UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-38441

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

(Address of principal executive offices) | (Zip Code) | |

(281 ) 403-5772

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☑ | Accelerated filer | ☐ | ||

Non-accelerated filer | ☐ | Smaller reporting company | ||

Emerging growth company | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant, determined by multiplying the outstanding shares on June 28, 2019, by the closing price on such day of $33.54 as reported on the New York Stock Exchange, was $2,575,029,140 . The registrant, solely for the purpose of this required presentation, deemed its Board of Directors and executive officers to be affiliates, and deducted their stockholdings in determining the aggregate market value.

The registrant had 77,492,835 shares of common stock, $0.01 par value, outstanding as of February 26, 2020.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement relating to its 2020 annual meeting of stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated, or such information will be included in an amendment to this Form 10-K in accordance with Instruction G(3) of Form 10-K.

APERGY CORPORATION

TABLE OF CONTENTS

PART I | Page |

PART II | |

PART III | |

PART IV | |

3

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact contained in this report are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “may,” “estimate,” “outlook,” “guidance,” “potential,” “target,” “forecast” and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. These forward-looking statements are based on our current expectations, beliefs and assumptions concerning future developments and business conditions and their potential effect on us. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate.

All of our forward-looking statements involve risks and uncertainties (some of which are significant or beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Known material factors that could cause our actual results to differ from those in the forward-looking statements are those described in Part I, Item 1A “Risk Factors” of this Annual Report on Form 10-K. We wish to caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any of our forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except to the extent required by law.

4

PART I

ITEM 1. BUSINESS

OVERVIEW

Apergy Corporation, a Delaware Corporation (“Apergy,” “we,” “us” or “our”), is a leading provider of highly engineered equipment and technologies that help companies drill for and produce oil and gas safely and efficiently around the world. Our products provide efficient functioning throughout the lifecycle of a well—from drilling to completion to production. We report our results of operations in the following reporting segments: Production & Automation Technologies and Drilling Technologies. Our Production & Automation Technologies segment offerings consist of artificial lift equipment and solutions, including rod pumping systems, electric submersible pump systems, progressive cavity pumps and drive systems and plunger lifts, as well as a full automation and digital offering consisting of equipment, software and Industrial Internet of Things solutions for downhole monitoring, wellsite productivity enhancement and asset integrity management. Our Drilling Technologies segment offering provides market leading polycrystalline diamond cutters and bearings that result in cost effective and efficient drilling.

Our products are used by a broad spectrum of customers in the global oil and gas industry, including national oil and gas companies, large integrated and independent oil and gas companies, major oilfield equipment and services providers, and pipeline companies. We compete across major oil and gas markets globally with a particular strength in the North American onshore market. Our products are particularly well suited for unconventional/shale oil and gas markets.

The quality, innovative technology and performance of our technologies drive improved cost-effectiveness, productivity, efficiency, reliability and safety for our customers. We believe our strong position in our core markets and our long-term customer relationships result from our focus on technological advancement, product reliability and our commitment to superior customer service across our organization. Our long-term customer relationships and the consumable nature of many of our products also enable us to benefit from recurring revenue throughout the lifecycle of a producing well. We believe we are differentiated from competitors through our proven business model focused on high customer intimacy, innovative technology, application engineering and a culture of continuous improvement.

We have a long history of innovation across our businesses, and our heritage in the oilfield equipment industry extends over 60 years. During this time, Apergy has expanded through a series of strategic acquisitions of well-known businesses and brands as well as internal growth initiatives. Key acquisitions that built our artificial lift platform include Harbison-Fischer, Wellmark, PCS Ferguson (f/k/a Production Controls Services, Inc.), Accelerated, and Oil Lift Technology. Our leading polycrystalline diamond cutter business was created through the acquisition of US Synthetic. Through our acquisitions, Apergy has developed experience as an effective operator and successful integrator of businesses.

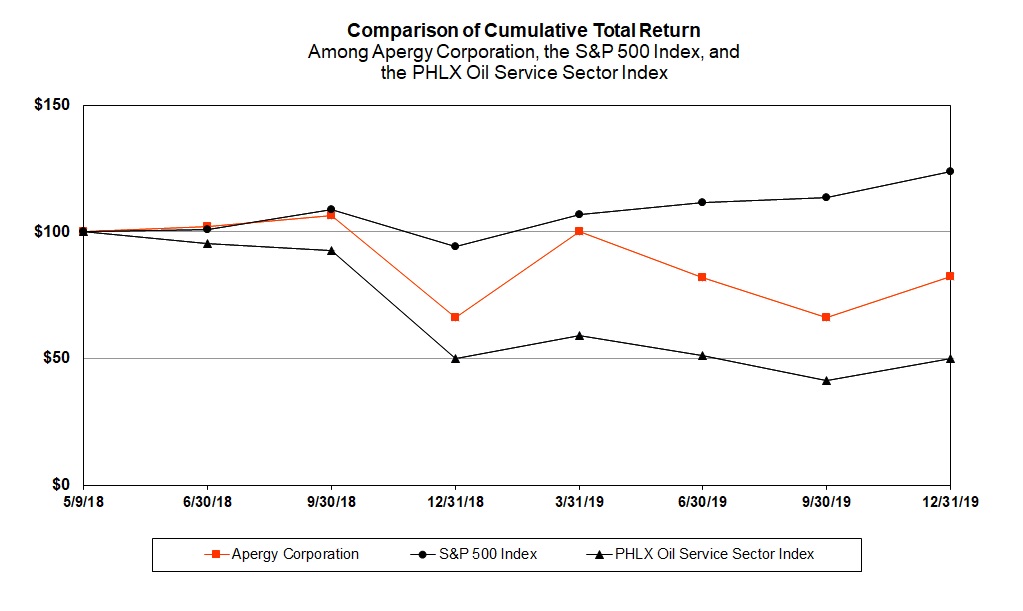

Separation and Distribution

On May 9, 2018, Apergy became an independent, publicly traded company as a result of the distribution by Dover Corporation (“Dover”) of 100% of the outstanding common stock of Apergy to Dover’s stockholders. Dover’s Board of Directors approved the distribution on April 18, 2018 and Apergy’s Registration Statement on Form 10 was declared effective by the U.S. Securities and Exchange Commission (“SEC”) on April 19, 2018. On May 9, 2018, Dover’s stockholders of record as of the close of business on the record date of April 30, 2018 received one share of Apergy stock for every two shares of Dover stock held at the close of business on the record date (the “Separation”). Following the Separation, Dover retained no ownership interest in Apergy. Apergy’s common stock began “regular-way” trading on the New York Stock Exchange (“NYSE”) under the “APY” symbol on May 9, 2018.

