Exhibit 99.2

|

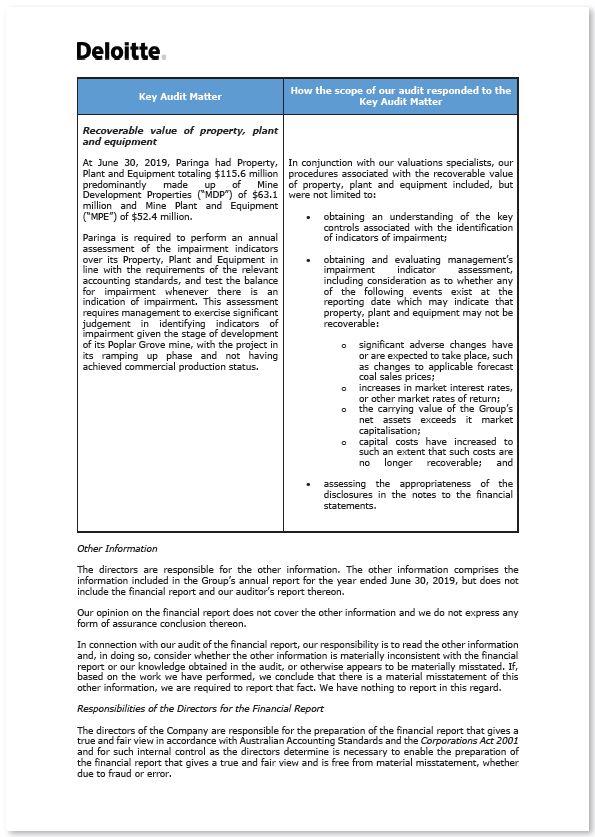

DIRECTORS’ REPORT

|

|

The Directors of Paringa Resources Limited present their report on the Consolidated Entity consisting of Paringa Resources Limited (“Company” or “Paringa”) and the entities it controlled at the end of, or during, the year ended June 30, 2019 (“Consolidated Entity” or “Group”).

OPERATING AND FINANCIAL REVIEW

Summary of Operations

Paringa Resources Limited operates the low cost, high quality Poplar Grove Mine, part of the Buck Creek Complex located in the Illinois Coal Basin in western Kentucky.

The Buck Creek Complex includes two thermal coal mines: (1) the operating Poplar Grove Mine with production capacity ramping up to 2.8 Mtpa; and (2) the permitted Cypress Mine with planned production capacity of

3.8 Mtpa.

The Poplar Grove Mine has commenced operations and production ramp-up is underway, with full production capacity targeted in 2020. The Company also has plans to develop the Cypress Mine.

Western Kentucky is one of the world’s best mining jurisdictions due to its access to low cost power, utilities, transportation and a non-union labor pool. Mining conditions at Poplar Grove are similar to those

encountered in neighbouring mines, which rank as some of the most productive room-and-pillar operations in the world.

|

Paringa Resources Limited ANNUAL REPORT 2019

|

1

|

DIRECTORS’ REPORT (Continued)

OPERATING AND FINANCIAL REVIEW (Continued)

Highlights

Highlights during, and since the end of, the financial year include:

Coal sales

| • |

Paringa achieved its maiden coal shipment from its Poplar Grove river dock in April, 2019.

|

| • |

Paringa delivered total coal shipments of 26.3 thousand tons (“Kt”) during the June quarter for gross sales of approximately US$1.1 million as shipments steadily increased with mine ramp-up.

|

| • |

Paringa maintains a strong forward sales book with ~100% of 2019, ~75% of 2020 and ~50% of the next 5 year’s production pre-sold with leading regional power utilities.

|

| • |

Paringa aims to be a highly valued supplier of coal to local utilities and expects to continue to build an excellent long term, low risk sales book.

|

Mining & processing

| • |

Paringa commenced mining operations at the Poplar Grove Mine in March 2019 using company operated equipment, with Paringa’s first mining unit (“Unit 1”) comprising two continuous mining machines (“CMs”).

|

| • |

Paringa’s second mining unit (“Unit 2”) commenced operations in July 2019, taking the total number of CMs in operation to four and significantly increasing the quantity of coal mined per shift.

|

| • |

Paringa activated the split ventilation system, allowing concurrent operation of both CMs in both Unit 1 and Unit 2, and has received regulatory approval for an extended cut plan for Unit 1.

|

| • |

Mining productivity is ramping-up, and Paringa expects to be free cash flow positive in February 2020 on a 2-mining unit basis.

|

| • |

Operations at the coal handling and preparation plant (“CHPP”) continue to ramp-up well, with fully washed plant yields moving towards designed thresholds.

|

Safety

| • |

No Lost Time Accidents (“LTAs”) were recorded during the year, with the Company recording 182 days without a LTA to June 30, 2019.

|

Coal market

| • |

Market conditions in the Illinois Coal Basin remain buoyant despite a weakening in the global seaborne thermal coal market through the first half of calendar 2019, primarily influenced by transportation challenges in the United

States and increased stockpiles in Europe.

|

| • |

Paringa remains focused on building out a pipeline of domestic sales to local customers served by the low-cost barge network in the Ohio River market, with the Poplar Grove Mine’s direct barge access to the Green and Ohio River

systems providing a significant transportation cost advantage over many other coal operations in the region.

|

| • |

The lack of investment in new supply in the Illinois Coal Basin, and limited spare capacity, is expected to provide support for strong market conditions over the medium term.

|

Corporate

| • |

Executed US$56 million Term Loan Facility with Tribeca Global Resources Credit Pty Limited (as agent) and the first US$40 million tranche was drawn in April 2019. Paringa’s previous US$21.7 million debt facility from Macquarie Bank

Limited was repaid in full.

|

| • |

Once the Term Loan Facility is fully drawn, Paringa will be funded to commence the expansion of production to 2.8 Mtpa at Poplar Grove.

|

| • |

Paringa appointed Mr. Egan Antill as Chief Executive Officer & Managing Director in December 2018.

|

| • |

In October 2018, the Company announced that its American Depositary Receipts (“ADRs”) had commenced trading in the U.S. on the Nasdaq Capital Market (“Nasdaq”) under the ticker symbol “PNRL”. Paringa’s ordinary shares continue to

trade on the Australian Stock Exchange (“ASX”) under the symbol “PNL”.

|

| • |

Executed a secured financing package with Komatsu Financial Limited Partnership to finance the purchase of mining equipment for the Poplar Grove Mine, and at June 30, 2019, had drawn approximately US$23.7 million under the

facility.

|

| 2 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Poplar Grove Operations

|

POPLAR GROVE PRODUCTION SUMMARY

|

|||||||||

|

Quarter ended Jun. 30, 2019

|

Year ended Jun. 30, 2019

|

||||||||

|

Tons mined (Kt)

|

85.6

|

85.6

|

|||||||

|

Tons produced (Kt)

|

31.3

|

31.3

|

|||||||

|

Tons sold (Kt)

|

26.3

|

26.3

|

|||||||

|

Realised sales price per ton (US$)

|

|

$

|

42.35

|

$

|

42.35

|

||||

Coal sales

Paringa achieved its maiden coal shipment from its Ainsworth Dock on the Green River on April 26, 2019.

During the June quarter, Paringa delivered total coal shipments of 26.3 Kt with a gross sales value of approximately US$1.1 million as shipments steadily increased with mine ramp-up. Coal is sold by Paringa on a

free-on-board (“FOB”) basis, with the Company’s customers responsible for the transportation of coal.

Finished coal product from Poplar Grove is designed to include around 20% – 30% of raw material (“bypass tons”) in addition to the fully washed portion to achieve a finished product energy content of around 11,200

– 11,300 Btu/lb per Paringa’s coal sales contracts. The finished product produced during the initial months of operations contains an energy content significantly higher than 11,200 – 11,300 Btu/lb, with the Company receiving a pricing premium

for the sale of these tons. Paringa has commenced introducing bypass tons to the final product mix as underground construction activities are completed and the amount of waste rock received by the CHPP reduces.

