UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended:

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____________ to ____________

Commission

file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

The

(NASDAQ Capital Market) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934

during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of the “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| ☒ | Smaller reporting company | |||

| Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed second fiscal quarter was $

As of April 1, 2024, there were shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING STATEMENTS

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements include, among others, those statements including the words “believes”, “anticipates”, “expects”, “intends”, “estimates”, “plans” and words of similar import. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are based on our current expectations and assumptions regarding our business, potential target businesses, the economy and other future conditions. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. We caution you therefore that you should not rely on any of these forward-looking statements as statements of historical fact or as guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include changes in local, regional, national or global political, economic, business, competitive, market (supply and demand) and regulatory conditions and the following:

| ● | Our ability to raise capital when needed and on acceptable terms and conditions; | |

| ● | Our ability to make acquisitions and integrate acquired businesses into our company; | |

| ● | Our ability to attract and retain management with experience in the business of importing, packaging and selling of seafood; | |

| ● | Our ability to negotiate, finalize and maintain economically feasible agreements with suppliers and customers; | |

| ● | The availability of crab meat and other premium seafood products we sell; | |

| ● | The intensity of competition; and | |

| ● | Changes in the political and regulatory environment and in business and fiscal conditions in the United States and overseas. |

These risks and others described under the section “Risk Factors” below are not exhaustive.

Given these uncertainties, readers of this Annual Report on Form 10-K (“Annual Report”) are cautioned not to place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

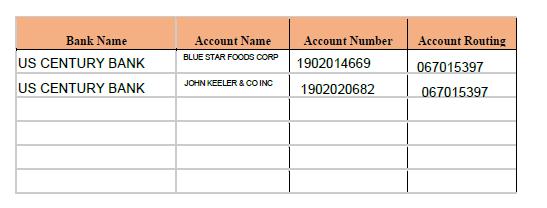

All references in this Annual Report to the “Company”, “we”, “us”, or “our”, are to Blue Star Foods Corp., a Delaware corporation, and its consolidated subsidiaries, John Keeler & Co., Inc., d/b/a Blue Star Foods, a Florida corporation (“Keeler & Co.”) and its wholly-owned subsidiary, Coastal Pride Seafood, LLC, a Florida limited liability company (“Coastal Pride”) and Taste of BC Aquafarms, Inc., a corporation formed under the laws of the Province of British Columbia, Canada (“TOBC”).

Unless otherwise noted, all share and the price per share information in this Annual Report for all periods presented reflect the reverse stock split of our outstanding common stock at a ratio of 1-for-20 (“Reverse Stock Split”), which became effective as of June 21, 2023. On the opening of the market on June 22, 2023, our common stock began trading on the NASDAQ Capital Market on a post-reverse stock split basis.

| 3 |

PART I

ITEM 1. BUSINESS

History

We were incorporated on October 17, 2017 in the State of Delaware as a blank check company to be used as a vehicle to pursue a business combination with an unidentified target. Following the Merger (as described below), we changed our name from “AG Acquisition Group II, Inc.” to “Blue Star Foods Corp.” and succeeded to the business of Keeler & Co.

Merger

On November 8, 2018 (the “Closing Date”), we entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”), with Keeler & Co., Blue Star Acquisition Corp., our newly formed, wholly-owned Florida subsidiary (“Acquisition Sub”), and John Keeler, Keeler & Co’s sole stockholder (the “Sole Stockholder”). Pursuant to the terms of the Merger Agreement, Acquisition Sub merged with and into Keeler & Co, which was the surviving corporation and thus became our wholly-owned subsidiary (the “Merger”).

At the Closing Date, each of the 25 shares of common stock of Keeler & Co issued and outstanding immediately prior to the closing of the Merger were converted into 1,500 shares of our common stock. As a result, an aggregate of 750,000 shares of our common stock were issued to the Sole Stockholder.

At the effective time of the Merger, the Company redeemed an aggregate of 462,500 shares of common stock from the pre-Merger stockholders of the Company (the “Pre-Merger Holders”) for cancellation by the Company (the “Share Redemption”) and, as a result, the Pre-Merger Holders retained an aggregate of 37,500 shares of common stock after the Merger, representing a value of $1.5 million. The shares were redeemed in consideration for the direct benefit the Pre-Merger Holders will receive in connection with the consummation of the Merger.

Offering

Concurrently with the closing of the Merger, we closed a private placement offering (the “Offering”) in which we sold an aggregate of 36 units of our securities (the “Units”) at a purchase price of $20,000 per Unit, for aggregate gross proceeds of $725,000. Each Unit consisted of one share of the Company’s 8% Series A convertible preferred stock, par value $0.0001 per share (the “Series A Stock”) and a three-year warrant (the “Warrant”) to purchase one-half of one share of common stock for every share of common stock that would be received upon conversion of a share of Series A Stock (the “Warrant Shares”), at an exercise price of $48.00. The Series A Stock is convertible into shares (the “Conversion Shares”) of the Company’s common stock, at a conversion rate of $40.00 per share (the “Conversion Rate”). We issued 17,663 Warrant Shares in the Offering, which Warrant Shares are exercisable independently of any conversion of Series A Stock. The net proceeds of the Offering were used by the Company for general corporate purposes. All of the Series A Stock have been converted to shares of the Company’s common stock.

Company Settlement

Effective upon the closing of the Merger, we issued an aggregate of 34 Units to eleven “accredited investors” (the “Settlement Parties”) for each such individual or entity entering into a settlement and mutual general release agreement (the “Settlement Agreement”) with the Company in full and complete settlement and satisfaction and release of claims such Settlement Parties may have against the Company (the “Company Settlement”).

Upon the closing of the Merger, (i) options to purchase an aggregate of 5 shares of Keeler & Co’s common stock at an exercise price of $200,000 per share, which were outstanding immediately prior to the closing of the Merger, were converted into a ten-year immediately exercisable options to purchase an aggregate of 156,000 shares of common stock at an exercise price of $6.66 (which option was subsequently terminated unexercised), and (ii) a ten-year option to purchase 156,000 shares of common stock at an exercise price of $40.00, which vested one-year from the date of grant.

| 4 |

Changes to the Board of Directors and Executive Officers

On the Closing Date of the Merger, the then-current directors and Chief Financial Officer and Chief Executive Officer of the Company resigned from all such positions as directors and officers of the Company and were replaced by new officers and directors.

Lock-ups

In connection with the Merger, each of our executive officers and directors after giving effect to the Merger (the “Restricted Holders”) and each of the Pre-Merger Holders, holding at the closing date of the Merger an aggregate of 37,500 shares of our common stock, entered into lock-up agreements (the “Lock-Up Agreements”), whereby the Restricted Holders were restricted for a period of 18 months and the Pre-Merger Holders were restricted for 12 months, after the Merger (the “Restricted Period”), from sales or dispositions (including pledges) in excess of 50% of all of the common stock held by (or issuable to) them and at a price below $44.0 per share (such restrictions together the “Lock-Up”). Notwithstanding such restrictions, during the Restricted Period (i) the Restricted Holders may transfer up to 10% of their shares to a charitable organization which agrees to be bound by such Lock-Up restrictions and (ii) the Pre-Merger Holders may transfer up to 10% of their shares to a third party which agrees to be bound by such Lock-Up restrictions. From and after the Restricted Period, neither the Restricted Holders nor the Pre-Merger Holders may sell, dispose or otherwise transfer more than one-third of the common stock held by such Holder in any two-month period.

