REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Title of each class |

Trade symbol |

Name of each exchange on which registered | ||

N/A |

* |

Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares. |

Large accelerated filer ☐ |

Non-accelerated filer ☐ |

Emerging growth company |

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

International Financial Reporting Standards as issued |

Other ☐ | |||||||

by the International Accounting Standards Board ☐ |

| * | Not for trading, but only in connection with the listing on the New York Stock Exchange of the American Depositary Shares |

| CORPORATE GOVERNANCE | 192 | |||||

| MINE SAFETY DISCLOSURE | 192 | |||||

| 192 | ||||||

| FINANCIAL STATEMENTS | 192 | |||||

| FINANCIAL STATEMENTS | 193 | |||||

| EXHIBITS | 193 | |||||

| • | the “Acquisition” are to our acquisition of an additional 50% of equity interest in Shanghai Chejia, which we completed at the end of September 2018; after the completion of the Acquisition, Shanghai Chejia became our wholly-owned consolidated subsidiary; |

| • | “active dealers” are to dealers which have sold at least one car which is funded by a financing transaction we facilitate in the specified period; |

| • | “ADSs” are to our American depositary shares, each of which represents two Class A ordinary shares, and “ADRs” are to the American depositary receipts that evidence our ADSs; |

| • | “CAGR” are to compound annual growth rate; |

| • | “Can Gu Long Shanghai” are to Can Gu Long (Shanghai) Information Technology Consultation Service Co., Ltd., a company established under the law of the PRC and our wholly-owned subsidiary; |

| • | “car buyers” are to individuals who have purchased a car; |

| • | “China” and the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan, the Hong Kong Special Administrative Region and the Macao Special Administrative Region; |

| • | “dealers” are to points of sale that are licensed to engage in retail automobile transactions; |

| • | “Didi Chuxing” are to Xiaoju Kuaizhi Inc., a company organized under the laws of the Cayman Islands, and its affiliates; |

| • | “exposure at risk” are to the amount of outstanding principal of specified financing transactions as of a specified date; |

| • | “financial institutions” are to (i) banks and (ii) financing lease companies licensed by the Ministry of Commerce of the PRC; |

| • | “financing transactions” are to loans and financing leases; financing transactions we facilitate include financing transactions funded by financial institutions and financing transactions funded by Shanghai Chejia; the “amount of financing transactions” refer to the principal amount of financing transactions we facilitated in a specified period; |

| • | “lower-tier cities” are to cities in China that are not tier-one and tier-two cities; |

| • | “M1+ overdue ratio” are to (i) exposure at risk relating to financing transactions for which any installment payment is 30 to 179 calendar days past due as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such date, excluding amounts of outstanding principal that are 180 calendar days or more past due; |

| • | “M3+ overdue ratio” are to (i) exposure at risk relating to financing transactions for which any installment payment is 90 to 179 calendar days past due as of a specified date, divided by (ii) exposure at risk relating to all financing transactions which remain outstanding as of such date, excluding amounts of outstanding principal that are 180 calendar days or more past due; |

| • | “MYbank” are to Zhejiang E-Commerce Bank Co., Ltd., a limited liability company established under the laws of the PRC; |

| • | “new car dealers” are to dealers that sell new cars to car buyers, including dealers that sell both new cars and used cars; |

| • | “OEMs” are to automotive original equipment manufacturer; |

| • | “ordinary shares” are to our Class A ordinary shares, par value US$0.0001 per share, and Class B ordinary shares, par value US$0.0001 per share; |

| • | “registered dealers” are to dealers who are registered with our platform; |

| • | “RMB” or “Renminbi” are to the legal currency of China; |

| • | “SaaS” are to software as a service; |

| • | “Shanghai Cango” are to Shanghai Cango Investment and Management Consultation Service Co., Ltd., a company established under the law of the PRC and our consolidated VIE; |

| • | “Shanghai Chejia” are to Shanghai Chejia Financing Lease Co., Ltd. (formerly translated as “Shanghai Autohome Financing Lease Co., Ltd.”), a company organized under the law of the PRC and our wholly-owned subsidiary after the completion of the Acquisition; |

| • | “tier-one and tier-two cities” refer to (i) tier-one cities in China, namely Beijing, Shanghai, Guangzhou and Shenzhen and (ii) tier-two cities in China, namely (a) Tianjin and Chongqing, (b) the provincial capital cities except for Guangzhou, Yinchuan, Xining and Lhasa and (c) several prefecture-level cities, namely, Qingdao, Foshan, Dalian, Ningbo, Suzhou, Wuxi, Xiamen, Dongguan and Wenzhou; |

| • | “US$,” “U.S. dollars,” or “dollars” are to the legal currency of the United States; |

| • | “we,” “us,” “our company” and “our” are to Cango Inc., its consolidated VIE and/or their respective subsidiaries, as the context requires; and |

| • | “WeBank” are to Shenzhen Qianhai WeBank Co., Ltd., a limited liability company established under the laws of the PRC; |

| • | “WP Fintech” are to Warburg Pincus Cango Fintech Investment Company Limited, a British Virgin Islands business company and one of our principal shareholders. |

| • | our goal and strategies; |

| • | our expansion plans; |

| • | our future business development, financial condition and results of operations; |

| • | our expectations regarding demand for, and market acceptance of, our solutions and services; |

| • | our expectations regarding keeping and strengthening our relationships with dealers, financial institutions, insurance brokers and companies, car buyers and other platform participants; and |

| • | general economic and business conditions. |

ITEM |

1. |

ITEM |

2. |

ITEM |

3. |

A. |

Selected Financial Data |

Year Ended December 31, |

||||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands, except for share and per share data) |

||||||||||||||||||||||||

| Revenues |

||||||||||||||||||||||||

| Loan facilitation income and other related income |

431,646 | 1,019,081 | 916,280 | 913,837 | 891,837 | 136,680 | ||||||||||||||||||

| Leasing income |

— | — | 59,093 | 300,078 | 286,079 | 43,844 | ||||||||||||||||||

| After-market services income |

1,831 | 26,102 | 100,053 | 205,998 | 241,193 | 36,964 | ||||||||||||||||||

| Automobile trading income |

— | — | 6,584 | 11,414 | 624,774 | 95,751 | ||||||||||||||||||

| Others |

802 | 7,021 | 9,403 | 8,742 | 8,549 | 1,310 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

434,280 | 1,052,204 | 1,091,414 | 1,440,069 | 2,052,432 | 314,549 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating cost and expenses: |

||||||||||||||||||||||||

| Cost of revenue |

170,044 | 386,054 | 430,059 | 539,267 | 1,098,121 | 168,294 | ||||||||||||||||||

| Sales and marketing |

39,537 | 114,145 | 167,244 | 192,811 | 195,894 | 30,022 | ||||||||||||||||||

| General and administrative |

34,550 | 101,277 | 151,076 | 236,551 | 265,691 | 40,719 | ||||||||||||||||||

| Research and development |

5,000 | 19,419 | 46,709 | 57,406 | 62,596 | 9,593 | ||||||||||||||||||

| Net loss/(gain) on risk assurance liabilities |

744 | (38,867 | ) | (354 | ) | 34,258 | 2,268 | 348 | ||||||||||||||||

| Provision for credit losses |

— | 156 | 19,960 | 56,479 | 109,565 | 16,792 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating cost and expenses |

249,875 |

582,184 |

814,695 |

1,116,772 |

1,734,135 |

265,768 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from operations |

184,405 |

470,020 |

276,720 |

323,296 |

318,297 |

48,781 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Interest and investment income |