Paringa maintains a strong pipeline of forward sales, with ~100% of 2019, ~75% of 2020 and ~50% of the next 5 year’s production pre-sold. Paringa’s contract book remains in a favorable position for domestic sales

in the Illinois Coal Basin, where sales contracts are typically negotiated on 1 to 2 year terms. The Company continues to maintain good standing with its current customers.

Barge loading at Paringa’s Ainsworth Dock on the Green River

|

Paringa Resources Limited ANNUAL REPORT 2019

|

3 |

DIRECTORS’ REPORT (Continued)

OPERATING AND FINANCIAL REVIEW (Continued)

Poplar Grove Operations (Continued)

Mining and processing operations

The Company commenced mining with its first continuous miner (“CM”) in March 2019. Underground mining and development significantly progressed during the June 2019 quarter, with the slope development contractor

demobilised from the mine site and activities transitioned to Paringa managed operations.

The Company successfully installed and commissioned the slope conveyor and established the permanent underground ventilation system. Operations using the mine slope conveyor allowed the Company to commence a

typical underground room and pillar mining sequence and enabled significantly increased production rates.

Paringa utilises room and pillar operations at Poplar Grove, an efficient and low-cost mining method widely employed in coal mines around the world. Room and pillar mining is undertaken by continuous mining units

(“Unit”), with each Unit consisting of two CMs and other ancillary equipment.

Mining began utilising the two CMs which form Unit 1, with ramp-up activities progressing well and productivity increasing. Construction of the ventilation overcasts are complete and the split ventilation system is

commissioned, enabling the concurrent operation of both CMs in Unit 1. Regulatory approval has also been received for an extended cut plan for Unit 1.

Unit 2 entered production in July 2019 and the split ventilation system has also been completed, enabling the concurrent operation of two continuous miners in Unit 2, taking the total number of CMs in operation to

four and significantly increasing the total quantity of coal mined per shift of operation. Unit 2 will progressively ramp-up over the coming months, with testing activities for the Unit 2 extended cut plan underway.

Paringa plans to operate three Units at Poplar Grove, with each Unit projected to produce approximately 0.9 Mt tons of clean coal per annum at full capacity. Unit 3 is scheduled for commissioning in 2020, enabling

total Poplar Grove production of up to 2.8 Mtpa of clean coal on an annualised run-rate basis.

Mining productivity is ramping-up, and Paringa expects to be free cash flow positive in February 2020 on a 2-mining unit basis.

CHPP operations continued to perform well, with yields increasing to ~55% as the amount of out-of-seam material being cut reduces as underground development activities wind back.

Continuous miner at a coal face at Poplar Grove

| 4 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Roof bolting activities at Poplar Grove

Coal handling and preparation plant (“CHPP”) at Poplar Grove

|

Paringa Resources Limited ANNUAL REPORT 2019

|

5 |

DIRECTORS’ REPORT (Continued)

OPERATING AND FINANCIAL REVIEW (Continued)

Buck Creek Complex

Paringa controls approximately 41,000 gross acres (17,000 hectares) of coal leases in Kentucky, United States, which comprise the Buck Creek Mining Complex. The area is controlled by the Group through approximately

300 individual coal leases with private mineral owners.

Paringa has completed a Bankable Feasibility Study (“BFS”) for the Poplar Grove and Cypress Mines, with the key outputs of the BFS outlined below.

|

Poplar Grove and Cypress Mines – BFS Fundamentals (to a maximum accuracy variation +/- 10%)

|

||

|

Poplar Grove Mine

|

Cypress Mine

|

|

|

Average ROM Coal Production Steady State

|

3.6 Mtpa

|

5.1 Mtpa

|

|

Total ROM Coal Produced Life-of-Mine (“LOM”)

|

89.0 million tons

|

86.3 million tons

|

|

Product Heating Content

|

11,200 Btu/lb

|

11,200 Btu/lb

|

|

Average Product Yield

|

76%

|

77%

|

|

Mine Life

|

25 years

|

18 years

|

|

Average Saleable Coal Production Steady State

|

2.8 Mtpa

|

3.8 Mtpa

|

|

Total Saleable Coal Produced (LOM)

|

67.7 million tons

|

66.2 million tons

|

|

Coal Processing Plant Capacity

|

400 tons per hour

|

700 tons per hour

|

|

Coal Processing Method

|

Dense Media 2-Stage

|

Dense Media 2-Stage

|

|

Underground Mining Method

|

Room-and-Pillar

|

Room-and-Pillar

|

|

Average Annual Operating Costs (steady state)

|

US$28.28 per ton

|

US$27.37 per ton

|

Coal Resources and Reserves

|

Poplar Grove and Cypress Mines Coal Resource Estimate (inclusive of Coal Reserves)

|

||

|

CRE Tonnage (tons)

|

||

|

Measured

|

Indicated

|

Total Measured & Indicated

|

|

103.0 million

|

227.3 million

|

332.2 million

|

|

Poplar Grove and Cypress Mines Ore Reserve Estimate

|

||||||

|

Recoverable* Coal Reserve (Mt)

|

Yield

|

Marketable Coal Reserve (Mt)

|

||||

|

Proven

|

Probable

|

Total

|

%

|

Proven

|

Probable

|

Total

|

|

44.3

|

91.4

|

135.7

|

76.54%

|

33.9

|

70.0

|

103.8

|

* Includes dilution.

The Poplar Grove and Cypress Mines have highly attractive coal quality properties compared to existing operating mines in the Illinois Basin. On a 100% washed basis, together with a 4% addition to equilibrium

moisture, the WK No.11 and WK No.9 coal seams have a high heat content of 12,160 Btu/lb and 11,851 Btu/lb respectively, which compares favourably with the larger producing mines in the Illinois Basin.

|

Coal Seam Coal Quality Specifications – WK No.11

|

|||||||||

|

Raw Proximate Analysis

(As Received)

|

Average Washed Core Product Qualities

(Float 1.60 SG with Moisture = Equilibrium Moisture +4%)

|

||||||||

|

EQ Moisture

|

Ash

|

Volatile Matter

|

Fixed Carbon

|

Chlorine

|

HGI

|

Calorific Value (Btu/lb)

|

Ash

|

Sulfur

|

Yield @ 1.60 Float)

|

|

4.9%

|

15.7%

|

38.6%

|

40.1%

|

0.12%

|

58

|

12,160

|

8.5%

|

3.4%

|

84.2%

|

|

Coal Seam Coal Quality Specifications – WK No.9

|

|||||||||

|

Raw Proximate Analysis

(As Received)

|

Average Washed Core Product Qualities

(Float 1.60 SG with Moisture = Equilibrium Moisture +4%)

|

||||||||

|

EQ Moisture

|

Ash

|

Volatile Matter

|

Fixed Carbon

|

Chlorine

|

HGI

|

Calorific Value (Btu/lb)

|

Ash

|

Sulfur

|

Yield @ 1.60 Float)

|

|

6.3%

|

11.8%

|

37.5%

|

44.2%

|

0.15%

|

60

|

11,863

|

8.7%

|

2.8%

|

93.0%

|

| 6 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Corporate

Royalty Financing and Entitlement Offer

After year end, the Company executed a term sheet with Tribeca Global Resources Credit Pty Limited (“Tribeca”) to grant a 2% gross revenue royalty to Tribeca to raise US$9.0 million (before costs) (“Proposed

Royalty Financing”), and will conduct a 1 for 4 pro-rata accelerated non-renounceable entitlement offer to raise up to approximately A$8.1 million (US$5.6 million1)

(before costs) (“Entitlement Offer”).

The term sheet has been approved by Tribeca’s Investment Committee but remains conditional upon completion of a minimum US$5 million equity raising (after costs), completion of legal and tax due diligence by

Tribeca, confirmation that the royalty can be granted, and completion of formal documentation. The term sheet also provides for amendments to the Company's Term Loan Facility with Tribeca (“Proposed Term Loan Amendment”) (see below).

Proceeds from the Proposed Royalty Financing and Entitlement Offer will be used to fund Poplar Grove’s mine ramp-up to positive cashflow. Paringa expects to be free cash flow positive in February 2020 on a 2 Unit

basis. The mine ramp up has been slower than expected which has led to a funding gap. Paringa’s business model remains intact and Paringa expects to generate significant free cash flow on achieving full capacity.

