|

Delaware

|

| |

7389

|

| |

98-1399727

|

|

(State or other jurisdiction of

incorporation or organization)

|

| |

(Primary Standard Industrial

Classification Code Number)

|

| |

(I.R.S. Employer Identification

Number)

|

|

Large accelerated filer

|

| |

☐

|

| |

|

| |

Accelerated filer

|

| |

☒

|

|

Non-accelerated filer

|

| |

☐

|

| |

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

|

| |

Emerging growth company

|

| |

☒

|

|

•

|

“Amended and Restated Registration Rights Agreement” are to the amended and restated registration rights agreement entered into by

DMS, Prism, Clairvest Direct Seller, Blocker Seller 1, Blocker Seller 2, Sponsor PIPE Entity and the Leo Independent Directors at Closing;

|

|

•

|

“Amended Partnership Agreement” are to the amended and restated limited liability company agreement of DMSH entered into by DMS,

DMSH, Prism, Clairvest Direct Seller, Blocker Corp and the Prism members at Closing;

|

|

•

|

“Amended and Restated Warrant Agreement” are to the amended and restated warrant agreement entered into by DMS and Continental at

Closing;

|

|

•

|

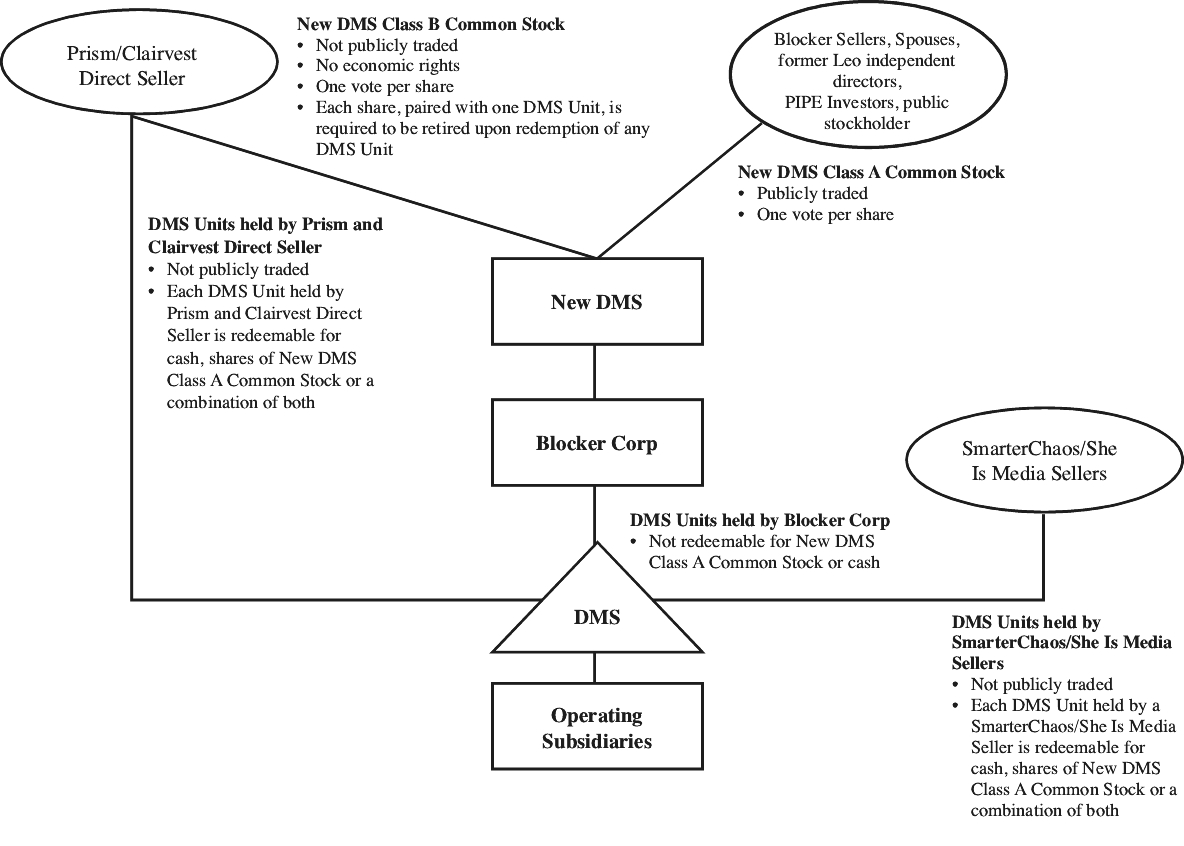

“Blocker Corp” are to CEP V DMS US Blocker Company, a Delaware corporation;

|

|

•

|

“Blocker Seller 1” are to Clairvest Equity Partners V Limited Partnership, an Ontario, Canada limited partnership;

|

|

•

|

“Blocker Seller 2” are to CEP V Co-Investment Limited Partnership, a Manitoba, Canada limited partnership;

|

|

•

|

“Blocker Sellers” are to Blocker Seller 1 and Blocker Seller 2;

|

|

•

|

“Board” are to the board of directors of DMS;

|

|

•

|

“Business Combination” are to the transactions contemplated by the Business Combination Agreement, collectively;

|

|

•

|

“Business Combination Agreement” are to Business Combination Agreement, dated as of April 23, 2020 by and among Leo, DMS, Blocker

Corp, Sellers, Clairvest GP Manageco Inc., an Ontario corporation as a Seller Representative, and, solely for the limited purposes set forth therein, Sponsor.

|

|

•

|

“Business Combination Consideration” are to a combination of cash consideration, the Seller Warrants, shares of Class B Common

Stock and shares of Class C Common Stock;

|

|

•

|

“Bylaws” are to the bylaws of DMS which were made effective upon the Domestication;

|

|

•

|

“Certificate of Incorporation” are to the certificate of incorporation of DMS which was made effective upon the Domestication;

|

|

•

|

“Clairvest” are to Clairvest Group Inc., an Ontario corporation;

|

|

•

|

“Clairvest Direct Seller” are to CEP V-A DMS AIV Limited Partnership, a Delaware limited partnership;

|

|

•

|

“Class A Common Stock” are to the Class A common stock, par value $0.0001 per share, of DMS;

|

|

•

|

“Class B Common Stock” are to the Class B common stock, par value $0.0001 per share, of DMS, which have no economic value but

entitle the holder thereof to one vote per share and, in accordance with the Certificate of Incorporation, will be retired on a one-for-one basis upon the redemption of any DMS Units held by Prism or Clairvest Direct Seller in accordance

with the Amended Partnership Agreement;

|

|

•

|

“Class C Common Stock” are to the Class C common stock, par value $0.0001 per share, of DMS, which are convertible into shares of

Class A Common Stock in accordance with the Certificate of Incorporation on a one-to-one basis;

|

|

•

|

“Class A ordinary shares” are to the Class A ordinary shares, par value $0.0001 per share, of DMS;

|

|

•

|

“Class B ordinary shares” or “Founder Shares” are to the 5,000,000 Class B ordinary shares, par value $0.0001 per share, of Leo

(of which at least 1,924,282 Class B ordinary shares were surrendered and forfeited pursuant to the Surrender Agreement described in this registration statement);

|

|

•

|

“Closing” are to the closing of the Business Combination;

|

|

•

|

“Continental” are to Continental Stock Transfer & Trust Company;

|

|

•

|

“Converted Founder Shares” are to the shares of Class A Common Stock issued as a matter of law upon the conversion of the Class B

ordinary shares at the time of the Domestication;

|

|

•

|

“Conversion” are to the conversion by Blocker Sellers of the shares of Class C Common Stock issued to them in the Business

