UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23323

Procure ETF Trust II.

(Exact name of registrant as specified in charter)

16 Firebush Road, Levittown, PA 19056

(Address of principal executive offices) (Zip code)

Robert Tull, 16 Firebush Road, Levittown, PA 19056

(Name and address of agent for service)

1-866-690-3837

Registrant's telephone number, including area code

Date of fiscal year end: October 31, 2021

Date of reporting period: October 31, 2021

Item 1. Reports to Stockholders.

(a) [Insert full text of semi-annual or annual report here]

Annual Report

October 31, 2021

Procure Space ETF Ticker:

UFO

Procure Space ETF

| October 31, 2021 |

|

|

| Page |

|

|

| 3 |

| |

|

|

|

|

|

|

| 5 |

| |

|

|

|

|

|

|

| 6 |

| |

|

|

|

|

|

|

| 7 |

| |

|

|

|

|

|

|

| 8 |

| |

|

|

|

|

|

|

| 9 |

| |

|

|

|

|

|

|

| 10 |

| |

|

|

|

|

|

|

| 13 |

| |

|

|

|

|

|

|

| 14 |

| |

|

|

|

|

|

|

| 15 |

| |

|

|

|

|

|

|

| 16 |

| |

|

|

|

|

|

|

| 17 |

| |

|

|

|

|

|

|

| 27 |

| |

|

|

|

|

|

|

| 28 |

| |

|

|

|

|

|

| Approval of Advisory/Sub-Advisory Agreements and Board Considerations |

| 29 |

|

|

|

|

|

|

|

| 34 |

| |

|

|

|

|

|

|

| 36 |

|

| 2 |

| Table of Contents |

Procure Space ETF

A LETTER FROM THE PRESIDENT AND CEO

Dear Shareholders,

As the Procure Space ETF (Ticker: UFO) closes out its fiscal year, we look back with extreme gratitude and look forward with great excitement. In another volatile year for the global economy, UFO has accomplished many significant milestones. Without the support of our numerous partners/service providers and YOU, our valued shareholders, none of this would have been possible.

Having launched the world’s first pure-play global space ETF, we are honored to provide the marketplace with a fund that represents an industry that is essential to our everyday lives. It has always been our belief that an index is the lifeblood of any passively managed thematic ETF. Understanding our responsibility and role in this industry, we find ourselves privileged to have licensed the S-Network Space Index; a collaboration between S-Network Global Indexes and Space Investing Services. Additionally, we are extremely proud that the index maintains the Space Foundation’s designation as its first ever “Certified Space Data Product”.

Fifty-two years ago, the world celebrated as the USA landed the first humans on the Moon. Fifty years later, ProcureAM celebrated the launch of the Procure Space ETF. Since its launch, we have witnessed incredible progress in the space industry. Numerous new companies have gone public via traditional IPOs and successful DeSPAC’s. A record number of operating satellites are now orbiting our planet. Several companies have started sending paid customers on space tourism adventures. Governments around the world have ramped up their space capabilities. Rocket launches have become an almost weekly occurrence.

We find it fitting that our first publicly traded product focuses on the space industry; an industry which celebrates and challenges our planet’s greatest minds to strive for unprecedented achievements. With wide ranges of forecasted growth, the space industry represents uncharted innovation development and investment possibilities in travel, technology, communications, defense, mining, manufacturing and beyond. Similarly, we hope to create new and innovative opportunities for investors in the future.

To our shareholders and the advisor community, we would like to thank you for being first-movers and for your belief in our company and ETFs. In this age of behemoth issuers and uneven playing fields, your support is essential to our success. We hope to make you proud as we grow and strive to provide you with more groundbreaking products for years to come. To the investors that have not yet invested, we hope you give UFO significant consideration, and we would be happy to answer any questions you may have. For more information, please contact us using the information listed below or visit www.ProcureETFs.com.

Sincerely,

Robert Tull

President & Chief Operating Officer

and

Andrew Chanin

Chief Executive Officer

ProcureAM, LLC

P: 866.690.ETFS

E: info@ProcureETFs.com

| 3 |

| Table of Contents |

Procure Space ETF

Investing involves risk. Principal loss is possible. The Fund is also subject to the following risks: Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Aerospace and defense companies can be significantly affected by government aerospace and defense regulation and spending policies. The exploration of space by private industry and the harvesting of space assets is a business based in future and is witnessing new entrants into the market. Investments in the Fund will be riskier than traditional investments in established industry sectors. The Fund is considered to be concentrated in securities of companies that operate or utilize satellites which are subject to manufacturing delays, launch delays or failures, and operational and environmental risks that could limit their ability to utilize the satellites needed to deliver services to customers. Investing in foreign securities are volatile, harder to price, and less liquid than U.S. securities. Securities of small- and mid-capitalization companies may experience much more price volatility, greater spreads between their bid and ask prices and significantly lower trading volumes than securities issued by large, more established companies. The Fund is not actively managed so it would not take defensive positions in declining markets unless such positions are reflected in the underlying index. Please refer to the summary prospectus for a more detailed explanation of the Funds’ principal risks. It is not possible to invest in an index.

UFO is distributed by Quasar Distributors LLC.

| 4 |

| Table of Contents |

Procure Space ETF

Important Disclosures and Key Risks Factors

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of the Fund’s investments, impair the Fund’s ability to satisfy redemption requests, and negatively impact the Fund’s performance.

The Fund is distributed by Quasar Distributors, LLC.

Must be preceded or accompanied by a prospectus.

| 5 |

| Table of Contents |

Procure Space ETF

(Unaudited)

|

|

|

| Since |

|

| Value of |

| |||||

| Average Annualized Returns |

| 1 Year |

|

| Inception |

|

| $10,000 |

| |||

| Year Ended October 31, 2021 |

| Return |

|

| (4/10/19) |

|

| (10/31/2021) |

| |||

| Procure Space ETF (NAV) |

|

| 45.69 | % |

|

| 8.34 | % |

| $ | 12,274 |

|

| Procure Space ETF (Market) |

|

| 46.18 | % |

|

| 8.44 | % |

| $ | 12,305 |

|

| S-Network Space Index |

|

| 47.21 | % |

|

| 9.29 | % |

| $ | 12,553 |

|

| S&P 500 Index |

|

| 42.91 | % |

|

| 22.09 | % |

| $ | 16,664 |

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-866-690-3837.