Redemption from Pre-Merger Holders

In connection with the Merger, the Company redeemed an aggregate of 462,500 shares of common stock from the Company’s Pre-Merger Holders for cancellation by the Company (the “Share Redemption”) and, as a result, the stockholders retained an aggregate of 37,500 shares of common stock after the Merger (the “Retained Shares”), representing a value of $1.5 million. The shares were redeemed in consideration for the direct benefit the Pre-Merger Holders will receive in connection with the consummation of the Merger.

Our authorized capital stock currently consists of 100,000,000 shares of common stock, and 5,000,000 shares of the preferred stock, of which 10,000 shares have been designated as Series A Stock. Our common stock is not traded on any exchange. Our common stock was quoted on the OTC pink sheets under the symbol “BSFC” since February 18, 2020. Our common stock was approved for listing on NASDAQ under the symbol “BSFC” and began trading on November 3, 2021.

Coastal Pride Acquisition

On November 26, 2019, Keeler & Co., Inc. (the “Purchaser”) entered into an Agreement and Plan of Merger and Reorganization (the “Coastal Merger Agreement”) with Coastal Pride Company, Inc., a South Carolina corporation, Coastal Pride Seafood, LLC, a Florida limited liability company and newly-formed, wholly-owned subsidiary of Keeler & Co. (the “Acquisition Subsidiary” and, upon the effective date of the Coastal Merger, the “Surviving Company), and The Walter F. Lubkin, Jr. Irrevocable Trust dated 1/8/03 (the “Trust”), Walter F. Lubkin III (“Lubkin III”), Tracy Lubkin Greco (“Greco”) and John C. Lubkin (“Lubkin”), constituting all of the shareholders of Coastal Pride Company, Inc. immediately prior to the Coastal Merger (collectively, the “Coastal Sellers”). Pursuant to the terms of the Coastal Merger Agreement, Coastal Pride Company, Inc. merged with and into the Acquisition Subsidiary, with the Acquisition Subsidiary being the surviving company (the “Coastal Merger”).

Coastal Pride is a seafood company, based in Beaufort, South Carolina, that imports pasteurized and fresh crabmeat sourced primarily from Mexico and Latin America and sells premium branded label crabmeat throughout North America.

Pursuant to the terms of the Coastal Merger Agreement, the following consideration was paid by Keeler & Co.: (i) an aggregate of $394,622 in cash; (ii) a five-year 4% promissory note in the principal amount of $500,000 (the “Lubkin Note), issued by Keeler & Co. to Walter Lubkin Jr. (“Walter Jr.”); (iii) three-year 4% convertible promissory notes in the aggregate principal amount of $210,000 (collectively, the “Sellers Notes” and together with the Lubkin Note, the “Notes”), issued by Keeler & Co. to Greco, Lubkin III and Lubkin, pro rata to their ownership of Coastal Pride Company, Inc. immediately prior to the Coastal Merger; (iii) 25,000 shares of common stock of the Company, issued to Walter Lubkin, Jr. (the “Walter Jr. Shares”); and (iii) an aggregate of 39,750 shares of common stock of the Company, issued to Greco, Lubkin III and Lubkin, pro rata to their ownership of Coastal Pride Company, Inc. immediately prior to the Coastal Merger (together with the Walter Jr. Shares, the “Consideration Shares”).

| 5 |

The Notes are subject to a right of offset against the Coastal Sellers’ indemnification obligations as described in the Coastal Merger Agreement and are subordinate and subject to prior payment of all indebtedness of John Keeler under the Loan Agreement with Lighthouse Financial Corp., a North Carolina corporation (“Lighthouse”).

Principal and interest under the Lubkin Note are payable quarterly, commencing February 26, 2020, in an amount equal to the lesser of (i) $25,000 and (i) 25% of the Surviving Company’s quarterly earnings before interest, tax, depreciation and amortization.

One-sixth of the principal and interest under the Sellers Notes are payable quarterly commencing on August 26, 2021. The Sellers Notes are convertible into shares of common stock of the Company at the Seller’s option, at any time after the first anniversary of the date of the Note, at the rate of 0.05 share for each $40.00 of principal and/or interest so converted (the “Conversion Shares”).

Keeler & Co. has the right to prepay the Notes in whole or in part at any time without penalty or premium.

At the effective time of the Coastal Merger, the Coastal Sellers entered into leak-out agreements (each, a “Leak-Out Agreement”) pursuant to which the Coastal Sellers and Walter Jr. may not directly or indirectly pledge, sell, or transfer any of the Consideration Shares or Conversion Shares, or enter into any swap or other arrangement that transfers any of the economic consequences of ownership of any such shares for one year from the date of the Coastal Merger. Thereafter, each Seller and Walter Jr. may transfer up to 25% of the aggregate of the Consideration Shares and the Conversion Shares held by such person, in each successive six-month period.

In connection with the Coastal Merger, Lubkin III and Greco agreed to serve as president and chief financial officer, respectively, of the Surviving Company.

ACF Finco I, LP (“ACF”) and Keeler & Co. were parties to a loan and security agreement, originally dated as of August 31, 2016. As a condition to ACF’s waiver of certain events of default under the Loan Agreement, and consent to the formation of the Acquisition Subsidiary and the Coastal Merger, the Acquisition Subsidiary and Keeler & Co. entered into the Joinder and Seventh Amendment to the Loan Agreement which resulted, among other things, in Coastal Pride becoming an additional borrower under the Loan Agreement. On March 31, 2021, Keeler & Co. and Coastal Pride entered into a loan and security agreement (the “Loan Agreement”) with Lighthouse, and the loan with ACF was extinguished.

On April 15, 2021, the Company issued an aggregate of 823 shares of common stock to the Coastal Seller in lieu of payment in cash of accrued interest in the aggregate amount of $39,504 under the Sellers’ Notes.

A combination of cash and shares of common stock were issued on the notes by the Company totaling an aggregate of $180,989 on the Walter Lubkin III Convertible Note, Tracy Greco Convertible Note and John Lubkin Convertible Note and such notes were extinguished on December 31, 2022.

