UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | ||

| SECURITIES EXCHANGE ACT OF 1934 | |||

| For the fiscal year ended December 31, 2020 | |||

| OR | |||

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | ||

| SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-55999

LUDUSON G InC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 82-3184409 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

|

17/F, 80 Gloucester Road Wanchai, Hong Kong | ||

|

(Address of principal executive offices and zip code) | ||

Registrant’s telephone number, including area code: + 852 2818 7199

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.0001 par value

Title of each class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Common Stock | Outstanding at March 23, 2021 | |

| Common Stock, $.0001 par value per share | 28,110,000 shares |

The aggregate market value of the 3,080,000 shares of Common Stock of the registrant held by non-affiliates on June 30, 2020, the last business day of the registrant’s second quarter, computed by reference to the closing price reported by the Over-the-Counter Bulletin Board on that date is $400,400.

DOCUMENTS INCORPORATED BY REFERENCE:

None

| i |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected. All statements, other than statements of historical facts, included in this Form 10-K including, without limitation, statements in the “Market Overview” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding the Company’s market projections, financial position, business strategy and the plans and objectives of management for future operations, events or developments which the Company expects or anticipates will or may occur in the future, including such things as future capital expenditures (including the amount and nature thereof); expansion and growth of the Company's business and operations; and other such matters are forward-looking statements. These statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate under the circumstances. However, whether actual results or developments will conform with the Company's expectations and predictions is subject to a number of risks and uncertainties, including general economic, market and business conditions; the business opportunities (or lack thereof) that may be presented to and pursued by the Company; changes in laws or regulation; and other factors, most of which are beyond the control of the Company.

These forward-looking statements can be identified by the use of predictive, future-tense or forward-looking terminology, such as "believes," "anticipates," "expects," "estimates," "plans," "may," "will," or similar terms. These statements appear in a number of places in this filing and include statements regarding the intent, belief or current expectations of the Company, and its directors or its officers with respect to, among other things: (i) trends affecting the Company's financial condition or results of operations for its limited history; (ii) the Company's business and growth strategies; and, (iii) the Company's financing plans. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements as a result of various factors. Such factors that could adversely affect actual results and performance include, but are not limited to, the Company's limited operating history, potential fluctuations in quarterly operating results and expenses, government regulation, technological change and competition. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, please refer to the Risk Factors section of the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on May 22, 2020.

Consequently, all of the forward-looking statements made in this Form 10-K are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequence to or effects on the Company or its business or operations. The Company assumes no obligations to update any such forward-looking statements.

| ii |

ITEM 1. DESCRIPTION OF BUSINESS.

Overview

We were incorporated under the laws of the State of Delaware on March 6, 2014, under the name “Jovanovic-Steele, Inc.” Our name was changed to Baja Custom Designs, Inc. on October 26, 2017. On May 8, 2020, we acquired Luduson Holding Company Limited, a limited liability company organized under the laws of British Virgin Islands (“LHCL”). As a result of our acquisition of LHCL, we entered into the business-to-business gaming technology industry.

We are business-to-business gaming technology company that provides events marketing strategies with a combination of digital interactive solutions and content production services in Hong Kong. In digital marketing industry, we offer business-to-business digital marketing solutions on our proprietary and secure network, which accommodates a wide range of devices and theme-based gaming content, including multi-touch table, body motion sensing, indoor positioning device and electronic circuit system, together with the customized game contents, as an integrated marketing solution. We are principally engaged in developing and granting a right-to-use digital entertainment - interactive game software and providing system development consultancy and maintenance services to our customers and interactive games installations in shopping mall events, exhibitions and brand promotions.

We provide our business customers in entertainment industry with a full line of custom-made interactive gaming services. In this entertainment segment, we offer a customized device box with a library of self-developed interactive game contents, such as, sport-themed social games, motion-sensing action games, logic and puzzle games, original IP characters education game for children, etc., to meet with our business customers’ operational use or business-to-business social solutions.

Our goal is to provide an innovative and effective interactive solution services to satisfy diverse marketing needs. We are committed to working at a high-quality standard to address the needs of differing budgets. We provide services to wide range of customer across different industry segments and regions.

Our principal executive and registered offices are located at 17/F, 80 Gloucester Road, Wanchai, Hong Kong, telephone number +852-2119 1031.

History

We were established as part of the Chapter 11 Plan of Reorganization of Pacific Shores Development, Inc. ("PSD"). PSD and its subsidiary, Jovanovic-Steele, were in the real estate development business, and the real estate crash and the recession of 2008 made it impossible for them to obtain the financing needed to carry on their projects. In 2010, PSD filed for chapter 11 bankruptcy protection. The U.S. Bankruptcy Court for the Southern District of California ordered the incorporation of the Company and the distribution of the following securities:

| · | 80,000 shares of the Company’s common stock were distributed to all general unsecured creditors of PSD on a pro rata basis according to amount of debt held; |

| 1 |

| · | 500,000 shares of the Company’s common stock were distributed to all administrative creditors of PSD, with these creditors receiving one share of common stock in the Company for each $0.10 of PSD's administrative debt held; |

| · | 2,500,000 common stock purchase warrants of the Company were distributed to all administrative creditors of PSD, with these creditors receiving five common stock purchase warrants of the Company for each $0.10 of PSD's administrative debt held. The 2,500,000 warrants consisted of 500,000 "A Warrants" each convertible into one share of common stock at an exercise price of $4.00; 500,000 "B Warrants" each convertible into one share of common stock at an exercise price of $5.00; 500,000 "C Warrants" each convertible into one share of common stock at an exercise price of $6.00; 500,000 "D Warrants" each convertible into one share of common stock at an exercise price of $7.00; and 500,000 "E Warrants" each convertible into one share of common stock at an exercise price of $8.00. All warrants are exercisable at any time prior to August 30, 2020. |

The exercise price of the warrants was reduced to $0.10 per share on April 7, 2020, and on April 15, 2020, the warrant expiration date was extended to August 30, 2025.

On March 6, 2014, we issued 20,000 common shares for services at par value, $0.0001 per share, for total value of $2. On June 16, 2014, we issued a total of 15,000,000 common shares for services at par value, $0.0001 per share, for total value of $1,500. On August 1, 2017, we issued a total of 10,000 common shares for services at par value, $0.0001 per share, for a total value of $1.

On April 3, 2020, the Company, Linda Masters, our Chief Executive Officer and President, entered into that certain Stock Purchase Agreement (the “SPA”), pursuant to which Ms. Masters agreed to sell to Lan CHAN 14,960,000 shares of common stock of the Company, par value $0.0001 (the “Shares”), representing approximately 95.8% of the issued and outstanding common stock of the Company, for aggregate consideration of Three Hundred Ninety One Thousand Dollars ($391,000) in accordance with the terms and conditions of the SPA. The acquisition of the Shares consummated on April 15, 2020, and was purchased by Lan CHAN with his personal funds. As a result of the acquisition, Mr. Chan holds a controlling interest in the Company and may unilaterally determine the election of the Board and other substantive matters requiring approval of the Company’s stockholders.

Upon the consummation of the sale of the Shares, Linda Masters, our Chief Executive Officer, President and director, and Kathleen Chula, our Vice President and Director, resigned from all of their positions with the Company, effective April 15, 2020. Their resignations were not due to any dispute or disagreement with the Company on any matter relating to the Company's operations, policies or practices.

