Exhibit99.1

BurgerFi Provides Fiscal Year 2021 Business Update

Sets Initial Guidance for Fiscal Year 2022

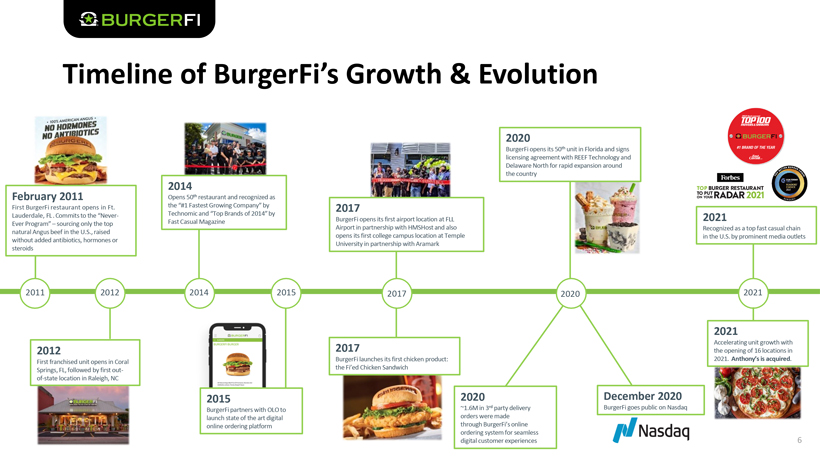

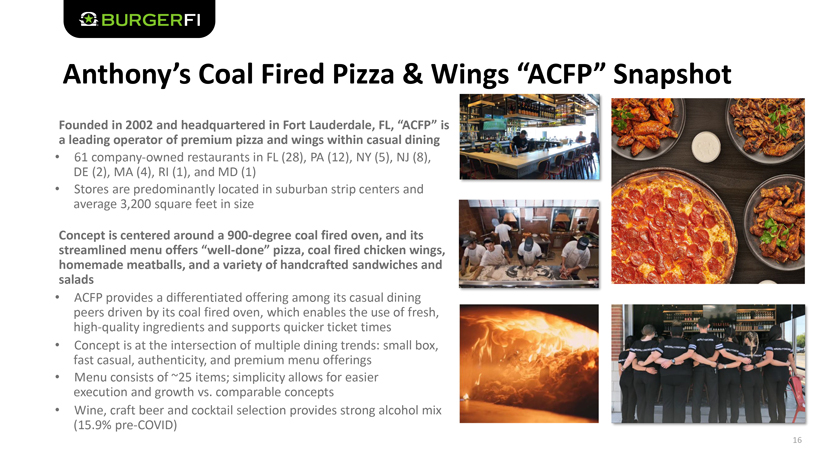

PALM BEACH, FL – January 10, 2021 – BurgerFi International Inc. (Nasdaq: BFI, BFIIW) (“BurgerFi” or the “Company”), owner of one of the nation’s fastest-growing premium fast-casual and casual dining concepts through the BurgerFi brand, and the premium, casual dining brand Anthony’s Coal Fired Pizza & Wings (“Anthony’s”), today released guidance for both the fiscal year ended December 31, 2021, and its fiscal year 2022.

