As filed with the Securities and Exchange Commission on June 20, 2024.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

___________________________________

METALLA ROYALTY & STREAMING LTD.

(Exact name of Registrant as specified in its charter)

| British Columbia | 1040 | Not Applicable |

| (Province or other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number, if applicable) |

543 Granville Street, Suite 501, Vancouver, B.C., V6C 1X8 (604) 696-0741

(Address and telephone number of Registrant's principal executive offices)

Registered Agent Solutions, Inc., 3400 Capitol Boulevard SE, Suite 101, Tumwater, Washington 98105,

1-800-547-7007

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

___________________________________

Copies to:

Christopher L. Doerksen

Dorsey & Whitney LLP

701 Fifth Avenue

Suite 6100

Seattle, WA 98104

USA

(206) 903-8800

___________________________________

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of the Registration Statement

Province of British Columbia

(Principal jurisdiction regulating this offering)

___________________________________

It is proposed that this filing shall become effective (check appropriate box below):

A. [ ] upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada).

B. [X] at some future date (check the appropriate box below)

1. [ ] pursuant to Rule 467(b) on ( ) at ( ) (designate a time not sooner than 7 calendar days after filing).

2. [ ] pursuant to Rule 467(b) on ( ) at ( ) (designate a time 7 calendar days or sooner after filing) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ).

3. [ ] pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto.

4. [X] after the filing of the next amendment to this Form (if preliminary material is being filed).

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. [X]

___________________________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act of 1933 or on such date as the Commission, acting pursuant to Section 8(a) of the Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities in any State in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such State.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This short form prospectus constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

Information has been incorporated by reference in this short form base shelf prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Metalla Royalty & Streaming Ltd. at 543 Granville Street, Suite 501, Vancouver, British Columbia V6C 1X8, telephone (604) 696-0741, and are also available electronically at www.sedarplus.ca.

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

| NEW ISSUE AND/OR SECONDARY OFFERING | June 20, 2024 |

METALLA ROYALTY & STREAMING LTD.

C$300,000,000

Common Shares

Warrants

Subscription Receipts

Units

Share Purchase Contracts

This short form base shelf prospectus relates to the offering for sale from time to time, during the 25-month period that this prospectus, including any amendments hereto, remains effective, of the securities of Metalla Royalty & Streaming Ltd. (the "Company", "Metalla", "we" or "us") listed above in one or more series, issuances or sales of outstanding securities, with a total offering price of such securities, in the aggregate, of up to $300,000,000 (or the equivalent thereof in U.S. dollars or one or more foreign currencies or composite currencies). The securities may be sold by the Company and/or certain of the Company's security holders ("Selling Securityholders", and each a "Selling Securityholder"). The securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in an accompanying prospectus supplement.

The common shares of the Company (the "Common Shares") are listed for trading: on the TSX Venture Exchange (the "TSXV") under the trading symbol "MTA"; on the NYSE American LLC ("NYSE American") under the symbol "MTA"; and on the Börse Frankfurt (Frankfurt Stock Exchange) (the "Frankfurt Exchange") under the symbol "X9C". On June 19, 2024, being the last trading day on the TSXV and on the Frankfurt Exchange prior to the date hereof, the closing price of the Common Shares on the TSXV was $3.97 and on the Frankfurt Exchange was €2.67. On June 18, 2024, being the last trading day on the NYSE American prior to the filing of this prospectus, the closing price of the Common Shares on the NYSE American was US$2.89. Unless otherwise specified in an applicable prospectus supplement, our subscription receipts, units, warrants and share purchase contracts will not be listed on any securities or stock exchange or on any automated dealer quotation system. There is currently no market through which these securities, other than our Common Shares, may be sold and purchasers may not be able to resell such securities purchased under this short form prospectus. This may affect the pricing of our securities, other than our Common Shares, in the secondary market, the transparency and availability of trading prices, the liquidity of these securities and the extent of issuer regulation. See "Risk Factors".

Investment in the securities being offered is highly speculative and involves significant risks that you should consider before purchasing such securities. You should carefully review the risks outlined in this prospectus (including any prospectus supplement) and in the documents incorporated by reference as well as the information under the heading "Cautionary Note Regarding Forward-Looking Statements" and consider such risks and information in connection with an investment in the securities. See "Risk Factors".

