SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

Commission File Number

(Exact name of Registrant as specified in its Charter)

|

||

( State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

||

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol |

Name of exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

|

☒ |

|

|

|

|

|

|||

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of March 31, 2022, the last day of the Registrant’s most recently completed second quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $

The number of shares of Registrant’s Common Stock outstanding as of October 31, 2022 was

DOCUMENTS INCORPORATED BY REFERENCE

i

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders, scheduled to be held on March 7, 2023, are incorporated by reference into Part III of this Report.

ii

Table of Contents

|

|

Page |

|

|

|

Item 1. |

7 |

|

Item 1A. |

16 |

|

Item 1B. |

30 |

|

Item 2. |

30 |

|

Item 3. |

30 |

|

Item 4. |

30 |

|

|

|

|

|

|

|

Item 5. |

31 |

|

Item 6. |

32 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

32 |

Item 7A. |

47 |

|

Item 8. |

48 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

48 |

Item 9A. |

48 |

|

Item 9B. |

49 |

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

49 |

|

|

|

|

|

|

Item 10. |

50 |

|

Item 11. |

50 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

50 |

Item 14. |

50 |

|

|

|

|

|

|

|

Item 15. |

51 |

|

Item 16. |

51 |

|

|

57 |

iii

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Form 10-K”) contains “forward-looking statements” within the meaning of the safe harbor provision of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts included in this Form 10-K, including statements concerning our plans, objectives, goals, beliefs, business strategies, future events, business conditions, results of operations, financial position, business outlook, business trends and other information, may be forward-looking statements.

Words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates,” or “anticipates,” and variations of such words or similar expressions are intended to identify forward-looking statements. The forward-looking statements are not historical facts, or guarantees of future performance and are based upon our current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond our control. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties and other important factors, many of which are beyond our control, that could cause our actual results to differ materially from the forward-looking statements contained in this Form 10-K. Such risks, uncertainties and other important factors that could cause actual results to differ include, among others, the risks, uncertainties and factors set forth under the heading “Business”, “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Form 10-K. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Some of the key factors that could cause actual results to differ from our expectations include those described below under “Summary of Risk Factors.”

We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances, any change in assumptions, beliefs or expectations or any change in circumstances upon which any such forward-looking statements are based, except as required by law.

Summary of Risk Factors

The following is a summary of the principal risks that could materially adversely affect our business, financial condition, results of operations and cash flows. You should read this summary together with the more detailed description of each risk contained below.

Risks Related to Our Business

iv

Risks Related to Our Indebtedness

Risks Related Ownership of Our Common Stock

v

General Risk Factors

vi

PART I

Item 1. Business

BrightView Holdings, Inc. is a holding company that conducts substantially all of its activity through its direct, wholly-owned operating subsidiary, BrightView Landscapes, LLC (“BrightView”) and its consolidated subsidiaries. The holding company and BrightView are collectively referred to on Form 10-K (the “Annual Report”) as “we,” “us,” “our,” “ourselves,” “Company,” or “BrightView.” Prior to its initial public offering completed in July 2018 (the “IPO”), the Company was a wholly-owned subsidiary of BrightView Parent L.P. (“Parent”), an affiliate of Kohlberg Kravis Roberts & Co. Inc. (“KKR”). The Parent and Company were formed through a series of transactions entered into by KKR to acquire the Company on December 18, 2013 (the “KKR Acquisition”). The Parent was dissolved in August 2018 following the IPO.

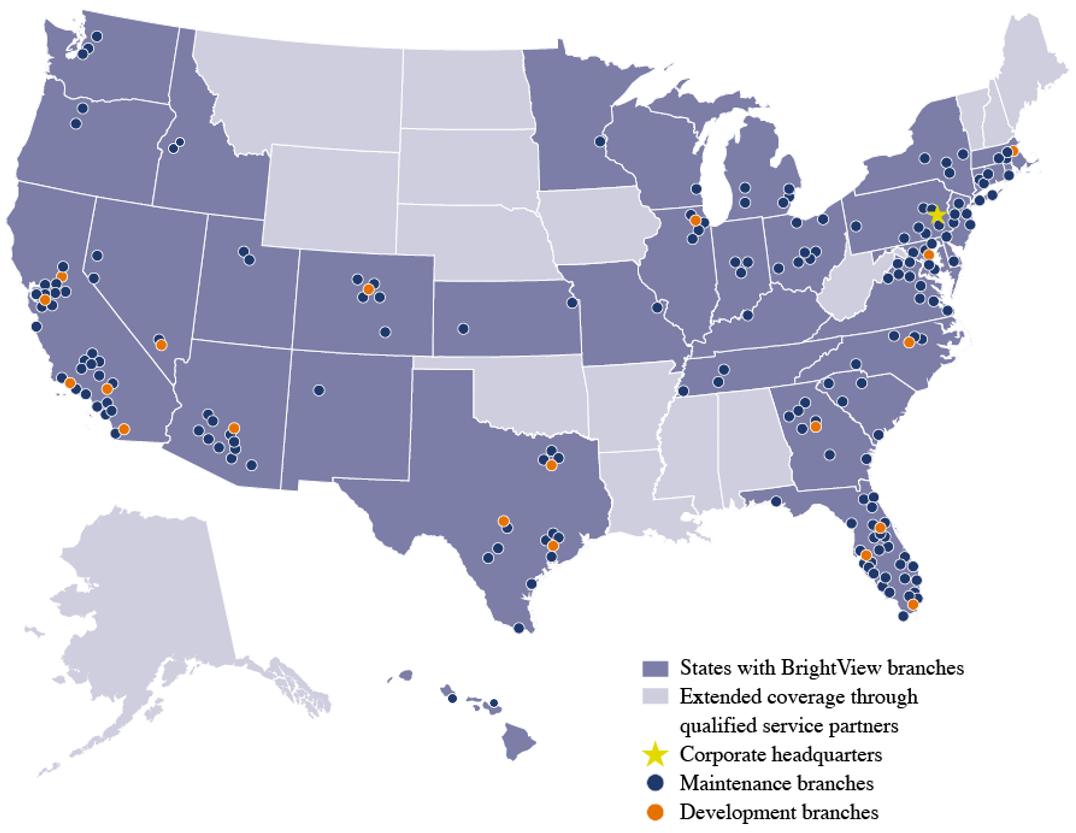

Our Company

We are the largest provider of commercial landscaping services in the United States, with revenues approximately 6 times those of our next largest commercial landscaping competitor. We provide commercial landscaping services, ranging from landscape maintenance and enhancements to tree care and landscape development. We operate through a differentiated and integrated national service model which systematically delivers services at the local level by combining our network of over 290 branches with a qualified service partner network. Our branch delivery model underpins our position as a single-source end-to-end landscaping solution provider to our diverse customer base at the national, regional and local levels, which we believe represents a significant competitive advantage. We believe our commercial customer base understands the financial and reputational risk associated with inadequate landscape maintenance and considers our services to be essential and non-discretionary.

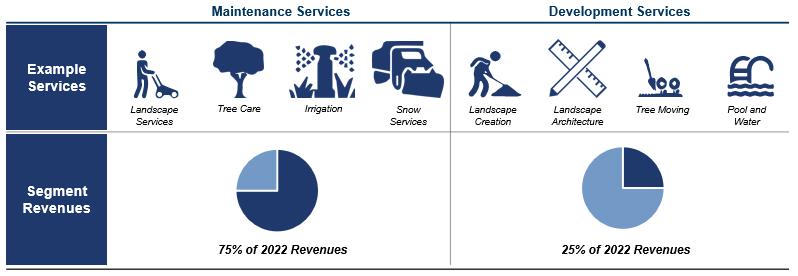

We operate through two segments: Maintenance Services and Development Services. Our maintenance services are primarily self-performed through our national branch network and are route-based in nature. Our development services are comprised of sophisticated design, coordination and installation of landscapes at some of the most recognizable corporate, athletic and university complexes and showcase highly visible work that is paramount to our customers’ perception of our brand as a market leader.

