Exhibit 99.2

CHINA SXT PHARMACEUTICALS, INC.

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2023 AND 2022

(UNAUDITED)

CHINA SXT PHARMACEUTICALS, INC.

INDEX TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

F-1

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(IN U.S. DOLLARS, EXCEPT FOR NUMBER OF SHARES DATA)

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Accounts receivable, net | ||||||||

| Inventories | ||||||||

| Advance to suppliers | ||||||||

| Prepayments, receivables and other current assets | ||||||||

| Total Current Assets | ||||||||

| Property, plant and equipment, net | ||||||||

| Intangible assets, net | ||||||||

| Long-term deposit | ||||||||

| Right-of-use assets - operating leases -related party | ||||||||

| Total Non-current Assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities | ||||||||

| Short-term borrowings | $ | $ | ||||||

| Long-term borrowings – current | ||||||||

| Short-term convertible note | ||||||||

| Accounts payable | ||||||||

| Refund liabilities | ||||||||

| Advance from customers | ||||||||

| Amounts due to related parties | ||||||||

| Accrued expenses and other liabilities | ||||||||

| Taxes payable | ||||||||

| Operating lease liabilities - current – related party | ||||||||

| Total Current Liabilities | ||||||||

| Non-current Liabilities | ||||||||

| Long-term borrowings | ||||||||

| Operating lease liabilities – non-current – related party | ||||||||

| Total Non-current Liabilities | ||||||||

| TOTAL LIABILITIES | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||

| Ordinary shares, unlimited shares authorized, $ | ||||||||

| Additional paid-in capital | ||||||||

| Accumulated deficits | ( | ) | ( | ) | ||||

| Accumulated other comprehensive income | ( | ) | ( | ) | ||||

| Total Shareholders’ Equity | ||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | $ | ||||||

| * |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-2

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME/(LOSS) AND COMPREHENSIVE INCOME/(LOSS)

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

(UNAUDITED)

| For the six months ended September 30, | ||||||||

| 2023 (Unaudited) | 2022 (Unaudited) | |||||||

| Revenues | $ | $ | ||||||

| Revenues generated from third parties | ||||||||

| Revenue generated from related parties | ||||||||

| Cost of revenues | ( | ) | ( | ) | ||||

| Gross profit | ||||||||

| Operating expenses: | ||||||||

| Selling and marketing | ( | ) | ( | ) | ||||

| General and administrative | ( | ) | ( | ) | ||||

| Total operating expenses | ( | ) | ( | ) | ||||

| Operating Loss | ( | ) | ( | ) | ||||

| Other income (expenses): | ||||||||

| Interest expenses, net | ( | ) | ( | ) | ||||

| Other income (expenses), net | ( | ) | ||||||

| Total other expenses, net | ( | ) | ( | ) | ||||

| Loss before income taxes | ( | ) | ( | ) | ||||

| Income tax provision | ||||||||

| Net loss | ( | ) | ( | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation adjustment | ( | ) | ( | ) | ||||

| Comprehensive loss | ( | ) | ( | ) | ||||

| Earnings per ordinary share | ||||||||

| $ | ( | ) | $ | ( | ) | |||

| Weighted average number of ordinary shares outstanding | ||||||||

| * |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-3

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED SEPTEMBER 30, 2023 and 2022

(IN U.S. DOLLARS, EXCEPT SHARES DATA)

(UNAUDITED)

| Shares* | Amount | Additional paid-in capital | Accumulated deficits | Accumulated other comprehensive income (loss) | Total equity | |||||||||||||||||||

| Balance as of March 31, 2022 | $ | $ | $ | ( | ) | $ | $ | |||||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||

| Shares issued as employee incentives | ||||||||||||||||||||||||

| Share issued due to reverse-split round up | ||||||||||||||||||||||||

| Shares issued for convertible notes | ||||||||||||||||||||||||

| Foreign currency translation gain | - | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of September 30, 2022 (Unaudited) | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Balance as of March 31, 2023 | $ | $ | $ | ( | ) | $ | ( | ) | $ | |||||||||||||||

| Net loss | - | ( | ) | ( | ) | |||||||||||||||||||

| Shares issued for convertible notes | ||||||||||||||||||||||||

| Foreign currency translation gain | - | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of September 30, 2023 (Unaudited) | ( | ) | ( | ) | ||||||||||||||||||||

| * |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-4

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN U.S. DOLLARS)

(UNAUDITED)

| For the six months ended September 30, | ||||||||

| 2023 (Unaudited) | 2022 (Unaudited) | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss from operations | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Convertible note - Accretion of financing cost | ||||||||

| Expected credit loss | ||||||||

| Depreciation and amortization expenses | ||||||||

| Equity incentive plan | ||||||||

| Non-cash operating lease expense | ||||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | ( | ) | ( | ) | ||||

| Note receivable | ||||||||

| Inventory | ||||||||

| Advance to suppliers | ( | ) | ( | ) | ||||

| Prepayments, receivables and other assets | ( | ) | ||||||

| Accounts payable | ||||||||

| Refund liabilities | ||||||||

| Advance from customers | ( | ) | ||||||

| Taxes payable | ( | ) | ||||||

| Change in related party lease liability – operating lease | ( | ) | ||||||

| Accrued expenses and other current liabilities | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Cash Flows from Investing Activities: | ||||||||

| Purchase of property, plant and equipment | ( | ) | ||||||

| Other receivable - Huangshan Panjie | ||||||||

| Net cash provided by investing activities | ||||||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from borrowings | ||||||||

| Repayment of borrowings | ( | ) | ( | ) | ||||

| Payment to related parties | ( | ) | ( | ) | ||||

| Net cash used in financing activities | ( | ) | ( | ) | ||||

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | ( | ) | ( | ) | ||||

| Net decrease in cash, cash equivalents and restricted cash | ( | ) | ( | ) | ||||

| Cash, cash equivalents and restricted cash at the beginning of period | ||||||||

| Cash, cash equivalents and restricted cash at the end of period | $ | $ | ||||||

| Supplemental disclosures of cash flows information: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest expense | $ | $ | ||||||

| Non-cash transactions: | ||||||||

| Issuance of shares for equity incentive plan | $ | $ | ||||||

| Issuance of shares for convertible notes principal and interest settlement | $ | $ | ||||||

| Offset between due from related parties and due to related parties balances | $ | $ | ||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

F-5

CHINA SXT PHARMACEUTICALS, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES

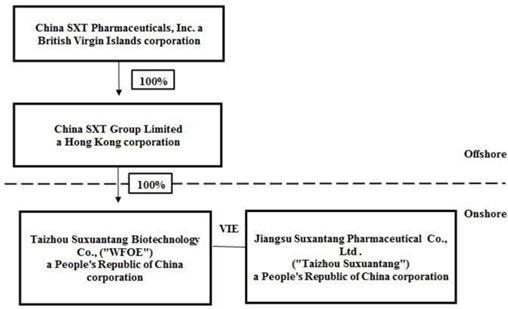

China SXT Pharmaceutical, Inc. (“SXT” or the “Company”) is a holding company incorporated in British Virgin Islands on July 4, 2017. The Company focuses on the research, development, manufacture, marketing and sales of traditional Chinese medicine pieces (the “TCMP”), through its variable interest entity (“VIE”), Jiangsu Suxuantang Pharmaceutical Co., Ltd, (“Taizhou Suxuantang”) in China. The Company currently sells three types of TCMP products: Advanced TCMP, Fine TCMP and Regular TCMP, and TCM Homologous Supplements (“TCMHS”) products. We currently have a product portfolio of 19 advanced TCMPs, 10 Fine TCMPs, 235 Regular TCMPs and 4 TCMHS solid beverage products that address a wide variety of diseases and medical indications. Most of our products are sold on a prescription basis across China. The Company’s principal executive offices are located in Taizhou, Jiangsu province, China.

