UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

May 11, 2023

10:00 a.m. Central Daylight Time

3400 Players Club Parkway, Ste. 300

Memphis, Tennessee 38125-1731

www.frontdoorhome.com

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF THE FOLLOWING WAYS: |

|

INTERNET www.proxyvote.com |

|

DURING THE MEETING www.virtualshareholdermeeting.com/FTDR2023 |

|

BY TELEPHONE Call 1-800-690-6903 (toll-free within the United States, U.S. territories and Canada) |

|

BY MAIL Complete, sign, date and promptly mail a paper proxy card, if you have received a paper copy of the proxy materials |

|

How to vote: Your vote is important. Please review the instructions on each of your voting options described in the accompanying proxy statement as well as in the notice you received in the mail. |

|

Record Date

Only stockholders of record at the close of business on March 27, 2023, the record date, are entitled to notice of, and to vote at, the 2023 Annual Meeting of Stockholders and at any and all adjournments or postponements. When you enter using your sixteen-digit control number, a list of these stockholders will be accessible electronically during the 2023 Annual Meeting at www.virtualshareholdermeeting.com/FTDR2023.

The 2023 Annual Meeting of Stockholders of Frontdoor, Inc. (the “Company”) will be held on Thursday, May 11, 2023 at 10:00 a.m. Central Daylight Time (the “2023 Annual Meeting”).

Virtual Meeting Items of Business |

1.

To elect the seven nominees named in the attached Proxy Statement as members of the Board of Directors to serve for a one-year term; 2.

To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2023; 3.

To hold a non-binding, advisory vote to approve the Company’s named executive officer compensation; and 4.

To conduct such other business as may properly come before the meeting and any and all adjournments or postponements thereof, if necessary. |

By Order of the Board of Directors

Jeffrey A. Fiarman

Senior Vice President, General Counsel and Secretary

March 30, 2023

frontdoor • 2023 Proxy Statement 1

3400 Players Club Parkway, Ste. 300

Memphis, Tennessee 38125-1731

2023 PROXY STATEMENT

FOR THE 2023 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 11, 2023

The Board of Directors of Frontdoor, Inc. is furnishing you with this Proxy Statement in connection with the solicitation of proxies for use at the 2023 Annual Meeting to be held via live audio webcast at www.virtualshareholdermeeting.com/FTDR2023 on Thursday, May 11, 2023 at 10:00 a.m. Central Daylight Time. At the 2023 Annual Meeting, stockholders will be asked to consider and act upon each of the following matters:

To elect the seven nominees named in the attached Proxy Statement as members of the Board of Directors to serve for a one-year term;

To ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2023;

To hold a non-binding, advisory vote to approve the Company’s named executive officer compensation; and

To conduct such other business as may properly come before the meeting and any and all adjournments or postponements thereof, if necessary.

By submitting your proxy (via the Internet, telephone or mail), you authorize William C. Cobb, Chief Executive Officer and Chairman of the Board of Directors of the Company, Jeffrey A. Fiarman, Senior Vice President, General Counsel and Secretary of the Company, and Jessica P. Ross, Senior Vice President and Chief Financial Officer of the Company, to represent you and vote your shares at the 2023 Annual Meeting in accordance with your instructions. They also may vote your shares to adjourn the meeting and will be authorized to vote your shares at any postponement(s) or adjournment(s) of the meeting.

The Company’s 2022 Annual Report is being made available to the Company’s stockholders concurrently herewith. Although the 2022 Annual Report is being made available concurrently with this Proxy Statement, it does not constitute a part of the proxy solicitation materials and is not incorporated by reference into this Proxy Statement.

We are first making this Proxy Statement and accompanying materials available to stockholders on or about March 30, 2023. We will be hosting the 2023 Annual Meeting live via audio webcast on the Internet. A summary of the information you need to participate in the meeting online is provided below:

Any stockholder can participate in the 2023 Annual Meeting live via audio webcast at www.virtualshareholdermeeting.com/FTDR2023

The audio webcast starts at 10:00 a.m. Central Daylight Time

Stockholders need a sixteen-digit control number to join the 2023 Annual Meeting

Stockholders of record at the close of business on March 27, 2023 may vote electronically and submit questions while participating in the 2023 Annual Meeting on the Internet

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY VOTE YOUR SHARES OVER THE INTERNET, BY TELEPHONE, OR BY MAIL.

frontdoor • 2023 Proxy Statement 2

frontdoor • 2023 Proxy Statement 3

In this Proxy Statement, unless the context indicates otherwise, references to “we,” “us,” “our,” “Frontdoor” and the “Company” refer to Frontdoor, Inc., a Delaware corporation, and its consolidated subsidiaries. References in this Proxy Statement to “Terminix” refer to Terminix Global Holdings, Inc. (formerly known as ServiceMaster Global Holdings, Inc.), a Delaware corporation, and its consolidated subsidiaries, unless the context otherwise requires. References to our historical business and operations prior to the distribution refer to the business and operations of Terminix’s American Home Shield business that was transferred to Frontdoor. References in this Proxy Statement to “Spin-off” refer to Terminix’s separation and distribution of the ownership and operations of the businesses operated under the American Home Shield, HSA, OneGuard and Landmark Home Warranty brand names into Frontdoor, which was completed on October 1, 2018. References in this Proxy Statement to the “separation” refer to the separation of the American Home Shield business from Terminix’s other businesses. References in this Proxy Statement to the “distribution” refer to the distribution on October 1, 2018 of shares of Frontdoor common stock (“Common Stock”) to Terminix stockholders on a pro rata basis.

We hold various service marks, trademarks and trade names such as Frontdoor®, American Home Shield®, HSA™, OneGuard®, Landmark Home Warranty®, ProConnect®, Streem® and the Frontdoor logo. Solely for convenience, the service marks, trademarks and trade names referred to in this Proxy Statement are presented without the SM, TM and ® symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these service marks, trademarks and trade names. All service marks, trademarks and trade names appearing in this Proxy Statement are the property of their respective owners.

frontdoor • 2023 Proxy Statement 4

Following is a summary of certain information presented in this Proxy Statement. This summary does not contain all of the information that you should consider. We encourage you to read the entire proxy statement for more information about these topics prior to voting.

When |

Time and Date: |

Location |

Virtual Meeting Address: www.virtualshareholdermeeting.com/FTDR2023 |

Record Date |

Record Date: |

Internet |

Admission/Audio Webcast: |

Proposal |

Board’s Voting Recommendation |

Page Reference |

1.

Election of Directors |

FOR EACH NOMINEE |

9 |

2.

Ratification of Independent Registered Public Accounting Firm |

FOR |

29 |

3.

Advisory Vote Approving Executive Compensation |

FOR |

32 |

On March 30, 2023, we posted on our corporate website at www.frontdoorhome.com, and began mailing to stockholders who requested paper copies, this Proxy Statement and our 2022 Annual Report.

