0001726978201912-31FYFALSEP4YP3YP3YP4Y00017269782019-01-012019-12-31iso4217:USD00017269782019-06-28xbrli:shares0001726978us-gaap:CommonClassAMember2020-03-130001726978us-gaap:CommonClassBMember2020-03-130001726978gshd:CommissionsAndAgencyFeesMember2019-01-012019-12-310001726978gshd:CommissionsAndAgencyFeesMember2018-01-012018-12-310001726978us-gaap:FranchiseMember2019-01-012019-12-310001726978us-gaap:FranchiseMember2018-01-012018-12-310001726978gshd:InterestIncome1Member2019-01-012019-12-310001726978gshd:InterestIncome1Member2018-01-012018-12-3100017269782018-01-012018-12-310001726978us-gaap:CapitalUnitClassBMember2018-01-012018-12-31iso4217:USDxbrli:shares00017269782019-12-3100017269782018-12-310001726978gshd:InitialFranchiseFeeMember2018-12-310001726978us-gaap:CommonClassAMember2019-12-310001726978us-gaap:CommonClassAMember2018-12-310001726978us-gaap:CommonClassBMember2019-12-310001726978us-gaap:CommonClassBMember2018-12-310001726978us-gaap:MemberUnitsMember2017-12-3100017269782017-12-310001726978us-gaap:MemberUnitsMember2018-01-012018-03-3100017269782018-01-012018-03-310001726978us-gaap:MemberUnitsMember2018-03-310001726978us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-03-310001726978us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-03-310001726978us-gaap:AdditionalPaidInCapitalMember2018-03-310001726978us-gaap:RetainedEarningsMember2018-03-310001726978us-gaap:ParentMember2018-03-310001726978us-gaap:NoncontrollingInterestMember2018-03-3100017269782018-03-310001726978us-gaap:MemberUnitsMember2018-04-012018-05-0100017269782018-04-012018-05-010001726978us-gaap:MemberUnitsMember2018-05-0100017269782018-05-010001726978us-gaap:MemberUnitsMember2018-05-022018-12-310001726978us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-05-022018-12-310001726978us-gaap:AdditionalPaidInCapitalMember2018-05-022018-12-310001726978us-gaap:RetainedEarningsMember2018-05-022018-12-310001726978us-gaap:ParentMember2018-05-022018-12-310001726978us-gaap:NoncontrollingInterestMember2018-05-022018-12-3100017269782018-05-022018-12-310001726978us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-05-022018-12-310001726978us-gaap:MemberUnitsMember2018-12-310001726978us-gaap:CommonClassAMemberus-gaap:CommonStockMember2018-12-310001726978us-gaap:CommonStockMemberus-gaap:CommonClassBMember2018-12-310001726978us-gaap:AdditionalPaidInCapitalMember2018-12-310001726978us-gaap:RetainedEarningsMember2018-12-310001726978us-gaap:ParentMember2018-12-310001726978us-gaap:NoncontrollingInterestMember2018-12-310001726978us-gaap:RetainedEarningsMember2019-01-010001726978us-gaap:ParentMember2019-01-010001726978us-gaap:NoncontrollingInterestMember2019-01-0100017269782019-01-010001726978us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001726978us-gaap:RetainedEarningsMember2019-01-012019-12-310001726978us-gaap:ParentMember2019-01-012019-12-310001726978us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001726978us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-01-012019-12-310001726978us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-01-012019-12-310001726978us-gaap:CommonClassAMemberus-gaap:CommonStockMember2019-12-310001726978us-gaap:CommonStockMemberus-gaap:CommonClassBMember2019-12-310001726978us-gaap:AdditionalPaidInCapitalMember2019-12-310001726978us-gaap:RetainedEarningsMember2019-12-310001726978us-gaap:ParentMember2019-12-310001726978us-gaap:NoncontrollingInterestMember2019-12-310001726978us-gaap:IPOMemberus-gaap:CommonClassAMember2018-05-012018-05-010001726978us-gaap:IPOMemberus-gaap:CommonClassAMember2018-05-010001726978us-gaap:OverAllotmentOptionMemberus-gaap:CommonClassAMember2018-05-012018-05-01gshd:locationxbrli:pure0001726978gshd:GooseheadInsuranceHoldingLLCMembergshd:GooseheadInsuranceAgencyLLCMember2019-01-012019-12-31gshd:franchisegshd:class0001726978gshd:PreIPOLLCMembersMemberus-gaap:CommonClassBMember2018-05-012018-05-01gshd:vote00017269782018-05-012018-05-010001726978gshd:GooseheadManagementNoteAndTexasWasatchNoteMember2018-05-010001726978gshd:GooseheadManagementLLCAndTexasWasatchInsuranceHoldingsGroupLLCMemberus-gaap:CommonClassAMember2018-05-012018-05-010001726978gshd:GooseheadInsuranceInc.Membergshd:GooseheadFinancialLLCMember2018-05-022018-05-020001726978gshd:PreIPOLLCMembersMembergshd:GooseheadFinancialLLCMember2018-05-022018-05-02gshd:carrier0001726978gshd:CarrierOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001726978us-gaap:CustomerConcentrationRiskMembergshd:CarrierTwoMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001726978gshd:CarrierOneMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310001726978us-gaap:CustomerConcentrationRiskMembergshd:CarrierTwoMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310001726978us-gaap:FurnitureAndFixturesMember2019-01-012019-12-310001726978us-gaap:ComputerEquipmentMember2019-01-012019-12-310001726978us-gaap:InternetDomainNamesMember2019-01-012019-12-310001726978us-gaap:ComputerSoftwareIntangibleAssetMember2019-01-012019-12-310001726978gshd:InitialFranchiseFeeMember2019-12-310001726978gshd:CommissionsAndAgencyFeesMemberus-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2019-01-012019-12-310001726978us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Membergshd:CommissionsAndAgencyFeesMember2019-01-012019-12-310001726978us-gaap:FranchiseMemberus-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2019-01-012019-12-310001726978us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Memberus-gaap:FranchiseMember2019-01-012019-12-310001726978us-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2019-01-012019-12-310001726978us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member2019-01-012019-12-310001726978us-gaap:CalculatedUnderRevenueGuidanceInEffectBeforeTopic606Member2019-12-310001726978us-gaap:DifferenceBetweenRevenueGuidanceInEffectBeforeAndAfterTopic606Member2019-12-310001726978gshd:RenewalCommissionsMembergshd:FranchiseChannelMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:RenewalCommissionsMember2019-01-012019-12-310001726978gshd:RenewalCommissionsMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:RenewalRoyaltyFeesMembergshd:FranchiseChannelMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:RenewalRoyaltyFeesMember2019-01-012019-12-310001726978gshd:RenewalRoyaltyFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:InitialFranchiseFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:InitialFranchiseFeesMember2019-01-012019-12-310001726978gshd:InitialFranchiseFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:OtherFranchiseRevenuesMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:OtherFranchiseRevenuesMember2019-01-012019-12-310001726978gshd:OtherFranchiseRevenuesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMembergshd:InterestIncome1Member2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:InterestIncome1Member2019-01-012019-12-310001726978gshd:FranchiseChannelMember2019-01-012019-12-310001726978gshd:CorporateChannelMember2019-01-012019-12-310001726978us-gaap:TransferredAtPointInTimeMembergshd:FranchiseChannelMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310001726978us-gaap:TransferredAtPointInTimeMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:TransferredOverTimeMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:TransferredOverTimeMember2019-01-012019-12-310001726978us-gaap:TransferredOverTimeMember2019-01-012019-12-310001726978gshd:FranchiseChannelMember2019-12-310001726978gshd:FranchiseFeesReceivableMember