As filed with the U.S. Securities and Exchange Commission on February 10, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

_________________________________________

(Exact name of registrant as specified in its charter)

| 3711 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

|

|

||

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | ||

|

Chief Executive Officer

|

||

| (Name, address, including zip code, and telephone number, including area code, of agent for service) | ||

| Copies to: | ||

|

Michael J. Blankenship Winston & Strawn LLP 800 Capitol St., Suite 2400 (713) 651-2600 |

Jordan Christensen WCAZ Law, PLLC 3825 N. Desert Oasis Cir Mesa, Arizona 85207 (815)751-0367 |

Barry I. Grossman Matthew Bernstein |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”) check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Large accelerated filer | o | Accelerated filer | o |

| x | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Company may not sell the securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell the securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED FEBRUARY 10, 2023

PRELIMINARY PROSPECTUS

Atlis Motor Vehicles Inc.

Up to 6,451,613 Units

(each Unit consists of One Share of Class A Common Stock or

One Pre-Funded Warrant to Purchase One Share of Class A Common Stock,

0.65 Series A Warrants to Purchase 0.65 Shares of Class A Common Stock and

0.75 Series B Warrants to Purchase 0.75 Shares of Class A Common Stock)

_____________________________

We are offering on a best-efforts basis up to 6,451,613 units (the “Units”), each unit consisting of (i) one share of our Class A common stock, $0.0001 par value per share (the “Class A common stock”), (ii) 0.65 Series A warrants to purchase 0.65 shares of our Class A common stock (the “Series A Warrants”) and (iii) and 0.75 Series B warrants to purchase 0.75 shares of our Class A common stock (the “Series B Warrants” and, together with the Series A Warrants, the “Warrants”).

Each whole Warrant is exercisable at an exercise price of $3.10 per share (100% of the offering price per Unit). The Series A Warrants will be immediately exercisable and will expire five (5) years after the date of issuance. The Series B Warrants will not be exercisable until after the date we effect the Corporate Reorganization (as defined herein) or until after the date Stockholder Approval (as defined herein) is obtained, and will then expire five (5) years after the date of the Corporate Reorganization or Stockholder Approval, as applicable. We are offering each Unit at an assumed public offering price of $3.10 per Unit, which represents the closing price of our Class A common stock on Nasdaq on February 6, 2023. The actual public offering price per Unit will be determined at the time of pricing between us, the Placement Agent (as defined below) and the investors in this offering, and may be at a discount to the current market price of our Class A common stock. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are also offering to each investor of Units that would otherwise result in the investor’s beneficial ownership exceeding 4.99% of our outstanding Class A common stock immediately following the consummation of this offering the opportunity to invest in Units consisting of one pre-funded warrant to purchase one share of Class A common stock (“Pre-Funded Warrant”) (in lieu of one share of Class A common stock), 0.65 Series A Warrants and 0.75 Series B Warrants. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the Class A common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of Class A common stock. The purchase price of each Unit including a Pre-Funded Warrant will be equal to the price per Unit including one share of common stock, minus $0.0001, and the exercise price of each Pre-Funded Warrant will equal $0.0001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant purchased (without regard to any limitation on exercise set forth therein), the number of Units including a share of Class A common stock we are offering will be decreased on a one-for-one basis.

The Units will be offered at a fixed price and are expected to be issued in a single closing. There is no minimum number of Units to be sold or minimum aggregate offering proceeds for this offering to close. We expect this offering to be completed not later than two business days following the commencement of this offering and we will deliver all securities issued in connection with this offering delivery versus payment (“DVP”)/receipt versus payment (“RVP”) upon our receipt of investor funds. Accordingly, neither we nor the Placement Agent has made any arrangements to place investor funds in an escrow account or trust account since the Placement Agent will not receive investor funds in connection with the sale of securities offered hereunder.

We are also registering the Class A common stock issuable from time to time upon exercise of the Warrants and Pre-Funded Warrants included in the Units offered hereby. See “Description of Securities” in this prospectus for more information.

Our Class A common stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “AMV.” On February 9, 2023, the last reported sales price of our Class A common stock as reported on Nasdaq was $2.82 per share.

The Units have no stand-alone rights and will not be issued or certificated. The shares of Class A common stock and the Warrants can only be purchased together in this offering but the securities contained in the Units will be issued separately. There is no established public trading market for the Units, Pre-Funded Warrants or Warrants and we do not expect markets to develop. Without an active trading market, the liquidity of these securities will be limited.

We are an “emerging growth company” as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced reporting requirements for this prospectus and may elect to do so in future filings.

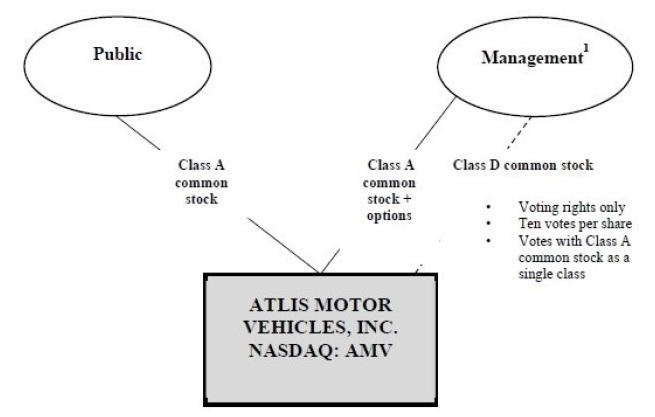

Our Company has a dual class structure. Our Class A common stock, which is the stock we are offering by means of this prospectus, has one vote per share and our Class D common stock, $0.0001 par value per share (the “Class D common stock”), has no economic rights and has 10 votes per share. See “Risk Factors – The dual class structure of our common stock has the effect of concentrating voting power with members of our management team, which will limit your ability to influence the outcome of important transactions, including a change in control” and “Risk Factors – We cannot predict the impact our dual class structure may have on our stock price” for more information. For more information on our capital stock, see the section titled “Description of Securities.”

Our Class D common stock is owned solely by our Chief Executive Officer, Mark Hanchett, and our President, Annie Pratt, who own 24,103,676 and 8,821,696 shares of our Class D common stock, respectively, representing approximately 71% and 26% of the voting power of our outstanding capital stock, respectively, for an aggregate of 96% of the voting power of our outstanding capital stock. Upon the closing of this offering, assuming the sale of the maximum number of Units offered hereby, our Chief Executive Officer and President will collectively hold approximately 94% of the voting power of our outstanding capital stock.