Merger Agreement with ChampionX

On December 19, 2019, Apergy and Ecolab Inc. (“Ecolab”) announced the execution of an Agreement and Plan of Merger and Reorganization in which Ecolab will separate their upstream energy business (“ChampionX”) and simultaneously combine it with Apergy in a Reverse Morris Trust transaction (“the Merger”). Immediately prior to the Merger, Ecolab will transfer their upstream energy business to ChampionX and its subsidiaries (“ChampionX Separation”) and, thereafter, will distribute 100% of the shares of ChampionX common stock to Ecolab stockholders (“the Distribution”). Ecolab will offer its stockholders the option to exchange all or a portion of their shares of Ecolab common stock for shares of ChampionX common stock (“Exchange Offer”). In the event the Exchange Offer is not fully subscribed, Ecolab will distribute the remaining shares of ChampionX common stock owned by Ecolab on a pro-rata basis to Ecolab stockholders whose shares of Ecolab common stock remain outstanding after the Exchange Offer. Immediately following the Distribution, Athena Merger Sub, Inc., a wholly

5

owned subsidiary of Apergy, will merge with and into ChampionX, with ChampionX continuing as the surviving company in the Merger and as a wholly owned subsidiary of Apergy. References to “the Transactions” refer to the transactions described as ChampionX Separation, the Distribution and the Merger.

Upon completion of the Merger, each issued and outstanding share of ChampionX common stock will be converted into the right to receive a number of shares of Apergy common stock at an exchange ratio calculated such that following the Merger, ChampionX equityholders will own, in the aggregate, approximately 62% of the issued and outstanding shares of the combined company. Apergy equityholders will own, in the aggregate, approximately 38% of the issued and outstanding shares of the combined company. The Board of Directors for the combined company will include the seven current members of Apergy and two members designated by Ecolab. The Merger is expected to close during the second quarter of 2020.

6

BUSINESS SEGMENTS

Our business is organized into two reporting segments: Production & Automation Technologies and Drilling Technologies.

Production & Automation Technologies

Production & Automation Technologies provides products, technologies and services that facilitate the safe, efficient, and cost effective extraction of oil and gas. We design, manufacture, market and service a full range of artificial lift equipment, end-to-end automation and digital solutions, as well as other production equipment. A portion of Production & Automation Technologies revenue is derived from activity-based consumable products, as customers routinely replace items such as sucker rods, plunger lifts and pump parts. We believe that the combination of our artificial lift equipment and our end-to-end proprietary automation solutions helps oil and gas operators lower production costs and optimize well efficiency by enabling oil and gas operators to monitor, predict and optimize performance. Our products are sold under a collection of premier brands, which we believe are recognized by customers as leaders in their market spaces, including Harbison-Fischer, Norris, Alberta Oil Tool, Oil Lift Technology, PCS Ferguson, Pro-Rod, Upco, ESP, Norriseal-Wellmark, Quartzdyne, Spirit, Theta, Timberline and Windrock.

Artificial Lift

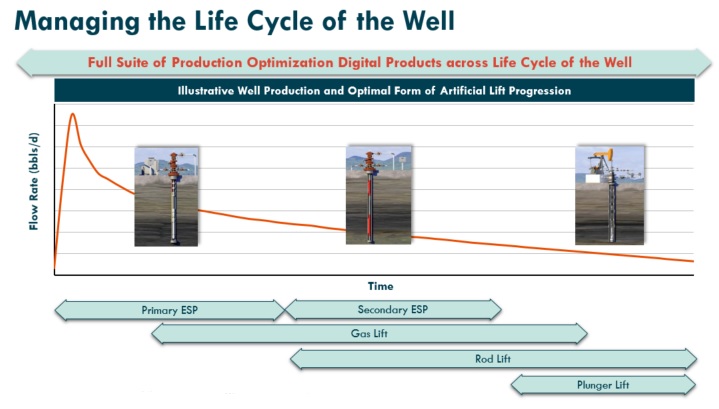

Artificial lift equipment is critical to oil and gas operators as a means to increase pressure within the reservoir and improve oil and gas production. Artificial lift is a key technology for increasing oil and gas production throughout the lifecycle of a producing well and is therefore directly linked to operator economics. Production & Automation Technologies offers a full suite of artificial lift solutions to meet the varying needs of operators as oil production volume levels decline over the lifecycle of a producing well, as illustrated in the figure below. Our comprehensive offering provides our customers with cost effective solutions tailored to a well’s specific characteristics and production volumes. We have a strong presence within key U.S. basins where artificial lift technologies are prevalent. We believe our offerings also have significant international potential, as production rates continue to decline in existing wells in regions such as the Middle East, South America and Eastern Europe.

Key artificial lift products include:

• | Electric Submersible Pump (“ESP”)—Our ESPs are fully integrated and customizable systems that are used during the earlier stages of production when barrels per day volume is at its highest level. Our ESP products include centrifugal pumps, gas handling devices, motors, controls and digital solutions to monitor and optimize ESP performance. |

• | Gas Lift—Gas lift is a method of artificial lift that involves injecting high pressure gas to lift oil from a well. Gas lift is a preferred artificial lift for deviated wells and wells characterized by large amounts of sand or solid materials. We have been delivering innovative and flexible gas lift solutions to our customers for more than 30 years. Our software takes into account the complexity and production characteristics of the well to deliver the best gas lift solution for each well. |

7

• | Rod Pumping Systems (“Rod Lift”)—As well production extends beyond the initial years, operators typically begin to employ a Rod Lift extraction solution. Our Rod Lift solutions include standard and fit-for-purpose sucker rods and accessories as well as a full range of downhole pumps that address all rod pumping applications. Rod Lift is one of the more prevalent lift solutions employed in wells in the United States and internationally. Our Rod Lift business provides for significant recurring revenue as sucker rods, pumps and accessories are replaced with use. |

• | Progressive Cavity Pumps (“PCP”) Plunger, Hydraulic and Jet Lift Systems—We offer a full range of PCP solutions including top drives, high performance pumps, drive rods and controls; a broad range of plunger lift systems including surface, downhole equipment and controllers; and a full range of hydraulic and jet lift systems including jet pumps, hydraulic reciprocating pumps, surface multiplex pumps and automation controllers. These solutions are typically used in wells that have been producing for multiple years and are essential for increasing productivity at lower production volumes. |

Digital

Our proprietary digital products are aimed at creating an end-to-end production optimization platform that enables oil and gas operators to monitor, predict and optimize well performance and drive improved return on investment during the production lifecycle. We are a leading provider of productivity tools and performance management software for artificial lift and asset integrity management. Our software has modular architecture that enables specific solutions to be tailored to meet exact customer needs. Real-time data is used by our customers to drive decisions, enhance well servicing and obtain an accurate picture of a well’s functioning over time, resulting in a more connected, digital wellsite that operates more efficiently and safely.

Digital solutions encompass multiple parts of the wellsite and allow an operator centralized monitoring and control capability. Smart instrumentation and hardware at the wellsite have sensing capabilities that allow for the capture of data. Once captured, the data is communicated to a cloud-based Industrial Internet of Things (“IIoT”) infrastructure platform where it can be analyzed and used to drive value enhancing insights for customers. We believe the combination of our digital products and our strong artificial lift presence enables us to drive continued adoption of digital solutions by our customers. We believe digital adoption is a key secular trend in the oil and gas industry, particularly in a lower oil price environment where operators are focused on lowering the cost per barrel produced over the lifecycle of a well.