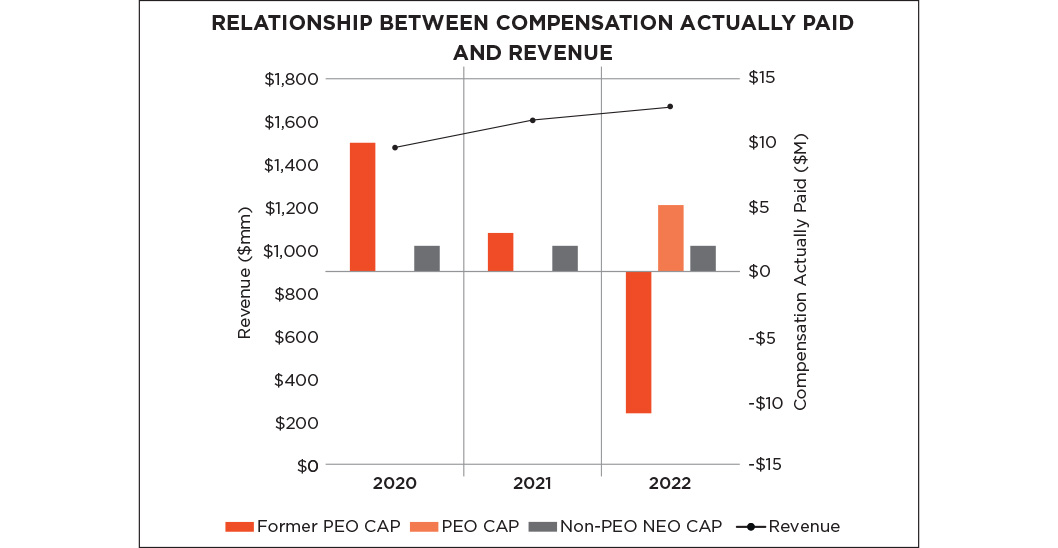

Despite 2022 being one of the most challenging macroeconomic environments that we have experienced, our Company, led by our named executive officers, delivered another year of growth in 2022 and advanced key strategic objectives, including:

Revenue increased 4% to $1,662 million, which was comprised of increases in price and a change in product mix, partially offset by lower volumes;

Gross Profit decreased 10% to $710 million, primarily driven by higher inflation;

Net Income decreased 45% to $71 million;

Adjusted EBITDA(1) decreased 33% to $214 million, primarily as a result of higher contract claims costs driven by inflationary cost pressures, partially offset by higher revenue conversion(2);

Customer retention rate improved 150 basis points to 75.7%(3); and

Utilization of Streem technology and on-demand business continued to evolve as we prepared for the launch of the Frontdoor brand in 2023.

We define “Adjusted EBITDA” as net income before: depreciation and amortization expense; goodwill and intangibles impairment; restructuring charges; provision for income taxes; non-cash stock-based compensation expense; interest expense; loss on extinguishment of debt; and other non-operating expenses. See Part II. Item 7 in our Form 10-K for the fiscal year ended December 31, 2022 for a reconciliation of net income to Adjusted EBITDA.

Revenue conversion includes the impact of the change in the number of home service plans as well as the impact of year-over-year price changes. The impact of the change in the number of home service plans considers the associated revenue on those plans less an estimate of contract claims costs based on margin experience in the prior year period.

Customer retention rate is presented on a rolling 12-month basis in order to avoid seasonal anomalies.

frontdoor • 2023 Proxy Statement 5

You are being asked to vote on the election of the seven directors listed below. Richard P. Fox is not standing for re-election; he will have reached the age of 75 at the time of the 2023 Annual Meeting and in accordance with our Corporate Governance Guidelines will serve on the Board of Directors until the 2023 Annual Meeting. Directors are elected by a majority of the votes cast. Detailed information about each director’s background, skills and experience can be found in “Proposal 1, Election of Directors.”

Following is information about the current members of our Board of Directors.

Name |

Age |

Independent |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

William C. Cobb(1) |

66 |

No |

|

|

|

D. Steve Boland |

54 |

Yes |

|

|

M |

Anna C. Catalano |

63 |

Yes |

|

C |

|

Peter L. Cella |

65 |

Yes |

M |

M |

|

Christopher L. Clipper |

54 |

Yes |

M |

|

|

Richard P. Fox(2) |

75 |

Yes |

C |

|

|

Brian P. McAndrews(3) |

64 |

Yes |

|

|

C |

Liane J. Pelletier |

65 |

Yes |

M |

M |

|

M = Member C = Chair |

|

|

|

|

|

(1)

Upon the resignation of Rexford J. Tibbens as President and Chief Executive Officer (“CEO”) and as a director on the Board of Directors effective June 1, 2022, Mr. Cobb was elected to serve as CEO, and has continued to serve as Chairman of the Board in a combined role. In accordance with the Company’s Corporate Governance Guidelines, which requires all members of the Corporate Governance Committee to be independent, as defined therein, as of June 1, 2022, Mr. Cobb no longer sits on the Nominating and Corporate Governance Committee. (2)

Mr. Fox will have reached the age of 75 at the time of the 2023 Annual Meeting, and in accordance with our Corporate Governance Guidelines, he will serve on the Board until the 2023 Annual Meeting, and is not standing for re-election at the 2023 Annual Meeting. (3)

As of June 1, 2022, Mr. McAndrews was elected to serve as Lead Director of the Board. |

|||||

frontdoor • 2023 Proxy Statement 6

At Frontdoor, corporate governance is the foundation for sustainable growth. Our governance policies and structures are designed to promote thoughtful consideration of our business actions and appropriate risk taking, with the goal of producing great business results for our stockholders.

In structuring our corporate governance, our Nominating and Corporate Governance Committee and Board of Directors have incorporated certain practices and omitted certain other practices, as follows.

What We Do |

|

What We Don’t Do |

||

|

Independent Lead Director |

|

|

No Non-independent Directors on Committees |

|

Board Diversity Disclosure |

|

|

No Classified Board |

|

Annual Board and Committee Self-Assessments |

|

|

No Dual Class Voting Stock |

|

Board Oversight of Risk, including ERM and Cybersecurity |

|

|

No Supermajority Voting Requirement to Amend Charter and Bylaws |

|

Annual Succession Planning |

|

|

No Supermajority Voting on Business Combinations |

|

Regular Board Executive Sessions |

|

|

No Cumulative Voting |

|

Board Oversight of ESG |

|

|

No Plurality Voting in Uncontested Elections |

|

Code of Conduct and Financial Code of Ethics |

|

|

|

Since the beginning of fiscal 2022, we have taken the following new governance actions:

Completed the declassification of our Board of Directors;

Appointed an independent lead director;

Amended our Corporate Governance Guidelines to specify and publish the lead director’s responsibilities, which are focused on helping to coordinate the efforts of the independent directors in the interest of ensuring that objective judgment is brought to bear on significant issues relating to the governance and operations of the Company; and

Published our 2022 Sustainability Report, our second Environmental, Social and Governance (“ESG”) report.

Our Compensation Committee made the following determinations with respect to our fiscal 2022 executive compensation program:

Increased the variable, at-risk portion of total direct compensation for our NEOs, other than our CEO, who was new in role in 2022;

Further aligned each executive’s annual long term incentive (“LTI”) opportunity to Company performance by structuring 50% of awards in the form of performance stock units (“PSUs”) and 50% of awards in the form of restricted stock units (“RSUs”) for our NEOs, and for our CEO, commencing June 1, 2022, 25% PSUs, 25% RSUs and 50% performance stock options (“PSOs”) tied to stock price appreciation;

Approved an Executive Severance Policy, confirming the compensation to which our executives may be entitled upon a separation to enhance executive retention; and

Determined that the Company performance under the annual incentive plan (“AIP”) was 63.6% in the aggregate in accordance with the weightings applicable to each performance goal.

frontdoor • 2023 Proxy Statement 7

In designing our executive compensation program, our Compensation Committee has incorporated certain practices into the program and omitted certain other practices, as follows.

What We Do |

|

What We Don’t Do |

||

|

Pay for Performance |

|

|

No Excessive Risk-Taking in Our Compensation Programs |

|

Competitive Compensation/Peer Group Benchmarking |

|

|

No Hedging, Pledging or Short Sales |

|

Annual Compensation Risk Assessment |

|

|

No Backdating or Repricing of Stock Options |

|

Clawback Policy |

|

|

No Tax Gross-Ups |

|

Stock Ownership Guidelines and Holdings Requirements |

|

|

|

|

Double Trigger Vesting for Equity Awards |

|

|

|

|

Independent Compensation Consultant |

|

|

|

A significant portion of the 2022 total direct compensation for our executives consisted of variable, at-risk compensation. Our calculation of the proportion of variable, at-risk total direct compensation includes the 2022 AIP award at target and long-term equity-based incentive award dollar value at target. The following charts illustrate the proportional components of 2022 compensation for our CEO, and the average proportional components of 2022 compensation for our other NEOs, as well as a percentage of overall, variable, at-risk compensation.

