UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ______________

For the transition period from to

Commission

file number

(Exact name of Registrant as specified in its charter)

(Exact name of Registrant as specified in its charter)

People’s

Republic of

(Address of principal executive offices)

Telephone:

Email:

At the address of the Company set forth above

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | None | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

(

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Class A ordinary shares were outstanding as of December 31, 2023

Class B ordinary shares were outstanding as of December 31, 2023

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes

☒

If

this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentivebased compensation received by any of the registrant’s executive offi cers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registration has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which consolidated financial statement item the registrant has elected to follow ☐ Item 17 ☐ Item 18

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities

Exchange Act of 1934) ☐ Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court ☐ Yes ☐ No

TABLE OF CONTENTS

| i |

CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT ON FORM 20-F

Except where the context otherwise requires, references in this annual report to:

| ● | “installed users” are to the aggregate number of unique mobile devices that have downloaded and launched the Group’s relevant mobile application at least once; | |

| ● | “ADSs” are to American depositary shares, with every four ADSs representing one Class A ordinary share, and “ADRs” are to American depositary receipts that evidence ADSs; | |

| ● | “CAGR” are to compound annual growth rate; | |

| ● | “China” and the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan, the Hong Kong Special Administrative Region and the Macao Special Administrative Region; | |

| ● | “DAUs” are to the number of unique mobile devices that accessed the Group’s relevant mobile application on a given day. “Combined average DAUs” for a particular period is the average of the DAUs for all of the Group’s mobile applications on each day during that period; | |

| ● | “the Group” are to Qutoutiao Inc., the Group VIEs and their respective subsidiaries; | |

| ● | “Group VIEs” are to the variable interest entities, or VIEs, that are controlled by us through contractual arrangements and are consolidated into the Group’s consolidated financial statements in accordance with U.S. GAAP; | |

| ● | “Key WFOEs” are to material wholly foreign-owned entities of Qutoutiao Inc., namely Shanghai Quyun Network Technology Co., Ltd. and Shanghai Zhicao Information Technology Co., Ltd.; | |

| ● | “Key VIEs” are to material variable interest entities of Qutoutiao Inc., namely Shanghai Jifen Culture Communications Co., Ltd., Shanghai Big Rhinoceros Horn Information Technology Co., Ltd., Beijing Churun Internet Technology Co., Ltd. and Shanghai Ququanquan Information Technology Co., Ltd.; | |

| ● | “MAUs” are to the number of unique mobile devices that accessed the Group’s relevant mobile application in a given month. “Combined average MAUs” for a particular period is the average of the MAUs for all of the Group’s mobile applications in each month during that period; | |

| ● | “oCPC” are to optimized cost-per-click as basis for charging the Group’s advertising services; | |

| ● | “oCPM” are to optimized cost-per-thousand-impressions as basis for charging the Group’s advertising services; | |

| ● | “Qutoutiao,” “we,” “us,” “our company” and “our” are to Qutoutiao Inc., its subsidiaries, and, in the context of describing its operations and consolidated financial information, the Group VIEs; | |

| ● | “R&D” are to research and development; | |

| ● | “registered users” are to users that have registered accounts on the Group’s relevant mobile application; | |

| ● | “RMB” or “Renminbi” are to the legal currency of China; | |

| ● | “lower-tier cities” are to cities in China that are not tier-1 and tier-2 cities; | |

| ● | “tier-1 and tier-2 cities” refer to (i) tier-1 cities in China, which are Beijing, Shanghai, Guangzhou and Shenzhen and (ii) tier-2 cities in China, which are Hangzhou, Nanjing, Jinan, Chongqing, Qingdao, Dalian, Ningbo, Xiamen, Tianjin, Chengdu, Wuhan, Harbin, Shenyang, Xi’an, Changchun, Changsha, Fuzhou, Zhengzhou, Shijiazhuang, Suzhou, Foshan, Dongguan, Wuxi, Yantai, Taiyuan, Hefei, Kunming, Nanchang, Nanning, Tangshan, Wenzhou and Zibo; and | |

| ● | “US$,” “U.S. dollars,” or “dollars” are to the legal currency of the United States. |

On December 10, 2021, we effected a change of the ratio of our ADSs to Class A ordinary shares from the then ADS ratio of four (4) ADSs to one (1) Class A ordinary share to a new ADS ratio of two (2) ADS representing five (5) Class A ordinary shares. Unless otherwise indicated, ADSs and per ADS amount in this annual report have been retroactively adjusted to reflect the change in ratio for all periods presented.

Unless specifically indicated otherwise or unless the context otherwise requires, all references to our ordinary shares exclude ordinary shares issuable upon the exercise of outstanding options with respect to our ordinary shares under our share incentive plan.

This annual report contains translations between Renminbi and U.S. dollars solely for the convenience of the reader. The translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi in this annual report were made at a rate of RMB7.0999 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on December 29, 2023. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

Unless the context indicates otherwise, all share and per share data in this annual report have given effect to a share split in September 2017 in which each one of the previously issued ordinary shares was split into 10,000 ordinary shares.

This annual report on Form 20-F includes the Group’s audited consolidated financial statements for the years ended December 31, 2021, 2022 and 2023, and as of December 31, 2022 and December 31, 2023.

| 1 |

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains statements of a forward-looking nature. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause the Group’s actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. These forward-looking statements relate to, among others:

| ● | the Group’s goal and strategies; | |

| ● | the Group’s ability to maintain and strengthen its position as a leader amongst mobile content platform companies in China’s mobile content industry; | |

| ● | the Group’s expansion plans; | |

| ● | the Group’s ability to monetize through advertising and other products and services that it plans to introduce; | |

| ● | the Group’s future business development, financial condition and results of operations; | |

| ● | PRC laws, regulations, and policies relating to the Internet and Internet content providers; and | |

| ● | general economic and business conditions. |

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect the Group’s financial condition, results of operations, business strategy and financial needs.

You should read these statements in conjunction with the risks disclosed in “Item 3. Key Information — D. Risk Factors” of this annual report and other risks outlined in our other filings with the Securities and Exchange Commission, or the SEC. Moreover, the Group operates in an emerging and evolving environment. New risks may emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of such risks on the Group’s business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this annual report and the documents that we have referred to in this annual report, completely and with the understanding that the Group’s actual future results may be materially different from what we expect.

| 2 |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not Applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not Applicable.