Combination into shares of Class A Common Stock, on a one-for-one basis, in accordance with the Certificate of Incorporation that was effective as of immediately prior to the close of business on July 17, 2020;

|

|

•

|

“Conversion Shares” are to the 17,937,954 shares of Class A Common Stock that were issued to the Blocker Sellers in connection

with the Conversion;

|

|

•

|

“Crisp Results Purchase Agreement” are to asset purchase agreement, dated as of April 1, 2021, by and among DMS, Inc., Edge

Marketing LLC, a Delaware LLC, Crisp Marketing LLC, a Florida LLC, Union Health, LLC, a Florida LLC and Justin Ferreira as Seller Representative in connection with the Crisp Results Acquisition.

|

|

•

|

“Director Nomination Agreement” are to the director nomination agreement to entered into by DMS, Sponsor, Sponsor PIPE Entity,

Clairvest and Prism at the Closing;

|

|

•

|

“DMS” are to Digital Media Solutions, Inc., a Delaware corporation, and its consolidated subsidiaries;

|

|

•

|

“DMS Common Stock” are collectively to Class A Common Stock, Class B Common Stock and Class C Common Stock;

|

|

•

|

“DMS LLC” are to Digital Media Solutions, LLC, a Delaware limited liability company;

|

|

•

|

“DMS Units” are to the membership interests in DMSH;

|

|

•

|

“DMSH” are to Digital Media Solutions Holdings, LLC, a Delaware limited liability company;

|

|

•

|

“Domestication” are to the domestication of Leo Holdings Corp. as a corporation incorporated in the State of Delaware;

|

|

•

|

“initial public offering” are to Leo’s initial public offering that was consummated on February 15, 2018;

|

|

•

|

“IPO registration statement” are to the Registration Statement on Form S-1 (333-222599) filed by Leo in connection with its

initial public offering and declared effective by the SEC on February 12, 2018;

|

|

•

|

“Leo” are to Leo Holdings Corp. prior to the Domestication;

|

|

•

|

“Leo Independent Directors” are to Mss. Bush and Minnick, and Mr. Bensoussan;

|

|

•

|

“Leo private placement warrants” are to the 4,000,000 private placement warrants of Leo (of which 2,000,000 Leo private placement

warrants were surrendered and forfeited pursuant to the Surrender Agreement described in this prospectus), which were automatically converted by operation of law, on a one-for-one basis without giving effect to any rights of adjustment or

other anti-dilution protections which adjustment and protections were waived by the holders of the Class B ordinary shares pursuant to the Surrender Agreement, into warrants to acquire shares of Class A Common Stock in the Domestication;

|

|

•

|

“Lion Capital” are to Lion Capital, LLP, an affiliate of Sponsor;

|

|

•

|

“Majority Shareholders” are to Prism and three Clairvest funds, CEP V-A DMS AIV Limited Partnership, Clairvest Equity Partners V

Limited Partnership, and CEP V Co-Investment Limited Partnership, collectively;

|

|

•

|

“Non-Blocker Member” are to any individual or entity (other than Blocker Corp) that is, from time to time, admitted to DMSH as a

member pursuant to the Delaware Limited Liability Company Act and the Amended Partnership Agreement and that has not ceased to be a member of DMSH pursuant to the Delaware Limited Liability Company Act and the Amended Partnership

Agreement;

|

|

•

|

the outstanding Class A Common Stock “on an as-redeemed basis” are to the number of shares of Class A Common Stock that would be

outstanding assuming all DMS Units held by Prism, Clairvest Direct Seller and the SmarterChaos sellers were acquired upon a Redemption by DMS for shares of Class A Common Stock in accordance with the Amended Partnership Agreement;

|

|

•

|

“ordinary shares” are to the Class A ordinary shares and the Class B ordinary shares, collectively;

|

|

•

|

“PIPE Investment” are to the transactions contemplated by the Subscription Agreements, pursuant to which the PIPE Investors

collectively committed to subscribe for the PIPE Shares for an aggregate purchase price equal to $100.0 million, which were consummated substantially concurrently with the Closing;

|

|

•

|

“PIPE Investors” are to the qualified institutional buyers and accredited investors (including Sponsor PIPE Entity) that received

the PIPE Shares in the PIPE Investment;

|

|

•

|

“PIPE Shares” are to the 10,424,282 shares of Class A Common Stock that were issued to the PIPE Investors in connection with the

PIPE Investment;

|

|

•

|

“Prism” are to Prism Data, LLC, a Delaware limited liability company;

|

|

•

|

“Private Placement Warrants” are to the 2,000,000 warrants of DMS issued as a matter of law upon the conversion at the time of the

Domestication of the Leo private placement warrants and the Seller Warrants;

|

|

•

|

“pro forma” are to giving pro forma effect to the Business Combination;

|

|

•

|

“Public Warrants” are to the 10,000,000 warrants of DMS issued as a matter of law upon the conversion at the time of the

Domestication of the public warrants that were offered and sold by Leo as part of units in its initial public offering and registered pursuant to the IPO registration statement;

|

|

•

|

“Redemption” are to an acquisition made pursuant to the Amended Partnership Agreement by DMS of DMS Units in exchange for Class A

Common Stock on a one-for-one basis (subject to customary conversion rate adjustments, including for stock splits, stock dividends and reclassifications);

|

|

•

|

“Redemption Shares” are to shares of Class A Common Stock issued in connection with a Redemption;

|

|

•

|

“SEC” are to the Securities and Exchange Commission;

|

|

•

|

“Sellers” are to Prism, Clairvest Direct Seller and Blocker Sellers;

|

|

•

|

“Seller Warrants” are to the 2,000,000 warrants issued to Sellers as part of the Business Combination Consideration and pursuant

to the Amended and Restated Warrant Agreement;

|

|

•

|

“Surrender Agreement” are to the Amended and Restated Sponsor Shares and Warrant Surrender Agreement, dated as of June 22, 2020,

entered into by Leo, the Sponsor and the Leo Independent Directors;

|

|

•

|

“Sponsor” are to Leo Investors Limited Partnership, a Cayman Islands exempted limited partnership;

|

|

•

|

“Sponsor PIPE Entity” are to Lion Capital (Guernsey) Bridgeco Limited, a company organized under the laws of Guernsey;

|

|

•

|

“Subscription Agreements” are to the subscription agreements, entered into by Leo and each of the PIPE Investors in connection

with the PIPE Investment;

|

|

•

|

“Tax Receivable Agreement” are to the tax receivable agreement entered into by DMS, Blocker Corp and the Sellers at the Closing;

and

|

|

•

|

“Trust Account” are to the trust account established at the consummation of Leo’s initial public offering at JP Morgan Chase Bank,

N.A. and maintained by Continental, acting as trustee.

