UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

or

For the transition period from __________ to __________

Commission file number:

(Exact name of registrant as specified in its charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

(Address of principal executive offices)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

State the aggregate market value of voting and

non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average

bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal

quarter: $

The

number of shares of the registrant’s common stock outstanding as of March 21,

2023 was

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

i

CAUTIONARY NOTICE

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Those forward-looking statements include our expectations, beliefs, intentions and strategies regarding the future.

These and other factors that may affect our financial results are discussed more fully in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in this report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We caution readers not to place undue reliance on any forward-looking statements. We do not undertake, and specifically disclaim any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur, and we urge readers to review and consider disclosures we make in this and other reports that discuss factors germane to our business. See in particular our reports on Forms 10-K, 10-Q, and 8-K subsequently filed from time to time with the Securities and Exchange Commission.

ii

RISK FACTOR SUMMARY

Our business is subject to numerous risks and uncertainties, including those described in “Risk Factors” in this Annual Report on Form 10-K. These risks include, but are not limited to the following:

| ● | We are a clinical-stage biopharmaceutical company with limited operating history. |

| ● | We have a history of significant operating losses and anticipate continued operating losses for the foreseeable future. |

| ● | We expect we will need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all. | |

| ● | The report of our independent registered public accounting firm for the year ended December 31, 2022 states that due to our lack of revenue from commercial operations, significant losses and need for additional capital there is substantial doubt about our ability to continue as a going concern. |

| ● | Our business model is entirely dependent on certain patent rights licensed to us from the University of Texas at Austin, and the loss of those license rights would, in all likelihood, cause our business, as presently contemplated, to fail. |

| ● | Our business model includes, in part, the licensing of our TFF Platform to other pharmaceutical companies, however technology licensing in the pharmaceutical industry is a lengthy process and subject to several risks and factors outside of our control, and we cannot forecast our ability to successfully license our technology or the length of time it may take to establish a new licensing relationship. |

| ● | Our business may be adversely affected by the COVID-19 pandemic. |

| ● | We will be completely dependent on third parties to manufacture our product candidates for clinical and commercial purposes, and the commercialization of our product candidates could be halted, delayed or made less profitable if those third parties fail to obtain manufacturing approval from the FDA or comparable foreign regulatory authorities fail to provide us with sufficient quantities of our product candidates or fail to do so at acceptable quality levels or prices. |

| ● | If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of our product candidates. |

| ● | Our business operations could suffer in the event of information technology systems’ failures or security breaches. |

| ● | Our success is entirely dependent on our ability to obtain the marketing approval for our product candidates by the FDA and the regulatory authorities in foreign jurisdictions in which we intend to market our product candidates, of which there can be no assurance. |

| ● | Clinical testing is expensive, is difficult to design and implement, can take many years to complete and is uncertain as to outcome. |

| ● | Even if we receive regulatory approval for any of our product candidates, we may not be able to successfully commercialize the product and the revenue that we generate from its sales, if any, may be limited. |

| ● | Even if we obtain marketing approval for any of our product candidates, we will be subject to ongoing obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates could be subject to labeling and other restrictions and withdrawal from the market and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our product candidates. |

| ● | Obtaining and maintaining regulatory approval of our product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our product candidates in other jurisdictions. |

iii

| ● | Even though we may apply for orphan drug designation for a product candidate, we may not be able to obtain orphan drug marketing exclusivity. |

| ● | Current and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and affect the prices we may obtain. |

| ● | Any termination or suspension of, or delays in the commencement or completion of, any necessary studies of any of our product candidates for any indications could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects. |

| ● | Third-party coverage and reimbursement and health care cost containment initiatives and treatment guidelines may constrain our future revenues. |

| ● | It is difficult and costly to protect our intellectual property rights, and we cannot ensure the protection of these rights. |

| ● | Our product candidates may infringe the intellectual property rights of others, which could increase our costs and delay or prevent our development and commercialization efforts. |

| ● | We may be subject to claims that we have wrongfully hired an employee from a competitor or that we or our employees have wrongfully used or disclosed alleged confidential information or trade secrets of their former employers. |

| ● | The market price of our shares may be subject to fluctuation and volatility. You could lose all or part of your investment. |

| ● | If securities or industry analysts do not continue to publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline. |

| ● | Future capital raises may dilute your ownership and/or have other adverse effects on our operations. |

| ● | If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud. |

| ● | We may be at an increased risk of securities class action litigation. |

| ● | Our charter documents and Delaware law may inhibit a takeover that stockholders consider favorable. |

| ● | Our certificate of incorporation and amended and restated bylaws designate the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain litigation that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or other employees. |

iv

PART I

Item 1. Business

Background

TFF Pharmaceuticals, Inc. was formed as a Delaware corporation on January 24, 2018 for the purpose of developing and commercializing innovative drug products based on our patented Thin Film Freezing, or TFF, technology platform. Since our formation, we have focused on the development of our initial drug candidates, the establishment of strategic relationships with established pharmaceutical companies for the licensing of our TFF technology platform and the pursuit of additional working capital. We have not commenced revenue-producing operations. Unless otherwise indicated, the terms “TFF Pharmaceuticals,” “Company,” “we,” “us,” and “our” refer to TFF Pharmaceuticals, Inc. and its wholly-owned subsidiaries.

Overview

We are a clinical stage biopharmaceutical company focused on developing and commercializing innovative drug products based on our patented Thin Film Freezing, or TFF, technology platform. Based on our internal and sponsored testing and studies, we believe that our TFF platform can significantly improve the solubility of poorly water-soluble drugs, which make up approximately 40% of marketed pharmaceuticals worldwide, thereby improving the bioavailability and pharmacokinetics of those drugs. We believe that in the case of some new drugs that cannot be developed due to poor water solubility, our TFF platform has the potential to increase the pharmacokinetic effect of the drug to a level allowing for its development and commercialization. When administered as an inhaled dry powder for treatment of lung disorders, we believe the TFF platform formulations can be used to increase efficacy and minimize systemic toxicities and drug-drug interactions.

As of the date of this report, we have two product candidates in clinical trials, TFF Voriconazole Inhalation Powder, or TFF VORI, and TFF Tacrolimus Inhalation Powder, or TFF TAC. To date, we have completed one Phase 1 study in healthy volunteers and one Phase 1b study in patients with asthma exploring the safety, tolerability and pharmacokinetics of TFF VORI. As of the date of this report, a Phase 2 clinical trial of TFF VORI in patients with invasive pulmonary aspergillosis has been initiated. We have also completed one Phase 1 study in healthy volunteers examining the safety, tolerability and pharmacokinetics of TFF TAC. As of the date of this report, a Phase 2 clinical trial of TFF TAC in lung transplant patients has been initiated.