Digital solutions bring together multiple layers of equipment, sensors and software. A site may employ a full-scale solution (e.g., a fully connected wellsite using our equipment and software) or a more application specific solution (e.g., a controller used for diagnostics on an ESP lift). Technologies included in our digital products offering include:

• | Production Optimization Solutions—Controllers and software solutions, including proprietary cloud-based software, to monitor and optimize artificial lift and production. Software is sold on a subscription based model and can be tailored to a breadth of customer requirements, resulting in a fit-for-purpose solution. |

• | Downhole Monitoring Solutions—Quartz pressure transducers and smart downhole tools for measuring, monitoring and logging downhole well conditions to improve well productivity. |

• | Asset Integrity Management Solutions—End-to-end digital IIoT solutions and portable analyzers to monitor, predict, and optimize health and performance of reciprocating compressors and engines used in wellsites, pipelines, refineries and chemical plants. |

Other Production Equipment

We also offer other production equipment including chemical injection systems and flow control valves. These products are complementary to our artificial lift and digital technologies offerings.

Drilling Technologies

Drilling Technologies provides highly specialized products used in drilling oil and gas wells. We design, manufacture and market polycrystalline diamond cutters (“PDC”) for use in drill bits under the US Synthetic brand. Our proprietary PDCs are based on years of innovation and intellectual property development in material science applications, including the production of highly stable synthetic diamonds, known as “polycrystalline diamonds.” US Synthetic has historically filed new patents at a rate of over 50 patents per year as we continue to advance our diamond science process knowledge and US Synthetic has previously received the prestigious Shingo Prize for operational excellence. We believe our highly engineered PDCs are distinguished by their quality, durability, rate of penetration and longevity. PDCs are a relatively small cost to the oil and gas operator in the context of overall drilling costs, but are critical to successful drilling. As a result, we believe our customers

8

value the quality and performance of US Synthetic PDCs over less expensive and lower capability alternatives because a lower quality PDC can cause unnecessary and expensive drilling delays. Our PDCs are primarily custom designed to meet unique customer requirements and are finished to exact customer specification to ensure optimal performance. PDCs are utilized in both vertical and horizontal drilling and are replaced as they wear during the drilling process.

Key products of our Drilling Technologies segment include:

• | PDC Drill Bit Inserts—Custom designed and manufactured drill bit inserts. |

• | Diamond Bearings—Long-lasting diamond bearings for process-fluid lubricated applications, including underwater applications, downhole drilling tools and industrial pumps. |

See Note 13—Revenue to our consolidated financial statements included in Part II, Item 8 of this Annual Report on Form 10-K for revenue by end market for each of our reportable segments.

OTHER BUSINESS INFORMATION

Competition

The businesses in which we operate are highly competitive. The competitive factors in our businesses are customer service, product quality and performance, price, breadth of product offering, market expertise and innovation. We believe we differentiate ourselves from our competitors through our model of high customer intimacy, differentiated technology, innovation, and a superior level of customer service and a culture of continuous improvement.

We face competition from other manufacturers and suppliers of oil and gas production and drilling equipment. Production & Automation Technologies’ key competitors include Weatherford International plc, Baker Hughes, Halliburton, Schlumberger Ltd., BORETS, Tenaris, Novomet and Emerson. Drilling Technologies’ key competitors include DeBeers (Element 6), Schlumberger Ltd. (Mega Diamond) and various suppliers in China.

Customers, Sales and Distribution

We have built our businesses through high customer intimacy and superior customer service, and we view our intense customer focus as being central to the goal of creating value for all of our stakeholders. Drawing on our industry and application engineering expertise, we strive to develop close, collaborative relationships with our customers. We work closely with our customers’ engineering teams to develop technologies and applications that help improve efficiency, reliability and productivity.

We have established long-standing customer relationships with some of the largest operators in oil and gas drilling and production. Our customers include national oil and gas companies, large integrated as well as independent oil and gas companies, major oilfield equipment and service providers and pipeline companies.

We market and sell our products and technologies through a combination of sales representatives, technical seminars, trade shows and print advertising. We sell directly to customers through our direct sales force and indirectly through independent distributors and sales representatives. Our direct sales force is comprised of highly trained industry experts who can advise our customers on the advantages of our technologies and product offerings. We have developed an extensive network of sales and service locations throughout key regions and basins in North America to better serve our customers. We also host forums and training sessions, such as our Artificial Lift Academy, where our customers can share their experiences, and where we can educate and train our customers in the use of our new technologies. Nearly all of our Drilling Technologies sales, and the majority of our Production & Automation Technologies sales in 2019, were sold directly to the end-use customer.

In addition to our direct sales force, we support a global network of distributors and representatives. We provide our distributors with sales and product literature, advertising and sales promotions, and technical assistance and training with our products. Many of our distributors also stock our products.

Our customer base is diverse. No single customer accounted for 10% or more of our 2019 consolidated revenue.

9

Intellectual Property

We own many patents, trademarks, licenses and other forms of intellectual property, which have been acquired over many years and, to the extent relevant, expire at various times. A large portion of our intellectual property consists of patents, unpatented technology and proprietary information constituting trade secrets that we seek to protect in various ways, including confidentiality agreements with employees and suppliers where appropriate. While our intellectual property is important to our success, the loss or expiration of any of these rights, or any group of related rights, is not likely to materially affect our results of operations on a consolidated basis. We believe that our commitment to continuous engineering improvements, new product development and improved manufacturing techniques, as well as sales, marketing and service expertise, are significant to our leadership positions in the markets we serve.

Research and Development

We operate in markets that are characterized by changing technology and frequent new product introductions. As a result, our success is dependent on our ability to develop and introduce new technologies and products for our customers. We maintain an active research, development and engineering program with a focus on developing innovative products and solutions, upgrading and improving existing offerings to satisfy the changing needs of our customers, expanding revenue opportunities domestically and internationally, maintaining or extending competitive advantages, improving product reliability and reducing production costs. We believe maintaining a robust innovation and product pipeline will allow us to continue to increase our penetration in key businesses and with key customers.

Raw Materials

We use a wide variety of raw materials, primarily metals and semi-processed or finished components. We have not historically experienced material impacts to our financial results due to shortages or the loss of any single supplier. Although the required raw materials are generally available, commodity pricing for metals, such as nickel, chrome, molybdenum, vanadium, manganese and steel scrap, fluctuate with market conditions. Recently, tariffs have increased our material input costs, and any further trade restrictions, retaliatory trade measures and additional tariffs implemented could result in higher input costs to our products. Although cost increases in commodities may be recovered through increased prices to customers, our operating results are exposed to such fluctuations. We attempt to control such costs through short-duration, fixed-price contracts with suppliers and various other programs, such as our global supply chain initiatives. We source material internationally to achieve the most competitive cost structure. Our global supply chain is intended to provide us with cost-effective solutions for raw materials. Our supply chain could be exposed to logistical disruptions. We maintain domestic suppliers in most cases to provide for contingencies and back-up sources. Despite contingencies and back-up supply optionality, sustained inflation and unpredictable disruptions to supply could have an adverse impact on our business.