Restructuring and Share Issuance

On July 4, 2017, we were incorporated in the British

Virgin Islands by issuance of

On July 21, 2017, our wholly owned subsidiary China SXT Group Limited (“SXT HK”) was incorporated in Hong Kong. China SXT Group Limited in turn holds all the capital stocks of Taizhou Suxantang Biotechnology Co. Ltd. (“WFOE”), a wholly foreign owned enterprise incorporated in China on October 13, 2017. On the same day, Taizhou Suxuantang and its shareholders entered into such a series of contractual arrangements, also known as VIE Agreements.

Taizhou Suxuantang was incorporated on June 9,

2005 by Jianping Zhou, Xiufang Yuan (the spouse of Jianping Zhou) and Jianbin Zhou, who held

The discussion and presentation of financial statements herein assumes the completion of the Restructuring, which is accounted for retroactively as if the aforementioned transactions had become effective as of the beginning of the first period presented in the accompanying condensed consolidated financial statements.

F-6

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

The following diagram illustrates our corporate structure, including our subsidiary and condensed consolidated variable interest entity as of the date of the financial statements assuming the completion of our Restructuring:

VIE Agreements with Taizhou Suxuantang

Due to PRC legal restrictions on foreign ownership in the pharmaceutical sector, neither the Company nor our subsidiaries own any equity interest in Taizhou Suxuantang. Instead, the Company controls and receives the economic benefits of Taizhou Suxuantang’s business operations through a series of contractual arrangements. WFOE, Taizhou Suxuantang and its shareholders entered into such a series of contractual arrangements, also known as VIE Agreements, on October 13, 2017. The VIE agreements are designed to provide WFOE with the power, rights and obligations equivalent in all material respects to those it would possess as the sole equity holder of Taizhou Suxuantang, including absolute control rights and the rights to the assets, property and revenue of Taizhou Suxuantang.

According to the Exclusive Business Cooperation Agreement between WFOE and Taizhou Suxuantang, which is one of the VIE Agreements that was also entered into on October 13, 2017, Taizhou Suxuantang is obligated to pay service fees to WFOE approximately equal to the net income of Taizhou Suxuantang.

Each of the VIE Agreements is described in detail below:

Exclusive Business Cooperation Agreement

Pursuant to the Exclusive Business Cooperation Agreement between Taizhou Suxuantang and WFOE, WFOE provides Taizhou Suxuantang with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, Taizhou Suxuantang granted an irrevocable and exclusive option to WFOE to purchase from Taizhou Suxuantang, any or all of Taizhou Suxuantang’s assets at the lowest purchase price permitted under the PRC laws. Should WFOE exercise such option, the parties shall enter into a separate asset transfer or similar agreement. For services rendered to Taizhou Suxuantang by WFOE under this agreement, WFOE is entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, plus the amount of the services fees or ratio decided by the board of directors of WFOE based on the value of services rendered by WFOE and the actual income of Taizhou Suxuantang from time to time, which is approximately equal to the net income of Taizhou Suxuantang.

F-7

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

The CEO and president of WFOE, Mr. Feng Zhou, is currently managing Taizhou Suxuantang pursuant to the terms of the Exclusive Business Cooperation Agreement. WFOE has absolute authority relating to the management of Taizhou Suxuantang, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. The Exclusive Business Cooperation Agreement does not prohibit related party transactions. The audit committee is required to review and approve in advance any related party transactions, including transactions involving WFOE or Taizhou Suxuantang.

Share Pledge Agreement

Under the Share Pledge Agreement among WFOE and

Feng Zhou, Ziqun Zhou, and Di Zhou, who together hold

The Share Pledge Agreement shall be effective until all payments due under the Exclusive Business Cooperation Agreement have been paid by Taizhou Suxuantang. WFOE shall cancel or terminate the Share Pledge Agreement upon with no additional expense.

The purposes of the Share Pledge Agreement are to (1) guarantee the performance of Taizhou Suxuantang’s obligations under the Exclusive Business Cooperation Agreement, (2) make sure the shareholders of Taizhou Suxuantang shall not transfer or assign the pledged equity interests, or create or allow any encumbrance that would prejudice WFOE’s interests without WFOE’s prior written consent and (3) provide WFOE control over Taizhou Suxuantang. Under the Exclusive Option Agreement (described below), WFOE may exercise its option to acquire the equity interests in Taizhou Suxuantang any time to the extent permitted by the PRC Law. In the event Taizhou Suxuantang breaches its contractual obligations under the Exclusive Business Cooperation Agreement, WFOE will be entitled to foreclose on the Taizhou Suxuantang Shareholders’ equity interests in Taizhou Suxuantang and may (1) exercise its option to purchase or designate third parties to purchase part or all of their equity interests in Taizhou Suxuantang and in this situation, WFOE may terminate the VIE agreements after acquisition of all equity interests in Taizhou Suxuantang or form a new VIE structure with the third parties designated by WFOE; or (2) dispose the pledged equity interests and be paid in priority out of the proceeds from the disposal in which case the VIE structure will be terminated.

F-8

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTITIVIES (CONTINUED)

Exclusive Option Agreement

Under the Exclusive Option Agreement, the Taizhou

Suxuantang Shareholders irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC

law, once or at multiple times, at any time, part or all of their equity interests in Taizhou Suxuantang at the exercise price of RMB

Under the Exclusive Option Agreement, WFOE may at any time under any circumstances, purchase, or have its designated person to purchase, at its discretion, to the extent permitted under PRC law, all or part of the shareholders’ equity interests in Taizhou Suxuantang.

This Agreement shall remain effective until all equity interests held by Taizhou Suxuantang Shareholders in Taizhou Suxuantang have been transferred or assigned to WFOE and/or any other person designated by WFOE in accordance with this Agreement.

Power of Attorney

Under the Power of Attorney, the Taizhou Suxuantang Shareholders authorize WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of Taizhou Suxuantang.

Although it is not explicitly stipulated in the Power of Attorney, the term of the Power of Attorney shall be the same as the term of that of the Exclusive Option Agreement.

This Power of Attorney is coupled with an interest and shall be irrevocable and continuously valid for each shareholder from the date it is executed until the date he/she no longer is a shareholder of Taizhou Suxuantang.

The Exclusive Option Agreement, together with the Share Pledge Agreement and the Power of Attorney enable WFOE to exercise effective control over Taizhou Suxuantang.

Basis of presentation and principles of consolidation

The accompany unaudited condensed consolidated financial statements of the Company has been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The accompanying condensed consolidated financial statements include our accounts and those of our wholly owned subsidiaries and VIE. Accordingly, all intercompany balances and transactions have been eliminated through the consolidation process.