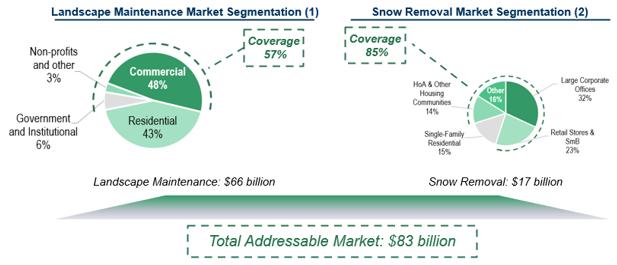

As the number one player in the highly attractive and growing $83 billion commercial landscape maintenance and snow removal market, we believe our size and scale present several compelling value propositions for our customers, and allow us to offer a single-source landscaping services solution to a diverse group of commercial customers across all 50 U.S. states. We serve a broad range of end market verticals, including corporate and commercial properties, Homeowners Associations (HOAs), public parks, hotels and resorts, hospitals and other healthcare facilities, educational institutions, restaurants and retail, and golf courses, among others. We are also the Official Field Consultant for Major League Baseball. Our diverse customer base includes approximately 9,500 office parks and corporate campuses, 7,500 residential communities, and 550 educational institutions. We believe that due to our unmatched geographic scale and breadth of service offerings, we are the only commercial landscaping services provider able to service clients whose geographically disperse locations require a broad range of landscaping services delivered consistently and with high quality. Our top ten customers accounted for approximately 10% of our fiscal 2022 revenues, with no single customer accounting for more than 2% of our fiscal 2022 revenues.

Our business model is characterized by stable, recurring revenues, a scalable operating model, strong operating margins, limited capital expenditures and low working capital requirements that together generate significant Free Cash Flow. For the year ended September 30, 2022, we generated net service revenues of $2,774.6 million, net income of $14.0 million and Adjusted EBITDA of $287.9 million, with a net income margin of 0.5% and an Adjusted EBITDA margin of 10.4%.

7

Our Operating Segments

We deliver our broad range of services through two operating segments: Maintenance Services and Development Services. We serve a geographically diverse set of customers through our strategically located network of branches in 34 U.S. states and, through our qualified service partner network, we are able to efficiently provide nationwide coverage in all 50 U.S. states, as illustrated below.

Maintenance Services Overview

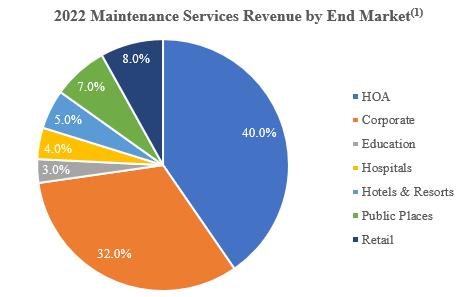

Our Maintenance Services segment delivers a full suite of recurring commercial landscaping services ranging from mowing, gardening, mulching and snow removal, to more horticulturally advanced services, such as water management, irrigation maintenance, tree care, golf course maintenance and specialty turf maintenance. Our maintenance services customers include Fortune 500 corporate campuses and commercial properties, HOAs, public parks, leading international hotels and resorts, airport authorities, municipalities, hospitals and other healthcare facilities, educational institutions, restaurants and retail, and golf courses, among others. The chart below illustrates the diversity of our Maintenance Services revenues:

(1) Reflects the fiscal year ended September 30, 2022.

8

In addition to contracted maintenance services, we also have a strong track record of providing value-added landscape enhancements, defined as supplemental, non-contract specified maintenance or improvement services which are typically sold by our account managers to our maintenance services customers. These landscape enhancements typically have a predictable level of demand related to our amount of contracted revenue with a customer.

We have a strong maintenance presence in both evergreen and seasonal markets. Evergreen markets are defined as those which require year-round landscape maintenance.

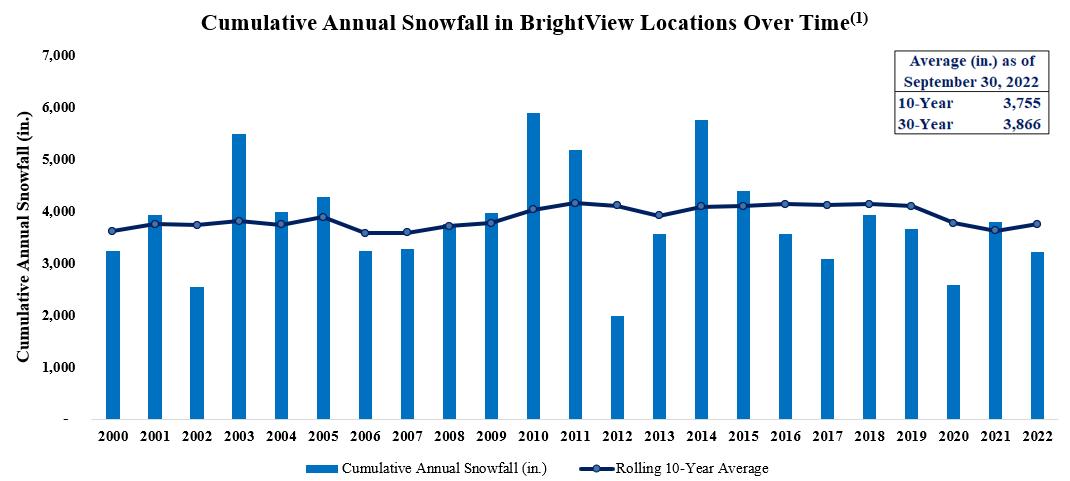

In our seasonal markets, we are also a leading provider of snow removal services. These route-based snow removal services provide us with a valuable counter-seasonal source of revenues, allowing us to better utilize our crews and certain equipment during the winter months. Our capabilities as a rapid-response, reliable service provider further strengthens our relationships with our customers, all of which have an immediate and critical need for snow removal services. Property managers also enjoy several benefits by using the same service provider for snow removal and landscape maintenance services, including consistency of service, single-source vendor efficiency and volume discount savings. This allows us to actively maintain relationships with key customers in seasonal markets year-round. A portion of our snow removal business is contracted each year under fixed fee servicing arrangements that are subject to guaranteed minimum payments regardless of the season’s snowfall.

The performance of our snow removal services business, however, is correlated with the amount of snowfall, the number of snowfall events and the nature of those events in a given season. We benchmark our performance against ten- and thirty-year averages, as annual snowfall amounts modulate around these figures.

(1) Reflects cumulative annual snowfall at locations where BrightView has a presence.

For the year ended September 30, 2022, in Maintenance Services, we generated net service revenues of $2,082.0 million, including $256.3 million from snow removal services, and Segment Adjusted EBITDA of $278.8 million, with a Segment Adjusted EBITDA Margin of 13.4%.

Development Services Overview

Through our Development Services segment, we provide landscape architecture and development services for new facilities and significant redesign projects. Specific services include project design and management services, landscape architecture, landscape installation, irrigation installation, tree moving and installation, pool and water features and sports field services, among others. These complex and specialized offerings showcase our technical expertise across a broad range of end market verticals.

We perform our services across the full spectrum of project sizes, with landscape development projects generally ranging from $100,000 to over $10 million, with an average size of approximately $1.2 million.

