☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of Each Class |

Trading Symbol |

Name of Each Exchange On Which Registered | ||

(The Nasdaq Global Market) |

| * |

| Large accelerated filer | ☐ | ☒ | ||||

Non-accelerated filer |

☐ | Emerging growth company | ||||

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

International Financial Reporting Standards as issued |

Other ☐ | |||||||

by the International Accounting Standards Board |

☐ |

1 |

||||||

2 |

||||||

3 |

||||||

Item 1. |

3 |

|||||

Item 2. |

3 |

|||||

Item 3. |

3 |

|||||

Item 4. |

58 |

|||||

Item 4A. |

95 |

|||||

Item 5. |

95 |

|||||

Item 6. |

114 |

|||||

Item 7. |

124 |

|||||

Item 8. |

127 |

|||||

Item 9. |

128 |

|||||

Item 10. |

129 |

|||||

Item 11. |

139 |

|||||

Item 12. |

140 |

|||||

PART II |

142 |

|||||

Item 13. |

142 |

|||||

Item 14. |

142 |

|||||

Item 15. |

142 |

|||||

Item 16A. |

143 |

|||||

Item 16B. |

143 |

|||||

Item 16C. |

144 |

|||||

Item 16D. |

144 |

|||||

Item 16E. |

144 |

|||||

Item 16F. |

144 |

|||||

Item 16G. |

144 |

|||||

Item 16H. |

145 |

|||||

Item 16I. |

145 |

|||||

PART III |

146 |

|||||

Item 17. |

146 |

|||||

Item 18. |

146 |

|||||

Item 19. |

146 |

|||||

| • | “ADSs” are to our American depositary shares, every three of which represent two Class A common shares; |

| • | “Aurora” are to Aurora Mobile Limited; |

| • | “BVI” are to the British Virgin Islands; |

| • | “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Hong Kong, Macau and Taiwan; |

| • | “Class A common shares” are to our Class A common shares of par value US$0.0001 per share; |

| • | “Class B common shares” are to our Class B common shares of par value US$0.0001 per share; |

| • | “common shares” are to our common shares, par value US$0.0001 per share; |

| • | “cumulative app installations” as of a certain date are to the cumulative number of apps that have installed one or more of the SDKs offered as part of our developer services as of the same date; |

| • | “customers” in a given period are to those that purchase at least one of our paid-for SAAS Businesses or targeted marketing during the same period. We treat each contracting party as a separate customer although it is possible that a company may have more than one contracting party to enter into contracts with us and multiple entities within one corporate group may use the same contracting party to enter into contracts with us; |

| • | “monthly active SDKs” in a given period are to the number of SDKs offered as part of our developer services and integrated into apps that have been installed on mobile devices, which have established active connection with our servers in the last month of the same period; |

| • | “monthly active unique mobile devices” in a given period are to the number of unique mobile devices that have at least one app establishing active connection with our servers in the last month of the same period; |

| • | “our SAAS Businesses” are to our developer services and vertical applications; |

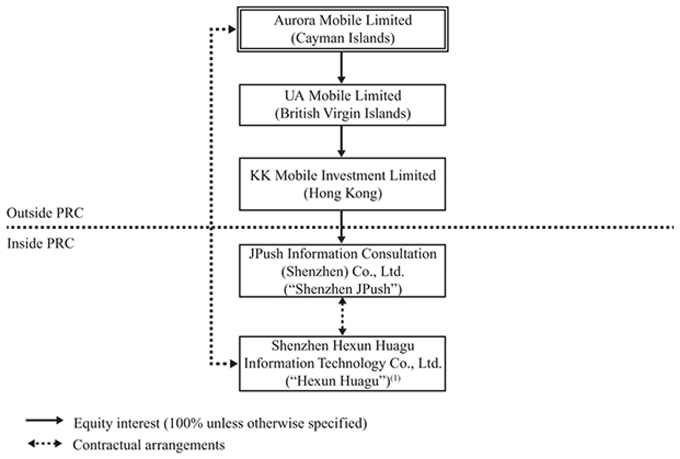

| • | “our VIE” are to Shenzhen Hexun Huagu Information Technology Co., Ltd., or Hexun Huagu; |

| • | “our WFOE” are to JPush Information Consultation (Shenzhen) Co., Ltd., or Shenzhen JPush; |

| • | “RMB” and “Renminbi” are to the legal currency of China; |

| • | “SAAS” are to Software-as-a-Service; |

| • | “US$,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States; and |

| • | “we,” “us,” “our company” and “our” are to Aurora Mobile Limited, our Cayman Islands holding company, and its subsidiaries, and, when describing our operations and consolidated financial information, also include our VIE in China and its subsidiaries. |

| • | our goals and strategies; |

| • | our future business development, financial conditions and results of operations; |

| • | the expected growth of the mobile internet industry and the mobile app developer services market in China; |

| • | the expected growing application of big data technology in China, including in areas such as mobile online marketing, financial risk management, market intelligence and location-based intelligence services; |

| • | our expectations regarding demand for and market acceptance of our SAAS Businesses and targeted marketing; |

| • | our expectations regarding our relationships with app developers, customers, strategic partners and other stakeholders; |

| • | competition in our industry; and |

| • | relevant government policies and regulations relating to our industry. |

Item 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Item 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

Item 3. |

KEY INFORMATION |

For the year ended December 31, |

||||||||||||

2019 |

2020 |

2021 |

||||||||||

(RMB in thousands) |

||||||||||||

| Loans from a subsidiary, JPush Information Consulting (Shenzhen) Co., Ltd. to the VIE |

197,943 | — | 80,000 | |||||||||

| Repayment of loans and interests by the VIE to a subsidiary, JPush Information Consulting (Shenzhen) Co., Ltd. |

— | 156,124 | 56,341 | |||||||||

| Employee’s individual income tax from the exercise of share options from a subsidiary, JPush Information Consulting (Shenzhen) Co., Ltd. to the VIE |

5,133 | 878 | 2,630 | |||||||||

For the year ended December 31, 2021 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Revenues |

— | 351,243 | 116,306 | (110,227 | ) | 357,322 | ||||||||||||||

| Loss from subsidiaries and VIE |

(117,029 | ) | — | — | 117,029 | — | ||||||||||||||

| Net loss |

(140,584 | ) | (100,782 | ) | (16,247 | ) | 117,029 | (140,584 | ) | |||||||||||

For the year ended December 31, 2020 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Revenues |

— | 465,066 | 103,435 | (96,887 | ) | 471,614 | ||||||||||||||

| Loss from subsidiaries and VIE |

(193,109 | ) | — | — | 193,109 | — | ||||||||||||||

| Net loss |

(225,075 | ) | (173,865 | ) | (19,244 | ) | 193,109 | (225,075 | ) | |||||||||||

For the year ended December 31, 2019 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Revenues |

— | 900,454 | 100,484 | (94,480 | ) | 906,458 | ||||||||||||||

| Loss from subsidiaries and VIE |

(93,328 | ) | — | — | 93,328 | — | ||||||||||||||

| Net (loss)/income |

(109,841 | ) | (95,829 | ) | 2,501 | 93,328 | (109,841 | ) | ||||||||||||

As of December 31, 2021 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Cash and cash equivalents |

6,724 | 55,946 | 27,882 | — | 90,552 | |||||||||||||||

| Restricted cash |

5,998 | 158,032 | — | — | 164,030 | |||||||||||||||

| Total current assets |

32,896 | 394,640 | 446,052 | (492,452 | ) | 381,136 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Investments in subsidiaries |

349,501 | — | 1,622,191 | (1,971,692 | ) | — | ||||||||||||||

| Total non-current assets |

401,447 | 144,382 | 1,917,264 | (2,248,692 | ) | 214,401 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