As a result of our Chief Executive Officer’s ownership of our Class D common stock, we are a “controlled company” within the meaning of the corporate governance standards of Nasdaq. See “Management – Controlled Company” and “Risk Factors – We are a “controlled company” within the meaning of the Nasdaq rules and, as a result, qualify for and rely on exemptions from certain corporate governance requirements. As a result, our stockholders do not have the same protections afforded to stockholders of companies that cannot rely on such exemptions and are subject to such requirements” for more information.

Our principal executive offices are located at 1828 N Higley Rd., Suite 116, Mesa, Arizona 85205, and our telephone number at that address is (408) 674-9027.

________________________

You should carefully read this prospectus and any prospectus supplement or amendment before you invest. See the section entitled “Risk Factors” beginning on page 14. You also should read the information included throughout this prospectus for information on our business and our financial statements, including information related to our predecessor.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Per Unit (including Class A common stock) | Per Unit (including Pre- | Total | ||||||||||

| Public offering price(1) | $ | $ | $ | |||||||||

| Placement Agent fees(1)(2) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us(3) | $ | $ | $ | |||||||||

_____________________

| (1) | The Placement Agent fees shall equal 7.0% of the gross proceeds of the securities sold by us in this offering. |

| (2) | The Placement Agent will receive compensation in addition to the Placement Agent fees described above, including warrants to purchase shares of our Class A common stock and reimbursement for out-of-pocket expenses incurred in connection with this offering, including the fees and expenses of the counsel for the Placement Agent, up to $100,000. See “Plan of Distribution” for a description of the compensation payable to the Placement Agent. |

| (3) | The amount of offering proceeds to us presented in this table assumes no Pre-Funded Warrants are issued in lieu of shares of Class A common stock and does not give effect to any exercise of the Warrants. |

We have engaged Maxim Group LLC as our exclusive placement agent (the “Placement Agent”) to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering, the actual public amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to pay the Placement Agent the Placement Agent fees set forth in the table above and to provide certain other compensation to the Placement Agent. See “Plan of Distribution” for more information regarding these arrangements.

We anticipate that delivery of the securities against payment therefor will be made on or about , 2023.

| Maxim Group LLC |

| Prospectus dated , 2023. |

TABLE OF CONTENTS

________________________

Please read this prospectus carefully. It describes our business, our financial condition and our results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision. You should rely only on the information contained in this prospectus or to which we have referred you. We and the Placement Agent have not authorized any person to provide you with additional information or different information. We and the Placement Agent take no responsibility for, and can provide no assurance as to the reliability of, any information that others may give you. This prospectus may only be used where it is legal to offer and sell the securities described herein and only during the effectiveness of the registration statement of which this prospectus forms a part. You should assume the information contained in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Class A common stock. Neither the delivery of this prospectus nor any distribution of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the SEC for this offering by us of Class A common stock.

Neither we nor the Placement Agent has authorized anyone to provide you with different or additional information, other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you, and neither we nor they take any responsibility for, or provide any assurance as to the reliability of, any other information that others may give you. Neither we nor the Placement Agent is making an offer to sell Class A common stock in any jurisdiction where the offer or sale thereof is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus titled “Where You Can Find More Information.”

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. Our management estimates have not been verified by any independent source, and we have not independently verified any third-party information. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Cautionary Note Regarding Forward-Looking Statements.”

For investors outside the United States: Neither we nor the Placement Agent has taken any action to permit the possession or distribution of this prospectus in any jurisdiction other than the United States where action for that purpose is required. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the Class A common stock and the distribution of this prospectus outside the United States.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to the terms “AMV,” the “Company,” “Atlis Motor Vehicles,” “Atlis,” “we,” “our” or “us” refer to Atlis Motor Vehicles Inc., a Delaware corporation.

| ii |

MARKET AND INDUSTRY DATA

Market and industry data and forecasts used in this prospectus have been obtained from independent industry sources as well as from research reports prepared for other purposes. We are responsible for all of the disclosure in this prospectus, and although we believe these third-party sources to be reliable, we have not independently verified the data obtained from these sources, and we cannot assure you of the accuracy or completeness of the data. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements in this prospectus.

| iii |

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This document contains references to trademarks, trade names and service marks belonging to other entities. Solely for convenience, trademarks, trade names and service marks referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| iv |

CERTAIN DEFINED TERMS

Unless the context otherwise requires, references in this prospectus to:

| ● | “A&R Bylaws” are to the amended and restated bylaws of Atlis Motor Vehicles Inc.; |

| ● | “Board” are to the board of directors of Atlis Motor Vehicles Inc.; |

| ● | “the Company,” “Atlis Motor Vehicles,” “Atlis,” “we,” “our” or “us” are to Atlis Motor Vehicles Inc., a Delaware corporation, either individually or together with its consolidated subsidiaries, as the context requires; |

| ● | “Class A common stock” are to shares of the Company’s Class A common stock, $0.0001 par value per share; |

| ● | “Class D common stock” are to shares of the Company’s Class D common stock, $0.0001 par value per share; |

| ● | “common stock” are to the Company’s Class A common stock and Class D common stock; |

| ● | “DGCL” are to the General Corporation Law of the State of Delaware. |

| ● | “Exchange Act” are to the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder; |

| ● | “GAAP” means United States Generally Accepted Accounting Principles; |

| ● | “Nasdaq” are to the Nasdaq Stock Market LLC; |

| ● | “SEC” are to the U.S. Securities and Exchange Commission; and |

| ● | “Securities Act” are to the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder. |

| v |

SUMMARY OF THE PROSPECTUS

This summary highlights selected information from this prospectus and does not contain all of the information that is important to you in making an investment decision. You should read the entire prospectus carefully, including the information under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements and the notes to those financial statements appearing elsewhere in this prospectus.

Overview

Atlis Motor Vehicles is a vertically integrated, electric vehicle technology company committed to electrifying vehicles and equipment for Work. We define “Work” as industries that contribute to the building, digging, growing, maintaining, moving, hauling, and towing of the goods and services that keep our communities moving forward. We believe that a majority of the electric vehicle solutions have overlooked the Work industry due to limitations of existing electric vehicle battery capabilities. Atlis is purposefully developing products to meet the demands and needs of the Work segment. We also intend to develop an ecosystem of services and adjacent products to support electrification for our intended customer segments.