Concurrently with such resignations, Lan CHAN was appointed to serve as the Chief Executive Officer, Chief Financial Officer, President, Secretary and sole Director of the Company, until the next annual meeting of stockholders of the Company and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal. None of the directors or executive officers has a direct family relationship with any of the Company’s directors or executive officers, or any person nominated or chosen by the Company to become a director or executive officer. Mr. Chan will serve in his positions without compensation. The Company hopes to enter into a compensatory arrangement with each officer in the future.

| 2 |

Acquisition of LHCL

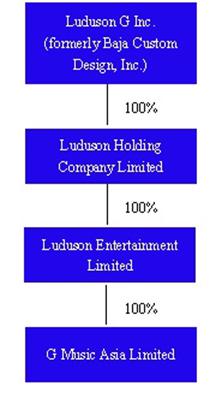

Effective May 22, 2020, we consummated the acquisition of LHCL. As a result of the acquisition, our corporate structure is below:

Our Products and Services

We provide a wide range of interactive game software that targets customers in Hong Kong and China. Notably a number of the games developed, operated or published by us are game adaptations of famous or popular literature, comics or animations. Our game library includes more than 100 games. Our game library consists of our self/co-developed games and third-party developed games. Our self/co-developed games generate revenue primarily from grant a right-to-use to our clients who subscribe to our games via an online portal. Clients are able to select from a wide range of games and download them from our portal.

For shopping malls, exhibition organizers and brand owners, we provide customized interactive games according to the intellectual properties, licenses or brands and offer technical consultancy services, including system deployment, service maintenance and user analytics. After initial commercialization or game launch with specific literature, comics or animations, we would further reuse the game engine to generate another game title with our self-developed characters. The newly developed interactive game will be included to our game library, and provide another stream of revenue, i.e. game license.

| 3 |

Markets and Regions

With the development of digital technology, interactive gaming and its applications have increased their footprint in the marketplace. Interactive gaming involves Sound Design, Interface Design, Design Simulation, Navigation Design, Application Design, etc. Today, interactive technology is used in art and games including in museums, commercial special exhibitions, marketing, mutual media, business innovation, theme parks, etc. We communicate with business customers to assist them in converting their thought into feasible technology, as part of their B2B marketing strategies and solutions to appeal to their target audience in the launch of their marketing events and campaigns.

Traditional forms of gaming such as PC game and online games with its single form of display are gradually being replaced by interactive gaming. The wide application of interactive game has attracted the attention of the public, mobilizing the enthusiasm of participants. We believe that, in the near future, the multimedia interactive games will be well-accepted, especially in Hong Kong and China. We believe that interactive games will become the trend in the 21th century globally.

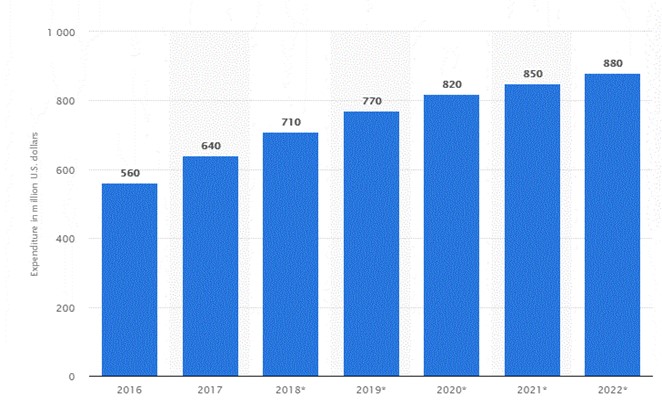

The below statistic shows the digital advertising expenditure in Hong Kong from 2016 to 2022.

* Projected figures

Sourced from Statista 2020

Currently, we derive revenue from two main business segments: digital marketing and entertainment. During the year ended December 31, 2020, our digital marketing and entertainment revenues accounted for 99% and 1% of our revenues as follows:

| Years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| US$ | US$ | |||||||

| Digital marketing | $ | 5,916,380 | $ | 502,324 | ||||

| Entertainment | 19,340 | 924,030 | ||||||

| $ | 5,935,720 | $ | 1,426,354 | |||||

| 4 |

We commenced our operations in Hong Kong. Our services and products are marketed and sold in Hong Kong and China. During the years ended December 31, 2020 and 2019, our revenues are attributable from the following regions:

| Region |

Revenue Percentage Year Ended December 31, 2020 |

Revenue Percentage Year Ended December 31, 2019 |

| Hong Kong | 56% | 63% |

| China | 44% | 37% |

| All other regions | –% | –% |

Digital Marketing

In Hong Kong, we usually co-operate with shopping malls, exhibition organizers, brand owners and marketing agency, offering events marketing strategies with the combination of intellectual-property or branding interactive game solutions in order to provide entertainment experiences to our target audience and increase attractions to the venue.

Entertainment

For the entertainment industry, the marketing strategy is slightly different. We offer and provide the library of our custom-made game contents in a customized computer device through a plug and play model for business-to-business (B2B) content aggregation used by their operators. Our device is easily connected to TV sets and our game contents are freely distributed to play for leisure and entertainment, such as, sport-themed social games, motion-sensing action games, logic and puzzle games, original IP characters education games for children, etc.

As of December 31, 2020, the following customers represented 10% or more of our revenues:

| Revenues (US$) | Percentages of Revenues | Accounts Receivable (US$) | ||||||||||

| Ease Audio Group Limited | $ | 3,284,657 | 55% | $ | 2,041,928 | |||||||

| Yu Lin Nuo Ya Interactive Entertainment Company Limited | 1,448,086 | 24% | 1,352,108 | |||||||||

| Shenzhen Jiu Sheng Optoelectronic Comm Tech Co., Ltd | 1,183,637 | 20% | 1,088,683 | |||||||||

| Total: | $ | 5,916,380 | 99% | $ | 4,482,719 | |||||||

As of December 31, 2019, the following customers represented 10% or more of our revenues:

| Revenues (US$) | Percentages of Revenues | Accounts Receivable (US$) | ||||||||||

| Shenzhen Jiu Sheng Optoelectronic Comm Tech Co., Ltd | $ | 316,545 | 22% | $ | 132,268 | |||||||

| Excellent Entertainment Limited | 256,555 | 18% | 139,331 | |||||||||

| Ease Audio Group Limited | 245,067 | 17% | 169,508 | |||||||||

| Yu Lin Nuo Ya Interactive Entertainment Company Limited | 210,604 | 15% | 94,000 | |||||||||

| Knotbase Technology Limited | 185,077 | 13% | 105,301 | |||||||||

| Total: | $ | 1,213,848 | 85% | $ | 640,408 | |||||||

| 5 |

Our Strategies

We are focused on executing on key strategies to achieve long-term growth in revenues, profit and cash flow. We seek to achieve our targets by delivering innovative and differentiated products that provide value to our clients and exciting experiences. We place great emphasis on developing creative solutions, in terms of interactive game and play, that deliver and sustain superior performance primarily for distributed gaming. This networked strategy often allows us to update our games and operating software remotely, keeping pace with evolving requirements in game play, security, technology and regulations.

