Prospectus

$1,122,300,000

Verizon Owner Trust 2019-B

Issuing Entity or Trust

Issuing Entity or Trust

(CIK Number: 0001777370)

|

Verizon ABS LLC

Depositor

(CIK Number: 0001737286)

|

Cellco Partnership d/b/a

Verizon Wireless

Sponsor and Servicer

(CIK Number: 0001175215)

|

Before you purchase any notes, be sure you understand the structure and the risks. You should review carefully the risk factors

beginning on page 32 of this prospectus.

The notes will be obligations of the issuing entity only and will not be obligations of or interests in the sponsor, the originators, the master

trust, the servicer, the depositor, the parent support provider, the marketing agent or any of their respective affiliates. The issuing entity will also issue certificates, which represent the equity interest in the issuing entity. The

certificates are not offered by this prospectus and will be retained by the depositor and by Verizon DPPA True-up Trust.

|

The trust will issue

|

Initial Note Balance

|

Interest Rate

|

Accrual Method

|

Final

Maturity Date |

|||

|

Class A-1a notes

|

$855,000,000

|

2.33%

|

30/360

|

December 20, 2023

|

|||

|

Class A-1b notes

|

$145,000,000

|

One-month LIBOR + 0.45%(1)

|

Actual/360

|

December 20, 2023

|

|||

|

Class B notes

|

$69,000,000

|

2.40%

|

30/360

|

December 20, 2023

|

|||

|

Class C notes

|

$53,300,000

|

2.60%

|

30/360

|

December 20, 2023

|

|||

|

Total

|

$1,122,300,000

|

||||||

|

Initial Public Offering Price

|

Underwriting Discounts and Commissions

|

Proceeds to Depositor(2)

|

|||||

|

Class A-1a notes

|

$854,940,235.50

|

0.250%

|

$852,802,735.50

|

||||

|

Class A-1b notes

|

$145,000,000.00

|

0.250%

|

$144,637,500.00

|

||||

|

Class B notes

|

$68,995,480.50

|

0.350%

|

$68,753,980.50

|

||||

|

Class C notes

|

$53,299,840.10

|

0.450%

|

$53,059,990.10

|

||||

|

Total

|

$1,122,235,556.10

|

$1,119,254,206.10

|

|||||

__________________

(1) If the sum of one-month LIBOR and the applicable spread set forth above is

less than 0.00% for any interest accrual period, then the interest rate for the Class A-1b notes for that interest accrual period will be deemed to be 0.00%. See “Description of the Notes—Payments of Interest.”

(2) Before deducting expenses estimated to be $1,550,000.

| • |

The notes will be backed by a revolving pool of device payment plan agreements originated by Cellco Partnership d/b/a Verizon Wireless and certain other

affiliates of Verizon Communications Inc.

|

| • |

The trust will pay interest on the notes on the 20th day of each month (or if not a business day, the next business day). The first payment date will be August

20, 2019.

|

| • |

No principal will be paid on the notes before the amortization period begins. The notes will be subject to optional redemption with a make-whole payment on any

payment date on and after the payment date in July 2020. See “Description of the Notes—Optional Redemption.” Make-whole payments may

also be paid on the notes after the notes have been paid in full following the occurrence of certain amortization events. See “Description

of the Notes—Make-Whole Payments.”

|

| • |

The credit and payment enhancement for the notes will consist of a negative carry account, a reserve account, an interest rate cap agreement, subordination of

the Class B and Class C notes, overcollateralization and the yield supplement overcollateralization amount.

|

Neither the U.S. Securities and

Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus is accurate or complete. Any representation to the contrary

is a criminal offense.

The trust is not registered or required to be registered as an “investment company” under the Investment Company Act of 1940,

as amended, and in making this determination, the trust will be relying on the definition of “investment company” in Section 3(c)(5) of the Investment Company Act of 1940, as amended, although there may be additional exemptions or exclusions

available to the trust. The trust is being structured so as not to constitute a “covered fund” for purposes of the regulations adopted to implement Section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

The notes will be delivered in book-entry form through the facilities of The Depository Trust Company to purchasers on or

about June 12, 2019, which is the “closing date.”

JOINT BOOKRUNNERS

|

MUFG

(sole structurer)