For comparison purposes, the information above for our CEO reflects an annualized fiscal 2022 salary and AIP award for Mr. Cobb and his long-term equity grants received due to his role as CEO, including his sign-on equity award; no compensation awarded to him for his services as a director and Chairman of the Board of Directors is reflected. The information above for “Average Other NEOs” reflects the average compensation paid to Messrs. Fiarman and Turcotte; Ms. Ross’ 2022 compensation components are not reflected, as she was not eligible to receive an AIP award or annual long-term equity-based incentive award for 2022.

frontdoor • 2023 Proxy Statement 8

The Company is seeking stockholder approval of the election of the seven nominees identified below who are currently serving as directors of the Company. In accordance with the Company’s restated certificate of incorporation, the Board of Directors was declassified as of the end of the 2022 Annual Meeting of Stockholders (the “2022 Annual Meeting”). In accordance with the Company’s Corporate Governance Guidelines, as Richard P. Fox attained the age of 75 after the 2022 Annual Meeting (at which time he was elected to serve a one-year term), he will serve on our Board until the 2023 Annual Meeting, and therefore is not standing for re-election. The size of the Board will be reduced to seven members upon the commencement of the 2023 Annual Meeting. Accordingly, each director nominee, if elected, will serve for a term of one year and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal from office.

The Board of Directors, upon the recommendation of the Nominating and Corporate Governance Committee of the Board (the “Nominating and Corporate Governance Committee”), has nominated for election at the 2023 Annual Meeting to serve as directors until the 2024 Annual Meeting of Stockholders and until their successors have been duly elected and qualified, the slate of nominees listed in the table below. Each of the director nominees is currently serving as a director of the Company.

The director nominees, last elected to the Board of Directors at the 2022 Annual Meeting, are as follows.

|

Director Nominees |

|

|

William C. Cobb |

|

|

D. Steve Boland |

|

|

Anna C. Catalano |

|

|

Peter L. Cella |

|

|

Christopher L. Clipper |

|

|

Brian P. McAndrews |

|

|

Liane J. Pelletier |

|

The Board of Directors knows of no reason why these nominees should be unable or unwilling to serve, but if that should be the case, proxies will be voted for the election of such substitute(s) as the Board may designate.

Background information about each of the director nominees can be found below under “—Directors of the Company.”

|

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES. |

frontdoor • 2023 Proxy Statement 9

Below is a list of our current directors and their respective ages and committee memberships (as of March 21, 2023).

Name |

Age |

Audit Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

William C. Cobb(1) |

66 |

|

|

|

D. Steve Boland |

54 |

|

|

M |

Anna C. Catalano |

63 |

|

C |

|

Peter L. Cella |

65 |

M |

M |

|

Christopher L. Clipper |

54 |

M |

|

|

Richard P. Fox(2) |

75 |

C |

|

|

Brian P. McAndrews(3) |

64 |

|

|

C |

Liane J. Pelletier |

65 |

M |

M |

|

M = Member C = Chair (1)

Upon the resignation of Rexford J. Tibbens as President and CEO and as a director on the Board of Directors effective June 1, 2022, Mr. Cobb was elected to serve as CEO, and continues to serve as Chairman of the Board in a combined role. In accordance with the Company’s Corporate Governance Guidelines, which requires all members of the Board’s committees to be independent, as defined therein, as of June 1, 2022, Mr. Cobb no longer sits on the Nominating and Corporate Governance Committee. (2)

Mr. Fox will have reached the age of 75 at the time of the 2023 Annual Meeting, and in accordance with our Corporate Governance Guidelines, he will serve on the Board of Directors until the 2023 Annual Meeting. (3)

As of June 1, 2022, Mr. McAndrews was elected to serve as Lead Director of the Board.

|

||||

WILLIAM C. COBB Chairman of the Board of Directors CEO |

||

Director Committees: •

None |

Mr. Cobb has served as the Chief Executive Officer of the Company since June 2022 and was appointed to the Board of Directors of the Company in October 2018, and serves as Chairman of the Board of Directors. Mr. Cobb served on the board of directors of Terminix from April 2018 until the Spin-off. From May 2011 through July 2017, Mr. Cobb served as President and Chief Executive Officer, and from August 2010 to July 2017 Mr. Cobb served as a director, of H&R Block, Inc., a provider of income tax return preparation and related services and products. From November 2000 to March 2008, Mr. Cobb served in various leadership roles at eBay, Inc., a global commerce and payments provider, including as President of eBay Marketplaces North America for four years and other senior management positions, including Senior Vice President and General Manager of eBay International and Senior Vice President of Global Marketing. Prior to joining eBay, Inc., Mr. Cobb held various marketing and executive positions at PepsiCo (and Tricon Global Restaurants when it was spun off in 1997) from 1987 to 2000. These positions included Senior Vice President and Chief Marketing Officer for Tricon International, Senior Vice President and Chief Marketing Officer at Pizza Hut, and Vice President, Colas at Pepsi Cola. Mr. Cobb currently serves on the board of directors and is chair of the finance committee of Deluxe Corporation, a technology-enabled solution company supporting financial institutions and small businesses. Mr. Cobb’s wide array of executive leadership roles, wealth of knowledge in technology and online-focused businesses, experience at a newly spun-off company, and history of service on public company boards qualify him to serve on our Board of Directors. Mr. Cobb holds an undergraduate degree in Economics from the University of Pennsylvania and an M.B.A. from the Kellogg School of Management at Northwestern University.

Current Public Company Directorships: •

Frontdoor, Inc. •

Deluxe Corporation Former Directorships (last 5 years): •

H&R Block, Inc. •

Terminix

|

|

frontdoor • 2023 Proxy Statement 10

D. STEVE BOLAND |

||

Director INDEPENDENT Committees: •

Nominating & |

Mr. Boland was appointed to the Board of Directors of the Company in October 2021, and serves on our Nominating and Corporate Governance Committee. Mr. Boland currently serves as the Chief Administrative Officer of Bank of America Corporation, one of the world’s leading financial institutions, serving individual consumers, small- and middle-market businesses and large corporations with a full range of banking, investing, asset management and other financial and risk management products and services. Previously, from July 2020 to September 2021, Mr. Boland served as the President, Retail, for Bank of America Corporation. From July 2008 to July 2020, Mr. Boland served in various senior leadership roles for Bank of America Corporation, including Managing Director, Consumer Lending and Managing Director, Secured Consumer Lending. From January 1997 to July 2008, Mr. Boland served in various leadership roles at Countrywide Financial Corporation including as Managing Director, Senior Vice President and Reverse Mortgage Executive, until Countrywide Financial Corporation was acquired by Bank of America Corporation in 2008. Previously, Mr. Boland served as Vice President, National Affordable Lending Manager with Fleet Bank. Mr. Boland’s extensive leadership and significant experience with customer-focused, digital-enabled businesses, as well as his deep understanding of banking, product and strategic management qualify him to serve on our Board of Directors. Mr. Boland holds a Bachelor of Science degree in Organizational Studies from the School of Education and Social Policy at Northwestern University.