2019-12-310001726978gshd:FranchiseFeesReceivableMember2018-12-310001726978gshd:FranchiseFeesReceivableMember2017-12-310001726978gshd:FranchiseFeesReceivableMember2018-01-012018-12-310001726978gshd:FranchiseFeesReceivableMemberus-gaap:AccountingStandardsUpdate201409Member2019-01-010001726978gshd:FranchiseFeesReceivableMember2019-01-010001726978gshd:FranchiseFeesReceivableMember2019-01-012019-12-310001726978gshd:AgencyFeesReceivablesMember2017-12-310001726978gshd:AgencyFeesReceivablesMember2018-01-012018-12-310001726978gshd:AgencyFeesReceivablesMember2018-12-310001726978gshd:AgencyFeesReceivablesMember2019-01-010001726978gshd:AgencyFeesReceivablesMember2019-01-012019-12-310001726978gshd:AgencyFeesReceivablesMember2019-12-310001726978us-gaap:FurnitureAndFixturesMember2019-12-310001726978us-gaap:FurnitureAndFixturesMember2018-12-310001726978us-gaap:ComputerEquipmentMember2019-12-310001726978us-gaap:ComputerEquipmentMember2018-12-310001726978gshd:NetworkEquipmentMember2019-12-310001726978gshd:NetworkEquipmentMember2018-12-310001726978gshd:PhoneSystemMember2019-12-310001726978gshd:PhoneSystemMember2018-12-310001726978us-gaap:LeaseholdImprovementsMember2019-12-310001726978us-gaap:LeaseholdImprovementsMember2018-12-31gshd:year0001726978us-gaap:LineOfCreditMember2018-08-020001726978us-gaap:NotesPayableToBanksMember2018-08-020001726978us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2020-03-050001726978us-gaap:NotesPayableToBanksMemberus-gaap:SubsequentEventMember2020-03-050001726978us-gaap:LineOfCreditMember2018-08-030001726978us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMember2018-08-032018-08-030001726978us-gaap:NotesPayableToBanksMemberus-gaap:LondonInterbankOfferedRateLIBORMember2018-08-032018-08-030001726978us-gaap:LineOfCreditMember2019-12-310001726978us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMember2020-03-060001726978us-gaap:LineOfCreditMember2019-01-012019-12-310001726978us-gaap:LineOfCreditMember2018-01-012018-12-310001726978us-gaap:NotesPayableToBanksMember2019-12-310001726978srt:ScenarioForecastMember2020-03-012020-06-300001726978srt:ScenarioForecastMember2020-09-302021-06-300001726978gshd:ThresholdOneMember2019-12-310001726978gshd:ThresholdOneMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001726978gshd:ThresholdTwoMember2019-12-310001726978gshd:ThresholdTwoMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001726978gshd:ThresholdThreeMember2019-12-310001726978gshd:ThresholdThreeMemberus-gaap:LondonInterbankOfferedRateLIBORMember2019-01-012019-12-310001726978gshd:ThresholdFourMember2019-12-310001726978us-gaap:LondonInterbankOfferedRateLIBORMembergshd:ThresholdFourMember2019-01-012019-12-310001726978us-gaap:NotesPayableToBanksMember2018-08-032018-08-030001726978gshd:TaxReceivableAgreementMembergshd:PreIPOLLCMembersMember2019-01-012019-12-310001726978gshd:LLCUnitsMember2019-01-012019-12-310001726978gshd:LLCUnitsMember2018-01-012018-12-310001726978gshd:TaxReceivableAgreementMember2019-01-012019-12-310001726978gshd:TaxReceivableAgreementMembergshd:PreIPOLLCMembersMember2019-12-310001726978gshd:TaxReceivableAgreementMembergshd:PreIPOLLCMembersMember2018-12-310001726978us-gaap:CommonClassAMember2019-01-012019-12-310001726978us-gaap:CommonClassAMember2018-01-012018-12-310001726978us-gaap:CommonClassBMember2019-01-012019-12-310001726978us-gaap:CommonClassBMember2018-01-012018-12-310001726978us-gaap:AdditionalPaidInCapitalMembersrt:ScenarioPreviouslyReportedMember2018-01-012018-12-310001726978us-gaap:AdditionalPaidInCapitalMembersrt:RestatementAdjustmentMember2018-01-012018-12-310001726978us-gaap:AdditionalPaidInCapitalMembergshd:AsCorrectedMember2018-01-012018-12-310001726978us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2018-01-012018-12-310001726978srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2018-01-012018-12-310001726978us-gaap:RetainedEarningsMembergshd:AsCorrectedMember2018-01-012018-12-310001726978us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2018-01-012018-12-310001726978us-gaap:ParentMembersrt:RestatementAdjustmentMember2018-01-012018-12-310001726978us-gaap:ParentMembergshd:AsCorrectedMember2018-01-012018-12-310001726978srt:ScenarioPreviouslyReportedMemberus-gaap:NoncontrollingInterestMember2018-01-012018-12-310001726978srt:RestatementAdjustmentMemberus-gaap:NoncontrollingInterestMember2018-01-012018-12-310001726978gshd:AsCorrectedMemberus-gaap:NoncontrollingInterestMember2018-01-012018-12-310001726978us-gaap:AdditionalPaidInCapitalMembersrt:ScenarioPreviouslyReportedMember2018-12-310001726978us-gaap:AdditionalPaidInCapitalMembersrt:RestatementAdjustmentMember2018-12-310001726978us-gaap:AdditionalPaidInCapitalMembergshd:AsCorrectedMember2018-12-310001726978us-gaap:RetainedEarningsMembersrt:ScenarioPreviouslyReportedMember2018-12-310001726978srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2018-12-310001726978us-gaap:RetainedEarningsMembergshd:AsCorrectedMember2018-12-310001726978us-gaap:ParentMembersrt:ScenarioPreviouslyReportedMember2018-12-310001726978us-gaap:ParentMembersrt:RestatementAdjustmentMember2018-12-310001726978us-gaap:ParentMembergshd:AsCorrectedMember2018-12-310001726978srt:ScenarioPreviouslyReportedMemberus-gaap:NoncontrollingInterestMember2018-12-310001726978srt:RestatementAdjustmentMemberus-gaap:NoncontrollingInterestMember2018-12-310001726978gshd:AsCorrectedMemberus-gaap:NoncontrollingInterestMember2018-12-310001726978us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001726978gshd:PreIPOLLCMembersMember2019-01-012019-12-310001726978gshd:PreIPOLLCMembersMember2018-01-012018-12-310001726978gshd:GooseheadInsuranceInc.Membergshd:LLCUnitsMember2019-01-012019-12-310001726978gshd:GooseheadInsuranceInc.Membergshd:LLCUnitsMember2018-01-012018-12-310001726978gshd:LLCUnitsMember2018-05-012018-05-010001726978gshd:PreIPOLLCMembersMembergshd:LLCUnitsMember2019-01-012019-12-310001726978gshd:PreIPOLLCMembersMembergshd:LLCUnitsMember2018-01-012018-12-310001726978gshd:PreIPOLLCMembersMemberus-gaap:CommonClassBMember2019-01-012019-12-310001726978gshd:PreIPOLLCMembersMemberus-gaap:CommonClassBMember2018-01-012018-12-310001726978us-gaap:ParentMember2019-12-312019-12-310001726978gshd:GooseheadFinancialLLCMember2019-12-310001726978us-gaap:ParentMember2018-12-312018-12-310001726978gshd:GooseheadFinancialLLCMember2018-12-310001726978us-gaap:NoncontrollingInterestMember2019-12-312019-12-310001726978gshd:VariousNoncontrollingInterestHoldersMember2019-12-310001726978us-gaap:NoncontrollingInterestMember2018-12-312018-12-310001726978gshd:VariousNoncontrollingInterestHoldersMember2018-12-3100017269782019-12-312019-12-3100017269782018-12-312018-12-310001726978srt:WeightedAverageMembergshd:VariousNoncontrollingInterestHoldersMember2019-12-310001726978srt:WeightedAverageMembergshd:VariousNoncontrollingInterestHoldersMember2018-12-310001726978us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001726978us-gaap:EmployeeStockOptionMember2018-01-012018-12-310001726978us-gaap:CommonClassBMember2018-04-012018-06-300001726978gshd:LLCUnitsAndCommonClassBMember2018-05-012018-05-010001726978gshd:LLCUnitsAndCommonClassBMember2018-04-012018-06-300001726978gshd:EmployeeMemberus-gaap:EmployeeStockOptionMember2018-05-012018-05-010001726978us-gaap:EmployeeStockOptionMember2018-05-012018-05-010001726978us-gaap:EmployeeStockOptionMembersrt:DirectorMember2018-05-012018-05-010001726978us-gaap:EmployeeStockOptionMember2019-12-310001726978us-gaap:EmployeeStockOptionMembersrt:DirectorMember2019-01-012019-12-310