condition. Once these models have been established, they then can be applied to the data from a new sample to make risk prediction for this individual. Each disease/disorder has similar group of diseased/disordered genes which were identified through the years of research and clinical trials in Malaysia.

Business Development.

As mentioned above, the screening provides a risk analysis of 11 diseases, of which eight are different forms of cancer. In Malaysia, the cost for the analysis is not covered by health insurance. Thus, patients are required to pay for the costs of the services, which under our current pricing of $975 for the 11-disease panel for an individual plan. We do have different pricing for groups, like companies and associations.

| 8 |

| Table of Contents |

As of December 31, 2021, we have 10 swab and blood sample collection centers, 8 in Klang Valley (which is comprised of our capital city Kuala Lumpur, together with towns on the northern and southern fringes of the capital city) recommending our blood based genomic screening protocol to their patients. Of these centers, Lifecare Medical Centre, Iheal Medical Centre, National Heart Centre, 1-Utama Clinic, Clinic Q, LYC Healthcare, Gene Therapy Centre, Nexus Reality Lab in Klang Valley, Sandakan hospital and Tawau Hospital and account for approximately 90% of our patient population from Jan 2020 through December 31, 2021. We believe that there are over 500 clinics and hospitals located in the Kuala Valley metropolitan area.

Our goal is to have a large percentage of health care providers in the Klang Valley refer patients to us for our screening protocol. Once we have established our brand and reputation in Klang Valley, we intend to expend to other large cities in Malaysia, followed by an expansion to large metropolitan areas other countries in Asia Pacific, such as Indonesia, Taiwan and Singapore. However, we do not foresee expansion beyond Malaysia until fiscal year 2022 and beyond.

Our existing equipment and personnel are sufficient to handle up to 94 patients a day. If our daily patient count increases above 200 patients, we will be required to hire another laboratory technician and purchase and install an additional semi-automatic Affymetrix station equipment estimate to be $200,000.

For health care providers, we pay a referral fee of between 20% to 25%. Typically, the patient, while in the offices of the health care provider, completes a form which identifies the name, address and other contact information of the patient.

During the 3rd fiscal quarter of 2020, we began testing for COVID 19 using our RNA platform apply qPCR process. During this period, the Ministry of Health began providing us with COVID samples taken at hospitals for testing using our laboratory. To date, we had screened more than 5,000 samples reported less than 100 positive covid-19 cases to the Health Ministry In addition, during 3rd quarter of 2020, we began promoting this q-PCR test through the Malaysian General & Life Insurance Association, various banks, airports and small and medium enterprises (SME) in Malaysia. The response from these markets have slow in developing. Our Covid screening generates substantially lower per ticket charges at $55 per test compared with $975 per customer for our RNA screening. They also generate lower margins than our RNA screenings.

Competition and Competitive Strengths.

While the Company believes that there is no similar commercialized blood based genomic screening for 11 diseases using RNA analysis, it believes that its blood based genomic screening protocol for disease detection could be utilized in conjunction with other medical procedures for disease diagnostics including lab (blood, urine or other body fluids) tests, imaging and biopsies. As such, the Company does not consider it to be in competition with these other medical procedures which have been industry standards for many years.

Disease detection for cancer, for example, are numerous and is dependent on the type of cancer tested. Information from the National Cancer Institute provides the following information;

· | Genetic testing, also known as DNA testing, allows the determination of bloodlines and the genetic diagnosis of vulnerabilities to inherited diseases. In humans, genetic testing can be used to determine a child’s parentage or in general a person’s ancestry; |

|

|

· | Lab tests. High or low levels of certain substances in your body can be a sign of cancer. So, lab tests of the blood, urine, or other body fluids that measure these substances can help doctors make a diagnosis. However, abnormal lab results are not a sure sign of cancer. Lab tests are an important tool, but doctors cannot rely on them alone to diagnose cancer. Current tumour markers available in many countries including Malaysia are CEA, CA 19-9, CA 125, PSA, AFP, β-hCG, CA 27.29. All are NOT suitable for screening and diagnostic use because of low sensitivity, specificity and predictive value. Source: American Family Physician (2003) Vol 68 (6) |

|

|

· | Imaging Procedures. Imaging procedures create pictures of areas inside your body that help the doctor see whether a tumor is present. These pictures can be made in several ways, including a CT Scan, Nuclear Scan, MRI, PET Scan, among others. |

|

|

· | Biopsies. In most cases, doctors need to do a biopsy to make a diagnosis of cancer. A biopsy is a procedure in which the doctor removes a sample of tissue. A pathologist then looks at the tissue under a microscope to see if it is cancer. |

| 9 |

| Table of Contents |

We however believe that we have a number of competitive strengths compared these other health diagnostic tools are as follows:

| · | Our screening is non-invasive (other than a simple blood draw), unlike biopsies; |

| · | In one test, we can screen for 11 diseases unlike conventional diagnostics; |

| · | Non-DNA blood tests for diseases like cancer are not dispositive and detect only elevated levels of proteins or other substances which are caused by cancer; |

| · | DNA blood tests are limited to certain types of inherited diseases, Huntington Disease, Cystic Fibrosis and Down Syndrome, among others. Such inherited disease(s) may or may not happen in a person’ life time; |

| · | MRI exams are uncomfortable and require fasting prior to testing, and implants in the body will distort result; |

| · | Most importantly, our screening provides a predictive risk assessment for developing the 11 diseases. Most other disease detection procedures detect diseases already present in the body, and in most cases in the final stages of the disease making it difficult to treat or reverse. With our screening, patients are able to monitor the development of these diseases in the future through further medical testing, including using our protocol. In addition, patients are able to make adjustments to their lifestyles in an effort to reduce the potentiality of these diseases. Lifestyle adjustments may include reduction or changes to food, tobacco and alcohol intake, change of working environment and the implementation of exercise programs, among other changes. |