Current Public Company Directorships: •

Frontdoor, Inc. Former Directorships (last 5 years): •

None

|

|

ANNA C. CATALANO |

||

Director INDEPENDENT Committees: •

Compensation Committee Chair |

Ms. Catalano was appointed to the Board of Directors of the Company in September 2018, and serves as Chair of our Compensation Committee. From 1979 until her retirement in 2003, Ms. Catalano served in various leadership roles at BP p.l.c., a global energy producer, and its predecessor Amoco Corporation. Most recently, from 2000 to 2003, she served as Group Vice President, Global Marketing, for BP p.l.c. Ms. Catalano has significant international business experience, having served as President of Amoco Orient Oil Company, including two years during which she lived in Beijing. Ms. Catalano serves on the board of directors and nominating and corporate governance committee of Ecovyst, Inc., an integrated and innovative global provider of specialty catalysts and services since July 2022; and on the board of directors, compensation committee and nominating, governance, and social responsibility committee of HF Sinclair Corporation, a petroleum and renewable fuels company since March 2022 (having served on the board of directors of HollyFrontier Corporation from 2017 until its acquisition by HF Sinclair Corporation). Ms. Catalano previously served on the boards of Kraton Corporation, a global producer of bio-based chemicals and specialty polymers, from 2011 until its acquisition in 2022; on the board of directors of Willis Towers Watson p.l.c., a global risk advisory, broking, and solutions company from 2016 to 2022 (having previously served on the board of directors of Willis Group from 2006 until the merger of Willis Group and Towers Watson & Co.), on the board of directors of Mead Johnson Nutrition Co., a global producer of infant and child nutrition, from 2010 until its acquisition in 2017; and on the board of directors of Chemtura Corp., a global specialty chemicals company, from 2011 to 2017. Ms. Catalano’s senior leadership experience and extensive knowledge in marketing and communications, combined with her broad public company board experience and expertise in corporate governance, executive compensation and board function, qualify her to serve on our Board of Directors. Ms. Catalano holds a Bachelor of Science degree in Business Administration from the University of Illinois, Champaign-Urbana.

Current Public Company Directorships: •

Frontdoor, Inc. •

Ecovyst, Inc. •

HF Sinclair Corporation Former Directorships (last 5 years): •

Chemtura Corp. •

Kraton Corporation •

Mead Johnson Nutrition Co. •

Willis Towers Watson p.l.c.

|

|

frontdoor • 2023 Proxy Statement 11

PETER L. CELLA |

||

Director |

Mr. Cella was appointed to the Board of Directors of the Company in October 2018, and serves as a member of our Audit Committee and our Compensation Committee. Mr. Cella served on the board of directors of Terminix from February 2017 until the Spin-off. Mr. Cella has been a private investor since August 2017. From 2011 to August 2017, Mr. Cella served as president and chief executive officer of Chevron Phillips Chemical Company LLC, a global petrochemical company. Previously, Mr. Cella served in various executive positions at BASF Corp., a global producer and marketer of chemicals and related products; INEOS Nitriles, a global producer of acrylonitrile, acetonitrile, and related chemicals; Innovene, LLC, a producer of olefins and derivatives; and BP p.l.c., a global energy producer. Mr. Cella serves on the board of directors of Saudi Aramco, a global energy and chemicals enterprise; Inter Pipeline Ltd., a petroleum transportation, natural gas liquids processing and bulk liquid storage business that was taken private in 2021; and Critica Infrastructure (formerly Clockspring NRI), a privately-held supplier of pipeline and infrastructure repair products and services. Mr. Cella’s financial background and experience in executive leadership and running varied businesses, history of building strong leadership teams and experience on other company boards qualify him to serve on our Board of Directors. Mr. Cella received a Bachelor of Science degree in Finance from the University of Illinois and an M.B.A. from Northwestern University’s Kellogg Graduate School of Management.

Current Public Company Directorships: •

Frontdoor, Inc. •

Saudi Aramco (listed in Saudi Arabia) Former Directorships (last 5 years): •

Terminix

|

|

INDEPENDENT |

||

Committees: •

Audit Committee •

Compensation Committee |

||

CHRISTOPHER L. CLIPPER |

||

Director |

Mr. Clipper was appointed to the Board of Directors of the Company in October 2021, and serves as a member of the Audit Committee. Currently, Mr. Clipper serves as the Senior Vice President and Chief Financial Officer, Innovation and Go-To-Market strategies of Ralph Lauren Corporation, a global leader in the design, marketing and distribution of premium lifestyle products. From November 2017 to February 2020, Mr. Clipper served as the Senior Vice President and Chief Financial Officer, North America and Club Monaco of Ralph Lauren Corporation. From January 2011 to July 2017, Mr. Clipper served in various leadership roles at Nike, Inc., a global retailer of athletic footwear and apparel, including as Vice President and Chief Financial Officer, Global Operations, North America and Vice President and Group Head, Global Strategy and Corporate Development. Prior to joining Nike, from January 2004 to January 2011, Mr. Clipper held various leadership positions at Time Warner, Inc., a leader in media and entertainment that operates Turner, Home Box Office (HBO) and Warner Bros. business units that was acquired by AT&T in June 2018. These positions included Group Vice President, Financial Planning and Analysis, Vice President, Investor Relations and Executive Director, Mergers and Acquisitions. Mr. Clipper’s extensive accounting, financial management and leadership experience as well as his deep understanding of consumer-focused businesses, operations, strategy, investor relations and mergers and acquisitions, qualify him to serve on our Board of Directors. Mr. Clipper holds a Bachelor of Arts degree in Economics from Brown University and an M.B.A. from Stanford University Graduate School of Business.

Current Public Company Directorships: •

Frontdoor, Inc. Former Directorships (last 5 years): •

None

|

|

INDEPENDENT |

||

Committees: •

Audit Committee |

||

frontdoor • 2023 Proxy Statement 12

RICHARD P. FOX |

||

Director INDEPENDENT Committees: •

Audit Committee Chair |

Mr. Fox was appointed to the Board of Directors of the Company in October 2018, and serves as Chair of our Audit Committee. Mr. Fox served on the board of directors of Terminix from March 2014 until the Spin-off. Since 2001, Mr. Fox has been an independent consultant. From 2000 to 2001, he was President and Chief Operating Officer of CyberSafe Corporation, a global security software provider. Mr. Fox spent 28 years at Ernst & Young LLP, a global accounting firm, last serving as managing partner at the firm’s Seattle office. He currently serves on the board of directors of Pinnacle West Capital Corporation, a vertically integrated electric utility serving the State of Arizona; and Univar Solutions, Inc., an international chemical distributor. Previously, he served on the boards of LiveRamp Holdings, Inc., a SaaS data connectivity platform company until August 2022; Pendrell Corporation, an intellectual property investment and advisory firm until 2014; Flow International Corporation, a machine tool manufacturer, until 2014; Orbitz Worldwide, Inc., an online travel company, until 2011; and PopCap Games, a developer and publisher of games, until it was acquired by Electronic Arts Inc. in 2011. Mr. Fox is a certified public accountant in the State of Washington and in 2018 he earned a professional certificate in cybersecurity from Carnegie Mellon’s Software Engineering Institute. As a result of his extensive accounting and financial management experience, Mr. Fox has a deep understanding of financial reporting processes, internal accounting and financial controls, independent auditor engagements and other audit committee and board functions. Mr. Fox’s financial, accounting and management expertise, along with his experience on other public company boards, qualify him to serve on our Board of Directors. Mr. Fox holds a Bachelor of Arts degree in Business Administration from Ohio University and an M.B.A. from the Fuqua School of Business, Duke University.