The chart illustrates the performance of a hypothetical $10,000 investment made on April 10, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The index returns do not reflect fees or expenses and are not available for direct investment. Due to market conditions, the fund experienced relatively high performance which may not be repeated or sustainable over the long term.

| 6 |

| Table of Contents |

Procure Space ETF

Top Ten Holdings as of October 31, 2021* (Unaudited)

|

| Security |

| % of Total Investments |

| |

| 1 | Eutelsat Communications SA |

|

| 4.94 | % |

| 2 | ViaSat, Inc. |

|

| 4.93 | % |

| 3 | Loral Space & Communications, Inc. |

|

| 4.56 | % |

| 4 | SES SA |

|

| 4.24 | % |

| 5 | Sirius XM Holdings, Inc. |

|

| 4.08 | % |

| 6 | MDA, Ltd. |

|

| 3.94 | % |

| 7 | Dish Network Corp. - Class A |

|

| 3.80 | % |

| 8 | Trimble, Inc. |

|

| 3.79 | % |

| 9 | EchoStar Corp. |

|

| 3.66 | % |

| 10 | Iridium Communications, Inc. |

|

| 3.51 | % |

|

| Top Ten Holdings = 41.45% of Total Investments |

|

|

|

|

___________

* Current Fund holdings may not be indicative of future Fund holdings.

| 7 |

| Table of Contents |

Procure Space ETF

| Expense Example |

As a shareholder of Procure Space ETF (the “Fund”) you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2021 to October 31, 2021).

Actual Expenses

The first line of the table provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then, multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period'' to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values based on a hypothetical return and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

Procure Space ETF

|

|

| Beginning Account Value May 1, 2021 |

|

| Ending Account Value October 31, 2021 |

|

| Expenses Paid During the Period^ |

|

| Annualized Expense Ratio During the Period May 1, 2021 to October 31, 2021 |

| ||||

| Actual |

| $ | 1,000.00 |

|

| $ | 1,012.20 |

|

| $ | 3.80 |

|

|

| 0.75 | % |

| Hypothetical (5% annual) |

| $ | 1,000.00 |

|

| $ | 1,021.42 |

|

| $ | 3.82 |

|

|

| 0.75 | % |

____________

^ The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by 184/365 (to reflect the period from May 1, 2021 to October 31, 2021).

| 8 |

| Table of Contents |

Procure Space ETF

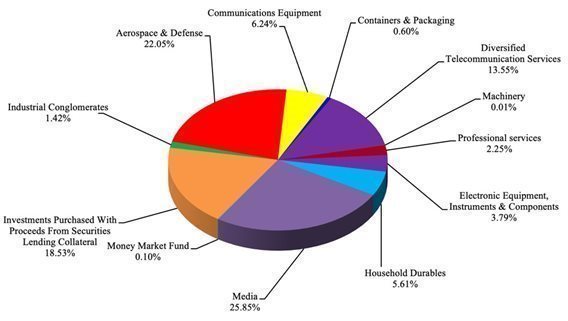

Portfolio Composition as of October 31, 2021 (Unaudited)

As a Percentage of Total Investments

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC ("S&P").

| 9 |

| Table of Contents |

Procure Space ETF

| October 31, 2021 |

|

|

| Shares |

|

| Value |

| ||

| COMMON STOCKS - 99.9% |

|

|

|

|

|

| ||

| Australia - 0.0% |

|

|

|

|

|

| ||

| Diversified Telecommunication Services - 0.0% |

|

|

|

|

|

| ||

| SpeedCast International, Ltd. (a)(e)(f) |

|

| 1,039,473 |

|

| $ | 78 |

|

|

|

|

|

|

|

|

|

|

|

| Canada - 4.9% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 4.9% (d) |

|

|

|

|

|

|

|

|

| MDA, Ltd. (a) |

|

| 457,815 |

|

|

| 5,599,190 |

|

|

|

|

|

|

|

|

|

|

|

| France - 6.2% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 0.1% (d) |

|

|

|

|

|

|

|

|

| Thales SA |

|

| 1,816 |

|

|

| 167,410 |

|

| Media - 6.1% (d) |

|

|

|

|

|

|

|

|

| Eutelsat Communications SA |

|

| 493,565 |

|

|

| 7,014,047 |

|

| Total France |

|

|

|

|

|

| 7,181,457 |

|

|

|

|

|

|

|

|

|

|

|

| Israel - 1.6% |

|

|

|

|

|

|

|

|

| Communications Equipment - 1.6% |

|

|

|

|

|

|

|

|

| Gilat Satellite Networks, Ltd. - ADR |

|

| 226,424 |

|

|

| 1,854,413 |

|

|

|

|

|

|

|

|

|

|

|

| Italy - 1.3% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 1.3% (d) |

|

|

|

|

|

|

|

|

| Avio SpA |

|

| 105,668 |

|

|

| 1,406,266 |

|

| Leonardo SpA (a) |

|

| 6,124 |

|

|

| 44,917 |

|

| Total Aerospace & Defense |

|

|

|

|

|

| 1,451,183 |

|

|

|

|

|

|

|

|

|

|

|

| Japan - 5.8% |

|

|

|

|

|

|

|

|

| Machinery - 0.0% |

|

|

|

|

|

|

|

|

| IHI Corp. |

|

| 800 |

|

|

| 18,621 |

|

| Media - 3.0% (d) |

|

|

|

|

|

|

|

|

| Sky Perfect JSAT Holdings, Inc. |

|

| 938,900 |

|

|

| 3,515,986 |

|

| Professional Services - 2.8% |

|

|

|

|

|

|

|

|

| Weathernews, Inc. |

|

| 43,900 |

|

|

| 3,199,377 |

|

| Total Japan |

|

|

|

|

|

| 6,733,984 |

|

|

|

|

|

|

|

|

|

|

|

| Luxembourg - 5.2% |

|

|

|

|

|

|

|

|

| Media - 5.2% (d) |

|

|

|

|

|

|

|

|

| SES SA |

|

| 669,365 |

|

|

| 6,017,251 |

|

|

|

|

|

|

|

|

|

|

|

| Netherlands - 3.9% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 1.2% (d) |

|

|

|

|

|

|

|

|

| Airbus SE (a) |

|

| 10,438 |

|

|

| 1,335,975 |

|

| Household Durables - 2.8% |

|

|

|

|

|

|

|

|

| TomTom NV (a) |

|

| 369,670 |

|

|

| 3,184,966 |

|

| Total Netherlands |

|

|

|

|

|

| 4,520,941 |

|

The accompanying notes are an integral part of these financial statements.