Seasonality

Our business is generally not impacted by high levels of seasonality, except for a small portion of our operations in Canada where the level of drilling activity during the first half of the year is influenced by weather patterns. During the spring months in Canada, wet weather and the spring thaw make the ground unstable and less capable of supporting heavy equipment and machinery. As a result, municipalities and provincial transportation departments enforce road bans that restrict the movement of heavy equipment during the spring months, which reduces our customers’ activity levels. As such, there is greater demand for our products, specifically those provided by our Drilling Technologies business, in the fall and winter seasons when weather conditions allow for increased levels of drilling activities. In recent years, there have been times of budget exhaustion by our customers, which lowers customers’ spending in the later part of the year, especially in the fourth quarter.

Employees

As of December 31, 2019, we had approximately 3,000 employees in ten countries. Approximately 100 of our employees in the United States are subject to a collective bargaining agreement. Outside the United States, some of our employees are represented by unions or works councils.

Regulation and Environmental and Occupational Health and Safety Matters

Our operations are subject to a variety of international, national, state and local laws and regulations, including those relating to the discharge of materials into the environment, worker health and safety, or otherwise relating to human health and environmental protection. Failure to comply with these laws or regulations may result in the assessment of administrative, civil

10

and criminal penalties, imposition of remedial or corrective action requirements, and the imposition of injunctions to prohibit certain activities or force future compliance.

In addition, we depend on the demand for our products and services from the oil and gas industry and, therefore, are affected by changing taxes, price controls, tariffs and trade restrictions and other laws and regulations relating to the oil and gas industry in general, including those specifically directed to hydraulic fracturing and onshore products. The adoption of laws and regulations curtailing exploration, drilling or production in the oil and gas industry, or the imposition of more stringent enforcement of existing regulations, could adversely affect our operations by limiting demand for our products and services or restricting our customers’ operations. Refer to Item 1A, Risk Factors for additional information related to certain risks regarding regulations and environmental matters.

We utilize behavioral-based safety practices to promote a safe working environment for all of our employees. On a constant basis, safety is prioritized, measured and promoted throughout all levels of our organization. We continued our “Journey to Zero” program which teaches that all incidents are preventable. The core tenets of our program advocate (i) constant awareness and education of safety principles, (ii) consistent safety behaviors and practices, and (iii) preventing and learning from incidents. Additionally, our operations are subject to a number of federal and state laws and regulations relating to workplace safety and worker health, such as the Occupational Safety and Health Act and regulations promulgated thereunder.

We have incurred and will continue to incur operating and capital expenditures to comply with environmental, health and safety laws and regulations. Historically, there have been no material effects upon our earnings and competitive position resulting from our compliance with such laws or regulations; however, there can be no assurance that such costs will not be material in the future or that such future compliance will not have a material adverse effect on our business or operational costs.

Website Access to Reports

Our Internet website address is https://apergy.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to each of those reports, are available free of charge through our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Alternatively, our reports may be accessed through the website maintained by the SEC at www.sec.gov. Unless expressly noted, the information on our website or any other website is not incorporated by reference in this Annual Report on Form 10-K and should not be considered part of this Annual Report on Form 10-K or any other filing we make with the SEC.

11

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

Name | Age | Current Position and Business Experience | ||

Sivasankaran Somasundaram | 54 | President and Chief Executive Officer (2018) Vice President of Dover Corporation and President and Chief Executive Officer of Dover Energy (2013) | ||

Jay A. Nutt | 56 | Senior Vice President and Chief Financial Officer (2018) Senior Vice President and Chief Financial Officer—Dover Energy of Dover Corporation (2018) Senior Vice President and Controller of TechnipFMC plc (2017) Vice President, Controller and Treasurer of FMC Technologies, Inc. (2015) Vice President and Controller of FMC Technologies, Inc. (2009) | ||

Amy Thompson Broussard | 43 | Senior Vice President and Chief Human Resources Officer (2018) Vice President, Human Resources—Dover Energy of Dover Corporation (2016) Vice President of Human Resources—Dover Artificial Lift of Dover Corporation (2014) Director of Human Resources—Western Hemisphere HR Service Centers of Baker Hughes Inc. (2013) | ||

Robert K. Galloway | 53 | President, Drilling Technologies (2018) President—US Synthetic of Dover Corporation (2010) | ||

Paul E. Mahoney | 55 | President, Production & Automation Technologies (2018) President—Dover Artificial Lift of Dover Corporation (2014) Chief Operations Officer and Senior Vice President of Global Sales and Operations—Dover Artificial Lift of Dover Corporation (2012) | ||

Syed Raza | 53 | Senior Vice President and Chief Digital Officer (2018) President—Dover Energy Automation of Dover Corporation (2016) Vice President and General Manager—Advanced Solutions of Honeywell Process Solutions (2014) General Manager Advanced Solutions—Europe, Middle East & Africa of Honeywell Process Solutions (2013) | ||

Julia Wright | 44 | Senior Vice President, General Counsel and Secretary (2018) Senior Vice President, General Counsel and Secretary—Dover Energy of Dover Corporation (2018) Vice President and General Counsel of Nabors Industries Ltd. (2016) Interim General Counsel of Nabors Industries Ltd. (2016) Assistant General Counsel of Nabors Industries Ltd. (2013) | ||

No family relationships exist among any of the above-listed officers, and there are no arrangements or understandings between any of the above-listed officers and any other person pursuant to which they serve as an officer. During the past ten years, none of the above-listed officers was involved in any legal proceedings as defined in Item 401(f) of Regulation S-K. All officers are elected by the Board of Directors to hold office until their successors are elected and qualified.

12

ITEM 1A. RISK FACTORS

In addition to other information in this Annual Report on Form 10-K, you should carefully consider the following risk factors. Each of these risk factors could materially and adversely affect our business, results of operations and financial condition, as well as affect the value of an investment in our common stock.

We also face certain risks in connection with our proposed acquisition of ChampionX as described above in Item 1 of this Form 10-K. We encourage you to consider the risks below under the caption “Risks Related to the Proposed Acquisition of ChampionX” and the risk factors set forth in our registration statement on Form S-4 (Registration No. 333-236379), filed with the SEC on February 11, 2020, for additional risk factors relating to our proposed acquisition of ChampionX.

Risks Related to Our Business

Trends in crude oil and natural gas prices may affect the drilling and production activity, profitability and financial stability of our customers and therefore the demand for, and profitability of, our products and services, which could have a material adverse effect on our business, results of operations and financial condition.

