Exhibit 99.1

Aphria Inc.

CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS AND NINE MONTHS ENDED FEBRUARY 28, 2019 AND FEBRUARY 28, 2018

(Unaudited, expressed in Canadian Dollars, unless otherwise noted)

Aphria Inc.

Condensed Interim Consolidated Statements of Financial Position

(Unaudited – In thousands of Canadian dollars)

| Note | February 28, 2019 |

May 31, 2018 | ||||

| Assets | ||||||

| Current assets | ||||||

| Cash and cash equivalents | $ 107,502 | $ 59,737 | ||||

| Marketable securities | 4 | 27,234 | 45,062 | |||

| Accounts receivable | 44,142 | 3,386 | ||||

| Other current assets | 5 | 24,615 | 14,384 | |||

| Inventory | 6 | 86,227 | 22,150 | |||

| Biological assets | 7 | 7,261 | 7,331 | |||

| Assets held for sale | -- | 40,620 | ||||

| Current portion of convertible notes receivable | 12 | 11,500 | 1,942 | |||

| 308,481 | 194,612 | |||||

| Capital assets | 9 | 466,349 | 303,151 | |||

| Intangible assets | 10 | 388,125 | 226,444 | |||

| Convertible notes receivable | 12 | 18,542 | 16,129 | |||

| Interest in equity investees | 13 | 9,604 | 4,966 | |||

| Long-term investments | 14 | 125,325 | 46,028 | |||

| Promissory notes receivable | 15 | 61,809 | -- | |||

| Goodwill | 11 | 674,412 | 522,762 | |||

| $ 2,052,647 | $ 1,314,092 | |||||

| Liabilities | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | $ 125,598 | $ 31,517 | ||||

| Income taxes payable | 1,568 | 3,584 | ||||

| Deferred revenue | 28,171 | 2,607 | ||||

| Current portion of promissory note payable | 18 | 489 | 610 | |||

| Current portion of long-term debt | 19 | 14,612 | 2,140 | |||

| Current portion of option payment liability | 20 | 6,765 | -- | |||

| Current portion of derivative liability | -- | 3,396 | ||||

| 177,203 | 43,854 | |||||

| Long-term liabilities | ||||||

| Long-term debt | 19 | 62,279 | 28,337 | |||

| Option payment liability | 20 | 14,277 | -- | |||

| Derivative liability | -- | 9,055 | ||||

| Deferred tax liability | 16 | 86,452 | 59,253 | |||

| 340,211 | 140,499 | |||||

| Shareholders’ equity | ||||||

| Share capital | 21 | 1,653,191 | 1,113,981 | |||

| Warrants | 22 | 1,336 | 1,375 | |||

| Share-based payment reserve | 33,218 | 22,006 | ||||

| Accumulated other comprehensive loss | (61) | (801) | ||||

| Non-controlling interest | 24 | 29,569 | 9,580 | |||

| Retained earnings (deficit) | (4,817) | 27,452 | ||||

| 1,712,436 | 1,173,593 | |||||

| $ 2,052,647 | $ 1,314,092 | |||||

Nature of operations (Note 1), Commitment and contingencies (Note 32), Subsequent events (Note 34)

Approved on behalf of the Board:

| “John Herhalt” | “Irwin Simon” |

| Signed: Director | Signed: Director |

The accompanying notes are an integral part of these condensed interim consolidated financial statements

| 2 |

Aphria Inc.

Condensed Interim Consolidated Statements of Income and Comprehensive Income

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| For the three months ended February 28, |

For the nine months ended February 28, | |||||||

| Note | 2019 | 2018 | 2019 | 2018 | ||||

| Revenue from cannabis produced | $ 17,862 | $ 10,267 | $ 52,816 | $ 24,891 | ||||

| Distribution revenue | 57,599 | -- | 58,745 | -- | ||||

| Other revenue | 545 | -- | 2,261 | -- | ||||

| Excise taxes | (2,424) | -- | (5,280) | -- | ||||

| Net revenue | 73,582 | 10,267 | 108,542 | 24,891 | ||||

| Production costs | 6 | 10,175 | 2,355 | 24,477 | 6,447 | |||

| Cost of goods purchased | 49,745 | -- | 50,856 | -- | ||||

| Other costs of sales | 296 | -- | 1,228 | -- | ||||

| Gross profit before fair value adjustments | 13,366 | 7,912 | 31,981 | 18,444 | ||||

| Fair value adjustment on sale of inventory | 6 | 5,542 | 3,443 | 18,075 | 7,250 | |||

| Fair value adjustment on growth of biological assets | 7 | (9,471) | (4,101) | (23,136) | (11,481) | |||

| Gross profit | 17,295 | 8,570 | 37,042 | 22,675 | ||||

| Operating expenses: | ||||||||

| General and administrative | 25 | 22,434 | 2,794 | 43,561 | 6,502 | |||

| Share-based compensation | 26 | 14,300 | 5,959 | 22,996 | 10,668 | |||

| Selling, marketing and promotion | 6,948 | 2,991 | 20,025 | 7,758 | ||||

| Amortization | 3,665 | 755 | 9,556 | 1,270 | ||||

| Research and development | 223 | 110 | 1,097 | 280 | ||||

| Impairment | 11 | 58,039 | -- | 58,039 | -- | |||

| Transaction costs | 942 | 4,253 | 2,930 | 4,253 | ||||

| 106,551 | 16,862 | 158,204 | 30,731 | |||||

| Operating income (loss) | (89,256) | (8,292) | (121,162) | (8,056) | ||||

| Non-operating income (loss) | 27 | (30,416) | 25,308 | 89,304 | 50,635 | |||

| Income (loss) before income taxes (recovery) | (119,672) | 17,016 | (31,858) | 42,579 | ||||

| Income taxes (recovery) | 16 | (11,463) | 4,072 | 401 | 8,139 | |||

| Net income (loss) | (108,209) | 12,944 | (32,259) | 34,440 | ||||

| Other comprehensive gain (loss) | ||||||||

| Other comprehensive gain (loss) | (61) | -- | (61) | (801) | ||||

| Net comprehensive income (loss) | $ (108,270) | $ 12,944 | $ (32,320) | $ 33,639 | ||||

| Total comprehensive income (loss) is attributable to: | ||||||||

| Shareholders of Aphria Inc. | (107,886) | 12,945 | (31,529) | 33,640 | ||||

| Non-controlling interest | 24 | (384) | (1) | (791) | (1) | |||

| $ (108,270) | $ 12,944 | $ (32,320) | $ 33,639 | |||||

| Weighted average number of common shares - basic | 250,149,598 | 161,120,698 | 240,106,147 | 147,274,372 | ||||

| Weighted average number of common shares - diluted | 250,149,598 | 167,494,603 | 240,106,147 | 153,189,773 | ||||

| Earnings (loss) per share - basic | 29 | $(0.43) | $ 0.08 | $(0.13) | $ 0.23 | |||

| Earnings (loss) per share - diluted | 29 | $(0.43) | $ 0.08 | $(0.13) | $ 0.22 | |||

The accompanying notes are an integral part of these condensed interim consolidated financial statements

| 3 |

Aphria Inc.

Condensed Interim Consolidated Statements of Changes in Equity

(Unaudited – In thousands of Canadian dollars, except share amounts)

Number of common shares |

Share capital (Note 21) |

Warrants (Note 22) |

Share-based payment reserve |

Accumulated other comprehensive loss | Non- controlling interest (Note 24) |

Retained earnings (deficit) |

Total | ||||

| Balance at May 31, 2017 | 138,628,704 | $ 274,317 | $ 445 | $ 3,230 | $ -- | $ -- | $ (4,123) | $ 273,869 | |||

| Share issuance - November 2017 bought deal | 12,689,675 | 86,661 | -- | -- | -- | -- | -- | 86,661 | |||

| Share issuance - Broken Coast acquisition | 8,363,651 | 109,000 | -- | -- | -- | -- | -- | 109,000 | |||

| Share issuance - January 2018 bought deal | 14,373,675 | 214,168 | -- | -- | -- | -- | -- | 214,168 | |||

| Share issuance - warrants exercised | 1,584,036 | 2,400 | -- | -- | -- | -- | -- | 2,400 | |||

| Share issuance - options exercised | 2,053,000 | 5,338 | -- | (2,000) | -- | -- | -- | 3,338 | |||

| Share issuance - deferred share issuance costs | 5,050 | 62 | -- | -- | -- | -- | -- | 62 | |||

| Share-based payments | -- | -- | -- | 9,769 | -- | -- | -- | 9,769 | |||

| Income tax recovery on share issuance costs | -- | 3,002 | -- | -- | -- | -- | -- | 3,002 | |||

| Shares held in escrow for services not yet earned | -- | 187 | -- | -- | -- | -- | -- | 187 | |||

| Non-controlling interest | -- | -- | -- | -- | -- | 9,800 | -- | 9,800 | |||

| Net comprehensive income for the period | -- | -- | -- | -- | (801) | (1) | 34,441 | 33,639 | |||