| 10 |

| Table of Contents |

Procure Space ETF

| Schedule of Investments October 31, 2021 (Continued) |

|

|

| Shares |

|

| Value |

| ||

| Switzerland - 4.1% |

|

|

|

|

|

| ||

| Household Durables - 4.1% |

|

|

|

|

|

| ||

| Garmin, Ltd. - ADR |

|

| 33,319 |

|

| $ | 4,784,608 |

|

|

|

|

|

|

|

|

|

|

|

| United States - 66.9% |

|

|

|

|

|

|

|

|

| Aerospace & Defense - 19.7% (d) |

|

|

|

|

|

|

|

|

| Aerojet Rocketdyne Holdings, Inc. |

|

| 4,649 |

|

|

| 204,602 |

|

| Boeing Co. (a) |

|

| 13,480 |

|

|

| 2,790,764 |

|

| L3Harris Technologies, Inc. |

|

| 10,263 |

|

|

| 2,366,032 |

|

| Lockheed Martin Corp. |

|

| 8,265 |

|

|

| 2,746,625 |

|

| Maxar Technologies, Inc. (b) |

|

| 185,645 |

|

|

| 4,928,875 |

|

| Northrop Grumman Corp. |

|

| 6,833 |

|

|

| 2,440,884 |

|

| Raytheon Technologies Corp. |

|

| 34,472 |

|

|

| 3,063,182 |

|

| Virgin Galactic Holdings, Inc. (a)(b) |

|

| 224,610 |

|

|

| 4,211,438 |

|

| Total Aerospace & Defense |

|

|

|

|

|

| 22,752,402 |

|

| Communications Equipment - 6.1% |

|

|

|

|

|

|

|

|

| ViaSat, Inc. (a)(b) |

|

| 117,283 |

|

|

| 7,000,622 |

|

| Containers & Packaging - 0.7% |

|

|

|

|

|

|

|

|

| Ball Corp. |

|

| 9,268 |

|

|

| 847,837 |

|

| Diversified Telecommunication Services - 16.6% |

|

|

|

|

|

|

|

|

| AST SPACEMOBILE, Inc. (a)(b) |

|

| 241,829 |

|

|

| 2,706,067 |

|

| AT&T, Inc. |

|

| 105,178 |

|

|

| 2,656,796 |

|

| EchoStar Corp. - Class A (a)(b) |

|

| 221,676 |

|

|

| 5,200,519 |

|

| Globalstar, Inc. (a)(b) |

|

| 2,235,662 |

|

|

| 3,688,842 |

|

| Iridium Communications, Inc. (a)(b) |

|

| 122,959 |

|

|

| 4,985,987 |

|

| Total Diversified Telecommunication Services |

|

|

|

|

|

| 19,238,211 |

|

| Electronic Equipment, Instruments & Components - 4.7% |

|

|

|

|

|

|

|

|

| Trimble, Inc. (a) |

|

| 61,591 |

|

|

| 5,381,206 |

|

| Industrial Conglomerates - 1.7% |

|

|

|

|

|

|

|

|

| Honeywell International, Inc. |

|

| 9,142 |

|

|

| 1,998,624 |

|

| Media - 17.4% (d) |

|

|

|

|

|

|

|

|

| Comcast Corp. - Class A |

|

| 48,421 |

|

|

| 2,490,292 |

|

| DISH Network Corp. - Class A (a) |

|

| 131,419 |

|

|

| 5,397,379 |

|

| Loral Space & Communications, Inc. |

|

| 130,088 |

|

|

| 6,480,984 |

|

| Sirius XM Holdings, Inc. (b) |

|

| 950,248 |

|

|

| 5,787,010 |

|

| Total Media |

|

|

|

|

|

| 20,155,665 |

|

| Total United States |

|

|

|

|

|

| 77,374,567 |

|

| TOTAL COMMON STOCKS (Cost $112,093,984) |

|

|

|

|

|

| 115,517,672 |

|

The accompanying notes are an integral part of these financial statements.

| 11 |

| Table of Contents |

Procure Space ETF

| Schedule of Investments October 31, 2021 (Continued) |

| INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL - 22.7% |

| Shares |

|

| Value |

| ||

| Mount Vernon Liquid Assets Portfolio, LLC, 0.10% (c) |

|

| 26,312,640 |

|

| $ | 26,312,640 |

|

| TOTAL INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING COLLATERAL (Cost 26,312,640) |

|

|

|

|

|

| 26,312,640 |

|

| SHORT-TERM INVESTMENTS - 0.1% Money Market Funds - 0.1% First American Government Obligations Fund - Class X, 0.03% (c) |

|

| 148,168 |

|

|

| 148,168 |

|

| TOTAL SHORT-TERM INVESTMENTS (Cost $148,168) |

|

|

|

|

|

| 148,168 |

|

| Total Investments (Cost $138,554,792) - 122.7% |

|

|

|

|

|

| 141,978,480 |

|

| Liabilities in Excess of Other Assets - (22.7)% |

|

|

|

|

|

| (26,268,626 | ) |

| TOTAL NET ASSETS - 100.0% |

|

|

|

|

| $ | 115,709,854 |

|

Percentages are stated as a percent of net assets.

| ADR | American Depository Receipt |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security is out on loan as of October 31, 2021. |

| (c) | Rate reflects annualized seven-day yield on October 30, 2021. |

| (d) | As of October 31, 2021, the Fund had a significant portion of its assets invested in the Media and Aerospace & Defense industry. |

| (e) | This security has been deemed illiquid according to the Fund's liquidity guidelines. The value of this security totals $78, which represents 0.0% of total net assets. |

| (f) | Value determined using significant unobservable inputs. Classified as Level 3 in the fair value hierarchy. |

The industry classifications listed above are in accordance with Global Industry Classification Standard (GICS®), which was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC ("S&P").