Taste of BC Aquafarms Acquisition

On April 27, 2021, we entered into a stock purchase agreement (the “SPA”) with TOBC, and Steve Atkinson and Janet Atkinson (the “TOBC Sellers”), the owners of all of the capital stock of TOBC (the “TOBC Shares”) pursuant to which we acquired all of the TOBC Shares from the TOBC Sellers for an aggregate purchase price of CAD$4,000,000, subject to adjustment based upon the amount of TOBC’s working capital on the closing date (the “Purchase Price”) as follows: (i) CAD$1,000,000 in cash, pro rata with each TOBC Seller’s ownership of TOBC (ii) by the issuance to each TOBC Seller of a non-interest bearing promissory note in the aggregate principal amount of CAD$200,000, with a maturity date of November 30, 2021, with the principal amount of each note to be pro rata with each TOBC Seller’s ownership of TOBC, and secured by a Company guarantee and a general security agreement creating a security interest over certain assets of the Company, and (iii) 49,387 shares of common stock, (representing CAD$2,800,000 of shares based on USD$46.00 per share) with each TOBC Seller receiving a pro rata portion of such shares based upon the total number of TOBC shares held by such TOBC Seller.

| 6 |

On June 24, 2021, the SPA was amended to increase the purchase price to an aggregate of CAD$5,000,000 and the TOBC acquisition closed. Pursuant to the amendment, on August 3, 2021, an aggregate of 17,248 shares of common stock (representing CAD$1,000,000 of additional shares calculated at USD$46.00 per share) was put in escrow until the 24-month anniversary of the closing. If, within 24 months of the closing, TOBC has cumulative revenue of at least CAD$1,300,000, the TOBC Sellers will receive all of the escrowed shares. If, as of the 24-month anniversary of the closing, TOBC has cumulative revenue of less than CAD$1,300,000, the TOBC Sellers will receive a prorated number of the escrowed shares based on the actual cumulative revenue of TOBC as of such date.

In addition to the foregoing consideration, at the time of the closing, the Company provided CAD$488,334 to TOBC for the extinguishment of certain of TOBC’s existing debt.

The shares of common stock received by the TOBC Sellers are subject to a leak-out restriction commencing on the date of issuance, as follows: (i) up to 25% may be sold after 12 months; (ii) up to 50% may be sold after 18 months; (iii) up to 75% may be sold after 24 months; and (iv) up to 100% may be sold after 30 months.

The TOBC Seller’s non-interest-bearing promissory notes were paid in full at maturity.

In connection with the TOBC acquisition, the TOBC Sellers entered into four-year confidentiality, non-competition and non-solicitation agreements with the Company.

On July 6, 2023, the Company, TOBC and Steve Atkinson and Janet Atkinson agreed to waive a requirement in the First Amendment to the SPA entered into as of June 24, 2021, that an aggregate of 17,247 shares of common stock of the Company (“Additional Shares”) held in escrow be released if at June 24, 2023, the twenty-four month anniversary of the closing of the acquisition of TOBC by the Company, TOBC had cumulative revenues of at least CAD$1,300,000, or if TOBC’s cumulative revenue had not reached CAD$1,300,000, a prorated number of Additional Shares be released. Accordingly, on July 6, 2023, the Company authorized the release of 8,451 Additional Shares to Steve Atkinson and 8,796 Additional Shares to Janet Atkinson.

Gault Seafood Asset Acquisition

On February 3, 2022, Coastal Pride entered into an asset purchase agreement with Gault Seafood, LLC, a South Carolina limited liability company ( “Gault Seafood”), and Robert J. Gault II, President of the Seller (“Gault”) pursuant to which Coastal Pride acquired all of Gault Seafood’s right, title and interest in and to assets relating to Gault Seafood’s soft-shell crab operations, including intellectual property, equipment, vehicles and other assets used in connection with the soft-shell crab operations. Coastal Pride did not assume any liabilities in connection with the acquisition. The purchase price for the assets consisted of a cash payment in the amount of $359,250 and the issuance of 8,355 shares of common stock of the Company with a fair value of $359,250.

Coastal Pride also entered into a consulting agreement with Gault under the terms of which Gault will provide consulting services to Coastal Pride at the rate of $100 per hour, however, the first 45 days of services will be provided at no cost. Gault also agreed not to compete with Coastal Pride and its affiliates for a period of five years in any market in which Coastal Pride is operating or is considering operating or solicit employees, consultants, customers or suppliers or in any way interfere with Coastal Pride’s business relationships for a five-year period, Gault is also bound by customary confidentiality provisions. The Consulting Agreement may be terminated by either party upon five days written notice and by Costal Pride immediately for cause.

In connection with the asset acquisition, Coastal Pride will lease 9,050 square feet from Gault for $1,000 per month under a one-year lease agreement and will continue to operate the acquired soft-shell crab operations at such location in Beaufort, South Carolina unless a new facility is earlier completed.

Our website address is www.bluestarfoods.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this Annual Report and is intended for informational purposes only.

| 7 |

Overview

We are an international seafood company based in Miami, Florida that imports, packages and sells refrigerated pasteurized crab meat, and other premium seafood products. Our current source of revenue is from importing blue and red swimming crab meat primarily from Indonesia, the Philippines and China and distributing it in the United States and Canada under several brand names such as Blue Star, Oceanica, Pacifika, Crab & Go, First Choice, Good Stuff and Coastal Pride Fresh, and steelhead salmon and rainbow trout fingerlings produced under the brand name Little Cedar Farms for distribution in Canada. The crab meat which we import is processed in 13 plants throughout Southeast Asia. Our suppliers are primarily via co-packing relationships, including two affiliated suppliers. We sell primarily to food service distributors. We also sell our products to wholesalers, retail establishments and seafood distributors.

Strategy

Our long-term strategy is to create a vertically integrated seafood company that offers customers high quality products while maintaining a focus on our core values of delivering food safety, traceability and certified resource sustainability.

We plan to grow the Company organically by continuing to increase our customer base and by introducing new high-value product lines and categories, as well as strategically acquiring companies that focus on additional species and proprietary technologies that we believe we can integrate into a larger, diversified company.

Operating Companies

We operate through the following subsidiary companies:

Keeler & Co., doing business as Blue Star Foods, is an international seafood company that imports, packages and sells refrigerated pasteurized crab meat sourced primarily from Southeast Asia and other premium seafood products.

Keeler & Co. purchases the majority of our crab product (Portunus Pelagicus and Portunus Haanii) from processors which source the crab meat from local fishermen in Indonesia, the Philippines, Thailand, Vietnam and India, to whom we pay a premium in order to outfit their boats with a proprietary GPS-based system. This system allows us to trace where the crab product originates and ensure that only mature crabs are being harvested by the use of collapsible traps and not gill nets.

The crab meat is purchased directly from processors with whom we have long-standing relationships, that have agreed to source their product in a sustainable manner. All crab meat is sourced under the Company’s U.S Food & Drug Administration (“FDA”) approved Hazard Analysis Critical Control Point (“HACCP”) Plan. Additionally, all suppliers are certified by the British Retail Consortium (the “BRC”) and are audited annually to ensure safety and quality of our product.

The imported crab meat is processed in six out of the ten plants available throughout Southeast Asia. Our suppliers are primarily via co-packing relationships, including two affiliated suppliers. We sell primarily to food service distributors. We also sell our products to wholesalers, retail establishments and seafood distributors.

We have created a technology platform that tracks the product through its entire chain of custody and collects and transmits various data to the Company in real-time, from the loading site to the packing plant, through the sorting and pasteurization process and the exporting process to the end customer. Our technology allows our customers access to their “Scan on Demand” QR code-enabled traceability application.

Our premium proprietary brands, Blue Star, Pacifika and Oceanica are differentiated in terms of quality and price point.

We believe that we utilize best-in-class technology, in both resource sustainability management and ecological packaging.

Coastal Pride is a seafood company, based in Beaufort, South Carolina, that imports pasteurized and fresh crab meat (Portunus Pelagicus, Portunus Haanii and Callinectes) sourced primarily from Mexico and Latin America and sells premium branded label crab meat throughout North America.

| 8 |

It has three premium branded label products, First Choice, Good Stuff and Coastal Pride Fresh.

