UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the fiscal year ended September 30, 2018

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission file number: 001-38532

i3 Verticals, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 82-4052852 | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

40 Burton Hills Blvd., Suite 415 | |||||

Nashville, TN | 37215 | ||||

| (Address of principal executive offices) | (Zip Code) | ||||

Registrant’s telephone number, including area code: (615) 465-4487 | |||||

| Securities registered pursuant to Section 12(b) of the Act: | |||||

| Title of each class | Name of each exchange on which registered | ||||

| Class A Common Stock, $0.0001 Par Value | Nasdaq Global Select Market | ||||

| Securities registered pursuant to Section 12(g) of the Act: None | |||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments of this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | o | Accelerated filer | o | ||||||||||||||

Non-accelerated filer | x | Smaller reporting company | o | ||||||||||||||

Emerging growth company | x | ||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of December 5, 2018, there were 9,108,032 outstanding shares of Class A common stock, $0.0001 par value per share, and 17,213,806 outstanding shares of Class B common stock, $0.0001 par value per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy materials for its 2019 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

Page | |||||

2

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of the federal securities laws. All statements other than statements of historical facts contained in this report may be forward-looking statements. These forward-looking statements can generally be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,” “pro forma,” “continues,” “anticipates,” “expects,” “seeks,” “projects,” “intends,” “plans,” “may,” “will,” “would” or “should” or, in each case, their negative or other variations or comparable terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. These factors include, but are not limited to, the following:

•our ability to generate revenues sufficient to maintain profitability and positive cash flow;

•competition in our industry and our ability to compete effectively;

•our dependence on non-exclusive distribution partners to market our products and services;

•our ability to keep pace with rapid developments and changes in our industry and provide new products and services;

•liability and reputation damage from unauthorized disclosure, destruction or modification of data or disruption of our services;

•technical, operational and regulatory risks related to our information technology systems and third-party providers’ systems;

•reliance on third parties for significant services;

•exposure to economic conditions and political risks affecting consumer and commercial spending, including the use of credit cards;

•our ability to increase our existing vertical markets, expand into new vertical markets and execute our growth strategy;

•our ability to successfully complete acquisitions and effectively integrate those acquisitions into our services;

•degradation of the quality of our products, services and support;

•our ability to retain clients, many of which are small- and medium-sized businesses ("SMBs"), which can be difficult and costly to retain;

•our ability to successfully manage our intellectual property;

•our ability to attract, recruit, retain and develop key personnel and qualified employees;

•risks related to laws, regulations and industry standards;

•our indebtedness and potential increases in our indebtedness;

•operating and financial restrictions imposed by our Senior Secured Credit Facility (as defined below); and

•the risk factors included in Part I, Item 1A of this Annual Report on Form 10-K.

Although we base these forward-looking statements on assumptions that we believe are reasonable when made, we caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and industry developments may differ materially from statements made in or suggested by the forward-looking statements contained in this Annual Report on Form 10-K. The matters summarized in “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K could cause our actual results to differ significantly from those contained in our forward-looking statements. In addition, even if our results of operations, financial condition and liquidity, and industry developments are consistent with the forward-looking statements contained in this filing, those results or developments may not be indicative of results or developments in subsequent periods.

3

In light of these risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements. Any forward-looking statement that we make in this filing speaks only as of the date of such statement, and we undertake no obligation to update any forward-looking statement or to publicly announce the results of any revision to any of those statements to reflect future events or developments, except as required by applicable law. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

PART I

Item 1. Business

i3 Verticals, Inc. was formed as a Delaware corporation on January 17, 2018 for the purpose of completing an initial public offering (“IPO”) of its Class A common stock and other related transactions in order to carry on the business of i3 Verticals, LLC and its subsidiaries. The Company’s headquarters are in Nashville, Tennessee, with operations throughout the United States. The terms “i3 Verticals,” the “Company,” “we,” “us” and “our” and similar references refer (1) before the completion of our IPO or the reorganization transactions entered into in connection therewith (the “Reorganization Transactions”), which are described in the notes to consolidated financial statements, to i3 Verticals, LLC and, where appropriate, its subsidiaries, and (2) after the Reorganization Transactions to i3 Verticals, Inc. and, where appropriate, its subsidiaries.

Our Company

Recognizing the convergence of software and payments, i3 Verticals was founded in 2012 with the purpose of delivering seamless integrated payment and software solutions to SMBs and other organizations in strategic vertical markets.

Since commencing operations, we have built a broad suite of payment and software solutions that address the specific needs of SMBs and other organizations in our strategic vertical markets, and we believe our suite of solutions differentiates us from our competition. Our primary strategic vertical markets include education, non-profit, public sector, property management and healthcare. These vertical markets are large, growing and tend to have increasing levels of electronic payments adoption compared to other industries. In addition to our strategic vertical markets, we also have a growing presence in the business-to-business (“B2B”) payments market. We processed approximately $11.6 billion in total payment volume in the year ended September 30, 2018.

We distribute our payment technology and proprietary software solutions to our clients through our direct sales force as well as through a growing network of distribution partners, including independent software vendors (“ISVs”), value-added resellers (“VARs”), independent sales organizations (“ISOs”) and other referral partners, including financial institutions. Our ISV partners represent a significant distribution channel and enable us to accelerate our market penetration through a cost effective one-to-many sales model that tends to result in high retention and faster growth. From September 30, 2016 to December 5, 2018, we increased our network of ISVs from 13 to 28. From September 30, 2016 to September 30, 2018, our average monthly payment volume increased 235%. We believe our model is highly effective at reaching new potential clients.

Our integrated payment and software solutions feature embedded payment capabilities tailored to the specific needs of our clients in strategic vertical markets. Our configurable payment technology solutions integrate seamlessly into clients’ third-party business management systems, provide security that complies with Payment Card Industry Data Security Standards (“PCI DSS”) and include extensive reporting tools. In addition to integrations with third party software, we deliver our own proprietary software solutions that increase the productivity of our clients by streamlining their business processes, particularly in the education, property management and public sector markets. We believe our proprietary software further differentiates us from our competitors in these strategic verticals and enables us to maximize our payment-related revenue. Through our proprietary gateway, we offer our clients a single point of access for a broad suite of payment and software solutions, enabling omni-channel point of sale (“POS”), spanning brick and mortar and electronic and mobile commerce, including app-based payments.

4

We primarily focus on strategic vertical markets where we believe we can be a leader in vertically-focused, integrated payment and software solutions. Our strategic vertical markets include:

•Education—We assist schools in completing payment processing functions such as accepting payments for school lunches (online, at school, or at the POS) and school activities, selling products from the online student store while managing inventory, ticket sales while tracking attendance at athletic and other events, enabling parents and students to complete forms electronically and enabling parents to make installment payments on higher-priced items.