|

|

•

|

our ability to identify, evaluate, and complete any strategic alternative in connection with our review of strategic alternatives;

|

|

•

|

the possibility that DMS may not be able to realize higher value for its business through a strategic alternative and therefore

retains its current corporate and business structure;

|

|

•

|

the possibility that DMS may decide not to undertake a strategic alternative or that it is not able to consummate any proposed

strategic alternative due to, among other things, market, regulatory and other factors;

|

|

•

|

the potential for disruption to DMS’s business, including, among other things, attracting and retaining customers, suppliers, key

personnel;

|

|

•

|

any potential adverse effects on DMS’s stock price resulting from the announcement of the process to review potential strategic

alternatives or the results of that review;

|

|

•

|

the COVID-19 pandemic or other public health crises;

|

|

•

|

changes in client demand for our services and our ability to adapt to such changes; (8) the entry of new competitors in the

market;

|

|

•

|

the ability to maintain and attract consumers and advertisers and successfully grow and operate our new health insurance agency

business, in the face of changing economic or competitive conditions;

|

|

•

|

the ability to maintain, grow and protect the data DMS obtains from consumers and advertisers;

|

|

•

|

the performance of DMS’s technology infrastructure;

|

|

•

|

the ability to protect DMS’s intellectual property rights;

|

|

•

|

the ability to successfully source and complete acquisitions and to integrate the operations of companies DMS acquires, including

the Crisp Results assets and Aimtell, PushPros and Aramis Interactive;

|

|

•

|

the ability to improve and maintain adequate internal controls over financial and management systems, and remediate the identified

material weakness;

|

|

•

|

changes in applicable laws or regulations and the ability to maintain compliance;

|

|

•

|

our substantial levels of indebtedness;

|

|

•

|

volatility in the trading price on the NYSE of our common stock and warrants;

|

|

•

|

fluctuations in value of our private placement warrants; and

|

|

•

|

other risks and uncertainties indicated from time to time in DMS’s filings with the SEC, including those described herein under

the heading “Risk Factors.”

|

|

•

|

Customer acquisition - The process of identifying and cultivating potential customers (also known as customers or near customers

otherwise known as leads) for our customer’s business products or services through impressions, clicks and direct messaging (email, push and text/SMS or short message service) based on predefined qualifying characteristics specified by

the customer. Revenue is earned based on the cost per action (“CPA”) defined within the executed insertion order (“IO”) and/or agreed to with the customer.

|

|

•

|

Managed Services - The management of a customer’s marketing spend and performance, through the utilization of proprietary

software delivery platform. Revenue in certain cases, is earned based on a percentage (%) of the customer’s total media spend, which is recognized as a net revenue, while other revenue is recognized on a gross basis.

|

|

•

|

Software Services (“SaaS”) - The application of propriety performance marketing software, which tracks lead counts, sources and

channels, pricing and overall spend for each client. The software allows online real-time management of marketing activities and spend to attract potential applicants, sourced through various digital online methods. Revenue is earned by

licensing the software to customers under a Software Services (“SaaS”) based contract.

|

|

•

|

changes in client demand for our services and our ability to adapt to such changes;

|

|

•

|

we participate in highly competitive markets, and the entry of new competitors in these markets;

|

|

•

|

the ability to maintain and attract consumers and advertisers in the face of changing economic or competitive conditions;

|

|

•

|

dependence on search engines, display advertising, social media, email, and content-based online advertising and other online

sources to attract consumers;

|

|

•

|

if our messages are not delivered and accepted or are routed by messaging providers less favorably than other messages, or if our

sites are not accessible or treated disadvantageously by internet service providers;

|

|

•

|

the ability to maintain, grow and protect the data DMS obtains from consumers and advertisers;

|

|

•

|

the performance of DMS technology infrastructure;

|

|

•

|

the ability to successfully source and complete acquisitions and to integrate the operations of companies DMS acquires;

|

|

•

|

our substantial levels of indebtedness, and maintaining covenants under our credit facility;

|

|

•

|

litigation could distract management, increase our expenses or subject us to material money damages and other remedies;

|

|

•

|

the change in fair value of our private placement warrants at each reporting period and the potential that such change may

adversely affect our net income (loss) in our consolidated statements of earnings (loss); and

|

|

•

|

dependence on key personnel to operate our business, and our management team has limited experience managing a public company.

|

|

•

|

the ability to protect DMS intellectual property rights; and

|

|

•

|

we may face litigation and liability due to claims of infringement of third-party intellectual property rights.

|

|

•

|

our businesses are heavily regulated, and are subject to a variety of international, federal, state, and local laws;

|

|

•

|

federal, state and international laws regulating telephone and messaging marketing practices impose certain obligations on

advertisers, which could reduce our ability to expand our business; and

|

|

•

|

changes in applicable laws or regulations and the ability to maintain compliance.

|

|

•

|

we are a holding company and our only material asset is our indirect interest in DMS, and we are accordingly dependent upon DMS

distributions;

|

|

•

|

we are required under the Tax Receivable Agreement to make payments to the Sellers (as defined below) in respect of certain tax

benefits and certain refunds of pre-Closing taxes of DMS and Blocker Corp, and such payments may be substantial;

|

|

•

|

the ability to improve and maintain adequate internal controls over financial and management systems;

|

|

•

|

our large shareholders have significant influence over us; and

|

|

•

|

volatility in the trading price on NYSE of our common stock and warrants.

|

|

•

|

the ability of our advertisers to earn an attractive return on investment from their spending with us;

|

|

•

|

our ability to increase the number of consumers using our marketplaces and brand direct solutions;

|

|

•

|

our ability to compete effectively with other media for advertising spending; and

|

|

•

|

our ability to keep pace with changes in technology and the practices and offerings of our competitors.

|

|

•

|

our ability to maintain marketplaces and brand direct solutions for consumers and advertisers that efficiently captures user

intent and effectively delivers relevant information to each individual consumer;

|

|

•

|

our ability to continue to innovate and improve our marketplaces and our brand direct solutions;

|

|

•

|

our ability to launch new vertical offerings that are effective and have a high degree of consumer and advertiser engagement;

|

|

•

|

our ability to maintain the compatibility of our mobile applications with operating systems, such as iOS and Android, and with

popular mobile devices running such operating systems; and

|

|

•

|

our ability to access a sufficient amount of data to enable us to provide relevant information to consumers. If the use of our

marketplaces and brand direct solutions declines or does not continue to grow, our business and operating results would be harmed.

|

|

•

|

increase the number of consumers using our marketplaces and brand direct solutions;

|

|

•

|

maintain and expand the number of advertisers that use our marketplaces and brand direct solutions or our revenue per provider;

|

|

•

|

further improve the quality of our marketplaces and brand direct solutions, and introduce high-quality new products;

|

|

•

|

increase the number of shoppers acquired by advertisers on our marketplaces and brand direct solutions;

|

|

•

|

timely adjust marketing expenditures in relation to changes in demand for the underlying products and services offered by our

advertisers;

|

|

•

|

maintain brand recognition and effectively leverage our brand; and

|

|

•

|

attract and retain management and other skilled personnel for our business.

|

|

•

|

regulatory hurdles;

|

|

•

|

failure of anticipated benefits to materialize;

|

|

•

|

diversion of management time and focus from operating our business to addressing acquisition integration challenges;

|

|

•

|

coordination of technology, research and development, and sales and marketing functions;

|

|

•

|

transition of the acquired company’s consumers and data to our marketplaces and brand direct solutions;

|

|

•

|

retention of employees from the acquired company;

|

|

•

|

cultural challenges associated with integrating employees from the acquired company into our organization;

|

|

•

|

integration of the acquired company’s products or technology;

|

|

•

|

integration of the acquired company’s accounting, management information, human resources and other administrative systems;

|

|

•

|

the need to implement or improve controls, procedures and policies at a business that prior to the acquisition may have lacked

effective controls, procedures and policies;

|

|

•

|

potential write-offs of intangibles or other assets acquired in such transactions that may have an adverse effect on our operating

results in a given period;

|

|

•

|

acquisitions targets may participate in markets, jurisdictions and verticals where our lack of experience makes an immediate

assessment of, and preparation for, possible risk difficult;

|

|

•

|

potential liabilities for activities of the acquired company before the acquisition, including patent and trademark infringement

claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities; and

|

|

•

|

litigation or other claims in connection with the acquired company, including claims from terminated employees, consumers, former

stockholders or other third parties.