TOBC is a land-based recirculating aquaculture system (“RAS”) farming operation located in Nanaimo, British Columbia, Canada with an annual production capacity of approximately 100 tons. It produces steelhead salmon and rainbow trout fingerlings under the brand name Little Cedar Farms for distribution in Canada.

TOBC’s RAS facility has been operated as a model farm for the development of salmon RAS technology. We currently intend to refine this model farm into a 150-ton standardized module that will be replicated in the development of future farms. The next facility we hope to build, subject to sufficient resources, will have 10 such modules, for a total production capacity of 1,500 tons.

The current RAS facility is in an insulated, bio-secure structure in which culture conditions are controlled. The primary RAS system is composed of thirteen culture tanks, a drum filter, a fluidized sand bed biofilter and a low head oxygenator and employs an efficient gravity fed low head arrangement which reduces energy use as compared to other RAS designs. Additionally, there are two independent partial reuse finishing tank systems.

Weekly harvests of approximately two tons of salmon are stunned and bled at the farm and then processed as fresh iced head on gutted (“HOG”) fish at a Canadian Food Inspection Agency approved processing facility. Currently, TOBC sells its salmon mainly to two wholesale seafood distributors in Canada.

Eggs are purchased from two primary suppliers and are hatched approximately every eight weeks. TOBC’s hatchery is composed of a recirculating system that utilizes an upwelling “heath stack” incubator and five tanks with moving bed biofiltration. The fish are then transferred to the main RAS system approximately 12 weeks post hatch. TOBC’s feed is largely terrestrial based from grains and other non-marine ingredients.

We believe that the faster life cycle from birth to harvesting of our salmon, as compared to conventional salmon, allows it to be produced more economically in contained, land-based RAS farms. Although RAS farms require greater capital investment than the sea cage approach, we believe that the higher costs are offset by more efficient growth and a shorter transportation distance to market.

Branded Products

We distribute our imported blue and red swimming crabmeat in the United States under the brand names Blue Star, Pacifika, Oceanica, Crab & Go Premium Seafood, First Choice, Good Stuff and Coastal Pride Fresh and steelhead salmon and rainbow trout fingerlings produced by TOBC under the brand name Little Cedar Falls.

Blue Star is packed with only high quality Portunus Pelagicus species crab and is produced under exacting specifications and quality control requirements.

Pacifika is a quality brand for the price conscious end user. The Portunus Haanii crab meat is packed in China and is ideal for upscale plate presentations.

Oceanica is made from the Portunus Haanii crab, which is caught and processed in Vietnam. It is an affordable choice to help reduce food cost without sacrificing the look/taste of dishes.

Crab + Go Premium Seafood is geared towards millennials as part of the trend toward pre-packaged, grab-and-go items. The product is packaged in flexible foil pouches.

Lubkin Brand is packed with quality Portunus Pelagicus species crab in the Philippines and Indonesia.

First Choice is a quality brand packed with Portunus Haanii crab meat from Malaysia.

Good Stuff is a premium brand packed with high quality Callinectes species crab from Mexico.

Coastal Pride Fresh is packed with Callinectes Sapidus from Venezuela and the United States.

Steelhead salmon and rainbow trout fingerlings are produced by TOBC under the Little Cedar Falls brand. The fish are sashimi grade and only sold as a fresh item, usually reaching end users within days of harvest.

| 9 |

Competitive Strengths

Sustainable and Traceable Product Sourcing. We believe that our greatest point of differentiation from other seafood companies is our efforts to ensure that our seafood products are ethically sourced in a method that is consistent with our core values and those of our customers.

Proprietary Brands. We have created several brands of crab meat that are well regarded amongst our customers and are differentiated by product quality and price point.

Eco-Friendly Packaging. Another major point of differentiation from our competitors is our use of sustainable and ethical packaging. Our green pouches for Eco-Fresh crab meat are patented in the United States, Europe, Thailand, the Philippines and Indonesia under patent Nos.1526091 B1 and US Patents 8,337,922 and 8,445,046. We believe since their introduction in 2003, these pouches have saved in excess of a million metric tons of carbon dioxide emissions versus metal can packaging material.

Growth Strategy

We intend to grow our business in several ways, including:

Growing our existing businesses. The three current existing businesses each have different pathways to organic growth, including by increasing their reliable access to sustainably sourced marine product and supplying to a larger and more diversified customer base. Our key objective is to optimize the management of the companies across all companies, specifically in the marketing, sourcing and financing departments.

Strategic Acquisitions. We will continue to seek opportunities to acquire companies that allow us to expand into new territories, diversify our species product categories, and where operational synergies with our existing companies may exist. We believe that we may have the ability to layer on a sustainability model to certain companies that operate in a more traditional way, with an opportunity to increase margins by selling a more premium product.

Scaling the RAS Business. We have an internal goal to reach production of 21,000 metric tons of steelhead salmon by 2028. If we can successfully access the necessary funding through the equity capital markets and through certain debt facilities, we hope to build a series of 1,500 metric ton and 3,000 metric ton facilities throughout strategic locations in British Columbia, Canada, where TOBC is currently based.

Industry Overview

The international seafood industry is going through a period of rapid change as it strives to meet the needs of a growing population around the world, where food consumption habits are evolving. We believe there are powerful trends emerging in the developing world (including a growing demand for animal-based protein) as well as in the developed world (where there is an increased awareness and focus on sustainable sourcing and protecting marine ecosystems).

Changes in Population Growth and Global Seafood Consumption:

The United Nations latest projections suggest that the global population could grow to around 8.5 billion in 2030, 9.7 billion in 2050 and 10.4 billion in 2100(1).

As the population has grown, so has per capita fish consumption. Per capita food fish consumption grew from 9.0 kg (live weight equivalent) in the 1960s to 20.2 kg in 2020, at an average annual rate of 3% compared with a population growth rate of 1.6%(2).

Rising incomes and urbanization, improvements in post-harvest practices and changes in dietary trends are projected to drive a 15% increase in aquatic food consumption, to supply on average 21.4 kg per capita in 2030(3).

| 10 |

Aquaculture Has Developed as a Major Source to Meet Global Seafood Demand:

In 2020, fisheries and aquaculture production reached an all-time record of 214 million tons, worth about $424 billion. Production of aquatic animals in 2020 was more than 60% higher than the average in the 1990s, considerably outpacing world population growth, largely due to increasing aquaculture production(4).

Total production of aquatic animals is expected to reach 202 million tons in 2030, mainly due to sustained growth of aquaculture, projected to reach 100 million tons for the first time in 2027 and 106 million tons in 2030(5).

We believe that the growth in consumption drives the increased growth of aquaculture and the need for recirculatory aquatic systems.

(1) United Nations – Department of Economic and Social Affairs – World Population Prospects (2022)

(2)(3)(4)(5) Food and Agriculture Organization of the United Nations “The State of the World Fisheries and Aquaculture – 2022.

Suppliers

We purchase crab meat directly from six processors with which we have long-standing relationships, that have agreed to source their product in a sustainable manner. All crab meat is sourced under the Company’s FDA approved HACCP Plan. Additionally, all suppliers are certified grade A by the BRC and are audited annually to ensure safety and quality.