|

BNP PARIBAS

|

BofA Merrill Lynch

|

TD Securities

|

|

CO-MANAGERS

|

|||

|

Scotiabank

|

SMBC Nikko

|

SOCIETE GENERALE

|

|

________________

The date of this prospectus is June 4, 2019

TABLE OF CONTENTS

|

Important Notice About Information in this Prospectus

|

5

|

|

Reading this Prospectus

|

5

|

|

Forward-Looking Statements

|

6

|

|

Copies of the Documents

|

6

|

|

Note Legend

|

6

|

|

Notice to Residents of the United Kingdom

|

7

|

|

Notice to Residents of the European Economic Area

|

7

|

|

Transaction Structure Diagram

|

8

|

|

Transaction Credit and Payment Enhancement Diagram

|

9

|

|

Transaction Parties and Documents Diagram

|

10

|

|

Transaction Payments Diagram

|

11

|

|

Summary

|

12

|

|

Risk Factors

|

32

|

|

Transaction Parties

|

59

|

|

Trust

|

59

|

|

Capitalization of the Trust

|

60

|

|

Depositor

|

61

|

|

Owner Trustee

|

61

|

|

Indenture Trustee

|

63

|

|

Asset Representations Reviewer

|

66

|

|

General

|

66

|

|

Fees and Expenses

|

67

|

|

Resignation and Removal

|

67

|

|

Indemnity and Liability

|

68

|

|

The Cap Counterparty

|

68

|

|

Sponsor, Servicer, Custodian, Marketing Agent and Administrator

|

69

|

|

General

|

69

|

|

Sponsor

|

69

|

|

Servicer, Custodian, Marketing Agent and Administrator

|

69

|

|

U.S. Credit Risk Retention

|

71

|

|

The Parent Support Provider

|

71

|

|

The Originators

|

73

|

|

The Master Trust

|

74

|

|

Origination and Description of Device Payment Plan Agreement Receivables

|

74

|

|

Wireless Devices and Wireless Device Marketing and Sales

|

74

|

|

Wireless Device Payment Plan Agreements

|

75

|

|

Insurance on Wireless Devices

|

76

|

|

Underwriting Criteria

|

76

|

|

Upgrade Offers

|

78

|

|

Account Credits

|

78

|

|

Transfer of Service

|

79

|

|

Bankruptcy Surrendered Devices

|

79

|

|

Origination Characteristics

|

79

|

|

Servicing the Receivables and the Securitization Transaction

|

81

|

|

General

|

81

|

|

Servicing Duties

|

81

|

|

Collections and Other Servicing Procedures

|

82

|

|

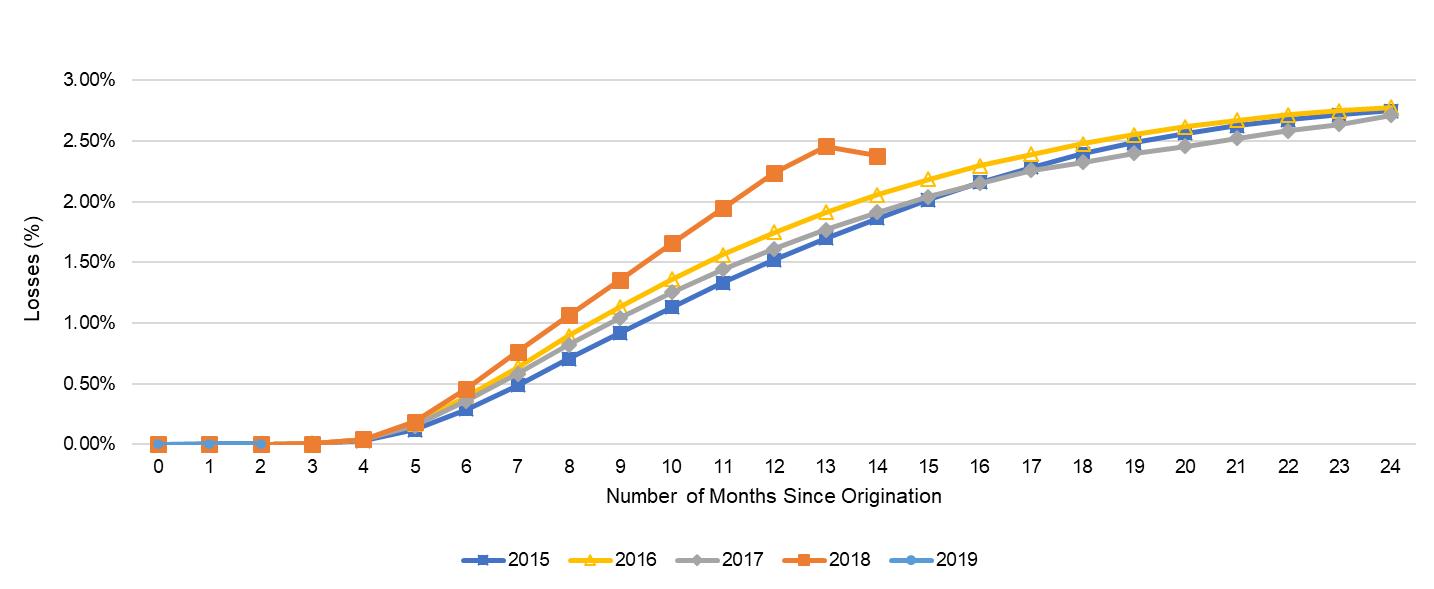

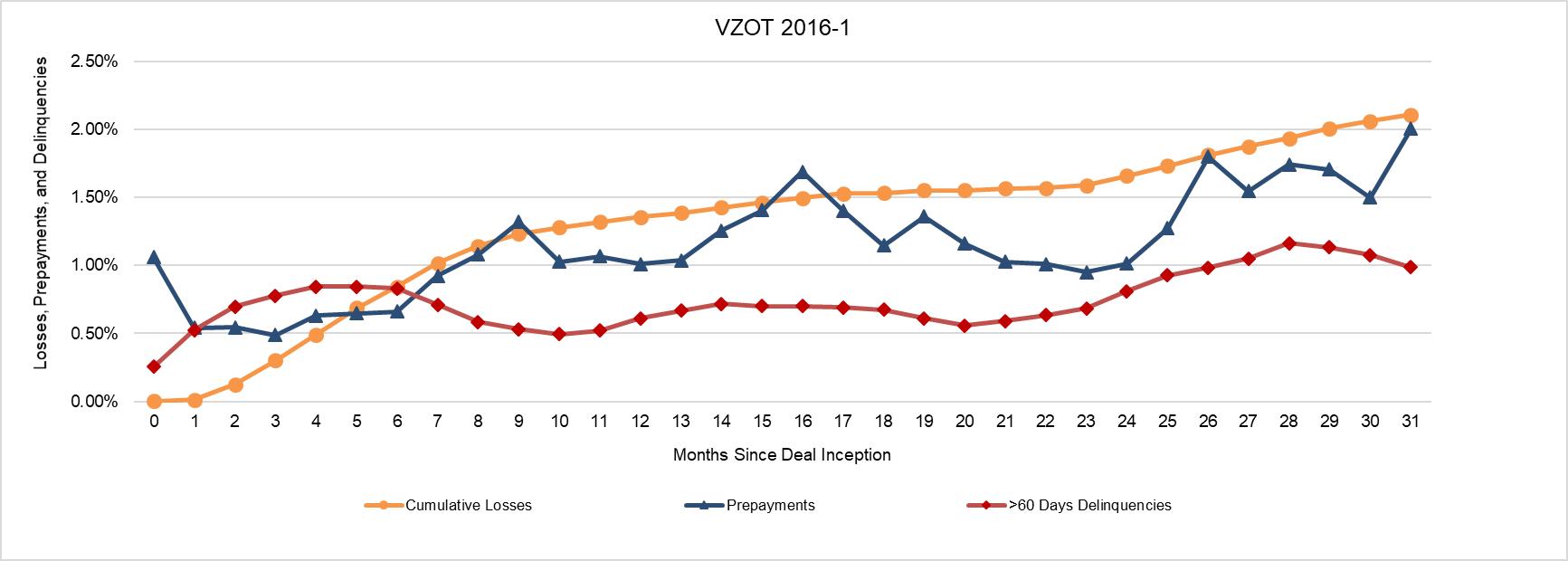

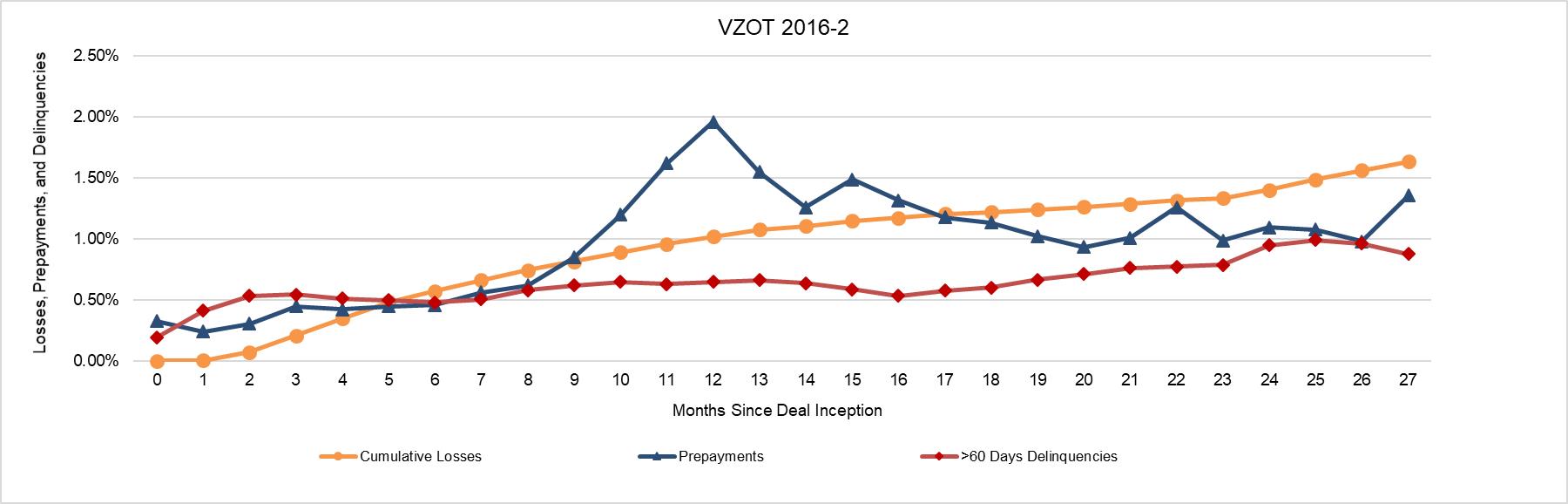

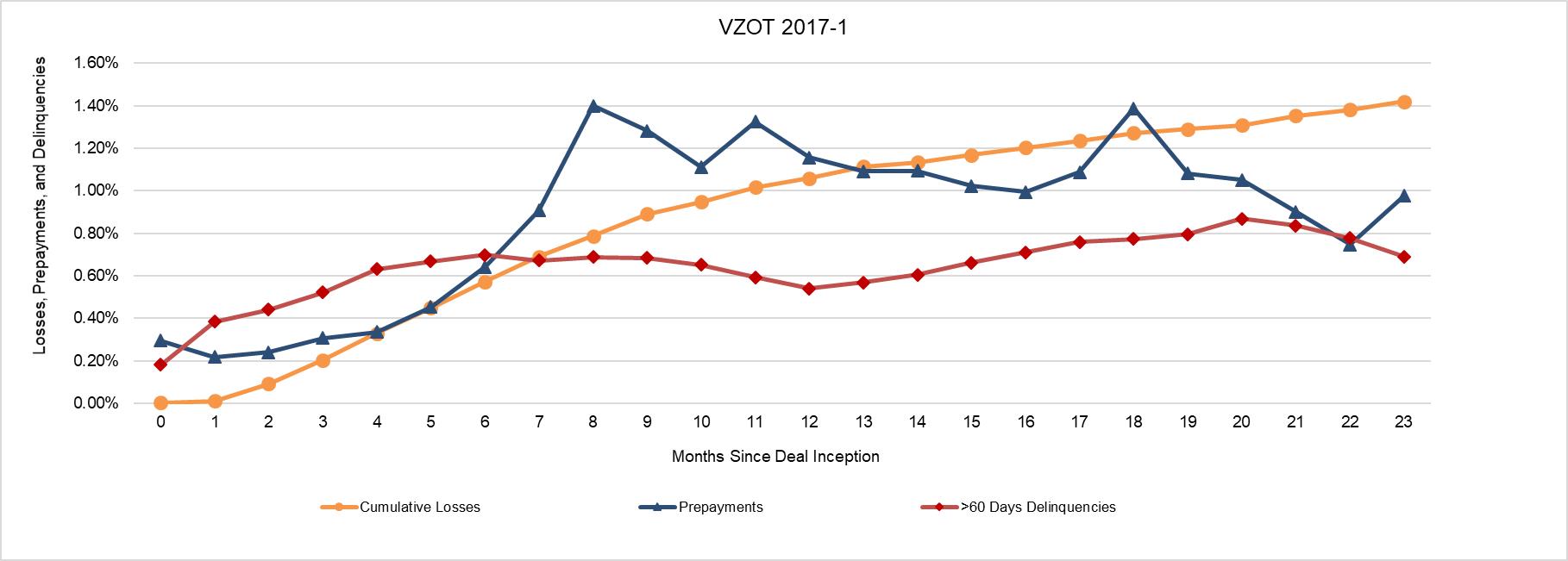

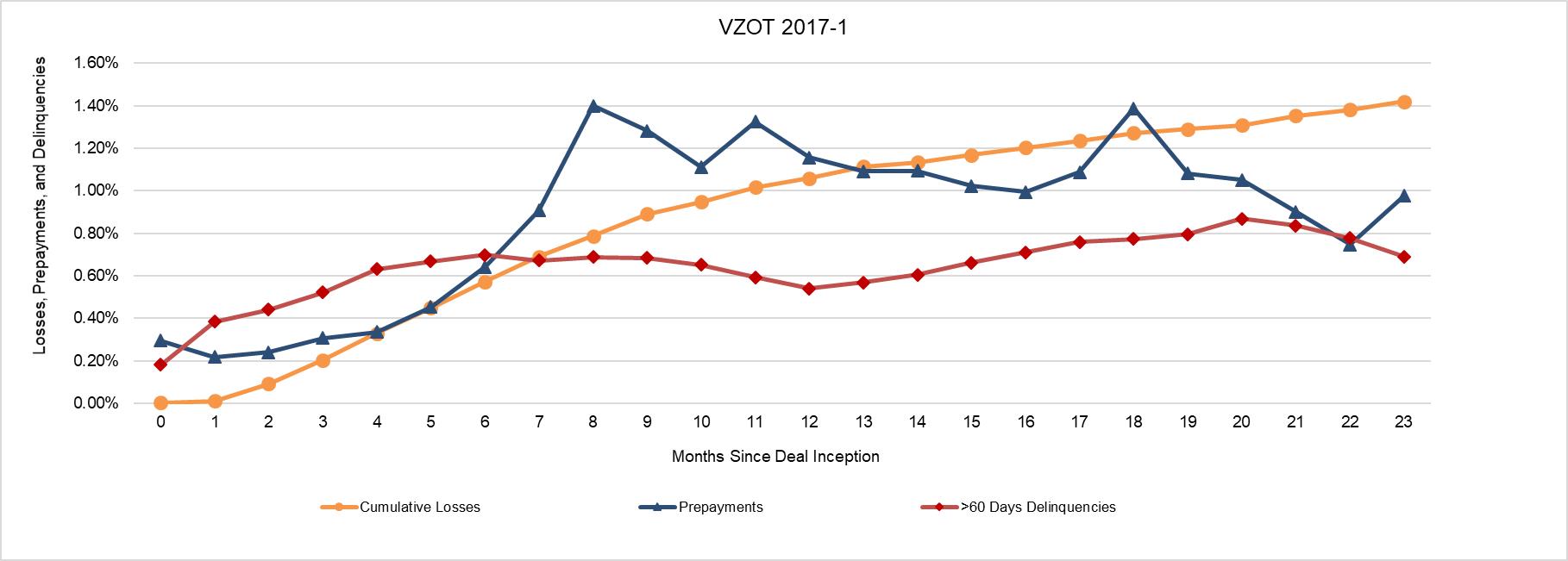

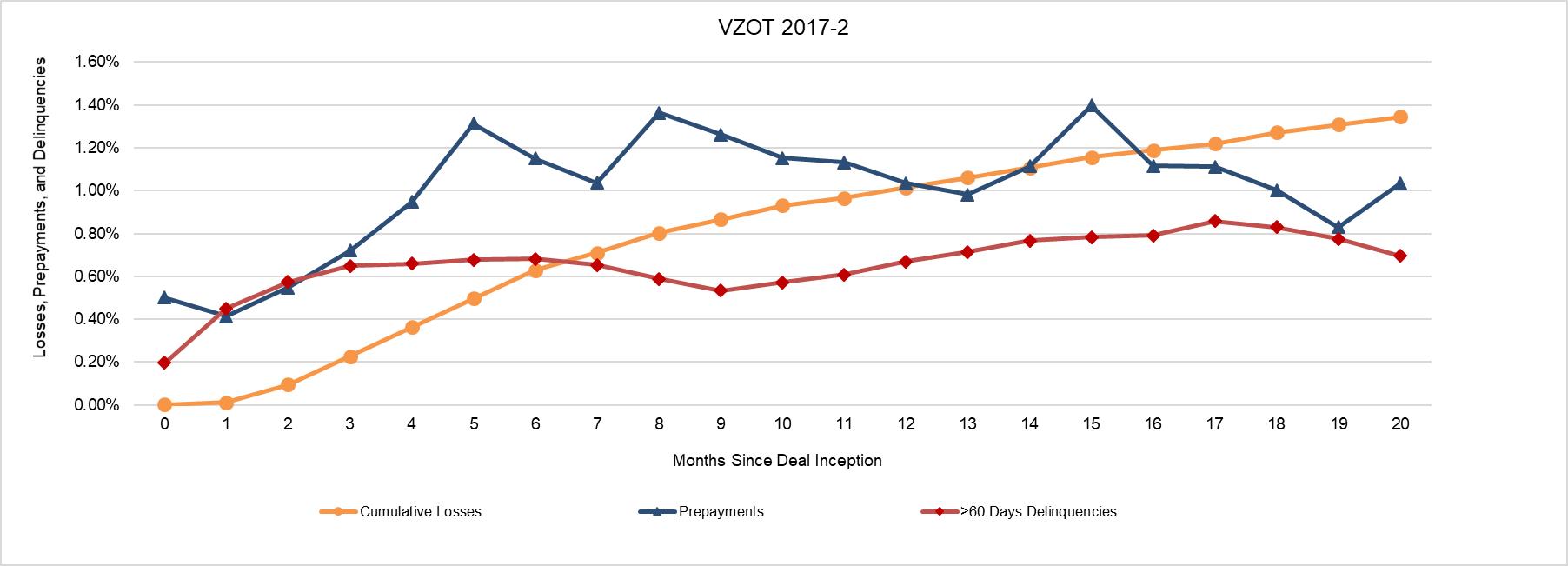

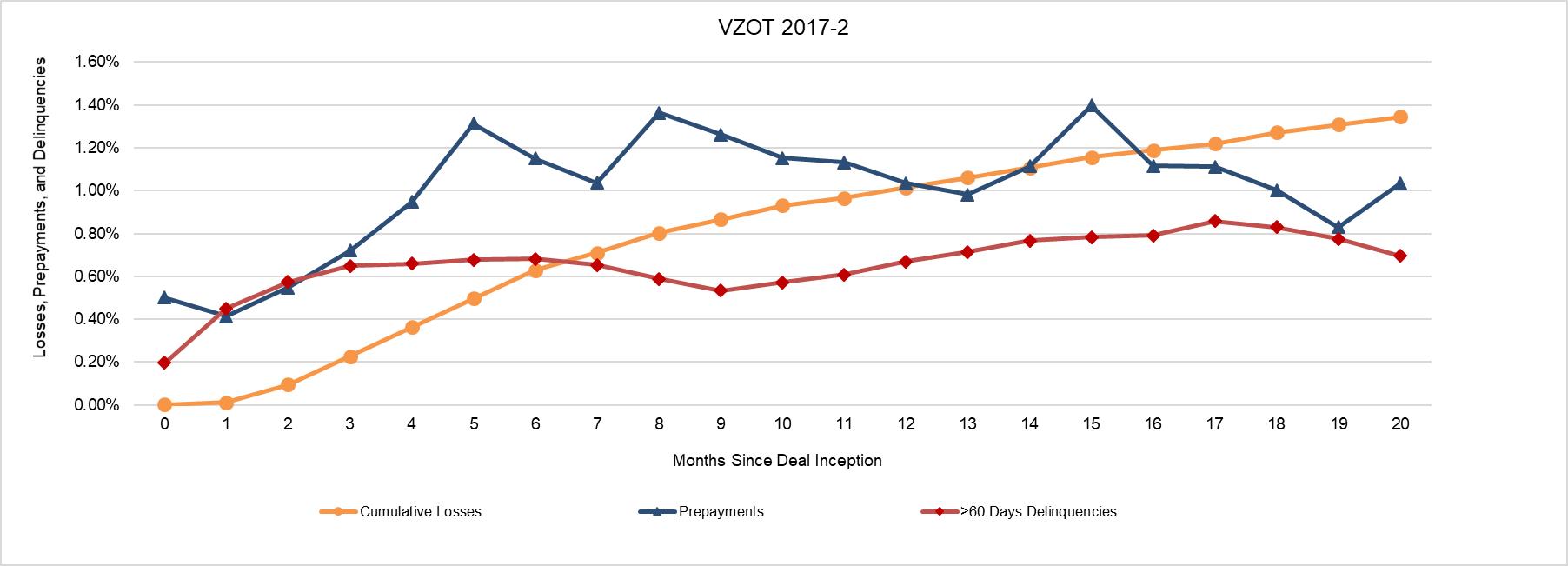

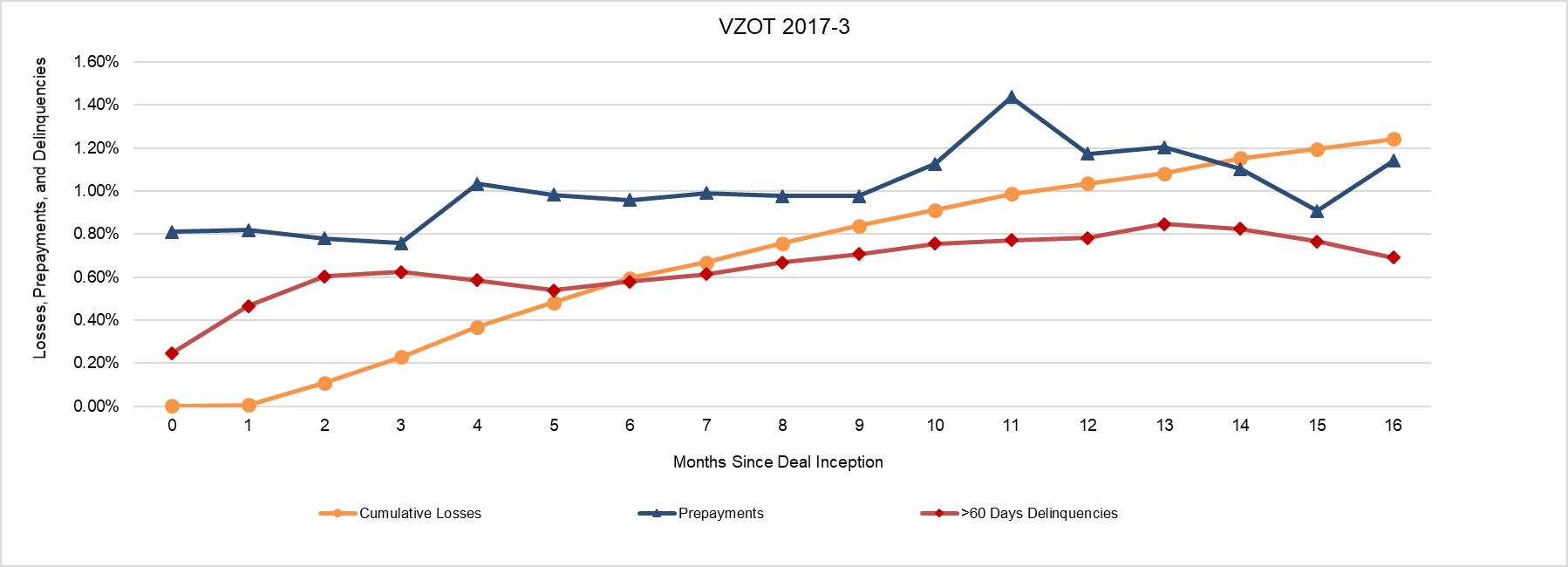

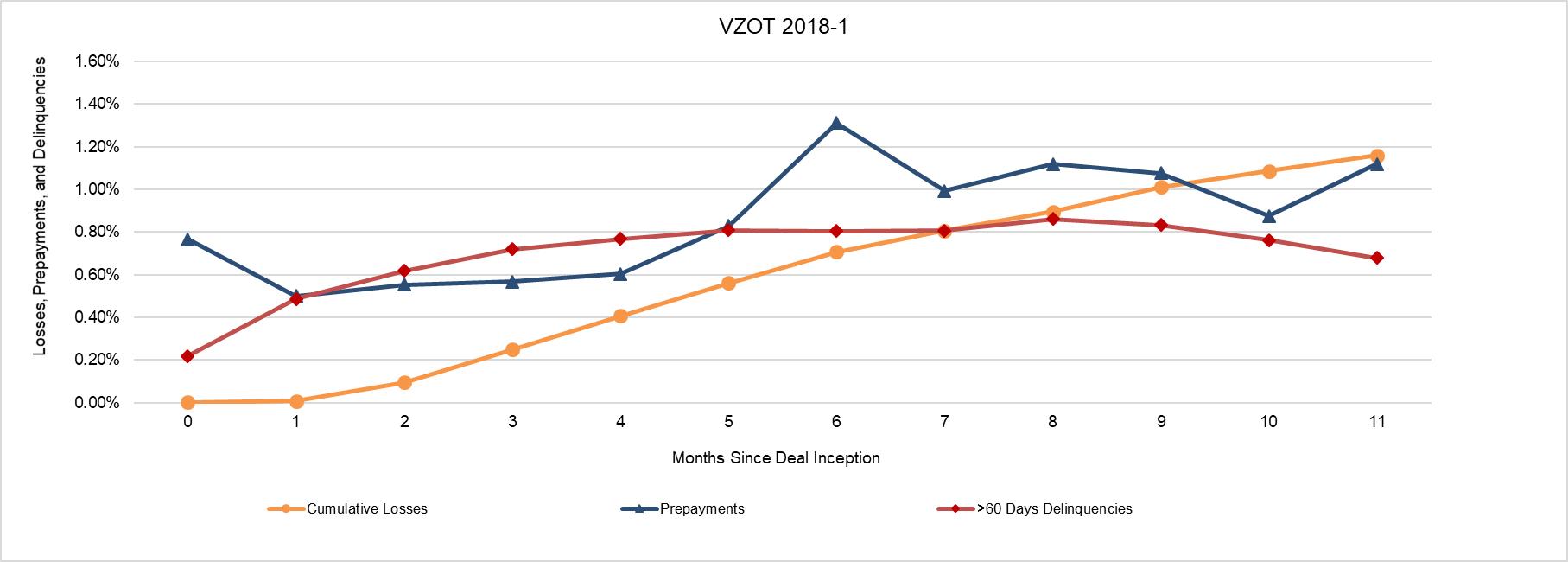

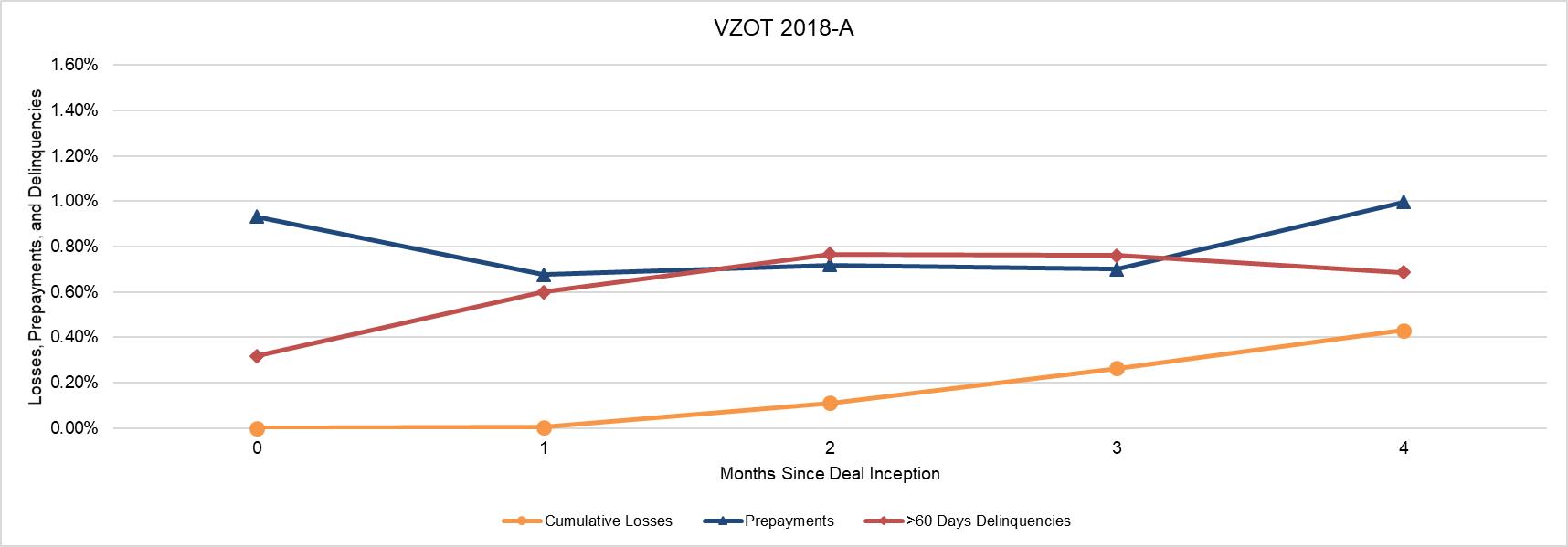

Delinquency and Write-Off Experience

|

84

|

|

Servicing Fees

|

86

|

|

Servicer Modifications and Obligation to Acquire Receivables

|

86

|

|

Trust Bank Accounts

|

87

|

|

Deposit of Collections

|

87

|

|

Custodial Obligations of Cellco

|

88

|

|

Servicing Obligations of Cellco

|

88

|

|

Limitations on Liability

|

89

|

|

Amendments to Transfer and Servicing Agreement

|

89

|

|

Resignation and Termination of Servicer

|

90

|

|

Notice Obligations of Cellco

|

91

|

|

Receivables

|

91

|

|

Receivables and Other Trust Assets

|

91

|

|

Description of the Receivables

|

92

|

|

Criteria for Selecting the Receivables

|

93

|

2

|

Composition of the Initial Receivables

|

94

|

|

Additional Receivables

|

99

|

|

Pool Composition and Credit Enhancement Tests

|

99

|

|

Representations About the Receivables

|

100

|

|

Asset Representations Review

|

101

|

|

Delinquency Trigger

|

104

|

|

Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit

Payments and Upgrade Prepayments

|

104

|

|

Dispute Resolution

|

106

|

|

Review of Receivables

|

108

|

|

Static Pool Information

|

109

|

|

Description of the Notes

|

110

|

|

Available Funds

|

110

|

|

Payments of Interest

|

111

|

|

Payments of Principal

|

112

|

|

