gtx-2022123100017357072022FYfalsehttp://fasb.org/us-gaap/2021-01-31#AccountingStandardsUpdate201613Member1one monthhttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent00017357072022-01-012022-12-310001735707us-gaap:CommonStockMember2022-01-012022-12-310001735707us-gaap:SeriesAPreferredStockMember2022-01-012022-12-3100017357072022-06-30iso4217:USD00017357072023-02-08xbrli:shares0001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2022-12-3100017357072021-01-012021-12-3100017357072020-01-012020-12-31iso4217:USDxbrli:shares00017357072022-12-3100017357072021-12-310001735707us-gaap:SeriesAPreferredStockMember2021-12-310001735707us-gaap:SeriesAPreferredStockMember2022-12-3100017357072020-12-3100017357072019-12-310001735707us-gaap:PreferredStockMember2019-12-310001735707us-gaap:CommonStockMember2019-12-310001735707us-gaap:AdditionalPaidInCapitalMember2019-12-310001735707us-gaap:RetainedEarningsMember2019-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001735707us-gaap:RetainedEarningsMember2020-01-012020-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001735707us-gaap:CommonStockMember2020-01-012020-12-310001735707us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-3100017357072019-01-012019-12-310001735707us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001735707srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001735707us-gaap:PreferredStockMember2020-12-310001735707us-gaap:CommonStockMember2020-12-310001735707us-gaap:AdditionalPaidInCapitalMember2020-12-310001735707us-gaap:RetainedEarningsMember2020-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001735707us-gaap:RetainedEarningsMember2021-01-012021-12-310001735707us-gaap:CommonStockMember2021-01-012021-12-310001735707us-gaap:PreferredStockMember2021-01-012021-12-310001735707us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001735707us-gaap:PreferredStockMember2021-12-310001735707us-gaap:CommonStockMember2021-12-310001735707us-gaap:AdditionalPaidInCapitalMember2021-12-310001735707us-gaap:RetainedEarningsMember2021-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001735707us-gaap:RetainedEarningsMember2022-01-012022-12-310001735707us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001735707us-gaap:PreferredStockMember2022-12-310001735707us-gaap:CommonStockMember2022-12-310001735707us-gaap:AdditionalPaidInCapitalMember2022-12-310001735707us-gaap:RetainedEarningsMember2022-12-310001735707us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100017357072021-04-262021-04-260001735707us-gaap:CommonStockMember2021-04-262021-04-260001735707us-gaap:SeriesAPreferredStockMember2021-04-262021-04-260001735707gtx:HoneywellInternationalIncMembergtx:PSAAndTransactionAmendedPlanMemberus-gaap:SeriesBPreferredStockMember2021-04-262021-04-260001735707gtx:HoneywellInternationalIncMembergtx:PSAAndTransactionAmendedPlanMember2021-04-262021-04-260001735707gtx:DebtorInPossessionTermLoanFacilityMember2021-04-262021-04-260001735707gtx:TermAFacilityMembergtx:SeniorSecuredCreditFacilitiesMembergtx:CreditAgreementMember2018-09-272018-09-270001735707gtx:CreditAgreementEURTrancheMembergtx:TermBFacilityMembergtx:SeniorSecuredCreditFacilitiesMember2018-09-272018-09-270001735707gtx:TermBFacilityMembergtx:SeniorSecuredCreditFacilitiesMembergtx:CreditAgreementUSDTrancheMember2018-09-272018-09-270001735707gtx:TermBFacilityMembergtx:SeniorSecuredCreditFacilitiesMembergtx:CreditAgreementMember2018-09-272018-09-270001735707gtx:SeniorSecuredCreditFacilitiesMembergtx:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2018-09-272018-09-270001735707gtx:SeniorSecuredCreditFacilitiesMembergtx:CreditAgreementMember2018-09-272018-09-270001735707us-gaap:SeniorNotesMembergtx:DebtorsMember2018-09-272018-09-27iso4217:EUR0001735707gtx:DebtorsMember2018-09-270001735707us-gaap:SettledLitigationMembergtx:DebtorsMember2018-09-270001735707us-gaap:SeniorNotesMembergtx:DebtorsMember2018-09-27xbrli:pure0001735707gtx:ProfessionalFeesAndExpensesMembergtx:CenterbridgeOaktreeAndHoneywellMember2022-01-012022-12-310001735707gtx:HoneywellInternationalIncMembergtx:PSAAndTransactionAmendedPlanMember2021-01-012021-12-310001735707us-gaap:SettledLitigationMember2021-12-310001735707srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001735707us-gaap:BuildingAndBuildingImprovementsMembersrt:MaximumMember2022-01-012022-12-310001735707us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-01-012022-12-310001735707us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2022-01-012022-12-310001735707us-gaap:ToolsDiesAndMoldsMembersrt:MinimumMember2022-01-012022-12-310001735707us-gaap:ToolsDiesAndMoldsMembersrt:MaximumMember2022-01-012022-12-310001735707us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2022-01-012022-12-310001735707us-gaap:SoftwareDevelopmentMembersrt:MaximumMember2022-01-012022-12-310001735707us-gaap:CostOfSalesMember2022-01-012022-12-310001735707us-gaap:CostOfSalesMember2021-01-012021-12-310001735707us-gaap:CostOfSalesMember2020-01-012020-12-310001735707gtx:HoneywellInternationalIncMember2022-01-012022-12-310001735707gtx:HoneywellInternationalIncMember2022-12-310001735707gtx:HoneywellInternationalIncMember2021-12-31gtx:Segment0001735707srt:MaximumMember2022-12-3100017357072023-01-012022-12-310001735707country:BR2022-12-310001735707country:LU2022-12-310001735707country:GB2022-12-310001735707gtx:OtherMember2022-12-310001735707us-gaap:NonUsMember2022-12-310001735707country:CN2022-01-012022-12-310001735707us-gaap:LandAndLandImprovementsMember2022-12-310001735707us-gaap:LandAndLandImprovementsMember2021-12-310001735707us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001735707us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001735707us-gaap:MachineryAndEquipmentMember2022-12-310001735707us-gaap:MachineryAndEquipmentMember2021-12-310001735707us-gaap:ToolsDiesAndMoldsMember2022-12-310001735707us-gaap:ToolsDiesAndMoldsMember2021-12-310001735707us-gaap:SoftwareDevelopmentMember2022-12-310001735707us-gaap:SoftwareDevelopmentMember2021-12-310001735707us-gaap:ConstructionInProgressMember2022-12-310001735707us-gaap:ConstructionInProgressMember2021-12-310001735707us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310001735707us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310001735707us-gaap:EmployeeSeveranceMember2020-12-310001735707us-gaap:SpinoffMember2020-12-310001735707us-gaap:EmployeeSeveranceMember2021-01-012021-12-310001735707us-gaap:SpinoffMember2021-01-012021-12-310001735707us-gaap:EmployeeSeveranceMember2021-12-310001735707us-gaap:SpinoffMember2021-12-310001735707us-gaap:EmployeeSeveranceMember2022-01-012022-12-310001735707us-gaap:SpinoffMember2022-01-012022-12-310001735707us-gaap:EmployeeSeveranceMember2022-12-310001735707us-gaap:SpinoffMember2022-12-310001735707gtx:TermLoanFacilityMembergtx:CreditAgreementUSDTrancheMemberus-gaap:SecuredDebtMember2021-04-262021-04-260001735707gtx:TermLoanFacilityMembergtx:CreditAgreementUSDTrancheMemberus-gaap:SecuredDebtMember2021-04-260001735707gtx:TermLoanFacilityMembergtx:CreditAgreementEURTrancheMemberus-gaap:SecuredDebtMember2021-04-262021-04-260001735707gtx:TermLoanFacilityMembergtx:CreditAgreementEURTrancheMemberus-gaap:SecuredDebtMember2021-04-260001735707gtx:USDollarTermLoanFacilityMember2022-12-310001735707gtx:USDollarTermLoanFacilityMember2021-12-310001735707gtx:EuroTermLoanFacilityMember2022-12-310001735707gtx:EuroTermLoanFacilityMember2021-12-310001735707gtx:CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2021-04-262021-04-260001735707gtx:CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2021-04-260001735707gtx:CreditAgreementMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001735707us-gaap:LetterOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-04-260001735707gtx:CreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001735707us-gaap:StandbyLettersOfCreditMembergtx:CreditAgreementMember2022-12-310001735707us-gaap:LetterOfCreditMember2021-12-310001735707us-gaap:LetterOfCreditMember2022-12-310001735707gtx:CreditAgreementMembersrt:MinimumMembergtx:AlternateBaseRateMember2022-01-012022-12-310001735707us-gaap:LondonInterbankOfferedRateLIBORMembergtx:CreditAgreementMembersrt:MinimumMember2022-01-012022-12-310001735707us-gaap:LondonInterbankOfferedRateLIBORMembergtx:CreditAgreementMember2022-01-012022-12-310001735707gtx:CreditAgreementMembergtx:AlternateBaseRateMember2022-01-012022-12-310001735707gtx:CreditAgreementMembersrt:MinimumMemberus-gaap:EurodollarMember2022-01-012022-12-310001735707us-gaap:EurodollarMember2022-01-012022-12-310001735707srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001735707srt:MinimumMembergtx:AlternateBaseRateMember2022-01-012022-12-310001735707srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001735707gtx:CreditAgreementMember2022-01-012022-12-310001735707gtx:CreditAgreementMembersrt:MaximumMember2022-01-012022-12-310001735707gtx:CreditAgreementMember2022-12-310001735707gtx:HoneywellInternationalIncMemberus-gaap:SeriesBPreferredStockMember2021-04-262021-04-260001735707gtx:HoneywellInternationalIncMemberus-gaap:SeriesBPreferredStockMember2021-12-282021-12-280001735707gtx:HoneywellInternationalIncMemberus-gaap:SeriesBPreferredStockMember2022-01-012022-12-310001735707gtx:HoneywellInternationalIncMemberus-gaap:SeriesBPreferredStockMember2022-12-310001735707srt:MaximumMember2022-01-012022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForeignExchangeForwardMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CrossCurrencyInterestRateContractMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeForwardMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:NondesignatedMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001735707us-gaap:InterestRateSwapMember2022-12-310001735707us-gaap:CrossCurrencyInterestRateContractMember2022-12-310001735707us-gaap:CrossCurrencyInterestRateContractMember2022-01-012022-12-310001735707us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001735707us-gaap:SeriesAPreferredStockMembergtx:CenterbridgeOaktreeAndAdditionalInvestorsMember2022-12-3100017357072021-04-260001735707us-gaap:SeriesAPreferredStockMember2022-09-082022-09-080001735707us-gaap:SeriesAPreferredStockMember2022-09-080001735707us-gaap:SeriesAPreferredStockMember2022-12-062022-12-060001735707us-gaap:SeriesAPreferredStockMember2022-12-060001735707us-gaap:SeriesAPreferredStockMember2022-12-280001735707us-gaap:SeriesAPreferredStockMembersrt:MaximumMember2022-12-310001735707us-gaap:SeriesBPreferredStockMembersrt:MaximumMember2022-12-310001735707srt:MinimumMember2022-01-012022-12-3100017357072021-11-160001735707us-gaap:SeriesAPreferredStockMember2021-11-162021-12-3100017357072021-11-162021-12-310001735707us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001735707us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001735707gtx:AccumulatedGainLossChangesInFairValueOfNetInvestmentHedgesMember2020-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001735707us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001735707us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001735707gtx:AccumulatedGainLossChangesInFairValueOfNetInvestmentHedgesMember2021-01-012021-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001735707us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001735707us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001735707gtx:AccumulatedGainLossChangesInFairValueOfNetInvestmentHedgesMember2021-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001735707us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001735707us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001735707gtx:AccumulatedGainLossChangesInFairValueOfNetInvestmentHedgesMember2022-01-012022-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001735707us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001735707us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001735707gtx:AccumulatedGainLossChangesInFairValueOfNetInvestmentHedgesMember2022-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001735707us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001735707us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001735707us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001735707us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001735707us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001735707us-gaap:RestrictedStockUnitsRSUMember2021-04-262021-04-260001735707us-gaap:RestrictedStockUnitsRSUMember2021-04-260001735707us-gaap:RestrictedStockUnitsRSUMembergtx:RecordedToEquityMember2021-04-262021-04-260001735707gtx:ReorganizationItemsNetMemberus-gaap:RestrictedStockUnitsRSUMember2021-04-262021-04-260001735707us-gaap:PerformanceSharesMember2021-04-262021-04-260001735707us-gaap:PerformanceSharesMember2021-04-260001735707us-gaap:PerformanceSharesMembergtx:ReorganizationItemsNetMember2021-04-262021-04-260001735707us-gaap:EmployeeStockOptionMembergtx:ReorganizationItemsNetMember2021-04-262021-04-260001735707gtx:CashPerformanceStockUnitsMember2021-04-262021-04-260001735707gtx:CashPerformanceStockUnitsMember2021-04-260001735707gtx:CashPerformanceStockUnitsMembergtx:ReorganizationItemsNetMember2021-04-262021-04-260001735707gtx:ContinuityAwardsMember2020-09-012020-09-300001735707gtx:ContinuityAwardsMember2021-01-012021-12-310001735707gtx:ContinuityAwardsMember2020-12-310001735707gtx:ContinuityAwardsMember2021-12-310001735707gtx:TwoThousandTwentyOneLongTermIncentivePlanMembersrt:MaximumMember2021-05-250001735707gtx:TwoThousandTwentyOneLongTermIncentivePlanMember2022-12-310001735707srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001735707srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001735707us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001735707gtx:StockIncentivePlanAndLongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