We believe Atlis technology will be used to power last mile delivery vehicles, pick-up trucks, garbage trucks, cement trucks, vans, RVs, box trucks, light to heavy-duty equipment and more. In addition, our batteries could be used for commercial and residential energy storage devices. At the core of our hardware ecosystem and platform, proprietary battery technology makes the charging of a full-size pickup truck possible in 15-minutes or less. We intend for our modular system platform architecture to be scalable to meet the specific vehicle or equipment application needs of those in construction, mining, and agribusiness field, as well as those with other use cases.

Atlis Motor Vehicles is an early-stage company, primarily engaged in research and development and has not yet scaled production of its products or delivered any products to customers. Of all the products we intend to bring to market, our proprietary battery technology is the furthest along in development and closest to mass production. We are working to deliver battery cells and packs to customers first, while we continue development on the XP Platform, XT Truck, and service offerings. Scaling to reach high-volume production will require significant effort and capital. Additionally, as of the date of this prospectus, we have no actionable plan of operation to commence sales of our products. As such, Atlis will need to build out detailed go-to-market plans as we get closer to customer deliveries and sales.

Production Development Phases

In producing its various products and services, Atlis Motor Vehicles follows a phased development approach comprised of the stages noted below.

Stage 1: “CVT” – Concept Verification and Test. This is the concept verification and test phase of development. Product ideas are evaluated to assess viability and whether or not there is potential to further develop and invest.

Stage 2: “EVT” – Engineering Verification and Test. This is the engineering verification and test phase of development. Validation of the technology within a product is completed.

Stage 3: “DVT” – Design Verification and Test. This is the design verification phase of development. The product has reached a final design phase and engineering and production teams are validating feasibility of the final product.

Stage 4: “PVT” – Production Verification and Test. This is the production validation phase of development. The product design has been finalized, and the production process is developing and undergoing verification before being sold to customers.

Principal Products and Services

The Work industry is composed of use cases like agriculture, mining, construction and utilities. These industries are seeking to transition from internal combustion engine (“ICE”) vehicles to electric vehicles, and they need capable vehicles at a competitive cost. When making the switch to electric vehicles, we believe that individuals and businesses will consider numerous factors, including vehicle capability, charging solutions, service and maintenance costs, insurance, and total cost. In the case of vehicles, our target customers are seeking pickup trucks with a range of up to 500 miles, the ability to haul 20,000 to 35,000 pounds and the ability to charge their electric vehicle in less than 15 minutes. The broader needs of our target customers are presented below. The Company plans to address these needs by developing products across three verticals: our proprietary AMV battery cell and pack technology; a modular and scalable electric powered platform; and an electric pickup truck. We believe that the Atlis vertically integrated electric vehicle technology ecosystem will address many of these concerns with its array of products, services, and unique business model.

| 1 |

Our Products

| · | AMV Energy 30 pack – We are developing a battery pack technology product. We refer to this battery technology as “AMV Energy.” AMV Energy starts with our “30 pack,” a 30KWh commodity battery pack configuration focused on mobility, equipment, and energy storage and infrastructure applications. The 30 pack will utilize our proprietary battery cell, pack, electronics, and software systems, each of which is currently in development internally. Additionally, the 30 pack will be a highly capable energy storage solution with a wide range of applications. Not only do we expect to utilize the 30 pack in our own products, but we also intend to manufacture and sell the 30 pack as a separate product line to address the growing demand for battery packs from other companies developing electric vehicles. The 30 pack is in the final stages of the DVT phase of development and transitioning to the PVT phase of development. Completion of the 30 pack engineering design and production line is not subject to any currently unknown advances in technology. Competitive manufacturers of vehicle battery packs typically utilize lithium-ion battery cells in either cylindrical or pouch form factor. Our AMV Energy 30 pack’s competitive advantage is our direct cell integration and approach and integration. ATLIS is developing a battery pack system with a completely integrated power management, thermal management, and battery management system. Our AMV Energy Cell is being developed as a purpose-built solution to directly integrate into our AMV Energy 30 pack product. Our efforts are focused on target customers that are looking to deploy packs in 2023. Our ability to deliver these battery packs to customers is entirely dependent on our ability to raise capital. |

| · | AMV Energy Cell – We are developing battery cells to be used in our battery packs, which we believe will be capable of charging in 15 minutes or less. This is the same amount of time it normally takes to fill an ICE vehicle with fuel. The AMV Energy Cell will utilize an in-house developed NMC-811 chemistry solution, combined with a proprietary mechanical construction in development, to significantly improve thermal management and reduce electrical resistance. The AMV Energy Cell, when implemented utilizing our AMV proprietary battery pack technology and AMV advanced charging station (the “AMV AAC”) solutions, which are currently under development, will be capable of delivering consistent power from 0% to 100% battery pack usable capacity, while charging from 0% to 100% usable capacity in 15 minutes. We have completed proof of concept testing and demonstrated this capability in publicly available videos published through social media channels. The AMV Energy Cell is currently in the PVT phase of development. This is the last stage of development before customer deliveries begin. The AMV Energy Cell is currently being produced in low volumes at our facility in Mesa, AZ and is not dependent on any currently unknown advances in technology. As of November 2022, Atlis is producing the AMV Energy Cell in a mass production pilot program with a daily production target of 30 cells per day. AMV Energy Cells will be used in the 30 pack as well as for testing and validation by potential 30 pack and AMV Energy Cell customers. Production of the AMV Energy Cell will scale as 30 pack, AMV XP, and AMV XT enter production. To ensure we are capable of scaling production output, ATLIS will need to continue to make investments in capital expenses, additional facilities, and team growth for the coming years. Atlis is currently finalizing negotiations in an RFP with Scannell Properties for a 190,000 square foot facility located in Mesa, Arizona. We anticipate that this facility will be available in the first quarter of 2023, which will provide Atlis with an opportunity to complete any tenant improvement activity in order to stand up manufacturing operations by the third quarter of 2023. Additionally, Atlis has earmarked capital investment to ramp cell production over the course of 2023 and fund battery pack assembly equipment. As part of this effort, ATLIS may make significant investments in equipment through 2023, 2024, 2025, and for the foreseeable future. ATLIS plans to continue securing MOUs and LOIs for additional battery pack demand and will work to expand production output in order to deliver on that demand as quickly as the facilities allow. Industry standard battery cells utilize lithium-ion battery cells in either cylindrical or pouch form factor. Our AMV Energy Cell is being developed to specifically address concerns with energy density by volume and weight when packaged into a battery pack through the physical cube design. The AMV Energy Cell utilizes a minimalistic approach in cell structure by eliminating excess volume and space. The AMV Cell is being developed to maximize thermal heat transfer, or energy transfer, into and out of the cell through a proprietary mechanical construction. The battery cells they use cannot meet the same fast-charging capabilities or cycle life as we expect to see in the AMV Energy Cell. |