Term Loan Facility

In March 2019, Paringa executed a Term Loan Facility (“TLF”) with Tribeca Global Resources Credit Pty Limited (“Tribeca”) (as agent) for the purpose of refinancing existing debt, expansion development of the Poplar

Grove Mine and working capital.

The Tribeca debt financing is an attractive funding package that provides low overall cost, low shareholder dilution and flexibility in relation to early repayment. Once the facility is fully drawn Paringa will be

funded to begin the expansion of production to 2.8 Mtpa at Poplar Grove.

The first US$40 million tranche of the TLF has been drawn, and the Company’s previous US$21.7 million debt facility from Macquarie Bank Limited has been repaid in full.

After year end, the Company executed a term sheet with Tribeca to amend the TLF to, amongst other things, resize the second tranche of the TLF from US$16 million to US$10 million (Unit 3 expansion capex is

projected to be US$5.9 million), and to ensure that the previously announced termination of the Company's supply agreement with Big Rivers Electric Corporation and issues arising from a funding gap do not result in any events of default under the

TLF.

Drawdown of the second tranche of the TLF is conditional upon satisfaction of a ramp-up test, financial undertakings and other customary conditions precedent.

Coal Sales Contracts

In October 2018, the Company executed an additional coal sales agreement with Indiana-Kentucky Electric Corporation, a wholly owned subsidiary of Ohio Valley Electric Corporation (“OVEC-IKEC”) to sell 650,000 tons

of coal from 2019 to 2020.

Coal is procured by American Electric Power (“AEP”) on behalf of OVEC-IKEC. AEP is OVEC-IKEC’s major shareholder and one of the largest electric energy companies in the United States.

Paringa already has a cornerstone coal sales contract with Louisville Gas and Electric Company and Kentucky Utilities Company (“LG&E and KU”), one of the biggest fuel buyers within the Ohio River, to sell

4,750,000 tons of its product from 2018 to 2022.

In January 2019, the Company signed a coal sales agreement with Big Rivers Electric Corporation (“BREC”). BREC subsequently elected to terminate the agreement due to the delayed delivery of first coal to BREC. The

termination of the contract will have a minimal sales impact over the next 2 years. The Company maintains a good relationship with BREC, and BREC has requested a test burn of Poplar Grove coal later in 2019.

Paringa maintains a strong pipeline of forward sales, with ~100% of 2019, ~75% of 2020 and ~50% of the next 5 years’ production pre-sold. Paringa is making progress with a wide range of customers for additional

coal sales contracts for deliveries from 2020 onwards.

1 Assuming an AUD:USD exchange rate of 0.69

|

Paringa Resources Limited ANNUAL REPORT 2019

|

7 |

DIRECTORS’ REPORT (Continued)

OPERATING AND FINANCIAL REVIEW (Continued)

Corporate (Continued)

Nasdaq Listing

In October 2018, the Company announced that its ADRs were approved for listing on Nasdaq and trading commenced in the U.S. under the ticker symbol “PNRL”. Each ADR represents 50 ordinary shares in the Company. No

additional ordinary shares were issued in connection with implementation of the ADR program.

The Company’s ordinary shares continue to trade on the Australian Stock Exchange under the symbol “PNL”.

Results of Operations

The net loss of the Group for the year ended June 30, 2019 was US$13.1 million (2018: US$7.1 million). Significant items contributing to the current year loss and the differences from the previous financial year

include:

| (i) |

Employee benefit expenses of US$3.6 million (2018: US$3.0 million) relating to the Group’s staffing and travel requirements required to support the development and operations of the Buck Creek Complex;

|

| (ii) |

Amortisation of borrowing costs of US$3.6 million (2018: US$0.0 million) relating to the Group’s previous debt facility from Macquarie Bank Limited which was repaid in full during the financial year, at which time the remaining

balance of unamortised borrowing costs (including non-cash share-based payments) were expensed through profit or loss;

|

| (iii) |

Depreciation and impairment of plant and equipment of US$2.1 million (2018: US$0.0 million) relating to mine plant and equipment that has begun depreciating in the current year as a result of the commencement of mining operations;

and

|

| (iv) |

Share-based payment expenses of US$1.5 million (2018: US$2.3 million) relating to the Group’s accounting policy of expensing the value of incentive securities granted to key employees and consultants over the period during which

the employees and consultants become entitled to the incentive securities.

|

Financial Position

At June 30, 2019, the Group had cash reserves of US$12.0 million (2018: US$22.6 million). The Group is in a strong financial position to conduct its current and planned operating activities.

At June 30, 2019, the Group had net assets of US$67.3 million (2018: US$77.1 million), a decrease of 12% compared with the previous year.

At June 30, 2019, the Group had debt of US$58.7 million (June 30, 2018: $0.4 million) (after offsetting borrowing costs, including non-cash share-based payments, of US$4.1 million).

Loss Per Share

|

2019 (US$)

|

2018 (US$)

|

||

|

Basic and diluted loss per share

|

$0.03

|

$0.02

|

Dividends

No dividends were paid or declared since the start of the financial year. No recommendation for payment of dividends has been made.

Environmental Regulation and Performance

The Group's operations are subject to various environmental laws and regulations under the relevant government's legislation. Full compliance with these laws and regulations is regarded as a minimum standard for

all operations to achieve. Instances of environmental non-compliance by an operation are identified either by external compliance audits or inspections by relevant government authorities. There have been no significant known breaches by the Group

during the financial year.

| 8 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Business Strategies and Prospects for Future Financial Years

The objective of the Group is to create long-term shareholder value through the successful development and commercial exploitation of its projects. To achieve its objective, the Group currently has the following

business strategies and prospects:

| (i) |

Ramp up production at the Poplar Grove Mine during 2019 and 2020 to reach full production capacity;

|

| (ii) |

Enter into additional coal sales with utilities located within the Ohio River and South-East markets; and

|

| (iii) |

Assess other mine development opportunities within the Buck Creek Complex and ILB, such as the Cypress Mine.

|

All of these activities are inherently risky and the Board is unable to provide certainty of the expected results of these activities, or that any or all of these likely activities will be achieved. The material

business risks faced by the Group that could have an effect on the Group’s future prospects, and how the Group manages these risks, include:

| • |

Operational risks – The Group’s production ramp up and coal mining operations are subject to operating risks that could impact the amount of coal produced at its coal mines, delay coal

deliveries or increase the cost of mining for varying lengths of time. Such difficulties include: changes or variations in geologic, hydrologic or other conditions; mining, processing and loading equipment failures and unexpected

maintenance problems; limited availability or increased costs of mining, processing and loading equipment and parts and other materials from suppliers; difficulties associated with mining under or around surface obstacles; mine safety

accidents, including fires and explosions from methane and other sources; adverse weather and natural disasters; and a shortage of skilled and unskilled labour. If any of these or other conditions or events occur in the future, they

may increase the cost of mining or delay or halt production or sales to our customers, which could adversely affect our results of operations or decrease the value of our assets. The Group has in place a framework for the management

of operational risks and an insurance program which provides insurance coverage for a number of these operating risks.

|

| • |

Volatility in coal prices – The Group’s future financial performance will be impacted by future coal prices. The price of coal is affected by numerous factors beyond the control of the

Group, including the outcome of future sales contract negotiations, general economic activity, industrial production levels, changes in foreign exchange rates, changes in coal demand, changes in the supply of seaborne coal, changes in

international freight rates and the cost of substitutes for coal. The Company does not currently hedge against coal price volatility.