| ITEM 3. | KEY INFORMATION |

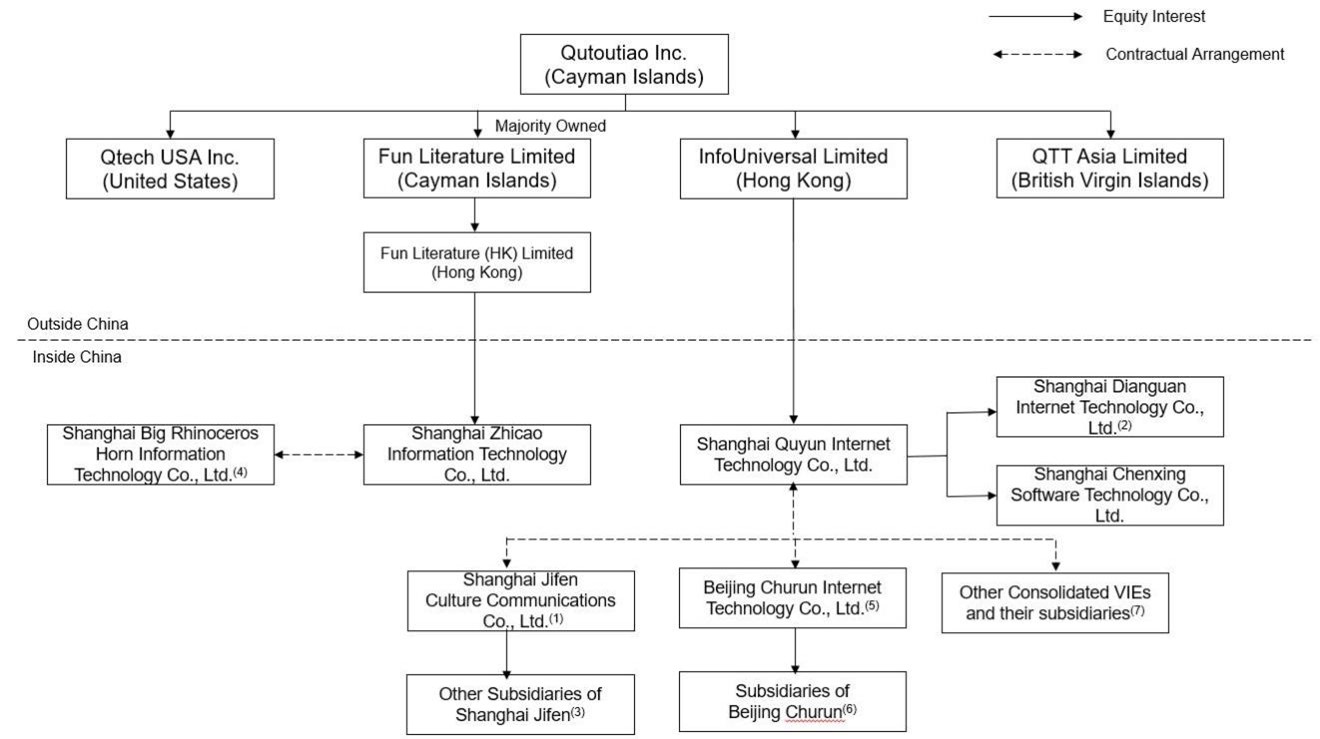

Our Corporate Structure and Contractual Arrangements

Qutoutiao Inc. is not a Chinese operating company but a holding company incorporated in the Cayman Islands as an exempted company with limited liability, with operations primarily conducted (i) through contractual arrangements with certain variable interest entities, or the Group VIEs, in China and (ii) by our subsidiaries in China. Qutoutiao Inc. does not own equity interests in the Group VIEs, and does not conduct business operations directly. PRC laws and regulations impose certain restrictions or prohibitions on foreign ownership of companies that engage in certain value-added telecommunication services, internet audio-video program services and certain other businesses. Therefore, we operate such businesses in China through the Group VIEs and their subsidiaries, and rely on contractual arrangements among our PRC subsidiaries, the Group VIEs and their respective shareholders to control the business operations of the Group VIEs. Investors in our ADSs do not hold equity interests in the Group’s operating entities in China, but instead hold equity interests in Qutoutiao Inc., a Cayman Islands holding company. See “Item 4. Information on the Company — D. Organizational Structure” for a diagram illustrating our corporate structure. As used in this annual report, “Qutoutiao,” “we,” “us,” “our company” or “our” refers to Qutoutiao Inc., its subsidiaries, and, in the context of describing its operations and consolidated financial information, the Group VIEs; “the Group” refers to Qutoutiao Inc., the Group VIEs and their respective subsidiaries; and “the Group VIEs” refer to the variable interest entities that conduct our business operations in China.

The contractual arrangements among our PRC subsidiaries, the Group VIEs and their respective shareholders collectively enable us to:

| ● | exercise effective control over the Group VIEs and their subsidiaries; | |

| ● | receive substantially all the economic benefits of the Group VIEs; and | |

| ● | have an exclusive option to purchase all or part of the equity interests and assets of the Group VIEs when and to the extent permitted by PRC law. |

As a result of the contractual arrangements, Qutoutiao Inc. and certain of its subsidiaries are considered the primary beneficiaries of the Group VIEs for accounting purposes, and we have consolidated the financial results of the Group VIEs in the Group’s consolidated financial statements. For more details on the contractual arrangements, see “Item 4. Information on the Company — D. Organizational Structure — Contractual Arrangements among Our Key WFOEs, the Key VIEs and Their Respective Shareholders.” Terms contained in each set of contractual arrangements with the Group VIEs are substantially similar.

| 3 |

We are subject to risks associated with our contractual arrangements with the Group VIEs and their shareholders. Our Cayman Islands holding company and its investors may never hold equity interests in the Group VIEs. The contractual arrangements may be less effective than equity ownership in providing us with control over the Group VIEs and we may incur substantial costs to enforce the terms of the arrangements. If the Group VIEs or their shareholders fail to perform their respective obligations under these contractual arrangements, our ability, as a Cayman Islands holding company, to enforce these contractual arrangements may be limited. The contractual arrangements have not been tested in a court of law in China. There are very few precedents and little formal guidance as to how contractual arrangements in the context of a variable interest entity should be interpreted or enforced under PRC law. In the event we are unable to enforce these contractual arrangements, or if we suffer significant delay or other obstacles in the process of enforcing these contractual arrangements, we may not be able to exert effective control over the Group VIEs, and our ability to conduct the Group’s business and the Group’s results of operations and financial condition may be materially and adversely affected. See “— D. Risk Factors — Risks Relating to Our Corporate Structure — We rely on contractual arrangements with the Group VIEs and their respective shareholders to operate the Group’s business, which may be less effective than equity ownership in providing operational control and otherwise materially and adversely affect the Group’s business” and “— The shareholders of the Group VIEs may have potential conflicts of interest with us, which may materially and adversely affect the Group’s business, results of operations and financial condition.”

There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules with regard to our corporate structure and the contractual arrangements with the Group VIEs and their shareholders. If Chinese regulatory authorities disallow such structure and arrangements, it would have a material effect on our operations and cause the value of our ADSs to significantly decline or become worthless. See “— D. Risk Factors — Risks Relating to Our Corporate Structure — If the PRC government deems that the contractual arrangements in relation to the Group VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. In addition, our ADSs may significantly decline in value or become worthless if we are unable to assert our contractual control over the assets of the Group VIEs” and “— Substantial uncertainties exist with respect to whether the controlling of PRC onshore variable interest entities by foreign investors via contractual arrangements will be recognized as ‘foreign investment’ and how it may impact the viability of the Group’s current corporate structure and operations.”

The Group also faces various legal and operational risks and uncertainties associated with being based in or having its operations primarily in China and the country’s complex and evolving laws and regulations. For example, the Group faces risks associated with regulatory approvals on offerings conducted overseas by and foreign investment in China-based issuers, the use of the Group VIEs, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, which may impact the Group’s ability to conduct certain businesses, accept foreign investments, or list on a U.S. or other foreign exchange outside of China. These risks could result in a material adverse change in the Group’s operations and the value of our ADSs, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. See “— D. Risks Factors — Risks Relating to Doing Business in China.”

Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted in December 2020 and amended pursuant to the Consolidated Appropriations Act, 2023 on December 29, 2022, and may affect the trading of our ADSs in the over-the-counter, or OTC, trading market in the United States. Pursuant to the HFCAA, if the SEC determines that we are an issuer, or a covered issuer, that has filed audit reports issued by a registered public accounting firm that has not been subject to inspection for the U.S. Public Company Accounting Oversight Board, or the PCAOB, for two consecutive years, the SEC shall prohibit our ADSs from being traded on a national securities exchange or in the OTC trading market in the United States. In December 2021, the PCAOB determined that it is unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, including our auditor as an independent registered public accounting firm. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong completely in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. On November 30, 2023, the PCAOB announced that it had completed its inspections on registered public accounting firms headquartered in mainland China and Hong Kong for 2023 with the complete access required under the HFCAA. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. If the PCAOB is unable to inspect and investigate completely registered public accounting firms located in China and we fail to retain another registered public accounting firm that the PCAOB is able to inspect and investigate completely in 2024 and beyond, or if we otherwise fail to meet the PCAOB’s requirements, our ADSs may be prohibited from trading on the OTC under the HFCAA.

| 4 |

Permissions and Approvals

As of the date of this annual report, the Group has obtained all material permissions and approvals that are, or may be, required for the Group’s main operations in China, except as disclosed in “— D. Risk Factors — Risk Relating to Our Business and Industry — The Group’s inability to fully comply with Audio-visual Program Provisions may expose it to administrative sanctions, which would materially and adversely affect the Group’s business, results of operations and financial condition” and “— The Group may be adversely affected by the complexity, uncertainties and changes in PRC regulation of Internet businesses and companies, including limitations on its ability to own key assets such as its mobile applications.” No material permission or approval for the Group has been denied by relevant authorities in China. See “Item 4. Information on the Company — C. Regulations — Permissions and Licenses Requirements” for more details.