001726978gshd:EmployeeMemberus-gaap:EmployeeStockOptionMember2019-01-012019-12-310001726978us-gaap:CommonClassAMembergshd:OmnibusIncentivePlanMember2018-04-300001726978us-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2018-04-300001726978gshd:OmnibusIncentivePlanMember2019-03-070001726978us-gaap:EmployeeStockMember2019-03-070001726978us-gaap:EmployeeStockMember2019-12-310001726978us-gaap:EmployeeStockMember2018-12-3100017269782019-03-072019-03-0700017269782019-03-182019-03-180001726978us-gaap:CommonClassAMember2019-03-182019-03-180001726978us-gaap:CommonClassBMember2019-03-182019-03-18gshd:segment0001726978gshd:RenewalCommissionsMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:RenewalCommissionsMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:RenewalCommissionsMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:AgencyFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:NewBusinessCommissionsMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:ContingentCommissionsMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:CommissionsAndAgencyFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:CommissionsAndAgencyFeesMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:CommissionsAndAgencyFeesMember2019-01-012019-12-310001726978gshd:RenewalRoyaltyFeesMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:RenewalRoyaltyFeesMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:RenewalRoyaltyFeesMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:NewBusinessRoyaltyFeesMember2019-01-012019-12-310001726978gshd:FranchiseFeesReceivableMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:FranchiseFeesReceivableMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:FranchiseFeesReceivableMember2019-01-012019-12-310001726978gshd:FranchiseFeesReceivableMember2019-01-012019-12-310001726978us-gaap:OperatingSegmentsMembergshd:FranchiseChannelMember2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMember2019-01-012019-12-310001726978gshd:FranchiseRevenueMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateChannelMembergshd:FranchiseRevenueMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:FranchiseRevenueMember2019-01-012019-12-310001726978gshd:FranchiseRevenueMember2019-01-012019-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:InterestIncome1Member2019-01-012019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:InterestIncome1Member2019-01-012019-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:InterestIncome1Member2019-01-012019-12-310001726978us-gaap:OperatingSegmentsMembergshd:FranchiseChannelMember2019-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMember2019-12-310001726978gshd:CorporateAndReconcilingItemsMember2019-12-310001726978gshd:RenewalCommissionsMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateChannelMembergshd:RenewalCommissionsMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:RenewalCommissionsMember2018-01-012018-12-310001726978gshd:RenewalCommissionsMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:AgencyFeesMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:AgencyFeesMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:AgencyFeesMember2018-01-012018-12-310001726978gshd:AgencyFeesMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessCommissionsMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessCommissionsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:NewBusinessCommissionsMember2018-01-012018-12-310001726978gshd:NewBusinessCommissionsMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:ContingentCommissionsMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:ContingentCommissionsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:ContingentCommissionsMember2018-01-012018-12-310001726978gshd:ContingentCommissionsMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:CommissionsAndAgencyFeesMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:CommissionsAndAgencyFeesMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:CommissionsAndAgencyFeesMember2018-01-012018-12-310001726978gshd:RenewalRoyaltyFeesMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateChannelMembergshd:RenewalRoyaltyFeesMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:RenewalRoyaltyFeesMember2018-01-012018-12-310001726978gshd:RenewalRoyaltyFeesMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessRoyaltyFeesMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:NewBusinessRoyaltyFeesMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:NewBusinessRoyaltyFeesMember2018-01-012018-12-310001726978gshd:NewBusinessRoyaltyFeesMember2018-01-012018-12-310001726978gshd:FranchiseFeesReceivableMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateChannelMembergshd:FranchiseFeesReceivableMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:FranchiseFeesReceivableMember2018-01-012018-12-310001726978gshd:FranchiseFeesReceivableMember2018-01-012018-12-310001726978us-gaap:OperatingSegmentsMembergshd:FranchiseChannelMember2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMember2018-01-012018-12-310001726978gshd:FranchiseRevenueMembergshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateChannelMembergshd:FranchiseRevenueMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:FranchiseRevenueMember2018-01-012018-12-310001726978gshd:FranchiseRevenueMember2018-01-012018-12-310001726978gshd:FranchiseChannelMemberus-gaap:OperatingSegmentsMembergshd:InterestIncome1Member2018-01-012018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMembergshd:InterestIncome1Member2018-01-012018-12-310001726978gshd:CorporateAndReconcilingItemsMembergshd:InterestIncome1Member2018-01-012018-12-310001726978us-gaap:OperatingSegmentsMembergshd:FranchiseChannelMember2018-12-310001726978gshd:CorporateChannelMemberus-gaap:OperatingSegmentsMember2018-12-310001726978gshd:CorporateAndReconcilingItemsMember2018-12-310001726978us-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2020-03-050001726978us-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2020-03-060001726978us-gaap:LineOfCreditMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-062020-03-060001726978us-gaap:SubsequentEventMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SecuredDebtMember2020-03-062020-03-060001726978us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2020-03-062020-03-060001726978us-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SubsequentEventMemberus-gaap:SecuredDebtMember2020-03-062020-03-060001726978gshd:ThresholdOneMemberus-gaap:SubsequentEventMember2020-03-060001726978gshd:ThresholdOneMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-062020-03-060001726978gshd:ThresholdTwoMemberus-gaap:SubsequentEventMember2020-03-060001726978gshd:ThresholdTwoMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-062020-03-060001726978gshd:ThresholdThreeMemberus-gaap:SubsequentEventMember2020-03-060001726978gshd:ThresholdThreeMemberus-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-03-062020-03-060001726978us-gaap:SubsequentEventMembergshd:ThresholdFourMember2020-03-060001726978us-gaap:SubsequentEventMemberus-gaap:LondonInterbankOfferedRateLIBORMembergshd:ThresholdFourMember2020-03-062020-03-060001726978us-gaap:SubsequentEventMember2020-03-0500017269782019-01-012019-03-3100017269782019-04-012019-06-3000017269782019-07-012019-09-3000017269782019-10-012019-12-3100017269782018-04-012018-06-3000017269782018-07-012018-09-3000017269782018-10-012018-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38466