|

|

•

|

requiring us to dedicate a portion of our cash resources to the payment of interest and principal, reducing money available to

fund working capital, capital expenditures, product development and other general corporate purposes;

|

|

•

|

increasing our vulnerability to adverse changes in general economic, industry and market conditions;

|

|

•

|

subjecting us to restrictive covenants that may reduce our ability to take certain corporate actions or obtain further debt or

equity financing;

|

|

•

|

limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we compete; and

|

|

•

|

placing us at a competitive disadvantage compared to our competitors that have less debt or better debt servicing options.

|

|

•

|

sell assets or make changes to the nature of our business;

|

|

•

|

engage in mergers or acquisitions;

|

|

•

|

incur, assume or permit additional indebtedness;

|

|

•

|

make restricted payments, including paying dividends on, repurchasing, redeeming or making distributions with respect to our

capital stock;

|

|

•

|

make specified investments;

|

|

•

|

engage in transactions with our affiliates; and

|

|

•

|

make payments in respect of subordinated debt.

|

|

•

|

the requirement that a majority of its board of directors consist of independent directors;

|

|

•

|

the requirement that the board have a nominating and governance committee composed entirely of independent directors with a

written charter addressing the committee’s purpose and responsibilities; and

|

|

•

|

the requirement that the board have a compensation committee composed entirely of independent directors with a written charter

addressing the committee’s purpose and responsibilities.

|

|

•

|

changes in the industries in which the Company and its customers operate;

|

|

•

|

variations in its operating performance and the performance of its competitors in general;

|

|

•

|

actual or anticipated fluctuations in the Company’s quarterly or annual operating results;

|

|

•

|

material and adverse impact of the COVID-19 pandemic on the markets and the broader global economy;

|

|

•

|

the public’s reaction to the Company’s press releases, its other public announcements and its filings with the SEC;

|

|

•

|

additions and departures of key personnel;

|

|

•

|

changes in laws and regulations affecting its business;

|

|

•

|

commencement of, or involvement in, litigation involving the Company;

|

|

•

|

changes in the Company’s capital structure, such as future issuances of securities or the incurrence of additional debt; and

|

|

•

|

the volume of shares of Class A Common Stock or Warrants available for public sale.

|

|

•

|

our existing stockholders’ proportionate ownership interest in us will decrease;

|

|

•

|

the amount of cash available per share, including for payment of dividends in the future, may decrease;

|

|

•

|

the relative voting strength of each previously outstanding share of Class A Common Stock may be diminished; and

|

|

•

|

the market price of our shares of Class A Common Stock may decline.

|

|

•

|

pursuant to the Surrender Agreement, Sponsor surrendered and forfeited to Leo 2,000,000 warrants to purchase Class A ordinary

shares and, together with certain other holders, 1,924,282 Class B ordinary shares;

|

|

•

|

Leo filed a notice of deregistration with the Cayman Islands Registrar of Companies, together with the necessary accompanying

documents, and filed the Certificate of Incorporation, and a certificate of corporate domestication with the Secretary of State of the State of Delaware, under which Leo was domesticated and continues as a Delaware corporation, changing

its name to “Digital Media Solutions, Inc.” and, in connection with the Domestication, the following transactions occurred:

|

|

•

|

the issued and outstanding Class A ordinary shares converted automatically by operation of law, on a one-for-one basis, into

shares of Class A Common Stock;

|

|

•

|

the issued and outstanding Class B ordinary shares converted automatically by operation of law, on a one-for-one basis without

giving effect to any rights of adjustment or other anti-dilution protections, into shares of Class A Common Stock;

|

|

•

|

the issued and outstanding redeemable warrants that were registered pursuant to the Registration Statement on Form S-1 (File No.

333-222599) of Leo became automatically redeemable warrants to acquire shares of Class A Common Stock;

|

|

•

|

each issued and outstanding unit of Leo that had not been previously separated into the underlying Class A ordinary share and

underlying warrant upon the request of the holder thereof was cancelled and the holder thereof became entitled to one share of Class A Common Stock and one-half of one redeemable warrant to acquire one share of Class A Common Stock; and

|

|

•

|

the issued and outstanding warrants of Leo to purchase Class A ordinary shares that were issued in a private placement

automatically became warrants to acquire shares of Class A Common Stock;

|

|

•

|

the Company consummated the PIPE Investment;

|

|

•

|

the Company paid $30,000,000 to DMS to be used as cash on the DMS balance sheet;

|

|

•

|

the Company paid $10,000,000 to DMS, which DMS used to pay down outstanding indebtedness under the Credit Facility; and

|

|

•

|

the Company purchased all of the issued and outstanding common stock of Blocker Corp and a portion of the DMS Units held by Prism

and Clairvest Direct Seller (which DMS Units were then immediately contributed to the capital of Blocker Corp), in exchange for the following aggregate consideration to the Sellers:

|

|

•

|

$57,255,217.33 in cash;

|

|

•

|

the Seller Warrants;

|

|

•

|

25,857,070 shares of Class B Common Stock; and

|

|

•

|

17,937,954 shares of Class C Common Stock.

|

|

•

|

recapitalize DMS such that, as of immediately following the consummation of the Business Combination, Prism and Clairvest Direct

Seller collectively owed 25,857,070 of the outstanding DMS Units and Blocker Corp owned 32,293,793 of the outstanding DMS Units; and

|

|

•

|

provide Clairvest Direct Seller and Prism the right to redeem their DMS Units for cash or, at the Company’s option, the Company

may acquire such DMS Units (which DMS Units are expected to be contributed to Blocker Corp) in exchange for cash or Redemption Shares, in each case subject to certain restrictions set forth therein.

|

|

1.

|

two individuals to be nominated for election to the Board, one of whom shall be independent under the applicable rules of the

NYSE, for so long as Clairvest and Prism collectively Beneficially Own (as defined in the Director Nomination Agreement) or control, directly or indirectly, at least 40% of the

|

|

2.

|

one individual to be nominated for election to the Board for so long as Clairvest Beneficially Owns or controls, directly or

indirectly, at least 8% of the total number of Voting Interests.

|

|

•

|

Customer acquisition — The process of identifying and cultivating potential customers (also known as customers or near customers

otherwise known as leads) for our customer’s business products or services through impressions, clicks and direct messaging (email, push and text/SMS or short message service) based on predefined qualifying characteristics specified by

the customer. Revenue is earned based on the CPA defined within the executed IO and/or agreed to with the customer.

|

|

•

|

Managed Services — The management of a customer’s marketing spend and performance, through the utilization of proprietary software

delivery platform. Revenue in certain cases, is earned based on a percentage (%) of the customer’s total media spend, which is recognized as a net revenue, while other revenue is recognized on a gross basis.

|

|

•

|

SaaS — The application of propriety performance marketing software, which tracks lead counts, sources and channels, pricing and

overall spend for each client. The software allows online real-time management of marketing activities and spend to attract potential applicants, sourced through various digital online methods. Revenue is earned by licensing the software

to customers under a SaaS based contract.