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in the United States and Canada to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board and are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

Owning our securities may subject you to tax consequences both in Canada and the United States. Such tax consequences are not fully described in this prospectus and may not be fully described in any applicable prospectus supplement. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the U.S. federal securities laws may be affected adversely because we are incorporated under the laws of Canada, some of our officers and directors and some or all of the experts named in this prospectus are residents of a country other than the United States, and the underwriters, dealers or agents named in any prospectus supplement may be residents of a country other than the United States, and a substantial portion of our assets are located outside of the United States.

NEITHER THE U.S. SECURITIES AND EXCHANGE COMMISSION (THE "SEC"), NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THE SECURITIES OFFERED HEREBY OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

ii

No underwriter or agent has been involved in the preparation of this prospectus or performed any review of the contents of this prospectus.

All applicable information permitted under securities legislation to be omitted from this prospectus that has been so omitted will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus. Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the securities to which the prospectus supplement pertains. You should read this prospectus and any applicable prospectus supplement carefully before you invest in any securities issued pursuant to this prospectus.

The Company's securities may be sold pursuant to this prospectus through underwriters or dealers or directly or through agents designated from time to time at amounts and prices and other terms determined by the Company or any Selling Securityholder from time to time, or by the Company or any Selling Securityholder directly pursuant to applicable statutory exemptions. In connection with any underwritten offering of securities, other than "at-the-market distributions" (as defined in National Instrument 44-102 - Shelf Distributions), the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the securities offered. Such transactions, if commenced, may discontinue at any time. See "Plan of Distribution". A prospectus supplement will set out the names of any underwriters, dealers or agents involved in the sale of our securities, the amounts, if any, to be purchased by underwriters, the plan of distribution for such securities, including the anticipated net proceeds to the Company or any Selling Securityholder from the sale of such securities, the amounts and prices at which such securities are sold and, if applicable, the compensation of such underwriters, dealers or agents.

This prospectus may qualify an "at-the-market distribution".

iii

Our head office is located at 543 Granville Street, Suite 501, Vancouver, British Columbia V6C 1X8, Canada.

Our registered and records office is at Suite 2700, 1133 Melville Street, Vancouver, British Columbia V6E 4E5, Canada.

Brett Heath, President and Chief Executive Officer and a director of the Company, and Alexander Molyneux, a director of the Company, each reside outside of Canada and have each appointed Metalla Royalty & Streaming Ltd. at 543 Granville Street, Suite 501, Vancouver, British Columbia V6C 1X8, Canada as agent for service of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process. See "Agent for Service of Process".

Investors should rely only on the information contained in or incorporated by reference into this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide investors with different information. Information contained on our website shall not be deemed to be a part of this prospectus (including any applicable prospectus supplement) or incorporated by reference and should not be relied upon by prospective investors for the purpose of determining whether to invest in the securities. We will not make an offer of these securities in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information contained in this prospectus is accurate as of any date other than the date on the face page of this prospectus, the date of any applicable prospectus supplement, or the date of any documents incorporated by reference herein.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

In this prospectus and in any prospectus supplement, unless the context otherwise requires, references to "we", "us", "our" or similar terms, as well as references to "Metalla" or the "Company", refer to Metalla Royalty & Streaming Ltd. together with our subsidiaries.

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement and on the other information included in any registration statement of which this prospectus forms a part. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus or any applicable prospectus supplement is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or of any sale of our securities pursuant thereto. Our business, financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry forecasts used in this prospectus or any applicable prospectus supplement and the documents incorporated by reference in this prospectus or any applicable prospectus supplement were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

AVAILABLE INFORMATION

We are required to file with the securities commission or authority in each of the applicable provinces of Canada annual and interim reports, material change reports and other information. In addition, we are subject to the informational requirements of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), and, in accordance with the Exchange Act, we also file reports with, and furnish other information to, the SEC. Under a multijurisdictional disclosure system adopted by the United States and Canada, these reports and other information (including financial information) may be prepared in accordance with the disclosure requirements of Canada, which differ in certain respects from those in the United States. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and our officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we may not be required to publish financial statements as promptly as U.S. companies.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with IFRS as issued by the International Accounting Standards Board and are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