Management Commentary

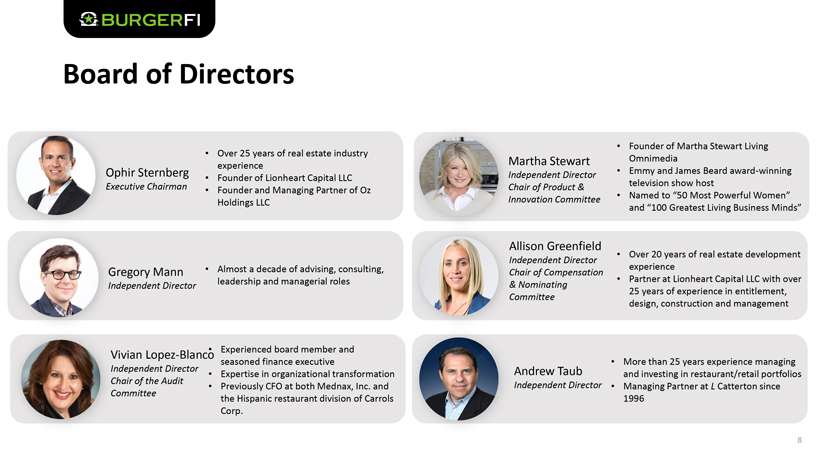

Ophir Sternberg, Executive Chairman of BurgerFi, stated, “I am encouraged by the opportunities that lie ahead from the Anthony’s acquisition and impressed by the speed of execution our refreshed management team is preparing Anthony’s for integration into the BurgerFi system to begin realizing synergies. I am thrilled for the year ahead, and confident we now have the right management team in place to maximize the potentials of our two strong restaurant brands.”