In addition, we, our PRC subsidiaries and the Group VIEs may be required to obtain permissions from the China Securities Regulatory Commission, or the CSRC, and may be required to go through cybersecurity review by the Cyberspace Administration of China, or the CAC, in connection with any future offering and listing in an overseas market. See “— D. Risks Factors — Risks Relating to Doing Business in China — The approval of and the filing with the China Securities Regulatory Commission, or the CSRC, or other PRC government authorities may be required in connection with our future offshore offerings under PRC law, which may hinder our ability to continue to offer securities to investors offshore; in addition, the regulation of the CSRC or other PRC regulatory agencies establish complex procedures for acquisitions conducted by foreign investors that could make it more difficult for us to grow through acquisitions” and “— Risks Relating to Our Industry and Business — We may be subject to cybersecurity review by regulatory authorities of the PRC in the future.”

Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future, and may not be able to maintain or renew our current licenses, permits, filings or approvals. In addition, rules and regulations in China can change quickly with little advance notice. Uncertainties due to evolving laws and regulations could impede the ability of a China-based issuer, such as us, to obtain or maintain permits or licenses required to conduct business in China. In the absence of required permits or licenses, governmental authorities could impose material sanctions or penalties on us. See “— D. Risks Factors — Risks Relating to Doing Business in China — Changes in the political and economic policies of the PRC government may materially and adversely affect the Group’s business, results of operations and financial condition and may result in the Group’s inability to sustain our growth and expansion strategies. The PRC government may intervene or influence our operations at any time, which could result in a material change in the Group’s operations and/or the value of our ADSs. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder the Group’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless” and “— There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. In addition, rules and regulations in China can change quickly with little advance notice.”

Cash Transfers Through Our Organization

Qutoutiao Inc. is a holding company with no material operations of its own. We conduct our operations primarily (i) through contractual arrangements with the Group VIEs in China and (ii) by our subsidiaries in China. As a result, Qutoutiao Inc.’s ability to pay dividends depends upon dividends paid by our PRC subsidiaries and remittances from the Group VIEs. If our PRC subsidiaries or the Group VIEs incur debt on their own in the future, the instruments governing their debt may restrict their ability to pay dividends or make other distributions or remittances to us. In addition, current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their retained earnings, if any, determined in accordance with PRC accounting standards and regulations. Furthermore, each of our PRC subsidiaries and the Group VIEs is required to set aside at least 10% of its net income each year to fund certain statutory reserves until the cumulative amount of such reserves reaches 50% of its registered capital. These reserves, together with the registered capital, are not distributable as cash dividends. For more details, see “— D. Risks Factors — Risks Relating to Doing Business in China — We rely to a significant extent on dividends and other distributions on equity paid by our principal operating subsidiaries and the Group VIEs to fund offshore cash and financing requirements. Any limitation on the ability of our PRC operating subsidiaries or the Group VIEs to make payments to us could materially and adversely affect our ability to conduct the Group’s business.”

| 5 |

Set forth in the table below is a summary of cash transfers that have occurred between our subsidiaries and the Group VIEs for the years ended December 31, 2021, 2022 and 2023, respectively.

| Year Ended December 31, | ||||||||||||

| 2021 | 2022 | 2023 | ||||||||||

| (RMB in thousands) | ||||||||||||

| Cash paid by the Group VIEs to our subsidiaries under service agreements | (756,962 | ) | (376,184 | ) | (571,434 | ) | ||||||

| Cash received by the Group VIEs from our subsidiaries under service agreements | 188,798 | 236,903 | 637,646 | |||||||||

| Cash received by the Group VIEs from our subsidiaries for intra-Group financing | 137,515 | 606,146 | 66,034 | |||||||||

For the years ended December 31, 2021, 2022 and 2023, no subsidiaries or Group VIEs paid dividends or made other distributions to the Cayman Islands holding company, and no dividends or distributions were paid or made to U.S. investors. For the years ended December 31, 2021, 2022 and 2023, no assets were transferred between our subsidiaries and the Group VIEs other than the cash transfers set forth in the table above. We do not have any present plan to pay any dividends on our shares in the foreseeable future. We intend to retain most, if not all, of our available funds and any future earnings to operate and expand our business. See “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Dividend Policy.” However, if our PRC subsidiaries or Group VIEs declare and distribute profits to us, such payments will be subject to withholding tax, which will increase our tax liability and reduce the amount of cash available to us. For PRC and United States federal income tax considerations in connection with an investment in our ADSs, see “Item 10. Additional Information — E. Taxation.” We plan to continue to determine the amount of service fee and payment method with the Group VIEs and their shareholders through bona fide negotiation, and settle fees under the contractual arrangements accordingly in the future.

In addition, our PRC subsidiaries, the Group VIEs and their subsidiaries generate their revenue primarily in Renminbi, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our PRC subsidiaries to pay dividends to us or our ability to pay dividends in foreign currencies to our investors. For more details, see “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China — We are subject to restrictions on currency exchange.”

Financial Information Related to the Group VIEs

We do not own any equity interest in the Group VIEs that are consolidated in the Group’s financial statements. The Group consolidates the results of the Group VIEs and their subsidiaries under U.S. GAAP through our contractual arrangements with the Group VIEs and their respective shareholders. For more details on such contractual arrangements, see “Item 4. — Information on the Company — D. Organizational Structure — Contractual Arrangements among Our Key WFOEs, the Key VIEs and Their Respective Shareholders.”

| 6 |

Condensed Consolidated Schedule of Results of Operation

The following table presents the Group’s condensed consolidated schedules of results of operations for our holding company, Qutoutiao Inc., our wholly foreign-owned entities that are the primary beneficiaries of the Group VIEs under U.S. GAAP, or the Primary Beneficiaries of the Group VIEs, our other subsidiaries that are not the Primary Beneficiaries of the Group VIEs, or Other Subsidiaries, and the Group VIEs and their subsidiaries that the Group consolidates for the periods presented:

| For the Year Ended December 31, 2021 | ||||||||||||||||||||||||

Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Third-party revenues | — | 225 | 2,990 | 4,336,388 | — | 4,339,603 | ||||||||||||||||||

| Intra-Group revenues(2) | — | — | 970,661 | 188,298 | (1,158,959 | ) | — | |||||||||||||||||

| Total revenues | — | 225 | 973,651 | 4,524,686 | (1,158,959 | ) | 4,339,603 | |||||||||||||||||

| Cost of revenues: | ||||||||||||||||||||||||

| Third-party cost of revenues | — | (325 | ) | (303,600 | ) | (867,701 | ) | — | (1,171,626 | ) | ||||||||||||||

| Intra-Group cost of revenues(2) | — | — | — | (18,959 | ) | 18,959 | — | |||||||||||||||||

| Total cost of revenues | — | (325 | ) | (303,600 | ) | (886,660 | ) | 18,959 | (1,171,626 | ) | ||||||||||||||

| Gross profit | — | (100 | ) | 670,051 | 3,638,026 | (1,140,000 | ) | 3,167,977 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Third-party operating expenses | (208,594 | ) | (12,210 | ) | (379,130 | ) | (4,067,548 | ) | 200,184 | (4,467,298 | ) | |||||||||||||

| Intra-Group operating expenses(2) | — | — | (188,298 | ) | (951,702 | ) | 1,140,000 | — | ||||||||||||||||

| Total operating expenses | (208,594 | ) | (12,210 | ) | (567,428 | ) | (5,019,250 | ) | 1,340,184 | (4,467,298 | ) | |||||||||||||