We are also actively engaged in the analysis and testing of dry powder formulations of several drugs and vaccines through parenteral, topical, ocular, pulmonary and nasal applications through feasibility studies and material transfer agreements with U.S. and international pharmaceutical companies and certain government agencies. We intend to initially focus on the development of inhaled dry powder drugs for the treatment of pulmonary diseases and conditions. While the TFF platform was designed to improve solubility of poorly water-soluble drugs generally, the researchers at University of Texas at Austin, or UT, found that the technology was particularly useful in generating dry powder particles with properties which allow for superior inhalation delivery, especially to the deep lung, which is an area of extreme interest in respiratory medicine. We believe that our TFF platform can significantly increase the number of pulmonary drug products that can be delivered directly to the lung. We intend to design our dry powder drug products for use with dry powder inhalers, which are generally considered to be the most effective and patient-friendly of all breath-actuated inhalers. We plan to focus on developing inhaled dry powder formulations of existing off-patent drugs suited for lung diseases and conditions, which we believe includes dozens of potential drug candidates, many of which have a potential market of over $1 billion.

We intend to directly pursue the development of dry powder formulations of off-patent drugs through the U.S. Food and Drug Administration’s, or FDA’s, 505(b)(2) regulatory pathway and in corresponding regulatory paths in other foreign jurisdictions. The 505(b)(2) pathway contains full reports of investigations of safety and effectiveness but at least some of the information required for approval comes from studies not conducted by or for the NDA applicant. 505(b)(2) products have the potential advantage of significantly lower development costs and shorter development timelines versus traditional new molecular entities. The clinical requirements for a 505(b)(2) drug candidate can vary widely from product to product depending primarily on whether the product candidate claims a new indication, provides for a different route of administration or claims improved safety compared to the existing approved product, and may include bioequivalence trials, limited safety and efficacy trials, or full Phase I through III trials. Unless the FDA releases a guidance document, the clinical requirement for a 505(b)(2) product candidate is typically not known until the drug sponsor has a pre-IND and an end of Phase 2 meeting with the FDA. For example, based on our meetings to date with the FDA, we believe we may need to conduct additional clinical trials beyond the current Phase 2 trials for TFF VORI and TFF TAC prior to filing for marketing approval for either product.

1

TFF TAC has been awarded orphan drug status. We also believe that in some cases our other dry powder drug products may qualify for the FDA’s orphan drug status.

We intend to commercialize our TFF platform and internally developed product candidates through the following means:

| ● | We may out-license our internally developed product candidates, such as TFF VORI and TFF TAC, or agree to jointly develop such products with a third-party pharmaceutical company; |

| ● | Upon and subject to receipt of the requisite approvals, we may directly commercialize our internally developed product candidates through a combination of our internal direct sales and third-party marketing and distribution partnerships; and |

| ● | We may pursue the licensing of our TFF platform or a joint development arrangement for a particular field of use with a third-party pharmaceutical company. |

The Problem We Address

Solubility is an issue that all drugs must address. No matter how active or potentially active a new drug is against a particular molecular target, if the drug is not available in solution at the site of action, it is most likely not a viable development candidate. Based on independent third-party studies, 40% of currently marketed drugs and at least 75% of drugs under development have poor water solubility, which can prohibit development since most pharmaceutical companies cannot or will not conduct rigorous preclinical and clinical studies on a molecule that does not have a sufficient pharmacokinetic profile due to poor water solubility. Water solubility can also be an issue for some marketed drugs. Based on independent third-party studies, only two-thirds of the drugs on the World Health Organization, or WHO, Essential Drug List were classified as high solubility. A marketed drug with poor water solubility can show performance limitations, such as incomplete or erratic absorption, poor bioavailability, and slow onset of action. Effectiveness can vary from patient to patient, and there can be a strong effect of food on drug absorption. Finally, it may be necessary to increase the dose of a poorly soluble drug to obtain the efficacy required, which can lead to adverse side effects, toxicity issues and increased costs.

In addition to water solubility issues generally, certain drugs that target lung conditions and diseases have poor solubility that prevents them from being delivered by way of inhalation, especially via a breath-actuated inhaler and can only be given orally or intravenously. Breath-actuated inhalers include dry powder inhalers, metered dose inhalers and some nebulizers. A dry powder inhaler delivers drugs in a dry powder form directly to the lungs by way of a deep, fast breath on the mouth of the inhaler. A metered dose inhaler uses propellant to push medication to the lungs. A nebulizer creates a mist that is breathed into the lungs through a mouthpiece. The dry powder inhaler is generally considered to be the most effective and convenient form of breath-actuated inhaler for all users, other than for those whose severe condition does not allow them to take a sufficiently deep breath.

We believe the primary benefit of a breath-actuated inhaler is its ability to administer a greater portion of the drug dosage directly to the target site. Dosing directly to the lungs has been shown to allow for better effect with fewer adverse events. In addition, it has been shown that dosing directly to the lungs requires a lower dose of drug, compared to delivery by oral or parenteral routes. While breath-actuated inhalers allow for a greater portion of the administered drug to reach the treatment site, which should allow for much smaller dosages compared to oral or intravenous delivery, not all drugs targeting lung conditions and diseases can be formulated for use with a breath-actuated inhaler. We believe there are dozens of off-patent drugs targeting lung conditions and diseases that are currently not eligible for delivery by way of breath-actuated inhalers, many of which have a potential market of over $1 billion. This is the market we intend to initially address through our development of dry powder drugs utilizing our TFF platform.

2

Our Thin Film Freezing Platform

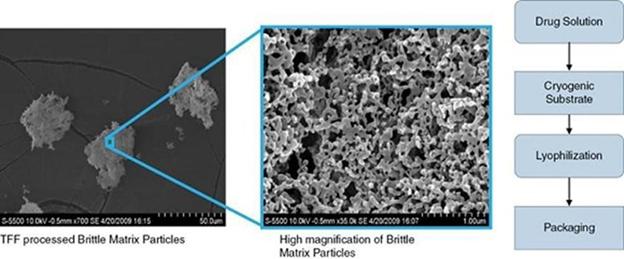

Our development of dry powder drugs is enabled by technology licensed to us by the University of Texas at Austin, or UT. Researchers at UT have developed a technology employing a process called Thin Film Freezing, or TFF. While the TFF platform was designed to improve solubility of poorly water-soluble drugs generally, the researchers at UT found that the technology was particularly useful in generating dry powder particles with properties suitable for inhalation delivery, especially to the deep lung, via dry powder inhaler delivery systems, an area of extreme interest in respiratory medicine. The TFF process results in a “Brittle Matrix Particle,” which exhibits a low bulk density, high surface area, and optionally an amorphous morphology, allowing the particles to supersaturate when contacting the target site, such as lung tissue. The aerodynamic properties of the particles are such that the amount of drug deposited to the deep lung may, in some cases, reach ten times that achieved via the oral route.