|

| • |

Health, safety and environment - A range of health, safety and environmental risks exist with coal mining activities. Accidents, environmental incidents and real or perceived threats to the

environment could result in a loss of the Group’s social licence to operate leading to delays, disruption or the shut-down of operations. Potential environment and safety risks include equipment failure, human errors in underground

operations, vehicle and mining equipment interactions, roof fall hazards in underground operations, and fires and explosions from methane and other sources. The Group has a comprehensive environmental, health and safety management

system to mitigate the risk of incidents and to ensure compliance with environmental and safety laws;

|

| • |

Title to properties – The Group conducts a significant part of its mining operations on properties that it has leased. As is industry practice in the U.S., title to most of the Group’s

leased properties and mineral rights is not thoroughly verified until mining commences. Accordingly, actual or alleged defects in title or boundaries may exist, which could adversely affect the Group’s ability to mine the associated

coal reserves. In addition, the Company is continuing with its leasing program to secure additional leased properties within the project area, however there can be no guarantee that the Group will secure additional leasing which could

impact on operations;

|

| • |

Government regulations – The Group is subject to extensive laws and regulations. Any material adverse changes in government policies or legislation of the U.S. that affect coal mining,

processing, development and mineral exploration activities, income tax laws, royalty regulations, government subsidies and environmental issues may affect the viability and profitability of the Group’s current and future projects. No

assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could adversely impact the Group’s mineral properties; and

|

| • |

Global financial conditions – Economic conditions, both domestic and global, may affect the performance of the Group. Adverse changes in macroeconomic conditions, including global and U.S.

growth rates, the cost and availability of credit, the rate of inflation, interest rates, exchange rates, government policy and regulations, general consumption and consumer spending, input costs, employment rates and industrial

disruptions, among others, are variables which while generally outside the Group’s control. A slowdown in the financial markets or other economic conditions may result in material adverse impacts on the Group’s businesses and its

operational and financial performance, and position.

|

PRINCIPAL ACTIVITIES

The principal activities of the Group during the financial year consisted of the development and operation of coal mines in the United States.

|

Paringa Resources Limited ANNUAL REPORT 2019

|

9 |

DIRECTORS’ REPORT (Continued)

DIRECTORS

The names and details of the Company's Directors in office at any time during the financial year or since the end of the financial year are:

|

Mr. Ian Middlemas

|

Chairman

|

|

Mr. Todd Hannigan

|

Deputy Chairman

|

|

Mr. Egan Antill

|

Managing Director & CEO (appointed effective December 12, 2018)

|

|

Mr. David Gay

|

Executive Director & President

|

|

Mr. Jonathan Hjelte

|

Non-Executive Director

|

|

Mr. Richard McCormick

|

Non-Executive Director

|

|

Mr. Thomas Todd

|

Non-Executive Director

|

Unless otherwise stated, Directors held their office from July 1, 2018 until the date of this report.

CURRENT DIRECTORS AND OFFICERS

Mr. Ian Middlemas B.Com, CA

Chairman (non-executive)

Mr. Middlemas is a Chartered Accountant, a member of the Financial Services Institute of Australasia and holds a Bachelor of Commerce degree. He worked for a large international Chartered Accounting firm before

joining the Normandy Mining Group where he was a senior group executive for approximately 10 years. He has had extensive corporate and management experience, and is currently a Director with a number of publicly listed companies in the resources

sector.

Mr. Middlemas was appointed as a Director of the Company on October 16, 2013 and as Chairman on January 7, 2014. During the three year period to the end of the financial year, Mr. Middlemas has held directorships

in Constellation Resources Limited (November 2017 – present), Apollo Minerals Limited (July 2016 – present), Berkeley Energia Limited (April 2012 – present), Prairie Mining Limited (August 2011 – present), Salt Lake Potash Limited (January 2010 –

present), Equatorial Resources Limited (November 2009 – present), Piedmont Lithium Limited (September 2009 – present), Sovereign Metals Limited (July 2006 – present), Odyssey Energy Limited (September 2005 – present), Cradle Resources Limited

(May 2016 – July 2019) and Syntonic Limited (April 2010 – June 2017).

Mr. Todd Hannigan B.Eng (Hons)

Deputy Chairman (non-executive)

Mr. Hannigan was the Chief Executive Officer of Aston Resources from 2010 to 2011. During this time, the company significantly progressed the Maules Creek project, including upgrades to the

project's resources and reserves, completion of all technical and design work for the Definitive Feasibility Study, negotiation of two major project stake sales and joint venture agreements, securing port and rail access and progression of

planning approvals to final stages. Mr. Hannigan has worked internationally in the mining and resources sector for over 18 years with Aston Resources, Xstrata Coal, Hanson PLC, BHP Billiton and MIM.

Mr. Hannigan was appointed as a Director of the Company on May 21, 2014, as Deputy Chairman on June 19, 2017. Mr. Hannigan previously served as Interim CEO of the Company from June

18, 2018 to December 11, 2018 and as Managing Director and CEO of the Company from November 7, 2016 to June 19, 2017. During the three-year period to the end of the financial year, Mr. Hannigan held a directorship in Prairie Mining

Limited (September 2014 – present).

Mr Egan Antill B.Eng, MBA

Managing Director and Chief Executive Officer

Mr. Antill studied Engineering at the University of Queensland and early in his career worked for Mount Isa Mines Ltd and Caterpillar of Australia Ltd. He then completed an MBA at Yale University and spent the next

20 years in investment banking on Wall Street in New York including Managing Director, Merrill Lynch & Co., New York, where he raised capital for and provided strategic advice to global Metals and Mining companies, and prior to that with

Credit Suisse First Boston, New York in the Mergers & Acquisitions department.

Mr. Antill’s background in mining and capital markets complements the proven operating team that Paringa has established at its Poplar Grove mine. The operating team based at site in Kentucky has in excess of 50

years of coal mining experience in the US. Mr. Antill’s focus is on delivering the mine ramp-up and unlocking shareholder value. Consistent with this, Mr. Antill’s equity performance rights are linked to coal production milestones.

Mr. Antill was appointed as a Managing Director and Chief Executive Officer of the Company on December 12, 2018. Mr. Antill has not held any other directorships in listed companies during the three-year

period to the end of the financial year.

| 10 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Mr. David Gay B.Eng, MBA, P.E.

Executive Director & President

Mr. Gay is a Professional Mining Engineer with an MBA and has over 35 years of experience in developing coal projects in the USA. Mr. Gay’s experience covers the entire coal development chain including leasing,

permitting, exploration, construction, commissioning, production, mergers & acquisitions and financing activities (including project finance, high yield bonds, bank debt, structured finance and equity). Prior to joining the Group, he was Vice

President, Mergers and Acquisitions and Business Development at Alpha Natural Resources, one of the USA’s largest coal producers. During his time, Alpha completed over US$10 billion worth of mergers and acquisitions and transitioned into one of

the largest coal companies in the US and the third largest coking coal exporter globally. Prior to that, Mr. Gay led several large regional coal companies and was Business Unit President at Pittston Coal Group (20 years’ experience) which at the

time was the largest coking coal exporter worldwide.

Mr. Gay was appointed as Director and President of the Company on June 23, 2015. Mr. Gay also served as Chief Executive Officer of the Company from January 7, 2014 to November 7, 2016

and as Managing Director from June 23, 2015 to November 7, 2016. Mr. Gay has not held any other directorships in listed companies during the three-year period to the end of the financial year.

Mr. Jonathan (Jon) Hjelte M.S., B.S., CFA

Non-Executive Director

Mr. Hjelte is Portfolio Manager of the Utilities, Metals and Mining division at Citadel LLC, one of the largest, most successful alternative investment management firms, specializing in utilities, metals and

mining. Prior to this, Mr. Hjelte was with Millennium Management LLC, a global investment management firm with approximately US$30 billion in assets under management. Mr. Hjelte managed an equity portfolio focused on a diverse mix of sectors

including power and mining. Mr. Hjelte began his career at Lehman Brothers as an investment banker. Mr. Hjelte graduated Summa Cum Laude from Lehigh University where he received an M.S. in Statistics and a B.S. in the Integrated Business and

Engineering honors program. He also holds the Chartered Financial Analyst (CFA) designation.

Mr. Hjelte was appointed as a Director of the Company on January 11, 2016. Mr. Hjelte has not held any other directorships in listed companies during the three-year period to the end of the financial year.

Mr. Richard (Rick) McCormick BSc, PE

Non-Executive Director

Mr. McCormick has spent the last 20 years of his career specializing in large-scale coal preparation plants and materials handling systems in the U.S., including the Illinois Basin. He has over 30

years of experience in coal preparation and coal preparation equipment, including operations, process and material handling design, construction, and process equipment design and application. Mr. McCormick was previously Chief Executive Officer

of DRA Taggart (the US operating arm of DRA Global) a large and highly respected coal mining services firm with significant experience in the Illinois Basin having conducted operational and construction activities of many coal handling and

preparation plants, including those owned by Alliance Resource Partners, LP. Mr. McCormick is also a consultant to Concentrate Capital Partners, the fund management and investment arm of DRA Global. Prior to this, Mr. McCormick served as Chief

Executive Officer and President of Taggart Global for over 10 years until DRA Global’s acquisition of Taggart Global in 2014. Mr. McCormick is a registered Professional Engineer and has a Bachelor of Science degree in Mechanical Engineering from

West Virginia University.

