UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from __________ to __________

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s Name into English)

(Jurisdiction of Incorporation or Organization)

Aptorum Group Limited

Tel:

Fax: +44 20 3928 8277

(Address of principal executive offices and

Name, Telephone, E-mail and/or Facsimile number and

Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Class A Ordinary Shares:

Class B Ordinary Shares:

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during

the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards+ provided pursuant to Section 13(a) of the Exchange Act. ☐

| + | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If the securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

| * | If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

☐ No

TABLE OF CONTENTS

i

INTRODUCTION

Unless the context otherwise requires, in this annual report on Form 20-F references to:

| ● | “505(b)(2) Application” refers to an application for which one or more of the investigations relied upon by the applicant for approval “were not conducted by or for the applicant and for which the applicant has not obtained a right of reference or use from the person by or for whom the investigations were conducted” (21 U.S.C. 355(b)(2)). | |

| ● | “A*STAR” refers to Agency for Science, Technology and Research. | |

| ● | “Acticule” refers to Acticule Life Sciences Limited, an 80% owned subsidiary of Aptorum Group. | |

| ● | “Aeneas Group” refers to Aeneas Limited and its subsidiaries. Aeneas Limited is 76.8% owned by Jurchen Investment Corporation. Because Mr. Huen, a director, holds 100% equity interest in Jurchen Investment Corporation, we refer Aeneas Group as a fellow subsidiary of Aptorum Group. | |

| ● | “AML” refers to Aptorum Medical Limited, a 90% owned subsidiary of Aptorum Group, as of the date of this report. | |

| ● | “AML Clinic” refers to an outpatient medical clinic operated by AML under the name of Talem Medical. |

| ● | “Aptorum Group,” and “Group” refer to Aptorum Group Limited, a Cayman Islands exempted company with limited liability whose principal place of business is in Hong Kong, all of its subsidiaries and the consolidated VIEs to which we are regarded as the primary beneficiary for accounting purposes. |

| ● | “Aptorum Non-Therapeutics Group” refers to the Company’s non-therapeutics segment that encompasses diagnostics projects including the novel molecular-based rapid pathogen identification and detection diagnostics (“PathsDx Test”, formerly known as “RPIDD”) technology. | |

| ● | “Aptorum Therapeutics Group” refers to the Company’s therapeutics segment that is operated through its wholly-owned subsidiary, Aptorum Therapeutics Limited, a Cayman Islands exempted company with limited liability, whose principal place of business is in Hong Kong and its indirect subsidiary companies, whose principal places of business are in the United Kingdom, Singapore and Hong Kong. | |

| ● | “At The Market Offering” or “ATM Offering” refers to the offering and sale of the Company’s Class A Ordinary Shares, offered pursuant to the prospectus supplement and the accompanying prospectus to the registration statement on Form F-3 (File No. 333-268873), in which H.C. Wainwright & Co., LLC (“Wainwright”), acted as the Company’s sales agent in accordance with certain at the market offering agreement (the “Sales Agreement”), dated as of March 26, 2021, by and between the Company and Wainwright. | |

| ● | “cGCP” refers to Current Good Clinical Practice as adopted by the applicable regulatory authority. | |

| ● | “cGLP” refers to Current Good Laboratory Practice as adopted by the applicable regulatory authority. | |

| ● | “cGMP” refers to Current Good Manufacturing Practice as adopted by the applicable regulatory authority. |

ii

| ● | “Class A Ordinary Shares” refers to the Company’s Class A Ordinary Shares, par value $0.00001 per share. | |

| ● | “Class B Ordinary Shares” refers to the Company’s Class B Ordinary Shares, par value $0.00001 per share. | |

| ● | “Company,” “we” and “us” refer to Aptorum Group Limited, a Cayman Islands exempted company with limited liability whose principal place of business is in Hong Kong. | |

| ● | “CMC” refers to chemical, manufacturing and control. | |

| ● | “Covar” refers to Covar Pharmaceuticals Incorporated, a contract research organization engaged by the Company. |

| ● | “CROs” refers to contract research organizations. | |

| ● | “CTA” refers to Clinical Trial Application. | |

| ● | “EEA” refers to the European Economic Area. | |

| ● | “EMA” refers to the European Medicines Agency. | |

| ● | “EMEA” refers to Europe, the Middle East and Africa. | |

| ● | “EPO” refers to the European Patent Organization or the European Patent Office operated by it. | |

| ● | “European Patent” refers to patents issuable by the EPO. | |

| ● | “EU” refers to the European Union. | |

| ● | “Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended. | |

| ● | “FDA” refers to U.S. Food and Drug Administration. | |

| ● | “FDCA” refers to the U.S. Federal Food, Drug and Cosmetic Act. | |

| ● | “Fiscal year” refers to the period from January 31 of each calendar year to December 31 of the following calendar year. | |

| ● | “HKD” refers to Hong Kong Dollars. | |

| ● | “Hong Kong” or “H.K.” refers to Hong Kong Special Administrative Region of the People’s Republic of China. | |

| ● | “Hong Kong Doctors” refers to the doctors in Hong Kong under the employment of AML Clinic. | |

| ● | “IND” refers to Investigational New Drugs. | |

| ● | “IP” refers to intellectual property. | |

| ● | “IPO” or “Offering” means the initial public offering by the Company of 76,142 Class A Ordinary Shares consummated on December 17, 2018. | |

| ● | “Jurchen” refers to Jurchen Investment Corporation, a company wholly-owned by one of our directors and former CEO, Ian Huen, and a holding company of Aptorum Group. | |

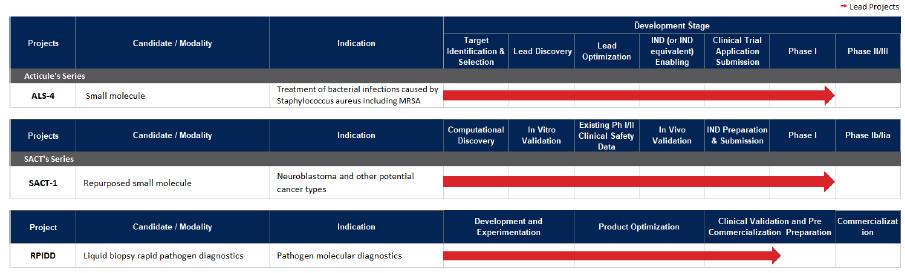

| ● | “Lead Projects” refers to ALS-4, SACT-1 and PathsDx Test. | |

| ● | “Libra” refers to Libra Sciences Limited, a VIE in which we hold 97.27% economic interest and 31.51% voting power. Libra is incorporated under the laws of the Cayman Islands. We are not deemed as the primary beneficiary of Libra for accounting purposes. |

| ● | “Major Patent Jurisdictions” refers to the United States, member states of the European Patent Organization and the People’s Republic of China. |

| ● | “Mios” refers to Mios Pharmaceuticals Limited, a consolidated VIE in which we indirectly hold 97.93% economic interest and 36.17% voting power. Aptorum is regarded as the primary beneficiary of Mios for accounting purposes. |