Current Public Company Directorships: •

Frontdoor, Inc. •

Pinnacle West Capital Corporation •

Univar Solutions, Inc. Former Directorships (last 5 years): •

Terminix •

LiveRamp Holdings, Inc.

|

|

BRIAN P. MCANDREWS Lead Director |

||

Director INDEPENDENT Committees: •

Nominating and Corporate Governance Committee Chair |

Mr. McAndrews was appointed to the Board of Directors of the Company in October 2018, serves as Lead Director since June 2022, and is Chair of our Nominating and Corporate Governance Committee. Most recently, Mr. McAndrews served as President and Chief Executive Officer, and chairman of the board of directors, of Pandora Media, Inc., an internet radio company, from 2013 until 2016. Prior to that, he served as a venture partner with Madrona Venture Group, LLC, a venture capital firm, from 2012 to September 2013, and as a managing director of Madrona from 2009 to 2011. He also previously held executive positions at Microsoft Corporation, a global software company, and aQuantive, a leading digital marketing services and technology company, which was acquired by Microsoft in 2007. Mr. McAndrews currently serves on the board of directors of The New York Times Company, a multimedia news and information company, and Xero Limited, a cloud-based accounting software company for small- and medium-sized businesses. Mr. McAndrews previously served on the boards of directors of Chewy, Inc., an online destination for pet parents until 2021; Grubhub Inc., an online and mobile food ordering company until 2021; Teladoc Health, Inc., an online provider of medical services until 2020; Fisher Communications, Inc., a media company until it was acquired in 2013; and Clearwire Corporation, a telecommunications company until it was acquired in 2013. Mr. McAndrews brings to the Company and the Board of Directors deep traditional and digital media experience gained through his role as a chief executive officer of public companies in the technology industry, as well as his private and public company directorships. In addition, his background and his understanding of digital advertising and the integration of emerging technologies qualifies Mr. McAndrews to serve on our Board of Directors. Mr. McAndrews holds a Bachelor’s degree in Economics from Harvard College and an M.B.A. from the Stanford Graduate School of Business.

Current Public Company Directorships: •

Frontdoor, Inc. •

The New York Times Company •

Xero Limited (listed in Australia) Former Directorships (last 5 years): •

Chewy, Inc. •

Grubhub Inc. •

Pandora Media, Inc. •

Teladoc Health, Inc.

|

|

frontdoor • 2023 Proxy Statement 13

LIANE J. PELLETIER |

||

Director INDEPENDENT Committees: •

Audit Committee •

Compensation Committee |

Ms. Pelletier was appointed to the Board of Directors of the Company in September 2018, and serves as a member of our Audit Committee and our Compensation Committee. Since 2011, Ms. Pelletier has served as a public company independent board director across multiple industries. From 2003 through 2011, Ms. Pelletier was the Chairwoman, Chief Executive Officer, and President of Alaska Communications Systems, an Alaska-based telecommunications and information technology services provider. Prior to this, Ms. Pelletier held a number of executive positions at Sprint Corporation, a telecommunications company. Ms. Pelletier currently serves on the board of directors and is chair of the nominating and corporate governance committee at Expeditors International of Washington, Inc., a global logistics company, and she also serves on the board of directors, is member of the compensation committee and the nominating and corporate governance committee at ATN International, Inc., a holding company of telecommunication companies. Ms. Pelletier previously served on the board of directors of Switch, Inc., a data center and technology infrastructure company, until it was sold in December 2022. In 2017, she earned a professional certificate in cybersecurity from Carnegie Mellon’s Software Engineering Institute. Ms. Pelletier’s experience in executive and boardroom leadership, particularly in highly regulated industries, and expertise in cybersecurity oversight, business model transformation and shareholder engagement qualify her to serve on our Board of Directors. Ms. Pelletier earned her B.A. in Economics from Wellesley College and an M.S. from the Sloan School of Business at the Massachusetts Institute of Technology.

Current Public Company Directorships: •

Frontdoor, Inc. •

ATN International, Inc. •

Expeditors International of Washington, Inc. Former Directorships (last 5 years): •

Switch, Inc.

|

|

There are no family relationships among our directors and executive officers.

frontdoor • 2023 Proxy Statement 14

The following matrix provides information regarding our directors, including certain types of knowledge, skills, and/or experience possessed by one or more of our directors, which our Board of Directors believes are relevant to our business and industry. The matrix also indicates which directors are independent and the tenure for each director.

The matrix does not encompass all of the knowledge, skills or experiences of our directors, but focuses on categories in which our directors possess substantial knowledge, skills and experience in an area. The fact that a director has not indicated substantial knowledge, skill and experience in an area does not mean the director in question is unable to contribute to the decision-making process in that area. The type and degree of knowledge, skill and experience listed below may vary among the members of the Board of Directors.

|

Boland |

Catalano |

Cella |

Clipper |

Cobb |

Fox |

McAndrews |

Pelletier |

Knowledge, Skills and Experience |

||||||||

Consumer Services |

|

|

|

|

|

|||

Technology |

|

|||||||

Digital and Platform Services |

|

|

|

|

|

|||

Executive Leadership |

|

|

|

|

|

|

|

|

Public Company Boards |

|

|

|

|

|

|

||

Marketing |

|

|

|

|

|

|

|

|

Product Development |

|

|

|

|||||

Public Accounting & Finance |

|

|

|

|||||

Strategy and M&A |

|

|

|

|

|

|

|

|

Independence |

||||||||

Non-Employee Director |

|

|

|

|

|

|

|

|

Tenure |

||||||||

Years |

1.5 | 4.5 | 4.5 | 1.5 | 4.5 | 4.5 | 4.5 | 4.5 |

frontdoor • 2023 Proxy Statement 15

The Company uses a combination of cash and equity-based compensation to attract and retain qualified candidates to serve on our Board of Directors. In setting director compensation for non-employee directors, our Board considers the significant amount of time that directors expend in fulfilling their duties to the Company, as well as the knowledge, skill and experience levels required by the Company of members of our Board. Directors who are employees of the Company receive no compensation for their service as directors.

Under the director compensation program, members of our Board of Directors who are not employees of the Company receive an annual retainer comprised of cash and stock. Additionally, the Chairman of the Board of Directors, if not an employee, or Lead Director and the chairs of the Audit Committee of the Board (the “Audit Committee”), the Compensation Committee of the Board (the “Compensation Committee”) and the Nominating and Corporate Governance Committee of the Board, each receive an additional retainer. The types, amounts, forms and timing of these retainers are set forth in the following table.

Retainer Type |

Annual Retainer |

Form of Payment |

Timing of Payment |

Base Retainer |

$230,000 |

•

$80,000 in Cash •

$150,000 in shares of fully vested Common Stock |

•

In quarterly installments (i.e., $20,000 per quarter) •

Annually, at the time of the annual meeting of stockholders |

Retainer for non-employee Chairman of the Board |

$150,000 |

•

$50,000 in Cash •

$100,000 in shares of fully vested Common Stock |

•

In quarterly installments (i.e., $12,500 per quarter) •

Annually, at the time of the annual meeting of stockholders |

Retainer for Lead Director |

$25,000 |

•

Cash |

•

In quarterly installments (i.e., $6,250 per quarter) |

Retainer for Chairs of Audit Committee and Compensation Committee |

$20,000 |

•

Cash |

•

In quarterly installments (i.e., $5,000 per quarter) |

Retainer for Chair of Nominating and Corporate Governance Committee |

$10,000 |

•

Cash |

•

In quarterly installments (i.e., $2,500 per quarter) |

Each director may elect to defer the receipt of the shares of Common Stock as deferred share equivalents (“DSEs”) to a point in the future. The shares are issued pursuant to the 2018 Omnibus Incentive Plan (the “2018 Plan”), and the number of shares of the Company’s Common Stock granted as part of the equity retainer is determined by using the grant date fair value, as defined in the 2018 Plan as the closing price of the Company’s Common Stock on the Nasdaq Global Select Market (“Nasdaq”) on the trading day that immediately precedes the grant date. This value is then used to determine the number of shares required to satisfy the share portion of the director’s equity retainer, rounded to the nearest whole share for the avoidance of fractional shares.

As of June 1, 2022, Mr. Cobb, our Chairman of the Board of Directors, was elected as the Company’s CEO and as of that time, ceased receiving compensation for his membership on our Board or as Chairman of our Board. Mr. McAndrews was appointed by the independent directors as the independent Lead Director, commencing June 1, 2022. On May 19, 2022, the Board approved an amendment to the director compensation program providing for the independent Lead Director to receive an additional annual cash retainer as described above. A new director, or director who assumes a role for which an additional retainer is payable, shall receive a prorated award of cash and/or Common Stock, as applicable, on the next regular payment date for the applicable retainer.