Depending on the scope of the work, the contracts can vary in length from 2-3 months to up to 2-3 years. We largely self-perform our work, and we subcontract certain services where we have strategically decided not to allocate resources, such as fencing, lighting and parking lot construction. We believe that our capabilities as a single-source landscape development provider represent a point of comfort for our customers who can be certain that we are managing their landscape development project from inception to completion.

9

In our Development Services business, we are typically hired by general contractors with whom we maintain strong relationships as a result of our superior technical and project management capabilities. We believe the quality of our work is also well-regarded by our end-customers, some of whom directly request that their general contractors utilize our services when outsourcing their landscape development projects. Similar to our maintenance contracts, we leverage our proven cost estimation framework and proactive cost management tactics to optimize the profitability of the work we perform under fixed rate development contracts.

For the year ended September 30, 2022, in Development Services, we generated net service revenues of $698.8 million and Segment Adjusted EBITDA of $73.7 million, with a Segment Adjusted EBITDA Margin of 10.5%.

Our History

In 2013, affiliates of KKR acquired our predecessor business, Brickman Holding Group, Inc. In 2014, we acquired ValleyCrest Holding Co. (“ValleyCrest Acquisition”) and changed our name to BrightView. As a result of the ValleyCrest Acquisition, BrightView nearly doubled in size and gained national coverage. Our predecessor companies have long histories in the landscaping industry, with Brickman Holding Group, Inc. founded in 1939 and ValleyCrest Holding Co. founded in 1949.

In 2016, we reconstituted our senior leadership team, including hiring a new chief executive officer and a new chief financial officer. Our management team refocused our strategy to realign with the fundamental strengths of our business. BrightView has undergone an organizational transformation recentered around a branch-centric model, empowering leaders at the local and regional levels, and supporting branch locations with appropriate back office functions and an effective corporate framework.

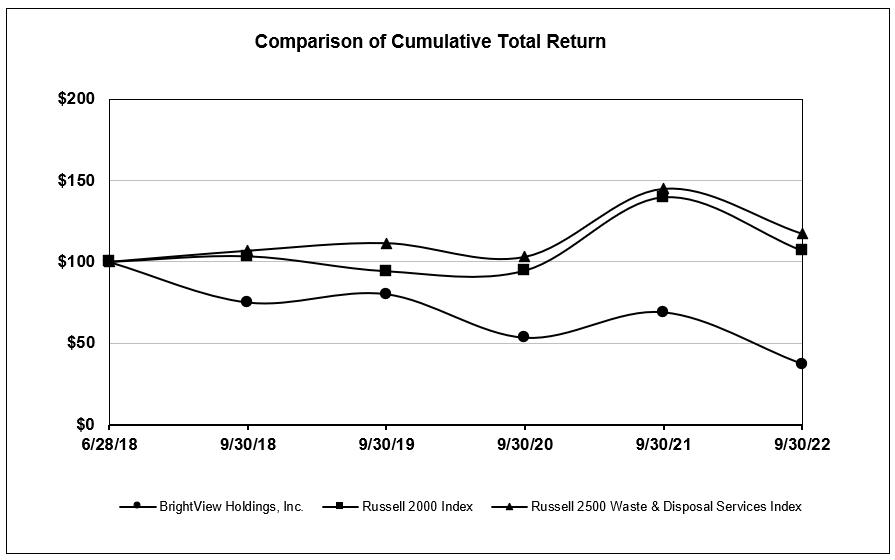

In July 2018, we completed the initial public offering of our common stock (the “IPO”). Our common stock trades on the New York Stock Exchange under the symbol “BV”. Our principal executive offices are located at 980 Jolly Road, Suite 300, Blue Bell, Pennsylvania 19422.

Market Opportunity

Commercial Landscaping Services Industry

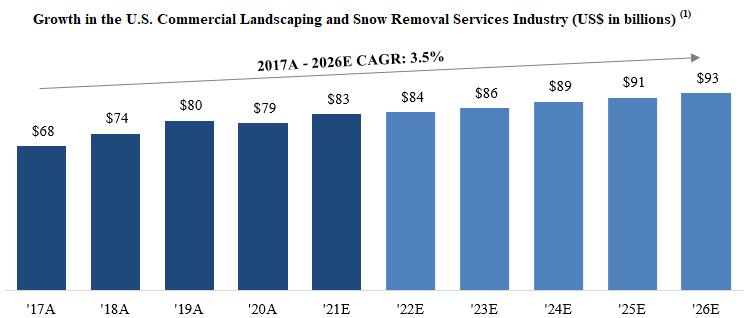

The landscape services industry consists of landscape maintenance and development services, as well as a number of related ancillary services such as tree care and snow removal, for both commercial and residential customers. BrightView operates only within the commercial sectors of each of the landscape maintenance, landscape development and snow removal industries. In 2021, commercial landscape maintenance, including snow removal, represented an $83 billion industry that is characterized by a number of attractive market drivers. The industry benefits from commercial customers’ need to provide consistently accessible and aesthetically-pleasing environments. Due to the essential and non-discretionary need of these recurring services, the commercial landscape maintenance services and snow removal services industries have exhibited, and are expected to continue to exhibit, stable and predictable growth.

Highlighting the consistency of this growth, the combined industry is expected to grow at a 3.5% CAGR from 2017 through 2026, as depicted in the chart below:

(1) Source: IBISWORLD-Landscaping Services in the U.S. (August 2021) IBISWorld—Snowplowing Services in the U.S. (April 2021). Presents commercial landscaping services and commercial snowplowing services as a share of the overall U.S. market at rates constant with IBISWorld figures for 2021.

10

In addition to its stable characteristics, the industry is also highly fragmented. Despite being the largest provider of commercial landscaping services, we currently hold only a 2.5% market share, representing a significant opportunity for future consolidation. According to the 2021 IBISWorld Report, there are over 600,000 enterprises providing landscape maintenance services in the United States. Approximately three-quarters of the industry participants are classified as sole proprietors, with a limited set of companies having the capabilities to deliver sophisticated, large-scale landscaping services or operate regionally or nationally. The chart below illustrates the segmentation of the landscape maintenance industry and highlights BrightView’s coverage of the non-residential sectors of the industry:

Steady growth in the commercial property markets has underpinned the commercial landscaping industry’s growth. Unlike individual residential customers, HOAs and military housing managers possess the same sophistication and expectation of high-quality services as corporations, and thus are more inclined to outsource landscaping needs to professional, scaled companies.

Key Trends and Industry Drivers

We believe we are well-positioned to capitalize on the following key industry trends that are expected to drive stable and growing demand for our landscaping services:

11

Organization

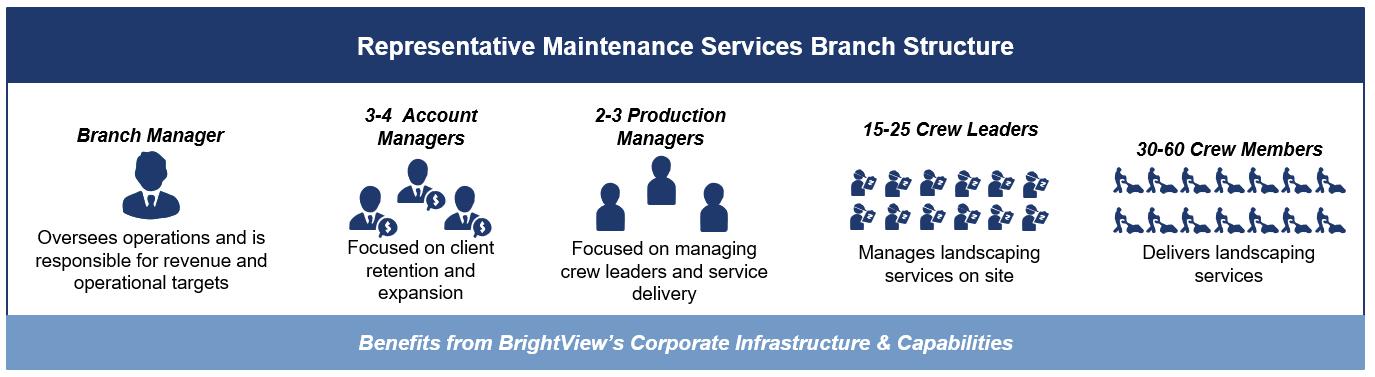

Our core operating strategy is to systematically deliver our services on a local level. Our organization is designed to allow our branch-level management teams to focus on identifying revenue opportunities and delivering high quality services to customers, with the support of a national organization to provide centralized core functions, such as human resources, procurement and other process-driven management functions.