2020-12-310001735707gtx:StockIncentivePlanAndLongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001735707gtx:StockIncentivePlanAndLongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-12-310001735707gtx:StockIncentivePlanAndLongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001735707gtx:StockIncentivePlanAndLongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001735707gtx:LongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-12-310001735707gtx:LongTermIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001735707gtx:OfficersAndCertainKeyEmployeesMemberus-gaap:PerformanceSharesMembergtx:LongTermIncentivePlanMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMembergtx:TwoThousandTwentyOnePerformanceStockUnitsLongTermIncentivePlanMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembergtx:TwoThousandTwentyOnePerformanceStockUnitsLongTermIncentivePlanForTotalShareHolderReturnMeasureMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembergtx:TwoThousandTwentyOnePerformanceStockUnitsLongTermIncentivePlanForAdjustedEBITDAAndAdjustedEBITDAMarginMeasuresMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembersrt:MinimumMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMembersrt:MaximumMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembergtx:TwoThousandTwentyOnePerformanceStockUnitsLongTermIncentivePlanForAdjustedEBITDAAndAdjustedEBITDAMarginMeasuresMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMembersrt:MaximumMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembergtx:StockIncentivePlanAndLongTermIncentivePlanMember2020-12-310001735707us-gaap:PerformanceSharesMembergtx:StockIncentivePlanAndLongTermIncentivePlanMember2021-01-012021-12-310001735707us-gaap:PerformanceSharesMembergtx:StockIncentivePlanAndLongTermIncentivePlanMember2021-12-310001735707us-gaap:PerformanceSharesMembergtx:StockIncentivePlanAndLongTermIncentivePlanMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMembergtx:StockIncentivePlanAndLongTermIncentivePlanMember2022-12-310001735707gtx:StockIncentivePlanMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001735707us-gaap:PerformanceSharesMember2022-12-310001735707us-gaap:PerformanceSharesMember2022-01-012022-12-310001735707us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001735707us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001735707us-gaap:PerformanceSharesMember2020-01-012020-12-310001735707us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001735707us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001735707us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001735707gtx:ContinuityAwardsMember2022-01-012022-12-310001735707gtx:ContinuityAwardsMember2020-01-012020-12-310001735707us-gaap:StockCompensationPlanMember2022-01-012022-12-310001735707us-gaap:StockCompensationPlanMember2021-01-012021-12-310001735707us-gaap:StockCompensationPlanMember2020-01-012020-12-310001735707us-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2022-12-310001735707us-gaap:SecretariatOfTheFederalRevenueBureauOfBrazilMember2021-03-012021-03-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-01-012021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-01-012021-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:IE2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:CH2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMembercountry:US2020-01-012020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2020-01-012020-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:BenefitObligationMember2022-01-012022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:BenefitObligationMember2021-01-012021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:BenefitObligationMember2020-01-012020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:BenefitObligationMember2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:BenefitObligationMember2021-01-012021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:BenefitObligationMember2020-01-012020-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:ServiceCostMember2022-01-012022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:ServiceCostMember2021-01-012021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:ServiceCostMember2020-01-012020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:ServiceCostMember2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:ServiceCostMember2021-01-012021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:ServiceCostMember2020-01-012020-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:InterestCostMember2022-01-012022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:InterestCostMember2021-01-012021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:InterestCostMember2020-01-012020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:InterestCostMember2022-01-012022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:InterestCostMember2021-01-012021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:InterestCostMember2020-01-012020-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanMultiAssetCreditIncomeMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:HedgeFundsMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMemberus-gaap:FairValueInputsLevel1Member2022-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:USus-gaap:PensionPlansDefinedBenefitMember2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMembercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMember2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2021-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USTreasuryAndGovernmentMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707country:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Membercountry:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707us-gaap:FairValueInputsLevel3Membercountry:USus-gaap:PensionPlansDefinedBenefitMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMemberus-gaap:FairValueInputsLevel1Member2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2022-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMemberus-gaap:DefinedBenefitPlanRealEstateMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMemberus-gaap:ForeignPlanMember2021-12-310001735707us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707us-gaap:FairValueInputsLevel2Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707us-gaap:FairValueInputsLevel3Memberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembergtx:DefinedBenefitPlanAssetsAtFairValueMember2021-12-310001735707country:USgtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707country:USgtx:AftermarketMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707country:USgtx:OtherMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707country:USus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:EuropeMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:EuropeMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:EuropeMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:EuropeMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:AsiaMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:AsiaMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:AsiaMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707srt:AsiaMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:OriginalEquipmentManufacturersMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:AftermarketMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:OtherMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:AftermarketMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:OtherMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707us-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707country:USgtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707country:USgtx:AftermarketMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707country:USgtx:OtherMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707country:USus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:EuropeMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:EuropeMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:EuropeMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:EuropeMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:AsiaMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:AsiaMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:AsiaMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707srt:AsiaMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:OriginalEquipmentManufacturersMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:AftermarketMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:OtherMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:AftermarketMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:OtherMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707us-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707country:USgtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707country:USgtx:AftermarketMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707country:USgtx:OtherMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707country:USus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:EuropeMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:EuropeMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:EuropeMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:EuropeMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:AsiaMembergtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:AsiaMembergtx:AftermarketMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:AsiaMembergtx:OtherMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707srt:AsiaMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:OriginalEquipmentManufacturersMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:AftermarketMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:OtherMembergtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:OtherInternationalMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:OriginalEquipmentManufacturersMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:AftermarketMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:OtherMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707us-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707gtx:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707gtx:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707gtx:CustomerAMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:CustomerBMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:CustomerBMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:CustomerBMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:OthersCustomerMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:OthersCustomerMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707us-gaap:CustomerConcentrationRiskMembergtx:OthersCustomerMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001735707us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001735707us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001735707country:USus-gaap:NetAssetsGeographicAreaMember2022-12-310001735707country:USus-gaap:NetAssetsGeographicAreaMember2021-12-310001735707country:USus-gaap:NetAssetsGeographicAreaMember2020-12-310001735707srt:EuropeMemberus-gaap:NetAssetsGeographicAreaMember2022-12-310001735707srt:EuropeMemberus-gaap:NetAssetsGeographicAreaMember2021-12-310001735707srt:EuropeMemberus-gaap:NetAssetsGeographicAreaMember2020-12-310001735707srt:AsiaMemberus-gaap:NetAssetsGeographicAreaMember2022-12-310001735707srt:AsiaMemberus-gaap:NetAssetsGeographicAreaMember2021-12-310001735707srt:AsiaMemberus-gaap:NetAssetsGeographicAreaMember2020-12-310001735707us-gaap:NetAssetsGeographicAreaMembergtx:OtherInternationalMember2022-12-310001735707us-gaap:NetAssetsGeographicAreaMembergtx:OtherInternationalMember2021-12-310001735707us-gaap:NetAssetsGeographicAreaMembergtx:OtherInternationalMember2020-12-310001735707us-gaap:NetAssetsGeographicAreaMember2022-12-310001735707us-gaap:NetAssetsGeographicAreaMember2021-12-310001735707us-gaap:NetAssetsGeographicAreaMember2020-12-310001735707us-gaap:CostOfGoodsTotalMembergtx:DirectMaterialPurchasesMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001735707us-gaap:CostOfGoodsTotalMembergtx:DirectMaterialPurchasesMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001735707us-gaap:CostOfGoodsTotalMembergtx:DirectMaterialPurchasesMemberus-gaap:SupplierConcentrationRiskMember2020-01-012020-12-3100017357072022-01-012022-03-3100017357072022-04-012022-06-3000017357072022-07-012022-09-3000017357072022-10-012022-12-3100017357072021-01-012021-03-3100017357072021-04-012021-06-3000017357072021-07-012021-09-3000017357072021-10-012021-12-310001735707us-gaap:AllowanceForCreditLossMember2021-12-310001735707us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001735707us-gaap:AllowanceForCreditLossMember2022-12-310001735707us-gaap:InventoryValuationReserveMember2021-12-310001735707us-gaap:InventoryValuationReserveMember2022-01-012022-12-310001735707us-gaap:InventoryValuationReserveMember2022-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001735707us-gaap:AllowanceForCreditLossMember2020-12-310001735707us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001735707us-gaap:InventoryValuationReserveMember2020-12-310001735707us-gaap:InventoryValuationReserveMember2021-01-012021-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310001735707us-gaap:AllowanceForCreditLossMember2019-12-310001735707us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310001735707us-gaap:InventoryValuationReserveMember2019-12-310001735707us-gaap:InventoryValuationReserveMember2020-01-012020-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310001735707us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 10-K

