Exhibit 99.2

Management’s

Discussion & Analysis

This management discussion and analysis (“MD&A”)

of the financial condition and results of operations of Aphria Inc. and its subsidiaries (the “Company” “Aphria”,

“we”, “us” or “our”), is for the three and nine months ended February 29, 2020. It is supplemental

to, and should be read in conjunction with the Company’s consolidated financial statements and the accompanying notes for

the three and nine months ended February 29, 2020, as well as the audited financial statements

and MD&A for the year ended May 31, 2019. The Company’s financial statements are prepared in accordance with International

Financial Reporting Standards (“IFRS”).

This MD&A has been prepared by reference

to the MD&A disclosure requirements established under National Instrument 51-102 - Continuous Disclosure Obligations

(“NI 51-102”) of the Canadian Securities Administrators. Under the United States (“U.S.”)/Canada

Multijurisdictional Disclosure System, we are permitted to prepare the MD&A in accordance with Canadian disclosure requirements,

which may differ from U.S. disclosure requirements. Additional information regarding Aphria (including its Annual Information Form

dated July 31, 2019) is available on our website at www.aphriainc.com or through the

System for Electronic Document Analysis and Retrieval (SEDAR) website at www.sedar.com.

In this MD&A, reference is made to gram equivalents,

“all-in” cost of sales of dried cannabis per gram, cash costs to produce dried cannabis per gram, cannabis gross profit,

cannabis gross margin, distribution gross profit, distribution gross margin, adjusted EBITDA, adjusted EBITDA from cannabis operations, adjusted EBITDA from distribution operations, adjusted EBITDA from businesses

under development, strategic investments, capital and intangible asset expenditures – wholly owned subsidiaries, and capital

and intangible asset expenditures – majority owned subsidiaries, which are not measures of financial performance under IFRS.

The Company calculates each as follows:

| · | Gram

equivalents include both grams of dried cannabis as well as grams of cannabis oil as derived using an ‘equivalency factor’

of 1 gram per 5.75 mL of cannabis oil. Management believes this measure provides useful information as a benchmark of the Company

against its competitors. |

| · | “All-in”

cost of sales of dried cannabis per gram is equal to production costs less the costs of accessories less cannabis oil conversion

costs (“cost of sales of dried cannabis”) plus (minus) increase (decrease) in plant inventory divided by gram equivalents

of cannabis sold in the quarter. This measure provides the cost per gram of dry cannabis and gram equivalent of oil sold before

the post harvesting processing costs to create oil or other ancillary products. |

| · | Cash

costs to produce dried cannabis per gram is equal to cost of sales of dried cannabis less amortization, packaging costs and distribution

costs plus (minus) increase (decrease) in plant inventory divided by gram equivalents of cannabis sold in the quarter. Management

believes this measure provides useful information as it removes non-cash amortization and packaging costs and provides a benchmark

of the Company against its competitors. |

| · | Cannabis

gross profit is equal to gross profit less distribution revenue, insurance recovery, cost of goods purchased, the non-cash increase

(plus the non-cash decrease) in the fair value adjustments on sale of inventory and on growth of biological assets, if any. Management

believes this measure provides useful information as it removes non-similar revenue, costs and fair value metrics tied to increasing

stock levels (decreasing stock levels) required by IFRS. |

| · | Cannabis

gross margin is cannabis gross profit divided by net revenue from cannabis products. Management believes this measure provides

useful information as it represents the gross profit based on the Company’s cost to produce inventory sold and removes fair

value metrics tied to increasing stock levels (decreasing stock levels) required by IFRS. |

| · | Distribution

gross profit is equal to gross profit less revenue from cannabis products, insurance recovery, excise taxes, production costs,

cost of cannabis purchased, the non-cash increase (plus the non-cash decrease) in the fair value adjustments on sale of inventory

and on growth of biological assets, if any. Management believes this measure provides useful information as it removes non-similar

revenue and costs. |

| · | Distribution

gross margin is distribution gross profit divided by distribution revenue. Management believes this measure provides useful information

as it represents the gross profit based on the Company’s costs to purchase inventory for resale. |

| Management’s Discussion & Analysis |2 |

| · | Adjusted

EBITDA is net income (loss), plus (minus) income taxes (recovery), plus (minus) non-operating (income) loss, net, plus amortization,

plus share-based compensation, plus (minus) non-cash fair value adjustments on sale of inventory and on growth of biological assets,

plus impairment, plus transaction costs, and certain one-time non-operating expenses, as determined by management. Management believes

this measure provides useful information as it is a commonly used measure in the capital markets and as it is a close proxy for

repeatable cash generated by operations. |

| · | Adjusted

EBITDA from cannabis operations is calculated based on the same approach outlined above for Adjusted EBITDA, based on the operations

of the following entities in the Company’s consolidated financial statements: Aphria Inc., Broken Coast Cannabis Ltd. and

1974568 Ontario Ltd. (“Aphria Diamond”). Management believes this measure provides useful information as it

is a commonly used measure in the capital markets and it is a close proxy for repeatable cash generated from the Company’s

operations in the cannabis regulated industry. |

| · | Adjusted

EBITDA from distribution operations is calculated based on the same approach outlined above for Adjusted EBITDA, based on the operations

of the following entities in the Company’s consolidated financial statements; CC Pharma GmbH, ABP, S.A. and FL-Group. Management

believes this measure provides useful information as it is a commonly used measure in the capital markets and it is a close proxy

for repeatable cash generated from the Company’s distribution operations. |

| · | Adjusted

EBITDA from businesses under development is adjusted EBITDA minus adjusted EBITDA from cannabis operations and adjusted EBITDA

from distribution operations. Management believes this measure provides useful information as it is a commonly used measure in

the capital markets and as it is a close proxy for repeatable cash generated by the Company’s businesses under development. |

| · | Strategic

investments are the total cash out flows used in investing activities relating to investment in long-term investments and equity

investees as well as both notes and convertible notes advanced. Management believes this measure provides useful information as

it helps provide an indication of the use of capital raised by the Company outside of its operating activities. |

| · | Capital

and intangible asset expenditures – wholly-owned subsidiaries are all cash out flows used in investing activities relating

to investment in capital assets and investment in intangible assets, net of shares issued for wholly owned subsidiaries. Management

believes this measure provides useful information as it helps provide an indication of the use of capital raised by the Company

outside of its operating activities. |

| · | Capital

and intangible asset expenditures – majority-owned subsidiaries are all cash out flows used in investing activities relating

to investment in capital assets and investment in intangible assets, net of shares issued for majority owned subsidiaries. Management

believes this measure provides useful information as it helps provide an indication of the use of capital raised by the Company

outside of its operating activities. |

These measures are not necessarily comparable

to similarly titled measures used by other companies.

All amounts in this MD&A are expressed in thousands

of Canadian dollars, except share and per share amounts, unless otherwise indicated.

This MD&A contains forward-looking information within the meaning

of Canadian securities laws. Refer to “Cautionary Note Regarding Forward-Looking Statements” for cautionary statements

regarding forward-looking statements.

This MD&A is prepared as of April 14, 2020.

■

Company Overview

The Company is an international organization with a focus on building

a global cannabis brand, with operations in Canada, Germany, Italy, Malta, Lesotho, Colombia, Argentina and Jamaica.

The Company is licensed to cultivate, process, and sell medical and adult-use

cannabis, cannabis-derived extracts, and derivative cannabis products in Canada under the provisions of the Cannabis Act.

| Management’s Discussion & Analysis |3 |

Aphria Inc. exists under the laws of the

Business Corporations Act (Ontario) and its common shares are listed under the symbol “APHA” on the Toronto

Stock Exchange (“TSX”) in Canada and the New York Stock Exchange (“NYSE”) in the United States.

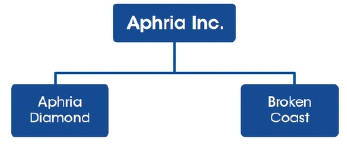

Canadian Cannabis Operations

The Company’s domestic Canadian cannabis operations

are comprised of the original Aphria One greenhouse facility held through Aphria Inc., and facilities held through its wholly-owned

British Columbia-based subsidiary Broken Coast, and its 51% majority owned Leamington-based subsidiary, Aphria Diamond.