iii

| ● | “Nativus” refers to Nativus Life Sciences Limited, a wholly-owned subsidiary of Aptorum Group. | |

| ● | “NMPA” refers to China’s National Medical Products Administration and its predecessor, the China Food and Drug Administration. | |

| ● | “NDA” refers to a New Drug Application issued by the FDA. | |

| ● | “Ordinary Shares” refers to the Class A Ordinary Shares and Class B Ordinary Shares collectively. | |

| ● | “PRC” and “China” refer to the People’s Republic of China. | |

| ● | “Registered Direct Offering” means the registered direct offering by the Company of 135,135 Class A Ordinary Shares and warrants to purchase up to 135,135 Class A Ordinary Share consummated on February 28, 2020. | |

| ● | “Restructure” refers to the Company’s change from an investment fund with management shares and non-voting participating redeemable preference shares to a holding company with operating subsidiaries, effective as of March 1, 2017. | |

| ● | “Registration Statement” refers to the Company’s Registration Statement on Form F-1 (File No. 333-227198) for the sale of up to 349,397 Class A Ordinary Shares (including Class A Ordinary Shares underlying certain warrants and a bond, as fully described therein) which initially filed on September 5, 2018 and became effective on December 3, 2018. | |

| ● | “R&D” refers to research and development. | |

| ● | “R&D Center” refers to an in-house pharmaceutical development center located in Hong Kong Science and Technology Park. |

| ● | “Securities Exchange Commission,” “SEC,” “Commission” or similar terms refer to the Securities Exchange Commission. | |

| ● | “Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002. | |

| ● | “Scipio” refers to Scipio Life Sciences Limited, a consolidated VIE in which we indirectly hold 97.93% economic interest and 35.06% voting power. Aptorum is regarded as the primary beneficiary of Scipio for accounting purposes. | |

| ● | “Securities Act” refers to the Securities Act of 1933. | |

| ● | “UK” refers to the United Kingdom. | |

| ● | “United States,” “U.S.” and “US” refer to the United States of America. | |

| ● | “Videns” refers to Videns Incorporation Limited, a wholly-owned subsidiary of Aptorum Group. | |

| ● | “VIE” refers to a variable interest entity. | |

| ● | “US$,” “U.S. dollars,” or “dollars” are to the legal currency of the United States. |

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 20-F includes our audited consolidated balance sheets as of December 31, 2023 and 2022, and the related consolidated statements of operations and comprehensive loss, equity and cash flows for the years ended December 31, 2023, 2022 and 2021.

Our operations and equity are funded in U.S. dollars and we currently incur the majority of our expenses in U.S. dollars or in H.K. dollars. H.K. dollar is currently pegged to the U.S. dollar; however, we cannot guarantee that such peg will continue to be in place in the future. Our exposure to foreign exchange risk primarily relates to the limited cash denominated in currencies other than the functional currencies of each entity and limited revenue contracts dominated in H.K. dollars in certain PRC operating entities. We do not believe that we currently have any significant direct foreign exchange risk and have not hedged exposures denominated in foreign currencies or any other derivative financial instruments.

iv

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business faces significant risks. You should carefully consider all of the information set forth in this annual report on Form 20-F and in our other filings with the United States Securities and Exchange Commission, or the SEC, including the following risk factors which we face and which are faced by our industry. Our business, financial condition, results of operations and growth prospects could be materially adversely affected by any of these risks. This report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this annual report and our other SEC filings. See “Special Note Regarding Forward-Looking Statements” below.

Summary Risk Factors

The following summarizes some, but not all, of the risks provided below. Please carefully consider all of the information discussed in this Item 3.D. “Risk Factors” in this annual report for a more thorough description of these and other risks.

1

Risks Related to Doing Business in Hong Kong

| ● | Risks relating to legal and regulatory risks associated with our operations in Hong Kong. | |

| ● | If we become directly subject to the recent scrutiny, criticism and negative publicity involving U.S.-listed Chinese companies, we may have to expend significant resources to investigate and resolve the matter which could harm our business operations, stock price and reputation and could result in a loss of your investment in our stock, especially if such matter cannot be addressed and resolved favorably. | |

| ● | The recent joint statement by the SEC, proposed rule changes submitted by Nasdaq, and an act passed by the U.S. Senate and the U.S. House of Representatives, all call for additional and more stringent criteria to be applied to emerging market companies. These developments could add uncertainties to our offering, business operations, share price and reputation. | |

| ● | Our business, financial condition and results of operations, and/or the value of our Class A Ordinary Shares or our ability to offer or continue to offer securities to investors may be materially and adversely affected to the extent the laws and regulations of the PRC become applicable to a company such as us. |

| ● | Our Class A Ordinary Shares may be delisted under the HFCA Act if the PCAOB is unable to inspect our auditors. The delisting of our Class A Ordinary Shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Furthermore, on December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things, an identical provision to the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which reduces the number of consecutive non-inspection years required for triggering the prohibitions under the HFCA Act from three years to two. |

| ● | Even though our auditor is based in New York, New York and under full inspection by the PCAOB and that it is not currently subject to the determinations announced by the PCAOB on December 16, 2021, if any PRC law relating to the access of the PCAOB to auditor files were to apply to a company such as us or its auditor, the PCAOB may be unable to fully inspect our auditor, which may result in our securities being delisted or prohibited from being traded “over-the-counter” pursuant to the HFCA Act and materially and adversely affect the value and/or liquidity of your investment. |

| ● | The uncertainties with respect to the Chinese legal system, including uncertainties regarding the enforcement of laws, and sudden or unexpected changes in laws and regulations in China with little advance notice could adversely affect us and limit the legal protections available to you and us. |

Risks Related to the Preclinical and Clinical Development of Our Drug Candidates

| ● | Risks relating to not generate sufficient revenue |

| ● | Risks relating to uncertainty in preclinical development process |

| ● | Risks relating to fail to identify additional drug candidates |

| ● | Risks relating to conduct clinical trials in or outside the U.S. |

Risks Related to Obtaining Regulatory Approval for Our Drug Candidates

| ● | Risks relating to fail or delay to obtain regulatory approval |

| ● | Risks relating to undesirable adverse event |

| ● | Risks relating to fail to complete the 505(b)(2) pathway for the pediatric formulation |

| ● | Risks relating to our third-party suppliers fail to comply with the FDA’s good manufacturing practice regulations or fail to respond to an FDA Form 483 or subsequent Warning Letter |

Risks Related to the Proposed Merger and Separation Transactions

| ● | The Proposed Transactions are subject to the satisfaction of certain conditions, which may not be satisfied on a timely basis, if at all | |

| ● | Aptorum and YOOV equity holders may not realize a benefit from the Proposed Transactions commensurate with the ownership dilution they will experience in connection with the Proposed Transactions. | |

| ● | The market price of Aptorum Class A ordinary shares following the Proposed Transactions may decline as a result of the merger. |