| Balance at February 28, 2018 | 177,697,791 | $ 695,135 | $ 445 | $ 10,999 | $ (801) | $ 9,799 | $ 30,318 | $ 745,895 | |||

| Number of common shares |

Share capital (Note 21) |

Warrants (Note 22) |

Share-based payment reserve |

Accumulated other comprehensive loss | Non- controlling interest (Note 24) |

Retained earnings (deficit) |

Total | ||||

| Balance at May 31, 2018 | 210,169,924 | $ 1,113,981 | $ 1,375 | $ 22,006 | $ (801) | $ 9,580 | $ 27,452 | $ 1,173,593 | |||

| Share issuance - June 2018 bought deal | 21,835,510 | 245,925 | -- | -- | -- | -- | -- | 245,925 | |||

| Additional share issuance - Broken Coast acquisition | 19,963 | 297 | -- | -- | -- | -- | -- | 297 | |||

| Share issuance - LATAM acquisition | 15,678,310 | 273,900 | -- | -- | -- | 11,341 | -- | 285,241 | |||

| Share issuance - warrants exercised | 448,518 | 1,609 | (39) | -- | -- | -- | -- | 1,570 | |||

| Share issuance - options exercised | 2,429,177 | 14,053 | -- | (9,192) | -- | -- | -- | 4,861 | |||

| Income tax recovery on share issuance costs | -- | 3,426 | -- | -- | -- | -- | -- | 3,426 | |||

| Share-based payments | -- | -- | -- | 20,404 | -- | -- | -- | 20,404 | |||

| Elimination of CTA on disposal of equity investee | -- | -- | -- | -- | 801 | -- | (801) | -- | |||

| Non-controlling interest | -- | -- | -- | -- | -- | 9,439 | -- | 9,439 | |||

| Net comprehensive income for the period | -- | -- | -- | -- | (61) | (791) | (31,468) | (32,320) | |||

| Balance at February 28, 2019 | 250,581,402 | $ 1,653,191 | $ 1,336 | $ 33,218 | $ (61) | $ 35,737 | $ (4,817) | $ 1,718,604 | |||

The accompanying notes are an integral part of these condensed interim consolidated financial statements

| 4 |

Aphria Inc.

Condensed Interim Consolidated Statements of Cash Flows

(Unaudited – In thousands of Canadian dollars)

| For the nine months ended February 28, | ||||||

| Note | 2019 | 2018 | ||||

| Cash generated from (used in) operating activities: | ||||||

| Net income (loss) for the period | $ (32,259) | $ 34,440 | ||||

| Adjustments for: | ||||||

| Other comprehensive income | (61) | -- | ||||

| Future income taxes | 16 | (4,297) | 6,030 | |||

| Fair value adjustment on sale of inventory | 6 | 18,075 | 7,250 | |||

| Fair value adjustment on growth of biological assets | 7 | (23,136) | (11,481) | |||

| Loss on marketable securities | 4 | 151 | 2,193 | |||

| Unrealized foreign exchange gain | (28) | (60) | ||||

| Amortization | 9,10 | 14,329 | 2,869 | |||

| Loss on sale of capital assets | 9 | -- | 191 | |||

| Impairment | 11 | 58,039 | -- | |||

| Unrealized loss (gain) on convertible notes receivable | 12 | 1,087 | (1,731) | |||

| Gain on dilution of ownership in equity investee | 13 | (2,210) | (7,535) | |||

| Loss from equity investees | 13 | 830 | 9,281 | |||

| Gain on sale of equity investee | 13 | (57,351) | (26,347) | |||

| Deferred gain recognized | (618) | (700) | ||||

| Consulting revenue | 18 | -- | (689) | |||

| Other non-cash items | (86) | 6 | ||||

| Share-based compensation | 26 | 22,996 | 10,668 | |||

| Gain (loss) on long-term investments | 28 | (23,235) | (39,701) | |||

| Unrealized loss on financial liabilities | 13 | 1,109 | 16,850 | |||

| Transaction costs | -- | 4,253 | ||||

| Change in non-cash working capital | 30 | (9,890) | (5,217) | |||

| (36,555) | 570 | |||||

| Cash provided by financing activities: | ||||||

| Share capital issued, net of cash issuance costs | 245,925 | 195,661 | ||||

| Share capital issued on warrants and options exercised | 6,431 | 5,800 | ||||

| Proceeds from non-controlling interest | -- | 9,800 | ||||

| Advances from related parties | 8 | 988 | 9,260 | |||

| Repayment of amounts due to related parties | 8 | (988) | (8,764) | |||

| Proceeds from long-term debt | 19 | 27,841 | -- | |||

| Repayment of long-term debt | 19 | (1,702) | (620) | |||

| 278,495 | 211,137 | |||||

| Cash used in investing activities: | ||||||

| Investment in marketable securities | 4 | -- | (7,365) | |||

| Proceeds from disposal of marketable securities | 4 | 17,677 | 38,271 | |||

| Investment in capital and intangible assets, net of shares issued | 9,10 | (162,194) | (153,605) | |||

| Proceeds from disposal of capital assets | 9 | -- | 200 | |||

| Convertible notes advances | 12 | (15,000) | (14,001) | |||

| Repayment of convertible notes receivable | 1,942 | 640 | ||||

| Investment in long-term investments and equity investees | (70,677) | (45,746) | ||||

| Proceeds from disposal of long-term investments and equity investees | 56,962 | 7,468 | ||||

| Net cash paid on business acquisitions and investment in CannInvest Africa Ltd. | (22,885) | 1,956 | ||||

| (194,175) | (172,182) | |||||

| Net increase in cash and cash equivalents | 47,765 | 39,525 | ||||

| Cash and cash equivalents, beginning of period | 59,737 | 79,910 | ||||

| Cash and cash equivalents, end of period | $ 107,502 | $ 119,435 | ||||

The accompanying notes are an integral part of these condensed interim consolidated financial statements

| 5 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| 1. | Nature of operations |

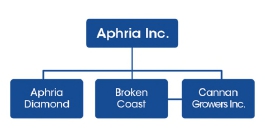

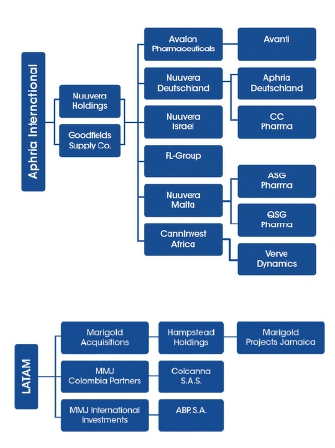

Aphria Inc. (the "Company" or “Aphria”) existing under the laws of Business Corporations Act (Ontario) and is licensed to produce and sell cannabis under The Cannabis Act. In February 2018, the Company acquired Broken Coast Cannabis Ltd. (“Broken Coast”) (Note 11). Broken Coast is licensed to produce and sell cannabis under The Cannabis Act. In March 2018, the Company acquired Nuuvera Inc. (“Nuuvera”) (Note 11). Nuuvera is an international organization with a focus on building a global cannabis brand, with operations in Germany, Italy, Malta, and Lesotho. In January 2019, Aphria through wholly-owned subsidiary Nuuvera Deutschland GmbH acquired CC Pharma GmbH (“CC Pharma”) (Note 11). CC Pharma is a leading distributor of pharmaceutical products, including medical cannabis, to more than 13,000 pharmacies in Germany. In September 2018, the Company acquired LATAM Holdings Inc. (“LATAM”) (Note 11). This purchase provides Aphria an early foothold into the Latin American cannabis market whereby LATAM holds licenses and license applications presently in-process for production, import, export and sale of cannabis and cannabis derivatives in Colombia, Argentina and Jamaica.

In July 2018, Aphria Inc. and its wholly-owned subsidiary, Pure Natures Wellness Inc. (o/a Aphria) amalgamated.

1974568 Ontario Ltd. (“Aphria Diamond”) is a 51% majority owned subsidiary of the Company, incorporated in November 2017. Aphria Diamond has applied for its cultivation licence under the provisions of The Cannabis Act.

The registered office of the Company is located at 1 Adelaide Street East Suite 2310, Toronto, Ontario.

The Company’s common shares are listed under the symbol “APHA” on the Toronto Stock Exchange (“TSX”) in Canada and the New York Stock Exchange (“NYSE”) in the United States.

These condensed interim consolidated financial statements were approved by the Company’s Board of Directors on April 14, 2019.

| 2. | Basis of preparation |

| (a) | Statement of compliance |

The Company’s condensed interim consolidated financial statements have been prepared in accordance with IAS 34, “Interim Financial Reporting”. These condensed interim consolidated financial statements do not include all notes of the type normally included within the annual financial report and should be read in conjunction with the audited financial statements of the Company for the year ended May 31, 2018, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and Interpretations of the IFRS Interpretations Committee.

| (b) | Basis of measurement |

These condensed interim consolidated financial statements have been prepared on the going concern basis, under the historical cost convention except for certain financial instruments that are measured at fair value and biological assets that are measured at fair value less costs to sell, as detailed in the Company’s accounting policies.

| (c) | Foreign currency |

All figures presented in the condensed interim consolidated financial statements are reflected in Canadian dollars; however, the functional currency of the Company includes the Canadian dollar and the Euro.