4,099 | 16,164 | 61,465 | 96,005 | 72,807 | 11,158 | ||||||||||||||||||

| Income/(loss) from equity method investments |

(9,988 | ) | 4,856 | 42,685 | (926 | ) | — | — | ||||||||||||||||

| Fair value change of equity investment |

— | — | — | 41,582 | 3,315,476 | 508,119 | ||||||||||||||||||

| Interest expense |

(450 | ) | (12,994 | ) | (19,011 | ) | (13,458 | ) | (2,759 | ) | (423 | ) | ||||||||||||

| Foreign exchange gain (loss), net |

— | (25,403 | ) | 1,447 | 5,141 | (8,848 | ) | (1,356 | ) | |||||||||||||||

| Other income, net |

8,429 | 15,818 | 32,701 | 41,300 | 49,139 | 7,531 | ||||||||||||||||||

| Other expenses |

— | — | — | (5,121 | ) | (838 | ) | (128 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income before income taxes |

186,495 |

468,460 |

396,007 |

487,819 |

3,743,274 |

573,682 |

||||||||||||||||||

| Income tax expenses |

(53,014 | ) | (119,403 | ) | (89,083 | ) | (82,960 | ) | (369,854 | ) | (56,683 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income |

133,481 |

349,057 |

306,924 |

404,859 |

3,373,420 |

516,999 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Net income attributable to the non-controlling interest shareholders |

4,575 | 8,048 | 4,232 | 13,945 | 3,902 | 598 | ||||||||||||||||||

| Net income attributable to Cango Inc.’s shareholders |

128,906 |

341,010 |

302,692 |

390,914 |

3,369,518 |

516,401 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings per share attributable to ordinary shareholders and Series A-2 convertible preferred shareholder: |

||||||||||||||||||||||||

| Basic: |

0.51 | 1.35 | ||||||||||||||||||||||

| Diluted: |

0.51 | 1.35 | ||||||||||||||||||||||

| Earnings per Class A and Class B ordinary share: |

||||||||||||||||||||||||

| Basic |

1.08 | 1.29 | 11.21 | 1.72 | ||||||||||||||||||||

| Diluted |

1.08 | 1.29 | 11.09 | 1.70 | ||||||||||||||||||||

| Earnings per ADS (two ordinary shares equal to one ADS): |

||||||||||||||||||||||||

| Basic |

2.17 | 2.59 | 22.43 | 3.44 | ||||||||||||||||||||

| Diluted |

2.16 | 2.58 | 22.18 | 3.40 | ||||||||||||||||||||

| Weighted average shares used to compute earnings per share attributable to ordinary shareholders and Series A-2 convertible preferred shareholder: : |

||||||||||||||||||||||||

| Basic: |

127,149,202 | 127,149,202 | ||||||||||||||||||||||

| Diluted: |

252,831,716 | 252,831,716 | ||||||||||||||||||||||

| Weighted average shares used to compute earnings per Class A and Class B share: |

||||||||||||||||||||||||

| Basic |

279,156,744 | 302,417,352 | 300,484,860 | 300,484,860 | ||||||||||||||||||||

| Diluted |

280,873,806 | 303,283,658 | 303,900,645 | 303,900,645 | ||||||||||||||||||||

| Other comprehensive income, net of tax |

||||||||||||||||||||||||

| Unrealized gain/(loss) on available-for-sale |

(2,464 | ) | 822 | (147 | ) | — | — | |||||||||||||||||

| Reclassification of losses to net income |

2,065 | — | (276 | ) | — | — | ||||||||||||||||||

| Foreign currency translation adjustment |

— | 109,029 | 10,401 | (234,817 | ) | (35,987 | ) | |||||||||||||||||

| Total comprehensive income, net of tax |

133,481 |

348,659 |

416,776 |

414,836 |

3,138,603 |

481,012 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income attributable to non-controlling interests |

4,575 |

8,048 |

4,232 |

13,945 |

3,902 |

598 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income attributable to Cango Inc.’s shareholders |

128,906 |

340,611 |

412,544 |

400,892 |

3,134,701 |

480,414 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

As of December 31, |

||||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Cash and cash equivalents |

44,989 | 803,271 | 2,912,901 | 2,002,315 | 1,426,900 | 218,682 | ||||||||||||||||||

| Restricted cash – current |

1,011 | 10,060 | 298,900 | 970,994 | 9,693 | 1,486 | ||||||||||||||||||

| Short-term investments |

106,000 | 62,380 | 265,870 | 597,266 | 4,342,357 | 665,495 | ||||||||||||||||||

| Accounts receivable, net |

469 | 85,595 | 86,514 | 148,563 | 141,594 | 21,700 | ||||||||||||||||||

| Finance receivables, net |

— | 832 | 5,421 | 9,104 | 20,106 | 3,081 | ||||||||||||||||||

| Short-term finance leasing receivable, net |

— | — | 1,123,704 | 1,661,082 | 2,035,398 | 311,938 | ||||||||||||||||||

| Short-term contract asset |

— | — | — | 20,688 | 364,619 | 55,880 | ||||||||||||||||||

| Prepayment and other current assets |

11,024 | 144,858 | 61,273 | 117,445 | 558,361 | 85,573 | ||||||||||||||||||

| Restricted cash – non-current |

— | 319,352 | 668,628 | 873,674 | 878,299 | 134,605 | ||||||||||||||||||

| Long-term investments |

185,800 | 191,003 | 292,099 | 547,889 | — | — | ||||||||||||||||||

| Goodwill |

— | — | 145,064 | 145,064 | 145,064 | 22,232 | ||||||||||||||||||

| Long-term contract asset |

— | — | — | 11,655 | 281,374 | 43,122 | ||||||||||||||||||

| Deferred tax assets |

54,889 | 67,774 | 100,195 | 100,668 | 170,951 | 26,199 | ||||||||||||||||||

| Long-term finance lease receivables – non-current, net |

— | — | 1,282,457 | 1,448,958 | 1,454,500 | 222,912 | ||||||||||||||||||

| Total assets |

714,857 |

1,996,868 |

7,301,140 |

8,736,574 |

12,145,933 |

1,861,446 |

||||||||||||||||||

| Short-term debts |

— | — | 660,000 | 1,439,750 | 355,817 | 54,531 | ||||||||||||||||||

| Long-term debts – current |

— | — | 467,194 | 863,419 | 1,228,784 | 188,319 | ||||||||||||||||||

| Accrued expenses and other current liabilities |

85,854 | 328,523 | 211,459 | 278,690 | 324,734 | 49,768 | ||||||||||||||||||

| Risk assurance liabilities |

149,788 | 129,935 | 173,210 | 259,952 | 460,829 | 70,625 | ||||||||||||||||||

| Long-term borrowings – non-current |

189,573 | 175,000 | 472,793 | 301,668 | 977,791 | 149,853 | ||||||||||||||||||

| Total liabilities |

503,769 |

736,860 |

2,045,773 |

3,244,914 |

3,770,723 |

577,889 |

||||||||||||||||||

| Total mezzanine equity |

3,941,846 |

3,941,846 |

— |

— |

— |

— |

||||||||||||||||||

| Total shareholders’ (deficit)/equity |

(3,730,759 |

) |

(2,681,838 |

) |

5,255,367 |

5,491,660 |

8,375,209 |

1,283,557 |

||||||||||||||||

| |

For the year ended December 31, |

|||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) US$ |

|||||||||||||||||||

| Net income |

133,481 | 349,057 | 306,924 | 404,859 | 3,373,420 | 516,999 | ||||||||||||||||||

| Add: ESOP Expenses (1) |

— | — | 33,411 | 82,266 | 78,755 | 12,070 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted net income |