434,343 | 539,022 | 2,363,316 | (2,741,144 | ) | 595,537 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

218,900 | 865,202 | 60,174 | (764,182 | ) | 380,094 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total equity |

215,443 | (326,180 | ) | 2,303,142 | (1,976,962 | ) | 215,443 | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

434,343 | 539,022 | 2,363,316 | (2,741,144 | ) | 595,537 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

As of December 31, 2020 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Cash and cash equivalents |

92,123 | 115,713 | 148,279 | — | 356,115 | |||||||||||||||

| Restricted cash |

— | 115 | — | — | 115 | |||||||||||||||

| Total current assets |

101,564 | 296,573 | 425,555 | (293,463 | ) | 530,229 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Investments in subsidiaries |

439,276 | — | 1,660,152 | (2,099,428 | ) | — | ||||||||||||||

| Total non-current assets |

494,422 | 173,546 | 1,985,658 | (2,396,428 | ) | 257,198 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total assets |

595,986 | 470,119 | 2,411,213 | (2,689,891 | ) | 787,427 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities |

274,747 | 709,702 | 68,218 | (586,479 | ) | 466,188 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total equity |

321,239 | (239,583 | ) | 2,342,995 | (2,103,412 | ) | 321,239 | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

| Total liabilities and equity |

595,986 | 470,119 | 2,411,213 | (2,689,891 | ) | 787,427 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||

For the year ended December 31, 2021 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Net cash (used in)/ provided by operating activities |

(24,383 | ) | 68,336 | (120,603 | ) | — | (76,650 | ) | ||||||||||||

| Net cash (used in)/ provided by investing activities |

(4,859 | ) | (186 | ) | 1,487 | 30,000 | 26,442 | |||||||||||||

| Net cash provided by / (used in) financing activities |

(54,520 | ) | 30,000 | — | (30,000 | ) | (54,520 | ) | ||||||||||||

| Effect of exchange rate fluctuation on cash and cash equivalents |

4,361 | — | (1,281 | ) | — | 3,080 | ||||||||||||||

| Net change in cash |

(79,401 | ) | 98,150 | (120,397 | ) | — | (101,648 | ) | ||||||||||||

| Opening cash balance |

92,123 | 115,828 | 148,279 | — | 356,230 | |||||||||||||||

| Ending cash balance |

12,722 | 213,978 | 27,882 | — | 254,582 | |||||||||||||||

For the year ended December 31, 2020 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Net cash (used in)/ provided by operating activities |

(17,412 | ) | 168,971 | (75,749 | ) | — | 75,810 | |||||||||||||

| Net cash (used in)/ provided by investing activities |

(6,525 | ) | (108,450 | ) | 121,742 | (151,182 | ) | (144,415 | ) | |||||||||||

| Net cash provided by / (used in) financing activities |

5,257 | (156,124 | ) | — | 151,182 | 315 | ||||||||||||||

| Effect of exchange rate fluctuation on cash and cash equivalents |

(3,686 | ) | — | (3,368 | ) | — | (7,054 | ) | ||||||||||||

| Net change in cash |

(22,366 | ) | (95,603 | ) | 42,625 | — | (75,344 | ) | ||||||||||||

| Opening cash balance |

114,489 | 211,429 | 105,656 | — | 431,574 | |||||||||||||||

| Ending cash balance |

92,123 | 115,828 | 148,279 | — | 356,230 | |||||||||||||||

For the year ended December 31, 2019 |

||||||||||||||||||||

Parent |

VIE |

Subsidiaries |

Eliminating adjustments |

Consolidated total |

||||||||||||||||

(RMB in thousands) |

||||||||||||||||||||

| Net cash provided by/(used in) operating activities |

15,273 | 16,059 | (57,090 | ) | — | (25,758 | ) | |||||||||||||

| Net cash used in investing activities |

(95,412 | ) | (34,451 | ) | (294,921 | ) | 335,818 | (88,966 | ) | |||||||||||

| Net cash (used in)/provided by financing activities |

(33,845 | ) | 197,943 | 137,837 | (335,818 | ) | (33,883 | ) | ||||||||||||

| Effect of exchange rate fluctuation on cash and cash equivalents |

(9,763 | ) | — | 13,267 | — | 3,504 | ||||||||||||||

| Net change in cash |

(123,747 | ) | 179,551 | (200,907 | ) | — | (145,103 | ) | ||||||||||||

| Opening cash balance |

238,236 | 31,878 | 306,563 | — | 576,677 | |||||||||||||||

| Ending cash balance |

114,489 | 211,429 | 105,656 | — | 431,574 | |||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands, except for per share data) |

||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Revenues |

284,709 |

714,141 |

906,458 |

471,614 |

357,322 |

56,072 |

||||||||||||||||||

| Cost of revenues (1) |

(213,370 |

) |

(517,074 |

) |

(649,596 |

) |

(265,436 |

) |

(92,393 |

) |

(14,498 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

71,339 |

197,067 |

256,862 |

206,178 |

264,929 |

41,574 |

||||||||||||||||||

| Operating expenses: (1) |

||||||||||||||||||||||||

| Research and development expenses |

(71,651 |

) |

(134,358 |

) |

(176,248 |

) |

(174,597 |

) |

(206,722 |

) |

(32,439 |

) | ||||||||||||

| Sales and marketing expenses |

(59,673 |

) |

(83,853 |

) |

(118,548 |

) |

(102,319 |

) |

(116,415 |

) |

(18,268 |

) | ||||||||||||

| General and administrative expenses |

(32,431 |

) |

(71,641 |

) |

(109,291 |

) |

(119,087 |

) |

(79,922 |

) |

(12,542 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

(163,755 |

) |

(289,852 |

) |

(404,087 |

) |

(396,003 |

) |

(403,059 |

) |

(63,249 |

) | ||||||||||||

| Loss from operations |

(92,416 |

) |

(92,785 |

) |

(147,225 |

) |

(189,825 |

) |

(138,130 |

) |

(21,675 |

) | ||||||||||||

| Loss before income taxes |

(94,271 |

) |

(66,167 |

) |

(109,679 |

) |

(224,989 |

) |

(140,552 |

) |

(22,055 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss |

(90,291 |

) |

(66,197 |

) |

(109,841 |

) |

(225,075 |

) |

(140,584 |

) |

(22,060 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to Aurora Mobile Limited’s shareholders |

(90,291 |

) |

(66,197 |

) |

(109,841 |

) |

(225,075 |

) |

(140,584 |

) |

(22,060 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Accretion of contingently redeemable convertible preferred shares |

(26,391 |

) |

(24,094 |

) |

— |

— |

— |

— |

||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to common shareholders |

(116,682 |

) |

(90,291 |

) |

(109,841 |

) |

(225,075 |

) |

(140,584 |

) |

(22,060 |

) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per common share: |

||||||||||||||||||||||||

| Basic and diluted |

(2.73 |

) |

(1.57 |

) |

(1.43 |

) |

(2.91 |

) |

(1.78 |

) |

(0.28 |

) | ||||||||||||

| Weighted average number of shares used in calculating basic and diluted loss per common share: |

||||||||||||||||||||||||

| Common shares — Basic and diluted |

42,666,670 |

— |

— |

— |

— |

— |

||||||||||||||||||

| Class A common share — Basic and diluted |

— |

40,441,999 |

59,721,341 |

60,415,978 |

61,809,501 |

61,809,501 |

||||||||||||||||||

| Class B common share — Basic and diluted |

— |

17,000,189 |

17,000,189 |

17,000,189 |

17,000,189 |

17,000,189 |

||||||||||||||||||

| (1) | Share-based compensation expenses are allocated in cost of revenues and operating expenses as follows: |