The TFF process, outlined in the figures below, involves processing a drug or drugs in a solvent system, and it will often include agents designed to promote dispersion and avoid clumping and excipients to promote adhesion to the target site. The drug solution is then applied to a cryogenic substrate, such as a liquid nitrogen cooled stainless steel drum. When the drug solution contacts the cryogenic surface it vitrifies, or flash freezes, resulting in a “drug ice.” The solvent system is removed by lyophilization, resulting in Brittle Matrix Particles, shown in the photographs below, that are highly porous, large surface area, low-density particles. The process uses industry standard solvents, recognized excipients, a custom-made TFF drum and conventional process equipment.

We believe our TFF platform is a breakthrough platform technology for making dry powders from drugs which previously were not candidates for the dry powder inhaler or any breath-actuated inhaler. We believe our TFF technology opens the way for direct-to-lung delivery of dozens of pharmaceuticals, including the reformulation of existing drugs into a more safe and convenient inhaled dry powder product. We believe the technology can be used with molecules of all types and works with existing and off-the-shelf dry powder inhalers without the need for any additional equipment or devices.

We believe our TFF platform presents the following high value opportunities:

| ● | Reformulation of drugs for lung conditions. Today, many drugs intended for lung conditions are only given orally or intravenously due to properties that make them ill-suited for direct delivery by inhalers. Given by these routes, typically only a small fraction of the drug reaches the lungs, and these drugs may cause unwanted and even deadly side effects. We believe that our TFF platform will for the first time allow many of these medications to be formulated into the convenient, direct-to-lung dry powder inhaler format, thereby enhancing efficacy and reducing or eliminating side effects by directly delivering the drug to the target site. |

3

| ● | Biologics. Biopharmaceuticals (or biologics) are by far the fastest growing sector in the pharmaceutical industry today. According to GlobalData, the market for biologics was valued at approximately $430 billion in 2022 and is expected to reach $720 billion by 2027. Biologics are most commonly delivered intravenously, and they can be an especially challenging class of drugs for formulation into a dry powder. We believe our TFF platform is uniquely suited to meet many of the challenges of biologic formulations, and our UT collaborators have demonstrated, via animal model testing and in vitro testing, the effectiveness of the TFF technology to produce dry powder biologics with, in some cases, up to 100% activity retained. We intend to explore dry powder forms of numerous biological drugs, including drugs intended to treat indications other than lung conditions and diseases. We are also pursuing TFF formulations of aluminum salt containing vaccines, which by virtue of providing a dry powder formulation would remove the requirement for liquid suspension and cold chain. | |

| ● | Combination Drugs. Combination drugs are products with two or more active pharmaceutical ingredients. In addition to providing for increased patient compliance with multiple medications, some drugs act synergistically and provide for superior benefit when given as a combination. However, combining pharmaceutical agents can be challenging, especially for inhalation delivery. Our TFF platform has shown the ability to produce fixed dose combinations of many agents in a manner that delivers the drugs simultaneously to the site of action in a precise amount. |

The TFF platform was invented and developed by researchers at University of Texas at Austin, or UT, led by Robert O. Williams, III, Ph.D. UT has granted to us an exclusive worldwide, royalty bearing license to the patent rights for the TFF platform in all fields of use. We continue to work with Dr. Williams and his UT team through a series of Sponsored Research Agreements, or SRAs, with UT. Our SRAs with UT are industry standard sponsored research agreements pursuant to which UT provides to us certain product formulation, characterization and evaluation services regarding potential product candidates incorporating our TFF technology in exchange for our payment of UT’s expenses and reasonable overhead. The services conducted by UT were carried out under the direction of Dr. Williams, who is the principal inventor of the TFF technology. The current SRA expires in July 2025 and is subject to renewal upon mutual agreement of the parties. The SRAs includes customary provisions concerning confidentiality, indemnification and intellectual property rights, including each party’s exclusive ownership of all intellectual property developed solely by them and the parties’ joint ownership of all intellectual property developed jointly. All patented intellectual property rights relating to the TFF technology developed solely or jointly by UT are subject to our patent license agreement with UT and are included among our licensed patent rights. Pursuant to those SRAs, Dr. Williams and his team, together with their labs and collaborators, provide expertise and initial development work, including:

| ● | the preliminary development and in vitro evaluation of our drug candidates; |

| ● | the determination of the key characteristics influencing performance of our product candidates; |

| ● | the determination of the formulation and manufacturing parameters that influence the key characteristics of our product candidates; |

| ● | supply of bulk dry powders for initial good laboratory practice, or GLP, and non-GLP toxicity studies; |

| ● | supportive stability for future GLP and GMP studies; and |

| ● | the evaluation of the in vivo performance of our product candidates in various animal models. |

In June 2022, we established our own laboratory in Austin,Texas where we undertake certain product formulation, characterization and evaluation services with regard to potential product candidates. We established our own laboratory to obtain direct ownership over all intellectual property developed within our laboratory and to address concerns on the part of our partners over potential conflicts with UT.

Our Internal Product Candidates

We intend to initially focus on the development of inhaled dry powder drugs for the treatment of pulmonary diseases and conditions. Our dry powder drug product candidates will be designed for use with dry powder inhalers, which are generally considered to be the most effective of all breath-actuated inhalers. We plan to focus on developing dry powder drugs intended for lung diseases and conditions that are off-patent, which we believe includes dozens of potential drug candidates, many of which have a potential market of over $1 billion. As of the date of this report, we have identified and are focusing on two initial drug candidates and with each we are in the early stages of clinical development.

4

TFF Voriconazole Inhalation Powder, TFF VORI – For the Treatment of Invasive Pulmonary Aspergillosis

We have developed an inhaled dry powder formulation of voriconazole, or TFF VORI, intended to treat invasive pulmonary aspergillosis, or IPA, a severe fungal pulmonary disease with an overall 84-day all-cause mortality rate of approximately 30% despite use of standard of care therapy. IPA occurs primarily in patients with severe immunodeficiency, such as bone marrow and solid organ transplant recipients, and patients with chemotherapy-induced immunodeficiency, hematologic malignancy, or HIV. To date, the approved antifungals used to treat IPA have been delivered orally or intravenously, where doses required to achieve efficacy have been associated with systemic toxicities and drug-drug interaction issues, which places a premium on any formulation that can improve the drugs’ efficacy and/or safety and tolerability. Due to the nature of these drugs, it has not been possible to make formulations for breath-actuated inhalers that might maximize lung concentration while limiting side effects.