The accompanying notes are an integral part of these financial statements.

| 12 |

| Table of Contents |

Procure Space ETF

| STATEMENT OF ASSETS AND LIABILITIES As of October 31, 2021 |

|

|

| Procure Space ETF |

| |

| ASSETS |

|

|

| |

| Investments in securities, at value*(1) |

| $ | 141,978,480 |

|

| Receivables: |

|

|

|

|

| Dividends, reclaims and interest receivable |

|

| 114,895 |

|

| Expense reimbursement by the Adviser |

|

| 2,250 |

|

| Securities Lending Receivable |

|

| 5,367 |

|

| Total Assets |

|

| 142,100,992 |

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

| Collateral received for securities loaned (Note 7) |

|

| 26,312,640 |

|

| Payables: |

|

|

|

|

| Payable for Chief Compliance Officer fees |

|

| 2,250 |

|

| Management fees payable |

|

| 76,248 |

|

| Total Liabilities |

|

| 26,391,138 |

|

| Net Assets |

| $ | 115,709,854 |

|

|

|

|

|

|

|

| NET ASSETS CONSIST OF: |

|

|

|

|

| Paid-in Capital |

| $ | 120,167,068 |

|

| Total Distributable Earnings/(Accumulated Deficit) |

|

| (4,457,214 | ) |

| Net Assets |

| $ | 115,709,854 |

|

|

|

|

|

|

|

| *Identified Cost: |

|

|

|

|

| Investments in securities |

| $ | 138,554,792 |

|

|

|

|

|

|

|

| Shares Outstanding^ |

|

| 3,850,000 |

|

| Net Asset Value, Offering and Redemption Price per Share |

| $ | 30.05 |

|

^ No par value, unlimited number of shares authorized

(1) Including securities on loan at a value of $25,738,834.

The accompanying notes are an integral part of these financial statements.

| 13 |

| Table of Contents |

Procure Space ETF

| For the Year ended October 31, 2021 |

|

|

| Procure |

| |

|

|

| Space ETF |

| |

| INVESTMENT INCOME |

|

|

| |

| Income: |

|

|

| |

| Dividends from securities (net of foreign withholdings tax of $180,858) |

| $ | 1,627,194 |

|

| Interest |

|

| 161 |

|

| Securities Lending Income |

|

| 69,435 |

|

| Total Investment Income |

|

| 1,696,790 |

|

| Expenses: |

|

|

|

|

| Management fees |

|

| 795,829 |

|

| Trustee Fees |

|

| 39,000 |

|

| Chief Compliance Officer fees |

|

| 27,000 |

|

| Total expenses before reimbursement |

|

| 861,829 |

|

| Expense reimbursement by Adviser |

|

| (66,000 | ) |

| Net Expenses |

|

| 795,829 |

|

| Net Investment Income |

|

| 900,961 |

|

|

|

|

|

|

|

| REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS |

|

|

|

|

| Net Realized Gain (Loss) on: |

|

|

|

|

| Investments |

|

| (3,981,144 | ) |

| In-Kind redemptions |

|

| 14,006,536 |

|

| Foreign currency translation |

|

| (79,342 | ) |

| Net Realized Gain (Loss) on Investments and Foreign Currency |

|

| 9,946,050 |

|

| Net Change in Unrealized Appreciation (Depreciation) of: |

|

|

| |

| Investments |

|

| 6,198,540 |

|

| Foreign currency translation |

|

| (1,472 | ) |

| Net Change in Unrealized Appreciation (Depreciation) of Investments and |

|

|

|

|

| Foreign Currency |

|

| 6,197,068 |

|

| Net Realized and Unrealized Gain (Loss) on Investments |

|

| 16,143,118 |

|

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS |

| $ | 17,044,079 |

|

The accompanying notes are an integral part of these financial statements.

| 14 |

| Table of Contents |

Procure Space ETF

STATEMENTS OF CHANGES IN NET ASSETS

|

|

| Year Ended October 31, 2021 |

|

| Year Ended October 31, 2020 |

| ||

|

|

|

|

|

|

|

| ||

| OPERATIONS |

|

|

|

|

|

| ||

| Net investment income |

| $ | 900,961 |

|

| $ | 142,263 |

|

| Net realized gain (loss) on investments and foreign currency |

|

| 9,946,050 |

|

|

| (2,121,435 | ) |

| Net change in unrealized appreciation (depreciation) of investments and foreign currency |

|

| 6,197,068 |

|

|

| (3,186,761 | ) |

| Net increase (decrease) in net assets resulting from operations |

|

| 17,044,079 |

|

|

| (5,165,933 | ) |

|

|

|

|

|

|

|

|

|

|

| DISTRIBUTIONS TO SHAREHOLDERS |

|

|

|

|

|

|

|

|

| Net Distributions to shareholders |

|

| (816,387 | ) |

|

| (141,601 | ) |

| Return of capital |

|

| (70,365 | ) |

|

| (30,923 | ) |

| Total distributions from distributable earnings |

|

| (886,752 | ) |

|

| (172,524 | ) |

|

|

|

|

|

|

|

|

|

|

| CAPITAL SHARE TRANSACTIONS |

|

|

|

|

|

|

|

|

| Shares Sold |

|

| 117,377,460 |

|

|

| 33,095,195 |

|

| Shares Redeemed |

|

| (46,499,595 | ) |

|

| (11,397,543 | ) |

| Total capital share transactions |

|

| 70,877,865 |

|

|

| 21,697,652 |

|

| Net increase (decrease) in net assets |

|

| 87,035,192 |

|

|

| 16,359,195 |

|

| NET ASSETS |

|

|

|

|

|

|

|

|

| Beginning of Year |

|

| 28,674,662 |

|

|

| 12,315,467 |

|

| End of Year |

| $ | 115,709,854 |

|

| $ | 28,674,662 |

|

Summary of share transactions is as follows:

|

|

| Year Ended |

|

| Year Ended |

| ||

|

|

| October 31, 2021 |

|

| October 31, 2020 |

| ||

| Shares Sold |

|

| 4,025,000 |

|

|

| 1,375,000 |

|

| Shares Redeemed |

|

| (1,550,000 | ) |

|

| (475,000 | ) |

|

|

|

| 2,475,000 |

|

|

| 900,000 |

|

| Beginning Shares |

|

| 1,375,000 |

|

|

| 475,000 |

|

| Ending Shares |

|

| 3,850,000 |

|

|

| 1,375,000 |

|

The accompanying notes are an integral part of these financial statements.