Our maintenance services model is grounded in our branch network. For example, a representative maintenance services branch typically serves 25-100 customers across 50-200 sites, generating between $5 million and $15 million in annual revenues. Each branch is led by a branch manager, who focuses on performance drivers, such as customer satisfaction, crew retention, safety and tactical procurement. Branch managers are supported by production managers, who focus on managing crew leaders, and account managers, who focus on customer retention and sales of landscape enhancement services. In addition to our network of branch managers, production managers and account managers, our platform is differentiated by a highly experienced team of operational senior vice presidents and vice presidents, organized regionally, with an average tenure of 14 years. These team members are responsible for leading, teaching and developing branch managers as well as maintaining adherence to key operational strategies. Our senior operating personnel also foster a culture of engagement and emphasize promotion from within, which has played a key role in making BrightView the employer of choice within the broader landscape maintenance industry.

Our scale supports centralizing key functions, which enables our branch, production and account managers to focus their efforts on fostering deep relationships with customers, delivering excellent service and finding new revenue opportunities. As branches grow and we win new business, our branch model is easily scalable within an existing, well-developed market-based management structure with supporting corporate infrastructure.

We supplement our branch network with our qualified service partner network, which is managed by our BrightView Enterprise Solutions team, or BES. Through our BES platform, we are able to provide landscape maintenance services in all 50 U.S. states. BES identifies qualified service providers in areas where we do not have branches, thereby extending our service area. Our qualified service partner screening process is designed to ensure that each of our service partners has the appropriate technical expertise, equipment and resources, including insurance coverage, to support the projects we assign to them.

Our Development Services organization is centered around 40 branch locations strategically located in large metropolitan areas with supportive demographics for growth and real estate development. Certain facilities used by our Development Services segment are shared or co-located with our Maintenance organization. Our Development Services branch network is supported by two design centers, as well as centralized support functions similar to our Maintenance Services organization.

Human Capital

Employees

As of September 30, 2022, we had a total of approximately 21,000 employees, including seasonal workers, consisting of approximately 20,300 full-time and approximately 700 part-time employees in our two business segments. The number of part-time employees varies significantly from time to time during the year due to seasonal and other operating requirements. We generally experience our highest level of employment during the spring and summer seasons, which correspond with our third and fourth fiscal quarters. The approximate number of full-time employees by segment, as of September 30, 2022, is as follows: Maintenance Services: 17,300; Development Services: 2,700. In addition, our corporate staff is approximately 300 employees. Approximately 4% of our employees are covered by collective bargaining agreements. We have not experienced any material interruptions of operations due to disputes with our employees and consider our relations with our employees to be satisfactory. Historically, we have used, and expect to continue to use in the future, a U.S. government program that provides H-2B temporary, non-immigrant visas to foreign workers to help satisfy a portion of our need for seasonal labor in certain markets. We employed approximately 2,100 seasonal workers in 2022, and 2021, through the H-2B visa program.

12

Safety

We care about our employees and we believe that our commercial success is linked to a safe and healthy workforce. We strive for zero injuries and an incident-free workplace and have achieved significant progress towards this goal through risk reduction activities, including robust training, jobsite safety observations and pre-job safety briefings to raise awareness around workplace hazards and reduce employee exposure to hazardous conditions. Our care and concern for employee wellbeing is enhanced by the BrightView Landscapes Foundation, a nonprofit organization used to support employees during periods of personal and financial stress. BrightView continues to demonstrate our commitment to preventing the spread of COVID-19 by continuing to adhere to the CDC guidelines and meet or exceed local government mandates.

Total Rewards

Our total rewards philosophy is designed to offer compensation and benefits programs that enable us to attract, motivate, reward and retain high-caliber employees who are capable of creating and sustaining value for our stockholders over the long-term and to design programs that are fair and competitive in order to appropriately reward employees for their contributions to our success. Our programs are structured to meet the diverse needs of our employees and their families. Among other things, we offer comprehensive health and wellness plans, retirement savings plans, and the opportunity to earn short-term and long-term incentive awards to eligible employees.

Training

We are committed to developing and unlocking the potential of our people and we make significant investments in training and professional development. BrightView University, our learning and development platform, underpins the development of leadership and professional skills.

Diversity, Equity and Inclusion

We are committed to creating and sustaining a diverse workplace that understands and values individual differences across demographics, experiences and perspectives. We want to ensure that collaborative and respectful business practices in a performance-based, supportive environment enable every employee to realize his/her/their career ambitions.

Competition

Although the United States landscaping, snow removal and landscape design and development industries have experienced some consolidation, there is significant competition in all the areas that we serve, and such competition varies across geographies. In our Maintenance Services segment, most competitors are smaller local and regional firms; however, we also face competition from other large national firms such as Yellowstone Landscape, Bartlett Tree Experts and HeartLand. In our Development Services segment, competitors are generally smaller local and regional firms. We believe that the primary competitive factors that affect our operations are quality, service, experience, breadth of service offerings and price. We believe that our ability to compete effectively is enhanced by the breadth of our services and the technological tools used by our teams as well as our nationwide reach.

Seasonality

Our services, particularly in our Maintenance Services segment, have seasonal variability such as increased mulching, flower planting and intensive mowing in the spring, leaf removal and cleanup work in the fall, snow removal services in the winter and potentially minimal mowing during drier summer months. This can drive fluctuations in revenue, costs and cash flows for interim periods.

We have a significant presence in our evergreen markets, which require landscape maintenance services year round. In our seasonal markets, which do not have a year-round growing season, the demand for our landscape maintenance services decreases during the winter months. Typically, our revenues and net income have been higher in the spring and summer seasons, which correspond with our third and fourth fiscal quarters. The lower level of activity in seasonal markets during our first and second fiscal quarters is partially offset by revenue from our snow removal services. Such seasonality causes our results of operations to vary from quarter to quarter.

Weather Conditions

Weather may impact the timing of performance of landscape maintenance and enhancement services and progress on development projects from quarter to quarter. Less predictable weather patterns, including snow events in the winter, hurricane-related cleanup in the summer and fall, and the effects of abnormally high rainfall or drought in a given market, can impact both our revenues and our costs, especially from quarter to quarter, but also from year to year in some cases. Extreme weather events such as hurricanes and tropical storms can result in a positive impact to our business in the form of increased enhancement services revenues related to cleanup and other services. However, such weather events may also negatively impact our ability to deliver our contracted services, sell and deliver enhancement services or impact the timing of performance.

13

In our seasonal markets, the performance of our snow removal services is correlated with the amount of snowfall, the number of snowfall events and the nature of those events in a given season. We benchmark our performance against ten- and thirty-year averages.

Intellectual Property

We, primarily through our subsidiaries, hold or have rights to use various service marks, trademarks and trade names we use in the operation of our businesses that we deem particularly important to each of our businesses. As of September 30, 2022, we had marks that were protected by registration (either by direct registration or by treaty) in the United States.