Foreign currency transactions are translated to the respective functional currencies of the Company’s entities at the exchange rates in effect on the date of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated to the functional currency at the foreign exchange rate applicable at the statement of financial position date. Non-monetary items carried at historical cost denominated in foreign currencies are translated to the functional currency at the date of the transactions. Non-monetary items carried at fair value denominated in foreign currencies are translated to the functional currency at the date when the fair value was determined. Realized and unrealized exchange gains and losses are recognized through profit and loss.

On consolidation, the assets and liabilities of foreign operations reported in their functional currencies, including marketable securities, long-term investments and promissory notes payable, are translated into Canadian dollars, the Group’s presentation currency, at period-end exchange rates. Income and expenses, and cash flows of foreign operations are translated into Canadian dollars using average exchange rates. Exchange differences resulting from translating foreign operations are recognized in other comprehensive income and accumulated in equity. The Company and all of its subsidiaries functional currency is Canadian dollars, with the exception of CC Pharma whose functional currency is the Euro.

| 6 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| (d) | Basis of consolidation |

Subsidiaries are entities controlled by the Company. Control exists when the Company has the power, directly and indirectly, to govern the financial and operating policies of an entity and be exposed to the variable returns from its activities. The financial statements of subsidiaries are included in the condensed interim consolidated financial statements from the date that control commences until the date that control ceases.

| Subsidiaries | Jurisdiction of incorporation | Ownership interest (1) |

| Aphria (Arizona) Inc. (2) | Arizona, United States | 100% |

| Cannan Growers Inc. | British Columbia, Canada | 100% |

| Nuuvera Inc. | Ontario, Canada | 100% |

| Nuuvera Holdings Limited | Ontario, Canada | 100% |

| ARA - Avanti Rx Analytics Inc. | Ontario, Canada | 100% |

| Avalon Pharmaceuticals Inc. | Ontario, Canada | 100% |

| Nuuvera Israel Ltd. (2) | Israel | 100% |

| Nuuvera Deutschland GmbH | Germany | 100% |

| Aphria Deutschland GmbH | Germany | 100% |

| FL-Group | Italy | 100% |

| Broken Coast Cannabis Ltd. | British Columbia, Canada | 100% |

| Goodfields Supply Co. Ltd. | United Kingdom | 100% |

| LATAM Holdings Inc. | British Columbia, Canada | 100% |

| MMJ Columbia Partners Inc. | Ontario, Canada | 100% |

| Marigold Acquisitions Inc. | British Columbia, Canada | 100% |

| Hampstead Holdings Ltd. | Bermuda | 100% |

| MMJ International Investments Inc. | British Columbia, Canada | 100% |

| ABP, S.A. | Argentina | 100% |

| CC Pharma GmbH | Germany | 100% |

| CC Pharma Research and Development GmbH | Germany | 100% |

| Marigold Projects Jamaica Limited | Jamaica | 95% |

| Nuuvera Malta Ltd. | Malta | 90% |

| ASG Pharma Ltd. | Malta | 90% |

| QSG Health Ltd. | Malta | 90% |

| ColCanna S.A.S. | Colombia | 90% |

| CC Pharma Nordic ApS | Denmark | 75% |

| 1974568 Ontario Ltd. | Ontario, Canada | 51% |

| Aphria Terra S.R.L. | Italy | 50.1% |

| Aphria Italy S.p.A. | Italy | 51% |

| CannInvest Africa Ltd. | South Africa | 50% |

| Verve Dynamics Incorporated (Pty) Ltd. | Lesotho | 30% |

| (1) | The Company defines ownership interest as the interest in which the Company is entitled a proportionate share of net income. Legal ownership of some subsidiaries may differ from ownership interest shown above. |

| (2) | Represents inactive subsidiaries, which have no operations and do not own any assets, save and except for related party balances owing to the Company. |

Intragroup balances, and any unrealized gains and losses or income and expenses arising from transactions with jointly controlled entities are eliminated to the extent of the Company’s interest in the entity.

The Company treats transactions with non-controlling interests that do not result in a loss of control as transactions with equity owners of the Company. A change in ownership interest results in an adjustment between the carrying amounts of the controlling and non-controlling interests to reflect their relative interests in the subsidiary. Any difference between the amount of the adjustment to non-controlling interests and any consideration paid or received is recognized in a separate reserve within equity attributable to the owners of the Company.

| 7 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| (e) | Amalgamations |

Effective June 1, 2017, CannWay Pharmaceuticals Ltd. (“CannWay”), a wholly-owned subsidiary of the Company, was amalgamated with Pure Natures Wellness Inc. (o/a Aphria). The Company has historically presented all balances and activities of CannWay as a fully consolidated entity for financial statement presentation purposes. As of the date of amalgamation, CannWay did not have any assets or outstanding liabilities. There are no material changes to be considered prospectively or to the comparative consolidated statements as a result of the amalgamation.

Effective July 23, 2018, Pure Natures Wellness Inc. (o/a Aphria). (“PNW”), a wholly-owned subsidiary of the Company, was amalgamated with Aphria Inc. The Company had historically presented all balances and activities of PNW as a fully consolidated entity for financial statement presentation purposes. There were no material changes to be considered prospectively or to the comparative consolidated statements as a result of the amalgamation.

Effective February 1, 2019, 2589671 Ontario Inc. and 2589674 Ontario Inc., each a wholly-owned subsidiary of the Company, were amalgamated with Avalon Pharmaceuticals Inc. The Company has historically presented all balances and activities of 2589671 Ontario Inc., 2589674 Ontario Inc. and Avalon Pharmaceuticals Inc. as a fully consolidated entity for financial statement presentation purposes. There were no material changes to be considered prospectively or to the comparative consolidated statements as a result of the amalgamation.

| (f) | Interest in equity investees |

The Company’s interest in equity investees is comprised of its interest in Althea Company Pty Ltd. (“Althea”).

In accordance with IFRS 10, associates are those in which the Company has significant influence, but not control or joint control over the financial and accounting policies.

Interests in associates are accounted for using the equity method in accordance with IAS 28. They are recognized initially at cost, which includes transaction costs. After initial recognition, the condensed interim consolidated financial statements include the Company’s share of the profit or loss and other comprehensive income (“OCI”) of equity investees until the date on which significant influence ceases.

If the Company’s share of losses in an equity investment equals or exceeds its interest in the entity, including any other unsecured long-term receivables, the group does not recognize further losses, unless it has incurred obligations or made payments on behalf of the other entity.

Unrealized gains on transactions between the Company and its associates are eliminated to the extent of the Company’s interest in these entities. Unrealized losses are also eliminated unless the transaction provides evidence of an impairment of the asset transferred.

The carrying amount of equity investments is tested for impairment in accordance with the policy described in the annual audited financial statements.

| 3. | Significant accounting policies |

These condensed interim consolidated financial statements have been prepared following the same accounting policies used in the preparation of the audited financial statements of the Company for the year ended May 31, 2018.

New standards applicable during the reporting period

IFRS 9 - Financial Instruments; Classification and Measurement, effective for annual periods beginning on or after January 1, 2018, with early adoption permitted, introduces new requirements for the classification, measurement and derecognition of financial instruments and introduces a new impairment model for financial assets.

| 8 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

Under IFRS 9, financial instruments are initially measured at fair value plus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs. Subsequently, all assets within scope of IFRS 9 are measured at:

| (i) | Amortized cost; |

| (ii) | Fair value through other comprehensive income (“FVOCI”); or |

| (iii) | Fair value through profit or loss (“FVTPL”). |

The classification is based on whether the contractual cash flows give rise to payments on specified dates that are solely payments of principal and interest (the “SPPI test”), and the objective of the Company’s business model is to hold assets only to collect cash flows, or to collect cash flows and to sell (the “Business Model test”). Financial assets are required to be reclassified only when the business model under which they are managed has changed. All reclassifications are to be applied prospectively from the reclassification date.

The impairment requirements under IFRS 9 are based on an expected credit loss (“ECL”) model, replacing the IAS 39 incurred loss model. The expected credit loss model applies to debt instruments recorded at amortized cost or at FVOCI, such as loans, debt, securities and trade receivables, lease receivables and most loan commitments and financial guarantee contracts.

The following table summarizes the original measurement categories under IAS 39 and the new measurement categories under IFRS 9 for each class of the Company’s financial assets and financial liabilities:

| Financial assets/liabilities | IAS 39 Classification | IFRS 9 Classification |

| Cash and cash equivalents | FVTPL | FVTPL |

| Marketable securities | FVTPL | FVTPL |

| Accounts receivable | loans and receivables | amortized cost |

| Other receivables | loans and receivables | amortized cost |

| Convertible notes receivable | AFS | FVTPL |

| Long-term investments | FVTPL | FVTPL |

| Accounts payable and accrued liabilities | other financial liabilities | other financial liabilities |

| Income taxes payable | other financial liabilities | other financial liabilities |

| Promissory note payable | other financial liabilities | other financial liabilities |

| Long-term debt | other financial liabilities | other financial liabilities |

| Derivative liability | derivative financial instruments | FVTPL |

There were no other changes on adoption aside from the above classification changes.