Our primary objectives are (i) to strengthen our position as an operator and developer in the interactive game industry in Hong Kong and China and (ii) to actively expand into overseas markets in respect of self/co-developed games. To this end, we plan to pursue the following business strategies:

| · | expand our game portfolio through developing more high-quality self/co-developed games and introducing licensed games with a focus on interactive games; |

| · | continue to secure development rights for popular literatures, comics and animations; |

| · | fully utilize existing games and development rights to broaden our revenue stream; |

| · | enhance our game development capacity and increase the investment in game technology to increase the number of self-developed games; |

| · | consolidate our market position and enhance our marketing efforts; |

| · | pursue strategic alliances and acquisition opportunities; |

| · | further expand into the interactive gaming market in China; |

| · | broaden reach into international markets; and |

| · | pursue strategic acquisitions and partnerships |

We currently develop and operate interactive games. To maximize the value of our self/co-developed games, we intend to explore market opportunities of other geographic markets by offering other language versions (such as English or Malay or Chinese versions) of our self/co-developed games.

We strive to introduce high-quality games and deliver a superior game experience to our customers in order to retain their interest in our games. It is our constant endeavour to elevate the awareness of our brand-name in order to associate our brand with high-quality games and appealing game experience. This is achieved through investments in our game development team and staff, upgrades of software such as game engines, game-designing tools, and the acquisition of hardware to accommodate increasing technical demands for operating the games. Furthermore, we believe that our investment in technology, both in terms of hardware and software, would raise the barrier to entry for future competitors as well as maintaining our competitive edge against existing competitors.

| 6 |

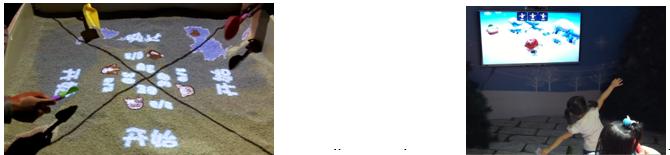

Here are some rolling campaigns with the distribution of interactive game contents in the marketing events.

| 7 |

|

Here is our customized computer device with a full line of our custom-made interactive game contents to offer the entertainment service, which we install a variety of digital games, such as:

· sport-themed social games, · motion-sensing action games, · logic and puzzle games, · original IP characters education game for children, etc.

| |

|

|

Examples of cartoon-themed game and motion-sensing action game.

Development and Modification

Our project team in our technical department is responsible for creating game logic, in-game graphics as long as music and sound effect. The project team may further adopt other interactive technologies such as augmented reality (AR), virtual reality (VR), mixed reality (MR), human motion sensing, gesture control, location-based detection, projection mapping and other special effects to our game so as to maximize the gaming experience for our players. We engage external service providers for the soundtracks, motion pictures and part of the artwork associated with the game. We also engage external third party services providers for special-themed game artwork.

| 8 |

During the development process, our project team will test-play the game to look for errors, bugs, lagging, faulty designs and etc. This is a continuous process until the project manager is satisfied with the performance and the overall playability of the alpha version.

INTELLECTUAL PROPERTY AND PATENTS

We expect to rely on, trade secrets, copyrights, know-how, trademarks, license agreements and contractual provisions to establish our intellectual property rights and protect our “Luduson” brand, as well as its related products and services. These legal means, however, afford only limited protection and may not adequately protect our rights. Litigation may be necessary in the future to enforce our intellectual property rights, protect our trade secrets or determine the validity and scope of the proprietary rights of others. Litigation could result in substantial costs and diversion of resources and management attention.

The laws of Hong Kong, China and our target countries may not protect our brand and services and intellectual property to the same extent as U.S. laws, if at all. We may be unable to fully protect our intellectual property rights in these countries. Further, companies in the internet, social media technology and other industries may own large numbers of patents, copyrights and trademarks and may frequently request license agreements, threaten litigation or file suit against us based on allegations of infringement or other violations of intellectual property rights.

We intend to seek the widest possible protection for significant product and process developments in our major markets through a combination of copyrights, trade secrets, trademarks, patents, confidentiality provisions and procedures and other contractual provisions, if applicable. We anticipate that the form of protection will vary depending upon the level of protection afforded by the particular jurisdiction. We expect that our revenue will be derived principally from our operations in Hong Kong and China where intellectual property protection may be limited and difficult to enforce. In such instances, we may seek protection of our intellectual property through measures taken to increase the confidentiality of our findings.

We intend to register trademarks as a means of protecting the brand names of our companies and products. We intend protect our trademarks against infringement and also seek to register design protection where appropriate.

We rely on trade secrets and unpatentable know-how that we seek to protect, in part, by confidentiality agreements. We expect that, where applicable, we will require our employees to execute confidentiality agreements upon the commencement of employment with us. We expect these agreements to provide that all confidential information developed or made known to the individual during the course of the individual's relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. The agreements will also provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of our company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

We also devote financial and operational resources to implement systems, processes and technologies to guard against cyber events and to help protect our intellectual property, employee and consumer data and information technology systems against intrusions or other security breaches. In addition, we engage in activities designed to limit the impact of abuse of our digital products and services, including monitoring our games for evidence of exploitation and re-balancing our game environments in the event that such abuse is discovered.

COMPETITION

Competition in the game industry is intense in Hong Kong and China. We compete with other game developers, operators and publishers of interactive games in Hong Kong and China. We may also face competition from emerging mobile game developers, operators and publishers, as well as some traditional online PC game companies that are entering the mobile game market. The game industry is fragmented and sensitive to price and service. We believe the principal competitive factors in our market include the following:

| 9 |

| · | strong in-house game development expertise with a track record of successful games and robust pipeline; |

| · | leading publishing platform; |

| · | large game portfolio and diversified publishing network; and |

| · | collaborative culture led by a stable management team. |

| · | local presence and understanding of local business trends; |

| · | ability to minimize the time-to-market of the game solutions; |

| · | ability to build up a high volume of game titles in the library; |

| · | ability to form partnership with famous IP and brand owners; |

| · | ability to assist our client to generate positive feedback on adopting our products; and |

| · | strength and recognition of our brand. |

Although we believe we compete favorably on the factors described above, many of our current and potential competitors have longer operating histories, significantly greater financial, technical, marketing and other resources, larger product and services offerings, larger customer base and greater brand recognition. These factors may allow our competitors to benefit from their existing customer base with lower development costs or to respond more quickly than we can to new or emerging technologies and changes in customer requirements.

These competitors may engage in more extensive research and development efforts, undertake more far-reaching marketing campaigns and adopt more aggressive pricing policies, which may allow them to build a larger customer base more effectively than us. Our competitors may develop products or services that are similar to our products and services or that achieve greater market acceptance than our products and services. In addition, although we do not believe that customer payment terms are a principal competitive factor in our market, they may become such a factor, and we may be unable to compete on such terms.

EMPLOYEES

As of March 23, 2021, we have the following full time employees:

| Administration / Finance | 3 | |||

| Total | 3 |

We work with our programmers and developers on a contractual basis as they are not employees of the Company.