The oil and gas industry is cyclical in nature and experiences periodic downturns of varying length and severity. The oil and gas industry experienced a significant downturn in 2015 and 2016 as a result of a sharp decline in crude oil prices. Crude oil prices slightly recovered in late 2016 and into 2017, but experienced a volatile decline again during late 2018. Price volatility continued throughout 2019 and into early 2020. Demand for our products and services is sensitive to the level of capital spending by oil and natural gas companies and the corresponding drilling and production activity. The level of drilling and production activity is directly affected by trends in crude oil and natural gas prices, which are influenced by numerous factors affecting the supply and demand for oil and gas, including:

• | worldwide economic activity including disruption to global trade; |

• | the level of exploration and production activity; |

• | interest rates and the cost of capital; |

• | environmental regulation; |

• | federal, state and foreign policies and regulations regarding current and future exploration and development of oil and gas; |

• | the ability and/or desire of the Organization of the Petroleum Exporting Countries (“OPEC”) and other major producers to set and maintain production levels and influence pricing; |

• | the cost of exploring and producing oil and gas; |

• | the pace of adoption and cost of developing alternative energy sources; |

• | the availability, expiration date and price of onshore and offshore leases; |

• | the discovery rate of new oil and gas reserves in onshore and offshore areas; |

• | the success of drilling for oil and gas in unconventional resource plays such as shale formations; |

• | the depletion rate of existing wells in productions; |

• | takeaway capacity within producing basins; |

• | alternative opportunities to invest in onshore exploration and production opportunities; |

• | domestic and global political and economic uncertainty, socio-political unrest and instability, terrorism or hostilities; |

• | the recent coronavirus outbreak or other health epidemics; |

• | technological advances; and |

• | weather conditions. |

We expect continued volatility in both crude oil and natural gas prices, as well as in the level of drilling and production related activities. Our ability to regulate our operating activities in response to lower oilfield service activity levels during periodic industry downturns is important to our business, results of operations and prospects. However, a significant downturn in the industry could result in the reduction in demand for our products and services and could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We might be unable to successfully compete with other companies in our industry.

The markets in which we operate are highly competitive. The principal competitive factors in our markets are customer service, product quality and performance, price, breadth of product offering, market expertise and innovation. In some of our product and service offerings, we compete with the oil and gas industry’s largest oilfield service providers. These large national and multi-national companies may have longer operating histories, greater brand recognition, and a stronger presence in geographic markets than us. They may also have more robust financial and technical capabilities. In addition, we compete with many

13

smaller companies capable of effectively competing on a regional or local basis. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. Many contracts are awarded on a bid basis, which further increases competition based on price. As a result of the competitive environment in which we operate, we may lose market share, be unable to maintain or increase prices for our products and services, or be unable to acquire additional business opportunities, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

If we are unable to develop new products and technologies, our competitive position may be impaired, which could materially and adversely affect our sales and market share.

The markets in which we operate are characterized by changing technologies and the introduction of new products and services. As a result, our success is dependent upon our ability to develop or acquire new products and services on a cost-effective basis, to introduce them into the marketplace in a timely manner, and to protect and maintain critical intellectual property assets related to these developments. Difficulties or delays in research, development or production of new products and technologies, or failure to gain market acceptance of new products and technologies, may significantly reduce future revenue and materially and adversely affect our competitive position. While we intend to continue to commit financial resources and effort to the development of new products and services, we may not be able to successfully differentiate our products and services from those of our competitors. Our customers may not consider our proposed products and services to be of value to them or may not view them as superior to our competitors’ products and services. In addition, our competitors or customers may develop new technologies which address similar or improved solutions to our existing technologies. Further, we may not be able to adapt to evolving markets and technologies, develop new products, achieve and maintain technological advantages or protect technological advantages through intellectual property rights. If we do not successfully compete through the development and introduction of new products and technologies, our business, results of operations, financial condition and cash flows could be materially adversely affected.

We could lose customers or generate lower revenue, operating profits and cash flows if there are significant increases in the cost of raw materials or if we are unable to obtain raw materials.

We purchase raw materials, sub-assemblies and components for use in our manufacturing operations, which exposes us to volatility in prices for certain commodities. Significant price increases for these commodities could adversely affect our operating profits. While we generally attempt to mitigate the impact of increased raw material prices by endeavoring to make strategic purchasing decisions, broadening our supplier base and passing along increased costs to customers, there may be a time delay between the increased raw material prices and the ability to increase the prices of our products. Additionally, we may be unable to increase the prices of our products due to a competitor’s pricing pressure or other factors. While raw materials are generally available now, the inability to obtain necessary raw materials could affect our ability to meet customer commitments and satisfy market demand for certain products. Certain of our product lines depend on a limited number of third-party suppliers and vendors. The ability of these third parties to deliver raw materials may be affected by events beyond our control. In addition, public health threats, such as the coronavirus, severe influenza and other highly communicable viruses or diseases could limit access to vendors and their facilities, as well as limited access or shutdown of our facilities, or the ability to transport raw materials from our vendors, adversely affecting our ability to obtain necessary raw materials for certain of our products. Consequently, a significant price increase in raw materials, or their unavailability, may result in a loss of customers and adversely impact our business, results of operations, financial condition and cash flows.

Federal, state and local legislative and regulatory initiatives relating to oil and gas development and the potential for related litigation could result in increased costs and additional operating restrictions or delays for our customers, which could reduce demand for our products and negatively impact our business, financial condition and results of operations.

Environmental laws and regulations could limit our customers’ exploration and production activities. Although we do not directly engage in drilling or hydraulic fracturing activities, we provide products and services to operators in the oil and gas industry. There has been significant growth in opposition to oil and gas development both in the United States and globally. This opposition is focused on attempting to limit or stop hydrocarbon development in certain areas. Examples of such opposition include: (i) efforts to reduce access to public and private lands, (ii) delaying or canceling permits for drilling or pipeline construction, (iii) limiting or banning industry techniques such as hydraulic fracturing, and/or adding restrictions on the use of water and associated disposal, (iv) delaying or denying air-quality permits, and (v) advocating for increased regulations, punitive taxation, or citizen ballot initiatives or moratoriums on industry activity.

In addition, various state and local governments have implemented, or are considering, increased regulatory oversight of oil and gas development through additional permitting requirements, operational restrictions, including on the time, place and manner of drilling activities, disclosure requirements and temporary or permanent bans on hydraulic fracturing or other facets

14

of crude oil and natural gas exploration and development in certain areas such as environmentally sensitive watersheds. Increased regulation and opposition to oil and gas activities could increase the potential for litigation concerning these activities, and could include companies who provide products and services used in hydrocarbon development, such as ours.

The adoption of new laws or regulations at the federal, state, or local levels imposing reporting obligations, or otherwise limiting or delaying hydrocarbon development, could make it more difficult to complete oil and gas wells, increase our customers’ costs of compliance and doing business, and otherwise adversely affect the oil and gas activities they pursue. Such developments could negatively impact demand for our products and services. In addition, heightened political, regulatory and public scrutiny, including lawsuits, could expose us or our customers to increased legal and regulatory proceedings, which could be time-consuming, costly, or result in substantial legal liability or significant reputational harm. We could be directly affected by adverse litigation or indirectly affected if the cost of compliance or the risks of liability limit the ability or willingness of our customers to operate. Such costs and scrutiny could directly or indirectly, through reduced demand for our products and services, have a material adverse effect on our business, results of operations, financial condition and cash flows.