2

| ● | Aptorum shareholders will have a reduced ownership and voting interest in, and will exercise less influence over the management of, the combined company following the closing as compared to their current ownership and voting interest in the respective companies. | |

| ● | The combined company may need to raise additional capital by issuing securities or debt or through licensing or other strategic arrangements, which may cause dilution to the combined company’s shareholders or restrict the combined company’s operations or impact its proprietary rights. | |

| ● | During the pendency of the Proposed Transactions, Aptorum and YOOV may not be able to enter into a business combination with another party because of restrictions in the Merger Agreement, which could adversely affect their respective businesses. |

Risks Related to Commercialization of Our Drug Candidates

| ● | Risks relating to fail to achieve market acceptance |

Risks Related to Our IP

| ● | Risks relating to being unaware of others’ pending patent applications |

| ● | Risks relating to unable to protect and enforce our IP rights throughout the world |

| ● | Risks relating to lawsuits for protecting our IP or against infringing IP rights of other parties |

| ● | Risks relating to non-compliance with patent protection requirements or obligations in the license agreements |

| ● | Risks relating to the terms and scope of our patents not sufficient to protect our candidates |

| ● | Risks relating to unable to obtain or maintain rights of the developing technology through acquisitions or licenses |

Risks Related to Our Reliance on Unrelated Parties

| ● | Risks relating to manufacturers fail to provide sufficient quantities of clinical supply on our candidate at acceptable quality levels or prices |

Risks Related to Our Industry, Business and Operation

| ● | Risks relating to not complying with laws |

| ● | Risks relating to difficulties in managing our growth |

| ● | Risks relating to unable to collaborations, strategic alliances or acquisitions or enter into royalty-seeking or sublicensing arrangements |

| ● | Risks relating to our disclosure controls and procedures and internal financial reporting controls |

| ● | Risks relating to do business internationally |

| ● | Risks relating to product liability lawsuits arise from clinical trials |

| ● | Risks relating to inadequate insurance coverage |

| ● | Risks relating to failure in safeguarding our computer network system |

| ● | Risks relating to outbreak of the novel coronavirus disease, COVID-19, or other pandemic, epidemic or outbreak of an infectious disease |

Risks Related to Our Corporate Structure

| ● | Risks relating to our Class B shareholders have higher voting rights |

Risks Related to our Securities

| ● | Risks relating to certain existing shareholders have substantial influence over our Company and their interests may not be aligned with the interests of our other shareholders |

| ● | Risks relating to conduct substantially all of our operations outside the United States |

| ● | Risks relating to adopt certain home country practices or take advantage of certain reduced reporting requirements | |

| ● | We have ceased to qualify as an “emerging growth company” and will incur increased costs as a result. |

3

Risks Related to the Preclinical and Clinical Development of Our Drug Candidates

We currently do not generate revenue from product sales and may never become profitable; unless we can raise more capital through additional financings, of which there can be no guarantee.

Our ability to generate revenue and become profitable depends upon our ability to successfully complete the development of, and obtain the necessary regulatory approvals for, the drug candidates in our Lead Projects and any future drug candidates we may develop, as we do not currently have any drugs that are available for commercial sale. We expect to continue to incur losses before commercialization of our drug candidates and any future drug candidates. None of our drug candidates has been approved for marketing in the U.S., Europe, the PRC or any other jurisdictions and may never receive such approval. Our ability to generate revenue and achieve profitability is dependent on our ability to complete the development of our drug candidates and any future drug candidates we develop in our portfolio, obtain necessary regulatory approvals, and have our drugs products under development manufactured and successfully marketed, of which there can be no guarantee. We may not be able to generate a profit until our drug candidates become profitable.

Even if we receive regulatory approval and marketing authorization for one or more of our drug candidates or one or more of any future drug candidates for commercial sale, a potential product may not generate revenue at all unless we are successful in:

| ● | developing a sustainable and scalable manufacturing process for our drug candidates and any approved products, including establishing and maintaining commercially viable supply relationships with third parties; | |

| ● | launching and commercializing drug candidates following regulatory approvals and marketing authorizations, either directly or with a collaborator or distributor; | |

| ● | obtaining market acceptance of our drug candidates as viable treatment options; |

| ● | addressing any competing technological and market developments; | |

| ● | negotiating and maintaining favorable terms in any collaboration, licensing or other arrangement into which we may enter to commercialize drug candidates for which we have obtained required approvals and marketing authorizations; and | |

| ● | maintaining, protecting and expanding our portfolio of IP rights, including patents, trade secrets and know-how. |

In addition, our ability to achieve and maintain profitability depends on timing and the amount of expenses we will incur. Our expenses could increase materially if we are required by the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities to perform studies in addition to those that we currently have anticipated. Even if our drug candidates are approved for commercial sale, we anticipate incurring significant costs associated with the commercial launch of these products.

Our ability to become and remain profitable depends on our ability to generate revenue. Even if we are able to generate revenues from the sale or sublicense of any products we may develop or license, we may not become profitable on a sustainable basis or at all. Our failure to become and remain profitable would decrease the value of our Company and adversely affect the market price of our Class A Ordinary Shares, which could impair our ability to raise capital, expand our business or continue our operations.

4

Preclinical development is a long, expensive and uncertain process, and we may terminate one or more of our current preclinical development programs.

Traditionally, drug discovery and development is a time-consuming, costly and high-risk business. On average, the cost of launching a new drug is estimated to approach US$2.6 billion and can take around 12 years to make it to the market (4 key benefits of drug repositioning. (n.d.). Retrieved from http://www.totalbiopharma.com/2012/07/04/4-key-benefits-drug-repositioning/). Despite the huge expenditures, only approximately 1 in 1,000 potential drugs is graduated to human clinical trials after pre-clinical testing in the United States, (Norman, G. A. Drugs, Devices, and the FDA: Part 1. JACC: Basic to Translational Science, 1(3), 170-179, 2016) and nearly 86.2% of drug candidates entering phase 1 trials fails to achieve drug approval. (Wong C. H., Siah K. W. & Lo A. W. (2019, April), “Estimation of clinical trial success rates and related parameters,” retrieved from https://academic.oup.com/biostatistics/article/20/2/273/4817524). Even after a drug is commercialized, there are just too many factors affecting the sales of pharmaceutical products, including unmet need/burden of disease (68.2%), clinical efficacy (47.3%), comparator choice (36.4%), safety profile (36.4%), and price (35.5%) (Sendyona, S., Odeyemi, I., & Maman, K. “Perceptions and factors affecting pharmaceutical market access: Results from a literature review and survey of stakeholders in different settings” Journal of Market Access & Health Policy, 4(1), 31660, 2016). In the end, on average, only 20% of approved new drugs generate revenues that exceed the average R&D investment. (Rosenblatt, M. (2014, December 19) “The Real Cost of “High-Priced” Drugs,” retrieved from https://hbr.org/2014/11/the-real-cost-of-high-priced-drugs). We may determine that certain preclinical product candidates or programs do not have sufficient potential to warrant the allocation of resources toward them. Accordingly, we may elect to terminate our programs for and, in certain cases, our licenses to, such product candidates or programs. If we terminate a preclinical program in which we have invested significant resources, we will have expended resources on a program that will not provide a full return on our investment and missed the opportunity to have allocated those resources to potentially more productive uses.