Voriconazole is an off-patent, first-line drug for the treatment of IPA. We believe TFF VORI represents an opportunity for the treatment of IPA, which has the potential to put the drug exactly where it is needed (viz., the lung) while minimizing off target toxic effects. Voriconazole is currently marketed in Australia, Canada, Europe and the U.S. as VFEND, and is available in several strengths and presentations for oral delivery or IV infusion. As of the date of this report, the Clinical Practice Guidelines released by the Infectious Diseases Society of America recommend voriconazole as first-line monotherapy for IPA. However, since the registration of VFEND in Europe and the U.S. in 2002, several studies have examined the exposure-response relationship with voriconazole. Those studies have identified a relationship between low voriconazole exposure and higher rates of treatment failure and high voriconazole exposure and higher propensity for neurotoxicity. Studies have also shown that voriconazole delivered orally or intravenously is associated with a high degree of exposure variability. In the case of oral delivery, the high degree of variability can be partly explained by the effect of food as high-fat meals decrease maximum concentrations by 34 to 58%. In addition, voriconazole when delivered orally or intravenously has been shown to have many serious adverse reactions, including hepatic toxicity, arrhythmias and QT prolongation, infusion related reactions, visual disturbances, severe cutaneous adverse reactions, photosensitivity and renal toxicity. Hepatic toxicity, arrythmias and severe cutaneous adverse reactions have been associated with fatalities. These studies confirm that when administered orally or intravenously, voriconazole provides a narrow therapeutic window between treatment success and unacceptable treatment toxicity.

We believe TFF VORI could be used for the treatment or prophylaxis of IPA and would benefit patients by providing the drug at the site of invasive fungal infections, while reducing or eliminating the potential serious side effects and fatal toxicities associated with oral and parenteral voriconazole. We believe the potential enhanced efficacy and/or improved safety and tolerability offered by TFF VORI may decrease the rate of voriconazole treatment failures and the need for later line therapies with their associated toxicities. We also believe that the administration of TFF VORI directly to the lungs will remove the variability in exposures due to the effects of food. In addition, animal and in vitro studies have shown that our TFF prepared dry powder formulation will improve the solubility of voriconazole compared to oral or intravenous delivery. We believe that the combination of improved solubility and direct-to-lung administration of TFF VORI will increase exposures in the lung while decreasing systemic exposures and minimizing systemic toxicities and drug-drug interactions.

To date, we have completed Good-Laboratory Practices (GLP) repeat-dose toxicity studies in rats (a 28-day inhalation toxicity study) and dogs (14-day, 13-week and 26-week inhalation toxicity studies). After a pre-IND meeting and gaining FDA agreement on the 505(b)(2) regulatory pathway, we filed an IND and initiated and completed a Phase 1 study in healthy volunteers and a Phase 1b study in patients with asthma to assess the safety, tolerability and pharmacokinetics of TFF VORI. As of the date of this report, a Phase 2 clinical trial of TFF VORI in patients with invasive pulmonary aspergillosis is underway. Future studies will be planned based on emerging data from this Phase 2 study.

5

TFF Tacrolimus Inhalation Powder, TFF TAC — For Prevention of Lung Transplant Rejection

We have developed TFF TAC, a dry powder formulation of tacrolimus, an immunosuppressive drug used in transplant medicine. Prograf (tacrolimus) is currently the first line calcineurin inhibitor used in the maintenance regimen to prevent rejection after lung transplantation despite its many significant systemic toxicities.

According to product labeling and prescribing information for Prograf, serious and otherwise important adverse drug reactions associated with Prograf include lymphoma and other malignancies, serious infections, new onset diabetes after transplant, nephrotoxicity, neurotoxicity, hyperkalemia, hypertension, anaphylactic reaction after injection, myocardial hypertrophy, pure red cell aplasia, and thrombotic microangiopathy, including hemolytic uremic syndrome and thrombotic thrombocytopenic purpura. Of particular concern is nephrotoxicity, which was reported in approximately 52% of kidney transplantation patients and in 40% and 36% of liver transplantation patients receiving Prograf in the U.S. and European randomized trials, respectively, and in 59% of heart transplantation patients in a European randomized trial.

Tacrolimus is an off-patent drug and we have developed TFF TAC to be used with a dry powder inhaler. Because our dry powder version would provide for a high local lung concentration, it is expected that the oral doses of tacrolimus can be weaned to minimize systemic toxicities while maintaining local lung immune suppression to prevent rejection. We believe our drug candidate may have a high likelihood of success in competing in the immunosuppressant market for lung and heart/lung transplants. TFF TAC has been awarded orphan drug status.

To date, we have completed GLP repeat-dose toxicity studies in rats (3-day and 28-day inhalation toxicity studies) and cynomolgus monkeys (28-day and 26-week inhalation toxicity studies). After a pre-IND meeting with the FDA, we gained FDA agreement on the 505(b)(2) regulatory pathway. We have since completed a Phase 1 study in healthy volunteers to assess the safety, tolerability and pharmacokinetics of TFF TAC. As of the date of this report, a Phase 2 clinical trial of TFF TAC in patients in lung transplant patients is underway. Future studies will be planned based on emerging data from this Phase 2 study.

Other Potential Dry Powder Products

Our business model is to develop proprietary innovative drug product candidates that offer functional or commercial advantages, or both, to currently available alternatives. In our initial evaluation of the market, we have identified a number of potential drug candidates that show promise upon initial assessment, for three of which we have conducted meaningful development activities, including dry powder formulations of:

Vaccines. Vaccines containing aluminum salts make up approximately 35% of all vaccines. Aluminum salts are incorporated into many vaccine formulations as an adjuvant, which is a substance added to vaccines to enhance the immune response of vaccinated individuals. A major limitation with these vaccines is that they are fragile and to maintain their efficacy they must be formulated as liquid suspensions and kept in a cold chain (2–8°C) during transport and storage, which is burdensome and expensive. Also, exposure of the liquid vaccines to either ambient or freezing temperatures will cause a loss of efficacy, including particle aggregation in the case of freezing. Alternatives to cold chain have been examined, including the introduction of stabilizing agents in vaccines to prevent aggregation during freezing and the application of novel freezing and drying techniques; however, we believe that to date none of these techniques have led to an acceptable alternative to cold chain.

We have conducted characterization analyses of certain TFF formulated aluminum salt containing vaccines. Our evaluations suggest that aluminum salt containing vaccines can be successfully converted from liquid suspension into dry powder using our TFF platform and that the dry powder can later be reconstituted at the time of use without causing particle aggregation or a decrease in immunogenicity. In addition, the dry powder vaccine did not aggregate after repeated dry-freezing-and-thawing. We believe that the TFF platform may be used to formulate new vaccines, or to reformulate existing vaccines, that are adjuvanted with aluminum salts into dry vaccine powder without an appreciable decline in immunogenicity.

6

We have engaged pharmaceutical companies in the vaccine space in discussions concerning a potential joint development of TFF formulated aluminum salt containing vaccines. However, we do not intend to pursue the development of our dry powder formulation of aluminum salt containing vaccines beyond performance characterization and efficacy data through early animal testing until such time, if ever, as we obtain a development partner. There can be no assurance, however, that our early testing and development will lead to a commercial dry powder formulation of aluminum salt containing vaccines.