Regulatory Overview

We are required to comply with various federal, state and local laws and regulations, which increases our operating costs, limits or restricts the services provided by our operating segments or the methods by which our operating segments offer, sell and fulfill those services or conduct their respective businesses, or subjects us to the possibility of regulatory actions or proceedings. Noncompliance with these laws and regulations can subject us to fines or various forms of civil or criminal prosecution, any of which could have a material adverse effect on our reputation, business, financial position, results of operations and cash flows.

These federal, state and local laws and regulations include laws relating to wage and hour, immigration, permitting and licensing, workers’ safety, tax, healthcare reforms, collective bargaining and other labor matters, environmental, federal motor carrier safety, employee benefits and privacy and customer data security. We must also meet certain requirements of federal and state transportation agencies, including requirements of the U.S. Department of Transportation and Federal Motor Carrier Safety Administration, with respect to certain types of vehicles in our fleets. We are also regulated by federal, state and local laws, ordinances and regulations which are enforced by Departments of Agriculture, environmental regulatory agencies and similar government entities.

Employee and Immigration Matters

We are subject to various federal, state and local laws and regulations governing our relationship with and other matters pertaining to our employees, including regulations relating to wage and hour, health insurance, working conditions, safety, citizenship or work authorization and related requirements, insurance and workers’ compensation, anti-discrimination, collective bargaining and other labor matters.

We are also subject to the regulations of U.S. Immigration and Customs Enforcement (“ICE”), and we are audited from time to time by ICE for compliance with work authorization requirements. In addition, some states in which we operate have adopted immigration employment protection laws. Even if we operate in strict compliance with ICE and state requirements, some of our employees may not meet federal work eligibility or residency requirements, despite our efforts and without our knowledge, which could lead to a disruption in our work force.

Environmental Matters

Our businesses are subject to various federal, state and local laws and regulations regarding environmental, health and safety matters, including the Comprehensive Environmental Response, Compensation and Liability Act, the Federal Insecticide, Fungicide and Rodenticide Act, the Resource Conservation and Recovery Act, the Clean Air Act, the Emergency Planning and Community Right-to-Know Act, the Oil Pollution Act and the Clean Water Act, each as amended. Among other things, these laws and regulations regulate the emission or discharge of materials into the environment, govern the use, storage, treatment, disposal, handling and management of hazardous substances and wastes and the registration, use, notification and labeling of pesticides, herbicides and fertilizers, and protect the health and safety of our employees. These laws also impose liability for the costs of investigating and remediating, and damages resulting from, present and past releases of hazardous substances, including releases by us or prior owners or operators, at sites we currently own, lease or operate, customer sites or third-party sites to which we sent wastes. During fiscal 2021, there were no material capital expenditures for environmental control facilities.

Information Technology

We have invested in technology designed to accelerate business performance, enhancing our ability to support standard processes while retaining local and regional flexibility. We believe these investments position BrightView at the forefront of technology within the commercial landscaping industry, enabling us to drive operational efficiencies throughout the business. Our IT systems allow us to provide a high level of convenience and service to our customers, representing a competitive advantage that is difficult to replicate for less technologically sophisticated competitors.

As an example, our proprietary, BrightView Connect application allows customers to submit service requests and landscape pictures directly to their account manager and field team, ensuring that specific service needs are accurately delivered in a timely and efficient manner. Similarly, our mobile quality site assessment application, which is designed for account managers to capture and annotate customer feedback, provides us with the ability to “walk the site” with our customers, confirm our understanding of their needs

14

and highlight future enhancement opportunities. These solutions are components of our integrated Customer Relationship Management (CRM) system for account managers in the Maintenance Services segment. Among other benefits, the CRM system is accessible on mobile devices and enables account managers to spend more time with their customers, enhancing the quality of those relationships and supporting long-term customer retention.

We have also made significant investments in our internal IT infrastructure, such as migrating to a consolidated enterprise resource planning system and enabling shared services for accounts payable, accounts receivable and payroll. Additionally, we have implemented an electronic time capture system, or ETC, for our crew leaders and supervisors in the field. ETC not only provides accurate information for compliance and payroll purposes, but also enables our leadership with granular, analytical insights into job costing and crew productivity.

Sales and Marketing

Our sales and marketing efforts are focused on both developing new customers and increasing penetration at existing customers. We primarily sell our services to businesses, commercial property managers, general contractors and landscape architects through our professionally trained core sales force. We have a field-based sales approach driven by our growing team of more than 210 business developers that are focused on winning new customers at a local level. We also have a separate 24-member sales team that is focused on targeting and capturing high-value, high-margin opportunities, including national accounts. Within our Maintenance Services segment, every customer relationship is maintained by one of our more than 700+ branch-level account managers, who are responsible for ensuring customer satisfaction, tracking service levels, promoting enhancement services and driving contract renewals. We believe our decentralized approach to customer acquisition and management facilitates a high-level of customer service as local managers are empowered and incentivized to better serve customers and grow their respective businesses.

Our marketing department is also integral to our strategy and helps drive business growth, retention and brand awareness through marketing and communications efforts, including promotional materials, marketing programs, and advertising; digital marketing, including search engine optimization and website development; and trade shows and company-wide public relations activities. Our field marketing teams focus at the branch level to make our corporate marketing strategies more localized. Given the local nature of our operations, we believe that a sizeable amount of our new sales are also driven by customer referrals which stem from our strong reputation, depth of customer relationships and quality of work.

Fleet

Our highly visible fleet of approximately 16,000 trucks and trailers foster the strong brand equity associated with BrightView. We manage our fleet with a dedicated centralized team, as well as regional equipment managers, who together focus on compliance, maintenance, asset utilization and procurement. We believe we have the largest fleet of vehicles in the commercial landscape maintenance industry.

Sourcing and Suppliers

Our size and broad national network make us an attractive partner for many industry-leading manufacturers and suppliers, which has allowed us to maintain strong, long-term relationships with our supply base.

We source our equipment, supplies and other related materials and products from a range of suppliers, including landscaping equipment companies, suppliers of fertilizer, seed, chemicals and other agricultural products, irrigation equipment manufacturers, and a variety of suppliers who specialize in nursery goods, outdoor lighting, hardscapes and other landscaping products.

We generally procure our products through purchase orders rather than under long-term contracts with firm commitments. We work to develop strong relationships with a select group of suppliers that we target based on a number of factors, including brand and market recognition, price, quality, product support and service, service levels, delivery terms and their strategic positioning.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available to the public over the internet at the SEC’s website at https://www.sec.gov. Our SEC filings are also available on our website at https://www.brightview.com as soon as reasonably practicable after they are filed with or furnished to the SEC.

From time to time, we may use our website as a distribution channel of material company information. Financial and other important information regarding our company is routinely accessible through and posted on our website at https://investor.brightview.com. In addition, you may automatically receive email alerts and other information about us when you enroll your email address by visiting the Email Alerts section at https://investor.brightview.com. Our website and the information contained on or connected to that site are not incorporated into this Annual Report on Form 10-K.

15

Item 1A. Risk Factors

You should carefully consider the following risk factors as well as the other information included in this Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto. Any of the following risks could materially and adversely affect our business, financial condition, or results of operations. The selected risks described below, however, are not the only risks facing us. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition, or results of operations.

Risks Related to Our Business

Our business is affected by general business, financial market and economic conditions, which could adversely affect our financial position, results of operations and cash flows.

