UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark one)

OR

For the fiscal year ended

OR

OR

for the transition period from ____________to ____________

Commission file number

(Exact name of the Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

Tel: (852) 37073600

(Address of principal executive office)

Tel:

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

On September 24, 2023, the issuer had

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an “emerging growth company.” See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

| ☐ Large Accelerated filer | ☐ Accelerated filer | ☒ |

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ☒ | ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

No

Table of Contents

i

CERTAIN INFORMATION

Unless otherwise indicated, numerical figures included in this Annual Report on Form 20-F (the “Annual Report”) have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

For the sake of clarity, this Annual Report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English. Certain market data and other statistical information contained in this Annual Report are based on information from independent industry organizations, publications, surveys and forecasts. Some market data and statistical information contained in this Annual Report are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources listed above, our internal research and our knowledge of the PRC information technology industry. While we believe such information is reliable, we have not independently verified any third-party information and our internal data has not been verified by any independent source.

Except where the context otherwise requires and for purposes of this Annual Report only:

| ● | Depending on the context, the terms “we,” “us,” “our company,” and “our” refer to CLPS Incorporation, a Cayman Islands company, and its subsidiary and affiliated companies: |

| ● | “Qinheng” refers to Qinheng Co., Limited, a Hong Kong company; |

| ● | “Qiner” refers to Qiner Co., Limited, a Hong Kong company; |

| ● | “CLPS QC (WOFE)” refers to Shanghai Qincheng Information Technology Co., Ltd., a PRC company; |

| ● | “CLPS Shanghai” refers to CLPS Shanghai Co., Ltd., formerly ChinaLink Professional Services Co., Ltd., a PRC company; |

| ● | “CLPS Dalian” refers to CLPS Dalian Co., Ltd., a PRC company; |

| ● | “CLPS RC” refers to CLPS Ruicheng Co., Ltd., a PRC company; |

| ● | “CLPS Beijing” refers to CLPS Beijing Hengtong Co., Ltd., a PRC company; |

| ● | “JAJI China” refers to JAJI (Shanghai) Co., Ltd., formerly Judge (Shanghai) Co., Ltd.., a PRC company; |

| ● | “JAJI HR” refers to JAJI (Shanghai) Human Resource Co., Ltd. formerly Judge (Shanghai) Human Resource Co., Ltd., a PRC company; |

| ● | “Ridik AU” refers to Ridik Technology (Australia) Pty. Ltd., formerly CLPS-Ridik Technology (Australia) Pty. Ltd., an Australian company; |

| ● | “CLPS SG” refers to CLPS Technology (Singapore) Pte. Ltd., a Singaporean company; |

| ● | “CLPS Hong Kong” refers to CLPS Technology (Hong Kong) Co., Limited, a Hong Kong company; |

| ● | “CLPS Shenzhen” refers to CLPS Shenzhen Co., Ltd., a PRC company; |

| ● | “Huanyu” refers to Tianjin Huanyu Qinshang Network Technology Co., Ltd., a PRC company |

| ● | “CLPS Guangzhou” refers to CLPS Guangzhou Co., Ltd., a PRC company. |

| ● | “CLPS US” refers to CLPS Technology (US) Ltd., a Delaware company. |

| ● | “CLPS California” refers to CLPS Technology (California) Inc., a California company. |

ii

| ● | “CLPS Lihong” refers to CLPS Lihong Financial Information Services Co., Ltd., formerly Lihong Financial Information Services Co., Ltd. before the investment, a PRC company. | |

| ● | “Infogain” refers to Infogain Solutions Pte. Ltd., a Singaporean company. | |

| ● | “EMIT” refers to Economic Modeling Information Technology Co., Ltd., a PRC company. | |

| ● | “CLPS Hangzhou” refers to CLPS Hangzhou Co. Ltd., a PRC company. | |

| ● | “CLPS Guangdong Zhichuang” refers to CLPS Guangdong Zhichuang Software Technology Co., Ltd. a PRC company. | |

| ● | “CLPS Shenzhen Robotics” refers to CLPS Shenzhen Robotics Co. Ltd., a PRC company. | |

| ● | “Ridik Pte.” refers to Ridik Pte. Ltd., a Singaporean company. | |

| ● | “Ridik Consulting” refers to Ridik Consulting Private Limited, an Indian company. | |

| ● | “Ridik Sdn.” refers to Ridik Sdn. Bhd., a Malaysian company. | |

| ● | “Ridik Software Pte.” refers to Ridik Software Solutions Pte. Ltd., a Singaporean company. | |

| ● | “Ridik Software” refers to Ridik Software Solutions Ltd., a UK company. | |

| ● | “Suzhou Ridik” refers to Suzhou Ridik Information Technology Co., Ltd., a PRC company. | |

| ● | “CLPS Japan” refers to CLPS Technology Japan, a Japanese company. | |

| ● | “Qinson” refers to Qinson Credit Card Services Limited, a Hong Kong company. |

| ● | “CLPS Hainan” refers to Hainan Qincheng Software Technology Co., Ltd., a PRC company. | |

| ● | “SSIT” refers to Shanghai Shier Information Technology Co., Ltd., a PRC company. | |

| ● | “CareerWin” refers to CareerWin Executive Search Co., Ltd., a PRC company. | |

| ● | “CLPS Xi’an” refers to CLPS Xi’an Co., Ltd., a PRC company. | |

| ● | “Growth Ring” refers to Growth Ring Ltd., a British Virgin Islands company.

| |

| ● | “Arabian Jasmine” refers to Arabian Jasmine Ltd., a British Virgin Islands company. | |

| ● | “Shanghai Chenqin” refers to Shanghai Chenqin Information Technology Services Co., Ltd., a PRC company. | |

| ● | “Noni Singapore” refers to Noni (Singapore) Pte. Ltd., a Singaporean company. | |

| ● | “CLPS-Beefinance” refers to CLPS-Beefinance Holding Limited, a British Virgin Islands company. | |

| ● | “Qinson Ltd.” refers to Qinson Ltd., a British Virgin Islands company. | |

| ● | “LQE” refers to LQE Ltd., a British Virgin Islands company.