| Other operating income/(expense) | — | — | 87,439 | 18,659 | — | 106,098 | ||||||||||||||||||

| Loss from Operations | (208,594 | ) | (12,310 | ) | 190,062 | (1,362,565 | ) | 200,184 | (1,193,223 | ) | ||||||||||||||

| Non-operating income/(expense) | (58,313 | ) | (16,944 | ) | 12,267 | 22,282 | — | (40,708 | ) | |||||||||||||||

| Loss before income tax expense | (266,907 | ) | (29,254 | ) | 202,329 | (1,340,283 | ) | 200,184 | (1,233,931 | ) | ||||||||||||||

| Income tax benefits/expense | — | (1 | ) | (2,918 | ) | (131 | ) | — | (3,050 | ) | ||||||||||||||

| Loss from subsidiaries and VIEs(1) | (972,710 | ) | (1,144,198 | ) | (1,343,609 | ) | — | 3,460,517 | — | |||||||||||||||

| Equity in loss of affiliate companies | — | — | — | (3,195 | ) | — | (3,195 | ) | ||||||||||||||||

| Net Loss | (1,239,617 | ) | (1,173,453 | ) | (1,144,198 | ) | (1,343,609 | ) | 3,660,701 | (1,240,176 | ) | |||||||||||||

| Less: Net loss attributable to the noncontrolling interest shareholders | — | 559 | — | — | — | 559 | ||||||||||||||||||

| Net loss attributable to Qutoutiao Inc. | (1,239,617 | ) | (1,172,894 | ) | (1,144,198 | ) | (1,343,609 | ) | 3,660,701 | (1,239,617 | ) | |||||||||||||

| Accretion to convertible redeemable preferred shares redemption value | (108,896 | ) | — | — | — | — | (108,896 | ) | ||||||||||||||||

| Net loss attributable to Qutoutiao Inc.’s ordinary shareholders | (1,348,513 | ) | (1,172,894 | ) | (1,144,198 | ) | (1,343,609 | ) | 3,660,701 | (1,348,513 | ) | |||||||||||||

| 7 |

| For the Year Ended December 31, 2022 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Third-party revenues | — | 297 | 254,407 | 828,341 | — | 1,083,045 | ||||||||||||||||||

| Intra-Group revenues(2) | — | — | 750,372 | 579,967 | (1,330,339 | ) | — | |||||||||||||||||

| Total revenues | — | 297 | 1,004,779 | 1,408,308 | (1,330,339 | ) | 1,083,045 | |||||||||||||||||

| Cost of revenues: | ||||||||||||||||||||||||

| Third-party cost of revenues | — | (14 | ) | (115,170 | ) | (446,189 | ) | (1,234 | ) | (562,607 | ) | |||||||||||||

| Intra-Group cost of revenues(2) | — | — | (523,625 | ) | (376,184 | ) | 899,809 | — | ||||||||||||||||

| Total cost of revenues | — | (14 | ) | (638,795 | ) | (822,373 | ) | 898,575 | (562,607 | ) | ||||||||||||||

| Gross profit | — | 283 | 365,984 | 585,935 | (431,764 | ) | 520,438 | |||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Third-party operating expenses | (77,185 | ) | 2,277 | (301,059 | ) | (572,365 | ) | 47,567 | (900,765 | ) | ||||||||||||||

| Intra-Group operating expenses(2) | — | — | — | (384,197 | ) | 384,197 | — | |||||||||||||||||

| Total operating expenses | (77,185 | ) | 2,277 | (301,059 | ) | (956,562 | ) | 431,764 | (900,765 | ) | ||||||||||||||

| Other operating income/(expense) | — | — | 52,676 | 9,153 | — | 61,829 | ||||||||||||||||||

| Loss from Operations | (77,185 | ) | 2,560 | 117,601 | (361,474 | ) | — | (318,498 | ) | |||||||||||||||

| Non-operating income/(expense) | (468,035 | ) | (49,754 | ) | (68,801 | ) | (9,311 | ) | — | (595,901 | ) | |||||||||||||

| Loss before income tax expense | (545,220 | ) | (47,194 | ) | 48,800 | (370,785 | ) | — | (914,399 | ) | ||||||||||||||

| Income tax benefits/expense | — | (15 | ) | 1,117 | (54 | ) | — | 1,048 | ||||||||||||||||

| Loss from subsidiaries and VIEs(1) | (369,547 | ) | (322,338 | ) | (372,255 | ) | — | 1,064,140 | — | |||||||||||||||

| Equity in loss of affiliate companies | — | — | — | (1,416 | ) | — | (1,416 | ) | ||||||||||||||||

| Net Loss | (914,767 | ) | (369,547 | ) | (322,338 | ) | (372,255 | ) | 1,064,140 | (914,767 | ) | |||||||||||||

| Less: Net loss attributable to the noncontrolling interest shareholders | — | — | — | — | — | — | ||||||||||||||||||

| Net loss attributable to Qutoutiao Inc. | (914,767 | ) | (369,547 | ) | (322,338 | ) | (372,255 | ) | 1,064,140 | (914,767 | ) | |||||||||||||

| Accretion to convertible redeemable preferred shares redemption value | — | (124,677 | ) | — | — | — | (124,677 | ) | ||||||||||||||||

| Net loss attributable to Qutoutiao Inc.’s ordinary shareholders | (914,767 | ) | (494,224 | ) | (322,338 | ) | (372,255 | ) | 1,064,140 | (1,039,444 | ) | |||||||||||||

| 8 |

| For the Year Ended December 31, 2023 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Third-party revenues | — | 16 | 71,811 | 673,730 | 0 | 745,557 | ||||||||||||||||||

| Intra-Group revenues(2) | — | - | 133,358 | 637,646 | (771,004 | ) | — | |||||||||||||||||

| Total revenues | — | 16 | 205,169 | 1,311,376 | (771,004 | ) | 745,557 | |||||||||||||||||

| Cost of revenues: | ||||||||||||||||||||||||

| Third-party cost of revenues | — | (32 | ) | (46,576 | ) | (365,857 | ) | (3,448 | ) | (415,913 | ) | |||||||||||||

| Intra-Group cost of revenues(2) | — | - | (51,201 | ) | (571,434 | ) | 622,635 | — | ||||||||||||||||

| Total cost of revenues | — | (32 | ) | (97,777 | ) | (937,291 | ) | 619,187 | (415,913 | ) | ||||||||||||||

| Gross profit | — | (16 | ) | 107,392 | 374,085 | (151,817 | ) | 329,644 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||

| Third-party operating expenses | (47,078 | ) | (4,119 | ) | (68,290 | ) | (248,310 | ) | 16,652 | (351,145 | ) | |||||||||||||

| Intra-Group operating expenses(2) | — | - | - | (140,418 | ) | 140,418 | — | |||||||||||||||||

| Total operating expenses | (47,078 | ) | (4,119 | ) | (68,290 | ) | (388,728 | ) | 157,070 | (351,145 | ) | |||||||||||||

| Other operating income/(expense) | — | - | 15,370 | 4,237 | - | 19,607 | ||||||||||||||||||

| Income/(Loss) from Operations | (47,078 | ) | (4,135 | ) | 54,472 | (10,406 | ) | 5,253 | (1,894 | ) | ||||||||||||||

| Non-operating income/(expense) | (184,433 | ) | 192 | 3,190 | 859 | (5,253 | ) | (185,445 | ) | |||||||||||||||

| Loss before income tax expense | (231,511 | ) | (3,943 | ) | 57,662 | (9,547 | ) | - | (187,339 | ) | ||||||||||||||

| Income tax benefits/expense | — | - | 1,614 | 412 | - | 2,026 | ||||||||||||||||||

| Income from subsidiaries and VIEs(1) | 46,198 | 50,141 | (9,135 | ) | — | (87,204 | ) | — | ||||||||||||||||

| Equity in loss of affiliate companies | — | - | - | — | - | — | ||||||||||||||||||

| Net Income/(Loss) | (185,313 | ) | 46,198 | 50,141 | (9,135 | ) | (87,204 | ) | (185,313 | ) | ||||||||||||||

| Less: Net loss attributable to the noncontrolling interest shareholders | — | - | - | — | - | — | ||||||||||||||||||

| Net income/(loss) attributable to Qutoutiao Inc. | (185,313 | ) | 46,198 | 50,141 | (9,135 | ) | (87,204 | ) | (185,313 | ) | ||||||||||||||

| Accretion to convertible redeemable preferred shares redemption value | — | (143,976 | ) | - | — | - | (143,976 | ) | ||||||||||||||||

| Net income/(loss) attributable to Qutoutiao Inc.’s ordinary shareholders | (185,313 | ) | (97,778 | ) | 50,141 | (9,135 | ) | (87,204 | ) | (329,289 | ) | |||||||||||||