Our business and results of operations are significantly affected by general business, financial market and economic conditions. General business, financial market and economic conditions that could impact the level of activity in the commercial landscape services industry include the level of commercial construction activity, the condition of the real estate markets where we operate, interest rate fluctuations, inflation, unemployment and wage levels, changes and uncertainties related to government fiscal and tax policies including change in tax rates, duties, tariffs, or other restrictions, capital spending, bankruptcies, volatility in both the debt and equity capital markets, liquidity of the global financial markets, the availability and cost of credit, investor and consumer confidence, global economic growth, local, state and federal government regulation, the cost and availability of our supplies and equipment and the strength of regional and local economies in which we operate. New or increased tariffs may impact the costs of some of our supplies and equipment. The degree of our exposure is dependent on (among other things) the type of goods, rates imposed and timing of the tariffs. These factors could also negatively impact the timing or the ultimate collection of accounts receivable, which would adversely impact our business, financial position, results of operations and cash flows.

During an economic downturn, our customers may decrease their spending on landscape services by seeking to reduce expenditures for landscape services, in particular enhancement services, engaging a lower cost service provider or performing landscape maintenance themselves rather than outsourcing to third parties like us or generally reducing the size and complexity of their new landscaping development projects.

Recent increases in raw material costs, fuel prices, wages and other operating costs, and changes in our ability to source adequate supplies and materials in a timely manner, have adversely impacted our business, financial position, results of operations and cash flows.

Our financial performance has been adversely affected by increases in our operating expenses, including fuel, fertilizer, chemicals, road salt, mulch, wages and salaries, employee benefits, health care, subcontractor costs, vehicle, facilities and equipment leases, insurance and regulatory compliance costs, all of which are subject to historic continuing inflationary pressures. While we seek to manage price and availability risks related to raw materials, such as fuel, fertilizer, chemicals, road salt and mulch, through procurement strategies, these efforts may not be successful and we may experience adverse impacts due to the rising prices of such products. In addition, we closely monitor wage, salary and benefit costs in an effort to remain competitive in our markets. Attracting and maintaining a high quality workforce is a priority for our business, and as wage, salary or benefit costs increase, including as a result of minimum wage legislation, our operating costs will continue to increase. We cannot predict the extent to which we may experience future increases in operating expenses as well as various regulatory compliance costs. To the extent such costs continue to increase, we may be prevented, in whole or in part, from passing these cost increases through to our existing and prospective customers, which could have a material adverse impact on our business, financial position, results of operations and cash flows.

Our ability to offer a wide variety of services to our customers is dependent upon our ability to obtain adequate supplies, materials and products from manufacturers, distributors and other suppliers. Any disruption or shortage in our sources of supply due to unanticipated increased demand or disruptions in production or delivery of products such as fertilizer, chemicals, road salt and mulch, could result in a loss of revenues, reduced margins and damage to our relationships with customers. In addition, we source certain materials and products we use in our business from a limited number of suppliers. If our suppliers experience difficulties or disruptions in their operations or if we lose any significant supplier, we may experience increased supply costs or may experience delays in establishing replacement supply sources that meet our quality and control standards. The loss of, or a substantial decrease in the availability of, supplies and products from our suppliers or the loss of key supplier arrangements could adversely impact our business, financial position, results of operations and cash flows.

Our industry and the markets in which we operate are highly competitive and increased competitive pressures could reduce our share of the markets we serve and adversely affect our business, financial position, results of operations and cash flows.

We operate in markets with relatively few large competitors, but barriers to entry in the landscape services industry are generally low, which has led to highly competitive markets consisting of entities ranging from small or local operators to large regional businesses, as well as potential customers that choose not to outsource their landscape maintenance services. Any of our competitors may foresee the course of market development more accurately than we do, provide superior service, have the ability to deliver similar services at a lower cost, develop stronger relationships with our customers and other consumers in the landscape services industry, adapt more quickly

16

to evolving customer requirements, devote greater resources to the promotion and sale of their services or access financing on more favorable terms than we can obtain. In addition, while regional competitors may be smaller than we are, some of these businesses may have a greater presence than we do in a particular market. As a result of any of these factors, we may not be able to compete successfully with our competitors, which could have an adverse effect on our business, financial position, results of operations and cash flows.

Our customers consider the quality and differentiation of the services we provide, our customer service and price when deciding whether to use our services. As we have worked to establish ourselves as leading, high-quality providers of landscape maintenance and development services, we compete predominantly on the basis of high levels of service and strong relationships. We may not be able to, or may choose not to, compete with certain competitors on the basis of price and accordingly, some of our customers may switch to lower cost services providers or perform such services themselves. If we are unable to compete effectively with our existing competitors or new competitors enter the markets in which we operate, or our current customers stop outsourcing their landscape maintenance services, our financial position, results of operations and cash flows may be materially and adversely affected.

In addition, our former employees may start landscape services businesses similar to ours and compete directly with us. While we customarily sign non-competition agreements, which typically continue for one year following the termination of employment, with certain of our employees, such agreements do not fully protect us against competition from former employees and may not be enforceable depending on local law and the surrounding circumstances. Consequently, we cannot predict with certainty whether, if challenged, a court will enforce any particular non-competition agreement. Any increased competition from businesses started by former employees may reduce our market share and adversely affect our business, financial position, results of operations and cash flows.

Our business success depends on our ability to preserve long-term customer relationships.

Our success depends on our ability to retain our current customers, renew our existing customer contracts and obtain new business. Our ability to do so generally depends on a variety of factors, including the quality, price and responsiveness of our services, as well as our ability to market these services effectively and differentiate ourselves from our competitors. We largely seek to differentiate ourselves from our competitors on the basis of high levels of service, breadth of service offerings and strong relationships and may not be able to, or may choose not to, compete with certain competitors on the basis of price. There can be no assurance that we will be able to obtain new business, renew existing customer contracts at the same or higher levels of pricing or that our current customers will not cease operations, elect to self-operate or terminate contracts with us. In our Maintenance Services segment, we primarily provide services pursuant to agreements that are cancelable by either party upon 30-days’ notice. Consequently, our customers can unilaterally terminate all services pursuant to the terms of our service agreements, without penalty.

We may be adversely affected if customers reduce their outsourcing.

Our business and growth strategies benefit from the continuation of a current trend toward outsourcing services. Customers will outsource if they perceive that outsourcing may provide quality services at a lower overall cost and permit them to focus on their core business activities. We cannot be certain that this trend will continue or that customers that have outsourced functions will not decide to perform these functions themselves. If a significant number of our existing customers reduced their outsourcing and elected to perform the services themselves, such loss of customers could have a material adverse impact on our business, financial position, results of operations and cash flows.

Because we operate our business through dispersed locations across the United States, our operations may be materially adversely affected by inconsistent practices and the operating results of individual branches may vary.

We operate our business through a network of dispersed locations throughout the United States, supported by corporate executives and certain centralized services in our headquarters, with local branch management retaining responsibility for day-to-day operations. Our operating structure could make it difficult for us to coordinate procedures across our operations in a timely manner or at all, and certain of our branches may require significant oversight and coordination from headquarters to support their growth. In addition, the operating results of an individual branch may differ from that of another branch for a variety of reasons, including market size, management practices, competitive landscape, regulatory requirements and local economic conditions. Inconsistent or incomplete implementation of corporate strategy and policies at the local level could materially and adversely affect our business, financial position, results of operations and cash flows.

We may not successfully implement our business strategies, including achieving our growth objectives.

We may not be able to fully implement our business strategies or realize, in whole or in part within the expected time frames, the anticipated benefits of our various growth or other initiatives. Our various business strategies and initiatives, including our growth, operational and management initiatives, are subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control. The execution of our business strategy and our financial performance will continue to depend in significant part on our executive management team and other key management personnel, our ability to identify and complete suitable acquisitions and our executive management team’s ability to execute new operational initiatives. In addition, we may incur certain costs as we pursue our growth, operational and management initiatives, and we may not meet anticipated implementation timetables or stay within budgeted costs. As these initiatives are undertaken, we may not fully achieve our expected efficiency improvements or growth rates, or these initiatives could adversely impact our customer retention, supplier relationships or operations. Also, our business strategies may change

17

from time to time in light of our ability to implement our business initiatives, competitive pressures, economic uncertainties or developments, or other factors.