IFRS 15 - Revenue from Contracts with Customers; effective for annual periods beginning on or after January 1, 2018, specifies how and when to recognize revenue, based on five-step model, and enhances relevant disclosures to be applied to all contracts with customers.

The Company has applied IFRS 15 retrospectively and determined that there is no change to the comparative periods or transitional adjustments required as a result of the adoption of this standard. The Company’s accounting policy for revenue recognition under IFRS 15 is as follows:

To recognize revenue under IFRS 15, the Company applies the following five steps:

| 1. | Identify the contract(s) with a customer |

| 2. | Identify the performance obligations in the contract |

| 3. | Determine the transaction price |

| 4. | Allocate the transaction price to the performance obligations in the contract |

| 5. | Recognize revenue when or as the Company satisfies a performance obligation |

Revenue from the direct sale of goods to customers for a fixed price is recognized when the company transfers control of the good to the customer.

New standards and interpretations issued but not yet adopted

IFRS 16 - Leases; in January 2016, the IASB issued IFRS 16, which specifies how an IFRS reporter will recognise, measure, present and disclose leases. The standard provides a single lessee accounting model, requiring lessees to recognise assets and liabilities for all leases unless the lease term is 12 months or less or the underlying asset has a low value. Lessors continue to classify leases as operating or finance, with IFRS 16’s approach to lessor accounting substantially unchanged from its predecessor, IAS 17. IFRS 16 is effective for annual reporting periods beginning on or after January 1, 2019, and a lessee shall either apply IFRS 16 with full retrospective effect or alternatively not restate comparative information but recognise the cumulative effect of initially applying IFRS 16 as an adjustment to opening equity at the date of initial application. Early adoption is permitted if IFRS 15 has also been adopted. Based on its current assets, interests and investments, no significant impact is anticipated from the new standard.

| 9 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

There are no other standards that are not yet effective and that would be expected to have a material impact on the Company in the current or future reporting periods and on foreseeable future transactions.

The Company has reclassified certain immaterial items on the comparative consolidated statements of financial position, consolidated statements of income and comprehensive income, and consolidated statements of cash flows to improve clarity.

| 4. | Marketable securities |

Marketable securities are classified as fair value through profit or loss, and are comprised of:

| S&P rating at purchase | Interest rate |

Maturity date |

February 28, 2019 |

May 31, 2018 | ||

| Fixed Income: | ||||||

| Ford Motor Credit Co. LLC | BBB | 3.700% | 8/2/2018 | $ -- | $ 1,015 | |

| Sobeys Inc. | BB+ | 3.520% | 8/8/2018 | -- | 3,040 | |

| Canadian Western Bank | A- | 3.077% | 1/14/2019 | -- | 1,528 | |

| Sun Life Financial Inc. | A | 2.770% | 5/13/2019 | 3,026 | 3,018 | |

| Ford Motor Credit Co. LLC | BBB | 3.140% | 6/14/2019 | 5,040 | 5,101 | |

| Canadian Western Bank | A- | 3.463% | 12/17/2019 | 1,011 | 1,025 | |

| Laurentian Bank of Canada | BBB | 2.500% | 1/23/2020 | -- | 3,003 | |

| Enercare Solutions Inc. | BBB | 4.600% | 2/3/2020 | 3,878 | 3,974 | |

| Enbridge Inc. | BBB+ | 4.530% | 3/9/2020 | 5,200 | 5,203 | |

| Choice Properties REIT | BBB | 3.600% | 4/20/2020 | 5,109 | 5,091 | |

| Westcoast Energy Inc. | BBB+ | 4.570% | 7/2/2020 | -- | 5,293 | |

| Citigroup Inc. (USD) | BBB+ | 2.050% | 12/17/2018 | -- | 3,914 | |

| Royal Bank of Canada (USD) | AA- | 1.625% | 4/15/2019 | 3,970 | 3,857 | |

| $ 27,234 | $ 45,062 | |||||

The cost of marketable securities as at February 28, 2019 was $27,932 (May 31, 2018 - $45,863). During the three and nine months ended February 28, 2019, the company divested of certain marketable securities in its Canadian portfolio for proceeds of $5,472 and $17,677, resulting in a gain (loss) on disposal of $30 and $(116) (2018 - $10 and $(377)), and re-invested $nil and $nil (2018 - $2,365 and $7,365). During the three and nine months ended February 28, 2019, the Company recognized a gain (loss) of $(41) and $(151) (2018 - $(502) and $(2,193)) on its marketable securities portfolio, of which $(71) and $(35) (2018 - $(512) and $(1,816)) represented unrealized fair value adjustments.

| 5. | Other current assets |

Other current assets are comprised of:

| February 28, 2019 |

May 31, 2018 | |||

| Sales tax receivable | $ 5,052 | $ 10,840 | ||

| Accrued interest | 2,811 | 831 | ||

| Prepaid assets | 14,491 | 1,720 | ||

| Other | 2,261 | 993 | ||

| $ 24,615 | $ 14,384 |

| 10 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| 6. | Inventory |

Inventory is comprised of:

| Capitalized cost |

Fair value adjustment |

February 28, 2019 |

May 31, 2018 | |

| Harvested cannabis | $ 8,977 | $ 10,278 | $ 19,255 | $ 12,331 |

| Harvested cannabis trim | 1,838 | 2,112 | 3,950 | 2,277 |

| Cannabis oil | 11,168 | 7,304 | 18,472 | 6,578 |

| Softgel capsules | 378 | 273 | 651 | -- |

| Distribution inventory | 34,447 | -- | 34,447 | -- |

| Other inventory items | 9,452 | -- | 9,452 | 964 |

| $ 66,260 | $ 19,967 | $ 86,227 | $ 22,150 |

During the three and nine months ended February 28, 2019, the Company recorded $10,175 and $24,447 (2018 - $2,355 and $6,447) related to production costs. Included in production costs for the three and nine months ended February 28, 2019 is $238 and $1,432 of cannabis oil conversion costs (2018 - $62 and $157), $22 and $135 related to the cost of accessories (2018 - $71 and $169) and $788 and $2,321 (2018 - $473 and $1,362) of amortization. The Company also included $1,016 and $2,452 of amortization in inventory for the three and nine months ended February 28, 2019 (2018 - $237 and $237) related to capital assets utilized in production. During the three and nine months ended February 28, 2019, the Company expensed $5,542 and $18,075 (2018 - $3,443 and $7,250) of fair value adjustments on the sale of its biological assets included in inventory.

During the three months ended August 31, 2018, the Company also disposed of 13,642 plants prior to harvest. Included in production costs is $979 of accumulated costs relating to these plants which were not harvested.

The Company holds 5,217.7 kilograms of harvested cannabis (May 31, 2018 - 3,221.3 kgs), 1,509.4 kilograms of harvested cannabis trim (May 31, 2018 - 702.0 kgs) and 23,456.3 litres of cannabis oils or 5,212.5 kilograms equivalent in various stages of production (May 31, 2018 - 7,724.7 litres or 1,716.6 kilograms equivalent), 836.5 litres of cannabis oils used in softgel capsules or 185.9 kilograms equivalent (May 31, 2018 - nil) at February 28, 2019.

| 7. | Biological assets |

Biological assets are comprised of:

| Amount | |||||

| Balance at May 31, 2018 | $ 7,331 | ||||

| Changes in fair value less costs to sell due to biological transformation | 23,136 | ||||

| Production costs capitalized | 24,233 | ||||

| Transferred to inventory upon harvest | (47,439) | ||||

| Balance at February 28, 2019 | $ 7,261 | ||||

The Company values medical cannabis plants at fair value. Management determined that cost approximates fair value from the date of initial clipping from mother plants until the fourth week prior to harvest. Measurement of the biological transformation of the plant at fair value less costs to sell begins in the fourth week prior to harvest and is recognized evenly until the point of harvest. The number of weeks in the growing cycle is between twelve and sixteen weeks from propagation to harvest. The Company has determined the fair value less costs to sell of greenhouse harvested cannabis and trim to be $3.50 and $2.75 per gram respectively (May 31, 2018 - $3.75 and $3.00 per gram) and $4.00 and $3.25 per gram respectively (May 31, 2018 - $4.25 and $3.50 per gram), upon harvest for indoor produced cannabis and trim.

The effect of the fair value less cost to sell over and above historical cost was an increase in non-cash value of biological assets and inventory of $9,471 and $23,136 during the three and nine months ended February 28, 2019 (2018 - increase of $4,101 and $11,481).