•Public Sector—We assist public entities by efficiently collecting taxes, fines and certain fees; providing customer service responses to customer calls; and increasing the number of means available to make payments (online, in person or via mobile). We have products and solutions that create an efficient flow of information throughout government entities. We have a proprietary accounting platform that allows government entities to adhere to their fund accounting requirements.

•Non-profit—We simplify the payment process for donations, charity auctions, church contributions and tickets to fundraising events, among others, empowering our clients to increase both their revenues and the time they devote to their core activities.

•Property Management—We assist landlords and property managers in the rent collection process by providing centralized reporting for card and automated clearing house (“ACH”) payments, bank-level PCI DSS compliant security and solutions that integrate with third-party accounting software. This solution is becoming a popular option in the fast-growing shared workspace industry.

•Healthcare—We enable clients in our healthcare vertical to accept payments through mobile and POS solutions; to use consumer-facing payment devices that allow receptionists and clerical staff to focus their attention elsewhere; and to use revenue cycle management tools to help minimize the volume of accounts that they turn over to collection agencies.

We have a longer term goal of being a leader in six to ten strategic vertical markets. We target vertical markets where businesses and organizations tend to lack integrated payment functionality within their business management systems and where we face less competition for our solutions. In many cases, we deliver our proprietary software solutions to strategic vertical markets through the payment facilitator (“PayFac”) model, where we:

•enable superior data management by aggregating multiple small merchants under our “master” account, resulting in the collection and management of data not historically readily available;

•streamline and simplify merchant onboarding, often resulting in client approval in minutes or hours rather than days or weeks; and

•provide ease of reporting and reconciliation, allowing our clients to accept electronic payments in a faster, more convenient fashion.

As more ISVs seek to differentiate their offerings by seamlessly integrating payment functionality into their software solutions, the PayFac model has gained significant momentum. Before PayFacs were an option, any business looking to accept credit cards was required to establish an individual merchant account, which is often costly and time-consuming for small merchants.

In addition to our vertical markets, we have a growing presence in the B2B payments sector, where we provide value-added solutions that enhance card capabilities and provide improved payment processing technology that integrates with our clients' accounting systems.

An important part of our long-term strategy is acquisition-driven growth. Since our inception, we have completed 10 “platform” acquisitions and 14 “tuck-in” acquisitions. Our platform acquisitions have opened new strategic vertical markets, broadened our technology and solutions suite and expanded our client base, while our tuck-in acquisitions have augmented our existing payment and software solutions and added clients. Our growth strategy is to continue to build our company through a disciplined combination of organic growth and growth through platform and tuck-in acquisitions.

5

We generate revenue primarily, but not exclusively, from volume-based fees generated by payment processing services provided to clients throughout the United States. Our payment processing services enable clients to accept electronic payments, facilitating the exchange of funds and transaction data between clients, financial institutions and payment networks. Services include merchant onboarding, risk and underwriting, authorization, settlement, chargeback processing and other merchant support services. We also generate revenue from software licensing subscriptions, ongoing support, and other POS-related solutions that we provide to our clients directly and through our distribution partners. Due to our integrated payment and software solutions and our distribution network, we are able to derive significant scale from operating efficiencies, which enable us to generate strong operating margins and profitability.

Our Competitive Strengths

We believe we have attributes that differentiate us from our competitors and provide us with significant competitive advantages. Our key competitive strengths are described below.

Innovative Payment and Software Solutions Tailored for Strategic Verticals

We believe our ability to deliver innovative payment and software solutions, tailored to the specific needs of businesses and organizations in our strategic vertical markets, differentiates us from our competitors. Our seamlessly integrated payment and software solutions can be used across multiple channels and industry verticals through our gateway and PayFac model and permit us to tailor our solutions to specific needs of individual vertical markets. We focus on providing value-add, flexible, scalable and innovative electronic payment and software solutions to clients in attractive, high growth strategic vertical markets such as education, non-profit, public sector, property management and healthcare. We target vertical markets that are large and growing, where businesses and other organizations typically lack integrated payment functionality within their business management system, there is potential for significant market penetration of our solutions and competition for our solutions is fragmented. We have built, through strategic acquisitions and internal development, a specialized and tailored payment and software solutions business, powered by a broad network of distribution partners that allows us to integrate and cross-sell our solutions to businesses and organizations in these strategic vertical markets. We believe our deep domain knowledge in each of our strategic vertical markets provides us unique insight into our clients’ needs, and enables us to deliver high-quality traditional and PayFac solutions with vertical-specific client support.

Additionally, we provide a comprehensive suite of horizontal solutions that complement our vertically focused solutions and enable us to further penetrate each vertical market. Our horizontal solutions include virtual terminals, POS technology, mobile solutions, countertop and wireless terminals, electronic invoice presentment and payment, event registration, online reporting, expedited funding, PCI validation, integrated forms and client analytics.

Expertise in ISV Distribution

We distribute our payment technology and proprietary software solutions to our clients through our direct sales force as well as through a growing network of distribution partners, including ISVs. We embed our payment technology into our proprietary vertical software solutions, or into solutions developed by ISVs, empowering our clients to benefit from the seamless integration of payments and software. We currently have approximately 28 ISV distribution partners. Our ISV partner strategy represents a significant distribution channel and enables us to accelerate our market penetration through a cost effective one-to-many distribution model that tends to result in high retention and faster growth. We sell our services to our ISV partners’ customer base, effectively broadening our target base. We consider our expertise in integrating our payment processing solutions into our distribution partners’ software to be a key competitive advantage that has enabled us to construct a highly diversified customer base with relatively high retention rates. We have also acquired ISVs in certain strategic vertical markets, which we believe further differentiates us from our competitors and improves our results of operations.