Notes:

| (1) | Represents the elimination of investments among Qutoutiao Inc., the Primary Beneficiaries of the Group VIEs, the Other Subsidiaries, and the Group VIEs and their subsidiaries that the Group consolidates. Share-based compensation expenses are recorded in Qutoutiao Inc., which issued these equity awards, and are also pushed down to the VIEs and subsidiaries. The expenses pushed down to the VIEs and subsidiaries are eliminated upon consolidation to avoid duplication. |

| (2) | Represents the elimination of the intercompany service charge at the consolidation level. |

| 9 |

Condensed Consolidated Schedule of Balance Sheets

The following table presents the Group’s condensed consolidated schedule of financial position for Qutoutiao Inc., the Primary Beneficiaries of the Group VIEs, our Other Subsidiaries, and the Group VIEs and their subsidiaries that the Group consolidates as of the dates presented:

| As of December 31, 2022 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||

| Cash and cash equivalents | 50,989 | 34,984 | 4,681 | 32,147 | — | 122,801 | ||||||||||||||||||

| Restricted cash | — | — | 216 | 7,384 | — | 7,600 | ||||||||||||||||||

| Short-term investments | — | — | 20,000 | 6,402 | — | 26,402 | ||||||||||||||||||

| Accounts receivable, net | — | 133 | 6,753 | 110,523 | — | 117,409 | ||||||||||||||||||

| Amount due from related parties | — | — | 788 | 48,284 | (270 | ) | 48,802 | |||||||||||||||||

| Prepaid and other current assets | 2,935 | 2,005 | 58,303 | 95,568 | — | 158,811 | ||||||||||||||||||

| Intra-Group receivables due from the Company’s subsidiaries(1) | 3,698,706 | 426,911 | 5,752,591 | 470,966 | (10,349,174 | ) | — | |||||||||||||||||

| Total current assets | 3,752,630 | 464,033 | 5,843,332 | 771,274 | (10,349,444 | ) | 481,825 | |||||||||||||||||

| Noncurrent assets: | ||||||||||||||||||||||||

| Property and equipment, net | — | — | 11 | 5,002 | — | 5,013 | ||||||||||||||||||

| Right-of-use assets, net | — | — | — | 21,879 | — | 21,879 | ||||||||||||||||||

| Intangible assets | — | — | 56,075 | 6,574 | — | 62,649 | ||||||||||||||||||

| Goodwill | — | — | 7,268 | — | — | 7,268 | ||||||||||||||||||

| Long-term Investments | — | — | — | — | — | — | ||||||||||||||||||

| Other non-current assets | 1,476 | — | — | 1,426 | — | 2,902 | ||||||||||||||||||

| Total noncurrent assets | 1,476 | — | 63,354 | 34,881 | — | 99,711 | ||||||||||||||||||

| Total assets | 3,754,106 | 464,033 | 5,906,686 | 806,155 | (10,349,444 | ) | 581,536 | |||||||||||||||||

| LIABILITIES | ||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||

| Accounts payable | — | — | 64,444 | 330,550 | — | 394,994 | ||||||||||||||||||

| Amount due to related parties | — | — | 862 | — | (270 | ) | 592 | |||||||||||||||||

| Registered users’ loyalty payable | — | — | — | 29,773 | — | 29,773 | ||||||||||||||||||

| Advance from advertising customers and deferred revenue | — | — | 36,743 | 11,963 | — | 48,706 | ||||||||||||||||||

| Salary and welfare payable | — | 82 | 31,431 | 28,048 | — | 59,561 | ||||||||||||||||||

| Tax payable | — | — | 10,890 | 29,584 | — | 40,474 | ||||||||||||||||||

| Lease liabilities, current | — | — | — | 15,083 | — | 15,083 | ||||||||||||||||||

| Accrued liabilities related to users’ loyalty program | — | — | — | 64,589 | — | 64,589 | ||||||||||||||||||

| Accrued liabilities and other current liabilities | 978 | 2,313 | 31,033 | 301,713 | 225 | 336,262 | ||||||||||||||||||

| Convertible Loan—current | 1,746,188 | — | — | — | — | 1,746,188 | ||||||||||||||||||

| Intra-Group payables due to the Company’s subsidiaries(1) | 181,598 | 3,710,864 | 928,758 | 5,644,725 | (10,465,945 | ) | — | |||||||||||||||||

| Total current liabilities | 1,928,764 | 3,713,259 | 1,104,161 | 6,456,028 | (10,465,990 | ) | 2,736,222 | |||||||||||||||||

| Lease liabilities, non-current | — | — | — | 7,599 | — | 7,599 | ||||||||||||||||||

| Deferred tax liabilities | — | — | 14,019 | — | — | 14,019 | ||||||||||||||||||

| Deficit of investment in subsidiaries and VIEs(2) | 5,416,081 | 868,966 | 5,657,472 | — | (11,942,519 | ) | — | |||||||||||||||||

| Total long-term liabilities | 5,416,081 | 868,966 | 5,671,491 | 7,599 | (11,942,519 | ) | 21,618 | |||||||||||||||||

| Total liabilities | 7,344,845 | 4,582,225 | 6,775,652 | 6,463,627 | (22,408,509 | ) | 2,757,840 | |||||||||||||||||

| Commitments and contingencies | — | — | — | — | — | — | ||||||||||||||||||

| Mezzanine equity | ||||||||||||||||||||||||

| Redeemable non-controlling interests | — | 1,414,435 | — | — | — | 1,414,435 | ||||||||||||||||||

| SHAREHOLDERS’ deficit | ||||||||||||||||||||||||

| Total Qutoutiao Inc. shareholders’ deficit | (3,590,739 | ) | (5,532,627 | ) | (868,966 | ) | (5,657,472 | ) | 12,059,065 | (3,590,739 | ) | |||||||||||||

| Noncontrolling interest | — | — | — | — | — | — | ||||||||||||||||||

| Total shareholders’ deficit(2) | (3,590,739 | ) | (5,532,627 | ) | (868,966 | ) | (5,657,472 | ) | 12,059,065 | (3,590,739 | ) | |||||||||||||

| Total liabilities and shareholders’ deficit | 3,754,106 | 464,033 | 5,906,686 | 806,155 | (10,349,444 | ) | 581,536 | |||||||||||||||||

| 10 |

| As of December 31, 2023 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||

| Current assets: | ||||||||||||||||||||||||

| Cash and cash equivalents | 43,409 | 6,606 | 1,043 | 23,590 | - | 74,648 | ||||||||||||||||||

| Restricted cash | — | - | 50 | 17,008 | - | 17,058 | ||||||||||||||||||

| Short-term investments | — | - | - | - | - | — | ||||||||||||||||||

| Accounts receivable, net | — | 151 | 276 | 73,143 | - | 73,570 | ||||||||||||||||||

| Amount due from related parties | — | - | 790 | 45,182 | (185 | ) | 45,787 | |||||||||||||||||

| Prepaid and other current assets | 9,436 | 21 | 37,250 | 91,422 | (195 | ) | 137,933 | |||||||||||||||||