Aphria One is the Company’s original 1,100,000 square foot

greenhouse facility, which is located in Leamington, Ontario. Aphria One is licensed to cultivate, process, and sell cannabis

under the provisions of the Cannabis Act. On March 20, 2020, Aphria One's licence was extended to March 20, 2023.

Broken Coast Cannabis Ltd. (“Broken Coast”),

a subsidiary of the Company acquired in February 2018, is licensed to cultivate, process, and sell cannabis under the provisions

of the Cannabis Act. Broken Coast’s purpose-built, indoor cannabis production facility on Vancouver Island provides

Aphria with ‘B.C. Bud’ and is a leading premium cannabis brand.

1974568 Ontario Limited (“Aphria Diamond”)

is a 51% majority owned subsidiary of the Company, incorporated in November 2017. This entity is the Company’s venture with

Double Diamond Farms (“Double Diamond”) and is licensed to cultivate cannabis under the provisions of the Cannabis

Act.

The Company has more than 2.4 million square feet

of flowering space capable of annual production of up to 255,000 kgs of cannabis.

References to Canadian cannabis operations include

the results of: (i) Canadian subsidiaries which hold investments and have no other operations; and (ii) companies which also actively

produce and sell cannabis under the Cannabis Act (Aphria One, Aphria Diamond and Broken Coast).

International Operations

As a leading global cannabis company driven by an

unrelenting commitment to our people, the planet, product quality and innovation, Aphria believes that it has been setting the

standard for the low-cost production of cannabis at scale, grown in environmentally responsible conditions. Focusing on untapped

opportunities and backed by the latest technologies, we are committed to bringing our expertise and breakthrough innovation to

the global cannabis market and expanding our international footprint to address countries legalizing the use cannabis for medical

purposes.

In establishing our international footprint, we

have sought to create operational hubs in those continents where we have identified the biggest opportunities for growth and have

designed our operations to provide for cannabis cultivation and processing as well as a distribution network. In Europe, we have

established our primary hub in Germany. With our acquisition of CC Pharma GmbH (“CC Pharma”), we have gained

access to an established distribution network throughout Europe. Currently, the majority of distribution activities for CC Pharma

within Europe relates to the distribution of non-cannabis medical products with plans to continue developing and incorporating

medical cannabis products into the product assortment.

In Europe, we are in the process of constructing

cultivation and production operations in Germany. Our wholly-owned subsidiary, Aphria Deutschland GmbH (“Aphria Deutschland”),

had participated in the tender process to award licences for In-country cultivation and was one of three companies selected by

the German Federal Institute for Drugs and Medical Devices (“BfArM”) to receive a licence for the cultivation

of medical cannabis in Germany. We were granted a total of five lots, the most available lots within the tender process, and we

are the only Canadian licensed producer in Germany with the permission to grow all three strains of medical cannabis approved by

the BfArM.

| Management’s Discussion & Analysis |4 |

In September 2018, we acquired LATAM Holdings Inc.

(“LATAM”), which holds key licences in Colombia, Argentina and Jamaica. We have identified Columbia as our hub

for South America and the Company is constructing a cultivation and production facility in Colombia to meet the demand for this

region. In addition, the Company maintains a distribution network in Argentina. In addition, through the LATAM acquisition,

the Company obtained an option to purchase a majority interest in a Brazilian entity upon such entity obtaining a medical cannabis

cultivation, processing and distribution licence in Brazil.

The Company’s controlled

subsidiaries are as follows:

| Subsidiaries |

Jurisdiction

of incorporation |

Ownership

interest 1 |

| Broken Coast Cannabis Ltd. |

British Columbia, Canada |

100% |

| LATAM Holdings Inc. |

British Columbia, Canada |

100% |

| Marigold Acquisitions Inc. |

British Columbia, Canada |

100% |

| MMJ International Investments Inc. |

British Columbia, Canada |

100% |

| Nuuvera Holdings Limited |

Ontario, Canada |

100% |

| ARA – Avanti Rx Analytics Inc. |

Ontario, Canada |

100% |

| MMJ Colombia Partners Inc. |

Ontario, Canada |

100% |

| Nuuvera Israel Ltd. 2 |

Israel |

100% |

| Nuuvera Italy Ltd. (FL-Group) |

Italy |

100% |

| Goodfields Supply Co. Ltd. |

United Kingdom |

100% |

| Hampstead International Inc. |

Barbados |

100% |

| ABP, S.A. |

Argentina |

100% |

| Nuuvera Deutschland GmbH |

Germany |

100% |

| Aphria Deutschland GmbH |

Germany |

100% |

| CC Pharma GmbH |

Germany |

100% |

| CC Pharma Research and Development GmbH |

Germany |

100% |

|

Aphria Wellbeing GmbH

Aphria Malta Limited

Nuuvera Malta Ltd. |

Germany

Malta

Malta |

100%

100%

100% |

| ASG Pharma Ltd. |

Malta |

100% |

|

QSG Health Ltd.

Marigold Projects Jamaica Limited |

Malta

Jamaica |

100%

95% 3 |

| ColCanna S.A.S. |

Colombia |

90% |

| CC Pharma Nordic ApS |

Denmark |

75% |

| 1974568 Ontario Ltd. |

Ontario, Canada |

51% |

| Aphria Terra S.R.L. |

Italy |

51% |

| CannInvest Africa Ltd. |

South Africa |

50% |

| Verve Dynamics Incorporated (Pty) Ltd. |

Lesotho |

30% 4 |

1 The Company defines ownership interest

as the interest in which the Company is entitled as a proportionate share of net income. Legal ownership of some subsidiaries

differs from ownership interest shown above.

2 Represents inactive subsidiaries, which

have no operations and do not own any assets, save and except for a related party balance owing to the Company, and is in the

process of being dissolved.

3 The Company holds 49% of the issued

and outstanding shares of Marigold Projects Jamaica Limited, through wholly owned subsidiary Marigold Acquisitions Inc. The Company

holds rights through a licensing agreement to 95% of the results of operations of Marigold Projects Jamaica Limited.

4 The Company holds 60% of the issued

and outstanding shares of Verve Dynamics Incorporated (Pty) Ltd., through 50% owned subsidiary CannInvest Africa Ltd.

| Management’s Discussion & Analysis |5 |

Strategy and Outlook

Aphria, a leading global cannabis consumer packaged

goods company, is setting the standard for brand development, product innovation, and industrial scale cultivation and automation

for the production of cannabis grown in environmentally responsible conditions. The Company was one of the first licensed producers

in Canada and the first Canadian licensed producer to fully exploit greenhouse cultivation and industrial-scale production to deliver

sustainable operating profit margins in the emerging cannabis industry. Through its international operations, the Company also

seeks opportunities to create long-term shareholder value by identifying partnership and investment opportunities where the Company

can apply experience and knowledge gained in the Canadian cannabis industry to other jurisdictions where a national cannabis legalization

framework is developing, and local market characteristics are expected to support the Company’s competitive strengths.

We continue to focus on the developing industry

in Canada and ensuring that the Company is successful through the launch of the newly legalized cannabis derivative products. The

Company will continue to focus on developing a presence in jurisdictions where legalization of cannabis use, whether medical or

adult-use, is permissible on a national basis.

Canadian medical market

brands

The Company currently has two medical cannabis brands

- Aphria and Broken Coast. Since 2014, the Aphria brand has been a leading, trusted choice for patients seeking high quality pharmaceutical-grade

medical cannabis. Broken Coast is a licensed producer of medical cannabis located on Vancouver Island. Its plants are grown in

small batches in single-strain rooms, and it is committed to the quality of its products, adhering to strict procedural and environmental

protocols in order to maximize purity, quality, and patient satisfaction. As the Canadian adult-use market continues to develop,

the Company expects to remain committed to and invest in the Canadian medical market while concurrently developing cannabis-based

products and brands targeting the adult-use market.

Canadian adult-use market

brands

The Company is investing capital and resources to

establish a leading position in the adult-use market in Canada. These investments are focused on consumer segmentation, brand development,

product innovation, marketing, sales, education, and research to enable the Company to capture, retain and grow a significant share

of the Canadian market as it continues to develop.

