As field with the U.S. Securities and Exchange Commission on September 28, 2018

Registration No. 333-226990

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2 TO

FORM F-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

China Xiangtai Food Co., Ltd.

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Cayman Islands | 2011 | Not Applicable |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification Number) |

c/o Chongqing Penglin Food Co., Ltd.

Xinganxian Plaza

Building B, Suite 21-1

Lianglukou, Yuzhong District 400800

Chongqing, People’s Republic of China

+86- 023-86330158– telephone

(Address, including zip code, and telephone number,

including area code, of principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th Floor

New York, NY 10016

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

William S. Rosenstadt, Esq. Mengyi “Jason”

Ye, Esq. +1-212-826-9307 — facsimile |

Benjamin Tan, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas, 37th Floor New York, NY 10036 (212) 930-9700 – telephone (212) 930-9725 – facsimile |

Approximate date of commencement of proposed sale to public: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company x

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| Title of Class of Securities to be Registered | Amount to be Registered |

Proposed Maximum Aggregate Price Per Share |

Proposed Maximum Aggregate offering Price(1) |

Amount of Registration Fee |

||||||||||||

| Ordinary Shares, par value $0.01 per share(2) | 3,000,000 | $ | 5.00 | $ | 15,000,000 | $ | 1867.50 | |||||||||

| Underwriter Warrant(3) | 210,000 | - | - | - | ||||||||||||

| Ordinary Shares, par value $0.01 per share underlying Underwriter Warrants(3) | 210,000 | 5.00 | $ | 1,050,000 | $ | 130.73 | ||||||||||

| Total | 3,691,500 | $ | 5.00 | $ | 16,050,000 | $ | 1,998.23 | (4) | ||||||||

| (1) | The registration fee for securities is based on an estimate of the Proposed Maximum Aggregate Offering Price of the securities, assuming the sale of the maximum number of shares at the highest expected offering price, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). |

| (2) | In accordance with Rule 416(a), the Registrant is also registering an indeterminate number of additional ordinary shares that shall be issuable pursuant to Rule 416 to prevent dilution resulting from share splits, share dividends or similar transactions. |

| (3) | The Registrant will issue to the Underwriter warrants to purchase a number of ordinary shares equal to an aggregate of seven percent (7%) of the ordinary shares sold in the offering (the “Underwriter Warrant”). The exercise price of the Underwriter Warrants is equal to 100% of the offering price of the ordinary shares offered hereby. Assuming a maximum placement and an exercise price of $5.00 per share, we would receive, in the aggregate, $1,050,000 upon exercise of the Underwriter Warrants. The Underwriter Warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the closing of the initial public offering and expiring five (5) years from the effective date of the registration statement for this Offering. | |

| (4) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We will not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED SEPTEMBER 28, 2018 |

China Xiangtai Food Co., Ltd.

Minimum Offering: 1,000,000 Ordinary Shares

Maximum Offering: 3,000,000 Ordinary Shares

This is an initial public offering of ordinary shares of China Xiangtai Food Co., Ltd., a Cayman Islands exempted company (“Xiangtai Cayman” or the “Company”). We are offering a minimum of 1,000,000 and a maximum of 3,000,000 of our ordinary shares.

Prior to this offering, there has been no public market for our ordinary shares. The initial public offering price of our ordinary shares is expected to be $5.00 per share. We have applied to list our ordinary shares on Nasdaq Capital Market under the symbol “PLIN.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 11.

Minimum Offering Per Ordinary |

Minimum Offering |

Maximum Offering Per Ordinary Share | Maximum Offering |

|||||||||||||||

| Assumed public offering price | $ | 5.00 | $ | 5,000,000 | $ | 5.00 | $ | 15,000,000 | ||||||||||

| Underwriter fees and commissions(1) | $ | 0.20 | $ | 200,000 | $ | 0.25 | * | $ | 750,000 | |||||||||

| Proceeds to us, before expenses(1)(2) | $ | 4.80 | $ | 4,800,000 | $ | 4.75 | $ | 14,250,000 | ||||||||||

* weighted average price per share

| (1) | We will pay the Underwriter four percent (4%) of the first USD five million ($5,000,000) and five and a half percent (5.5%) of any gross proceeds over $5,000,000 of this offering. In addition to the cash commission, we will also reimburse the Underwriter for its expenses in an amount not to exceed $180,000. See “Underwriting” in this prospectus for more information regarding our arrangements with the underwriter. |

|

(2) | The total estimated expenses related to this offering are set forth in the section entitled “Fees, Commission and Expense Reimbursement.” |

We expect our total cash expenses for this offering, including cash expenses payable to our underwriter, Boustead Securities, LLC (the “Underwriter”), for its reasonable non-accountable expenses and accountable expenses referenced above, exclusive of the above commissions. The Underwriter must sell the minimum number of securities offered (1,000,000) if any are sold. The Underwriter is only required to use its best efforts to sell the maximum number of securities offered (3,000,000). We have agreed to issue to the underwriters and to register herein warrants to purchase up to a total of 210,000 ordinary shares (equal to 7% of the maximum number of ordinary shares sold in this offering) and to also register herein such underlying shares. The warrants will be exercised at any time, and from time to time, in whole or in part, commencing from the closing of the initial public offering and expiring five (5) years from the effective date of the registration statement for this Offering. The warrants are exercisable at a per share price of 100% of the offering price of the ordinary shares offered hereby. The offering will close or terminate, as the case may be, upon the earlier of: (i) a date mutually acceptable to us and the Underwriter after the minimum offering amount of our offering is raised, or (ii) 180 days from the effective date (the “Effective Date”) of the Registration Statement (and for a period of up to 45 additional days if extended by agreement of the Company and the Underwriter) (the “Termination Date”). Trading on the Nasdaq Capital Market will not start until the Termination Date. Until we sell at least 1,000,000 shares, all investor funds will be held in an escrow account at Fintech Clearing, LLC. If we do not sell at least 1,000,000 shares by the Termination Date, all funds will be promptly returned to investors without interest or deduction. If on the Termination Date we do not qualify to list on Nasdaq, all funds will be promptly returned to investors within one (1) business days of the Termination Date. If we complete this offering, net proceeds will be delivered to us on the closing date. We plan to use our proceeds in our subsidiaries in China, however, we will not be able to use such proceeds until we complete certain remittance procedures in China. Please see Risk Factors – “Risks for Doing Business in the People’s Republic of China - We must remit the offering proceeds to PRC before they may be used to benefit our business in the PRC, and this process may take a number of months” beginning on page 27. If we complete this offering, then on the closing date, we will issue ordinary shares to investors in the offering on ordinary shares sold in this offering. One of the conditions to our obligation to sell any securities through the Underwriter is that, upon the closing of the offering, the Ordinary Shares would conditionally qualify for listing on the Nasdaq Capital Market.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _____________, 2018.

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any related free-writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus or in any related free-writing prospectus. We are offering to sell, and seeking offers to buy, the ordinary shares offered hereby, but only under circumstances and in jurisdictions where offers and sales are permitted and lawful to do so. The information contained in this prospectus is current only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the ordinary shares.