Intra-Group receivables due from the Company’s subsidiaries(1) | 3,783,399 | 735,153 | 5,227,827 | 320,387 | (10,066,766 | ) | — | |||||||||||||||||

| Total current assets | 3,836,244 | 741,931 | 5,267,236 | 570,732 | (10,067,146 | ) | 348,996 | |||||||||||||||||

| Noncurrent assets: | ||||||||||||||||||||||||

| Property and equipment, net | — | - | 11 | 493 | - | 504 | ||||||||||||||||||

| Right-of-use assets, net | — | - | - | 5,633 | - | 5,633 | ||||||||||||||||||

| Intangible assets | — | - | 46,461 | 3,883 | - | 50,344 | ||||||||||||||||||

| Goodwill | — | - | 7,268 | — | - | 7,268 | ||||||||||||||||||

| Long-term Investments | — | - | - | - | - | — | ||||||||||||||||||

| Other non-current assets | — | - | - | 666 | - | 666 | ||||||||||||||||||

| Total noncurrent assets | — | - | 53,740 | 10,675 | - | 64,415 | ||||||||||||||||||

| Total assets | 3,836,244 | 741,931 | 5,320,976 | 581,407 | (10,067,146 | ) | 413,411 | |||||||||||||||||

| LIABILITIES | ||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||

| Accounts payable | — | - | 29,580 | 349,993 | - | 379,573 | ||||||||||||||||||

| Amount due to related parties | — | - | 258 | 81 | (185 | ) | 154 | |||||||||||||||||

| Registered users’ loyalty payable | — | - | - | 13,863 | - | 13,863 | ||||||||||||||||||

| Advance from advertising customers and deferred revenue | — | - | 44,259 | 12,351 | - | 56,610 | ||||||||||||||||||

| Salary and welfare payable | — | 84 | 21,598 | 15,784 | - | 37,466 | ||||||||||||||||||

| Tax payable | — | - | 3,860 | 36,588 | - | 40,483 | ||||||||||||||||||

| Lease liabilities, current | — | - | - | 2,407 | - | 2,407 | ||||||||||||||||||

| Accrued liabilities related to users’ loyalty program | — | - | - | 33,489 | - | 33,489 | ||||||||||||||||||

| Accrued liabilities and other current liabilities | — | 707 | 23,003 | 220,104 | 29 | 243,843 | ||||||||||||||||||

| Convertible Loan—current | 1,944,834 | - | - | — | - | 1,944,834 | ||||||||||||||||||

| Intra-Group payables due to the Company’s subsidiaries(1) | 230,306 | 4,049,389 | 339,019 | 5,560,180 | (10,178,894 | ) | — | |||||||||||||||||

| Total current liabilities | 2,175,140 | 4,050,180 | 461,577 | 6,244,840 | (10,179,050 | ) | 2,752,687 | |||||||||||||||||

| Lease liabilities, non-current | — | - | - | 3,366 | - | 3,366 | ||||||||||||||||||

| Deferred tax liabilities | — | - | 11,616 | — | - | 11,616 | ||||||||||||||||||

Deficit of investment in subsidiaries and VIEs(2) | 5,598,492 | 819,016 | 5,666,799 | — | (12,084,307 | ) | — | |||||||||||||||||

| Total long-term liabilities | 5,598,492 | 819,016 | 5,678,415 | 3,366 | (12,084,307 | ) | 14,982 | |||||||||||||||||

| Total liabilities | 7,773,632 | 4,869,196 | 6,139,992 | 6,248,206 | (22,263,357 | ) | 2,767,669 | |||||||||||||||||

| Commitments and contingencies | — | - | - | — | - | — | ||||||||||||||||||

| Mezzanine equity | ||||||||||||||||||||||||

| Redeemable non-controlling interests | — | 1,583,130 | - | — | - | 1,583,130 | ||||||||||||||||||

| SHAREHOLDERS’ deficit | ||||||||||||||||||||||||

| Total Qutoutiao Inc. shareholders’ deficit | (3,937,388 | ) | (5,710,395 | ) | (819,016 | ) | (5,666,799 | ) | 12,196,210 | (3,937,388 | ) | |||||||||||||

| Noncontrolling interest | — | - | - | — | - | — | ||||||||||||||||||

| Total shareholders’ deficit(2) | (3,937,388 | ) | (5,710,395 | ) | (819,016 | ) | (5,666,799 | ) | 12,196,210 | (3,937,388 | ) | |||||||||||||

| Total liabilities and shareholders’ deficit | 3,836,244 | 741,931 | 5,320,976 | 581,407 | (10,067,147 | ) | 413,411 | |||||||||||||||||

Notes:

| (1) | Represents the elimination of intercompany balances among Qutoutiao Inc., the Primary Beneficiaries of the Group VIEs, the Other Subsidiaries, and the Group VIEs and their subsidiaries that we consolidate. |

| (2) | Represents the elimination of investments among Qutoutiao Inc., the Primary Beneficiaries of the Group VIEs, the Other Subsidiaries, and the Group VIEs and their subsidiaries that the Group consolidates. Share-based compensation expenses are recorded in Qutoutiao Inc., which issued these equity awards, and are also pushed down to the VIEs and subsidiaries. The expenses pushed down to the VIEs and subsidiaries are eliminated upon consolidation to avoid duplication. |

| 11 |

Condensed Consolidated Schedule of Cash Flows

The following table presents our condensed consolidated schedules of cash flows for Qutoutiao Inc., the Primary Beneficiaries of the Group VIEs, our Other Subsidiaries, and the Group VIEs and their subsidiaries that the Group consolidates for the periods presented:

| For the Year Ended December 31, 2021 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | (14,807 | ) | 67,637 | (709,141 | ) | 377,189 | — | (279,122 | ) | |||||||||||||||

| Net cash provided by/(used in) transactions with intra-Group entities | — | — | 568,164 | (568,164 | ) | — | — | |||||||||||||||||

| Net cash provided by/(used in) operating activities | (14,807 | ) | 67,637 | (140,977 | ) | (190,975 | ) | — | (279,122 | ) | ||||||||||||||

| Cash flows from investing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | — | (84,723 | ) | 97,197 | 63,047 | — | 75,521 | |||||||||||||||||

| Cash used in capital contribution to intra-Group entities | — | (198,086 | ) | — | — | 198,086 | — | |||||||||||||||||

| Cash used in providing borrowings to intra-Group entities | — | — | (137,515 | ) | — | 137,515 | — | |||||||||||||||||

| Cash provided by repayment of borrowings from intra-Group entities | 32,506 | — | — | — | (32,506 | ) | — | |||||||||||||||||

| Net cash provided by/(used in) investing activities | 32,506 | (282,809 | ) | (40,318 | ) | 63,047 | 303,095 | 75,521 | ||||||||||||||||

| Cash flows from financing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | — | (13,050 | ) | — | (53,044 | ) | — | (66,094 | ) | |||||||||||||||

| Cash provided by capital contribution from intra-Group entities | — | — | 198,086 | — | (198,086 | ) | — | |||||||||||||||||

| Cash provided by borrowings from intra-Group entities | — | — | — | 137,515 | (137,515 | ) | — | |||||||||||||||||

| Cash used in repayment of borrowings to intra-Group entities | — | (32,506 | ) | — | — | 32,506 | — | |||||||||||||||||

| Net cash provided by/(used in) financing activities | — | (45,556 | ) | 198,086 | 84,471 | (303,095 | ) | (66,094 | ) | |||||||||||||||

| For the Year Ended December 31, 2022 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | (39,578 | ) | (3,089 | ) | 227,053 | (628,183 | ) | — | (443,797 | ) | ||||||||||||||

| Net cash provided by/(used in) transactions with intra-Group entities | — | — | (606,146 | ) | 606,146 | — | — | |||||||||||||||||

| Net cash provided by/(used in) operating activities | (39,578 | ) | (3,089 | ) | (379,093 | ) | (22,037 | ) | — | (443,797 | ) | |||||||||||||