Technical disclosure regarding our properties included herein and in the documents incorporated herein by reference has not been prepared in accordance with the requirements of U.S. securities laws. Without limiting the foregoing, such technical disclosure uses terms that comply with reporting standards in Canada and certain estimates are made in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all mineral reserve and mineral resource estimates contained in the technical disclosure have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC. Accordingly, information concerning mineral deposits set forth herein and in the documents incorporated herein by reference may not be comparable with information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference herein, contains "forward-looking information" or "forward-looking statements" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. The forward-looking statements in this prospectus are provided as of the date of this prospectus and forward-looking statements incorporated by reference are made as of the date of those documents. The Company does not intend to and does not assume any obligation to update forward-looking information, except as required by applicable law. For this reason and the reasons set forth below, investors should not place undue reliance on forward-looking statements.

All statements included and incorporated by reference herein that address events or developments that we expect to occur in the future are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

The forward-looking statements are based on reasonable assumptions that have been made by Metalla as at the date hereof, or as of the date of the documents incorporated by reference, as applicable, and are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Metalla to be materially different from those expressed or implied by such forward-looking statements, including but not limited to:

• risks related to commodity price fluctuations;

• the absence of control over mining operations from which Metalla will purchase precious metals pursuant to gold streams, silver streams and other agreements (collectively, "Streams" and each individually a "Stream") or from which it will receive royalty payments pursuant to net smelter returns, gross overriding royalties, gross value royalties and other royalty agreements or interests (collectively, "Royalties" and each individually a "Royalty") and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined;

• risks related to exchange rate fluctuations;

• that payments in respect of Streams and Royalties may be delayed or may never be made;

• risks related to Metalla's reliance on public disclosure and other information regarding the mines or projects underlying its Streams and Royalties;

• that some Royalties or Streams may be subject to confidentiality arrangements that limit or prohibit disclosure regarding those Royalties and Streams;

• business opportunities that become available to, or are pursued by, Metalla;

• that Metalla's cash flow is dependent on the activities of others;

• that Metalla has had negative cash flow from operating activities in the past;

• that some Royalty and Stream interests are subject to rights of other interest-holders;

• that Metalla's Royalties and Streams may have unknown defects;

• risks related to Metalla's two material assets, the Côté Property (as defined below) and the Taca Taca Property (as defined below);

• risks related to global financial conditions;

• risks related to geopolitical events and other uncertainties, such as the conflict in the Middle East and Ukraine;

• risks related to epidemics, pandemics or other public health crises, including the novel coronavirus global health pandemic, and the spread of other viruses or pathogens, and the potential impact thereof on Metalla's business, operations and financial condition;

• that Metalla is dependent on its key personnel;

• risks related to Metalla's financial controls;

• dividend policy and future payment of dividends;

• competition;

• that project operators may not respect contractual obligations;

• that Metalla's Royalties and Streams may be unenforceable;

• risks related to conflicts of interest of Metalla's directors and officers;

• that Metalla may not be able to obtain adequate financing in the future;

• risks related to Metalla's current credit facility and financing agreements;

• litigation;

• interpretation by government entities of tax laws or the implementation of new tax laws;

• changes in tax laws impacting Metalla;

• risks related to anti-bribery and anti-corruption laws;

• credit and liquidity risk;

• risks related to Metalla's information systems and cyber security;

• risks posed by activist shareholders;

• that Metalla may suffer reputational damage in the ordinary course of business;

• risks related to acquiring, investing in or developing resource projects;

• risks applicable to owners and operators of properties in which Metalla holds an interest;

• exploration, development and operating risks;

• risks related to climate change;

• environmental risks;

• that the exploration and development activities related to mine operations are subject to extensive laws and regulations;

• that the operation of a mine or project is subject to the receipt and maintenance of permits from governmental authorities;

• risks associated with the acquisition and maintenance of mining infrastructure;

• that Metalla's success is dependent on the efforts of operators' employees;

• risks related to mineral resource and mineral reserve estimates;

• that mining depletion may not be replaced by the discovery of new mineral reserves;