We reimburse all of our directors for reasonable expenses incurred in connection with attending Board meetings and committee meetings. The Company will also reimburse certain expenses incurred by directors in connection with attending director education programs, as well as memberships in director organizations.

frontdoor • 2023 Proxy Statement 16

The following table sets forth information concerning the compensation by the Company to our directors (other than Mr. Cobb, who is Chairman of the Board of Directors and has served as our CEO since June 1, 2022, and Mr. Tibbens who was a director of the Company until June 1, 2022 and was formerly a named executive officer) for fiscal 2022. See the “Summary Compensation Table” for the compensation paid to Messrs. Cobb and Tibbens.

Name |

Fees Earned or Paid in Cash(1) |

Stock Awards(2) |

Total |

|||

D. Steve Boland |

$ |

80,000 |

$ |

150,005 |

$ |

230,005 |

Anna C. Catalano(3) |

$ |

100,000 |

$ |

150,005 |

$ |

250,005 |

Peter L. Cella |

$ |

80,000 |

$ |

150,005 |

$ |

230,005 |

Christopher L. Clipper |

$ |

80,000 |

$ |

150,005 |

$ |

230,005 |

Richard P. Fox(4) |

$ |

100,000 |

$ |

150,005 |

$ |

250,005 |

Brian P. McAndrews(5) |

$ |

104,555 |

$ |

150,005 |

$ |

254,560 |

Liane J. Pelletier |

$ |

80,000 |

$ |

150,005 |

$ |

230,005 |

(1)

Amounts consist of the cash retainers earned in fiscal 2022 and paid quarterly for services rendered as directors on our Board of Directors. Mr. McAndrews’s cash retainer for his service as Lead Director was pro-rated from June 1, 2022, when he commenced serving in that role. (2)

Stock awards consist solely of awards of the Company’s fully vested Common Stock. The amounts shown represent the aggregate grant date fair value of stock awards granted by the Company on May 11, 2022, calculated in accordance with applicable accounting standards for services on the Company’s Board of Directors, and based solely on the closing price of our Common Stock on the Nasdaq on the day before the date of the grant, and rounded to the nearest whole share. Messrs. Boland, Cella and Clipper elected to defer receipt of their grants of the annual stock award as DSEs until 30 days after they no longer sit on the Company’s Board. (3)

Chair of the Compensation Committee (4)

Chair of the Audit Committee. (5)

Lead Director, effective June 1, 2022, and Chair of the Nominating and Corporate Governance Committee. |

||||||

frontdoor • 2023 Proxy Statement 17

In designing our corporate governance, our Nominating and Corporate Governance Committee and Board of Directors and have incorporated certain practices and omitted certain other practices, as follows.

What We Do |

|

What We Don’t Do |

||

|

Independent Lead Director |

|

|

No Non-independent Directors on Committees |

|

Board Diversity Disclosure |

|

|

No Classified Board |

|

Annual Board and Committee Self-Assessment |

|

|

No Dual Class Voting Stock |

|

Board Oversight of Risk, including ERM and Cybersecurity |

|

|

No Supermajority Voting Requirement to Amend Charter and Bylaws |

|

Annual Succession Planning |

|

|

No Supermajority Voting on Business Combinations |

|

Regular Board Executive Sessions |

|

|

No Cumulative Voting |

|

Board Oversight of ESG |

|

|

No Plurality Voting in Uncontested Elections |

|

Code of Conduct and Financial Code of Ethics |

|

|

|

Our business and affairs are managed under the direction of our Board of Directors. Our Board is composed of a majority of independent directors. In accordance with our Charter, effective upon the conclusion of our 2022 Annual Meeting, our Board became fully declassified, and each director will serve for a term of one year and until his or her successor is duly elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal from office.

At any meeting of stockholders for the election of directors at which a quorum is present, the election will be determined by a majority of the votes cast, in the case of an uncontested election, with directors not receiving a majority of the votes cast required to tender their resignations for consideration by the Board of Directors. In the case of a contested election, the election will be determined by a plurality of the votes cast.

The number of members on our Board of Directors may be fixed by resolution adopted from time to time by the Board. Any vacancies or newly created directorships may be filled only by the affirmative vote of a majority of directors then in office, even if less than a quorum, or by a sole remaining director. Each director shall hold office until his or her successor has been duly elected and qualified, or until his or her earlier death, resignation, retirement, disqualification or removal.

The names and certain information with respect to each of our current directors, including Mr. Fox who is not standing for re-election at the 2023 Annual Meeting, is set forth above in the section entitled “Proposal 1, Election of Directors—Directors of the Company.”

The Board of Directors held 11 meetings during fiscal 2022. In fiscal 2022, each director attended our 2022 Annual Meeting, and each of our directors attended at least 95% of the meetings of the Board and committees on which he or she served as a member during fiscal 2022.

frontdoor • 2023 Proxy Statement 18

Our Board of Directors values diversity of its members, including gender, racial and ethnic diversity, as well as a range of different experiences, educations, backgrounds, perspectives, skills and knowledge. Our Board is committed to seeking women and individuals from minority groups to serve as directors. To that end, the Nominating and Corporate Governance Committee will endeavor to include women and individuals from minority groups in the pool from which new nominees are chosen.

The following table reflects information provided by our directors regarding their race, ethnicity and gender.

|

Boland |

Catalano |

Cella |

Clipper |

Cobb |

Fox |

McAndrews |

Pelletier |

Race and Ethnicity |

||||||||

African American or Black |

|

|

||||||

Alaskan Native or Native American |

||||||||

Asian |

|

|||||||

Hispanic or Latinx |

||||||||

Native Hawaiian or Pacific Islander |

||||||||

White |

|

|

|

|

|

|||

Two or More Races or Ethnicities |

||||||||

LGBTQ+ |

||||||||

Did Not Disclose Demographic Background |

||||||||

Gender |

||||||||

Male |

|

|

|

|

|

|

||

Female |

|

|

||||||

Non-Binary |

||||||||

Did Not Disclose Gender |

||||||||

A majority of our Board of Directors is composed of directors who are “independent,” as defined by the rules of the Nasdaq and the Corporate Governance Guidelines adopted by our Board. We seek to have all of our non-management directors qualify as “independent” under these standards. Our Board has established guidelines to assist it in making its determination of director independence. These guidelines provide that no director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with our Company or our subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with our Company or any of our subsidiaries). In making its assessment, our Board determined that any transactions both made in the ordinary course of business between our Company and any director affiliate, and within Nasdaq and our independence standards, were not pertinent to an evaluation of independence.

As of June 1, 2022, Mr. Cobb, our Chairman of the Board of Directors, was elected as the Company’s CEO and was therefore no longer considered independent by our Board. Accordingly, also effective on June 1, 2022, Mr. Cobb ceased to serve as a member of any of the Board’s committees, which are comprised of directors who have been determined to meet the independence standards described above. In accordance with the Company’s Corporate Governance Guidelines, in the event that the Chairman of the Board is not independent, the independent directors are required to annually appoint an independent Lead Director. On May 19, 2022, Mr. McAndrews was appointed by the independent directors as the independent Lead Director of the Board as of June 1, 2022.

frontdoor • 2023 Proxy Statement 19

Our Board of Directors has determined that each of Messrs. Boland, Cella, Clipper, Fox and McAndrews and each of Mses. Catalano and Pelletier were independent under the director independence standards described above. Our Board will assess on a regular basis, and at least annually, the independence of directors and, based on the recommendation of the Nominating and Corporate Governance Committee, will make a determination as to which members are independent.

Our Board of Directors has the following standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The charter for each of these committees is available without charge on our corporate website at www.frontdoorhome.com.

We have an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the rules and regulations of the Securities and Exchange Commission (the “SEC”) and the Nasdaq listing standards.