|

|

Name

|

| |

Age

|

| |

Position

|

|

Joseph Marinucci

|

| |

47

|

| |

President, Chief Executive Officer and Director

|

|

Fernando Borghese

|

| |

43

|

| |

Chief Operating Officer and Director

|

|

Vasundara Srenivas

|

| |

46

|

| |

Chief Financial Officer

|

|

Joseph Liner

|

| |

44

|

| |

Chief Revenue Officer

|

|

Matthew Goodman

|

| |

47

|

| |

Chief Information Officer

|

|

Jason Rudolph

|

| |

48

|

| |

Chief Product Officer

|

|

Anthony Saldana

|

| |

52

|

| |

General Counsel, Executive Vice President of Legal & Compliance

and Secretary

|

|

•

|

Customer acquisition - The process of identifying and cultivating potential customers (also known as customers or near customers

otherwise known as leads) for our customer’s business products or services through impressions, clicks and direct messaging (email, push and text/SMS or short message service) based on predefined qualifying characteristics specified by

the customer. Revenue is earned based on the cost per action (“CPA”) defined within the executed insertion order (“IO”) and/or agreed to with the customer.

|

|

•

|

Managed Services - The management of a customer’s marketing spend and performance, through the utilization of proprietary software

delivery platform. Revenue in certain cases, is earned based on a percentage (%) of the customer’s total media spend, which is recognized as a net revenue, while other revenue is recognized on a gross basis.

|

|

•

|

Software Services (“SaaS”) - The application of propriety performance marketing software, which tracks lead counts, sources and

channels, pricing and overall spend for each client. The software allows online real-time management of marketing activities and spend to attract potential applicants, sourced through various digital online methods. Revenue is earned by

licensing the software to customers under a Software Services (“SaaS”) based contract.LA

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Revenue by type:

|

| |

|

| |

|

|

Customer acquisition

|

| |

95.7%

|

| |

91.8%

|

|

Managed services

|

| |

3.6%

|

| |

7.2%

|

|

Software services

|

| |

0.7%

|

| |

1.0%

|

|

Total net revenue

|

| |

100.0%

|

| |

100.0%

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Revenue by segment:

|

| |

|

| |

|

|

Brand Direct

|

| |

59.3%

|

| |

59.3%

|

|

Marketplace

|

| |

52.4%

|

| |

46.9%

|

|

Other

|

| |

2.2%

|

| |

2.8%

|

|

Corporate and other

|

| |

(13.9)%

|

| |

(9.0)%

|

|

Net revenue

|

| |

100.0%

|

| |

100.0%

|

|

Cost of revenue

|

| |

70.1%

|

| |

70.5%

|

|

Salaries and related costs

|

| |

11.2%

|

| |

10.0%

|

|

General and administrative

|

| |

10.1%

|

| |

9.0%

|

|

Depreciation and amortization

|

| |

5.9%

|

| |

5.4%

|

|

Acquisition costs

|

| |

0.5%

|

| |

1.4%

|

|

Change in fair value of contingent consideration

|

| |

0.3%

|

| |

—%

|

|

Income from operations

|

| |

2.0%

|

| |

3.6%

|

|

Interest expense

|

| |

3.3%

|

| |

4.1%

|

|

Change in fair value of warrant liabilities

|

| |

(4.2)%

|

| |

2.7%

|

|

Change in tax receivable agreement liability

|

| |

(3.6)%

|

| |

—%

|

|

Loss on debt extinguishment

|

| |

0.5%

|

| |

—%

|

|

Loss on disposal of assets

|

| |

—%

|

| |

—%

|

|

Net income (loss) before income taxes

|

| |

6.0%

|

| |

(3.2)%

|

|

Income tax expense

|

| |

4.5%

|

| |

0.9%

|

|

Net income (loss)

|

| |

1.5%

|

| |

(4.1)%

|

|

Net income (loss) attributable to non-controlling interest

|

| |

0.9%

|

| |

(1.5)%

|

|

Net loss attributable to Digital Media Solutions, Inc.

|

| |

0.6%

|

| |

(2.6)%

|

|

|

| |

Years Ended December 31,

|

|||||||||

|

|

| |

2021

|

| |

2020

|

| |

$ Change

|

| |

% Change

|

|

Net revenue

|

| |

$427,935

|

| |

$332,856

|

| |

$95,079

|

| |

29%

|

|

Cost of revenue

|

| |

300,016

|

| |

234,731

|

| |

65,285

|

| |

28%

|

|

Salaries and related costs

|

| |

48,014

|

| |

33,386

|

| |

14,628

|

| |

44%

|

|

General and administrative

|

| |

43,049

|

| |

30,020

|

| |

13,029

|

| |

43%

|

|

Depreciation and amortization

|

| |

25,401

|

| |

17,954

|

| |

7,447

|

| |

41%

|

|

Acquisition costs

|

| |

1,967

|

| |

4,814

|

| |

(2,847)

|

| |

(59)%

|

|

Change in fair value of contingent consideration

|

| |

1,106

|

| |

—

|

| |

$1,106

|

| |

100%

|

|

Income from operations

|

| |

8,382

|

| |

11,951

|

| |

(3,569)

|

| |

(30)%

|

|

Interest expense

|

| |

14,166

|

| |

13,740

|

| |

426

|

| |

3%

|

|

Change in fair value of warrant liabilities

|

| |

(18,115)

|

| |

8,840

|

| |

(26,955)

|

| |

(305)%

|

|

Change in tax receivable agreement liability

|

| |

(15,289)

|

| |

—

|

| |

(15,289)

|

| |

(100)%

|

|

Loss on debt extinguishment

|

| |

2,108

|

| |

—

|

| |

2,108

|

| |

100%

|

|

Loss on disposal of assets

|

| |

8

|

| |

—

|

| |

8

|

| |

100%

|

|

Net income (loss) before income taxes

|

| |

$25,504

|

| |

$(10,629)

|

| |

$36,133

|

| |

(340)%

|

|

Income tax expense

|

| |

19,311

|

| |

3,085

|

| |

16,226

|

| |

526%

|

|

Net income (loss)

|

| |

$6,193

|

| |

$(13,714)

|

| |

$19,907

|

| |

(145)%

|

|

Net income (loss) attributable to non-controlling interest

|

| |

3,991

|

| |

(5,018)

|

| |

$9,009

|

| |

(180)%

|

|

Net loss attributable to Digital Media Solutions, Inc.

|

| |

$2,202

|

| |

$(8,696)

|

| |

$10,898

|

| |

(125)%

|

|

|

| |

Years Ended December 31,

|

|||||||||

|

|

| |

2021

|

| |

2020

|

| |

$ Change

|

| |

% Change

|

|

Brand Direct

|

| |

|

| |

|

| |

|

| |

|

|

Customer acquisition

|

| |

$244,942

|

| |

$179,682

|

| |

$65,260

|

| |

36%

|

|

Managed services

|

| |

8,845

|

| |

17,869

|

| |

(9,024)

|

| |

(51)%

|

|

Total Brand Direct

|

| |

$253,787

|

| |

$197,551

|

| |

$56,236

|

| |

28%

|

|

Marketplace

|

| |

|

| |

|

| |

|

| |

|

|

Customer acquisition

|

| |

$224,158

|

| |

$155,999

|

| |

$68,159

|

| |

44%

|

|

Other

|

| |

|

| |

|

| |

|

| |

|

|

Managed services

|

| |

$6,471

|

| |

$6,139

|

| |

$332

|

| |

5%

|

|

Software services

|

| |

3,169

|

| |

3,218

|

| |

(49)

|

| |

(2)%

|

|

Total Other

|

| |

$9,640

|

| |

$9,357

|

| |

$283

|

| |

3%

|

|

Corporate and Other

|

| |

|

| |

|

| |

|

| |

|

|

Customer acquisition

|

| |

$(59,650)

|

| |

$(30,051)

|

| |

$(29,599)

