As

confidentially submitted to the U.S. Securities and Exchange Commission on November 1, 2018.

This

draft registration statement has not been filed publicly with the Securities and Exchange Commission and

all

information contained herein remains confidential.

Registration No. _____

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INX LIMITED

(Exact name of registrant as specified in its charter)

| Gibraltar | 6200 | Not Applicable | ||

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| incorporation or organization) | Classification Code Number) | Identification No.) |

57/63 Line Wall Road

Gibraltar, GX11 1AA

Gibraltar

Tel: +350 200 79000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware

+1 302 738 6680

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Mark

S. Selinger, Esq. McDermott Will & Emery LLP 340 Madison Avenue New York, NY 10173 +1 212 547 5400 |

Yuval Horn, Adv. Roy Ribon, Adv. Horn & Co. Law Offices Amot Investments Tower 2 Weizmann Street, 24th Floor Tel Aviv 6423902, Israel +972 3 637 8200 |

Aaron

Payas, CFA Hassans International Law Firm 57/63 Line Wall Road P.O. Box 199 Gibraltar GX11 1AA +350 200 79000 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

| Title

of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per Token(2) | Proposed

maximum aggregate offering price(2) | Amount

of registration fee(3) | ||||||||||||

| INX Token (1) | 130,000,000 | $ | $ | $ | ||||||||||||

| (1) | Described more fully on page 83. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission has declared this registration statement effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state or jurisdiction where such offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION | DATED __, 2018 |

INX LIMITED

130,000,000 INX Tokens

This is our initial public offering. We are offering 130,000,000 INX Tokens, (the “INX Tokens” or “Tokens”). Each INX Token will entitle its holder to an annual pro rata distribution of 20% of the Company’s net cash flow from operating activities, excluding any cash proceeds from an initial sale by the Company of an INX Token (“Adjusted Operating Cash Flow”). The annual distribution will be based on the Company’s cumulative Adjusted Operating Cash Flow net of cash flows which have already formed a basis for a prior distribution, calculated as of December 31 of each year. The distribution is payable on an annual basis commencing on April 30, 2020, and may thereafter be calculated and paid on an annual or a quarterly basis, subject to the board’s discretion. The pro rata distribution of the adjusted net cash flow is not self-executing and requires that our board of directors approve the Company’s financial statements and calculate such distribution in good faith. In addition, the INX Token may be used as a form of payment for transaction fees on the INX Trading platform, and INX Tokens are entitled to, at a minimum, a 10% discount as compared to other forms of payment. INX Tokens may also be used as a portion of the collateral deposited with the INX Trading platform for short positions. See “Description of INX Tokens.”

None of the rights granted to holders of INX Tokens are defined by the INX Token source code, the underlying blockchain, or its network attributes. Holders of INX Tokens have contractual rights determined by the INX Token Purchase Agreement. Pursuant to the terms of the INX Token Purchase Agreement, ownership of the INX Tokens and all rights under the INX Token Purchase Agreement are contingent upon holders of INX Tokens satisfying the Company’s KYC/AML procedures, including any requirements to periodically or otherwise update information provided to the Company. Each holder’s interest in INX Tokens will be evidenced by the INX Token Distributed Ledger.

There is currently no public market for the INX Token and no guarantee can be provided whether such a market will be established. We expect an initial public offering price of $__ per Token. The initial public offering price was arbitrarily determined by our Board of Directors. Payment for INX Tokens will be accepted in U.S. Dollars. After the Company meets the minimum offering requirement (as described below), payment for INX Tokens will also be accepted in Bitcoin (BTC) and Ether (ETH). BTC/USD and ETH/USD exchange rates will be determined by TradeBlock’s XBX and ETX Indices, respectively, as of 12:01 a.m. (GMT) on the date a purchaser has submitted an executed INX Token Purchase Agreement.

We will not complete the sale of any INX Tokens unless we raise gross offering proceeds of $5,000,000 from this offering (in U.S. Dollars) within one year from the date of this prospectus, which we refer to as the minimum offering requirement. See “Plan of Distribution.” Pending satisfaction of this condition, all subscription payments will be placed in an escrow account specifically established for this offering (the “Escrow Account”). If we do not meet the minimum offering requirement prior to the termination of this Offering, we will promptly return all funds in the Escrow Account (in U.S. Dollars) without interest or deduction. If the Company meets the minimum offering requirement, then the Company will conduct a closing of the committed purchases and the funds in the Escrow Account will be made immediately available to fund the Company’s operations. After the initial closing, sales will be conducted on a continuous basis. Any rejected subscription will have its funds returned promptly. We will continue our public offering until its termination, which will be effective upon the earliest to occur of: (i) the sale of all of the 130,000,000 INX Tokens being offered, (ii) 365 days after this registration statement is declared effective, or (iii) such shorter period as may be determined by the Company in its sole discretion.

The foregoing description of the INX Token Purchase Agreement is not a complete description of its terms. For more details about the INX Token Purchase Agreement, you should read the INX Token Purchase Agreement, which is attached as Exhibit 4.1 hereto, and is incorporated herein by reference.

In their report dated November 1, 2018, our independent auditors stated that our financial statements for the period ended December 31, 2017 were prepared assuming that we would continue as a going concern and they expressed substantial doubt about our ability to continue as a going concern.

We are an emerging growth company, as defined in the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, have elected to comply with certain reduced public company reporting requirements.

Purchasing INX Tokens involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus.

| Per Token | Total Minimum | Total Maximum | ||||||||||

| Initial public offering price | $ | $ | 5,000,000 | $ | ||||||||

| Underwriter’s discounts and commissions(1)(2) | $ | - | $ | 500,000 | $ | - | ||||||

| Net Proceeds to us (before expenses) | $ | $ | 4,500,000 | $ | ||||||||

| (1) | INX Tokens offered pursuant to this prospectus may be sold by our Company from time to time by our officers and directors directly to one or more purchasers. Our officers and directors will not receive any direct or indirect compensation for sales of INX Tokens. We have entered into an agreement with A-Labs Finance and Advisory Ltd. pursuant to which A-Labs will promote this offering to non-U.S. persons only, and will receive a contingent cash payment based on sales of INX Tokens to non-U.S. persons only. See “Plan of Distribution — Selling Agents and Expenses”. A-Labs will also receive a payment for non-broker services in an amount of $500,000 upon the Company selling at least $10 million worth of INX Tokens to U.S. persons. In addition, we reserve the right to engage broker-dealers who are FINRA members to participate in the offer and sale of our INX Tokens and to pay to such broker-dealers cash commissions of up to 7% of the gross proceeds from the sales of INX Tokens placed by them. Please refer to the section entitled “Plan of Distribution” for additional information. |

| (2) | For purposes of this calculation, we have assumed that (i) 100% of the INX Tokens sold in this offering will be sold to non-U.S. persons, which would entitle A-Labs to its contingent cash payment based on 100% of the gross proceeds received by us in this offering, and (ii) no other broker-dealers participate in this offering. |

None of the United States Securities and Exchange Commission, the Gibraltar Financial Services Commission, or any state securities commission or other jurisdiction has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

We expect to deliver the INX Tokens to the purchasers in this offering commencing on or about __, 2018.