| · | AMV AAC – We are developing our proprietary AMV Advanced charging station. The AMV AAC is intended to be capable of delivering up to 1.5MW of continuous power, deployable in standalone form as a drop-in direct-grid connection solution. The AMV AAC is a proprietary charging solution, utilizing strategic partnerships, to provide charging capabilities to AMV XT, AMV XP, and non-Atlis branded electric vehicle utilizing CCS 2.0 (Combined Charging System 2.0). We are also developing larger AAC 1.5MW charging locations for pull-thru large vehicle applications. Current readily available electric vehicle charging stations from other companies range from 50kW to 250kW. We expect charging costs to be covered as part of our “vehicle-as-a-service” business model described below. The AMV AAC is still in the research and development phase and is not yet in production. Atlis has completed the concept and EVT phase of development. Atlis is currently working through the DVT phase of development for the AMV AAC charging system. The AMV AAC is expected to complete the PVT phase as early as 2023. Our ability to execute this plan is dependent on our ability to raise the necessary capital. Engineering design of the AMV AAC is not yet complete, and we expect to encounter unforeseen engineering challenges or to be reliant on any unknown advances in technology. The AMV AAC is intended to be the world’s first, greater than 1 Megawatt, direct current charging solution with single phase, and 3 phase AC options through a single inlet and charging handle. This is a unique technology solution that current has not been shown in the market and creates the opportunity for a singular charging solution, eliminating fragmentation with multiple standards for vehicles, equipment, and commercial systems today. |

| 2 |

| · | AMV XP – The AMV XP aims to provide a scalable technology solution with a connected cloud, mobile, service, and charging ecosystem that will provide positive workflows and customer experiences moving forward. The AMV XP is a proprietary modular vehicle system, or electric skateboard, providing all technology, software, and mobility technology required to develop a vehicle. The AMV XP utilizes our proprietary battery, electronics hardware, mechanical, and software technologies to create a modular vehicle platform that may be utilized by vehicle coach builders and vehicle OEMS to develop new vehicle solutions for niche- and mass-market opportunities while leveraging the network of capabilities and services that we will provide. The AMV XP is the only work-focused electric vehicle skateboard platform currently in development. We expect that the production start of AMV XP will follow AMV Cell, 30 pack, and AMV AAC production start. The engineering design of AMV XP is not yet complete, and we expect to encounter unforeseen engineering challenges or to be reliant on any unknown advances in technology. The AMV XP has completed the CVT phase of development and Atlis has produced a functioning concept demonstrated during 2021 on our social media channels and is currently beginning the EVT phase of development. The AMV XP is expected to complete the DVT phase of development as early as 2024. Our ability to execute is dependent on our ability to raise the necessary capital. The AMV XP is intended to be a universal, connected, complete vehicle hardware and mechanical architecture system, created so niche and low volume vehicle and OEM manufacturers can develop an electric vehicle solution for their specific target market, while leveraging the ATLIS ecosystem of charging, maintenance, connectivity, cloud services, and service solutions. |

· AMV XT pickup truck – The AMV XT pickup truck is intended to be our flagship vehicle and a 100% electric full-sized work truck. The development effort is focused on delivering a full-sized light to medium duty truck capable of meeting the demand of work centric customer applications. The AMV XT pickup truck will be our market entry solution into the world of Work and is intended to be just the beginning of a long line of vehicle solutions constructed using our AMV XP platform. We intend to provide up to 500 miles of range utilizing our battery cell and pack technology, up to 35,000 pounds of towing capacity utilizing our AMV XP Platform, and a simplistic operational approach with fleet connectivity that utilizes our software and cloud service solutions. The AMV XT has completed the CVT phase of development and pending available funding is expected to begin the EVT phase of development as early as 2023. AMV XT is still in the research and development phase and is not yet in production. We expect that the start of AMV XT production will follow commencement of AMV Cell, 30 pack, AMV AAC, and AMV XP production. The final engineering design of AMV XT is not yet complete, and we expect to encounter unforeseen engineering challenges or to be reliant on any unknown advances in technology.

Beyond our products and solutions in development, we believe the largest competitive advantage ATLIS has is our culture. Our company culture embodies the idea that a transition to electrification and a sustainable future does not require compromise. We are unwilling to bend in our belief and when a technology does not exist, we find creative and innovative ways of developing solutions to solve these great challenges. Our team is built of a diverse group of individuals with a singular focus, to power the future of work through an ecosystem of technologies and products that bring daily value to those who build, dig, grow, and maintain.

The execution of our vision is highly dependent on two factors: our ability to raise the necessary capital required to bring all products and services to market and, more specifically, our ability to successfully deliver the AMV Energy Cell and AMV Energy 30 pack. The AMV Energy Cell and AMV Energy 30 pack are instrumental in many ways to the success of the Company and its vision. Our successful implementation of the AMV Energy Cell and AMV Energy 30 pack would allow us to tackle a key challenge that we face in the industry, the lack of available and accessible battery technology. Thus, we have focused our attention on developing our own battery technology through the AMV Energy Cell and AMV Energy 30 pack in order to mitigate the external risk created from a lack of suitable and available battery technology in the market.

Additionally, our ability to scale high volume vehicle mobility and energy storage solutions is highly dependent on our success with the AMV Energy Cell and AMV Energy 30 pack. As there is a limited supply of these materials, any disruption from competitors or any disruption to material and cell availability can impact the Company’s ability to succeed in these programs.