In the opinion of management, these unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly, in all material respects, the Company’s condensed consolidated financial position, results of operations, cash flows and changes in equity for the interim periods presented. These unaudited condensed financial statements do not include certain information and footnote disclosures as required by the U.S. GAAP for complete annual financial statements. Therefore, these unaudited condensed consolidated interim financial statements should be read in conjunction with the financial statements and related notes included in the Company’s first initial offering Registration Statement on Form 20-F for the year ended March 31, 2023 and 2022.

The VIE, Taizhou Suxuantang is owned by three shareholders, each of which act as the Company’s nominee shareholder. For the consolidated VIEs, the Company’s management made evaluations of the relationships between the Company and the VIE and the economic benefit flow of contractual arrangements with Taizhou Suxuantang. In connection with such evaluation, management also took into account the fact that, as a result of such contractual arrangements, the Company control the shareholders’ voting interests in these VIEs. As a result of such evaluation, management concluded that the Company is the primary beneficiary of the consolidated VIEs, Taizhou Suxuantang. The Company does not have any VIEs that are not consolidated in the financial statements.

F-9

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Risks in relation to the VIE structure

It is possible that the Company’s operation of certain of its operations and businesses through its VIE could be found by PRC authorities to be in violation of PRC law and regulations prohibiting or restricting foreign ownership of companies that engage in such operations and businesses. While the Company’s management considers the possibility of such a finding by PRC regulatory authorities under current law and regulations to be remote. On January 19, 2015, the Ministry of Commerce of the PRC, or (the “MOFCOM”) released on its Website for public comment a proposed PRC law (the “Draft FIE Law”) that appears to include VIE within the scope of entities that could be considered to be foreign invested enterprises (or “FIEs”) that would be subject to restrictions under existing PRC law on foreign investment in certain categories of industry. Specifically, the Draft FIE Law introduces the concept of “actual control” for determining whether an entity is considered to be an FIE. In addition to control through direct or indirect ownership or equity, the Draft FIE Law includes control through contractual arrangements within the definition of “actual control.” If the Draft FIE Law was passed by the People’s Congress of the PRC and went into effect in its current form and as a result the Company’s VIE could become explicitly subject to the current restrictions on foreign investment in certain categories of industry. The Draft FIE Law includes provisions that would exempt from the definition of foreign invested enterprises entities where the ultimate controlling shareholders are either entities organized under PRC law or individuals who are PRC citizens. The Draft FIE Law is silent as to what type of enforcement action might be taken against existing VIEs that operate in restricted or prohibited industries and are not controlled by entities organized under PRC law or individuals who are PRC citizens. If a finding were made by PRC authorities, under existing law and regulations or under the Draft FIE Law if it becomes effective, about the Company’s operation of certain of its operations and businesses through its VIEs, regulatory authorities with jurisdiction over the licensing and operation of such operations and businesses would have broad discretion in dealing with such a violation, including levying fines, confiscating the Company’s income, revoking the business or operating licenses of the affected businesses, requiring the Company to restructure its ownership structure or operations, or requiring the Company to discontinue all or any portion of its operations. Any of these actions could cause significant disruption to the Company’s business operations and have a severe adverse impact on the Company’s cash flows, financial position and operating performance.

In addition, it is possible that the contracts among Taizhou Suxuantang, WFOE, and the nominee shareholders of Taizhou Suxuantang would not be enforceable in China if PRC government authorities or courts were to find that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event that the Company was unable to enforce these contractual arrangements, the Company would not be able to exert effective control over the VIEs. Consequently, the VIEs’ results of operations, assets and liabilities would not be included in the Company’s condensed consolidated financial statements. If such were the case, the Company’s cash flows, financial position, and operating performance would be materially adversely affected. The Company’s contractual arrangements Taizhou Suxuantang, WFOE, and the nominee shareholders of Taizhou Suxuantang are approved and in place. Management believes that such contracts are enforceable and considers the possibility remote that PRC regulatory authorities with jurisdiction over the Company’s operations and contractual relationships would find the contracts to be unenforceable.

The Company’s operations and businesses rely on the operations and businesses of its VIEs, which hold certain recognized revenue-producing assets. The VIEs also have an assembled workforce, focused primarily on research and development, whose costs are expensed as incurred. The Company’s operations and businesses may be adversely impacted if the Company loses the ability to use and enjoy assets held by its VIE.

F-10

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign currency translation

Transactions denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded in the statement of operations.

The reporting and functional currencies of the Company and SXT HK are the United States Dollars (“US$”) and the accompanying financial statements have been expressed in US$. In addition, the WFOE and the VIE maintain their books and records in their respective local currency, Renminbi (“RMB”), which is also the respective functional currency for each subsidiary and VIE as they are the primary currency of the economic environment in which each subsidiary operates.

In general, for consolidation purposes, assets, and liabilities of its subsidiaries whose functional currency is not the US$ are translated into US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation of financial statements of a foreign subsidiary are recorded as a separate component of accumulated other comprehensive income within the statement of stockholders’ equity. Other equity items are translated using the exchange rates on the transaction date.

| September 30, 2023 | March 31, 2023 | September 30, 2022 | ||||||||||

| Balance sheet items, except for equity accounts | ||||||||||||

| Items in the statements of income(loss) and comprehensive income(loss), and statements of cash flows | ||||||||||||

Measurement of credit losses on financial instruments

On April 1, 2023, the Company adopted ASU 2016-13, “Financial Instruments — Credit Losses (Topic 326) — Measurement of Credit Losses on Financial Instruments,” for financial assets at amortized cost including accounts receivable, refundable deposits, other receivables, and retention receivable. This guidance replaced the “incurred loss” impairment methodology with an approach based on “expected losses” to estimate credit losses on certain types of financial instruments and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates. The guidance requires financial assets to be presented at the net amount expected to be collected. The allowance for credit losses is a valuation account that is deducted from the cost of the financial asset to present the net carrying value at the amount expected to be collected on the financial asset.

Use of estimates

The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, management reviews these estimates and assumptions using the currently available information.

Changes in facts and circumstances may cause the Company to revise its estimates. The Company bases its estimates on historical experience and on various other assumptions that are believed to be reasonable, the results of which form the basis for making judgments about the carrying values of assets and liabilities. The following are some of the areas requiring significant judgments and estimates as of September 30, 2023 and March 31, 2023: determinations of the useful lives of long-lived assets, estimates of expected credit loss for accounts receivable and other receivables, estimates of inventory provision, sales return rate, valuation assumptions in performing asset impairment tests of long-lived assets and determinations of fair value of convertible notes (liability component, etc.) and warrants.

F-11

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Going Concern

The condensed consolidated financial statements for the six months ended September 30, 2023 and 2022 have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business.

As reflected in the consolidated financial statements,

the Company reported net loss of $

The Company is in the process of building its customer base to generate more revenues as well as cutting expenses, and the Company is seeking to raise capital through additional debt from equity financings to fund its operations. However, there can be no assurance that these plans and arrangements will be sufficient to fund the Company's ongoing capital expenditure, working capital, and other requirements. The accompanying consolidated financial statements do not include any adjustments related to the recoverability or classification of asset and the amounts or classification of liabilities that may result from the outcome of this uncertainty. If the going concern assumption is not appropriate, material adjustments to the financial statements could be required.