Niclosamide. On August 12, 2020, we entered into a licensing and collaboration agreement with UNION Therapeutics A/S in which UNION acquired an option to obtain a worldwide exclusive license for the TFF technology formulated niclosamide. In the first quarter of 2022, we completed a Phase 1 clinical trial of TFF Niclosamide. We and UNION Therapeutics have not further progressed TFF Niclosamide pending the parties’ further review of the Phase 1 results, animal data, and anti-viral market opportunities. We have conducted independent market research to assess the additional therapeutic and market opportunities for TFF Niclosamide in other serious viral infections.

Augmenta monoclonal antibodies (mAbs). On November 1, 2020, we entered into a joint development and collaboration agreement with Augmenta Bioworks, Inc. pursuant to which the parties agreed to collaborate on the joint development of novel commercial products incorporating Augmenta’s human-derived mAbs for potential COVID-19 therapeutics. Both companies collaborated to conduct pre-clinical evaluations and successfully formulated the active pharmaceutical ingredient. Based on the pre-clinical results in the Omicron COVID-19 variant, however we have suspended further development at this time.

Other Potential Product Candidates. We have identified a number of additional promising drug candidates for dry powder formulation. Many of these potential drug candidates are off-patent drugs for which we would directly pursue the development of a dry powder formulation through the FDA’s 505(b)(2) regulatory pathway. We have not commenced meaningful development activities for any of these product candidates at this time and there can be no assurance that we will pursue any of the product candidates below.

| Candidate | Intervention | Indication | ||

| Rapamycin | Acute Treatment | Lymphangioleiomyomatosis | ||

| Alpha-1-antitrypsin | Chronic Treatment | Alpha-1antitrypsin deficiency | ||

| GM-CSF (filgrastim) | Treatment | Autoimmune pulmonary alveolar proteinosis | ||

| Treprostinil | Treatment | Pulmonary Arterial Hypertension | ||

| Pembrolizumab (Keytruda) | Acute Treatment | Cancer: Non–Small Cell Lung Cancer, Liver, brain, melanoma, metastatic | ||

| Cisplatin | Acute Treatment | Lung or esophageal cancer | ||

| Gemcitabine | Acute Treatment | Lung or esophageal cancer | ||

| Isoniazid/Rifampicin | Acute Treatment | Tuberculosis | ||

| Amphotericin B | Acute Treatment | Antifungal | ||

| Palivizumab | Prophylaxis | Tuberculosis | ||

| Ciprofloxacin | Acute Treatment | Infection | ||

| Tobramycin | Acute Treatment | Infection | ||

| Azithromycin | Acute Treatment | Infection | ||

| Calcium channel blockers | Acute Treatment | Raynaud’s disease | ||

| Sumatriptin | Acute Treatment | Migraine | ||

| Stem cells | Lung remodeling | Pneumococcal pneumonia; cardiomyopathy |

We believe that our TFF technology provides a diverse and effective way to develop solutions for lung specific disorders. Many potentially beneficial drugs for lung diseases and disorders are unable to be dosed in high enough concentrations to provide therapeutic benefit to the lung due to the systemic nature (oral or IV dosing) of the drug leading to systemic toxicities before the drug reaches therapeutic levels in the lung. We believe our TFF platform has the potential to take these difficult to formulate drugs and develop products to be delivered directly to the lung for treatment of lung disorders. This direct dosing to the lung may reduce plasma levels and has the potential to increase efficacy while reducing side effects.

7

Our Intended Regulatory Pathway

The 505(b)(2) pathway is intended for molecules that have been previously approved by the FDA or have already been proven to be safe and effective. A 505(b)(2) product reformulates the known molecule in a new strength or dosage form, or for a new route of administration. 505(b)(2) products have the advantage of potentially significantly lower development costs and shorter development timelines versus traditional new molecular entities. We intend to maximize our use of the 505(b)(2) pathway for our current product candidates.

A 505(b)(2) new drug application, or NDA, is an application that contains full reports of investigations of safety and effectiveness, but where at least some of the information required for approval comes from studies not conducted by or for the applicant. This alternate regulatory pathway enables the applicant to rely, in part, on the FDA’s findings of safety and efficacy for an existing product, or published literature, in support of its application. A 505(b)(2) product candidate might rely on the clinical studies or literature of a previously FDA-approved drug or rely on the literature and physician usage of an FDA-unapproved drug. The clinical requirements for a 505(b)(2) drug candidate can vary widely from product to product depending primarily on whether the product candidate claims a new indication or claims improved safety compared to the existing approved product, and may include bioequivalence trials, limited safety and efficacy trials, or full Phase I through III trials. Unless the FDA releases a guidance document, the clinical requirement for a new product candidate is typically not known until the drug sponsor has obtained FDA feedback. We believe there is a significant opportunity to pursue dry powder formulations of off-patent drugs using the 505(b)(2) regulatory pathway.

Because our 505(b)(2) dry powder drug candidates will represent a new formulation of an existing drug, we will need to obtain FDA approval of the TFF prepared drug candidate before we can begin commercialization. However, because we begin our formulation with a drug that has previously received FDA approval in another form, we believe that in most cases we should qualify for the FDA’s 505(b)(2) regulatory pathway, which potentially will take less time and investment than the standard FDA approval process.

TFF TAC has been awarded orphan drug status. We also believe that in some cases our other dry powder drug products may qualify for the FDA’s orphan drug status. Under the Orphan Drug Act, the FDA may grant orphan designation to a drug intended to treat a rare disease or condition generally affecting fewer than 200,000 individuals in the United States, or in other limited cases. Orphan drug designation provides for seven years of exclusivity, independent of patent protection, to the company that brings a particular orphan drug to market. In addition, companies developing orphan drugs are eligible for certain incentives, including tax credits for qualified clinical testing. Furthermore, an NDA for a product that has received orphan drug designation is not subject to a prescription drug user fee unless the application includes an indication other than the rare disease or condition for which the drug was designated.

Manufacturing

We have entered into short-term contract manufacturing agreements with Societal CDMO, CoreRx, Inc., Catalent Pharma Solutions, and Experic, LLC for their provision of certain product testing, development and preclinical and clinical manufacturing services for our TFF VORI and TFF TAC product candidates. Our agreements with Societal CDMO, CoreRx, Catalent, and Experic include customary provisions concerning confidentiality, indemnification and intellectual property rights, including our exclusive ownership of all intellectual property developed severally or jointly relating to our TFF technology. We have not entered into agreements with any contract manufacturers for commercial supply, however, we believe that Societal CDMO, CoreRx, Catalent, and Experic, among several other manufacturers, have the experience and the capacity to serve as a commercial contract manufacturer. We believe we will be able to engage a commercial contract manufacturer for our product candidates in a timely manner at competitive pricing.