While we remain optimistic in our ability to bring the AMV Energy Cell and AMV Energy 30 pack to market, these two programs carry high technical challenges due to the fact that the intellectual property required for the programs to successfully run must be developed, as it cannot be purchased nor is it readily available in the market. Atlis appreciates the importance of overcoming this challenge and is accordingly focusing the majority of its efforts on completing its AMV Energy Cell and AMV Energy 30 pack.

| 3 |

Our Services

| · | Atlis Cloud Services – Atlis Cloud Services is intended to tie the entire customer experience together across vehicles, charging, and energy systems. We are developing Atlis Cloud Services to bring a seamless customer experience for Atlis customers across all of our business verticals. We intend for this to include the customer facing portal that provides purchasing, customer service, repair and maintenance services, and charging across desktop, mobile, and vehicle interfaces. Development of Atlis Cloud Services requires extensive front-end and back-end software development, and the software engineering team at Atlis is in the process of developing the foundational architecture. Atlis Cloud Services is still in the research and development phase and is currently in the EVT phase of development. We intend to launch parts of the Atlis Cloud Services to support initial AMV AAC deployments and AMV Energy Solutions as early as 2023, while additional features and improvements will be made continuously as part of Atlis’ software development efforts following the initial launch. |

| · | Atlis Subscription – Atlis subscription is a subscription-based financing approach to marketing and selling product solutions to end customers. We believe the future of the Work industry is a flexible subscription model that allows our customers to focus on business execution while we ensure the infrastructure and products that power work provide a seamless operational experience. The Atlis subscription service is intended to provide a selectable set of services the customer can include or add to existing services. Expected solutions include fleet management, energy storage, charging, and future vehicle applications. The AMV XT subscription is still in the research and development phase and is expected to include charging, maintenance, charging, vehicle purchase, and insurance. |

Our Market Opportunity

We have a tiered approach that encompasses the following foundational markets. Each phased business vertical, starting with the energy vertical, will employ both single use point of sale models as well as a longer-term strategic subscription ownership schedule.

| · | AMV Ecosystem – This opportunity represents the combined ecosystem opportunity and yearly recurring revenue opportunity for Atlis. We believe this recurring revenue opportunity for Energy, Mobility, Equipment, and Services represents the full-circle solution for commercial and individual consumer or individual commercial customers. This opportunity represents, across the targeted Energy and XP/XT mobility markets, a significant and growing yearly recurring revenue opportunity for the foreseeable future. |

| · | AMV Vehicle Batteries – According to Fairfield Market Research, the global vehicle battery market includes a total opportunity of over 2 TWH of battery capacity needed in the year 2030 for light to heavy duty vehicles. This segment has historically been dominated by the commercial vehicle segments, which typically carry significantly more stored energy than consumer vehicles. The global vehicle battery market is expected to exhibit steady growth and reach revenue of more than $43.4 billion by 2030. |

| · | AMV Energy –AMV energy storage is being developed on our proprietary battery technology. We will market our AMB energy storage solutions with the energy market, which encompasses an approximate $360B market opportunity in energy storage, infrastructure, and charging solutions according to Wood Mackenzie. The Atlis energy vertical represents a foundational pillar in the mobility, equipment, and energy production or storage sectors. |

| · | AMV XP and AMV XT - The second and tier of our market leverages energy and vehicle technology solutions for mass- and niche-mobility markets focused on coach build construction methods. This market opportunity includes commercial, vocational, and recreational vehicles in the Class 2 to Class 6 markets, and represents an approximately 1,400,000 vehicles to be sold by 2030. The light duty electric truck market for Class 2 and 3 vehicle segments is currently dominated by the Ford F250 to F450, the GMC 2500 to 4500, and the Ram 2500 to 4500 vehicles with internal combustion and diesel engines. The current automakers are foregoing electric vehicle offerings in this segment until 2030, but with an internally estimated 400,000 yearly vehicle demand by 2030, we believe this segment represents an untouched opportunity to leverage our AMV energy cell cell and 30 pack technology to make electrification of these vehicle segments possible. |

Competitive Strengths

Our competitive strengths include:

| · | Vertical Integration. By taking a vertically integrated approach to development, Atlis is engineering solutions from the ground up. Atlis is starting at the battery cell and building up to battery packs, XP Platform, and ultimately the XT Truck. By developing from cell to vehicle, Atlis’ product offering, development costs, pricing, and success is not dependent on Tier 1 suppliers. |

| · | Fast-Charging Atlis Battery Tech with Superior Cycle Life. Atlis battery technology is being designed to charge in 15 minutes or less and sustain performance for as long as 1 million miles of vehicle life. This provides customers with a battery option that has faster charging times and longer utility in comparison to our competitors’ batteries which on average charge in over 45 minutes and last half as long. Atlis has developed a battery technology that is industry competitive in terms of energy density through chemistry development of proprietary coating mixtures. However, the main differentiation in the Atlis battery technology is the terminal sizing of the battery cells themselves, which can enable a much higher current intake at a cell level which would enable faster charging times. This has been applied to both the pouch cell product in the early production phase as well as a proposed prismatic style cell with a target of development finalization in early 2023. |

| 4 |

| · | Robust Intellectual Property Portfolio. As of January 5, 2023, Atlis has one issued and 32 pending U.S. patents. Our issued patent is effective until April 9, 2039. For all other patents, the rights and duration are pending grant of the patent by the U.S. Patent and Trademark Office. |

| · | Subscription-based Business Model. Atlis subscription is a subscription-based financing approach to marketing and selling product solutions to end customers. We believe the future of the Work industry is a flexible subscription model that allows our customers to focus on business execution while we ensure the infrastructure and products that power work provide a seamless operational experience. This is designed to provide predictable monthly costs for customers. |

| · | A Team with Deep Experience in Disruption. Atlis’ leadership team is made up of individuals with experience in developing products or working in companies that have disrupted traditional industries. Instead of building a team with traditional automotive experience, Atlis has prioritized innovation as a requirement when recruiting talent. |

| · | Magnetic Brand with an Engaged Community. Atlis has built a social media following of over 120,000 combined followers across Facebook, Instagram, LinkedIn, and YouTube. This community is highly engaged in Atlis’ progress and updates, and many of them have even participated in one of our previous equity crowdfunding offerings. This community base is a resource for Atlis to test new ideas, validate product-market fit, and solicit feedback from a community that we believe is representative of our future customer base. |

| · | First Principles Approach to Solving Problems. Atlis has built a culture within its team of solving problems by starting first with engineering principles. Atlis does not accept traditional solutions as the only way, and this mindset is what has resulted in the innovative solutions Atlis is developing today. |

| · | Company Core Values & Culture. Atlis has three Core Values: “Transparency”, “Team First”, and “Make it Happen”. These three foundational beliefs make Atlis a very unique company. Atlis has been dedicated to Transparency from its inception, as can be seen in the YouTube videos and social media updates that the company publishes on a regular basis. This level of transparency and authenticity sets Atlis apart from other companies in the electric vehicle and battery industries. “Team First” is a commitment to always do what is best for the team over any one individual, holding Atlis to a high standard of performance management internally. Finally, “Make It Happen” instills in the team a relentlessness and perseverance that has resulted in Atlis delivering results with far less resources than our competitors. |

| · | Made in the USA. Atlis plans to build its products in-house in its facility in Mesa, AZ. As Atlis scales production output, we may need to expand into additional or alternative facilities. Atlis intends to keep manufacturing in the United States, which will likely make Atlis one of the only American companies building electric vehicle batteries on US soil. |