Neither we nor any of the underwriters have taken any action that would permit a public offering of the ordinary shares outside the United States or permit the possession or distribution of this prospectus or any related free-writing prospectus outside the United States. Persons outside the United States who come into possession of this prospectus or any related free-writing prospectus must inform themselves about and observe any restrictions relating to the offering of the ordinary shares and the distribution of the prospectus outside the United States.

Until , 2018 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade ordinary shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

| 1 |

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our Ordinary Shares. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

Prospectus Conventions

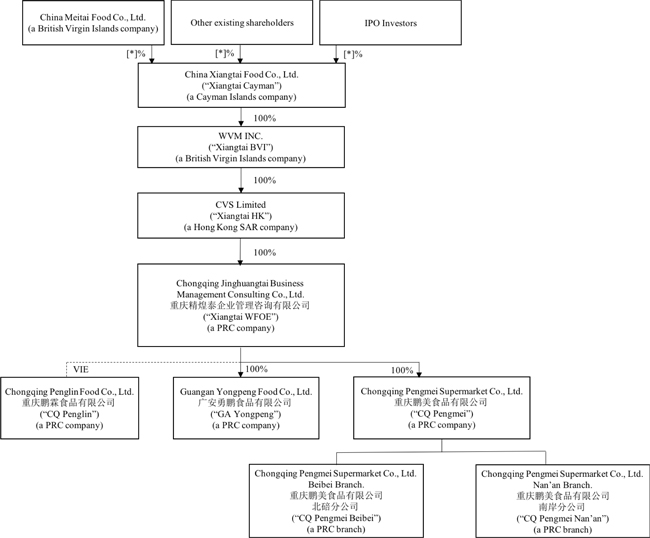

Except where the context otherwise requires and for purposes of this prospectus only, “we”, “us”, “our company”, “Company”, “our” and “Fortunes Capital” refer to

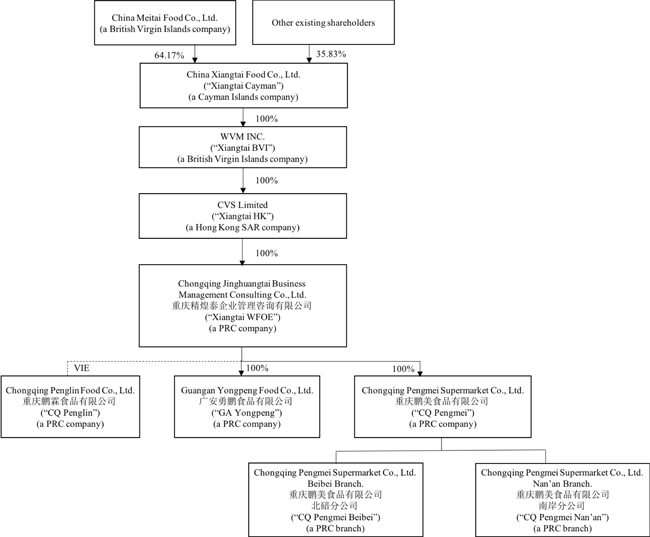

China Xiangtai Food Co., Ltd., a Cayman Islands exempted company (“Xiangtai Cayman” or the “Company” when individually referenced);

WVM Inc., a British Virgin Islands company (“Xiangtai BVI” when individually referenced)

CVS Limited (“Xiangtai HK” when individually referenced), a Hong Kong company that is a wholly-owned subsidiary of Xiangtai BVI;

Chongqing Jinghuangtai Business Management Consulting Co., Ltd. (also known as “重庆精煌泰企业管理咨询有限公司”) “Xiangtai WFOE” when individually referenced), a PRC wholly foreign-owned enterprise and a wholly owned subsidiary of Xiangtai HK;

Guangan Yongpeng Food Co., Ltd. (also known as “广安勇鹏食品有限公司”) (“GA Yongpeng” when individually referenced), a PRC company and a wholly owned subsidiary of Xiangtai WFOE.

Chongqing Penglin Food Co., Ltd. (also known as “重庆鹏霖食品有限公司”) (“CQ Penglin” when individually referenced), a PRC company and a variable interest entity (“VIE”) contractually controlled by Xiangtai WFOE.

Xiangtai WFOE, CQ Penglin and GA Yongpeng are collected referred to as the “PRC entities” hereafter.

This prospectus contains translations of certain RMB amounts into U.S. dollar amounts at specified rates solely for the convenience of the reader. The relevant exchange rates are listed below:

| For the Six Months Ended June 30, 2017 | For the Year Ended June 30, 2017 | For the Year Ended June 30, 2016 | ||||||||||

| Period Ended RMB: USD exchange rate | 6.51 | 6.78 | 6.64 | |||||||||

| Period Average RMB: USD exchange rate | 6.64 | 6.81 | 6.43 | |||||||||

For the sake of clarity, this prospectus follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. For example, the name of our Chairwoman will be presented as “Zeshu Dai,” even though, in Chinese, Ms. Dai’s name is presented as “Dai Zeshu.”

We have relied on statistics provided by a variety of publicly-available sources regarding China’s expectations of growth. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus. We have sought to provide current information in this prospectus and believe that the statistics provided in this prospectus remain up-to-date and reliable, and these materials are not incorporated in this prospectus other than to the extent specifically cited in this prospectus. Except where otherwise stated, all ordinary share accounts provided herein are on a pre-share-increase basis.

Overview

China Xiangtai Food Co., Ltd. is a Cayman Islands exempted company incorporated on January 23, 2018 and we conduct our business in China through our subsidiaries and variable interest entity in China. We are primarily a pork processing company that has operations across key sections of the industry value chain, including slaughtering, packing, distribution, and wholesale of a variety of fresh pork meat and parts. We are committed to provide consumers with high-quality, nutritious and tasty products through our portfolio of trusted and well-known brands and to driving consumption trends, while setting a high industry standard in product quality and food safety. We can efficiently match supply with demand and benefit from the strong industry trends in China.

Maintaining the highest industry standards for food safety, product quality and sustainability is one of our core values. We have food circulation permit and national industrial production certificate. We have strict quality control systems in each segment of our value chain, from production through sales and distribution. These objectives are grounded in our sustainability program, which focuses on key areas such as animal care, employee welfare, the environment, food safety and quality, helping communities and value creation.

| 2 |

We purchase live hogs through distributors who purchase hogs from well-known big hog farms located in different cities in southern China. We use an automated standard modern production line to slaughter the hogs and pack the fresh pork and byproducts. We deliver the fresh pork to local distributors who then resell the fresh pork to smaller wholesalers and retail vendors. We also purchase fresh pork, beef, lamb, chicken, duck, and rabbit meat from local farmers. We process fresh pork, beef, lamb, chicken, duck, and rabbit meat into processed products. We sell fresh pork and processed meat products to both wholesale and retail markets.

We have more than 200 employees. In our slaughterhouse and processing facility, we have a standardized and automatic production line for hog slaughtering and meat packing. We also have meat processing rooms and standardized freezers to process and store processed meat product. Additionally, we have established environment protection facilities, such as sewage treatment, harmless treatment and incineration treatment, etc.