Management has discretion to terminate the development of any of our projects at any time.

In light of the costs, both in time and expense, as well as the preclinical results and general business considerations, management may decide not to continue developing a particular preclinical program without announcement. Management will always base its decision on what it believes to be the most efficient use of the Company’s resources to provide the most value to its shareholders. As a result, investors may not always be aware of the termination of a previously announced study or trial. The Company will continue to provide update on its active preclinical projects in its SEC filings and/or press releases, as appropriate.

We may not be successful in our efforts to identify or discover additional drug candidates. Due to our limited resources and access to capital, we must continue to prioritize development of certain drug candidates; such decisions may prove to be wrong and may adversely affect our business.

Although we intend to explore other therapeutic opportunities in addition to the drug candidates that we are currently developing, we may fail to identify other drug candidates for a number of reasons. For example, our research methodology may be unsuccessful in identifying potential drug candidates or those we identify may be shown to have harmful side effects or other undesirable characteristics that make them unmarketable or unlikely to receive regulatory approval.

Research programs to pursue the development of our drug candidates for additional indications and to identify new drug candidates and disease targets require substantial technical, financial and human resources whether or not we ultimately are successful. Our research programs may initially show promise in identifying potential indications and/or drug candidates, yet fail to yield results for clinical development for a number of reasons, including but not limited to:

| ● | the research methodology used may not be successful in identifying potential indications and/or drug candidates; |

| ● | potential drug candidates may, after further study, be shown to have harmful adverse effects or other characteristics that indicate they are unlikely to be effective drugs; or |

| ● | it may take greater human and financial resources to identify additional therapeutic opportunities for our drug candidates or to develop suitable potential drug candidates through internal research programs than we will possess, thereby limiting our ability to diversify and expand our drug portfolio. |

5

Because we have limited financial and managerial resources, we have chosen to focus at present on our three Lead Projects, which may ultimately prove to be unsuccessful. As a result of this focus, we may forego or delay pursuit of opportunities with other drug candidates, or for other indications that later prove to have greater commercial potential or a greater likelihood of success. Even if we determine to pursue alternative therapeutic or diagnostic drug candidates, these other drug candidates or other potential programs may ultimately prove to be unsuccessful. In short, our resource allocation decisions may cause us to fail to capitalize on viable commercial products or profitable market opportunities.

Accordingly, there can be no assurance that we will ever be able to develop suitable potential drug candidates through internal research programs. This could materially adversely affect our future growth and prospects.

If we encounter difficulties enrolling patients in our clinical trials, our clinical development activities could be delayed or otherwise adversely affected.

Although we obtained CTA/FDA approval to initiate clinical trials for our Lead Projects, there can be no assurance, timely completion of clinical trials in accordance with their protocols depends, among other things, on our ability to enroll a sufficient number of patients who meet the trial criteria and remain in the trial until its conclusion. We may experience difficulties enrolling and retaining appropriate patients in our clinical trials for a variety of reasons, including but not limited to:

| ● | the size and nature of the patient population; | |

| ● | patient eligibility criteria defined in the clinical protocol; |

| ● | the size of study population required for statistical analysis of the trial’s primary endpoints; | |

| ● | the proximity of patients to trial sites; | |

| ● | the design of the trial and changes to the design of the trial; | |

| ● | our ability to recruit clinical trial investigators with the appropriate competencies and experience; | |

| ● | competing clinical trials for similar therapies or other new therapeutics exist and will reduce the number and types of patients available to us; | |

| ● | clinicians’ and patients’ perceptions as to the potential advantages and side effects of the drug candidate being studied in relation to other available therapies, including any new drugs or treatments that may be approved for the indications we are investigating; |

| ● | our ability to obtain and maintain patient consents; | |

| ● | patients enrolled in clinical trials may not complete a clinical trial; and | |

| ● | the availability of approved therapies that are similar to our drug candidates. |

Even if we are able to enroll a sufficient number of patients in our clinical trials, delays in patient enrollment may result in increased costs or may affect the timing or outcome of the planned clinical trials, which could prevent completion of these trials and adversely affect our ability to advance the development of our drug candidates.

6

Clinical drug development involves a lengthy and expensive process and could fail at any stage of the process. We have limited experience in conducting clinical trials and results of earlier studies and trials may not be reproduced in future clinical trials.

For our drug candidates, clinical testing is expensive and can take many years to complete, while failure can occur at any time during the clinical trial process. The results of studies in animals and early clinical trials of our drug candidates may not predict the results of later-stage clinical trials. Drug candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through studies in animals and initial clinical trials. In some instances, there can be significant variability in safety and/or efficacy results between different trials of the same drug candidate due to numerous factors, including changes in trial procedures set forth in protocols, differences in the size and type of the patient populations (including genetic differences), patient adherence to the dosing regimen and the patient dropout rate. Results in later trials may also differ from earlier trials due to a larger number of clinical trial sites and additional countries and languages involved in such trials. In addition, the design of a clinical trial can determine whether its results will support approval of a drug candidate, and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced and significant expense has been incurred.

A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials due to lack of demonstrated efficacy or adverse safety profiles, notwithstanding promising results in earlier trials. Clinical trials of potential products often reveal that it is not practical or feasible to continue development efforts. Furthermore, if the trials we conduct fail to meet their primary statistical and clinical endpoints, they will not support the approval from the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities for our drug candidates. If this occurs, we would need to replace the failed study with new trials, which would require significant additional expense, cause substantial delays in commercialization and materially adversely affect our business, financial condition, cash flows and results of operations.

If clinical trials of our drug candidates fail to demonstrate safety and efficacy to the satisfaction of the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities, or do not otherwise produce positive results, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our drug candidates.

Before applying for and obtaining regulatory approval for the sale of any of our drug candidates, we must conduct extensive clinical trials to demonstrate the safety and efficacy of our drug candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and may fail. A failure of one or more of our clinical trials can occur at any stage of testing and successful interim results of a clinical trial do not necessarily predict successful final results.

We and our CROs are required to comply with current Good Clinical Practices (“cGCP”) requirements, which are regulations and guidelines enforced by the FDA, NMPA, EMA, Health Canada and other comparable regulatory authorities for all drugs in clinical development. Regulatory authorities enforce these cGCP through periodic inspections of trial sponsors, principal investigators and trial sites. Compliance with cGCP can be costly and if we or any of our CROs fail to comply with applicable cGCP, the clinical data generated in our clinical trials may be deemed unreliable and the FDA, NMPA, EMA, Health Canada or comparable regulatory authorities may require us to perform additional clinical trials before approving our marketing applications.