Our Growth Strategy

We will look to grow and expand our business by further penetrating the Klang Valley market and expand our marketing efforts elsewhere in Malaysia. We believe that an increase in our marketing and promotional efforts will correlate to increased revenues and the expansion of our business. Our growth and expansion strategy for the next 6-12 months are as follows:

• Continue to leverage our relationships with healthcare providers

To date, we have relied upon the efforts of management and their relationships with health care providers to create the initial interest in our blood based genomic screening. These relationships have been located primarily in the Kuala Lumpur market. We will continue to use our relationships with providers in the Kuala Lumpur market and elsewhere in Malaysia to increase sales and product awareness.

• Allocate more capital resources to our marketing efforts

Apart from sales through existing relationships with health care providers, we intend to allocate more capital resources to marketing and promotion. As part of these efforts, we have appointed two commission-based Marketing Companies last year and they managed to bring some business after creating awareness of our services nationwide.

• Increase focus on corporate clients.

To date, we have entered into arrangements with two corporate clients for screening on their employees. We intend to solicit more corporate clients in the Klang Valley and major cities in Malaysia. We commenced these efforts last year and is continued in 2022. These efforts will be undertaken by the officers and the Marketing Companies.

• Expand to other regions in Malaysia.

We intend to reach other large cities in Malaysian, such as Penang, Ipoh, Seremban, Melaka, Johor Bahru and Kuantan.

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations. We are subject to the laws and regulations of those jurisdictions in wellness operation and advertising materials circulation. Generally, business licensing requirements, income taxes and payroll taxes are applicable to all types of business operations. The development and operation of our business is not subject to special regulatory and/or supervisory requirements. In 2007, the Malaysian Parliament passed the Pathology Laboratory Bill of 2007 (“Pathology Act”), subject to the finalization of the underlying regulations. Since the passage of the Pathology Act, the Malaysian government has not implemented the legislation. Currently, we are only required an operating permit from local council, which we have received. However, we cannot predict whether we would be able to comply with the Pathology Act and its regulations, if implemented.

| 10 |

| Table of Contents |

Employees

As of the date of this this filing, BioNexus Malaysia has eight full-time employee and five directors/officers who work part-time. Management does not plan to hire additional employees at this time. Our employees are not represented by any collective bargaining agreement, and we have never experienced a work stoppage. We believe we have good relations with our employees.

Currently, BioNexus Malaysia has not entered into an employment agreement with any of our officers. The Company presently does not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, the Company may adopt plans in the future. Management does not plan to hire additional employees at this time.

Intellectual Property.

BioNexus Malaysia does not have any patents protecting our blood based genomic screening process. Instead, we rely on trade secrets and know-how using the process developed by Dr. Liew. There is no assurance that others will not independently develop the same or similar technology or obtain unauthorized access to our trade secrets, know-how and other unpatented technology. To protect our rights in these areas, we require all employees that work in our lab to enter into strict confidentiality agreements. Presently, we have one lab manager and 2 casual lab technicians. These agreements may not provide meaningful protection for our unpatented technology in the event of an unauthorized use, misappropriation or disclosure. While we have attempted to protect the unpatented proprietary technology that we develop or acquire, and will continue to attempt to protect future proprietary technology through patents, copyrights and trade secrets, we believe that our success will depend, to a large extent, upon continued innovation and technological expertise.

In general, the level of protection afforded by a patent is directly proportional to the ability of the patent owner to protect and enforce those rights through legal action. Since our financial resources are limited, and patent litigation can be both expensive and time consuming, there can be no assurance that we will be able to successfully prosecute an infringement claim in the event that a competitor develops a technology or introduces a product that infringes on one or more of our patents or patent applications. There can be no assurance that our competitors will not independently develop other technologies that render our proposed products obsolete. In general, we believe the best protection of our proprietary technology will come from market position, technical innovation, speed-to-market, and product performance. There is no assurance that we will realize any benefit from our intellectual property rights.

Product Liability.

Due to nature of the Company’s business, the Company may face claims for product liability resulting from the inaccurate or erroneous diagnosis using our screening process. Presently, the Company does not maintain any product liability insurance to cover any claims for an erroneous diagnosis.

Chemrex

Chemrex is a wholesaler of industrial chemicals for the manufacture of industrial, medical, appliance, aero, automotive, mechanical and electronic industries in South East Asia region. These countries include Malaysia, Indonesia, Vietnam and numerous other countries. These superior graded industrial chemicals come with JIS, ANSI / IPC and ISO 9002 certification since 2004.

Chemrex’s corporate office and distribution and storage center is located at 4 Jalan CJ 1/6 Kawasan Perusahaan Cheras Jaya, Selangor, Malaysia. Its phone number is (+60) 1922-23815 and web-site is www.chemrex.com.my.