The Company had four major suppliers located in the United States, Canada and China which accounted for approximately 82% of the Company’s total purchases during the year ended December 31, 2023. The Company’s largest supplier is located in Miami and accounted for 35% of the Company’s total purchases in the year ended December 31, 2023.

Sales, Marketing and Distribution

The Company’s products are sold in the United States and Canada. Its primary current source of revenue is importing blue and red swimming crab meat primarily from Indonesia, the Philippines and China and distributing it in the United States and Canada under several brand names such as Blue Star, Oceanica, Pacifika, Crab & Go, Lubkin’s Coastal Pride, First Choice, Good Stuff, Coastal Pride Fresh and TOBC steelhead salmon and rainbow trout fingerlings produced under the brand name Little Cedar Falls.

The Company stores its crab meat inventory at a third-party facility in Miami, Florida and distribution takes place from this facility.

The Company has a sales team based throughout the United States who sell directly to customers, most of whom are in the food service and retail industry and also manage a network of regional and national brokers, that cover both the retail and wholesale segments. The sales team and brokers help to pull the products through the system by creating demand at the end user level and pulling the demand through our distributor customers. The Company sells to retail customers either directly or via distributors that specialize in the retail segment.

The Company does not own its own fleet of trucks and utilizes less than truckload freight shipping (“LTL”) national freight carriers to deliver its products to its customers. LTL is used for the transportation of small freight or when freight does not require the use of an entire trailer. When shipping LTL, the Company pays for a portion of a standard truck trailer, and other shippers and their shipments fill the unoccupied space.

Customers

Our customer base is comprised of some of the largest companies in the food service and retail industry throughout the United States. We sell our crab meat to our customers through purchase orders. For the year ended December 31, 2023, sales to food distributors and retail and wholesale clubs accounted for 52% of our revenue. The balance of our revenue is derived from smaller seafood distributors and value-added processors.

| 11 |

The Company had nine customers which accounted for approximately 52% of revenue during the year ended December 31, 2023. Two customers accounted for 22% of revenue during the year ended December 31, 2023. The loss of any major customer could have a material adverse impact on the Company’s results of operations, cash flows and financial position.

Competition

In general, the international seafood industry is intensely competitive and highly fragmented. We compete with local and overseas manufacturers and importers engaged in similar products.

The Company’s primary competitors in its traditional sustainable seafood businesses are Tri Union Frozen Products, Inc. (Chicken of the Sea Frozen Foods), Phillips Foods, Inc., Harbor Seafood, Inc., Newport International and Twin Tails Seafood Corp.

The Company’s primary competitors in its RAS business are Aquabounty, Atlantic Sapphire, Aquaco, Nordic Aquafarms, Whole Oceans, West Coast Salmon and Pure Salmon.

Intellectual Property

Our intellectual property is an essential element of our business. We use a combination of patent, trademark, copyright, trade secret and other intellectual property laws and confidentiality agreements to protect our intellectual property. Our policy is to seek patent protection in the United States and in certain foreign jurisdictions for our products, processes and other technology where available and when appropriate. We also in-license technology, inventions and improvements we consider important to the development of our business.

In addition to our patents, we also rely upon trade secrets, know-how, trademarks, copyright protection and continuing technological and licensing opportunities to develop and maintain our competitive position. We monitor the activities of our competitors and other third parties with respect to their use of intellectual property. We require our employees to execute confidentiality and non-competition agreements upon commencing employment with us. Despite these safeguards, any of our know-how or trade secrets not protected by a patent could be disclosed to, or independently developed by, a competitor.

It is our standard practice to require our employees to sign agreements acknowledging that all inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership in those works. Despite our precautions, it may be possible for third parties to obtain and use without consent intellectual property that we own. Unauthorized use of our intellectual property by third parties and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

Borrowings under our loan and security agreement with Lighthouse are secured by substantially all of our personal property, including our intellectual property.

The following is a list of our patents:

| Title | Country | Patent No. OR Publication No |

Issue Date | Application No. | Application Date | |||||

| POUCH-PACKAGED CRABMEAT PRODUCT AND METHOD | US | 2015/0257426 A1 | 14/205,742 | 3/12/2014 | ||||||

| METHOD FOR PACKAGING CRABMEAT | US | 8445046 B2 | 5/21/2013 | 13/681,027 | 11/19/2012 | |||||

| METHOD FOR PACKAGING CRABMEAT | US | 8337922 B2 | 12/25/2012 | 10/691,480 | 10/21/2003 | |||||

| METHOD FOR PACKAGING CRABMEAT | EPC | 1526091 B1 | 10/21/2004 | |||||||

| TH | 28,256 | |||||||||

| PH | 1-2005-000216 | |||||||||

| ID | 20261 |

Our patents expire 20 years from the date of issuance which range from year 2007 to 2015.

| 12 |

The following is a list of our registered trademarks and trademarks for which we have filed applications.

| Mark | Registration No | Registration Date | Application No. | Application Date | ||||

| AMERICA’S FAVORITE CRABMEAT | 2961590 | 6/7/05 | 78344059 | 12/22/03 | ||||

| ECO-FRESH | 4525998 | 5/6/14 | 77922376 | 1/28/10 | ||||

|

3858522 | 10/5/10 | 77885209 | 12/3/09 | ||||

|

3818057 | 7/13/10 | 77885203 | 12/3/09 | ||||

| OCEANICA | 3711200 | 11/17/09 | 77595180 | 10/17/08 | ||||

|

2419060 | 1/9/01 | 75855876 | 11/19/19 | ||||

| Lubkin’s Coastal Pride | 2879531 | 8/31/04 | 78289067 | 8/19/03 | ||||

| Lubkin’s Good Stuff | N/A | N/A | 87919629 | 5/14/18 | ||||

| Lubkin’s First Choice | H/A | N/A | 88645685 | 10/8/19 |

Canadian Intellectual Property Office registered trademarks:

Little Cedar Falls – Registration #1766337- Expiration: June 20, 2032

Taste of BC – Registration #1561871 - Expiration: January 31, 2034

Government Regulation

Our third-party distribution facilities and our international suppliers are certified in accordance with the HACCP, standards for exporting aquatic products to the United States. The HACCP standards are developed by the FDA, pursuant to the FDA’s HACCP regulation, Title 21, Code of Federal Regulations, part 123, and are used by the FDA to help ensure food safety and control sanitary standards.

Food Safety and Labeling

We are subject to extensive regulation, including, among other things, the Food, Drug and Cosmetic Act, as amended by the Food Safety Modernization Act (“FSMA”), the Public Health Security and Bioterrorism Preparedness and Response Act of 2002, and the rules and regulations promulgated thereunder by the FDA. The FSMA was enacted in order to aid the effective prevention of food safety issues in the food supply. This comprehensive and evolving regulatory program impacts how food is grown, packed, processed, shipped and imported into the United States and it governs compliance with Good Manufacturing Practices regulations. The FDA has finalized seven major rules to implement FSMA, recognizing that ensuring the safety of the food supply is a shared responsibility among many different points in the global supply chain. The FSMA rules are designed to make clear specific actions that must be taken at each of these points to prevent contamination. Some aspects of these laws use a strict liability standard for imposing sanctions on corporate behavior. If we fail to comply with applicable laws and regulations, we may be subject to civil remedies, including fines, injunctions, recalls, or seizures, and criminal sanctions, any of which could impact our results of operations.