The fair value of biological assets is determined using a valuation model to estimate expected harvest yield per plant applied to the estimated price per gram less processing and selling costs. When there is a material change from the expected fair value used for cannabis, the Company will necessitate the fair value used in this calculation be adjusted. In the prior quarter, as a result of the newly enacted adult-use market along with the introduction of the excise duty tax, the Company determined a reduction of $0.25 per gram was warranted. The majority of the adult-use transactions are wholesale through provincial distribution agencies and as a result the net selling price and the selling costs are lower.

| 11 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

In determining the fair value of biological assets, management has made the following estimates in this valuation model:

| • | The harvest yield is between 40 grams and 80 grams per plant; |

| • | The selling price is between $3.00 and $7.00 per gram; |

| • | Processing costs include drying and curing, testing, post-harvest overhead allocation, packaging and labelling costs between $0.30 and $0.80 per gram; and |

| • | Selling costs include shipping, order fulfilment, patient acquisition and patient maintenance costs between $0.00 and $1.50 per gram. |

Sales price used in the valuation of biological assets is based on the historical average selling price of all cannabis products and can vary based on different strains being grown as well as the proportion of sales derived from wholesale compared to retail. The low-end of the selling price, processing costs and selling costs are derived from historical wholesale sales, while the higher end prices and costs are from historical retail sales. Selling costs vary depending on methods of selling and are considered based on the expected method of selling and the determined additional costs which would be incurred. Expected yields for the cannabis plant is also subject to a variety of factors, such as strains being grown, length of growing cycle, and space allocated for growing. Management reviews all significant inputs, at each reporting period, based on historical information obtained as well as based on planned production schedules.

Management has quantified the sensitivity of the inputs and determined the following:

| • | Selling price per gram - a decrease in the average selling price per gram by 5% would result in the biological asset value decreasing by $255 (May 31, 2018 - $267) and inventory decreasing by $2,146 (May 31, 2018 - $1,040); |

| • | Harvest yield per plant - a decrease in the harvest yield per plant of 5% would result in the biological asset value decreasing by $135 (May 31, 2019 - $179). |

These inputs are level 3 on the fair value hierarchy, and are subject to volatility in market prices and several uncontrollable factors, which could significantly affect the fair value of biological assets in future periods.

| 8. | Related party transactions |

During the prior quarter, the Company disposed of its remaining shares in Liberty Health Sciences Inc. (“Liberty”) (note 13).

The Company previously funded a portion of the Canadian operating costs of Liberty, for which Liberty reimbursed the Company quarterly. Liberty was considered a related party because certain officers and directors of Aphria were directors of Liberty. During the quarter, those directors resigned from Liberty’s board and the Company ceased its relationship with Liberty.

The Company purchased certain electrical generation equipment from and pays rent to a company owned by a former director. Subsequent to quarter end, the director resigned his officer and director position with the Company.

During the three and nine months ended February 28, 2019, related party corporations charged or incurred expenditures on behalf of the Company (including rent) totaling $20 and $158 (2018 - $112 and $205). Included in this amount was rent of $12 and $20 charged during the three and nine months ended February 28, 2019 (2017 - $10 and $36).

| Amount | |||||

| Balance due to (from) related parties as at May 31, 2018 | $ -- | ||||

| Related party charges in the period | 158 | ||||

| Payments to related parties in the period | (158) | ||||

| Payments made on behalf of related parties in the period | (830) | ||||

| Repayments made by related parties in the period | 830 | ||||

| Balance at February 28, 2019 | $ -- | ||||

| 12 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

Key management personnel compensation for the nine months ended February 28, 2019 and 2018 was comprised of:

| For the nine months ended February 28, | |||||

| 2019 | 2018 | ||||

| Salaries | $ 3,257 | $ 1,197 | |||

| Short-term employment benefits (included in office and general) | 87 | 49 | |||

| Share-based compensation | 9,610 | 4,276 | |||

| $ 12,954 | $ 5,522 | ||||

Key management personnel compensation for the three months ended February 28, 2019 and 2018 was comprised of:

| For the three months ended February 28, | |||||

| 2019 | 2018 | ||||

| Salaries | $ 1,580 | $ 537 | |||

| Short-term employment benefits (included in office and general) | 29 | 13 | |||

| Share-based compensation | 8,308 | 2,059 | |||

| $ 9,917 | $ 2,609 | ||||

Directors and officers of the Company control 8.2% or 20,508,714 of the voting shares of the Company.

Prior to the end of the quarter, the Company announced a planned transition plan for its Chief Executive Officer, Mr. Neufeld. Prior to his resignation, the Company appointed Mr. Simon as Interim CEO and Chair of the Board. Mr. Simon’s base compensation is $1,100 annually, includes a target bonus of up to 45% of his base compensation and participation in the Company’s Omnibus Incentive Plan. On February 24, 2019, the Board of Aphria declared 1,000,000 stock options and 25,000 restricted share units to Mr. Simon, which vested immediately.

Subsequent to quarter end, certain officers and non-independent directors retired from the Company. No amounts were paid to the retired officers and directors as part of their retirement.

Subsequent to quarter end, the Board of Directors amended their compensation to $300 annually, with $150 paid in cash and $150 in Deferred Share Units under the Company’s Omnibus Plan each, plus a one-time award of 7,500 Restricted Share Units each.

| 13 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| 9. | Capital assets |

| Land | Production Facility | Equipment | Leasehold improvements | Construction in process | Total capital assets | |||

| Cost | ||||||||

| At May 31, 2017 | $ 10,829 | $ 16,170 | $ 5,340 | $ 262 | $ 42,159 | $ 74,760 | ||

| Business acquisitions | 854 | 6,992 | 2,860 | 1,388 | 5,947 | 18,041 | ||

| Additions | 12,716 | 47,149 | 4,759 | 15 | 151,899 | 216,538 | ||

| Transfers | 105 | 29,338 | 2,990 | -- | (32,433) | -- | ||

| Disposals | -- | (207) | -- | -- | (415) | (622) | ||

| At May 31, 2018 | 24,504 | 99,442 | 15,949 | 1,665 | 167,157 | 308,717 | ||

| Business acquisitions | 345 | 4,524 | 1,662 | 182 | 154 | 6,867 | ||

| Additions | 7,225 | 1,620 | 14,984 | 73 | 138,591 | 162,493 | ||

| Transfers | -- | 1,737 | 1,247 | (1,389) | (1,595) | -- | ||

| At February 28, 2019 | $ 32,074 | $ 107,323 | $ 33,842 | $ 531 | $ 304,307 | $ 478,077 | ||

| Accumulated depreciation | ||||||||

| At May 31, 2017 | $ -- | $ 983 | $ 1,260 | $ 62 | $ -- | $ 2,305 | ||

| Amortization | -- | 1,517 | 1,697 | 47 | -- | 3,261 | ||

| At May 31, 2018 | -- | 2,500 | 2,957 | 109 | -- | 5,566 | ||

| Amortization | -- | 2,690 | 3,441 | 31 | -- | 6,162 | ||

| At February 28, 2019 | $ -- | $ 5,190 | $ 6,398 | $ 140 | $ -- | $ 11,728 | ||

| Net book value | ||||||||

| At May 31, 2017 | $ 10,829 | $ 15,187 | $ 4,080 | $ 200 | $ 42,159 | $ 72,455 | ||

| At May 31, 2018 | $ 24,504 | $ 96,942 | $ 12,992 | $ 1,556 | $ 167,157 | $ 303,151 | ||

| At February 28, 2019 | $ 32,074 | $ 102,133 | $ 27,444 | $ 391 | $ 304,307 | $ 466,349 | ||

| 14 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| 10. | Intangible assets |

| Customer relationships | Corporate website | Licences, permits & applications | Non-compete agreements | Tokyo Smoke licensing agreement | Intellectual property, trademarks & brands | Total intangible assets | ||

| Cost | ||||||||

| At May 31, 2017 | $ -- | $ 218 | $ 1,250 | $ -- | $ 459 | $ 4,428 | $ 6,355 | |

| Business acquisitions | 11,730 | 39 | 137,920 | 1,930 | -- | 76,190 | 227,809 | |

| Additions | -- | 152 | -- | -- | -- | 9 | 161 | |

| At May 31, 2018 | 11,730 | 409 | 139,170 | 1,930 | 459 | 80,627 | 234,325 | |

| Business acquisitions | 17,213 | -- | 123,956 | 433 | -- | 15,042 | 156,644 | |

| Additions | -- | 221 | 11,778 | -- | -- | 1,205 | 13,204 | |

| At February 28, 2019 | $ 28,943 | $ 630 | $ 274,904 | $ 2,363 | $ 459 | $ 96,874 | $ 404,173 | |

| Accumulated depreciation | ||||||||

| At May 31, 2017 | $ -- | $ 156 | $ 153 | $ -- | $ -- | $ 4,155 | $ 4,464 | |

| Amortization | 1,274 | 100 | 124 | 314 | 92 | 1,513 | 3,417 | |

| At May 31, 2018 | 1,274 | 256 | 277 | 314 | 92 | 5,668 | 7,881 | |

| Amortization | 3,211 | 86 | 428 | 758 | 69 | 3,615 | 8,167 | |

| At February 28, 2019 | $ 4,485 | $ 342 | $ 705 | $ 1,072 | $ 161 | $ 9,283 | $ 16,048 | |

| Net book value | ||||||||

| At May 31, 2017 | $ -- | $ 62 | $ 1,097 | $ -- | $ 459 | $ 273 | $ 1,891 | |

| At May 31, 2018 | $ 10,456 | $ 153 | $ 138,893 | $ 1,616 | $ 367 | $ 74,959 | $ 226,444 | |

| At February 28, 2019 | $ 24,458 | $ 288 | $ 274,199 | $ 1,291 | $ 298 | $ 87,591 | $ 388,125 | |

| 15 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| 11. | Business Acquisitions |

Acquisition of Broken Coast Cannabis Ltd.