Aphria’s differentiated portfolio of brands

were conceived specifically to meet the evolving needs of Canada’s most profitable consumer segments. The Company leveraged

its strengths to offer products with unique attributes – from price through to potency and assortment – to best serve

its consumers. The suite of brands created by the Company for Canada’s adult-use market include Solei, RIFF, Good Supply,

and Broken Coast. Each brand is unique to a specific target consumer segment with various product offerings designed to meet the

needs of its targeted segments, described below:

Solei Sungrown Cannabis (“Solei”)

is designed for current and novice users, pairing an assortment of carefully curated strains and product formats. Solei’s

signature ‘Moments’ based approach has received very positive feedback from retailers and consumers seeking a simplified

approach to cannabis.

RIFF is a culture and community

focused brand supporting the artistic community across Canada. The brand has high potency offerings available for more experienced

users. Riff’s community and culture focus is brought to life through its relationship with the Maker Arcade, an art and community

focused program backed by Universal Music.

| Management’s Discussion & Analysis |6 |

Good Supply offers experienced

cannabis users with a no-frills, yet excellent value-for-money assortment that does not sacrifice quality.

Complementing Aphria’s in-house brands,

the Company’s wholly-owned subsidiary Broken Coast is a multi-award-winning craft grower that delivers a premium product

and provides consumers with an opportunity to access a brand synonymous with British Columbia-grown cannabis. Broken Coast’s

craft cannabis is grown on the shores of the Salish Sea in small batches using single-strain growing rooms. All flower is hand-trimmed

and slow-cured ensuring premium product quality and consistency.

Product development

On October 17, 2019, the Canadian government legalized

the production and sale of cannabis infused products. According to Headset Inc., an organization which tracks data including sales

data across the cannabis category in the U.S., the vape market makes up 17% to 30% of U.S. sales (California, Nevada, Colorado,

Washington) depending on the market. Aphria has and continues to invest capital and resources in product research, development,

and production technologies in anticipation of the significant demand for this new category. In addition to perfecting the art

of formulation, the Company has partnered with top tier hardware suppliers to deliver an elevated possible consumer vape

experience. This includes being one of only five brand partners to partner with industry-leading vape giant PAX Labs. The Company

is equally focused on the development of other categories of cannabis derivative products. As part of these R&D efforts, the

Company is investing in the following areas to develop consistent and unique formulations to be used in its end-products:

| · | Industrial-scaIe extraction

technologies using different methods including CO2, butane and ethanol; |

| · | The effective isolation of

terpenes, cannabinoids (moving beyond cannabidiol (“CBD”) and tetrahydrocannabinol (“THC”))

and other cannabis compounds; and |

| · | Development of nano-emulsification

technology providing flavourless and colourless input material into derivative products such as edibles and beverages. |

The Company is currently engaged in R&D,

and formulation development for a broad suite of high margin derivative products such as edibles, beverages, concentrates, topicals

and other products such as oral thin strips.

Within these categories, the Company’s primary

focus at the launch of cannabis derivatives in Canada (known as Cannabis 2.0) was vape products as the Company anticipated, similar

to the U.S. market, that said products would grow to represent a significant percentage of the Canadian cannabis market demand

for 2.0 products. Additionally, vape products are aligned to the Company’s extraction capabilities and know-how. Once legislatively

allowed, the Company successfully launched over 30 new vape SKUs into the Canadian market with positive reviews from liquor boards

and consumers alike. The Company benefited from being first to market, as the only supplier of the popular Pax platform during

the first three months of Cannabis 2.0 legalization.

The Company still believes edibles, concentrates

and beverage products will collectively represent a smaller, yet growing proportion of the Cannabis 2.0 market and has developed

a strategy to meet this demand.

The Company anticipates launching the following

products:

| Management’s Discussion & Analysis |7 |

Fiscal H1 2021:

| · | Beverage enhancers using our

propriety nano-technology. Enhancers offer consumers a conveniently dosed flavourless additive that transforms any beverage into

a cannabis beverage; |

| · | QuickStrips through our partnership

with Rapid Dose Therapeutics. These thin, flavoured tongue strips are a conveniently dosed, rapid-absorption option for consumers

on the go; and, |

| · | Concentrates across two different

formats, catering to the experienced cannabis user seeking unique and intense experience. |

In development:

| · | Premium chocolates leveraging

the Company’s relationship with an experienced contract manufacturer. Various premium chocolate products will be launched

across two brands in popular and unique flavour profiles, using premium cacao and developed with the expertise of experienced chocolatiers;

|

| · | Topicals will feature multiple

brands leveraging unique IP licensed from a premiere product development partner in the U.S. ; and |

| · | Soft chews leveraging the

Company’s relationship with a contract manufacturer. Soft chews will feature three brands in various popular flavours. Over

a year of R&D has gone into perfecting the textures and flavour profiles of our soft chew lineup. |

The Company

will also continue to evolve its flower, pre-roll, vape and oil product lines to meet the needs of consumers across the country.

Distribution

The Company has supply agreements with all

the provinces and the Yukon Territory in Canada, representing access to 99.8% of Canadians, showing the Company’s commitment

to becoming a leader in the adult-use market. The Company is one of the few licensed producers which has agreements with every

province in Canada.

The Company is party to an exclusive distribution

agreement with Great North Distributors Inc. (“Great North Distributors”), a wholly-owned Canadian subsidiary

of Southern Glazer’s Wine & Spirits, to provide the Company with the sales force and wholesale/retail channel expertise

required to efficiently distribute the Company’s products through each of the provincial/territorial cannabis control agencies.

As one of the leading distributors of alcoholic beverages in Canada, Great North Distributors has extensive expertise in managing

compliance with the unique rules that govern the marketing of controlled substances in each of the jurisdictions where the Company

has supply agreements.

Production

As of the date of this MD&A, the Company's

Canadian cultivation facilities are fully planted and we expect that our total production capacity 5 will be up to

255,000 kgs a year from such facilities. In addition, the Company is currently expanding its extraction and processing

capacity at Aphria One in areas already licensed for cannabis processing. These expansions are expected to provide increased

capacity to help meet the rising demand for derivative cannabis products.

Aphria One

The Company has innovated among licensed producers

by integrating industrial horticulture production technology into the cultivation of cannabis within a greenhouse environment.

This cutting-edge technology automates the following functions of the plant growing cycle:

| · | Transplanting cuttings through

various stages into the final pots for flowering; |

| · | Aiding in evaluation of the

health and quality of plants to ensure plants meet the Company’s stringent quality standards throughout the many stages of

the growing cycle; |

| · | Monitoring and providing water

and nutrients to the plants during the growing cycle; and |

| · | Transporting plants through

different areas in the greenhouse including to the processing room once harvested. |

5 These figures are considered forward-looking

information and are based on the Company’s experience in growing cannabis, and data available concerning the wide variety

of strains under the growing conditions maintained at its facilities. Material assumptions to derive capacity at full completion

include, but are not limited to, the number of plants expected to occupy each facility, the number of harvest cycles and average

yield per harvest cycle per year for the strains expected to be grown at each facility.

| Management’s Discussion & Analysis |8 |

With this innovative technology implemented, the

only human interaction throughout the plants’ growth cycle for plants grown in these areas are at the initial phase of taking

the cuttings and to trim and prune the plants.

Additional state-of-the-art automation employed

throughout the rest of the facilities include processes that involve:

| · | Cutting the plants, and transferring

them to be processed; |

| · | Automating the de-budding

and trimming process; |

| · | Disposing of waste produced

in the cutting, de-budding and trimming phase of production; and |

| · | Distributing the buds into

trays in a drying rack to evenly dry and cure the harvested product. |

Automating labour-intensive parts of the production

process enables the Company to achieve optimal product consistency and quality control while significantly reducing operating costs.

In addition to the reduction of labour costs, the Company has also introduced measures that significantly reduce energy costs and

consumption.

The Company installed a co-generation power plant

that utilizes natural gas to generate its own electricity and as a by-product of this process, hot and cold water and CO2.

This combined-cycle process not only generates electricity for use in the greenhouse to operate the lights and air conditioners,

but also hot and cold water that is used to control the temperature and humidity in the greenhouse. The residual gas emissions

created by this process are directed through a catalytic converter to create CO2 which is used during the growing cycle.