We may experience numerous unexpected events during, or as a result of, clinical trials that could delay or prevent our ability to receive regulatory approval or commercialize our drug candidates, including but not limited to:

| ● | regulators, institutional review boards (“IRBs”) or ethics committees may not authorize us or our investigators to commence a clinical trial or conduct a clinical trial at a prospective trial site; | |

| ● | clinical trials of our drug candidates may produce negative or inconclusive results, and we may decide, or regulators may require us, to conduct additional clinical trials or abandon drug development programs; | |

| ● | the number of patients required for clinical trials of our drug candidates may be larger than we anticipate, enrollment may be insufficient or slower than we anticipate or patients may drop out at a higher rate than we anticipate; |

7

| ● | our contractors and investigators may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; | |

| ● | we might have to suspend or terminate clinical trials of our drug candidates for various reasons, including a lack of clinical response or a determination that participants are being exposed to unacceptable health risks; | |

| ● | regulators, IRBs or ethics committees may require that we or our investigators suspend or terminate clinical research for various reasons, including non-compliance with regulatory requirements; | |

| ● | the cost of clinical trials of our drug candidates may be greater than we anticipate; | |

| ● | the supply or quality of our drug candidates or other materials necessary to conduct clinical trials of our drug candidates may be insufficient or inadequate; and | |

| ● | our drug candidates may cause adverse events, have undesirable side effects or other unexpected characteristics, causing us, our investigators, or regulators to suspend or terminate the trials. |

If we are required to conduct additional clinical trials or other testing of our drug candidates beyond those that we currently contemplate, if we are unable to successfully complete clinical trials of our drug candidates or other testing, if the results of these trials or tests are not positive or are only modestly positive or if they raise safety concerns, we may:

| ● | be delayed in obtaining regulatory approval for our drug candidates; | |

| ● | not obtain regulatory approval at all; |

| ● | obtain approval for indications that are not as broad as intended; | |

| ● | have a drug removed from the market after obtaining regulatory approval; | |

| ● | be subject to additional post-marketing testing requirements; | |

| ● | be subject to restrictions on how a drug is distributed or used; or | |

| ● | be unable to obtain reimbursement for use of a drug. |

Delays in testing or approvals may result in increases in our drug development costs. We do not know whether any clinical trials will begin as planned, will need to be restructured, or will be completed on schedule, or at all. Clinical trials may produce negative or inconclusive results. Moreover, these trials may be delayed or proceed less quickly than intended. Delays in completing our clinical trials will increase our costs, slow down our drug candidate development and approval process, and jeopardize our ability to commence product sales and generate revenues and we may not have sufficient funding to complete the testing and approval process. Any of these events may significantly harm our business, financial condition and prospects, lead to the denial of regulatory approval of our drug candidates or allow our competitors to bring drugs to market before we do, impairing our ability to commercialize our drugs if and when approved.

Significant clinical trial delays also could shorten any periods during which we have the exclusive right to commercialize our drug candidates or allow our competitors to bring products to market before we do, impair our ability to commercialize our drug candidates and may harm our business and results of operations.

We may in the future conduct clinical trials for our drug candidates in sites outside the U.S. and the FDA may not accept data from trials conducted in such locations.

We may in the future conduct certain of our clinical trials outside the U.S. Although the FDA may accept data from clinical trials conducted outside the U.S. for our New Drug Application (“NDA”), acceptance of this data is subject to certain conditions imposed by the FDA. There can be no assurance the FDA will accept data from any of the clinical trials we conduct outside the U.S. If the FDA does not accept the data from any of our clinical trials conducted outside the U.S., it would likely result in the need for additional clinical trials in the U.S., which would be costly and time-consuming and could delay or prevent the commercialization of any of our drug candidates.

8

Risks Related to Obtaining Regulatory Approval for Our Drug Candidates

The regulatory approval processes of the FDA, NMPA, EMA, Health Canada and other comparable regulatory authorities are lengthy, time-consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our current drug candidates or any future drug candidates we may develop, our business will be substantially harmed.

We cannot commercialize drug candidates without first obtaining regulatory approval to market each drug from the FDA, NMPA, EMA, Health Canada or comparable regulatory authorities. Before obtaining regulatory approvals for the commercial sale of any drug candidate for a target indication, we must demonstrate in studies in animals and well-controlled clinical trials, and, with respect to approval in the United States and other regulatory agencies, to the satisfaction of the FDA, NMPA, EMA, Health Canada or comparable regulatory authorities, that the drug candidate is safe and effective for use for that target indication and that the manufacturing facilities, processes and controls are adequate.

The time required to obtain approval from the FDA, NMPA, EMA, Health Canada and other comparable regulatory authorities is unpredictable but typically takes many years following the commencement of studies in animals and clinical trials and depends upon numerous factors, including the substantial discretion of the regulatory authorities.

In addition, approval policies, regulations or the type and amount of clinical data necessary to gain approval can differ among regulatory authorities and may change during the course of the development of a drug candidate. We have not obtained regulatory approval for any drug candidate. It is possible that neither our existing drug candidates nor any drug candidates we may discover or acquire for development in the future will ever obtain regulatory approval. Even if we obtain regulatory approval in one jurisdiction, we may not obtain it in other jurisdictions.

Our drug candidates could fail to receive regulatory approval from any of the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities for many reasons, including but not limited to:

| ● | disagreement with regulators regarding the design or implementation of our clinical trials; | |

| ● | failure to demonstrate that a drug candidate is safe and effective or safe, pure and potent for its proposed indication; | |

| ● | failure of clinical trial results to meet the level of statistical significance required for approval; | |

| ● | failure to demonstrate that a drug candidate’s clinical and other benefits outweigh its safety risks; | |

| ● | disagreement with regulators regarding our interpretation of data from studies in animals or clinical trials; | |

| ● | insufficiency of data collected from clinical trials of our drug candidates to support the submission and filing of a New Drug Application (“NDA”), or other submission or to obtain marketing approval; | |

| ● | the FDA, NMPA, EMA, Health Canada or a comparable regulatory authority’s finding of deficiencies related to the manufacturing processes or facilities of third-party manufacturers with whom we contract for clinical and commercial supplies; and | |

| ● | changes in approval policies or regulations that render our preclinical studies and clinical data insufficient for approval. |

Any of the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities may require more information, including additional preclinical studies or clinical data, to support approval, which may delay or prevent approval and our commercialization plans, or we may decide to abandon the development program. If we were to obtain approval, regulatory authorities may approve any of our drug candidates for fewer or more limited indications than we request. Regulatory authorities also may grant approval contingent on the performance of costly post-marketing clinical trials, or may approve a drug candidate with a label that is not desirable for the successful commercialization of that drug candidate. In addition, if our drug candidate produces undesirable side effects or involves other safety issues, the FDA may require the establishment of a Risk Evaluation Mitigation Strategy (“REMS”), or NMPA, EMA, Health Canada or other comparable regulatory authorities may require the establishment of a similar strategy. Such a strategy may, for instance, restrict distribution of our drug candidates, require patient or physician education, or impose other burdensome implementation requirements on us.