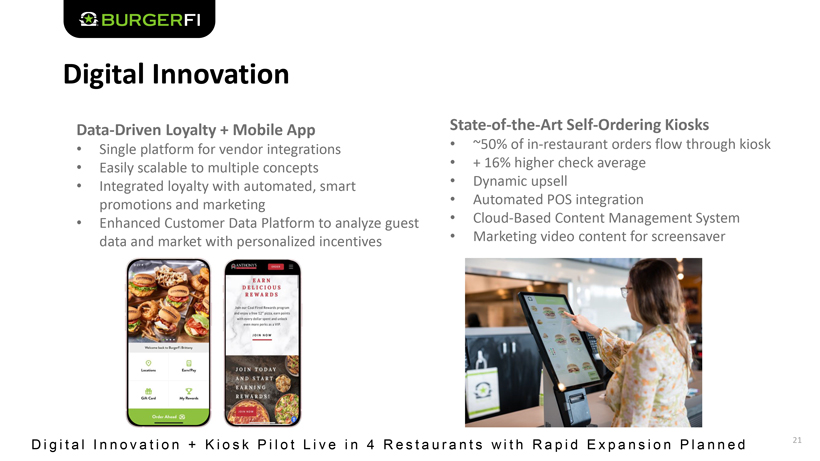

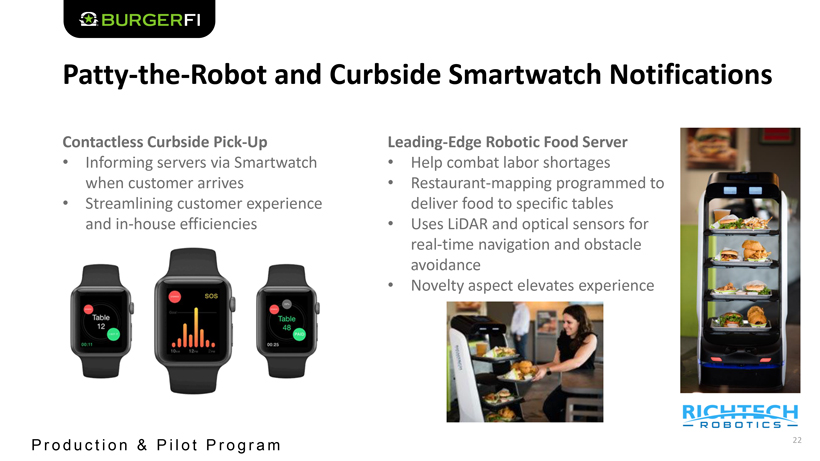

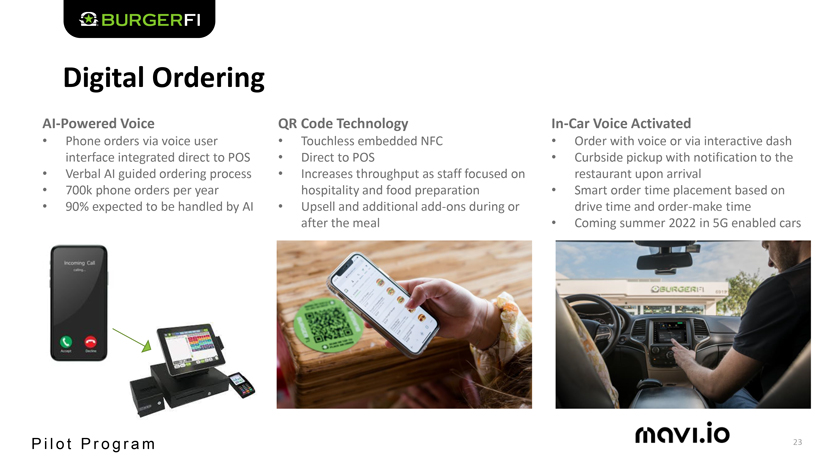

Ian Baines, Chief Executive Officer of BurgerFi, added, “In the fourth quarter, we focused on laying the groundwork for the efficient integration of Anthony’s Coal Fired Pizza into our network, while navigating the challenges presented by the new Omicron variant on our core business. In 2022, we expect to begin to realize the synergies from the combination of the BurgerFi and Anthony’s brands, providing improved financial performance and additional growth strategies. Lastly, we plan to continue our investment in technological advancements and innovation to provide our customers with a seamless omni-channel experience at all touch points. We are very excited to continue progressing on each vertical of our growth strategy here at BurgerFi in 2022, and I believe this will be a great year for the Company.”