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

| Cost of revenue |

— |

— |

73 |

4 |

41 |

6 |

||||||||||||||||||

| Research and development expenses |

1,408 |

9,448 |

12,819 |

7,176 |

13,801 |

2,166 |

||||||||||||||||||

| Sales and marketing expenses |

944 |

3,347 |

6,040 |

3,965 |

2,609 |

409 |

||||||||||||||||||

| General and administrative expenses |

5,923 |

11,766 |

28,352 |

17,713 |

13,761 |

2,160 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

8,275 |

24,561 |

47,284 |

28,858 |

30,212 |

4,741 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

As of December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||||||

| Cash and cash equivalents |

208,161 |

576,562 |

431,459 |

356,115 |

90,552 |

14,210 |

||||||||||||||||||

| Accounts receivable, net |

49,594 |

141,911 |

135,417 |

44,886 |

43,860 |

6,883 |

||||||||||||||||||

| Prepayments and other current assets |

34,228 |

80,578 |

86,087 |

49,013 |

46,670 |

7,323 |

||||||||||||||||||

| Total assets |

359,450 |

992,068 |

939,923 |

787,427 |

595,537 |

93,453 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Accounts payable |

8,340 |

18,811 |

19,996 |

16,592 |

18,292 |

2,870 |

||||||||||||||||||

| Deferred revenue and customer deposits |

49,557 |

59,483 |

77,561 |

109,182 |

119,991 |

18,829 |

||||||||||||||||||

| Accrued liabilities and other current liabilities |

52,639 |

76,666 |

96,277 |

109,136 |

85,305 |

13,388 |

||||||||||||||||||

| Total liabilities |

117,197 |

390,408 |

432,135 |

466,188 |

380,094 |

59,645 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total mezzanine equity |

466,637 |

— |

— |

— |

— |

— |

||||||||||||||||||

| Total shareholders’ deficit |

(224,384 |

) |

601,660 |

507,788 |

321,239 |

215,443 |

33,808 |

|||||||||||||||||

| Total liabilities, mezzanine equity and equity |

359,450 |

992,068 |

939,923 |

787,427 |

595,537 |

93,453 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Consolidated Cash Flow Data: |

||||||||||||||||||||||||

| Net cash (used in)/provided by operating activities |

(75,532 | ) | (97,925 | ) | (25,758 | ) | 75,810 | (76,650 | ) | (12,027 | ) | |||||||||||||

| Net cash (used in)/provided investing activities |

(28,644 | ) | (139,206 | ) | (88,966 | ) | (144,415 | ) | 26,442 | 4,150 | ||||||||||||||

| Net cash provided by/(used in) financing activities |

217,446 | 614,884 | (33,883 | ) | 315 | (54,520 | ) | (8,556 | ) | |||||||||||||||

| Effect of foreign currency exchange rate changes on cash and cash equivalents and restricted cash |

(8,282 | ) | (9,352 | ) | 3,504 | (7,054 | ) | 3,080 | 483 | |||||||||||||||

| Net increase/(decrease) in cash and cash equivalents and restricted cash |

104,988 | 368,401 | (145,103 | ) | (75,344 | ) | (101,648 | ) | (15,950 | ) | ||||||||||||||

| Cash and cash equivalents and restricted cash at the beginning of year |

103,288 | 208,276 | 576,677 | 431,574 | 356,230 | 55,900 | ||||||||||||||||||

| Cash and cash equivalents and restricted cash at the end of year |

208,276 | 576,677 | 431,574 | 356,230 | 254,582 | 39,950 | ||||||||||||||||||

| • | We have experienced rapid growth in recent periods, and our recent growth rates may not be indicative of our future growth; |

| • | We have incurred net losses in the past, which we may continue to experience in the future; |

| • | If we cannot successfully execute our strategy and continue to develop and effectively market SAAS Businesses and our other business initiatives that anticipate and respond to the needs of app developers and our customers, our business, operating results and financial condition may suffer; |

| • | If we are not able to continue to gain access to mobile data in the future, our business, operating results and financial condition could be materially and adversely affected; |

| • | If the market for our SAAS Businesses and other business initiatives develops more slowly than we expect, our growth may slow or stall and our operating results could be harmed; |

| • | Our and our VIE’s business generates and processes a large amount of data, and we are required to comply with PRC and other applicable laws relating to privacy and cybersecurity. The improper use or disclosure of data could have a material and adverse effect on our business and prospects; |

| • | Our business depends on strong brand and failing to maintain and enhance our brand would hurt our ability to expand our base of app developers and customers; |

| • | If we fail to keep up with rapid changes in technologies, our future success may be adversely affected; and |

| • | We may not be able to compete successfully with our current or future competitors. |

| • | Aurora is a Cayman Islands holding company with no equity ownership in our VIE, and we conduct our operations in China primarily through (i) our PRC subsidiary and (ii) our VIE with which we have maintained contractual arrangements. Investors in our ADSs thus are not purchasing equity interest in our operating entities in China but instead are purchasing equity interest in Cayman Islands holding company. If the PRC government finds that the agreements that establish the structure for operating some of our business operations in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we and our VIE could be subject to severe penalties, or be forced to relinquish our interest in those operations. Our holding company in the Cayman Islands, our PRC subsidiary, our VIE, and investors of Aurora face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements without VIE and, consequently, significantly affect the financial performance of our VIE and our company as a whole; |

| • | We rely on contractual arrangements with our VIE and its shareholders for substantially all of our business operation, which may not be as effective as direct ownership. we rely on the performance by our VIE and its shareholders of their obligations under the contracts to exercise control over our VIE. However, the shareholders of our consolidated VIE may not act in the best interests of our company or may not perform their obligations under these contracts. Such risks exist throughout the period in which we intend to operate certain portions of our business through the contractual arrangements with our VIE; |

| • | Any failure by our VIE or its shareholders to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business. if our VIE or its shareholders fail to perform their respective obligations under the contractual arrangements, we may have to incur substantial costs and expend additional resources to enforce such arrangements. We may also have to rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages, which we cannot assure will be effective under PRC law; and |

| • | The shareholders of our VIE may have potential conflicts of interest with Aurora, which may materially and adversely affect our business and financial condition. These shareholders may breach, or cause our VIE to breach, or refuse to renew, the existing contractual arrangements we have with them and our VIE, which would have a material and adverse effect on our ability to effectively control our VIE and receive economic benefits from them. If we cannot resolve any conflict of interest or dispute between us and the shareholders of our VIE, we would have to rely on legal proceedings, which could result in disruption of our business and subject us to substantial uncertainty as to the outcome of any such legal proceedings. |

| • | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations. The enforcement of laws and rules and regulations in China may change quickly with little advance notice, which could result in a material adverse change in our operations and the value of our ADSs; |

| • | We and our VIE may be adversely affected by the complexity, uncertainties and changes in PRC regulation of internet-related businesses and companies, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations; |

| • | The approval and/or other requirements of the CSRC or other PRC governmental authorities may be required in connection with an offering under PRC rules, regulations or policies, and, if required, we cannot predict whether or how soon we will be able to obtain such approval. Any failure to obtain or delay in obtaining the requisite governmental approval for an offering, or a rescission of such approval, would subject us to sanctions imposed by the relevant PRC regulatory authority; |

| • | The PRC government’s significant oversight over our business operation could result in a material adverse change in our operations and the value of our ADSs. The Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless; |

| • | The PCAOB is currently unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor deprives our investors with the benefits of such inspections; and |

| • | Our ADSs will be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, in 2024 if the PCAOB is unable to inspect or fully investigate auditors located in China, or in 2023 if proposed changes to the law are enacted. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| • | The trading price of the ADSs is likely to be volatile, which could result in substantial losses to investors; |

| • | We cannot guarantee that any share repurchase program will be fully consummated or that any share repurchase program will enhance long-term shareholder value, and share repurchases could increase the volatility of the trading price of the ADSs and could diminish our cash reserves; |