Revolving Period

|

114

|

|

Amortization Period

|

114

|

|

Optional Acquisition of Receivables; Clean-up Redemption of the Notes

|

115

|

|

Optional Redemption of the Notes

|

115

|

|

Make-Whole Payments

|

116

|

|

Final Maturity Dates

|

117

|

|

Expected Final Maturity Dates

|

117

|

|

Priority of Payments

|

117

|

|

Post-Acceleration Priority of Payments

|

121

|

|

Events of Default

|

121

|

|

Notes Owned by Transaction Parties

|

124

|

|

List of Noteholders

|

124

|

|

Noteholder Communications

|

124

|

|

Satisfaction and Discharge of Indenture

|

125

|

|

Amendments to Indenture

|

125

|

|

Equity Interest; Issuance of Additional Securities

|

126

|

|

Book-Entry Registration

|

126

|

|

Definitive Securities

|

128

|

|

Computing the Outstanding Note Balance of the Notes

|

129

|

|

Credit and Payment Enhancement

|

129

|

|

Negative Carry Account

|

129

|

|

Reserve Account

|

130

|

|

Subordination

|

130

|

|

Overcollateralization

|

131

|

|

Yield Supplement Overcollateralization Amount

|

133

|

|

The Cap Agreement

|

133

|

|

Modifications and Amendment of the Cap Agreement

|

134

|

|

Defaults Under the Cap Agreement

|

135

|

|

Termination Date

|

135

|

|

Early Termination of the Cap Agreement

|

135

|

|

Credit Risk Retention

|

136

|

|

European Securitization Rules

|

138

|

|

Maturity And Prepayment Considerations

|

139

|

|

General

|

139

|

|

Weighted Average Life

|

140

|

|

Some Important Legal Considerations

|

147

|

|

Matters Relating to Bankruptcy

|

147

|

|

Security Interests in Receivables

|

152

|

|

Realization on the Receivables

|

152

|

|

Use of Proceeds

|

154

|

|

Transaction Fees and Expenses

|

154

|

|

Fees and Expenses for the Notes

|

154

|

|

Monthly Investor Reports

|

155

|

|

Annual Compliance Reports

|

157

|

|

U.S. Tax Consequences

|

158

|

|

Tax Characterization of the Trust

|

158

|

|

Tax Consequences to Owners of the Notes

|

159

|

|

Material State Tax Consequences

|

163

|

|

Certain Considerations for ERISA and Other Benefit Plans

|

163

|

3

|

General Investment Considerations for Fiduciaries Investing Plan Assets

|

163

|

|

Prohibited Transactions

|

164

|

|

Benefit Plans Not Subject to ERISA or the Code

|

165

|

|

Additional Considerations

|

166

|

|

Affiliations and Relationships and Related Transactions

|

166

|

|

Where You Can Find More Information About Your Notes

|

167

|

|

The Trust

|

167

|

|

The Depositor

|

167

|

|

Static Pool Data

|

167

|

|

Legal Proceedings

|

168

|

|

Underwriting

|

168

|

|

Legal Opinions

|

171

|

|

Available Information

|

171

|

|

Index of Defined Terms in this Prospectus

|

172

|

|

Schedule I: Cap Notional Amount Schedule

|

S‑I-1

|

|

Annex A: Static Pool Data—Vintage Pools

|

A‑1

|

|

Annex B: Static Pool Data—Prior Securitized Pools

|

B‑1

|

4

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

This prospectus has been prepared by Verizon ABS LLC, as depositor, and Cellco Partnership d/b/a Verizon Wireless, as

sponsor. The U.S. Securities and Exchange Commission (the “SEC”) allows us to “incorporate by reference” information filed with it by the trust or

by the depositor on behalf of the trust, which means that we can disclose important information to you by referring you to those documents. Verizon ABS LLC has met the registrant requirements of General Instruction I.A.1 of Form SF-3. The

information incorporated by reference is considered to be part of this prospectus. Information that we file later with the SEC will automatically update the information in this prospectus. In all cases, you should rely on the later information