All of our employees are located in Hong Kong. None of our employees are members of a trade union. We believe that we maintain good relationships with our employees and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

GOVERNMENT AND INDUSTRY REGULATIONS

We are subject to the general laws in Hong Kong governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

The Employment Ordinance is the main piece of legislation governing conditions of employment in Hong Kong since 1968. It covers a comprehensive range of employment protection and benefits for employees, including Wage Protection, Rest Days, Holidays with Pay, Paid Annual Leave, Sickness Allowance, Maternity Protection, Statutory Paternity Leave, Severance Payment, Long Service Payment, Employment Protection, Termination of Employment Contract, Protection Against Anti-Union Discrimination. In addition, every employer must take out employees’ compensation insurance to protect the claims made by employees in respect of accidents occurred during the course of their employment.

| 10 |

An employer must also comply with all legal obligations under the Mandatory Provident Fund Schemes Ordinance, (CAP485). These include enrolling all qualifying employees in MPF schemes and making MPF contributions for them. Except for exempt persons, employer should enroll both full-time and part-time employees who are at least 18 but under 65 years of age in an MPF scheme within the first 60 days of employment. The 60-day employment rule does not apply to casual employees in the construction and catering industries. Pursuant to the said Ordinance, we are required to make MPF contributions for our Hong Kong employees once every contribution period (generally the wage period within 1 month). Employers and employees are each required to make regular mandatory contributions of 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly-paid employee, the minimum and maximum relevant income levels are $7,100 and $30,000, respectively.

Seasonality.

Our business is highly dependent upon various festivals in Hong Kong and China. In Hong Kong and China, we experience peak demand for our services during Chinese new year, Easter holiday, summer holiday and Christmas in December.

Insurance.

Our business is located in Hong Kong are subject to the laws and regulations of Hong Kong governing businesses concerning, in particular labor, occupational safety and health, contracts, tort and intellectual property. Furthermore, we need to comply with the rules and regulations of Hong Kong governing the data usage and regular terms of service applicable to our potential customers or clients. As the information of our potential customers or clients is preserved in Hong Kong, we need to comply with the Hong Kong Personal Data (Privacy) Ordinance.

CORPORATE INFORMATION

Our principal executive and registered offices are located at 17/F, 80 Gloucester Road, Wanchai, Hong Kong, telephone number +852-2119 1031.

Near-Term Requirements For Additional Capital

We believe that we will require approximately $1,000,000 over the next 18-24 months to implement our business plan of expanding throughout Hong Kong. For the immediate future, we intend to finance our business expansion efforts through loans from existing shareholders or financial institutions.

Available Information

Access to all of our Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is provided, free of charge, on our website (www.luduson.com) as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC.

Globex Transfer, LLC located at 780 Deltona Boulevard, Suite 202, Deltona, Florida 32725, telephone number (813) 344-4490, facsimile (386) 267-3124, serves as our stock transfer agent.

| 11 |

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

ITEM 1B. Unresolved Staff Comments.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

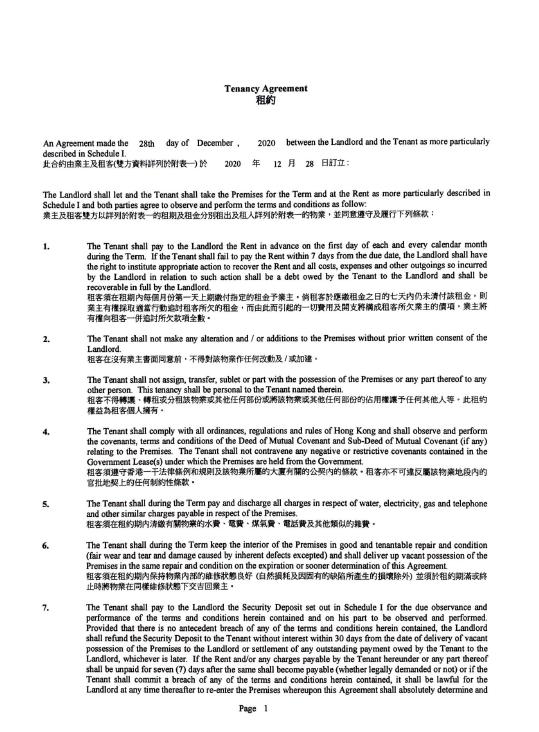

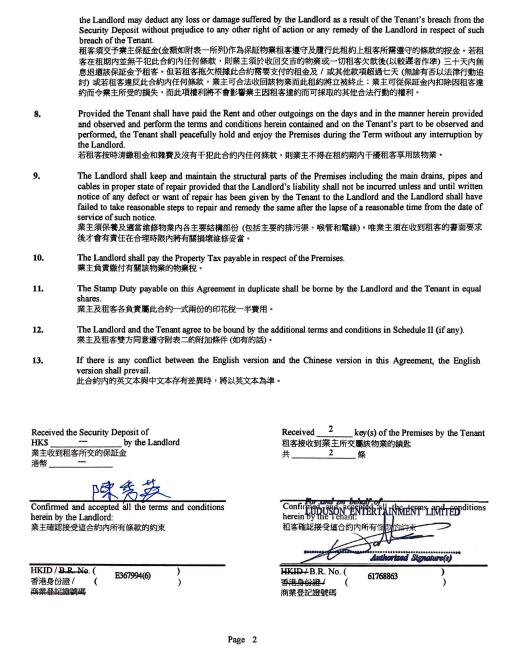

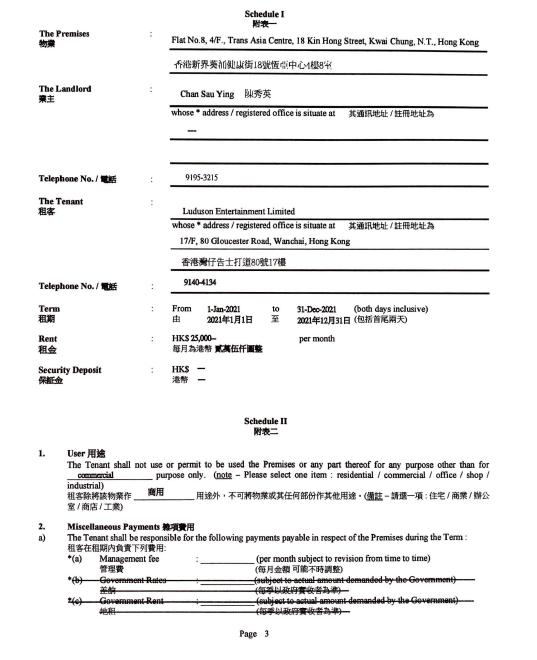

We maintain our approximately 2,186 square feet production workshop at Room 8, 4/F, Trans Asia Centre, 18 Kin Hong St, Kwai Chung, Kowloon, Hong Kong. According to the lease, we pay a monthly rent of HK$25,000 (approximately US$3,205). The lease initially expired on December 31, 2020, but was extended for an additional one (1) year term to December 31, 2021. The foregoing description of the lease and lease extension is qualified in its entirety by reference to the Lease Agreement and Extension Agreement, which are filed as Exhibits 10.1 and 10.2 to this Annual Report and incorporated herein by reference.

We believe that our current facilities are adequate for our current needs. We expect to secure new facilities or expand existing facilities as necessary to support future growth. We believe that suitable additional space will be available on commercially reasonable terms as needed to accommodate our operations.

There are no material pending legal proceedings to which we or our subsidiaries are a party or to which any of our or their property is subject, nor are there any such proceedings known to be contemplated by governmental authorities. None of our directors, officers, affiliates or any owner of record or beneficially of more than 5% of our common stock, or any associate of any of the foregoing, is involved in a proceeding adverse to our business or has a material interest adverse to our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

| 12 |

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

(a) Market Information

Shares of our common stock are quoted on the OTC Pink under the symbol “LDSN”. Shares of our common stock began trading on April 1, 2020. As of March 23, 2021, the last closing price of our securities was $0, with little to no quoting activity. There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained.