__________________________

(Mark One)

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from_____to_____

Commission File Number 001-38636

__________________________

Garrett Motion Inc.

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | |

| Delaware | | 82-4873189 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

La Pièce 16 , Rolle, Switzerland | | 1180 |

| (Address of Principal Executive Offices) | | (Zip Code) |

+41 21 695 30 00

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | GTX | The Nasdaq Stock Market LLC |

| Series A Cumulative Convertible Preferred Stock, par value $0.001 per share | GTXAP | The Nasdaq Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☒ |

| | | | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | |

| Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $501 million based on the closing price of its shares of Common Stock, par value $0.001 per share, on the Nasdaq Global Select Market on June 30, 2022, the last business day of the registrant’s second fiscal quarter.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

As of February 8, 2023, the registrant had 64,842,997 shares of common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement relating to its 2023 annual meeting of shareholders (the “2023 Proxy Statement”) are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The 2023 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

BASIS OF PRESENTATION

Unless the context otherwise requires, references to “Garrett,” “we,” “us,” “our,” and “the Company” in this Annual Report on Form 10-K refer to Garrett Motion Inc. and its subsidiaries.

The accompanying consolidated financial statements of Garrett reflect the consolidated results of operations, financial position and cash flows of Garrett, in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP” or "GAAP").

Throughout this Annual Report on Form 10-K, we reference certain industry sources. While we believe the compound annual growth rate (“CAGR”) and other projections of the industry sources referenced in this Annual Report on Form 10-K are reasonable, forecasts based upon such data involve inherent uncertainties, and actual outcomes are subject to change based upon various factors beyond our control. All data from industry sources is provided as of the latest practicable date prior to the filing of this Annual Report on Form 10-K and may be subject to change.

| | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

This Annual Report on Form 10-K (this "Annual Report") contains forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended ("the Securities Act"). All statements other than statements of historical fact contained in this Annual Report, including without limitation statements regarding our future results of operations and financial position, expectations regarding the growth of the turbocharger and electric vehicle markets and other industry trends, the sufficiency of our cash and cash equivalents, anticipated sources and uses of cash, anticipated investments in our business, our business strategy, pending litigation, anticipated interest expense, and the plans and objectives of management for future operations and capital expenditures are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Annual Report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this Annual Report and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described in Part I, Item 1A. “Risk Factors,” of this Annual Report and in our other filings with the Securities and Exchange Commission (the "SEC").

You should read this Annual Report and the documents that we reference herein completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

PART I

Item 1. Business

Our Company

Garrett designs, manufactures and sells highly engineered turbocharger and electric-boosting technologies for light and commercial vehicle original equipment manufacturers (“OEMs”) and the global vehicle independent aftermarket as well as automotive software solutions. These OEMs, in turn, ship to consumers globally. We are a global technology leader with significant expertise in delivering products for internal combustion engines ("ICE") using gasoline, diesel, natural gas and electrified powertrains (hybrid and fuel cell). Additionally, we are currently in the development stage of turbochargers for internal combustion engines using hydrogen as fuel and other highly engineered components for zero emission vehicles. These products are key enablers for fuel (and/or energy) economy and emissions standards compliance.

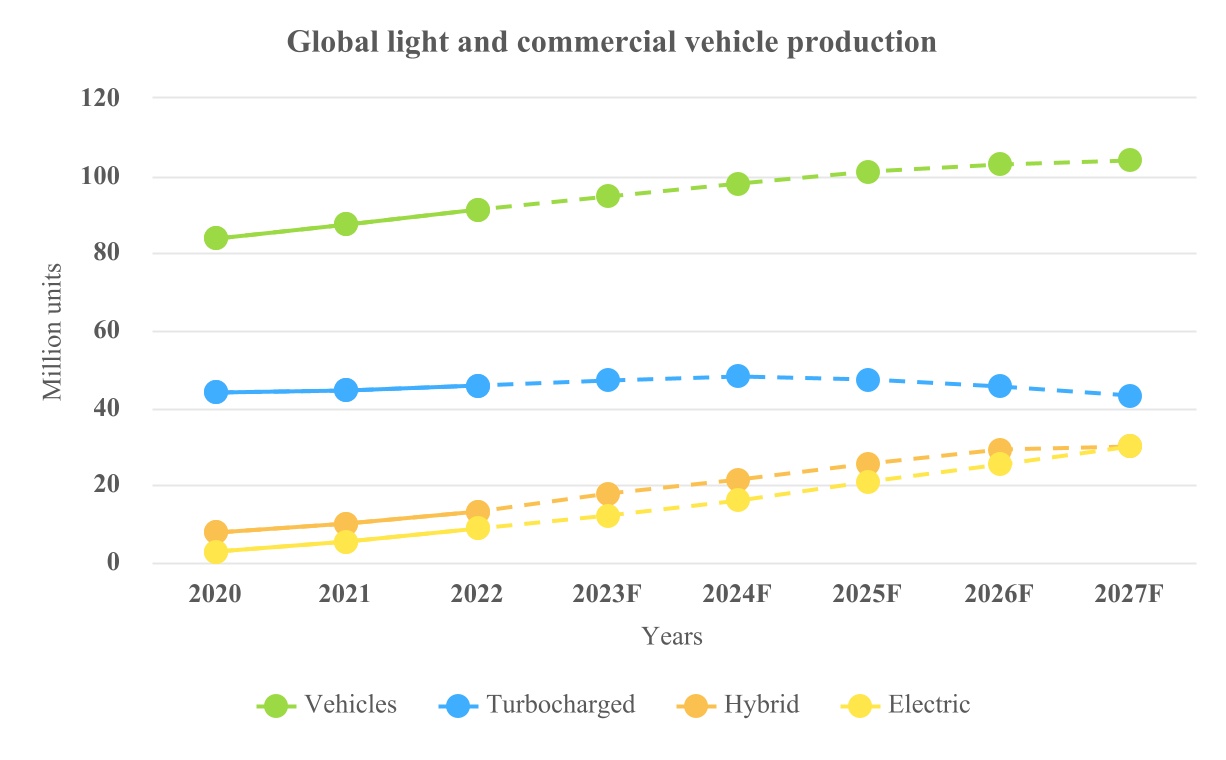

The turbocharger industry is expected to increase from approximately 46 million units in 2022 to approximately 48 million units by 2024, then gradually plateau and drop to approximately 41 million units by 2028, according to S&P ("S&P", formerly IHS) for light vehicles and Knibb, Gormezano and Partners ("KGP") and Power Systems Research ("PSR") for on-highway and off-highway commercial vehicles. The turbocharger industry growth is mainly driven in the short and medium term by an expected increase in the penetration of hybrid vehicles, from approximately 13 million hybrid cars globally in 2022 to an anticipated 29 million hybrid cars globally in 2026.