In addition, the Nutrition Labeling and Education Act of 1990 prescribes the format and content of certain information required to appear on the labels of food products.

| 13 |

Our operations and products are also subject to state and local regulation, including the registration and licensing of plants, enforcement by state health agencies of various state standards, and the registration and inspection of facilities. Compliance with federal, state and local regulation is costly and time-consuming. Enforcement actions for violations of federal, state, and local regulations may include seizure and condemnation of products, cease and desist orders, injunctions or monetary penalties. We believe that our practices are sufficient to maintain compliance with applicable government regulations.

Trade

For the purchase of products harvested or manufactured outside of the United States, and for the shipment of products to customers located outside of the United States, we are subject to customs laws regarding the import and export of shipments. Our activities, including working with customs brokers and freight forwarders, are subject to regulation by U.S. Customs and Border Protection, part of the Department of Homeland Security.

TOBC

TOBC’s aquafarms facility in Nanaimo, British Columbia, Canada with an annual production capacity of approximately 100 tons are licensed under the Canadian Department of Fisheries and Oceans. Harvests of steelhead salmon and rainbow trout fingerlings are processed as iced HOG fish locally at a Canadian Food Inspection Agency approved processing facility.

Federal Trade Commission

We are subject to certain regulations by the U.S. Federal Trade Commission. Advertising of our products is subject to such regulation pursuant to the Federal Trade Commission Act and the regulations promulgated thereunder.

Employee Safety Regulations

We are subject to certain health and safety regulations, including regulations issued pursuant to the Occupational Safety and Health Act. These regulations require us to comply with certain manufacturing, health, and safety standards to protect our employees from accidents.

Anticorruption

Because we are organized under the laws of a state and our principal place of business is in the United States, we are considered a “domestic concern” under the Foreign Corrupt Practices Act (“FCPA”) and are covered by the anti-bribery provisions of the FCPA. The provisions prohibit any domestic concern and any officer, director, employee, or agent, acting on behalf of the domestic concern from paying or authorizing payment of anything of value to (i) influence any act or decision by a foreign official; (ii) induce a foreign official to do or omit to do any act in violation of his/her lawful duty; (iii) secure any improper advantage; or (iv) induce a foreign official to use his/her influence to assist the payor in obtaining or retaining business, or directing business to another person.

Environmental Regulation

We are subject to a number of federal, state, and local laws and other requirements relating to the protection of the environment and the safety and health of personnel and the public. These requirements relate to a broad range of our activities, including the discharge of pollutants into the air and water; the identification, generation, storage, handling, transportation, disposal, recordkeeping, labeling, and reporting of, and emergency response in connection with, hazardous materials (including asbestos) associated with our operations; noise emissions from our facilities; and safety and health standards, practices, and procedures that apply to the workplace and the operation of our facilities.

Employees

As of March 28, 2024, we had thirty-nine full time employees and no part-time employees. We believe that our future success will depend, in part, on our continued ability to attract, hire and retain qualified personnel.

| 14 |

ITEM 1A. RISK FACTORS

This Annual Report contains certain statements relating to future events or the future financial performance of our Company. You are cautioned that such statements are only predictions and involve risks and uncertainties, and that actual events or results may differ materially. In evaluating such statements, you should specifically consider the various factors identified in this annual report, including the matters set forth below, which could cause actual results to differ materially from those indicated by such forward-looking statements.

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors before deciding to invest in our Company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer.

Risks Relating to Our Company and Business

Future acquisitions may have an adverse effect on our ability to manage our business.

Selective acquisitions currently form part of our strategy to further expand our business. If we are presented with appropriate opportunities, we may acquire additional businesses, services or products that are complementary to our core business. Future acquisitions and the subsequent integration of new companies into ours would require significant attention from management. Future acquisitions would also expose us to potential risks, including risks associated with the assimilation of new operations, services and personnel, unforeseen or hidden liabilities, the diversion of resources from our existing businesses and technologies, the inability to generate sufficient revenue to offset the costs and expenses of acquisitions and potential loss of, or harm to, relationships with employees as a result of integration of new businesses. The diversion of our management’s attention and any difficulties encountered in any integration process could have a material adverse effect on our ability to manage our business.

The value of crab meat is subject to fluctuation which may result in volatility of our results of operations and the value of an investment in the Company.

Our business is dependent upon the sale of a commodity which value is subject to fluctuation. Our net sales and operating results vary significantly due to the volatility of the value of the crab meat that we sell which may result in the volatility of the market price of our common stock.

A material decline in the population and biomass of crab meat that we sell in the fisheries from which we obtain our crab meat would materially and adversely affect our business.

The population and biomass of crab meat are subject to natural fluctuations which are beyond our control and which may be exacerbated by disease, reproductive problems or other biological issues and may be affected by changes in weather and the global environment. The overall health of a crab or other fish is difficult to measure, and fisheries management is still a relatively inexact science. Since we are unable to predict the timing and extent of fluctuations in the population and biomass of our products, we are unable to engage in any measures that might alleviate the adverse effects of these fluctuations. Any such fluctuation which results in a material decline in the population and biomass in the fisheries from which we obtain our crab meat would materially and adversely affect our business. Our operations are also subject to the risk of variations in supply.

We are subject to the risk of product contamination and product liability claims.

The sales of our products may involve the risk of injury to consumers. Such injuries may result from tampering by unauthorized personnel, product contamination or spoilage, including the presence of foreign objects, substances, chemicals, or residues introduced during the packing, storage, handling or transportation phases. While we are subject to governmental inspection and regulations and believe our facilities comply in all material respects with all applicable laws and regulations, including internal product safety policies, we cannot be sure that consumption of our products will not cause a health-related illness in the future or that we will not be subject to claims or lawsuits relating to such matters. Even if a product liability claim is unsuccessful, the negative publicity surrounding any assertion that our products caused illness or injury could adversely affect our reputation with existing and potential customers and our brand image.

| 15 |

A significant portion of our revenues are derived from a single product, crab meat, and therefore we are highly susceptible to changes in market demand, which may be affected by factors over which we have limited or no control.

A significant portion of our revenues are derived from a single product, crab meat. We therefore are highly susceptible to changes in market demand, which may be impacted by factors over which we have limited or no control. Factors that could lead to a decline in market demand for crab meat include economic conditions and evolving consumer preferences. A substantial downturn in market demand for crab meat may have a material adverse effect on our business and on our results of operations.

Risks Related to Our Industry and TOBC’s RAS Operations

Regulation of the fishing industry may have an adverse impact on our business.

The international community has been aware of and concerned with the worldwide problem of depletion of natural fish stocks. In the past, these concerns have resulted in the imposition of quotas that subject individual countries to strict limitations on the amount of seafood that is allowed to be caught or harvested. Environmental groups have been lobbying for additional limitations. If international organizations or national governments were to impose additional limitations on crab meat or the seafood products we sell, this could have a negative impact on our results of operations.