The date of this prospectus is __, 2018.

i

You should rely only on the information contained in this prospectus and any related free-writing prospectus that we authorize to be distributed to you. We have not authorized any person, including any underwriter, to provide you with information different from that contained in this prospectus or any related free-writing prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, the INX Tokens in any state or jurisdiction where such offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of the INX Tokens offered hereby. Our business, financial condition, results of operations, and prospects may have changed since that date. We do not take any responsibility for, nor do we provide any assurance as to the reliability of, any information other than the information in this prospectus and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus nor the sale of INX Tokens means that information contained in this prospectus is correct after the date of this prospectus.

Market data and certain industry data and forecasts used throughout this prospectus were obtained from sources we believe to be reliable, including market research databases, publicly available information, reports of governmental agencies, and industry publications and surveys. We have relied on certain data from third party sources, including internal surveys, industry forecasts, and market research, which we believe to be reliable based on our management’s knowledge of the industry. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” and elsewhere in this prospectus.

Our financial statements are prepared and presented in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our historical results do not necessarily indicate our expected results for any future periods.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Unless derived from our financial statements or otherwise noted, the terms “dollar,” “U.S. dollar,” “US$,” “USD,” and “$” refer to U.S. dollars, the lawful currency of the United States.

ii

This is only a summary of the prospectus and does not contain or summarize all of the information contained in this prospectus which is material and/or which may be important to you. You should read this entire prospectus, including “Risk Factors,” before making an investment decision about the INX Tokens. Definitions used in this prospectus can be found in the section entitled “Glossary of Defined Terms”. Unless otherwise stated in this prospectus, references to:

| ● | “we,” “us,” “Company,” “our company” or “INX” refer to INX Limited and its wholly owned subsidiaries; |

| ● | “INX Services” refer to INX Services, Inc., a Delaware corporation, which we intend to register as a broker-dealer; |

| ● | “INX Trading” refer to INX Trading, an order book platform with a matching engine solution for the trading of different types of digital blockchain assets and fiat currencies which we intend to register as an alternative trading system (ATS) operated by INX Services; |

| ● | “INX Tokens,” “Tokens” or “our Tokens” refer to INX Tokens, an ERC20 blockchain asset that is programmed using a smart contract that is compatible with the Ethereum blockchain, and the rights of the INX Token holder, which are contractual rights set forth in the INX Token Purchase Agreement, as more fully described at page 75; |

| ● | “Trades” refer to changes in ownership of a blockchain asset that is not a transfer of a blockchain asset from one digital wallet to another digital wallet, and therefore is not recorded on a blockchain ledger, but which is recorded on the INX Services private and centralized database; |

| ● | “Transaction Fees” refer to fees that are charged by INX Services for the execution of a trade that occurs on the INX Trading platform; provided, however, that “transaction fees” do not include deposit fees, withdrawal fees or other fees that may be charged for the maintenance of the INX Brokerage Accounts; |

| ● | “Transfers” refer to transfers of blockchain assets from one digital wallet to another digital wallet as recorded on a blockchain ledger; |

| ● | “Transfer Fees” refer to fees that are charged blockchain network participants when a transfer is recorded on the blockchain; and |

| ● | “Companies Act” refers to Gibraltar Companies Act 2014. |

Overview

We are developing a regulated platform for trading blockchain assets and their derivatives (“INX Trading”) which will be operated by INX Services, Inc. (“INX Services”), our wholly-owned subsidiary. Our vision is to establish a trading platform and token that introduce regulatory transparency to the blockchain asset trading ecosystem. We plan to achieve this by: (1) obtaining appropriate regulatory licenses, including U.S. Broker-Dealer and Alternative Trading System licenses; (2) maintaining the INX Registry, which reflects a real time list of INX Token owners and holdings; (3) requiring compliance with KYC/AML procedures by all INX Token holders; and (4) granting certain rights to INX Token holders, including certain benefits on the INX Trading platform.

Through INX Services, which will be registered as a licensed broker-dealer, and the INX Trading platform, which will be registered as an alternative trading system (“ATS”), the Company intends to facilitate a market for blockchain assets, including security tokens. When fully operational, the INX Trading platform is expected to offer professional traders and other institutional investors, among other things, a trading platform with traditional marketplace practices, supported by a cash reserve. INX Trading will utilize established practices common in other regulated financial services markets, such as customary trading, clearing, and settlement procedures, regulatory compliance, capital and liquidity reserves and operational transparency. We plan to develop INX Trading as a centralized platform that facilitates peer-to-peer professional trading services through a suite of marketplace features and trading products, including the ability to take short positions and trade derivatives such as futures, options, and swaps. The architectural solution for the INX Trading platform is based on a sequential processing and storage, meaning that transactions on the trading platform can be processed only one after the other and not in parallel. INX Trading will enable trading via web portal and application programming interface (“API”) solutions.

In order to facilitate liquidity and support a vibrant trading market on the INX Trading platform, we intend to offer incentives to attract high volume traders and establish strategic partnerships with market makers. As we further develop the INX Trading platform, broker-dealers or other appropriately regulated third parties may route their customers’ trades to INX Trading by INX Trading platform API.

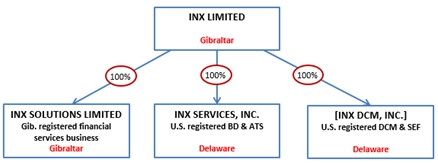

INX Services intends to file applications for registration as a broker-dealer and to operate INX Trading as an ATS. We intend to form another U.S. subsidiary to register with the CFTC as a designated contract market or swap execution facility. Our subsidiary in Gibraltar intends to apply to the Gibraltar Financial Services Commission for licenses under the Financial Services (Markets in Financial Instruments) Act 2018 and the Financial Services (Distributed Ledger Technology Providers) Regulations 2017 for our European-based operations.

1

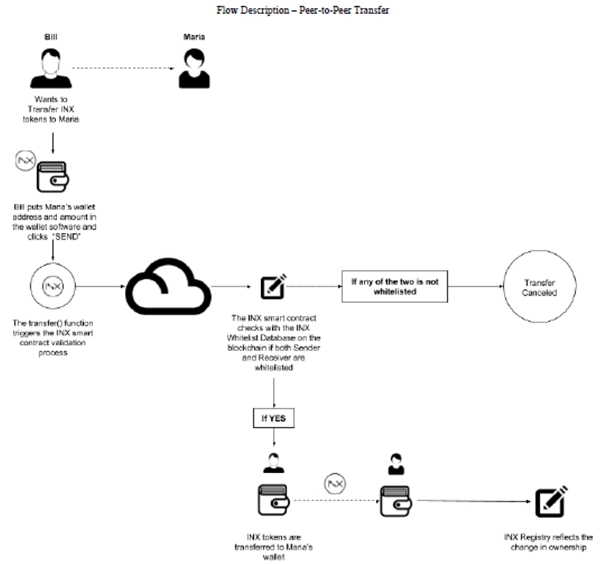

As part of the INX decentralized blockchain ecosystem, we have created the INX Token, which is offered pursuant to this prospectus. The INX Token is an ERC20 blockchain asset that is programmed using a smart contract that is compatible with the Ethereum blockchain. Prospective investors who have been duly identified through know-your-customer and anti-money laundering (“KYC/AML”) procedures may purchase, hold and transfer INX Tokens. In order to verify that INX Tokens are transferred between KYC/AML-vetted holders, transfers of INX Tokens will be executed by the INX Token smart contract under conditional permission that the wallet addresses of both the sender and receiver of INX Tokens are listed on a database stored on the data section of the INX Token smart contract (the “Whitelist Database”). If either the sender or receiver wallet address is not listed in the Whitelist Database, the smart contract rejects the transfer and the distributed ledger is not updated. The transferor of INX Tokens will be responsible for payment of the transfer fees on the Ethereum blockchain. For additional information regarding the fees incurred in connection with transfers, see “Description of INX Tokens”.