Financial Performance and Indebtedness

For the years ended December 31, 2021 and 2020, we incurred net losses of approximately $133.7 million and approximately $12.0 million, respectively, as we invested in product development, continued our research and development efforts and prepared for the initial launch of our battery manufacturing capabilities in late 2022. For the nine months ended September 30, 2022, we incurred losses of approximately $53.1 million and as of September 30, 2022, Atlis did not have debt on its balance sheet. The Company plans to continue considering all avenues available to it in order to obtain the necessary capital to be able to continue as a going concern and to execute on our business objectives including but not limited to debt financing, private placements, and equity lines of credit. The Company’s success is dependent upon achieving its strategic and financial objectives, including acquiring capital through public markets.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2022, as amended; |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| · | submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and pay ratio; and |

| 5 |

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues are $1.07 billion or more, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Class A common stock that are held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

We are also a “smaller reporting company” as defined by Rule 12b-2 of the Exchange Act. We may continue to be a smaller reporting company even after we are no longer an emerging growth company. We may take advantage of certain of the scaled disclosures available to smaller reporting companies and will be able to take advantage of these scaled disclosures for so long as the market value of our voting and non-voting Class A common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter, or our annual revenue is less than $100.0 million during the most recently completed fiscal year and the market value of our voting and non-voting Class A common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

Controlled Company Exemption

Our Chief Executive Officer, Mark Hanchett, beneficially owns and controls a majority of the combined voting power of our common stock. As a result, we are a “controlled company” within the meaning of the Nasdaq listing rules. Under these rules, a company of which more than 50% of the voting power is held by an individual, a group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements of Nasdaq. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements. Mark Hanchett also serves as the Chairman of the Board of AMV.

Corporate Information

We were incorporated under the laws of the State of Delaware on November 9, 2016. Our principal executive offices are located at 1828 North Higley Road, Mesa, AZ 85205. Our website address is www.atlismotorvehicles.com. The information provided on or accessible through our website (or any other website referred to in the registration statement, of which this prospectus forms a part, or the documents incorporated by reference herein) is not part of the registration statement, of which this prospectus forms a part, and is not incorporated by reference as part of the registration statement, of which this prospectus forms a part.

Recent Developments

Our Initial Public Offering

On September 27, 2022, we completed our initial public offering (the “IPO”) under Regulation A of the Securities Act and became listed on the Nasdaq Stock Market. In our IPO, we sold 1,015,802 shares of our Class A common stock at a weighted-average price of $14.28 per share. We used the proceeds from the IPO to fund our production and marketing activities.

Following our IPO, trading our Class A common stock has been volatile and subject to wide fluctuations from a high price of $243.99 on September 28, 2022 to a low price of $2.68 on January 10, 2023. These swings in our trading prices are unrelated and disproportionate to our operating performance. As a startup company, we expect this volatility in our stock price to continue for the foreseeable future. As a result, we determine, and advise potential investors to determine, the value of our Class A common stock based on the information contained in our public disclosures and other industry information rather than by reference to its current trading price. See “Risk Factors – The market price of our Class A common stock has fluctuated, and may continue to fluctuate, significantly, and our stockholders may lose all or part of their investment.”

| 6 |

The below chart depicts our capital structure following our IPO:

| _________________________ | ||

| (1) | Consists of Mark Hanchett, our Chief Executive Officer and a member of our Board of Directors; and Annie Pratt, our President and a member of our Board of Directors. Mr. Hanchett owns 30 shares of Class A common stock, 24,103,676 options to purchase shares of Class A common stock and 24,103,676 shares of Class D common stock, representing approximately 71% of the combined voting power of our common stock. Ms. Pratt owns 8,821,696 options to purchase shares of Class A common stock and 8,821,696 shares of Class D common stock, representing approximately 26% of the combined voting power of our common stock. | |

Private Placement

On November 3, 2022, we entered into the Securities Purchase Agreement (the “Purchase Agreement”) with certain investors (collectively, the “Investors”), pursuant to which we agreed to issue to the Investors, for gross proceeds of up to $27,000,000, Senior Secured Original Issue 10% Discount Convertible Promissory Notes (the “convertible notes”) in the aggregate principal amount of up to $30,000,000 and warrants to purchase a number of shares of our Class A common stock equal to 30% of the face value of the convertible notes divided by the volume weighted average price, in three tranches.

Under the first tranche of funding, which closed upon signing of the Purchase Agreement, for gross proceeds of $9,000,000, we issued convertible notes to the Investors in the aggregate principal amount of $10,000,000 (the “First Tranche Notes”) and warrants to purchase up to an aggregate of 231,312 shares of our Class A common stock (the “First Tranche Warrants”).

On January 5, 2023, we entered into an amendment (the “Amendment”) to the Purchase Agreement with each Investor, pursuant to which we and each Investor agreed, among other things, to amend the terms and conditions of the second tranche of funding and terminate the third tranche of funding contemplated under the Purchase Agreement.

The Amendment provides that, with respect to the second tranche of funding, at any time prior to the earlier to occur of (x) April 30, 2024 and (y) the twentieth (20th) trading day following the effectiveness of the resale registration statement covering the resale of all of the shares of the Company’s Class A common stock issuable under the first tranche of funding, each Investor shall have the right, severally and not jointly, to purchase a base allocation of $5.0 million in convertible notes and warrants to purchase a number of shares of the Company’s Class A common stock equal to 30% of the face value of the convertible notes divided by the volume weighted average price at one or more closings (with a total base allocation of $10.0 million, in the aggregate, for all Investors) and, solely with respect to the initial closing, up to an additional $5.0 million in additional convertible notes and related warrants pursuant to oversubscription rights, to the extent then available. In connection with the Amendment, we also issued top-ups warrant to the Investors to purchase up to an aggregate of 537,960 shares of our Class A common stock (the “Top-Up Warrants”).

| 7 |

On January 27, 2023, the Investors elected to purchase convertible notes and warrants pursuant to the second tranche of funding. Under the second tranche of funding, which closed on January 31, 2023, for gross proceeds of $9,000,000, we issued convertible notes to the Investors in the aggregate principal amount of $10,000,000 (the “Second Tranche Notes”) and warrants to purchase up to an aggregate of 942,034 shares of our Class A common stock (the “Second Tranche Warrants”).