The following table sets forth, for the fiscal quarters indicated, the high and low bid information for our common stock, as reported on the Pink Sheets. The following quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

| Quarterly period | High | Low | ||||||

| Fiscal year ended December 31, 2020: | ||||||||

| Fourth Quarter | $ | 2.00 | $ | 0.13 | ||||

| Third Quarter | $ | 0.13 | $ | 0.13 | ||||

| Second Quarter | $ | 0.13 | $ | 0.13 | ||||

| First Quarter | $ | – | $ | – | ||||

| Fiscal year ended December 31, 2019: | ||||||||

| Fourth Quarter | $ | – | $ | – | ||||

| Third Quarter | $ | – | $ | – | ||||

| Second Quarter | $ | – | $ | – | ||||

| First Quarter | $ | – | $ | – | ||||

(b) Approximate Number of Holders of Common Stock

As of March 23, 2021, there were approximately 61 shareholders of record of our common stock. Such number does not include any shareholders holding shares in nominee or “street name”.

(c) Dividends

Holders of our common stock are entitled to receive such dividends as may be declared by our board of directors. On January 2, 2020, prior to the consummation of the acquisition of LHCL, LHCL declared and paid dividends of $184,919 to the shareholders. Except as otherwise set forth above, we paid no dividends during the periods reported herein, nor do we anticipate paying any dividends in the foreseeable future.

(d) Equity Compensation Plan Information

None.

(e) Recent Sales of Unregistered Securities

None.

| 13 |

ITEM 6. Selected Financial Data.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company and its subsidiary for the fiscal years ended December 31, 2021, and 2020. The discussion and analysis that follows should be read together with the section entitled “Cautionary Note Concerning Forward-Looking Statements” and our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this annual report on Form 10-K.

Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report.

Currency and exchange rate

Unless otherwise noted, all currency figures quoted as “U.S. dollars”, “dollars” or “US$” refer to the legal currency of the United States. References to “Hong Kong Dollar” are to the Hong Kong Dollar, the legal currency of the Hong Kong Special Administrative Region of the People’s Republic of China. Throughout this report, assets and liabilities of the Company’s subsidiaries are translated into U.S. dollars using the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiaries are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity.

Impact of COVID-19 on our business

The outbreak of COVID-19 that started in late January 2020 in the PRC has negatively affected our business. In March 2020, the World Health Organization declared COVID-19 as a pandemic and has resulted in quarantines, travel restrictions, and the temporary closure of stores and business facilities in China and the U.S. in the subsequent months. Given the rapidly expanding nature of the COVID-19 pandemic, and because substantially all of the Company’s business operations and its workforce are concentrated in China, the Company’s business, results of operations, and financial condition for calendar year 2020 have been adversely affected.

Management believes that COVID-19 could continue to have a material impact on its financial results for the first half of calendar year 2021 and could cause the potential impairment of certain assets. To mitigate the overall financial impact of COVID-19 on the Company’s business, management has worked closely with its service centers to enhance their marketing and promotion activities during the second quarter of 2021 that were designed to generate sales in the second, third and fourth quarters of 2021.

To resume normal operations in the second quarter of 2021, we believe that the Company can generate sufficient cash flow over the next 12 months to implement the revised business plan.

| 14 |

Results of Operations

Our audited consolidated financial statements have been prepared on a going concern basis, which assumes that we will be able to continue to operate in the future in the normal course of business. In our audited condensed consolidated financial statements for the year ended December 31, 2020, it has included a note about our ability to continue as a going concern due to consecutive quarterly losses from operations in 2020 as a result of COVID-19. Business closures in Hong Kong and limitations on business operations arising from COVID-19 has significantly disrupted our ability to generate revenues and cash flow during the fiscal year 2020.

The success of our business strategy is dependent in part upon the availability of additional capital resources on terms satisfactory to management as we are not generating sufficient revenues from our business operations. Our sources of capital in the past have included advance from stockholders and affiliates. There can be no assurance that we can raise such additional capital resources on satisfactory terms. We believe that our current cash and other sources of liquidity discussed above are adequate to support operations for at least the next 12 months. We anticipate continuing to rely on equity sales of our common shares and shareholder loans in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our plan of operations.

Comparison of the years ended December 31, 2020 and December 31, 2019

The following table sets forth certain operational data for the years ended December 31, 2020 and 2019:

| Years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenues | $ | 5,935,720 | $ | 1,426,354 | ||||

| Cost of revenue | (1,027,662 | ) | (283,828 | ) | ||||

| Gross profit | 4,908,058 | 1,142,526 | ||||||

| Total operating expenses | (659,097 | ) | (164,293 | ) | ||||

| Other (expenses) income | (1,898 | ) | 2 | |||||

| Income before Income Taxes | 4,247,063 | 978,235 | ||||||

| Income tax expense | (602,877 | ) | (138,959 | ) | ||||

| Net income | 3,644,186 | 839,276 | ||||||

| Net income (excluding stock-based compensation expense) | 3,969,186 | 839,276 | ||||||

Revenue. We generated revenues of $5,935,720 and $1,426,354 for the years ended December 31, 2020 and 2019. The significant increase is due to the increase in business volume in digital advertising income from online entertainment portal. To cope with the change to entertaining lifestyle since the COVID-19 pandemic, during the quarter ended June 30, 2020 we launched our self-developed online portal and shared freely our game contents with users, with online advertising services.

| 15 |

During the years ended December 31, 2020, the following customers accounted for 10% or more of our total net revenues:

| Revenues (US$) | Percentages of Revenues | Accounts Receivable (US$) | ||||||||||

| Ease Audio Group Limited | $ | 3,284,657 | 55% | $ | 2,041,928 | |||||||

| Yu Lin Nuo Ya Interactive Entertainment Company Limited | 1,448,086 | 24% | 1,352,108 | |||||||||

| Shenzhen Jiu Sheng Optoelectronic Comm Tech Co., Ltd | 1,183,637 | 20% | 1,088,683 | |||||||||

| Total: | $ | 5,916,380 | 99% | $ | 4,482,719 | |||||||

During the years ended December 31, 2019, the following customers accounted for 10% or more of our total net revenues:

| Revenues (US$) | Percentages of Revenues | Accounts Receivable (US$) | ||||||||||

| Shenzhen Jiu Sheng Optoelectronic Comm Tech Co., Ltd | $ | 316,545 | 22% | $ | 132,268 | |||||||

| Excellent Entertainment Limited | 256,555 | 18% | 139,331 | |||||||||

| Ease Audio Group Limited | 245,067 | 17% | 169,508 | |||||||||

| Yu Lin Nuo Ya Interactive Entertainment Company Limited | 210,604 | 15% | 94,000 | |||||||||

| Knotbase Technology Limited | 185,077 | 13% | 105,301 | |||||||||

| Total: | $ | 1,213,848 | 85% | $ | 640,408 | |||||||

All customers are located in the PRC and Hong Kong.