6

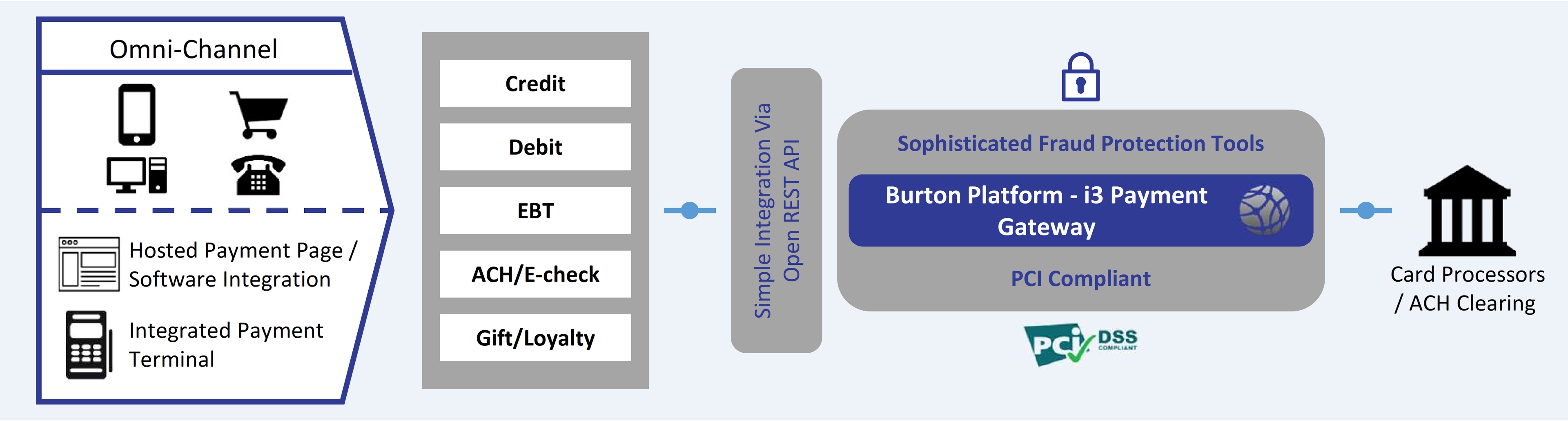

Robust Gateway and Technology Platform Delivering Sophisticated Payment and Software Solutions

We have developed a suite of technology solutions that can be deployed on a variety of platforms. Our solutions include a range of traditional and innovative products, and our technology includes proprietary software that serves our verticals and offers a unified suite of APIs that provide streamlined payment integration. Our defined project development processes enable us to deploy initial downloads and upgrades in a quick and efficient manner via the cloud. Our centralized development process and the broad compatibility of our products permit us to quickly respond to changing market trends, which competitors who rely on third-party providers for their technological needs are less equipped to do. Our solutions provide redundancy, scalability, high availability and PCI Service Level Provider (“SLP”) Level 1 Security.

Through our proprietary gateway, we provide our clients a single point of access for a broad suite of payment and software solutions, spanning POS, e-commerce and mobile devices. Leveraging our technology, we are able to provide our clients with solutions that are highly secure, scalable and available. In addition, our broad suite of payment and software solutions can evolve to meet the needs of our clients as their complexity, size or requirements change through sophisticated reporting and intelligence tools embedded within each client’s existing business management systems. In certain vertical markets such as education, property management and public sector, we offer proprietary software solutions that increase the productivity of our clients by streamlining their business processes. Our payment solutions, including PCI DSS-compliant security, integrate seamlessly into a client’s business management system and can be tailored to the client’s needs, with extensive reporting tools.

Attractive Operating Model

We have grown rapidly since our founding, with payment volume growth over the prior year of 12.5% in fiscal year 2018, 26.1% in fiscal year 2017, and 138.2% in fiscal year 2016. We believe our domain expertise within our strategic vertical markets, the embedded nature of our integrated payment and proprietary software solutions and our strong client relationships drive year-over-year improvements in client retention and revenue growth. We have invested significantly in our software solutions to increase the usability, functionality and capacity of our integrated solutions, and with the continued growth of our business, we have been able to benefit from economies of scale. By leveraging our technology, we have grown our client portfolio at a rate exceeding our other non-processing expenses. The relationships we have developed with a significant number of distribution partners, including ISVs and VARs, contribute to efficient client acquisition, high retention and lifetime value and, ultimately, strong revenue and earnings growth. Given that we predominantly generate transaction-based revenue, we can confidently predict at the beginning of each fiscal year our recurring revenue and cash flow, excluding the effects of acquisitions, for that fiscal year. Further, we have minimal client and vertical market concentration, which insulates us from fluctuations within any given vertical market.

Proven Acquisition and Integration Strategy

A core component of our growth strategy includes a disciplined approach to acquisitions of companies and technology, evidenced by ten platform acquisitions and fourteen tuck-in acquisitions since our inception in 2012. Our acquisitions have opened new strategic vertical markets, increased the number of businesses and organizations to whom we provide solutions and augmented our existing payment and software solutions and capabilities. Our management team has significant experience acquiring and integrating providers of payment processing services and providers of vertical market software that complement our existing suite of products and solutions. Due to our management team’s longstanding relationships and domain expertise, we have developed a strong pipeline of acquisition targets and are constantly evaluating businesses against our acquisition criteria.

Our Growth Strategy

Expand Our Network of Distribution Partners

We have experienced significant growth through our network of distribution partners, particularly within integrated channels. We have approximately 28 ISV distribution partners and intend to continue expanding our distribution network to reach new ISVs as well as other new partners within our strategic vertical markets. Further, we intend to expand into new verticals as our current distribution partners and clients expand their own businesses. We believe that our differentiated payments platform, combined with our vertical expertise, will enable us to methodically engage new distribution partners.

7

Continue to Enhance Our Suite of Technology Solutions

We intend to strengthen our position in our various vertical markets through continuous product innovation and enhancement. We have a strong track record of introducing to our clients new products and solutions that increase convenience, enhance ease of use, improve integration with their other business management systems and offer greater functionality. For example, we take advantage of our proprietary, integrated gateway and service capabilities to provide PayFac services in our strategic vertical markets. Through continued product innovation and enhancement, we believe we can increase client retention and improve our ability to win new business. Further, we will continue to invest in our technology and proprietary software that drives our competitiveness and position within our verticals.

Grow With Our Existing Distribution Partners and Clients

We focus on strategic vertical markets where there is a large addressable market, the client base is highly fragmented and penetration of electronic payments is below that of the overall economy. Our potential clients are in continual search of payment solutions and software to help them offer multiple value-added services and sell through various channels to provide a convenient customer experience, increase sales and create business efficiencies. We intend to grow organically with our existing distribution partners by providing compelling integrated payment technology and proprietary software solutions to clients. We believe that by cross-selling new and value-added services and promoting our omni-channel capabilities to our existing clients, we will help our clients succeed and grow their payment volume. We believe a subset of our client base uses integrated payment solutions, and we intend to promote the adoption of these technologies.

Certain of our specific growth strategies include:

•Cross-sell Opportunities: We provide our distribution partners with the opportunity to market new products as they become available, making available new content that enhances the value of our distribution partners to their members.

•Event Participation: We identify opportunities to engage with clients through event participation, including by sponsoring luncheons, attending tradeshows, and presenting at user conferences.

•Electronic Marketing: Our marketing team utilizes a variety of marketing techniques to enhance the awareness of our offerings to the distribution partner network, which align with our outbound sales effort and are intended to monitor the level of client engagement.

•Content Development: Our sales and marketing team partners with our distribution network to identify key topics of interest to their members, and we intend to continue work to craft new content covering popular topics related to the electronic payment industry.