This co-generation power plant also incorporates state-of-the-art power switching capability that automatically selects between

the public electrical grid and the Company’s private power co-generation equipment to ensure it is constantly using the most

cost-effective energy available.

In addition to these energy saving initiatives,

the Company has installed systems that recycle the water used in the irrigation process. The ‘used’ water is sterilized

through a pasteurization process which then allows it to be reused to irrigate additional plants thereby reducing the total amount

and cost of water used on a per gram basis.

Aphria Diamond

Through this 51% owned subsidiary, the Company has

partnered with Double Diamond, a company with multi-generational expertise in the commercial greenhouse industry. This partnership

provides Aphria with access to an industry leading team of growers and operators with expertise in large-scale greenhouse operations

as well as contracted exclusive access to all of the production output from Aphria Diamond.

All production from Aphria Diamond is sold to Aphria

at an agreed upon transfer price, allowing Aphria to recognize 100% of the remaining profit from any further processing into a

derivative product, and 100% of the wholesale margin from branding on all product from Aphria Diamond.

Broken Coast

Broken Coast is the Company’s premium brand

of indoor-grown cannabis. Broken Coast provides the Company access to the quality associated with British Columbia-grown cannabis

as well as an award-winning genetic bank of cannabis strains which in turn can be produced at scale through the Company’s

Aphria One and Aphria Diamond facilities. Broken Coast will continue the development of new premium strains and continue to represent

what is the highest level of premium cannabis grown through their custom-built indoor facilities.

| Management’s Discussion & Analysis |9 |

Licences

With respect to its Canadian operations and sales,

both the Aphria One and Broken Coast locations are licensed under the Cannabis Act for cultivation, processing and sale.

The Company also holds a third licence under the Cannabis Act for cultivation at its Aphria Diamond location.

The Company has received European Union Good Manufacturing

Practices (“EU GMP”) certification in respect of medicinal products for human use and investigational medicinal

products for human use (Part I - Medical Products) at its ARA - RX Analytics Inc. (“Avanti”) location, which

will allow the Company to ship bulk and finished dried flower, as well as bulk cannabis oil for medicinal use in permitted jurisdictions

throughout the European Union and in any jurisdiction that mutually recognizes the European GMP Standards.

It also received its EU GMP certification as an

active substance manufacturer (Part II - Medical Products) at its Aphria One location, which allows the Company to be a supplier

of bulk dried flower for medicinal use to other EU GMP certified facilities licensed to further process or package bulk dried flower

into finished cannabis product for sale in permitted jurisdictions.

Collectively, these licences and certification provide

the Company with the ability to cultivate, process and sell cannabis within Canada and to ship bulk and finished dried flower,

as well as bulk cannabis oil for medicinal use in permitted jurisdictions throughout the European Union and in any jurisdiction

that mutually recognizes the European GMP standards.

In addition to its EU GMP certification discussed

above, Avanti is also licensed pursuant to the Cannabis Act as well as under the Food and Drugs Act and related regulations.

Avanti also holds four Canadian licences: (i) Cannabis Processing Licence; (ii) Cannabis Analytical Testing Licence; (iii) Drug

Establishment Licence; and (iv) Medical Device Establishment Licence. These licences allow the Company to possess, handle, process

and test cannabis and cannabis derivative products, and to engage in the distribution and testing of drugs as well as to manufacture

Class 1 medical devices. The Company is also able to complete testing/analysis of active pharmaceutical ingredients and finished

dosage forms as a third-party tester.

■

U.S. Expansion Strategy

The Company believes that the existing U.S. cannabis

market is hindered by the federal prohibition on cannabis and unclear guidance on the use of CBD. Given the current regulatory

landscape, operators are required to create cultivation and distribution centers in each state in which they wish to participate

and thereby, must invest capital to build and expend ongoing working capital to operate multiple facilities in order to become

a multi-state operator (“MSO”). We believe the MSO model results in poor capital allocation as money is invested

within multiple individual states where such duplicative investments would not be made but for the current regulatory framework

that restricts interstate commerce. We, however, continue to believe that the U.S. is an important market and therefore, we monitor

the regulatory landscape and may engage in investments in complementary categories that may be converted to include a cannabis

business if and when it becomes legal on the federal level. Furthermore, the Company is evaluating potential strategic partnerships

that qualify under the Company’s current U.S. strategy that will accelerate and escalate the Company’s brand capabilities

and product offering once federally legal.

| Management’s Discussion & Analysis |10 |

■

International Operations

Outside of Canada, the Company

is continuously evaluating opportunities in countries where there is an existing or emerging legal cannabis market. The Company

believes that, with its significant experience in the highly regulated Canadian cannabis market, it will be able to export its

industry leading knowledge and practices to its global subsidiaries as these markets mature. Given that only a few countries have

legalized cannabis for adult-use, the Company’s international strategy is currently focused on expanding its business to

include medical cannabis markets in stable economic and political jurisdictions that have legalized the use of cannabis for medical

purposes.

In establishing our international

footprint, we have sought to establish operational hubs in those continents where we have identified the biggest opportunities

for growth and have designed our operations to provide for cannabis production as well as a distribution network to distribute

such products throughout the region served by such hub. The Company is developing such footprint by investing directly in assets

and through acquisition.

Through acquisitions, the Company

has secured access to key international markets as well as management team bench strength with a proven knowledge and demonstrated

executional success.

Currently the Company has international operations

or strategic relationships in Australia, Argentina, Colombia, Denmark, Germany, Italy, Jamaica, Lesotho, Malta, Paraguay and maintains

an option for entry into Brazil. While these markets are still in their infancy, and the regulatory environment around them is

still being formed, we believe the Company is uniquely positioned to bring the knowledge and expertise gained from working within

Canada during the development of the cannabis regulations to these developing global cannabis markets.

Export facility from Canada

Avanti currently holds four Canadian licences: (i)

Cannabis Processing Licence; (ii) Cannabis Analytical Testing Licence; (iii) Drug Establishment Licence; and (iv) Medical Device

Establishment Licence. In addition, Avanti received its EU GMP certification in respect of medicinal products for human use and

investigational medicinal products for human use (Part 1 – Medical Products) in January 2020. Avanti provides testing services

to the Canadian cannabis operations and, its EU GMP certification allows Avanti to process, package, label cannabis oil as well

as package, label dried cannabis for medicinal use in permitted jurisdictions throughout the European Union and in any jurisdiction

that mutually recognizes the European GMP standards.

The Company also received its EU GMP certification

as an active substance manufacturer (Part II - Medical Products) at its Aphria One location, which allows the Company to be a supplier

of bulk dried flower for medicinal use worldwide to other EU GMP certified facilities licensed to further process or package bulk

dried flower into finished cannabis product for sale in permitted jurisdictions.

| Management’s Discussion & Analysis |11 |

These certifications provide the Company with the

ability to cultivate, process and sell cannabis within Canada and to ship bulk and finished dried flower, as well as bulk cannabis

oil for medicinal use in permitted jurisdictions throughout the European Union and in any jurisdiction that mutually recognizes

the European GMP standards.

In Germany, we have been preparing for the importation

of EU-GMP certified cannabis from Canada from one of our EU GMP facilities, allowing for shipments to CC Pharma in order to leverage

CC Pharma’s extensive in-country distribution network.

Pan-Asia

Australia

Aphria maintains relationships in Australia with

two companies conducting medical cannabis clinical trials.

Medlab Pty Ltd. is currently in a clinical trial

related to oncology pain using Aphria blended cannabis strains for oil, subsequently converted in Australia into a nanocell mucosol

spray. Aphria and Medlab Pty Ltd. share the rights in the intellectual property associated with the active pharmaceutical ingredient

on this trial.

CannPal Pty Ltd., is currently in a clinical trial

related to animal pain in cats and dogs, wherein the test product is fabricated using Aphria strains.

Aphria also maintains a supply relationship with

Althea Company Pty Ltd., a licensed producer in Australia.