• that operators' mining operations are subject to risks that may not be able to be insured against;

• risks related to land title;

• risks related to international operations;

• risks related to operating in countries with developing economies;

• risks related to construction, development and expansion of mines or projects;

• risks associated with operating in areas that are presently, or were formerly, inhabited or used by indigenous peoples;

• that Metalla is required, in certain jurisdictions, to allow individuals from that jurisdiction to hold nominal interests in Metalla's subsidiaries in that jurisdiction;

• the volatility of the stock market;

• that existing securityholders may be diluted;

• risks related to Metalla's public disclosure obligations;

• risks associated with future sales or issuances of debt or equity securities;

• risks associated with any future at-the-market equity program of the Company;

• that there can be no assurance that an active trading market for Metalla's securities will be sustained;

• risks related to the enforcement of civil judgments against Metalla; and

• risks relating to Metalla potentially being a passive foreign investment company within the meaning of U.S. federal tax laws.

As well as those factors discussed under the heading "Risk Factors" in this prospectus.

Forward-looking statements included in this prospectus include statements regarding:

• the completion of future transactions;

• our plans and objectives;

• our future financial and operational performance;

• expectations regarding the Streams of Metalla;

• royalty payments to be paid to Metalla by property owners or operators of mining projects pursuant to each Royalty;

• the future outlook of Metalla and the mineral reserves and resource estimates for the Côté Property, the Taca Taca Property, and other properties with respect to which the Company has or proposes to acquire an interest;

• the expected output, costs, and date of commercial production for the Côté Property, the Taca Taca Property, and other properties with respect to which the Company has or proposes to acquire an interest;

• future gold, silver and copper prices;

• other potential developments relating to, or achievements by, the counterparties for our Stream and Royalty agreements, and with respect to the mines and other properties in which we have, or may acquire, a Stream or Royalty interest;

• estimates of future production, costs and other financial or economic measures;

• prospective transactions, growth and achievements;

• financing and adequacy of capital;

• future payment of dividends;

• future sales of securities under any ATM Program;

• the future achievement of any milestones in respect of the payment or satisfaction of contingent consideration by Metalla, including with respect to the CentroGold Project in accordance with the purchase and sale agreement with Jaguar Mining Inc. and Mineração Serras Do Oeste Ltda.

Estimates of mineral resources and mineral reserves are also forward-looking statements because they involve estimates of mineralization that will be encountered in the future, and projections regarding other matters that are uncertain, such as future costs and commodity prices.

Forward-looking statements are based on a number of material assumptions, which management of Metalla believe to be reasonable, including, but not limited to, the continuation of mining operations from which Metalla will purchase precious or other metals or in respect of which Metalla will receive Royalty payments, that commodity prices will not experience a material decline, mining operations that underlie Streams or Royalties will operate in accordance with disclosed parameters and achieve their stated production outcomes and such other assumptions as may be set out herein.

Although Metalla has attempted to identify important factors that could cause actual actions, events or results to differ materially from those contained in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. Investors and readers of this prospectus should also carefully review the risk factors set out in this prospectus under the heading "Risk Factors".

NOTICE REGARDING NON-IFRS MEASURES

The documents incorporated by reference herein include certain terms or performance measures that are not defined under IFRS, such as (a) attributable gold equivalent ounces ("GEOs"), (b) average cash cost per attributable GEO, (c) average realized price per attributable GEO, (d) operating cash margin per attributable GEO, which is based on the two preceding measures, and (e) adjusted EBITDA. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. For further information, see "Non-IFRS Financial Measures" in Metalla's management's discussion and analysis for the year ended December 31, 2023, which is incorporated herein by reference. These non-IFRS measures should be read in conjunction with the Company's financial statements incorporated herein by reference.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with the securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of Metalla Royalty & Streaming Ltd. at 543 Granville Street, Suite 501, Vancouver, British Columbia V6C 1X8, telephone (604) 696-0741 or by accessing the disclosure documents through the Internet on the Canadian System for Electronic Document Analysis and Retrieval ("SEDAR+"), at www.sedarplus.ca. Documents filed with, or furnished to, the SEC are available through the SEC's Electronic Data Gathering and Retrieval System, or EDGAR, at www.sec.gov. Our filings through SEDAR+ and EDGAR are not incorporated by reference in this prospectus except as specifically set forth herein.