For the years ended June 30, 2017 and 2016, the total assets were $27.0 million and $15.4 million, respectively, and the revenues were $63.3 million and $34.6 million, respectively. We have received many awards and honors, including "Honest and Trustworthy Seller", “Annual Sales Star”, “Best Partner,” and “First Place in Fresh Grocery” from New Century Department Store, “Industrial Leading Enterprise” from Chongqing City Fuling District government, “Vice President Entity” from Chongqing Tongchuan Chamber of Commerce. We won these awards and honors because we have had a close and successful working relationship with big supermarkets and department stores, that we have effectively discharged our sales and marketing effort, and that we penetrated deep into the meat market in Chongqing City.

Products

We offer two main series of our products, namely the fresh series and the processed series. Summary description of our main product series are set forth below.

| Product Series | Main Products |

| Fresh Series | Fresh pork and byproducts, beef, lamb, chicken, duck and rabbit meat |

| Processed Series | Shredded meat, sliced meat, meat stuffing, pickled meat, lamb and offal, sausage, bacon, steamed meat, breaded chicken, spicy meat |

Industry and Market Background

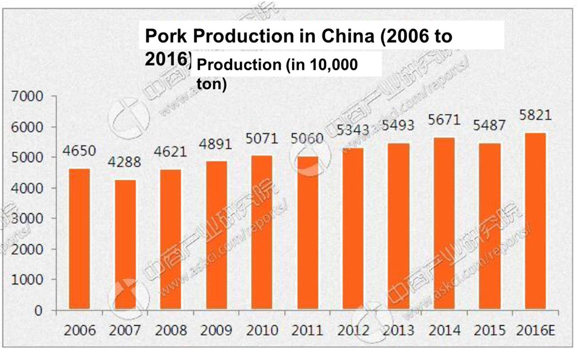

The China-Industrial Research Institute’s “2016-2021 China Pork Industry Market Research and Investment Opportunity Research Report” pointed out that China’s pork production increased from 45.55 million tons in 2005 to 54.87 million tons in 2015, with an average annual growth rate of 1.88%. The growth of China's pork industry was mainly driven by economic development, continued urbanization, and increased disposable income.

(Source: “2016-2021 China Pork Industry Market Research and Investment Opportunity Research Report” by China-Industrial Research Institute)

| 3 |

Although China’s pork production has been steadily increasing in the past, the supply and demand gap of pork has always existed. The per capita annual pork consumption of urban residents in China has remained stable, from about 20.2 kg in 2005 to about 20.8 kg in 2014, which is caused by the slow economic growth in China and the evolution of consumption patterns.

(Source: “2016-2021 China Pork Industry Market Research and Investment Opportunity Research Report” by China-Industrial Research Institute)

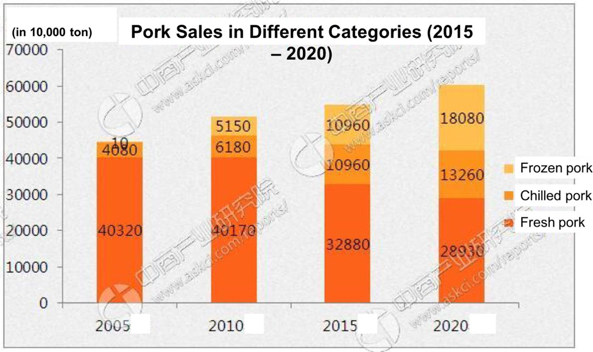

According to different cooling process after slaughtering, pork is subdivided into three categories: fresh, chilled, and frozen pork. Due to traditional consumption habits, Chinese fresh pork products account for most of pork consumption. However, due to an increasing demand for safe and high-quality pork, the consumption of chilled pork has grown rapidly in recent years, reaching nearly 11 million tons in 2015, accounting for 20% the total pork consumption, an increase from 2% in 2005. Meanwhile fresh pork consumption has decreased from 89% of total pork consumption in 2005 to 60% in 2015. It is expected that similar trends will continue in the future and that demand for chilled pork will continue to increase.

(Source: “2016-2021 China Pork Industry Market Research and Investment Opportunity Research Report” by China-Industrial Research Institute)

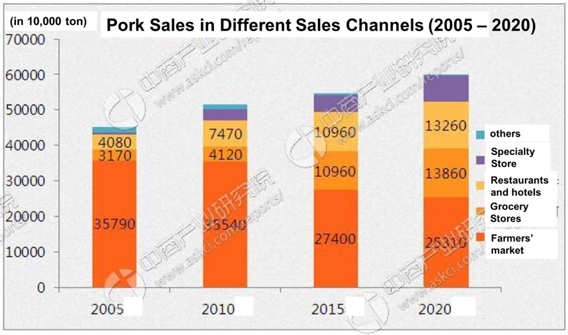

Sales and distribution Channels in China include farmers' markets, grocery stores and supermarkets, hotels and restaurants, and specialty stores. In 2015, farmers' markets dominated the Chinese pork market, accounting for approximately 60% to 65% of the total market across the country. Sales of pork in grocery stores and supermarkets have achieved strong growth, from about 3 million tons in 2005 to nearly 11 million tons in 2015. In the future, it is expected that grocery stores and supermarkets will play a more important role in pork distribution.

| 4 |

The increase in pork demand was mainly attributable to the continuous increase in disposable income and living standards, the continuous progress of urbanization, the expansion of the middle class, and the increasing demand for quality safe products. As a result of changing consumer behavior and growing demand, producers are experiencing accelerated industry concentration and a trend toward vertical integration.

In the pork market, chilled pork has become more common and popular among consumers. It is expected that chilled pork will become the mainstream product category. In addition, in China, grocery stores, supermarkets and other modern retailers are expected to have a greater influence on China's food retail market, especially due to better sanitation and a more comfortable environment than traditional farmers’ markets, especially in more developed urban areas, like Chongqing City. Additionally, brand image is playing a more important role in the pork industry, particularly as it relates to the perception of better food safety and higher product quality. The demand for packaged pork products has increased, driven by the improvements in the PRC economy and greater influence of western dietary habits. Consumers are placing greater importance on product safety, nutrition, convenience and diversification, which can be better satisfied by packaged pork products.

Barriers to entry for competitors include substantial investment required in branding, food safety control and production scale, as well as a strong understanding of consumer preferences.

Competitor entry barriers include the huge investment needed for branding, food safety control and production scale, and an in-depth understanding of consumer preferences. Market Prospects and Opportunities The development of urbanization and the increase in income of rural residents have brought about changes in consumption habits from economic choice to quality, which will lead to substantial growth in the industry.

According to tradition, fresh meat accounts for the majority of pork consumption in China. However, due to changes in consumption habits and increased attention to food safety, the consumption of fresh meat fell from about 403.2 million tons in 2005 to about 32.8 million tons in 2015, while the consumption of chilled or frozen meat, collectively the cold meat, increased from about 9.1 million tons to about 180.8 million tons in the same period. The better sanitation status of cold meat is the reason for the change in consumer behavior. Given the increased demands, the industry will focus on enhancing the distribution chain of cold meat, and more retailers will expand the sales market for cold meat.