We and our customers are subject to extensive environmental and health and safety laws and regulations that may increase our costs, limit the demand for our products and services or restrict our operations.

Our operations and the operations of our customers are subject to numerous and complex federal, state, local and foreign laws and regulations relating to the protection of human health, safety and the environment. These laws and regulations may adversely affect our customers by limiting or curtailing their exploration, drilling and production activities, the products and services we design, market and sell and the facilities where we manufacture our products. For example, our operations and the operations of our customers are subject to numerous and complex laws and regulations that, among other things: may regulate the management and disposal of hazardous and non-hazardous wastes; may require acquisition of environmental permits related to operations; may restrict the types, quantities and concentrations of various materials that can be released into the environment; may limit or prohibit operational activities in certain ecologically sensitive and other protected areas; may regulate specific health and safety criteria addressing worker protection; may require compliance with operational and equipment standards; may impose testing, reporting and record-keeping requirements; and may require remedial measures to mitigate pollution from former and ongoing operations. Sanctions for noncompliance with such laws and regulations may include revocation of permits, corrective action orders, administrative or civil penalties, criminal prosecution and the imposition of injunctions to prohibit certain activities or force future compliance.

Some environmental laws and regulations provide for joint and several strict liability for remediation of spills and releases of hazardous substances. In addition, Apergy or its customers may be subject to claims alleging personal injury or property damage as a result of alleged exposure to hazardous substances, as well as damage to natural resources. These laws and regulations may expose Apergy or its customers to liability for the conduct of or conditions caused by others, or for our acts or for the acts of our customers that were in compliance with all applicable laws and regulations at the time such acts were performed. Any of these laws and regulations could result in claims, fines or expenditures that could be material to our business, results of operations, financial condition and cash flows.

Environmental laws and regulations, and the interpretation and enforcement thereof, frequently change, and have tended to become more stringent over time. New laws and regulations may have a material adverse effect on our customers by limiting or curtailing their exploration, drilling and production activities, which may adversely affect our operations by limiting demand for our products and services. Additionally, the implementation of new laws and regulations may have a material adverse effect on our operating results by requiring us to modify our operations or products or shut down some or all of our facilities.

Numerous proposals have been made, and are likely to continue to be made, at various levels of government to monitor and limit emissions of greenhouse gases (“GHG”). Past sessions of the U.S. Congress considered, but did not enact, legislation to address climate change. The EPA and other federal agencies previously issued regulations that aim to reduce GHG emissions; however, the current administration has generally indicated an interest in scaling back or rescinding regulations addressing GHG emissions, including those affecting the U.S. oil and gas industry. It is difficult to predict the extent to which such policies will be implemented or the outcome of any related litigation. Any regulation of GHG emissions could result in increased compliance costs or additional operating restrictions for Apergy and/or its customers and limit or curtail exploration, drilling and production activities of our customers, which could directly or indirectly, through reduced demand for our products and services, adversely affect our business, results of operations, financial condition and cash flows.

15

Our growth and results of operations may be adversely affected if we are unable to complete third party acquisitions on acceptable terms.

Over time, we expect to acquire value creating, add-on capabilities that broaden our existing technological, geographic, and cost position, thereby complementing our existing businesses. However, there can be no assurance that we will be able to find suitable opportunities to purchase or to acquire such capabilities on acceptable terms. If we are unsuccessful in our acquisition efforts, our revenue growth could be adversely affected. In addition, we face the risk that a completed acquisition may underperform relative to expectations. We may not achieve the synergies originally anticipated, may become exposed to unexpected liabilities, or may not be able to sufficiently integrate completed acquisitions into our current business and growth model. These factors could potentially have an adverse impact on our business, results of operations, financial condition and cash flows.

Our products are used in operations that are subject to potential hazards inherent in the oil and gas industry, and as a result, we are exposed to potential liabilities that may affect our financial condition and reputation.

Our products are used in potentially hazardous drilling, completion and production applications in the oil and gas industry where an accident or a failure of a product can potentially have catastrophic consequences. Risks inherent in these applications, such as equipment malfunctions and failures, equipment misuse and defects, explosions, blowouts and uncontrollable flows of oil, natural gas or well fluids can cause personal injury, loss of life, suspension of operations, damage to formations, damage to facilities, business interruption and damage to or destruction of property, surface and drinking water resources, equipment and the environment. While we currently maintain insurance protection against some of these risks and seek to obtain indemnity agreements from our customers requiring them to hold us harmless from some of these risks, our current insurance and contractual indemnity protection may not be sufficient or effective enough to protect us under all circumstances or against all risks. The occurrence of a significant event not fully insured or indemnified against, or the failure of a customer to meet its indemnification obligations to us could adversely affect our business, results of operations, financial condition and cash flows.

Our industry is undergoing continuing consolidation that may impact our results of operations.

The oil and gas industry continues to experience consolidation, and as a result, some of our largest customers have consolidated and are using their size and purchasing power to seek economies of scale and pricing concessions. This consolidation may result in reduced capital spending by some of our customers or the acquisition of one or more of our primary customers, which may lead to decreased demand for our products and services. There is no assurance that we will be able to maintain our level of sales to a customer that has consolidated, or replace that revenue with increased business activity with other customers. As a result, the acquisition of one or more of our primary customers may have a significant adverse impact on our business, results of operations, financial condition and cash flows. We are unable to predict what effect consolidations in the industry may have on prices, capital spending by our customers, our selling strategies, our competitive position, our ability to retain customers or our ability to negotiate favorable agreements with our customers.

We are subject to information technology, cybersecurity and privacy risks.

We depend on various information technologies to store and process information and support our business activities. We also manufacture and sell hardware and software to provide monitoring, controls and optimization of customer critical assets in oil and gas production and distribution. We also provide services to maintain these systems. Additionally, our operations rely upon partners, vendors and other third-party providers of information technology software and services. If any of these information technologies, products or services are damaged, cease to properly function, are breached due to employee error, malfeasance, system errors, or other vulnerabilities, or are subject to cybersecurity attacks, such as those involving unauthorized access, malicious software and/or other intrusions, Apergy or its partners, vendors or other third parties could experience: (i) production downtimes, (ii) operational delays, (iii) the compromising of confidential, proprietary or otherwise protected information, including personal and customer data, (iv) destruction, corruption, or theft of data, (v) security breaches, (vi) other manipulation, disruption, misappropriation or improper use of its systems or networks, (vii) financial losses from remedial actions, (viii) loss of business or potential liability, (ix) adverse media coverage, and (x) legal claims or legal proceedings, including regulatory investigations and actions, and/or damage to reputation. While we attempt to mitigate these risks by employing a number of measures, including employee training, technical security controls and maintenance of backup and protective systems, Apergy’s and its partners’, vendors’ and other third-parties’ systems, networks, products and services remain potentially vulnerable to known or unknown cybersecurity attacks and other threats, any of which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

16

We are subject to risks relating to existing international operations and expansion into new geographical markets.