over different information included in this prospectus. We incorporate by reference any current reports on Form 8-K filed with the SEC by or on behalf of the trust pursuant to Sections 13 or 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), before the termination of the offering of the notes.

In making your investment decision, you should rely only on the information contained or incorporated by reference in this

prospectus. We and the underwriters have not authorized anyone to provide you with any other information. If you receive any other information, you should not rely on it.

We and the underwriters are offering to sell the notes only in places where offers and sales are permitted.

You should not assume that the information contained or incorporated by reference in this prospectus is accurate as of any

date other than the date of such information.

READING THIS PROSPECTUS

This prospectus begins with the following brief introductory sections:

| • |

Transaction Structure Diagram – illustrates the structure of

this securitization transaction and the credit and payment enhancement available for the notes,

|

| • |

Transaction Credit and Payment Enhancement Diagram –

illustrates the credit and payment enhancement available for the notes on the closing date and how credit and payment enhancement is used to absorb losses on the receivables,

|

| • |

Transaction Parties and Documents Diagram – illustrates the

role of each transaction party and the obligations that are governed by each transaction document relating to the notes,

|

| • |

Transaction Payments Diagram – illustrates how available

funds will be paid on each payment date,

|

| • |

Summary – describes the transaction parties, the main terms of the issuance of and payments on the notes, the assets of the trust, the cash flows in this securitization transaction and the

credit and payment enhancement available for the notes, and

|

| • |

Risk Factors – describes the most significant risks of

investing in the notes.

|

The other sections of this prospectus contain more detailed descriptions of the parties to this securitization transaction,

the assets of the trust and the servicing of the assets, the notes and the structure of this securitization transaction. Cross-references refer you to more detailed descriptions of a particular topic or related information elsewhere in this

prospectus. The Table of Contents contains references to key topics. The information set forth in Schedule I, Annex A and Annex B is deemed to be a part of this prospectus.

5

An index of defined terms is at the end of this prospectus.

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains both historical and forward-looking

statements. These forward-looking statements are not historical facts, but only predictions and generally can be identified by use of statements that include phrases such as “will,” “may,” “should,” “continue,” “anticipate,” “believe,” “expect,”

“plan,” “appear,” “project,” “estimate,” “intend,” or other words or phrases of similar import. Similarly, statements that describe our objectives, plans or goals also are forward-looking statements. These forward-looking statements are subject to

risks and uncertainties which could cause actual results to differ materially from those currently anticipated. Factors that could materially affect these forward-looking statements can be found in this prospectus and our periodic reports filed

with the SEC.

Potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking

statements and are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this prospectus are made only as of the date of this prospectus, and we undertake no obligation to update

publicly these forward-looking statements to reflect new information, future events or otherwise, except as and to the extent required by the federal securities laws. In light of these risks, uncertainties and assumptions, the forward-looking

events might or might not occur. We cannot assure you that projected results or events will be achieved.