|

| |

98%

|

|

Total Customer acquisition

|

| |

409,450

|

| |

305,630

|

| |

103,820

|

| |

34%

|

|

Total Managed services

|

| |

15,316

|

| |

24,008

|

| |

(8,692)

|

| |

(36)%

|

|

Total Software services

|

| |

3,169

|

| |

3,218

|

| |

(49)

|

| |

(2)%

|

|

Total Net revenue

|

| |

$427,935

|

| |

$332,856

|

| |

$95,079

|

| |

29%

|

|

|

| |

Years Ended December 31,

|

||||||

|

|

| |

2021

|

| |

2020

|

| |

PPTS

Change

|

|

Brand Direct

|

| |

24.2%

|

| |

23.3%

|

| |

0.9

|

|

Marketplace

|

| |

27.0%

|

| |

29.5%

|

| |

-2.5

|

|

Other

|

| |

63.2%

|

| |

64.4%

|

| |

-1.2

|

|

Total gross profit percentage

|

| |

29.9%

|

| |

29.5%

|

| |

0.4

|

|

|

| |

Year Ended December 31, 2021

|

| |

Year Ended December 31, 2020

|

||||||||||||

|

|

| |

Reported

(GAAP)

|

| |

Adjustments(1)

|

| |

Adjusted

(Non-GAAP)

|

| |

Reported

(GAAP)

|

| |

Adjustments(1)

|

| |

Adjusted

(Non-GAAP)

|

|

Net revenue

|

| |

$427,935

|

| |

$14,387

|

| |

$442,322

|

| |

$332,856

|

| |

$7,801

|

| |

$340,657

|

|

Cost of revenue

|

| |

300,016

|

| |

14,387

|

| |

314,403

|

| |

234,731

|

| |

7,801

|

| |

242,532

|

|

Gross profit

|

| |

$127,919

|

| |

$—

|

| |

$127,919

|

| |

$98,125

|

| |

$—

|

| |

$98,125

|

|

Gross profit margin

|

| |

29.9%

|

| |

—%

|

| |

28.9%

|

| |

29.5%

|

| |

—%

|

| |

28.8%

|

|

(1)

|

Includes the gross up for certain Managed services contracts that are presented net of costs under GAAP.

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Net income

|

| |

$6,193

|

| |

$(13,714)

|

|

Adjustments

|

| |

|

| |

|

|

Interest expense

|

| |

14,166

|

| |

13,740

|

|

Income tax expense

|

| |

19,311

|

| |

3,085

|

|

Depreciation and amortization

|

| |

25,401

|

| |

17,954

|

|

Change in fair value of warrant liabilities(1)

|

| |

(18,115)

|

| |

8,840

|

|

Change in tax receivable agreement liability

|

| |

(15,289)

|

| |

—

|

|

Loss on debt extinguishment

|

| |

2,108

|

| |

—

|

|

Stock-based compensation expense

|

| |

6,463

|

| |

958

|

|

Restructuring costs

|

| |

1,118

|

| |

4,203

|

|

Acquisition costs(2)

|

| |

3,073

|

| |

4,814

|

|

Other expense(3)

|

| |

6,744

|

| |

5,702

|

|

Adjusted net income

|

| |

$51,173

|

| |

$45,582

|

|

Additional adjustments

|

| |

|

| |

|

|

Pro forma cost savings – Reorganization(4)

|

| |

31

|

| |

1,056

|

|

Pro forma cost savings – Acquisitions(5)

|

| |

3,330

|

| |

5,666

|

|

Acquisitions EBITDA(6)

|

| |

2,711

|

| |

400

|

|

Accounts reserved(7)

|

| |

944

|

| |

1,606

|

|

Adjusted EBITDA

|

| |

$58,189

|

| |

$54,310

|

|

Less: Capex

|

| |

$9,114

|

| |

$10,372

|

|

Unlevered free cash flow

|

| |

$49,075

|

| |

$43,938

|

|

Unlevered free cash flow conversion

|

| |

84.3%

|

| |

80.9%

|

|

(1)

|

Mark-to-market warrant liability adjustments.

|

|

(2)

|

Balance includes business combination transaction fees and related payments on Company’s EIP, acquisition incentive payments,

contingent consideration accretion, earnout payments and pre-acquisition expenses.

|

|

(3)

|

Balance includes legal fees associated with acquisitions, investor management fees and costs related to philanthropic initiatives,

and private warrant transaction related costs.

|

|

(4)

|

Costs savings as a result of the company reorganization initiated in Q2 2020.

|

|

(5)

|

Cost synergies expected as a result of the full integration of the acquisitions.

|

|

(6)

|

Pre-acquisition Adjusted EBITDA results from the Aimtell/Aramis/PushPro and Crisp, and SmarterChaos acquisitions during the years

ended December 31, 2021 and 2020, respectively.

|

|

(7)

|

For the year ended December 31, 2020, represents certain unusual bad debt expenses related to potentially uncollectible receivables

that resulted from the impact of the COVID-19 pandemic and an unexpected business interruption. Management has determined that these items are not indicative of normal operations. For the year ended December 31, 2021, represents bad debt

expense associated with a specific strategic customer that we believe will be settled over time.

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Unlevered free cash flow

|

| |

$49,075

|

| |

$43,938

|

|

Capital expenditures

|

| |

9,114

|

| |

10,372

|

|

Adjusted EBITDA

|

| |

$58,189

|

| |

$54,310

|

|

Accounts reserved(1)

|

| |

944

|

| |

1,606

|

|

Acquisitions EBITDA(2)

|

| |

2,711

|

| |

400

|

|

Pro forma cost savings – Reorganization(3)

|

| |

31

|

| |

1,056

|

|

Pro forma cost savings – Acquisitions(4)

|

| |

3,330

|

| |

5,666

|

|

Adjusted net income

|

| |

$51,173

|

| |

$45,582

|

|

Acquisition costs(5)

|

| |

3,073

|

| |

4,814

|

|

Other expenses(6)

|

| |

6,744

|

| |

5,702

|

|

Stock-based compensation

|

| |

6,463

|

| |

958

|

|

Restructuring costs

|

| |

1,118

|

| |

4,203

|

|

Change in fair value of warrant liabilities(7)

|

| |

(18,115)

|

| |

8,840

|

|

Loss on debt extinguishment

|

| |

2,108

|

| |

—

|

|

Subtotal before additional adjustments

|

| |

$49,782

|

| |

$21,065

|

|

Less: Interest expense

|

| |

14,166

|

| |

13,740

|

|

Less: Income tax expense

|

| |

19,311

|

| |

3,085

|

|

Less: Change in tax receivable agreement liability –

Consolidated statements of operations

|

| |

(15,289)

|

| |

—

|

|

Provision for bad debt

|

| |

4,798

|

| |

3,039

|

|

Loss from sales of assets

|

| |

—

|

| |

411

|

|

Loss on disposal of assets

|

| |

8

|

| |

—

|

|

Lease restructuring charges

|

| |

542

|

| |

4,203

|

|

Debt extinguishment

|

| |

2,108

|

| |

—

|

|

Stock-based compensation, net of amounts capitalized

|

| |

6,393

|

| |

958

|

|

Payment of contingent consideration

|

| |

—

|

| |

(1,000)

|

|

Amortization of debt issuance costs

|

| |

1,379

|

| |

936

|

|

Deferred income tax provision, net

|

| |

16,459

|

| |

(479)

|

|

Other

|

| |

—

|

| |

400

|

|

Change in fair value of contingent consideration

|

| |

1,106

|

| |

—

|

|

Change in fair value of warrant liability

|

| |

(18,115)

|

| |

8,840

|

|

Change in tax receivable agreement liabilities –

Consolidated statements of cash flows

|

| |

(16,402)

|

| |

1,138

|

|

Change in income tax receivable and payable

|

| |

(727)

|

| |

—

|

|

Change in accounts receivable

|

| |

(8,369)

|

| |

(14,409)

|

|

Change in prepaid expenses and other current assets

|

| |

(419)

|

| |

(630)

|

|

Change in accounts payable and accrued expenses

|

| |

(612)

|

| |

8,742

|

|

Change in other liabilities

|

| |

(956)

|

| |

622

|

|

Net cash provided by operating activities

|

| |

$18,787

|

| |

$17,011

|

|

(1)

|

For the year ended December 31, 2020, represents certain unusual bad debt expenses related to potentially uncollectible receivables

that resulted from the impact of the COVID-19 pandemic and an unexpected business interruption. Management has determined that these items are not indicative of normal operations. For the year ended December 31, 2021, represents bad debt

expense associated with a specific strategic customer that we believe will be settled over time.