Our Audit Committee is primarily responsible, among its other duties and responsibilities, for oversight of the following:

The establishment of an effective “tone at the top” by the CEO and other members of senior management;

Our accounting, financial and external reporting processes and practices;

The quality and integrity of our financial statements and the audits of such financial statements;

The independence, qualifications and performance of our independent registered public accounting firm;

The effectiveness of our internal control over financial reporting and the performance of our internal audit function;

Our system of disclosure controls and procedures;

The administration of our enterprise risk management (“ERM”) program and monitoring of the risks assigned to it by our Board of Directors;

The policies for hiring employees or former employees of our independent registered public accounting firm;

The review of the Company’s earnings press release as well as financial information and earnings guidance provided therein;

The review of the annual audited financial statements or quarterly financial statements, as applicable, and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein;

The identification, monitoring and reporting of related party transactions;

Emerging trends relevant to the work of audit committees;

Our compliance with legal and regulatory requirements and our standards of business conduct and ethics;

Our cybersecurity risk, including policies and procedures for assessing, managing and responding to that risk;

The preparation of the Audit Committee Report required to be included in this Proxy Statement; and

The appointment, compensation, retention, evaluation and oversight of our independent registered public accounting firm.

The current members of the Audit Committee are Richard P. Fox (Chair), Peter L. Cella, Christopher L. Clipper and Liane J. Pelletier. Our Board of Directors has designated each member as an “audit committee financial expert” and has determined that each member is “financially literate” under the Nasdaq listing standards and SEC rules. Our Board also has determined that each member of the Audit Committee is “independent” as defined under the Nasdaq listing standards and Exchange Act rules and regulations.

The Audit Committee held 5 meetings during fiscal 2022.

frontdoor • 2023 Proxy Statement 20

Our Compensation Committee is primarily responsible, among its other duties and responsibilities, for the following:

Reviewing and approving all forms of compensation to be provided to, and employment agreements with, the executive officers of our Company and its subsidiaries (including the CEO) and to make recommendations to our Board of Directors regarding non-management director compensation;

Reviewing and approving the “Compensation Discussion and Analysis” and “Compensation Committee Report” required to be included in this Proxy Statement;

Establishing and overseeing the general compensation philosophy, structure, policies and compliance of our Company and its subsidiaries and reviewing, approving and overseeing the administration of the employee benefits plans of our Company and its subsidiaries;

Taking such other actions relating to the compensation and benefits structure, succession planning, talent review and diversity and inclusion initiatives of the Company as the Committee deems necessary or appropriate; and

Periodically reviewing management development and succession plans.

For additional information on the Compensation Committee’s activities, its use of outside advisors and its consideration and determination of executive compensation, as well as the role of our CEO in recommending the amount or form of compensation paid to the other named executive officers, see “Compensation Discussion and Analysis.”

The current members of the Compensation Committee are Anna C. Catalano (Chair), Peter L. Cella and Liane J. Pelletier. Our Board of Directors has determined that each member of the Compensation Committee is “independent” as defined under the Nasdaq listing standards and SEC rules. The Compensation Committee has the authority to retain compensation consultants, outside counsel and other advisers.

The Compensation Committee held 10 meetings during fiscal 2022.

During 2022, no member of the Compensation Committee was at any time an officer or employee of our Company or any of our subsidiaries, nor was any such person a former officer of our Company or any one of our subsidiaries. During 2022, there were no related person transactions between our Company and any of our Compensation Committee members that require disclosure under SEC rules.

frontdoor • 2023 Proxy Statement 21

Our Nominating and Corporate Governance Committee is primarily responsible, among its other duties and responsibilities, for the following:

Identifying and recommending candidates to the Board of Directors for election to our Board, consistent with criteria approved by our Board;

Overseeing the system of corporate governance of the Company, including recommending to the Board of Directors corporate governance guidelines that are applicable to us;

Reviewing the composition of the Board of Directors and its committees;

Reviewing and evaluating current directors for re-nomination to the Board or re-appointment to any Board committee;

Overseeing the self-evaluation of the Board of Directors and its committees; and

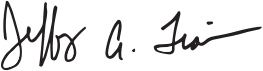

Overseeing the Company’s ESG initiatives and management of ESG-related risk.

The current members of the Nominating and Corporate Governance Committee are Brian P. McAndrews (Chair) and D. Steve Boland. Our Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is “independent” as defined under the Nasdaq listing standards.

The Nominating and Corporate Governance Committee held 5 meetings during fiscal 2022.

Following are highlights of corporate governance at the Company. Please see the following pages of this section for more information.

Board Independence |

•

All of our directors other than our Chairman and CEO are independent. |

Board Committees |

•

We have three Board committees—Audit, Compensation and Nominating and Corporate Governance. •

All committees are comprised of independent directors. |

Executive Sessions |

•

Independent members of the Board and each of the committees regularly meet in executive session with no member of management present. |

Board Leadership |

•

Our Board elected an independent Lead Director upon the commencement of the Chairman of the Board’s dual role as Chairman and CEO. •

The authority and responsibilities of the Lead Director are specified in our Corporate Governance Guidelines, as discussed below. |

Board Diversity |

•

The composition of the Board encompasses a broad range of skills, experience and industry knowledge, as well as gender, racial and ethnic diversity; comprised of 50% women and underrepresented minorities. |

Risk Oversight |

•

The Board and its committees are active in overseeing Company risk and regularly review the allocation of risk oversight among the Board and committees. |

Accountability to Stockholders |

•

All directors are elected annually. •

Only a majority vote of stockholders is required to amend our restated certificate of incorporation or our amended and restated bylaws. •

We have a robust stockholder engagement program. |

Self-Assessment |

•

The Board and its committees annually evaluate and discuss their respective performance and effectiveness. •

The Nominating and Corporate Governance Committee establishes procedures to oversee and report findings to the Board. |

Succession Planning |

•

The CEO reports to the Board on succession planning at least annually. •

The full Board is responsible for ensuring that there is a succession plan for the CEO. |

Environmental Social and Governance Oversight |

•

The Nominating and Corporate Governance Committee is responsible for overseeing ESG initiatives and risk at the Company and receives regular updates from management. |

frontdoor • 2023 Proxy Statement 22

Our Board of Directors is currently led by our Chairman, William C. Cobb. As stated in our Corporate Governance Guidelines, the Board has no policy with respect to the separation of the offices of Chairman of the Board and CEO. Following the resignation of Rexford Tibbens as the Company’s President, CEO and Director, and effective as of June 1, 2022, Mr. Cobb has also served as the Company’s CEO. The Board determined that Mr. Cobb’s qualifications, background, skills and experience qualified him to serve as the Company’s CEO, notwithstanding that Mr. Cobb would no longer be an independent director.

In accordance with the Company’s Corporate Governance Guidelines, since the Chairman of the Board of Directors is not independent, the independent directors are required to annually appoint an independent Lead Director. Mr. McAndrews was appointed by the independent directors as the independent Lead Director as of June 1, 2022.

The Company’s Corporate Governance Guidelines further specify the authority and responsibilities of the Lead Director, who is responsible to help coordinate the efforts of the independent directors in the interest of ensuring that objective judgment is brought to bear on significant issues relating to the governance and operations of the Company, including:

Presiding over all meetings of the Board of Directors at which the Chairman of the Board is not present, including meetings of the non-management and independent directors;

Collaborating with the Chairman of the Board of Directors on Board meeting agendas and advising on such agendas;

Assisting in scheduling Board of Directors meetings to ensure that there is sufficient time for discussion of all agenda items;

Requesting the inclusion of items in Board of Directors meeting materials and advising on Board meeting materials generally to ensure the appropriate flow of information to the Board;

Calling meetings of the independent directors when necessary and appropriate;

Collaborating with the Chairman of the Board of Directors in determining the need for special meetings of the Board;

Serving as the liaison for major stockholders who request direct communications with the Lead Director;

Serving as the liaison between the independent directors and the Chairman of the Board of Directors and the Company’s management team, as appropriate; and

Such other powers, duties and responsibilities as a majority of the independent directors of the Board shall approve.