Segments of the seafood industry in which we operate are competitive, and our inability to compete successfully could adversely affect our business, results of operations and financial condition.

We compete with major integrated seafood companies such as Tri Union Frozen Products, Inc. (Chicken of the Sea Frozen Foods), Phillips Foods, Inc., Harbor Seafood, Inc., and Twin Tails Seafood Corp. in our traditional sustainable seafood business and our primary competitors in our RAS business are Aquabounty, Atlantic Sapphire, Aquacon, Nordic Aquafarms, Whole Oceans, West Coast Salmon and Pure Salmon. Some of our competitors have the benefit of marketing their products under brand names that have better market recognition than ours or have stronger marketing and distribution channels than we do. Increased competition as to any of our products could result in price reduction, reduced margins and loss of market share, which could negatively affect our profitability. An increase in imported products in the United States at low prices could also negatively affect our profitability.

Our insurance coverage may be inadequate to cover losses we may incur or to fully replace a significant loss of assets.

Our involvement in the fishing industry may result in liability for pollution, property damage, personal injury or other hazards. Although we believe we have obtained insurance in accordance with industry standards to address such risks, such insurance has limitations on liability and/or deductible amounts that may not be sufficient to cover the full extent of such liabilities or losses. In addition, such risks may not, in all circumstances, be insurable or, in certain circumstances, we may choose not to obtain insurance to protect against specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to us. If we suffer a significant event or occurrence that is not fully insured, or if the insurer of such event is not solvent, we could be required to divert funds from capital investment or other uses towards covering any liability or loss for such events.

Our operations, revenue and profitability could be adversely affected by changes in laws and regulations in the countries where we do business.

The governments of countries into which we sell our products, from time to time, consider regulatory proposals relating to raw materials, food safety and markets, and environmental regulations, which, if adopted, could lead to disruptions in distribution of our products and increase our operational costs, which, in turn, could affect our profitability. To the extent that we increase our product prices as a result of such changes, our sales volume and revenues may be adversely affected.

| 16 |

Furthermore, these governments may change import regulations or impose additional taxes or duties on certain imports from time to time. These regulations and fees or new regulatory developments may have a material adverse impact on our operations, revenue and profitability. If one or more of the countries into which we sell our products bars the import or sale of crab meat or related products, our available market would shrink significantly, adversely impacting our results of operations and growth potential.

A decline in discretionary consumer spending may adversely affect our industry, our operations and ultimately our profitability.

Luxury products, such as premium grade crab meat, are discretionary purchases for consumers. Any reduction in consumer discretionary spending or disposable income may affect the crab meat industry significantly. Many economic factors outside of our control could affect consumer discretionary spending, including the financial markets, consumer credit availability, prevailing interest rates, energy costs, employment levels, salary levels, and tax rates. Any reduction in discretionary consumer spending could materially adversely affect our business and financial condition.

Our business is affected by the quality and quantity of the salmon that is harvested by TOBC.

We sell our products in a highly competitive market. The ability of TOBC to successfully sell its salmon and the price therefor, is highly dependent on the quality of the salmon. A number of factors can negatively affect the quality of the salmon sold, including the quality of the broodstock, water conditions in the farm, the food and additives consumed by the fish, population levels in the tanks, and the amount of time that it takes to bring a fish to harvest, including transportation and processing. Optimal growing conditions cannot always be assured. Although fish grown in RAS production systems are not subject to the disease and parasite issues that can affect salmon grown in ocean pens, there is the potential for organisms that are ubiquitous to freshwater environments to become pathogenic if the fish are subjected to stressful conditions or there is an issue with biomass management.

High standards for the quality of the product are maintained and if we determine that a harvest has not met such standards, we may be required to reduce inventory and write down the value of the harvest to reflect net realizable value. Sub-optimal conditions could lead to smaller harvests and or lower quality fish. Conversely, if we experience better than expected growth rates, we may not be able to process and bring our fish to market in a timely manner, which may result in overcrowding that can cause negative health impacts and/or require culling our fish population.

Furthermore, if our salmon is perceived by the market to be of lower quality than other available sources of salmon or other fish, we may experience reduced demand for our product and may not be able to sell our products at the prices that we expect or at all.

As we continue to expand our operations and build new farms, we potentially may face additional challenges with maintaining the quality of our products. We cannot guarantee that we will not face quality issues in the future, any of which could cause damage to our reputation, and a loss of consumer confidence in our products, which could have a material adverse effect on our business results and the value of our brands.

A shutdown, damage to any of our farms, or lack of availability of power, fuel, oxygen, eggs, water, or other key components needed for our operations, could result in our prematurely harvesting fish, a loss of a material percentage of our fish in production, a delay in our commercialization plans, and a material adverse effect on our operations, business results, reputation, and the value of our brands.

An interruption in the power, fuel, oxygen supply, water quality systems, or other critical infrastructure of an aquaculture facility for more than a short period of time could lead to the loss of a large number of fish. A shutdown of or damage to our farm due to natural disaster, shortages of key components to our operations due to a pandemic, reduction in water supply, contamination of our aquifers, interruption in services, or human interference could require us to prematurely harvest some or all of the fish or could result in a loss of our fish in production.

We also are dependent on egg availability. If we had a disruption in our ability to purchase eggs, we would not be able to continue to stock our farm. We cannot guarantee that any disruptions might not occur in the future, any of which could cause loss of salmon to sell, damage to our reputation, loss of consumer confidence in our products and company, and lost revenues, all of which could have a material adverse effect on our business results.

| 17 |

The successful development of our TOBC business depends on TOBC’s ability to efficiently and cost-effectively produce and sell salmon at large commercial scale.

Our business plans depend on our ability to increase our production capacity through the development of larger farms. We have limited experience constructing, ramping up, and managing such large, commercial-scale facilities, and we may not have anticipated all of the factors or costs that could affect our production, harvest, sale, and delivery of salmon at such a scale. Our salmon may not perform as expected when raised at very large commercial scale, we may encounter operational challenges, control deficiencies may surface, our vendors may experience capacity constraints, or our production cost and timeline projections may prove to be inaccurate. Any of these could decrease process efficiency, create delays, and increase our costs. We are also subject to volatility in market demand and prices, such as the disruption of the salmon market including reduction in market prices for salmon.

In addition, competitive pressures, customer volatility and the possible inability to secure established and ongoing customer partnerships and contracts, may result in a lack of buyers for our fish. Customers of our fish may not wish to follow our terms and conditions of sale, potentially resulting in a violation of labeling or disclosure laws, improper food handling, nonpayment for product, and similar issues. The competitive landscape for salmon may create challenges in securing competitive pricing for our salmon to reach our competitive goals. In addition, it is possible that we may not be able to service our customers to meet their expectations regarding fish quality, ongoing harvest supply availability, order processing fill rate, on time or correct deliveries, potential issues with third party processors, and other factors, which could impact our relationships with customers, our reputation, and our business results.

Risks Related to Our Reliance on Third Parties

We are dependent on third parties for our operations and our business may be affected by supply chain interruptions and delays.

Our business is dependent upon our relationships with vendors in Southeast Asia and Latin America for co-packing, processing and shipping product to us. If for any reason these companies became unable or unwilling to continue to provide services to us, this would likely lead to a temporary interruption in our ability to import our products until we found another entity that could provide these services. Moreover, if supply chain delays occur, our product will arrive late which will adversely impact our revenue. Failure to find a suitable replacement, even on a temporary basis, would have an adverse effect on our results of operations.