In addition, industry consolidation will bring opportunities for large companies to expand their business scope and network, and they can take advantage of their quality, brand and scale. Accelerating the development of self-owned brand stores and enhancing the distribution chain of cold meat will help companies achieve cross-regional pork sales and achieve higher profits, especially in large and medium-sized cities. The integration of hog breeding, slaughtering, processing and retailing can help overcome bottlenecks in the industry chain. With the implementation of the government's policy of supporting large enterprises, low-volume enterprises will eventually be eliminated by the market, thus creating other opportunities that benefit larger enterprises. However, industry consolidation and elimination of small businesses may exacerbate competition among large companies and increase their operating costs as they try to improve product quality and maximize production capacity in the long run.

| 5 |

Our Growth Strategy

We will continue to adhere to our business principles of providing high quality and safe animal protein to consumers and promoting social responsibility. We believe that our pursuit of these goals will lead to sustainable growth, solidify our position in the industry, and create long-term value for our shareholders, employees and our communities.

Solidify our industry position by gaining additional market share. Our goal is to strengthen our market position and accelerate our expansion by expanding our scale and gaining additional market share. We plan to increase investment in our business and expand our production capacity through horizontal or vertical acquisitions, strategic partnership, and joint venture. We plan to invest additional capital to acquire new slaughterhouses to increase production capacity. In addition, we plan to invest in opening supermarkets that only sell our fresh pork and meat products in areas nearby Chongqing. Furthermore, we plan to reach retail markets by opening grocery stores or supermarkets, where we will sell our products as well as other consumer goods in Chongqing or nearby areas. Chongqing borders with Sichuan, Xi’an, Hubei, Guizhou, and Hunan Province. We believe the location of our business will enable us to continue servicing Chongqing and expand our presence to the neighboring provinces. With more exposure and promotion, our product and brand will be better recognized.

Uphold our commitment to food safety and product quality. We intend to uphold our commitment to food safety and product quality to ensure consistently high standards throughout our operations. We intend to achieve greater traceability of our products and maintain the highest quality standards in all of our business units. To this end, we plan to maintain our safety and quality monitoring systems across the entire operation by strictly selecting suppliers, closing monitoring quality before and after slaughtering, maintaining the hygiene of the slaughter house, keeping records of everyday operations, and complying with the national and local law and regulations on animal care, employees, environment sustainability, food safety and quality. We believe such practice largely conform with industry’s best practice in China.

Expand our sales and distribution network. We intend to expand our sales and distribution network to penetrate new geographic markets, further gaining market share in existing markets and accessing a broader range of customers. We will continue to expand our sales network, leveraging our local resources to quickly enter new markets, while also minimizing requirements for capital outlay. We plan to expand our logistics operations and increase our presence in both new and existing markets. We plan to scale up our logistics capacity and extend the geographic coverage of our logistic system to ensure efficient, accurate, reliable and secure distribution. Additionally, we also intend to start an online sales channel though our website and mobile phone application, so that consumers can easily access to our products wherever they are.

Expand our product portfolio. We intend to expand our current product portfolio to better meet consumers’ needs. We plan to introduce ready-to-eat products, which will include stewed pork, salty braised pork, braised pork, crisp pork, canned pork, roasted sausage, crisp sausage, soy sauce stewed pork sausage, etc. These products will be vacuum packaged, making them convenient for storage and transportation with longer shelf life. They will be ready for consumption from the package or after heating. Canned meat and ham can also be added into soup or cooked with other food.

Competitive Advantages

We have a number of competitive advantages that will enable us to maintain and further increase our market position in the industry. Our competitive strengths include:

Diversified Distribution Channels. Our sales and distribution network consists of a diversified range of points of sales, including access to more than 200 farmers’ markets and supermarkets in Chongqing and Sichuan Province, such as Chongqing New Century, Sichuan Yonghui, Chongqing Lotte Mart and Chongqing Carrefour. In April 2017, we opened up our sales channel in the city of Shenzhen, in Guangdong province, by cooperating with Renrenlei, a big local supermarket chain. Our consumers can easily find our products nearby their homes. In addition, on July 2, 2018, we acquired two grocery stores under common control of Ms. Zeshu Dai, our CEO, and her spouse in the city of Chongqing, in order to increase retail outlets.

| 6 |

Considerable Production Capacity. Our automated slaughtering line, clean processing facilities, and large storage space enable us to slaughter on average more than 700 hogs per day. Because of our production and processing capacity, we are one of the leading companies in providing Chongqing with fresh pork products.

Premium Quality Product. Maintaining the highest industry standards for food safety, product quality and sustainability is one of our core values. We have food circulation permit and national industrial production certificate. We have strict quality control systems in each segment of our value chain, from production through sales and distribution. We only source live hogs from farms with good reputation and strict quality control procedures. Every live hog will be examined by the local Food Safety Administration (“FSA”) officers for illness at our slaughtering house before can be slaughtered and throughout the slaughtering process Our slaughter house is the only level A slaughter house in Linshui, Sichaun province, where we use an automated standard modern line to slaughter, process and pack. We operate in an efficient and timely manner in producing and distributing fresh pork and meat product to ensure that the products are always clean and fresh.

Our Challenges and Risk Factors Summary

The following section outlines the primary challenges and risks inherent to our business model. Before deciding to invest in our ordinary shares, we strongly recommend a close reading and consider all of the risks in the section entitled “Risk Factors” beginning on page 11.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| · | the ability to include only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations disclosure; and |

| · | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, have more than $700 million in market value of our ordinary shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period.

Implication of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| · | we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company; |

| · | for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies; |

| · | we are not required to provide the same level of disclosure on certain issues, such as executive compensation; |

| · | we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| · | we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and |

| · | we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction. |

| 7 |

Implication of Being a “Controlled Company”

We are and will remain, following this offering, to be a “controlled company” within the meaning of the Nasdaq Stock Market Rules and, as a result, may rely on exemptions from certain corporate governance requirements that provide protection to shareholders of other companies.

We are and will be a “controlled company” as defined under the Nasdaq Stock Market Rules our majority shareholder, China Meitai Food Co., Ltd. owns and holds more than 50% of our outstanding ordinary shares. For so long as we are a controlled company under that definition, we are permitted to elect to rely, and may rely, on certain exemptions from corporate governance rules, including:

| · | an exemption from the rule that a majority of our board of directors must be independent directors; |

| · | an exemption from the rule that the compensation of our chief executive officer must be determined or recommended solely by independent directors; and |

| · | an exemption from the rule that our director nominees must be selected or recommended solely by independent directors. |

As a result, you will not have the same protection afforded to shareholders of companies that are subject to these corporate governance requirements.

Although we do not intend to rely on the “controlled company” exemption under the Nasdaq listing rules, we could elect to rely on this exemption in the future. If we elected to rely on the “controlled company” exemption, a majority of the members of our board of directors might not be independent directors and our nominating and corporate governance and compensation committees might not consist entirely of independent directors upon closing of the offering.

Corporate Information

Our principal executive office is located at Xinganxian Plaza, Building B, Suite 21-1, Lianglukou, Yuzhong District, Chongqing, People’s Republic of China 400800. The telephone number of our principal executive offices is +86 (023) 86330158. Our registered agent in Cayman Islands is Offshore Business Consulting & Services Limited. Our registered office and our registered agent’s office in Cayman Islands are both at 3rd Floor, Harbour Centre, PO Box 613, Grand Cayman KYl-1107, Cayman Islands. Our registered agent in the United States is Cogency Global Inc. We maintain our corporate website at cqplsp.chinapyp.com. We do not incorporate the information on our website into this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus.