European Union

Germany

The German market is considered to be one of the

most highly sought-after medical cannabis markets in the world. Our wholly-owned subsidiary, Aphria Deutschland, participated

in the tender process for in-country cultivation licences and was one of three companies selected by the BfArM to receive

a licence for the cultivation of medical cannabis in Germany. We were granted a total of five lots, which was the most available

lots within the tender process and is the only licensed producer in Germany with the permission to grow all three strains of medical

cannabis approved by the BfArM. Each lot is expected to provide a minimum annual capacity of 200 kgs. Germany currently

allows for the sale of medical cannabis and cannabis extracts to pharmacies. These cannabis-based products are also covered by

insurance companies. This coverage provides the opportunity for a greater number of medical cannabis patients with access to the

full use and benefits of these products.

The Company’s approach in Germany is a three-pronged

approach covering: demand; supply; and distribution.

Demand

We have developed educational programs and other

means for outreach to healthcare professionals which provides the Company with access to doctors to educate on the uses of medical

cannabinoids. The Company also plans to build and operate pain treatment centers including the new possibilities of digital health

care throughout Germany, which will further provide access to patients once supply is available from its German facility. The Company

has partnered with a leading company in digital apps and medical software to build a modern, patient centric clinic for telemedicine.

| Management’s Discussion & Analysis |12 |

Supply

The Company will, through imports and local production,

supply cannabis products into the German market. The Company entered into a strategic partnership with a prominent European flower

producer to obtain access to EU GMP-certified organic medical cannabis for both the German market as well as throughout Europe.

In addition, pursuant to the licence granted by BfArM, the Company is in the process of constructing its cultivation facility from

which we expect to deliver the first harvest to BfArM by the end of calendar year 2020. In addition, we have completed the construction

of a storage facility. The cultivation and storage facilities are being constructed in line with EU-GMP requirements.

Distribution

Through the acquisition of CC Pharma, the Company

obtained a leading importer and distributor of EU-pharmaceuticals for the German market. With over 286 active German national pharmaceutical

licences, 640 active EU pharmaceutical licences, and access to approximately 13,000 active pharmacy accounts, CC Pharma operates

a production, repackaging and labelling facility. Based on regulations, pharmacies can only supply the branded product that has

been named in a prescription to the patient by a physician. Substitution of the product is only possible if the particular brand

of product is unavailable. As such, the Company will expand CC Pharma’s operations to meet the high demand for medicinal

cannabis by distributing cannabis throughout the German pharmacies, leveraging its existing business and know-how to ensure that

the Company’s products are sufficiently stocked in the pharmacies in Germany.

Malta

Through its subsidiary, ASG Pharma Ltd. (“ASG”),

the Company received the first import permit for medical cannabis issued by the Government of Malta’s Ministry of Health.

The Company intends on using ASG to import cannabis resin and dried flower for processing, packaging and distribution of EU-GMP

compliant cannabis products throughout Europe. The constructions of the analytical laboratory as well as the processing and packaging

of bulk cannabis operations are expected to be fully operational as an EU GMP certified facility in the second half of fiscal 2020,

pending certification by the Malta Medicines Authority.

Italy

The Company’s wholly owned subsidiary, Nuuvera

Italy Ltd. (FL-Group) (“FL-Group”), is authorized to import cannabis products into Italy and to distribute pharmaceutical

products, including cannabis-based and cannabinoids products in Italy to pharmacies. In addition, the Company has established Aphria

Terra as a grassroots organization focused on furthering the Company’s presence in the Italian cannabis industry.

Africa

Lesotho

The Company invested in CannInvest Africa Ltd. (“CannInvest”),

a South African corporation. Through this transaction, the Company obtained a controlling interest in Verve Dynamics Incorporated

(Pty) Ltd. (“Verve”). Verve holds a licence in Lesotho for prohibited drug operations, which allows Verve to

cultivate, manufacture, supply, distribute, store, export and import cannabis and cannabis resin for medical purposes or scientific

use. Verve is currently constructing and licensing a large scale extraction operation.

The Company also entered into a supply agreement

with Verve, where Verve will supply cannabis THC and CBD extract from its planned EU-GMP certified facility. This is expected to

provide the Company with access to EU-GMP-certified extract for distribution into South Africa and other nationally legal markets.

| Management’s Discussion & Analysis |13 |

South America

Colombia

The Company has a 90% ownership interest in ColCanna

S.A.S. (“ColCanna”). This ownership provides the Company with the ability to further develop the global Aphria

brand with Aphria branded products distributed to patients across South America. ColCanna is developing its 54 acres of land for

the cultivation of cannabis, which is expected to produce EU-GMP certified dried flower annually for purposes of supplying the

South American region. The Company intends to secure an export licence to distribute its production within the LATAM region. Furthermore,

the Company signed an exclusive three-year agreement with the Colombian Medical Federation (“FMC”), a national

guild that oversees the ethical exercise of the medical profession in Colombia. Under this agreement, Aphria and the FMC will jointly

develop an academic curriculum on the appropriate medicinal use of cannabis, as well as execute other initiatives that will promote

training and education on the use and prescription of cannabis across the medical community. The Colombian Medical Federation has

nearly 2,000 affiliated doctors and a database of more than 70,000 medical professionals that rely on the organization for research

and educational resources, including through a virtual platform that offers certified courses on a range of subjects.

Argentina

The Company owns ABP, S.A. (“ABP”),

a distributor of traditional pharmaceutical medicines and medical cannabis products for the Argentinean market. On June 6, 2019,

the Ministry of Health in Argentina approved a resolution authorizing public and private health insurance companies to import and

stock medical cannabis inventory for sale to patients suffering from refractory epilepsy. This represents a significant improvement

for these patients since previous products could only be imported on a named patient basis. This represent a significant improvement

for epileptic patient access, since it would reduce the delay in patients ordering and receiving their prescribed medical cannabis.

The Company believes that this recent resolution, represents an evolution of the medical cannabis regulatory framework in Argentina

towards sustainable commercialization. With the ability to store medical cannabis inventory, ABP has focused its efforts on growing

its epileptic cannabis patient base since product can now be supplied without delay.

Commencing in January 2020, ABP began shipping,

distributing and delivering Its first consolidated units (in bulk) of medical cannabis Into Argentina under the Argentinean "Compassionate

Use" national law for patients with refractory epilepsy, holding a medical prescription from a neurologist. In addition, in

compliance with the national drug law, patients are required to pick up controlled substances products at an authorized pharmacy.

ABP is fully authorized and licensed by the national regulatory agency (ANMAT) to distribute and deliver controlled substances

via authorized pharmaceutical channels.

Importantly, the Company continues to work with

Hospital Garrahan, a leading pediatric hospital in Buenos Aires which recently published favourable results in epileptic patients

following treatment with Aphria products.

Jamaica

The Company owns a 49% ownership interest in Marigold

Projects Jamaica Limited (“Marigold”), through multiple subsidiaries and a 95% royalty on profits through a

licensing agreement. This provides the Company with several key licences including a Tier 3 cultivation licence, a Tier 2 herb

house licence, as well as conditional licences for import, export and research purposes. We also have been granted a licence to

open a second herb house and a Tier 1 Processing licence.

Brazil

The Company maintains an option to purchase 50.1%

of a Brazilian entity for $24,000 USD if it should secure a medical cannabis cultivation and distribution licence from the Brazilian

government and a right of first offer and refusal on another 20% to 39% of the Brazilian entity. This right of first refusal provides

the Company with lower risk at a fixed price to enter into the Brazilian cannabis market pending the Brazilian company obtaining

a licence to cultivate and distribute cannabis lawfully within the country.

| Management’s Discussion & Analysis |14 |

■

Aphria’s Purpose

Mission

To be the premier global cannabis company through an unrelenting

commitment to our people, the planet, product quality and innovation.

Vision

To be the best performing cannabis company globally, providing

investors with access to the most accretive cannabis opportunities around the world.

Our Values

In an emerging and constantly evolving industry,

our values unite us, informing and inspiring the way we work with our employees, patients, consumers and one another. Our commitment

to our people, the planet, product quality and innovation helps us create stronger, healthier communities everywhere we do business.

Our corporate social responsibility (CSR) goes beyond our borders. We are committed to exporting our industry leading knowledge

and practices to our global subsidiaries. For the communities we touch, we are vigilant of the impact we have and strive to be

a positive contributor to their well-being.