Fair values of financial instruments

ASC Topic 825, Financial Instruments (“Topic 825”) requires disclosure of fair value information of financial instruments, whether recognized in the balance sheets, for which it is practicable to estimate that value. In cases where quoted market prices are not available, fair values are based on estimates using present value or other valuation techniques. Those techniques are significantly affected by the assumptions used, including the discount rate and estimates of future cash flows. In that regard, the derived fair value estimates cannot be substantiated by comparison to independent markets and, in many cases, could not be realized in immediate settlement of the instruments. Topic 825 excludes certain financial instruments and all nonfinancial assets and liabilities from its disclosure requirements. Accordingly, the aggregate fair value amounts do not represent the underlying value of the Company.

| ● | Level 1 - inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities inactive markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| ● | Level 3 - inputs to the valuation methodology are unobservable and significant to the fair value. |

F-12

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Fair values of financial instruments (continued)

As of September 30, 2023 and March 31, 2023, financial instruments of the Company primarily comprised of cash and cash equivalents, accounts receivables, receivables and other current assets (exclude prepayments and deposits), borrowings (current and non-current portion), accounts payable, amounts due to related parties and accrued expenses, lease liabilities and other liabilities. The carrying amounts of these financial instruments approximated their fair values because of their generally short maturities.

For lease liabilities, fair value approximates their carrying value at the period end as the interest rates used to discount the host contracts approximate market rates. The carrying amount of the long-term borrowings approximates its fair value due to the fact that the related interest rate approximates the interest rates currently offered by financial institutions for similar debt instruments of comparable maturities.

The Company noted no transfers between levels during any of the periods presented. The Company did not have any instruments that were measured at fair value on a recurring nor non-recurring basis as of September 30, 2023 and March 31, 2023, respectively.

Cash and cash equivalents

The Company considers all highly liquid investment instruments with an original maturity of three months or less from the date of purchase to be cash equivalents. The Company maintains most of the bank accounts in the PRC. Cash balances in bank accounts in PRC are not insured by the Federal Deposit Insurance Corporation or other programs.

Accounts receivable, net

Accounts receivable are recorded at the invoiced amount less an allowance for any uncollectible accounts and do not bear interest, which are due on demand. Management reviews the adequacy of the allowance for doubtful accounts on an ongoing basis, using historical collection trends and aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to adjust in the allowance when it is considered necessary. Account balances are charged off against the allowance after all means of collection have been exhausted and the potential for recovery is considered remote.

The Company use a loss rate method to estimate the allowance for credit losses. For those past due balances over one year and other higher risk receivables identified by the Company are reviewed individually for collectability. The Company evaluates the expected credit loss of accounts receivable based on historical collection experience, the financial condition of its customers and assumptions for the future movement of different economic drivers and how these drivers will affect each other. The Company writes off potentially uncollectible accounts receivable against the allowance for credit losses if it is determined that the amounts will not be collected or if a settlement with respect to a disputed receivable is reached for an amount that is less than the carrying value.

As of September 30, 2023 and March 31, 2023, the

Company assessed the recoverability of its accounts receivable and record an allowance of $

Inventories

Inventories primarily include raw materials and finished goods.

Inventories are stated at the lower of cost or

net realizable value. Cost is determined by the weighted-average method. Raw material cost is based on purchase costs while work-in-progress

and finished goods comprise direct materials, direct labor and an allocation of manufacturing overhead costs. Net realizable value represents

the anticipated selling price, net of distribution cost, less estimated costs to completion for inventories. As of September 30, 2023

and March 31, 2023, the Company assessed the net realizable value of its inventories and record a provision of $

F-13

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Advance to suppliers

Advance to suppliers represent amounts advanced to suppliers for future purchases of raw materials and for other services. The suppliers usually require advance payments when the Company makes purchase or orders service, and the advanced payments will be utilized to offset the Company’s future payments.

Property, plant and equipment, net

| Residual value rate | Useful Lives | |||||

| Machinery | % | |||||

| Electric equipment | % | |||||

| Office equipment | % | |||||

| Vehicles | % | |||||

| Leasehold improvement cost | % | |||||

The Company reviews property, plant and equipment for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. An asset is considered impaired if its carrying amount exceeds the future net undiscounted cash flows that the asset is expected to generate. If such asset is considered to be impaired, the impairment recognized is the amount by which the carrying amount of the asset, if any, exceeds its fair value determined using a discounted cash flow model. For the six months ended September 30, 2023 and 2022, there was no impairment of property, plant and equipment.

Costs of repairs and maintenance are expensed as incurred and asset improvements are capitalized. The cost and related accumulated depreciation and amortization of assets disposed of or retired are removed from the accounts, and any resulting gain or loss is reflected in the condensed consolidated income statements.

Intangible assets, net

Intangible assets are stated at cost less accumulated

amortization. Intangible assets represented the trademark registered in the PRC and purchased software which are amortized on a straight-line

basis over a useful life of

The Company follows ASC Topic 350 in accounting for intangible assets, which requires impairment losses to be recorded when indicators of impairment are present and the undiscounted cash flows estimated to be generated by the assets are less than the assets’ carrying amounts. For the six months ended September 30, 2023 and 2022, the Company record no impairment of intangible assets.

F-14

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Impairment of long-lived assets

Long-lived assets primarily include property, plant and equipment and intangible assets. In accordance with the provision of ASC Topic 360-10-5, “Impairment or Disposal of Long-Lived Assets”, the Company generally conducts its annual impairment evaluation to its long-lived assets, usually in the fourth quarter of each year, or more frequently if indicators of impairment exist, such as a significant sustained change in the business climate. The recoverability of long-lived assets is measured at the reporting unit level, which is an operating segment or one level below an operating segment. If the total of the expected undiscounted future net cash flows is less than the carrying amount of the asset, a loss is recognized for the difference between the fair value and carrying amount of the asset. The Company record no impairment charge for the six months ended September 30, 2023 and 2022, respectively.

Convertible note, net

ASU 2020-06, Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity, provides simplification of the convertible debt accounting framework by eliminating the cash conversion and the beneficial conversion feature accounting models for convertible debt and convertible preferred stock. The new guidance removes from GAAP separation models for convertible debt that require the convertible debt to be separated into a debt and equity component, unless the conversion feature is required to be bifurcated and accounted for as a derivative or the debt is issued at a substantial premium. ASU 2020-06 requires adoption using either modified retrospective method or full retrospective method.

Under the new framework, the reporting entity will decide the accounting for its convertible notes in the following steps: (1) a reporting entity will first decide whether to elect the fair value option under ASC 825-10 (convertible debt issued with a substantial premium may be ineligible for the fair value option); (2) if the fair value option is not elected, the reporting entity must assess whether the conversion feature requires bifurcation pursuant to ASC 815; (3) if bifurcation is not required, the reporting entity must evaluate whether the convertible debt was issued with a substantial premium; (4) if the fair value option is not elected, the conversion option is not required to be bifurcated, and the convertible debt was not issued with a substantial premium, the convertible debt will be accounted for as a single unit of account under the “traditional convertible security” model. Debt discount is amortized over the period during which the convertible note is expected to be outstanding (through the maturity date) as additional non-cash interest expense.

Revenue recognition

The Company adopted ASC Topic 606 Revenue from Contracts with Customers (“ASC 606”), on April 1, 2018, using the modified retrospective method.