9

Regulatory approval may be substantially delayed or may not be obtained for one or all of our drug candidates if regulatory authorities require additional time or studies to assess the safety or efficacy of our drug candidates.

We currently do not have any drug candidates that have gained approval for sale by the FDA, NMPA or EMA, Health Canada or other regulatory authorities in any other country, and we cannot guarantee that we will ever have marketable drugs. Despite SACT-1 having been granted orphan drug status, this is not an approval for sale by the FDA. Our business is substantially dependent on our ability to complete the development of, obtain marketing approval for and successfully commercialize drug candidates in a timely manner. We cannot commercialize drug candidates without first obtaining marketing approval from the FDA, NMPA, EMA, Health Canada and comparable regulatory authorities. In the U.S., we hope to file INDs for the drug candidates from our Lead Projects and, subject to the approval of IND, Phase 1 clinical trials in humans. Even if we are permitted to commence such clinical trials, they may not be successful and regulators may not agree with our conclusions regarding the data generated by our clinical trials.

We may be unable to complete development of our drug candidates or initiate or complete development of any future drug candidates we may develop on our projected schedule. While we believe that our existing cash will likely enable us to complete the preclinical development of at least one of our current Lead Projects, the full clinical development, manufacturing and launch of that drug candidate, will take significant additional time and likely require funding beyond the existing cash. In addition, if regulatory authorities require additional time or studies to assess the safety or efficacy of our drug candidates, we may not have or be able to obtain adequate funding to complete the necessary steps for approval for our drug candidates or any future drug candidates.

Preclinical studies in animals and clinical trials in humans to demonstrate the safety and efficacy of our drug candidates are time-consuming, expensive and take several years or more to complete. Delays in preclinical or clinical trials, regulatory approvals or rejections of applications for regulatory approval in the U.S., Europe, the PRC or other markets may result from many factors, including but not limited to:

| ● | our inability to obtain sufficient funds required to conduct or continue a trial, including lack of funding due to unforeseen costs or other business decisions; | |

| ● | regulatory reports for additional analysts, reports, data, preclinical studies and clinical trials; | |

| ● | failure to reach agreement with, or inability to comply with conditions imposed by the FDA, NMPA, EMA, Health Canada or other regulators regarding the scope or design of our clinical trials; | |

| ● | regulatory questions regarding interpretations of data and results and the emergence of new information regarding our drug candidates or other products; | |

| ● | delay or failure in obtaining authorization to commence a clinical trial or inability to comply with conditions imposed by a regulatory authority regarding the scope or design of a clinical trial; | |

| ● | withdrawal of clinical trial sites from our clinical trials as a result of changing standards of care or the ineligibility of a site to participate in our clinical trials; | |

| ● | unfavorable or inconclusive results of clinical trials and supportive non-clinical studies, including unfavorable results regarding effectiveness of drug candidates during clinical trials; | |

| ● | difficulty in maintaining contact with patients during or after treatment, resulting in incomplete data; | |

| ● | our inability to obtain approval from IRBs or ethics committees to conduct clinical trials at their respective sites; | |

| ● | our inability to enroll and retain a sufficient number of patients who meet the inclusion and exclusion criteria in a clinical trial; |

10

| ● | our inability to conduct a clinical trial in accordance with regulatory requirements or our clinical protocols; |

| ● | clinical sites and investigators deviating from trial protocol, failing to conduct the trial in accordance with regulatory requirements, withdrawing from or dropping out of a trial, or becoming ineligible to participate in a trial; | |

| ● | failure of our clinical trial managers to satisfy their contractual duties or meet expected deadlines; | |

| ● | manufacturing issues, including problems with manufacturing or timely obtaining from third parties sufficient quantities of a drug candidate for use in a clinical trial; | |

| ● | ambiguous or negative interim results, or results that are inconsistent with earlier results; |

| ● | feedback from the FDA, NMPA, EMA, Health Canada, an IRB, data safety monitoring boards, or comparable entities, or results from earlier stage or concurrent studies in animals and clinical trials, regarding our drug candidates, including which might require modification of a trial protocol; | |

| ● | unacceptable risk-benefit profile or unforeseen safety issues or adverse side effects; and | |

| ● | a decision by the FDA, NMPA, EMA, Health Canada, an IRB, comparable entities, or the Company, or recommendation by a data safety monitoring board or comparable regulatory entity, to suspend or terminate clinical trials at any time for safety issues or for any other reason. |

Changes in regulatory requirements and guidance may also occur, and we may need to amend clinical trial protocols submitted to applicable regulatory authorities to reflect these changes. Amendments may require us to resubmit clinical trial protocols to IRBs or ethics committees for re-examination, which may increase the costs or time required to complete a clinical trial.

If we experience delays in the completion of, or the termination of, a clinical trial, of any of our drug candidates, the commercial prospects of our drug candidates will be harmed, and our ability to generate product sales revenues from any of those drug candidates will be delayed. In addition, any delay in completing our clinical trials will increase our costs, slow down our drug candidate development and approval process, and jeopardize our ability to commence product sales and generate revenues. Any of these occurrences may harm our business, financial condition and prospects significantly. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our drug candidates.

If we are required to conduct additional clinical trials or other studies with respect to any of our drug candidates beyond those that we initially contemplated, if we are unable to successfully complete our clinical trials or other studies or if the results of these studies are not positive or are only modestly positive, we may be delayed in obtaining regulatory approval for that drug candidate, we may not be able to obtain regulatory approval at all or we may obtain approval for indications that are not as broad as intended. Our product development costs will also increase if we experience delays in testing or approvals, and we may not have sufficient funding to complete the testing and approval process. Significant clinical trial delays could allow our competitors to bring their products to market before we do and impair our ability to commercialize our drugs, if and when approved. If any of this occurs, our business will be materially harmed.

Our drug candidates may cause undesirable adverse events or have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following any regulatory approval.

Undesirable adverse events caused by our drug candidates or any future drug candidates we may develop could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in a more restrictive label or the delay or denial of regulatory approval by the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities. Results of our potential clinical trials could reveal a high and unacceptable severity or prevalence of adverse effects. In such event, our trials could be suspended or terminated and the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities could order us to cease further development of, or deny approval of, our drug candidates for any or all target indications. Drug-related adverse events could also affect patient recruitment or the ability of enrolled subjects to complete the trial, could result in potential product liability claims and may harm our reputation, business, financial condition and business prospects significantly.