| Cash flows from investing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | — | 99,630 | 139,300 | 28,625 | — | 267,555 | ||||||||||||||||||

| Cash used in capital contribution to intra-Group entities | 68,089 | (101,304 | ) | — | — | 33,215 | — | |||||||||||||||||

| Cash used in providing borrowings to intra-Group entities | — | — | — | — | — | — | ||||||||||||||||||

| Net cash provided by/(used in) investing activities | 68,089 | (1,674 | ) | 139,300 | 28,625 | 33,215 | 267,555 | |||||||||||||||||

| Cash flows from financing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | — | — | (20,000 | ) | — | — | (20,000 | ) | ||||||||||||||||

| Cash provided by capital contribution from intra-Group entities | — | (68,089 | ) | 101,304 | — | (33,215 | ) | — | ||||||||||||||||

| Cash provided by borrowings from intra-Group entities | — | — | — | — | — | — | ||||||||||||||||||

| Net cash provided by/(used in) financing activities | — | (68,089 | ) | 81,304 | — | (33,215 | ) | (20,000 | ) | |||||||||||||||

| 12 |

| For the Year Ended December 31, 2023 | ||||||||||||||||||||||||

| Qutoutiao Inc. | Other subsidiaries | Primary Beneficiaries of the Group VIEs | Group VIEs and their subsidiaries | Eliminating adjustments | Consolidated totals | |||||||||||||||||||

| (RMB in thousands) | ||||||||||||||||||||||||

| Cash flows from operating activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | (31,937 | ) | (4,541 | ) | 28,935 | (58,155 | ) | - | (65,698 | ) | ||||||||||||||

| Net cash provided by/(used in) transactions with intra-Group entities | - | - | - | - | - | — | ||||||||||||||||||

| Net cash provided by/(used in) operating activities | (31,937 | ) | (4,541 | ) | 28,935 | (58,155 | ) | - | (65,698 | ) | ||||||||||||||

| Cash flows from investing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | - | - | 33,295 | (6,812 | ) | - | 26,483 | |||||||||||||||||

| Cash used in capital contribution to intra-Group entities | 23,535 | - | - | 66,034 | (89,569 | ) | — | |||||||||||||||||

| Cash used in providing borrowings to intra-Group entities | - | - | - | - | - | - | ||||||||||||||||||

| Net cash provided by/(used in) investing activities | 23,535 | - | 33,295 | 59,222 | (89,569 | ) | 26,483 | |||||||||||||||||

| Cash flows from financing activities: | ||||||||||||||||||||||||

| Net cash provided by/(used in) transactions with external parties | - | - | - | - | - | — | ||||||||||||||||||

| Cash provided by capital contribution from intra-Group entities | - | (23,535 | ) | (66,034 | ) | - | 89,569 | — | ||||||||||||||||

| Cash provided by borrowings from intra-Group entities | - | - | - | - | - | — | ||||||||||||||||||

| Net cash provided by/(used in) financing activities | - | (23,535 | ) | (66,034 | ) | - | 89,569 | — | ||||||||||||||||

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not Applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

| 13 |

| D. | Risk Factors |

Summary of Risk Factors

An investment in our ADSs is subject to a number of risks, including risks relating to our industry and business, risks relating to the Group’s corporate structure, risks relating to doing business in China and risks relating to the ADSs. The following summarizes some, but not all, of these risks. Please carefully consider all of the information discussed in “Item 3. Key Information — D. Risk Factors” in this annual report for a more thorough description of these and other risks.

Risks Relating to Our Industry and Business

| ● | The Group has a limited operating history, which makes it difficult to evaluate its business. | |

| ● | If the Group fails to acquire new users or retain existing users, or if user engagement on the Group’s platform declines, its business, results of operations and financial condition may be materially and adversely affected. | |

| ● | There is substantial doubt as to our ability to continue as a going concern. | |

| ● | We require a significant amount of cash to fund our operations as well as to meet our Convertible Loan obligations. If we cannot obtain additional financing and liquidity, our business, financial condition and results of operation will be materially and adversely affected. | |

| ● | The Group has incurred net losses in the past and may continue to incur losses in the future. | |

| ● | The Group’s inability to fully comply with Audio-visual Program Provisions may expose it to administrative sanctions, which would materially and adversely affect the Group’s business, results of operations and financial condition. | |

| ● | If the Group does not continue to increase the strength of its brand, the Group may not be able to maintain current or attract new users and customers for its products and services. | |

| ● | Any catastrophe, including natural catastrophes and outbreaks of health pandemics and other extraordinary events, could disrupt the Group’s business operation. For example, the COVID-19 pandemic may have a material adverse effect on the Group’s business, results of operations and financial condition, as well as the trading price of the ADSs. | |

| ● | If the Group is unable to compete effectively in the industry it operates, the Group’s business, results of operations and financial condition may be materially and adversely affected. | |

| ● | The Group generates a substantial majority of its revenues from advertising and marketing. A decline in the Group’s advertising and marketing revenues could harm its business. | |

| ● | The Group may be adversely affected by the complexity, uncertainties and changes in PRC regulation of Internet businesses and companies, including limitations on its ability to own key assets such as its mobile applications. | |

| ● | Privacy concerns relating to the Group’s products and services and the use of user information could damage its reputation, deter current and potential users and customers from using the Group’s mobile applications and negatively impact its business. | |

| ● | We may be subject to cybersecurity review by regulatory authorities of the PRC in the future. |

| 14 |

Risks Relating to Our Corporate Structure

| ● | We rely on contractual arrangements with the Group VIEs and their respective shareholders to operate the Group’s business, which may be less effective than equity ownership in providing operational control and otherwise materially and adversely affect the Group’s business. | |

| ● | The shareholders of the Group VIEs may have potential conflicts of interest with us, which may materially and adversely affect the Group’s business, results of operations and financial condition. | |

| ● | If the PRC government deems that the contractual arrangements in relation to the Group VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. In addition, our ADSs may significantly decline in value or become worthless if we are unable to assert our contractual control over the assets of the Group VIEs. | |

| ● | Substantial uncertainties exist with respect to whether the controlling of PRC onshore variable interest entities by foreign investors via contractual arrangements will be recognized as “foreign investment” and how it may impact the viability of the Group’s current corporate structure and operations. |

Risks Relating to Doing Business in China

| ● | Changes in the political and economic policies of the PRC government may materially and adversely affect the Group’s business, results of operations and financial condition and may result in the Group’s inability to sustain our growth and expansion strategies. The PRC government may intervene or influence our operations at any time, which could result in a material change in the Group’s operations and/or the value of our ADSs. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder the Group’s ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless. | |

| ● | There are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. In addition, rules and regulations in China can change quickly with little advance notice. | |

| ● | The approval of and the filing with the China Securities Regulatory Commission, or the CSRC, or other PRC government authorities may be required in connection with our future offshore offerings under PRC law, which may hinder our ability to continue to offer securities to investors offshore; in addition, the regulation of the CSRC or other PRC regulatory agencies establish complex procedures for acquisitions conducted by foreign investors that could make it more difficult for us to grow through acquisitions. | |

| ● | PRC regulations relating to investments in offshore companies by PRC residents may subject our PRC-resident beneficial owners or our PRC subsidiaries to liability or penalties, limit our ability to inject capital into our PRC subsidiaries or limit our PRC subsidiaries’ ability to increase their registered capital or distribute profits. | |

| ● | We rely to a significant extent on dividends and other distributions on equity paid by our principal operating subsidiaries and the Group VIEs to fund offshore cash and financing requirements. Any limitation on the ability of our PRC operating subsidiaries or the Group VIEs to make payments to us could materially and adversely affect our ability to conduct the Group’s business. | |

| ● | We are subject to restrictions on currency exchange. | |

| ● | The audit report included in this annual report is prepared by an auditor which the U.S. Public Company Accounting Oversight Board was unable to inspect and investigate completely before 2022 and, as such, our investors have been deprived of the benefits of such inspections in the past, and may be deprived of the benefits of such inspections in the future. | |

| ● | Our ADSs will be prohibited from trading on the OTC in the United States under the Holding Foreign Companies Accountable Act, as amended, or the HFCAA if the PCAOB is unable to inspect or fully investigate auditors located in China at any point in the future. |

| 15 |

Risks Relating to the ADSs

| ● | The trading price of the ADSs may be volatile, which could result in substantial losses to you. | |

| ● | The delisting of our ADSs from Nasdaq may continue to have a material adverse effect on the trading and price of our ADSs, and we cannot assure you that our ADSs will be relisted, or that once relisted, they will remain listed. | |

| ● | There are no independent directors on our board, which may create a potential conflict of interest. | |

| ● | Because we do not expect to pay cash dividends in the foreseeable future, you may not receive any return on your investment unless you sell your Class A ordinary shares or ADSs for a price greater than that which you paid for them. | |

| ● | Your right to participate in any future rights offerings may be limited, which may cause dilution to your holdings. | |

| ● | The dual-class structure of our ordinary shares may adversely affect the trading market for the ADSs. | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law. |

Risks Relating to Our Industry and Business

The Group has a limited operating history, which makes it difficult to evaluate its business.