133,481 |

349,057 |

340,335 |

487,125 |

3,452,175 |

529,069 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Net income attributable to the noncontrolling interest shareholders |

4,575 | 8,048 | 4,232 | 13,945 | 3,902 | 598 | ||||||||||||||||||

| Adjusted net income attributable to Cango Inc.’s ordinary shareholders |

128,906 |

341,010 |

336,103 |

473,180 |

3,448,273 |

528,471 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted net income per ADS-basic (2) |

1.02 |

2.70 |

2.41 |

3.13 |

22.95 |

3.52 |

||||||||||||||||||

| Adjusted net income per ADS-diluted (2) |

1.02 |

2.70 |

2.39 |

3.12 |

22.69 |

3.48 |

||||||||||||||||||

| Weighted average ADS outstanding—basic |

63,574,601 | 63,574,601 | 139,578,372 | 151,208,676 | 150,242,430 | 150,242,430 | ||||||||||||||||||

| Weighted average ADS outstanding—diluted |

126,415,858 | 126,415,858 | 140,436,903 | 151,641,829 | 151,950,322 | 151,950,322 | ||||||||||||||||||

| (1) | ESOP Expenses are allocated in operating cost and expenses as follows: |

For the year ended December 31, |

||||||||||||||||||||||||

2016 |

2017 |

2018 |

2019 |

2020 |

||||||||||||||||||||

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) RMB |

(Unaudited) US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Cost of revenue |

— | — | 1,370 | 3,373 | 3,075 | 471 | ||||||||||||||||||

| Sales and marketing |

— | — | 7,117 | 17,523 | 16,003 | 2,453 | ||||||||||||||||||

| General and administrative |

— | — | 23,187 | 57,093 | 55,591 | 8,520 | ||||||||||||||||||

| Research and development |

— | — | 1,737 | 4,278 | 4,085 | 626 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| ESOP Expenses |

— | — | 33,411 |

82,266 |

78,755 |

12,070 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (2) | Each ADS represents two ordinary shares. |

B. |

Capitalization and Indebtedness |

C. |

Reasons for the Offer and Use of Proceeds |

D. |

Risk Factors |

| • | offer automotive financing solutions to a growing number of car buyers; |

| • | maintain and enhance our relationships and business collaboration with dealers, financial institutions, insurance brokers and companies and other platform participants; |

| • | charge competitive service fees to platform participants while driving the growth and profitability of our business; |

| • | maintain low overdue ratios of financing transactions we facilitate; |

| • | comply with complex and evolving laws and regulations; |

| • | improve our operational efficiency; |

| • | attract, retain and motivate talented employees, particularly sales and marketing, risk management as well as research and development personnel to support our business growth; |

| • | enhance our technology infrastructure to support the growth of our business and maintain the security of our system and the confidentiality of the information provided and collected across our system; |

| • | navigate economic conditions and fluctuations; |

| • | successfully implement our business strategies and offer new services, such as automobile trading solutions; and |

| • | defend ourselves against legal and regulatory actions, such as actions involving intellectual property or data privacy claims. |

| • | become delinquent in the payment of an outstanding obligation; |

| • | defaulted on a pre-existing debt obligation; |

| • | taken on additional debt, including pledging the car as collateral for such debt; or |

| • | sustained other adverse financial events. |

| • | our failure to predict market demand accurately and supply solutions and services that meet this demand in a timely fashion; |

| • | platform participants may not like, find useful or agree with any changes we make; |

| • | our failure to properly price new solutions and services; |

| • | negative publicity about our solutions and services or our platform’s performance or effectiveness; |

| • | failure to seamlessly integrate our technology system with those of existing or new financial institutions we collaborate with; |

| • | failure to evaluate credit applications efficiently; |

| • | views taken by regulatory authorities that the new solutions and services or platform changes do not comply with PRC laws, rules or regulations applicable to us; and |

| • | the introduction or anticipated introduction of competing solutions and services by our competitors. |

| • | maintain the quality and reliability of our platform; |

| • | maintain and develop relationships with dealers, financial institutions, insurance brokers and insurance companies; |

| • | maintain and develop relationships with OEMs; |

| • | provide prospective car buyers and existing car buyers with superior experiences; |

| • | enhance and improve our credit assessment of car buyers; |

| • | effectively manage and resolve any complaints of dealers, financial institutions or car buyers; and |

| • | effectively protect personal information and privacy of car buyers and any sensitive data received from financial institutions. |

| • | our ability to attract new car buyers; |

| • | our ability to maintain existing relationships with business partners and establish new relationships with additional business partners, such as dealers, financial institutions and OEMs; |

| • | the amount of financing transactions, automobile trading transactions and insurance transactions on our platform; |

| • | overdue ratios of financing transactions we facilitate; |

| • | the mix of solutions and services we offer; |

| • | the amount and timing of our operating cost and expenses and the maintenance and expansion of our business, operations and infrastructure; |

| • | financial institutions’ willingness and ability to fund financing transactions through our platform on reasonable terms; |

| • | our emphasis on experience of car buyers, instead of near-term growth; |

| • | the timing of expenses related to the development or acquisition of technologies or businesses; |

| • | proper and sufficient accounting policies with respect to our risk assurance liabilities and implementation; |

| • | network outages or security breaches; |

| • | general economic, industry and market conditions; and |

| • | changes in applicable laws and regulations. |

| • | the growth in car ownership and the rate of any such growth; |

| • | changes in car buyer demographics, tastes and preferences; |

| • | changing financing behavior of car buyers; |

| • | the selection, price and popularity of cars offered by dealers and OEMs; and |

| • | whether alternative channels or business models that better address the needs of car buyers emerge in China. |

| • | difficulties in assimilating and integrating the operations, personnel, systems, data, technologies, products and services of the acquired business; |

| • | inability of the acquired technologies, products or businesses to achieve expected levels of revenue, profitability, productivity or other benefits including the failure to successfully further develop the acquired technology; |

| • | difficulties in retaining, training, motivating and integrating key personnel; |

| • | diversion of management’s time and resources from our normal daily operations and potential disruptions to our ongoing businesses; |

| • | strain on our liquidity and capital resources; |

| • | difficulties in executing intended business plans and achieving synergies from such strategic investments or acquisitions; |

| • | difficulties in maintaining uniform standards, controls, procedures and policies within the overall organization; |

| • | difficulties in retaining relationships with existing dealers, financial institutions, car buyers, employees and other partners of the acquired business; |

| • | risks of entering markets in which we have limited or no prior experience; |

| • | regulatory risks, including remaining in good standing with existing regulatory bodies or receiving any necessary pre-closing or post-closing approvals, as well as being subject to new regulators with oversight over an acquired business; |

| • | assumption of contractual obligations that contain terms that are not beneficial to us, require us to license or waive intellectual property rights or increase our risk for liability; |

| • | liability for activities of the acquired business before the acquisition, including intellectual property infringement claims, violations of laws, commercial disputes, tax liabilities and other known and unknown liabilities; and |

| • | unexpected costs and unknown risks and liabilities associated with strategic investments or acquisitions. |

| • | the composition of our board of directors and, through it, any determinations with respect to our operations, business direction and policies, including the appointment and removal of officers; |

| • | any determinations with respect to mergers or other business combinations; |