Mr. McCormick was appointed as a Director of the Company on August 11, 2016. Mr. McCormick has not held any other directorships in listed companies during the three-year period to the end of the financial year.

Mr. Thomas (Tom) Todd BSc (Hons), CA

Non-Executive Director

Mr. Todd was the Chief Financial Officer of Aston Resources from 2009 to November 2011. Prior to Aston Resources, Mr. Todd was Chief Financial Officer of Custom Mining, where his experience included

project acquisition and funding of project development for the Middlemount project prior to the sale of the company to Macarthur Coal. A graduate of Imperial College, Mr. Todd holds a Bachelor of Physics with first class Honours. He was a

chartered accountant (Institute of Chartered Accountants in England and Wales) and a graduate of the Australian Institute of Company Directors.

Mr. Todd was appointed as a Director of the Company on May 21, 2014. Mr. Todd also served as Executive

Director from November 7, 2016 to June 19, 2017. During the three-year period to the end of the financial year,

Mr. Todd held a directorship in Prairie Mining Limited (September 2014 – present).

|

Paringa Resources Limited ANNUAL REPORT 2019

|

11

|

DIRECTORS’ REPORT (Continued)

CURRENT DIRECTORS AND OFFICERS (Continued)

Mr. Gregory (Greg) Swan BCom, CA, FCIS, FFin

Company Secretary

Mr. Swan is a Chartered Accountant and Chartered Secretary and is currently Company Secretary and Chief Financial Officer for several ASX-listed companies that operate in the resources sector. He commenced his

career with a large international chartered accounting firm and has since been involved with a number of exploration and development companies, including Mantra Resources Limited, Papillon Resources Limited, Coalspur Mines Limited, and Piedmont

Lithium Limited.

Mr. Swan was appointed Company Secretary of the Company on November 25, 2013.

SIGNIFICANT CHANGES IN THE STATE OF AFFAIRS

Significant changes in the state of affairs of the Group during the financial year were as follows:

| (i) |

On September 5, 2018, the Company announced that it had filed a registration statement on Form 20-F to register its ordinary shares with the United States Securities and Exchange Commission ("SEC") and allow American depositary

receipts (“ADRs”) representing ordinary shares to be listed in the United States;

|

| (ii) |

On September 10, 2018, the Company announced that it had reached financial close for its US$21.7 million project loan facility from Macquarie Bank Limited, and drawn down the first US$15 million tranche of the project loan

facility;

|

| (iii) |

On October 2, 2018, the Company announced that its ADRs had been approved for listing on the Nasdaq Capital Market (“Nasdaq”) and trading had commenced in the U.S. under the ticker symbol “PNRL”. Each ADR represents 50 ordinary

shares in the Company. No additional ordinary shares were issued in connection with implementation of the ADR program. The Company’s ordinary shares continue to trade on the Australian Stock Exchange under the symbol “PNL”;

|

| (iv) |

On October 3, 2018, the Company announced that it had signed an additional coal sales agreement with Indiana-Kentucky Electric Corporation, a wholly owned subsidiary of Ohio Valley Electric Corporation (“OVEC-IKEC”) to sell 650,000

tons of coal from 2019 to 2020;

|

| (v) |

On December 11, 2018, the Company announced that it had appointed Mr. Egan Antill as Chief Executive Officer & Managing Director of the Company, effective from December 12, 2018;

|

| (vi) |

On January 31, 2019, the Company announced that it had signed an additional coal sales agreement with Big Rivers Electric Corporation (“BREC”) for coal sales from its Poplar Grove Mine, for up to 1,400,000 tons of coal from 2019 to

2023. BREC subsequently elected to terminate its coal sales agreement (refer below);

|

| (vii) |

On March 5, 2019, the Company announced that production ramp-up had begun with the commencement of continuous underground mining operations at the Poplar Grove Mine with Company operated mining equipment and labour, and that raw

coal is being brought to the surface and has been processed by Poplar Grove’s CHPP;

|

| (viii) |

On March 20, 2019, the Company announced that Tribeca Global Resources Credit Pty Limited (“Tribeca”) had agreed to provide a Term Loan Facility (“TLF”) of US$56 million for the purpose of refinancing existing debt, expansion

development of the Poplar Grove Mine and working capital;

|

| (ix) |

On April 29, 2019, the Company announced that a maiden shipment of approximately 1,500 tons of coal was loaded into barges at Paringa’s dock on the Green River; and

|

| (x) |

On May 1, 2019, the Company announced that it had reached financial close for its US$56 million TLF and had drawn the first US$40 million tranche of the TLF. The Company’s previous US$21.7 million debt facility from Macquarie Bank

Limited has been repaid in full.

|

SIGNIFICANT EVENTS AFTER THE BALANCE DATE

| (i) |

On July 19, 2019, the Company announced that the second mining unit (“Unit 2”) had entered production at the Poplar Grove Mine, taking the total number of CMs in operation to four and significantly increasing the total quantity of

coal mined per shift of operation;

|

| 12 |

Paringa Resources Limited ANNUAL REPORT 2019

|

| (ii) |

On July 19, 2019, the Company announced that BREC had elected to terminate its coal sales agreement with the Company (which represents a potential event of default under the TLF) due to the delayed delivery of first coal to BREC.

Under the TLF, the Group has a period 90 days to replace the terminated contract with alternative arrangements which are acceptable to Tribeca, or to negotiate an extension or waiver of this requirement, otherwise an event of default

will be triggered under the TLF. The Company maintains a good relationship with BREC, and BREC has requested a test burn of Poplar Grove coal later in 2019;

|

| (iii) |

On August 24, 2019, the Company announced that an extended cut plan for Unit 1 at the Poplar Grove Mine had been approved, enabling the CMs to increase the depth of each cut into the coal seam from 20 ft to 40 ft. The extended cut

plan resulted in an immediate increase in Unit 1 mining productivity;

|

| (iv) |

On September 17, 2019, the Company announced the appointment of Mr. Jim Middleton as Executive Advisor to Paringa’s Board, with specific responsibility to provide guidance to the Company’s Poplar Grove Mine, to assist in further

developing safe, efficient, reliable and cost effective mine operations. Mr. Middleton is an experienced underground mining executive with a long and successful history of running coal mining operations for major natural resource

companies, including Glencore, BHP, Xstrata, Exxon Coal and Coal & Allied;

|

| (v) |

On September 18, 2019, the Company announced that it had entered into a term sheet to grant a 2% gross revenue royalty to Tribeca Global Resources Credit Pty Limited (“Tribeca”) to raise US$9.0 million (before costs) (“Proposed

Royalty Financing”), conditional upon completion of a minimum US$5 million equity raising (after costs), legal and tax due diligence, and completion of formal documentation. The term sheet also provides for amendments to the Company's

TLF with Tribeca (as agent) (“Proposed Term Loan Amendment”) to, amongst other things, resize the second tranche of the TLF from US$16 million to US$10 million (Unit 3 expansion capex is projected to be US$5.9 million), and to ensure

that the previously announced termination of the Company's supply agreement with Big Rivers Electric Corporation and issues arising from a funding gap do not result in any events of default under the TLF. Upon completion of the

Proposed Royalty Financing and Proposed Term Loan Amendment, the Company will: (a) grant 60,000,000 new options to the lenders (30,000,000 with a strike price of A$0.085 per option and 30,000,000 with a strike price of A$0.10 per

option) (subject to shareholder approval and ASX waivers); (b) cancel 25,000,000 options previously granted to the lenders (with a strike price of A$0.20) (subject to shareholder approval and ASX waivers); and (c) issue shares to