We

put people first

We're committed to the needs of our patients and

consumers whether they are looking for natural options for medical needs, exploring the options in wellness, or seeking alternatives

to their lifestyle. We're driven by a desire to help others live their best life.

This includes continuous product development on

different methods of administering the product through oil, softgels, vapes and eventually edibles, oral strip and other derivatives,

as well as being proactive in aiding patients who have difficulties obtaining the required medical care. The Company continues

to provide access to treatment on a compassionate basis for a four-year-old epileptic girl; a treatment that has decreased daily

seizures from around thirty to just three or four.

At Aphria, we understand some patients may have

barriers that can impact their financial wellbeing. To help, we offer compassionate pricing for eligible patients that require

financial assistance. Patients with an annual gross income of less than $30 are eligible to participate in Aphria’s compassionate

pricing program.

We

lead by example

We're passionate about pushing our industry forward.

Our commitment to innovation means we're always on the lookout for new opportunities, that we attract those who share our outlook,

and that we never stop focusing and imagining what's coming next.

This includes the continuous push for innovations

in expansionary projects, product development and market research. In the current year, the Company has made strides to be in the

forefront of providing an innovative suite of Cannabis 2.0 products and continues to partner with various organizations to further

develop product offerings including edibles, beverages, topicals, oral thin strips, and other cannabis-infused products. The Company

offers the only CBN oil on the market, Solei CBN Renew oil, which won 'Innovation of the Year’ at the 6th Annual Canadian

Cannabis Awards.

In addition to the innovative strides, the Company

has consistently delivered the quality of products consumers are looking for, resulting in all five of the Company’s medical

and recreational brands taking home top honours at the Canadian Cannabis Awards in product categories.

We

respect the earth

As a conscientious company, we're committed to ensuring

that our actions and those of our employees have a positive impact on the environment around us, no matter where we operate. Recently

the Company launched Plant Positivity, Aphria’s social impact platform. With a vision of social impact for communities and

individuals, through Plant Positivity, Aphria is providing people with better access to plants and leading education on the role

plants can play in improving everyday well-being. As part of the platform, Aphria partnered with Evergreen, a national not-for-profit

dedicated to making cities flourish to create the Plant Positivity Gardens: six gardens that add more than 50 varieties of native

plant species to the existing 8,000-square-metres of gardens across Evergreen Brick Works. This partnership has created new spaces

for people to reflect, socialize and learn more about the natural world. Further, the themed gardens contribute to a thriving community

and educational space where people can experience sustainable practices that make cities flourish.

| Management’s Discussion & Analysis |15 |

The Company is proud to employ – and continuously

improve - sustainable growing and business practices to provide efficiencies, cost reduction benefits and lessen our impact on

the environment. This includes:

| · | Reducing the plastic and cardboard

used in secondary packaging across all products targeting saving in excess of 35% net packaging weight. |

| · | Utilizing computerized systems

to monitor and reduce water usage, and collection and cleaning of run-off water so that it can be safely reused. |

| · | Co-generating electricity,

hot water, CO2 and cold water which is more efficient and reduces impact on local communities. |

| · | Capturing and cleaning the

CO2 from the exhaust and adding it into the greenhouse to promote plant growth and reduce our carbon footprint. |

We

take responsibility to heart

We believe it is our responsibility to protect the

safety of our employees, patients, consumers, and society. Our partnerships and programs reflect our ongoing commitment to the

safety of our communities through education, responsible use, and meaningful corporate citizenship.

The Company places a great deal of energy and

effort towards ensuring the safety of children and families in communities we serve. Our Charter Agreement with Drug Free

Kids Canada and participation in the Global Cannabis Partnership, reflect our ongoing commitment to the safety

of our communities through education, responsible use, and meaningful responsible corporate citizenship in our industry.

Recently, the Company launched ‘Aphria Educates’ a program aimed to educate Canadians on responsible and safe use

of all cannabis products legally available now and in the future. The first initiative was a two-city educational panel in

conjunction with Drugs Free Kids Canada, a Canadian non-profit organization providing parents with evidence-based information

about youth and substance use while promoting frequent, balanced parent-youth discussions about drugs. In addition to

partnerships mentioned above, the Company has also partnerships with various organizations in countries like Colombia in

order to jointly develop academic curriculums on the medicinal use of cannabis.

The company recently launched the “Aphria

Academy’, an e-learning site for budtender education designed to educate budtenders and retail staff across Canada about

recreational brands and products.

The Company firmly believes in the importance of

investing in local businesses as well as the Canadian economy. Since its incorporation, the Company has paid over $450,000 to Canadian

vendors for construction build-outs, of which over $300,000 was paid to local Leamington vendors. In addition, the Company has

spent more than $130,000 on wages to employees residing in Canada and has paid fees, withholding taxes and income taxes to the

Canadian government of almost $30,000. This combines to over $610,000 of economic activity created by Aphria for the Ontario and

Canadian economies. Using the Keynesian Multiplier, assuming an MPC of 0.8, results in over $3 billion of trickle down economic

creation tied directly to Aphria since 2014.

These core values serve as a compass impacting the

Company’s strategic decisions and its outlook. The activities and outlooks covered within each of the operations below as

well as the activities within the Investor Highlights are intended to align to these core values.

| Management’s Discussion & Analysis |16 |

■

Investor Highlights

| |

|

|

|

|

|

| |

|

|

|

Q3 - 2020 |

Q2 - 2020 |

| Distribution revenue |

|

|

|

$ 88,308 |

$ 86,442 |

| Net cannabis revenue |

|

|

|

$ 55,566 |

$ 33,708 |

| Kilogram equivalents sold |

|

|

|

14,014.1 |

7,062.4 |

| Kilograms produced, net |

|

|

|

31,086.1 |

13,866.0 |

| Production costs |

|

|

|

$ 16,707 |

$ 13,894 |

| Cost of goods purchased |

|

|

|

$ 76,911 |

$ 75,483 |

| Cash cost to produce dried cannabis / gram6 |

|

|

$ 0.93 |

$ 1.11 |

| "All-in" cost of sales of dried cannabis / gram6 |

|

|

$ 1.69 |

$ 1.98 |

| Gross profit before fair value adjustments6 |

|

|

$ 35,691 |

$ 30,488 |

| Adjusted distribution margin6 |

|

|

12.9% |

12.7% |

| Adjusted cannabis margin6 |

|

|

|

42.7% |

56.6% |

| Adjusted EBITDA from cannabis operations6 |

|

|

$ 6,031 |

$ 3,386 |

| Adjusted EBITDA from businesses under development6 |

|

$ (2,859) |

$ (3,547) |

| Adjusted EBITDA from distribution operations6 |

|

|

$ 2,564 |

$ 2,064 |

| Cash and cash equivalents & marketable securities |

|

$ 515,102 |

$ 497,694 |

| Working capital |

|

|

|

$ 746,572 |

$ 675,932 |

| Capital and intangible asset expenditures - wholly-owned subsidiaries6 |

$ 23,839 |

$ 8,230 |

| Capital and intangible asset expenditures - majority-owned subsidiaries6 |

$ 14,507 |

$ 18,472 |

| Strategic investments6 |

|

|

$ 605 |

$ -- |

| · | Closed bought deal financing for net proceeds of approximately

$99,700; |

| · | Licensed Aphria Diamond facility on November 4, 2019;

|

| · | Maintained potential annualized capacity of up to 255,000

kgs; |

| · | Recorded fourth consecutive quarter with positive adjusted

EBITDA and positive adjusted EBITDA from cannabis operations; |

| · | Won top honours at 2019 Canadian Cannabis Awards with

a total of seven awards for Aphria owned brands; and, |

| · | Recognized for Executive

Gender Diversity by Globe and Mail's inaugural Report on Business Women Lead Here list,

an annual benchmark of executive gender diversity in corporate Canada. |

■

Recent Events

Coronavirus ("COVID-19")

Pandemic, Its Impact and Influence on Our Guidance

Aphria continues to closely monitor and

respond where possible to the ongoing COVID-19 situation. As the global situation continues to change rapidly, ensuring the

well-being of our employees remains one of our top priorities. The Company also remains committed to providing best in class

care and service to our valued patients and customers – facilities in Leamington and Brampton, Ontario, Duncan, British

Columbia, Densborn, Germany and Buenos Aires, Argentina remain open and operational with heightened measures in place to

protect the health and safety of employees, vendors, partners and their families. The Company is committed to enhancing these

measures and implementing other necessary practices as the situation warrants.