After INX Trading is operational, holders of INX Tokens may trade the INX Tokens on the INX Trading platform. All transfers of INX Tokens will be recorded on the INX Token Distributed Ledger. All trading transactions performed on the INX Trading Platform (for both INX Tokens and any other tokens listed for trading on the INX trading platform) will be recorded only on the internal centralized servers of INX Services. INX Services shall be responsible for the KYC/AML compliance of its customers and thus for any trade performed on the INX Trading Platform.

After the Offering is completed, new purchasers of INX Tokens can be added to the Whitelist Database by successfully completing KYC/AML procedures conducted by the Company, including INX Services, or by an appropriately regulated third party approved by the Company, such as a broker-dealer.

INX Token holders will be able to use the INX Token to pay INX Services transaction fees, which are entitled to, at a minimum, a 10% discount to other forms of payment. INX Token holders will also be able to use Tokens to post collateral on the INX Trading platform. In addition, holders of INX Tokens will be entitled to receive an annual pro rata distribution of 20% of the Adjusted Operating Cash Flow. The annual distribution will be based on the Company’s cumulative Adjusted Operating Cash Flow net of cash flows which have already formed a basis for a prior distribution, calculated as of December 31 of each year. The distribution will be payable on an annual basis commencing on April 30, 2020, and may thereafter be calculated and paid on an annual or a quarterly basis, subject to the board’s discretion. Further, in addition to a cash reserve to be comprised of 80% of the net proceeds from this offering in excess of $18 million, we plan to maintain a capital reserve and liquidity fund (the “Capital Reserve and Liquidity Fund”). The Capital Reserve and Liquidity Fund will consist initially of 35 million INX Tokens created but not previously sold by the Company to the public. In addition, we plan to reserve an additional 20% of the INX Tokens received by INX Services as payment of transaction fees, as long as the total amount of INX Tokens reserved does not exceed 35 million plus 50% of the number of INX Tokens sold by the Company to the public pursuant to this offering and subsequent offerings of INX Tokens (excluding re-issuances of reacquired INX Tokens), up to a maximum of 100 million INX Tokens. INX Tokens received as payment of transaction fees and not allocated to the Capital Reserve and Liquidity Fund or otherwise reserved by the Company may be sold in future offerings. See “Description of INX Tokens.”

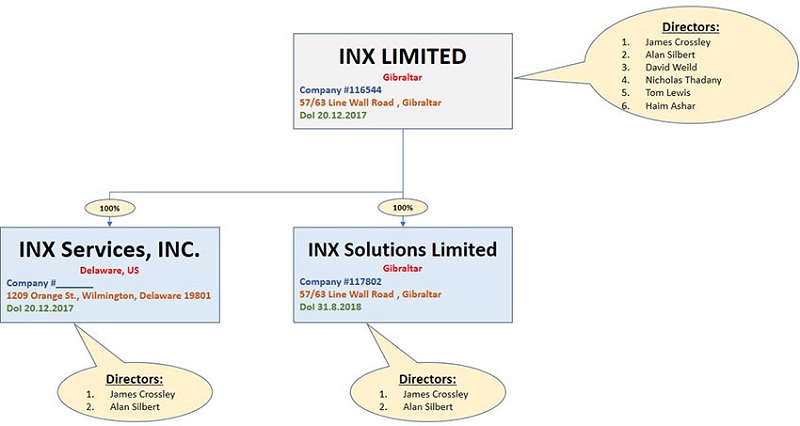

Corporate Information and Structure of INX

We are a Gibraltar private company limited by shares, incorporated on November 27, 2017. Approximately thirty-one percent (31%) of our issued share capital is held by Triple-V (1999) Ltd, an entity wholly owned by Shy Datika, one of our founders, our controlling shareholder and President (see – “Principal Shareholders”). The balance of our issued share capital is held by our employees, lenders, service providers and investors. We plan to have the following wholly-owned subsidiaries:

| ● | INX Services, Inc., a Delaware corporation, which we intend to register as a broker-dealer and an alternative trading system; |

| ● | INX DCM, Inc., which we plan to incorporate in Delaware to act as a designated contract market or swap execution facility, under separate governance; and |

| ● | INX Solutions Limited., incorporated in Gibraltar as a private company limited by shares, through which we intend to offer the Company’s services and products to the European market. We intend to apply to the Gibraltar Financial Services Commission for licenses under the Financial Services (Markets in Financial Instruments) Act 2018 and the Financial Services (Distributed Ledger Technology Providers) Regulations 2017 for our European-based operations. |

INX Limited’s registered office is located at 57/63 Line Wall Road, Gibraltar, GX11 1AA, Gibraltar, and its telephone number is +350 200 79000. After the INX Trading platform becomes fully operational, INX Limited intends to relocate its principal office to the United States.

2

Industry Overview

Background & Current Market

Blockchain assets, popularly known as “tokens” or “coins,” have experienced rapid growth mixed with dramatic volatility since first introduced in 2009 with the launch of Bitcoin. For example, on December 31, 2017, total market capitalization for all blockchain assets was over $570 billion. In early January 2018, total market capitalization of blockchain assets increased to approximately $835 billion, before beginning a significant decline throughout 2018. As of September 30, 2018, blockchain assets had a total market capitalization of approximately $200 billion.

Blockchain assets historically have not been issued by governments, banks or similar organizations but rather are collectively maintained by a decentralized user base, accessed through software, which also governs the blockchain asset’s creation, movement, and ownership. This lack of a single point of data collection is believed to enhance the security of traditional blockchain networks and blockchain assets. Nonetheless, blockchain assets and blockchain trading platforms remain susceptible to security breaches and cybercrime. For example, in January 2018, about $500 million worth of blockchain assets were stolen from a major Japanese trading platform.

The blockchain market has grown dramatically. As of July 31, 2018, approximately $21 billion in the aggregate had been raised through offerings of blockchain assets, many of which are initial coin offerings (“ICOs”), and over 120 blockchain asset trading platforms provide basic buy and sell services for one or more blockchain assets. As of September 30 2018, 46 trading platforms of blockchain assets average daily trading volumes over $20,000,000 and 15 trading platforms of blockchain assets average daily trading volume over $100,000,000. As of June 30, 2018, top blockchain asset trading platforms, based on USD 24-hour trading volume, include Binance, OKEx, Huobi, Bitfinex, Bithumb, Upbit, HitBTC, ZB.com, DigiFinex and BCEX.