Cost of Revenue. Cost of revenue for the year ended December 31, 2020, was $1,027,662, and as a percentage of net revenue, approximately 17.3%. Cost of revenue for the year ended December 31, 2019, was $283,828, and as a percentage of net revenue, approximately 19.9%. Cost of revenue increased primarily as a result of the increase in our business volume.

Gross Profit. We achieved a gross profit of $4,908,058 and $1,142,526 for the years ended December 31, 2020 and 2019, respectively. The increase in gross profit is primarily attributable to the increase in our business volume.

Operating Expenses. We incurred operating expenses of $659,097 and $164,293 for the years ended December 31, 2020, and 2019, respectively. Operating expenses for the year ended December 31, 2020, consisted of $325,000 in share based compensation, $127,416 of professional fees and $206,681 of general and administrative expenses. Operating expenses for the year ended December 31, 2019, consisted solely of general and administrative expenses. The increase in general and administrative expenses is attributable to the increase in our business volume.

Income Tax Expense. Our income tax expenses for the years ended December 31, 2020 and 2019 was $602,877 and $138,959, respectively.

Net Income. We incurred a net income of $3,644,186 and $839,276 for the years ended December 31, 2020 and 2019, respectively. The increase in net income is primarily attributable to the increase in our business volume.

Liquidity and Capital Resources

As of December 31, 2020, we had cash and cash equivalents of $40,447, accounts receivable of $4,499,746, and deposits, prepayments and other receivables of $665,051.

| 16 |

As of December 31, 2019, we had cash and cash equivalents of $269,691, accounts receivable of $760,733, and deposits, prepayments and other receivables of $142,001 and operating right-of-use assets of $35,816.

We believe that our current cash and other sources of liquidity discussed below are adequate to support general operations for at least the next 12 months.

| Years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Net cash provided by operating activities | $ | 422,094 | $ | 97,331 | ||||

| Net cash used in investing activities | (462,109 | ) | – | |||||

| Net cash (used in) provided by financing activities | (195,154 | ) | 138,596 | |||||

Net Cash Provided by Operating Activities.

For the year ended December 31, 2020, net cash provided by operating activities was $422,094, which consisted primarily of a net income of $3,644,186, stock-based compensation expense of $325,000, depreciation of plant and equipment of $48,889, non-cash lease expenses of $35,600, an increase in tax payable of $603,758, an increase in accounts payable of $3,251, and increase in lease liabilities of $2,051 and an increase in accrued expenses and other payable of $22,232, offset by an increase in accounts receivable of $3,739,013 and an increase in deposits, prepayments and other receivables of $523,050.

For the year ended December 31, 2019, net cash provided by operating activities was $97,331, which consisted primarily of net income of $839,276, depreciation of plant and equipment of $5,946, non-cash lease expenses of $874 and an increase of tax payable of $138,959, offset by an increase in accounts receivable of $746,361, an increase in deposits, prepayments and other receivables of $138,809 and a decrease in accrued expenses and other payables of $2,554.

Net Cash Used In Investing Activities.

For the year ended December 31, 2020, cash used in investing activities was $462,109 from the purchase of plant and equipment.

For the year ended December 31, 2019, there is no net cash provided by investing activities.

Net Cash (Used In) Provided by Financing Activities.

For the year ended December 31, 2020, net cash used in financing activities was $195,154 consisting primarily of $184,919 dividend paid to the shareholder of the Company and repayment of lease liabilities of $38,525, offset by $28,290 advances from a director.

For the year ended December 31, 2019, net cash provided by financing activities was $138,596, consisting primarily of advances from a director.

Off-Balance Sheet Arrangements

We have not entered into any financial guarantees or other commitments to guarantee the payment obligations of any third parties. In addition, we have not entered into any derivative contracts that are indexed to our own shares and classified as shareholders’ equity, or that are not reflected in our financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. Moreover, we do not have any variable interest in an unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

| 17 |

Critical Accounting Policies and Estimates

We prepare our financial statements in conformity with accounting principles generally accepted by the United States of America (“U.S. GAAP”), which require us to make judgments, estimates, and assumptions that affect our reported amount of assets, liabilities, revenue, costs and expenses, and any related disclosures. Although there were no material changes made to the accounting estimates and assumptions in the past three years, we continually evaluate these estimates and assumptions based on the most recently available information, our own historical experience and various other assumptions that we believe to be reasonable under the circumstances. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from our expectations as a result of changes in our estimates.

We believe that our accounting policies involve a higher degree of judgment and complexity in their application and require us to make significant accounting estimates. Accordingly, the policies we believe are the most critical to understanding and evaluating our consolidated financial condition and results of operations are summarized in “Note 3 - Summary of Significant Accounting Policies” in the notes to our consolidated financial statements.

Recent Accounting Pronouncements

See “Note 2 - Summary of Significant Accounting Policies” in the notes to our consolidated financial statements for a discussion of recent accounting pronouncements.

The Company believes that other recent accounting pronouncement will not have a material effect on the Company’s consolidated financial position, results of operations and cash flows.

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. Financial Statements and Supplementary Data.

The consolidated financial statements and the Report of Independent Registered Certified Public Accounting Firm thereon are filed pursuant to this Item 8 and are included in this report beginning on page F-1.

| 18 |

LUDUSON G INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| F-1 |

|

TOTAL ASIA ASSOCIATES PLT (AF002128 & LLP0016837-LCA) A Firm registered with US PCAOB and Malaysian MIA

Block C-3-1, Megan Avenue 1, 189, Off Jalan Tun Razak, 50400, Kuala Lumpur. Tel: (603) 2733 9989 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Shareholders of

LUDUSON G INC.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Luduson G Inc. and its subsidiaries (the ‘Company’) as of December 31, 2020 and 2019, and the related consolidated statements of operations and comprehensive income, changes in shareholders’ equity and cash flows for the years ended December 31, 2020 and 2019, and the related notes (collectively referred to as the “financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for the years ended December 31, 2020 and 2019, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ TOTAL ASIA ASSOCIATES PLT

TOTAL ASIA ASSOCIATES PLT

March 25, 2021

We have served as the Company’s auditor since 2020.

Kuala Lumpur, Malaysia

| F-2 |

LUDUSON G INC.

AS OF DECEMBER 31, 2020 and 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| As of December 31, | ||||||||

| 2020 | 2019 | |||||||

| ASSETS | ||||||||

| Current asset: | ||||||||

| Cash and cash equivalents | $ | 40,447 | $ | 269,691 | ||||

| Accounts receivable | 4,499,746 | 760,733 | ||||||

| Deposits, prepayments and other receivables | 665,052 | 142,001 | ||||||

| Operating lease right-of-use assets | – | 35,816 | ||||||

| Total current assets | 5,205,245 | 1,208,241 | ||||||

| Non-current asset: | ||||||||

| Plant and equipment | 422,414 | 9,172 | ||||||

| TOTAL ASSETS | $ | 5,627,659 | $ | 1,217,413 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 3,251 | $ | – | ||||

| Accrued liabilities and other payables | 23,521 | 1,289 | ||||||

| Tax payable | 743,562 | 139,804 | ||||||

| Operating lease liabilities | – | 36,690 | ||||||

| Amount due to a director | 28,290 | – | ||||||

| Total current liabilities | 798,624 | 177,783 | ||||||

| TOTAL LIABILITIES | 798,624 | 177,783 | ||||||

| Commitments and contingencies | – | – | ||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Preferred stock, $0.0001 par value, 20,000,000 shares authorized, no shares issued and outstanding at December 31, 2020 and 2019, respectively | – | – | ||||||

| Common stock, $0.0001 par value, 100,000,000 shares authorized, 28,110,000 and 10,000,000 shares issued and outstanding at December 31, 2020 and 2019, respectively | 2,811 | 1,000 | ||||||

| Additional paid-in capital | 332,189 | 9,000 | ||||||

| Accumulated other comprehensive income | 10,573 | 5,435 | ||||||

| Retained earnings | 4,483,462 | 1,024,195 | ||||||

| Shareholders’ equity | 4,829,035 | 1,039,630 | ||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 5,627,659 | $ | 1,217,413 | ||||

See accompanying notes to consolidated financial statements.

| F-3 |

LUDUSON G INC.