GOOSEHEAD INSURANCE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | | |

| Delaware | | 82-3886022 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

| 1500 Solana Blvd, Building 4, Suite 4500 | | |

| Westlake | | |

| Texas | | 76262 | |

| (Address of principal executive offices) | | (Zip Code) |

(214) 838-5500

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class A Common Stock, par value $.01 per share | | GSHD | | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No þ.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No þ.

Note: Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Large accelerated filer | | ☐

| | Accelerated filer | | ☑ |

| | | | | | | |

| Non-accelerated filer | | ☐

| | Smaller reporting company | | ☑

|

| | | | | | |

| | | | Emerging growth company | | ☑

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ.

The aggregate market value of the voting common equity held by non-affiliates of the registrant, computed by reference to the last reported price at which the registrant’s common equity was sold on June 28, 2019 (the last day of the registrant’s most recently completed second quarter) was $562,753,750, computed using a closing price on that day of $47.8.

As of March 13, 2020, there were 15,756,999 shares of Class A common stock outstanding and 20,536,015 shares of Class B common stock outstanding

Documents incorporated by reference:

Portions of the registrant's definitive Proxy Statement for its 2020 Annual Meeting of Shareholders, which will be filed with the Securities and Exchange Commission within 120 days of December 31, 2019, are incorporated by reference into Part III, Items 10-14 of this Annual Report on Form 10-K.

Table of contents

| | | | | |

| | Page |

| PART I | |

| Item 1. Business | |

| Item 1A. Risk Factors | |

| Item 1B. Unresolved staff comments | |

| Item 2. Properties | |

| Item 3. Legal proceedings | |

| Item 4. Mine safety disclosures | |

| PART II | |

| Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| Item 6. Selected financial data | |

| Item 7. Management’s discussion and analysis of financial condition and results of operations | |

| Item 7A. Quantitative and qualitative disclosure of market risks | |

| Item 8. Financial statements and supplementary data | |

| Item 9. Changes in and disagreements with accountants on accounting and financial statement disclosure | |

| Item 9A. Controls and procedures | |

| Item 9B. Other information | |

| PART III | |

| Item 10. Directors, executive officers, and corporate governance | |

| Item 11. Executive compensation | |

| Item 12. Security ownership of certain beneficial owners and management and related stockholder matters | |

| Item 13. Certain relationships and related transactions, and director independence | |

| Item 14. Principal accountant fees and services | |

| PART IV | |

| Item 15. Exhibits and financial statement schedules | |

| Signatures | |

In this annual report on Form 10-K (“Annual Report”), “Goosehead,” the “Company,” “GSHD,” “we,” “us” and “our” refer to Goosehead Insurance, Inc. and its consolidated subsidiaries, including Goosehead Financial, LLC, together.

Commonly used defined terms

As used in this Annual Report, unless the context indicates or otherwise requires, the following terms have the following meanings:

•Ancillary Revenue: Revenue that is supplemental to our Core Revenue and Cost Recovery Revenue, Ancillary Revenue is unpredictable and often outside of the Company's control. Included in Ancillary Revenue are Contingent Commissions and other income.

•Agency Fees: Fees separate from commissions charged directly to clients for efforts performed in the issuance of new insurance policies.

•ASC 605: Legacy revenue recognition standard ASC 605, Revenue Recognition. This legacy revenue recognition was used for periods prior to 2019.

•ASC 606 ("Topic 606"): ASU 2014-09 - Revenue from Contracts with Customers.

•Book of Business: Insurance policies bound by us with our Carriers on behalf of our clients.

•Best Practices Study: The industry group metrics are based on the latest date for which complete financial data are publicly available such as a 2018 Best Practices Study containing 2017 industry data conducted by Reagan Consulting and the Independent Insurance Agents & Brokers of America, Inc.

•Captive Agent: An insurance agent who only sells insurance policies for one Carrier.

•Carrier: An insurance company.

•Carrier Appointment: A contractual relationship with a Carrier.

•Client Retention: Calculated by comparing the number of all clients that had at least one policy in force twelve months prior to the date of measurement and still have at least one policy in force at the date of measurement.

•Contingent Commission: Revenue in the form of contractual payments from Carriers contingent upon several factors, including growth and profitability of the business placed with the Carrier.

•Core Revenue: The most predictable revenue stream for the Company, these revenues consist of New Business Revenue and Renewal Revenue. New Business Revenue is lower-margin, but fairly predictable. Renewal Revenue is higher-margin and very predictable.

•Corporate Channel: The Corporate Channel distributes insurance through a network of company-owned and financed operations with employees that are hired, trained and managed by Goosehead.

•Corporate Channel Adjusted EBITDA: Segment earnings before interest, income taxes, depreciation and amortization allocable to the Corporate Channel.

•Cost Recovery Revenue: Revenue received by the Company associated with cost recovery efforts associated with selling and financing franchises. Included in Cost Recovery Revenue are Initial Franchise Fees and Interest Income.

•Franchise Agreement: Agreements governing our relationships with Franchisees.

•Franchise Channel: The Franchise Channel network consists of Franchisee operations that are owned and managed by Franchisees. These business owners have a contractual relationship with Goosehead to use our processes, training, implementation, systems and back-office support team to place insurance. In exchange, Goosehead is entitled to an Initial Franchise Fee and Royalty Fees.

•Franchise Channel Adjusted EBITDA: Segment earnings before interest, income taxes, depreciation and amortization, adjusted to exclude other non-operating items allocable to the Franchise Channel.

•Franchisee: An individual or entity who has entered into a Franchise Agreement with us.

•GF: Goosehead Financial, LLC.

•GM: Goosehead Management, LLC.

•Initial Franchise Fee: Contracted fees paid by Franchisees to compensate Goosehead for the training, onboarding and ongoing support of new franchise locations.

•LLC Unit: a limited liability company unit of Goosehead Financial, LLC.

•New Business Commission: Commissions received from Carriers relating to policies in their first term.

•New Business Production per Agent (Corporate): The New Business Revenue collected in the Corporate Channel, divided by the average number of full-time Corporate Channel sales agents for the same period. This calculation excludes interns, part-time sales agents and partial full-time equivalent sales managers.

•New Business Production per Agent (Franchise): The gross commissions paid by Carriers and Agency Fees received related to policies in their first term sold in the Franchise Channel divided by the average number of sales agents in the Franchise Channel for the same period prior to paying Royalty Fees to the Company. This calculation excludes part-time agents and production related to the Book of Business that was sold in 2017 related to a Franchisee termination.

•New Business Production per Agency: The gross commissions paid by Carriers and Agency Fees received related to policies in their first term sold in the Franchise Channel divided by the average number of franchises in the Franchise Channel for the same period prior to paying Royalty Fees to the Company.

•New Business Revenue: New Business Commissions, Agency Fees, and New Business Royalty Fees.

•New Business Royalty Fees: Royalty Fees received from Franchisees relating to policies in their first term

•NPS: Net Promoter Score is calculated based on a single question: “How likely are you to refer Goosehead Insurance to a friend, family member or colleague?” Customers that respond with a 6 or below are Detractors, a score of 7 or 8 are called Passives, and a 9 or 10 are Promoters. NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

•P&C: Property and casualty insurance.

•Policies in Force: As of any reported date, the total count of current (non-cancelled) policies placed by us with our Carriers.

•Pre-IPO LLC Members: owners of LLC Units of GF prior to the Offering.

•Referral Partner: An individual or entity with whom a sales agent establishes a referral relationship.

•Renewal Revenue: Renewal Commissions and Renewal Royalty Fees.

•Royalty Fees: Fees paid by Franchisees to the Company that are tied to the gross commissions paid by the Carriers related to policies sold or renewed in the Franchise Channel.

•Segment: One of the two Goosehead sales distribution channels, the Corporate Channel or the Franchise Channel.

•Segment Adjusted EBITDA: Either Corporate Channel Adjusted EBITDA or Franchise Channel Adjusted EBITDA.

•The Offering: The initial public offering completed by Goosehead Insurance, Inc. on May 1st, 2018.

•Total Written Premium: As of any reported date, the total amount of current (non-cancelled) gross premium that is placed with Goosehead’s portfolio of Carriers.

•TWIHG: Texas Wasatch Insurance Holdings Group, LLC.

•Unvalidated Producers: A metric used by Reagan Consulting describing agents whose production does not yet cover their wages under their agency’s commission formula.

Special note regarding forward-looking statements

We have made statements under the captions “Item 1. Business,” “Item 1A. Risk factors,” “Item 7. Management’s discussion and analysis of financial condition and results of operations” and in other sections of this Annual Report that are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including those factors discussed under “Item 1A. Risk factors.” You should specifically consider the numerous risks outlined under “Item 1A. Risk factors.”