Revenue is recognized when control of promised

goods is transferred to the Company’s customers in an amount of consideration of which the Company expect to be entitled to in exchange

for the goods, and the Company can reasonably estimates return provision for the goods. The product return provisions are estimated based

on (1) historical rates, (2) specific identification of outstanding returns not yet received from customers and outstanding discounts

and claims and (3) estimated returns, discounts and claims expected, but not yet finalized with customers. As of September 30, 2023 and

March 31, 2023, sales return provision recorded in refund liabilities were $

For the six months ended September 30, 2023 and 2022, the Company did not have any significant incremental costs of obtaining contracts with customers incurred or costs incurred in fulfilling contracts with customers within the scope of ASC Topic 606, that shall be recognized as an asset and amortized to expenses in a pattern that matches the timing of the revenue recognition of the related contract.

The Company does not have amounts of contract

assets since revenue is recognized as control of goods is transferred. The contract liabilities consist of advance payments from customers.

The contract liabilities are reported in a net position on a customer-by-customer basis at the end of each reporting period. All contract

liabilities are included in advance from customers in the condensed consolidated balance sheets. As of September 30, 2023 and March 31,

2023, the Company record advance from customers of $

Cost of revenue

Cost of revenue consists primarily of cost of materials, direct labors, overhead, and other related incidental expenses that are directly attributable to the Company’s principal operations.

F-15

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Market development fees

Market development fees relate mainly to market

development and advertisements of our pharmaceutical products. For the six months ended September 30, 2023 and 2022, marketing and advertising

expenses are $

Income Taxes

Current income tax expenses are provided for in accordance with the laws of the relevant taxing authorities. As part of the process of preparing the condensed consolidated financial statements, the Company is required to estimate its income taxes in each of the jurisdictions in which it operates. The Company accounts for income taxes using the liability method, under which deferred income taxes are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred taxes of a change in tax rates is recognized as income or expense in the period that includes the enactment date. Valuation allowance is provided on deferred tax assets to the extent that it is more likely than not that the asset will not be realizable in the foreseeable future.

The Company adopts ASC 740-10-25 “Income Taxes” which prescribes a more likely than not threshold for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. It also provides guidance on derecognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting for income taxes in interim periods and income tax disclosures. The Company did not have significant unrecognized uncertain tax positions or any unrecognized liabilities, interest or penalties associated with unrecognized tax benefit as of September 30, 2023 and March 31, 2023.

Comprehensive income (loss)

Comprehensive income includes net income and foreign

currency adjustments. Comprehensive income is reported in the condensed consolidated statements of operations and comprehensive income.

Accumulated other comprehensive income, as presented on the balance sheets are the cumulative foreign currency translation adjustments.

As of September 30, 2023 and March 31, 2023, the balances of accumulated other comprehensive loss amounted to $

Leases

Leases are classified at lease commencement date as either a finance lease or an operating lease. A lease is a finance lease if it meets any of the following criteria: (a) the lease transfers ownership of the underlying asset to the lessee by the end of the lease term. (b) the lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise, (c) the lease term is for the major part of the remaining economic life of the underlying asset, (d) the present value of the sum of the lease payments and any residual value guaranteed by the lessee that is not already reflected in the lease payments equals or exceeds substantially all of the fair value of the underlying asset or (e) the underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term. When none of the criteria meets, the lease shall be classified as an operating lease.

F-16

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Leases (continued)

For lessee, a lease is recognized as a right-of-use asset with a corresponding liability at lease commencement date. The lease liability is calculated at the present value of the lease payments not yet paid by using the lease term and discount rate determined at lease commencement. The right-of-use asset is calculated as the lease liability, increased by any initial direct costs and prepaid lease payments, reduced by any lease incentives received before lease commencement. The right-of-use asset itself is amortized on a straight-line basis unless another systematic method better reflects how the underlying asset will be used by and benefits the lessee over the lease term.

In February 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2016-02, Leases (Topic 842). The amendments in this ASU require an entity to recognize a right-of-use asset and lease liability for all leases with terms of more than 12 months. Recognition, measurement and presentation of expenses will depend on classification as a finance or operating lease. The amendments also require certain quantitative and qualitative disclosures about leasing arrangements. The Company adopted ASC 842 effective as of the beginning of the year ended March 31, 2023 by using a modified retrospective transition approach in the accompanying financial statements of the Company. The adoption of this standard had a material impact on the Company’s financial position as increased its assets and liabilities due to the recognition of right-of-use assets and lease liabilities on its consolidated balance sheets, and no material impact on its consolidated statements of comprehensive loss and cash flows.

Segment reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision-maker, which is a strategic committee comprised of members of the Company’s management team. In the respective periods presented, the Company had one single operating and reportable segment, namely the manufacture and distribution of TCMP. Although TCMP consist of different business units of the Company, information provided to the chief operating decision-maker is at the revenue level and the Company does not allocate operating costs or assets across business units, as the chief operating decision-maker does not use such information to allocate resources or evaluate the performance of the business units. As the Company’s long-lived assets are substantially all located in the PRC and substantially all of the Company’s revenue is derived from within the PRC, no geographical information is presented.

Earnings per share

Earnings (loss) per share is calculated in accordance with ASC 260 Earnings per Share. Basic earnings (loss) per share is computed by dividing the net income (loss) attributable to shareholders of the Company by the weighted average number of ordinary shares outstanding during the year. Diluted earnings per share is computed in accordance with the treasury stock method and based on the weighted average number of ordinary shares and dilutive ordinary share equivalents. Dilutive ordinary share equivalents are excluded from the computation of diluted earnings per share if their effects would be anti-dilutive. There were no dilutive ordinary share equivalents outstanding during the six months ended September 30, 2023 and 2022.

Related party transactions

In general, related parties exist when there is

a relationship that offers the potential for transactions at less than arm’s-length, favorable treatment, or the ability to influence

the outcome of events different from that which might result in the absence of that relationship. A related party may be any of the following:

a) an affiliate, which is a party that directly or indirectly controls, is controlled by, or is under common control with another party;

b) a principle owner, owner of record or known beneficial owner of more than

F-17

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Significant risks and uncertainties

Credit risk

Assets that potentially subject the Company to

significant concentration of credit risk primarily consist of cash and cash equivalents, accounts receivable, other receivables, advances

to suppliers. The maximum exposure of such assets to credit risk is their carrying amount as at the balance sheet dates. As of September

30, 2023 and March 31, 2023 the Company held cash and cash equivalents of $

The Company conducts credit evaluations of its

customers and suppliers and generally does not require collateral or other security from them. The Company use a loss rate method to estimate

the allowance for credit losses. For those past due balances over one year and other higher risk receivables identified by the Company

are reviewed individually for collectability. The Company evaluates the expected credit loss of receivables based on historical collection

experience, the financial condition of its customers and assumptions for the future movement of different economic drivers and how these

drivers will affect each other. The Company writes off potentially uncollectible receivables against the allowance for credit losses if

it is determined that the amounts will not be collected or if a settlement with respect to a disputed receivable is reached for an amount

that is less than the carrying value. As of September 30, 2023 and March 31, 2023, the Company record expected credit loss of $

Liquidity risk

The Company is also exposed to liquidity risk which is risk that it is unable to provide sufficient capital resources and liquidity to meet its commitments and business needs. Liabilities that potentially subject the Company to significant concentration of liquidity risk primarily consist of bank loans (current and non-current portion), accounts payable, amounts due to related parties, and accrued expenses and other liabilities. Liquidity risk is controlled by the application of financial position analysis and monitoring procedures. When necessary, the Company will turn to other financial institutions and the owners to obtain short-term funding to meet the liquidity shortage.