•Incentive Programs: Our sales and marketing team works directly with our distribution partners to launch incentive programs intended to increase new referral activity through a variety of competitions and programs implemented each year.

Further Penetrate the Installed Merchant Base of Our Distribution Partners

We intend to continue to actively pursue the merchant base of our distribution partners. A significant number of businesses and other organizations within these channels are not currently using our solutions and have not yet been proactively approached or have not faced a reason to switch providers, such as contract expiration or a customer service issue. Many already have their electronic payments processed through another provider, while others are not yet accepting electronic payments. We intend to continue to capitalize on this significant opportunity by leveraging our relationships with our distribution partners, our extensive marketing capabilities, our vertically-focused sales force and our innovative payment technology. This focus allows us to expand within these markets and benefit from our clients’ organic growth.

8

Selectively Pursue Platform and Tuck-in Acquisitions

We intend to pursue platform acquisitions of vertically-focused integrated payment and software solution providers in new vertical markets. We also intend to continue to complement our organic expansion with accretive tuck-in acquisitions that enhance our market position within our existing strategic vertical markets. We expect that these acquisitions will expand our integrated platform, existing payment solutions and client reach. Since our formation in 2012, we have completed a total of ten platform and fourteen tuck-in acquisitions that enabled us to enter new, or expand within existing, vertical markets. We have demonstrated the ability to execute and integrate acquisitions that augment our products and services and enhance the solution set we offer to our clients.

We intend to continue to acquire targets through our strong pipeline, in addition to engaging new candidates. We target companies that have a strong management team with significant expertise in a particular vertical market and that offer attractive growth potential. Once we have completed an acquisition, we monitor the acquired company’s performance and seek to improve its operations. Our corporate structure enables us to provide financial and strategic support, including capital, recruitment, back-office and IT functions to the companies we acquire. This decentralized management structure allows us to create management teams positioned to maximize the growth potential in existing and new vertical markets.

Our Segments

We have two reportable segments, Merchant Services and Proprietary Software and Payments, and an Other category. For additional information on our segments, see Note 16 to our consolidated financial statements and “Management's Discussion and Analysis of Financial Condition and Results of Operations.”

Merchant Services

Our Merchant Services segment provides comprehensive payment solutions to businesses and organizations. Our Merchant Services segment includes third-party integrated payment solutions as well as traditional payment services across our strategic vertical markets.

Proprietary Software and Payments

Our Proprietary Software and Payments segment delivers embedded payment solutions to our clients through company-owned software. Payments are delivered through both the PayFac model and the traditional merchant processing model. Our Proprietary Software and Payments clients are primarily in the education, property management and public sector markets.

Other

Our Other category includes corporate overhead expenses, when presenting reportable segment information.

Our Products, Solutions and Technology

We deliver to our clients and distribution partners a comprehensive suite of integrated payment technology and software solutions to address the needs of SMBs and organizations in our strategic vertical markets. Our products and solutions are strategically aligned to support new client growth and promote customer retention.

We have developed a suite of payment technology solutions that:

•integrate with a broad number of client business management systems;

•perform a broad range of risk management, transaction processing and value-added services beneficial to our clients;

•increase convenience to our clients;

•provide ease of use and greater functionality for our clients;

•offer point-to-point encryption (“P2PE”); and

•offer PCI-compliant security and extensive reporting tools.

9

We offer our clients a single point of access through our powerful, simple and capable proprietary core platform (“Burton Platform”). Combining a centralized environment for scalability, PCI SLP Level 1 security and redundancy, Burton Platform offers a broad suite of payment and software solutions, enabling omni-channel POS, spanning brick and mortar locations and electronic- and mobile-commerce, including app-based payments. We employ project management, release management and product development lifecycle methodologies that enable us to deploy initial downloads and upgrades in a quick and efficient manner via the cloud.

Our Technology Framework and Strategic Vertical Software Solutions

We have a suite of proprietary solutions designed around horizontal and vertical market needs. This suite includes 26 vertical software solutions and our core platform, Burton Platform.

Burton Platform is the core of our technology suite. A platform designed to be highly scalable, built for minimal downtime and high transaction volume, Burton Platform brings together common components of our vertical software technologies as well as several historically disparate solutions.

Burton Platform includes an API suite that provides access to traditional merchant processing, ACH processing and PayFac merchant processing capabilities. The platform APIs allow access to EMV devices as well as P2PE certified devices using an implementation that shields software providers from the requirements of PCI / payment application data security standard (“PA-DSS”) certification.

We target vertical markets in which businesses and organizations tend to lack integrated payment functionality within their business management system. Additional attributes of these verticals often include a fragmented competitive environment, a large and increasing addressable market and an opportunity for significant market penetration and growth. We enter select vertical markets where we believe we can be a leader in vertically-focused, integrated payment technology and software solutions. We deliver all of our vertical software solutions as software-as-a-service (“SaaS”) solutions for web and mobile application.

In most cases, we deliver our proprietary software solutions to key verticals through a PayFac model, which we believe gives us a competitive advantage. Our PayFac solution streamlines and simplifies client onboarding, provides ease of reporting and reconciliation, and enables superior data management.

Our software solutions in our strategic vertical markets include the following:

Education—We serve K-12 school district leaders and staff members who need to collect and manage parent, student and community data and payments for supplementing budgets, quick reference, and reporting. Our education solution, which utilizes the PayFac model, is a self-serve payment and data collection software platform that manages critical parent and student information via web, mobile, and on-site transaction processing. We help schools with every aspect of payments, including online payments, on-campus POS and data collection functionality for tracking, reporting and collecting funds. Ancillary value-add options enable our school districts to manage event, program and sports registrations. Using our convenience-fee payment technology, our school clients in this vertical often receive the full principal amount which alleviates reconciliation issues and processing costs.

10

Public Sector—We have products and solutions that create an efficient flow of information throughout government entities. We have a proprietary accounting platform that allows government entities to adhere to their fund accounting requirements. We also deliver integrated payment solutions in our public-sector vertical. These solutions allow our clients to process court, tax, utility, bail, and other public-sector payments, typically utilizing the PayFac model. Convenience-fee payment technology is also available to our public sector clients.

Non-Profit—We deliver an integrated solution for processing payments from donors to non-profit organizations. These solutions assist non-profit organizations with ordinary course fundraising along with special one-time or “giving day” promotions that may include many separate organizations seeking donations within a single marketing campaign. Our integrated solutions seamlessly integrate into the business management system for each respective non-profit to allow for efficient data capture and reporting.

Healthcare—We provide businesses in our healthcare vertical with an integrated solution for processing payments from patients for various healthcare-related costs and fees. These payment solutions seamlessly integrate into our distribution partner ISV software to provide clients and their customers a bundled card payment solution. These ISV relationships promote our integrated payment solutions in a one-to-many fashion to prospective clients.