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. We are under no duty to update any of these forward-looking statements after the date of this Annual Report to conform our prior statements to actual results or revised expectations.

PART I

Item 1. Business

Company overview

We are a leading independent personal lines insurance agency, based on personal lines revenue, reinventing the traditional approach to distributing insurance products and services throughout the United States. We were founded with one vision: to put our clients at the center of our universe and build the business around delivering them the best experience and value. By leveraging our differentiated business model and innovative technology platform, we are able to deliver to consumers a superior insurance experience. Our business model is unique in how we combine the following attributes to drive operation excellence:

•Choice Model: We represent over 100 insurance companies that underwrite personal lines and small commercial lines risks, which typically enables us to provide broader insurance coverage at a lower price point than competing agents who represent only a few Carriers, Carriers with Captive Agents or Carriers that distribute directly to consumers.

•Best-In-Class Service Center: In contrast to the traditional insurance agency model, we separate the sales function from the service function, thus enabling agents to focus on selling, and service personnel to focus on delivering superior client service. We have achieved best-in-class net promoter scores for client service, nearly 2.4x the 2018 P&C industry average.

•Proprietary Technology: Our technology platform empowers our agents with tools to better manage their sales initiatives and provides our service personnel with real-time 360-degree visibility of client accounts.

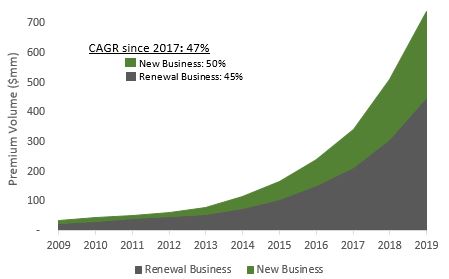

Our business has grown substantially since our founding in 2003. Today we are a rapidly-growing independent insurance agency and franchisor in the United States. Our operations now include a network of seven corporate sales offices and 948 franchise locations (inclusive of 334 franchises which are under contract but yet to be opened as of December 31, 2019). In addition, we have service center operations at our headquarters in Westlake, Texas and a second service center in Henderson, Nevada. Our growth is reflected in our financial performance. Beginning as of 2019, the Company adopted the new accounting guidance, ASC Topic 606, related to revenue from contracts with customers. Under this new accounting standard, revenue grew period over period by 29% for the year ended December 31, 2019. Total Written Premium, which we believe is the best leading indicator of future revenue growth because it drives our future Core Revenue and gives us potential opportunities to earn Ancillary Revenue in the form of Contingent Commissions, grew 45% to $739 million from $509 million in 2018. This growth has been driven by our team’s ability to recruit talented agents to our platform, our agents’ leveraging of Goosehead's sales blueprint and proprietary technology leading to higher levels of productivity in winning new business, and our service centers’ ability to retain renewal business. All of our growth has been organic; we have not relied on mergers or acquisitions. Furthermore, we are profitable. For the year ended December 31, 2019 the Company had $10.4 million of net income, a $29.0 million increase over 2018. See "Item 7. Management's discussions and analysis of financial condition and results of operations - Key performance indicators" for additional information and a reconciliation to the most directly comparable GAAP financial measure.

Our insurance product offerings primarily consist of (i) homeowner’s insurance, (ii) auto insurance, (iii) other personal lines products, including flood, wind and earthquake insurance, (iv) excess liability or umbrella insurance, (v) specialty lines insurance, including motorcycle, recreational vehicle and other insurance, (vi) commercial lines insurance, including general liability, property and auto insurance for small businesses, and (vii) life insurance. We do not take any insurance underwriting risk in the operation of our business.

We enter into contracts with our insurance Carriers called appointments that set the terms of engagement, define legal ownership of client accounts and client data, and determine compensation. Our 2019 average commission rate on new business premium was 15% and on renewal business premium was 13%. Commission rates can vary across Carriers, states and lines of business, and typically range from 10% to 20%. Because we represent a broad set of Carriers that all have unique risk appetites and underwriting strategies, we can usually provide our clients with broader insurance coverage at a lower price point than competing agents who represent only one Carrier exclusively, or Carriers that distribute directly to insurance buyers.

We have two Segments that work together to drive our growth: the Corporate Channel and Franchise Channel.

The Corporate Channel

The Corporate Channel consists of company-owned and financed operations with employees who are hired, trained and managed by us. The Corporate Channel also serves as a research and development department, where we develop best practices and beta test new technology before implementing system-wide. Additionally, the Corporate Channel serves as an invaluable support network for our Franchise Channel, providing sales coaching and mentoring for Franchisees.

In the Corporate Channel, we generate Core Revenue in the form of Renewal Commissions, New Business Commissions and non-refundable Agency Fees charged directly to clients for efforts performed in the issuance of new insurance policies. We also generate Ancillary Revenue in the form of Contingent Commissions from Carriers related to the overall growth and loss performance of the Book of Business we have placed with them. The Corporate Channel is comprised of employed sales agents located in six sales offices in Texas and one in Illinois. We have experienced rapid growth in sales agents and revenue in this Segment. During 2019, our Corporate Channel sales agent headcount increased by 49% and our Corporate Channel premiums placed grew by 28%, in each case, versus the prior year. Corporate Channel premium growth trailed headcount growth due to the large renewal mix of our premiums placed and the ongoing ramp up of recently hired producers. As of December 31, 2019, we had corporate sales offices operating in the following locations: Westlake, Texas; Irving, Texas; Fort Worth, Texas; Houston, Texas; The Woodlands, Texas; Austin, Texas; and Rosemont, Illinois. We expect to continue our expansion in 2020 with the addition of corporate sales offices in Charlotte, North Carolina and a new office in Fort Worth, Texas.

The Franchise Channel

The Franchise Channel consists of operations that are owned and managed by Franchisees. These Franchisees have a contractual relationship with the Company to use our processes, Carrier appointments, systems, and back-office support team to sell insurance and manage their business. In exchange, the Company is entitled to an Initial Franchise Fee and ongoing Royalty Fees. In addition to managing our two Segments, our headquarters is responsible for overseeing our client service centers, our network of Referral Partners, our recruiting team and our technology functions which tie all aspects of our business together. Our headquarters also provides various risk management, quality control, accounting, legal and finance functions in support of both the Corporate Channel and the Franchise Channel.

In the Franchise Channel, we earn Core Revenue in the form of New Business Royalty Fees and Renewal Royalty Fees generated by the franchise location. New Business Royalty Fees are set in the Franchise Agreements at 20% of commissions and Agency Fees received during the first term of the policy, and 50% of commissions every year the policy is renewed. This economic relationship creates a mechanical step-up in revenue at the first renewal of each policy, creating strong revenue and margin expansion opportunities.

Cost Recovery Revenue consists of non-refundable Initial Franchise Fees, which compensate us for the training and onboarding efforts to launch a new franchise location, and Interest Income related to Franchisees which elect the payment plan option for their Initial Franchise Fee. Ancillary Revenue consists of Contingent Commissions and other income.

The Franchise Channel is comprised of Franchisees and sales agents that they hire as employees in their franchised businesses. Our Franchise Agreement has a ten-year term and governs the terms under which we operate together, among other things, defining the Initial Franchise Fee, Royalty Fees and other costs a Franchisee pays. Franchisees have contractual rights to revenue related to the Book of Business during the term of their agreement, but we retain ultimate ownership over the policies written in each franchised business.