The Group launched Qutoutiao in June 2016 and Midu Novels in May 2018, and further introduced Midu Lite in May 2019. The Group has experienced rapid growth in terms of installed users, MAUs, DAUs and revenues from 2016 to 2020, but declines in terms of these operating metrics and revenues in 2021, 2022 and 2023. As our operating history has suggested, the Group’s historical development trend may not be indicative of its future performance, and we cannot assure you that the level of growth we had prior to 2020 will be sustainable or achievable at all in the future. The Group’s growth prospects should be considered in light of the risks and uncertainties that companies with a limited operating history in our industry may encounter, including, among others, risks and uncertainties regarding our ability to:

| ● | retain existing users on, and attract new users to, the Group’s platform; | |

| ● | present real-time customized feeds to users based on their profiles, behaviors and social relationships; | |

| ● | maintain the effectiveness of the Group’s user loyalty programs; | |

| ● | maintain stable relationships with the Group’s content providers; | |

| ● | develop and implement successful monetization measures; | |

| ● | convince advertising customers of the benefits of the Group’s advertising and marketing services compared to alternative forms of marketing; |

| 16 |

| ● | increase brand awareness through marketing and promotional activities; | |

| ● | upgrade existing technology and infrastructure and develop new technologies to support increasing user traffic, improve user experience, expand functionality and ensure system stability; | |

| ● | successfully compete with other companies that are currently in, or may in the future enter, our industry; | |

| ● | attract, retain and motivate talented employees; | |

| ● | adapt to the evolving regulatory environment; and | |

| ● | defend the Group against litigation, regulatory, intellectual property, privacy or other claims. |

All of these endeavors involve risks and will require significant capital expenditures and allocation of valuable management and employee resources. We cannot assure you that we will be able to effectively manage the Group’s growth or implement our business strategies effectively. If the market for the Group’s platform does not develop as we expect or if we fail to address the needs of this dynamic market, the Group’s business, results of operations and financial condition will be materially and adversely affected.

If the Group fails to acquire new users or retain existing users, or if user engagement on the Group’s platform declines, its business, results of operations and financial condition may be materially and adversely affected.

The size of the Group’s user base and the level of user engagement are critical to its success. The Group’s mobile applications had approximately 8.5 million combined average MAUs, approximately 2.9 million combined average DAUs and average daily time spent per DAU of approximately 41.8 minutes in the three months ended December 31, 2023. The Group’s business has been and will continue to be significantly affected by its ability in growing the number of active users and increasing their overall level of engagement on the Group’s platform. The size of the Group’s user base and the level of user engagement faced downward pressures in 2021 and 2022 due to the change of the operating strategies we adopted as we faced uncertainties in the advertising market, the tightening regulatory environment in internet and technology sector in China and the negative impacts of the COVID-19 pandemic on China’s macro-economic environment, and continued to face downward pressures in 2023 due to macroeconomic downturn and customer advertising budget constraints. We could also see user base decreases for certain future periods of time if we further adjust or change our strategy. To the extent the Group’s user growth rate slows or its user base decreases, the Group’s success will become increasingly dependent on our ability to increase user engagement with the Group’s platform. The Group has implemented user account systems and loyalty programs to, among other things, help it cost-effectively acquire new users and develop an engaged and loyal user base. However, although such user account systems and loyalty programs have contributed significantly to the growth in the Group’s installed users and high user engagement in the past, there can be no assurance that such systems and programs will continue to function effectively. Additionally, the Group’s acquisition cost per user may increase as it implements new marketing initiatives, such as placing advertisements in app stores. The Group’s user engagement efforts, including by increasing the number of content providers, expanding the breadth and quality of content, including video and user generated content, on its platform, diversifying into new content formats and strengthening its content recommendation capabilities, may also not achieve expected results. Users may no longer perceive content and other products and services on the Group’s platform to be entertaining and relevant, and it may not be able to attract users or increase their usage frequency of its platform. If we fail to execute any such new initiatives successfully or in a cost-effective manner, the Group’s business, results of operations and financial condition would be materially and adversely affected. If the Group is unable to grow its user base or the level of user engagement, or if the number of users or their level of engagement declines, this could result in its platform being less attractive to potential new users and thus advertising customers, which would have a material and adverse impact on the Group’s business, results of operations and financial condition.

| 17 |

The Chinese government may prevent the Group from distributing content that it believes is noncompliant and the Group may be subject to penalties for such content or the Group may have to interrupt or suspend the operation of the Group’s platform to comply with these regulatory requirements from time to time, which may materially and adversely affect the Group’s results of operation.

China has enacted regulations governing Internet access and the distribution of news and other information. In the past, the Chinese government has stopped the distribution of information over the Internet or through mobile Internet devices that it believes violates Chinese law, including content that it believes is obscene, defamatory, misleading or inappropriately satirical, incites violence, endangers the national security, concerns politically sensitive topics, or contravenes the national interest. In the past, new downloads of certain mobile content aggregator applications and mobile news applications were temporarily blocked and suspended for different lengths of time, ranging from a few days to weeks, following the publication of content considered to be noncompliant. In July 2018, PRC governmental and regulatory authorities responsible for “eradicating pornography and illegal publications” announced new coordinated efforts to regulate and control the nascent online short video sector, including citations against 19 online short video platforms which allegedly had disregarded repeated warnings not to distribute content deemed by the authorities as obscene, misleading, pornographic, violent, infringing, sensationalist, deviant from socialist core values, harmful to younger viewers, or otherwise unlawful or detrimental.

Of these 19 platforms, 15 had their applications removed from app stores and new downloads blocked; among these 15 platforms, three also had their operations suspended by relevant authorities. Any such future suspension in operations or downloads of the Group’s mobile applications for this or other reasons may negatively affect the Group’s relationships with users and advertisers, and adversely affect the Group’s business and results of operations.

While we strive to comply with applicable regulatory requirements and other obligations we may have with respect to the Group’s operation, the failure or perceived failure to comply may result, and in some cases has resulted, in inquiries and other proceedings or actions against us by government agencies or others, as well as negative publicity and damage to our reputation and brand, any of which could cause the Group to lose users and customers and may materially and adversely affect the Group’s business, results of operations and financial condition. For example, in order to comply with regulatory requirements, the Group undertook product upgrades and temporarily suspended content updates and certain commercial activities on Midu Novels from July 16 to October 15, 2019. Midu Novels has resumed regular content updates and commercial activities since October 16, 2019. We have endeavored to use the Group’s technologies, employees and other resources in a manner that complies with applicable regulatory requirements, and as such, we believe that the likelihood of us receiving material administrative penalties is low. However, there can be no assurance that similar suspensions relating to the Group’s mobile applications will not recur in the future, or that such incidents will not result in loss of users or advertisers, decrease in revenues or reputational damage to us, or have an adverse effect on the Group’s business and results of operations.