Property Management—We provide payment solutions for the residential property management and fast-growing workspace industry. Our products deliver a fully integrated payment solution for rent payments, including a branded mobile payment application as part of a software suite provided by our distribution partner ISVs. Our instruction-based funding model, enabled by our PayFac platform, accommodates complex fund distribution to multiple depository accounts, which is important to property managers and landlords. Property managers can use our convenience fee payment capabilities to reduce card processing costs by nearly 90%.

Horizontally-Integrated and Other Solutions

We also provide a comprehensive suite of horizontal solutions to our clients and distribution partners that complement our vertically-integrated solutions and enable us to further penetrate within each vertical market while cross-selling additional solutions across our client base. We have 8 horizontal software solutions, including Burton Platform described above. In the B2B market, we provide payment solutions to clients in industries that include professional services (including law firms), manufacturing, contractor services, construction, and other industries where a significant percentage of payments are received using a commercial, business, purchasing, or virtual card. Our B2B payment solutions offer clients secure processing technology to authorize and settle transactions at reasonable card rates, automate the pass-through of line item details, and enhance the automation of the accounts receivable process. Our distribution partners include card issuers and industry associations, each of whom provides a predictable source of new client leads.

In addition, we provide payment processing solutions to many retail establishments using both an integrated and traditional merchant account approach. For example, we have reseller arrangements with National Cash Register (“NCR”), pursuant to which we re-sell integrated POS solutions that consist of both hardware and software. We provide support services to these NCR POS clients, most of which are in the restaurant and hospitality markets, and we also cross-sell our payment processing solutions to this client base.

Our solutions are positioned to support new client growth and promote client retention both within and outside our existing verticals, but most importantly to provide a stable and secure payment experience.

Our Sales and Marketing

Our sales strategy leverages a broad network of distribution partners, comprised of ISVs, VARs, ISOs and our referral partners which include financial institutions, trade associations, chambers of commerce and card issuers. These distribution partners are a consistent and scalable source for new client acquisition. Leveraging our vertically focused suite of products and services, we are able to maximize the performance and retention of current distribution partners while attracting new partners. These one-to-many distribution partners accelerate penetration within our vertical markets in a cost-effective manner.

11

We focus on recruiting and retaining our distribution partners by providing them with financial incentives and support tools that enable them to be more successful in attracting new clients. We utilize our distribution partner sales force to identify new distribution partner relationships. These partner relationships are intended to expand our presence in existing strategic verticals, or extend into new industry verticals. The distribution partner sales team engages new opportunities, negotiates economic terms, and coordinates with marketing and direct sales to launch the partnership.

Our sales force includes both outside and inside representatives to manage each distribution partner relationship and deliver optimal response times to new client referrals. Our product and partner marketing is delivered through a shared-services model which is coordinated with each business unit. Marketing is tightly aligned with our sales efforts by providing event coordination, demand generation resources, physical and electronic marketing campaigns and partner marketing collateral.

Our direct sales team is responsible for selling our proprietary software and payment technology solutions to clients primarily through our distribution and referral partner networks. The assigned sales team is the primary liaison for managing the partner relationship, coordinating with marketing team efforts and engaging new client referral opportunities. We utilize our direct sales team to sell our proprietary software and payment technology solutions directly to clients in our education, property management and public sector markets.

Distribution Partners

Integrated Software Vendors. Our ISV partners are software companies that integrate our payment technology into their software and market our acquiring services to their clients in a one-to-many fashion. The integration streamlines the onboarding of new clients, provides a consistent support structure for our joint client, and delivers a bundled payment offering that clients find attractive. An integrated payment and software solution enhances client satisfaction and increases client retention.

Value Added Resellers. We partner with VARs to sell our proprietary software products in conjunction with the services that the VAR is able to provide to our client. This type of relationship allows us to expand our sales of software licensing subscriptions by allowing a VAR to bundle our software product with other value-add services provided by the VAR.

Independent Sales Organizations. We partner with ISOs to market our broad offering of payment solutions. The majority of our ISOs will market under our brand which allows them to promote our suite of products and payment solutions. We provide valuable support, training, and portfolio management tools to our ISOs.

Referral Partners

Financial Institutions. We partner with financial institutions to offer our suite of products and services to their commercial banking clients. Through our partner bank program, our sales team works directly with treasury management, business banking, and retail banking centers to promote our products and services to current or prospective clients. When we receive the merchant referral, we establish pricing and manage the ongoing support of that client relationship.

Trade Associations. We partner with a broad and diverse network of industry associations and business alliances to promote our products and services both within and outside our strategic verticals. Our participation within the association varies by relationship but often involves tradeshow participation, member benefit offerings, and other engagement opportunities intended to attract new clients and strengthen our brand awareness.

Chambers of Commerce. Our chamber referral partner network serves to benefit both the chamber and chamber member. Our sales and marketing team works closely with the chamber to establish a group rate program for the members of that specific chamber. The chamber then promotes our processing solutions as a membership benefit and in many cases the cost savings we can deliver a member will offset such member's chamber dues. The chamber receives a portion of our revenue which acts as a non-dues revenue source for the chamber and helps offset the costs incurred by the chamber to promote the program.

12

Card Issuers. Our growth in the B2B market is largely attributable to partnerships with commercial card issuers. Our card issuing partner will work with a business client to convert outgoing supplier/vendor payments from check, ACH, or cash to a card network-based product. Our B2B sales team supports the client to maximize vendor enrollment rates by negotiating better card processing fees or optimizing the interchange qualification of the card network payment.

i3 Verticals Sales Force

Distribution and Referral Partner Sales. Our distribution and referral partner sales function is responsible for identifying new distribution and referral partner relationships. These partner relationships are intended to expand our presence in existing strategic verticals, or extend into new industry verticals. The distribution and referral partner sales team engages new opportunities, negotiates economic terms and coordinates with marketing and direct sales to launch the partnership.

Direct Sales. Our direct sales team is responsible for selling our proprietary software and payment technology solutions to clients primarily through our distribution and referral partner networks. The assigned sales team is the primary liaison for managing the partner relationship, coordinating with marketing team efforts and engaging new client referral opportunities. We also utilize our direct sales team to sell our proprietary software and payment technology solutions directly to clients in our education, property management and public sector markets.

Marketing

Our enterprise marketing function serves as a shared-services team to coordinate corporate communications and support the sales team. The marketing team establishes our overall corporate marketing strategy to enhance brand awareness and demand generation. We use a broad variety of traditional and digital marketing mediums to engage prospective clients. These include:

Corporate Communications and Public Relations. The corporate communications and public relations team manages press releases, industry announcements and overall external corporate messaging.

Product Marketing. The product marketing function is responsible for coordinating communications related to our software solutions.