Each of CoreRx’s, Societal CDMO’s, Catalent’s, and Experic’s facilities and services are conducted in accordance with the FDA’s current good manufacturing practices, or cGMPs, regulations. Pursuant to the agreements with CoreRx, Societal CDMO, Catalent, and Experic, they will support clinical supplies and provide release and stability testing of the respective TFF drug product candidate. Specific tasks will include:

| ● | Engineering review and TFF technology installation; |

| ● | Familiarization with TFF technology, including powder processing and handling; |

| ● | Analytical method transfer, development, and validation; |

8

| ● | Conducting process development trials and short-term supportive stability analysis; |

| ● | Scale-up and demonstration batches of the product candidate; |

| ● | Manufacture and analytical characterization of materials to support toxicology studies, both placebo and active; |

| ● | Process train qualification for cGMP manufacturing; |

| ● | Manufacturing and release of cGMP batches for clinical trials; and |

| ● | Conducting formal stability study under the guidelines of International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use, or ICH. |

Licenses and Intellectual Property Rights

We hold rights to our TFF technology pursuant to a patent license agreement with the University of Texas at Austin, or UT. UT is the owner of 141 U.S. and international patents and patent applications with claims covering the TFF platform. Pursuant to the patent license agreement, we hold an exclusive worldwide, royalty bearing license to the rights to all current and future patents held by UT relating to the TFF technology, including any divisionals, continuations and extensions, in all fields of use. The patent license agreement also provides us with a non-exclusive license to all know-how related to the TFF technology. We have also filed four US and foreign patent applications relating to certain elements of the thin film freezing platform.

We are required to pay royalties to UT in the amount of 2% of net sales received by us from the sale of products covered by the licensed patent rights. We will also be required to make certain milestone payments to UT in connection with the certain regulatory submissions and approvals and pay fees in connection with any assignments or sublicenses, including:

| ● | $50,000 upon each approval of an IND for the first indication of each product candidate; | |

| ● | $100,000 upon submission of a final Phase II report (or a foreign equivalent) on the first product candidate; | |

| ● | $250,000 upon submission of a final Phase III report (or a foreign equivalent) on the first product candidate; | |

| ● | $500,000 upon regulatory approval in the U.S. (or a foreign equivalent) on the first product candidate; and | |

| ● | $500,000 upon regulatory approval in the U.S. (or a foreign equivalent) on the second product candidate or on the second indication of the first product candidate. Pursuant to the UT patent license agreement, UT has agreed to consult with us concerning the development and implementation of a strategy for the prosecution and maintenance of the licensed patent rights, including any infringement of the licensed patents rights by third parties. However, UT has retained control and final decision-making authority over such matters. We are responsible for the payment of all fees and expenses involved in the prosecution and maintenance of the licensed patent rights and are obligated to negotiate in good faith with UT over the funding and allocation of any recovery involved in any patent infringement action brought to enforce the licensed patent rights, which are presently scheduled to expire over a period of time commencing in 2023 and ending in 2035. The term of the UT patent license agreement is co-terminus with the licensed patent rights. However, UT has the right to terminate the patent license agreement, or any part of the licensed patent rights or field of use, in the event of our breach of any provision of the patent license agreement that remains uncured after UT’s written notice of breach and an applicable cure period or in the event we initiate any proceeding to challenge the validity or scope of the licensed patent rights. The agreement also contains customary representations, warranties, covenants and indemnities by the parties. |

In addition to the licensed patent rights, we also rely on our trade secrets, know-how and continuing technological innovation to develop and maintain our proprietary position. We will vigorously defend our intellectual property to preserve our rights and gain the benefit of our technological investments.

9

Government Regulations and Funding

Pharmaceutical companies are subject to extensive regulation by foreign, federal, state and local agencies, such as the U.S. FDA, and various similar agencies in most countries worldwide. The manufacture, distribution, marketing and sale of pharmaceutical products are subject to government regulation in the U.S. and various foreign countries. Additionally, in the U.S., we must follow rules and regulations established by the FDA requiring the presentation of data indicating that our product candidates are safe and efficacious and are manufactured in accordance with cGMP regulations. If we do not comply with applicable requirements, we may be fined, the government may refuse to approve our marketing applications or allow us to manufacture or market our product candidates, and we may be criminally prosecuted. We, our manufacturers and clinical research organizations, may also be subject to regulations under other foreign, federal, state and local laws, including, but not limited to, the U.S. Occupational Safety and Health Act, the Resource Conservation and Recovery Act, the Clean Air Act and import, export and customs regulations as well as the laws and regulations of other countries. The U.S. government has increased its enforcement activity regarding illegal marketing practices domestically and internationally. As a result, pharmaceutical companies must ensure their compliance with the Foreign Corrupt Practices Act and federal healthcare fraud and abuse laws, including the False Claims Act.

These regulatory requirements impact our operations and differ from one country to another, so that securing the applicable regulatory approvals of one country does not imply the approval of another country. The approval procedures involve high costs and are manpower intensive, usually extend over many years and require highly skilled and professional resources.

FDA Market Approval Process

The steps usually required to be taken before a new drug may be marketed in the U.S. generally include:

| ● | completion of pre-clinical laboratory and animal testing; |

| ● | completion of required chemistry, manufacturing and controls testing; |

| ● | the submission to the FDA of an IND, which must be evaluated and found acceptable by the FDA before human clinical trials may commence; |

| ● | performance of adequate and well-controlled human clinical trials to establish the safety, pharmacokinetics and efficacy of the proposed drug for its intended use; |

| ● | submission and approval of an NDA; |

| ● | successful pre-approval inspection of the manufacturer and analytical testing facilities; and |

| ● | agreement with FDA of the label language, including the prescribing information insert. |

Clinical studies are conducted under protocols detailing, among other things, the objectives of the study, what types of patients may enter the study, schedules of tests and procedures, drugs, dosages, and length of study, as well as the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. A protocol for each clinical study and any subsequent protocol amendments must be submitted to the FDA as part of the IND process.

Clinical trials are usually conducted in three phases. Phase I clinical trials are normally conducted in small groups of healthy volunteers to assess safety and tolerability of various dosing regimens and pharmacokinetics. After a safe dose has been established, in Phase II clinical trials the drug is administered to small populations of sick patients to look for initial signs of efficacy via dose ranging studies in treating the targeted disease or condition and to continue to assess safety and the effective doses to be studied in larger trials in Phase III. In the case of vaccines, the participants are healthy and the signs of efficacy can be obtained in early Phase I, therefore this Phase is defined as Phase I/II. Phase III clinical trials are usually multi-center, double-blind controlled trials in hundreds or even thousands of subjects at various sites to assess as fully as possible both the safety and effectiveness of the drug.