Acquisition of Chemrex Sdn. Bhd.

On December 31, 2020, BioNexus completed a Share Exchange Agreement with Chemrex, and the shareholders of the Chemrex ("Chemrex Shareholders") pursuant to which the Company acquired all of the issued and outstanding shares of capital stock of Chemrex from the Chemrex Shareholders in exchange for 68,487,261 shares of common stock of the Company issued to the Chemrex Shareholders on a pro-rata basis.

Liong Tai Tan, our Chief Operating Officer (appointed on November 27, 2020), who is also the Chief Operating Officer of Chemrex, was a Chemrex shareholder and received 14,553,543 shares of common stock in connection with the transaction.

| 11 |

| Table of Contents |

Business of Chemrex

Chremrex buys raw materials (chemicals) from domestic and international manufacturers. Chemrex wholesales these Fibre Reinforced Polymer (FRP) materials to various manufacturers in South East Asia. The chemicals are used to produce a wide variety of finished goods. Common products using FRP are handrails, bench tops, automotive and aero parts, paneling for hospital/laboratory/industrial clean rooms, covers for various instruments under in manufacturing, among other uses. FRP materials have strong design and technology. According to the product shape technical requirements, use and quantity flexible choice of molding process. The process is simple, can be shaped at one time, the economic effect is outstanding, especially for the complex shape, not easy to shape the number of products, more outstanding its process superiority.

Examples of FRP products manufactured by Chemrex customers are displayed below:

Medical and Industrial Equipment.

Platform, Handrail and Decking.

| 12 |

| Table of Contents |

Medical appliances.

|

|

|

|

Key features of FRP products are as follows:

- Lightweight with high strength.

- Good electrical insulator with no electro-magnetic behavior and no electric spark.

- Rust free and resistant to acid, alkali, organic dissolvents and other gas and liquid mixtures.

- Anti-aging with more than 20 years of useful life under normal working condition.

- Ease of maintenance.

The following table reflects Chemrex’s five top selling products for fiscal 2021, indicated by revenues, finished goods use and percentage of total revenues of $11,846,894:

Raw Materials |

| Finished Goods |

| Revenue |

|

| % of total Revenue |

| ||

1. Chopped Strand Mat 450gm |

| Chemical tanks |

| $ | 1,600,000 |

|

|

| 13.51 |

|

2. Laminating Resin 268 |

| Public transport bodies, water resistant items |

| $ | 1,200,000 |

|

|

| 10.13 |

|

3. High Viscosity polyester Resin 9509 |

| Clean room, ICU flooring & wall and marine boat |

| $ | 820,000 |

|

|

| 6.92 |

|

4. Centrifugal Resin 8452A |

| pipes for oil & gas industry, sewerage |

| $ | 650,000 |

|

|

| 5.49 |

|

5. Casting Resin 2720 |

| hospital and laboratory counter coating |

| $ | 610,000 |

|

|

| 5.15 |

|

Sales and Marketing.

Our product sales and marketing are performed internally by Mr. Tham Too Kam, Managing Director, Mr. Tan Liong Tai, Executive Director and Mr. Chan Kwan Wah, Marketing Manager and 3 other marketing and technical representatives.

New customers would check through our website for products and forward their enquiries to us. Our marketing and technical representatives would contact the prospective customer and discuss a range of company products to suit their needs.

Most of our existing customers also are well-established manufacturers and contractors who know us well and place their orders regular basis. Typically, the provide us with a forecast and accordingly place their orders with us on a monthly basis. If they need an item in small quantity, they would normally get it from hardware retailer. Chemrex has distinct advantage of having full range with competitive prices fulfilling customers’ complete requirement.

We also assist customers on their new product development or projects with suitable and compatible raw materials. We jointly explore with customers all technical and aesthetic requirements of the new products or projects. In view of our years of successful dealings with local and international raw materials manufacturers, we often collaborate with their research teams to meet the new product needs of our customers.

Competition and Competitive Strengths.

Chemrex is a well-established, reliable quality composite material distributor with professional services. As a dominant, well-stocked company, it has complete range of products couple with strong technical supports as compared to its competitors’ incomplete range resulting in higher logistics and purchasing costs.

| 13 |

| Table of Contents |

Chemrex has a number of competitors in Malaysia, some of which have greater resources than us. However, we believe that we offer the following competitive advantages to our existing and potential customers:

| - | Our Technical Staff. Our technical staff, comprised of two chemists and one engineer, are highly competent and familiar with the trending advancements in the FRP industry. They provide technical know-how on mixing various products and offer product suggestions/modifications to our customers which can involve strengthening or enhancing existing products sold by our customers. |

|

|

|

| - | Sourcing Raw Materials. We source a broad range of raw materials on a world-wide basis. This feature greatly expands our reach to potential customers. It also assists our customers in developing new products. |

Regulatory Matters

We are unaware of and do not anticipate having to expend significant resources to comply with any governmental regulations. We are subject to the laws and regulations of those jurisdictions in Malaysia

Intellectual Property.

Chemrex does not have any patent, trademark, copyright or licensing rights.

Employees

As of the date of this this filing, Chemrex has 19 full-time employees, including 12 Directors/Executives and 7 Warehouse Staff for the Company. Chemrex believes its relationship with employees to be excellent.