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”))

| Years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Revenue, net | $ | 5,935,720 | $ | 1,426,354 | ||||

| Cost of revenue | (1,027,662 | ) | (283,828 | ) | ||||

| Gross profit | 4,908,058 | 1,142,526 | ||||||

| Operating expenses: | ||||||||

| General and administrative expenses | (531,681 | ) | (164,293 | ) | ||||

| Professional fee | (127,416 | ) | – | |||||

| Total operating expenses | (659,097 | ) | (164,293 | ) | ||||

| Other (expenses) income: | ||||||||

| Interest income | 40 | 2 | ||||||

| Interest expenses | (1,938 | ) | – | |||||

| Total other (expenses) income | (1,898 | ) | 2 | |||||

| INCOME BEFORE INCOME TAXES | 4,247,063 | 978,235 | ||||||

| Income tax expense | (602,877 | ) | (138,959 | ) | ||||

| NET INCOME | 3,644,186 | 839,276 | ||||||

| Other comprehensive income: | ||||||||

| Foreign currency translation gain | 5,138 | 6,152 | ||||||

| COMPREHENSIVE INCOME | $ | 3,649,324 | $ | 845,428 | ||||

| Net income per share: | ||||||||

| Basic and diluted | $ | 0.18 | $ | 0.08 | ||||

| Weighted average shares outstanding | ||||||||

| Basic and diluted | 20,332,350 | 10,000,000 | ||||||

See accompanying notes to consolidated financial statements.

| F-4 |

LUDUSON G INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”))

| Years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash flow from operating activities: | ||||||||

| Net income | $ | 3,644,186 | $ | 839,276 | ||||

| Adjustments to reconcile net income to net cash generated from operating activities | ||||||||

| Depreciation of plant and equipment | 48,889 | 5,946 | ||||||

| Share-based compensation for services | 325,000 | – | ||||||

| Non-cash lease expenses | 35,600 | 874 | ||||||

| Change in operating assets and liabilities: | ||||||||

| Accounts receivable | (3,739,013 | ) | (746,361 | ) | ||||

| Deposits, prepayments and other receivables | (523,050 | ) | (138,809 | ) | ||||

| Accounts payable | 3,251 | – | ||||||

| Accrued expenses and other payables | 22,232 | (2,554 | ) | |||||

| Lease liabilities | 2,051 | – | ||||||

| Tax payable | 603,758 | 138,959 | ||||||

| Net cash generated from operating activities | 422,904 | 97,331 | ||||||

| Cash flow from investing activities: | ||||||||

| Purchases of plant and equipment | (462,109 | ) | – | |||||

| Net cash used in investing activities | (462,109 | ) | – | |||||

| Cash flow from financing activities: | ||||||||

| Advances from a director | 28,290 | 138,596 | ||||||

| Repayment of lease liabilities | (38,525 | ) | – | |||||

| Dividend paid to former shareholders | (184,919 | ) | – | |||||

| Net cash (used in) generated from financing activities | (195,154 | ) | 138,596 | |||||

| Effect on exchange rate change on cash and cash equivalents | 5,115 | 6,949 | ||||||

| Net change in cash and cash equivalents | (229,244 | ) | 242,876 | |||||

| BEGINNING OF YEAR | 269,691 | 26,815 | ||||||

| END OF YEAR | $ | 40,447 | $ | 269,691 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Cash paid for tax | $ | – | $ | – | ||||

| Cash paid for interest | $ | – | $ | – | ||||

See accompanying notes to consolidated financial statements.

| F-5 |

LUDUSON G INC.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| Common stock | Additional paid-in | Accumulated other comprehensive (loss) | Retained | Total shareholders’ | ||||||||||||||||||||

No. of shares | Amount | capital | income | earnings | equity | |||||||||||||||||||

| Balance as at January 1, 2019 (restated) | 10,000,000 | $ | 1,000 | $ | 9,000 | $ | (717 | ) | $ | 184,919 | $ | 194,202 | ||||||||||||

| Foreign currency translation adjustment | – | – | – | 6,152 | – | 6,152 | ||||||||||||||||||

| Net income for the year | – | – | – | – | 839,276 | 839,276 | ||||||||||||||||||

| Balance as at December 31, 2019 | 10,000,000 | $ | 1,000 | $ | 9,000 | $ | 5,435 | $ | 1,024,195 | $ | 1,039,630 | |||||||||||||

| Balance as at January 1, 2020 | 10,000,000 | $ | 1,000 | $ | 9,000 | $ | 5,435 | $ | 1,024,195 | $ | 1,039,630 | |||||||||||||

| Dividends paid to former shareholders | – | – | – | – | (184,919 | ) | (184,919 | ) | ||||||||||||||||

| – | – | |||||||||||||||||||||||

| Shares issued for acquisition of legal acquirer | 15,610,000 | 1,561 | (1,561 | ) | – | – | – | |||||||||||||||||

| Shares issued for service rendered | 2,500,000 | 250 | 324,750 | – | – | 325,000 | ||||||||||||||||||

| Foreign currency translation adjustment | – | – | – | 5,138 | – | 5,138 | ||||||||||||||||||

| Net income for the year | – | – | – | – | 3,644,186 | 3,644,186 | ||||||||||||||||||

| Balance as at December 31, 2020 | 28,110,000 | $ | 2,811 | $ | 332,189 | $ | 10,573 | $ | 4,483,462 | $ | 4,829,035 | |||||||||||||

See accompanying notes to consolidated financial statements.

| F-6 |

LUDUSON G INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| 1. | DESCRIPTION OF BUSINESS AND ORGANIZATION |

Luduson G Inc. (formerly Baja Custom Designs, Inc., or "the Company" or "LDSN") was organized under the laws of the State of Delaware on March 6, 2014 under the name Jovanovic-Steele, Inc. The Company’s name was changed to Baja Custom Designs, Inc. on September 30, 2017. The Company was established as part of the Chapter 11 Plan of Reorganization of Pacific Shores Development, Inc. ("PSD"). The Company’s name was further changed to Luduson G Inc. on July 15, 2020.

On April 15, 2020, Linda Master, the former Chief Executive Officer, President and majority owner of the Company, sold 14,960,000 shares of her common stock of the Company, or 95.8% of the issued and outstanding stock of the Company, to Lan Chan, the current Chief Executive Officer, Chief Financial Officer and Secretary of the Company.

On May 8, 2020, the Company executed a Share Exchange Agreement with Luduson Holding Company Limited, a limited liability company organized under the laws of British Virgin Islands (“LHCL”), and the shareholders of LHCL. Pursuant to the Share Exchange Agreement, the Company purchased Ten Thousand (10,000) shares of LHCL (the “LHCL Shares”), representing all of the issued and outstanding shares of common stock of LHCL. As consideration, the Company agreed to issue to the shareholders of LHCL Ten Million (10,000,000) shares of its common stock, at a value of US$0.10 per share, for an aggregate value of US$1,000,000. The Company consummated the acquisition of LHCL on May 22, 2020.

Because the Company is a shell company, LHCL will comprise the ongoing operations of the combined entity and its senior management will serve as the senior management of the combined entity, LHCL is deemed to be the accounting acquirer for accounting purposes. The transaction will be treated as a recapitalization of the Company. Accordingly, the consolidated assets, liabilities and results of operations of the Company will become the historical financial statements of LHCL, and the Company’s assets, liabilities and results of operations will be consolidated with LHCL beginning on the acquisition date. LHCL was the legal acquiree but deemed to be the accounting acquirer. The Company was the legal acquirer but deemed to be the accounting acquiree in the reverse merger. The historical financial statements prior to the acquisition are those of the accounting acquirer (LHCL). After completion of the Share Exchange Transaction, the Company’s consolidated financial statements include the assets and liabilities, the operations and cash flow of the accounting acquirer.

Description of subsidiaries

| Name |

Place of incorporation and kind of legal entity |

Principal activities |

Particulars of registered/ paid up share capital |

Effective interest held | ||||

| Luduson Holding Company Limited | British Virgin Island | Investment holding | 10,000 ordinary shares at par value of $1 | 100% | ||||

| Luduson Entertainment Limited | Hong Kong | Sales and marketing | 10,000 ordinary shares for HK$10,000 | 100% | ||||

| G Music Asia Limited | British Virgin Islands | Event planning | 2 ordinary shares at par value of US$1 | 100% |

The Company and its subsidiaries are hereinafter referred to as (the “Company”).

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

The accompanying consolidated financial statements reflect the application of certain significant accounting policies as described in this note and elsewhere in the accompanying consolidated financial statements and notes.

| l | Basis of presentation |

These accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”).

| F-7 |

LUDUSON G INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

| l | Use of estimates and assumptions |

In preparing these consolidated financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheet and revenues and expenses during the years reported. Actual results may differ from these estimates.

| l | Basis of consolidation |

The consolidated financial statements include the financial statements of the Company and its subsidiaries. All significant inter-company balances and transactions within the Company have been eliminated upon consolidation.

| l | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| l | Accounts receivable |

Accounts receivable are recorded at the invoiced amount and do not bear interest, which are due within contractual payment terms, generally 30 to 90 days from completion of service. Credit is extended based on evaluation of a customer's financial condition, the customer credit-worthiness and their payment history. Accounts receivable outstanding longer than the contractual payment terms are considered past due. Past due balances over 90 days and over a specified amount are reviewed individually for collectibility. At the end of fiscal year, the Company specifically evaluates individual customer’s financial condition, credit history, and the current economic conditions to monitor the progress of the collection of accounts receivables. The Company will consider the allowance for doubtful accounts for any estimated losses resulting from the inability of its customers to make required payments. For the receivables that are past due or not being paid according to payment terms, the appropriate actions are taken to exhaust all means of collection, including seeking legal resolution in a court of law. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote. The Company does not have any off-balance-sheet credit exposure related to its customers. As of December 31, 2020 and 2019, there was no allowance for doubtful accounts.

| l | Plant and equipment |

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

| Expected useful lives | |||

| Leasehold improvement | 3 years | ||

| Computer equipment | 3-5 years | ||

| Furniture and equipment | 5 years |

Expenditures for repairs and maintenance are expensed as incurred. When assets have been retired or sold, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is recognized in the results of operations.

| l | Revenue recognition |

The Company adopted Accounting Standards Codification (“ASC”) 606 – Revenue from Contracts with Customers” (“ASC 606”) as of January 1, 2019 using the modified retrospective method. This method allows the Company to apply ASC 606 to new contracts entered into after January 1, 2019, and to its existing contracts for which revenue earned through December 31, 2018 has been recognized under the guidance in effect prior to the effective date of ASC 606. The revenue recognition processes the Company applied prior to adoption of ASC 606 align with the recognition and measurement guidance of the new standard, therefore adoption of ASC 606 did not require a cumulative adjustment to opening equity.

| F-8 |

LUDUSON G INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

Under ASC 606, a performance obligation is a promise within a contract to transfer a distinct good or service, or a series of distinct goods and services, to a customer. Revenue is recognized when performance obligations are satisfied and the customer obtains control of promised goods or services. The amount of revenue recognized reflects the consideration to which the Company expects to be entitled to receive in exchange for goods or services. Under the standard, a contract’s transaction price is allocated to each distinct performance obligation. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, the Company performs the following five steps:

| • | identify the contract with a customer; | |

| • | identify the performance obligations in the contract; | |

| • | determine the transaction price; | |

| • | allocate the transaction price to performance obligations in the contract; and | |

| • | recognize revenue as the performance obligation is satisfied. |

| l | Cost of revenue |

Cost of revenue consists primarily of the fees paid to contracted programmers and labor costs, which are directly attributable to the rendering of services and the production of contents.

| l | Income taxes |

The Company adopted the ASC 740 Income tax provisions of paragraph 740-10-25-13, which addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the consolidated financial statements. Under paragraph 740-10-25-13, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the consolidated financial statements from such a position should be measured based on the largest benefit that has a greater than fifty percent (50%) likelihood of being realized upon ultimate settlement. Paragraph 740-10-25-13 also provides guidance on de-recognition, classification, interest and penalties on income taxes, accounting in interim periods and requires increased disclosures. The Company had no material adjustments to its liabilities for unrecognized income tax benefits according to the provisions of paragraph 740-10-25-13.

The estimated future tax effects of temporary differences between the tax basis of assets and liabilities are reported in the accompanying balance sheets, as well as tax credit carry-backs and carry-forwards. The Company periodically reviews the recoverability of deferred tax assets recorded on its balance sheets and provides valuation allowances as management deems necessary.

| l | Uncertain tax positions |

The Company did not take any uncertain tax positions and had no adjustments to its income tax liabilities or benefits pursuant to the ASC 740 provisions of Section 740-10-25 for the years ended December 31, 2020 and 2019.

| l | Foreign currencies translation |

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the consolidated statement of operations.

| F-9 |

LUDUSON G INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2020 AND 2019

(Currency expressed in United States Dollars (“US$”), except for number of shares)

The reporting currency of the Company is United States Dollar ("US$") and the accompanying consolidated financial statements have been expressed in US$. In addition, the Company is operating in Hong Kong and maintain its books and record in its local currency, Hong Kong Dollars (“HKD”), which is a functional currency as being the primary currency of the economic environment in which their operations are conducted. In general, for consolidation purposes, assets and liabilities of its subsidiary whose functional currency is not US$ are translated into US$, in accordance with ASC Topic 830-30, “ Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statements of changes in shareholders’ equity.

Translation of amounts from HKD into US$ has been made at the following exchange rates for the years ended December 31, 2020 and 2019:

| December 31,2020 | December 31,2019 | |||||||

| Year-end HKD:US$ exchange rate | 0.12899 | 0.12842 | ||||||