COPIES OF THE DOCUMENTS

If you have received a copy of this prospectus, you may request a copy of any information that we have incorporated by

reference in this prospectus, excluding any exhibit to that information unless the exhibit is specifically incorporated by reference in that information, at no cost by contacting Verizon ABS LLC at the following address or telephone number:

Verizon ABS LLC

One Verizon Way

Basking Ridge, New Jersey 07920

Telephone number: 212-395-1525

Attention: Investor Relations

Attention: Investor Relations

You may also read these materials through the SEC’s EDGAR system at http://www.sec.gov.

NOTE LEGEND

Each note will bear the following legend:

“EACH HOLDER OF THIS NOTE (OR AN INTEREST OR PARTICIPATION IN THIS NOTE) THAT IS SUBJECT TO TITLE I OF

THE EMPLOYEE RETIREMENT INCOME SECURITY ACT OF 1974, AS AMENDED (“ERISA”), SECTION 4975 OF THE INTERNAL REVENUE CODE OF 1986, AS AMENDED (THE “CODE”), OR A FEDERAL, STATE, LOCAL OR NON-U.S. LAW OR REGULATION THAT IS SUBSTANTIALLY SIMILAR TO TITLE I OF ERISA OR SECTION 4975 OF THE CODE (A “SIMILAR LAW”) AND ANY FIDUCIARY ACTING ON BEHALF OF THE HOLDER, BY ACCEPTING THIS NOTE (OR AN INTEREST OR PARTICIPATION IN THIS NOTE), IS DEEMED TO

REPRESENT THAT ITS PURCHASE, HOLDING AND DISPOSITION OF THIS NOTE (OR AN INTEREST OR PARTICIPATION IN THIS NOTE) DOES NOT AND WILL NOT RESULT IN A NON-EXEMPT PROHIBITED TRANSACTION UNDER TITLE I OF ERISA OR SECTION 4975 OF THE CODE DUE TO THE

APPLICABILITY OF A STATUTORY

6

OR ADMINISTRATIVE EXEMPTION FROM THE PROHIBITED TRANSACTION RULES (OR, IF THE HOLDER IS SUBJECT TO ANY

SIMILAR LAW, ITS PURCHASE, HOLDING AND DISPOSITION DOES NOT AND WILL NOT RESULT IN A NON-EXEMPT VIOLATION OF THE SIMILAR LAW).”

NOTICE TO RESIDENTS OF THE UNITED KINGDOM

THIS PROSPECTUS MAY ONLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED IN THE UNITED KINGDOM TO PERSONS HAVING PROFESSIONAL

EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFYING AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(5) (INVESTMENT PROFESSIONALS) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER “), OR TO PERSONS FALLING WITHIN ARTICLE 49(2) (A)-(D) (HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, PARTNERSHIPS OR TRUSTEES) OF THE

ORDER OR TO ANY OTHER PERSON TO WHOM THIS PROSPECTUS MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “RELEVANT PERSONS “). NEITHER THIS PROSPECTUS NOR THE NOTES ARE OR WILL BE AVAILABLE TO PERSONS IN THE UNITED KINGDOM WHO ARE NOT RELEVANT PERSONS AND THIS PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON IN THE UNITED

KINGDOM BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS RELATES, INCLUDING THE NOTES, IS AVAILABLE IN THE UNITED KINGDOM ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN THE UNITED KINGDOM ONLY

WITH RELEVANT PERSONS. THE COMMUNICATION OF THIS PROSPECTUS TO ANY PERSON IN THE UNITED KINGDOM WHO IS NOT A RELEVANT PERSON IS UNAUTHORIZED AND MAY CONTRAVENE THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”).

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY

RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA. FOR THESE PURPOSES, A RETAIL INVESTOR MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU, AS AMENDED (“MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97, AS AMENDED, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN

POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN DIRECTIVE 2003/71/EC (AS AMENDED OR SUPERSEDED) (THE “PROSPECTUS

DIRECTIVE”). CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “PRIIPS REGULATION”) FOR

OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO RETAIL INVESTORS IN THE EUROPEAN ECONOMIC AREA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY RETAIL INVESTOR IN THE

EUROPEAN ECONOMIC AREA MAY BE UNLAWFUL UNDER THE PRIIPS REGULATION.

7

TRANSACTION STRUCTURE DIAGRAM

The following diagram provides a simplified overview of the structure of this securitization transaction

and the credit and payment enhancement available for the notes. You should read this prospectus in its entirety for a more detailed description of this securitization transaction.

| (1) |

The certificates will initially be held by the depositor and Verizon DPPA True-up Trust, as nominee of the originators and equityholder of Verizon DPPA

Master Trust, another Delaware statutory trust similar to the trust, which is beneficially owned by the originators. The certificates represent the right to all funds not needed to make required payments on the notes, pay fees,

expenses and indemnities of the trust or make deposits into the reserve account, the acquisition account or the negative carry account.

|

| (2) |

On the closing date, the reserve account will be fully funded by the depositor with an amount equal to $12,539,666.52 (which is expected to be approximately

1% of the adjusted pool balance as of the initial cutoff date). The “adjusted pool balance” is the pool balance reduced by the yield supplement overcollateralization amount. The “pool balance” is the aggregate principal balance of the

receivables, other than any temporarily excluded receivables.

|

| (3) |

The acquisition account will be funded by the depositor on the closing date to the extent, if necessary, to satisfy the overcollateralization target amount

on the closing date. Amounts on deposit in the acquisition account may be used periodically by the trust during the revolving period to acquire additional receivables from the depositor who will acquire them from the originators or

Verizon DPPA Master Trust. It is expected that any funds deposited into the acquisition account on the closing date will be completely utilized on the first payment date.

|

| (4) |

If the depositor funds the acquisition account on the closing date, it will also make a corresponding deposit into the negative carry account in an amount

equal to the required negative carry amount for the amount on deposit in the acquisition account, which will be calculated as set forth under “Summary—Credit and

Payment Enhancement—Negative Carry Account.” Thereafter, the negative carry account will be funded by the trust from available funds on each payment date during the revolving period on which amounts are on deposit in the

acquisition account, in an amount equal to the required negative carry amount as described under “Summary—Credit and Payment Enhancement—Negative Carry Account.”

|

| (5) |

All notes other than the Class C notes benefit from subordination of more junior classes to more senior classes. The order of subordination varies

depending on whether interest or principal is being paid and whether an event of default that results in acceleration has occurred. For more details about

subordination, you should read “Description of the Notes—Priority of Payments,” “—Post-Acceleration Priority of Payments” and “Credit and Payment Enhancement—Subordination.”

|

| (6) |

Overcollateralization is the amount by which, on any date of determination (x) the sum of (i) the adjusted pool balance as of the last day of the related

collection period and (ii) the amount on deposit in the acquisition account after giving effect to the acquisition of receivables on that date exceeds (y) the aggregate note balance. The initial amount of overcollateralization for the

notes on the closing date (inclusive of any deposit into the acquisition account on the closing date) will be approximately 10.50% of the adjusted pool balance as of the initial cutoff date, and thereafter, the overcollateralization

target amount will be calculated as described under “Summary—Credit and Payment Enhancement—Overcollateralization.”

|

| (7) |

The yield supplement overcollateralization amount is calculated as described under “Summary—Credit and Payment Enhancement—Yield Supplement Overcollateralization Amount.” A portion of the yield supplement overcollateralization amount may be a source of funds to absorb losses on the receivables and

to maintain overcollateralization.

|

| (8) |

The Class A-1b notes bear interest based on the one-month London Interbank Offered Rate (“LIBOR”) as described under “Description of the Notes—Payments of Interest.” Although the initial receivables are non-interest bearing and

the additional receivables may also be non-interest bearing, the receivables are discounted at a fixed rate, thereby creating basis risk between the receivables and the floating rate Class A-1b notes. To mitigate this basis risk and

the impact of fluctuations in one-month LIBOR, the trust will enter into an interest rate cap agreement on the terms described under “The Cap Agreement.”

|

8

TRANSACTION CREDIT AND PAYMENT ENHANCEMENT DIAGRAM

This diagram is a simplified overview of the credit and payment enhancement available for the notes on

the closing date and how credit and payment enhancement is used to absorb losses on the receivables. If losses on the receivables and other shortfalls in cash flows exceed the amount of available credit and payment enhancement, the amount

available to make payments on the notes will be reduced to the extent of these losses. The risk of loss will be borne first by the Class C notes, then the Class B notes, and finally, the Class A notes. You should read this prospectus completely,

including “Credit and Payment Enhancement,” for more details about the credit and payment enhancement available for the notes. The percentages listed below assume that no deposit is made into the acquisition account on the closing date by the

depositor.

________________________

| (1) |

The Class A notes consist of the Class A-1a and Class A-1b notes, which notes rank pari passu. All notes other than the Class C notes benefit from

subordination of more junior classes to more senior classes. The order of the subordination varies depending on whether interest or principal is being paid and whether an event of default that results in acceleration has occurred. For more details about subordination, you should read “Description of the Notes—Priority of Payments,” “—Post-Acceleration Priority of Payments” and “Credit and Payment Enhancement—Subordination.”

|

| (2) |

On the closing date, the reserve account will be fully funded by the depositor with an amount equal to

$12,539,666.52 (which is expected to be approximately 1% of the adjusted pool balance as of the initial cutoff date). For more details about the

reserve account, you should read “Credit and Payment Enhancement—Reserve Account.”

|

| (3) |

Overcollateralization is the amount by which, on any date of determination (x) the sum of (i) the adjusted pool balance as of the last day of the related

collection period and (ii) the amount on deposit in the acquisition account after giving effect to the acquisition of receivables on that date exceeds (y) the aggregate note balance. The initial amount of overcollateralization for the notes on the closing date (inclusive of any deposit into the acquisition account on the closing date) will be approximately 10.50% of the adjusted pool

balance as of the initial cutoff date, and thereafter, the overcollateralization target amount will be calculated as described under “Summary—Credit and Payment

Enhancement—Overcollateralization.”

|

| (4) |

Excess spread is the portion of the yield supplement overcollateralization amount that provides a source of funds to absorb losses on the receivables and to

maintain overcollateralization.

|

9

TRANSACTION PARTIES AND DOCUMENTS DIAGRAM

The following diagram shows the role of each transaction party and the obligations that are governed by

each transaction document relating to the notes.

10

TRANSACTION PAYMENTS DIAGRAM

This diagram shows how available funds will be paid on each payment date. The priority of payments shown

in this diagram will apply unless the notes are accelerated after an event of default under the indenture. You should read this prospectus completely, including “Description of the Notes—Priority of Payments” and “—Post-Acceleration Priority of

Payments,” for more details about the priority of payments for the notes.

11

SUMMARY

This summary describes the transaction parties, the main terms of the issuance of and payments on the

notes, the assets of the trust, the cash flows in this securitization transaction and the credit and payment enhancement available for the notes. It does not contain all of the information that you should consider in making your investment

decision. To understand fully the terms of the notes and the transaction structure, you should read this prospectus, especially “Risk Factors” beginning on page 32, in its entirety, including any documents incorporated by reference herein.