| |

| ● | “LinkCrypto” refers to LinkCrypto Finance Technology Limited, a Hong Kong company. |

iii

| ● | “MNYC” refers to MNYC HOLDINGS (HK) LIMITED, a Hong Kong company. | |

| ● | “MSCT” refers to MSCT Investment Holdings Limited, a British Virgin Islands company. |

| ● | “CLPS Philippines” refers to CLPS TECHNOLOGY (PHILIPPINES) CORP., a Philippine company. |

| ● | “Beijing Bozhuo” refers to Beijing Bozhuo Education Technology Co., Ltd., a PRC company. | |

| ● | “Haikou Huaqin” refers to Haikou Huaqin Minshang Software Development Co., Ltd., a PRC company. | |

| ● | “UniDev” refers to Beijing UniDev Software Co., Ltd., a PRC company. | |

| ● | “Fuson” refers to Fuson Group Limited, a Hong Kong company. | |

| ● | “CLPS Chengdu” refers to CLPS Chengdu Co., Ltd., a PRC company. | |

| ● | “CLPS Investment” refers to CLPS Investment Management Ltd., a British Virgin Islands company. | |

| ● | “JAJI Global” refers to JAJI Global Incorporation, a Cayman Islands company. | |

| ● | “JAJI Singapore” refers to JAJI Singapore Pte. Ltd., a Singaporean company. | |

| ● | “Ridik Canada” refers to Ridik Technology Canada Limited, a Canadian company. | |

| ● | “Qinson Singapore” refers to Qinson Singapore Pte. Ltd., a Singaporean company. | |

| ● | “Yingjia Technology” refers to Shanghai Yingjia Technology Limited, a PRC company. | |

| ● | all references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, and all references to “USD,” and “U.S. dollars” are to the legal currency of the United States. |

| ● | “Shares” and “Common Shares” refer to our shares, $0.0001 par value per share; |

| ● | “China” and “PRC” refer to the People’s Republic of China; and |

| ● | “EBIT margin” refers to earnings before interest and taxes margin. |

Unless otherwise noted, all currency figures in this filing are in U.S. dollars. Any discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding. Our reporting currency is U.S. dollar and our functional currency is Renminbi. This Annual Report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Other than in accordance with relevant accounting rules and as otherwise stated, all translations of Renminbi into U.S. dollars in this Annual Report were made at the rate of RMB 7.2513 to USD1.00, the noon buying rate on June 30, 2023, as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. Where we make period-on-period comparisons of operational metrics, such calculations are based on the Renminbi amount and not the translated U.S. dollar equivalent. We make no representation that the Renminbi or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

iv

FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based for the success of our business.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” “Information on the Company” and elsewhere in this Annual Report.

This Annual Report should be read in conjunction with our audited financial statements and the accompanying notes thereto, which are included in Item 18 of this Annual Report.

v

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

| A. | Selected financial data |

The following selected consolidated financial data as of and for the years ended June 30, 2023, 2022, and 2021 have been derived from the audited consolidated financial statements of the Company included in this Annual Report. This information is only a summary and should be read together with the consolidated financial statements, the related notes, the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other financial information included in this Annual Report. The Company’s results of operations in any period may not necessarily be indicative of the results that may be expected for any future period. See “Risk Factors” included elsewhere in this Annual Report.

The following table presents our summary consolidated statements of comprehensive income for the fiscal years ended June 30, 2023, 2022, and 2021, respectively.

Selected Consolidated Statement of Comprehensive Income

| For the years ended June 30, | ||||||||||||

| 2023 | 2022 | 2021 | ||||||||||

| Revenue from third parties | $ | 150,298,963 | $ | 151,970,357 | $ | 125,792,221 | ||||||

| Revenue from related parties | 57,576 | 52,024 | 269,472 | |||||||||

| Cost of revenue from third parties | (115,827,597 | ) | (110,989,394 | ) | (85,664,401 | ) | ||||||

| Cost of revenue from related parties | (47,212 | ) | (43,951 | ) | (226,356 | ) | ||||||

| Gross profit | 34,481,730 | 40,989,036 | 40,170,936 | |||||||||

| Operating income (expenses): | ||||||||||||

| Selling and marketing expenses | (3,300,555 | ) | (4,103,066 | ) | (3,753,236 | ) | ||||||

| Research and development (R&D) expenses | (8,336,999 | ) | (7,971,145 | ) | (13,337,913 | ) | ||||||

| General and administrative expenses | (21,641,317 | ) | (23,045,664 | ) | (16,784,688 | ) | ||||||

| Impairment of goodwill | (2,382,538 | ) | - | - | ||||||||

| Subsidies and other operating income | 1,256,070 | 1,536,394 | 2,080,087 | |||||||||

| Total operating expenses | (34,405,339 | ) | (33,583,481 | ) | (31,795,750 | ) | ||||||

| Income from operations | 76,391 | 7,405,555 | 8,375,186 | |||||||||

| Other income | 1,123,612 | 854,250 | 296,319 | |||||||||

| Other expenses | (430,357 | ) | (575,605 | ) | (351,045 | ) | ||||||

| Income before income tax and share of income in equity investees | 769,646 | 7,684,200 | 8,320,460 | |||||||||

| Provision for income taxes | 674,344 | 3,045,992 | 1,257,124 | |||||||||

| Income before share of income in equity investees | 95,302 | 4,638,208 | 7,063,336 | |||||||||

| Share of income (loss) in equity investees, net of tax | 70,263 | (50,297 | ) | (44,121 | ) | |||||||

| Net income | 165,565 | 4,587,911 | 7,019,215 | |||||||||

| Less: Net (loss) income attributable to noncontrolling interests | (26,964 | ) | 132,483 | 202,643 | ||||||||

| Net income attributable to CLPS Incorporation’s shareholders | $ | 192,529 | $ | 4,455,428 | $ | 6,816,572 | ||||||

| Other comprehensive (loss) income | ||||||||||||

| Foreign currency translation (loss) income | $ | (3,532,507 | ) | $ | (1,828,542 | ) | $ | 2,695,223 | ||||

| Less: Foreign currency translation (loss) income attributable to noncontrolling interests | (92,161 | ) | (48,211 | ) | 102,475 | |||||||

| Other comprehensive (loss) income attributable to CLPS Incorporation’s shareholders | $ | (3,440,346 | ) | $ | (1,780,331 | ) | $ | 2,592,748 | ||||

| Comprehensive (loss) income attributable to CLPS Incorporation’s shareholders | $ | (3,247,817 | ) | $ | 2,675,097 | $ | 9,409,320 | |||||

| Comprehensive (loss) income attributable to noncontrolling interests | (119,125 | ) | 84,272 | 305,118 | ||||||||

| Comprehensive (loss) income | $ | (3,366,942 | ) | $ | 2,759,369 | $ | 9,714,438 | |||||

| Basic earnings per common share | 0.01 | 0.21 | 0.39 | |||||||||

| Weighted average number of share outstanding – basic | 23,153,976 | 20,924,683 | 17,279,443 | |||||||||

| Diluted earnings per common share | 0.01 | 0.21 | 0.39 | |||||||||

| Weighted average number of share outstanding – diluted | 23,153,976 | 21,057,063 | 17,569,440 | |||||||||

| Supplemental information: | ||||||||||||

| Non-GAAP income before income tax and share of income of equity investees | 5,630,480 | 14,869,062 | 13,449,156 | |||||||||

| Non-GAAP net income | 5,026,399 | 11,772,773 | 12,147,911 | |||||||||

| Non-GAAP net income attributable to CLPS Incorporation’s shareholders | 5,053,363 | 11,640,290 | 11,945,268 | |||||||||

| Non-GAAP basic earnings per common share | 0.22 | 0.56 | 0.69 | |||||||||

| Weighted average number of share outstanding – basic | 23,153,976 | 20,924,683 | 17,279,443 | |||||||||

| Non-GAAP diluted earnings per common share | 0.22 | 0.55 | 0.68 | |||||||||

| Weighted average number of share outstanding – diluted | 23,153,976 | 21,057,063 | 17,569,440 | |||||||||