| 15 |

| Table of Contents |

Procure Space ETF

| For a capital share outstanding throughout the year/period |

|

|

| Year Ended October 31, 2021 |

|

| Year Ended October 31, 2020 |

|

| Period Ended October 31, 20191 |

| |||

| Net Asset Value, Beginning of Year/Period |

| $ | 20.85 |

|

| $ | 25.93 |

|

| $ | 25.00 |

|

| Income from Investment Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net investment income 2 |

|

| 0.25 |

|

|

| 0.16 |

|

|

| 0.04 |

|

| Net realized and unrealized gain (loss) on investments |

|

| 9.25 |

|

|

| (5.06 | ) |

|

| 0.946 |

|

| Total from investment operations |

|

| 9.50 |

|

|

| (4.90 | ) |

|

| 0.98 |

|

| Less Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions from net investment income |

|

| (0.28 | ) |

|

| (0.15 | ) |

|

| (0.03 | ) |

| Distributions from return of capital |

|

| (0.02 | ) |

|

| (0.03 | ) |

|

| (0.02 | ) |

| Total distributions |

|

| (0.30 | ) |

|

| (0.18 | ) |

|

| (0.05 | ) |

| Capital Share Transactions: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net asset value, end of year/period |

|

| 30.05 |

|

|

| 20.85 |

|

|

| 25.93 |

|

| Total Return |

|

| 45.69 | % |

|

| -18.93 | % |

| 3.91 | %3 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratios/Supplemental Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net assets at end of year/period (000's) |

| $ | 115,710 |

|

| $ | 28,675 |

|

| $ | 12,315 |

|

| Ratio of expenses to Average Net Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Before waivers and reimbursements of expenses |

|

| 0.81 | % |

|

| 1.12 | % |

| 1.71 | %4 | |

| After waivers and reimbursements of expenses |

|

| 0.75 | % |

|

| 0.75 | % |

| 0.75 | %4 | |

| Net Investment Income to Average Net Assets |

|

| 0.85 | % |

|

| 0.72 | % |

| 0.28 | %4 | |

| Portfolio Turnover Rate5 |

|

| 52 | % |

|

| 44 | % |

| 17 | %3 | |

_______________

| 1 | Commencement of operations on April 10, 2019. |

| 2 | Calculated based on average shares outstanding during the year/period. |

| 3 | Not annualized. |

| 4 | Annualized. |

| 5 | Excludes the impact of in-kind transactions. |

| 6 | Net realized and unrealized gains (loss) per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions the period. |

The accompanying notes are an integral part of these financial statements.

| 16 |

| Table of Contents |

Procure Space ETF

| October 31, 2021 |

NOTE 1 – ORGANIZATION

Procure Space ETF (the “Fund”) is a non-diversified series of Procure ETF Trust II (the “Trust”), an open-end management investment company consisting of one investment series, organized as a Delaware statutory trust on December 19, 2017. The Trust is registered with the SEC under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Fund’s shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The Fund seeks investment results that correspond generally to the performance, before the Fund’s fees and expenses, of an equity index called the “S- Network Space Index” (the “Underlying Index”) developed by S-Network Global Indexes (the “Index Provider”). The Fund commenced operations on April 10, 2019.

The Fund currently offers one class of Shares, which has no front-end sales load, no deferred sales charges, and no redemption fees. The Fund may issue an unlimited number of Shares of beneficial interest, with no par value. All Shares of the Fund have equal rights and privileges.

Shares of the Fund are listed and traded on Nasdaq, Inc. Market prices for the Shares may be different from their net asset value (“NAV”). The Fund issues and redeems Shares on a continuous basis at NAV only in blocks of 25,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified Index. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in quantities less than a Creation Unit. Except when aggregated in Creation Units, Shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the Shares directly from a Fund. Rather, most retail investors may purchase Shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

Authorized Participants pay fixed transaction fees to offset the transfer and other transaction costs associated with the issuance and redemption of Creation Units. The fixed transaction fee will be the same regardless of the number of Creation Units issued or redeemed by an investor. The fixed transaction fee charged by the Fund for each creation and redemption order is $500. Fixed transaction fees may be waived when the Advisor or Sub-Advisor believes that waiver of the fee is in the best interest of the Fund. An additional variable fee of up to four (4) times the fixed transaction fee (expressed as a percentage of the value of the Deposit Securities) for creations or (expressed as a percentage value of the Fund Securities) for redemptions may be imposed for (1) creations/redemption effected outside the Clearing Process and (2) cash creations/redemptions (to offset the Fund's brokerage and other transaction costs associated with using cash to purchase the requisite Deposit/Fund Securities). Investors are responsible for the costs of transferring the securities constituting the Deposit/Fund Securities to the account of the Fund or on their order. Such variable charges, if any, are included in “Transaction Fees” in the Statements of Changes in Net Assets.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

| 17 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

The Fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

| A. | Security Valuation. Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available (except for securities traded on NASDAQ), including securities traded over the counter, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded on the valuation date (or at approximately 4:00 PM Eastern Time if a security’s primary exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. For securities traded on NASDAQ, the NASDAQ Official Closing Price will be used. |

|

|

|

|

| Money market funds are valued at NAV. |

|

|

|

|

| Securities for which quotations are not readily available are valued at their respective fair values as determined in good faith by the Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Fund’s Board. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. As of October 31, 2021, the Fund held one Level 3 security. |

|

|

|

|

| As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are: |

|

| Level 1 | Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

|

|

|

|

|

| Level 2 | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

|

|

|

|

|

| Level 3 | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

|

|

|

|

|

| The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. | |

|

|

| |

|

| The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. | |

| 18 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

The following table presents a summary of the Fund’s investments in securities, at fair value, as of October 31, 2021:

Procure Space ETF

| Assets^ |

| Level 1 |

|

| Level 2 |

|

| Level 3 |

|

| Total |

| ||||

| Common Stocks |

| $ | 115,517,594 |

|

| $ | — |

|

| $ | 78 |

|

| $ | 115,517,672 |

|

| Short Term Investments |

|

| 148,168 |

|

|

| — |

|

|

| — |

|

|

| 148,168 |

|

| Investments Purchased with Proceeds From Securities Lending Collateral* |

|

| — |

|

|

| — |

|

|

| — |

|

|

| 26,312,640 |

|

| Total Investments in Securities |

| $ | 115,665,762 |

|

| $ | — |

|

| $ | 78 |

|

| $ | 141,978,480 |

|

^ See Schedule of Investments for classifications by country and industry.

* Certain investments that are measured at fair value using the net asset value per share (or its equivalent) have not been categorized in the fair value hierarchy in accordance with ASC 820. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities.