Interest Rate Risks

The Company is exposed to interest rate risk primarily relates to the

variable-rate borrowings, which carry interest rates ranging from

Foreign currency risk

The Company has significant operating activities in China, thus has assets and liabilities are denominated in RMB, which is not freely convertible into foreign currencies. All foreign exchange transactions take place either through the Peoples’ Bank of China (“PBOC”) or other authorized financial institutions at exchange rates quoted by PBOC. Approval of foreign currency payments by the PBOC or other regulatory institutions requires submitting a payment application form together with suppliers ‘invoices and signed contracts”. The value of RMB is subject to changes in central government policies and to international economic and political developments affecting supply and demand in the China Foreign Exchange Trading System market. Where there is a significant change in value of RMB, the gains and losses resulting from translation of financial statements of a foreign subsidiary will be significantly affected.

F-18

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Significant risks and uncertainties (continued)

Concentration risk

Significant customers and suppliers are those

that account for greater than

During the six months ended September 30, 2023,

there are two customers generated sales which accounted for over 10% of total revenues generated for that period.

| For the six months ended September 30, | ||||||||

| 2023 (Unaudited) | 2022 (Unaudited) | |||||||

| Customer A | % | % | ||||||

| Customer B | % | % | ||||||

| Customer C | % | % | ||||||

As of September 30, 2023 and March 31, 2023, accounts receivable due from these customers as a percentage of consolidated accounts receivable balances were as follows:

| As of | ||||||||

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Customer A | % | % | ||||||

| Customer B | % | % | ||||||

| Customer C | % | % | ||||||

F-19

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Significant risks and uncertainties (continued)

During the six months ended September 30, 2023

and 2022, there were three and one suppliers which accounted for over

| For the six months ended September 30, | ||||||||

| 2023 (Unaudited) | 2022 (Unaudited) | |||||||

| Supplier A | % | % | ||||||

| Supplier B | % | % | ||||||

| Supplier C | % | % | ||||||

| Supplier D | % | % | ||||||

As of September 30, 2023 and March 31, 2023, accounts payable due to these suppliers as a percentage of consolidated accounts payable balances were as follows:

| As of | ||||||||

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Supplier A | % | % | ||||||

| Supplier B | % | % | ||||||

| Supplier C | % | % | ||||||

| Supplier D | % | % | ||||||

Recently issued accounting standards

The Jumpstart Our Business Startups Act (“JOBS Act”) provides that an emerging growth company (“EGC”) as defined therein can take advantage of an extended transition period for complying with new or revised accounting standards. This allows an EGC to delay adoption of certain accounting standards until those standards would otherwise apply to private companies. The Company has adopted the extended transition period.

The Company does not believe other recently issued but not yet effective accounting statements, if recently adopted, would have a material effect on the Company’s condensed consolidated balance sheets, statements of income (loss) and comprehensive income (loss) and statements of cash flows.

F-20

NOTE 3 – ACCOUNTS RECEIVABLE, NET

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Accounts receivable, gross | $ | $ | ||||||

| Less: allowance for doubtful accounts | ( | ) | ( | ) | ||||

| Accounts receivable, net | $ | $ | ||||||

| For the six months ended September 30, | ||||||||

| 2023 | 2022 | |||||||

| Beginning balance | $ | $ | ||||||

| Additional reserve through bad debt expense | ||||||||

| Exchange rate difference | ( | ) | ( | ) | ||||

| Ending balance | $ | $ | ||||||

For the six months ended September 30, 2023 and

2022, the Company record expected credit loss of $

NOTE 4 – INVENTORIES

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Raw materials | $ | $ | ||||||

| Finished goods | ||||||||

| Provision for inventory | ( | ) | ( | ) | ||||

| Total inventories, net | $ | $ | ||||||

Impairment provision of inventories recorded for lower of cost or net realizable value adjustments were $ and $ for the six months ended September 30, 2023 and 2022, respectively.

Inventory amounts recognized into cost of goods

sold for the six months ended September 30, 2023 and 2022 were $

NOTE 5 – PREPAYMENTS, RECEIVABLES AND OTHER ASSETS

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Receivable from a third-party company | $ | $ | ||||||

| Others | ||||||||

| Total prepayments, receivables and other assets | ||||||||

| Less: allowance for doubtful accounts | ( | ) | ( | ) | ||||

| Prepayments, receivables and other assets, net | $ | $ | ||||||

F-21

NOTE 5 – PREPAYMENTS, RECEIVABLES AND OTHER ASSETS (CONTINUED)

In June 2019, Taizhou Suxuantang entered into

a limited partnership agreement with Huangshan Panjie Investment Management Co., Ltd. (the “Fund” or “Huangshan Panjie”).

The company is committed to contribute $

NOTE 6 – PROPERTY, PLANT AND EQUIPMENT

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Machinery | $ | $ | ||||||

| Vehicles | ||||||||

| Electric equipment | ||||||||

| Office equipment | ||||||||

| Leasehold improvement | ||||||||

| Total property plant and equipment, at cost | ||||||||

| Less: accumulated depreciation | ( | ) | ( | ) | ||||

| Total property, plant and equipment, net | $ | $ | ||||||

Depreciation expenses were $

NOTE 7 – INTANGIBLE ASSETS, NET

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Trademark | $ | $ | ||||||

| Software | ||||||||

| Total intangible assets, at cost | ||||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total intangible assets, net | $ | $ | ||||||

Amortization expenses were $

F-22

NOTE 8 – LONG-TERM DEPOSIT

Long-term deposit consisted of cash deposit of

RMB

NOTE 9 – OPERATING LEASES

On January 1, 2018, the Company entered into a

lease agreement with its related party company to obtain the right of use for office and warehouse of

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Office and warehouse* | $ | $ | ||||||

| Less: accumulated amortization | ( | ) | ( | ) | ||||

| Total right-of-use assets, net | $ | $ | ||||||

The Company recognized lease expenses for the

operating lease right-of-use assets office and warehouse over the lease period which is

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Office and warehouse | $ | $ | ||||||

| Total operating lease liabilities, net | $ | $ | ||||||

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Non-current portion of operating lease liabilities – related party | $ | $ | ||||||

| Current portion of operating lease liabilities – related party | ||||||||

| Total operating lease liabilities | $ | $ | ||||||

F-23

NOTE 9 – OPERATING LEASES (CONTINUED)

The discount rate used for the office and warehouse

was

| Office and warehouse | ||||||||

| RMB | USD | |||||||

| Discount rate at commencement | % | $ | % | |||||

| One year | ||||||||

| Two years | ||||||||

| Three years | ||||||||

| Four years | ||||||||

| Five years and thereafter | ||||||||

| Total undiscounted cash flows | $ | |||||||

| Less: imputed interest | ( | ) | ( | ) | ||||

| Operating lease liabilities | ||||||||

| Office and warehouse | ||||||||

| RMB | USD | |||||||

| Discount rate at commencement | % | $ | % | |||||

| One year | ||||||||

| Two years | ||||||||

| Three years | ||||||||

| Four years | ||||||||

| Five years and thereafter | ||||||||

| Total undiscounted cash flows | $ | |||||||

| Less: imputed interest | ( | ) | ( | ) | ||||

| Operating lease liabilities | ||||||||

The Company had no other operating or financing lease agreements or short-term leases, defined as leases with initial term of 12 months or less, for the six months ended September 30, 2023 and 2022.