11

Additionally, if any of our current or future drug candidates receives regulatory approval, and we or others later identify undesirable side effects caused by such drugs, a number of potentially significant negative consequences could result, including but not limited to:

| ● | suspending the marketing of the drug; | |

| ● | having regulatory authorities withdraw approvals of the drug; | |

| ● | adding warnings on the label; | |

| ● | developing a REMS for the drug or, if a REMS is already in place, incorporating additional requirements under the REMS, or to develop a similar strategy as required by a comparable regulatory authority; |

| ● | conducting post-market studies; | |

| ● | being sued and held liable for harm caused to subjects or patients; and | |

| ● | damage to our reputation. |

Any of these events could prevent us from achieving or maintaining market acceptance of the particular drug candidate, if approved, and could significantly harm our business, results of operations and prospects.

Even if we receive regulatory approval for our drug candidates, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our drug candidates.

If our drug candidates or any future drug candidates we develop are approved, they will be subject to ongoing regulatory requirements for manufacturing, labeling, packaging, storage, advertising, promotion, sampling, record-keeping, conduct of post-marketing studies, and submission of safety, efficacy, and other post-market information, including both federal and state requirements in the United States and requirements of comparable regulatory authorities outside of the United States.

Manufacturers and manufacturers’ facilities are required to comply with extensive requirements from the FDA, NMPA, EMA, Health Canada and comparable regulatory authorities, including, in the United States, ensuring that quality control and manufacturing procedures conform to cGMP regulations. As such, our contract manufacturers will be subject to continual review and inspections to assess compliance with cGMP and adherence to commitments made in any NDA, other marketing application, and previous responses to inspection observations. Accordingly, we and others with whom we work must continue to expend time, money and effort in all areas of regulatory compliance, including manufacturing, production and quality control.

Any regulatory approvals that we receive for our drug candidates may be subject to limitations on the approved indicated uses for which the drug may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials and surveillance to monitor the safety and efficacy of the drug candidate. The regulatory authorities may also require risk management plans or programs as a condition of approval of our drug candidates (such as REMS of the FDA and risk-management plan of the EMA), which could entail requirements for long-term patient follow-up, a medication guide, physician communication plans or additional elements to ensure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. In addition, if the FDA, NMPA, EMA, Health Canada or a comparable regulatory authority approves our drug candidates, we will have to comply with requirements including, for example, submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with cGCP and cGMP, for any clinical trials that we conduct post-approval.

12

The FDA may impose consent decrees or withdraw approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the drug reaches the market. Later discovery of previously unknown problems with our drug candidates, including adverse events of unanticipated severity or frequency, or with our third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may result in revisions to the approved labeling to add new safety information; imposition of post-market studies or clinical studies to assess new safety risks; or imposition of distribution restrictions or other restrictions under a REMS program. Other potential consequences include, among other things:

| ● | restrictions on the marketing or manufacturing of our drug candidates, withdrawal of the product from the market, or voluntary or mandatory product recalls; |

| ● | fines, untitled or warning letters, or holds on clinical trials; | |

| ● | refusal by the FDA to approve pending applications or supplements to approved applications filed by us or suspension or revocation of license approvals; |

| ● | product seizure or detention, or refusal to permit the import or export of our drug candidates; and | |

| ● | injunctions or the imposition of civil or criminal penalties. |

The FDA strictly regulates marketing, labeling, advertising and promotion of products that are placed on the market. Companies may promote drugs only for the approved indications and in accordance with the provisions of the approved label and may not promote drugs for any off-label use, such as uses that are not described in the product’s labeling and that differ from those approved by the regulatory authorities. However, physicians may prescribe drug products for off-label uses and such off-label uses are common across some medical specialties. Thus, they may, unbeknownst to us, use our product for an “off label” indication for a specific treatment recipient. The FDA, NMPA, EMA, Health Canada and other regulatory authorities actively enforce the laws and regulations prohibiting the promotion of off-label uses, and if we are found to be out of compliance with the requirements and restrictions imposed on us under those laws and restrictions, we may be subject to significant liability, including civil and administrative remedies as well as criminal sanctions, and the off-label use of our products may increase the risk of product liability claims. In addition, management’s attention could be diverted from our business operations and our reputation could be damaged.

The policies of the FDA, NMPA, EMA, Health Canada and other regulatory authorities may change and we cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any regulatory approval that we may have obtained and we may not achieve or sustain profitability.

Despite FDA’s consent for us to pursue the 505(b)(2) development pathway for SACT-1, we may be unable to successfully complete the 505(b)(2) pathway for the pediatric formulation of SACT-1 to treat neuroblastoma as planned, which would materially impact our likelihood of obtaining FDA approval.

Even though the FDA is allowing us to pursue the 505(b)(2) regulatory pathway for our product candidates, we will need to conduct additional clinical trials, provide additional data and information and meet additional standards for regulatory approval. If this were to occur, the time and financial resources required to obtain FDA approval for our product candidates would likely substantially increase. We cannot assure you that we will receive the requisite or timely approvals for commercialization of such product candidate. Any failure to obtain regulatory approval of our product candidates would significantly limit our ability to generate revenues, and any failure to obtain such approval for all of the indications and labeling claims we deem desirable could reduce our potential revenues.

13

If we or our third-party suppliers fail to comply with the FDA’s good manufacturing practice regulations or fail to adequately, timely, or sufficiently respond to an FDA Form 483 or subsequent Warning Letter, this could impair our ability to market our products in a cost-effective and timely manner and could result in FDA enforcement action.

We and our third-party suppliers are required to comply with the FDA’s Current Good Manufacturing Practices (cGMP) which covers the methods and documentation of the design, testing, production, control, quality assurance, labeling, packaging, sterilization, storage and shipping of our products. The FDA audits compliance with the cGMP and related regulations through periodic announced and unannounced inspections of manufacturing and other facilities. The FDA may conduct these inspections or audits at any time. If, during the inspection, FDA identifies issues which, in FDA’s judgment, may constitute violations of the Federal Food, Drug, and Cosmetic Act or FDA’s regulations, the FDA inspector may issue an FDA Form 483 listing these observations.

Note that if an entity does not address observations found in an FDA Form 483 to FDA’s satisfaction, the FDA could take enforcement action, including any of the following sanctions:

| ● | untitled letters, warning letters, fines, injunctions, consent decrees and civil penalties; |

| ● | customer notifications or recall, detention or seizure of our product; |

| ● | operating restrictions or partial suspension or total shutdown of production; |

| ● | refusing or delaying our requests for pre-market approval of new products; |

| ● | withdrawing pre-market approvals that have already been granted; |

| ● | refusal to grant export approval for our product; or |

| ● | criminal prosecution. |

Any of the foregoing actions could have a material adverse effect on our reputation, business, financial condition and operating results.

Risks Related to Commercialization of Our Drug Candidates

Even if any of our drug candidates receive regulatory approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the medical community necessary for commercial success.