1

The following table presents our consolidated balance sheet data as of June 30, 2023 and 2022, respectively.

| As of June 30, | ||||||||

| 2023 | 2022 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 22,214,029 | $ | 18,396,987 | ||||

| Restricted cash | 87,604 | - | ||||||

| Accounts receivable, net | 48,515,467 | 53,769,887 | ||||||

| Prepayments, deposits and other assets, net | 1,665,736 | 4,215,414 | ||||||

| Amounts due from related parties | 391,271 | 377,642 | ||||||

| Total Current Assets | $ | 72,874,107 | $ | 76,759,930 | ||||

| Non-current assets: | ||||||||

| Property and equipment, net | 20,112,305 | 20,601,098 | ||||||

| Intangible assets, net | 726,175 | 970,044 | ||||||

| Goodwill | - | 2,363,841 | ||||||

| Operating lease right-of-use assets | 815,324 | - | ||||||

| Long-term investments | 456,598 | 610,386 | ||||||

| Prepayments, deposits and other assets, net | 252,656 | 248,456 | ||||||

| Deferred tax assets, net | 81,899 | 327,040 | ||||||

| Total Assets | $ | 95,319,064 | $ | 101,880,795 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Bank loans | $ | 10,554,617 | $ | 14,474,363 | ||||

| Accounts payable | 690,035 | 343,597 | ||||||

| Accrued expenses and other current liabilities | 324,021 | 352,402 | ||||||

| Tax payables | 2,503,375 | 2,355,066 | ||||||

| Contract liabilities | 918,470 | 587,140 | ||||||

| Salaries and benefits payable | 10,586,239 | 12,203,933 | ||||||

| Operating lease liabilities | 712,302 | - | ||||||

| Amounts due to related party | 24,889 | 66,884 | ||||||

| Total current liabilities | $ | 26,313,948 | $ | 30,383,385 | ||||

| Non-current liabilities: | ||||||||

| Operating lease liabilities | 104,114 | - | ||||||

| Deferred tax liabilities | 185,382 | 150,547 | ||||||

| Unrecognized tax benefit | 2,320,918 | 2,587,194 | ||||||

| Other non-current liabilities | 885,901 | 959,069 | ||||||

| Total Liabilities | $ | 29,810,263 | $ | 34,080,195 | ||||

| Commitments and Contingencies | ||||||||

| Shareholders’ Equity: | ||||||||

| Common stock, $0.0001 par value, 100,000,000 shares authorized; 23,650,122 shares issued and outstanding as of June 30, 2023; 22,444,822 shares issued and outstanding as of June 30, 2022 | 2,365 | 2,244 | ||||||

| Additional paid-in capital | 58,183,383 | 55,705,209 | ||||||

| Statutory reserves | 5,356,828 | 5,071,876 | ||||||

| Retained earnings | 5,029,021 | 6,323,792 | ||||||

| Accumulated other comprehensive losses | (3,990,594 | ) | (550,248 | ) | ||||

| Total CLPS Incorporation’s Shareholders’ Equity | 64,581,003 | 66,552,873 | ||||||

| Noncontrolling interests | 927,798 | 1,247,727 | ||||||

| Total Shareholders’ Equity | 65,508,801 | 67,800,600 | ||||||

| Total Liabilities and Shareholders’ Equity | $ | 95,319,064 | $ | 101,880,795 | ||||

2

The following table sets forth information concerning exchange rates between the RMB and the U.S. dollar for the periods indicated. On September 29, 2023, the buying rate announced by the Federal Reserve Statistical Release was RMB 7.2960 to $1.00.

| Spot Exchange Rate | ||||||||||||||||

| Period Ended | Average (1) | Low | High | |||||||||||||

| Period | (RMB per US$1.00) | |||||||||||||||

| 2020 | 6.5250 | 6.9043 | 6.5208 | 7.1681 | ||||||||||||

| 2021 | 6.3726 | 6.4382 | 6.3640 | 6.5518 | ||||||||||||

| 2022 | 6.8972 | 6.7290 | 6.3084 | 7.3048 | ||||||||||||

| 2023 | ||||||||||||||||

| January | 6.7540 | 6.7904 | 6.7010 | 6.9135 | ||||||||||||

| February | 6.9325 | 6.8380 | 6.7266 | 6.9545 | ||||||||||||

| March | 6.8676 | 6.8909 | 6.8188 | 6.9630 | ||||||||||||

| April | 6.9110 | 6.8876 | 6.8677 | 6.9320 | ||||||||||||

| May | 7.1100 | 6.9854 | 6.9094 | 7.1100 | ||||||||||||

| June | 7.2513 | 7.1614 | 7.0827 | 7.2515 | ||||||||||||

| July | 7.1426 | 7.1863 | 7.1340 | 7.2500 | ||||||||||||

| August | 7.2582 | 7.2486 | 7.1651 | 7.2985 | ||||||||||||

| September | 7.2960 | 7.2979 | 7.2606 | 7.3430 | ||||||||||||

Source: https://www.federalreserve.gov/releases/h10/hist/default.htm

| (1) | Annual averages, lows, and highs are calculated from month-end rates. Monthly averages, lows, and highs are calculated using the average of the daily rates during the relevant period. |

| B. | Capitalization and Indebtedness |

Not required.

| C. | Reasons for the Offer and Use of Proceeds |

Not required.

3

| D. | Risk factors |

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report. Investment in our securities involves a high degree of risk. You should carefully consider the risks described below together with all of the other information included in this Annual Report before making an investment decision. The risks and uncertainties described below represent our known material risks to our business. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, you may lose all or part of your investment. A summary of risk factors is provided concisely below:

Risks Related to Our Business

| ● | Risks Related to Our Ability to Manage Our Business and Growth |

| ● | Risks Related to Adverse Economic Conditions Affecting Our Clients’ Purchase |

| ● | Risks Related to Intense Competition from Other Service Provider |

| ● | Risks Related to Lack of Skilled Employees |

| ● | Risks Related to Lack of Diverse Clients |

| ● | Risks Related to Collection of Account Receivables |

| ● | Risks Related to Our Inability to Develop New Technology and Services |

| ● | Risks Related to Our Inability to Continue Mergers and Acquisitions |

| ● | Risks Related to Our Inability to Post-merger Integration |

| ● | Risks Related to Our Inability to Generate New Businesses |

| ● | Risks Related to Complexity to Evaluate Our Business |

| ● | Risks Related to Lack of Full Utilization of Resources |

| ● | Risks Related to Underestimate of Cap on Our Service Fees |

| ● | Risks Related to Our Exposure to Wage-related High Costs |

| ● | Risks Related to Pricing Pressure due to Competition |

| ● | Risks Related to Unauthorized Disclosure of Confidential Client Information by Us |