Future acquisitions or other strategic transactions could negatively impact our reputation, business, financial position, results of operations and cash flows.

We have acquired businesses in the past and expect to continue to acquire businesses or assets in the future. However, there can be no assurance that we will be able to identify and complete suitable acquisitions. For example, due to the highly fragmented nature of our industry, it may be difficult for us to identify potential targets with revenues sufficient to justify taking on the risks associated with pursuing their acquisition. The failure to identify suitable acquisitions and successfully integrate these acquired businesses may limit our ability to expand our operations and could have an adverse effect on our business, financial position and results of operations.

In addition, acquired businesses may not perform in accordance with expectations, and our business judgments concerning the value, strengths and weaknesses of acquired businesses may not prove to be correct. We may also be unable to achieve expected improvements or achievements in businesses that we acquire. The process of integrating an acquired business may create unforeseen difficulties and expenses, including the diversion of resources away from our operations; the inability to retain employees, customers and suppliers; difficulties implementing our strategy at the acquired business; the assumption of actual or contingent liabilities (including those relating to the environment); failure to effectively and timely adopt and adhere to our internal control processes, accounting systems and other policies; write-offs or impairment charges relating to goodwill and other intangible assets; unanticipated liabilities relating to acquired businesses; and potential expenses associated with litigation with sellers of such businesses.

If management is not able to effectively manage the integration process, or if any significant business activities are interrupted as a result of the integration process, we may not be able to realize anticipated benefits and revenue opportunities resulting from acquisitions and our business could suffer. Although we conduct due diligence investigations prior to each acquisition, there can be no assurance that we will discover or adequately protect against all material liabilities of an acquired business for which we may be responsible as a successor owner or operator.

In connection with our acquisitions, we generally require that key management and former principals of the businesses we acquire enter into non-competition agreements in our favor. Enforceability of these non-competition agreements varies from state to state, and may depend on the relevant facts and circumstances. Consequently, we cannot predict with certainty whether, if challenged, a court will enforce any particular non-competition agreement. Increased competition could materially and adversely affect our business, financial position, results of operations and cash flows.

Seasonality affects the demand for our services and our results of operations and cash flows.

The demand for our services and our results of operations are affected by the seasonal nature of our landscape maintenance services in certain regions. In geographies that do not have a year-round growing season, the demand for our landscape maintenance services decreases during the winter months. Typically, our revenues and net income have been higher in the spring and summer seasons, which correspond with our third and fourth fiscal quarters. The lower level of activity in seasonal markets during our first and second fiscal quarters is partially offset by revenue from our snow removal services. In our Development Services segment, we typically experience lower activity levels during the winter months. Such seasonality causes our results of operations to vary from quarter to quarter. Due to the seasonal nature of the services we provide, we also experience seasonality in our employment and working capital needs. Our employment and working capital needs generally correspond with the increased demand for our services in the spring and summer months and employment levels and operating costs are generally at their highest during such months. Consequently, our results of operations and financial position can vary from year-to-year, as well as from quarter-to-quarter. If we are unable to effectively manage the seasonality and year-to-year variability, our results of operations, financial position and cash flow may be adversely affected.

Our operations are impacted by weather conditions and climate change.

We perform landscape services, the demand for which is affected by weather conditions, including impacts from climate change, droughts, severe storms and significant rain or snowfall, all of which may impact the timing and frequency of the performance of our services, or our ability to perform the services at all. For example, severe weather conditions, such as excessive heat or cold, may result in maintenance services being omitted for part of a season or beginning or ending earlier than anticipated, which could result in lost revenues or require additional services to be performed for which we may not receive corresponding incremental revenues. Variability in the frequency of which we must perform our services can affect the margins we realize on a given contract.

Certain extreme weather events, such as hurricanes and tropical storms, can result in increased enhancement revenues related to cleanup and other services. However, such weather events may also impact our ability to deliver our contracted services or cause damage to our facilities or equipment. These weather events can also result in higher fuel costs, higher labor costs and shortages of raw materials and products. As a result, a perceived earnings benefits related to extreme weather events may be moderated. Droughts could cause shortage in the water supply and governments may impose limitations on water usage, which may change customer demand for landscape maintenance and irrigation services. There is a risk that demand for our services will change in ways that we are unable to predict.

Climate change may increase in the frequency, duration and severity of extreme weather events and make weather patterns change or more difficult to predict. Such changes may impede our ability to provide services or make it difficult for us to anticipate customer

18

demand. We have made certain commitments to mitigate against climate change, but it may take us longer than expected to meet these commitments, or we may not meet them at all.

The continued effects of the COVID-19 pandemic could adversely impact our business, financial condition and results of operations.

The ongoing effects of the public health crisis caused by the COVID-19 pandemic and efforts to mitigate the health impact of the pandemic have profoundly and adversely affected economic activity. In addition to past limitations on our operations as a result of governmental orders or restrictions, the COVID-19 pandemic has caused, and may continue to cause, disruptions to our business and operations as a result of any social distancing measures, restrictions on or consumer reluctance to travel and labor shortages as a result of illness and possible delays in H2-B visa processing in connection with government orders and regulations related to immigration. In addition, the COVID-19 pandemic has caused and may continue to cause disruptions in the business and operations of the general contractors with which we work and our suppliers. We may be unable to timely obtain the supplies we need to provide our services, which could have a material adverse impact on our ability to operate our business. As a result, we may lose business opportunities, have reduced revenues or have difficulty collecting payments from clients, which could have a material adverse impact on our business, financial condition and results of operation. The COVID-19 pandemic has resulted in reduced demand for our ancillary services which has, as a result, led to a decline in ancillary revenues.

In addition to the risks specifically described above, the continuing impact of COVID-19 is likely to implicate and exacerbate certain risks, including those related to our customers, demand for our services, reliance on workers, suppliers, our indebtedness, and potential additional impairment of our goodwill and other intangible assets.

If we are unable to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us, we may achieve lower than anticipated profits or incur contract losses.

A significant portion of our contracts are subject to competitive bidding and/or are negotiated on a fixed- or capped-fee basis for the services covered. Such contracts generally require that the total amount of work, or a specified portion thereof, be performed for a single price irrespective of our actual costs. If our cost estimates for a contract are inaccurate, or if we do not execute the contract within our cost estimates, then cost overruns may cause the contract not to be as profitable as we expected or could cause us to incur losses.

Our landscape development services have been, and in the future may be, adversely impacted by fluctuations or declines in the new commercial construction sector, as well as in spending on repair and upgrade activities. Such variability in this part of our business could result in lower revenues and reduced cash flows and profitability.

With respect to our Development Services segment, a significant portion of our revenues are derived from development activities associated with new commercial real estate development, including hospitality and leisure, which has experienced periodic declines, some of which have been severe, including recent and sustained declines associated with the COVID-19 pandemic. The strength of these markets depends on, among other things, housing starts, local occupancy rates, demand for commercial space, non-residential construction spending activity, business investment and general economic conditions, which are a function of many factors beyond our control, including interest rates, employment levels, availability of credit, consumer spending, consumer confidence and capital spending. During a downturn in the commercial real estate development industry, customers may decrease their spending on landscape development services by generally reducing the size and complexity of their new landscaping development projects. Additionally, when interest rates rise, there may be a decrease in the spending activities of our current and potential Development Services customers. Fluctuations in commercial real estate development markets could have an adverse effect on our business, financial position, results of operations or cash flows.