In 2022, a significant increase in battery electric vehicle (“BEV”) production has been observed in Europe and China, with BEV representing, respectively, 8% and 18% of light vehicles produced. In China, renewed sales incentives, especially in Tier 2 and Tier 3 cities, as well as non-financial incentives such as more generous license-plate quotas for major metropolitan areas, have bolstered Chinese BEV penetration. In the long-term, the proposal in the European Union ("E.U.") for all new cars to be zero-emission at tail pipe by 2035, as well as local regulations, could drive a further increase of BEV penetration in Europe beyond currently forecasted levels. In the United States of America ("US" or "United States"), the tightening of CO2/mileage targets is expected to drive higher turbo penetration in the short to medium-term. The President of the United States signed an executive order with the goal of making half of all new vehicles sold in 2030 zero-emissions vehicles, including battery electric, plug-in hybrid electric, or fuel cell electric vehicles, which is expected to accelerate the electrification trend in the mid-to-long term. Garrett's portfolio for hybrid powertrains includes new electric boosting solutions that leverage our unique technologies for electrical high speed boosting machinery. Garrett's product portfolio also includes fuel cell compressors for which we are developing the third generation. We are well positioned to take advantage of growing opportunities especially in the application of commercial vehicles. In China, the roadmap released by the China Society of Automotive Engineers, Energy-saving and New Energy Vehicle Technology Roadmap 2.0, outlines a technology path for the next ten years that aims to find a balance between fuel consumption improvement for hybrids and the introduction of electric vehicles. In that context, the turbocharger industry is expected to keep contributing to fuel economy optimization of gasoline, diesel vehicles and hybrid vehicles.

In the short to medium term, we continue to believe that turbocharger demand will grow as turbochargers remain one of the most cost-efficient levers to improve the fuel efficiency of gasoline, diesel and hybrid vehicles. In 2021, Garrett won the prestigious Automotive News PACE™ award for the industry's first E-turbo that successfully launched in 2022. The unique high speed electric motor technology developed for this product came from Garrett's fuel cell compressors that are required by fuel cell vehicles. Additionally, this technology also offers opportunities for new products to support all types of electrified drivetrains. In the commercial vehicle industry, we expect a slower transition to BEVs due to the requirements of specific applications and associated range and charging time constraints, which translates into more resilient turbocharger demand, as most commercial vehicles are turbocharged. In addition, low or zero emission alternative fuels for ICE, like natural gas or hydrogen, are expected to gain momentum in coming years, supporting continued turbocharger demand. Growth in the turbocharger industry is expected globally, with special mention for high-growth regions in Asia, where rising income levels continue to drive long-term automotive demand. While these positive factors do not isolate the turbocharger industry from fluctuations in global vehicle production volumes, such factors may assist in mitigating the negative impact of macroeconomic cycles. In addition, approximately 30% of our revenue comes from commercial vehicle and aftermarket sales that are less sensitive to the trend of electrification.

Emergence from Chapter 11

On September 20, 2020 (the “Petition Date”), the Company and certain of its subsidiaries (collectively, the “Debtors”) each filed a voluntary petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”). The

Debtors’ chapter 11 cases (the “Chapter 11 Cases”) were jointly administered under the caption “In re: Garrett Motion Inc., 20-12212.” On April 20, 2021, the Debtors filed the Revised Amended Plan of Reorganization (the “Plan”). On April 26, 2021, the Bankruptcy Court entered an order (the “Confirmation Order”) among other things, confirming the Plan. On April 30, 2021 (the “Effective Date”), the conditions to the effectiveness of the Plan were satisfied or waived and the Company emerged from bankruptcy (the "Emergence").

Macroeconomic disruptions

The automotive industry continues to be impacted by uncertainty due to worldwide semiconductor shortages, the Covid-19 pandemic, governmental responses to the pandemic including the lockdown measures in China, and geopolitical tensions. The semiconductor shortage is expected to continue into 2023 although to a lesser extent compared to the previous year, and production levels may be reduced further should Covid-related lockdown measures persist or extend. The evolution of geopolitical conflicts and the consequent energy shortage in Europe, especially during the winter season, may further expose supply related challenges for the automotive industry while adding inflationary pressure and triggering recessionary scenarios. The Company continues to review production levels at OEM plants and closely monitor supply-chain disruptions related to logistics and component shortages in order to minimize the impact of the bottleneck in supply and mitigate any potential disruption in production. Additionally, we have in place procedures for the monitoring of supplier risks and we believe we have substantially addressed such risks with manageable economic impacts including use of premium freight or adjusted payment terms that are limited in time. We have prepared contingency plans for multiple scenarios that we believe will allow us to react swiftly to changes in customer demand while protecting Garrett’s long-term growth potential. See "- Risks Relating to our Business - Volatility in the cost and availability of raw materials, components, energy and transportation, in addition to disruptions in the supply chain, including supplier insolvency, has increased, and may continue to increase, the cost of our products and services, and may impact our ability to meet commitments to customers and cause us to incur significant liabilities." - in Item 1A - Risk Factors of this Annual Report.

Analyst consensus for the full year 2022 estimates growth of approximately 6% in global light vehicle production and approximately 15% drop in commercial vehicle production. As for the turbocharger industry, a 5% increase for the combined light and commercial vehicle turbocharger industry volume occurred in 2022. In 2023, 4% growth is expected by S&P for light vehicle production, and commercial vehicles are expected by KGP and PSR to grow at 5%. We have prepared contingency plans for multiple scenarios that we believe will allow us to react swiftly to changes in customer demand while protecting Garrett’s long-term growth potential. The supplies needed for our operations were generally available throughout 2022. In limited circumstances, certain suppliers experienced financial distress during 2022, resulting in supply disruptions. However, we had implemented new procedures in 2021 for monitoring of supplier risks associated with Covid-19 and we believe we have substantially addressed such risks with manageable economic impacts including use of premium freight or adjusted payment terms that are limited in time. As the global supply chain restarts, it is possible that additional supply constraints will appear for the industry. In addition, we sustained cost control measures and cash management actions in 2022 including:

•Postponing capital expenditures;

•Optimizing working capital requirements;

•Lowering discretionary spending;

•Flexing organizational costs by implementing short-term working schemes;

•Reducing temporary workforce and contract service workers; and

•Restricting external hiring.