Argonaut Capital Limited in an amount equal to US$270,000 at an issue price of A$0.07 for financial advisory services provided in respect to the Proposed Royalty Financing;

|

| (vi) |

On September 18, 2019, the Company announced that it would make a non-renounceable accelerated pro rata entitlement offer to eligible Shareholders of new shares at an offer price of A$0.07 each, on the basis of one (1) new share

for every four (4) shares held on the record date, to raise approximately A$8.1 million (US$5.6 million1) (before costs) (“Entitlement Offer”). The Entitlement Offer will comprise an Institutional Entitlement Offer to be

conducted on an accelerated basis and a Retail Entitlement Offer. Net proceeds from the Entitlement Offer will be used to fund Poplar Grove’s ongoing mine ramp-up to positive cashflow, to satisfy the minimum US$5 million equity

raising in respect of the Proposed Royalty Financing and Proposed Term Loan Amendment, and for general working capital purposes;

|

| (vii) |

On September 20, 2019, the Company announced that it had completed the Institutional Entitlement Offer of its Entitlement Offer to raise approximately A$3.12 million. The Institutional Entitlement Offer was well supported with the

majority of substantial existing institutional shareholders electing to take up their entitlements. The Retail Entitlement Offer will raise up to a further A$4.95 million; and

|

| (viii) |

On September 25, 2019, the Company announced that it had commenced coal sales to OVEC-IKEC. Coal is procured by AEP on behalf of OVEC-IKEC. AEP is OVEC-IKEC’s major shareholder and one of the largest electric energy companies in

the United States. The Company continues to ramp up sales to its cornerstone customer LG&E and KU, with August shipping rates to LG&E and KU of approximately 700 Ktpa on an annualised basis.

|

Other than the above, at the date of this report, there are no matters or circumstances, which have arisen since June 30, 2019 that have significantly affected or may significantly affect:

| • |

the operations, in financial years subsequent to June 30, 2019, of the Group;

|

| • |

the results of those operations, in financial years subsequent to June 30, 2019, of the Group; or

|

| • |

the state of affairs, in financial years subsequent to June 30, 2019, of the Group.

|

1 Assuming an AUD:USD exchange rate of 0.69

|

Paringa Resources Limited ANNUAL REPORT 2019

|

13

|

DIRECTORS’ REPORT (Continued)

DIRECTORS' INTERESTS

As at the date of this report, the Directors' interests in the securities of the Company are as follows:

|

Interest in securities at the date of this report

|

|||

|

Shares1

|

Options2

|

Rights3

|

|

|

Mr. Ian Middlemas

|

14,015,152

|

-

|

-

|

|

Mr. Todd Hannigan

|

12,111,104

|

-

|

1,750,000

|

|

Mr. Egan Antill

|

-

|

2,300,000

|

5,500,000

|

|

Mr. David Gay

|

3,520,292

|

-

|

2,100,000

|

|

Mr. Jonathan Hjelte

|

1,449,001

|

-

|

-

|

|

Mr. Richard McCormick

|

1,000,000

|

-

|

-

|

|

Mr. Thomas Todd

|

6,949,359

|

-

|

875,000

|

Notes:

| 1 |

“Shares” means a fully paid ordinary share in the capital of the Company.

|

| 2 |

“Options” means an unlisted option to subscribe for one Share in the capital of the Company.

|

| 3 |

“Rights” means an unlisted performance right that converts into one Share in the capital of the Company upon the satisfaction of various performance conditions.

|

SHARE OPTIONS AND RIGHTS

At the date of this report the following Options and Rights have been issued over unissued Shares of the Company:

| • |

575,000 employee incentive Options exercisable at A$0.30 on or before December 31, 2023;

|

| • |

575,000 employee incentive Options exercisable at A$0.40 on or before December 31, 2023;

|

| • |

575,000 employee incentive Options exercisable at A$0.50 on or before December 31, 2023;

|

| • |

575,000 employee incentive Options exercisable at A$0.60 on or before December 31, 2023;

|

| • |

4,444,444 lender Options exercisable at A$0.66 each on or before April 5, 2021;

|

| • |

4,444,444 lender Options exercisable at A$0.34 each on or before September 10, 2022;

|

| • |

6,000,000 underwriter Options exercisable at A$0.33 each on or before June 30, 2021;

|

| • |

18,000,000 lender Options exercisable at A$0.20 each on or before April 30, 2023;

|

| • |

7,000,000 lender Options exercisable at A$0.20 each on or before June 13, 2023;

|

| • |

4,635,000 employee Rights subject to the First Coal Production Milestone expiring on December 31, 2019;

|

| • |

6,260,000 employee Rights subject to the Nameplate Production Milestone expiring on December 31, 2020;

|

| • |

2,500,000 employee Rights subject to the 1.7 Mtpa Coal Production Milestone expiring on December 31, 2020; and

|

| • |

3,000,000 employee Rights subject to the 2.7 Mtpa Coal Production Milestone expiring on December 31, 2021.

|

During the year ended June 30, 2019, 3,835,000 Shares were issued as a result of the conversion of Rights. Subsequent to year end, and up until the date of this report, no Shares have been issued as a result of the

exercise of Options or conversion of Rights.

INDEMNIFICATION AND INSURANCE OF OFFICERS AND AUDITORS

The Constitution of the Company requires the Company, to the extent permitted by law, to indemnify any person who is or has been a Director or officer of the Company or Group for any liability caused as such a

Director or officer and any legal costs incurred by a Director or officer in defending an action for any liability caused as such a Director or officer.

During or since the end of the financial year, no amounts have been paid by the Company or Group in relation to the above indemnities. During the year, the Company incurred an insurance premium of US$86,429 (2018:

US$42,782) to provide adequate insurance cover for Directors and officers of the Company and its subsidiaries against any potential liability and the associated legal costs of a proceeding.

The Company has not otherwise, during or since the end of the financial year, except to the extent permitted by law, indemnified or agreed to indemnify an officer or auditor of the Company or of any related body

corporate against a liability incurred as such an officer or auditor.

| 14 |

Paringa Resources Limited ANNUAL REPORT 2019

|

REMUNERATION REPORT (AUDITED)

This Remuneration Report, which forms part of the Directors’ Report, sets out information about the remuneration of Key Management Personnel (“KMP”) of the Group.

Details of Key Management Personnel

Details of the KMP of the Group during or since the end of the financial year are set out below:

|

Directors

|

|

|

Mr. Ian Middlemas

|

Chairman

|

|

Mr. Todd Hannigan

|

Deputy Chairman

|

|

Mr. Egan Antill

|

Managing Director & Chief Executive Officer (appointed effective December 12, 2018)

|

|

Mr. David Gay

|

Executive Director & President

|

|

Mr. Jonathan Hjelte

|

Non-Executive Director

|

|

Mr. Richard McCormick

|

Non-Executive Director

|

|

Mr. Thomas Todd

|

Non-Executive Director

|

|

Senior Executives

|

|

|

Mr. Richard Kim

|

Chief Operating Officer

|

|

Mr. Dominic Allen

|

Vice President, Finance (appointed effective August 13, 2018)

|

|

Mr. Bruce Czachor

|

Vice President, General Counsel

|

|

Mr. Gregory Swan

|

Company Secretary

|

|

Mr. Adam Anderson

|

Senior Vice President, Coal Sales and Marketing (ceased employment January 9, 2019)

|

Unless otherwise disclosed, the KMP held their position from July 1, 2018 until the date of this report.

Remuneration Policy

The Group’s remuneration policy for its KMP has been developed by the Board taking into account the size of the Group, the size of the management team for the Group, the nature and stage of the Group’s current

operations, and market conditions and comparable salary levels for companies of a similar size and operating in similar sectors.

In addition to considering the above general factors, the Board has also placed emphasis on the following specific issues in determining the remuneration policy for KMP: (a) the Group currently has a single

operation, being the Poplar Grove Mine in the United States; (b) risks associated with construction and commissioning of mineral resource projects, such as the Poplar Grove Mine; and (c) the Group commenced operations at its Poplar Grove Mine

during fiscal 2019 and ramp-up activities are underway with full production capacity targeted in 2021.