A registration statement registering the resale of the shares of Class A common stock issuable upon the conversion of the First Tranche Notes and exercise of the First Tranche Warrants went effective on January 20, 2023. A registration statement registering the resale of the shares of Class A common stock issuable upon the conversion of the Second Tranche Notes and exercise of the Second Tranche Warrants and the Top-Up Warrants went effective on February 9, 2023. As of February 9, 2023, there was an aggregate of $21,250,000 of convertible notes outstanding and 2,111,932 warrants outstanding.

The Offering

| Issuer | Atlis Motor Vehicles Inc., a Delaware corporation. |

| Securities Offered |

Up to 6,451,613 Units on a best-efforts basis, at an assumed public offering price of $3.10 per Unit, which represents the closing price of our Class A common stock on Nasdaq on February 6, 2023. Each Unit consists of (i) one share of Class A common stock, (ii) 0.65 Series A Warrants and (iii) 0.75 Series B Warrants. Each whole Warrant is exercisable for one share of Class A common stock.

We are also offering to each investor of Units that would otherwise result in the investor’s beneficial ownership exceeding 4.99% of our outstanding Class A common stock immediately following the consummation of this offering the opportunity to invest in Units consisting of one Pre-Funded Warrant (in lieu of one share of Class A common stock), 0.65 Series A Warrants and 0.75 Series B Warrants. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the Class A common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of Class A common stock. The purchase price of each Unit including a Pre-Funded Warrant will be equal to the price per Unit including one share of common stock, minus $0.0001, and the exercise price of each Pre-Funded Warrant will equal $0. 0001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant purchased (without regard to any limitation on exercise set forth therein), the number of Units including a share of Class A common stock we are offering will be decreased on a one-for-one basis. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of Class A common stock (or Pre-Funded Warrants) and the Warrants comprising the Units are immediately separable and will be issued separately in this offering. |

| Warrants | Each Unit includes 0.65 Series A Warrants to purchase 0.65 shares of our Class A common stock and 0.75 Series B Warrants to purchase 0.75 shares of our Class A common stock. Each whole Warrant is exercisable at a price of $3.10 per share (100% of the offering price per Unit). The Series A Warrants will be immediately exercisable and will expire five (5) years after the date of issuance. The Series B Warrants will not be exercisable until after the date we effect the Corporate Reorganization or until after the date Stockholder Approval is obtained, and will then expire five (5) years after the date of the Corporate Reorganization or Stockholder Approval, as applicable. Subject to certain conditions, the Series A Warrants may also be exercised on a cashless basis for a number of shares equal to the product of (x) the number of shares that would be received if the warrant was exercised for cash and (y) 1.00. This offering also relates to the shares of Class A common stock issuable upon exercise of any Warrants sold in this offering. See “Description of Securities – Warrants”. |

| 8 |

| Class A Common Stock Outstanding Prior to this Offering | 12,790,205 shares. |

| Class A Common Stock Outstanding After this Offering | 19,241,818 shares, assuming the maximum number of Units are sold in this offering at an assumed public offering price of $3.10 per Unit, which represents the closing price of our Class A common stock on Nasdaq on February 6, 2023, and assuming no issuance of Pre-Funded Warrants and no exercise of Warrants issued in connection with this offering. |

| Use of Proceeds | We intend to use the net proceeds of this offering primarily for general corporate purposes, which may include, but is not limited to, research and development and operations, capital equipment and raw materials. These uses may include building AMV battery manufacturing capabilities, working capital to support the continued manufacturing of our battery cell and the continued development of the AMV charging infrastructure, the XP platform and XT pickup truck. The amounts that we actually spend for any specific purpose may vary significantly, and will depend on a number of factors including, but not limited to, the pace of progress of our research and development, market conditions, and our ability to secure supply of goods and services for both equipment and raw material. See the section titled “Use of Proceeds” appearing elsewhere in this prospectus for more information and see “Risk Factors” for a discussion of certain risks that may affect our intended use of the net proceeds from this offering. |

| Dividend Policy | We have never declared or paid any cash dividends on our shares, and we do not anticipate paying any cash dividends on our shares in the foreseeable future. It is presently intended that we will retain our earnings for future operations and expansion. |

| 9 |

| Risk Factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. |

| Market Symbol and Trading | Our shares of Class A common stock are listed on Nasdaq under the symbol “AMV.” There is no established trading market for the Units, Warrants or Pre-Funded Warrants, and we do not expect a trading market for those securities to develop. We do not intend to list the Units, Warrants or Pre-Funded Warrants on any securities exchange or other trading market. Without a trading market, the liquidity of those securities will be extremely limited |

The above discussion is based on 12,790,205 shares of our Class A common stock outstanding as of February 6, 2023 and excludes, as of that date, the following: (a) 35,975,728 shares of Class A common stock issuable upon the exercise of options outstanding prior to this offering at a weighted average exercise price equal to $7.00; (b) up to an aggregate of 22,500,000 shares of Class A common stock issuable upon the conversion of our outstanding convertible notes (assuming conversion at a conversion price equal to $1.00); and (c) up to an aggregate of 2,111,932 shares of Class A common stock issuable upon the exercise of our outstanding warrants.

| 10 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this prospectus includes “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements, other than statements of present or historical fact included in this prospectus, regarding Atlis Motor Vehicles’, strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward-looking statements. When used in this prospectus, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Atlis Motor Vehicles disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this prospectus. Atlis Motor Vehicles cautions you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Atlis Motor Vehicles, incident to the development, production, gathering and sale of oil, natural gas and natural gas liquids.