Below is a reconciliation of Level 3 assets for which significant unobservable inputs were used to determine fair value.

| Description |

| Common Stocks |

| |

| Balance as of November 1, 2020 |

| $ | —* |

|

| Purchases |

|

| — |

|

| Sales proceeds and paydowns |

|

| — |

|

| Accreted discounts, net |

|

| — |

|

| Corporate Actions |

|

| — |

|

| Realized gain (loss) |

|

| — |

|

| Change in unrealized appreciation (depreciation) |

|

| 78 |

|

| Transfers into/(out of) Level 3 |

|

| — |

|

| Balance as of October 31, 2021 |

| $ | 78 |

|

______

*Amount is less than $0.05

| B. | Federal Income Taxes. The Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all taxable income to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have been made. |

|

|

|

|

| To avoid imposition of the excise tax applicable to regulated investment companies, the Fund intends to declare each year as dividends, in each calendar year, at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

Net capital losses incurred after October 31, within the taxable year are deemed to arise on the first business day of the Fund’s next taxable year.

The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Fund has analyzed its tax position and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s 2021 tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal, the State of Pennsylvania, and the State of Delaware; however the Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months. |

| 19 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

|

| As of October 31, 2021, management has reviewed the tax positions for open years (for Federal purposes, three years from the date of filing and for state purposes, four years from the date of filing), as applicable to the Fund, and has determined that no provision for income tax is required in the Fund’s financial statements. |

|

|

|

| C. | Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date or, in the case of foreign securities, as soon as the Fund is informed of the ex-dividend date. Interest income is recorded on an accrual basis. Income, including gains, from investments in foreign securities received by the Fund may be subject to withholding or other taxes imposed by foreign countries. |

|

|

|

| D. | Foreign Currency Translations and Transactions. The Fund may engage in foreign currency transactions. Foreign currency transactions are translated into U.S. dollars on the following basis: |

|

| (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and |

|

| (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Fund does not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities for unrealized gains and losses. However, for federal income tax purposes, the Fund does isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gains or losses from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences. |

|

|

|

| E. | Distributions to Shareholders. Distributions to shareholders from net investment income are typically declared and paid for the Fund on a quarterly basis. Net realized gains on securities for the Fund normally are declared and paid on an annual basis. Distributions are recorded on the ex- dividend date. |

|

|

|

| F. | Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the year. Actual results could differ from those estimates. |

|

|

|

| G. | Share Valuation. NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of Shares outstanding for the Fund, rounded to the nearest cent. The Fund’s Shares will not be priced on the days on which the NYSE is closed for trading. |

|

|

|

| H. | Guarantees and Indemnifications. In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote. |

| 20 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

NOTE 3 – PRINCIPAL RISKS

Investors should consider the principal risks associated with investing in the Fund, which are summarized below. The value of an investment in the Fund will fluctuate and you could lose money by investing in the Fund. The Fund may not achieve its investment objective.

Aerospace and Defense Companies Risk - Aerospace and defense companies can be significantly affected by government aerospace and defense regulation and spending policies because companies involved in this industry rely to a significant extent on U.S. (and other) government demand for their products and services. Thus, the financial condition of, and investor interest in, aerospace and defense companies are heavily influenced by governmental defense spending policies which are typically under pressure from efforts to control the U.S. (and other) government budgets.

Equity Securities Risk - The prices of equity securities generally fluctuate in value more than fixed- income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund. Common stocks generally represent the riskiest investment in a company and dividend payments (if declared) to preferred stockholders generally rank junior to payments due to a company’s debtholders. The Fund may lose a substantial part, or even all, of its investment in a company’s stock.

Foreign Securities Risk - The Underlying Index contains equities listed in foreign markets. These securities markets are subject to various regulations, market trading times and contractual settlement dates. Market liquidity may also differ from the U.S. equity markets as many foreign market shares trade OTC and prices are not published to the official exchanges until after the trades are completed. In addition, where all or a portion of the Fund’s underlying securities trade in a market that is closed when the market in which the Fund’s shares are listed and trading in that market is open, there may be changes between the last quote from its closed foreign market and the value of such security during the Fund’s domestic trading day. Consequently, this could lead to differences between the market price of the Fund’s shares and the value of the shares of its underlying portfolio holdings.

Index Construction Risk - A stock included in the Underlying Index may not exhibit the factor trait or provide specific factor exposure for which it was selected and consequently the Fund’s holdings may not exhibit returns consistent with that factor trait.

Issuer-Specific Changes Risk - The value of an individual security or type of security can be more volatile than the total market and can perform differently from the value of the total market. The value of securities of smaller issuers can be more volatile than that of larger issuers.

Large-Capitalization Securities Risk - The Fund is subject to the risk that large-capitalization securities may underperform other segments of the equity market or the total equity market. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in technology and may not be able to attain the high growth rate of smaller companies, especially during extended years of economic expansion.

Liquidity Risk - The Fund’s shares are subject to liquidity risk, which means that, in stressed market conditions, the market for the Fund’s shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s underlying portfolio holdings. Please also note that this adverse effect on liquidity for the Fund’s shares in turn could lead to differences between the market price of the Fund’s shares and the underlying value of those shares. Further, the Underlying Index’s screening process requires that each component security have a three month average trading volume minimum of $1,000,000 on the date of the Underlying Index’s semi-annual reconstitution date, therefore the number of stocks available to the Underlying Index may be negatively affected during stressed market conditions.

| 21 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

Market Price Risk - Shares are listed for trading on Nasdaq, Inc. and are bought and sold in the secondary market at market prices. The market prices of Shares may fluctuate continuously during trading hours, in some cases materially, in response to changes in the net asset value (“NAV”) and supply and demand for Shares, among other factors. Although it is expected that the market price of Shares typically will remain closely correlated to the NAV, the market price will generally differ from the NAV because of timing reasons, supply and demand imbalances and other factors. As a result, the trading prices of Shares may deviate significantly from NAV during certain years, especially those of market volatility. The Investment Advisor cannot predict whether Shares will trade above (premium), below (discount) or at their NAV prices. Thus, an investor may pay more than NAV when buying Shares in the secondary market and receive less than NAV when selling Shares in the secondary market.

Non-Correlation Risk - The Fund’s return may not match the return of the Underlying Index. For example, the Fund incurs operating expenses not applicable to the Underlying Index, and incurs costs in buying and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Underlying Index. In addition, the performance of the Fund and the Underlying Index may vary due to asset valuation differences and differences between the Fund’s portfolio and the Underlying Index resulting from legal restrictions, cash flows or operational inefficiencies.