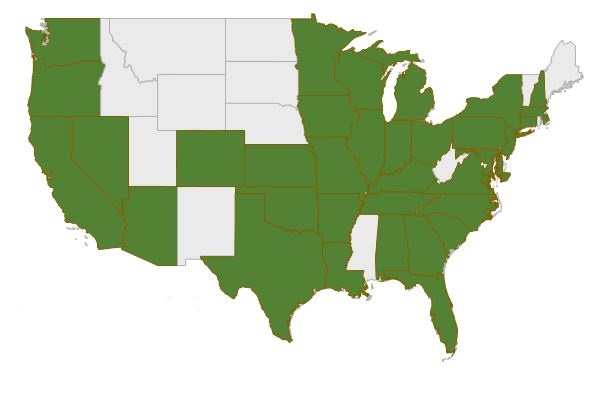

We started franchising in 2012 and have since expanded rapidly. Premiums in the Franchise Channel grew 56% during 2019. As of December 31, 2019, we have 948 total franchises, including 614 franchises operating and 334 in implementation, a 47% increase in total franchises and a 34% increase in operating agencies in 2019 compared to 2018. As of December 31, 2019, we had 334 signed Franchise Agreements that are in the implementation process. We have franchise locations either operating or signed in the following states, which cover over 90% of the US population:z

| | | | | | | | |

| Geographic footprint | Operating or signed agencies | |

| State | December 31, 2019 |

| Texas | 231 | |

| California | 101 | |

| Illinois | 63 | |

| Florida | 60 | |

| Michigan | 46 | |

| Pennsylvania | 45 | |

| Georgia | 37 | |

| New York | 37 | |

| North Carolina | 34 | |

| Louisiana | 30 | |

| New Jersey | 28 | |

| South Carolina | 29 | |

| Virginia | 27 | |

| Ohio | 26 | |

| Other | 154 | |

| Total(1) | 948 | |

(1)Number of franchise locations include 334 franchises which are under contract but yet to be opened as of December 31, 2019.

Our Go-to-Market Strategy

Our business model allows our sales agents in both Segments to concentrate on sales and marketing activities related to acquiring new clients and issuing new policies, thus growing New Business Revenue and Renewal Revenue more rapidly than in other systems. Their primary marketing efforts are focused on establishing referral relationships with other financial services providers in their communities using our marketing strategy. This strategy is effective primarily due to our world-class service team handling all service work related to the sales agents' existing Book of Business. The nature of Referral Partner leads allows us to realize higher close rates and lower client acquisition costs than what we believe to be standard in the industry. Furthermore, our agents are typically dealing with homeowners who own other assets, such as automobiles and therefore tend to be better insurance risks from a Carrier’s perspective. Such clients often purchase additional policies, such as auto insurance, which allows us to capture additional revenue and increases the likelihood of retaining the client in the future. We do not compensate Referral Partners for leads, but rather rely on our servicing capabilities to generate repeat business.

We have significant room to expand our market share across the country. Our biggest presence is in Texas where we have been operating the longest. By leveraging our Referral Partners, we placed approximately 43 thousand policies related to mortgage originations in 2019. This represents 12.1% of the approximately 357 thousand Texas mortgage originations in 2019, according to the Texas A&M Real Estate Center.

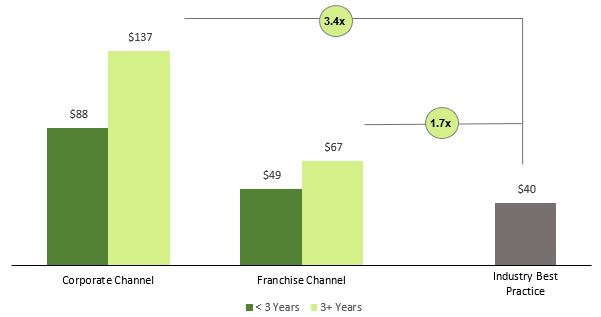

Our model, which allows agents to focus on New Business Revenue, is highly differentiated from the traditional insurance agency model. In the traditional agency model, agents are responsible for both new business and ongoing service. The burden of providing ongoing service distracts from the ability to acquire new clients, and ultimately limits an agent's opportunity for growth. Our agents are not only freed from the burden of ongoing service, but also given technology tools that create efficiencies by allowing them to quote faster and prioritize marketing efforts to the highest producing Referral Partners. As a result, agents in both Segments are substantially more productive than top performers in our industry as it relates to new sales. Compared to the 2019 Best Practices Study, which uses 2018 industry data, Corporate Channel agents with more than three years of tenure averaged 3.4x as much New Business Production per Agent as the industry best practice during 2018. Franchise Channel agents with more than three years of tenure averaged 1.7x as much New Business Production per Agent (Franchise) as the industry best practice during 2018.

| | |

| New Business Revenue per agent by tenure ($000s) |

|

Source: Internal data for 2018; Carrier provided information; Reagan Consulting 2019 Best Practices Study (using 2018 data)

(1)Represents industry best practice per Reagan Consulting; does not include Unvalidated Producers; most industry agents have tenures significantly longer than 2 to 3 years.

We believe our agent productivity compares even more favorably to the industry than the Best Practices Study would imply because the Best Practices Study excludes Unvalidated Producers. If the Best Practices Study included Unvalidated Producers, our New Business Production per Agent outperformance would be even larger.

In 2019, New Business Production per Agent in the Corporate Channel was $61 thousand for agents with less than 1 year of tenure and $123 thousand for agents with more than one year of tenure. Including all producers in the Franchise Channel in 2019, New Business Production per Agency was $50 thousand for agencies with less than 1 year of tenure and $95 thousand for agents with more than one year of tenure in Texas. Outside of Texas during 2019, New Business Production per Agency was $38 thousand for agencies with less than 1 year of tenure and $66 thousand for agencies with more than one year of tenure.

Our Service Centers

Both the Corporate Channel and the Franchise Channel are supported by our client service centers. Our service centers are staffed by fully licensed property and casualty service agents, who provide fulfillment and quality control services for newly issued insurance policies, accounting services and ongoing support services for clients. Ongoing support services for clients include: handling client inquiries, facilitating the claims process with Carriers, accepting premium payments and processing policy changes, and renewals. Our service agents are also focused on selling additional insurance coverages to clients which account for additional New Business Revenue.

Our two separate service centers provide us with the ability to cover the U.S. time zones more broadly, and the ability to better manage business continuity risks. We manage our service centers with the goal to maximize NPS, which we believe maximize retention. This differentiated level of service has enabled us to earn an NPS of 89 in 2019 and 2018—greater than highly regarded brands like Ritz Carlton and Nordstrom and 2.4x the 2018 industry average, according to Satmetrix. Our high degree of client satisfaction drove our 88% Client Retention rate during 2019, which we believe to be among the highest in the industry. Our retention rate is even stronger on a premium basis. In 2019, we retained 91% of the premiums we distributed in 2018. Our premium retention rate is higher than our Client Retention rate as a result of both premiums increasing year over year and additional coverages sold by our service team. By maintaining this strong level of Client Retention, we are able to generate revenue that is highly predictable and recurring in nature.

The combination of expanding headcount in the Corporate and Franchise Channels, leveraging technology and maintaining our commitment to service led to revenue growth of 40% (net of revenue changes due to the adoption

of Topic 606) and Total Written Premium growth of 45% in 2019. As of December 31, 2019, our 10-year Total Written Premium CAGR was 36% and our 5-year premium CAGR was 45%.

| | | | | | | | |

| Total Written Premium by Channel | | Total Written Premium by Term |

| | |

Source: Carrier provided information

In addition to strong revenue and Total Written Premium growth, we have also experienced Franchise Channel and Corporate Channel Adjusted EBITDA margin expansion when adjusted for the impact of the adoption of ASC 606. If reported under ASC 605, Franchise Channel Adjusted EBITDA margin was 37% in 2019, up from 33% in 2018 due to continue growth in our more profitable Renewal Royalty Fees and Contingent Commissions. Corporate Channel Adjusted EBITDA margin, if reported under ASC 605, was 26% in 2019, up from 22% in 2018 due to our Corporate Channel sales agent headcount growth of 49%, high retention rates of 88%, and Contingent Commission revenue. As reported under ASC 606, our Franchise Channel and Corporate Channel margins were 30% and 23%, respectively. While we believe our margins will mechanically expand over time, we are focused predominately on maintaining our industry leading levels of strong organic growth as we increase our market share.