After we complete clinical trials and receive regulatory approval for any of our drug candidates, which may not happen for some time, we recognize that such candidate(s) may ultimately fail to gain sufficient market acceptance by physicians, patients, third-party payors and others in the medical community. We may not be able to achieve or maintain market acceptance of our products over time if new products or technology are introduced that are more favorably received than our products, are more cost effective or render our drug obsolete. We will face competition with respect to our drug candidates from other pharmaceutical companies developing products in the same disease/therapeutic area and specialty pharmaceutical and biotechnology companies worldwide. Many of the companies against which we may be competing have significantly greater financial resources and expertise in research and development, manufacturing, animal testing, conducting clinical trials, obtaining regulatory approvals and marketing approval for drugs than we do. Physicians, patients and third-party payors may prefer other novel products to ours, which means that we may not generate significant sales revenues for that product and that product may not become profitable. The degree of market acceptance of our drug candidates, if approved for commercial sale, will depend on a number of factors, including but not limited to:

| ● | clinical indications for which our drug candidates are approved; |

| ● | physicians, hospitals, and patients considering our drug candidates as a safe and effective treatment; | |

| ● | the potential and perceived advantages of our drug candidates over alternative treatments; |

14

| ● | the prevalence and severity of any side effects; | |

| ● | product labeling or product insert requirements of the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities; | |

| ● | limitations or warnings contained in the labeling approved by the FDA, NMPA, EMA, Health Canada or other comparable regulatory authorities; | |

| ● | the timing of market introduction of our drug candidates as well as competitive drugs; | |

| ● | the cost of treatment in relation to alternative treatments and their relative benefits; | |

| ● | the availability of adequate coverage, reimbursement and pricing by third-party payors and government authorities; | |

| ● | lack of experience and financial and other limitations on our ability to create and sustain effective sales and marketing efforts or ineffectiveness of our sales and marketing partners; and | |

| ● | changes in legislative and regulatory requirements that could prevent or delay regulatory approval of our drug candidates, restrict or regulate post-approval activities and affect our ability to profitably sell any drug candidates for which we obtain regulatory approval. |

We depend substantially on the success of the drug candidates being researched as our current Lead Projects. If we are unable to license or sublicense, sell or otherwise commercialize our drug candidates, or experience significant delays in doing so, our business will be materially harmed.

Our business and the ability to generate revenue related to product sales, if ever achieved, will depend on the successful development, regulatory approval and licensing or sublicensing or other commercialization of our drug candidates or any other drug candidates we may develop. We have invested a significant amount of financial resources in the development of our drug candidates and we may invest in other drug candidates. The success of our drug candidates and any other potential drug candidates will depend on many factors, including but not limited to:

| ● | successful enrollment in, and completion of, studies in animals and clinical trials; | |

| ● | other parties’ ability in conducting our clinical trials safely, efficiently and according to the agreed protocol; |

| ● | receipt of regulatory approvals from the FDA, NMPA, EMA, Health Canada and other comparable regulatory authorities for our drug candidates; | |

| ● | our ability to establish commercial manufacturing capabilities by making arrangements with third-party manufacturers; | |

| ● | reliance on other parties to conduct our clinical trials swiftly and effectively; | |

| ● | launch of commercial sales of our drug candidates, if and when approved; | |

| ● | obtaining and maintaining patents, trade secrets and other IP protection and regulatory exclusivity, as well as protecting our rights in our own IP; | |

| ● | ensuring that we do not infringe, misappropriate or otherwise violate patents, trade secrets or other IP rights of other parties; | |

| ● | obtaining acceptance of our drug candidates by doctors and patients; |

| ● | obtaining reimbursement from third-party payors for our drug candidates, if and when approved; | |

| ● | our ability to compete with other drug candidates and drugs; and | |

| ● | maintenance of an acceptable safety profile for our drug candidates following regulatory approval, if and when received. |

15

We may not achieve regulatory approval and commercialization in a timely manner or at all. Significant delays in obtaining approval for and/or to successfully commercialize our drug candidates would materially harm our business and we may not be able to generate sufficient revenues and cash flows to continue our operations.

Risks Related to Our IP

A significant portion of our IP portfolio currently includes pending patent applications that have not yet been issued as granted patents and if the pending patent applications covering our product candidates fail to be issued, our business will be adversely affected. If we or our licensors are unable to obtain and maintain patent protection for our technology and drugs, our competitors could develop and commercialize technology and drugs similar or identical to ours, and our ability to successfully commercialize our technology and drugs may be adversely affected.

Our success depends largely on our ability to obtain and maintain patent protection and other forms of IP rights for the composition of matter, method of use and/or method of manufacture for each of our drug candidates. Failure to obtain, maintain protection, enforce or extend adequate patent and other IP rights could materially adversely affect our ability to develop and market one or more of our drug candidates. We also rely on trade secrets and know-how to develop and maintain our proprietary and IP position for each of our drug candidates. Any failure to protect our trade secrets and know-how with respect to any specific drug and diagnostics technology candidate could adversely affect the market potential of that potential product.

As of the date of this report, the Company has, through its licenses, obtained rights to patents and patent applications covering some or all its drug and diagnostics technology candidates that have been filed in major jurisdictions such as the United States, member states of the European Patent Organization (the “EPO”) and the PRC (collectively, “Major Patent Jurisdictions”), as well as in other countries. We have also filed a number of provisional applications to establish earlier filing dates for certain of our other ongoing researches, the specifics of which are currently proprietary and confidential. To the extent we do not seek or obtain patent protection in a particular jurisdiction, we may not have commercial incentive to seek marketing authorization in such jurisdiction. Nonetheless, other parties might enter those markets with generic versions or copies of our products and received regulatory approval without having significantly invested in their own research and development costs compared to the Company’s investment. For more information about our IP portfolio, please refer to the Intellectual Property section below.

With respect to issued patents in certain jurisdictions, for example in the U.S. and under the EPO, we may be entitled to obtain a patent term extension to extend the patent expiration date provided we meet the applicable requirements for obtaining such patent term extensions. We have sought to support our proprietary position by working with our licensors in filing patent applications in the names of the licensors in the United States and through the PCT, related to the Lead Projects and certain other drug candidates. In the future, we intend to file patent applications on supplemental or improvement IP derived from the licensed technologies, where those IP would be solely or jointly owned by the Company pursuant to the terms of respective license agreements. Filing patents covering multiple technologies in multiple countries is time-consuming and expensive, and we may not have the resources file and prosecute all necessary or desirable patent applications in a timely manner. It is also possible that we will fail to identify patentable aspects of our research and development output before it is too late to obtain patent protection.

We cannot be certain that patents will be issued or granted with respect to patent applications that are currently pending, or that issued or granted patents will not later be found to be invalid or unenforceable.

The patent position of biotechnology and pharmaceutical companies is generally uncertain because it involves complex legal and factual considerations. The standards applied by the EPO, the U.S. Patent and Trademark Office, or USPTO, and foreign patent offices in granting patents are not always applied uniformly or predictably. For example, there is no uniform worldwide policy regarding patentable subject matter or the scope of claims allowable in biotechnology and pharmaceutical patents. Consequently, patents may not issue from our pending patent applications and even if they do issue, such patents may not issue in a form that effectively prevents others from commercializing competing products. As such, we do not know the degree of future protection that we will have on our proprietary products and technology.

16