There has been growing institutional interest in operating regulated blockchain asset exchanges and trading platforms and utilizing blockchain assets in bank financing practices. In January 2017, UBS, BNY Mellon, Deutsche Bank, Santander, NEX and blockchain startup Clearmatics announced their own blockchain asset issuances with the intent to incorporate blockchain assets in currency-related transactions, encourage regulation by central banks and create fiat-like asset-collateralized networks on custom blockchain platforms. In December 2017, Bank of America was awarded a patent for an automated digital currency exchange system. On December 18, 2017, the Chicago Board of Exchange began trading in bitcoin futures, and was joined shortly thereafter by CME Group, also offering bitcoin futures. Also in December 2017, Bloomberg added three cryptocurrencies to its terminal service (previously having provided bitcoin data since 2014) the Australian Securities Exchange (ASX) announced it would move forward with a plan to replace its current clearing and settlement process with a blockchain solution. In February 2018, Circle Internet Financial, a financial technology startup which counts Goldman Sachs as a key investor, purchased Poloniex, a digital asset exchange. As of March 2018, the European Central Bank and Bank of Japan are continuing to research blockchain applications for securities settlement systems. In May 2018, it was reported that Goldman Sachs will offer trading in bitcoin futures and non-deliverable forwards to its clients. In June 2018, The Gibraltar Blockchain Exchange, a subsidiary of the Gibraltar Stock Exchange, began operating as a trading platform for digital assets.

The significant growth of the blockchain asset market and the lack of regulated trading in blockchain assets have triggered an increase in governmental scrutiny. On July 25, 2017, the Securities and Exchange Commission (the “SEC”) issued a Report of Investigation pursuant to Section 21(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) that found that sales of tokens by a virtual organization known as The DAO (a “decentralized autonomous organization”) violated the federal securities laws by participating in the unregistered sale of securities. The SEC also has cautioned brokers, dealers and other market participants that (i) allow for payments in virtual currencies, (ii) allow customers to purchase virtual currencies on margin, or (iii) otherwise use virtual currencies to facilitate securities transactions to exercise particular caution, including ensuring that their virtual currency activities do not undermine their know-your-customer and anti-money laundering obligations. In December 2017, the SEC announced two enforcement actions against entities conducting token sales, followed soon after by a public statement by the Commission Chairman regarding cryptocurrencies and initial coin offerings addressed to both investors and market participants. In March 2018, the SEC Divisions of Enforcement and Trading and Markets issued a public statement noting that trading platforms for digital assets are required to comply with the federal securities laws and register with the SEC if the assets being traded are securities. Other recent regulatory action, speeches and enforcement actions have further developed the SEC’s position that the issuance of tokens are often securities offerings.

3

Finally, the CFTC has stated that virtual currencies, like bitcoin, may be commodities that are within the purview of the CFTC. On August 23, 2018, the United States District Court for the Eastern District of New York ruled in CFTC v. McDonnell, et al., No. 18-cv-361, ECF No. 29 (E.D.N.Y. Mar. 6, 2018), that “virtual currencies can be regulated by CFTC as a commodity” but left the door open for other regulatory bodies to regulate virtual currency concurrently.

However, because of the uncertainty built into a “facts and circumstances” analysis, as well as general regulatory uncertainty worldwide, companies have begun to structure their blockchain assets as securities and conduct sales of their blockchain assets as registered securities offerings. As blockchain assets take on the attributes of securities and market makers expand the breadth of blockchain asset trading products into spot, futures and derivative trading instruments, the need and demand for a regulated blockchain asset trading solution continues to grow.

Identified problems in the current blockchain asset trading platforms and exchange markets include the following:

| ● | Pre-trade and post-trade services are limited. Current blockchain exchanges do not provide investment tools that would allow clients to continually monitor and manage blotter, credit, position, and other technical analysis. The current market of exchanges do not offer analytical capabilities during the pre-trading period and do not provide trade confirmations, reporting and access to pricing data during the post-trading period. This lack of transparency results in lower pricing performance, inefficiencies and ultimately higher trading risks. |

| ● | Lack of Trading History. Most blockchain asset trading platforms do not or cannot present the entire history of trades to exchange participants in a manner that would be requested by a regulator. This lack of trading history does not allow regulatory agencies to effectively monitor transactions. |

| ● | Lack of Regulatory Compliance. Many blockchain asset trading platforms are not prepared to comply (or are not willing to comply) with regulatory requirements imposed by U.S. federal and state securities law. Blockchain asset trading platforms assume less responsibility for what takes place on their platforms as compared to regulated exchanges. For example, blockchain asset trading platforms are generally unable to verify the legitimate origin of funds in a trade and therefore cannot confirm that the trades are not in violation of anti-money laundering laws. In addition, current blockchain asset trading platforms do not provide traditional trading protections, such as trading collateral capital and liquidity reserves, making professional traders unable or reluctant to conduct derivative trading on these exchanges. The lack of compliant exchanges for the trading of blockchain assets leads to low customer and public confidence in both the exchanges and the blockchain assets traded. |

| ● | No Physical Delivery for Short Trades. Physical delivery of underlying assets between parties to a short transaction helps ensure the completion of the transaction, regardless of other activities that are being conducted on the same exchange for other clients. Current blockchain asset marketplaces allow clients to leverage their trades without possessing the assets being traded, known as a “naked” short sale, resulting in potential disruption of trading activity on the exchange or the weakening of the exchange’s financial stability due to the costs incurred by the exchange to cover naked short sales. |

| ● | Lack of Technological Capability. The platforms currently utilized for blockchain asset trading generally lack the technological capability to handle the large trading volumes or capture trades for multiple simultaneous trading requests without disruption or significant errors. The technology of many blockchain asset trading platforms was not developed to handle the dramatic growth in demand to engage in blockchain trades and the market has witnessed exchange outages, sometimes for many hours, pricing errors, intermittent periods of limited access to user funds, and other service related complaints. |

4

| ● | Lack of Fee Transparency. There is currently no clear market standard for fees for trading blockchain assets. This is particularly true in the retail market, where many trading platforms do not separately state the transaction fee but instead include any fees as part of the price of the blockchain asset. In this way, many unregulated exchanges do not disclose their fees, creating uncertainty regarding the cost of trading. |

| ● | Poor Price Discovery. Blockchain asset trading platforms experience inefficiencies in the form of significant arbitrage due to recurrent operational issues including temporary service outages and other temporary restrictions on access to the trading platform, the ability to withdraw or deposit fiat currencies and cryptocurrencies, or otherwise perform a trade on the platform. This creates significant exposure to arbitrage trading between exchanges. Further, the operator of a blockchain asset trading platform may trade on its own behalf on the trading platform. Doing so provides liquidity to platform participants. However, it also presents potential conflicts of interest, such as front-running customer order flow and engaging in price manipulation. By acting as a trading participant on one’s own platform, trading platforms may artificially inflate or deflate prices, which impairs market pricing discovery. |

These weaknesses in current blockchain asset trading platforms reveal a significant opportunity in the blockchain asset industry for exchange providers with operations and services that provide functionality, transparency and collateralized trading platforms similar to those of regulated trading marketplaces.