| ● | Risks Related to Unauthorized Use of Our Intellectual Property by Others |

| ● | Risks Related to Our Inability to Raise Additional Capital |

| ● | Risks Related to Our Business Interruptions |

| ● | Risks Related to COVID-19 Pandemic |

| ● | Risks Related to Fluctuation of Renminbi to US dollar Exchange Rate |

| ● | Risks Related to Lack of Effective Internal Control in Our Company |

4

Risks Related to Corporate Structure

| ● | Risks Related to Our Refusal to Declare Dividends |

| ● | Risks Related to Our Subsidiaries’ Bankruptcy |

| ● | Risks Related to Our Subsidiaries’ Lack of Regulatory Approval by Chinese Authorities |

| ● | Risks Related to Our Subsidiaries’ Chops Being Lost or Stolen |

| ● | Risks Related to Our Non-compliance with PRC regulations |

Risks Related to Doing Business in China

| ● | Risks Related to Adverse Economic Conditions in China |

| ● | Risks Related to Lack of Permission to Do Business in China |

| ● | Risks Related to Uncertainty on Compliance with Cybersecurity Law of China |

| ● | Risks Related to Government Regulations on US-listed Chinese Companies |

| ● | Risks Related to US Regulator’s Inability to Conduct Investigation in China |

| ● | Risks Related to Tax Reporting Obligations in China |

| ● | Risks Related to PRC Regulations Governing Offshore Special Purpose Companies |

| ● | Risks Related to PRC Regulations Governing Inter-company Loans |

| ● | Risks Related to Government Control on Currency Conversion |

| ● | Risks Related to Complex M&A Rules Governing Our Acquisitions |

| ● | Risks Related to PRC Regulations Governing Registration of Employee Stock Ownership |

| ● | Risks Related to Our Subsidiaries’ Ability to Pay Dividends to Us |

| ● | Risks Related to PRC Labor Law’s Restriction on Our Employment Practice |

| ● | Risks Related to PCAOB’s Inability to Inspect Our Independent Auditors |

| ● | Risks Related to Uncertainty as to the Cooperation between PCAOB and CSRC of China |

| ● | Risks Related to Our Possible Delisting under HFCAA |

| ● | Risks Related to Accelerated Compliance Schedule under HFCAA |

| ● | Risks Related to Our Exposure to Direct Scrutiny by US Regulators |

| ● | Risks Related to Regulations by Cyberspace Administration of China |

5

Risks Related to Our Business

We may be unable to effectively manage our rapid growth, which could place significant strain on our management personnel, systems and resources. We may not be able to achieve anticipated growth, which could materially and adversely affect our business and prospects.

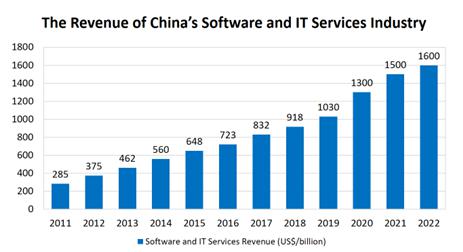

Our revenues grew from $126.1 million in fiscal 2021 to $152.0 million in fiscal 2022 and decreased to $150.4 million in fiscal 2023. We maintain 20 delivery and/or R&D centers, of which 10 are located in Mainland China (Shanghai, Beijing, Dalian, Tianjin, Xi’an, Chengdu, Guangzhou, Shenzhen, Hangzhou, and Hainan) and ten are located globally (Hong Kong SAR, the United States of America, Japan, Singapore, Australia, Malaysia, India, the Philippines, Vietnam, and Canada), to serve different customers in various geographic locations. The number of our total employees grew from 3,352 in fiscal 2021 to 3,824 in fiscal 2022. As of June 30, 2023 we had 3,509 full-time employees. We are actively looking for additional locations to establish new offices and expand our current offices and sales and delivery centers. We intend to continue our expansion in the foreseeable future to pursue existing and potential market opportunities. Our growth has placed and will continue to place significant demands on our management and our administrative, operational and financial infrastructure. Continued expansion increases the challenges we face in:

| ● | recruiting, training, developing and retaining sufficient IT talent and management personnel; |

| ● | creating and capitalizing upon economies of scale; |

| ● | managing a larger number of clients in a greater number of industries and locations; |

| ● | maintaining effective oversight of personnel and offices; |

| ● | coordinating work among offices and project teams and maintaining high resource utilization rates; |

| ● | integrating new management personnel and expanded operations while preserving our culture and core values; |

| ● | developing and improving our internal administrative infrastructure, particularly our financial, operational, human resources, communications and other internal systems, procedures and controls; and |

| ● | adhering to and further improving our high quality and process execution standards and maintaining high levels of client satisfaction. |

Moreover, as we introduce new services or enter into new markets, we may face new market, technological and operational risks and challenges with which we are unfamiliar, and it may require substantial management efforts and skills to mitigate these risks and challenges. As a result of any of these challenges associated with expansion, our business, results of operations and financial condition could be materially and adversely affected. Furthermore, we may not be able to achieve anticipated growth, which could materially and adversely affect our business and prospects.

6

Adverse changes in the economic environment, either in China or globally, could reduce our clients’ purchases from us and increase pricing pressure, which could materially and adversely affect our revenues and results of operations.

The IT services industry is particularly sensitive to the economic environment, whether in China or globally, and tends to decline during general economic downturns. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to the economic environment, especially for regions in which we and our clients operate. During an economic downturn, our clients may cancel, reduce or delay their IT spending or change their IT outsourcing strategy, and reduce their purchases from us. The recent global economic slowdown and any future economic slowdown, and the resulting reduction in IT spending, could also lead to increased pricing pressure from our clients. The occurrence of any of these events could materially and adversely affect our revenues and results of operations.

We face intense competition from onshore and offshore IT services companies, and, if we are unable to compete effectively, we may lose clients, and our revenues may decline.

The market for IT services is highly competitive, and we expect competition to persist and intensify. We believe that the principal competitive factors in our markets are industry expertise, breadth and depth of service offerings, quality of the services offered, reputation and track record, marketing and selling skills, scalability of infrastructure and price. In addition, the trend towards offshore outsourcing, international expansion by foreign and domestic competitors and continuing technological changes will result in new and different competitors entering our markets. In the IT outsourcing market, clients tend to engage multiple outsourcing service providers instead of using an exclusive service provider, which could reduce our revenues to the extent that clients obtain services from other competing providers. Clients may prefer service providers that have facilities located globally or that are based in countries more cost-competitive than in China. Our ability to compete also depends in part on a number of factors beyond our control, including the ability of our competitors to recruit, train, develop and retain highly skilled professionals, the price at which our competitors offer comparable services and our competitors’ responsiveness to client needs. Therefore, we cannot assure you that we will be able to retain our clients while competing against such competitors. Increased competition, our inability to compete successfully against competitors, pricing pressures or loss of market share could harm our business, financial condition and results of operations.

Due to intense competition for highly skilled personnel, we may fail to attract and retain enough sufficiently trained personnel to support our operations; as a result, our ability to bid for and obtain new projects may be negatively affected and our revenues could decline.