Offering Summary

Following completion of our initial public offering, ownership of China Xiangtai Food Co., Ltd. will be as follows, assuming completion of the minimum and maximum offerings, respectively. To the extent we complete an offering between the minimum and maximum offerings, the percentage ownership of participants in our initial public offering will between the below amounts:

| Minimum Offering | Maximum Offering | |||||||||||

| Existing | IPO | Existing | IPO | |||||||||

| Shareholders | Shareholders | Shareholders | Shareholders | |||||||||

| 95.41% | 4.59% | 87.39% | 12.61% | |||||||||

| China Xiangtai Food Co., Ltd. | China Xiangtai Food Co., Ltd. | |||||||||||

| 8 |

The Offering

| Shares Offered by us: | Minimum: 1,000,000 ordinary shares | |

| Maximum: 3,000,000 ordinary shares | ||

| Shares Outstanding Prior to Completion of Offering: | 20,791,667 ordinary shares | |

| Shares to be Outstanding after Offering: | Minimum: 21,791,667 ordinary shares | |

| Maximum: 23,791,667 ordinary shares | ||

| Assumed Offering Price per Share: | $5.00 | |

| Gross Proceeds to Us Before Expenses: | Minimum: $4,800,000 | |

| Maximum: $14,250,000 | ||

| Best efforts | The underwriters are selling our ordinary shares on a “best efforts, minimum/maximum” basis. Accordingly, the underwriter has no obligation or commitment to purchase any securities. The underwriters are not required to sell any specific number of dollar amount of ordinary shares but will use its best efforts to sell the ordinary shares offered. | |

| We will not complete this offering unless we sell at least a minimum number of ordinary share, at the price per ordinary share set forth on the cover page of this prospectus, to result in sufficient proceeds to list our ordinary shares on the Nasdaq Capital Market, and unless our application to list on the Nasdaq Capital Market is approved. | ||

| Escrow account | The gross proceeds from the sale of the ordinary shares in this offering will be deposited in a non-interest bearing escrow account maintained by the deposit account agent, Fintech Clearing, LLC, at 6 Venture, Suite 265, Irvine, CA 92618 (the “Deposit Account Agent”). Payments may only be made by wire transfer, and no payments may be made by check. All wire transfers will be made directly to the escrow account. The funds will be held in escrow until the Deposit Account Agent has advised us and the Deposit Account Agent that it has received $5,000,000, the minimum offering, in cleared funds. If we do not receive the minimum of $5,000,000 by the Termination Date, all funds will be promptly returned to purchasers in this offering after the termination of the offering, without charge, deduction or interest. Prior to the Termination Date, in no event will funds be returned to you unless the offering is terminated. You will only be entitled to receive a refund of your subscription price if we do not raise a minimum of $5,000,000 by the Termination Date. No interest will be paid either to us or to you. See “Underwriting — Deposit of Offering Proceeds.” | |

| Proposed Nasdaq Capital Market Symbol: | “PLIN” | |

| Transfer Agent: | Securities Transfer Corporation |

| 9 |

| Risk Factors: | Investing in these securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section of this prospectus before deciding to invest in our ordinary shares. | |

| Closing of Offering: | The offering contemplated by this prospectus will terminate upon the earlier of: (i) a date mutually acceptable to us and the Underwriter after the minimum offering is sold or (ii) 180 days from the effective date of this Registration Statement, unless extended by us for an additional 45 days (“Termination Date”). If we complete this offering, net proceeds will be delivered to us on the closing date (such closing date being the above mutually acceptable date on or before 180 days from the effective date of this Registration Statement, unless extended by the Company and the Underwriter for an additional 45 days, provided that the minimum offering has been sold). Trading on the Nasdaq Capital Market will not start until the Termination Date. We will not complete this offering unless our application to list on the Nasdaq Capital Market is approved. We will not be able to use such proceeds in China, however, until we complete certain remittance procedures in China. | |

| Use of Proceeds: | We intend to use the proceeds from this offering for opening of supermarkets and working capital. To the extent that we are unable to raise the maximum proceeds in this offering, we may not be able to achieve all of our business objectives in a timely manner. See “Use of Proceeds” for more information. | |

| Dividend Policy: | We have no present plans to declare dividends and plan to retain our earnings to continue to grow our business. |

Summary Financial Information

In the table below, we provide you with historical selected financial data for the years ended June 30, 2017 and 2016 and for the six months ended December 31, 2017. This information is derived from our consolidated financial statements included elsewhere in this prospectus. Historical results are not necessarily indicative of the results that may be expected for any future period. When you read this historical selected financial data, it is important that you read it along with the historical financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

| For the Six Months Ended December 31, | For the Years Ended June 30, | |||||||||||||||

| 2017 | 2016 | 2017 | 2016 | |||||||||||||

| US$ | US$ | US$ | US$ | |||||||||||||

| Statement of operation data: | ||||||||||||||||

| Revenues | 47,199,001 | 23,497,742 | 63,276,479 | 34,629,351 | ||||||||||||

| Gross profit | 3,928,198 | 2,100,830 | 5,067,075 | 4,951,639 | ||||||||||||

| Operating expenses | (1,009,411 | ) | (765,783 | ) | (1,545,556 | ) | (2,222,581 | ) | ||||||||

| Income from operations | 2,918,787 | 1,335,047 | 3,521,519 | 2,729,058 | ||||||||||||

| Other non-operating income (expenses), net | (452,603 | ) | (201,249 | ) | (190,908 | ) | 182,720 | |||||||||

| Provision for income taxes | 572,360 | 309,871 | 875,737 | 727,945 | ||||||||||||

| Net income | 1,893,824 | 823,927 | 2,454,874 | 2,183,833 | ||||||||||||

| Earnings per share, basic and diluted | 0.09 | 0.04 | 0.12 | 0.11 | ||||||||||||

| Weighted average Ordinary Shares outstanding | 20,000,000 | 20,000,000 | 20,000,000 | 20,000,000 | ||||||||||||

| December 31, 2017 | June 30, 2017 | June 30, 2016 | ||||||||||

| Balance sheet data | US$ | US$ | US$ | |||||||||

| Current assets | 41,568,982 | 22,126,781 | 7,643,345 | |||||||||

| Total assets | 46,540,899 | 27,015,948 | 15,414,265 | |||||||||

| Current liabilities | 34,051,809 | 16,884,075 | 6,907,596 | |||||||||

| Total liabilities | 34,051,809 | 16,884,075 | 7,885,872 | |||||||||

| Total equity | 12,489,090 | 10,131,873 | 7,528,393 | |||||||||

| 10 |

Before you decide to purchase our ordinary shares, you should understand the high degree of risk involved. You should consider carefully the following risks and other information in this prospectus, including our consolidated financial statements and related notes. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our ordinary shares could decline, perhaps significantly.

Risks Related to Our Business and Industry

Changes in consumer preferences could adversely affect our business.