Our Proposed Solution: A Single Regulated Integrated Platform for Trading Blockchain Assets

We believe that the only comprehensive solution to the issues that we have identified, and to the shortcomings of the current marketplace, is the development of a new marketplace for blockchain assets that is subject to governmental oversight. We are designing our platform to provide the following solutions to the problems identified above, which we believe will make INX Trading an attractive choice for the trading of blockchain assets:

| ● | Robust Pre-Trade and Post-Trade Services. We are designing INX Trading to permit clients to continually monitor and manage blotter, credit, position, and other technical analysis. We also plan to offer investment tools during the pre-trading period and provide trade confirmations, reporting and access to pricing data during the post-trading period. |

| ● | Historical Trading Record. Beginning with the first recorded transaction on the INX Trading platform, we plan to apply KYC/AML procedures for all account holders and provide transparency so that clients have the ability to review all activities taken by them. We believe that this accessibility will supplement the transparency of blockchain assets. |

| ● | Regulation. We believe that regulatory oversight of INX Trading, which we intend to be a registered ATS, will instill greater confidence in INX Trading compared to unregulated blockchain asset trading platforms. As the ownership of blockchain assets becomes more commonplace and professional traders continue to enter the blockchain market, we believe that clients will expect regulatory safeguards, comparable to the current fiat and share based exchanges, when making blockchain trades. All customers of INX Trading, whether participating in initial offerings or secondary trading, will be required to complete KYC/AML checks in compliance with applicable laws and regulations. |

| ● | Cash Reserve; Capital Reserve and Liquidity Fund. We plan to establish a cash reserve comprised of 80% of the net proceeds from this offering in excess of $18 million. In addition, we plan to establish the Capital Reserve and Liquidity Fund, which will consist initially of 35 million INX Tokens created but not previously sold by the Company to the public, we plan to reserve an additional 20% of the INX Tokens received by INX Services as payment of transaction fees, as long as the total amount of INX Tokens reserved does not exceed 35 million plus 50% of the number of INX Tokens sold by the Company to the public pursuant to this offering and subsequent offerings of INX Tokens (excluding re-issuances of reacquired INX Tokens), up to a maximum of 100 million INX Tokens. We believe that designated cash and INX Token reserves will provide the Company with flexibility in financing extraordinary expenses, such as instances where the INX Services must cover shortfalls in trading transactions. This feature of our business introduces an important, additional layer of comfort for the investors, traders and clients. |

| ● | Physical Delivery and Short Trading. We believe that INX Trading’s sequential processing and storage architecture, together with the requirement of physical delivery in short and derivatives transactions improves exchange participants’ risk management abilities and will result in increased trade volumes and greater diversity in the financial instruments utilized for blockchain assets. We believe that hedge transactions, accompanied with physical delivery, will therefore be an incentive for trading on the INX Trading platform. | |

| ● | Our Robust Technology. We intend to develop technology for INX Trading to support high volumes of traffic to enable rapid trading activity. Because the INX Trading platform is being custom built to support the growing blockchain asset market, it is being designed to scale along with the continued growth of the market. |

5

| ● | Transaction Fee Transparency. We plan to establish transaction fees as a percentage of the value of each trade executed on INX Trading. Such fees will be disclosed to INX Trading customers prior to executing a trade or performing other transactions on the INX Trading platform. | |

| ● | Decentralization. Record-keeping of peer-to-peer transfer transactions is performed in real time using a distributed ledger, with no need for third party or intermediary validation. | |

| ● | Traceability. Full historical transaction data of INX Tokens is recorded on the Ethereum blockchain. | |

| ● | Immutability. Once the smart contract is deployed and data has been written into the blockchain, it is almost impossible to change, ensuring the veracity of the data. | |

| ● | High Availability. Because the Ethereum blockchain is based on thousands of nodes in a peer-to-peer network, and data is replicated and updated on each and every node, the distributed ledger becomes highly available. | |

| ● | Privacy. Personal information of INX Token holders is stored in an encrypted form and only available to the Company. |

Our Development Plan

We are designing our trading platform to provide clients with a cross-asset, multi-currency non-biased execution trading solution and to function as broker, execution, and clearing agent. We plan to provide trading of different types of digital blockchain assets, including securities, consumptive tokens and virtual currencies, with the optionality for execution of trades in both traditional fiat currencies and digital assets.

Our goal in the development of the INX Trading platform is to offer professionals in the financial services community a comprehensive, interactive platform that allows for seamless integrated trading, real-time risk management and reporting and administration tools. The INX Trading platform will permit trading of multiple blockchain assets, including trades in spot, futures and derivative forms. We plan to develop the INX Trading platform as a centralized platform that facilitates peer-to-peer professional trading services. This trading platform will help our customers automate and coordinate front-office trading functions, middle-office risk management and reporting functions, and back-office accounting functions.

We are developing our system in modules to allow for a phased roll out of features in accordance with regulatory approvals that we receive and the technological development of the INX Trading platform. See “Business— Phases of Development.”

We have currently developed the INX Token. After the INX Trading platform is operational, prospective investors who have been duly identified through KYC/AML procedures may purchase and trade INX Tokens on the INX Trading platform. INX Token holders will be able to use the INX Token to pay INX Trading platform transaction fees, which are entitled to, at a minimum, a 10% discount to other forms of payment or to post collateral on the INX Trading platform. Holders of INX Tokens will also be entitled to receive a pro rata distribution of 20% of our cumulative Adjusted Operating Cash Flow. The distribution will be payable on an annual basis, calculated as of December 31 of each year, commencing on April 30, 2020, and may thereafter be calculated and paid on an annual or a quarterly basis, subject to the board’s discretion. Further, in addition to a cash reserve to be comprised of 80% of the net proceeds from this offering in excess of $18 million, we plan to maintain a capital reserve and liquidity fund (the “Capital Reserve and Liquidity Fund”). The Capital Reserve and Liquidity Fund will consist initially of 35 million INX Tokens created but not previously sold by the Company to the public. In addition, we plan to reserve an additional 20% of the INX Tokens received by INX Services as payment of transaction fees, as long as the total amount of INX Tokens reserved does not exceed 35 million plus 50% of the number of INX Tokens sold by the Company to the public pursuant to this offering and subsequent offerings of INX Tokens (excluding re-issuances of reacquired INX Tokens), up to a maximum of 100 million INX Tokens. INX Tokens received as payment of transaction fees and not allocated to the Capital Reserve and Liquidity Fund may be sold in future offerings. See “Description of INX Tokens.”

Our Growth Strategies

We believe that our operational capabilities will strengthen and expand as the INX Trading platform completes each phase of development. This will enable us to launch several growth strategies, including the following:

| ● | Active expansion of institutional blockchain asset trading and large-scale block transactions. The Company plans to promote the INX Trading platform with institutional and other accredited investors such as family offices, hedge funds and others who require a platform that allows blockchain asset derivative trading and large-scale block transactions. |

| ● | Monetize market data and connectivity. We plan to serve as a hub for blockchain asset traders, institutional investors, commercial banks and individuals trading blockchain asset derivatives. As we attract more clients, we expect that we will accumulate non-proprietary big-data relating to trading behavior and related market statistics. We plan to use this data for internal use and as a product to be sold to institutional investors and trade analysts. |

| ● | Strategic opportunities. We plan to pursue strategic alliances with commercial banks and other licensed and regulated blockchain asset trading platforms for the expansion of our business. In addition, we believe that a part of our future growth strategy will include the acquisition and integration of other blockchain service providers under the INX Trading platform’s regulated processes. |

6

| ● | The INX Token. Use of the INX Token is intended to create a “virtuous cycle.” Holders of INX Tokens will be entitled to a distribution based on our net cash flow from operating activities, excluding any cash proceeds from an initial sale by the Company of an INX Token. Our profit share model makes these INX Token holders beneficiaries of the growth and success of the Company’s operations. This in turn increases the value of the INX Token and its acceptance as a method of payment and as collateral on the INX Trading platform. |

| ● | Single integrated platform. We believe that developing the INX Trading platform with the capability to provide customers with a single integrated platform to access an array of services and features will be preferred by participants in the financial services community and will attract high volume traders who need a multifunctional trading platform. We intend to bolster our competitive position by developing a wide breadth of workflow functionalities across the entire transaction lifecycle, including pre-trade, trade and post-trade services. |

Competition

We face intense competition in the blockchain asset trading market on a global level. During the end of 2017 and throughout 2018, an ever-growing number of previously unregulated trading platforms have announced intentions to operate as a regulated broker-dealers, or as otherwise regulated entities either under the federal securities laws, U.S. state or local laws or, as applicable, the laws of other jurisdictions (outside the U.S.) such as the EU. The market for trading blockchain assets has generated considerable interest and is continually evolving with new entrants to the market. In addition, established financial institutions have expressed interest in operating regulated blockchain asset exchanges or trading platforms and utilizing blockchain assets in bank financing practices. See “Business— Competition.”