| • | We are an emerging growth company within the meaning of the Securities Act and may take advantage of certain reduced reporting requirements; |

| • | Our dual-class voting structure will limit your ability to influence corporate matters and could discourage others from pursuing any change of control transactions that holders of our Class A common shares and the ADSs may view as beneficial; and |

| • | The sale or availability for sale, or perceived sale or availability for sale, of substantial amounts of the ADSs could adversely affect their market price. |

| • | attract new app developers and customers, including from diversified industry verticals, and retain and expand our relationships with existing app developers and customers on a cost-effective basis; |

| • | maintain the breadth of our ad publisher network and attract new publishers; |

| • | innovate and adapt our services and solutions to meet evolving needs of current and potential customers, including to address market trends; |

| • | maintain and increase our access to data necessary for the development and performance of our solutions; |

| • | maintain the proper functioning of SAAS Businesses which include Developer Services and Vertical Applications, and other business initiatives as we continue to collect increasing amounts of data from a growing user base; |

| • | continuously improve on the algorithms underlying the products and the technologies; |

| • | adapt to a changing regulatory landscape governing privacy matters; |

| • | keep pace with the new technological development in the industry; |

| • | invest sufficiently in our technology and infrastructure, at the pace required to support our growth; |

| • | productize new solutions; |

| • | introduce our services and solutions to new geographic markets; |

| • | increase awareness of our brand among more businesses; and |

| • | attract and retain employees. |

| • | investments in our research and development team and in the development of new solutions and enhancement of our solutions; |

| • | investments in sales and marketing, including expanding our sales force, increasing our customer base and increasing market awareness of our platform; |

| • | expanding our operations and infrastructure, including internationally; and |

| • | incurring costs associated with general administration, including legal, accounting and other expenses related to being a public company. |

| • | the failure to accurately predict market or customer demands; |

| • | defects, errors or failures in the design or performance of our new products or product enhancements; |

| • | negative publicity about the performance or effectiveness of our SAAS Businesses; |

| • | delays in developing and enhancing existing products or releasing our new products to the market; |

| • | the introduction or anticipated introduction of competing products by our competitors; |

| • | poor business conditions for our customers, causing them to delay purchases; and |

| • | the perceived value of our services and SAAS Businesses relative to their cost. |

| • | protecting the data in and hosted on our system, including against attacks on our system by outside parties or fraudulent behavior or improper use by our employees; |

| • | addressing concerns related to privacy and sharing, safety and other factors; and |

| • | complying with applicable laws, rules and regulations relating to the collection, use, storage, transfer and disclosure of personal information, including any requests from regulatory and government authorities relating to these data. |

| • | The Anti-monopoly Guidelines for the Platform Economy Sector published by the Anti-monopoly Committee of the State Council, effective on February 7, 2021, prohibits collection of user information through coercive means by online platforms operators. |

| • | In August 2021, the Standing Committee of the NPC promulgated the Personal Information Protection Law, which integrates the scattered rules with respect to personal information rights and privacy protection and took effect on November 1, 2021. We update our privacy policies from time to time to meet the latest regulatory requirements of PRC government authorities and adopt technical measures to protect data and ensure cybersecurity in a systematic way. Nonetheless, the Personal Information Protection Law elevates the protection requirements for personal information processing, and many specific requirements of this law remain to be clarified by the CAC, other regulatory authorities, and courts in practice. We may be required to make further adjustments to our business practices to comply with the personal information protection laws and regulations. |

| • | In June 2021, the Standing Committee of the NPC promulgated the Data Security Law, which took effect in September 2021. The Data Security Law, among other things, provides for security review procedure for data-related activities that may affect national security. In July 2021, the state council promulgated the Regulations on Protection of Critical Information Infrastructure, which became effective on September 1, 2021. Pursuant to this regulation, critical information infrastructure means key network facilities or information systems of critical industries or sectors, such as public communication and information service, energy, transportation, water conservation, finance, public services, e-government affairs and national defense science, the damage, malfunction or data leakage of which may endanger national security, people’s livelihoods and the public interest. In December 2021, the CAC, together with other authorities, jointly promulgated the Cybersecurity Review Measures, which became effective on February 15, 2022 and replaces its predecessor regulation. Pursuant to the Cybersecurity Review Measures, critical information infrastructure operators that procure internet products and services must be subject to the cybersecurity review if their activities affect or may affect national security. The Cybersecurity Review Measures further stipulates that critical information infrastructure operators or network platform operators that hold personal information of over one million users shall apply with the Cybersecurity Review Office for a cybersecurity review before any public offering at a foreign stock exchange. As of the date of this annual report, no detailed rules or implementation rules have been issued by any authority and we have not been informed that we are a critical information infrastructure operator by any government authorities. Furthermore, the exact scope of “critical information infrastructure operators” under the current regulatory regime remains unclear, and the PRC government authorities may have wide discretion in the interpretation and enforcement of the applicable laws. Therefore, it is uncertain whether we would be deemed to be a critical information infrastructure operator under PRC law. If we are deemed to be a critical information infrastructure operator under the PRC cybersecurity laws and regulations, we may be subject to obligations in addition to what we have fulfilled under the PRC cybersecurity laws and regulations. |

| • | In November 2021, the CAC released the Regulations on the Network Data Security (Draft for Comments), or the Draft Regulations. The Draft Regulations provide that data processors refer to individuals or organizations that, during their data processing activities such as data collection, storage, utilization, transmission, publication and deletion, have autonomy over the purpose and the manner of data processing. In accordance with the Draft Regulations, data processors shall apply for a cybersecurity review for certain activities, including, among other things, (i) the listing abroad of data processors that process the personal information of more than one million users and (ii) any data processing activity that affects or may affect national security. However, there have been no clarifications from the relevant authorities as of the date of this annual report as to the standards for determining whether an activity is one that “affects or may affect national security.” In addition, the Draft Regulations requires that data processors that process “important data” or are listed overseas must conduct an annual data security assessment by itself or commission a data security service provider to do so, and submit the assessment report of the preceding year to the municipal cybersecurity department by the end of January each year. As of the date of this annual report, the Draft Regulations was released for public comment only, and their respective provisions and anticipated adoption or effective date may be subject to change with substantial uncertainty. |

| • | greater name recognition, longer operating histories and larger user bases; |

| • | broader, deeper or otherwise more established relationships with technology, channel and business partners, including ad publishers and customers; |

| • | greater resources to make acquisitions; |

| • | larger and more mature intellectual property portfolios; |

| • | larger sales and marketing budgets and resources and the capacity to leverage their sales efforts and marketing expenditures across a broader portfolio of products; and |

| • | substantially greater financial, technical and other resources to provide support, to make acquisitions and to develop and introduce new products. |

| • | difficulties in integrating the operations, technologies, services and personnel of acquired businesses, especially if those businesses operate outside of our core competency; |

| • | cultural challenges associated with integrating employees from the acquired company into our organization; |

| • | reputation and perception risks associated with the acquired product or technology by the general public; |

| • | ineffectiveness or incompatibility of acquired technologies or services; |

| • | potential loss of key employees of acquired businesses; |

| • | inability to maintain the key business relationships and the reputations of acquired businesses; |

| • | diversion of management’s attention from other business concerns; |

| • | litigation for activities of the acquired company, including claims from terminated employees, clients, former shareholders or other third parties; |

| • | failure to identify all of the problems, liabilities or other shortcomings or challenges of an acquired company, technology, or solution, including issues related to intellectual property, solution quality or architecture, regulatory compliance practices, revenue recognition or other accounting practices or employee or client issues; |

| • | in the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political and regulatory risks associated with specific countries; |

| • | costs necessary to establish and maintain effective internal controls for acquired businesses; |