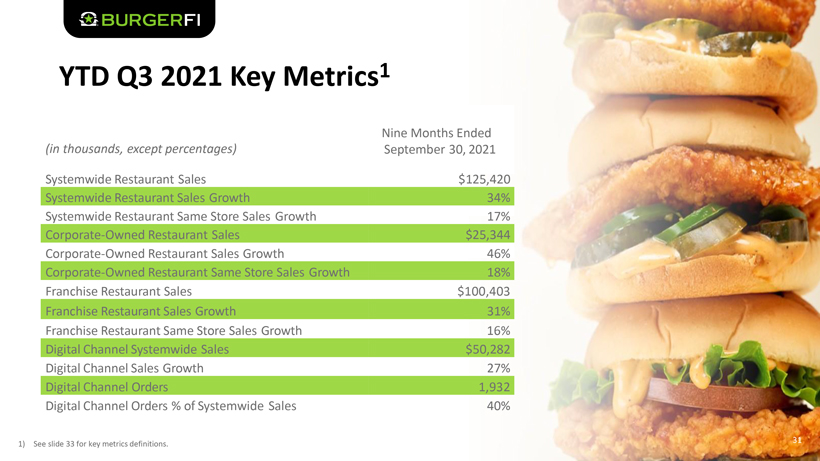

Fourth Quarter/Fiscal Year 2021 Update

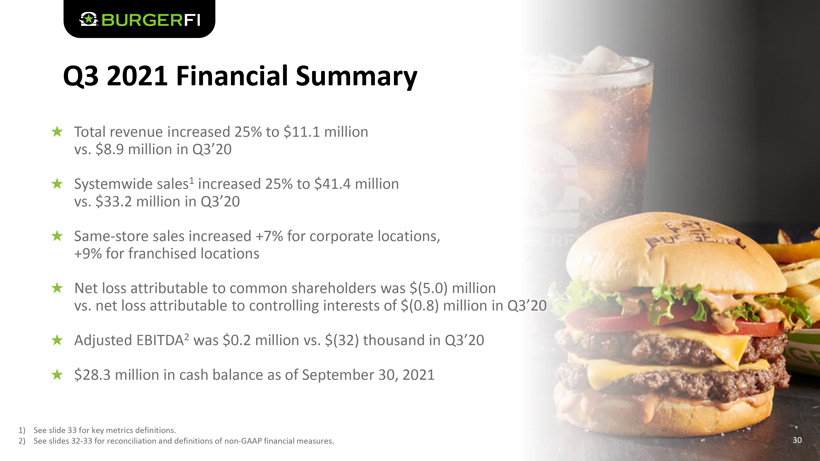

Total revenue for fiscal year 2021 is expected to be approximately $68 million and is comprised of 12 months of BurgerFi brand revenue of $46 million and $22 million for the Anthony’s brand for the period from acquisition on November 3, 2021, through the end of the fiscal year. Same store sales increased 5% during the fourth quarter and 14% for the full year for company owned BurgerFi’s while franchised BurgerFi’s same store sales increased 8% for the fourth quarter and 15% for the full year. BurgerFi opened 16 new locations throughout fiscal year 2021, comprised of 10 company owned and 6 franchised BurgerFi brand restaurants.

Fiscal Year 2022 Outlook

The impacts of Covid-19 are expected to continue to challenge our industry and our business and are reflected in the following preliminary outlook for BurgerFi in 2022:

Total revenue for fiscal year 2022 is expected to be between $180 million—$190 million. Same store sales are assumed to modestly increase through 2022 representing a full year mid-single digit percentage increase. To offset the increased cost of food and labor continuing in our industry, both brands have implemented modest price increases that will go into effect in January of approximately 3% at BurgerFi and 2% at Anthony’s. Also planned are 15 to 20 new restaurant openings throughout the year, mostly through new franchise locations.

The Company has identified annualized G&A synergies of $1.5 million through the combination of the businesses, of which over half are planned to contribute to 2022 Adjusted EBITDA.

Total Adjusted EBITDA for fiscal year 2022 is expected to be between $12 million—$14 million.

ICR Conference Virtual Fireside Chat Discussion

Ian Baines, Chief Executive Officer, and Mike Rabinovitch, Chief Financial Officer, will participate in a virtual fireside chat hosted by Peter Saleh, Managing Director at BTIG, on Tuesday, January 11, 2022, at the 24th Annual ICR Virtual Conference.

The fireside chat will be webcast live on the Company’s Investor Relations website at https://ir.burgerfi.com/, and available for replay for 90 days. For more information, please contact your ICR representative.

Key Metrics Definitions

The following definitions apply to the terms listed below:

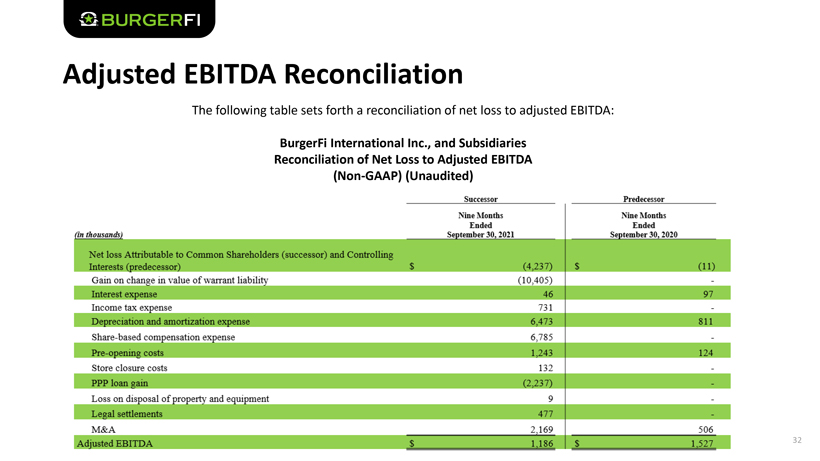

“Adjusted EBITDA,” a non-GAAP measure, is defined as net (loss) income attributable to common shareholders and controlling interests before interest, income taxes, depreciation and amortization, merger, acquisition and integration related costs, preopening costs, share-based compensation expense, gains and losses on change in value of warrant liabilities, Paycheck Protection Program loan gain, certain legal matters costs, and may include certain other non-recurring items, such as store closure costs and loss on disposal of property and equipment.