We do not have long-term agreements with many of our customers and suppliers.

Many of our customers and suppliers operate through purchase orders. Though we have long-term business relationships with many of our customers and suppliers and alternative sources of supply for key items, we do not have long-term agreements with such customers and suppliers and cannot be sure that any of these customers or suppliers will continue to do business with us on the same basis or on terms that are favorable to us. The termination or modification of any of these relationships may adversely affect our business, financial performance and results of operations.

Risks Related to Our Financial Condition and Capital Requirements

Our independent registered public accounting firm has included an explanatory paragraph relating to our ability to continue as a going concern in its report on our audited financial statements.

The report from our independent registered public accounting firm for the year ended December 31, 2023 includes an explanatory paragraph stating that the Company has suffered recurring losses from operations and has a net capital deficiency that raises substantial doubt about its ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent on its ability to increase revenues, execute on its business plan to acquire complimentary companies, raise capital and continue to sustain adequate working capital to finance its operations. If we are unable to do so, our financial condition and results of operations will be materially and adversely affected and we may be unable to continue as a going concern.

| 18 |

We may need to raise additional capital to fund our existing commercial operations and develop and commercialize new products and expand our operations.

If our available cash balances, net proceeds from an offering and anticipated cash flow from operations are insufficient to satisfy our liquidity requirements including because of lower demand for our products or due to other risks described herein, we may seek to sell common stock or preferred stock or convertible debt securities, enter into an additional credit facility or another form of third-party funding or seek other debt financing.

We may consider raising additional capital in the future to expand our business, to pursue strategic investments, to take advantage of financing opportunities or for other reasons, including to:

| ● | increase our sales and marketing efforts and address competitive developments; | |

| ● | provide for supply and inventory costs; | |

| ● | fund development and marketing efforts of any future products or additional features to then-current products; | |

| ● | acquire, license or invest in new technologies; | |

| ● | acquire or invest in complementary businesses or assets; and | |

| ● | finance capital expenditures and general and administrative expenses |

Our present and future funding requirements will depend on many factors, including:

| ● | our ability to achieve revenue growth and improve gross margins; | |

| ● | the cost of expanding our operations and offerings, including our sales and marketing efforts; | |

| ● | the effect of competing market developments; and | |

| ● | costs related to international expansion. |

The various ways we could raise additional capital carry potential risks. If we raise funds by issuing equity securities, dilution to our stockholders could result. Any equity securities issued also could provide for rights, preferences or privileges senior to those of holders of our common stock. If we raise funds by issuing debt securities, those debt securities would have rights, preferences and privileges senior to those of holders of our common stock. The terms of debt securities issued or borrowings pursuant to a credit agreement could impose significant restrictions on our operations. If we raise funds through collaborations and licensing arrangements, we might be required to relinquish significant rights or grant licenses on terms that are not favorable to us.

We incur significant costs as a result of operating as a public company and our management devotes substantial time to public company compliance.

As a public company, we incur significant legal, accounting and other expenses due to our compliance with regulations and disclosure obligations applicable to us, including compliance with the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), and the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) as well as rules implemented by the SEC, and the OTC Markets. Stockholder activism, the current political environment and the current high level of government intervention and regulatory reform may lead to substantial new regulations and disclosure obligations, which may lead to additional compliance costs and impact, in ways we cannot currently anticipate, the manner in which we operate our business. Our management and other personnel devote a substantial amount of time to monitoring of and compliance with, public company reporting obligations. These rules and regulations cause us to incur significant legal and financial compliance costs and make some activities more time consuming and costly.

| 19 |

To comply with the requirements of being a public company, we may need to undertake various actions, including implementing internal controls and procedures. The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal control over financial reporting. We are continuing to develop and refine our disclosure controls and other procedures that are designed to ensure that information disclosed to the SEC is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms. Any failure to develop or maintain effective controls could harm our operating results, cause us to fail to meet our reporting obligations or result in a restatement of prior period financial statements. In the event that we are not able to demonstrate compliance with the Sarbanes-Oxley Act, that our internal control over financial reporting is perceived as inadequate or that we are unable to produce timely or accurate financial statements, investors may lose confidence in our operating results and the price of our common stock could decline. In addition, if we are unable to continue to meet these requirements, our common stock may not be able to continue to meet the eligibility requirements for the NASDAQ Stock Market.

Our independent registered public accounting firm will not be required to formally attest to the effectiveness of our internal control over financial reporting until the later of our second annual report or the first annual report required to be filed with the SEC following the date we are no longer an “emerging growth company” as defined in the JOBS Act depending on whether we choose to rely on certain exemptions set forth in the JOBS Act. If we are unable to assert that our internal control over financial reporting is effective, or if our independent registered public accounting firm is unable to express an opinion on the effectiveness of our internal control over financial reporting, we could lose investor confidence in the accuracy and completeness of our financial reports, which could harm our business.

Risks Related to Administrative, Organizational and Commercial Operations and Growth

We may be unable to manage our future growth effectively, which could make it difficult to execute our business strategy.

We anticipate growth in our business operations. This future growth could create a strain on our organizational, administrative and operational infrastructure, including manufacturing operations, quality control, technical support and customer service, sales force management and general and financial administration. Our ability to manage our growth properly will require us to continue to improve our operational, financial and management controls, as well as our reporting systems and procedures. If we are unable to manage our growth effectively, we may be unable to execute our business plan, which could have a material adverse effect on our business and our results of operations.

If we are unable to support demand for our current and our future products, including ensuring that we have adequate resources to meet increased demand and mitigate any supply chain delays our business could be harmed.

As our commercial operations and sales volume grow, we will need to continue to increase our workflow capacity for processing, customer service, billing and general process improvements and expand our internal quality assurance program, and mitigate any supply chain delays we could have with our vendors, among other things. We may also need to purchase additional equipment and increase our manufacturing, maintenance, software and computing capacity to meet increased demand. We cannot assure you that any of these increases in scale, expansion of personnel, purchase of equipment or process enhancements will be successfully implemented.

The loss of our Executive Chairman and Chief Executive Officer or our inability to attract and retain highly skilled officers and key personnel could negatively impact our business.

Our success depends on the skills, experience and performance of John Keeler, our Executive Chairman and Chief Executive Officer. The individual and collective efforts of such individual will be important as we continue to develop and expand our commercial activities. The loss or incapacity of Mr. Keeler could negatively impact our operations if we experience difficulties in hiring qualified successors. Qualified employees periodically are in great demand and may be unavailable in the time frame required to satisfy our customers’ requirements. Expansion of our business could require us to employ additional personnel. There can be no assurance that we will be able to attract and retain sufficient numbers of skilled employees in the future. The loss of personnel or our inability to hire or retain sufficient personnel at competitive rates could impair the growth of our business.

| 20 |

If we were sued for product liability or professional liability, we could face substantial liabilities that exceed our resources.

The marketing and sale of our products could lead to the filing of product liability claims alleging that our product made users ill. A product liability claim could result in substantial damages and be costly and time-consuming for us to defend.