The IT services industry relies on skilled personnel, and our success depends to a significant extent on our ability to recruit, train, develop and retain qualified personnel, especially experienced middle and senior level management. The IT services industry in China has experienced significant levels of employee attrition. Our annual voluntarily attrition rates were 15% and 15.4% in fiscal 2021 and fiscal 2022, respectively; in fiscal 2023, this rate was 18%. We may encounter higher attrition rates in the future, particularly if China continues to experience strong economic growth. There is significant competition in China for skilled personnel, especially experienced middle and senior level management, with the skills necessary to perform the services we offer to our clients. Increased competition for these personnel, in the IT industry or otherwise, could have an adverse effect on us. Spearheaded by the institution that provides continuing education to all CLPS staff and develop new talents from partner universities to further drive the Company’s growth (“CLPS Academy”), we have established Talent Creation Program (“TCP”) and Talent Development Program (“TDP”) to increase our human capital and employee loyalty, however, a significant increase in our attrition rate could decrease our operating efficiency and productivity and could lead to a decline in demand for our services. Additionally, failure to recruit, train, develop and retain personnel with the qualifications necessary to fulfill the needs of our existing and future clients or to assimilate new personnel successfully could have a material adverse effect on our business, financial condition and results of operations. Failure to retain our key personnel on client projects or find suitable replacements for key personnel upon their departure may lead to termination of some of our client contracts or cancellation of some of our projects, which could materially and adversely affect our business.

7

Our success depends substantially on the continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily depends upon the continued services of our senior executives and other key employees. In particular, we rely on the expertise, experience, client relationships and reputation of Xiao Feng Yang, our Chairman of the Board. We currently do not maintain key-man life insurance for any of the senior members of our management team or other key personnel. If one or more of our senior executives or key employees are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace them easily or at all. In addition, competition for senior executives and key personnel in our industry is intense, and we may be unable to retain our senior executives and key personnel or attract and retain new senior executive and key personnel in the future, in which case our business may be severely disrupted, and our financial condition and results of operations may be materially and adversely affected. If any of our senior executives or key personnel joins a competitor or forms a competing company, we may lose clients, suppliers, know-how and key professionals and staff members to them. Also, if any of our business development managers, who generally keep a close relationship with our clients, joins a competitor or forms a competing company, we may lose clients, and our revenues may be materially and adversely affected. Additionally, there could be unauthorized disclosure or use of our technical knowledge, practices or procedures by such personnel. Most of our executives and key personnel have entered into employment agreements with us that contain non-competition provisions, non-solicitation and nondisclosure covenants. However, if any dispute arises between our executive officers and key personnel and us, such non-competition, non-solicitation and nondisclosure provisions might not provide effective protection to us, especially in China in light of the uncertainties with China’s legal system.

We generate a significant portion of our revenues from a relatively small number of major clients and loss of business from these clients could reduce our revenues and significantly harm our business.

We believe that in the foreseeable future we will continue to derive a significant portion of our revenues from a small number of major clients. For the years ended June 30, 2023, 2022, and 2021, Citibank and its affiliates accounted for 21.4%, 20.6%, and 19.1% of the Company’s total revenues, respectively. For fiscal 2023 and 2022, substantially all the service provided by the Company to Citibank was IT consulting services and billed through time-and-expense contracts. The Company has not entered into any material long term contracts with Citibank. Our ability to maintain close relationships with these and other major clients is essential to the growth and profitability of our business. However, the volume of work performed for a specific client is likely to vary from year to year, especially since we are generally not our clients’ exclusive IT services provider, and we do not have long-term commitments from any of our clients to purchase our services. The typical term for our service agreements is between one and three years. A major client in one year may not provide the same level of revenues for us in any subsequent year. The IT services we provide to our clients, and the revenues and income from those services, may decline or vary as the type and quantity of IT services we provide change over time. In addition, our reliance on any individual client for a significant portion of our revenues may give that client a certain degree of pricing leverage against us when negotiating contracts and terms of service. In addition, a number of factors other than our performance could cause the loss of or reduction in business or revenues from a client, and these factors are not predictable. These factors may include corporate restructuring, pricing pressure, changes to its outsourcing strategy, switching to another services provider or returning work in-house. In the future, a small number of customers may continue to represent a significant portion of our total revenues in any given period. The loss of any of our major clients could adversely affect our financial condition and results of operations.

If we are unable to collect our receivables from our clients, our results of operations and cash flows could be adversely affected.

Our business depends on our ability to successfully obtain payment from our clients of the amounts they owe us for work performed. As of June 30, 2023 and 2022, our accounts receivable balance, net of allowance, amounted to approximately $48.5 million and $53.8 million, respectively. As of the years ended June 30, 2023 and 2022, Citibank accounted for 32.3% and 30.2% and of the Company’s total accounts receivable balance. Since we generally do not require collateral or other security from our clients, we establish an allowance for doubtful accounts based upon estimates, historical experience and other factors surrounding the credit risk of specific clients. However, actual losses on client receivables balance could differ from those that we anticipate and as a result we might need to adjust our allowance. There is no guarantee that we will accurately assess the creditworthiness of our clients. Macroeconomic conditions, including related turmoil in the global financial system, could also result in financial difficulties for our clients, including limited access to the credit markets, insolvency or bankruptcy, and as a result could cause clients to delay payments to us, request modifications to their payment arrangements that could increase our receivables balance, or default on their payment obligations to us. As a result, an extended delay or default in payment relating to a significant account will have a material and adverse effect on the aging schedule and turnover days of our accounts receivable. If we are unable to collect our receivables from our clients in accordance with the contracts with our clients, our results of operations and cash flows could be adversely affected.

8

The growth and success of our business depends on our ability to anticipate and develop new services and enhance existing services in order to keep pace with rapid changes in technology and in the industries we focus on.

The market for our services is characterized by rapid technological changes, evolving industry standards, changing client preferences and new product and service introductions. Our future growth and success depend significantly on our ability to anticipate developments in IT services, develop and offer new product and service lines to meet our clients’ evolving needs. We may not be successful in anticipating or responding to these developments in a timely manner, or if we do respond, the services or technologies we develop may not be successful in the marketplace. The development of some of the services and technologies may involve significant upfront investments, and the failure of these services and technologies may result in our being unable to recover these investments, in part or in full. Further, services or technologies that are developed by our competitors may render our services uncompetitive or obsolete. In addition, new technologies may be developed that allow our clients to more cost-effectively perform the services that we provide, thereby reducing demand for our services. Should we fail to adapt to the rapidly changing IT services market, or if we fail to develop suitable services to meet the evolving and increasingly sophisticated requirements of our clients in a timely manner, our business and results of operations could be materially and adversely affected.

We may be unsuccessful in entering into strategic alliances or identifying and acquiring suitable acquisition candidates, which could impede our growth and negatively affect our revenues and net income.

We have pursued and may continue to pursue strategic alliances and strategic acquisition opportunities to increase our scale and geographic presence, expand our service offerings and capabilities and enhance our industry and technical expertise. However, it is possible that in the future we may not succeed in identifying suitable alliances or acquisition candidates. Even if we identify suitable candidates, we may not be able to consummate these arrangements on terms commercially acceptable to us or to obtain necessary regulatory approvals in the case of acquisitions. Many of our competitors are likely to be seeking to enter into similar arrangements or acquire the same targets that we are looking to enter into or acquire. Such competitors may have substantially greater financial resources than we do and may be more attractive to our strategic partners or be able to outbid us for the targets. In addition, we may also be unable to timely deploy our existing cash balances to effect a potential acquisition, as use of cash balances located onshore in China may require specific governmental approvals or result in withholding and other tax payments. If we are unable to enter into suitable strategic alliances or complete suitable acquisitions, our growth strategy may be impeded, and our revenues and net income could be negatively affected.