| • | failure to successfully further develop the acquired technology in order to recoup our investment; and |

| • | increased fixed costs. |

| • | temporary closure of offices, travel restrictions or suspension of services of our customers and suppliers have negatively affected, and could continue to negatively affect, the demand for our services; |

| • | our customers in industries that are negatively impacted by the outbreak of COVID-19, including healthcare, travel, auto/transportation, and financial services sectors, may reduce their budgets on advertising and marketing, which may materially adversely impact our revenue from advertisement; and |

| • | our customers may require additional time to pay us or fail to pay us at all, which could significantly increase the amount of accounts receivable and require us to record additional allowances for doubtful accounts. |

| • | variations in our net revenues, earnings and cash flow; |

| • | announcements of new investments, acquisitions, strategic partnerships, or joint ventures by us or our competitors; |

| • | announcements of new products and services and expansions by us or our competitors; |

| • | changes in financial estimates by securities analysts; |

| • | fluctuations in operating metrics; |

| • | failure on our part to realize monetization opportunities as expected; |

| • | changes in revenues generated from our significant business partners; |

| • | additions or departures of key personnel; |

| • | release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; |

| • | detrimental negative publicity about us, our management, our competitors or our industry; |

| • | any share repurchase program; |

| • | fluctuations of exchange rates between RMB and the U.S. dollar; |

| • | regulatory developments affecting us or our industry; |

| • | potential litigation or regulatory investigations; and |

| • | general economic or political conditions in China or elsewhere in the world. |

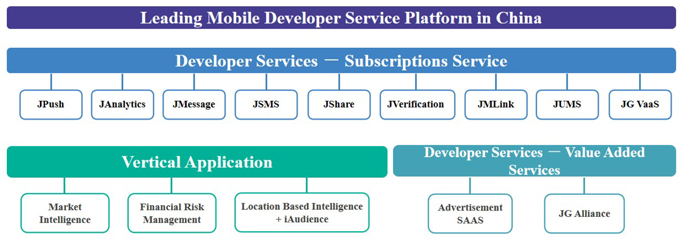

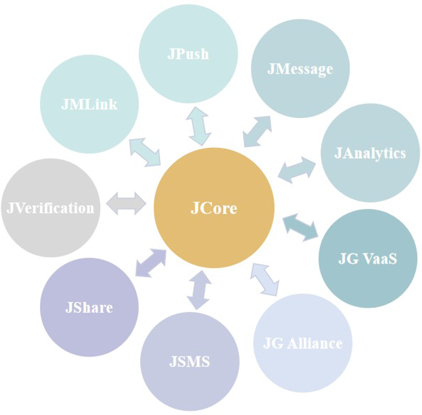

Item 4. |

INFORMATION ON THE COMPANY |

| • | Vertical Applications |

| • | Market intelligence |

| • | Financial risk management |

| • | Location-based intelligence iZone brick-and-mortar |

| • | Targeted marketing |

| • | Volume—massive and ever-growing data pool |

| • | Variety—multi-dimensional data |

| • | Velocity—data timeliness |

| • | Veracity—data accuracy |

| • | Storage |

| • | Cleansing non-usable, corrupted or redundant data. |

| • | Structuring |

| • | Encrypting |

| • | Modeling |

| • | We have optimized our data warehouse structure to make it more suitable for AI and machine learning processes. We have also designed and built our data warehouse based on the types and features of our data to allow for flexible yet secured access by our engineers and data scientists for developing and maintaining multiple solutions. |

| • | Based on the features of our data sets, we constantly refine rules engines and machine learning algorithms to improve the accuracy and comprehensiveness of tags generated. |

| • | We design and tailor machine learning algorithms based on the nature of our solutions. For example, to enhance our financial risk management solutions, we improve traditional deep learning algorithms by utilizing the machine learning technique of GBDT (gradient boosting decision tree), which not only preserves the correlations between variables but also maximizes the explanatory ability of patterns. |

| • | Enterprise-oriented solutions |

| • | Fund-oriented solutions |

| • | Project-based tailor-made solutions in-depth analytics services and generate customized statistics reports based on customers’ specific requirements. |

| • | Customer insights easy-to-use |

| • | Customer acquisition and re-targeting re-engagement plans through our targeted marketing platform. We charge a performance-based fee for our customer acquisition and re-targeting solutions based on a CPC or CPA pricing model. |

| • | Operation optimization project-by-project |

| • | Developer services |

| • | Market intelligence |

| • | Financial risk management |

| • | Location-based intelligence iZone brick-and-mortar |

| • | Collaboration with media partners |

| • | Offline events |

| • | Online channels follow-up marketing attempts. |

| • | Online customer acquisition |

| • | the primary location of the day-to-day |

| • | decisions relating to the enterprise’s financial and human resource matters are made or are subject to approval of organizations or personnel in the PRC; |

| • | the enterprise’s primary assets, accounting books and records, company seals and board and shareholder resolutions are located or maintained in the PRC; and |

| • | 50% or more of voting board members or senior executives habitually reside in the PRC. |

| • | PRC Labor Law, promulgated by the Standing Committee of the National People’s Congress on July 5, 1994, effective since January 1, 1995 and most recently amended on December 29, 2018; |

| • | PRC Labor Contract Law, promulgated by the Standing Committee of the National People’s Congress on June 29, 2007 and effective since January 1, 2008 and amended on December 28, 2012; |

| • | Implementation Rules of the PRC Labor Contract Law, promulgated by the State Council on September 18, 2008 and effective since September 18, 2008; |

| • | Work-related Injury Insurance Regulations, promulgated by the State Council on April 27, 2003 and effective since January 1, 2004 and amended on December 20, 2010; |

| • | Interim Regulations on the Collection and Payment of Social Insurance Fees, promulgated by the State Council on January 22, 1999 and effective since January 22, 1999 and amended on March 24, 2019; |

| • | PRC Social Insurance Law promulgated by the National People’s Congress on October 28, 2010, effective since July 1, 2011 and subsequently amended on December 29, 2018; and |

| • | Regulation on the Administration of Housing Fund promulgated by the State Council on April 3, 1999 and amended in 2002 and 2019 respectively. |

C. |

Organizational Structure |

| (1) | Mr. Weidong Luo, our founder, chairman of our board of directors, chief executive officer and a principal beneficial owner of the shares of our company, holds 80% equity interests in our VIE. Messrs. Xiaodao Wang and Jiawen Fang are both beneficial owners of the shares of our company and they each hold 10% equity interests in our VIE. |

| • | the ownership structures of our VIE in China and our WFOE are not in violation of applicable PRC laws and regulations currently in effect; and |

| • | the contractual arrangements between our company, our WFOE, our VIE and its shareholders governed by PRC laws and regulations are valid, binding and enforceable, and will not result in any violation of applicable PRC laws and regulations. |

D. |

Property, Plant and Equipment |

Item 4A. |

UNRESOLVED STAFF COMMENTS |

Item 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

A. |

Operating Results |

| • | our ability to increase the number of customers and average spending per customer; |

| • | our ability to develop new SAAS Businesses and targeted marketing that meet market demands; |

| • | our ability to broaden and deepen our data pool and enhance our AI and machine learning technology; and |

| • | our ability to further improve our margins. |

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentage data) |

||||||||||||||||||||||||||||

| Targeted Marketing |

696,190 | 76.5 | 213,662 | 45.3 | — | — | — | |||||||||||||||||||||

| SaaS Products |

210,268 | 23.5 | 257,952 | 54.7 | 357,322 | 56,072 | 100.0 | |||||||||||||||||||||

| Total |

906,458 | 100.0 | 471,614 | 100.0 | 357,322 | 56,072 | 100.0 | |||||||||||||||||||||