About BurgerFi International (Nasdaq: BFI, BFIIW)

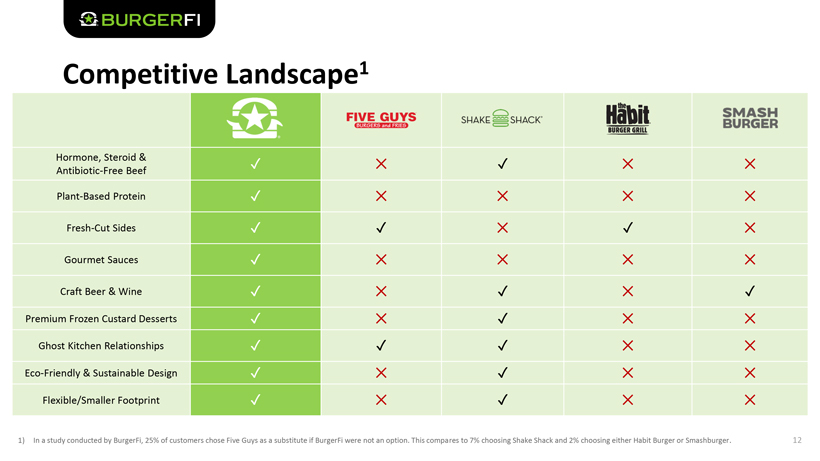

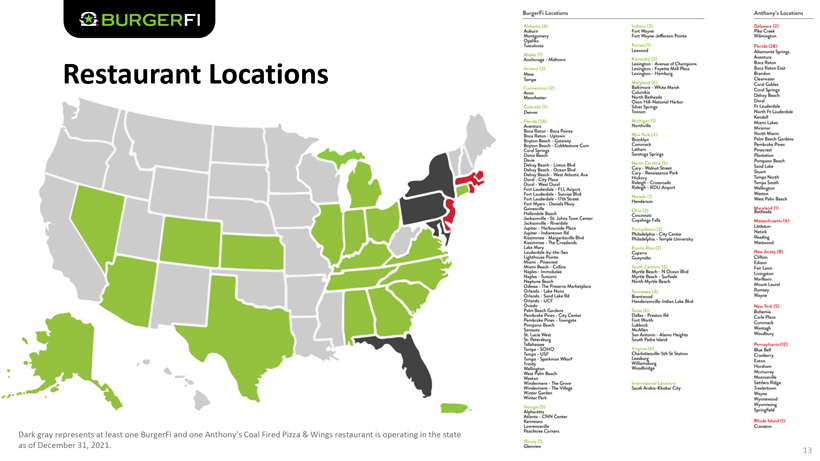

Established in 2011, BurgerFi is among the nation’s fastest-growing better burger concepts with 118 BurgerFi restaurants (25 company owned, 93 franchised) domestically and internationally as of December 31, 2021. The concept is chef-founded and is committed to serving fresh food of transparent quality. BurgerFi uses 100% American Angus Beef with no steroids, antibiotics, growth hormones, chemicals, or additives. BurgerFi’s menu also includes high quality wagyu beef, antibiotic and cage-free chicken offerings, fresh, hand-cut sides and custard shakes and concretes. On November