Transaction Overview

On the closing date, each of the originators and/or Verizon DPPA Master Trust, a Delaware statutory trust beneficially owned by the

originators and which was formed to acquire and finance device payment plan agreements originated by the originators (the “master trust”), will

transfer all of its right, title and interest in an initial pool of device payment plan agreements, including all amounts received and applied on those device payment plan agreements after the end of the calendar day on the initial cutoff date,

and all payments on or under and all proceeds of the device payment plan agreements, to the depositor, who will transfer all of its right, title and interest in them to the trust. We refer to these device payment plan agreements as the “initial receivables.” On the closing date, the trust will issue the

notes and the certificates to the depositor in exchange for the initial receivables, and the depositor will sell the notes to the underwriters who will sell them to investors. The depositor will distribute the net proceeds from the offering to

the originators and the master trust, pro rata based on the value of the related initial receivables transferred by the originators and the master trust, and will transfer certain of the certificates to the true-up trust, a majority owned

affiliate of the sponsor, which is owned by the originators and is the equityholder of the master trust.

On any day during the revolving period, but no more than five times during any calendar month, the depositor may acquire additional device payment plan agreements (the “additional receivables”) from the

originators and/or the master trust, and in turn transfer them to the trust. The trust may acquire the additional receivables from the depositor using cash in the acquisition account and by increasing the value of certain of the certificates, if

necessary, as described under “—Revolving Period; Additional Receivables” below. The depositor will use the amounts so received from the trust

during the

revolving period to acquire the additional receivables from the originators and/or the master trust.

The initial receivables and the additional receivables are collectively referred to as the “receivables.”

Transaction Parties

Sponsor, Servicer, Custodian, Marketing Agent and Administrator

Cellco Partnership d/b/a Verizon Wireless (“Cellco”),

a Delaware general partnership, is a subsidiary of Verizon Communications Inc., a Delaware corporation (“Verizon”).

Cellco will be the sponsor of the securitization transaction in which the notes will be issued. As sponsor, Cellco will be responsible for

structuring the securitization transaction, selecting the initial pool of receivables and each additional pool of receivables, selecting the transaction parties and paying the costs and expenses of forming the trust, legal fees of some of the

transaction parties, rating agency fees for rating the notes and other transaction expenses.

Cellco will also be the servicer, the custodian and the marketing agent and the administrator for the trust.

As servicer, Cellco is responsible for collecting payments on the receivables and administering payoffs, prepayments, defaults and

delinquencies, as further described under “Servicing the Receivables and the Securitization Transaction—Servicing Obligations of Cellco.” Cellco

will also act as custodian and maintain custody of the receivable files, as further described under “Servicing the Receivables and the Securitization

Transaction—Custodial Obligations of Cellco.”

12

Cellco, in its capacity as marketing agent, will, or will cause the originators to, make certain prepayments, apply certain credits on the

receivables and manage certain account transfers, as further described under “Receivables—Obligation to Acquire or Reacquire Receivables; Obligation to

Make Credit Payments and Upgrade Prepayments.”

Cellco, in its capacity as administrator of the trust, will perform certain administrative duties of the trust pursuant to the terms of the

administration agreement, as further described under “Sponsor, Servicer, Custodian, Marketing Agent and Administrator.”

Although Cellco is responsible for the performance of its obligations as sponsor, servicer, custodian, marketing agent and administrator,

certain affiliates or third parties may undertake the actual performance of those obligations, as permitted by the terms of the transaction documents.

For more information about the sponsor, servicer, custodian, marketing agent and administrator, you should read “Sponsor,

Servicer, Custodian, Marketing Agent and Administrator.”

Verizon Wireless

As used in this prospectus, “Verizon Wireless”

refers to the wireless business of Verizon, operated by Cellco and various other indirect subsidiaries of Verizon, including the originators.

Depositor

Verizon ABS LLC, or the “depositor,” is a

Delaware limited liability company and a special purpose company wholly owned by Cellco.

Issuing Entity

Verizon Owner Trust 2019-B (“VZOT 2019-B”

or the “trust”) is a Delaware statutory trust governed by a trust agreement between the depositor and the owner trustee and will be the issuer of

the notes.

The Master Trust

Verizon DPPA Master Trust, or the “master trust,” is a Delaware statutory trust beneficially owned by the originators. All receivables owned by the master trust and subsequently transferred

to the trust were originated by the originators.

For additional information regarding the master trust, see “The Master Trust.”

Originators

Cellco and certain other affiliates of Verizon are the “originators” who have originated or will originate the receivables under contracts entered into by Verizon Wireless Services, LLC, as agent of each originator or another affiliated agent as may be appointed by the originators from

time to time. All of the originators are either wholly owned by, or are affiliates of, the sponsor and originate the receivables under the same underwriting guidelines as determined by the sponsor. For additional information regarding the originators, see “The Originators.”

Parent Support Provider

Under the parent support agreement, Verizon, or the “parent support provider,” will guarantee the payment obligations of the originators, and Cellco, in its capacities as servicer and marketing agent, including, but not limited to, their respective reacquisition, acquisition and

prepayment obligations. The parent support provider will not guarantee any payments on the notes or any payments on the receivables. For additional

information regarding the obligations of the parent support provider, see “The Parent Support Provider,” “Origination and Description of Device Payment Plan Agreement Receivables—Upgrade Offers,” “—Account Credits” and “Receivables—Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit Payments and Upgrade Prepayments.”

Owner Trustee

Wilmington Trust, National Association, a national banking association.

Indenture Trustee and Paying Agent

U.S. Bank National Association, a national banking association.

Asset Representations Reviewer

Pentalpha Surveillance LLC, a Delaware limited liability company.

True-up Trust

Verizon DPPA True-up Trust, or the “true-up trust,”

is a Delaware statutory trust beneficially owned by the originators. The true-up trust is also the equityholder of the master trust.

13

Cap Counterparty

Wells Fargo Bank, National Association, a national banking association.

Calculation Agent

The “calculation agent” will be the

indenture trustee. The calculation agent will calculate one-month LIBOR and calculate the interest rate for the Class A-1b notes, as set forth under “Description

of the Notes—Payments of Interest.”

Closing Date

The trust expects to issue the notes on or about June 12, 2019, or the “closing date.”

Cutoff Date

The trust will be entitled to collections (a) with respect to the initial receivables, received after the end of the calendar day on May 31,

2019, or the “initial cutoff date,” and (b) with respect to the additional receivables, received after the end of the calendar day on the last day

of the month immediately preceding the month in which that acquisition date occurs, each a “cutoff date.”

Collection Period

The period commencing on the first day of the applicable month and ending on the last day of the applicable month (or in the case of the first

collection period, from the end of the calendar day on the initial cutoff date to the last day of the month immediately preceding the first payment date); provided that, for any payment date, the applicable month will be the immediately preceding

calendar month.

Notes

The trust will issue the following classes of notes:

|

Initial Note Balance

|

Interest Rate

|

||

|

Class A-1a notes

|

$855,000,000

|

2.33%

|

|

|

Class A-1b notes

|

$145,000,000

|

one-month LIBOR + 0.45%

|

|

|

Class B notes

|

$69,000,000

|

2.40%

|

|

|

Class C notes

|

$53,300,000

|

2.60%

|

The Class A-1a and Class A-1b notes are referred to collectively as the “Class A notes.”

The Class A, Class B and Class C notes will be offered and are referred to collectively as the “notes.” The equity interest in the trust will be represented by one or more classes

of certificates, which are not offered by this prospectus. The depositor and the true-up trust will initially hold the certificates. The equity interest holders will be referred to collectively as the “certificateholders” and individually as a “certificateholder.” The certificates will

not have an interest rate.

Final Maturity Dates

The final maturity date for each class of notes is the date on which the remaining aggregate outstanding principal balance of the notes as of

the related date of determination (the “note balance”) of that class of notes is due and payable. Any failure to pay the note balance of a class of notes in full on

its final maturity date constitutes an event of default under the indenture.

Class A-1a notes: December 20, 2023.

Class A-1b notes: December 20, 2023.

Class B notes: December 20, 2023.

Class C notes: December 20, 2023.

Expected Final Maturity Dates

The expected final maturity date for each class of notes is the date by which, based on the assumptions set forth under “Maturity and Prepayment Considerations,” using a prepayment assumption percentage of 100% and assuming exercise of the optional acquisition on the

earliest applicable payment date, it is expected that the note balance of that class of notes will have been paid in full. Any failure to pay the note balance of a class of notes in full by its expected final maturity date will not constitute an

event of default under the indenture.

Class A-1a notes: August 22, 2022.

Class A-1b notes: August 22, 2022.

Class B notes: August 22, 2022.

Class C notes: August 22, 2022.

Form and Minimum Denomination

The notes will be issued in book-entry form and will be available in minimum denominations of $1,000 and in multiples of $1,000 in excess

thereof.

14

Payment Dates

The trust will pay interest on the notes, and during the amortization period, interest on and principal of the notes, on “payment dates,” which will be the 20th day of each month (or, if not a business day, the next business day). The first payment date will be on August

20, 2019.

Interest Payments

The trust will pay interest on the notes on each payment date. Interest will be paid, first, to the Class A notes, pro rata based on the

amount of interest due to the Class A-1a and Class A-1b notes, then to the Class B notes and then to the Class C notes.

With respect to each payment date, interest on the Class A-1a, Class B and Class C notes will accrue on a “30/360” day basis from and

including the 20th day of the calendar month immediately preceding that payment date to but excluding the 20th day of the calendar month in which that payment date occurs (or from and including the closing date to but excluding August 20, 2019

for the first payment date).

With respect to each payment date, interest on the Class A-1b notes will accrue on an “actual/360” basis from and including the immediately

preceding payment date to but excluding the current payment date (or, in the case of the first payment date, from and including the closing date to but excluding August 20, 2019). This means that the interest due on the Class A-1b notes on each

payment date will be the product of: (i) the note balance of the Class A-1b notes on that payment date, before giving effect to any payments made on that date; (ii) the interest rate on the Class A-1b notes for that payment date; and (iii) the

actual number of days since the previous payment date (or, in the case of the first payment date, from and including the closing date to but excluding August 20, 2019) divided by 360.

If the sum of one-month LIBOR and the applicable spread set forth on the front cover of this prospectus is less than 0.00% for any interest

accrual period, then the interest rate for the Class A-1b notes for that interest accrual period will be deemed to be 0.00%.

For a more detailed description of the payment of interest on the notes, you should read

“Description of the Notes—Payments of Interest.”

Principal Payments

No principal will be paid on the notes before the amortization period begins. Instead, prior to the beginning of the amortization period and

to the extent of available funds, funds in an amount equal to the acquisition deposit amount will be deposited into the acquisition account on each payment date and will be available for the acquisition of additional receivables by the trust. See “—Revolving Period; Additional Receivables” below.