Passive Management Risk - Unlike many investment companies, the Fund is not “actively” managed. Therefore, it would not necessarily sell a security because the security’s issuer was in financial trouble or defaulted on its obligations under the security, or whose credit rating was downgraded, unless that security is removed from the Underlying Index. In addition, the Fund will not otherwise take defensive positions in declining markets unless such positions are reflected in the Underlying Index.

Satellite Companies Concentration Risk - The Fund is considered to be concentrated in securities of companies that operate or utilize satellites which are subject to manufacturing delays, launch delays or failures, and operational and environmental risks (such as signal interference or space debris) that could limit their ability to utilize the satellites needed to deliver services to customers. Some companies that operate or utilize satellites do not carry commercial launch or in-orbit insurance for the full value of their satellites and could face significant impairment charges if the satellites experience full or partial failures. Rapid and significant technological changes in the satellite communications industry or in competing terrestrial industries may impair a company’s competitive position and require significant additional capital expenditures. There are also regulatory risks associated with the allocation of orbital positions and spectrum under the International Telecommunication Union (“ITU”) and the regulatory bodies in each of the countries in which companies provide service. In addition, the ground facilities used for controlling satellites or relaying data between Earth and the satellites may be subject to operational and environmental risks (such as natural disasters) or licensing and regulatory risks. If a company does not obtain or maintain regulatory authorizations for its satellites and associated ground facilities, it may not be able to operate its existing satellites or expand its operations.

Small and Mid-Capitalization Securities Risk - The Fund may be subject to the risk that small- and mid-capitalization securities may underperform other segments of the equity market or the equity market as a whole. Securities of small- and mid-capitalization companies may experience much more price volatility, greater spreads between their bid and ask prices and significantly lower trading volumes than securities issued by large, more established companies. Accordingly, it may be difficult for the Fund to sell small- and mid-capitalization securities at a desired time or price. Small-and mid- capitalization companies tend to have inexperienced management as well as limited product and market diversification and financial resources. Small- and mid-capitalization companies have more speculative prospects for future growth, sustained earnings and market share than large companies, and may be more vulnerable to adverse economic, market or industry developments than large capitalization companies.

| 22 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

Space Industry Risk - The exploration of space by private industry and the utilization of space assets is a business focused on the future and is witnessing new entrants into the market. This is a global event with a growing number of corporate participants looking to meet the future needs of a growing global population. Therefore, investments in the Fund will be riskier than traditional investments in established industry sectors and the growth of these companies may be slower and subject to setbacks as new technology advancements are made to expand into space.

Natural Disaster/Epidemic Risk - Natural or environmental disasters, such as earthquakes, fires, floods, hurricanes, tsunamis and other severe weather-related phenomena generally, and widespread disease, including pandemics and epidemics, have been and may be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of the Fund’s investments. Given the increasing interdependence among global economies and markets, conditions in one country, market, or region are increasingly likely to adversely affect markets, issuers, and/or foreign exchange rates in other countries, including the U.S. Any such events could have a significant adverse impact on the value of the Fund’s investments.

NOTE 4 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS.

Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and ProcureAM, LLC (the “Advisor”), the Advisor provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust.

Under the Advisory Agreement, the Advisor agrees to pay all expenses of the Trust, except brokerage and other transaction expenses including taxes; legal fees or expenses, such as those for litigation or arbitration; compensation and expenses of the Independent Trustees, counsel to the Independent Trustees, and the Trust’s chief compliance officer; extraordinary expenses; distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act; and the advisory fee payable to the Advisor hereunder. For services provided to the Fund, the Fund pays the Adviser 0.75% at an annual rate based on the Fund’s average daily net assets. Certain officers and an Interested Trustee of the Trust are affiliated with the Advisor. Those officers’ and Interested Trustee’s compensation is paid for by the Advisor.

Penserra Capital Management, LLC serves as the Sub-Advisor (the “Sub-Advisor”) to the Fund. The Sub-Advisor has overall responsibility for selecting and continuously monitoring the Fund’s investments. The Advisor compensates the Sub-Advisor for these services under a sub-advisory agreement between the two entities. The Advisor has overall responsibility for overseeing the investment of the Fund’s assets, managing the Fund’s business affairs and providing certain clerical, bookkeeping and other administrative services for the Trust.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (the “Administrator”), provides fund accounting, fund administration, and transfer agency services to the Fund. The Advisor compensates the Administrator for these services under an administration agreement between the two entities. U.S. Bank National Association, an affiliate of U.S. Bank Global Fund Services, serves as the Fund’s custodian pursuant to a custody agreement. Quasar Distributors, LLC, serves as the Fund’s distributor pursuant to a distribution agreement.

The Fund pays, in the aggregate, each Independent Trustee an annual fee of $12,000. The Chairmen of the Audit Committee, the Valuation Committee and the Nominating and Governance Committee each receive an additional annual fee of $1,000. In addition, the Independent Trustees are reimbursed for all reasonable travel expenses relating to their attendance at Board Meetings. The Fund pays Cipperman Compliance, LLC $27,000 over the period October 31, 2020 to October 31, 2021 less a 10% discount for the initial two years for CCO fees effective February 1, 2020. During the year ended October 31, 2021, the Advisor paid $66,000, in the aggregate, for Trustee, and CCO fees on the Fund's behalf, as a contractual waiver of its management fee. Such contractual waivers are not subject to recoupment by the Advisor. This Agreement with respect to the Fund shall continue in effect until October 31, 2022, and from year to year thereafter provided each such continuance is specifically approved by a majority of the Trustees of the Trust.

| 23 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

NOTE 5 – DISTRIBUTION PLAN

The Fund has adopted a Plan of Distribution pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Fund may pay compensation to the Distributor or any other distributor or financial institution with which the Trust has an agreement with respect to the Fund, with the amount of such compensation not to exceed an annual rate of 0.25% of each Fund’s daily average net assets. For the year ended October 31, 2021 the Fund did not incur any 12b-1 expenses.