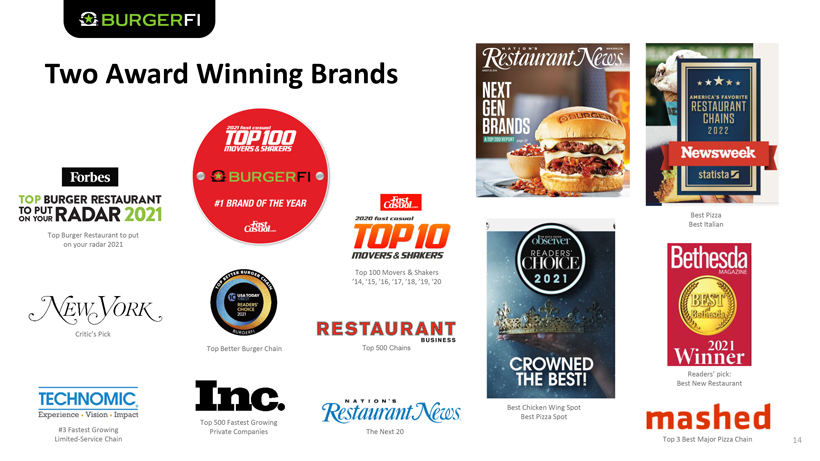

3, 2021, BurgerFi completed the acquisition of Anthony’s Coal Fired Pizza & Wings with 61 company-owned locations in eight states. BurgerFi was named QSR Magazine’s Breakout Brand of 2020, Fast Casual’s 2021 #1 Brand of the Year, a “Top Restaurant Brand to Watch” by Nation’s Restaurant News in 2019 and is included in Inc. Magazine’s Fastest Growing Private Companies List. In 2021, in Consumer Report’s Chain Reaction Report, BurgerFi was praised for serving “no antibiotic beef” across all of its restaurants and Consumer Reports awarded BurgerFi an “A-Grade Angus Beef” rating for the third consecutive year. To learn more about BurgerFi or to find a full list of locations, please visit www.burgerfi.com. Download the BurgerFi App on iOS or Android devices for rewards and ‘Like’ BurgerFi on Facebook or follow @BurgerFi on Instagram and Twitter.

BurgerFi® is a Registered Trademark of BurgerFi IP, LLC, a wholly owned subsidiary of BurgerFi.

About Non-GAAP Projected Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the measure Adjusted EBITDA. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use this non-GAAP financial measure for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that this non-GAAP financial measure provides meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results. We believe that both management and investors benefit from referring to this non-GAAP financial measure in assessing our performance and when planning, forecasting, and analyzing future periods. This non-GAAP financial measure also facilitates management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe this non-GAAP financial measure is useful to investors both because (1) it allows for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) it is used by our institutional investors and the analyst community to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from this non-GAAP financial measure and evaluating this non-GAAP financial measure together with its relevant financial measures in accordance with GAAP.

A reconciliation of this non-GAAP financial measure is not being provided due to the nature of this forward-looking non-GAAP measure containing certain elements that are impractical to predict given their market-based nature, such as share-based compensation expense and gain and losses on change in value of warrant liabilities, without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information, nor can we accurately predict all of the components of the applicable non-GAAP financial measure and reconciling adjustments thereto; accordingly, the corresponding GAAP measure may be materially different than the non-GAAP measure. Such forward looking information is also subject to uncertainty and various risks, and there can be no assurance that any forecasted results or conditions will actually be achieved.

Forward-Looking Statements

This press release may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, including statements relating to BurgerFi’s estimates of its future business outlook, prospects or financial results, its acquisition of Anthony’s and the impact of the acquisition on BurgerFi’s growth and profitability, including those regarding our ongoing strategic partnership with L Catterton, confidence in our management teams leading the brands as we begin the integration process, take advantage of strategic synergies and execute on the combined company strategy, store opening plans, same store sales, restaurant operating margin growth plans, prospects or financial results, statements regarding the impact of the COVID-19 pandemic on our business, as well as statements set forth under the section entitled “2022 Outlook” above. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in our Annual Report on Form 10-K for the year ended December 31, 2020 and subsequent Quarterly Reports on Form 10-Q, and those discussed in other documents we file with the Securities and Exchange Commission, including our ability to successfully realize the expected benefits of the acquisition of Anthony’s as a result of the impact of COVID-19 or any other factors. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

Investor Relations:

ICR

Lynne Collier

IR-BFI@icrinc.com

646-430-2216

BurgerFi Contact:

BurgerFi International Inc.

IR@burgerfi.com

Media Relations

Contact: rbb Communications

Christine Parsons, Christine.Parsons@rbbcommunications.com