During the amortization period, to the extent of available funds, principal will be payable on the notes on each payment date generally in an

amount sufficient to reduce the balance of the notes to the adjusted pool balance less the overcollateralization target amount. These principal payments will be applied sequentially to the Class A notes (with any principal payments applied to

the Class A notes allocated to the Class A-1a and Class A-1b notes, pro rata, based on the note balance of the Class A-1a and Class A-1b notes on the related payment date, before giving effect to any payments made on that date), the Class B notes

and the Class C notes, in that order until the note balance of each class of notes is reduced to zero. See “—Priority of Payments” below.

For a more detailed description of the payment of principal of the notes, you should read “Description of the

Notes—Payments of Principal.” For more information about the amortization events, you should read “Description of the Notes—Amortization Period.”

Optional Acquisition of Receivables; Clean-up Redemption of Notes

Certificateholders representing 100% of the voting interests of the certificates held by the originators or affiliates of the originators have

the right to acquire the receivables on any payment date when the pool balance as of the last day of the related collection period is equal to or less than 10% of the pool balance on the closing date (an “optional acquisition”). Upon the exercise of this right, the trust will redeem the notes, in whole but not in part (a “clean-up redemption”), without a make-whole payment

15

(other than any make-whole payments already due and payable on that date).

In order for an optional acquisition to occur, 100% of these certificateholders must elect to exercise the option and the administrator, on

behalf of the trust, must agree. The certificateholders must provide to the trust an amount equal to the fair market value of the receivables; provided, that the transfer may only occur if that amount, together with amounts on deposit in the reserve account, the collection account, the acquisition account

and the negative carry account, is sufficient to pay off all principal of, and accrued and unpaid interest on, the notes, pay any applicable make-whole payments already due and payable on that date, and pay any remaining obligations of the trust in full.

Optional Redemption of the Notes

Certificateholders representing 100% of the voting interests of the certificates held by the originators or affiliates of the originators have

the right to redeem the notes, in whole but not in part, on any payment date on and after the payment date in July 2020 (an “optional redemption”),

with a make-whole payment, as described below.

In order for an optional redemption to occur, 100% of these certificateholders must elect to exercise the option and the administrator, on

behalf of the trust, must agree.

In connection with an optional redemption, the trust may offer to transfer the receivables to another Verizon special purpose entity and/or a

third-party purchaser for an amount equal to the fair market value of the receivables; provided that the transfer may only occur if that amount, together with amounts on deposit in the reserve account, the collection account, the acquisition

account and the negative carry account, is sufficient to pay off all principal of, and accrued and unpaid interest on, the notes, pay any applicable make-whole payments due and payable on that date, and pay any remaining obligations of the trust

in full.

Make-Whole Payments

A make-whole payment will be due in connection with the optional redemption of the notes. A make-whole payment will also be due

on each principal payment made prior to the payment date in July 2021 as a result of the occurrence of an amortization event resulting from

either (i) the failure to fund the negative carry account to the required negative carry amount or (ii) the adjusted pool balance declining to less than 50.00% of the initial aggregate note balance.

No make-whole payment will be payable in connection with any principal payment on the notes resulting from the amortization events described

above after the payment date in July 2021 or as a result of a clean-up redemption, as described under “Description of the Notes—Optional Acquisition of

Receivables; Clean-up Redemption of Notes,” other than any make-whole payment already due and payable on that date.

Make-whole payments will only be made once the notes have been paid in full and to the extent funds are available therefor. Any unpaid

make-whole payments will be payable on the final maturity date, the clean-up redemption date or the optional redemption date on which the notes are required to be paid in full.

For a description of the make-whole payments, you should read “Description of the Notes—Make-Whole Payments.”

Trust Assets

The trust assets will include:

| · |

the receivables and collections on the receivables received after the end of the calendar day on the applicable cutoff date (other than net recoveries on

written-off receivables (including any proceeds from the sale

of a wireless device securing a device payment plan agreement), which will be retained by the servicer as a supplemental servicing fee, and collections on temporarily excluded receivables),

|

| · |

rights to funds in the reserve account, collection account, acquisition account and negative carry account,

|

| · |

rights to payments received under the interest rate cap agreement,

|

16

| · |

rights of the trust under the transfer and servicing agreement, the receivables transfer agreements and the other transaction documents,

|

| · |

rights to funds from (i) the reacquisition by originators of receivables that, as of the applicable cutoff date, are not eligible receivables, (ii) the

acquisition by the servicer of receivables that breach certain covenants or that were transferred by the master trust and, as of the applicable cutoff date, are not eligible receivables, (iii) the reacquisition or acquisition by

originators or the servicer, as applicable, of secured receivables (that are not written-off receivables) if the related obligor becomes the subject of a bankruptcy proceeding and Verizon Wireless accepts the surrender of the related

wireless device in satisfaction of the receivable, (iv) the acquisition by the marketing agent or an originator of receivables that are subject to certain transfers, (v) credit payments and upgrade prepayments made by the marketing

agent or an originator, and (vi) any amounts remitted by the parent support provider under the parent support agreement, and

|

| · |

all proceeds of the above.

|

Servicing Fees

On each payment date, the trust will pay the servicer a servicing fee equal to 1/12 of 0.75% of the adjusted pool balance at the beginning

of the full calendar month immediately preceding that payment date, provided that the servicing fee for the initial payment date will equal the product of (i) a fraction, the numerator of which is the number of days from and including the

closing date to and including the last day of the first collection period and the denominator of which is 360, and (ii) 0.75% of the adjusted pool balance as of the closing date. In addition, the servicer will be entitled to retain as a

supplemental servicing fee any net recoveries on written-off receivables (including any proceeds from the sale of a wireless device securing a

device payment plan agreement), late fees, if any, and certain other administrative and similar fees and charges on the receivables.

Also, any successor servicer is entitled to (i) a one-time successor servicer engagement fee of $150,000, payable on the first payment date

after it assumes its duties as successor servicer, and (ii) a monthly supplemental successor servicing fee equal to the excess, if any, of (x) $425,000 over (y) the servicing fee.

Trustee Fees

Each of the indenture trustee and the owner trustee will be entitled to a fee in connection with the performance of its respective duties

under the applicable transaction documents. The trust will pay (i) the indenture trustee a monthly fee equal to $1,000 and (ii) the owner trustee a monthly fee equal to $1,250. Each of the indenture trustee and the owner trustee will also be

entitled to reimbursement or payment by the trust for all fees, expenses and indemnification amounts incurred by it in connection with the performance of its respective duties under the applicable transaction documents.

Asset Representations Reviewer Fees

The asset representations reviewer will be entitled to a fee in connection with the performance of its duties under the asset representations

review agreement. The trust will pay the asset representations reviewer a monthly fee equal to $416.67 and, in the event an asset representations review occurs, the asset representations reviewer will be entitled to a fee of $50,000, as

described under “Asset Representations Reviewer.”

The asset representations reviewer will also be entitled to reimbursement or payment by the trust for all fees, expenses and indemnification amounts incurred by it in connection with the performance of its duties under the asset representations

review agreement.

Collections and Other Deposits

Unless Cellco meets certain requirements as specified under “Servicing the Receivables and the Securitization Transaction—Deposit of Collections,” Cellco will deposit all collections into the collection account within two business days after identification by Cellco of receipt

of good funds.

In addition, as described under “Origination

and Description of Device Payment Plan Agreement Receivables—Upgrade Offers,” “—Account

17

Credits,” “Servicing the Receivables and the Securitization Transaction—Servicer Modifications and Obligation to Acquire Receivables,” and “Receivables—Obligation to Acquire or Reacquire Receivables; Obligation to Make Credit Payments and Upgrade Prepayments,” under the circumstances specified therein, an originator, the

servicer or the marketing agent, as applicable, will be required to remit certain amounts from time to time to the collection account with respect to upgrades, credit payments, account transfers, reacquisitions of receivables and acquisitions of

receivables, as applicable.

Initial Receivables

The receivables that will be transferred to the trust are device payment plan agreements for wireless devices sold or financed by the

originators. These wireless devices include smartphones, basic phones, tablets and watches and may in the future include other devices that utilize a wireless

connection. Each initial receivable is required to be an “eligible receivable” as described under “Receivables—Criteria for Selecting the Receivables.”

As of the initial cutoff date, the aggregate principal balance of the eligible receivables less the aggregate principal balance of any

receivables deemed to be temporarily excluded receivables (the “pool balance”) was $1,346,174,562.76. As of the initial cutoff date, the “adjusted pool balance,” which is an amount equal to the pool balance less the yield supplement overcollateralization amount, was $1,253,966,652.32. The adjusted pool balance as of the initial cutoff date will be determined based on the yield supplement overcollateralization amount for the closing date, which will

be calculated as described under “Credit and Payment Enhancement—Yield Supplement Overcollateralization Amount” below. The acquisition account

will be funded by the depositor on the closing date to the extent, if necessary, to satisfy the overcollateralization target amount on the closing date.

The information concerning the receivables presented throughout this prospectus is based on the initial receivables as of the initial cutoff

date.

Below is a summary of the characteristics of the initial receivables as of the initial cutoff date. All percentages and averages are based on

the aggregate principal balance of the initial receivables as of the initial cutoff date unless otherwise stated.

|

Number of receivables

|

2,168,784

|

|

Aggregate principal balance

|

$1,346,174,562.76

|

|

Average principal balance

|

$620.70

|

|

Average monthly payment

|

$31.23

|

|

Weighted average remaining installments (in months)(1)

|

20

|

|

Weighted average FICO® Score(1)(2)(3)

|

707

|

|

Percentage of receivables with obligors without a FICO®

Score(3)

|

2.36%

|

|

Geographic concentration (Top 3 States)(4)

|

|

|

California

|

10.83%

|

|

Texas

|

6.15%

|

|

New York

|

5.94%

|

|

Weighted average customer tenure (in months)(1)(5)

|

98

|

|

Percentage of receivables with obligors with smartphones

|

94.10%

|

|

Percentage of receivables with obligors with basic phones, tablets or watches

|

5.90%

|

___________________

| (1) |

Weighted averages are weighted by the aggregate principal balance of the initial receivables as of the initial cutoff date.

|

| (2) |

Excludes receivables that have obligors who did not have FICO® Scores

because they are individuals with minimal or no recent credit history.

|

| (3) |

This FICO® Score reflects the FICO® Score 8 of the related obligor. The FICO® Score is calculated with respect to each obligor on or about the

date on which such receivable was originated.

|

| (4) |

Based on the billing addresses of the obligors.

|

| (5) |

For a complete description of the calculation of customer tenure included in this summary, see “Origination and Description of Device Payment Plan Agreement Receivables—Origination Characteristics.”

|

All receivables acquired by the trust must satisfy the eligibility criteria specified under “Receivables—Criteria for Selecting the Receivables.”