If we fail to integrate or manage acquired companies efficiently, or if the acquired companies do not perform to our expectations, we may not be able to realize the benefits envisioned for such acquisitions, and our overall profitability and growth plans may be adversely affected.

Historically, we have expanded our service capabilities and gained new clients through selective acquisitions. Our ability to successfully integrate an acquired entity and realize the benefits of any acquisition requires, among other things, successful integration of technologies, operations and personnel. Challenges we face in the acquisition and integration process include:

| ● | integrating operations, services and personnel in a timely and efficient manner; |

| ● | unforeseen or undisclosed liabilities; |

| ● | generating sufficient revenue and net income to offset acquisition costs; | |

| ● | potential loss of, or harm to, employee or client relationships; |

9

| ● | properly structuring our acquisition consideration and any related post-acquisition earn-outs and successfully monitoring any earn-out calculations and payments; |

| ● | retaining key senior management and key sales and marketing and research and development personnel; |

| ● | potential incompatibility of solutions, services and technology or corporate cultures; |

| ● | consolidating and rationalizing corporate, information technology and administrative infrastructures; |

| ● | integrating and documenting processes and controls; |

| ● | entry into unfamiliar markets; and |

| ● | increased complexity from potentially operating additional geographically dispersed sites, particularly if we acquire a company or business with facilities or operations outside of China. |

In addition, the primary value of many potential targets in the outsourcing industry lies in their skilled professionals and established client relationships. Transitioning these types of assets to our business can be particularly difficult due to different corporate cultures and values, geographic distance and other intangible factors. For example, some newly acquired employees may decide not to work with us or to leave shortly after their move to our company and some acquired clients may decide to discontinue their commercial relationships with us. These challenges could disrupt our ongoing business, distract our management and employees and increase our expenses, including causing us to incur significant one-time expenses and write-offs, and make it more difficult and complex for our management to effectively manage our operations. If we are not able to successfully integrate an acquired entity and its operations and to realize the benefits envisioned for such acquisition, our overall growth and profitability plans may be adversely affected.

If we do not succeed in attracting new clients for our services and or growing revenues from existing clients, we may not achieve our revenue growth goals.

We plan to significantly expand the number of clients we serve to diversify our client base and grow our revenues. Revenues from a new client often rise quickly over the first several years following our initial engagement as we expand the services we provide to that client. Therefore, obtaining new clients is important for us to achieve rapid revenue growth. We also plan to grow revenues from our existing clients by identifying and selling additional services to them. Our ability to attract new clients, as well as our ability to grow revenues from existing clients, depends on a number of factors, including our ability to offer high quality services at competitive prices, the strength of our competitors and the capabilities of our sales and marketing teams. If we are not able to continue to attract new clients or to grow revenues from our existing clients in the future, we may not be able to grow our revenues as quickly as we anticipate or at all.

As a result of our significant recent growth, evaluating our business and prospects may be difficult and our past results may not be indicative of our future performance.

Our future success depends on our ability to significantly increase revenue and maintain profitability from our operations. Our business has grown and evolved significantly in recent years. Our growth in recent years makes it difficult to evaluate our historical performance and makes a period-to-period comparison of our historical operating results less meaningful. We may not be able to achieve a similar growth rate or maintain profitability in future periods. Therefore, you should not rely on our past results or our historic rate of growth as an indication of our future performance. You should consider our future prospects in light of the risks and challenges encountered by a company seeking to grow and expand in a competitive industry that is characterized by rapid technological change, evolving industry standards, changing client preferences and new product and service introductions. These risks and challenges include, among others:

| ● | the uncertainties associated with our ability to continue our growth and maintain profitability; |

| ● | preserving our competitive position in the IT services industry in China; |

| ● | offering consistent and high-quality services to retain and attract clients; |

10

| ● | implementing our strategy and modifying it from time to time to respond effectively to competition and changes in client preferences; |

| ● | managing our expanding operations and successfully expanding our solution and service offerings; |

| ● | responding in a timely manner to technological or other changes in the IT services industry; |

| ● | managing risks associated with intellectual property; and |

| ● | recruiting, training, developing and retaining qualified managerial and other personnel. |

If we are unsuccessful in addressing any of these risks or challenges, our business may be materially and adversely affected.

We face risks associated with having a long selling and implementation cycle for our services that require us to make significant resource commitments prior to realizing revenues for those services.

We have a long selling cycle for our technology services, which requires significant investment of capital, human resources and time by both our clients and us. In our consulting service request, we collect service fees on monthly and quarterly basis; in our solution services segment – by performance obligation fulfillment. Before committing to use our services, potential clients require us to expend substantial time and resources educating them on the value of our services and our ability to meet their requirements. Therefore, our selling cycle is subject to many risks and delays over which we have little or no control, including our clients’ decision to choose alternatives to our services (such as other providers or in-house resources) and the timing of our clients’ budget cycles and approval processes. Implementing our services also involves a significant commitment of resources over an extended period of time from both our clients and us. Our clients may experience delays in obtaining internal approvals or delays associated with technology, thereby further delaying the implementation process. Our current and future clients may not be willing or able to invest the time and resources necessary to implement our services, and we may fail to close sales with potential clients to which we have devoted significant time and resources, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Our profitability will suffer if we are not able to maintain our resource utilization levels and continue to improve our productivity levels.

Our gross margin and profitability are significantly impacted by our utilization levels of human resources as well as other resources, such as computers, IT infrastructure and office space, and our ability to increase our productivity levels. We have expanded our operations significantly in recent years through organic growth and external acquisitions, which has resulted in a significant increase in our headcount and fixed overhead costs. We may face difficulties maintaining high levels of utilization, especially for our newly established or newly acquired businesses and resources. The master service agreements with our clients typically do not impose a minimum or maximum purchase amount and allow our clients to place service orders from time to time at their discretion. Client demand may fall to zero or surge to a level that we cannot cost-effectively satisfy. Although we try to use all commercially reasonable efforts to accurately estimate service orders and resource requirements from our clients, we may overestimate or underestimate, which may result in unexpected cost and strain or redundancy of our human capital and adversely impact our utilization levels. In addition, some of our professionals are specially trained to work for specific clients or on specific projects, and some of our sales and delivery center facilities are dedicated to specific clients or specific projects. Our ability to continually increase our productivity levels depends significantly on our ability to recruit, train, develop and retain high-performing professionals, staff projects appropriately and optimize our mix of services and delivery methods. If we experience a slowdown or stoppage of work for any client or on any project for which we have dedicated professionals or facilities, we may not be able to efficiently reallocate these professionals and facilities to other clients and projects to keep their utilization and productivity levels high. If we are not able to maintain high resource utilization levels without corresponding cost reductions or price increases, our profitability will suffer.