The following documents, filed with the securities commissions or similar regulatory authorities in certain provinces of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this prospectus:

a) our annual information form dated Match 28, 2024, for the financial year ended December 31, 2023 (the "AIF");

b) our audited annual consolidated financial statements as at and for the years ended December 31, 2023 and 2022, together with the independent registered public accounting firm's report and independent auditors' report thereon and the notes thereto;

c) our management's discussion and analysis of our results of operations and financial position as at and for the year ended December 31, 2023 (the "Annual MD&A");

d) our condensed interim financial statements as at and for the three months ended March 31, 2024 (the "Interim Financial Statements");

e) our management's discussion and analysis of our results of operations and financial position as at and for the three months ended March 31, 2024 (the "Interim MD&A");

f) our business acquisition report dated December 22, 2023 (the "BAR") in respect of the acquisition by Metalla of all of the issued and outstanding common shares of Nova Royalty Corp. ("Nova") completed on December 1, 2023; and

g) our management information circular dated May 14, 2024, in respect of the annual general meeting of shareholders of the Company to be held on June 26, 2024.

Any documents of the type described in Section 11.1 of Form 44-101F1 - Short Form Prospectus Distributions ("NI 44-101") filed by the Company with a securities commission or similar authority in any province of Canada subsequent to the date of this prospectus and prior to the expiry of this prospectus, or the completion of the issuance of securities pursuant hereto, will be deemed to be incorporated by reference into this prospectus.

Any template version of any "marketing materials" (as such term is defined in NI 44-101) filed by the Company after the date of a prospectus supplement and before the termination of the distribution of the securities offered pursuant to such prospectus supplement (together with this prospectus) is deemed to be incorporated by reference in such prospectus supplement.

In addition, any future document or information that the Company files with, or furnishes to, the SEC pursuant to Sections 13(a), 13(c) or 15(d) of the Exchange Act after the date of this prospectus and before the termination of the offerings thereunder, will be deemed to be incorporated by reference in the registration statement of which this prospectus forms a part (in the case of a furnished document, if and to the extent expressly provided therein).

A prospectus supplement containing the specific terms of any offering of our securities will be delivered to purchasers of our securities together with this prospectus and will be deemed to be incorporated by reference in this prospectus as of the date of the prospectus supplement and only for the purposes of the offering of our securities to which that prospectus supplement pertains.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein, in any prospectus supplement hereto or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of material fact or an omission to state a material fact that is required to be stated or is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Upon our filing of a new annual information form and the related annual consolidated financial statements and management's discussion and analysis with applicable securities regulatory authorities during the duration of this prospectus, the previous annual information form, the previous annual consolidated financial statements and all interim financial statements (and accompanying management's discussion and analysis for such periods), any material change reports filed prior to the commencement of our financial year in which the Company's new annual information form is filed, and any business acquisition reports filed for acquisitions completed prior to the commencement of our financial year in respect of which the Company's new annual information form is filed will be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of our securities under this prospectus. Upon interim consolidated financial statements and the accompanying management's discussion and analysis being filed by us with the applicable securities regulatory authorities during the duration of this prospectus, all condensed consolidated interim statements and the accompanying management's discussion and analysis filed prior to the new interim condensed consolidated financial statements shall be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of securities under this prospectus. In addition, upon a new management information circular for the annual meeting of shareholders being filed by the Company with the applicable securities regulatory authorities during the period that this prospectus is effective, the previous management information circular filed in respect of the prior annual meeting of shareholders shall no longer be deemed to be incorporated into this prospectus for purposes of future offers and sales of securities under this prospectus. References to our website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the registration statement of which this prospectus forms a part: (i) the documents listed under the heading "Documents Incorporated by Reference"; (ii) powers of attorney from our directors and officers included on the signature pages of the registration statement; (iii) the consents of KPMG LLP, Deloitte LLP and Davidson & Company LLP ; (iv) the consent of each "qualified person" for the purposes of NI 43-101 listed on the Exhibit Index of the registration statement, and (v) a filing fee table. A copy of the form of warrant indenture or warrant agency agreement, subscription receipt agreement or statement of eligibility of trustee on Form T-1, as applicable, will be filed by post-effective amendment or by incorporation by reference to documents filed or furnished with the SEC under the Exchange Act.