For more information about the characteristics of the initial receivables as of the initial cutoff date, you should read

“Receivables—Composition of the Initial Receivables.”

Cellco does not consider any of the initial receivables to have been originated pursuant to exceptions to its underwriting criteria. For more information regarding Verizon Wireless’ underwriting criteria see “Origination and Description of Device Payment Plan Agreement Receivables—Underwriting Criteria.”

18

Revolving Period; Additional Receivables

The “revolving period” will begin on the

closing date and end when the amortization period begins. On each payment date during the revolving period, the trust will deposit collections on the receivables into the acquisition account, to the extent of available funds, in an amount equal

to the acquisition deposit amount for the payment date.

Amounts in the acquisition account may be used by the trust to acquire additional eligible receivables from the depositor, but only if the

credit enhancement test and pool composition tests would be satisfied immediately following that acquisition. The characteristics (as of the applicable cutoff date) of the receivables sold to the trust during the revolving period will not differ

materially from those of the initial receivables as of the initial cutoff date.

The “acquisition deposit amount” for any

payment date during the revolving period is the required acquisition account amount, less any amounts on deposit in the acquisition account immediately prior to any deposit into the acquisition account on that payment date, where the “required acquisition account amount” for any payment date during the revolving period will equal the excess, if any, of (a) the aggregate note balance

over (b) the adjusted pool balance as of the last day of the related collection period less the overcollateralization target amount. The acquisition account will be funded by the depositor on the closing date to the extent, if necessary, to

satisfy the overcollateralization target amount on the closing date. It is expected that any funds on deposit in the acquisition account on the closing date will be completely utilized on the first payment date to acquire additional receivables.

For a more detailed description of the revolving period and the acquisition of additional receivables by the trust, you

should read “Receivables—Additional Receivables” and “Description of the Notes—Revolving Period.”

Credit Enhancement Test and Pool Composition Tests

The “credit enhancement test” must be

satisfied on the closing date and on each date on which additional receivables are acquired by the trust. The credit enhancement test will be

satisfied on these dates if, after giving effect to all payments required to be made and the acquisition of receivables on that date, the

adjusted pool balance as of the end of the immediately preceding collection period plus any amounts on deposit in the acquisition account minus the overcollateralization target amount, is equal to or greater than the aggregate note balance.

In addition, the pool of receivables must satisfy all of the pool composition tests on the closing date, on each payment date and on each date

on which additional receivables are acquired by the trust. Subject to the requirements set forth under “Receivables—Pool Composition and Credit

Enhancement Tests,” if the pool of receivables does not pass all of the tests, the administrator may, but is not obligated to, identify receivables in the

pool as “temporarily excluded receivables,” so that the remaining

receivables in the pool will satisfy all of the pool composition tests. The administrator may also deem temporarily excluded receivables to no longer be temporarily excluded receivables from time to time, as described under “Receivables—Pool Composition and Credit Enhancement Tests.”

The “pool composition tests” are:

| · |

the weighted average FICO® Score of the obligors with respect to the

receivables is at least 685 (excluding receivables with obligors for whom FICO® Scores are not available),

|

| · |

receivables with obligors for whom FICO® Scores are not available represent no

more than 5.00% of the pool balance,

|

| · |

receivables with obligors that have less than 12 months of customer tenure with Verizon Wireless represent no more than 28.00% of the pool balance,

|

| · |

receivables with obligors that have 7 months or more, but less than 24 months of customer tenure

|

19

with Verizon Wireless represent no more than 15.00% of the pool balance,

| · |

receivables with obligors that have 60 months or more of customer tenure with Verizon Wireless represent at least 50.00% of the pool balance,

|

| · |

receivables with obligors that have less than 12 months customer tenure with Verizon Wireless and (i) for whom FICO® Scores are not available or (ii) that have FICO® Scores below 650, represent no more than 10.00% of the

pool balance,

|

| · |

receivables with obligors that have 12 months or more, but less than 60 months of customer tenure with Verizon Wireless and (i) for whom FICO® Scores are not available or (ii) that have FICO® Scores below 650,

represent no more than 55.00% of the aggregate principal balance of all receivables with obligors that have 12 months or more, but less than 60 months of customer tenure with Verizon Wireless, and

|

| · |

receivables with obligors that have 60 months or more of customer tenure with Verizon Wireless and (i) for whom FICO® Scores are not available or (ii) that have FICO® Scores below 650, represent no more than 30.00% of the

aggregate principal balance of all receivables with obligors that have 60 months or more of customer tenure with Verizon Wireless.

|

The FICO® Score used for purposes of the pool composition

tests above refers to an obligor’s FICO® Score 8 and is calculated on or about the date on which the receivable was originated. For a description of the calculation of each obligor’s customer tenure, see “Origination and Description of Device Payment Plan Agreement Receivables—Origination Characteristics.”

Below are statistics relevant to the pool composition tests. All percentages and averages are based on the aggregate principal balance of

the initial receivables as of the initial cutoff date unless otherwise stated.

|

Weighted average FICO® Score(1)(2)(3)

|

707

|

|

Percentage of receivables with obligors without a FICO® Score(3)

|

2.36%

|

|

Percentage of receivables with obligors with:

|

|

|

Less than 12 months of customer tenure with Verizon Wireless(4)

|

15.78%

|

|

7 months or more, but less than 24 months of customer tenure with Verizon

Wireless(4)

|

8.31%

|

|

60 months or more of customer tenure with Verizon Wireless(4)

|

60.56%

|

|

Percentage of receivables with obligors (i) for whom FICO® Scores are not available or (ii) that have

FICO® Scores below 650 and with:

|

|

|

Less than 12 months of customer tenure with Verizon Wireless(3)(4)

|

7.47%

|

|

12 months or more, but less than 60 months of customer tenure with Verizon

Wireless(3)(4)(5)

|

41.04%

|

|

60 months or more of customer tenure with Verizon Wireless(3)(4)(6)

|

22.49%

|

_________________

| (1) |

Weighted averages are weighted by the aggregate principal balance of the initial receivables as of the initial cutoff date.

|

| (2) |

Excludes receivables that have obligors who did not have FICO® Scores

because they are individuals with minimal or no recent credit history.

|

| (3) |

This FICO® Score reflects the FICO® Score 8 of the related obligor. The FICO® Score is calculated with respect to each obligor on or about the

date on which such receivable was originated.

|

| (4) |

For a complete description of the calculation of customer tenure, see “Origination

and Description of Device Payment Plan Agreement Receivables—Origination Characteristics.”

|

| (5) |

As a percentage of the aggregate principal balance for receivables with obligors with 12 months or more, but less than 60 months of customer tenure with

Verizon Wireless.

|

| (6) |

As a percentage of the aggregate principal balance for receivables with obligors with 60 months or more of customer tenure with Verizon Wireless.

|

Amortization Period

The “amortization period” will begin on

the payment date occurring on the earlier of (i) the payment date occurring in July 2021, or (ii) the payment date on or immediately following the occurrence of an amortization event, and will continue until the final maturity date or an earlier

payment date on which the notes are paid in full. During the amortization period, (a) the trust will be prohibited from purchasing additional receivables and (b) the notes will receive payments of principal in the amounts and priorities

applicable during an amortization period, as set forth under “—Priority of Payments” below.

For a more detailed description of the amortization period, you should read “Description of the Notes—Amortization

Period.”

The following will be “amortization events”

for the notes:

| · |

on any payment date during the revolving period (a) interest due is not paid on the notes, (b) the required

|

20

| · |

a servicer termination event has occurred and is continuing, or

|

| · |

an event of default has occurred and is continuing.

|

For purposes of the amortization event listed in the second bullet point above, “receivables which are written-off” means any receivable that, in accordance with the servicer’s customary servicing practices, has been charged off or written-off by the servicer.

If an amortization event occurs on a payment date, the amortization period will begin on that payment date. If an amortization event occurs

on any date that is not a payment date, the amortization period will begin on the following payment date.

For a more detailed description of the amortization events, you should read “Description of the Notes—Amortization

Period.”

Each of the following events will be an “event

of default” under the indenture:

| · |

failure to pay interest due on any class of notes of the controlling class within five days after any payment date,

|

| · |

failure to pay the note balance of, or any make-whole payments due on, any class of notes in full by its final maturity date,

|

| · |

failure by the trust to observe or perform any material covenant or agreement made in the indenture, or any representation or warranty of the trust made in

the indenture or in any officer’s certificate delivered under the indenture is incorrect in any material respect when made, and, in either case, is not cured for a period of 60 days after written notice was given to the trust by the

indenture trustee (after receipt of written notice or actual knowledge thereof by a responsible officer of the indenture trustee) or to the trust and the indenture trustee by the holders of at least 25% of the note balance of the

controlling class, or

|

reserve amount is not on deposit in the reserve account or (c) the required negative carry amount is

not on deposit in the negative carry account,

| · |

for any payment date, the sum of the fractions, expressed as percentages, for each of the three collection periods immediately preceding that payment date,

calculated by dividing the aggregate principal balance of all receivables which are written-off during each of the three prior collection periods by the pool balance as of the first day of each of those collection periods, multiplied

by four, exceeds 10.00%,

|

| · |

for any payment date, the sum of the fractions, expressed as percentages, for each of the three collection periods immediately preceding that payment date,

calculated by dividing the aggregate principal balance of all receivables that are 91 days or more delinquent at the end of each of the three prior collection periods by the pool balance as of the last day of each of those collection

periods, divided by three, exceeds 2.00%,

|

| · |

the adjusted pool balance is less than 50.00% of the aggregate note balance,

|

| · |

on any payment date, after giving effect to all payments to be made and the acquisition of receivables on that date, the amount of “overcollateralization” for

the notes is not at least equal to the overcollateralization target amount (as defined under “—Credit and Payment

Enhancement—Overcollateralization” below); provided, that if the overcollateralization target amount is not reached on any payment date solely due to a change in the percentage used to calculate the overcollateralization

target amount as described under “—Credit and Payment Enhancement—Overcollateralization” below, that event will not constitute an

“amortization event” unless the overcollateralization target amount is not reached by the end of the third month after the related payment date,

|

21

| · |

a bankruptcy or dissolution of the trust.

|

For a more detailed description of the events of default, you should read “Description of the Notes—Events of Default.”

Each of the following events will be a “servicer

termination event” under the transfer and servicing agreement:

| · |

failure by (i) the servicer to deposit, or to deliver to the owner trustee or indenture trustee for deposit, any collections or payments, (ii) so long as

Cellco is the servicer, the marketing agent to deposit, or to cause the related originators to deposit, any prepayments required by upgrade contracts

under an upgrade program, or (iii) so long as Cellco is the servicer, the parent support provider to make the payments set forth in clause (i) or clause (ii) above to the extent the servicer or marketing agent or any related

originator, respectively, fails to do so, in each case, which failure continues for five business days after the servicer, marketing agent or parent support provider, as applicable, receives written notice of the failure from the