Distribution Partner Marketing. Our distribution partner marketing team partners with sales to promote our services to prospective clients through our distribution partner network. This includes email marketing campaigns, sales promotions, obtaining client testimonials and identifying product cross-selling opportunities.

Digital Marketing. Our digital marketing efforts include client and partner newsletters, email campaigns, search engine optimization and digital advertising.

Our Operations

Our operations team is uniquely structured to optimize the experience of our clients and distribution partners. These regionally distributed and vertically focused business support teams allow us to establish a level of expertise that delivers a scalable support structure and enables us to align our services with the economic goals and specific expectations of the respective business unit. Each operations team is positioned to support the functions of their respective client base and key performance indicators mark their progress toward achieving the goals established by each business unit. Our client and partner databases provide visibility into each overall client relationship, tracking the status of the relationship from initial contact through the lifecycle of that client or partner relationship. Our centralized technology department is structured to rapidly enhance and effectively maintain our products and services.

13

Business Operations

Our operations team is structured to effectively support the individual needs of our clients and distribution partners. This support includes:

Client Onboarding. Our onboarding process is streamlined to deliver shortened activation timelines, ensuring our clients and those of our distribution partners can quickly begin transaction processing. Real-time account approval for low-risk customer profiles expedites onboarding and allows our underwriting team to focus on more complex client activations. Onboarding under our PayFac model is even more efficient because less information must be gathered from the merchant, reducing the time required to create a merchant account.

Client Support and Retention. Our client support team is structured to serve our business units through a central client support center and strategically located support centers. Each support team is trained to serve the specific needs of the clients it serves and is positioned to serve as redundancy to other business units as necessary. This provides us the flexibility to scale our operations as needs arise. Our client support team is also involved in retention efforts and has direct lines of communication to sales and management to resolve client matters in a timely manner.

Client Training and Activations. Our client activation teams handle the setup, testing, deployment, and configuration of client installations. These team members are distributed across our business units and trained to specialize in the client profile of that business unit. Product-specific training and certifications are often required for certain POS and processing systems. The training and activation team works directly with client sales and support to enhance the client experience.

Billing and Financial Review. Our billing and financial review function is responsible for the billing of fees related to merchant acquiring, products, and services. The team also monitors the accuracy of merchant billing, network processing costs and third-party partner costs.

Credit Underwriting and Risk Management. Our credit underwriting and risk management operations are designed to efficiently manage new account approvals and establish profiles to effectively manage the ongoing monitoring of client accounts. Once an account is actively processing, our risk systems are configured to monitor and flag activity requiring additional research, minimizing losses attributable to client fraud or default. Our processes are established to align with card brand and sponsor bank guidelines. Pending transactions are efficiently managed to minimize funding disruptions while limiting risk exposure.

Dispute and Chargeback Processing. Our dispute and chargeback team provides clients and partners an efficient support structure to manage the dispute resolution process. We work directly with the client, payment card networks and card issuing brands to collect and analyze the data provided to determine liability and resolve open dispute claims.

Distribution Partner Support. Our distribution partner support is designed to offer partners single access to the tools, products and services we offer to ensure they can effectively attract new clients and support existing client portfolios.

Customer Support. Our customer support team resides within our client support team and is often staffed by crossed-trained team members. The customer support team provides transaction processing support to customers attempting to make payments through our payment systems. This service is offered through a subset of our vertical product offerings such as education and public-sector payments, where live customer-level support is deemed necessary. Bi-lingual support, in Spanish and English, is also offered in certain business units.

14

Technology Operations

Our technical operations team oversees the execution of development, quality control, delivery and support for our payment processing applications and the hosted user applications. Applications are developed and tested according to the software development lifecycle, composed of iterative development and testing with a dedicated focus on planning and execution. Releases are modeled on continuous deployment and added to the live environment on a routine basis. Each application stack is built with redundancy to foster resiliency and built to be easily managed during a disaster recovery scenario. The entire solution is hosted within a managed, dedicated environment that is certified PCI-compliant to protect all personal and transactional data.

Network and Security. Our network and security team is responsible for ensuring that our processing technology is secure, stable and aligns to the current standards set forth by the payment card networks. This includes PCI Level 1 and PA-DSS security requirements.

Product Development, Testing and Deployment. We follow a very strict product development methodology from concept to release. This methodology includes testing as well as security review for each development sprint to ensure our products are stable and secure. This shared-services team works directly with our business units and distribution partners to gather business requirements, manage product release schedules, schedule product development and testing and coordinate the release schedules.

Developer Integration. Our developer integration team works directly with our business units and ISVs to accept new integration inquiries and support activities related to integrating business applications into our payment technology platform.

Technical Support. Our technical support team is responsible for technical inquiries related to our merchant acquiring and software products. The team is trained to resolve most technical inquiries and will engage third party partners where additional assistance is required.

Our Competition

We compete with a variety of merchant acquirers that have different business models, go-to-market strategies and technical capabilities. We believe the most significant competitive factors in our markets are:

1.trust, including a strong reputation for quality service and trusted distribution partners;

2.convenience, such as speed in approving applications, client onboarding and dispute resolution;

3.service, including product functionality, value-added solutions and strong customer support; and

4.economics, including fees charged to clients and residuals and incentives offered to distribution partners.

Our competitors range from large and well established companies to smaller, earlier-stage businesses. See “Risk Factors—Risks Related to Our Business and Industry—The payment processing industry is highly competitive. Such competition could adversely affect the fees we receive, and as a result, our margins, business, financial condition and results of operations” in Part I, Item 1A of this Annual Report on Form 10-K.

Government Regulation

We operate in an increasingly complex legal and regulatory environment. Our business and the products and services that we offer are subject to a variety of federal, state and local laws and regulations and the rules and standards of the payment networks that we utilize to provide our electronic payment services, as more fully described below.

15

Dodd-Frank Act

The 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") and the related rules and regulations have resulted in significant changes to the regulation of the financial services industry. Changes impacting the electronic payment industry include providing merchants with the ability to set minimum dollar amounts for the acceptance of credit cards and to offer discounts or incentives to entice consumers to pay with cash, checks, debit cards or credit cards, as the merchant prefers. New rules also contain certain prohibitions on payment network exclusivity and merchant routing restrictions of debit card transactions. Additionally, the Durbin Amendment to the Dodd-Frank Act provides that the interchange fees that certain issuers charge merchants for debit transactions will be regulated by the Federal Reserve and must be “reasonable and proportional” to the cost incurred by the issuer in authorizing, clearing and settling the transactions. Rules released by the Federal Reserve in July 2011 to implement the Durbin Amendment mandate a cap on debit transaction interchange fees for issuers with assets of $10 billion or greater.