In total, Chemrex and Bionexus Malaysia have 27 full-time employees, including 4 Chemrex’ Directors, 13 Technical and Administrative Executives and 10 warehouse staff. On the holding level, BGLC has 5 Directors/Officers on part-time basis

Item 1A. Risk Factors

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this Form 10-K in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

| 14 |

| Table of Contents |

Risk Factors Relating to Our Business

BIONEXUS MALAYSIA HAS A LIMITED OPERATING HISTORY AND LIMITED BUSINESS GROWTH. BioNexus Malaysia has been operational since April 2017; therefore, it has had limited operations which makes it difficult to evaluate its business and our prospects. In addition, to date, they have not experienced substantial growth in our business. The likelihood of its success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small operating company trying to expand its business enterprise and the highly competitive environment in which we will operate. Consequently, there can be no assurance that the business of BioNexus Malaysia will grow in the future. Moreover, because of its limited operating history, it is difficult to extrapolate any meaningful projections about its future.

THE EFFICACY OF BIONEXUS MALAYSIA BLOOD SCREENING PROCESS HAS NOT SUPPORTED BY ANY INDEPENDENT STUDIES OR TESTS. BioNexus Malaysia blood screening process, which was commercially launched in July 2017, has been developed by late Dr. Choong Chin Liew, our largest shareholder. Dr. Liew has spent many years developing and testing various aspects of his current protocols and has published numerous articles concerning his blood screening protocols. Nonetheless, these protocols and procedures have not been the subject of a wide scale independent study or studies proving the efficacy of our testing protocols.

As a result, it is conceivable, that despite Dr. Liew’s efforts, our current blood based genomic screening process may not be as efficacious as we believe, which in effect would yield false positive or false negative test results. Inaccurate test results in turn could lead to significant financial exposure to the Company. The exposure would arise from claims by patients for a misdiagnosis of current or perceived current medical conditions. Claims for a false positive diagnosis could include increased medical costs arising from more medical tests and physician examinations in response to the false positive diagnosis. Claims for false negative diagnosis could include claims for loss of life and pain and suffering arising from the failure to diagnose a current medical condition. While we inform patients that our diagnostics are merely one of many tools employed in a health care diagnoses, these claims could be substantial and cause a material adverse impact on our business.

BIONEXUS MALAYSIA MAY FACE PRODUCT LIABILITY CLAIMS. Due to the nature of our business, we may face claims for product liability. These claims may arise from the inaccurate or erroneous diagnosis of patient information or the mix-up of patient information whereby a patient receives the wrong diagnostic information. While we feel confident in our accuracy of our diagnostic analysis and the procedures which we have implemented to ensure the safeguard of patient information, we cannot provide assurances that product liability claims will arise in the future.

Moreover, litigation or adverse publicity resulting from these allegations could materially and adversely affect our business, regardless of whether the allegations are valid or whether we are liable. Currently we have no product liability insurance coverage, and even if there was such coverage, there would be no assurance that such coverage would be sufficient to properly protect us. Further, claims of this type, whether substantiated or not, may divert our financial and management resources from revenue generating activities and the business operation.

Presently, we do not have insurance to cover any product liability claims. This lack of insurance may cause a material adverse impact on the Company if product liability claims arise.

INEFFECTIVE RISK MANAGEMENT POLICIES AND PROCEDURES. The Company relies on a combination of technical and human factors to protect the Company against risks. Its policies, procedures and practices are used to identify, monitor and control a variety of risks, including risks related to human error and hardware and software errors. The administration and results of each test are reviewed by a physician and a scientist in Malaysia before the results are released to the patient. The Company’s standard of operations has been developed internally primarily by Dr. Liew. These risk-management methods may not adequately prevent losses and may not protect us against all risks, in which case our business, economic conditions, operations and cash flows may be materially adversely affected.

| 15 |

| Table of Contents |

We have risk-management policies, control systems and compliance manuals in place; however, there is no guarantee that such policies, systems, and manuals will be effectively applied in every circumstance by our staff for example; employees could override the system technology and theoretically waive requirements, thereby exposing our company to the risk of compromised test result.

WE WILL NEED ADDITIONAL FINANCING IN ORDER TO GROW OUR BUSINESS. We do not have significant assets with which to expand our business. We intend to expand our business through increased marketing efforts in Malaysia and elsewhere for both of our business line, the blood based genomic screening process and chemical distribution business. These additional expenditures are intended to be funded from cash on hand and, if necessary, third-party sources, including the incurring of debt and/or the sale of additional equity securities. In addition to requiring additional financing to fund expansion, the Company may require additional financing to fund working capital and operating losses in the future should the need arise. The incurrence of debt creates additional financial leverage and therefore an increase in the financial risk of the Company’s operations. The sale of additional equity securities will be dilutive to the interests of current equity holders. In addition, there can be no assurance that such additional financing, whether debt or equity, will be available to the Company or that it will be available on acceptable commercial terms. Any inability to secure such additional financing on appropriate terms could have a materially adverse impact on the business, financial condition and operating results of the Company.