The objective of the Group’s remuneration structure reward framework is to ensure that reward for performance is competitive and appropriate for the results delivered. The remuneration framework provides a mix of

fixed and variable remuneration, which incorporates a blend of short and long-term incentives. There is a deliberate emphasis on lower fixed base and higher variable results-based remuneration to ensure that management focus is aligned with that

of shareholders. This has been achieved by ensuring that a significant proportion of executive’s remuneration is ‘at risk’. Long-term incentives are based on Company milestones linked to value drivers of the Poplar Grove Project.

Executive Remuneration

The Group’s remuneration policy is to provide a fixed remuneration component and a performance based component (short term incentive and long-term incentive). The Board believes that this remuneration policy is

appropriate given the considerations discussed in the section above and is appropriate in aligning executives’ objectives with shareholder and business objectives.

Fixed Remuneration

Fixed remuneration consists of base salaries, as well as employer 401(k) contributions or contributions to superannuation funds, and other non-cash benefits. Non-cash benefits may include provision of car parking,

health care benefits, health insurance and life insurance.

Fixed remuneration is reviewed annually by the Board. The process consists of a review of company and individual performance, relevant comparative remuneration externally and internally and, where appropriate,

external advice on policies and practices. No external remuneration consultants were used during the financial year.

|

Paringa Resources Limited ANNUAL REPORT 2019

|

15

|

DIRECTORS’ REPORT (Continued)

REMUNERATION REPORT (AUDITED) (Continued)

Executive Remuneration (Continued)

Performance Based Remuneration – Short Term Incentives (“STI”)

Some executives are entitled to an annual or semi-annual cash bonus upon achieving various key performance indicators (“KPI’s”), as set by the Board. Having regard to the current size, nature and opportunities of

the Company, the Board has determined that these KPI’s will include measures such as successful construction activities (e.g. completion of construction programs within budgeted timeframes and cost), operating activities (e.g. achievement of

certain production milestones), corporate activities (e.g. recruitment of key personnel) and business development activities (e.g. successful investor relations activities). These measures were chosen as the Board believes these represent the key

drivers in the short and medium-term success of the project’s development. The Board currently assesses performance against these criteria annually.

During the 2019 financial year, no bonuses were paid to KMP (2018: US$133,115).

Performance Based Remuneration – Long Term Incentives

The Group has adopted a long-term incentive plan (“LTIP”) comprising the “Paringa Performance Rights Plan” (the “Plan”) to reward KMP and key employees and contractors for long-term performance.

The Plan provides for the issuance of performance rights (“employee rights”) which, upon satisfaction of the relevant performance conditions attached to the employee rights, will result in the issue of an ordinary

share for each employee right. Employee rights are issued for no consideration and no amount is payable upon conversion thereof.

To achieve its corporate objectives the Company needs to attract and retain its key staff, whether employees or contractors. Grants made to eligible participants under the Plan will assist with the Company's

employment strategy and will:

| (a) |

enable the Company to recruit, incentivise and retain KMP and other eligible employees to assist with the Buck Creek Complex operations to achieve the Company’s strategic objectives;

|

| (b) |

link the reward of eligible employees with the achievements of strategic goals and the long-term performance of the Company;

|

| (c) |

align the financial interests of eligible participants of the proposed Plan with those of Shareholders; and

|

| (d) |

provide incentives to eligible employees of the Plan to focus on superior performance that creates Shareholder value.

|

Employee rights granted under the Plan to eligible participants will be linked to the achievement by the Company of certain performance conditions as determined by the Board from time to time. These performance

conditions must be satisfied in order for the employee rights to vest. The employee rights also vest where there is a change of control of the Company. Upon employee rights vesting, ordinary shares are automatically issued for no consideration.

If a performance condition of an employee right is not achieved by the expiry date then the employee right will lapse.

During the financial year, 6,800,000 employee rights were granted by the Company to executive KMP. During the financial year, 2,975,000 employee rights held by executive KMP vested upon achievement of the

Construction Milestone in relation to the Buck Creek Complex. During the financial year, 700,000 employee rights held by executive KMP were either forfeited or lapsed. At June 30, 2019, executive KMP held 12,950,000 employee rights that will vest

upon achievement of certain performance conditions in relation to the Buck Creek Complex including: (a) First Coal Production Milestone; (b) Nameplate Production Milestone; (c) 1.7 Mtpa Coal Production Milestone; and (d) 2.7 Mtpa Coal Production

Milestone.

In addition, the Group has chosen to provide incentive options (“employee options”) to some KMP as part of their remuneration and incentive arrangements in order to attract and retain their services and to provide

an incentive linked to the performance of the Group. The Board has a policy of granting employee options to KMP with exercise prices at or above market share price (at the time of agreement). As such, the employee options granted to KMP are

generally only of benefit if the KMP perform to the level whereby the value of the Group increases sufficiently to warrant exercising the employee options granted.

| 16 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Other than service-based vesting conditions (if any), there are no additional performance criteria on the employee options granted to KMP, as given the speculative nature of the Group’s activities at the time and

the previously small management team responsible for its running, it is considered the performance of the KMP and the performance and value of the Group are closely related. The Company prohibits executives entering into arrangements to limit

their exposure to employee options granted as part of their remuneration package.

During the financial year, 2,300,000 employee options were granted by the Company to executive KMP. During the financial year, no employee options held by executive KMP were exercised, and no employee options held

by executive KMP were forfeited or lapsed. At June 30, 2019, executive KMP held 2,300,000 employee options.

Non-Executive Director Remuneration

The Board’s policy is for fees to Non-Executive Directors to be no greater than market rates for comparable companies for time, commitment and responsibilities. Given the current size, nature and risks of the

Company, employee options and/or employee rights may also be used to attract and retain Non-Executive Directors. The Board determines payments to the Non-Executive Directors and reviews their remuneration annually, based on market practice,

duties and accountability. Independent external advice is sought when required. No external remuneration consultants were used during the financial year.

The maximum aggregate amount of fees that can be paid to Non-Executive Directors is subject to approval by shareholders at a General Meeting. Director’s fees paid to Non-Executive Directors accrue on a daily basis.

Fees for Non-Executive Directors are not linked to the performance of the economic entity. However, to align Directors’ interests with shareholder interests, the Directors are encouraged to hold shares in the Company and given the current size,

nature and opportunities of the Company, Non-Executive Directors may receive employee options and/or employee rights in order to secure their initial or ongoing holding and retain their services. The Company prohibits non-executives entering into

arrangements to limit their exposure to employee options granted as part of their remuneration package.

Fees for the Chairman are presently A$50,000 (US$35,065) per annum, however the Chairman, Mr. Ian Middlemas, elected to only receive fees of A$36,000 (US$24,624) for the 2019 financial year. Fees for Non-Executive

Directors’ are presently set at A$30,000 (US$21,039) per annum. These fees cover main board activities only. Non-Executive Directors may receive additional remuneration for other services provided to the Company, including, but not limited to,

membership of committees. During the financial year, the Company established an Audit Committee.

Relationship between Remuneration of KMP and Shareholder Wealth

As discussed above, the Poplar Grove Mine commenced operations during the year and production ramp-up activities are underway, with full production capacity targeted in 2021. The Group expects to be free cash flow

positive in February 2020 on a 2-mining unit basis. During the Company’s ramp-up phase, the Board anticipates that the Company will retain earnings (if any) and other cash resources for its ramp-up operations. Accordingly, the Company does not

currently have a policy with respect to the payment of dividends and returns of capital. Therefore, there was no relationship between the Board’s policy for determining, or in relation to, the nature and amount of remuneration of KMP and

dividends paid and returns of capital by the Company during the current and previous financial years. The Board did not determine, and in relation to, the nature and amount of remuneration of the KMP by reference to changes in the price at which

shares in the Company traded between the beginning and end of the current and the previous financial years. Discretionary annual cash bonuses are based upon achieving various non-financial key performance indicators as detailed under “Performance

Based Remuneration – Short Term Incentive” and are not based on share price or earnings. However, as noted above, certain KMP are granted employee options and/or employee rights which generally will be of greater value to KMP if the value of the

Company’s shares increases (subject to vesting conditions being met).