In addition, Atlis Motor Vehicles cautions you that the forward-looking statements regarding Atlis Motor Vehicles, which are contained in this prospectus, are subject to the following factors:

| · | the length, scope and severity of the ongoing coronavirus pandemic (“COVID-19”), including the effects of related public health concerns and the impact of continued actions taken by governmental authorities and other third parties in response to the pandemic and its impact on commodity prices, supply and demand considerations and storage capacity; |

| · | U.S. and global economic conditions and political and economic developments; |

| · | economic and competitive conditions; |

| · | the availability of capital resources; |

| · | capital expenditures and other contractual obligations; |

| · | inflation rates; |

| · | the availability of goods and services; |

| · | legislative, regulatory or policy changes; |

| · | cyber-attacks; and |

| · | the securities or capital markets and related risks such as general credit, liquidity, market and interest-rate risks. |

Should one or more of the risks or uncertainties described in this prospectus occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact the operations and projections discussed herein can be found in the section entitled “Risk Factors” herein and in Atlis Motor Vehicles’ periodic filings with the SEC. Atlis Motor Vehicles’ SEC filings are available publicly on the SEC’s website at www.sec.gov.

| 11 |

SUMMARY RISK FACTORS

We are providing the following summary of the risk factors contained in this prospectus to enhance the readability and accessibility of our risk factor disclosures. We encourage our stockholders to carefully review the full risk factors contained under the section entitled “Risk Factors” in this prospectus in their entirety for additional information regarding the risks and uncertainties that could cause our actual results to vary materially from recent results or from our anticipated future results.

Risks Related to Our Business

| · | Atlis is a fledgling company without having developed any products in the past. |

| · | Uncertainty exists as to whether Atlis will be able to raise sufficient funds to continue developing the XP platform and XT pickup truck. |

| · | Future capital raises may dilute current stockholders’ ownership interests. |

| · | Atlis will experience losses for the foreseeable future. |

| · | Our intense capital requirements could be costly. |

| · | Development timelines are at risk of delays outside of Atlis’s control. |

| · | Competition will be stiff. |

| · | Supply chain bottlenecks may be out of our control. |

| · | Natural resources and battery raw materials may experience periods of scarcity. |

| · | Raw material prices can fluctuate based on volatility within the market. |

| · | We may experience a significant interruption of our information technology systems or the loss of confidential or other sensitive data. |

| · | Increases in costs, disruption of supply, or shortage of materials, could harm our business. |

| · | Rising interest rates may adversely impact our business. |

| · | Inflation has resulted in increased costs of operations. |

| · | Scaling up manufacturing will be a challenge and fraught with potential pitfalls. |

| · | Product recall could cripple growth. |

| · | Product liability could result in costly litigation. |

| · | We may face regulatory challenges. |

| · | We may not be able to successfully manage growth. |

| · | Our growth rate may not meet our expectations. |

| · | Our management team does not have experience running a public company. |

| · | We may not be successful in developing an effective direct sales force. |

| · | Raising capital may be costly. |

| 12 |

| · | The loss of personnel may have a material adverse effect on our business and operations. |

Risks Related to this Offering and Ownership of Our Securities

| · | You will incur immediate and substantial dilution. |

| · | This is a best-efforts offering and there can be no assurance that it will be consummated or result in any proceeds. |

| · | There is no public market for the Units, the Warrants or the Pre-Funded Warrants. |

| · | The Warrants and the Pre-Funded Warrants are speculative in nature. |

| · | Holders of the Warrants and, if applicable, Pre-Funded Warrants have no rights as stockholders until they acquire our Class A common stock. |

| · | Lack of diversification could cause you to lose all or some of your investment if initial products fail. |

| · | Our executive officers and executive staff will retain most of Atlis’s voting rights. |

| · | The market price and trading volume of our Class A common stock has fluctuated, and may continue to fluctuate, significantly. |

| · | Management will have broad discretion in the application of the net proceeds from this offering. |

| 13 |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before making an investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to us or that we consider immaterial as of the date of this prospectus. The trading price of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment. Our actual results may differ materially from any future results expressed or implied by such forward-looking statements as a result of various factors, including, but not limited to, those discussed in the sections of this prospectus entitled “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

RISKS RELATED TO OUR BUSINESS

Atlis is an early-stage company that has never turned a profit and there are no assurances that the Company will ever be profitable.

Atlis is a relatively new company that was incorporated on November 9, 2016. If you are investing in this company, it’s because you think Atlis’s business model is a good idea, and Atlis will be able to successfully grow their 3 business units and become profitable. We have yet to fully develop or sell any electric vehicles. We are launching our Energy business and have yet to start mass manufacturing of battery cells and pack solutions. As of right now, we are aiming to develop an electric truck that currently has no commercial contemporaries. In the meantime, other companies could develop successful alternatives. We have never turned a profit and there is no assurance that we will ever be profitable.

We also have no history in the automotive industry. Although Atlis has taken significant steps in developing brand awareness, Atlis is a new company and currently has no experience developing or selling motor vehicles. As such, it is possible that Atlis’s lack of history in the industry may impact our brand, business, financial goals, operation performance, and products.

We should be considered a “Development Stage Company,” and our operations will be subject to all the risks inherent in the establishment of a new business enterprise, including, but not limited to, hurdles or barriers to the implementation of our business plans. Further, because there is no history of operations there is also no operating history from which to evaluate our executive management’s ability to manage our business and operations and achieve our goals or the likely performance of the Company. Prospective investors should also consider the fact that our management team has not previously developed or managed similar companies. No assurances can be given that we will be able to achieve or sustain profitability.

Our limited operating history makes it difficult for us to evaluate our future business prospects.

We are a company with an extremely limited operating history and have not generated material revenue from sales of our vehicles or other products and services to date. As we continue to transition from research and development activities to production and sales, it is difficult, if not impossible, to forecast our future results, and we have limited insight into trends that may emerge and affect our business. The estimated costs and timelines that we have developed to reach full scale commercial production are subject to inherent risks and uncertainties involved in the transition from a start-up company focused on research and development activities to the large-scale manufacture and sale of vehicles. There can be no assurance that our estimates related to the costs and timing necessary to complete the design and engineering of our products, will prove accurate. These are complex processes that may be subject to delays, cost overruns and other unforeseen issues. In addition, we have engaged in limited marketing activities to date, so even if we are able to bring our other commercial products to market, on time and on budget, there can be no assurance that customers will embrace our products in significant numbers at the prices we establish. Market and geopolitical conditions, many of which are outside of our control and subject to change, including general economic conditions, the availability and terms of financing, the impacts and ongoing uncertainties created by the COVID-19 pandemic, the conflict in the Ukraine, fuel and energy prices, regulatory requirements and incentives, competition, and the pace and extent of vehicle electrification generally, will impact demand for our products, and ultimately our success.

| 14 |

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.