AS WE UNDERTAKE BIONEXUS MALAYSIA’S BUSINESS, WE WILL BE SUBJECT TO COMPLIANCE WITH POTENTIAL GOVERNMENT REGULATION THAT MAY INCREASE IN THE FUTURE. Currently, there are no governmental regulations that materially restrict our screening business. Pathology Laboratory Bill of 2007 (“Pathology Act”) has been passed by the Malaysian Parliament, however, since 2007, the government has not implemented the regulations underlying the legislation nor has the government enforced the Pathology Act. Any such regulations could establish criteria for the various classes and specialties of laboratories, the organization and management system of the laboratory, the qualification and experience of the person-in-charge, the qualification and competence of pathologists, scientific and technical staff engaged to conduct tests, and the standards of laboratory practice. We cannot predict whether we would be able to comply with the Pathology Act and its regulations, if implemented. In addition, there also is a risk that the regulations arising from the Pathology Act or new legislation or regulations could increase our costs of doing business or otherwise prevent us from carrying out the expansion of our business. Accordingly, our business may be harmed if we are no able to comply with any future governmental legislation or regulations, including the Pathology Act.

OUR BLOOD BASED GENOMIC SCREENING PROCESS MAY NOT ACHIEVE COMMERCIAL SUCCESSES IN THE MARKETPLACE. Our blood based genomic screening process may not be acceptable in the marketplace for a variety of factors. One factor may be that doctors and hospitals may be loathed to recommend our screening process as it may be deemed competitive to existing health care services that are offered by doctors and hospitals. Another factor may be that patients could be fearful of learning potentially negative health results and as a consequence, may not subscribe to our screening process. The occurrence of either of these factors may impact the successful reception of our product in the marketplace and negatively impair our further revenue potential.

BUSINESS DISRUPTIONS COULD SERIOUSLY HARM OUR FUTURE REVENUE AND FINANCIAL CONDITION AND INCREASE OUR COSTS AND EXPENSES. Our operations could be subject to power shortages, telecommunications failures, wildfires, water shortages, floods, earthquakes, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics and other natural or man-made disasters or business interruptions. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. Unfavorable global economic conditions could adversely affect both of our business segments, financial condition, or results of operations.

We do not carry insurance for all categories of risk that our business may encounter. Although we intend to obtain some form of business interruption insurance in the future, there can be no assurance that we will secure adequate insurance coverage or that any such insurance coverage will be sufficient to protect our operations to significant potential liability in the future. Any significant uninsured liability may require us to pay substantial amounts, which would adversely affect our financial position and results of operations.

| 16 |

| Table of Contents |

OUR SOFTWARE IS HIGHLY COMPLEX AND MAY CONTAIN UNDETECTED ERRORS. Our proprietary software underlying our diagnosis is highly complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after a diagnosis. This may result in an inaccurate diagnosis which could expose us to substantial liability due to the misdiagnosis. Any errors or vulnerabilities discovered in our software could result in damage to our reputation, loss of clients, loss of revenue or liability for damages, any of which could adversely affect our growth prospects and our business.

WE MAY BE UNABLE TO PROTECT OUR INTELLECTUAL PROPERTY ADEQUATELY. Our proprietary software is an essential asset of our business. To establish and protect our intellectual property rights, we rely primarily upon a trade secret, and to a lesser extent, contractual provisions with current and future employees. Further, our software is not patent protected nor is it copyrighted. Resultantly, our efforts to protect our intellectual property may not be sufficient or effective. If these measures do not protect our intellectual property rights, third parties could use the Company’s technology, and its ability to compete in the market would be reduced significantly.

In addition, we may not be effective in policing unauthorized use of our intellectual property. Even if we do detect violations, we may need to engage in litigation to enforce our intellectual property rights. Any enforcement efforts we undertake, including litigation, could be time-consuming and expensive and could divert our management’s attention. In addition, our efforts may be met with defenses and counterclaims challenging the validity and enforceability of our intellectual property rights or may result in a court determining that our intellectual property rights are unenforceable. If we are unable to cost-effectively protect our intellectual property rights, then our business could be harmed.

WE MAY BE SUBJECT TO INTELLECTUAL PROPERTY CLAIMS, WHICH ARE EXTREMELY COSTLY TO DEFEND, COULD REQUIRE US TO PAY SIGNIFICANT DAMAGES AND COULD LIMIT OUR ABILITY TO USE CERTAIN TECHNOLOGIES IN THE FUTURE. Companies in bio-medical or bio-technology industries are frequently subject to litigation based on allegations of infringement or other violations of intellectual property rights. To the extent we gain greater public recognition, we may face a higher risk of being the subject of intellectual property claims. Third-party intellectual property rights may cover significant aspects of our technologies or business methods or block us from expanding our offerings. Any intellectual property claims against us, with or without merit, could be time consuming and expensive to settle or litigate and could divert the attention of our management. Litigation regarding intellectual property rights is inherently uncertain due to the complex issues involved, and we may not be successful in defending ourselves in such matters.

In addition, some of our competitors have extensive portfolios of issued patents. Many potential litigants, including some of our competitors and patent holding companies, have the ability to dedicate substantial resources to enforcing their intellectual property rights. Any claims successfully brought against us could subject us to significant liability for damages and we may be required to stop using technology or other intellectual property alleged to be in violation of a third party’s rights. We also might be required to seek a license for third-party intellectual property. Even if a license is available, we could be required to pay significant royalties or submit to unreasonable terms, which would increase our operating expenses. We may also be required to develop alternative non-infringing technology, which could require significant time and expense. If we cannot license or develop technology for any allegedly infringing aspect of our business, we would be forced to limit our service and may be unable to compete effectively. Any of these results could harm our business.