|

|

(2)

|

Pre-acquisition Adjusted EBITDA results from the Aimtell/Aramis/PushPro and Crisp, and SmarterChaos acquisitions during the years

ended December 31, 2021 and 2020, respectively.

|

|

(3)

|

Costs savings as a result of the company reorganization initiated in Q2 2020.

|

|

(4)

|

Cost synergies expected as a result of the full integration of the acquisitions.

|

|

(5)

|

Balance includes business combination transaction fees and related payments on Company’s EIP, acquisition incentive payments,

contingent consideration accretion, earnout payments and pre-acquisition expenses.

|

|

(6)

|

Balance includes legal fees associated with acquisitions, investor management fees and costs related to philanthropic initiatives,

and private warrant transaction related costs.

|

|

(7)

|

Mark-to-market warrant liability adjustments.

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Numerator:

|

| |

|

| |

|

|

Net income (loss)

|

| |

$6,193

|

| |

$(13,714)

|

|

Net income (loss) attributable to DMSH prior to the Business Combination

|

| |

—

|

| |

(1,345)

|

|

Net income (loss) attributable to non-controlling interest

|

| |

3,991

|

| |

(5,018)

|

|

Net income (loss) attributable to Digital Media Solutions, Inc. - basic and

diluted

|

| |

$2,202

|

| |

$(7,351)

|

|

|

| |

|

| |

|

|

Denominator:

|

| |

|

| |

|

|

Weighted average shares – basic

|

| |

$35,249

|

| |

$32,335

|

|

Add: dilutive effects of employee equity awards

|

| |

389

|

| |

—

|

|

Add: dilutive effects of public warrants

|

| |

126

|

| |

—

|

|

Weighted average shares – diluted

|

| |

$35,764

|

| |

$32,335

|

|

|

| |

|

| |

|

|

Net earnings (loss) per common share:

|

| |

|

| |

|

|

Basic

|

| |

$0.06

|

| |

$(0.23)

|

|

Diluted

|

| |

$0.06

|

| |

$(0.23)

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Numerator:

|

| |

|

| |

|

|

Net income (loss) attributable to Digital Media Solutions, Inc. - basic and

diluted

|

| |

$2,202

|

| |

$(7,351)

|

|

Add adjustments:

|

| |

|

| |

|

|

Change in fair value of warrant liabilities

|

| |

(18,115)

|

| |

8,840

|

|

Acquisition and related costs

|

| |

3,073

|

| |

1,658

|

|

Lease restructuring costs

|

| |

1,118

|

| |

4,157

|

|

Business combination expenses

|

| |

3,330

|

| |

3,157

|

|

|

| |

Years Ended December 31,

|

|||

|

|

| |

2021

|

| |

2020

|

|

Equity-based compensation

|

| |

6,463

|

| |

958

|

|

Accounts reserved

|

| |

944

|

| |

1,606

|

|

|

| |

$(3,187)

|

| |

$20,376

|

|

Net income tax expense based on conversion of units

|

| |

—

|

| |

175

|

|

Adjusted net income (loss) attributable to Digital Media

Solutions, Inc. – basic and diluted

|

| |

$(985)

|

| |

$13,200

|

|

|

| |

|

| |

|

|

Denominator:

|

| |

|

| |

|

|

Weighted-average shares outstanding – basic and diluted

|

| |

$35,249

|

| |

$32,335

|

|

Weighted-average average LLC Units of DMSH, LLC that are

convertible into Class A common stock

|

| |

25,853

|

| |

26,306

|

|

|

| |

61,102

|

| |

58,641

|

|

|

| |

|

| |

|

|

Adjusted EPS - basic and diluted

|

| |

$(0.02)

|

| |

$0.23

|

|

|

| |

December 31,

2021

|

| |

December 31,

2020

|

| |

$ Change

|

| |

% Change

|

|

Cash

|

| |

$26,394

|

| |

$31,397

|

| |

$(5,003)

|

| |

(16)%

|

|

Availability under revolving credit facility

|

| |

$50,000

|

| |

$11,000

|

| |

$39,000

|

| |

355%

|

|

Total Debt

|

| |

$217,755

|

| |

$201,558

|

| |

$16,197

|

| |

8%

|

|

Name and Principal

Position

|

| |

Year

|

| |

Salary(1)

($)

|

| |

Bonus(1)(2)

($)

|

| |

Stock

Awards(3)

($)

|

| |

Option

Awards(3)

($)

|

| |

Non-Equity

Incentive Plan

Compensation(4)

($)

|

| |

All Other

Compensation(5)

($)

|

| |

Total

($)

|

|

Joseph Marinucci

Chief Executive Officer

|

| |

2021

|

| |

320,000

|

| |

—

|

| |

319,900

|

| |

17,006

|

| |

—

|

| |

32,833

|

| |

708,114

|

| |

2020

|

| |

320,333

|

| |

933

|

| |

170,311

|

| |

767,500

|

| |

—

|

| |

32,692

|

| |

1,291,769

|

||

|

|

| | | | | | | | | | | | | | | | ||||||||

|

Joseph Liner

Chief Revenue Officer

|

| |

2021

|

| |

400,000

|

| |

—

|

| |

120,017

|

| |

6,380

|

| |

120,902

|

| |

37,903

|

| |

703,547

|

| |

2020

|

| |

397,660

|

| |

4,216

|

| |

287,963

|

| |

63,898

|

| |

170,450

|

| |

32,508

|

| |

956,695

|

||

|

|

| | | | | | | | | | | | | | | | ||||||||

|

Fernando Borghese

Chief Operating Officer

|

| |

2021

|

| |

320,000

|

| |

—

|

| |

319,900

|

| |

17,006

|

| |

—

|

| |

33,488

|

| |

709,908

|

| |

2020

|

| |

320,333

|

| |

933

|

| |

170,311

|

| |

767,500

|

| |

—

|

| |

32,076

|

| |

1,291,153

|

|

(1)

|

During 2020, we took temporary precautionary measures intended to help minimize the risk of the COVID-19 pandemic to our employees,

our advertisers and the communities in which we participate, which could negatively impact our business, and implemented a Coronavirus Communications Plan, including a 90-day 20% reduction in the salaries of all of our employees at or

above the director level, with the unpaid salary amounts to be repaid at a future date, along with a 5% bonus (subject to the satisfaction of certain conditions) for the months of April, May and June 2020. On July 22, 2020, the 5% bonus

was paid: Mr. Marinucci received $933; Mr. Liner received $1,299; and Mr. Borghese received $933.