| • | our disposition of substantially all of our assets; and |

| • | any change in control. |

| • | revoking our business and operating licenses; |

| • | levying fines on us; |

| • | confiscating any of our income that they deem to be obtained through illegal operations; |

| • | shutting down our services; |

| • | discontinuing or restricting our operations in China; |

| • | imposing conditions or requirements with which we may not be able to comply; |

| • | requiring us to change our corporate structure and contractual arrangements; |

| • | restricting or prohibiting our use of the proceeds from overseas offering to finance our consolidated VIE’s business and operations; and |

| • | taking other regulatory or enforcement actions that could be harmful to our business. |

| • | regulatory developments affecting us or our industry; |

| • | announcements of studies and reports relating to the quality of our credit offerings or those of our competitors; |

| • | changes in the economic performance or market valuations of other transaction service platforms; |

| • | actual or anticipated fluctuations in our quarterly results of operations and changes or revisions of our expected results; |

| • | changes in financial estimates by securities research analysts; |

| • | conditions in the markets for car buyers and for financing facilitation services; |

| • | announcements by us or our competitors of new product and service offerings, acquisitions, strategic relationships, joint ventures, capital raisings or capital commitments; |

| • | additions to or departures of our senior management; |

| • | fluctuations of exchange rates between the Renminbi and the U.S. dollar; |

| • | release or expiry of lock-up or other transfer restrictions on our outstanding shares or ADSs; and |

| • | sales or perceived potential sales of additional Class A ordinary shares or ADSs. |

| • | at least 75% of our gross income is passive income, or |

| • | at least 50% of the value (determined based on a quarterly average) of our assets is attributable to assets that produce or are held for the production of passive income. |

ITEM |

4. |

A. |

History and Development of the Company |

B. |

Business Overview |

| • | B2B transactions non-4S dealers source cars cost-efficiently and help OEMs better address market demands across China, especially in lower-tier cities. As part of our SaaS solutions, we offer dealers a mobile application on which they can search and view car models available on our platform and place orders. We periodically update the selection of car models based on new car launches and demands by dealers. When placing an order, a dealer is required to pay a deposit, which represents a percentage of the total purchase price. We purchase cars from OEMs based on orders from dealers. Dealers are required to pay purchase prices in full and pick up cars from local warehouses maintained by OEMs or us before specific deadlines. If dealers fail to make timely payments, their deposits are forfeited and we will seek to sell the relevant cars to other buyers. |

| • | B2C transactions |

| • | Credit origination |

| • | Credit assessment in-depth collaboration with financial institutions and incorporate the credit policies and standards of these financial institutions into our credit assessment system. Our IT system is also highly integrated with financial institutions with which we directly collaborate. As such, we provide significant value to facilitate the ultimate credit decision making process of financial institutions by enhancing its efficiency. For example, it only takes less than two hours on average from submission of credit application to credit decision. In some instances, credit decisions can be provided in less than half an hour. |

| • | Credit servicing |

| • | Delinquent asset management in-person visits, recovery, disposal and legal actions. We have established a nationwide network of external counsel to supplement our own resources. Our in-house team is also closely involved in each stage of the delinquent asset management process to ensure compliance with the relevant laws and regulations. |

| • | Automotive Financing Solutions |

Year ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Financing transactions funded by third-party financial institutions |

19,937,411 | 91.8 | 25,969,896 | 92.6 | 27,161,201 | 4,162,636 | 98.1 | |||||||||||||||||||||

| Financing transactions funded by Shanghai Chejia |

1,781,983 | 8.2 | 2,084,397 | 7.4 | 536,538 | 82,228 | 1.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

21,719,395 |

100.0 |

28,054,293 |

100.0 |

27,697,739 |

4,244,864 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Three months ended |

||||||||||||||||||||||||||||||||

March 31, |

June 30, |

September 30, |

December 31, |

March 31, |

June 30, |

September 30, |

December 31, |

|||||||||||||||||||||||||

2019 |

2020 |

|||||||||||||||||||||||||||||||

| Number of credit applications |

128,243 | 121,307 | 110,331 | 173,059 | 74,339 | 92,711 | 131,037 | 180,811 | ||||||||||||||||||||||||

| Number of financing transactions facilitated |

99,242 | 87,947 | 79,728 | 123,223 | 57,905 | 63,541 | 86,329 | 121,518 | ||||||||||||||||||||||||

| • | Purchase Facilitation |

As of / in the three months ended |

||||||||||||||||||||||||||||||||

March 31, |

June 30, |

September 30, |

December 31, |

March 31, |

June 30, |

September 30, |

December 31, |

|||||||||||||||||||||||||

2019 |

2020 |

|||||||||||||||||||||||||||||||

| Registered dealers at end of period |

47,879 | 48,367 | 49,396 | 49,238 | 45,688 | 44,521 | 46,248 | 48,487 | ||||||||||||||||||||||||

| Active dealers (%) |

36.6 | 35.5 | 35.1 | 43.0 | 32.7 | 34.3 | 38.7 | 40.6 | ||||||||||||||||||||||||

As of December 31, |

||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||

Number |

% |

Number |

% |

Number |

% |

|||||||||||||||||||

| Tier-one and tier-two cities |

12,684 | 27.2 | 13,536 | 27.5 | 13,014 | 26.8 | ||||||||||||||||||

| Lower-tier cities |

33,881 | 72.8 | 35,702 | 72.5 | 35,473 | 73.2 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

46,565 |

100.0 |

49,238 |

100.0 |

48,487 |

100.0 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

As of December 31, |

||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||

Number |

% |

Number |

% |

Number |

% |

|||||||||||||||||||

| 4S dealers |

8,342 | 17.9 | 9,231 | 18.7 | 9,214 | 19.0 | ||||||||||||||||||

| Non-4S dealers |

38,223 | 82.1 | 40,007 | 81.3 | 39,273 | 81.0 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

46,565 |

100.0 |

49,238 |

100.0 |

48,487 |

100.0 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| • | Self-operated sales model in-house sales team, who will come to the dealer’s store and explain the terms of our automotive financing solutions to the prospective car buyer and offers assistance in completing the credit application. Our sales team then uploads the credit application to our online system for our credit assessment team to evaluate. |

| • | Dealer financial manager model |

| • | Sales agent model |

As of December 31, |

||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||

Number |

% |

Number |

% |

Number |

% |

|||||||||||||||||||

| Self-operated sales model |

41,411 | 88.9 | 46,586 | 94.6 | 45,990 | 94.9 | ||||||||||||||||||

| Dealer financial manager model |

1,055 | 2.3 | 879 | 1.8 | 1,958 | 4.0 | ||||||||||||||||||

| Sales agent model |

4,099 | 8.8 | 1,773 | 3.6 | 539 | 1.1 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

46,565 |

100.0 |

49,238 |

100.0 |

48,487 |

100.0 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

For the year ending December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Self-operated sales model |

18,333,271 | 84.4 | 26,030,152 | 92.8 | 25,364,140 | 3,887,225 | 91.6 | |||||||||||||||||||||

| Dealer financial manager model |

1,916,017 | 8.8 | 1,555,218 | 5.5 | 2,270,661 | 347,994 | 8.2 | |||||||||||||||||||||

| Sales agent model |

1,470,106 | 6.8 | 468,923 | 1.7 | 62,938 | 9,645 | 0.2 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