6 Non-IFRS measure

| Management’s Discussion & Analysis |17 |

Leamington, Ontario and Brampton, Ontario

Our Leamington facilities, Aphria One and Aphria

Diamond, and Brampton facility, ARA-Avanti, remain open as they are currently considered essential businesses by the Ontario government.

While the vast majority of our operational staff continue coming to work, we are experiencing an increase of workplace absences

at Aphria One, some of which are caused by self-quarantines and the remainder by choice. Our administrative staff are largely on

work from home programs. The workplace absences are slowing packaging and release capabilities but, as of the date of this MD&A,

are not impacting the delivery of orders to our customers.

Duncan, British Colombia

Our Duncan facility in British Colombia ("BC"),

Broken Coast, remains open and is currently considered an essential business by the BC government. While the majority of our operational

staff continue coming to work, in the early days of the BC government pandemic procedures, there were higher workplace absences

than current levels. Broken Coast’s administrative staff are on work from home programs. The early workplace absences resulted

in slower packaging and release capabilities but, to date, have not impacted the delivery of orders to our customers.

Supply chain in Canada

Our supply chain team continues to work closely

with our supply chain partners on a day-to-day basis to prevent and minimize any sort of disruption. As of the date of this MD&A,

there do not appear to be any indications of challenges or delays in our supply chain; however, the Company has undertaken pre-emptive

measures to ensure alternate supply sources in different continents.

Canadian cannabis distribution system

While the Canadian cannabis distribution system

remains mostly open, we have been presented with a number of challenges getting our products to our patients and customers, including

but not limited to:

| · | E-commerce purchases on our

website by medical consumers increased by approximately 18% since the COVID-19 restrictions came into place, up to the date of

this MD&A; |

| · | Most provincial control boards

had a March 31st year-end and closed their facilities to deliveries and shipments for seven days around the March 31st

date; |

| · | In the early days of the pandemic,

retail outlets reported experiencing significant sales increases caused by ‘pantry loading’; |

| · | Thereafter, and as at the

date of this MD&A, retail sales levels averaged across the Country appear to have gone back to pre-pandemic levels; |

| o | The Ontario government initially

deemed cannabis retailers an essential service, but this position was subsequently withdrawn forcing retail outlets to close. By

emergency order, the Ontario government allowed the re-opening of retail outlets but only for click and collect / curbside service; |

| o | The Ontario control board

cancelled all open purchase orders and suspended deliveries for a two-week period as it transitioned from a majority wholesale

model to a majority e-commerce model; |

| o | The Ontario government announced

that it was suspending its previous guidance on the pace and quantum of its retail roll-out; |

| · | The Alberta control board

has advised that it is seeing an approximate 25% reduction in retail stores placing orders and in turn appears to have reduced

replenishments from licensed producers by approximately 40%; |

| · | The BC control board has advised

that it has been dealing with a transition from retail outlets to click and collect. During this transition, the control board

has maintained replenishments but the success of the transition remains unknown; and, |

| · | In Quebec, consumers appear

to be maintaining the elevated levels of purchasing that were observed at the early ‘pantry loading’ level as of the

date of this MD&A, with Quebec experiencing sales growth of over 40%. Further, as of the date of this MD&A, the Quebec

control board has maintained its orders for replenishment of supply. However, it remains unknown if the continued purchasing at

‘pantry loading’ levels will continue. |

| Management’s Discussion & Analysis |18 |

Densborn, Germany

Our Densborn facility, CC Pharma, remains open and

is considered an essential service by the German government. Despite significant measures in place to ensure social distancing

and self-isolation in Germany, the facility has not experienced an impact on its operational levels. Our administrative staff remain

on work at home programs.

Supply chain in Germany

Our supply chain team continues to work closely

with our supply chain partners on a day-to-day basis to prevent and minimize any sort of disruption. As of the date of this MD&A,

there do not appear to be any indications of challenges or delays in our supply chain. However, as an import business, CC Pharma

remains highly dependent on open international, and more specifically EU member states borders. Any changes to EU member states

border or export policies will have a material impact on CC Pharma's ability to purchase products and replenish supply, which will

in turn, given our low level of inventory in comparison to monthly revenues, have a material impact on our revenues.

German distribution system

CC Pharma’s sells directly to almost 13,000

pharmacies, which are considered essential services by the German government. While impacted by social distancing requirements

experienced by all retail locations, ‘pantry loading’ of essential medications appear to be occurring in Germany. CC

Pharma’s weekly net revenue levels for March were up between 10% and 15%. It is unclear, as at the date of this MD&A,

whether this elevated level of sales will continue and whether sales levels may decrease as a direct result of EU member states

imposing measures to prevent or reduce import and export across the European Union.

Liquidity

At the present time, Aphria believes it has sufficient

levels of cash to respond to the current pandemic through its currently announced expected duration. As at February 29, 2020, Aphria

maintained cash balances of over $515,000. Aphria has access to very minor line of credit facilities of just under $4,000 and $78,894

of accounts receivable balances, all offset by required payments in the next 12 months of $178,054. To further improve liquidity

during the pandemic, we ceased commencing any new CAPEX projects in mid-March and have reduced our OPEX forecasts by over $4,000

in the fourth quarter.

While there are certain principal payments due in

the next 12 months, our earliest debt maturity, with a balance of less than $900, is over a year from now in June 2021.

Loan covenants (based on current market conditions

only)

Aphria maintains a debt service charge covenant

on certain loans secured by its Aphria One facilities that is measured at year-end only. The Company currently anticipates meeting

the debt service charge covenant at year-end. Aphria maintains a corporate guarantee and a minimum liquidity covenant on certain

loans secured by Aphria Diamond that are measured quarterly. The Company does not anticipate approaching the minimum liquidity

covenant at any time during the next 12 months. Aphria Diamond’s loan with its lender is not subject to any income related

covenants until after May 31, 2020. Thereafter it is subject to a debt service charge covenant, based solely on Aphria Diamond

results. The Company currently anticipates meeting the debt service charge covenant on all testing dates during the next 12 months.

CC Pharma maintains certain covenants on its loans, secured by the Densborn facilities and inventory. The Company currently anticipates

meeting those covenants on all testing dates during the next 12 months.

| Management’s Discussion & Analysis |19 |

Protection of our employees

We have taken important steps to protect our employees

during this period, including:

| · | Staggering of work schedules,

banning of all non-essential contractors and closing our facility to guests, all to reduce flow of traffic into and out of our

facilities; |

| · | Staggered employee breaks,

redesigned work cells and processes to minimize employee interaction and ensure appropriate social distancing; |

| · | Significantly enhanced all

sanitation of work areas, both in terms of breadth and depth of cleanings; and |

| · | Implemented mandatory 14-day

quarantines for all workers returning from vacations or out of country visits. |

In addition, during this period, we have taken the

following actions to reinforce our commitment to our front-line hourly employees:

| · | Ramped up hiring at Aphria

One and Broken Coast to ensure employees properly supported and to offset staggered work schedules and temporary workplace absences.

|

| · | Accelerated a planned wage

increase at our Aphria One facility from June 1st to April 1st, generating a 3% to 5% increase in pay for

all manufacturing employees; and, |

| · | Implemented a Company paid

lunch program for all employees at our Canadian facilities, during this period. |

Giving back to our communities

We are providing multiple programs to seniors and

front-line healthcare workers in the local Leamington community to support them during this period, including having:

| · | Made a major donation to Erie

Shores Community Hospital to allow them to acquire additional equipment and resources for their staff; |

| · | Made a donation of excess

personal protective equipment to Erie Shores Community Hospital; |

| · | Implemented the Aphria Supports

program, where employee volunteers operate a dedicated local phone number for seniors and front-line healthcare workers to purchase

and deliver groceries and other necessities during this difficult time; and, |

| · | Implemented a 10% discount

on medical products to compensate for the current economic climate. |

Fiscal 2020 Guidance

For all of the factors previously listed surrounding

the growing uncertainty and the near-term financial impact of the pandemic, the Company is suspending its previously announced

guidance for revenue, of $575,000 to $625,000, and adjusted EBITDA, of $35,000 to $42,000, for fiscal 2020. The pandemic and its

impact on the economy is constantly evolving and presents too many variables and contingencies to accurately forecast our fourth

quarter results. For instance any one of the following could have material impacts on our anticipated fourth quarter revenue levels:

(i) the United Kingdom government, or any EU government of a country that materially supplies CC Pharma, closes its border to exports;

(ii) either the Alberta or Ontario government implements a more restrictive 'shelter in place program' or materially adjusts its

anticipated sales orders; (iii) current ‘pantry loading’ sales levels in Quebec reverse to pre-pandemic sales levels;

(iv) the Alberta, Ontario or Quebec government eliminate or scale-back delivery methods for retail sales as part of a stronger

‘shelter in place program’; (v) our Leamington or Densborn facilities face greater than current levels of employee

absences reasons related to COVID-19; and/or (vi) our supply chain partners materially increase their prices or experience unanticipated

material disruptions to their business or chose to implement policy changes affecting Aphria in light of 'shelter in place programs'.

Without clarity on our expected revenue levels, it is improbable to accurately forecast EBITDA levels on these revised revenue

levels. The Company intends to re-instate its annual guidance once the pandemic stabilizes, which may not be until a point in the

Company’s Fiscal 2021 year.

| Management’s Discussion & Analysis |20 |

Bridging Gaps in Cannabis

Supply

The receipt of Aphria Diamond’s cultivation

licence occurred later than anticipated by management. This delay led to a reduction in the amount of available finished product

and necessary variety of product to meet current market demands for our brands. To better meet current market demands for our branded

products, the Company supplemented its own supply by purchasing wholesale flower for re-sale during the prior and current quarter.

During the prior

and current quarter, the Company purchased a total of $29,757 (8,910.2 kgs) of dried flower cannabis on the wholesale market, of

which $15,115 (4,442.2 kgs) was sold during the current quarter and $735 (200.9 kgs) in the prior quarter. The purchased cannabis

expensed in the quarter, on average, cost the Company $3.40 a gram. Based on the Company’s average gross selling price to

control boards less excise taxes, the Company realized net revenue of approximately $4.55 a gram, translating to $20,214 in net

revenue during the quarter with a gross margin of over $5,000. If, instead of purchasing the dried cannabis, the Company had been

able to supply the product from its own cultivation, based on its current quarter “all-in” costs of sales of

dried cannabis per gram of $1.69, the Company would have recorded an additional approximately $7,600

of gross margin and adjusted EBITDA in the quarter7.

At the end of the current quarter, the Company maintained

$13,907 (4,267.1 kgs) of purchased cannabis in inventory. The Company anticipates selling all its remaining purchased cannabis

in the next quarter.

Annualized Harvests Following

Aphria Diamond Ramp Up

In the current quarter, the Company harvested 31,086.1

kgs of dried cannabis and trim. This translates to an annualized rate of approximately 125,000 kgs. However, harvests did not begin

until late in the quarter from Aphria Diamond. Excluding the first few weeks of Aphria Diamond harvests and annualizing the rest

of the harvests, Aphria Diamond harvested at an annualized rate of approximately 105,000 kgs. During the quarter, Aphria One harvested

at an annualized rate of approximately 70,000 kgs. Combining the two, Aphria would have harvested at an annualized rate of 175,000

kgs at the end of the quarter. Readers are cautioned that this calculation is based on assumptions and small sample sizes and may

not reflect actual harvests over a 52 week period.

7 If the Company had cultivated the

cannabis purchased, the actual “all-in” costs of sales of dried cannabis per gram may have been different.

| Management’s Discussion & Analysis |21 |

■

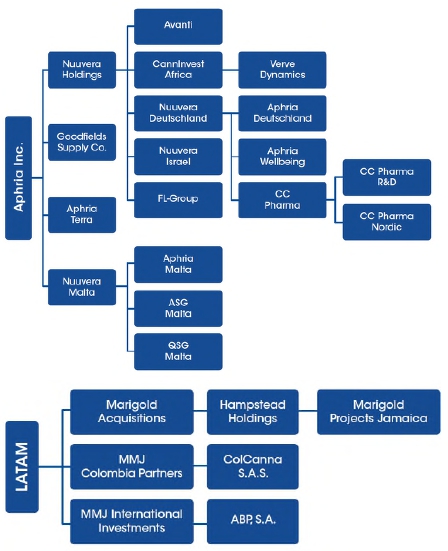

Comparison to competitors7

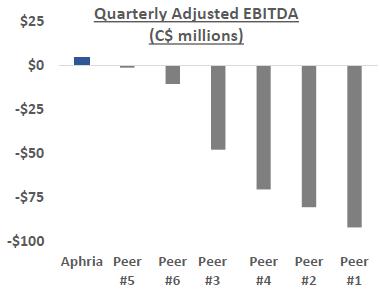

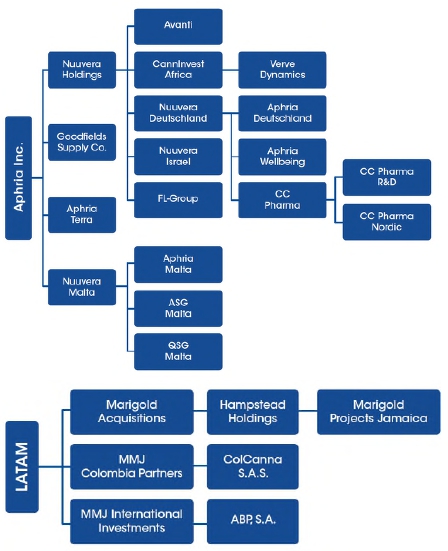

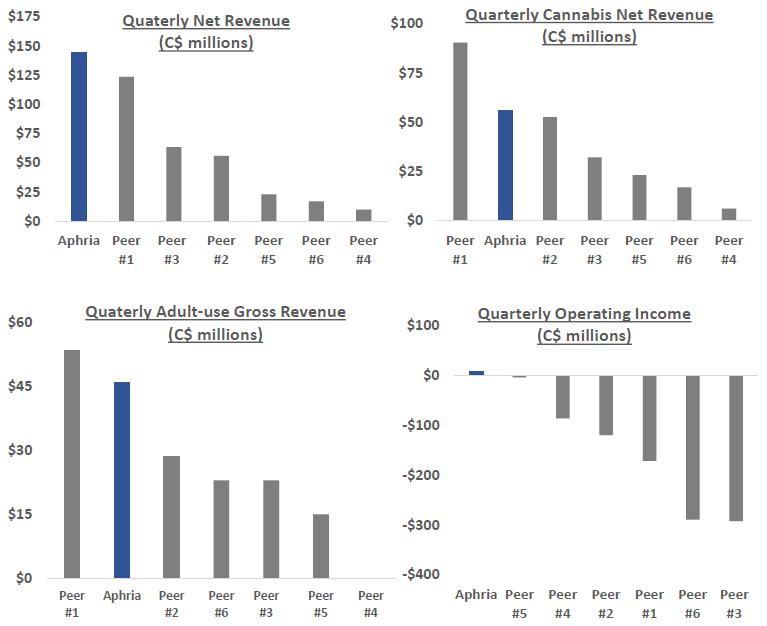

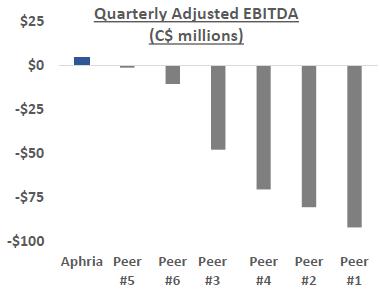

Aphria continues to be a leader in measurable financial

performance in the highly competitive legal cannabis market, exceeding most of its competitors on a variety of metrics. The Company’s

record of consecutive quarters of positive adjusted EBITDA, focus on profitability, operational efficiency and cannabis revenue

is at or near the top of its peer group. Further, the Company continues to maintain a strong cash position, reflecting its strong