10

Clinical trials must be conducted in accordance with the FDA’s good clinical practice, or GCP, requirements. The FDA may order the temporary or permanent discontinuation of a clinical study at any time or impose other sanctions if it believes that the clinical study is not being conducted in accordance with FDA requirements or that the participants are being exposed to an unacceptable health risk. An institutional review board, or IRB, generally must approve the clinical trial design and patient informed consent at study sites that the IRB oversees and also may halt a study, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions. Additionally, some clinical studies are overseen by an independent group of qualified experts organized by the clinical study sponsor, known as a data safety monitoring board or committee. This group recommends whether or not a trial may move forward at designated check points based on access to certain data from the study. The clinical study sponsor may also suspend or terminate a clinical trial based on evolving business objectives and/or competitive climate.

As a product candidate moves through the clinical testing phases, manufacturing processes are further defined, refined, controlled and validated. The level of control and validation required by the FDA increases as clinical studies progress. We and the third-party manufacturers on which we rely for the manufacture of our product candidates and their respective components (including the API) are subject to requirements that drugs be manufactured, packaged and labeled in conformity with cGMPs. To comply with cGMP requirements, manufacturers must continue to spend time, money and effort to meet requirements relating to personnel, facilities, equipment, production and process, labeling and packaging, quality control, recordkeeping and other requirements.

Assuming completion of all required testing in accordance with all applicable regulatory requirements, detailed information on the product candidate is submitted to the FDA in the form of an NDA, requesting approval to market the product for one or more indications, together with payment of a user fee, unless waived. An NDA includes all relevant data available from pertinent nonclinical and clinical studies, including negative or ambiguous results as well as positive findings, together with detailed information on the chemistry, manufacture, controls and proposed labeling, among other things. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and efficacy of the product candidate for its intended use to the satisfaction of the FDA. The FDA also conducts a pre-approval inspection of the manufacturer and laboratory prior to approval of the NDA.

If an NDA submission is accepted for filing, the FDA begins an in-depth review of the NDA. Under the Prescription Drug User Fee Act, or PDUFA, the FDA’s goal is to complete its initial review and respond to the applicant within ten months of submission, unless the application relates to an unmet medical need, or is for a serious or life-threatening indication, in which case the goal may be within six months of NDA submission. However, PDUFA goal dates are not legal mandates and the FDA response often occurs several months beyond the original PDUFA goal date. Further, the review process and the target response date under PDUFA may be extended if the FDA requests or the NDA sponsor otherwise provides additional information or clarification regarding information already provided in the NDA. The NDA review process can, accordingly, be very lengthy. During its review of an NDA, the FDA may refer the application to an advisory committee for review, evaluation and recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it typically follows such recommendations. Data from clinical studies are not always conclusive and the FDA and/or any advisory committee it appoints may interpret data differently than the applicant.

After the FDA evaluates the NDA and inspects manufacturing facilities where the drug product and/or its API will be produced and tested, it will either approve commercial marketing of the drug product with prescribing information for specific indications or issue a complete response letter indicating that the application is not ready for approval and stating the conditions that must be met in order to secure approval of the NDA. If the complete response letter requires additional data and the applicant subsequently submits that data, the FDA nevertheless may ultimately decide that the NDA does not satisfy its criteria for approval. The FDA could also approve the NDA with a Risk Evaluation and Mitigation Strategies, or REMS, plan to mitigate risks, which could include medication guides, physician communication plans, or elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. The FDA also may condition approval on, among other things, changes to proposed labeling, development of adequate controls and specifications, or a commitment to conduct post-marketing testing. Such post-marketing testing may include Phase IV clinical trials and surveillance to further assess and monitor the product’s safety and efficacy after approval. Regulatory approval of products for serious or life-threatening indications may require that participants in clinical studies be followed for long periods to determine the overall survival benefit of the drug.

11

If the FDA approves one of our product candidates, we will be required to comply with a number of post-approval regulatory requirements. We would be required to report, among other things, certain adverse reactions and production problems to the FDA, provide updated safety and efficacy information and comply with requirements concerning advertising and promotional labeling for any of our product candidates. Also, quality control and manufacturing procedures must continue to conform to cGMPs after approval, and the FDA periodically inspects manufacturing facilities to assess compliance with cGMPs, which imposes extensive procedural, substantive and record keeping requirements. If we seek to make certain changes to an approved product, such as certain manufacturing changes, we may need FDA review and approval before the change can be implemented.

While physicians may use products for indications that have not been approved by the FDA, we may not label or promote the product for an indication that has not been approved. Securing FDA approval for new indications is similar to the process for approval of the original indication and requires, among other things, submitting data from adequate and well-controlled studies that demonstrate the product’s safety and efficacy in the new indication. Even if such studies are conducted, the FDA may not approve any change in a timely fashion, or at all.

The FDA may also require post-marketing testing, or Phase IV testing, as well as risk minimization action plans and surveillance to monitor the effects of an approved product or place conditions or an approval that could otherwise restrict the distribution or use of the product.

Section 505(b)(2) New Drug Applications

We intend to submit applications for both of our lead therapeutic candidates via the 505(b)(2) regulatory pathway. As an alternate path for FDA approval of new indications or new formulations of previously-approved products, a company may file a Section 505(b)(2) NDA, instead of a “stand-alone” or “full” NDA. Section 505(b)(2) of the FDCA was enacted as part of the Drug Price Competition and Patent Term Restoration Act of 1984, otherwise known as the Hatch-Waxman Amendments. Section 505(b)(2) permits the submission of an NDA where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. Some examples of products that may be allowed to follow a 505(b)(2) path to approval are drugs that have a new dosage form, strength, route of administration, formulation or indication.

The Hatch-Waxman Amendments permit the applicant to rely upon certain published nonclinical or clinical studies conducted for an approved product or the FDA’s conclusions from prior review of such studies. The FDA may require companies to perform additional studies or measurements to support any changes from the approved product. The FDA may then approve the new product for all or some of the labeled indications for which the reference product has been approved, as well as for any new indication supported by the Section 505(b)(2) application. While references to nonclinical and clinical data not generated by the applicant or for which the applicant does not have a right of reference are allowed, all development, process, stability, qualification and validation data related to the manufacturing and quality of the new product must be included in an NDA submitted under Section 505(b)(2).

To the extent that the Section 505(b)(2) applicant is relying on the FDA’s conclusions regarding studies conducted for an already approved product, the applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations, or Orange Book. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or (iv) the listed patent is invalid or will not be infringed by the new product. The Section 505(b)(2) application also will not be approved until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, listed in the Orange Book for the reference product has expired. If the Orange Book certifications outlined above are not accomplished, the Section 505(b)(2) applicant may invest a significant amount of time and expense in the development of its products only to be subject to significant delay and patent litigation before its products may be commercialized.