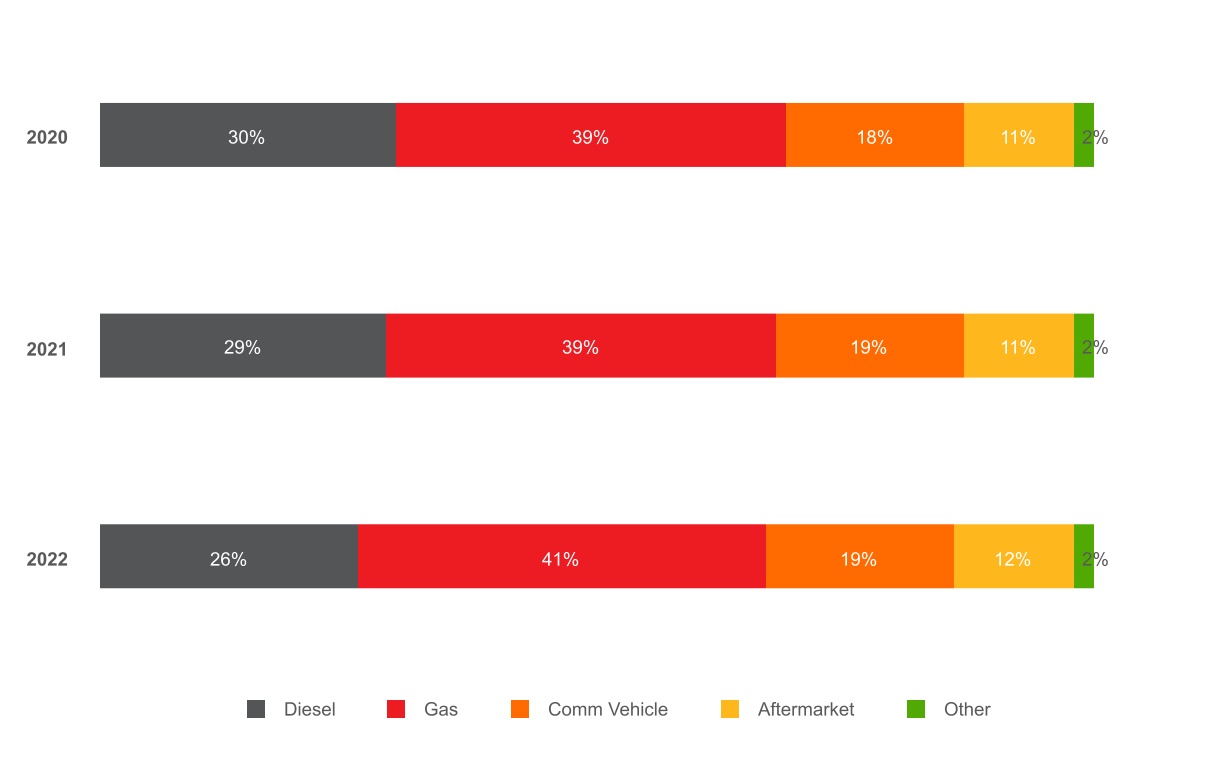

The following charts show our percentage of revenues by geographic region and product line for the years ended December 31, 2022, 2021 and 2020, and the percentage changes from the prior years.

Revenue Summary

| | | | | | | | | | | | | | | | | | | | | | | |

| North America | | Europe | | Asia | | Other |

•We are a global business that generated revenues of approximately $3.6 billion in 2022.

•In 2022, our OEM sales contributed approximately 86% of our revenues while our aftermarket and other products contributed 14%.

•Amongst OEM sales, light vehicle products (products for passenger cars, SUVs, light trucks, and other products) accounted for approximately 78% of our revenues. Commercial vehicle products (products for on-highway trucks and off-highway trucks, construction, agriculture and power-generation machines) accounted for 22%.

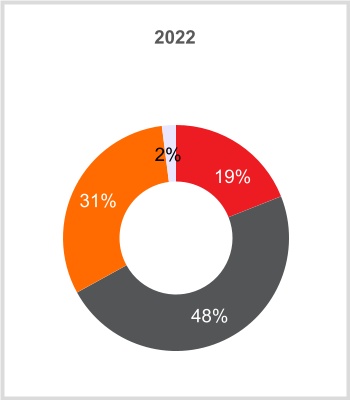

•Approximately 48% of our 2022 revenues came from sales shipped from Europe, 31% from sales shipped from Asia and 19% from sales shipped from North America. For more information, see Note 27, Concentrations, of the Notes to our Consolidated Financial Statements.

Our Industry

We currently compete in the global turbocharger industry for gasoline, diesel and natural gas engines, in the electric-boosting industry for electrified (hybrid and fuel cell) vehicle powertrains and in the emerging connected vehicle software industry. As vehicles become more electrified, our electric-boosting products use principles similar to our turbochargers to further optimize air intake and thus further enhance performance, fuel economy and exhaust emissions with the help of an integrated high-speed electric motor. By using a turbocharger or electric-boosting technology, an OEM can deploy smaller, lighter powertrains with better fuel economy and exhaust emissions while delivering the same power and acceleration as larger, heavier powertrains. As such, turbochargers have become one of the most highly effective technologies for helping global OEMs meet increasingly stricter emission standards. At the same time, we have developed unique technological competencies, which we aim to continue leveraging to solve our customers’ energy related challenges in the electrification evolution related to ICE, hybrids and electric powertrains. We are developing solutions and increasing our research and development ("R&D") spend, focusing more than 50% of total R&D expenditure in 2023 on electrification technologies like fuel cell compressors for a broad range of stack power (40kW to 250kW) and high value electric vehicle components. We are also continuing to develop Model Predictive Controls ("MPC") algorithms and cybersecurity software solutions that leverage our knowledge of vehicle powertrains and experience working closely with OEM manufacturers.

Global Turbocharger Industry

The global turbocharger industry includes turbochargers for new light and commercial vehicles as well as turbochargers for replacement use in the global aftermarket. According to S&P, KGP and PSR, the global turbocharger industry consisted of approximately 46 million turbocharged vehicles with an estimated total value of approximately $10 billion in 2022. Within the global turbocharger industry in 2022, light vehicles accounted for approximately 86% of total unit volume and commercial vehicles accounted for the remaining 14%.