NOTE 10 – BORROWINGS

Short-term borrowings

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Short-term loans from related parties | $ | $ | ||||||

| Short-term loans from third-party individuals | ||||||||

| Total short-term borrowings | $ | $ | ||||||

Short-term borrowings included loans from various

individuals and entities that are unsecured. Short-term loans from related parties represents the loan of $

F-24

NOTE 10 – BORROWINGS (CONTINUED)

Short-term borrowings (continued)

As of September 30, 2023 and March 31, 2023, the

total amount of these loans was $

Long-term borrowings

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Car loans | ||||||||

| Current portion | $ | $ | ||||||

| Non-current portion | ||||||||

| Total car loans | $ | $ | ||||||

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Bank loans | ||||||||

| Current portion | $ | $ | ||||||

| Non-current portion | ||||||||

| Total long-term bank loans | $ | $ | ||||||

Long-term bank loans are loans the Company borrowed from Jiangsu Taizhou

Rural Commercial Bank which are valid from

As of September 30, 2023, one car loan of $

F-25

NOTE 10 – BORROWINGS (CONTINUED)

Long-term borrowings (continued)

| RMB | USD | |||||||

| One year | $ | |||||||

| Two years | ||||||||

| Three years | ||||||||

| Four years | ||||||||

| Five years and thereafter | ||||||||

| Total payment | $ | |||||||

Future loan payments as of March 31, 2023 is as follows:

| RMB | USD | |||||||

| One year | $ | |||||||

| Two years | ||||||||

| Three years | ||||||||

| Four years | ||||||||

| Five years and thereafter | ||||||||

| Total payment | $ | |||||||

NOTE 11 – CONVERTIBLE NOTES

The Convertible Note 2022-1

On March 16, 2022, the Company entered into a

securities purchase agreement with an institutional investor pursuant to which the Company issued an unsecured convertible promissory

note with a 12-months maturity (the “Convertible Note 2022-1”) to the investor. The Convertible Note 2022-1 has the original

principal amount of $

Material Terms of the Convertible Note 2022-1:

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 12% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 22% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is $ |

F-26

NOTE 11 – CONVERTIBLE NOTES (CONTINUED)

The Convertible Note 2022-1 (continued)

In

accounting for the issuance of the Convertible Note 2022-1 under ASU 2020-06, the Company recorded the convertible note as a single liability

in its entirety according to the new framework. Debt issuance costs related to the Convertible Note 2022-1 comprised of commissions paid

to third party placement agents, lawyers, and warrants value of $

For the year ended March 31, 2023, the Company

issued

The Convertible Note 2022-2

On December 19, 2022, the Company entered into

a securities purchase agreement with Streeterville Capital, LLC, pursuant to which the Company issued the investor an unsecured promissory

note on December 19, 2022 in the original principal amount of $

Material Terms of the Convertible Note 2022-2:

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 15% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 15% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is lower of (i) the Lender Conversion Price which is initially $0.60 and (ii) 80% of the average of the lowest VWAP during the fifteen (15) trading days immediately preceding the redemption notice is delivered. |

In

accounting for the issuance of the Convertible Note 2022-2 under ASU 2020-06, the Company recorded the convertible note as a single liability

in its entirety according to the new framework. Debt issuance costs related to the Convertible Note 2022-2 comprised of commissions

paid to third party placement agents, lawyers, and warrants value of $

F-27

NOTE 11 – CONVERTIBLE NOTES (CONTINUED)

The Convertible Note 2023

On March 7, 2023, the Company entered into a securities

purchase agreement with Streeterville Capital, LLC, pursuant to which the Company issued the investor an unsecured promissory note on

March 7, 2023 in the original principal amount of $

Material Terms of the Convertible Note 2023:

| ● | Interest accrues on the outstanding balance of the Note at 6% per annum from the purchase price date until the same is paid in full. All interest calculations hereunder shall be computed on the basis of a 360-day year comprised of twelve (12) thirty (30) day months, shall compound daily and shall be payable in accordance with the terms of this Note. |

| ● | Upon the occurrence of a trigger event, the investor may increase the outstanding balance payable under the Note by 15% or 5%, depending on the nature of such event. If the Company fails to cure the trigger event within the required five trading days, the trigger event will automatically become an event of default and interest will accrue at the lesser of 15% per annum or the maximum rate permitted by applicable law. |

| ● | Subject to adjustment as set forth in this Note, the price at which the lender has the right to convert all or any portion of the outstanding balance into ordinary shares is lower of (i) the Lender Conversion Price which is initially $0.60 and (ii) 80% of the average of the lowest VWAP during the fifteen (15) trading days immediately preceding the redemption notice is delivered. |

In accounting for the issuance of the Convertible

Note 2023 under ASU 2020-06, the Company recorded the convertible note as a single liability in its entirety according to the new framework.

Debt issuance costs related to the Convertible Note 2023 comprised of commissions paid to third party placement agents, lawyers, and warrants

value of $

For the year ended March 31, 2023, the Company

issued

For the six months ended September 30, 2023, the

Company issued

| Principal outstanding | Unamortized issuance cost | Net carrying value | ||||||||||

| Convertible Note – 2022-2 | $ | $ | ( | ) | $ | |||||||

| Convertible Note – 2023 | ( | ) | ||||||||||

| Total | $ | $ | ( | ) | $ | |||||||

Net carrying amount of the liability component Convertible Notes dated as of March 31, 2023 were as follows:

| Principal outstanding | Unamortized issuance cost | Net carrying value | ||||||||||

| Convertible Note – 2022-2 | $ | $ | ( | ) | $ | |||||||

| Convertible Note – 2023 | ( | ) | ||||||||||

| Total | $ | ( | ) | $ | ||||||||

F-28

NOTE 11 – CONVERTIBLE NOTES (CONTINUED)

The Convertible Note 2023 (continued)

Accretion | Convertible note interest | Total | ||||||||||

| Convertible Note – 2022-2 | ||||||||||||

| Convertible Note – 2023 | ||||||||||||

| Total | $ | $ | $ | |||||||||

Amortization of issuance cost, debt discount and interest cost for the six months ended September 30, 2022 were as follows:

| Accretion of debt discount |

Convertible note interest |

Total | ||||||||||

| Convertible Note – 2022-1 | $ | $ | $ | |||||||||

NOTE 12 – REFUND LIABILITY

Refund liabilities represents the accrued liability for sales return based on the sales and the Company’s estimate of sale return rate.

Estimates of discretionary authorized returns, discounts and claims are based on (1) historical rates, (2) specific identification of outstanding returns not yet received from customers and outstanding discounts and claims and (3) estimated returns, discounts and claims expected, but not yet finalized with customers. Actual returns, discounts and claims in any future period are inherently uncertain and thus may differ from estimates recorded. If actual or expected future returns, discounts or claims were significantly greater or lower than the reserves established, a reduction or increase to net revenues would be recorded in the period in which such determination was made.