WE FACE COMPETITION FROM OTHER LABORATORIES AND OUR OPERATING RESULTS WILL SUFFER IF WE FAIL TO COMPETE EFFECTIVELY. We believe there are a limited number of companies worldwide that specialize in RNA blood analysis to detect disease. However, there are a few laboratories in universities and research institutions that are attempting to extend their researches from DNA into RNA screening. If they have some breakthrough and they could be our potential competitors. Many of our potential competitors may have strong financial and resources, such as sophisticated research capabilities and development staff than we do. Their discovery and development of novel protocol that could make our genomic screening obsolete even though with FDA and European Union certification. As a result of these factors, our competitors may succeed in obtaining patent protection and/or FDA approval or discovering, developing and commercializing screening process for the cancer, inflammation, osteoarthritis and many more indications.

| 17 |

| Table of Contents |

In addition, smaller or early-stage companies also may prove to be significant competitors, particularly through collaborative arrangements with large, established companies. In addition, many universities and private and public research institutes may become active in our target disease areas.

If our competitors market products that are more effective, safer or less expensive or that reach the market sooner than our future products, if any, we may not achieve commercial success. In addition, because of our limited resources, it may be difficult for us to stay abreast of the rapid changes in each technology. If we fail to stay at the forefront of technological change, we may be unable to compete effectively. Technological advances or products developed by our competitors may render our technologies or product candidates obsolete, less competitive or not economical.

WE ALSO FACE COMPETITION FROM OTHER CHEMICAL DISTRIBUTORS AND OUR OPERATING RESULTS WILL SUFFER IF WE FAIL TO COMPETE EFFECTIVELY. We believe there are a limited number of companies in Malaysia that provide the broad range of chemicals that we provide to customers. Many of our existing and potential competitors may have stronger financial, product development and marketing capabilities than our existing capabilities. As a result of these factors, our competitors may succeed in attracting new customers which we may need to further develop our business.

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS. We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect these costs to approximate $50,000 per year, consisting of $30,000 in legal, $50,000 in audit and $10,000 for EDGAR filing and transfer agent fees. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We may not be able to cover these costs from our operations and may need to raise or borrow additional funds. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

OUR OFFICERS AND DIRECTORS MAY HAVE A CONFLICT OF INTEREST WITH THE MINORITY SHAREHOLDERS AT SOME TIME IN THE FUTURE. SINCE THE MAJORITY OF OUR SHARES OF COMMON STOCK ARE OWNED BY OUR OFFICERS AND DIRECTORS AND A KEY CONSULTANT, OUR OTHER STOCKHOLDERS MAY NOT BE ABLE TO INFLUENCE CONTROL OF THE COMPANY OR DECISION MAKING BY MANAGEMENT OF THE COMPANY. Our Officers and Directors beneficially own approximately 35% of our outstanding common stock. The interests of our Officers and Directors may not be, at all times, the same as that of our other shareholders. Our Officers and Directors are not simply passive investors but are also executives of the Company, their interests as executives may, at times be averse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our directors exercising, in a manner fair to all of our shareholders, their fiduciary duties as officers or as member of the Company’s Board of Directors. Also, our directors will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our articles of incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

BECAUSE OUR OFFICERS AND DIRECTORS MAY IN FUTURE HAVE OUTSIDE BUSINESS ACTIVITIES, THERE IS A POTENTIAL CONFLICT OF INTEREST, INCLUDING THE AMOUNT OF TIME THEY WILL BE ABLE TO DEDICATE TO THE COMPANY. Currently our officers, who are also directors, have been working on promoting business for the Company. A potential conflict of interest may arise in the future that may cause our business to fail, including conflicts of interest in allocating their time to our company and their other business interests. While our officers have verbally agreed to devote sufficient time and attention to the affairs of the Company, we have no written arrangement with our officers regarding this matter. As a result, we may face conflicts between business decisions that they may have to make regarding our operations and that of their other business interests.

| 18 |

| Table of Contents |

BECAUSE OUR MANAGEMENT DOES NOT HAVE PRIOR EXPERIENCE RUNNING A PUBLIC COMPANY, WE MAY HAVE TO HIRE INDIVIDUALS OR SUSPEND OR CEASE OPERATIONS. Because our management has limited prior experience in running a public company, including the preparation of reports under the Securities Act of 1934, we may have to hire additional experienced personnel to assist us with the preparation thereof. If we need the additional experienced personnel and we do not hire them, we could fail in our plan of operations and have to suspend operations or cease operations entirely.

INDEPENDENT AUDIT COMMITTEE. Although the common stock is not listed on any national securities exchange, for purposes of independence we use the definition of independence applied by NASDAQ. Currently, BGLC has three independent directors and they served as audit committee members. They are considered to be “independent” in accordance with the requirements set forth in NASDAQ Listing Rule 5605(a)(2). An independent audit committee plays a crucial role in the corporate governance process, assessing our Company’s processes relating to our risks and control environment, overseeing financial reporting, and evaluating internal and independent audit processes.