21,719,395 |

100.0 |

28,054,293 |

100.0 |

27,697,739 |

4,244,864 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the year ending December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Financing transactions funded by third-party financial institutions: |

||||||||||||||||||||||||||||

| Direct partnership model |

10,832,748 | 49.8 | 20,851,684 | 74.4 | 17,248,796 | 2,643,494 | 62.3 | |||||||||||||||||||||

| Co-partnership model |

9,104,663 | 42.0 | 5,118,212 | 18.2 | 9,912,405 | 1,519,142 | 35.8 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total financing transactions funded by third-party financial institutions |

19,937,411 |

91.8 |

25,969,896 |

92.6 |

27,161,201 |

4,162,636 |

98.1 |

|||||||||||||||||||||

| Financing transactions funded by Shanghai Chejia |

1,781,983 | 8.2 | 2,084,397 | 7.4 | 536,538 | 82,228 | 1.9 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

21,719,395 |

100.0 |

28,054,293 |

100.0 |

27,697,739 |

4,244,864 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

For the year ending December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Outstanding principal of financing transactions funded by third-party financial institutions: |

||||||||||||||||||||||||||||

| Direct partnership model |

20,733,146 | 60.5 | 26,734,880 | 66.8 | 29,367,657 | 4,500,791 | 67.5 | |||||||||||||||||||||

| Co-partnership model |

11,540,508 | 33.7 | 10,533,733 | 26.3 | 12,311,059 | 1,886,752 | 28.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total outstanding principal of financing transactions funded by third-party financial institutions |

32,273,655 |

94.2 |

37,268,613 |

93.1 |

41,678,716 |

6,387,543 |

95.8 |

|||||||||||||||||||||

| Outstanding principal of financing transactions funded by Shanghai Chejia |

1,982,722 | 5.8 | 2,763,137 | 6.9 | 1,826,119 | 279,865 | 4.2 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

34,256,376 |

100.0 |

40,031,750 |

100.0 |

43,504,835 |

6,667,408 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Insurance Brokers and Companies |

| • | Online Automotive Advertising Platforms |

| • | OEMs OEM-sponsored subsidy programs. We enable collaboration between OEMs and financial institutions to design low-interest financing solutions for car buyers. As of December 31, 2020, 14 OEMs participated in our platform by subsidizing low-interest financing transactions that we facilitate. Our platform creates significant value for OEMs, as we help them extend their sales channels through our vast dealer network, and our automotive financing solutions make their cars more affordable to prospective car buyers. We plan to broaden the offering of subsidized financing solutions through collaboration with foreign and sino-foreign joint venture OEMs as well as national banks. As the financing solutions will be marketed to prospective car buyers with stronger credit profiles, we expect to seize new market opportunities while improving our credit performance through such strategy. We started to significantly expand the number of automobile trading transactions in the third quarter of 2020. In connection with such transactions, we purchase cars from OEMs based on orders from dealers and on-sell cars to the relevant dealers. We aim to help OEMs better address market demands across China, especially in lower-tier cities. |

| (1) | After receiving the credit application from a car buyer, we utilize our credit assessment system to perform the initial evaluation. To assist financial institutions in making ultimate credit decisions, we refer qualified credit applications to such financial institutions, which perform independent credit assessment. |

| (2) | After the credit application is approved, the car buyer enters into a loan agreement with the financial institution. The car buyer is required to make the down payment to the dealer. On behalf of the car buyer, the financial institution pays the purchase price of the car, net of the down payment, to the dealer. |

| (3) | The car buyer is required to pledge the car as collateral in favor of the financial institution. The pledge is registered with local government authorities. |

| (4) | The financial institution pays us service fees. A dealer may receive commissions from us or the relevant financial institution, depending on the arrangement among us, the dealer and the relevant financial institution. |

| (5) | In the form of automatic payments, the car buyer repays principal and interest in installments to the financial institution. The financial institution’s security interest in the collateral is released upon the full repayment of the loan. |

| (1) | Prospective car buyers submit lease applications to us, and we process these applications by utilizing our credit assessment system. |

| (2) | After we approve a lease application, the car buyer enters into a lease agreement with us, and we are identified as the lessor. The car buyer is required to make the down payment to the dealer. We fund the remainder of the purchase price to the dealer. The car is then delivered to the car buyer, who temporarily obtains title to the car. |

| (3) | The car buyer is contractually required to transfer the title to us. In order to simplify the transaction process, we do not require the car buyer to register the transfer with the government authorities. |

| (4) | In addition, we require the car buyer to pledge the car as collateral for the car buyer’s payment obligations under the lease. |

| (5) | The car buyer is required to designate a bank account for repayments and authorize automatic lease payments from such account. The payments are made in monthly installments. We have the right to recover the collateral in the event of default. |

| (6) | Upon the expiration of the lease term, we transfer the title back to the car buyer, and our security interest in the collateral is also released. |

| • | Down payments |

| • | Principal |

| • | Interest rate |

| • | Installments |

| • | Prepayment |

| • | Late payment penalty fee |

| (1) | Automated reminders |

| (2) | Live phone calls |

| (3) | In-person visitsin-person visits when we determine such measures are warranted. Around 50 members of our delinquent asset management team are responsible for this task. We view the visits as opportunities to collect repayments as well as to investigate the status of the collateral. |

| (4) | Recovery |

| (5) | Disposal on-site visits to ensure these warehouses are suitable for automotive storage and are properly guarded to prevent theft. |

| (6) | Legal actions |

| • | Integration with financial institutions |

| • | Mobile applications |

| Mobile Application |

User Type |

Main Functions | ||

| Cango Car Loan | Car buyers | Car buyers can select cars available on our dealer network as well as submit credit applications to purchase these cars with financing leases offered by Shanghai Chejia. | ||

| Car Owner eGeneration | Car buyers | We provide information relating to insurance products and financing solutions we facilitate. We also provide customer support, traffic infraction inquiries, vehicle valuation and other services through this mobile application. | ||

| Cango Financial Services | Our sales team, dealer financial managers and sales agents | Users of the mobile application are able to receive real time updates for automotive financing solutions on our platform. They can also verify prospective car buyers’ identities using facial recognition function, submit credit applications, receive credit decisions and arrange for electronic signing of financing transaction documents through this mobile application. | ||

| Our in-house sales team uses the mobile application to engage new dealers and monitor existing dealers’ sales efforts. | ||||

| We also utilize the mobile application to assign tasks to personnel involved in our sales efforts and monitor the status of our sales efforts based on 42 parameters. | ||||

| Jingang—Warehousing | Warehouse staff | The mobile application allows us to effectively manage warehouse staff. We send notices before delivering recovered cars to the warehouses. The warehouse staff provide us with confirmations when they receive the cars. We also notify the warehouse staff when we need to deliver the cars to the relevant purchasers or car buyers. | ||

| Cango GPS | Our delinquent asset management team | Users of the mobile application are able to locate the collateral to facilitate the delinquent asset management process. | ||