Risk Factors

Our business is subject to numerous risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary. You should read and carefully consider these risks and all of the other information in this prospectus, including the financial statements and the related notes included elsewhere in this prospectus, before deciding whether to invest in INX Tokens. In particular, such risks include, but are not limited to, the following:

| ● | We may not be able to develop the INX Trading platform as contemplated or at all, or receive the regulatory approvals necessary to operate our business as currently contemplated. |

| ● | Blockchain networks represent a new and rapidly changing industry and there remains relatively limited use of blockchain networks and assets. |

| ● | Blockchain technology is an emerging technology that is novel and untested. |

| ● | The legal framework of regulations applicable to blockchain technologies, virtual currencies, tokens and token offerings is uncertain and evolving quickly. |

| ● | Tax authorities may disagree with our tax positions with regard to the Company, its business and the INX Token and may ask us to revise these positions in a manner that could adversely affect you. |

| ● | The prices of blockchain assets are extremely volatile and fluctuations in the price of blockchain assets could materially affect our profits. |

| ● | Our company has no operating history and our independent auditors have expressed substantial doubt about our ability to continue as a going concern. | |

| ● | There is currently no trading market for our INX Tokens and, if a trading market were to develop, the price of the INX Tokens may be volatile. |

| ● | We expect to face intense competition from other companies. |

| ● | We may not receive regulatory approval in the various jurisdictions in which we plan to operate our businesses. |

| ● | We may not be able to prevent illegal activity from occurring over our platform, which could subject us to disciplinary action, including fines. |

| ● | Our securities business and related clearing operations expose us to material default and liquidity risk. |

| ● | We rely on third party contractors for the design, development and implementation of our trading platform infrastructure. |

| ● | Systems failures or capacity constraints could materially harm our ability to conduct our operations and execute our business strategy. |

| ● | We may be a target of cyber-attacks and other cyber security risks. |

7

| ● | Valuation of the INX Token is difficult and the offering price of the INX Tokens has been arbitrarily determined and should not be used by an investor as an indicator of the fair market value of the INX Tokens. |

| ● | There can be no assurance that we will be able to distribute any funds to INX Token holders. |

| ● | The tax characterization of Tokens is uncertain and you must seek your own tax advice in connection with purchasing Tokens. |

Implications of Our Emerging Growth Company and Foreign Private Issuer Status

As a company with less than $1.07 billion in revenue for our year ending December 31, 2017, we qualify as an “emerging growth company” under Section 2(a) of the Securities Act of 1933, as amended, (the “Securities Act”), as modified by the U.S. Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an emerging growth company, we may take advantage of certain exemptions from reporting requirements that generally apply to public companies, including the auditor attestation requirements with respect to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), compliance with new standards adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring communication of critical audit matters in the independent public accounting firm report on our annual financial statements, exemption from say-on-pay, say-on-frequency, and say-on-golden parachute voting requirements, and reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements. We have irrevocably elected not to avail ourselves of the exemption from new or revised accounting standards.

We will remain an emerging growth company until the earliest of: (i) the last day of our fiscal year during which we have total annual gross revenue of at least $1.07 billion; (ii) the last day of our fiscal year following the fifth anniversary of the completion of this offering; (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt; or (iv) the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended. Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided to emerging growth companies under the JOBS Act.

Upon completion of this offering, we will be subject to the reporting requirements of Section 15(d) of the Exchange Act, that are applicable to “foreign private issuers,” and under those requirements we will file reports with the SEC. The INX Tokens are not currently registered under the Exchange Act, but if, within 120 days after the last day of its fiscal year ended on which the Company has total assets of more than $10,000,000, the number of record holders of the INX Tokens is more than 2,000 persons, or 500 persons who are not accredited investors, the Company will be required to register the INX Tokens under the Exchange Act, in accordance with Section 12(g) of the Exchange Act, and to continue to file such reports. The Company intends to remain subject to the reporting requirements of the Exchange Act either through continued compliance with Section 15(d) of the Exchange Act or by registration of the INX Tokens in accordance with Section 12(g) of the Exchange Act.

As a foreign private issuer we are exempt from certain rules and regulations under the Exchange Act that are applicable to other public companies that are not foreign private issuers. For example, we will not be required to issue quarterly reports, proxy statements that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that is as detailed as that required of U.S. domestic reporting companies. We will also have four months after the end of each fiscal year to file our annual report with the SEC and will not be required to file current reports as frequently or promptly as U.S. domestic reporting companies. We may also present financial statements pursuant to International Financial Reporting Standards (“IFRS”), instead of pursuant to U.S. generally accepted accounting principles (“U.S. GAAP” or “GAAP”). Our executive officers, directors, and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we will also not be subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act.

We may choose to take advantage of any, some, or all of the exemptions available to us as an emerging growth company or as a foreign private issuer. We have taken advantage of reduced reporting requirements in this prospectus.

Accordingly, the information contained in this prospectus may be different from the information you receive from other public companies in which you hold shares. Please see the section of this prospectus titled “Risk Factors—Risks Relating to our Incorporation in Gibraltar” for a description of exemptions that apply to emerging growth companies and foreign private issuers.

8

THE OFFERING

| Security Offered | INX Tokens, an ERC20 compliant token. | |

| Token ticker on INX Trading | INX | |

| Total Tokens offered in this Offering | 130,000,000 Tokens | |

| Total Tokens to be outstanding (and not held by INX Limited) immediately after this Offering | [-] Tokens | |

| Minimum Offering Amount | $5,000,000; we will not complete the sale of any INX Tokens unless we raise gross offering proceeds exceeding $5,000,000 (in U.S. Dollars). See “Plan of Distribution.” | |

| Use of Proceeds | We intend to use the first $18 of million net proceeds raised from the sale of INX Tokens in this offering for the continued development and operation of the INX Trading platform (See “Business—Phases of Development”); 80% of the net proceeds from this offering in excess of $18 million will be used to establish and capitalize a cash reserve fund for the INX Trading platform. We intend to use the remaining amount of net proceeds from this offering for general corporate purposes and working capital. See “Use of Proceeds.”

| |

| Termination of the Offering | The offering will terminate upon the earliest to occur of: (i) the sale of all of the 130,000,000 Tokens being offered, (ii) 365 days after this registration statement is declared effective by the SEC, or (iii) such shorter period as may be determined by the Company in its sole discretion. | |

| Uses of the INX Token on the INX Trading platform | (1) Payment of transaction fees. When used as payment of transaction fees on the INX Trading platform, the INX Token entitles holders to a ten percent (10%) discount as compared to fees paid using other currencies. The Company, from time to time in its sole discretion, may offer promotional incentives such as a greater discount compared to other forms of payment for transaction fees. In no case however, will the discount right included in the INX Token be less than the ten percent (10%).