On February 13, 2018, the Company entered into a share purchase agreement to purchase all of the shares of Cannan Growers Inc. (“Cannan”), a holding company owning shares of Broken Coast Cannabis Ltd. (“Broken Coast”), and to acquire the remaining shares for a combined total of 99.86% of the issued and outstanding shares of Broken Coast. The combined purchase price was $214,168 satisfied through the issuance of an aggregate 14,373,675 common shares. The share purchase agreement entitled the Company to control over Broken Coast on February 1, 2018, which became the effective acquisition date. In August 2018, the Company came to terms with the holder of the remaining 0.14% of the issued and outstanding shares of Broken Coast. In exchange for purchasing the remaining shares, the Company issued 19,963 shares to the holder.

The table below summarizes the fair value of the assets acquired and the liabilities assumed at the acquisition date:

| Note | Number of shares | Share price | Amount | |||

| Consideration paid | ||||||

| Shares issued | (i) | 14,393,638 | $ 14.90 | $ 214,465 | ||

| Total consideration paid | $ 214,465 | |||||

| Net assets acquired | ||||||

| Current assets | ||||||

| Cash and cash equivalents | 2,007 | |||||

| Accounts receivable | 299 | |||||

| Other current assets | 43 | |||||

| Inventory | 2,572 | |||||

| Biological assets | 826 | |||||

| Long-term assets | ||||||

| Capital assets | 13,298 | |||||

| Customer relationships | 11,730 | |||||

| Corporate website | 39 | |||||

| Licences, permits & applications | 6,320 | |||||

| Non-competition agreements | 1,930 | |||||

| Intellectual property, trademarks & brands | 72,490 | |||||

| Goodwill | 146,091 | |||||

| Total assets | 257,645 | |||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 10,455 | |||||

| Income taxes payable | 922 | |||||

| Long-term liabilities | ||||||

| Deferred tax liability | 25,889 | |||||

| Long-term debt | 5,914 | |||||

| Total liabilities | 43,180 | |||||

| Total net assets acquired | $ 214,465 | |||||

| (i) | Share price based on the price of the shares on February 1, 2018. |

Net income and comprehensive income for the Company would have been higher by approximately $1,134 and $2,268 for the three and nine months ended February 28, 2018, if the acquisition had taken place on June 1, 2017. In connection with this transaction, the Company incurred transaction costs to date of $1,643.

| 16 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

Acquisition of Nuuvera Corp.

On March 23, 2018, the Company completed a definitive arrangement agreement (the “Arrangement Agreement”) pursuant to which the Company acquired Nuuvera, by way of a court-approved plan of arrangement, under the Business Corporations Act (Ontario) (the “Transaction”). The Company acquired 100% of the issued and outstanding common shares (on a fully diluted basis) of Nuuvera for a total consideration of $0.62 in cash plus 0.3546 of an Aphria share for each Nuuvera share held. All of Nuuvera’s outstanding options were exchanged for an equivalent option granted pursuant to Aphria’s stock option plan (each, a “Replacement Option”) to purchase from Aphria the number of common shares (rounded to the nearest whole share) equal to: (i) the exchange ratio multiplied by (ii) the number of Nuuvera shares subject to such Nuuvera Option. Each such Replacement Option shall provide for an exercise price per common share (rounded to the nearest whole cent) equal to: (i) the exercise price per Nuuvera share purchasable pursuant to such Nuuvera Option; divided by (ii) the exchange ratio.

The table below summarizes the fair value of the assets acquired and the liabilities assumed at the effective acquisition date:

| Note | Number of shares | Share price | Amount | |||

| Consideration paid | ||||||

| Cash | $ 54,604 | |||||

| Shares issued | (i) | 31,226,910 | $ 13.17 | 411,258 | ||

| Warrants outstanding | (ii) | 1,345,866 | 1,015 | |||

| Replacement options issued | (Ii) | 1,280,330 | 12,133 | |||

| 479,010 | ||||||

| Fair value of previously held investment | ||||||

| Shares held by Aphria | (i) | 1,878,738 | $ 14.92 | 28,028 | ||

| Warrants held by Aphria | (ii) | 322,365 | 243 | |||

| 28,271 | ||||||

| Total fair value of consideration | $ 507,281 | |||||

| Net assets acquired | ||||||

| Current assets | ||||||

| Cash and cash equivalents | 35,033 | |||||

| Accounts receivable | 464 | |||||

| Other current assets | 1,142 | |||||

| Inventory | 401 | |||||

| Long-term assets | ||||||

| Capital assets | 4,743 | |||||

| Intellectual property, trademarks & brands | 3,700 | |||||

| Licences, permits & applications | 131,600 | |||||

| Goodwilll | 377,221 | |||||

| Total assets | 554,304 | |||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 11,000 | |||||

| Long-term liabilities | ||||||

| Deferred tax liability | 36,023 | |||||

| Total liabilities | 47,023 | |||||

| Total net assets acquired | $ 507,281 | |||||

| (i) | Share price based on the price of the shares on March 23, 2018; shares held by Aphria include the cash consideration paid. |

| (ii) | Options and warrants are valued using the Black-Scholes option pricing model using the following assumptions: the risk-free rate of 2.19%; expected life of 1- 10 years; volatility of 30% based on volatility used for similar instruments on the open market; forfeiture rate of nil; dividend yield of nil; and the exercise price of $2.52 - $20.30. |

| 17 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

Net income and comprehensive net income for the Company would have been lower by approximately $4,902 and $14,706 for the three and nine months ended February 28, 2018, if the acquisition had taken place on June 1, 2017. In connection with this transaction, the Company expensed transaction costs of $3,439.

Acquisition of LATAM Holdings Inc.

On July 17, 2018, the Company signed a share purchase agreement with Scythian Biosciences Corp. (“Scythian”) to purchase 100% of the issued and outstanding shares of LATAM Holdings Inc. (“LATAM Holdings”); a direct wholly-owned subsidiary of Scythian. As outlined in the share purchase agreement, the negotiated purchase price was to be settled with the issuance of 15,678,310 shares of the Company valued on July 17, 2018 at $193,000 and the assumption of $1,000 USD ($1,310 CAD) short-term liabilities. The acquisition of LATAM Holdings closed on September 27, 2018. Therefore, in accordance with IFRS 3 - Business Combinations, the equity consideration transferred was measured at fair value at the acquisition date, which is the date control was obtained, which in this case was determined to be September 27, 2018. The fair value of the consideration shares on September 27, 2018 was $273,900.

LATAM Holdings, through other subsidiaries, provides the Company with access to the emerging cannabis markets in Latin America and the Caribbean. Through this acquisition, the Company secured key licenses in Colombia, Argentina and Jamaica which is anticipated to provide substantial first mover advantage in these countries. In addition, the Company acquired an option and rights of first refusal to purchase a Brazilian incorporated entity, with the option and right of first refusal vesting only upon the entity obtaining a medical cannabis cultivation, processing and distribution license in Brazil.

The Company is in the process of assessing the fair value of the net assets acquired and, as a result, the fair value of the net assets acquired may be subject to adjustments pending completion of final valuations and post-closing adjustments. The table below summarizes the preliminary estimated fair value of the assets acquired and the liabilities assumed at the effective acquisition date:

| Note | Number of shares | Share price | Amount | |||

| Consideration paid | ||||||

| Shares issued | (i) | 15,678,310 | $ 17.47 | $ 273,900 | ||

| Total consideration paid | $ 273,900 | |||||

| Net assets acquired | ||||||

| Current assets | ||||||

| Cash and cash equivalents | 2,704 | |||||

| Accounts receivable | 571 | |||||

| Other current assets | 106 | |||||

| Inventory | 65 | |||||

| Long-term assets | ||||||

| Capital assets | 494 | |||||

| Licences, permits & applications | 123,956 | |||||

| Goodwill | 189,188 | |||||

| Total assets | 317,084 | |||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities | 1,986 | |||||

| Income taxes payable | 20 | |||||

| Long-term liabilities | ||||||

| Deferred tax liability | 29,837 | |||||

| Total liabilities | 31,843 | |||||

| Non-controlling interest | 11,341 | |||||

| Total net assets acquired | $ 273,900 | |||||

| (i) | Share price based on the price of the shares on September 27th, 2018. |

Net income and comprehensive net income for the Company would have been lower by approximately $1,139 and $3,417 for the three and nine months ended February 28, 2018, if the acquisition had taken place on June 1, 2017. In connection with this transaction, the Company expensed transaction costs of $1,133.

| 18 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

Acquisition of CC Pharma GmbH

On November 7 ,2018, the Company signed a share purchase agreement to acquire 100% of the issued and outstanding shares of CC Pharma. The purchase price was cash consideration of €18,920 ($28,775 CAD) and additional cash consideration of up to €23,500 ($35,741 CAD) contingent on CC Pharma obtaining a specified EBITDA target. The acquisition of CC Pharma closed on January 9, 2019.