Our Board of Directors holds regular and special meetings throughout each calendar year. In conjunction with those meetings, executive sessions, including separate meetings of only the independent directors, are regularly scheduled throughout the year. Our independent Lead Director presides over the executive sessions of the Board. The committees of the Board, as described more fully above, also meet regularly in executive sessions.

Our Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee will identify and select, or recommend that the Board of Directors select, Board candidates who the Nominating and Corporate Governance Committee believes are qualified and suitable to become members of the Board, consistent with the criteria for selection of new directors adopted from time to time by the Board. The Nominating and Corporate Governance Committee will consider, among other things, the Board’s current composition, including experience, diversity and balance of inside, outside and independent directors, and the general qualifications of the potential nominees in light of director qualification criteria established by our Board, as described further below under “—Director Qualification Standards.”

In identifying candidates for election to the Board of Directors, the Nominating and Corporate Governance Committee will consider nominees recommended by directors, stockholders and other sources. The Nominating

frontdoor • 2023 Proxy Statement 23

and Corporate Governance Committee will review each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating and Corporate Governance Committee will recommend the candidate for consideration by the full Board. The Nominating and Corporate Governance Committee has engaged third-party search firms to assist it in identifying, evaluating and recommending potential nominees.

The Nominating and Corporate Governance Committee will consider director candidates proposed by stockholders on the same basis as recommendations from other sources. Any stockholder who wishes to recommend a prospective candidate for the Board of Directors for consideration by the Nominating and Corporate Governance Committee may do so by submitting the name and qualifications of the prospective candidate in writing to the following address: c/o Corporate Secretary, Frontdoor, Inc., 3400 Players Club Parkway, Ste. 300, Memphis, Tennessee 38125-1731. Any such submission should also describe, among other things, the experience, qualifications, attributes and skills that make the prospective candidate a suitable nominee for the Board. Our Bylaws set forth the complete requirements for direct nomination by a stockholder of persons for election to the Board.

The Nominating and Corporate Governance Committee charter sets forth certain criteria for the committee to consider in evaluating potential director nominees. In addition to evaluating a potential director’s independence, the committee will consider whether director candidates satisfy criteria established by the Board of Directors in order to assure that our Board will have the necessary breadth and depth to perform its oversight function effectively, such as: integrity, honesty and adherence to high ethical standards; demonstrated business acumen, experience and ability to exercise sound judgments and willingness to contribute positively to the decision-making process of the Company; skills and experience in one or more areas relevant to us; willingness and capability to take the time to actively participate in Board and committee meetings and related activities; ability to understand the interests of our various constituencies; and the ability to satisfy independence standards with no conflicts of interest. Our Board values diversity on the Board, including gender, racial and ethnic diversity, as well as a range of different experiences, educations, backgrounds, perspectives, skills and knowledge. Our Board is committed to seeking women and individuals from minority groups to serve as directors. To that end, the Nominating and Corporate Governance Committee will endeavor to include women and individuals from minority groups in the pool from which new nominees are chosen. The committee may reevaluate and recommend for Board approval the relevant criteria for Board membership from time to time in response to changing business factors or regulatory requirements. Our full Board will be responsible for selecting candidates for election as directors based on the recommendation of the Nominating and Corporate Governance Committee.

Our Board of Directors has adopted Corporate Governance Guidelines to address significant corporate governance issues. These guidelines provide a framework for our corporate governance initiatives and cover topics including, but not limited to, director qualification and responsibilities, Board composition, director orientation and continuing education, ethics and conflict of interest, Board access to management and advisers, director compensation, Board and committee self-evaluation, the responsibilities of our Lead Director, Board meetings and administration and succession planning. The Nominating and Corporate Governance Committee is responsible for overseeing and reviewing the guidelines and reporting and recommending to our Board any changes to the guidelines. The guidelines are available without charge on our corporate website.

frontdoor • 2023 Proxy Statement 24

We expect all of our directors to attend our annual meetings of stockholders and be available to answer questions from stockholders at the meetings. Between meetings, we expect William C. Cobb, our Chairman of the Board of Directors and CEO, and/or Jessica P. Ross, our Senior Vice President and Chief Financial Officer (“CFO”), to engage with stockholders on a regular basis at industry and financial conferences, road shows, and one-on-one meetings. In addition, we are committed to engaging in stockholder outreach to better understand our stockholders’ perspectives and to better understand their priorities and concerns on the topics of our corporate governance and executive compensation, as well as broader ESG practices. We believe that ongoing engagement builds mutual trust and understanding with our stockholders.

During the last twelve months, we have reached out to or engaged with many of our largest stockholders—representing a majority of our outstanding shares—to discuss any feedback they may have. The feedback we have received from our major stockholders has been supportive, and included suggestions regarding our strategy, shareholder communications, a focus on stock price appreciation, ESG disclosure and linkage to strategy and considerations for linkage of incentive compensation to our strategy. See the sections below“—Environmental, Social and Governance” and “Compensation Discussion and Analysis—Determination of Executive Compensation—Prior Year Say on Pay Vote” and “Compensation Discussion and Analysis—Components of 2022 Compensation—Long-Term Equity Incentive Awards—2022 Awards” for more information on how we addressed these comments in fiscal 2022.

Any stockholder or interested party who wishes to communicate with our Board of Directors as a whole, the independent directors, or any individual member of the Board or any committee of the Board may write to or email the Company at: c/o General Counsel, Frontdoor, Inc., 3400 Players Club Parkway, Ste. 300, Memphis, Tennessee 38125-1731 or Board_of_Directors@frontdoorhome.com.

Our Board of Directors has designated our General Counsel or his or her designee as its agent to receive and review written communications addressed to the Board, any of its committees, or any Board member or group of Board members. The General Counsel may communicate with the sender for any clarification. The General Counsel will promptly forward to the Chairman of the Board and Lead Director all communications, other than ordinary business communications, and in consultation with the Chairman of the Board and CEO, will determine the next steps. The General Counsel will also forward to the appropriate committee chair any communication alleging financial, legal, ethical or compliance issues or any other matter deemed by the General Counsel to be potentially material to us. As an initial matter, the General Counsel will determine whether the communication is a proper communication for the Board. The General Counsel will not forward to the Board, any committee or any director communications of a personal nature or not related to the duties and responsibilities of the Board, including, without limitation, junk mail and mass mailings, business or employment solicitations, routine customer service complaints, new product or service suggestions, opinion survey polls or any other communications deemed by the General Counsel to be insignificant to the Company, which we consider to be ordinary business communications. The General Counsel provides regular reports on the communications received to the Nominating and Corporate Governance Committee.

frontdoor • 2023 Proxy Statement 25

Our Board of Directors as a whole has responsibility for overseeing our risk management. The Board exercises this oversight responsibility directly and through its committees, and each committee provides reports to the full Board regarding the matters that it oversees. Because it directly impacts oversight of our operations and our strategy, the Board is also responsible for oversight of our enterprise risk management (“ERM”) program. The oversight responsibility of the Board and its committees is informed by reports from our management team and from our internal audit department that are designed to provide visibility to the Board into the identification and assessment of key risks and our risk mitigation strategies, and the Board also has access to external advisors as needed.

The full Board of Directors has primary responsibility for evaluating strategic and operational risk management, and succession planning. Our Audit Committee is responsible for overseeing our major financial and accounting risk exposures and the steps our management has taken to monitor and control these exposures, including policies and procedures for assessing and managing risk, and for overseeing compliance related to legal and regulatory exposure, and meets regularly with our chief legal and compliance officer. Our Audit Committee also undertakes responsibility for assisting the Board in overseeing cybersecurity risk, including policies and procedures for assessing and managing that risk, and meets with appropriate members of our management team regarding such risk at least quarterly. Our Compensation Committee evaluates risks arising from our compensation policies and practices, as more fully described below. The Nominating and Corporate Governance Committee oversees risks associated with ESG issues, including the assessment and development of plans to address risks arising from ESG issues.