| • | Credit assessment and data security |

| • | Dealer SaaS Solutions |

| • | Telematics |

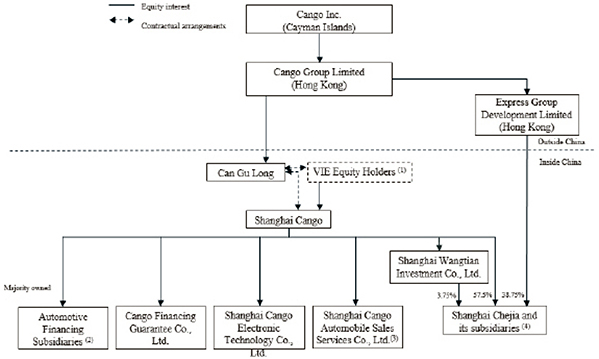

C. |

Organizational Structure |

| (1) | Include Shanghai Wangjin Investment Management Co., Ltd. (controlled by Mr. Xiaojun Zhang), Mr. Jiayuan Lin, Warburg Pincus Financial Global Ltd., Tencent Mobility Limited, Shanghai Xiehuai Investment Management L.P., the Taikang Onshore Entities (including Taikang Life Insurance Co., Ltd. and Shandong State-controlled Taikang Phase I Industrial Development Fund Partnership Enterprise (Limited Partnership)) and Shanghai Huaiyuan Investment Management L.P. (of which Shouyan Xu is the general partner) respectively hold 15.6%, 15.8%, 21.1%, 12.5%, 8.4%, 6.3% and 5.2% of equity interests in Shanghai Cango. The remaining equity interests in Shanghai Cango are held by nine other shareholders. Each shareholder of Shanghai Cango is either an affiliate of or identical to a shareholder of Cango Inc. For information as to the principal shareholders of Cango Inc., see “Item 6. Directors, Senior Management and Employees—E. Share Ownership.” |

| (2) | Includes 25 subsidiaries that are majority owned by Shanghai Cango. These subsidiaries are located in various cities across China and are primarily involved in providing automotive financing facilitation services to financial institutions and car buyers. |

| (3) | Primarily involved in the operation of our automobile trading, including purchasing cars from OEMs to facilitate the sales of such cars to our registered dealers. One subsidiary, Shanghai Quanpin Insurance Brokerage Co., Ltd., wholly owns Fushun Insurance Brokerage Co., Ltd., which operates our insurance brokerage business. |

| (4) | Includes 28 subsidiaries that are wholly-owned by Shanghai Chejia, which primarily engages in providing financing leases to car buyers. Shanghai Cango, our consolidate VIE, currently owns 61.25% equity interest (directly and through Shanghai Wangtian Investment Co., Ltd., its wholly-owned subsidiary) in Shanghai Chejia and Express Group Development Limited, our wholly-owned consolidated subsidiary, owns 38.75% equity interest in Shanghai Chejia. As a result, Shanghai Chejia is our wholly-owned consolidated subsidiary. |

| • | exercise effective control over our consolidated VIE and its subsidiaries; |

| • | receive substantially all the economic benefits of our consolidated VIE; and |

| • | have an exclusive option to purchase all or part of the equity interests in the equity interest in or all or part of the assets of Shanghai Cango when and to the extent permitted by PRC law. |

| • | the ownership structures of Can Gu Long and our consolidated VIE in China do not violate any applicable PRC law, regulation, or rule currently in effect; and |

| • | the contractual arrangements among Can Gu Long, Shanghai Cango and its shareholders governed by PRC laws are valid, binding and enforceable in accordance with their terms and applicable PRC laws, rules, and regulations currently in effect, and do not violate any applicable PRC law, regulation, or rule currently in effect, except that the pledges in respect of Shanghai Cango’s equity interests would not be deemed validly created until they are registered with the local administration for market regulation. |

D. |

Facilities |

ITEM 4A. |

UNRESOLVED STAFF COMMENTS |

ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

A. |

Operating Results |

For the Year Ended December 31, |

||||||||||||

2018 |

2019 |

2020 |

||||||||||

| Number of financing transactions facilitated |

356,576 | 390,140 | 329,293 | |||||||||

| Number of B2B and B2C transactions |

66 | 118 | 4,999 | |||||||||

As of / For the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Outstanding principal of financing transactions facilitated |

34,256,376 | 40,031,750 | 43,504,835 | 6,667,408 | ||||||||||||

| Amount of financing transactions facilitated |

21,719,395 | 28,054,293 | 27,697,739 | 4,244,864 | ||||||||||||

As of |

||||||||||||||||||||||||||||||||||||||||||||||||

March |

June |

September |

December |

March |

June |

September |

December |

March |

June |

September |

December |

|||||||||||||||||||||||||||||||||||||

31, |

30, |

30, |

31, |

31, |

30, |

30, |

31, |

31, |

30, |

30, |

31, |

|||||||||||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||||||||||||||||||||||

(%) |

||||||||||||||||||||||||||||||||||||||||||||||||

| M1+ overdue ratio |

1.09 | 0.92 | 0.83 | 0.74 | 0.77 | 0.72 | 0.85 | 0.85 | 2.00 | 1.59 | 1.11 | 0.98 | ||||||||||||||||||||||||||||||||||||

| M3+ overdue ratio |

0.46 | 0.46 | 0.36 | 0.37 | 0.37 | 0.30 | 0.33 | 0.40 | 0.56 | 0.84 | 0.53 | 0.42 | ||||||||||||||||||||||||||||||||||||

As of / in the Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Balance at the beginning of the period |

129,935 | 173,210 | 259,952 | 39,839 | ||||||||||||

| Fair value of risk assurance liabilities upon the inception of new loans |

121,329 | 166,911 | 348,921 | 53,475 | ||||||||||||

| Performed risk assurance liabilities |

(77,700 | ) | (114,427 | ) | (150,313 | ) | (23,036 | ) | ||||||||

| Net loss/(gain) on risk assurance liabilities |

(354 | ) | 34,258 | 2,268 | 348 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Balance at the closing of the period |

173,210 | 259,952 | 460,829 | 70,625 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| Loan facilitation income and other related income |

916,280 | 84.0 | 913,837 | 63.5 | 891,837 | 136,680 | 43.5 | |||||||||||||||||||||

| Leasing income |

59,093 | 5.4 | 300,078 | 20.8 | 286,079 | 43,844 | 13.9 | |||||||||||||||||||||

| After-market services income |

100,053 | 9.2 | 205,998 | 14.3 | 241,193 | 36,964 | 11.8 | |||||||||||||||||||||

| Automobile trading income |

6,584 | 0.6 | 11,414 | 0.8 | 624,774 | 95,751 | 30.4 | |||||||||||||||||||||

| Others |

9,403 | 0.9 | 8,742 | 0.6 | 8,549 | 1,310 | 0.4 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

1,091,414 |

100.0 |

1,440,069 |

100.0 |

2,052,432 |

314,549 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Operating cost and expenses: |

||||||||||||||||||||||||||||

| Cost of revenue |

430,059 | 39.4 | 539,267 | 37.4 | 1,098,121 | 168,294 | 53.5 | |||||||||||||||||||||

| Sales and marketing |

167,244 | 15.3 | 192,811 | 13.4 | 195,894 | 30,022 | 9.5 | |||||||||||||||||||||

| General and administrative |

151,076 | 13.8 | 236,551 | 16.4 | 265,691 | 40,719 | 12.9 | |||||||||||||||||||||

| Research and development |

46,709 | 4.3 | 57,406 | 4.0 | 62,596 | 9,593 | 3.0 | |||||||||||||||||||||

| Net loss/(gain) on risk assurance liabilities |

(354 | ) | (0.0 | ) | 34,258 | 2.4 | 2,268 | 348 | 0.1 | |||||||||||||||||||

| Provision for credit losses |

19,960 | 1.8 | 56,479 | 3.9 | 109,565 | 16,792 | 5.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