| | | | | | | | | | | | | | | | | | | | | | | |

| 2019 | | | | 2018 | | |

| Franchise

Channel | | Corporate

Channel | | Franchise

Channel | | Corporate

Channel |

| ($000s) | | | | | | | |

| Revenue | $ | 34,650 | | | | $ | 42,836 | | | | $ | 25,861 | | | | $ | 34,287 | |

| Segment Adjusted EBITDA | 10,464 | | | | 9,947 | | | | 8,615 | | | | 7,536 | |

| Segment Adjusted EBITDA margin | 30 | % | | | 23 | % | | | 33 | % | | | 22 | % |

Industry trends

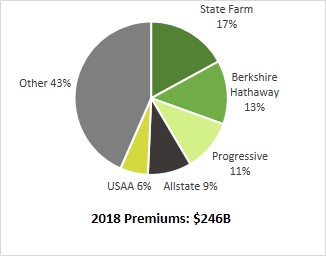

We primarily compete in the United States personal lines insurance distribution industry. Personal lines products typically include home, auto, umbrella, motorcycle, flood and recreational insurance. We compete for business on the basis of reputation, client service, product offerings and the ability to tailor our products to the specific needs of a client. There are principally three types of businesses that sell personal lines products:

•Independent agencies (35% personal lines market share in 2017 according to the Independent Insurance Agents & Brokers of America, Inc.). Independent agencies are “independent” of any one Carrier and can offer insurance products from multiple Carriers to their clients. There are approximately 36,500 independent insurance agencies in the United States, according to the 2019 Future One Agency Universe Case Study. Many of the largest insurance agencies, such as Aon plc, Arthur J. Gallagher & Co., Brown & Brown Inc., Marsh & McLennan Companies, Inc. and Willis Towers Watson plc, focus primarily on commercial lines. We believe that we are one of the largest independent insurance agencies focused primarily on personal lines.

•Captive Agencies (47% personal lines market share in 2017 according to the Independent Insurance Agents & Brokers of America, Inc.). Captive Agencies sell products for only one Carrier. The Carrier compensates the Captive Agency through sales commissions based on premiums placed on behalf of clients. The Carrier also provides the Captive Agency with operational support including advertising and certain back office functions. The largest Captive Agencies in the United States include Allstate Corporation, State Farm Mutual Automobile Insurance Company and Farmers Group, Inc.

•Direct distribution (18% personal lines market share in 2017 according to the Independent Insurance Agents & Brokers of America, Inc.). Certain Carriers market their products directly to clients. Historically, this strategy has been most effective for targeting clients who require auto insurance only, with clients seeking bundled solutions relying on advice from independent and Captive Agents. The largest Carriers that sell directly to clients include Berkshire Hathaway Inc. (via GEICO Corp.) and Progressive Corporation (Progressive also distributes through independent agencies, including GSHD).

Personal lines insurance agents generate revenues through commissions, which are calculated as a percentage of the total insurance premium placed on behalf of clients, and through fees for other related services. Premiums in the personal lines insurance market have grown consistently with underlying insured values and the overall economy.

| | | | | | | | | | | | | | |

| Personal lines products | | | | Personal lines premium trends ($ billions) |

| Auto premiums | | Homeowners premiums | | |

| | | | |

Source: S&P Global Market Intelligence and National Association of Insurance Commissioners

Premium pricing within the P&C insurance industry has historically been cyclical, based on the underwriting capacity of the insurance industry and economic conditions. External events, such as terrorist attacks, and man-made and natural disasters, may have significant impacts on the insurance market. We use the terms ‘‘soft market’’ and ‘‘hard market’’ to describe the business cycles experienced by the industry. A soft market is an insurance market characterized by a period of declining premium rates, which can negatively affect commissions earned by insurance agents. A hard market is an insurance market characterized by a period of rising premium rates, which, absent other changes, can positively affect commissions earned by insurance agents.

Our Segments

Our Segments are geared to leverage the strengths of two different talent pools to maximize productivity. Our recruiting team, which included 61 people at December 31, 2019, is responsible for recruiting both Corporate sales agents and potential Franchise owners. The Corporate Channel recruits driven agents who are typically new to insurance distribution; the Franchise Channel recruits agents with business or industry experience. The combination of our two Segments enables us to prudently expand our business model while providing differentiated service to our clients.

Corporate Channel (55% of 2019 total revenue)

The Corporate Channel is a key support structure for our Franchise Channel and a primary competitive advantage for the Company. This channel primarily targets top college graduates or sales professionals who typically do not have experience in the insurance industry. The majority of candidates are sourced through a combination of on-campus recruiting, employee referrals and highly targeted internet recruiting campaigns. Our recruitment team seeks candidates with strong communication skills who display a high aptitude for learning new concepts, are motivated by professional and financial incentives and display the ability to succeed in a team-oriented environment.

After the recruitment team has selected candidates, they are placed into a training class that lasts approximately two weeks. Both Corporate and Franchise Channel agents are required to become fully licensed P&C agents prior to training. During the training class, Corporate Channel agents acquire a wide variety of skills including:

•knowledge of all available personal lines products and the trade-offs between pricing and coverage;

•the ability to fit their clients to the best insurance products at the right price point;

•the ability to leverage our well-established network of Referral Partners to win new business;

•the ability to leverage our service centers to service policies and handle renewal activities; and

•the ability to leverage our technology tools to increase productivity.

The combination of hiring highly motivated and talented individuals, giving them proper tools and training and removing the burden of ongoing client service allows our Corporate Channel agents to become significantly more productive than average personal lines agents. Compared to the 2019 Best Practices Study, Corporate Channel agents with more than two years of tenure averaged 3.4x as much New Business Production per Agent (Corporate) as the industry best practice.

Franchise Channel (45% of 2019 total revenue)

The Franchise Channel primarily recruits agents with prior business or industry experience. Our Franchise Channel has a unique value proposition to experienced agents who understand the limits and pain points of the traditional agency model:

•Franchise Channel agents gain access to products from multiple Carriers in their markets, allowing the agents to better serve their clients and Referral Partners by providing choice. Captive Agents typically can only sell products from one Carrier.

•Franchise Channel agents can leverage our service centers to handle service requests and process renewals. Most traditional agencies require their agents to handle client service and renewals which diminishes the time they can devote to winning additional new business and growing their agencies. Traditional agencies can become the victims of their own success as their increasing service burden crowds out time to sell new business.

•Franchise Channel agents use our well-established sales processes to win new business. Franchise Channel agents are trained side by side with Corporate Channel agents to leverage our training program, to acquire product and Carrier knowledge and to utilize our technology and back office support. Our Corporate Channel continues its investment in the success of our Franchise Channel well past initial training in the form of ongoing sales coaching and mentoring, as well as serving as fertile recruiting ground for future regional territory managers within our franchise support team.

•Franchise Channel agents benefit from lean startup costs as they do not require additional employees or a retail location to launch their agencies. Captive Agents are often required to immediately hire two to three additional employees as support staff, lease a storefront location, and contribute a specific percentage of revenue toward an advertising budget. Further, most fixed costs in a traditional agency (e.g., administrative costs, technology fees, training expenses and service costs) are diminished or eliminated in our Franchise Channel due to Goosehead’s scale, and we expect that fixed costs will continue to decrease as the Franchise Channel grows.

•Franchise Channel agents own an economic interest in their Books of Business.

The recruiting team seeks applicants who have demonstrated a strong capacity to win new business and a desire to own their own business. Our recruiting efforts have helped us create a franchise pool which is significantly more productive than average personal lines agents. Compared to the 2019 Best Practices Study, Franchise Channel agents with more than three years of tenure averaged 1.7x as much New Business Production per Agent (Franchise) as the industry best practice. Franchise Channel agents with less than two years of tenure maintained equally as much New Business Production per Agent (Franchise) as the industry best practice.