We continue to focus on expanding sales globally as part of our overall growth strategy and expect sales from outside the United States to continue to represent a significant portion of our revenue. Our international operations and our global expansion strategy are subject to general risks related to such operations, including:

• | political, social and economic instability and disruptions; |

• | government export controls, economic sanctions, embargoes or trade restrictions; |

• | the imposition of duties and tariffs and other trade barriers; |

• | limitations on ownership and on repatriation or dividend of earnings; |

• | transportation delays and interruptions; |

• | labor unrest and current and changing regulatory environments; |

• | increased compliance costs, including costs associated with disclosure requirements and related due diligence; |

• | difficulties in staffing and managing multi-national operations; |

• | limitations on our ability to enforce legal rights and remedies; |

• | access to or control of networks and confidential information due to local government controls and vulnerability of local networks to cyber risks; and |

• | fluctuations in foreign currency exchange rates. |

If we are unable to successfully manage the risks associated with expanding our global business or adequately manage operational risks of our existing international operations, these risks could have a material adverse effect on our growth strategy into new geographical markets, our reputation, our business, results of operations, financial condition and cash flows.

Tariffs and other trade measures could adversely affect our results of operations, financial position and cash flows.

In 2019 the U.S. government continued to impose tariffs on steel and aluminum and a broad range of other products imported into the United States. In response to the tariffs imposed by the U.S. government, the European Union, Canada, Mexico, India and China have announced tariffs on U.S. goods and services. The tariffs have increased our material input costs, and any further trade restrictions, retaliatory trade measures and additional tariffs could result in higher input costs to our products. We may not be able to fully mitigate the impact of these increased costs or pass price increases on to our customers. While tariffs and other retaliatory trade measures imposed by other countries on U.S. goods have not yet had a significant impact on our business or results of operations, we cannot predict further developments, and such existing or future tariffs could have a material adverse effect on our results of operations, financial position and cash flows.

Changes in domestic and foreign governmental and public policy changes, risks associated with emerging markets, changes in statutory tax rates and laws, and unanticipated outcomes with respect to tax audits could adversely affect our business, profitability and reputation.

Our domestic and international sales and operations are subject to risks associated with changes in laws, regulations and policies (including environmental and employment regulations, export/import laws, tax policies such as export subsidy programs and research and experimentation credits, carbon emission regulations and other similar programs). Failure to comply with any of the foregoing laws, regulations and policies could result in civil and criminal, monetary and non-monetary penalties, as well as damage to our reputation. In addition, we cannot provide assurance that our costs of complying with new and evolving regulatory reporting requirements and current or future laws, including environmental protection, employment, data security, data privacy and health and safety laws, will not exceed our estimates. In addition, Apergy has made investments in certain countries, including Argentina, Australia, Bahrain, Colombia and Oman, and may in the future invest in other countries, any of which may carry high levels of currency, political, compliance, or economic risk. While these risks or the impact of these risks are difficult to predict, any one or more of them could adversely affect our business, results of operations and reputation.

We are subject to taxation in a number of jurisdictions, including foreign and domestic. Accordingly, our effective tax rate is impacted by changes in the mix among earnings in countries with differing statutory tax rates. A material change in the statutory tax rate or interpretation of local law in a jurisdiction in which we have significant operations could adversely impact our effective tax rate and impact our financial results. For example, the U.S. bill commonly referred to as the Tax Cuts and Jobs Act (“Tax Reform Act”), which was enacted on December 22, 2017, significantly changed U.S. tax law by, among other things, imposing a repatriation tax on deemed repatriated earnings of foreign subsidiaries and imposing limitations on the ability to deduct interest expense.

17

Our tax returns are subject to audit and taxing authorities could challenge our operating structure, taxable presence, application of treaty benefits or transfer pricing policies. If changes in statutory tax rates or laws or audits result in assessments different from amounts estimated, then our business, results of operations, financial condition and cash flows may be adversely affected. In addition, changes in tax laws could have an adverse effect on our customers, resulting in lower demand for our products and services.

Failure to attract, retain and develop personnel for key management could have an adverse effect on our results of operations, financial condition and cash flows.

Our growth, profitability and effectiveness in conducting our operations and executing our strategic plans depend in part on our ability to attract, retain and develop qualified personnel, align them with appropriate opportunities for key management positions and support for strategic initiatives. Additionally, during periods of increased investment in the oil and gas industry, competition to hire may increase and the availability of qualified personnel may be reduced. If we are unsuccessful in our efforts to attract and retain qualified personnel, our business, results of operations, financial condition, cash flows, market share and competitive position could be adversely affected. Additionally, we could miss opportunities for growth and efficiencies.

The credit risks of our customer base could result in losses.

Many of our customers are oil and gas companies that have faced or may in the future face liquidity constraints during adverse commodity price environments. These customers impact our overall exposure to credit risk as they are also affected by prolonged changes in economic and industry conditions such as the current downturn in the oil and gas industry as a result of the lower crude oil and natural gas price environment. If a significant number of our customers experience a prolonged business decline or disruptions, we may incur increased exposure to credit risk and bad debts.

The loss of one or more significant customers could have an adverse impact on our financial results.

Our customers represent a combination of some of the largest operators in the oil and gas drilling and production markets, including major integrated, large, medium and small independents, and foreign national oil and gas companies, as well as oilfield equipment and service providers. In 2019, our top 10 customers represented approximately 41% of total revenue. While Apergy is not dependent on any one customer or group of customers, the loss of one or more of our significant customers could have an adverse effect on our business, results of operations, financial condition and cash flows.

The inability to protect or obtain patent and other intellectual property rights could adversely affect our revenue, operating profits and cash flows.

We own patents, trademarks, licenses and other intellectual property related to our product and services, and continuously invest in research and development that may result in innovations and intellectual property rights. We employ various measures to develop, maintain and protect our innovations and intellectual property rights. These measures may not be effective in capturing intellectual property rights, and they may not prevent our intellectual property from being challenged, invalidated, circumvented, infringed, misappropriated or otherwise violated, particularly in countries where intellectual property rights are not highly developed or protected. Unauthorized use of our intellectual property rights and any potential litigation we may initiate or may have been initiated against us in respect of our intellectual property rights could adversely impact our competitive position and have a negative impact on our business, results of operations, financial condition and cash flows.

A deterioration in our future expected profitability or cash flows could result in an impairment of our recorded goodwill and intangible assets.

Apergy has significant goodwill and intangible assets recorded on its consolidated balance sheet. The valuation and classification of these assets and the assignment of useful lives to intangible assets involve significant judgments and the use of estimates. Impairment testing of goodwill and intangible assets requires significant use of judgment and assumptions, particularly as it relates to the determination of fair market value. A decrease in the long-term economic outlook and future cash flows of our business could significantly impact asset values and potentially result in the impairment of intangible assets, including goodwill. Although fair values currently exceed carrying values for each reporting unit, the value of our business could be unfavorably impacted by steep declines in revenue and order rates as drilling and production activity would be reduced due to sustained unfavorable crude oil prices and lower U.S. rig counts. Accordingly, sustained future economic declines could result in impairment charges that could have a material adverse effect on our results of operations.