The food industry, in general, is subject to changing consumer trends, demands and preferences. Our products compete with other protein sources, such as fish. Trends within the food industry frequently change, and our failure to anticipate, identify or react to changes in these trends could lead to reduced demand and prices for our products, among other concerns, and could have a material adverse effect on our business, financial condition and results of operations.

| 11 |

We operate in a highly competitive industry and may face increased competition.

We operate in the pork industry in China and face strong competition in terms of distribution, brand recognition, taste, quality, price, availability, and product positioning. The market is highly fragmented, particularly in China, and the resources of our competitors may increase due to mergers, consolidations or alliances, and we may face new competitors in the future. Our main competitors include Shuanghui Group, New Hope Group, Hunan New Wellful Co., Ltd., Huamu Group. Furthermore, we face competition from producers of other animal proteins. In addition, as we seek to expand our market share in the Chinese markets in which we currently distribute our products and to distribute new products and to penetrate into new markets, we may have difficulty competing with local producers due to protectionist efforts by local governments to benefit local companies. From time to time in response to competitive and customer pressures or to maintain market share, we may be forced to reduce our selling prices or increase or reallocate spending on marketing, advertising, or promotions in order to compete. These types of actions could decrease our profit margins. Such pressures may also restrict our ability to increase our selling prices in response to raw material and other cost increases. In light of the strong competition that we currently face, and which may intensify in the future, there can be no assurance that we will be able to increase the sales of our products or even maintain our past levels of sales, or that our profit margins will not be reduced. If we are unable to increase our product sales or to maintain our past levels of sales and profit margins, our business, financial condition, results of operations and prospects may be materially and adversely affected.

Our results of operations may fluctuate from period to period due to seasonality.

Our business is subject to seasonal fluctuations. There are seasonal patterns for pork production and pork product purchases in China, where consumer purchases of pork products usually peak around the Chinese Lunar New Year and other major holidays. In addition, our hog production segment experiences lower farrowing performance during the winter months and slower animal growth rates during the hot summer months, resulting in a decrease in hog supplies in the summer and an increase in hog supplies in the fall. Due to the seasonality of our business, the results of any period of a year are not necessarily indicative of the results that may be achieved for the full year.

We face risks relating to fluctuations in the prices of substitute products.

Fluctuations in the market prices of substitutes to our products, especially decreases in the prices of substitute meat products relative to pork, affect the prices of pork products. As a result of decreases in the prices of substitute meat products relative to pork, consumers may purchase less pork. For example, past outbreaks of avian influenza in various parts of the world reduced the global demand for poultry and thus created temporary surpluses of poultry. These poultry surpluses placed downward pressure on poultry prices, which in turn reduced meat prices including pork prices. Even where we are able to adjust our selling prices in relation to decreases in the prices of substitute products, our profit margin may experience contraction, which in turn may have a material adverse impact on our business, financial condition, results of operations and prospects.

Outbreaks of livestock diseases may affect our ability to conduct our business and harm demand for our products.

Outbreaks of diseases affecting livestock, such as BSE, FMD and various strains of influenza, which may be caused by factors beyond our control, or concerns that these diseases may occur and spread in the future, could lead to cancellation of orders by our customers or governmental restrictions on the import and export of our products to or from our suppliers, facilities or customers. Moreover, outbreaks of livestock diseases could have a significant effect on the livestock we own by requiring us to, among other things, destroy any affected livestock and create negative publicity that may have a material adverse effect on customer demand for our products. In addition, if the products of our competitors become contaminated, the adverse publicity associated with such an event may lower consumer demand for our products.

Any perceived or real health risks related to the food industry could adversely affect our ability to sell our products. If our products become contaminated, we may be subject to product liability claims and product recalls.

We are subject to risks affecting the food industry generally, including risks posed by the following:

| · | food spoilage or food contamination; |

| 12 |

| · | contamination of raw materials; |

| · | consumer product liability claims; |

| · | product tampering; |

| · | product labeling errors; |

| · | the possible unavailability and expense of product liability insurance; and |

| · | the potential cost and disruption of a product recall. |

Our products may be exposed to contamination by organisms that may produce food borne illnesses, such as E. coli, listeria monocytogenes and salmonella. These organisms are generally found in the environment and, as a result, there is a risk that they could be present in our products. These pathogens can also be introduced to our products through tampering or as a result of improper handling at the further processing, foodservice or consumer level. Once contaminated products have been shipped for distribution, illness or death may result if the products are not properly prepared prior to consumption or if the pathogens are not eliminated in further processing.

Our systems designed to monitor food safety risks throughout all stages of our processes may not eliminate the risks related to food safety. As a result, we may voluntarily recall, or be required to recall, our products if they are or may be contaminated, spoiled or inappropriately labeled.

We may be subject to significant liability in the jurisdictions in which our products are sold if the consumption of any of our products causes injury, illness or death. Such liability may result from proceedings filed by the government’s attorney’s office, consumer agencies and individual consumers. We may have to pay significant damages to consumers or to the government and such liability may be in excess of applicable liability insurance policy limits. Adverse publicity concerning any perceived or real health risk associated with our products could also cause customers to lose confidence in the safety and quality of our food products, which could adversely affect our ability to sell our products. We could also be adversely affected by perceived or real health risks associated with similar products produced by others to the extent such risks cause customers to lose confidence in the safety and quality of such products generally.

Environmental regulation and related litigation and commitments could have a material adverse effect on us.

Our past and present business operations and properties are subject to extensive and increasingly stringent laws and regulations in the countries in which we have operations pertaining to protection of the environment, including among others:

| · | the treatment and discharge of materials into the environment; |

| · | the handling and disposition of manure and solid wastes; and |

| · | the emission of greenhouse gases. |

Failure to comply with these laws and regulations may result in significant consequences to us, including administrative, civil and criminal penalties, liability for damages and negative publicity. Some requirements applicable to us may also be enforced by citizen groups or other third parties. Natural disasters, such as flooding and hurricanes, can cause the discharge of effluents or other waste into the environment, potentially resulting in our being subject to further liability claims and governmental regulation, as has occurred in the past. See the section headed “Business — Environmental Matters” for further discussion of our regulatory compliance as it relates to environmental risk. We have incurred, and will continue to incur, significant capital and operating expenditures to comply with these laws and regulations.

In addition, new environmental issues could arise that could cause currently unanticipated investigations, assessments, costs or expenditures. We may be subject to higher compliance costs if environmental protection laws become more stringent. Environmental claims or failure to comply with any present or future environmental protection laws may require us to spend additional funds and may adversely affect our results of operations.

| 13 |

PRC laws and regulations require enterprises engaged in manufacturing and construction that may produce environmental waste to adopt measures to effectively control and properly dispose of waste gases, waste water, industrial waste, dust and other environmental waste materials. These laws and regulations also require payments from producers discharging waste substances. If we fail to comply with such laws or regulations and such failure results in environmental pollution, we may be required to pay fines. If the breach is serious, the PRC government may suspend or close any operation failing to comply with such laws or regulations. We cannot assure you that the PRC government will not change existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditure that we may not be able to pass on to our customers through increased product prices.