The Dodd-Frank Act also created the Consumer Financial Protection Bureau (the “CFPB”), which has assumed responsibility for most federal consumer protection laws, and the Financial Stability Oversight Council, which has the authority to determine whether any non-bank financial company, such as us, should be supervised by the Board of Governors of the Federal Reserve System because it is systemically important to the U.S. financial system. Any new rules or regulations implemented by the CFPB or the Financial Stability Oversight Council or in connection with the Dodd-Frank Act that are applicable to us, or any changes that are adverse to us resulting from litigation brought by third parties challenging such rules and regulations, could increase our cost of doing business or limit permissible activities.

Privacy and Information Security Regulations

We provide services that may be subject to privacy laws and regulations of a variety of jurisdictions. Relevant federal privacy laws include the Gramm-Leach-Bliley Act of 1999, which applies directly to a broad range of financial institutions and indirectly, or in some instances directly, to companies that provide services to financial institutions. These laws and regulations restrict the collection, processing, storage, use and disclosure of personal information, require notice to individuals of privacy practices and provide individuals with certain rights to prevent the use and disclosure of certain nonpublic or otherwise legally protected information. These laws also impose requirements for safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. Our business may also be subject to the Fair Credit Reporting Act and the Fair and Accurate Credit Transactions Act of 2003, which regulate the use and reporting of consumer credit information and also impose disclosure requirements on entities who take adverse action based on information obtained from credit reporting agencies. In addition, there are state laws restricting the ability to collect and utilize certain types of personal information such as Social Security and driver’s license numbers and imposing secure disposal requirements for personal data. Certain state laws mandate businesses to implement reasonable data security measures. Massachusetts requires any business that processes the personal information of a Massachusetts resident to adopt and implement a written information security program. States are increasingly legislating data protection requirements for a broader list of personal data, such as biometric data, and are strengthening protections for students' personal information. All fifty states, Puerto Rico, and the U.S. Virgin Islands have now enacted data breach notification laws requiring businesses that experience a security breach of their computer databases that contain personal information to notify affected individuals, consumer reporting agencies and governmental agencies that possess data. In June 2018, the State of California enacted the California Consumer Privacy Act of 2018 (the “CCPA”), which will come into effect on January 1, 2020. The CCPA will require companies that process personal information of California residents to make new disclosures to consumers about their data collection, use and sharing practices, will grant consumers specific access rights to their data, will allow consumers to opt out of certain data sharing with or sales to third parties and will create a new cause of action for data breaches. The CCPA has broadly defined personal information to include any information that is linked or linkable to a consumer. Clarifying legislative amendments and regulations are expected. Each privacy law and regulation that applies to us could increase our cost of doing business or limit permissible activities.

16

Anti-Money Laundering and Counter-Terrorism Regulation

Our business is subject to U.S. federal anti-money laundering laws and regulations, including the Bank Secrecy Act of 1970, as amended by the USA PATRIOT Act of 2001, which we refer to collectively as the “BSA.” The BSA, among other things, requires money services businesses to develop and implement risk-based anti-money laundering programs, report large cash transactions and suspicious activity and maintain transaction records. We are also subject to certain economic and trade sanctions programs that are administered by the Office of Foreign Assets Control (“OFAC”) that prohibit or restrict transactions to or from (or transactions dealing with) specified countries, their governments and, in certain circumstances, their nationals, such as those who might be narcotics traffickers and terrorists or terrorist organizations. Similar anti-money laundering, counter terrorist financing and proceeds of crime laws apply to movements of currency and payments through electronic transactions and to dealings with persons specified on lists maintained by organizations similar to OFAC in several other countries and which may impose specific data retention obligations or prohibitions on intermediaries in the payment process. We have developed and continue to enhance compliance programs and policies to monitor and address related legal and regulatory requirements and developments.

Unfair or Deceptive Acts or Practices

We and many of our clients are subject to Section 5 of the Federal Trade Commission Act prohibiting unfair or deceptive acts or practices. In addition, laws prohibiting these activities and other laws, rules and or regulations, including the Telemarketing Sales Act, may directly impact the activities of certain of our clients, and in some cases may subject us, as the client’s payment processor or provider of certain services, to investigations, fees, fines and disgorgement of funds if we are deemed to have aided and abetted or otherwise provided the means and instrumentalities to facilitate the illegal or improper activities of the client through our services. Various federal and state regulatory enforcement agencies, including the Federal Trade Commission and the states attorneys general, have authority to take action against non-banks that engage in unfair or deceptive acts or practices or violate other laws, rules and regulations and to the extent we are processing payments or providing services for a client that may be in violation of laws, rules and regulations, we may be subject to enforcement actions and as a result may incur losses and liabilities that may impact our business.

In addition, the CFPB has recently attempted to extend certain provisions of the Dodd-Frank Act that prevent the employment of unfair, deceptive or abusive acts or practices (“UDAAP”) to payment processors. Though there is still litigation involving whether payment processing companies are subject to these requirements (and the extent of their application), these requirements may apply or be applicable in the future. UDAAPs could involve omissions or misrepresentations of important information to consumers or practices that take advantage of vulnerable consumers, such as elderly or low-income consumers.

Stored Value Services

Stored value cards, store gift cards and electronic gift certificates are subject to various federal and state laws and regulations, which may include laws and regulations related to consumer and data protection, licensing, consumer disclosures, escheat, anti-money laundering, banking, trade practices and competition and wage and employment. The clients who utilize the gift card processing products and services that we may sell may be subject to these laws and regulations. In the future, if we seek to expand these stored value card products and services, or as a result of regulatory changes, we may be subject to additional regulation and may be required to obtain additional licenses and registrations which we may not be able to obtain.

The Credit Card Accountability Responsibility and Disclosure Act of 2009 (the “Card Act”) created new requirements applicable to general-use prepaid gift cards, store gift cards and electronic gift certificates. The Card Act, along with the Federal Reserve’s amended Regulation E, created new requirements with respect to these cards and electronic certificates. These include certain prohibited features and revised disclosure obligations. Prepaid services may also be subject to the rules and regulations of Visa, Mastercard, Discover and American Express and other payment networks with which our clients and the card issuers do business. The clients who utilize the gift card processing products and services that we may sell are responsible for compliance with all applicable rules and requirements relating to their gift product program.

17

Additionally, the Financial Crimes Enforcement Network of the U.S. Department of the Treasury, or “FinCEN”, issued a final rule in July 2011 regarding the applicability of the BSA’s regulations to “prepaid access” products and services. This rulemaking clarifies the anti-money laundering obligations for entities engaged in the provision and sale of prepaid services, such as prepaid gift cards. We are not registered with FinCEN based on our determination that our current products and services do not constitute a “prepaid program” as defined in the BSA and we are not a “provider” of prepaid access. We may in the future need to register with FinCEN as a “money services business-provider of prepaid access” in accordance with the rule based on changes to our products or services.