18

Our reputation, ability to do business and results of operations may be impaired by improper conduct by or disputes with any of our employees, agents or business partners.

Our operations require us to comply with a number of U.S. and international laws and regulations, including those governing payments to government officials, bribery, fraud, anti-kickback and false claims, competition, export and import compliance, money laundering and data privacy, as well as the improper use of proprietary information or social media. In particular, our international operations are subject to the regulations imposed by the Foreign Corrupt Practices Act and the United Kingdom Bribery Act 2010 as well as anti-bribery and anti-corruption laws of various jurisdictions in which we operate. While we strive to maintain high standards, we cannot provide assurance that our internal controls and compliance systems will always protect us from acts committed by our employees, agents or business partners that would violate such U.S. or international laws or regulations or fail to protect our confidential information. Any such violations of law or improper actions could subject us to civil or criminal investigations in the United States or other jurisdictions, could lead to substantial civil or criminal, monetary and non-monetary penalties and related stockholder lawsuits, could lead to increased costs of compliance and could damage our reputation, business, results of operations, financial condition and cash flows.

Additionally, we conduct some operations through joint ventures in which unaffiliated third parties may control or have significant influence on the operations of the joint venture. As with any joint venture arrangement, differences in views among the joint venture participants may result in delayed decisions, the joint venture operating in a manner that is contrary to our preference or in failures to agree on major issues. These factors could have a material adverse effect on the business and results of operations of our joint ventures and, in turn, our business and consolidated results of operations.

Our exposure to exchange rate fluctuations on cross-border transactions and the translation of local currency results into U.S. dollars could negatively impact our results of operations.

A portion of our business is transacted and/or denominated in foreign currencies, and fluctuations in currency exchange rates could have a significant impact on our results of operations, financial condition and cash flows, which are presented in U.S. dollars. Cross-border transactions, both with external parties and intercompany relationships, result in increased exposure to foreign exchange effects. Although the impact of foreign currency fluctuations on our results of operations has historically not been material, significant changes in currency exchange rates, principally the Canadian Dollar, Australian Dollar, Argentinian Peso, Omani Rial, and Colombian Peso, could negatively affect our results of operations. Additionally, the strengthening of the U.S. dollar potentially exposes us to competitive threats from lower cost producers in other countries and could result in unfavorable translation effects as the results of foreign locations are translated into U.S. dollars for reporting purposes.

Natural disasters and unusual weather conditions could have an adverse impact on our business.

Our business could be materially and adversely affected by natural disasters or severe weather conditions. Hurricanes, tropical storms, flash floods, blizzards, cold weather and other natural disasters or severe weather conditions could result in evacuation of personnel, curtailment of services, damage to equipment and facilities, interruption in transportation of products and materials, and loss of productivity. For example, certain of our manufactured products and components are manufactured at a single facility, and disruptions in operations or damage to any such facilities could reduce our ability to manufacture our products and satisfy customer demand. If our customers are unable to operate or are required to reduce operations due to severe weather conditions, our business could be adversely affected as a result of curtailed deliveries of our products and services.

Our indebtedness could adversely affect our financial condition and operating flexibility.

In connection with the Separation, we incurred a significant amount of indebtedness. Subject to the limits contained in the credit agreement governing our senior secured credit facilities and the indenture that governs our senior notes, we may incur substantial additional indebtedness from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes. If we do so, the risks related to our level of indebtedness could intensify.

Specifically, our level of indebtedness could have important consequences, including:

• | difficulty for us to satisfy our obligations with respect to our outstanding debt; |

• | limiting our ability to obtain additional financing to fund our business operations; |

• | requiring a substantial portion of our cash flows to be dedicated to debt service payments; |

• | increasing our vulnerability to general adverse economic and industry conditions; |

• | exposing us to the risk of increased interest rates as certain of our borrowings, including borrowings under our senior secured credit facilities, are at variable rates of interest; |

• | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; |

19

• | placing us at a disadvantage compared to other, less leveraged competitors; and |

• | increasing our cost of borrowing. |

In addition, the credit agreement governing our senior secured credit facilities and the indenture that governs our senior notes contain restrictive covenants that limit our ability to engage in activities that may be in our long-term interests. Our failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of the repayment obligations of our debt.

Our ability to make payments on and to refinance our indebtedness, as well as any future indebtedness that we may incur, depends upon the level of cash flows generated by our operations, our ability to sell assets, availability under our revolving credit facility, and our ability to access the capital markets and/or other sources of financing. Our ability to generate cash is subject to general economic, industry, financial, competitive, legislative, regulatory and other factors that are beyond our control. If we are not able to repay or refinance our indebtedness as it becomes due, we may be forced to sell assets or take other disadvantageous actions, including (i) reducing financing in the future for working capital, capital expenditures, acquisitions and general corporate purposes or (ii) dedicating an unsustainable level of our cash flow from operations to the payment of principal and interest on our indebtedness. In addition, our ability to withstand competitive pressures and to react to changes in the oil and gas industry could be impaired.

We have identified material weaknesses in our internal control over financial reporting and, as a result, our internal control over financial reporting and our disclosure controls and procedures are not effective.

Management has identified material weaknesses in our internal control over financial reporting as a result of which management has concluded that our internal control over financial reporting and our disclosure controls and procedures were not effective as of December 31, 2019. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. These material weaknesses relate to (a) the ineffective control environment due to a lack of a sufficient complement of personnel with the appropriate level of knowledge, experience and training at our Artificial Lift business, (b) ineffective risk assessment component of internal control related to the ESP subsidiary (which is part of the Artificial Lift business) as controls were not appropriately designed to ensure that the subsidiary, which was experiencing significant growth and turnover of personnel, had the proper resources to operate a complex business model, (c) a lack of controls designed and maintained within certain of our Artificial Lift businesses over the completeness, accuracy, occurrence or cut-off of revenue and within ESP over the valuation of accounts receivable, (d) a lack of controls maintained to ensure that journal entries were properly prepared with appropriate supporting documentation or were reviewed and approved appropriately to ensure the accuracy of journal entries at ESP, (e) a lack controls designed and maintained over the completeness, accuracy, and existence or presentation and disclosure of inventory and fixed assets at ESP, and (f) a lack of controls designed and maintained over user roles within the general ledger system across the Company, which defines the actions an individual can perform within the system.

We are currently in the process of developing and implementing a remediation plan to address these material weaknesses. We expect to incur significant additional expenses in connection with implementing remedial measures. If our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control over financial reporting are identified or subsequently arise, our consolidated financial statements may contain material misstatements, and we may be required to restate our financial results, which could have a material adverse effect on our financial condition, results of operations or cash flows, restrict our ability to access the capital markets, require significant resources to correct the material weaknesses or deficiencies, subject us to fines, penalties or judgments, harm our reputation or otherwise cause a decline in investor confidence and cause a decline in the market price of our stock.

Risks Related to the Separation

Potential indemnification liabilities between Apergy and Dover pursuant to the separation and distribution agreement could materially and adversely affect our business, financial condition, results of operations and cash flows.