Our results of operations for our snow removal services depend primarily on the level, timing and location of snowfall. As a result, a decline in frequency or total amounts of snowfall in multiple regions for an extended time could cause our results of operations to decline and adversely affect our ability to generate cash flow.

As a provider of snow removal services, our revenues are impacted by the frequency, amount, timing and location of snowfall in the regions in which we offer our services. A high number of snowfalls in a given season generally has a positive effect on the results of our operations. However, snowfall in the months of March, April, October and/or November could have a potentially adverse effect on ordinary course maintenance landscape services typically performed during those periods. A low level or lack of snowfall in any given year in any of the snow-belt regions in North America (primarily the Midwest, Mid-Atlantic and Northeast regions of the United States) or a sustained period of reduced snowfall events in one or more of the geographic regions in which we operate will likely cause revenues from our snow removal services to decline in such year, which in turn may adversely affect our revenues, results of operations and cash flow. In the past ten- and thirty-year periods, the regions that we service have averaged 3,865.0 inches and 3,755.0 inches of annual snowfall, respectively. However, there can be no assurance that these regions will receive seasonal snowfalls near their historical average in the future. Variability in the frequency and timing of snowfalls creates challenges associated with budgeting and forecasting for the Maintenance Services segment. Additionally, the effects of climate change may impact the frequency and total amounts of future snowfall, which could have a material adverse effect on our revenues, results of operations and cash flow.

19

Our success depends on our executive management and other key personnel.

Our future success depends to a significant degree on the skills, experience and efforts of our executive management and other key personnel and their ability to provide us with uninterrupted leadership and direction. The failure to retain our executive officers and other key personnel or a failure to provide adequate succession plans could have an adverse impact. The availability of highly qualified talent is limited, and the competition for talent is robust. A failure to efficiently or effectively replace executive management members or other key personnel and to attract, retain and develop new qualified personnel could have an adverse effect on our operations and implementation of our strategic plan.

Our future success depends on our ability to attract, retain and maintain positive relations with workers.

Our future success and financial performance depend substantially on our ability to attract, train and retain hourly and field workers, as well as trained workers, including account, branch and regional management personnel. The landscape services industry is labor intensive, and industry participants, including us, experience high turnover rates among hourly workers and competition for qualified supervisory personnel. In addition, we, like many landscape service providers who conduct a portion of their operations in seasonal climates, employ a portion of our field personnel for only part of the year. In addition, general labor shortages, a high turnover rate and difficulty in recruiting and retaining qualified employees at any level of our organization could result in delays in our services.

The competition for talent and labor in general is currently extremely high. In this competitive environment, our business could be adversely impacted by increases in labor costs, which may include increases in wages and benefits necessary to attract and retain high quality employees with the right skill sets, increases triggered by regulatory actions regarding wages, scheduling and benefits; increases in health care and workers’ compensation insurance costs; and increases in benefits and costs related to the COVID-19 pandemic and its resurgence. In light of the current challenging labor market conditions, our wages and benefits programs and any steps we take to increase our wages and benefits, may be insufficient to attract and retain talent at all levels of our organization. Any increase in labor costs due to minimum wage laws or customer requirements about scheduling and overtime that we are unable to pass on to our customers could materially adversely affect our business, financial condition, and results of operations. Existing labor shortages, and our inability to attract employees to maintain a qualified workforce, could adversely affect our production and our overall business and financial performance.

We have historically relied on the H-2B visa program to bring workers to the United States on a seasonal basis. We employed approximately 2,100 seasonal workers in 2022 and 2021 through the H-2B visa program. If we are unable to hire sufficient numbers of seasonal workers, through the H-2B program or otherwise, we may experience a labor shortage. In the event of a labor shortage, whether related to seasonal or permanent staff, we could experience difficulty in delivering our services in a high-quality or timely manner and could experience increased recruiting, training and wage costs in order to attract and retain employees, which would result in higher operating costs and reduced profitability.

As of September 30, 2022, we had approximately 21,000 employees, approximately 4% of which are represented by a union pursuant to collective bargaining agreements. If a significant number of our employees were to attempt to unionize, and/or successfully unionized, including in the wake of any future legislation that makes it easier for employees to unionize, our business could be negatively affected. Any inability by us to negotiate collective bargaining arrangements could result in strikes or other work stoppages disrupting our operations, and new union contracts could increase operating and labor costs. If these labor organizing activities were successful, it could further increase labor costs, decrease operating efficiency and productivity in the future, or otherwise disrupt or negatively impact our operations. Moreover, certain of the collective bargaining agreements we participate in require periodic contributions to multiemployer defined benefit pension plans. Our required contributions to these plans could increase because of a shrinking contribution base as a result of the insolvency or withdrawal of other companies that currently contribute to these plans, the inability or failure of withdrawing companies to pay their withdrawal liability, low interest rates, lower than expected returns on pension fund assets or other funding deficiencies. Additionally, in the event we were to withdraw from some or all of these plans as a result of our exiting certain markets or otherwise, and the relevant plans are underfunded, we may become subject to a withdrawal liability. The amount of these required contributions may be material.

Our business could be adversely affected by a failure to properly verify the employment eligibility of our employees.

We use the U.S. government’s “E-Verify” program to verify employment eligibility for all new employees throughout our company. However, use of E-Verify does not guarantee that we will successfully identify all applicants who are ineligible for employment. Although we use E-Verify and require all new employees to provide us with government-specified documentation evidencing their employment eligibility, some of our employees may, without our knowledge, be unauthorized workers. The employment of unauthorized workers may subject us to fines or penalties, and adverse publicity that negatively impacts our reputation and may make it more difficult to hire and keep qualified employees. We are subject to regulations of U.S. Immigration and Customs Enforcement, or ICE, and we are audited from time to time by ICE for compliance with work authentication requirements. While we believe we are in compliance with applicable laws and regulations, if we are found not to be in compliance as a result of any audits, we may be subject to fines or other remedial actions. See “Business—Regulatory Overview—Employee and Immigration Matters.”

20

Termination of a significant number of employees in specific markets or across our company due to work authorization or other regulatory issues would disrupt our operations, and could also cause adverse publicity and temporary increases in our labor costs as we train new employees. We could also become subject to fines, penalties and other costs related to claims that we did not fully comply with all recordkeeping obligations of federal and state immigration compliance laws. Our reputation and financial performance may be materially harmed as a result of any of these factors. Furthermore, immigration laws have been an area of considerable political focus in recent years, and the U.S. Congress and the Executive Branch of the U.S. government from time to time consider or implement changes to federal immigration laws, regulations or enforcement programs. Further changes in immigration or work authorization laws may increase our obligations for compliance and oversight, which could subject us to additional costs and potential liability and make our hiring process more cumbersome, or reduce the availability of potential employees.

Our use of subcontractors to perform work under certain customer contracts exposes us to liability and financial risk.

In our Development Services segment and through our qualified service partner network in our Maintenance Services segment, we use subcontractors to perform work in situations in which we are not able to self-perform such work. If we are unable to hire qualified subcontractors, our ability to successfully complete a project or perform services could be impaired. If we are not able to locate qualified third-party subcontractors or the amount we are required to pay for subcontractors exceeds what we have estimated, we could incur losses or realize lower than expected margins. We may not have direct control over our subcontractors, and although we have in place controls and programs to monitor the work of our subcontractors, there can be no assurance that these programs will have the desired effect. The actual or alleged failure to perform or negligence of a subcontractor may damage our reputation or expose us to liability, which could impact our results of operations. Furthermore, if our subcontractors are unable to cover the cost of damages or physical injuries caused by their actions, whether through insurance or otherwise, we may be held liable for such costs.

A significant portion of our assets consists of goodwill and other intangible assets, the value of which may be reduced if we determine that additional assets are impaired.