12

Orphan Drugs

Under the Orphan Drug Act, the FDA may grant orphan designation to a drug intended to treat a rare disease or condition affecting fewer than 200,000 individuals in the United States, or in other limited cases. Orphan drug designation (ODD) provides for seven years of market exclusivity, independent of patent protection, to the company with ODD that brings a particular product to market. In addition, companies developing orphan drugs are eligible for certain incentives, including tax credits for qualified clinical testing. In addition, an NDA for a product that has received orphan drug designation is not subject to a prescription drug user fee unless the application includes an indication other than the rare disease or condition for which the drug was designated.

To gain exclusivity, if a product that has orphan drug designation subsequently receives the first FDA approval for the disease or condition for which it has such designation, the product is entitled to the orphan drug exclusivity, which means that the FDA may not approve any other applications to market the same active moiety for the same indication for seven years, except in limited circumstances, such as another drug’s showing of clinical superiority over the drug with orphan exclusivity. Competitors, however, may receive approval of different active moieties for the same indication or obtain approval for the same active moiety for a different indication. In addition, doctors may prescribe products for off-label uses and undermine our exclusivity. Orphan drug exclusivity could block the approval of one of our product candidates for seven years if a competitor obtains approval for the same active moiety for the same indication before we do, unless we are able to demonstrate that our product is clinically superior.

We may plan to pursue orphan drug designation and exclusivity for some of our product candidates in the United States, European Union, and other geographies of interest for specific products. We cannot guarantee that we will obtain orphan drug designation for any products in any jurisdiction. Even if we are able to obtain orphan drug designation for a product, we cannot be sure that such product will be approved, that we will be able to obtain orphan drug exclusivity upon approval, if ever, or that we will be able to maintain any exclusivity that is granted.

Continuing Regulation

After a drug is approved for marketing and enters the marketplace, numerous regulatory requirements continue to apply. These include, but are not limited to:

| ● | the FDA’s cGMP regulations require manufacturers, including third party manufacturers, to follow stringent requirements for the methods, facilities and controls used in manufacturing, processing and packing of a drug product; |

| ● | labeling regulations and the FDA prohibitions against the promotion of drugs for unapproved uses (known as off-label uses), as well as requirements to provide adequate information on both risks and benefits during promotion of the drug; |

| ● | approval of product modifications or use of a drug for an indication other than approved in an NDA; |

| ● | adverse drug experience regulations, which require us to report information on adverse events during pre-market testing and post-approval safety reporting; |

| ● | NDA quarterly reporting for the first three years, then annual reporting thereafter, of changes in chemistry, manufacturing and control or CMC, labeling, clinical studies and findings, and toxicology studies from the data submitted in the NDA; |

| ● | post-market testing and surveillance requirements, including Phase IV trials, when necessary to protect the public health or to provide additional safety and effectiveness data for the drug; and |

| ● | the FDA’s recall authority, whereby it can ask, or under certain conditions order, drug manufacturers to recall from the market a product that is in violation of governing laws and regulation. After a drug receives approval, any modification in conditions of use, active ingredient(s), route of administration, dosage form, strength or bioavailability, will require a new approval, for which it may be possible to submit a 505(b)(2), accompanied by additional clinical data necessary to demonstrate the safety and effectiveness of the product with the proposed changes. Additional clinical studies may be required for proposed changes. |

13

Other U.S. Healthcare Laws and Compliance Requirements

For products distributed in the United States, we will also be subject to additional healthcare regulation and enforcement by the federal government and the states in which we conduct our business. Applicable federal and state healthcare laws and regulations include the following:

| ● | The federal healthcare anti-kickback statute prohibits, among other things, persons from knowingly and willfully soliciting, offering, receiving, or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order, or recommendation of, any good or service, for which payment may be made under federal healthcare programs such as Medicare and Medicaid; |

| ● | The Ethics in Patient Referrals Act, commonly referred to as the Stark Law, and its corresponding regulations, prohibit physicians from referring patients for designated health services (including outpatient drugs) reimbursed under the Medicare or Medicaid programs to entities with which the physicians or their immediate family members have a financial relationship or an ownership interest, subject to narrow regulatory exceptions, and prohibits those entities from submitting claims to Medicare or Medicaid for payment of items or services provided to a referred beneficiary; |

| ● | The federal False Claims Act imposes criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the federal government claims for payment that are false or fraudulent or making a false statement to avoid, decrease, or conceal an obligation to pay money to the federal government; |

| ● | Health Insurance Portability and Accountability Act of 1996, imposes criminal and civil liability for executing a scheme to defraud any healthcare benefit program and also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information. This statute also prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement in connection with the delivery of or payment for healthcare benefits, items, or services; and |

| ● | Analogous state laws and regulations, such as state anti-kickback and false claims laws, may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third-party payors, including private insurers, and some state laws require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government. |

Reimbursement

Sales of our product candidates in the United States may depend, in part, on the extent to which the costs of the product candidates will be covered by third-party payers, such as government health programs, commercial insurance and managed health care organizations. These third-party payers are increasingly challenging the prices charged for medical products and services. Additionally, the containment of health care costs has become a priority of federal and state governments, and the prices of drugs have been a focus in this effort. The United States government, state legislatures and foreign governments have shown significant interest in implementing cost-containment programs, including price controls, restrictions on reimbursement and requirements for substitution of generic products. Adoption of price controls and cost-containment measures, and adoption of more restrictive policies in jurisdictions with existing controls and measures, could further limit our net revenue and results. If these third-party payers do not consider our product candidates to be cost-effective compared to other available therapies, they may not cover our product candidates after approval as a benefit under their plans or, if they do, the level of payment may not be sufficient to allow us to sell our product candidates on a profitable basis.

14

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or the MMA, imposes new requirements for the distribution and pricing of prescription drugs for Medicare beneficiaries and includes a major expansion of the prescription drug benefit under Medicare Part D. Under Part D, Medicare beneficiaries may enroll in prescription drug plans offered by private entities which will provide coverage of outpatient prescription drugs. Part D plans include both stand-alone prescription drug benefit plans and prescription drug coverage as a supplement to Medicare Advantage plans. Unlike Medicare Parts A and B, Part D coverage is not standardized. Part D prescription drug plan sponsors are not required to pay for all covered Part D drugs, and each drug plan can develop its own drug formulary that identifies which drugs it will cover and at what tier or level. However, Part D prescription drug formularies must include drugs within each therapeutic category and class of covered Part D drugs, though not necessarily all the drugs in each category or class. Any formulary used by a Part D prescription drug plan must be developed and reviewed by a pharmacy and therapeutic committee. Government payment for some of the costs of prescription drugs may increase demand for product candidates for which we receive marketing approval. However, any negotiated prices for our product candidates covered by a Part D prescription drug plan will likely be lower than the prices we might otherwise obtain. Moreover, while the MMA applies only to drug benefits for Medicare beneficiaries, private payers often follow Medicare coverage policy and payment limitations in setting their own payment rates. Any reduction in payment that results from the MMA may result in a similar reduction in payments from non-governmental payers.