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

(in thousands, except for percentage data) |

||||||||||||||||

| Gross profit |

RMB256,862 | RMB206,178 | RMB264,929 | US$ | 41,574 | |||||||||||

| Gross margin |

28.3 | % | 43.7 | % | 74.1 | % | 74.1 | % | ||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentage data) |

||||||||||||||||||||||||||||

| Research and development expenses |

176,248 | 43.6 | 174,597 | 44.1 | 206,722 | 32,439 | 51.3 | |||||||||||||||||||||

| Sales and marketing expenses |

118,548 | 29.3 | 102,319 | 25.8 | 116,415 | 18,268 | 28.9 | |||||||||||||||||||||

| General and administrative expenses |

109,291 | 27.1 | 119,087 | 30.1 | 79,922 | 12,542 | 19.8 | |||||||||||||||||||||

| Total |

404,087 | 100.0 | 396,003 | 100.0 | 403,059 | 63,249 | 100.0 | |||||||||||||||||||||

For the Year Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Revenues |

906,458 | 100.0 | 471,614 | 100.0 | 357,322 | 56,072 | 100.0 | |||||||||||||||||||||

| Cost of revenues (1) |

(649,596 | ) | (71.7 | ) | (265,436 | ) | (56.3 | ) | (92,393 | ) | (14,498 | ) | (25.9 | ) | ||||||||||||||

| Gross profit |

256,862 | 28.3 | 206,178 | 43.7 | 264,929 | 41,574 | 74.1 | |||||||||||||||||||||

| Operating expenses: (1) |

||||||||||||||||||||||||||||

| Research and development expenses |

(176,248 | ) | (19.4 | ) | (174,597 | ) | (37.0 | ) | (206,722 | ) | (32,439 | ) | (57.9 | ) | ||||||||||||||

| Sales and marketing expenses |

(118,548 | ) | (13.1 | ) | (102,319 | ) | (21.7 | ) | (116,415 | ) | (18,268 | ) | (32.6 | ) | ||||||||||||||

| General and administrative expenses |

(109,291 | ) | (12.1 | ) | (119,087 | ) | (25.3 | ) | (79,922 | ) | (12,542 | ) | (22.4 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

(404,087 |

) |

(44.6 |

) |

(396,003 |

) |

(84.0 |

) |

(403,059 |

) |

(63,249 |

) |

(112.8 |

) | ||||||||||||||

| Loss from operations |

(147,225 |

) |

(16.2 |

) |

(189,825 |

) |

(40.3 |

) |

(138,130 |

) |

(21,675 |

) |

(38.7 |

) | ||||||||||||||

| Foreign exchange (loss)/gain, net |

435 | 0.0 | 10 | 0.0 | (3,376 | ) | (530 | ) | (0.9 | ) | ||||||||||||||||||

| Interest income |

6,300 | 0.7 | 6,131 | 1.3 | 6,597 | 1,035 | 1.8 | |||||||||||||||||||||

| Interest expense |

(11,118 | ) | (1.2 | ) | (11,724 | ) | (2.5 | ) | (8,815 | ) | (1,383 | ) | (2.5 | ) | ||||||||||||||

| Other income |

38,812 | 4.3 | (30,814 | ) | (6.5 | ) | (2,908 | ) | (456 | ) | (0.8 | ) | ||||||||||||||||

| Change in fair value of structured notes |

3,117 | 0.3 | 1,233 | 0.3 | 20 | 3 | 0.0 | |||||||||||||||||||||

| Change in fair value of foreign currency swap contract |

— | — | — | — | 6,060 | 951 | 1.7 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Loss before income taxes |

(109,679 |

) |

(12.1 |

) |

(224,989 |

) |

(47.7 |

) |

(140,552 |

) |

(22,055 |

) |

(39.3 |

) | ||||||||||||||

| Income tax benefit/(expense) |

(162 | ) | (0.0 | ) | (86 | ) | 0.0 | (32 | ) | (5 | ) | (0.0 | ) | |||||||||||||||

| Net loss |

(109,841 |

) |

(12.1 |

) |

(225,075 |

) |

(47.7 |

) |

(140,584 |

) |

(22,060 |

) |

(39.3 |

) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Share-based compensation expenses are allocated in cost of revenues and operating expenses items as follows: |

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

| Cost of revenue |

73 | 4 | 41 | 6 | ||||||||||||

| Research and development expenses |

12,819 | 7,176 | 13,801 | 2,166 | ||||||||||||

| Sales and marketing expenses |

6,040 | 3,965 | 2,609 | 409 | ||||||||||||

| General and administrative expenses |

28,352 | 17,713 | 13,761 | 2,160 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

47,284 |

28,858 |

30,212 |

4,741 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Grant Date |

Number of Restricted Share Units Granted |

Weighted-Average Grant-date Fair Value per Restricted Share Unit |

||||||

| |

US$ |

|||||||

| Various dates in 2019 |

33,643 | 6.48 | ||||||

| Various dates in 2020 |

95,095 | 3.13 | ||||||

| Various dates in 2021 |

119,568 | 2.18 | ||||||

| Grant Date |

Number of Options Granted |

Weighted- Average Per Option Exercise Price |

Weighted- Average Grant- date Fair Value per Option |

|||||||||

| |

US$ |

US$ |

||||||||||

| Various dates in 2019 |

333,077 | 1.29 | 7.21 | |||||||||

| Various dates in 2020 |

1,578,809 | 0.04 | 2.91 | |||||||||

| Various dates in 2021 |

1,367,791 | 1.14 | 3.86 | |||||||||

2019 |

2020 |

2021 |

||||||||||

| Risk-free interest rate (1) |

1.65% ~ 2.54% | 0.63% ~ 1.88% | 0.94% - 1.70% | |||||||||

| Expected dividend yield (2) |

— | — | — | |||||||||

| Expected volatility range (3) |

44.23% ~ 44.71% | 44.37% ~ 47.83% | 47.45% - 56.62% |

|||||||||

| Weighted average expected volatility |

44.53% | 46.37% | 50.26% | |||||||||

| Expected exercise multiple (4) |

2.5 | 2.5 ~ 2.8 | 2.2 ~ 2.8 | |||||||||

| (1) | The risk-free interest rate of periods within the contractual life of the share options was estimated based on the U.S. Treasury yield in effect as of the valuation dates. |

| (2) | The expected dividend yield is zero as we have never declared or paid any cash dividends on our shares, and we do not anticipate any dividend payments in the foreseeable future. |

| (3) | The expected volatility was estimated based on the average of historical volatilities of the common shares of comparable publicly-traded companies in the same industry as of the valuation dates. |

| (4) | Expected exercise multiple is estimated based on changes in intrinsic value of the option and likelihood of early exercises by employees. |

B. |

Liquidity and Capital Resources |

For the Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

Selected Consolidated Cash Flow Data: |

(in thousands) |

|||||||||||||||

| Net cash (used in)/provided by operating activities |

(25,758 | ) | 75,810 | (76,650 | ) | (12,027 | ) | |||||||||

| Net cash (used in)/provided by investing activities |

(88,966 | ) | (144,415 | ) | 26,442 | 4,150 | ||||||||||

| Net cash (used in)/provided by financing activities |

(33,883 | ) | 315 | (54,520 | ) | (8,556 | ) | |||||||||

| Effect of exchange rate on cash and cash equivalents and restricted cash |

3,504 | (7,054 | ) | 3,080 | 483 | |||||||||||

| Net decrease in cash and cash equivalents and restricted cash |

(145,103 | ) | (75,344 | ) | (101,648 | ) | (15,950 | ) | ||||||||

| Cash and cash equivalents and restricted cash at the beginning of year or period |

576,677 | 431,574 | 356,230 | 55,900 | ||||||||||||

| Cash and cash equivalents and restricted cash at the end of the year or period |