S&P, KGP and PSR project that the turbocharger production volume will peak in 2024 and return to 2022 levels by 2026, driven mainly by turbochargers for light vehicle gasoline engines and continued slow growth for commercial vehicles, offset by a decline in diesel turbochargers given a decline in diesel powertrains, particularly for light vehicles. This annual sales estimate would add 230 million new turbocharged vehicles on the road globally between 2023 and 2027.

Key trends affecting our industry

Current global economic conditions due to Covid-19 and geopolitical conflicts have adversely affected and may continue to adversely affect many industries including the automotive sector. Chip shortages and rising raw material prices and inflation also had significant impacts on the automotive industry, making it unable to serve the recovery in demand. Consequently, S&P reduced its light vehicle production volume forecast for 2023 from approximately 91 million units that they forecasted in 2021 to between 80 to 88 million units in their January 2023 light vehicle industry production volume forecast.

Growth in overall vehicle production. After an increase of 3% in light vehicle production and 1% in commercial vehicle production in 2021, a stronger growth was expected in 2022. However, supply chain disruptions, driven by shortages in semiconductors and the continuous impact of Covid-19 particularly in China, affected vehicle production in 2022 resulting in flat volumes versus 2021. For 2023, S&P, KGP and PSR expect limited growth in light vehicle production and growth in commercial vehicle production of approximately 6%. However, significant uncertainty level remains with further Covid-19 waves, continued supply chain disruptions and geopolitical tensions. The shift from pure gasoline and diesel ICE to hybridized powertrains is expected to continue in response to increasingly strict fuel efficiency and regulatory standards. In parallel, the share of pure electric vehicles is expected to continue to increase from a low base as technology and supporting infrastructure continue to improve.

Global vehicle fuel efficiency and emissions standards. OEMs are facing increasingly strict constraints for vehicle fuel efficiency and emissions standards globally. Regulatory authorities in key vehicle regions such as the United States, the European Union, China, Japan, and Korea have instituted regulations that require sustained and significant reductions in greenhouse gas (including CO2 and NOx) and particulate matter vehicle emissions. OEMs are required to evaluate and adopt various solutions to address these stricter standards. Turbochargers allow OEMs to reduce engine size without sacrificing vehicle performance, thereby increasing fuel efficiency and decreasing harmful emissions. Furthermore, turbochargers allow more precise “air control” over both engine intake and exhaust conditions such as gas pressures, flows and temperatures, enabling optimization of the combustion process. This combustion optimization is critical to engine efficiency, exhaust emissions, power and transient response and enables such concepts as exhaust gas recirculation for diesel engines and Miller-cycle operation for gasoline engines. Consequently, we believe turbocharging will continue to be

a key technology for automakers to meet future tough fuel economy and emissions standards without sacrificing performance.

Turbocharger penetration. The utilization of turbochargers and electric-boosting technologies on vehicle powertrain systems is one of the most cost-effective solutions to address stricter standards, and OEMs are increasing their adoption of these technologies. S&P, KGP and PSR expect total turbocharger penetration to increase globally from approximately 46 million units in 2022 to approximately 48 million units by 2024; after this year, the turbocharger penetration will plateau then start decreasing based on current expectations on hybrid solutions adopted by different OEMs, reaching the same volumes from 2022 in 2026. S&P forecasts turbocharger penetration growth for gasoline turbochargers, expecting an increase in light vehicles from approximately 47% in 2022 to 51% in 2025.

Medium-Term Powertrain Trends

Note - Years 2020 - 2022 represent actual data and years 2023 - 2027 represent forecasted data.

Source: S&P, KGP, PSR

Engine size and complexity. In order to address stricter fuel economy standards, OEMs have used turbochargers to reduce the average engine size on their vehicles over time without compromising performance. Stricter pollutants emissions standards (primarily for NOx and particulates) have driven higher turbocharger adoption as well, which we believe will continue in the future, with a predicted total automotive turbocharger production volume CAGR of 1% between 2022 and 2025, in an industry with a predicted total automobile production volume CAGR of approximately 3% over the same period, in each case according to S&P, KGP and PSR.

Electrification. To address stricter fuel economy standards, OEMs also have been increasing the electrification of their vehicle offerings, primarily with the addition of hybrid vehicles, which have powertrains equipped with a gasoline or diesel internal combustion engine in combination with an electric motor. S&P estimates that hybrid vehicles produced globally will grow from a total of approximately 17.4 million vehicles in 2023 to 28.6 million vehicles by 2026, representing a CAGR of 17%. The electrified powertrain of hybrid vehicles enables the usage of highly synergistic electric-boosting technologies which augment standard turbochargers with electrically assisted boosting and electrical-generation capability. Furthermore, the application of electric boosting extends the requirement for engineering collaboration with OEMs to include electrical integration, software controls, and advanced sensing. Overall, this move to electric boosting further increases the role and value of turbocharging in improving vehicle fuel economy and exhaust emissions.

Battery electric and fuel cell technologies. OEMs are investing in full BEVs to comply with increasingly tight regulatory targets across regions. S&P, KGP and PSR expect that BEVs will compose 26% of total light and commercial vehicle production globally by 2026. Consumer adoption hinges on future "cost of range”, tightly linked to the energy capacity of the battery, but also how well that energy is used. Energy efficiency increases (including how to best address thermal management challenges), battery price (and consequently vehicle price), weight reduction through increases in power density, and shorter recharging times are all critical problems to solve. As OEMs strive to solve these issues, they are increasing investment in hydrogen fuel cell powered electric vehicles for demanding applications requiring long range, especially in the commercial vehicle space. These vehicles, like battery electric vehicles, have fully electric motor powertrains, but they rely on the hydrogen fuel cell to generate the required electricity. The hydrogen fuel cell also requires advanced electric-boosting technology to run efficiently and optimize range and cost of ownership. We are investing to address selected challenges raised by the electrification trend, where our differentiated technology can bring benefits related to lighter, more compact and more energy efficient components for electric vehicles.