Our financial success is dependent on our continued innovation and successful launch of new products and promoting our brands through marketing investments, and we may not be able to anticipate or make timely responses to changes in the tastes and preferences of consumers.

The success of our operations depends on our ability to identify market trends and introduce new or enhanced products in a timely manner that satisfy the tastes and preferences of customers. Customer preferences differ across and within each of our operating regions and shift over time in response to changes in culinary, demographic and social trends, economic circumstances and the marketing efforts of our competitors. There can be no assurance that our existing products will continue to be accepted by our customers or that we will be able to anticipate or respond to changes in consumer tastes and preferences in a timely manner. Our failure to anticipate, identify or react to these particular tastes or changes could adversely affect our sales performance and our profitability. In addition, demand for many of our consumer products is closely linked to consumers’ purchasing power and disposable income levels, which may be adversely affected by unfavorable economic development in the countries in which we operate.

We devote significant resources to new product development and product extensions. However, we may not be successful in developing innovative new products, and our new products may not be commercially successful. To the extent we are not able to effectively gauge the direction of our key markets and successfully identify, develop and manufacture new or improved products in these changing markets, our financial results and our competitive position will suffer. Moreover, there are inherent market risks associated with new product introductions, including uncertainties about marketing and consumer acceptance, and there can be no assurance that we will be successful in introducing new products. We may expend substantial resources developing and marketing new products which may not achieve expected sales levels.

In addition, we may not be successful in maintaining or strengthening our brand image. We seek to maintain and strengthen our brand image through marketing investments, including advertising, consumer promotions and trade promotions. Maintaining and strengthening our brand image depends on our ability to adapt to a rapidly changing media environment, including on social media other online dissemination of advertising campaigns. If we do not maintain and strengthen our brand image, our business, financial condition, results of operations and prospects could be materially and adversely affected.

We face competition in our business, which may adversely affect our market share and profitability.

The beef, pork and chicken industries are highly competitive. Competition exists both in the purchase of live hogs, and in the sale of pork and meat products. In addition, our pork and meat products compete with other protein sources, such as fish. We face competition from a number of pork producers in Chongqing City and Sichuan province where we operate.

The principal competitive factors in the animal protein processing industries are operating efficiency and the availability, quality and cost of raw materials and labor, price, quality, food safety, product distribution, technological innovations and brand loyalty. Our ability to be an effective competitor depends on our ability to compete on the basis of these characteristics. In addition, some of our competitors may have greater financial and other resources than us. We may be unable to compete effectively with these companies, and if we are unable to remain competitive with these meat producers in the future, our market share may be adversely affected.

Our growth (organic and inorganic) may require substantial capital and long-term investments.

Our competitiveness and growth depend on our ability to fund our capital expenditures. We cannot assure you that we will be able to fund our capital expenditures at reasonable costs due to adverse macroeconomic conditions, our performance or other external factors.

| 14 |

We may pursue additional opportunities to acquire complementary businesses, which could further increase leverage and debt service requirements and could adversely affect our financial situation if we fail to successfully integrate the acquired business.

We intend to continue to pursue selective acquisitions of complementary businesses in the future. Inherent in any future acquisitions are certain risks such as increasing leverage and debt service requirements and combining company cultures and facilities, which could have a material adverse effect on our operating results, particularly during the period immediately following such acquisitions. Additional debt or equity capital may be required to complete future acquisitions, and there can be no assurance that we will be able to raise the required capital. Furthermore, acquisitions involve a number of risks and challenges, including:

| · | diversion of management’s attention; |

| · | potential loss of key employees and customers of the acquired companies; |

| · | an increase in our expenses and working capital requirements; |

| · | failure of the acquired entities to achieve expected results; |

| · | our failure to successfully integrate any acquired entities into our business; and |

| · | our inability to achieve expected synergies and/or economies of scale. |

These opportunities may also expose us to successor liability relating to actions involving any acquired entities, their respective management or contingent liabilities incurred prior to our involvement and will expose us to liabilities associated with ongoing operations, in particular to the extent we are unable to adequately and safely manage such acquired operations. These transactions may also be structured in such a manner that would result in our assumption of obligations or liabilities not identified during our pre-acquisition due diligence.

Any of these and other factors could adversely affect our ability to achieve anticipated cash flows at acquired operations or realize other anticipated benefits of acquisitions, which could adversely affect our reputation and have a material adverse effect on us.

We are subject to various risks relating to worker safety.

Given the nature of our operations, we are subject to various risks relating to worker safety. We conduct training and educational campaigns to improve awareness of risks and safety in the work environment and strive to improve safety conditions in the workplace, but cannot ensure that accidents will not occur. If our efforts to improve worker safety and reduce the frequency and number of workplace accidents are not successful, our business, financial condition and results of operations may be adversely affected.

We may fail to comply with legal or regulatory requirements or to obtain or adhere to requirements under relevant licenses or permits.

Our manufacturing and other production facilities, including hog farming, as well as the processing, packaging, storage, distribution, advertising and labeling of our products, are subject to extensive legal and regulatory food safety requirements, including regular government inspections and governmental food processing controls, in the countries in which we operate. In China, under applicable laws and regulations, we are required to obtain and maintain various licenses and permits in order to operate our hog farming and slaughtering operations. These include, amongst others, “Livestock and Poultry Breeders Production Operation Permit”, “Certificate for Animal Epidemic Disease Prevention” and “Certificate of Designated Location of Slaughterhouse for Hogs”. We are also required to obtain various government approvals and comply with applicable hygiene and food safety standards in relation to our production processes, premises and products. Loss of or failure to obtain necessary permits and licenses could delay or prevent us from meeting current product demand, introducing new products, building new facilities or acquiring new businesses and could adversely affect our operating results. If we are found not to be in compliance with applicable laws and regulations, particularly if it relates to or compromises food safety, we could be subject to civil remedies, including fines, injunctions, recalls or asset seizures, as well as potential criminal sanctions, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects. In addition, future material changes in food safety regulations could result in increased operating costs or affect our ordinary operations, which could also have a material adverse effect on our operations and our financial results.

| 15 |

We rely substantially on external suppliers for hogs, beef, lamb, chicken, duck, rabbit meat and other raw materials.

We purchase live hogs and fresh pork, beef, lamb, chicken, duck, and rabbit meat from external distributors for use in our production of processed products. A continuous and stable supply of ordinary live hogs and other meat that meet our standards is crucial to our operations. We expect to continue to rely on external suppliers for all of live hogs, fresh pork, beef, lamb, chicken, duck, and rabbit meat production requirements. We also rely on external suppliers for other key raw materials, including seasonings. There can be no assurance that we will continue to be able to source live hogs, fresh pork, beef, lamb, chicken, duck, rabbit meat, seasonings, or other raw materials meeting our requirements on reasonable prices or terms or at all. In the event that our supply of the raw materials is interrupted for whatever reason, our business, financial condition, results of operations and prospects may be materially and adversely affected.

The loss of one or more of our largest customers, or changes in the trade terms required by such customers could adversely affect our business, financial condition and results of operations.