CC Pharma is a leading distributor of pharmaceutical products, including medical cannabis, to more than 13,000 pharmacies in Germany as well as throughout Europe. The acquisition of CC Pharma provides the Company access to the cannabis markets in Germany and ultimately pan-European platforms.

The Company is in the process of assessing the fair value of the net assets acquired and, as a result, the fair value of the net assets acquired may be subject to adjustments pending completion of final valuations and post-closing adjustments. The table below summarizes the preliminary estimated fair value of the assets acquired and the liabilities assumed at the effective acquisition date:

| Amount | ||||||

| Consideration | ||||||

| Cash | $ 28,775 | |||||

| Contingent consideration | 35,741 | |||||

| Total consideration | $ 64,516 | |||||

| Net assets acquired | ||||||

| Current assets | ||||||

| Cash and cash equivalents | 7,237 | |||||

| Accounts receivable | 33,989 | |||||

| Other current assets | 14,616 | |||||

| Inventory | 28,352 | |||||

| Long-term assets | ||||||

| Capital assets | 6,373 | |||||

| Intangible assets | 32,688 | |||||

| Goodwill | 10,712 | |||||

| Total assets | 133,967 | |||||

| Current liabilities | ||||||

| Bank loans and overdrafts | 20,255 | |||||

| Accounts payable and accrued liabilities | 44,111 | |||||

| Income taxes payable | -- | |||||

| Long-term liabilities | ||||||

| Deferred tax liability | 5,085 | |||||

| Total liabilities | 69,451 | |||||

| Total net assets acquired | $ 64,516 | |||||

Net income and comprehensive net income for the Company would have been higher by approximately $2,625 and $7,875 for the three and nine months ended February 28, 2019, if the acquisition had taken place on June 1, 2018. In connection with this transaction, the Company expensed transaction costs of $595.

Goodwill is comprised of:

| February 28, 2019 | May 31, 2018 | |||||

| CannWay goodwill | $ 1,200 | $ 1,200 | ||||

| Broken Coast goodwill | 146,091 | 145,794 | ||||

| Nuuvera goodwill | 377,221 | 375,768 | ||||

| LATAM goodwill | 139,188 | -- | ||||

| CC Pharma goodwill | 10,712 | -- | ||||

| $ 674,412 | $ 522,762 | |||||

| 19 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

During the quarter, independent third party completed their review of the LATAM acquisition, which provided the Company with new information. In accordance with IAS 36, the Company completed an impairment analysis and determined the fair value of the assets based on a discounted cash flows for the three operating entities acquired in the transaction; Colcanna S.A.S (“Colcanna”), ABP, S.A. (“ABP”) and Marigold Projects Jamaica Limited (“Marigold”).

As a result of new information obtained from independent third party’s review, the Company determined some changes in the projected cashflows and adjusted the discount rates from 31.0%, 21.3%, and 36.5% to 33.0%, 23.3%, and 38.5% for Colcanna, ABP and Marigold respectively. Based on the determined fair value, the Company recognized $50,000 in impairment of goodwill. Also included in impairment is £4,600 GBP ($8,039 CAD) related to uncollectible notes receivable (Note 15) for a total impairment of $58,039.

| 12. | Convertible notes receivable |

| February 28, 2019 | May 31, 2018 | ||||

| Copperstate Farms Investors, LLC | $ -- | $ 1,942 | |||

| HydRx Farms Ltd. (d/b/a Scientus Pharma) | 11,500 | 16,129 | |||

| Fire & Flower Inc. | 13,450 | -- | |||

| 10330698 Canada Ltd. (d/b/a Starbuds) | 5,092 | -- | |||

| 30,042 | 18,071 | ||||

| Deduct - current portion | (11,500) | (1,942) | |||

| $ 18,542 | $ 16,129 | ||||

Copperstate Farms Investors, LLC

As at February 28, 2019, this note was paid in full.

HydRx Farms Ltd. (d/b/a Scientus Pharma)

On August 14, 2017, Aphria purchased $11,500 in secured convertible debentures of Scientus Pharma (“SP”). The convertible debenture bears interest at 8%, paid semi-annually, matures in two years and includes the right to convert the debenture into common shares of SP at $2.75 per common share at any time before maturity. SP maintains the option of forced conversion of the convertible debenture if the common shares of SP trade on a stock exchange at a value of $3.02 or more for 30 consecutive days. The Company maintains a first charge on all assets of SP. In October 2018, the Company agreed to share its first charge on all assets of SP with a third party on a pari passu basis. As at February 28, 2019, the third party has not completed its investment.

During the three and nine months ended February 28, 2019, the Company’s note receivable from SP decreased by $4,896 and $4,629, representing the change in fair value on the note. As at February 28, 2019, the convertible note receivable totaled $11,500.

Fire & Flower Inc.

On July 26, 2018, Aphria purchased $10,000 in unsecured convertible debentures of Fire & Flower Inc. (“F&F”). The convertible debentures bear interest at 8% per annum compounded, accrued and paid semi-annually in arrears (the “Debentures”). The Debentures mature on July 31, 2020, at which point, they automatically convert into common shares of F&F at the lower of $1.15 and the share price on July 31, 2020. The Debentures may also be converted into a loan on July 31, 2020 bearing interest at 12%, at the holder’s option.

During the three and nine months ended February 28, 2019, the Company’s note receivable from F&F increased by $855 and $3,450, representing the change in fair value on the note. As at February 28, 2019, the convertible note receivable totaled $13,450.

10330698 Canada Ltd. (d/b/a Starbuds)

On December 28, 2018, Aphria purchased $5,000 in secured convertible debentures of Starbuds. The convertible debentures bear interest at 8.5% per annum accruing daily due on the December 28, 2020 (the “Debentures”). The Debentures are secured against the assets of Starbuds. The Debentures and any accrued and unpaid interest are convertible into common shares for $0.50 per common share and mature on December 28, 2020.

| 20 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

During the three and nine months ended February 28, 2019, the Company’s note receivable from Starbuds increased by $92 and $92, representing the change in fair value on the note. As at February 28, 2019, the convertible note receivable totaled $5,092.

Convertible notes receivable

During the nine-month period, the Company purchased a total of $15,000 in convertible notes. The unrealized gain (loss) on convertible notes receivable recognized in the results of operations amounts to $(3,949) and $(1,087) for the three and nine months ended February 28, 2019 (2018 - $(52) and $576).

The fair value was determined using the Black-Scholes option pricing model using the following assumptions: the risk-free rate of 0.85-- 1.51%; expected life of the convertible note; volatility of 70% based on comparable companies; forfeiture rate of nil; dividend yield of nil; and, the exercise price of the respective conversion feature.

| 13. | Interest in equity investee |

Summary of equity investees:

| February 28, 2019 | May 31, 2018 | ||||

| Associated company | |||||

| Althea Company Pty Ltd. | $ 9,604 | $ 4,966 | |||

| $ 9,604 | $ 4,966 | ||||

Liberty Health Sciences Inc. (“LHS”)

In February 2018, the Company entered into a call/put obligation (“Obligation Agreement”) for the remaining shares held in Liberty, which were subject to CSE mandatory escrow requirements. As each new tranche of shares became freely trading, the Obligation Agreement resulted in the buyers acquiring the newly freely trading shares at an 18% discount to the market price of Liberty, based on Liberty’s 10-day volume weighted trading price.

The Obligation Agreement included an opt-out for Aphria’s benefit, in the event that the Toronto Stock Exchange amended their regulations such that it permitted investments by Canadian companies in U.S. based cannabis businesses, and in such instance, the Obligation Agreement would be automatically terminated. In exchange for the opt-out, the Company agreed to pay the buyers a $2,500 termination fee.

Based on the terms of the Obligation Agreement, the Company determined that the remaining shares held in Liberty met the requirements under IFRS 5 and were reclassified from interest in equity investees to assets held for sale. The Company ceased accounting for the investment as an equity investment as of November 30, 2017 and transferred the carrying value to assets held for sale.