POTENTIAL DATA BREACHES. If we are successful, our services will generate and process a large quantity of personal health condition data. We face risks inherent in handling large volumes of data and in protecting the security of such data. In particular, we face a number of challenges relating to data inter-connected with regional labs, including:

· | protecting the data in and hosted on our system, including against hacking on our system by outside parties or our employees; |

· | addressing concerns related to privacy and sharing, safety, security and others; |

· | complying with applicable laws, rules and regulations relating to the collection, use, disclosure of personal information, including any requests from regulatory and government authorities relating to such data; |

· | Any systems failure or security breach or lapse those results in the release of user data could harm our reputation and brand and, consequently, our business, in addition to exposing us to potential legal liability. |

As we expand our operations, we may be subject to these laws in other jurisdictions where our customers and other participants are located. The laws, rules and regulations of other jurisdictions may impose more stringent or conflicting requirements and penalties than those in Malaysia, compliance with which could require significant resources and costs. Our privacy policies and practices concerning the collection, use and disclosure of user data are posted on our websites. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any regulatory requirements or privacy protection-related laws, rules and regulations could result in proceedings or actions against us by authorities or others. These proceedings or actions may subject us to significant penalties and negative publicity, require us to change our business practices, increase our costs and severely disrupt our business.

| 19 |

| Table of Contents |

CROSS-BORDER OPERATIONS. As we plan to continue expanding our existing cross-border operations into existing and other markets, we will face risks associated with expanding into markets in which we have limited or no experience and in which our company may be less well-known. We may be unable to attract a sufficient number of customers and other participants, fail to anticipate competitive conditions or face difficulties in operating effectively in these new markets. The expansion of our cross-border business will also expose us to risks relating to staffing and managing cross-border operations, increased costs to protect intellectual property, tariffs and other trade barriers, differing and potentially adverse tax consequences, increased and conflicting regulatory compliance requirements, lack of acceptance of our service offerings, challenges caused by distance, language and cultural differences, exchange rate risk and political instability. Accordingly, any efforts we make to expand our cross-border operations may not be successful, which could limit our ability to grow our revenue, net income and profitability.

RISKS RELATED TO DOING BUSINESS IN ASIA PACIFIC REGION. Changes in the political and economic policies of the local government may materially and adversely affect our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies. Accordingly, our financial condition and results of operations are affected to a significant extent by economic, political and legal developments in Asia Pacific region.

The Asia Pacific economy differs from the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. In addition, the government continues to play a significant role in regulating industry development by imposing industrial policies. The government also exercises significant control over economic growth by allocating resources, controlling payment of foreign currency-denominated obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular industries or companies.

The local government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures may benefit the overall economy, but may also have a negative effect on us. Our financial condition and results of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, the government has implemented in the past certain measures, including interest rate increases, to control the pace of economic growth. These measures may cause decreased economic activity, which in turn could lead to a reduction in demand for our services and consequently have a material adverse effect on our businesses, financial condition and results of operations.

YOU MAY EXPERIENCE DIFFICULTIES IN EFFECTING SERVICE OF LEGAL PROCESS, ENFORCING FOREIGN JUDGMENTS OR BRINGING ORIGINAL ACTIONS IN MALAYSIA BASED ON UNITED STATES OR OTHER FOREIGN LAWS AGAINST US OR OUR MANAGEMENT. Our operating subsidiary is incorporated in Malaysia and conducts substantially all of our operations in Asia Pacific. All of our executive officers and directors reside outside the United States and all of their assets are located outside of the United States. As a result, it may be difficult or impossible for shareholders to bring an action against us or against these individuals in Malaysia in the event that you believe that your rights have been infringed under the securities laws of the United States or otherwise. Even if you are successful in bringing an action of this kind, the laws of Malaysia may render you unable to enforce a judgment against our assets or the assets of our directors and officers. There is no statutory recognition in Malaysia of judgments obtained in the United States, although the courts of Malaysia will generally recognize and enforce a non-penal judgment of a foreign court of competent jurisdiction without retrial on the merits. The rights of shareholders to take legal action against us and our directors, actions by minority shareholders and the fiduciary responsibilities of our directors are to a large extent governed by the common law of Malaysia. The common law of Malaysia is derived in part from comparatively limited judicial precedent in Malaysia as well as from English common law, which provides persuasive, but not binding, authority in a court in Malaysia. The rights of our shareholders and the fiduciary responsibilities of our directors under Malaysian law are not as clearly established as they would be under statutes or judicial precedents in the United States. In particular, Malaysia has a less developed body of securities laws than the United States and provides significantly less protection to investors. As a result, our public shareholders may have more difficulty in protecting their interests through actions against us, our management, our directors or our major shareholders than would shareholders of a corporation incorporated in a jurisdiction in the United States.

| 20 |

| Table of Contents |

Risks Related to Our Common Stock

SALES OF OUR COMMON STOCK IN RELIANCE ON RULE 144 MAY REDUCE PRICES IN THAT MARKET BY A MATERIAL AMOUNT. A significant number of the outstanding shares of our common stock are “restricted securities” within the meaning of Rule 144 under the Securities Act. As restricted securities, those shares may be resold only pursuant to an effective registration statement or pursuant to the requirements of Rule 144 or other applicable exemptions from registration under the Securities Act and as required under applicable state securities laws. Rule 144 provides in essence that an affiliate (i.e., an officer, director or control person) who has held restricted securities for a prescribed period may, under certain conditions, sell every three months, in brokerage transactions, a number of shares that does not exceed 1.0% of the issuer’s outstanding common stock. The alternative limitation on the number of shares that may be sold by an affiliate, which is related to the average weekly trading volume during the four calendar weeks prior to the sale is not available to stockholders of companies whose securities are not traded on an “automated quotation system”; because the OTC-QB Market is not such a system, market-based volume limitations are not available for holders of our securities selling under Rule 144.