Our business could suffer significant setbacks in sales and operating income if our customers’ business plans or markets change significantly or if we lose one or more of our largest customers. For the year ended June 30, 2017, one customer accounted for 79.1% of our total revenue. For the year ended June 30, 2016, two customers accounted for 21.5% and 13.7% of the total revenue. Moreover, consolidation within the retail industry is likely to continue in China, including among supermarkets, warehouse clubs and food distributors, which would result in us having an increasingly concentrated retail base and increased credit exposure to certain customers. Furthermore, as the retail branded food and foodservice industries continue to consolidate, our large customers may seek to use their position to improve their profitability through improved inventory efficiency, lower pricing, increased promotional programs and increased emphasis on private label products. If we are unable to use our scale, marketing expertise, product innovation and category leadership positions to effectively respond, our profitability or volume growth could be negatively affected. To the extent we provide concessions or trade terms that are more favorable to our customers, our margins would be reduced. The loss of a significant customer or a material reduction in sales to, or adverse change to trade terms with, a significant customer could materially and adversely affect our product sales, financial condition, results of operations and prospects.

Our operations are subject to the general risks of litigation.

We are involved on an ongoing basis in litigation arising in the ordinary course of business or otherwise. Trends in litigation may include class actions involving consumers, shareholders, employees or injured persons, and claims related to commercial, labor, employment, antitrust, securities or environmental matters. Moreover, the process of litigating cases, even if we are successful, may be costly, and may approximate the cost of damages sought. These actions could also expose us to adverse publicity, which might adversely affect our brands, reputation and/or customer preference for our products and distract our management from other tasks. Litigation trends and expenses and the outcome of litigation cannot be predicted with certainty and adverse litigation trends, expenses and outcomes could adversely affect our financial results. Please see the section headed “Business — Legal Compliance and Proceedings” in this prospectus for details of our material litigation and proceedings.

The consolidation of our customers could adversely affect our business.

Our customers, such as supermarkets and farmers’ markets, have consolidated in recent years, and consolidation is expected to continue. These consolidations have produced large, sophisticated customers with increased buying power who are more capable of operating with reduced inventories, opposing price increases, and demanding lower pricing, increased promotional programs and specifically tailored products. These customers also may use shelf space currently used for our products for their own private label products. If we fail to respond to these trends, our volume growth could slow or we may need to lower prices or increase promotional spending for our products, any of which would adversely affect our financial results.

Macroeconomic conditions could have a material adverse effect on our business, results of operations, financial condition and stock price.

Key macroeconomic conditions are likely to affect our business, results of operations and financial condition. Consumer confidence, energy price, labor cost, prices, unemployment are among the factors that often impact the borrowing behavior of our customers. Poor economic conditions reduce the demand for consumption of pork and pork products.

| 16 |

While certain economic conditions in China have shown signs of improvement following the recent global economic crisis, economic growth has been slow and uneven as consumers continue to face domestic concerns, as well as economic and political conditions in the global markets. A prolonged period of slow economic growth or a significant deterioration in economic conditions would likely affect our customers’ activity levels and the ability and willingness of customers to obtain financing from us or to pay amounts already owed to us, and could have a material adverse effect on our business, results of operations and financial condition.

If we are not able to continue to innovate or if we fail to adapt to changes in our industry, our business, financial condition and results of operations would be materially and adversely affected.

Although the livestock industry is not directly affected by the rapidly changing technology, evolving industry standards, new service and product introductions and changing customer demands have changed the way we and our competitors do business over the years. Furthermore, our competitors are constantly developing innovations in online marketing, communications, social networking and other services to expand the basis of suppliers and customers. We continue to invest significant resources in our infrastructure, research and development and other areas in order to enhance our quality control, information technology, and our existing products and services. The changes and developments taking place in our industry may also require us to re-evaluate our business model and adopt significant changes to our long-term strategies and business plan. Our failure to innovate and adapt to these changes would have a material adverse effect on our business, financial condition and results of operations.

If we fail to promote and maintain our brand in an effective and cost-efficient way, our business and results of operations may be harmed.

We believe that developing and maintaining awareness of our brand effectively is critical to attracting new and retaining existing customers. Successful promotion of our brand and our ability to attract customers depend largely on the effectiveness of our marketing efforts and the success of the channels we use to promote our services. It is likely that our future marketing efforts will require us to incur significant additional expenses. These efforts may not result in increased revenues in the immediate future or at all and, even if they do, any increases in revenues may not offset the expenses incurred. If we fail to successfully promote and maintain our brand while incurring substantial expenses, our results of operations and financial condition would be adversely affected, which may impair our ability to grow our business.

New lines of business or new products and services may subject us to additional risks.

From time to time, we may implement new lines of business or offer new products and services within existing lines of business. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new services may not be achieved and price and profitability targets may not prove feasible. External factors, such as compliance with regulations, competitive alternatives and shifting market preferences, may also impact the successful implementation of a new line of business or a new product or service. Furthermore, any new line of business and/or new service could have a significant impact on the effectiveness of our system of internal controls. Failure to successfully manage these risks in the development and implementation of new lines of business or new services could have a material adverse effect on our business, results of operations and financial condition.

We may not be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position.

We regard our trademarks, copyrights, domain names, know-how, proprietary technologies and similar intellectual property as critical to our success, and we rely on a combination of intellectual property laws and contractual arrangements, including confidentiality, invention assignment and non-compete agreements with our employees and others to protect our proprietary rights. We own certain intellectual properties. See “Business — Intellectual Property.” Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated, or such intellectual property may not be sufficient to provide us with competitive advantages. In addition, because of the rapid pace of technological change in our industry, parts of our business rely on technologies developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and technologies from these third parties on reasonable terms, or at all.

| 17 |

It is often difficult to register, maintain and enforce intellectual property rights in China. Statutory laws and regulations are subject to judicial interpretation and enforcement and may not be applied consistently due to the lack of clear guidance on statutory interpretation. Confidentiality, invention assignment and non-compete agreements may be breached by counterparties, and there may not be adequate remedies available to us for any such breach. Accordingly, we may not be able to effectively protect our intellectual property rights or to enforce our contractual rights in China. Preventing any unauthorized use of our intellectual property is difficult and costly and the steps we take may be inadequate to prevent the misappropriation of our intellectual property. In the event that we resort to litigation to enforce our intellectual property rights, such litigation could result in substantial costs and a diversion of our managerial and financial resources. We can provide no assurance that we will prevail in such litigation. In addition, our trade secrets may be leaked or otherwise become available to, or be independently discovered by, our competitors. To the extent that our employees or consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights in related know-how and inventions. Any failure in protecting or enforcing our intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate trademarks, patents, copyrights, know-how or other intellectual property rights held by third parties. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. In addition, there may be third-party trademarks, patents, copyrights, know-how or other intellectual property rights that are infringed by our products, services or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such intellectual property rights against us in China, the United States or other jurisdictions. If any third-party infringement claims are brought against us, we may be forced to divert management’s time and other resources from our business and operations to defend against these claims, regardless of their merits.

Additionally, the application and interpretation of China’s intellectual property right laws and the procedures and standards for granting trademarks, patents, copyrights, know-how or other intellectual property rights in China are still evolving and are uncertain, and we cannot assure you that PRC courts or regulatory authorities would agree with our analysis. If we were found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and results of operations may be materially and adversely affected.