11

A portion of our income is generated, and will in the future continue to be generated, on a project basis with a fixed price; we may not be able to accurately estimate costs and determine resource requirements in relation to our projects, which would reduce our margins and profitability.

A portion of our income is generated, and will in the future continue to be generated, from fees we receive for our projects with a fixed price. Our projects often involve complex technologies, entail the coordination of operations and workforces in multiple locations, utilizing workforces with different skill sets and competencies and geographically distributed service centers, and must be completed within compressed timeframes and meet client requirements that are subject to change and increasingly stringent. In addition, some of our fixed-price projects are multi-year projects that require us to undertake significant projections and planning related to resource utilization and costs. If we fail to accurately assess the time and resources required for completing projects and to price our projects profitably, our business, results of operations and financial condition could be adversely affected.

Increases in wages for professionals in China could prevent us from sustaining our competitive advantage and could reduce our profit margins.

Our most significant costs are the salaries and other compensation expenses for our professionals and other employees. Wage costs for professionals in China are lower than those in more developed countries and India. However, because of rapid economic growth, increased productivity levels, and increased competition for skilled employees in China, wages for highly skilled employees in China, in particular middle- and senior-level managers, are increasing at a faster rate than in the past. We may need to increase the levels of employee compensation more rapidly than in the past to remain competitive in attracting and retaining the quality and number of employees that our business requires. Increases in the wages and other compensation we pay our employees in China could reduce our competitive advantage unless we are able to increase the efficiency and productivity of our professionals as well as the prices we can charge for our services. In addition, any appreciation in the value of the Renminbi relative to U.S. dollar and other foreign currencies will cause an increase in the relative wage levels in China, which could further reduce our competitive advantage and adversely impact our profit margin.

The international nature of our business exposes us to risks that could adversely affect our financial condition and results of operations.

We conduct our business throughout the world in multiple locations. As a result, we are exposed to risks typically associated with conducting business internationally, many of which are beyond our control. These risks include:

| ● | significant currency fluctuations between the Renminbi and the U.S. dollar and other currencies in which we transact business; |

| ● | legal uncertainty owing to the overlap and inconsistencies of different legal regimes, problems in asserting contractual or other rights across international borders and the burden and expense of complying with the laws and regulations of various jurisdictions; |

| ● | potentially adverse tax consequences, such as scrutiny of transfer pricing arrangements by authorities in the countries in which we operate; |

| ● | current and future tariffs and other trade barriers, including restrictions on technology and data transfers; |

| ● | unexpected changes in regulatory requirements; and |

| ● | terrorist attacks and other acts of violence or war. |

The occurrence of any of these events could have a material adverse effect on our results of operations and financial condition.

12

Our net revenues and results of operations are affected by seasonal trends.

Our business is affected by seasonal trends. In particular, our net revenues are typically progressively higher in the second, third and fourth quarters of each year compared to the first quarter of each year due to seasonal trends, such as: (i) a general slowdown in business activities and a reduced number of working days for our professionals during the first quarter of each year as a result of the Chinese New Year holiday period, and (ii) our customers in general tend to spend their IT budgets in the second half of the year and in particular the fourth quarter. Other factors that may cause our quarterly operating results to fluctuate include, among others, changes in general economic conditions in China and the impact of unforeseen events. We believe that our net revenues will continue to be affected in the future by seasonal trends. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance, and we believe it is more meaningful to evaluate our business on an annual basis.

We may be forced to reduce the prices of our services due to increased competition and reduced bargaining power with our clients, which could lead to reduced revenues and profitability.

The services outsourcing industry in China is developing rapidly, and related technology trends are constantly evolving. This results in the frequent introduction of new services and significant price competition from our competitors. We may be unable to offset the effect of declining average sales prices through increased sales volumes and/or reductions in our costs. Furthermore, we may be forced to reduce the prices of our services in response to offerings made by our competitors. Finally, we may not have the same level of bargaining power we have enjoyed in the past when it comes to negotiating the prices of our services.

If we cause disruptions to our clients’ businesses or provide inadequate service, our clients may have claims for substantial damages against us, and as a result our profits may be substantially reduced.

If our professionals make errors in the course of delivering services to our clients or fail to consistently meet service requirements of a client, these errors or failures could disrupt the client’s business, which could result in a reduction in our net revenues or a claim for substantial damages against us. In addition, a failure or inability to meet a contractual requirement could seriously damage our reputation and affect our ability to attract new business. The services we provide are often critical to our clients’ businesses. We generally provide customer support from three months to one year after our customized application is delivered. Certain of our client contracts require us to comply with security obligations including maintaining network security and back-up data, ensuring our network is virus-free, maintaining business continuity planning procedures, and verifying the integrity of employees that work with our clients by conducting background checks. Any failure in a client’s system or breach of security relating to the services we provide to the client could damage our reputation or result in a claim for substantial damages against us. Any significant failure of our equipment or systems, or any major disruption to basic infrastructure like power and telecommunications in the locations in which we operate, could impede our ability to provide services to our clients, have a negative impact on our reputation, cause us to lose clients, reduce our revenues and harm our business. Under our contracts with our clients, our liability for breach of our obligations is in some cases limited to a certain percentage of contract price. Such limitations may be unenforceable or otherwise may not protect us from liability for damages. In addition, certain liabilities, such as claims of third parties for which we may be required to indemnify our clients, are generally not limited under our contracts. We currently do not have commercial general or public liability insurance. The successful assertion of one or more large claims against us could have a material adverse effect on our business, reputation, results of operations, financial condition and cash flows. Even if such assertions against us are unsuccessful, we may incur reputational harm and substantial legal fees.

13

We may be liable to our clients for damages caused by unauthorized disclosure of sensitive and confidential information, whether through our employees or otherwise.

We are typically required to manage, utilize and store sensitive or confidential client data in connection with the services we provide. Under the terms of our client contracts, we are required to keep such information strictly confidential. We use network security technologies, surveillance equipment and other methods to protect sensitive and confidential client data. We also require our employees and subcontractors to enter into confidentiality agreements to limit access to and distribution of our clients’ sensitive and confidential information as well as our own trade secrets. We can give no assurance that the steps taken by us in this regard will be adequate to protect our clients’ confidential information. If our clients’ proprietary rights are misappropriated by our employees or our subcontractors or their employees, in violation of any applicable confidentiality agreements or otherwise, our clients may consider us liable for those acts and seek damages and compensation from us. Any such acts could cause us to lose existing and future business and damage our reputation in the market. In addition, we currently do not have any insurance coverage for mismanagement or misappropriation of such information by our subcontractors or employees. Any litigation with respect to unauthorized disclosure of sensitive and confidential information might result in substantial costs and diversion of resources and management attention.

We may not be able to prevent others from unauthorized use of intellectual property of our clients, which could harm our business and competitive position.