|

|

(2)

|

Mr. Liner was participant in the Digital Media Solutions, LLC Employee Incentive Plan (the “EIP”), which was a transaction-based

bonus plan. In connection with the Business Combination, Mr. Liner entered into a letter agreement with DMS, pursuant to which he waived his respective rights to receive any transaction bonus under the EIP in exchange for a lump-sum cash

payment equal to $2,917, and the potential to receive equity incentive awards from the Company in the future.

|

|

(3)

|

Amounts represent the aggregate grant date fair value of options and and/or restricted stock units (“RSUs”) granted in 2021 and

2020, respectively, computed in accordance with ASC 718. A discussion of the assumptions used in determining grant date fair value may be found in Note 13. Employee and director incentive plans to the Consolidated Financial Statements,

included in this prospectus.

|

|

(4)

|

Represents Mr. Liner’s commission payments under our Direct Sales Commissions Plan, which entitles Mr. Liner to 6% of gross profits

for direct sales introduced and closed by him, and 3% of gross profits for direct sales where Mr. Liner either introduced or closed the sale (but not both).

|

|

(5)

|

The other compensation listed in this column includes:

|

|

•

|

For the year ended December 31, 2021: (a) for Mr. Marinucci: (i) matching contributions under our 401(k) savings plan of $9,300;

and (ii) medical and other benefits of $23,533; (b) for Mr. Liner: (i) matching contributions under our 401(k) savings plan of $11,400; and (ii) medical and other benefits of $26,503; and (c) for Mr. Borghese (i) matching contributions

under our 401(k) savings plan of $8,400; and (ii) medical and other benefits of $25,088.

|

|

•

|

For the year ended December 31, 2020: (a) for Mr. Marinucci: (i) matching contributions under our 401(k) savings plan of $10,586;

and (ii) medical benefits of $22,106; (b) for Mr. Liner (i) matching contributions under our 401(k) savings plan of $9,081; and (ii) medical and long term disability benefits of $23,427; and (c) for Mr. Borghese (i) matching contributions

under our 401(k) savings plan of $8,645; and (ii) medical and other benefits of $23,431.

|

|

|

| |

Options

|

| |

Stock

|

|||||||||||||||||||||

|

Name and Principal

Position

|

| |

Grant Date

|

| |

Number of

Securities

Underlying

Unexercised

Options (#)

|

| |

Number of

Securities

Underlying

Unexercised

Options

Exercisable (#)(1)

|

| |

Option

Exercise

Price

($)

|

| |

Option

Expiration

Date

|

| |

Number of

Shares or

Units of

Stock That

Have Not

Vested (#)(1)

|

| |

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($)(2)

|

| |

Equity

Incentive

Plan Awards:

Number of

Unearned

Shares,

Units or Other

Rights That

Have

Not Vested (#)

|

| |

Equity

Incentive

Plan Awards:

Market or

Payout

Value of

Unearned

Shares,

Units or Other

Rights That

Have

Not Vested ($)

|

|

Joseph Marinucci

Chief Executive Officer

|

| |

10/28/2020

|

| |

34,014

|

| |

17,006

|

| |

$7.31

|

| |

10/28/2030

|

| |

70,000

|

| |

$334,600

|

| |

104,014

|

| |

$334,600

|

| |

8/19/2021

|

| |

230,548

|

| |

—

|

| |

$7.98

|

| |

8/19/2031

|

| |

100,251

|

| |

$479,200

|

| |

330,799

|

| |

$479,200

|

||

|

|

| | | | | | | | | | | | | | | | | | |||||||||

|

Joseph Liner

Chief Revenue Officer

|

| |

10/28/2020

|

| |

12,762

|

| |

6,380

|

| |

$7.31

|

| |

10/28/2030

|

| |

26,262

|

| |

$125,532

|

| |

39,024

|

| |

$125,532

|

| |

8/19/2021

|

| |

36,023

|

| |

—

|

| |

$7.98

|

| |

8/19/2031

|

| |

15,664

|

| |

$74,874

|

| |

51,687

|

| |

$74,874

|

||

|

|

| | | | | | | | | | | | | | | | | | |||||||||

|

Fernando Borghese

Chief Operating Officer

|

| |

10/28/2020

|

| |

34,014

|

| |

17,006

|

| |

$7.31

|

| |

10/28/2030

|

| |

70,000

|

| |

$334,600

|

| |

104,014

|

| |

$334,600

|

| |

8/19/2021

|

| |

230,548

|

| |

—

|

| |

$7.98

|

| |

8/19/2031

|

| |

100,251

|

| |

$479,200

|

| |

330,799

|

| |

$479,200

|

||

|

(1)

|

The options and RSUs granted in 2021 and in 2020 vest in four and three equal annual installments, respectively, beginning on the

first anniversary of the closing of the Business Combination, subject, in each case, to the executive’s continued employment on each applicable vesting date.

|

|

(2)

|

The dollar values are calculated using a per share stock price of $4.78, the closing price of our common stock reported on NYSE on

December 31, 2021.

|

|

|

| |

Cash

|

|

Annual director retainer

|

| |

$40,000

|

|

Lead director annual retainer

|

| |

$20,000

|

|

Audit Committee chairman annual retainer

|

| |

$20,000

|

|

Compensation Committee chairman annual retainer

|

| |

$15,000

|

|

Audit Committee member annual retainer

|

| |

$10,000

|

|

Compensation Committee member annual retainer

|

| |

$7,500

|

|

Name(1)

|

| |

Fees Earned or

Paid in Cash

|

| |

Stock Awards

|

| |

Total

|

|

Robbie Isenberg

|

| |

$47,500

|

| |

$95,030

|

| |

$142,530

|

|

James Miller

|

| |

$47,500

|

| |

$95,030

|

| |

$142,530

|

|

Name(1)

|

| |

Fees Earned or

Paid in Cash

|

| |

Stock Awards

|

| |

Total

|

|

Mary Minnick

|

| |

$85,000

|

| |

$95,030

|

| |

$180,030

|

|

Lyndon Lea

|

| |

$50,000

|

| |

$95,030

|

| |

$145,030

|

|

Robert Darwent

|

| |

$60,000

|

| |

$95,030

|

| |

$155,030

|

|

(1)

|

In addition to serving as a director, Mr. Marinucci serves as our Chief Executive Officer and his compensation is reflected in the

Summary Compensation Table. Mr. Borghese serves as our Chief Operating Officer. Messrs. Marinucci and Borghese do not receive any compensation for serving as directors. Accordingly, they are omitted from the table.

|

|

(2)

|

Represents the full grant date fair value of RSUs granted in 2021, calculated in accordance with FASB ASC Topic 718. We value RSUs

using the closing market price of our common stock reported on NYSE on the applicable grant date. All RSUs vest on the 2021 annual meeting of stockholders, provided the director remains in continuous service with the Company through such

date. For additional valuation assumptions, see Note 13 to our Consolidated Financial Statements for the fiscal year ended December 31, 2021.

|

|

Name

|

| |

Stock Awards

(in units)

|

|

Robbie Isenberg

|

| |

16,291

|

|

James Miller

|

| |

16,291

|

|

Mary Minnick

|

| |

16,291

|

|

Lyndon Lea

|

| |

16,291

|

|

Robert Darwent

|

| |

16,291

|

|

•

|

determine which eligible recipients will be participants to whom awards will be granted, whether and to what extent awards will be

granted and the number of shares (or amount of cash or other property) subject to each award;

|

|

•

|

determine the terms and conditions, not inconsistent with the terms of the Plan, of each award, including, the restrictions

applicable to restricted share awards or restricted share units and the

|

|

•

|