814,695 |

74.6 |

1,116,772 |

77.5 |

1,734,135 |

265,768 |

84.5 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands, except for percentages) |

||||||||||||||||||||||||||||

| Cost of revenue: |

||||||||||||||||||||||||||||

| Cost of vehicle |

6,597 | 0.6 | 11,176 | 0.8 | 619,227 | 94,901 | 30.2 | |||||||||||||||||||||

| Leasing interest expense |

21,223 | 1.9 | 116,966 | 8.1 | 132,323 | 20,279 | 6.4 | |||||||||||||||||||||

| Commission to car dealerships |

203,846 | 18.7 | 158,101 | 11.0 | 117,986 | 18,082 | 5.7 | |||||||||||||||||||||

| Staff incentive |

71,539 | 6.6 | 98,173 | 6.8 | 84,047 | 12,881 | 4.1 | |||||||||||||||||||||

| Staff cost |

59,631 | 5.5 | 72,999 | 5.1 | 73,975 | 11,337 | 3.6 | |||||||||||||||||||||

| Others |

67,223 | 6.2 | 81,852 | 5.7 | 70,563 | 10,814 | 3.4 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

430,059 |

39.4 |

539,267 |

37.4 |

1,098,121 |

168,294 |

53.5 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Identify the contract(s) with a customer; |

| • | Identify the performance obligations in the contract; |

| • | Determine the transaction price; |

| • | Allocate the transaction price to the performance obligations in the contract; and |

| • | Recognize revenue when (or as) the entity satisfies a performance obligation. |

As of |

||||||||||||

25-May-18 |

15-Feb-19 |

15-Oct-20 |

||||||||||

| Risk-free interest rate (%) |

2.93 | 2.66 | 0.74 | |||||||||

| Volatility (%) |

38.7 | 38.7 | 37.6 | |||||||||

| Expected exercise multiple |

2.8 | 2.3 | 2.3 | |||||||||

| Dividend yield |

Nil | Nil | Nil | |||||||||

| Expected life (in years) |

10 | 10 | 10 | |||||||||

| Exercise price (US$) |

1.7951 | 1.7951 | 1.7951 | |||||||||

| Fair value of ordinary shares (RMB) |

37.82 | 26.8 | 19.03 | |||||||||

| • | Weighted average cost of capital, or WACC: The discount rates we listed in the table above were based on the WACCs determined based on a consideration of the factors, including risk-free rate, comparative industry risk, equity risk premium, company size and non-systematic risk factors. |

| • | Comparable companies: In deriving the WACCs, which are used as the discount rates under the income approach, nine publicly traded companies were selected for reference as our guideline companies. The guideline companies were selected based on the following criteria: (i) online retail and mobile commerce companies or companies that provide credit facilitation services and (ii) China-based companies that are publicly listed in the United States, publicly listed companies in China and United States-based publicly listed companies. |

| • | Discount for lack of marketability, or DLOM: DLOM was quantified by the Finnerty’s Average-Strike put options model. Under this option-pricing model, which assumed that the put option is struck at the average price of the stock before the privately held shares can be sold, the cost of the put option was considered as a basis to determine the DLOM. This option pricing model is one of the methods commonly used in estimating DLOM as it can take into consideration factors like timing of a liquidity event, such as an initial public offering, and estimated volatility of our shares. The farther the valuation date is from an expected liquidity event, the higher the put option value and thus the higher the implied DLOM. The lower DLOM is used for the valuation, the higher is the determined fair value of the ordinary shares. |

Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| Loan facilitation income and other related income |

916,280 | 84.0 | 913,837 | 63.5 | 891,837 | 136,680 | 43.5 | |||||||||||||||||||||

| Leasing income |

59,093 | 5.4 | 300,078 | 20.8 | 286,079 | 43,844 | 13.9 | |||||||||||||||||||||

| After-market services income |

100,053 | 9.2 | 205,998 | 14.3 | 241,193 | 36,964 | 11.8 | |||||||||||||||||||||

| Automobile trading income |

6,584 | 0.6 | 11,414 | 0.8 | 624,774 | 95,751 | 30.4 | |||||||||||||||||||||

| Others |

9,403 | 0.9 | 8,742 | 0.6 | 8,549 | 1,310 | 0.4 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total revenues |

1,091,414 |

100.0 |

1,440,069 |

100.0 |

2,052,432 |

314,549 |

100.0 |

|||||||||||||||||||||

| Operating cost and expenses: |

||||||||||||||||||||||||||||

| Cost of revenue |

430,059 | 39.4 | 539,267 | 37.4 | 1,098,121 | 168,294 | 53.5 | |||||||||||||||||||||

| Sales and marketing |

167,244 | 15.3 | 192,811 | 13.4 | 195,894 | 30,022 | 9.5 | |||||||||||||||||||||

| General and administrative |

151,076 | 13.8 | 236,551 | 16.4 | 265,691 | 40,719 | 12.9 | |||||||||||||||||||||

| Research and development |

46,709 | 4.3 | 57,406 | 4.0 | 62,596 | 9,593 | 3.0 | |||||||||||||||||||||

| Net (gain) loss on risk assurance liabilities |

(354 | ) | (0.0 | ) | 34,258 | 2.4 | 2,268 | 348 | 0.1 | |||||||||||||||||||

| Provision for credit losses |

19,960 | 1.8 | 56,479 | 3.9 | 109,565 | 16,792 | 5.3 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating cost and expenses |

814,695 |

74.6 |

1,116,772 |

77.5 |

1,734,135 |

265,768 |

84.5 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income from operations |

276,720 |

25.4 |

323,296 |

22.5 |

318,297 |

48,781 |

15.5 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Interest and investment income |

61,465 | 5.6 | 96,005 | 6.7 | 72,807 | 11,158 | 3.5 | |||||||||||||||||||||

| Income/(loss) from equity method investments |

42,685 | 3.9 | (926 | ) | (0.1 | ) | — | — | — | |||||||||||||||||||

| Fair value change of equity investment |

— | — | 41,582 | 2.9 | 3,315,476 | 508,119 | 161.5 | |||||||||||||||||||||

| Interest expense |

(19,011 | ) | (1.7 | ) | (13,458 | ) | (0.9 | ) | (2,759 | ) | (423 | ) | (0.1 | ) | ||||||||||||||

| Foreign exchange gain (loss), net |

1,447 | 0.1 | 5,141 | 0.4 | (8,848 | ) | (1,356 | ) | (0.4 | ) | ||||||||||||||||||

| Other income, net |

32,701 | 3.0 | 41,300 | 2.9 | 49,139 | 7,531 | 2.4 | |||||||||||||||||||||

| Other expenses |

— | — | (5,121 | ) | (0.4 | ) | (838 | ) | (128 | ) | (0.0 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income before income taxes |

396,007 |

36.3 |

487,819 |

33.9 |

3,743,274 |

573,682 |

182.4 |

|||||||||||||||||||||

| Income tax expenses |

(89,083 | ) | (8.2 | ) | (82,960 | ) | (5.8 | ) | (369,854 | ) | (56,683 | ) | (18.0 | ) | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income |

306,924 |

28.1 |

404,859 |

28.1 |

3,373,420 |

516,999 |

164.4 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Year Ended December 31, |

||||||||||||||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||||||||||||||

RMB |

% |

RMB |

% |

RMB |

US$ |

% |

||||||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||||||

| Less: Net income attributable to the non-controlling interest shareholders |

4,232 | 0.4 | 13,945 | 1.0 | 3,902 | 598 | 0.2 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net income attributable to Cango Inc.’s ordinary shareholders |