Our competitive strengths

We believe that our competitive strengths include the following:

•Highly motivated producers in the Corporate Channel. The agents in the Corporate Channel are fundamentally different than the typical agents in the personal lines industry. Substantially all of our agents are recent college graduates, whereas 64% of personal lines agents in the industry are over 50 years old, according to the 2018

Future One Agency Universe Case Study. This gives us a significant advantage both in the short- and long-term. In the short-term, our agents have proven to be especially adept at learning new techniques and mastering new technologies. This has enabled our agents to generate approximately 3.4x as much new business as top performing personal lines agents after three years, according to the 2019 Best Practices Study. Over the long-term, we believe our youth will enable us to avoid the shrinking workforce challenges that many of our competitors face and win an even larger market share from other agencies. According to Independent Insurance Agents & Brokers of America, Inc., 42% of independent agencies anticipate a change of control within the next five years. We believe an aging industry workforce will create significant disruption in the personal lines distribution industry, and we will be in a position to win displaced clients. Additionally, our Corporate Channel agents view the success of the Franchise Channel as a potential catalyst to their career trajectories. The support structure provided by the Corporate Channel to the Franchise Channel creates unique career paths in sales management, territory management, and even franchise ownership.

•Franchise Channel solves the inherent flaws in the traditional agency model. We believe that the traditional agency model is flawed for several reasons, including: (1) Captive Agents can only offer clients products from one Carrier, limiting the agents’ ability to best serve their clients, (2) agents are typically responsible for handling their own client service and renewals, diminishing the time they can devote to marketing, winning new business and growing their overall Book of Business, (3) agents are often using antiquated and decentralized tech platforms to sell and service their Book of Business, and (4) some Captive Agents do not own their Book of Business, giving them less incentive to win new business. Given the size of the traditional agency market and its inability to adapt to these challenges without introducing significant channel conflict, we believe there is a meaningful opportunity to disrupt the traditional agency marketplace. Agents in the Franchise Channel are able to focus on marketing, winning new business, providing clients with choice by offering products from multiple Carriers, and they own an economic interest in their Book of Business. Furthermore, by removing the service burden which takes a significant amount of time and energy, we believe our platform provides Franchise Channel agents with the ability to grow more quickly and manage larger Books of Business than agents working in a traditional agency model. As a result, the Goosehead model has proven to be attractive to high-performing agents who wish to achieve greater professional and financial success.

•Single technology platform with end-to-end business process management. Our operations utilize an innovative proprietary cloud-based technology solution customized to suit our needs. Our technology provides our agents with tools to better manage their sales and marketing activities, and our service center operations with real-time 360-degree visibility of client accounts. Additionally, our technology provides agents with data and analytics which allow them to make smarter business decisions. Importantly, our integrated solution allows us to pivot quickly and upgrade our technology offering without a large financial investment. We believe our single, sales-oriented technology platform is differentiated relative to most insurance agency IT environments that utilize disparate accounting-driven agency management vendors and legacy mainframe systems across their operations. Our technology platform has been a key enabler of our rapid growth while also driving efficiencies. One of these efficiencies is service expenses. Our 2018 service expenses as a percentage of gross commissions were 3.8x lower than the industry best practice according to the 2019 Best Practices Study, which uses 2018 data. Despite our reduced service expense load, we are able to maintain best in class NPS scores and retention.

•Service centers drive both new and renewal business. Our service centers handle all of our client service and renewals and have achieved a highly differentiated level of service as indicated by our NPS scores of 89 in 2019 and 2018—higher than many global service leaders such as Ritz Carlton and Nordstrom and 2.4x the P&C industry average, according to Satmetrix. Having such a skilled and fully licensed service team provides three tangible benefits to our business: (1) allowing our agents to focus virtually all of their time on cultivating new Referral Partner relationships and winning new business (instead of preserving existing business), (2) generating strong Client Retention which provides a stable source of highly visible and recurring revenue and (3) providing opportunities to earn additional revenue as our service agents are highly trained in cross-selling and generating referral business. Our service agents typically originate significant amounts of New Business Revenue through cross-sale and referral generation. We believe that our service centers will continue to drive a competitive advantage by supporting our industry-leading productivity and our recruiting efforts. We continue to make the necessary technology, staffing and real estate investments in our service centers to support our planned agent hiring which we believe will allow us to readily scale and increase market share. Each of our service agents can service, on average, a Book of Business that it would take a good sales agent years to generate.

•Unique value proposition to Referral Partners. We have highly standardized processes across our entire organization due to the strong quality controls instituted in our service centers. Both new business and renewal business move through our systems in a tightly choreographed manner which enables both strong quality

controls and quick delivery of services. We have found that the ability to quickly and accurately bind an insurance policy is attractive to both individuals buying insurance and third parties, such as Referral Partners, who can drive new business to us. Referral Partners include financial services providers who depend on us to timely place insurance policies and to provide the flexibility to facilitate necessary changes rapidly, including at the time of home closings. We typically deliver policy binders in under an hour, which allows our Referral Partners to close transactions on time and ultimately become more productive in their business. We do not compensate our Referral Partners for sending us new business.

•Proven and experienced senior management team. Our senior management team has a long history of cohesively operating together and implementing our business model.

◦Our Chairman and Chief Executive Officer, Mark E. Jones, co-founded Goosehead in 2003. Prior to co-founding Goosehead, Mr. Jones was a Senior Partner and Director at Bain & Company, a global management consulting firm, where he also served for many years as Global Head of Recruiting. Many of our management, sales and recruiting practices were developed and refined by Mr. Jones during his time at Bain and instituted at Goosehead. Mr. Jones has received a wide variety of accolades for his leadership accomplishments, including being recognized as one of the Top Rated CEOs from among more than 7,000 companies with less than 1,000 employees on Glassdoor’s “Employee’s Choice Award” in 2017.

◦In 2006, Michael Colby was recruited to join Goosehead as Controller. Over the last 12 years, Mr. Colby has worked closely with Mr. Jones in all aspects of the business, taking on increasing responsibility; becoming Chief Financial Officer in 2010, Chief Operating Officer of our Franchise Channel in 2011, Chief Operating Officer of Goosehead in 2014, and President and Chief Operating Officer of Goosehead in 2016.

◦Mark Colby has served as Chief Financial Officer since 2016. Mr. Colby joined Goosehead in 2012 as Manager of Strategic Initiatives, where he worked on Information Systems platform development and migration, real estate planning, and business diversification initiatives. Mr. Colby oversees Goosehead’s internal and external financial reporting, budgeting and forecasting, payroll/401(k) administration, treasury function, and investor relations.

◦Ryan Langston joined Goosehead Insurance in 2014 as Vice President and General Counsel. He is responsible for coordinating and leading legal activity and compliance. Prior to joining Goosehead, Mr. Langston was an attorney with Strasburger & Price, LLP where he represented businesses in commercial litigation and arbitration involving business dissolutions, theft of trade secrets, enforcement of noncompetition agreements, and breach of contracts.

Key elements of our growth strategy

Our goal is to achieve long-term returns for our stockholders by establishing ourselves as the premier national distributor of personal lines insurance products. To accomplish this goal, we intend to focus on the following key areas:

•Continue to expand recruiting in the Corporate Channel. In order to grow both the Corporate Channel and Franchise Channel, we must expand our agent count in the Corporate Channel. We have a highly developed process for recruiting new agents which we have continually refined over the last decade and has resulted in higher success rates for our Corporate Channel agents. We plan to continue to expand our recruiting to additional college campuses and engage in highly targeted internet recruiting campaigns as we grow. As demonstrated in the chart below, our compensation package for sales agents is very competitive in comparison to other professional services and offers attractive long-term compensation opportunities.

| | |

| Average corporate agent compensation by vintage ($000) |

|