(2) Deposit as a portion of collateral for short positions. | |

| Distributions on INX Tokens | Each INX Token will entitle its holder to a pro rata distribution of 20% of the Company’s Adjusted Operating Cash Flow. The annual distribution will be based on the Company’s cumulative Adjusted Operating Cash Flow net of cash flows which have already formed a basis for a prior distribution, calculated as of December 31 of each year. The distribution will be payable on an annual basis commencing on April 30, 2020, and may thereafter be calculated and paid on an annual or a quarterly basis, subject to the board’s discretion. See “Description of INX Tokens.” |

9

| Rights Upon Liquidation |

A breach of the INX Token Purchase Agreement will occur (x) if the Company fails to develop and operate a trading platform that permits the trading of Bitcoin, Ether and fiat currencies on the over the counter trading market by December 31, 2021 or permanently discontinues all the activities of the INX Trading platform and there is no successor trading platform having substantially similar or superior trading features that utilizes INX Tokens, and (y) there is an Insolvency Event (as defined in the Token Purchase Agreement). This breach would create a claim in favor of INX Token holders that could be asserted by INX Token holders in the event of a liquidation of the Company. The amount of a Token holder’s claim in such a scenario will likely be based on the damages sustained by the Token holder as a result of the Company’s breach of the Token Purchase Agreement, similar to how the value for any other breach of contract claim is typically determined under applicable law. Ultimately, the claim amount will be determined by the liquidator, a court of competent jurisdiction overseeing the liquidation, or some other authority pursuant to applicable insolvency law.

Additionally, the Company has caused current shareholders who hold approximately 78% of its issued share capital, and shall cause its future shareholders, to enter an agreement, pursuant to which such shareholders (i) irrevocably subordinate their rights to receive any distributions and payments from the Company prior to the payment in full by the Company of all distributions owed to INX Token holders, and (ii) irrevocably waive and subordinate their rights, in the event of an Insolvency Event, to any cash held in the Cash Reserve Fund. See “Description of INX Tokens.” | |

| Capital Reserve and Liquidity Fund | The Capital Reserve and Liquidity Fund will consist initially of 35 million INX Tokens created but not previously sold by the Company to the public. In addition, we plan to reserve an additional 20% of the INX Tokens received by INX Services as payment of transaction fees, as long as the total amount of INX Tokens reserved does not exceed 35 million plus 50% of the number of INX Tokens sold by the Company to the public pursuant to this offering and subsequent offerings of INX Tokens (excluding re-issuances of reacquired INX Tokens), up to a maximum of 100 million INX Tokens. | |

| Tokens Reserved for Additional Issuances | The Company reserved 17,373,438 INX Tokens for sales and issuances to employees, directors, advisors and early investors in the Company. Of this amount, 1,068,000 INX Tokens have been issued and the Company has commitments to issue up to [ ] additional INX Tokens. | |

| Total Tokens; Mining | 200,000,000 INX Tokens have been created. There is no mining of INX Tokens and there is no other means of creating new INX Tokens. |

10

SUMMARY FINANCIAL DATA

The following table sets forth a summary of our consolidated statement of comprehensive loss and summary of our consolidated balance sheet data for the periods indicated. This information should be read together with our consolidated financial statements and related notes included elsewhere in this prospectus. The operating results in any period are not necessarily indicative of the results that may be expected for any future period.

Summary Statement of Comprehensive Loss

(U.S, Dollars in thousands except share and per share data)

| Six

months ended June 30, 2018 (unaudited) | From September 1, (date of inception) through December 31, 2017 | |||||||

| Operating expenses: | ||||||||

| Research and development | 204 | 56 | ||||||

| General and administrative | 1,699 | 530 | ||||||

| Loss from operations | 1,903 | 586 | ||||||

| Fair value adjustment of INX Token and derivative liabilities | 301 | 50 | ||||||

| Finance expenses | 8 | 1 | ||||||

| Net loss and total comprehensive loss | 2,212 | 637 | ||||||

| Net loss per share, basic and diluted | (0.32 | ) | (0.13 | ) | ||||

| Weighted average number of shares outstanding, basic and diluted | 7,011,176 | 4,917,166 | ||||||

Summary Balance Sheet Data

| June

30, 2018 unaudited | December 31, 2017 | |||||||

| Total Assets | 2,268 | 517 | ||||||

| Working Capital | 1,147 | 62 | ||||||

| Total Liabilities | 1,121 | 455 | ||||||

| Total Equity | 1,147 | 62 | ||||||

11

Investing in INX Tokens involves a high degree of risk. You should carefully consider the risks we describe below, along with all of the other information set forth in this prospectus, including the section entitled “Cautionary Note Regarding Forward-Looking Statements” and our financial statements and the related notes beginning on page F-1, before deciding to purchase INX Tokens. The risks and uncertainties described below are those significant risk factors, currently known and specific to us, that we believe are relevant to an investment in INX Tokens. If any of these risks materialize, our business, results of operations or financial condition could suffer, the price of INX Tokens could decline substantially and you could lose part or all of your investment. Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us and adversely affect your investment in INX Tokens.

You may lose all monies that you spend purchasing INX Tokens. If you are uncertain as to our business and operations or you are not prepared to lose all monies that you spend purchasing INX Tokens, we strongly urge you not to purchase any INX Tokens. We recommend you consult legal, financial, tax and other professional advisors or experts for further guidance before participating in the offering of our INX Token as further detailed in this prospectus. Further, we recommend you consult independent legal advice in respect of the legality of your participation in the INX Token sale.

We do not recommend that you purchase INX Tokens unless you have prior experience with cryptographic tokens, blockchain-based software and distributed ledger technology and unless you have received independent professional advice.

We have no operating history and our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

We are a recently formed company established under the laws of Gibraltar with minimal activity and no historical operating results. In their report dated November 1, 2018 our independent auditors stated that our financial statements for the period ended December 31, 2017 were prepared assuming that we would continue as a going concern and they expressed substantial doubt about our ability to continue as a going concern. This doubt is based upon the Company’s current lack of resources to execute its business plan. Since our date of inception in September 2017, the Company has incurred a loss from operations and as of June 30, 2018, the Company has an accumulated deficit of $2,849,000. In addition to the accumulated deficit, we have entered into contractual arrangements committing us to future expenses, including the repayment of loans, as well as significant contingent obligations which are not currently reflected on our balance sheet. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Commitments and Contractual Obligations.” We expect that we will incur approximately $9 million of expenses to complete the three phases of development contained in our business plan. “See “Business – Phases of Development.”

This offering is subject to a minimum offering amount of $5,000,000 and we will not commence operations of the INX Trading platform until obtaining funding through this offering. However, we may meet our minimum offering amount, close on committed purchases and have access to investor funds before we obtain the funding that we expect will be required to complete our business plan. There is no guarantee that we will be able to raise any additional capital in the future.

Because we lack an operating history, you have no basis upon which to evaluate our ability to achieve our business objective. Our proposed operations are subject to all business risks associated with a new enterprise. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the inception of a business operating in a relatively new, highly competitive, and developing industry. Even if we close this offering, there can be no assurance that we will ever generate any operating activity or develop and operate the business as planned. If we are unsuccessful at executing on our business plan, our business, prospects, and results of operations may be materially adversely affected and investors may lose all or a substantial portion of their investment.