302,692 |

27.7 |

390,914 |

27.1 |

3,369,518 |

516,401 |

164.2 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | Cost of revenue |

| • | Sales and marketing |

| • | General and administrative |

| • | Research and development |

| • | Net (gain)/loss on risk assurance liabilities |

| • | Provision for credit losses |

| • | Cost of revenue |

| • | Sales and marketing |

| • | General and administrative |

| • | Research and development |

| • | Net (gain)/loss on risk assurance liabilities |

| • | Provision for credit losses |

B. |

Liquidity and Capital Resources |

Year Ended December 31, |

||||||||||||||||

2018 |

2019 |

2020 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Summary Consolidated Cash Flow Data: |

||||||||||||||||

| Net cash provided by/ (used in) operating activities |

184,786 | 422,895 | (621,612 | ) | (95,266 | ) | ||||||||||

| Net cash provided by/ (used in) investing activities |

(1,638,647 | ) | (1,198,406 | ) | (493,563 | ) | (75,642 | ) | ||||||||

| Net cash provided by (used in) financing activities |

4,091,130 | 730,548 | (380,822 | ) | (58,364 | ) | ||||||||||

| Cash, cash equivalents and restricted cash at beginning of the year |

1,132,684 | 3,880,429 | 3,846,983 | 589,576 | ||||||||||||

| Cash, cash equivalents and restricted cash at end of the year |

3,880,429 | 3,846,983 | 2,314,892 | 354,773 | ||||||||||||

Payment due by period |

||||||||||||||||||||||||

Total |

Less than 1 Year |

1 – 3 Years |

3 –5 Years |

More than 5 Years |

||||||||||||||||||||

RMB |

US$ |

RMB |

||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Long-term debts – non current |

1,094,258 | 167,702 | 62,364 | 1,031,894 | — | — | ||||||||||||||||||

| Operating lease commitments |

132,088 | 20,243 | 17,380 | 26,085 | 26,533 | 62,090 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

1,226,346 |

187,945 |

79,744 |

1,057,979 |

26,533 |

62,090 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

C. |

Research and Development |

D. |

Trend Information |

E. |

Off - Balance Sheet Arrangements |

F. |

Tabular Disclosure of Contractual Obligations |

Payment due by period |

||||||||||||||||||||||||

Total |

Less than 1 Year |

1 – 3 Years |

3 – 5 Years |

More than 5 Years |

||||||||||||||||||||

RMB |

US$ |

RMB |

||||||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

| Long-term debts – non-current |

1,094,258 | 167,702 | 62,364 | 1,031,894 | — | — | ||||||||||||||||||

| Operating lease commitments |

132,088 | 20,243 | 17,380 | 26,085 | 26,533 | 62,090 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

1,226,346 |

187,945 |

79,744 |

1,057,979 |

26,533 |

62,090 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

G. |

Safe Harbor |

ITEM 6. |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

A. |

Directors and Senior Management |

| Name |

Age |

Position/Title | ||||

| Xiaojun Zhang |

49 | Co-founder and chairman | ||||

| Jiayuan Lin |

52 | Co-founder, director and chief executive officer | ||||

| Langlang Zhou |

40 | Director | ||||

| Yongyi Zhang |

48 | Chief financial officer and director | ||||

| Xiaoyu Liu |

38 | Director | ||||

| Zhipeng Song |

36 | Director | ||||

| Chi Ming Lee |

68 | Independent director | ||||

| Dongsheng Zhou |

53 | Independent director | ||||

| Rong Liu |

72 | Independent director | ||||

B. |

Compensation |

| Name |

Position |

Ordinary Shares Underlying Option Awards |

Option Exercise Price (US$)** |

Grant Date |

Option Expiration Date | |||||||||

| Xiaojun Zhang |

Chairman | 5,233,862 | |

1.7951 1.7951 |

|

May 25, 2018 February 15, 2019 |

May 24, 2028 February 14, 2029 | |||||||

| 1.7951 | October 15, 2020 | October 14, 2030 | ||||||||||||

| Jiayuan Lin |

Chief executive officer and director | 5,331,362 | |

1.7951 1.7951 |

|

May 25, 2018 February 15, 2019 |

May 24, 2028 February 14, 2029 | |||||||

| 1.7951 | October 15, 2020 | October 14, 2030 | ||||||||||||

| Yongyi Zhang |

Chief financial officer and director | * | |

1.7951 1.7951 |

|

May 25, 2018 February 15, 2019 |

May 24, 2028 February 14, 2029 | |||||||

| 1.7951 | October 15, 2020 | October 14, 2030 | ||||||||||||

| Zhipeng Song |

Director | * | |

1.7951 1.7951 |

|

May 25, 2018 February 15, 2019 |

May 24, 2028 February 14, 2029 | |||||||

| 1.7951 | October 15, 2020 | October 14, 2030 | ||||||||||||

| * | Less than 1% of our outstanding shares, assuming conversion of our preferred shares into ordinary shares. |

| ** | In March 2021, we adjusted the option exercise price to US$1.2951 per share due to the cash dividend paid in April 2021. |

C. |

Board Practices |

| • | conducting and managing the business of our company; |

| • | representing our company in contracts and deals; |

| • | appointing attorneys for our company; |

| • | select senior management such as managing directors and executive directors; |

| • | providing employee benefits and pension; |

| • | managing our company’s finance and bank accounts; |

| • | exercising the borrowing powers of our company and mortgaging the property of our company; and |

| • | exercising any other powers conferred by the shareholders meetings or under our memorandum and articles of association. |

| • | selecting the independent auditor; |

| • | pre-approving auditing and non-auditing services permitted to be performed by the independent auditor; |

| • | annually reviewing the independent auditor’s report describing the auditing firm’s internal quality control procedures, any material issues raised by the most recent internal quality control review, or peer review, of the independent auditors and all relationships between the independent auditor and our company; |

| • | setting clear hiring policies for employees and former employees of the independent auditors; |

| • | reviewing with the independent auditor any audit problems or difficulties and management’s response; |

| • | reviewing and, if material, approving all related party transactions on an ongoing basis; |

| • | reviewing and discussing the annual audited financial statements with management and the independent auditor; |

| • | reviewing and discussing with management and the independent auditors major issues regarding accounting principles and financial statement presentations; |

| • | reviewing reports prepared by management or the independent auditors relating to significant financial reporting issues and judgments; |

| • | discussing earnings press releases with management, as well as financial information and earnings guidance provided to analysts and rating agencies; |

| • | reviewing with management and the independent auditors the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on our financial statements; |

| • | discussing policies with respect to risk assessment and risk management with management, internal auditors and the independent auditor; |

| • | timely reviewing reports from the independent auditor regarding all critical accounting policies and practices to be used by our company, all alternative treatments of financial information within U.S. GAAP that have been discussed with management and all other material written communications between the independent auditor and management; |

| • | establishing procedures for the receipt, retention and treatment of complaints received from our employees regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters; |

| • | annually reviewing and reassessing the adequacy of our audit committee charter; |

| • | such other matters that are specifically delegated to our audit committee by our board of directors from time to time; |

| • | meeting separately, periodically, with management, internal auditors and the independent auditor; and |

| • | reporting regularly to the full board of directors. |

| • | reviewing, evaluating and, if necessary, revising our overall compensation policies; |

| • | reviewing and evaluating the performance of our directors and senior officers and determining the compensation of our senior officers; |

| • | reviewing and approving our senior officers’ employment agreements with us; |

| • | setting performance targets for our senior officers with respect to our incentive—compensation plan and equity-based compensation plans; |

| • | administering our equity-based compensation plans in accordance with the terms thereof; and such other matters that are specifically delegated to the remuneration committee by our board of directors from time to time. |

| • | selecting and recommending to the board nominees for election by the shareholders or appointment by the board; |

| • | reviewing annually with the board the current composition of the board with regards to characteristics such as independence, knowledge, skills, experience and diversity; |