In July 2018, 16,029,615 shares were released from escrow and sold as part of the Obligation Agreement. The Company received gross proceeds of $11,514 and recognized a gain on sale of equity investee of $9,880. As part of the transaction, the Company paid $480 in exchange for an option to buy back the shares at $1.00 a share, subject to certain downside risk protection which results in the purchaser sharing a portion of the difference between the share price on the day the option is exercised and the exercise price, provided the share price exceeds $1.25. The option to repurchase the shares is subject to the following conditions (collectively, the enumerated conditions (1) through (5), the “Conditions”):

| (1) | Cannabis becoming legalized federally in the United States; and |

One or more of the following conditions have been satisfied:

| (2) | The TSX has provided its approval for the purchase of the U.S. cannabis assets; |

| 21 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| (3) | The TSX revises its rules such that it no longer has a prohibition against its listed companies having an interest in US assets which are involved in the cannabis business; |

| (4) | The common shares of the Company are voluntarily or involuntarily delisted from the TSX; and/or |

| (5) | The Company is acquired by another entity, provided that the common shares of the Company will be delisted from the TSX upon the change of control. |

This option was initially included in long-term investments (Note 14).

During the prior quarter, the Company and the third party agreed to terminate the Obligation Agreement, in exchange for a $1,000 termination fee. The Company then entered into a share purchase agreement to divest of the remaining 64,118,462 Liberty shares in exchange for consideration in the form of a promissory note in the amount of $59,098, bearing interest at a rate of 12% due in 5 years (Note 15). As a security for the promissory note, the Liberty shares were placed in trust with an escrow agent. The purchaser was able to remove the Liberty shares from the escrow at any time by paying off the promissory note. In the event that the Company enforces the security, the escrow agent was to return the shares to the Company, provided that the Conditions are met. In the event they are not met, the escrow agent was to transfer the securities to a third-party investment bank for liquidation, with the proceeds of liquidation delivered to the Company. Simultaneously with this sale, the Company entered into an option agreement to repurchase the Liberty shares for the amount of the promissory note (Note 14). The Company agreed to pay an annual fee equal to 12.975% of the face value of the promissory note to maintain this option (Note 20). The option to repurchase the shares was subject to the Conditions described above. During the three and nine months ended February 28, 2019, the Company reported a gain on sale of equity investee of $nil and $57,351.

On February 19, 2019, the Company and the third party agreed to liquidate the promissory note, security agreement and the option in exchange for a cash payment of $47,448 and a contingent payment up to $10,000, in the event the third party monetizes the assets held under the option within six (6) months of the transaction date.

During the three and six months ended November 30, 2017, the Company reported a total (loss) gain on dilution of ownership in equity investee of $(16) and $7,535. Prior to the Company no longer recording Liberty as an equity investee, Liberty reported a net loss of $23,493 and a net comprehensive loss of $27,001. In accordance with the equity method, the Company recorded a loss of $441 and $9,281 and other comprehensive gain (loss) of $520 and $(801).

Althea Company Pty Ltd. (“Althea”)

As at February 28, 2019 the Company held 50,750,000 common shares of Althea (May 31, 2018 - 4,500) representing an ownership interest of 25% (May 31, 2018 - 37.5%).

The following table summarizes, in aggregate, the financial information of the Company’s associate as included in their own financial statements.

| December 31, 2018 |

March 31, 2018 | ||||

| Current assets | $ 19,812 | $ 3,857 | |||

| Non-current assets | 553 | 3 | |||

| Current liabilities | (251) | (14) | |||

| Non-current liabilities | -- | -- | |||

| Net assets | $ 20,114 | $ 3,846 | |||

For the period from April 1, 2018 to December 31, 2018, the investee reported a net loss of $3,132 AUD on its financial statements. In accordance with the equity method, the Company recorded a loss of $8 and $830 for the three and nine months ended February 28, 2019 from its investee relative to its ownership of the outstanding common shares at the time.

During the period, Althea completed a share split of 7,500 shares for each existing share. Althea also issued 101,310,000 common shares for total proceeds of $19,650 AUD during the quarter. The Company participated in the financing of Althea contributing $3,400 AUD ($3,258 CAD) of the total $19,650 AUD raised. This additional raise reduced the Company’s ownership interest in Althea from 37.5% to 25% and accordingly, the Company recognized a gain on dilution of $2,210.

| 22 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

| February 28, 2019 |

May 31, 2018 | ||||

| Reconciliation to carrying amount: | |||||

| Opening balance | $ 4,966 | $ -- | |||

| Transfer from long-term investments | -- | 2,483 | |||

| Cash contributions, net of share issuance costs | 3,258 | 2,497 | |||

| Gain on account of dilution of ownership | 2,210 | -- | |||

| Share of reported net (loss) income | (830) | (14) | |||

| Closing balance | $ 9,604 | $ 4,966 | |||

| 14. | Long-term investments |

| Cost May 31, 2018 |

Fair value May 31, 2018 |

Investment | Divesture/ Transfer | Subtotal February 28, 2019 |

Change in fair value | Fair value February 28, 2019 | ||

| Level 1 on fair value hierarchy | ||||||||

| CannaRoyalty Corp. | $ 1,500 | $ 3,765 | $ -- | $ (3,765) | $ -- | $ -- | $ -- | |

| MassRoots, Inc. | 304 | 164 | -- | (164) | -- | -- | -- | |

| Tetra Bio-Pharma Inc. | 2,300 | 6,800 | 16,757 | -- | 23,557 | (4,189) | 19,368 | |

| Hiku Brands Company Ltd. | 9,775 | 13,558 | -- | (13,558) | -- | -- | -- | |

| Scythian Biosciences Corp. | 9,349 | 8,603 | 298 | (8,901) | -- | -- | -- | |

| National Access Cannabis Corp. | 1,093 | 710 | 10,481 | -- | 11,191 | (3,250) | 7,941 | |

| Emblem Corp. | -- | -- | 10,000 | -- | 10,000 | 2,097 | 12,097 | |

| Rapid Dose Therapeutics Inc. | -- | -- | 5,400 | -- | 5,400 | 576 | 5,976 | |

| Fire & Flower Inc. | -- | -- | 3,416 | -- | 3,416 | 204 | 3,620 | |

| 24,321 | 33,600 | 46,352 | (26,388) | 53,564 | (4,562) | 49,002 | ||

| Level 2 on fair value hierarchy | ||||||||

| Hiku Brands Company Ltd. | 2,336 | 1,906 | 16,787 | (18,693) | -- | -- | -- | |

| Scythian Biosciences Corp. | 3,153 | 661 | -- | (661) | -- | -- | -- | |

| 5,489 | 2,567 | 16,787 | (19,354) | -- | -- | -- | ||

| Level 3 on fair value hierarchy | ||||||||

| Copperstate Farms, LLC | 1,755 | 5,300 | -- | (5,300) | -- | -- | -- | |

| Copperstate Farms Investors, LLC | 9,407 | 14,700 | -- | (14,700) | -- | -- | -- | |

| Resolve Digital Health Inc. | 718 | 3,300 | -- | -- | 3,300 | (2,200) | 1,100 | |

| Resolve Digital Health Inc. | 282 | 1,916 | -- | -- | 1,916 | (1,611) | 305 | |

| Green Acre Capital Fund I | 1,600 | 2,042 | 400 | -- | 2,442 | 2,137 | 4,579 | |

| Green Acre Capital Fund II | -- | -- | 3,000 | -- | 3,000 | (2,500) | 500 | |

| Green Tank Holdings Corp. | 650 | 647 | -- | -- | 647 | 3,475 | 4,122 | |

| IBBZ Krankenhaus GmbH | 1,956 | 1,956 | -- | -- | 1,956 | (5) | 1,951 | |

| Greenwell Brands GmbH | -- | -- | 152 | -- | 152 | -- | 152 | |

| HighArchy Ventures Ltd. | -- | -- | 9,995 | -- | 9,995 | -- | 9,995 | |

| US legalization options | -- | -- | 54,762 | (26,969) | 27,793 | 25,826 | 53,619 | |

| 16,368 | 29,861 | 68,309 | (46,969) | 51,201 | 25,122 | 76,323 | ||

| Deduct - assets held for sale | (11,162) | (20,000) | -- | 20,000 | -- | -- | -- | |

| $ 35,016 | $ 46,028 | $ 131,448 | $ (72,711) | $ 104,765 | $ 20,560 | $ 125,325 | ||

The fair value attached to warrants in both Level 1 and Level 3 were determined using the Black-Scholes option pricing model using the following assumptions: risk-free rate of 0.75-1.70% on the date of grant; expected life of 1 and 2 years; volatility of 70% based on comparable companies; forfeiture rate of 0%; dividend yield of nil; and, the exercise price of the respective warrant.

CannaRoyalty Corp. (“CR”)

During the nine-month period, the Company sold its remaining 750,000 shares of CR for proceeds of $4,111, resulting in an accounting gain of $346 (Note 28).

| 23 |

Aphria Inc.

Notes to the Condensed Interim Consolidated Financial Statements

For the three months and nine months ended February 28, 2019 and February 28, 2018

(Unaudited – In thousands of Canadian dollars, except share and per share amounts)

MassRoots, Inc.

During the period, the Company sold its remaining 500,000 common shares in MassRoots, Inc. for proceeds of $1, resulting in a loss of

$163 (Note 28).

Tetra Bio-Pharma Inc.