Relationship between Remuneration of KMP and Earnings

As discussed above, the Poplar Grove Mine commenced operations during the year and production ramp-up activities are underway, with full production capacity targeted in 2021. The Group expects to be free cash flow

positive in February 2020 on a 2-mining unit basis. Until such time, the Company does not expect to be undertaking profitable operations. Accordingly, the Board does not consider earnings during the current and previous financial years when

determining, and in relation to, the nature and amount of remuneration of KMP.

|

Paringa Resources Limited ANNUAL REPORT 2019

|

17

|

DIRECTORS’ REPORT (Continued)

REMUNERATION REPORT (AUDITED) (Continued)

Emoluments of Directors and Other KMP

Details of the nature and amount of each element of the emoluments of each Director and KMP of Paringa Resources Limited are as follows:

|

2019

|

Short-term benefits

|

Post-

employment

benefits

US$

|

Share-

based

payments

US$

|

Termin-

ation

Payments

US$

|

Total

US$

|

Perform-

ance

related

%

|

||

|

Salary

& fees

US$

|

Cash

Bonus

US$

|

Other

US$

|

||||||

|

Directors

|

||||||||

|

Mr. Ian Middlemas

|

24,624

|

-

|

-

|

-

|

-

|

-

|

24,624

|

-

|

|

Mr. Todd Hannigan

|

21,223

|

-

|

-

|

2,016

|

248,078

|

-

|

271,317

|

91%

|

|

Mr. Egan Antill1

|

192,500

|

-

|

4,593

|

3,231

|

181,316

|

-

|

381,640

|

48%

|

|

Mr. David Gay

|

280,000

|

-

|

24,097

|

11,000

|

263,246

|

-

|

578,343

|

46%

|

|

Mr. Jonathan Hjelte

|

21,223

|

-

|

-

|

-

|

-

|

-

|

21,223

|

-

|

|

Mr. Richard McCormick

|

21,223

|

-

|

-

|

-

|

-

|

-

|

21,223

|

-

|

|

Mr. Thomas Todd

|

21,223

|

-

|

-

|

1,025

|

124,039

|

-

|

146,287

|

85%

|

|

Other KMP

|

||||||||

|

Mr. Richard Kim

|

210,000

|

-

|

36,039

|

8,400

|

161,752

|

-

|

416,191

|

39%

|

|

Mr. Dominic Allen2

|

123,846

|

-

|

16,110

|

-

|

120,073

|

-

|

260,029

|

46%

|

|

Mr. Bruce Czachor

|

100,000

|

-

|

15,665

|

4,000

|

36,268

|

-

|

155,933

|

23%

|

|

Mr. Gregory Swan3

|

-

|

-

|

-

|

-

|

69,395

|

-

|

69,395

|

100%

|

|

Mr. Adam Anderson4

|

100,846

|

11,838

|

3,800

|

(48,132)

|

31,667

|

100,019

|

-

|

|

|

1,116,708

|

-

|

108,342

|

33,472

|

1,156,035

|

31,667

|

2,446,224

|

||

|

2018

|

Short-term benefits

|

Post-

employment

benefits

US$

|

Share-

based

payments

US$

|

Termin-

ation

Payments

US$

|

Total

US$

|

Perform-

ance

related

%

|

||

|

Salary

& fees

US$

|

Cash

Bonus

US$

|

Other

US$

|

||||||

|

Directors

|

||||||||

|

Mr. Ian Middlemas

|

26,633

|

-

|

-

|

-

|

-

|

-

|

26,633

|

-

|

|

Mr. Todd Hannigan

|

22,969

|

-

|

-

|

2,182

|

446,794

|

-

|

471,945

|

95%

|

|

Mr. David Gay

|

280,000

|

50,000

|

21,057

|

9,000

|

560,330

|

-

|

920,387

|

66%

|

|

Mr. Jonathan Hjelte

|

22,800

|

-

|

-

|

-

|

-

|

-

|

22,800

|

-

|

|

Mr. Richard McCormick

|

22,800

|

-

|

-

|

-

|

-

|

-

|

22,800

|

-

|

|

Mr. Thomas Todd

|

22,969

|

-

|

-

|

2,182

|

223,397

|

-

|

248,548

|

90%

|

|

Mr. Grant Quasha5

|

337,885

|

-

|

947

|

10,514

|

(11,688)

|

5,375

|

343,033

|

-

|

|

Other KMP

|

||||||||

|

Mr. Richard Kim

|

174,616

|

15,000

|

33,322

|

6,985

|

319,285

|

-

|

549,208

|

61%

|

|

Mr. Adam Anderson4

|

135,192

|

48,115

|

15,837

|

3,508

|

48,132

|

-

|

250,784

|

38%

|

|

Mr. Bruce Czachor6

|

55,769

|

-

|

962

|

1,231

|

15,316

|

-

|

73,278

|

21%

|

|

Mr. Gregory Swan3

|

-

|

-

|

-

|

-

|

102,235

|

-

|

102,235

|

100%

|

|

Mr. Nathan Ainsworth7

|

98,366

|

20,000

|

7,110

|

-

|

189,613

|

-

|

315,089

|

67%

|

|

Mr. Mathew Haaga8

|

23,331

|

-

|

-

|

-

|

35,717

|

-

|

59,048

|

60%

|

|

Mr. James Plaisted9

|

12,365

|

-

|

10,610

|

-

|

20,760

|

-

|

43,735

|

47%

|

|

1,235,695

|

133,115

|

89,845

|

35,602

|

1,949,891

|

5,375

|

3,449,523

|

||

Notes:

| 1 |

Mr. Egan Antill was appointed effective December 12, 2018.

|

| 2 |

Mr. Dominic Allen was appointed effective August 13, 2018.

|

| 3 |

Mr. Swan provides services as the Company Secretary through a services agreement with Apollo Group Pty Ltd. During fiscal 2019, Apollo Group Pty Ltd was paid A$180,000 (2018: $180,000) for the provision of a

fully serviced office and administrative, accounting and company secretarial services to the Company, based on a monthly retainer of A$15,000.

|

| 4 |

Mr. Adam Anderson was appointed effective October 16, 2017 and ceased employment effective January 9, 2019. Upon cessation of employment, Mr Anderson forfeited his employee rights. Any share-based payment

expense previously recognised under AASB 2 in respect of these employee rights has been reversed.

|

| 5 |

Mr. Grant Quasha resigned effective June 18, 2018. Upon cessation of employment, Mr. Quasha terminated his employee rights. Any share-based payment expense previously recognised under AASB 2 in respect of

these employee rights has been reversed.

|

| 6 |

Mr. Bruce Czachor was appointed effective December 11, 2017.

|

| 7 |

Mr. Nathan Ainsworth ceased to be KMP effective February 4, 2018.

|

| 8 |

Mr. Mathew Haaga ceased to be KMP effective October 16, 2017.

|

| 9 |

Mr. James Plaisted ceased to be KMP effective October 16, 2017.

|

| 18 |

Paringa Resources Limited ANNUAL REPORT 2019

|

Options and Rights Granted to KMP

Details of the values of employee options and employee rights granted, exercised or lapsed for each KMP of the Group during the 2019 financial year are as follows:

|

2019

|

No. of

Options &

Rights granted

as part of

remuneration

during year

|

No. of

Options &

Rights granted

as remuneration

that vested

during year

|

No. of

Options &

Rights granted

as remuneration

that lapsed or

were forfeited

during year1

|

Value of

Options &

Rights granted

as remuneration

during year2

US$

|

Value of

Options &

Rights granted

as remuneration

that were

exercised

during year3

US$

|

Value of Options

& Rights

included in

remuneration for

year

US$

|

|

Directors

|

||||||

|

Mr Todd Hannigan

|

-

|

750,000

|

(500,000)

|

-

|

101,973

|

248,078

|

|

Mr Egan Antill

|

7,800,000

|

-

|

-

|

845,464

|

-

|

181,316

|

|

Mr David Gay

|

-

|

900,000

|

-

|

-

|

122,368

|

263,246

|

|

Mr Jonathan Hjelte

|

-

|

-

|

(500,000)

|

-

|

-

|

-

|

|

Mr Thomas Todd

|

-

|

375,000

|

(500,000)

|

-

|

50,987

|

124,039

|

|

Other KMP

|

||||||

|

Mr Richard Kim

|

-

|

500,000

|

-

|

-

|

67,982

|