The estimated cost of inventory for product returns

of $

NOTE 13 – ACCRUED EXPENSES AND OTHER LIABILITIES

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Accrued payroll and welfare | $ | $ | ||||||

| Other payable for leasehold improvements | ||||||||

| Accrued professional service expenses | ||||||||

| Other current liabilities | ||||||||

| Total | $ | $ | ||||||

As of September 30, 2023 and March 31, 2023, the balances of other

current liabilities $

F-29

NOTE 14 – SHAREHOLDERS’ EQUITY

Ordinary shares

The Company is authorized to issue unlimited shares

of $

On December 31, 2018, the Company completed the

closing of its initial public offering of

For the year ended March 31, 2020,

For the year ended March 31, 2021,

For the year ended March 31, 2023,

For the six months ended September 30, 2023, the

Company issued

Warrant

The fair value of this Warrants was $

F-30

.

NOTE 14 – SHAREHOLDERS’ EQUITY (CONTINUED)

2021 Reverse stock split

On January 23, 2021, the Company’s board of directors approved

to effect a one-for-four reverse stock split of its ordinary shares (the “2021 Reverse Stock Split”) with the market effective

on February 22, 2021, such that the number of the Company’s authorized preferred and ordinary shares is unchanged, which will remain

as unlimited, and the par value of each ordinary share is increased from US$

2021 Equity incentive plan

In September 2021, the Company adopted a share

incentive plan (the “2021 Equity Incentive Plan”), which provides for the granting of share incentives, including incentive

share options (“ISOs”), restricted shares and any other form of award pursuant to the Equity Incentive Plan, to members of

the board, and employees of the Company. The Company reserved

Under the 2021 Equity Incentive Plan, the exercise

price of an option may be amended or adjusted at the discretion of the compensation committee, the determination of which would be final,

binding and conclusive.

Pursuant to the 2021 Equity Incentive Plan, the Company issued 2,325,000 ordinary shares (4,650 shares retrospectively restated for effect of reverse stock split on May 19, 2022 and October 5, 2023) to its management. The fair value of shares issued pursuant to the 2021 Equity Incentive Plan of $2,334,397 (deducted by legal expenses of $30,000) had been determined using the average share price for the dates of issuance ($0.9911 per ordinary share, $495.57 per ordinary share retrospectively restated for effect of reverse stock split on May 19, 2022 and October 5, 2023).

F-31

NOTE 14 – SHAREHOLDERS’ EQUITY (CONTINUED)

The 2022 Public Offering

On January 18, 2022, the Company entered into

an underwriting agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”), pursuant

to which the Company agreed to sell to the Underwriter, in a firm commitment public offering (the “2022 Public Offering”)

The Pre-funded Warrants have an exercise price

of $

Pursuant to the 2022 Public Offering, the Company

issued

2022 Equity incentive plan

In March 2022, the Company adopted a share incentive

plan (the “2022 Equity Incentive Plan”), which provides for the granting of share incentives, including incentive share options

(“ISOs”), restricted shares and any other form of award pursuant to the Equity Incentive Plan, to members of the board, and

employees of the Company. The vesting schedule, time and condition to exercise options is determined by the Company’s compensation

committee. The term of the options may not exceed

Under the 2022 Equity Incentive Plan, the exercise

price of an option may be amended or adjusted at the discretion of the compensation committee, the determination of which would be final,

binding and conclusive. If the Company grants an ISO to an employee who, at the time of that grant, owns shares representing more than

Pursuant to the 2022 Equity Incentive Plan, the

Company issued

F-32

NOTE 14 – SHAREHOLDERS’ EQUITY (CONTINUED)

2022 Reverse stock split

On May 10, 2022, the Company’s board of

directors approved to effect a one-for-twenty reverse stock split of its ordinary shares (the “2022 Reverse Stock Split”)

with the market effective on May 19, 2022, such that the number of the Company’s authorized preferred and ordinary shares is unchanged,

which will remain as unlimited, and the par value of each ordinary share is increased from US$

Securities purchase agreement

On September 22, 2022, the Company entered into

certain securities purchase agreement with Zhijun Xiao, a non-affiliate non-U.S. person, pursuant to which Mr. Xiao agreed to purchase

On February 22, 2023, the Company entered into

certain securities purchase agreement with Rising Sun Capital Ltd., a limited liability company organized under the laws of Australia,

pursuant to which the investor agreed to purchase

NOTE 15 – INCOME TAXES

| (a) | Corporate Income Taxes |

Under the current laws of the British Virgin Islands

(“BVI”), the Company is not subject to tax on its income or capital gains. In addition, upon payments of dividends by the

Company to its shareholders, no BVI withholding tax is imposed. The Company’s subsidiaries incorporated in Hong Kong were subject

to the Hong Kong profits tax rate at

F-33

NOTE 15 – INCOME TAXES (CONTINUED)

| For the six months ended September 30, |

||||||||

| 2023 (Unaudited) |

2023 (Unaudited) |

|||||||

| Current income tax provision | $ | $ | ||||||

| Deferred income tax provision | ||||||||

| Total income tax expense | $ | $ | ||||||

| (b) | Deferred Tax Assets |

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Tax loss carry forward | $ | $ | ||||||

| Allowance for doubtful account - accounts receivable | ||||||||

| Allowance for doubtful account – prepayment, receivable and other current assets | ||||||||

| Impairment provision for inventory | ||||||||

| Allowance for deferred tax assets | ( | ) | ( | ) | ||||

| Total | $ | $ | ||||||

The Company evaluates the level of authority for each uncertain tax position (including the potential application of interest and penalties) based on the technical merits, and measures the unrecognized benefits associated with the tax positions. For the six months ended September 30, 2023 and 2022, the Company had no unrecognized tax benefits. The Company does not anticipate any significant increase to its asset for unrecognized tax benefit within the next 12 months. The Company will classify interest and penalties related to income tax matters, if any, in income tax expense.

NOTE 16 – RELATED PARTY TRANSACTIONS

| Name of related parties | Relationship with the Company | |

| Feng Zhou | ||

| Jianping Zhou | ||

| Zhijun Xiao | ||

| Jun Zheng | ||

| Xiaodong Ji | ||

| Xiaodong Pan | ||

| Taizhou Jiutian Pharmaceutical Co. Ltd. | ||

| Jiangsu Health Pharmaceutical Investment Co., Ltd. | ||

| Taizhou Su Xuan Tang Chinese Medicine Clinic | ||

| Taizhou Su Xuan Tang Chinese hospital Co., Ltd. | ||

| Jiangsu Sutaitang Online Commercial Co., Ltd. |

F-34

NOTE 16 – RELATED PARTY TRANSACTIONS (CONTINUED)

Related party balances

| September 30, 2023 (Unaudited) | March 31, 2023 | |||||||

| Jiangsu Health Pharmaceutical Investment Co., Ltd. | $ | $ | ||||||

| Feng Zhou | ||||||||

| Jiangsu Sutaitang Online Commercial Co., Ltd. | ||||||||

| Xiaodong Pan | ||||||||

| Zhijun Xiao | ||||||||

| Jun Zheng | ||||||||

| Total | $ | $ | ||||||

Related party transactions

For the six months ended September 30, 2023 and

2022, the Company generated revenues of and $

For the six months ended September 30, 2023 and

2022, the Company generated revenues of $

For the six months ended September 30, 2023 and