RISKS RELATED TO BLOCKCHAIN ASSETS

Blockchain is a nascent and rapidly changing technology and there remains relatively small use of blockchain networks and blockchain assets in the retail and commercial marketplace. The slowing or stopping of the development or acceptance of blockchain networks may adversely affect an investment in our Company.

The development of blockchain networks is a new and rapidly evolving industry that is subject to a high degree of uncertainty. Factors affecting the further development of the blockchain industry include:

| ● | continued worldwide growth in the adoption and use of blockchain networks and assets; |

| ● | the maintenance and development of the open-source software protocol of blockchain networks; |

| ● | changes in consumer demographics and public tastes and preferences; |

| ● | the popularity or acceptance of the Bitcoin or Ethereum networks; |

12

| ● | the availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies; |

| ● | government and quasi-government regulation of blockchain networks and assets, including any restrictions on access, operation and use of blockchain networks and assets; and |

| ● | the general economic environment and conditions relating to blockchain networks and assets. |

Our business model is dependent on continued investment in and development of the blockchain industry and related technologies. If investments in the blockchain industry become less attractive to investors or innovators and developers, or if blockchain networks and assets do not gain public acceptance or are not adopted and used by a substantial number of individuals, companies and other entities, it could have a material adverse impact on our prospects and our operations.

The application of distributed ledger technology is novel and untested and may contain inherent flaws or limitations.

Blockchain is an emerging technology that offers new capabilities which are not fully proven in use. There are limited examples of the application of distributed ledger technology. In most cases, software used by blockchain asset issuing entities will be in an early development stage and still unproven. As with other novel software products, the computer code underpinning the INX Tokens and Ethereum blockchain may contain errors, or function in unexpected ways. Insufficient testing of smart contract code, as well as the use of external code libraries, may cause the software to break or function incorrectly. Any error or unexpected functionality may cause a decline in value of the INX Token and result in substantial losses to purchasers of INX Tokens.

The creation and operation of a digital platform for the public trading of blockchain assets utilizing a distributed ledger will be subject to potential technical, legal and regulatory constraints. There is no warranty that the process for receiving, use and ownership of blockchain assets will be uninterrupted or error-free and there is an inherent risk that the software, network, blockchain assets and related technologies and theories could contain undiscovered technical flaws or weaknesses, the cryptographic security measures that authenticate transactions and the distributed ledger could be compromised, and breakdowns and trading halts could cause the partial or complete inability to use or loss of blockchain assets.

Risks associated with the distributed ledger technology could affect the market for blockchain assets which could have a materially adverse effect on an investment in the Company.

The open-source structure of blockchain software means that blockchain networks may be susceptible to malicious cyber-attacks or may contain exploitable flaws, which may result in security breaches and the loss or theft of blockchain assets.

Most blockchain networks operate based on some form of open-source software. An open source project is not represented, maintained or monitored by an official organization or authority. Because of the nature of open-source software projects, it may be easier for third parties not affiliated with the issuer to introduce weaknesses or bugs into the core infrastructure elements of the blockchain network. This could result in the corruption of the open-source code which may result in the loss or theft of blockchain assets.

Blockchain networks may be the target of malicious attacks seeking to identify and exploit weaknesses in the software. Such events may result in a loss of trust in the security and operation of blockchain networks and a decline in user activity which could have a negative impact on the Company.

13

Blockchain networks are dependent on its contributors and developments by users or contributors, or the lack thereof, could damage the reputation of blockchain network, including the Etheruem network.

Developers and other contributors to blockchain network protocols generally maintain or develop those blockchain networks, including the verification of transactions on such networks. Because the networks are decentralized, these contributors are generally not directly compensated for their actions. Therefore, most blockchain networks provide that such contributors receive awards and transfer fees for recording transactions and otherwise maintaining the blockchain network. Such fees are generally paid in the blockchain asset of that network.

If the awards and fees paid for maintenance of a network are not sufficiently high to incentivize miners, miners may respond in a way that reduces confidence in the blockchain network. To the extent that any miners cease to record transactions in solved blocks, transactions that do not include the payment of a transfer fee will not be recorded on the blockchain until a block is solved by a miner who does not require the payment of transfer fees. Any widespread delays in the recording of transactions could result in a loss of confidence in the blockchain network and its assets.

The prices of blockchain assets are extremely volatile. Fluctuations in the price of Bitcoin, Ether and/or other blockchain assets could materially and adversely affect the Company.

The prices of blockchain assets such as Bitcoin and Ether have historically been subject to dramatic fluctuations and are highly volatile, and the market price of other blockchain assets may also be highly volatile. As relatively new products and technologies, blockchain assets have only recently become accepted as a means of payment for goods and services, and such acceptance and use remains limited. Conversely, a significant portion of demand for blockchain assets is generated by speculators and investors seeking to profit from the short- or long-term holding of blockchain assets. A lack of expansion, or a contraction of adoption and use of blockchain assets, may result in increased volatility or a reduction in the price of blockchain assets.

Several additional factors may influence the market price of blockchain assets, including, but not limited to:

| ● | Global blockchain asset supply; | |

| ● | Global blockchain asset demand, which can be influenced by the growth of retail merchants’ and commercial businesses’ acceptance of blockchain assets like virtual currencies as payment for goods and services, the security of online blockchain asset trading platforms and digital wallets that hold blockchain assets, the perception that the use and holding of blockchain assets is safe and secure, and the regulatory restrictions on their use; | |

| ● | Changes in the software, software requirements or hardware requirements underlying the blockchain networks; | |

| ● | Changes in the rights, obligations, incentives, or rewards for the various participants in blockchain networks; | |

| ● | The cost of trading and transacting in blockchain assets, and whether such costs may become fixed or standardized; | |

| ● | Investors’ expectations with respect to the rate of inflation; | |

| ● | Interest rates; | |

| ● | Currency exchange rates, including the rates at which blockchain assets may be exchanged for fiat currencies; | |

| ● | Fiat currency withdrawal and deposit policies of blockchain asset trading platforms and liquidity on such platforms; | |

| ● | Interruptions in service or other failures of major blockchain asset trading platforms; | |

| ● | Investment and trading activities of large investors, including private and registered funds, that may directly or indirectly invest in blockchain networks or blockchain assets; |

14

| ● | Monetary policies of governments, trade restrictions, currency devaluations and revaluations; | |

| ● | Regulatory measures, if any, that affect the use of blockchain assets; |

| ● | The maintenance and development of the open-source software utilized in blockchain networks; | |

| ● | Global or regional political, economic or financial events and situations; or | |

| ● | Expectations among blockchain network participants that the value of such blockchain assets will soon change. |

A decrease in the price of a single blockchain asset may cause volatility in the entire blockchain industry and may affect other blockchain assets. For example, a security breach that affects investor or user confidence in Ether or Bitcoin may affect the industry as a whole and may also cause the price of other blockchain assets to fluctuate.

The value of blockchain assets and fluctuations in the price of blockchain assets could materially and adversely affect our business and investment in the Company.

The regulatory regimes governing blockchain technologies, blockchain assets and the purchase and sale of blockchain assets are uncertain, and new regulations or policies may materially adversely affect the development of blockchain networks and the use of blockchain assets.

Initially, it was unclear how distributed ledger technologies, blockchain assets and the businesses and activities utilizing such technologies and assets would fit into the current web of government regulation. As blockchain networks and blockchain assets have grown in popularity and in market size, international, federal, state and local regulatory agencies have begun to clarify their position regarding the sale, purchase, ownership and trading of blockchain assets.