We rely on software licenses from our clients with respect to certain projects. To protect proprietary information and other intellectual property of our clients, we require our employees, subcontractors, consultants, advisors and collaborators to enter into confidentiality agreements with us. These agreements may not provide effective protection for trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Implementation of intellectual property-related laws in China has historically been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, protection of intellectual property rights and confidentiality in China may not be as effective as that in the United States or other developed countries. Policing unauthorized use of proprietary technology is difficult and expensive. The steps we have taken may be inadequate to prevent the misappropriation of proprietary technology of our clients. Reverse engineering, unauthorized copying or other misappropriation of proprietary technologies of our clients could enable third parties to benefit from our or our clients’ technologies without paying us and our clients for doing so, and our clients may hold us liable for that act and seek damages and compensation from us, which could harm our business and competitive position.

We may not be able to prevent others from unauthorized use of our intellectual property, which could cause a loss of clients, reduce our revenues and harm our competitive position.

We rely on a combination of copyright, trademark, software registration, anti-unfair competition and trade secret laws, as well as confidentiality agreements and other methods to protect our intellectual property rights. To protect our trade secrets and other proprietary information, employees, clients, subcontractors, consultants, advisors and collaborators are required to enter into confidentiality agreements. These agreements might not provide effective protection for the trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or disclosure of such trade secrets, know-how or other proprietary information. Implementation of intellectual property-related laws in China has historically been lacking, primarily because of ambiguities in the PRC laws and difficulties in enforcement. Accordingly, intellectual property rights and confidentiality protections in China may not be as effective as those in the United States or other developed countries, and infringement of intellectual property rights continues to pose a serious risk of doing business in China. Policing unauthorized use of proprietary technology is difficult and expensive. The steps we have taken may be inadequate to prevent the misappropriation of our proprietary technology. Reverse engineering, unauthorized copying, other misappropriation, or negligent or accidental leakage of our proprietary technologies could enable third parties to benefit from our technologies without obtaining our consent or paying us for doing so, which could harm our business and competitive position. Though we are not currently involved in any litigation with respect to intellectual property, we may need to enforce our intellectual property rights through litigation. Litigation relating to our intellectual property may not prove successful and might result in substantial costs and diversion of resources and management attention.

14

We may face intellectual property infringement claims that could be time-consuming and costly to defend. If we fail to defend ourselves against such claims, we may lose significant intellectual property rights and may be unable to continue providing our existing services.

Our success largely depends on our ability to use and develop our technology and services without infringing the intellectual property rights of third parties, including copyrights, trade secrets and trademarks. We may be subject to litigation involving claims of violation of other intellectual property rights of third parties. We typically indemnify clients who purchase our services and solutions against potential infringement of intellectual property rights underlying our services and solutions, which subjects us to the risk of indemnification claims. The holders of other intellectual property rights potentially relevant to our service offerings may make it difficult for us to acquire a license on commercially acceptable terms. Also, we may be unaware of intellectual property registrations or applications relating to our services that may give rise to potential infringement claims against us. There may also be technologies licensed to and relied on by us that are subject to infringement or other corresponding allegations or claims by third parties which may damage our ability to rely on such technologies. We are subject to additional risks as a result of our recent and proposed acquisitions and the hiring of new employees who may misappropriate intellectual property from their former employers. Parties making infringement claims may be able to obtain an injunction to prevent us from delivering our services or using technology involving the allegedly infringing intellectual property. Intellectual property litigation is expensive and time-consuming and could divert management’s attention from our business. A successful infringement claim against us, whether with or without merit, could, among others things, require us to pay substantial damages, develop non-infringing technology, or re-brand our name or enter into royalty or license agreements that may not be available on acceptable terms, if at all, and cease making, licensing or using products that have infringed a third party’s intellectual property rights. Protracted litigation could also result in existing or potential clients deferring or limiting their purchase or use of our products until resolution of such litigation, or could require us to indemnify our clients against infringement claims in certain instances. Any intellectual property claim or litigation in this area, whether we ultimately win or lose, could damage our reputation and have a material adverse effect on our business, results of operations or financial condition.

We may need additional capital and any failure by us to raise additional capital on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our service offerings to respond to market demand or competitive challenges.

We believe that our current cash, cash flow from operations and the available lines of credit from financial institutions should be sufficient to meet our anticipated cash needs for at least the next 12 months. We may, however, require additional cash resources due to changed business conditions or other future developments, including any investments or acquisitions we may decide to pursue. If these resources are insufficient to satisfy our cash requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities could result in dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financing covenants that would restrict our operations. Our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

| ● | investors’ perception of, and demand for, securities of technology services outsourcing companies; |

| ● | conditions of the U.S. and other capital markets in which we may seek to raise funds; |

| ● | our future results of operations and financial condition; |

| ● | PRC government regulation of foreign investment in China; |

| ● | economic, political and other conditions in China; and |

| ● | PRC government policies relating to the borrowing and remittance outside China of foreign currency. |

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to grow our business and develop or enhance our product and service offerings to respond to market demand or competitive challenges.

Failure to adhere to regulations that govern our clients’ businesses could result in breaches of contracts with our clients. Failure to adhere to the regulations that govern our business could result in our being unable to effectively perform our services.

Our clients’ business operations are subject to certain rules and regulations in China or elsewhere. Our clients may contractually require that we perform our services in a manner that would enable them to comply with such rules and regulations. Failure to perform our services in such a manner could result in breaches of contract with our clients and, in some limited circumstances, civil fines and criminal penalties for us. In addition, we are required under various Chinese laws to obtain and maintain permits and licenses to conduct our business. If we do not maintain our licenses or other qualifications to provide our services, we may not be able to provide services to existing clients or be able to attract new clients and could lose revenues, which could have a material adverse effect on our business and results of operations.

15

We may incur losses resulting from business interruptions resulting from occurrence of natural disasters, health epidemics and other outbreaks or events.

Our operational facilities may be damaged in natural disasters such as earthquakes, floods, heavy rains, and storms, tsunamis and cyclones, or other events such as fires. Such natural disasters or other events may lead to disruption of information systems and telephone service for sustained periods. Damage or destruction that interrupts our provision of outsourcing services could damage our relationships with our clients and may cause us to incur substantial additional expenses to repair or replace damaged equipment or facilities. We may also be liable to our clients for disruption in service resulting from such damage or destruction. Prolonged disruption of our services as a result of natural disasters or other events may also entitle our clients to terminate their contracts with us. We currently do not have insurance against business interruptions.

Our results of operations may be negatively impacted by the COVID-19 pandemic.

In December 2019, the 2019 novel coronavirus (COVID-19) surfaced in Wuhan, China. The World Health Organization declared a global emergency on January 30, 2020 with respect to the outbreak then characterized it as a pandemic on March 11, 2020. The outbreak has spread throughout Europe and the Middle East, and there have been many cases of COVID-19 in Canada and the United States, causing companies and various international jurisdictions to impose restrictions, such as quarantines, closures, cancellations and travel restrictions. While these effects are expected to be temporary, the duration of the business disruptions internationally and related operational impact are expected to last until the end of fiscal 2023 and beyond. Similarly, we cannot estimate whether or to what extent this outbreak and potential financial impact may extend to countries outside of those currently impacted. At this point, the extent to which the coronavirus has slowed down our projected revenue growth is reflected in our fiscal 2023 financial statements and may continue to slow down our growth in the future.