Pursuant to the provisions of Rule 144, there is no limit on the number of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days before the date of the proposed sale) after the restricted securities have been held by the owner for a prescribed period, although there may be other limitations and/or criteria to satisfy. A sale pursuant to Rule 144 or pursuant to any other exemption from the Securities Act, if available, or pursuant to registration of shares of our common stock held by our stockholders, may reduce the price of our common stock in any market that may develop.

YOU MAY NOT BE ABLE TO LIQUIDATE YOUR INVESTMENT SINCE THERE IS NO ASSURANCE THAT A PUBLIC MARKET WILL DEVELOP FOR OUR COMMON STOCK OR THAT OUR COMMON STOCK WILL EVER BE APPROVED FOR TRADING ON A RECOGNIZED EXCHANGE. There is no established public trading market for our securities. Although we intend to be quoted on the OTC-QB Market in the United States, our shares are not and have not been quoted on any exchange or quotation system. We cannot assure you that a market maker will agree to file the necessary documents with the FINRA, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate its investment, which will result in the loss of your investment.

OUR COMMON STOCK IS SUBJECT TO THE “PENNY STOCK” RULES OF THE SEC AND THE TRADING MARKET IN OUR SECURITIES IS LIMITED, WHICH MAKES TRANSACTIONS IN OUR STOCK CUMBERSOME AND MAY REDUCE THE VALUE OF AN INVESTMENT IN OUR STOCK. Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

| 21 |

| Table of Contents |

IN THE FUTURE, WE MAY ISSUE ADDITIONAL COMMON AND PREFERRED SHARES, WHICH WOULD REDUCE INVESTORS’ PERCENT OF OWNERSHIP AND MAY DILUTE OUR SHARE VALUE. Our Articles of Incorporation authorize the issuance of 300,000,000 shares of common stock. As of the date of this filing, the Company had 171,218,152 shares of common stock outstanding. Accordingly, we may issue up to an additional 128,781,848 shares of common stock. In addition, we have the right to issue 30,000,000 shares of preferred stock. The preferred stock is known as “blank check” as the Board of Directors is authorized to set the rights, privileges and preference of the preferred stock. The future issuance of common stock and preferred may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock or preferred stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

UPON EFFECTIVENESS OF THIS REGISTRATION STATEMENT, WE WILL NOT BE A FULLY REPORTING COMPANY UNDER SECTION 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934, RATHER WE WILL BE SUBJECT TO THE REPORTING REQUIREMENTS OF SECTION 15(D) OF THE EXCHANGE ACT WHICH IS LESS RESTRICTIVE ON US AND OUR INSIDERS. In order for us to become a fully reporting company under Section 12(g) of the Exchange Act, we will have to file a Registration Statement on Form 8-A. If we do not become subject to Section 12 of the Exchange Act, we will be subject to Section 15(d) of the Exchange Act, and as such we will not be required to comply with (i) the proxy statement requirements which means shareholders may have less notice of pending matters, and (ii) the Williams Act which requires disclosure of persons or groups that acquire 5% of a company’s publicly traded stock and also regulates tender offers. In addition, our officer, director and 10% stockholder will not be required to submit reports to the SEC on their stock ownership and stock trading activity. These reports include Form 3, 4 and 5. Therefore, as a shareholder, less information and disclosure concerning these matters will be available to you.

WE DO NOT INTEND TO PAY ANY CASH DIVIDENDS ON OUR COMMON STOCK, OUR STOCKHOLDERS WILL NOT BE ABLE TO RECEIVE A RETURN ON THEIR SHARES UNLESS THEY SELL THEM. We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

OUR COMMON STOCK PRICE IS LIKELY TO BE HIGHLY VOLATILE WHICH MAY SUBJECT US TO SECURITIES LITIGATION THEREBY DIVERTING OUR RESOURCES WHICH MAY AFFECT OUR PROFITABILITY AND RESULTS OF OPERATION. The market price for our common stock is likely to be highly volatile as the stock market in general and the market for Internet-related stocks.

The following factors will add to our common stock price’s volatility:

| - | fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us; |

| - | changes in estimates of our financial results or recommendations by securities analysts; |

| - | changes in market valuations of similar companies; |

| 22 |

| Table of Contents |

| - | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| - | regulatory developments in Malaysia or other countries wherein we expect to conduct business; |

| - | litigation involving our company, our general industry or both; |

| - | investors’ general perception of us; and |

| - | changes in general economic, industry and market conditions. |

Many of these factors are beyond our control. These factors may decrease the market price of our common stock, regardless of our operating performance. In the past, plaintiffs have initiated securities class action litigation against a company following periods of volatility in the market price of its securities. In the future, we may be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES MAY MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS. We qualify as an “emerging growth company” under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

· | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

· | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

· | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |