UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM

_____________________

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) (Address of principal executive offices) | (I.R.S. Employer Identification No.) (Zip Code) | |

Registrant’s telephone number, including area code: ( Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class |

| Trading |

| Name of each exchange on which registered |

The | ||||

Securities registered pursuant to Section 12(g) of the Act: None | ||||

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

☒ | Smaller reporting company | |||||

Emerging growth company | ||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the registrant’s common stock, $0.001 per value per share, held by non-affiliates of the registrant on June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $

The number of shares of Registrant’s Common Stock outstanding as of March 15, 2023 was

Auditor Name: | Auditor Location: | Auditor Firm ID: |

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the registrant’s definitive proxy statement for the 2023 annual meeting of stockholders (the “2023 Proxy Statement”) to be filed pursuant to Regulation 14A with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2022.

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Form 10-K”) contains forward-looking statements that involve risks and uncertainties. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these words or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

| ● | our ability to obtain and maintain regulatory approval of ibezapolstat and/or our other product candidates; |

| ● | our ability to successfully commercialize and market ibezapolstat and/or our other product candidates, if approved; |

| ● | our ability to contract with third-party suppliers, manufacturers and other service providers and their ability to perform adequately; |

| ● | the potential market size, opportunity and growth potential for ibezapolstat and/or our other product candidates, if approved; |

| ● | our ability to build our own sales and marketing capabilities, or seek collaborative partners, to commercialize ibezapolstat and/or our other product candidates, if approved; |

| ● | our ability to obtain funding for our operations; |

| ● | the initiation, timing, progress and results of our preclinical studies and clinical trials, and our research and development programs; |

| ● | the timing of anticipated regulatory filings; |

| ● | the timing of availability of data from our clinical trials; |

| ● | the impact of the ongoing COVID-19 pandemic and our response to it; |

| ● | the accuracy of our estimates regarding expenses, capital requirements and needs for additional financing; |

| ● | our ability to retain the continued service of our key professionals and to identify, hire and retain additional qualified professionals; |

| ● | our ability to advance product candidates into, and successfully complete, clinical trials; |

| ● | our ability to recruit and enroll suitable patients in our clinical trials and the timing of enrollment; |

| ● | the timing or likelihood of the accomplishment of various scientific, clinical, regulatory and other product development objectives; |

| ● | the pricing and reimbursement of our product candidates, if approved; |

| ● | the rate and degree of market acceptance of our product candidates, if approved; |

| ● | the implementation of our business model and strategic plans for our business, product candidates and technology; |

| ● | the scope of protection we are able to establish and maintain for intellectual property rights covering our product candidates and technology; |

| ● | developments relating to our competitors and our industry; |

| ● | the development of major public health concerns, including the novel coronavirus outbreak or other pandemics arising globally, and the future impact of it and COVID-19 on our clinical trials, business operations and funding requirements; |

| ● | the effects of the recent disruptions to and volatility in the credit and financial markets in the United States and worldwide from the conflict between Russia and Ukraine; |

| ● | the volatility of the price of our common stock; |

| ● | our financial performance; and |

| ● | other risks and uncertainties, including those listed in “Risk Factors.” |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors” section and elsewhere in this Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or

1

combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Form 10-K may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable as of the date of this Form 10-K, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to new information, actual results or to changes in our expectations, except as required by law.

You should read this Form 10-K and the documents that we reference in this Form 10-K and have filed with the Securities and Exchange Commission, or SEC, as exhibits to this Form 10-K with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

This Form 10-K includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the markets in which we operate and intend to operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

This Form 10-K contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Form 10-K, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

2

PART I

Item 1. Business.

Overview

We are a clinical stage biopharmaceutical company developing a new class of antibiotics for infections caused by bacteria listed as priority pathogens by the World Health Organization (“WHO”), the U.S. Centers for Disease Control and Prevention (“CDC”) and the U.S. Food and Drug Administration (“FDA”). Priority pathogens are those which require new antibiotics to address the worldwide crisis of antimicrobial resistance (“AMR”) as identified by the WHO, CDC and FDA. The CDC estimates that, in the U.S., antibiotic-resistant pathogens infect one individual every 11 seconds and result in one death every 15 minutes. The WHO recently stated that growing antimicrobial resistance is equally as dangerous as the ongoing COVID-19 pandemic, threatens to unwind a century of medical progress and may leave us defenseless against infections that today can be treated easily. According to the WHO, the current clinical development pipeline remains insufficient to tackle the challenge of the increasing emergence and spread of antimicrobial resistance.

Our approach is to develop a new class of antibiotic candidates that block the DNA polymerase IIIC enzyme (“Pol IIIC”). We believe we are developing the first Pol IIIC inhibitor to enter clinical trials and have clinically validated the efficacy of our lead Pol IIIC antibiotic candidate in a Phase 2a clinical trial. Pol IIIC is the primary catalyst for DNA replication of several Gram-positive bacterial cells. Our research and development pipeline includes clinical stage and early stage antibiotic candidates that target Gram-positive bacteria for oral and/or parenteral treatment of infections caused by Clostridium difficile (“C. difficile”), Enterococcus (including vancomycin-resistant strains (“VRE”)), Staphylococcus (including methicillin-resistant strains (“MRSA”)), and Streptococcus (including antibiotic resistant strains).

Pol IIIC is required for the replication of DNA in certain Gram-positive bacterial species. By blocking this enzyme, our antibiotic candidates are believed to be bactericidal and inhibit proliferation of several common Gram-positive bacterial pathogens, including both sensitive and resistant C. difficile, MRSA, vancomycin-resistant Enterococcus, penicillin-resistant Streptococcus pneumonia (“PRSP”) and other resistant bacteria.

We intend to “de-risk” this new class of antibiotics through our drug development activities and potentially partner with a fully-integrated pharmaceutical company for late-stage clinical trials and commercialization.

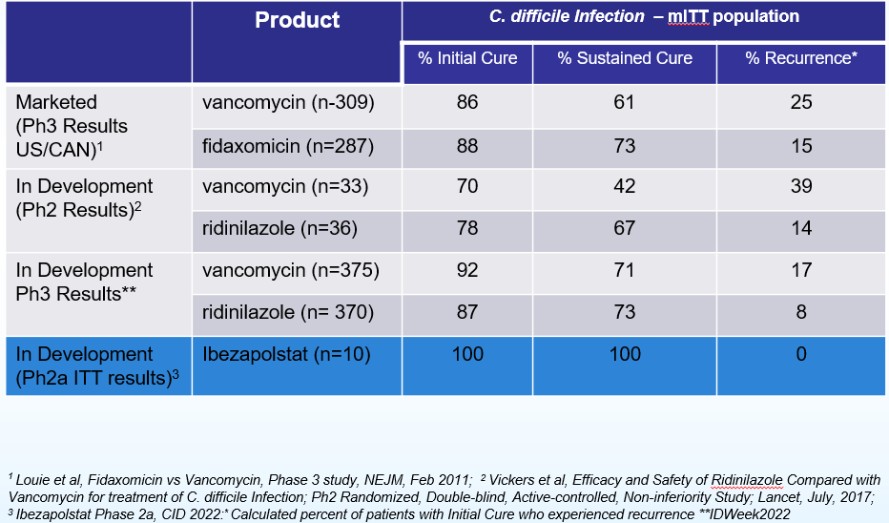

Our lead antibiotic candidate, ibezapolstat (formerly named ACX-362E), has a novel mechanism of action that targets the Pol IIIC enzyme, a previously unexploited scientific target. Phase 2a clinical data validate the efficacy of our lead antibiotic candidate as well as Pol IIIC as an appropriate bacterial target. On December 3, 2021, we commenced enrollment in a Phase 2b 64-patient, randomized (1-to1), non-inferiority, double-blind trial of oral ibezapolstat compared to oral vancomycin, a standard of care to treat C. difficile infections (“CDI”).

Prior to that, we completed our Phase 2a clinical trial of ibezapolstat to treat patients with CDI and reported the top-line data in November 2020. The Phase 2a clinical trial was terminated early based upon the recommendation of our Scientific Advisory Board (the “SAB”). The SAB reviewed the study data presented by management, including adverse events and efficacy outcomes, and discussed its clinical impressions. The SAB unanimously supported the early termination of the Phase 2a trial after 10 patients were enrolled in the trial instead of 20 patients as originally planned. The early termination was further based on the evidence of meeting the treatment goals of eliminating the infection with an acceptable adverse event profile.

The SAB noted that 10 out of 10 patients enrolled in the Phase 2a trial reached the Clinical Cure endpoint, defined in the study protocol as the resolution of diarrhea in the 24-hour period immediately before the end-of-treatment that is maintained for 48 hours after end of treatment. Such cure was sustained, meaning that the patients showed no sign of infection recurrence, for 30 days thereafter. This constitutes a 100% response rate for the primary and secondary endpoints of the trial. All 10 patients enrolled in the Phase 2a trial met the study’s primary and secondary efficacy endpoints, namely, Clinical Cure at end of treatment and Sustained Clinical Cure of no recurrence of CDI at the 28-day

3

follow-up visit. No treatment-related serious adverse events (“SAEs”) were reported by the investigators who enrolled patients in the trial. We believe these results represent the first-ever clinical data showing Pol IIIC has potential as a therapeutically-relevant antibacterial target. Our Phase 2b clinical trial commenced enrollment on December 3, 2021.

The SAB is comprised of seven scientists and clinicians who have significant expertise in the scientific disciplines required for the research and development of antibiotics. The members of the SAB serve at the pleasure of management, are paid in cash on an hourly basis for their services and do not receive equity compensation. Generally, the SAB is consulted by management during the process of designing our preclinical and clinical trials as well as in the process of analyzing data generated from these trials, although the SAB’s services are not limited to such activities.

Currently available antibiotics used to treat CDI infections utilize other mechanisms of action. We believe ibezapolstat is the first antibiotic candidate to work by blocking the DNA Pol IIIC enzyme in C. difficile. This enzyme is necessary for replication of the DNA of certain Gram-positive bacteria, like C. difficile.

We also have an early-stage pipeline of antibiotic product candidates with the same previously unexploited mechanism of action which has established proof of concept in animal studies. This pipeline includes ACX-375C, a potential oral and parenteral treatment targeting Gram-positive bacteria, including MRSA, VRE and PRSP.

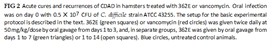

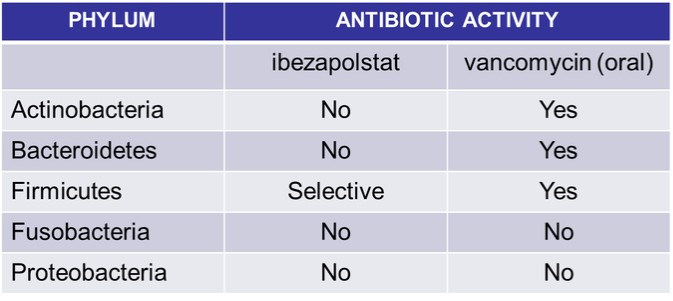

Our Technology

The results of our Phase 2a clinical trial also represent the first-ever clinical validation of DNA polymerase IIIC as a therapeutically relevant antibacterial target. Ibezapolstat was very well tolerated with no treatment-related SAEs noted in the Phase 2a trial. Additionally, data obtained to date demonstrate that ibezapolstat enhances actinobacteria in the microbiome and suppresses regrowth of proteobacteria; potentially lessening the likelihood of CDI recurrence or new infection by MDR Gram-negative bacteria. Additionally, the unexpected finding from further analysis of the Phase 2a study is that the beneficial Firmicutes were shown to regrow while patients were receiving ibezapolstat therapy. Several follow-up experiments have demonstrated that many of these beneficial Firmicutes have heterogeneous susceptibility to ibezapolstat allowing them to continue to perform their beneficial biologic functions even while a patient is receiving ibezapolstat for their C. difficile infection. (Garey, Oral Presentation, IDSA, IDWeek 2022 Conference, Oct 19-23, 2022).

Prior to conducting the Phase 2a clinical trial, we successfully completed a Phase 1 clinical trial of ibezapolstat for the oral treatment of CDI (the “Phase 1 Trial”). The Phase 1 Trial, conducted in the U.S., was a double-blind, placebo- controlled study to determine safety, tolerability, pharmacokinetics (“PK”) and fecal concentrations of ibezapolstat in 62 healthy volunteers. It was conducted in two parts; first, single ascending doses were administered to four cohorts of eight subjects each, and second, multiple ascending doses were administered that simulate the anticipated clinical treatment regimen. Safety information was analyzed through assessment of adverse events and other standard safety measures, while concentrations of ibezapolstat were determined in both blood and the feces, the latter being the critical site of drug delivery for treating CDI. In addition, the laboratory of Dr. Kevin Garey at the University of Houston performed state-

4

of-the-art microbiomic testing of gastrointestinal flora in trial subjects as compared with vancomycin, the standard of care for the treatment of patients with CDI, which testing was the first of its kind in Phase 1 clinical trials for CDI.

Data from the case report forms completed by the principal investigators of the Phase I Trial showed that single and multiple ascending doses of ibezapolstat demonstrated a safety signal similar to placebo according to the principal investigators as evidenced by the case report forms. There were no safety signals reported on the case report forms related to physical examination or vital signs (blood pressure, pulse or oral temperature) in any part of the study. No significant abnormalities developed in the 12-lead electrocardiogram traces for any subject at any dose given according to the data reported by the principal investigators in the case report forms. No changes were observed in serum biochemistry or hematological blood evaluations. No dose-dependent increase in adverse events, (each, an “AE”) was reported, and no serious AEs were observed. The proportion of ibezapolstat-dosed subjects with an AE was similar to placebo at each dosing level. All AEs were considered mild or moderate and none required a change in therapy or intervention.

Systemic exposure following oral dosing was very low and no accumulation occurred after ten days of repeated dosing. In addition, oral dosing of ibezapolstat resulted in rapid and sustained fecal concentrations that are approximately 2,500 times the minimum inhibitory concentration of ibezapolstat required to kill the CDI bacteria in the colon at the site of the infection. Comparative microbiome analysis versus vancomycin demonstrated a two to three log favorable difference in the reduction of the predominantly healthy bacteria in the gut microbiome. Free concentrations of ibezapolstat were found to be high enough to kill C. difficile but too low to kill healthy bacteria like Bacteroides & Firmicutes which constitute approximately 90% of healthy microbiome in the judgment of our scientific advisors. Upon review of the final Phase 1 Trial data, our medical and scientific advisors suggested these data supported advancing ibezapolstat into a Phase 2 clinical trial at doses up to 450 mg, twice daily, for 10 days of treatment, as described above. We believe that ibezapolstat is the only clinical-stage compound currently known to target C. difficile by acting specifically on Pol IIIC.

We have worked closely with the FDA to obtain our investigational new drug application (“IND”), and to obtain FDA fast track designation as well as designation of ibezapolstat as a qualified infectious disease product (“QIDP”), which provides incentives through the Generating Antibiotic Incentives Now Act (the “GAIN Act”) including FDA priority review for the first application submitted for the QIDP, fast track designation eligibility and extension of statutory exclusivity periods in the U.S. for an additional 5 years upon FDA marketing approval of the product to treat patients with CDI.

Ibezapolstat originally was sponsored by GLSynthesis Inc., which completed several pre-clinical studies, developed the current manufacturing process and filed for several of the patents that have been granted to date. We acquired worldwide rights to manufacture, develop and commercialize ibezapolstat from GLSynthesis Inc. on February 5, 2018, pursuant to an asset purchase agreement executed by the parties on that date. At closing, we paid GLSynthesis $110,174 in cash and 100,000 Class B Membership Interests. We are also required to pay up to $700,000 in success-based clinical milestone payments to GLSynthesis, including a payment of $500,000 upon the successful completion of two phase 3 clinical trials and a royalty of 4% on net sales of ibezapolstat throughout the duration of the patent period, which currently extends to September 2030.

As of the date of this Form 10-K, of the $700,000 of potential milestone payments, we have paid to GLSynthesis a total of $50,000, including $25,000 paid upon receipt of a “safe to proceed” notification from FDA relating to the commencement of clinical trials (December 2018) and $25,000 paid upon the successful completion of clinical trial drug supply suitable to support our Phase 1 clinical trial (December 2018). The patent jurisdictions of the acquired patents include the U.S., European Union, Japan and Canada.

About QIDP and Fast Track Designations

The GAIN Act, which was enacted as part of the Food and Drug Administration Safety and Innovation Act (“FDASIA”) in 2012, created incentives for the development of novel antibiotic and antifungal products intended to treat serious and life-threatening infections. The GAIN Act amended the federal Food, Drug, and Cosmetic Act to add a designation for QIDPs. A QIDP is defined as “an antibacterial or antifungal drug for human use intended to treat serious

5

or life-threatening infections, including those caused by (1) an antibacterial or antifungal resistant pathogen, including novel or infectious pathogens, or (2) qualifying pathogens listed under” 21 C.F.R. § 317.2. The primary incentive for developing a QIDP is a five-year exclusivity extension for the relevant antibiotic or antifungal indications of the QIDP, but the designation also offers FDA priority review for the first application submitted for the QIDP and eligibility for fast track designation.

FDA’s fast track designation is a process designed to facilitate the development and expedite the regulatory pathway of new drugs to treat serious or life-threatening conditions and that fill a high unmet medical need. To be eligible for a fast track designation, the FDA must determine, based on the request of a sponsor, that a product is intended to treat a serious or life-threatening disease or condition and demonstrates the potential to address an unmet medical need by providing a therapy where none exists or a therapy that may be potentially superior to existing therapy based on efficacy or safety factors. Fast track designation provides opportunities for more frequent interactions with the FDA review team to expedite development and review of the product. The FDA may also review sections of the new drug application (“NDA”) for a fast track product on a rolling basis before the complete application is submitted, if the sponsor and the FDA agree on a schedule for the submission of the application sections and the sponsor pays any required user fees upon submission of the first section of the NDA. In addition, fast track designation may be withdrawn by the sponsor or rescinded by the FDA if the designation is no longer supported by data emerging from the clinical trial process.

Based upon advice from our scientific advisors, we believe ACX-375C, our second antibiotic candidate currently in pre-clinical development, will also be eligible for FDA’s QIDP and fast track designations. This advice is supported by the “qualifying” criteria for a QIDP listed in GAIN Act legislation of 2012 enacted as part of the FDASIA. A QIDP is defined as “an antibacterial or antifungal drug for human use intended to treat serious or life-threatening infections, including those caused by qualifying pathogens listed under 21 C.F.R. § 317.2 which include bacterial pathogens against which ACX-375C has demonstrated microbiological activity namely, methicillin-resistant Staphylococcus aureus and vancomycin-resistant enterococcus. These bacteria are generally causative of serious or life-threatening infections, including, but not limited to, acute bacterial skin and skin structure infections, community acquired pneumonia, blood stream infections, hospital acquired bacterial pneumonia and ventilator acquired bacterial pneumonia, which are planned to be studied in future clinical trials at the appropriate time in product development.

Mechanism of Action

DNA Pol IIIC has proved essential for replicative DNA synthesis in aerobic, low G-C Gram-positive bacteria, i.e. those with a low guanine-cytosine (G-C) ratio relative to their adenine-thymine (A-T) ratio. Pol IIIC-specific genes of several such Gram-positive bacteria have been cloned and expressed, and the DNA Pol IIIC enzymes appear to share a unique capacity to be inhibited by 6-anilinouracils (AU), 2-phenylguanines (PG) and related compounds which are analogs of 2 ‘-deoxyguanosine 5’ -triphosphate (dGTP).

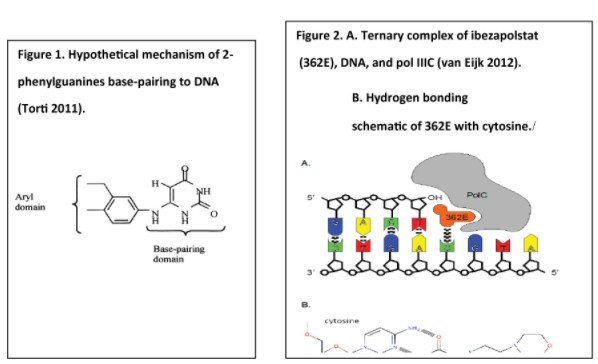

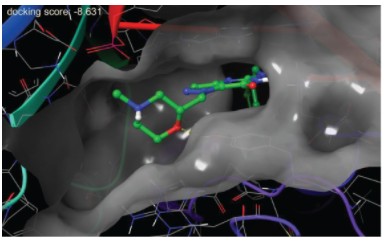

The hypothesis supporting further development of ibezapolstat is that dGTP analog compounds bind to Pol IIIC via a “base-pairing domain” and an enzyme-specific “aryl domain” (Figure 1). Through its base-pairing domain, which mimics that of guanine, the dGTP analog base pairs with an un-apposed template cytosine just distal to the DNA primer terminus. Simultaneously, the aryl domain binds an aryl-specific “receptor” near the POL IIIC enzyme’s dNTP binding site, causing the formation of an inactive ternary complex of inhibitor (dGTP analog), DNA and Pol IIIC (Figure 2).

6

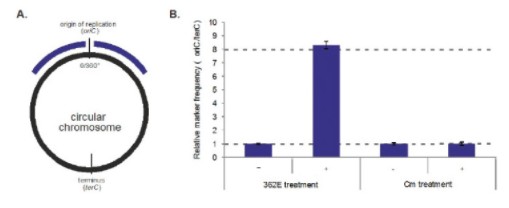

Following the ternary binding hypothesis described above, Torti et al. (2011) reported that ibezapolstat (362E) inhibited purified Pol IIIC derived from C. difficile (Ki 0.325 µM) and from Bacillus subtilis (Ki 0.34 µM) in in vitro resting. C. difficile has a single circular chromosome and one origin of replication (oriC) from which DNA replication begins in a bi-directional fashion (Figure 3A). Using marker frequency analysis, the abundance of the oriC proximal genes relative to the terminus (terC) proximal genes can be determined. C. difficile treated with 4 µg/mL of ibezapolstat (362E) demonstrated an 8-16-fold increased oriC:terC ratio, which would be expected for inhibition of DNA replication (Figure 3B).

Figure 3. (A) Bi-directional replication of prokaryotes. (B) Marker Frequency Analysis of subinhibitory effects of PolC inhibitor ibezapolstat (362E) compared to the antibiotic Chloramphenicol (Cm).

Leiden University Medical Center/Health Holland Research Project

In August 2021, Health Holland awarded a grant of approximately $500,000 USD to Leiden University Medical Center (“LUMC”) to further study the mechanism of action of pol IIIC inhibitors in a consortium partnership with our

7

Company (the “Health Holland Research Project”). This innovative research project entitled “Bad bugs, new drugs: Elucidation of the Structure of DNA Polymerase C (PolC) of Multidrug Resistant Bacteria in Complex with Novel Classes of Antimicrobials (POLSTOP2)” will study 3-dimensional structures of DNA polymerases and their binding interactions with our inhibitors. The antibacterial molecular target of our pipeline of novel DNA pol IIIC inhibitors has been clinically validated by ibezapolstat’s recent completion of a Phase 2a trial in patients with CDI. The Health Holland Research Project is intended to accelerate lead product candidate selection for our ACX-375 program for systemic treatment against multidrug resistant bacteria such as methicillin resistant Staphylococcus aureus (MRSA), vancomycin resistant Enterococci (VRE) and Drug-Resistant Streptococcus Pneumoniae (DRSP) and for other WHO, CDC and FDA high-priority, drug-resistant Gram-positive pathogens where new classes of antibiotics are needed. This project was initiated by LUMC in September 2021 and emerging data are expected to contribute to the ACX-375C program development.

Pre-Clinical Studies

All IND-enabling preclinical studies for ibezapolstat have been completed, including FDA-required toxicology, pharmacokinetics and in vitro microbiology studies and in vivo animal models. Highlights from these studies are included below:

Toxicology

Genetic Toxicology Studies:

| ● | Ames test: Negative |

| ● | Mouse Lymphoma Assay: Negative |

| ● | Micronucleus assay: Negative |

Cardiovascular Safety:

| ● | hERG Assay: The IC50 observed represents an adequate safety margin |

| ● | Cardiovascular safety studies in telemetered dogs showed no significant CV risk |

14-day Toxicology Studies:

| ● | Rat: No effect on clinical observations, body weight, ophthalmology, hematology, clinical chemistry, urinalysis, micronucleus, gross necropsy, and microscopic endpoints; the no observed adverse effect level (“NOAEL”), is considered to be approximately 1000 mg/kg via oral administration |

| ● | Dog: Emesis and diarrhea were observed in the high dose groups, which are considered test article-related; No drug-related effects were observed for body weights, food consumption, ophthalmology, clinical pathology, organ weight, gross necropsy and microscopic evaluations; the NOAEL is approximately 200 mg/kg/day following 14 days oral administration |

Pharmacokinetics

Administration in male rats of a 5 mg/kg IV bolus dose of a salt form of GLS362E showed rapid systemic clearance and a short terminal half-life (0.34 hours). Plasma concentrations were BQL (<0.5ng/mL) at three to four hours post-dose. All oral dosing of GLS362E, now known as ibezapolstat, did not use the salt form, only the parent molecule since the salt form is not necessary for oral dosing. Administration in male rats of a single 50mg/kg oral dose of ibezapolstat in a suspension formulation, Cmax was 119ng/mL and was observed at 15 minutes post-dose. Plasma levels declined with an apparent terminal half — life of 3.82 hours and were still quantifiable at 24 hours post-dose. Oral bioavailability in

8

male rats was 8.6%. Ibezapolstat excretion in feces was much greater than urinary excretion, consistent with incomplete oral bioavailability. After administration in male rats of a single 50 mg/kg oral dose of ibezapolstat in a suspension formulation, concentrations in the GI mucosa of all regions of the gastrointestinal tract were >10µg/mL at four hours post-dose, and >10 µg/mL at ten hours post-dose for ileum, cecum, colon and rectum. Fecal concentrations after oral dosing were approximately 100 to 200 mcg/mL.

In vitro Microbiology

Several in vitro susceptibility tests have been completed. Below is a summary data table showing MIC values for 22 C. difficile strains, conducted in triplicate, with the testing conducted by the R.M. Alden Laboratory in California and the isolates obtained from the same. The table below shows that the activity of GLS362E was similar to that of vancomycin and metronidazole.

22 C. difficile isolate MIC testing (µ g/mL), Median values Testing Conducted at R.M. Alden Labs in California

Drug |

| MIC range |

| MIC50 |

| MIC90 |

Ibezapolstat |

| 1 – 4 |

| 2 |

| 4 |

Vancomycin |

| 1 – 8 |

| 1 |

| 4 |

Metronidazole |

| 0.25 – 4 |

| 1 |

| 4 |

Data in the table below show that ibezapolstat was not active against two Bifidobacterium species or Eubacterium lentum at 32 µg/mL, the highest concentration tested. Activity was observed for lactobacilli and Clostridium perfringens. Most importantly, ibezapolstat was active against ten clinical isolates of C. difficile with an MIC range of 0.5 – 4 µg/mL, MIC50 of 2 µg/mL, and an MIC90 of 4 µg/mL. Since the Pol IIIC target enzyme is present in only a narrow spectrum of Gram-positive organisms, minimal disruption of gut flora is anticipated. This is supported by the data in the table below, which shows that representative specimens of other gut bacteria — lactobacillus, bifidobacterium, and eubacterium — are not susceptible to ibezapolstat.

Study Report GLS001: Agar Dilution MIC (µ g/mL) Testing Conducted at Micromyx, 2010.

Organism |

| Micromyx Number |

| 362E |

| Metronidazole |

Bifidobacterium brevi |

| 3967 (ATCC(1) 15698) |

| >32 |

| 2 |

Bifidobacterium longum |

| 3968 (ATCC 15707) |

| >32 |

| 4 |

Lactobacillus casei |

| 1722 (ATCC 393) |

| 16 |

| >32 |

Lactobacillus acidophilus |

| 0681 |

| 4 |

| >32 |

Eubacterium lentum |

| 1274 (ATCC 43055) |

| >32 |

| 0.25 |

Clostridium perfringens |

| 3414 |

| 16 |

| 1 |

Clostridium difficile |

| 3579 |

| 4 |

| 0.25 |

| 3580 |

| 2 |

| 0.25 | |

| 3581 |

| 2 |

| 0.5 | |

| 3582 |

| 4 |

| 0.5 | |

| 3584 |

| 1 |

| 0.25 | |

| 3585 |

| 2 |

| 0.25 | |

| 3587 |

| 2 |

| 0.5 |

9

Study Report GLS001: Agar Dilution MIC (µ g/mL) Testing Conducted at Micromyx, 2010.

Organism |

| Micromyx Number |

| 362E |

| Metronidazole |

| 3588 |

| 0.5 |

| 0.25 | |

| 3589 |

| 2 |

| 1 | |

Quality Control Strains |

|

|

|

|

|

|

Clostridium difficile |

| 4381 (ATCC 700057) |

| 1 |

| 0.25 (0.12 – 0.5)(2) |

Bacteroides fragilis |

| 0123 (ATCC 25285) |

| >32 |

| 0.25 (0.25 – 1) |

| (1) | American Type Culture Collection |

| (2) | Quality control range |

Additional testing has shown that ibezapolstat is highly potent against 98 strains of recent clinical isolates of C. difficile in the U.S., with an MIC50 of 2 µg/mL and an MIC90 of 4 µg/mL, as shown in the table below. Similar recent testing of 364 European isolates showed identical MIC values.

| 362E |

| MTZ |

| VAN |

| FDX | |

MIC range: |

| 0.5 – 8 |

| 0.25 – >32 |

| 0.5 – 16 |

| 0.03 – > 8 |

MIC50: |

| 2 |

| 0.5 |

| 1 |

| 0.5 |

MIC90: |

| 4 |

| 4 |

| 4 |

| 2 |

Abbreviations: MTZ=metronidazole; VAN=vancomyein; FDX=fidaxomicin.

The in vitro activity of ibezapolstat was tested in June 2019 by conducting minimum inhibitory concentration (MIC) testing against 104 C. difficile clinical isolates, including those with important ribotypes. Fidaxomicin, vancomycin, and metronidazole were used as comparators. When ibezapolstat achieved the ≥99.9% bacterial kill (i.e., 3-log reduction in bacterial numbers), it met the Clinical Laboratory Standards Institute (“CLSI”) criteria for bactericidal activity which is accepted by FDA. This represents a laboratory measure of antibacterial potency but does not translate directly into human efficacy which can only be established in clinical trials.

Results indicated that the activity of ibezapolstat was similar to that of the comparators evaluated, with a narrow MIC range against 104 C. difficile clinical isolates, of which ~30% were of different ribotypes and another 30% were toxigenic. In addition, 4 isolates of the epidemic strain ribotypes 027 and 078 demonstrated ACX-362E sensitivities similar to those of other ribotypes. In Vitro Activity (in μg/mL) of ACX-362E (ibezapolstat) and Comparators against 104 C. difficile Clinical Isolates.

In Vitro Activity (in µg/mL) of ACX-362E (ibezapolstat) and Comparators against 104 C. difficile Clinical Isolates

| ACX-362E |

|

|

| ||||

| (ibezapolstat) |

| MTZ |

| VAN |

| FDX | |

MIC range: |

| 1 – 8 |

| 0.25 – 16 |

| 0.5 – 4 |

| 0.015 – 1 |

MIC50: |

| 4 |

| 0.5 |

| 1 |

| 0.12 |

MIC90: |

| 4 |

| 1 |

| 2 |

| 0.25 |

Abbreviations: FDX=fidaxomicin; MIC=minimum inhibitory concentration; MTZ=metronidazole; VAN=vancomycin.

Overall, the results of this study indicated that the activity of ibezapolstat was similar to that of the comparators evaluated in this study. With a narrow MIC range against 104 C. difficile clinical isolates, approximately 30% were of different ribotypes and another 30% were toxigenic.

10

In July 2019 the bactericidal activity of ibezapolstat was evaluated by first determining the MIC and then the minimum bactericidal concentration (MBC) against 3 C. difficile isolates; vancomycin and metronidazole were used as comparators in these assays. In a second measure of bactericidal activity, the time-kill kinetics of ibezapolstat was assessed in comparison to vancomycin and metronidazole against the same 3 C. difficile isolates.

Against two of the three isolates, ibezapolstat had MBC:MIC ratios of 1 to 4 across replicates indicating bactericidal activity. For the remaining isolate, MBC:MIC ratios of 2 to >8 were observed although in instances where the ratio was >8, counts indicated >2-log10 killing at or near the MIC. When the time-kill kinetics (or the result of a microbiological laboratory study of antimicrobial activity of a compound over time) of ibezapolstat were evaluated against C. difficile MMX 5680 and BAA-1382, bactericidal activity was observed at the two later time points and at all three evaluated doses (MMX 5680) or the two highest doses (BAA-1382). Against C. difficile isolate BAA-1875, ibezapolstat did not demonstrate the ≥3 log10 CFU/mL killing required for bactericidal activity, but bacterial levels were reduced by >2 log10 CFU at the 24- and 48-hour time points at 16X and 32X the MIC. In the case of metronidazole and vancomycin, the highest MIC value recorded from the triplicate testing was used to calculate 8X, 16X, and 32X the MIC for the time kill study.

Activity of ibezapolstat and Comparators against C. difficile Isolates

|

|

|

| ACX-362E |

|

| ||||||||||||

(ibezapolstat) | Metronidazole | Vancomycin | ||||||||||||||||

Organism |

| Isolate No. |

| Type |

| Replicate |

| MIC |

| MBC |

| MIC |

| MBC |

| MIC |

| MBC |

C. difficile |

| MMX 5680 |

| Ribotype 027 |

| A |

| 1 |

| 1 |

| 2 |

| 2 |

| 0.5 |

| 0.5 |

| B |

| 1 |

| 1 |

| 4 |

| 4 |

| 0.5 |

| 0.5 | |||||

| C |

| 1 |

| 2 |

| 2 |

| 2 |

| 0.25 |

| 0.25 | |||||

| BAA- 1382 |

| Ribotype 012 |

| A |

| 1 |

| 4 |

| 0.5 |

| 0.5 |

| 1 |

| 2 | |

| B |

| 1 |

| 2 |

| 0.5 |

| 1 |

| 1 |

| 1 | |||||

| C |

| 1 |

| 2 |

| 1 |

| 1 |

| 1 |

| 2 | |||||

| BAA- 1875 |

| Ribotype 078 |

| A |

| 1 |

| >8* |

| 0.5 |

| 1 |

| 0.25 |

| 0.5 | |

| B |

| 1 |

| 2 |

| 1 |

| 1 |

| 0.5 |

| 0.5 | |||||

| C |

| 1 |

| >8* |

| 0.5 |

| 0.5 |

| 0.5 |

| 0.5 | |||||

Abbreviations: MIC=minimum inhibitory concentration; MBC=minimum bactericidal concentration.

* | Counts only slightly exceeded the rejection values for 3-log killing (indicating that 3-log killing was nearly achieved). |

Nonclinical data indicate that ibezapolstat demonstrates reproducible and consistent in vitro potency against C. difficile and is comparable to vancomycin in the standard and predictive Syrian Golden Hamster model of CDI. The nonclinical data also indicate that ibezapolstat may be active against C. difficile in the human colon, and in fact, ibezapolstat concentrations reached approximately 2,500-fold greater than the MIC needed to kill the C. difficile in this Phase 1 first-in-man clinical trial.

In vivo Efficacy Animal Models

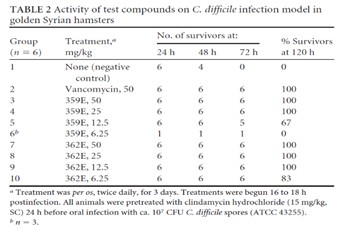

GLS-362E (and GLS-359E) were studied in vivo in the golden Syrian hamster model of C. difficile-induced colitis. Both compounds had low GI absorption (<5% of an oral dose of 75 mg/kg was absorbed) and low toxicity (up to 1,000 mg/kg in hamsters). In the in vivo model, hamsters are first treated subcutaneously with clindamycin, followed 24 h later with ~107 CFU of C. difficile spores administered orally; therapy was initiated ~17 hours post-infection. Initial experiments evaluated the efficacy of the two compounds in this model (Dvoskin, et al, 2012, AAC) with studies designed to optimize the dose and length of therapy. In experiment 1 (shown in Table 2, below), treatment was given twice daily for three days with either vancomycin (50 mg/kg),

11

|

|

GLS-359E or GLS-362E (GLS-359E and GLS-362E dosed at 50, 25, 12.5, or 6.25 mg/kg), with survivorship followed through 120 hours. 362E was found to be more efficacious at lower doses than GLS-359E: 6.25 mg/kg of 362E was superior to an equivalent dose of GLS-359E (P<0.001). For this reason, GLS-362E was profiled further.

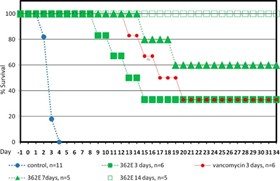

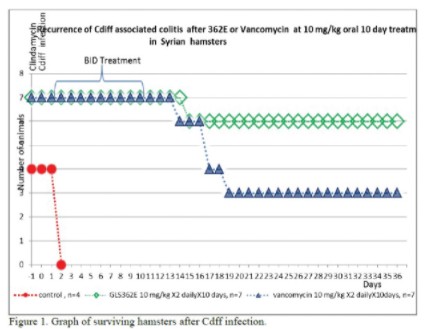

Subsequent experiments extended the length of therapy for GLS-362E to 7 or 14 days because in the experiment shown in Table 2 it was observed that survival was not maintained beyond five days after the end of treatment in any group; studies were then designed to evaluate recurrence rates. Table 2 displays (below, from Dvoskin, et. al, 2012, AAC) twice-daily treatment for three days with either GLS-362E (50 mg/kg) or vancomycin (50 mg/kg), 67% of treated animals died. When treatment with GLS-362E is extended to 7 or 14 days, survival increased to 60 and 100%, respectively. Upon necropsy, the intestinal contents of surviving hamsters were negative for toxin A and/or B whereas those for animals that had died were positive. The results for the 3-day dosing shown in Table 2 above were from additional studies. Other studies conducted by Dvoskin et al. evaluated GLS-362E efficacy/recurrence rates in the hamster model at lower doses: after 14 days of dosing (100% survival for all groups at 25, 12.5 and 6.25 mg/kg out to 36 days; negative for A/B toxins): after 10 days of dosing at 10 mg/kg, GLS-362E treatment resulted in 86% survival on Day 36 post-infection, compared to vancomycin treatment’s 43% survival at the same dose (see graph and table below) and animals that died with C. difficile disease symptoms tested positive for A/B toxin, whereas the surviving animals did not.

12

Hamster Efficacy vs C. difficile infection**

| Survivors acute |

| Survivors with no recurrent | |

Drug | infection/total animals | infection /total animals | ||

GLS362 |

| 7/7 |

| 6/7 |

(ibezapolstat) | ||||

vancomycin |

| 7/7 |

| 3/7 |

** | Animals were infected and treated orally with 2x10mg/kg/day of the indicated drug for 10 days; acute responses were determined during the treatment and recurrent infections after 36 days. |

C. difficile Infection Overview

Clostridioides difficile infection (“CDI”) is a bacterial infection of the colon that produces toxins causing inflammation of the colon and severe diarrhea. CDI can also result in more serious disease complications, including pseudomembranous colitis, bowel perforation, toxic megacolon and sepsis. CDI represents a serious healthcare issue in hospitals, long-term care homes and, increasingly, in the wider community. We estimate that there are over one million cases of CDI each year in the U.S. and Europe, based on an epidemiology report on CDI that was published in 2015 by Decision Resources, a healthcare research and consulting company. In addition, CDI is responsible for approximately 29,000 deaths per year in the U.S., according to a study published in the New England Journal of Medicine in 2015. A separate study published in 2018 in Clinical Microbiology and Infection, a peer reviewed journal published by the European Society of Clinical Microbiology and Infectious Diseases, indicated that CDI may be underdiagnosed in approximately 25% of cases. A study published in The Journal of Hospital Infection, a peer reviewed journal published by the Healthcare Infection Society, reported that CDI is two to four times more common than hospital associated infections caused by methicillin-resistant Staphylococcus aureus, a bacterium frequently associated with such infections. The Healthcare Cost and Utilization Project, a family of databases developed through a federal-state-industry partnership sponsored by the Agency for Healthcare Research and Quality of the U.S. Department of Health and Human Services, reported an approximate three and one-half-fold increase in hospital stays associated with CDI between 2000 and 2008. The economic impact of CDI is significant. A study published in 2012 in Clinical Infectious Diseases estimated that acute care costs for CDI total $4.8 billion per year in the U.S. alone. According to the 2017 Update (published February 2018) of the Clinical Practice Guidelines for C. difficile Infection by the Infectious Diseases Society of America (IDSA) and Society or Healthcare Epidemiology of America (SHEA), CDI remains a significant medical

13

problem in hospitals, in long-term care facilities and in the community. C. difficile is one of the most common causes of health care-associated infections in U.S. hospitals (Lessa, et al, 2015, New England Journal of Medicine). Recent estimates suggest C. difficile approaches 500,000 infections annually in the U.S. and is associated with approximately 20,000 deaths annually. (Guh, 2020, New England Journal of Medicine). Based on internal estimates, the recurrence rate of two of the three antibiotics currently used to treat CDI is between 20% and 40% among approximately 150,000 patients treated. We believe the annual incidence of CDI in the U.S. approaches 600,000 infections and a mortality rate of approximately 9.3%. There are an additional six million patients in the U.S. per year with other Gram+ infections, such as Staphylococcus, Streptococcus or Enterococcal, with approximately 300,000 patients treated for such infections.

CDI originates from a bacterium known as Clostridium difficile, or Clostridioides difficile, or C. difficile.

C. difficile can be a harmless resident of the gastrointestinal tract. The complex community of microorganisms that make up the natural gut flora usually moderates levels and pathogenicity of C. difficile. The natural gut flora is an essential part of the normal function of the gastrointestinal tract and also has wide implications to human health, such as the proper function of the immune system. CDI typically develops following the use of broad-spectrum antibiotic agents that can cause widespread damage to the natural gut flora and allow overgrowth of C. difficile. Hypervirulent C. difficile strains have also emerged and are frequently associated with more severe disease. In the U.S., the hypervirulent strain, ribotype 027, accounts for approximately one-third of all CDI cases.

An important clinical issue with CDI is disease recurrence. This is in contrast to other bacterial threats for which drug resistance is the principal concern. According to an article published in 2012 in the peer reviewed journal Clinical Microbiology and Infection, 20% to 40% of patients with CDI suffer a second episode of the infection. The risk of further recurrence rises to 65% after a patient suffers a third episode of CDI. In addition, each episode of recurrent disease is associated with greater disease severity and higher mortality rates. Recurrent disease is associated with an increased burden on the healthcare system.

In 2013, and again in a 2019 Update, the CDC highlighted C. difficile as one of five pathogens that pose an immediate public health threat and require urgent and aggressive action. In 2012, the GAIN Act provisions became law along with the rest of FDASIA. The goal of the GAIN Act is to encourage the development of new antibiotics that treat specific pathogens, including C. difficile, which cause serious and life-threatening infections. Since the GAIN Act was adopted, there have been two antibiotic candidates developed for CDI that have been granted QIDP status under the GAIN Act, one of which was approved by the FDA in 2011. See “Current CDI Antibiotic Treatments” below.

Current CDI Antibiotic Treatments

Current treatment options for CDI are limited. The current standard-of-care for CDI is treatment with vancomycin or off label use of metronidazole, both of which are broad-spectrum antibiotics. Although these antibiotics reduce levels of C. difficile, both also cause significant collateral damage to the gut flora as a result of their broad spectrum of activity. This collateral damage to the gut flora leaves patients vulnerable to recurrent CDI. A review published in 2012 in the peer reviewed journal International Journal of Antimicrobial Agents reported recurrence rates of 24.0% for vancomycin and 27.1% for metronidazole. Metronidazole is frequently used in mild or moderate cases of CDI and has been associated with a number of side effects. The 2017 Update (published February 2018) of the Clinical Practice Guidelines for C. difficile Infection by the Infectious Diseases Society of America (IDSA) and Society of Healthcare Epidemiology of America (SHEA) provides a recommendation for clinicians to prescribe either vancomycin or fidaxomicin over metronidazole for an initial episode of CDI and metronidazole is no longer recommended for treatment of patients with CDI.

Fidaxomicin (Dificid®) is an antibiotic approved to treat patients with CDI in the U.S. and the European Union, but it has not been shown to be superior to vancomycin in the treatment of patients with the hypervirulent strain ribotype 027. Fidaxomicin (Dificid®) was approved by FDA in 2011. In July 2013, Optimer Pharmaceuticals, Inc., the sponsor of the fidaxomicin program, was sold to Cubist Pharmaceuticals for $535 million plus up to $266 million in contingent value right (“CVR”) payments post-closing. Fidaxomicin was the first antibacterial drug the FDA approved in more than 30 years to treat CDI. Cubist Pharmaceuticals was acquired by Merck in 2015 for approximately $8.4 billion. Merck

14

continues to market fidaxomicin (Dificid®) and is expected to continue through the patent life which is expected to expire in mid-2027.

Summit Therapeutics had a clinical stage antibiotic, ridinilazole, and in January 2019 had opened enrollment of two Phase 3 clinical trials to treat patients with CDI. In December 2021, Summit Therapeutics announced that ridinilazole had failed to achieve the primary endpoint in the Phase 3 clinical trials and has since announced a plan to partner ridinalazole and has moved strategically into oncology drug development. The ridinilazole Phase 3 program included two randomized trials testing efficacy in CDI versus oral vancomycin, the standard of care, as the positive control. The trials appeared to be identical in design and planned to enroll 680 patients each. Prior to failing to achieve the primary endpoint in its Phase 3 clinical trials, in the fourth quarter of 2021, Summit Therapeutics announced that the FDA had rejected Summit’s request to change the endpoint in the then ongoing Phase 3 clinical trials. Ridinilazole is an orally administered small molecule antibiotic designed to selectively target C. difficile bacteria without causing collateral damage to the gut flora and thereby reduce CDI recurrence rates. Prior to failing in its Phase 3 clinical trial, ridinilazole completed two Phase 2 clinical trials successfully meeting or exceeding its primary efficacy endpoints.

Despite the approval of fidaxomicin to treat CDI, the CDC continues to cite C. difficile bacteria as an urgent need for new antibiotics to treat CDI.

Clinical Strategy

Based on advice from our medical and scientific consultants and advisors, we believe we will need to conduct one Phase 2 clinical trial prior to conducting one or two large Phase 3 clinical trials in order to file a new drug application with the FDA for the oral use of ibezapolstat to treat patients with CDI. The trial design and anticipated size of the required clinical trials is as follows:

Phase 1 Clinical Trial: Data reported in August 2019.

The Phase 1 clinical trial design was a randomized, double-blind, placebo-controlled, single and multiple ascending dose trial to determine the safety, pharmacokinetics and fecal microbiological effects of ibezapolstat administered orally to 62 healthy adults 18 years of age or older. For the single-dose ascending portion of the trial, the objectives were to evaluate the safety and determine the pharmacokinetics and systemic exposure of single doses as well as the effects of food on PK. The multiple ascending dose portion of the trial evaluated the safety, PK and fecal concentrations of repeated doses as well as evaluate the effects of ibezapolstat on characteristics of the gut microbiome in comparison to the current standard of care treatment antibiotic, oral vancomycin. We successfully completed the Phase 1 clinical trial in August 2019 and the data supported advancing to Phase 2 according to our medical and scientific advisors. Blood levels

15

of ibezapolstat show low systemic exposure, as predicted by previously conducted animal studies and are desirable in treating CDI, and fecal concentrations of ibezapolstat were 2 to 3 orders of magnitude above the level required to kill CDI bacteria at the site of the infection.

Phase 2 Clinical Trial.

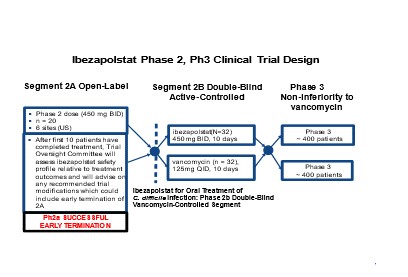

The Phase 2 clinical trial design is structured as a randomized, controlled Phase 2 trial of the efficacy and safety of ibezapolstat compared to vancomycin in the treatment of CDI in a total of up to 84 evaluable patients (Phase 2a; up to 20 patients; Phase 2b; 64 patients). Phase 2a was designed to enroll up to 20 patients with a data review planned by a Trial Oversight Committee after 10 patients completed the trial.

Based upon the recommendation of the SAB, in August 2020, we terminated enrollment in Phase 2a early and advanced to Phase 2b in December 2021. The SAB unanimously supported the early termination of the Phase 2a trial after 10 patients were enrolled in the trial instead of 20 patients as originally planned. The early termination was further based on the evidence of meeting the treatment goals of eliminating the infection with an acceptable adverse event profile.

The SAB noted that 10 out of 10 patients enrolled in the Phase 2a trial reached the Clinical Cure endpoint, defined in the study protocol as the resolution of diarrhea in the 24-hour period immediately before the end-of-treatment that is maintained for 48 hours after end of treatment. Such cure was sustained, meaning that the patients showed no sign of infection recurrence, for 30 days thereafter. This constitutes a 100% response rate for the primary and secondary endpoints of the trial. All 10 patients enrolled in the Phase 2a trial met the study’s primary and secondary efficacy endpoints, namely, Clinical Cure at end of treatment and Sustained Clinical Cure of no recurrence of CDI at the 28-day follow-up visit. No treatment-related serious adverse events were reported by the investigators who enrolled patients in the trial. We believe these results represent the first-ever clinical data showing Pol IIIC has potential as a therapeutically-relevant antibacterial target. The Phase 2b portion of the Phase 2 clinical trial is designed as a 64-patient vancomycin- controlled, non-inferiority designed efficacy study. 32 of the patients will receive 450mg of ibezapolstat twice per day, and 32 of the patients will receive 125mg of vancomycin four times per day. Both groups of patients will receive this treatment for 10 days. Phase 2b began enrollment on December 3, 2021. In the event non-inferiority of ibezapolstat to vancomycin is demonstrated, further analysis will be conducted to test for superiority.

The SAB is comprised of seven scientists and clinicians who have significant expertise in the scientific disciplines required for the research and development of antibiotics. The members of the SAB serve at the pleasure of management, are paid in cash on an hourly basis for their services and do not receive equity compensation. Generally, the SAB is consulted by management during the process of designing our preclinical and clinical trials as well as in the process of analyzing data generated from these trials, although the SAB’s services are not limited to such activities.

Phase 3 Clinical Trial(s).

We intend to meet with the FDA after completing the Phase 2b clinical trial to finalize the size and scope of the Phase 3 clinical trial program. Regulatory precedent indicates that two Phase 3 trials of approximately 400 patients each would need to be conducted.

Regulatory Status

The regulatory timeline for a newly proposed product can take eight to ten years from pre-clinical studies through marketing approval. However, we inherited the manufacturing and pre-clinical data generated by the prior sponsor of our lead product candidate which we believe will reduce the timeline for regulatory approval by two to three years.

We have worked closely with the FDA to obtain our IND, and to obtain FDA fast track designation as well as designation of ibezapolstat as a QIDP, which provides incentives through the GAIN Act including FDA priority review for the first application submitted for the QIDP, fast-track designation eligibility and extension of statutory exclusivity periods in the U.S. for an additional five years upon FDA approval of the product for the treatment of CDI.

16

Government Regulation

The research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, marketing, among other things, of drug products are extensively regulated by governmental authorities in the U.S. and other countries. The processes for obtaining regulatory approvals in the U.S. and in foreign countries and jurisdictions, along with subsequent compliance with applicable statutes and regulations and other regulatory requirements, require the expenditure of substantial time and financial resources.

U.S. Government regulation of drug products

In the U.S., the FDA regulates human drugs under the FDCA, and its implementing regulations. Failure to comply with the applicable U.S. requirements may subject an applicant to administrative or judicial sanctions, such as FDA refusal to approve pending NDAs, or the agency’s issuance of warning letters, or the imposition of fines, civil penalties, product recalls, product seizures, total or partial suspension of production or distribution, injunctions and/or criminal prosecution brought by the FDA and the U.S. Department of Justice or other governmental entities.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

| ● | completion of preclinical laboratory tests, animal studies and formulation studies according to Good Laboratory Practices (“GLP”), regulations or other applicable regulations; |

| ● | submission to the FDA of an IND, which must become effective before human clinical trials may begin; |

| ● | approval by an independent institutional review board (“IRB”), or ethics committee at each clinical trial site before each clinical trial may be initiated; |

| ● | performance of adequate and well-controlled human clinical trials in accordance with applicable IND regulations, good clinical practice regulations and standards (“GCP”), and other clinical-trial related regulations to evaluate the safety and efficacy of the investigational product for each proposed indication; |

| ● | submission to the FDA of an NDA for marketing approval, including payment of application user fees; |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the drug is produced to assess compliance with current good manufacturing practice regulations (“cGMP”), to assure that the facilities, methods and controls are adequate to preserve the product’s identity, strength, quality and purity; |

| ● | potential FDA audit of the clinical trial sites to assure compliance with GCP and the integrity of the clinical data submitted in support of the NDA; and |

| ● | FDA review and approval of the NDA, including satisfactory completion of an FDA advisory committee review of the product candidate, where appropriate or if applicable, prior to any commercial marketing or sale of the product in the United States. |

Before testing any drug product candidate in humans, the product candidate must undergo rigorous preclinical testing. The preclinical developmental stage generally involves laboratory evaluations of drug chemistry, formulation and stability, as well as studies to evaluate toxicity in animals, which support subsequent clinical testing. The sponsor must submit the results of the preclinical studies, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of the IND. An IND is a request for authorization from the FDA to administer an investigational product to humans, and must become effective before human clinical trials may begin.

17

Preclinical studies include laboratory evaluation of product chemistry and formulation, as well as in vitro and animal studies, to assess the potential for adverse events and in some cases to establish a rationale for therapeutic use. The conduct of preclinical studies is subject to federal regulations and requirements, including GLP regulations for safety and toxicology studies.

All clinical trials must be conducted under the supervision of qualified investigators and in accordance with protocols detailing the objectives of the study, the parameters to be used in monitoring the safety and effectiveness criteria to be evaluated. Each protocol must be submitted to the FDA as part of the IND and each study subject must sign an informed consent form before participating in a clinical trial. An IND automatically becomes effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to one or more proposed clinical trials and places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Clinical holds may be imposed by the FDA at any time before or during studies due to safety concerns or non-compliance.

In addition, an IRB representing each institution that is participating in the clinical trial must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must thereafter conduct a continuing review and reapprove the trial at least annually.

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

Phase 1: The product candidate is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion. In the case of some products for severe or life-threatening diseases, such as cancer, especially when the product may be too inherently toxic to ethically administer to healthy volunteers, the initial human testing is often conducted in patients.

Phase 2: This phase involves studies in a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

Phase 3: Clinical trials are undertaken with an expanded patient population to further evaluate dosage, clinical efficacy and safety in an expanded patient population, often at geographically dispersed clinical study sites. These studies are intended to establish the overall risk-benefit ratio of the product candidate and provide, if appropriate, an adequate basis for product labeling. These trials may include comparisons with placebo and/or other comparator treatments. The duration of treatment is often extended to mimic the actual use of a product during marketing.

Post-approval trials, sometimes referred to as Phase 4 clinical trials, may be conducted after initial marketing approval. These trials are used to gain additional experience from the treatment of patients in the intended therapeutic indication. In certain instances, the FDA may mandate the performance of Phase 4 clinical trials as a condition of approval of an NDA.

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently if serious adverse events (“SAEs”) occur. The FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the clinical protocol, GCP, or other IRB requirements or if the drug has been associated with unexpected serious harm to patients.

Assuming successful completion of the required clinical testing, the results of the preclinical studies and clinical trials, along with information relating to the product’s chemistry, manufacturing, and controls and proposed labeling, are submitted to the FDA as part of an NDA requesting approval to market the product for one or more indications. Under federal law, the fee for the submission of an NDA for which clinical data is substantial (for example, for fiscal year 2021 this application fee exceeds $2.8 million), and the sponsor of an approved NDA is also subject to an annual program fee, currently more than $300,000 per program. These fees are typically adjusted annually, but exemptions and waivers may be available under certain circumstances.

18

Under the goals and policies agreed to by the FDA under the Prescription Drug User Fee Act (“PDUFA”), for original NDAs, the FDA has ten months from the filing date in which to complete its initial review of a standard application and respond to the applicant, and six months from the filing date for an application with priority review. For an all new molecular entity (“NME”), NDAs, the ten and six-month time periods run from the filing date; for all other original applications, the ten and six-month time periods run from the submission date. Despite these review goals, it is not uncommon for FDA review of an NDA to extend beyond the goal date.

Before approving an NDA, the FDA will typically conduct a pre-approval inspection of the manufacturing facilities for the new product to determine whether the manufacturing processes and facilities comply with cGMP. The FDA will not approve the product unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. The FDA also may inspect the sponsor and one or more clinical trial sites to assure compliance with GCP requirements and the integrity of the clinical data submitted to the FDA.

The FDA reviews an NDA to determine, among other things, whether a product is safe and effective for its intended use and whether its manufacturing is cGMP-compliant to assure and preserve the product’s identity, strength, quality and purity. On the basis of the FDA’s evaluation of the NDA and accompanying information, including the results of the inspection of the manufacturing facilities, the FDA may issue either an approval letter or a Complete Response Letter (“CRL”). An approval letter authorizes commercial marketing of the product with specific prescribing information for specific indications. A CRL indicates that the review cycle of the application is complete and the application will not be approved in its present form and outlines the deficiencies in the submission that must be addressed for the FDA to reconsider the application. If and when those deficiencies have been addressed to the FDA’s satisfaction in a resubmission of the NDA, the FDA will issue an approval letter.

Following approval of a new product, the manufacturer and the approved product are subject to pervasive and continuing regulation by the FDA, including, among other things, monitoring and recordkeeping activities, reporting of adverse experiences with the product, product sampling and distribution restrictions, complying with promotion and advertising requirements, which include restrictions on promoting drugs for unapproved uses or patient populations (i.e., “off-label use”) and limitations on industry-sponsored scientific and educational activities. Once a drug is granted approval, the FDA may withdraw the approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the product reaches the market. Later discovery of previously unknown problems with a product, including adverse events of unanticipated severity or frequency, or with manufacturing processes, or failure to comply with regulatory requirements, may result in mandatory revisions to the approved labeling to add new safety information; imposition of post-market or clinical trials to assess new safety risks; or imposition of distribution or other restrictions. Other potential consequences include, among other things:

| ● | restrictions on the marketing or manufacturing of the product, complete withdrawal of the product from the market or product recalls; |

| ● | fines, warning letters or other enforcement-related letters or clinical holds on post-approval clinical trials; |

| ● | refusal of the FDA to approve pending NDAs or supplements to approved NDAs, or suspension or revocation of product approvals; |

| ● | product seizure or detention, or refusal to permit the import or export of products; |

| ● | injunctions or the imposition of civil or criminal penalties; and |

| ● | consent decrees, corporate integrity agreements, debarment, or exclusion from federal health care programs; or mandated modification of promotional materials and labeling and the issuance of corrective information. |

19

Manufacturing

Overall, management believes the manufacturing process established by the prior sponsor of our ibezapolstat development program is efficient with cost of goods sold expected to be less than 5% of a preliminary range of proposed sales price estimates.

Thus far, ibezapolstat drug substance (DS) has been manufactured successfully in both 1 kg and 9 kg batches, with 9 kg batches considered to be a commercial scale. We anticipate that the commercial batch size upon completion of the clinical development program and submission of a New Drug Application (NDA) will be 10 kg to 15 kg which in our estimation will further reduce our cost of goods sold. The 9 kg batch was sufficient to support the Phase 1 and Phase 2 clinical trial needs (Phase 2a and Phase 2b). No material issues were noted in the manufacture of either the 1 kg or 9 kg batches of ibezapolstat to date with 36-month stability very good and well within acceptable FDA standards. Additionally, we can extrapolate to 48-months stability per FDA Manufacturing Guidance in advance of a 48-month pull point to occur in the first half of 2023.

Ibezapolstat drug product (DP), 150mg capsules, have been manufactured and used in the Phase 1 and Phase 2a clinical trial and are being used in the Phase 2b clinical trial. Thirty-six months stability data on capsules show no significant changes in the key quality attributes and no discernable data trends at any of the storage conditions. A minimum of 24-months shelf-life is anticipated. Through our outside manufacturing vendors, we will continue to monitor the stability of DS and DP on an ongoing basis as we continue to advance the clinical development program.

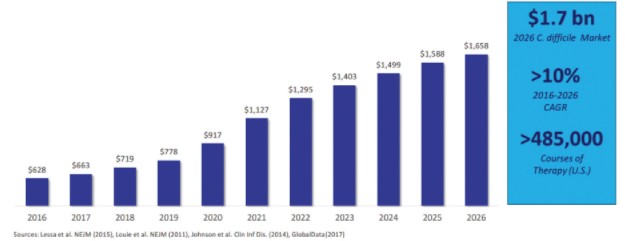

Market Opportunity

According to the 2017 Update (published February 2018) of the Clinical Practice Guidelines for Clostridium difficile Infection in Adults and Children by the Infectious Diseases Society of America (IDSA) and Society of Healthcare Epidemiology of America (SHEA), CDI remains a significant medical problem in hospitals, in long-term care facilities and in the community. Clostridioides (formerly Clostridium) difficile, also known as C. difficile or C. diff, is one of the most common causes of health care-associated infections in U.S. hospitals (Lessa, et al, 2015, New England Journal of Medicine). Recent estimates suggest C. difficile approaches 500,000 infections annually in the U.S. and is associated with approximately 20,000 deaths. (Guh, 2020, New England Journal of Medicine). Based on internal estimates including a recurrence rate of between 20% and 40% among approximately 150,000 patients treated, we believe that the annual incidence in the U.S. approaches 600,000 infections and a mortality rate of approximately 9.3%.

Antibiotics are the gold standard to treat CDI. However, while currently marketed antibiotics achieve a relatively high initial cure rate, they can fail to eliminate C. difficile, especially drug-resistant strains, in the gut, allowing the continued growth of the bacteria. This, together with a pronounced detrimental effect on the gut microbiome, leads to recurrence in over 25% of CDI patients after therapy is stopped. A significant unmet need remains for antibiotics that can meaningfully reduce recurrence. According to our recent clinical data, we believe ibezapolstat has the potential to continue to provide a bactericidal effect combined with a low incidence of recurrence when used to treat CDI.

Antibiotics provide advantages over the use of antibodies, microbiologics, and vaccines. Antibodies are generally only administered in combination with an antibiotic. Due to high costs and the inability to use antibodies as a first-line treatment, antibodies have gained limited commercial traction and there has only been one antibody treatment for CDI approved to date. As of the date of this Form 10-K, there are currently two microbiologics in late-stage development with clinical data forthcoming. Safety is a concern with microbiologics, and this course of treatment is only recommended for patients with multiple recurrences of CDI who have failed appropriate antibiotic treatments. There are also several vaccines against C. difficile in late-stage development, but none are currently approved. A vaccine is only likely to be commercially viable as a prevention of recurrent CDI in high-risk patients, if such patients can be identified. Additionally, large numbers of patients are required for clinical trials of vaccines, which could significantly delay the clinical development process for and eventual release of any CDI vaccine products currently in development.

C. difficile has surpassed MRSA, as the leading cause of death among hospitalized patients. CDI is a serious illness resulting from infection of the inner lining of the colon by C. difficile bacteria that produce toxins causing inflammation of the colon, severe diarrhea and, in the most serious cases, death. Patients typically develop CDI from the use of broad-

20

spectrum antibiotics that disrupt normal gastrointestinal (gut) flora, thus allowing C. difficile bacteria to flourish and produce toxins. C. difficile is a spore forming bacterium, creating spores excreted in the environment of the patients that can survive for months on dry surfaces in hospital rooms such as beds and doors, and can contaminate other patients by fecal-oral transmission through the hands of healthcare workers.