Indirect Regulatory Requirements

Certain of our distribution partners are financial institutions that are directly subject to various regulations and compliance obligations issued by the CFPB, the Federal Reserve System, the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the National Credit Union Administration and other agencies responsible for regulating financial institutions, which includes state financial institution regulators. While these regulatory requirements and compliance obligations do not apply directly to us, many of these requirements materially affect the services we provide to our clients and us overall. The financial institution regulators have imposed requirements on regulated financial institutions to manage their third-party service providers. Among other things, these requirements include performing appropriate due diligence when selecting third-party service providers; evaluating the risk management, information security, and information management systems of third-party service providers; imposing contractual protections in agreements with third-party service providers (such as performance measures, audit and remediation rights, indemnification, compliance requirements, confidentiality and information security obligations, insurance requirements, and limits on liability); and conducting ongoing monitoring, diligence and audits of the performance of third-party service providers. Accommodating these requirements applicable to our clients imposes additional costs and risks in connection with our financial institution relationships. We expect to expend significant resources on an ongoing basis in an effort to assist our clients in meeting their legal requirements.

Payment Network Rules and Standards

Payment networks establish their own rules and standards that allocate liabilities and responsibilities among the payment networks and their participants. These rules and standards, including the PCI DSS, govern a variety of areas including how consumers and clients may use their cards, the security features of cards, security standards for processing, data security and allocation of liability for certain acts or omissions including liability in the event of a data breach. The payment networks may change these rules and standards from time to time as they may determine in their sole discretion and with or without advance notice to their participants. These changes may be made for any number of reasons, including as a result of changes in the regulatory environment, to maintain or attract new participants, or to serve the strategic initiatives of the networks and may impose additional costs and expenses on or be disadvantageous to certain participants. Participants are subject to audit by the payment networks to ensure compliance with applicable rules and standards. The networks may fine, penalize or suspend the registration of participants for certain acts or omissions or the failure of the participants to comply with applicable rules and standards.

An example of a recent standard is the “chip and pin” or “chip and signature” card requirement, known as EMV, which was mandated by Visa, Mastercard, American Express and Discover to be supported by payment processors by April 2013 and by merchants by October 2015. This mandate set new requirements and technical standards, including requiring integrated point of sale systems to be capable of accepting the more secure “chip” cards that utilize the EMV standard and setting new rules for data handling and security. Processors and clients that do not comply with the mandate or do not use systems that are EMV compliant risk fines and liability for fraud-related losses. We have invested significant resources to ensure our systems’ compliance with the mandate, and to assist our clients in becoming compliant.

18

To provide our electronic payment services, we must be registered either indirectly or directly as a service provider with each of the payment networks that we utilize. Because we are not a bank, we are not eligible for primary membership in certain payment networks, including Visa and Mastercard, and are therefore unable to directly access these networks. The operating regulations of certain payment networks, including Visa and Mastercard, require us to be sponsored by a member bank as a service provider. We are registered with certain payment networks, including Visa and Mastercard, through various sponsor banks. The agreements with our bank sponsors give them substantial discretion in approving certain aspects of our business practices including our solicitation, application and qualification procedures for clients and the terms of our agreements with clients. We are also subject to network operating rules and guidelines promulgated by the National Automated Clearing House Association (“NACHA”) relating to payment transactions we process using the ACH Network. Like the card networks, NACHA may update its operating rules and guidelines at any time and we will be subject to these changes. These operating rules and guidelines allocate responsibility and liabilities to the various participants in the payment network. Recently, NACHA has focused upon data security and privacy responsibilities. We are subject to audit by our partner financial institutions for compliance with the rules and guidelines. Our sponsor financial institutions have substantial discretion in approving certain aspects of our business practices, including the terms of our agreements with our ACH processing clients.

Money Transmitter Regulation

We are subject to various U.S. federal, state, and foreign laws and regulations governing money transmission and the issuance and sale of payment instruments, including some of the prepaid products we may sell.

In the United States, most states license money transmitters and issuers of payment instruments. These states not only regulate and control money transmitters, but they also license entities engaged in the transmission of funds. Many states exercise authority over the operations of our services related to money transmission and payment instruments and, as part of this authority, subject us to periodic examinations. Many states require, among other things, that proceeds from money transmission activity and payment instrument sales be invested in high-quality marketable securities before the settlement of the transactions or otherwise restrict the use and safekeeping of such funds. Such licensing laws also may cover matters such as regulatory approval of consumer forms, consumer disclosures and the filing of periodic reports by the licensee and require the licensee to demonstrate and maintain specified levels of net worth. Many states also require money transmitters, issuers of payment instruments, and their agents to comply with federal and/or state anti-money laundering laws and regulations.

Other Regulation

We are subject to U.S. federal and state unclaimed or abandoned property (escheat) laws which require us to turn over to certain government authorities the property of others we hold that has been unclaimed for a specified period of time such as account balances that are due to a distribution partner or client following discontinuation of its relationship with us. The Housing Assistance Tax Act of 2008 requires certain merchant acquiring entities and third-party settlement organizations to provide information returns for each calendar year with respect to payments made in settlement of electronic payment transactions and third-party payment network transactions occurring in that calendar year. Reportable transactions are also subject to backup withholding requirements.

The foregoing is not an exhaustive list of the laws and regulations to which we are subject and the regulatory framework governing our business is changing continuously. See “Risk Factors—Risks Related to Our Business and Industry” in Part I, Item 1A of this Annual Report on Form 10-K.

Our Intellectual Property

Certain of our products and services are based on proprietary software and related payment systems solutions. We rely on a combination of copyright, trademark, and trade secret laws, as well as employee and third-party non-disclosure, confidentiality, and contractual arrangements to establish, maintain, and enforce our intellectual property rights in our technology, including with respect to our proprietary rights related to our products and services. In addition, we license technology from third parties that is integrated into some of our solutions.

We own a number of registered federal service marks, including i3 Verticals®, PaySchools® and Axia®. We also own a number of domain names, including www.i3verticals.com.

19

Our Employees

As of September 30, 2018, we had 338 employees. None of our employees is represented by a labor union and we have experienced no work stoppages. We consider our employee relations to be in good standing.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are filed with the Securities and Exchange Commission (the “SEC”). We are subject to the informational requirements of the Exchange Act and file or furnish reports, proxy statements and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. We also maintain a website at www.i3verticals.com, through which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Information contained on our website is not a part of this Annual Report on Form 10-K and the inclusion of our website address in this report is an inactive textual reference only.

Item 1A. Risk Factors

Our business faces significant risks and uncertainties. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. The following risk factors, some of which contain statements that constitute forward-looking statements, should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes.

Risks Related to Our Business and Industry

We have a history of operating losses and will need to generate significant revenues to attain and maintain profitability and positive cash flow.