431,574 | 356,230 | 254,582 | 39,950 | ||||||||||||

| • | On April 17, 2018, we issued zero coupon convertible notes due 2021 in an aggregate principal amount of US$35.0 million to two investors. The convertible notes are non-interest bearing, subject to certain exceptions, including when an event of default occurs, such as failure to make any payment due on the due date, and the majority noteholders have, in their sole discretion, accelerated their convertible notes by giving notice to us that their outstanding notes are due and repayable. In such event, we will be required to pay interest at a simple interest rate of 15% per annum on the aggregate outstanding principal amount of the convertible notes. Holders of the convertible notes may, at their option during a period starting from the issue date until seven days prior to the maturity of the notes, subject to certain exceptions, convert the notes into Class A common shares of our company at the then applicable conversion price. In April 2021, we fully redeemed such US$35.0 million of convertible notes. |

| • | In July and August 2018, we raised from our initial public offering approximately US$68.0 million in net proceeds after deducting underwriting commissions and discounts and the offering expenses payable by us. |

| • | On April 16, 2021, we entered into a term loan agreement with Shanghai Pudong Development Bank, or SPD Bank. Under the loan agreement, SPD Bank agreed to provide us with a one-year RMB150 million term loan facility. The facility is priced at 50 basis points over one-year RMB Loan Prime Rate. The use of proceeds of the facility is for general corporate purpose. As of December 31, 2021, the outstanding balance of this loan was RMB150.0 million (US$23.5 million) and the total deposits in restricted cash pledged for the loan was RMB157.9 million (US$24.8 million). |

C. |

Research and Development, Patents and Licenses, Etc. |

D. |

Trend Information |

E. |

Critical Accounting Estimates |

Item 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| Directors and Executive Officers |

Age |

Position/Title | ||

| Weidong Luo | 41 | Chairman of the Board of Directors and Chief Executive Officer | ||

| Qing Zhang | 44 | Deputy Chief Technology Officer | ||

Shan-Nen Bong |

49 | Chief Financial Officer | ||

| Guoxiao Ben | 46 | Chief Human Resource Officer | ||

| Kwok Hin Tang | 42 | Director | ||

| Hon Sang Lee | 63 | Independent Director | ||

| John Tiong Lu Koh | 66 | Independent Director | ||

| Peter Si Ngai Yeung | 66 | Independent Director |

| Name |

Common Shares Underlying Options and Restricted Share Units |

Exercise Price (US$/Share) |

Date of Grant |

Date of Expiration |

||||||||||||

| Qing Zhang |

* | — | June 2, 2020 | June 2, 2030 | ||||||||||||

| Shan-Nen Bong |

* | 0.00 to 2.876 | |

November 13, 2017 and April 1, 2019 |

|

|

November 13, 2027 and April 1, 2029 |

| ||||||||

| Guoxiao Ben |

* | — | January 8, 2020 | January 8, 2030 | ||||||||||||

| Kwok Hin Tang |

* | (1) |

— | |

Between April 1, 2019 and April 1, 2021 |

|

|

Between April 1, 2029 and April 1, 2031 |

| |||||||

| John Tiong Lu Koh |

* | (1) |

— | |

Between September 4, 2018 and December 28, 2021 |

|

|

Between September 4, 2028 and December 28, 2031 |

| |||||||

| Peter Si Ngai Yeung |

* | (1) |

— | |

Between September 4, 2018 and December 28, 2021 |

|

|

Between September 4, 2028 and December 28, 2031 |

| |||||||

| Hon Sang Lee |

* | (1) |

— | |

Between May 7, 2020 and May 7, 2021 |

|

|

Between May 7, 2030 and May 7, 2031 |

| |||||||

| All directors and executive officers as a group |

790,633 | |||||||||||||||

| * | Aggregate number of shares represented by all grants of options and restricted share units to the person accounts for less than 1% of our total outstanding common shares as of the date of February 28, 2022. |

| (1) | Represents restricted share units. |

| • | appointing the independent auditors and pre-approving all auditing and non-auditing services permitted to be performed by the independent auditors; |

| • | reviewing with the independent auditors any audit problems or difficulties and management’s response; |

| • | discussing the annual audited financial statements with management and the independent auditors; |

| • | reviewing the adequacy and effectiveness of our accounting and internal control policies and procedures and any steps taken to monitor and control major financial risk exposures; |

| • | reviewing and approving all proposed related party transactions; |

| • | meeting separately and periodically with management and the independent auditors; and |

| • | monitoring compliance with our code of business conduct and ethics, including reviewing the adequacy and effectiveness of our procedures to ensure proper compliance. |

| • | reviewing and approving, or recommending to the board for its approval, the compensation for our chief executive officer and other executive officers; |

| • | reviewing and recommending to the board for determination with respect to the compensation of our non-employee directors; |

| • | reviewing periodically and approving any incentive compensation or equity plans, programs or similar arrangements; and |

| • | selecting compensation consultant, legal counsel or other adviser only after taking into consideration all factors relevant to that person’s independence from management. |

| • | selecting and recommending to the board nominees for election by the shareholders or appointment by the board; |

| • | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; |

| • | making recommendations on the frequency and structure of board meetings and monitoring the functioning of the committees of the board; and |

| • | advising the board periodically with regards to significant developments in the law and practice of corporate governance as well as our compliance with applicable laws and regulations, and making recommendations to the board on all matters of corporate governance and on any remedial action to be taken. |

| • | convening shareholders’ annual and extraordinary general meetings and reporting its work to shareholders at such meetings; |

| • | declaring dividends and distributions; |

| • | appointing officers and determining the term of office of the officers; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | approving the transfer of shares in our company, including the registration of such shares in our share register. |

| Board Diversity Matrix (As of February 28, 2022) |

||||

| Country of Principal Executive Offices |

PRC | |||

| Foreign Private Issuer |

Yes | |||

| Disclosure Prohibited Under Home Country Law |

No |

|||

| Total Number of Directors |

5 | |||

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

|||||||||||||

| Part I: Gender Identity |

||||||||||||||||

| Directors |

0 | 5 | 0 | 0 | ||||||||||||

| Part II: Demographic Background |

||||||||||||||||

| Underrepresented Individual in Home Country Jurisdiction |

0 | |||||||||||||||

| LGBTQ+ |

0 | |||||||||||||||

| Did Not Disclose Demographic Background |

0 | |||||||||||||||

Function: |

Number |

|||

| Research and Development |

242 | |||

| Sales and Marketing |

206 | |||

| General and Administrative |

78 | |||

| Cost of Revenue |

15 | |||

| |

|

|||

| Total |

541 | |||

| |

|

|||

| • | each of our directors and executive officers; and |

| • | each person known to us to own beneficially more than 5% of our total outstanding shares. |