NOTE 6 - PURCHASES AND SALES OF SECURITIES

The costs of purchases and sales of securities, excluding short-term securities and in-kind transactions, for the year ended October 31, 2021:

| Purchases |

|

| Sales |

| ||

| $ | 64,821,079 |

|

| $ | 53,649,247 |

|

The costs of purchases and sales of in-kind transactions associated with creations and redemptions for the year ended October 31, 2021:

| Purchases In-Kind |

|

| Sales In- Kind |

| ||

| $ | 105,731,862 |

|

| $ | 46,110,836 |

|

There were no purchases or sales of U.S. Government obligations for the year ended October 31, 2021.

During the year ended October 31, 2021, the Fund paid $0 brokerage commissions on trades of securities to Penserra Securities, LLC, an affiliate of the Sub-Adviser.

NOTE 7 — SECURITIES LENDING

The Fund may lend up to 33 1⁄3% of the value of the securities in its portfolio to brokers, dealers and financial institutions (but not individuals) under terms of participation in a securities lending program administered by U.S. Bank N.A. (the “Custodian”). The securities lending agreement requires that loans are collateralized at all times in an amount equal to at least 102% of the value of any domestic loaned securities or 105% of the value of any foreign securities at the time of the loan, plus accrued interest. The Fund receives compensation in the form of fees and earn interest on the cash collateral. The amount of fees depends on a number of factors including the type of security and length of the loan. The Fund continues to receive interest payments or dividends on the securities loaned during the borrowing period. Gain or loss in the fair value of securities loaned that may occur during the term of the loan will be for the account of the Fund. The Fund has the right under the terms of the securities lending agreement to recall the securities from the borrower on demand. The cash collateral is invested by the Custodian in accordance with approved investment guidelines. Those guidelines require the cash collateral to be invested in readily marketable, high quality, short-term obligations either directly on behalf of the Fund or through one or more joint accounts, money market funds, or short-term bond funds, including those advised by or affiliated with the Advisor; however, such investments are subject to risk of payment delays or default on the part of the issuer or counterparty or otherwise may not generate sufficient interest to support the costs associated with securities lending. Other investment companies, in which the Fund may invest cash collateral, can be expected to incur fees and expenses for operations, such as investment advisory and administration fees, which would be in addition to those incurred by the Fund, and which may be received in full or in part by the Advisor. Pursuant to guidance issued by the SEC staff, fees and expenses of money market funds used for cash collateral received in connection with loans of securities are not treated as Acquired Fund Fees and Expenses, which reflect a fund’s pro rata share of the fees and expenses incurred by other investment companies in which the Fund invests (as disclosed in the Prospectus, as applicable). The Fund could also experience delays in recovering its securities and possible loss of income or value if the borrower fails to return the borrowed securities, although the Fund is indemnified from this risk by contract with the securities lending agent.

| 24 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

As of October 31, 2021, the value of the securities on loan and payable for collateral due to broker were as follows:

Value of Securities on Loan Collateral Received

| Fund |

| Values of Securities on Loan |

|

| Fund Collateral Received* |

| ||

| UFO |

| $ | 25,738,834 |

|

| $ | 26,312,640 |

|

______

* The cash collateral received was invested in the Mount Vernon Liquid Assets Portfolio as shown on the Schedule of Investments, an investment with an overnight and continuous maturity.

NOTE 8 – FEDERAL INCOME TAXES

The components of distributable earnings/(accumulated deficit) and cost basis of investments for federal income tax purposes at October 31, 2021 were as follows:

|

|

|

| Gross |

|

| Gross |

|

| Net Unrealized |

| ||||

| Cost |

|

| Unrealized Appreciation |

|

| Unrealized Depreciation |

|

| Appreciation (Depreciation) |

| ||||

| $ | 141,090,181 |

|

| $ | 11,548,894 |

|

| $ | (10,660,595 | ) |

| $ | 888,299 |

|

| Undistributed Ordinary Income |

|

| Undistributed Long-term Gain |

|

| Other Accumulated (Loss) |

|

| Unrealized Appreciation/ (Depreciation) |

|

| Total Distributable Earnings/ (Accumulated Deficit) |

| |||||

| $ | — |

|

| $ | — |

|

| $ | (5,345,513 | ) |

| $ | 888,299 |

|

| $ | (4,457,214 | ) |

The difference between the cost basis for financial statement and federal income tax purposes was primarily due to the tax deferral of losses from wash sales.

| 25 |

| Table of Contents |

Procure Space ETF

| NOTES TO FINANCIAL STATEMENTS October 31, 2021 (Continued) |

As of October 31, 2021, the Fund had accumulated capital loss carryovers of:

| Capital Loss Carryover ST |

|

| Capital Loss Carryover LT |

|

| Expires | |||

| $ | 4,482,131 |

|

| $ | 863,382 |

|

| Indefinite | |

Under current tax law, late-year ordinary losses realized after December 31 of a Fund's fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund deferred $0 of late-year ordinary losses for the tax year ending October 31, 2021.

U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications relate to redemptions in-kind and have no effect on net assets or net asset value per share.

For the fiscal year ended October 31, 2021, the following table shows the reclassifications made:

| Total Distributable Earnings (Loss) |

|

| Paid in Capital |

| ||

| $ | (13,333,290 | ) |

| $ | 13,333,290 |

|

The tax character of distributions paid by the Fund during the fiscal year ended October 31, 2020, and the year ended October 31, 2021 as follows:

| Year Ended October 31, 2021 |

|

| Period Ended October 31, 2020 |

| ||||||||||

| From Ordinary Income |

|

| From Return of Capital |

|

| From Ordinary Income |

|

| From Return of Capital |

| ||||

| $ | 816,387 |

|

| $ | 70,365 |

|

| $ | 141,601 |

|

| $ | 30,923 |

|

NOTE 9 – SUBSEQUENT EVENTS

In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no other events or transactions that occurred during the period subsequent to the end of the current period that materially impacted the amounts or disclosures in the Fund’s financial statements through the date the financial statements were issued.

| 26 |

| Table of Contents |

Procure Space ETF

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Procure Space ETF and

Board of Trustees of Procure ETF Trust II

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Procure Space ETF (the “Fund”), a series of Procure ETF Trust II, as of October 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, including the related notes, and the financial highlights for each of the three periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of October 31, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the three periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of October 31, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor for one or more ProcureAM, LLC’s investment companies since 2018.

COHEN & COMPANY, LTD.

Cleveland, Ohio

December 22, 2021

| 27 |

| Table of Contents |

Procure Space ETF

| October 31, 2021 (Unaudited) |

NOTE 1 – FREQUENCY DISTRIBUTION OF PREMIUMS AND DISCOUNTS