Common Shares Beneficially Owned |

||||||||||||||||||||

Class A common shares |

Class B common shares |

Total common shares |

Percentage of total common shares |

Percentage of aggregate voting power † |

||||||||||||||||

| Directors and Executive Officers:** |

||||||||||||||||||||

| Weidong Luo (1) |

7,171,333 | 17,000,189 | 24,171,522 | 30.6 | % | 76.4 | % | |||||||||||||

| Qing Zhang (2) |

* | — | * | * | * | |||||||||||||||

| Shan-Nen Bong(3) |

* | — | * | * | * | |||||||||||||||

| Guoxiao Ben (4) |

* | — | * | * | * | |||||||||||||||

| Kwok Hin Tang (5) |

* | — | * | * | * | |||||||||||||||

| Hon Sang Lee |

— | — | — | — | — | |||||||||||||||

| John Tiong Lu Koh (6) |

* | — | * | * | * | |||||||||||||||

| Peter Si Ngai Yeung (7) |

* | — | * | * | * | |||||||||||||||

| All Directors and Executive Officers as a Group |

7,696,780 | 17,000,189 | 24,696,969 | 31.2 | % | 76.6 | % | |||||||||||||

| Principal Shareholders: |

||||||||||||||||||||

| KK Mobile Limited (8) |

7,100,000 | 17,000,189 | 24,100,189 | 30.5 | % | 76.3 | % | |||||||||||||

| Mandra iBase Limited (9) |

14,109,001 | — | 14,109,001 | 17.9 | % | 6.1 | % | |||||||||||||

| Fei Chen (10) |

5,002,056 | — | 5,002,056 | 6.3 | % | 2.2 | % | |||||||||||||

| Entities affiliated with IDG-Accel (11) |

4,672,006 | — | 4,672,006 | 5.9 | % | 2.0 | % | |||||||||||||

| Fosun International Limited (12) |

6,020,218 | — | 6,020,218 | 7.6 | % | 2.6 | % | |||||||||||||

| FIL Limited and its affiliated entities (13) |

4,394,283 | — | 4,394,283 | 5.6 | % | 1.9 | % | |||||||||||||

| † | For each person or group included in this column, percentage of total voting power represents voting power based on both Class A and Class B common shares held by such person or group with respect to all outstanding shares of our Class A and Class B common shares as a single class. Each holder of our Class A common shares is entitled to one vote per share. Each holder of our Class B common shares is entitled to ten votes per share. Our Class B common shares are convertible at any time by the holder into Class A common shares on a one-for-one |

| * | Aggregate number of shares accounts for less than 1% of our total outstanding common shares and aggregate voting power. |

| ** | The business address of Messrs. Weidong Luo, Qing Zhang, Shan-Nen Bong, Guoxiao Ben and Hon Sang Lee is 14/F, China Certification and Inspection Building, No. 8 Keji South 12th Road, Nanshan District, Shenzhen, Guangdong 518057, People’s Republic of China. Mr. Kwok Hin Tang’s business address is 10/F, Fung House, 19-20 Connaught Road Central, Hong Kong. Mr. John Tiong Lu Koh’s business address is 279 River Valley Road, #05-01, Singapore 238320. Mr. Peter Si Ngai Yeung’s business address is 5A Block 3, The Morning Glory, 1 Lok Ha Square, Shatin, Hong Kong. |

| (1) | Represents (i) 7,100,000 Class A common shares and 17,000,189 Class B common shares held by KK Mobile Limited, a British Virgin Islands company, and (ii) 107,000 ADSs, representing 71,333 Class A common shares, owned by Mr. Weidong Luo. KK Mobile Limited is wholly owned by Mr. Weidong Luo. The registered address of KK Mobile Limited is Unit 8, 3/F., Qwomar Trading Complex, Blacburne Road, Port Purcell, Road Town, Tortola, British Virgin Islands. |

| (2) | Represents the Class A common shares Mr. Qing Zhang has the right to acquire upon exercise of share options within 60 days after February 28, 2022. |

| (3) | Represents the Class A common shares Mr. Shan-Nen Bong has the right to acquire upon exercise of share options within 60 days after February 28, 2022. |

| (4) | Represents the Class A common shares Mr. Guoxiao Ben has the right to acquire upon exercise of share options within 60 days after February 28, 2022. |

| (5) | Represents the Class A common shares held by and the Class A common shares Mr. Kwok Hin Tang has the right to acquire upon exercise of share options within 60 days after February 28, 2022. |

| (6) | Represents the Class A common shares held by Mr. John Tiong Lu Koh. |

| (7) | Represents the Class A common shares held by Mr. Peter Si Ngai Yeung. |

| (8) | Represents 7,100,000 Class A common shares and 17,000,189 Class B common shares held by KK Mobile Limited. |

| (9) | Represents 13,825,461 Class A common shares and 425,310 ADSs, representing 283,540 Class A common shares, directly held by Mandra iBase Limited, a British Virgin Islands company, as reported on the Schedule 13G filed by Mandra iBase Limited and affiliated parties on February 11, 2022. The registered address of Mandra iBase Limited is 3rd Floor J&C Building, PO Box 933, Road Town, Tortola, British Virgin Islands, VG1110. Mandra iBase Limited is wholly owned by Beansprouts Ltd., a British Virgin Islands company. The shareholders of Beansprouts Ltd. are Bing How Mui and Song Yi Zhang, each holding 50% of the issued and outstanding share capital of Beansprouts Ltd. |

| (10) | Represents 3,816,026 Class A common shares held by Elite Bright International Limited, a British Virgin Islands company, and 1,186,030 Class A common shares that Mr. Fei Chen has the right to acquire upon exercise of share options within 60 days after February 28, 2022, as reported on the Schedule 13G filed by Fei Chen on January 25, 2019. Elite Bright International Limited is wholly owned by Mr. Fei Chen. The registered address of Elite Bright International Limited is Akara Bldg, 24 De Castro Street, Wickhams Cay 1, Road Town, Tortola, British Virgin Islands. |

| (11) | Represents (i) 4,362,710 Class A common shares held by IDG-Accel China Growth Fund III L.P., a Cayman Islands limited partnership, and (ii) 309,296 Class A common shares held by IDG-Accel China III Investors L.P., a Cayman Islands limited partnership, as reported on the Schedule 13G filed by IDG-Accel China Growth Fund III L.P. and affiliated parties on February 25, 2022. The general partner of IDG-Accel China Growth Fund III L.P. is IDG-Accel China Growth Fund III Associates L.P., and the general partner of IDG-Accel China Growth Fund III Associates L.P. is IDG-Accel China Growth Fund GP III Associates Ltd. The general partner of IDG-Accel China III Investors L.P. is IDG-Accel China Growth Fund GP III Associates Ltd. IDG-Accel China Growth Fund GP III Associates Ltd. is 50% owned by Mr. Chi Sing Ho, its largest shareholder, and the current members of its board of directors are Mr. Quan Zhou and Mr. Chi Sing Ho. The address of the principal business office for IDG-Accel China Growth Fund III L.P. and IDG-Accel China III Investors L.P. is Unit 5505, The Center, 99 Queen’s Road Central, Hong Kong . |

| (12) | Represents 6,019,288 Class A common shares held by Greatest Investments Limited, a British Virgin Islands company, and 1,395 ADSs, representing 930 Class A common shares, held by Fidelidade—Companhia de Seguros, S.A., as reported on the Schedule 13G filed by Greatest Investments Limited, Fidelidade—Companhia de Seguros, S.A. and Fosun International Limited on January 21, 2022. The address of the principal business office for Greatest Investments is Maples Corporate Services (BVI) Limited of Kingston Chambers, PO Box 173, Road Town, Tortola, British Virgin Islands. The address of the principal business office for Fidelidade is Largo do Calhariz, 30, Lisbon, Portugal. The address of the principal business office for Fosun International is Room 808, ICBC Tower, 3 Garden Road, Central, Hong Kong. |

| (13) | Represents 4,394,283 Class A common shares beneficially owned by FIL Limited, as reported on the Schedule 13G filed by FIL Limited and affiliated parties on February 9, 2022. The address of FIL Limited is Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda, HM19. |

Item 7. |

MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

Item 8. |

FINANCIAL INFORMATION |

Item 9. |

THE OFFER AND LISTING |

Item 10. |

ADDITIONAL INFORMATION |

| • | the instrument of transfer is lodged with us, accompanied by the certificate for the common shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor to make the transfer; |

| • | the instrument of transfer is in respect of only one class of common shares; |

| • | the instrument of transfer is properly stamped, if required; |

| • | in the case of a transfer to joint holders, the number of joint holders to whom the common share is to be transferred does not exceed four; and |

| • | a fee of such maximum sum as the Nasdaq Global Market may determine to be payable or such lesser sum as our directors may from time to time require is paid to us in respect thereof. |

| • | the designation of the series; |