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in the documents incorporated by reference relating to properties and operations on the properties in which the Company holds Royalty, Stream or other interests, and included in the Company's AIF in the section entitled "Material Assets" is based on information publicly disclosed by the owners or operators of those properties and information/data available in the public domain as at the date of (or as specified in) the documents incorporated by reference herein, as applicable, and none of this information has been independently verified by the Company. Specifically, as a Royalty or Stream holder, the Company has limited, if any, access to properties included in its asset portfolio. Additionally, the Company may from time to time receive operating information from the owners and operators of the properties, which it is not permitted to disclose to the public. The Company is dependent on (i) the operators of the properties and their qualified persons to provide information to the Company, or (ii) on publicly available information, to prepare disclosure pertaining to properties and operations on the properties on which the Company holds Royalty, Stream or other interests, and generally has limited or no ability to independently verify such information. Although the Company does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by the Company's Royalty, Stream or other interest. The Company's Royalty, Stream or other interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

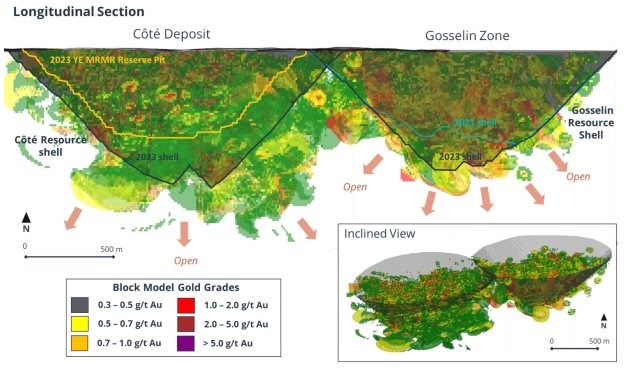

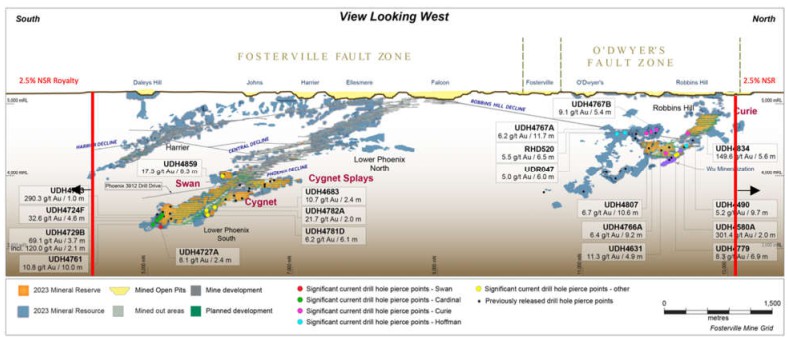

As of the date hereof, the Company considers its Royalty interests in a portion of the Côté deposit and all of the Gosselin deposit which form the Côté gold project (collectively, the "Côté Property") and in the Taca Taca copper-gold-molybdenum project in Salta Province, Argentina (the "Taca Taca Property") to be its only material mineral properties for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Information included in or incorporated by reference into this prospectus with respect to the Côté Property and with respect to the Taca Taca Property has been prepared in accordance with the exemption set forth in section 9.2 of NI 43-101.

Charles Beaudry, M.Sc., P.Geo. and géo. for Metalla and a "Qualified Person" under NI 43-101 has reviewed and approved the scientific and technical disclosure contained in the AIF, the Annual MD&A and the Interim MD&A.

FINANCIAL AND EXCHANGE RATE INFORMATION

The annual consolidated financial statements of the Company incorporated by reference in this prospectus have been prepared in accordance with IFRS and are reported in United States dollars, and the audit of such financial statements may be subject to Canadian auditing and auditor independence standards. They may not be comparable to financial statements of United States companies.

In this prospectus and any prospectus supplement, unless otherwise indicated, all dollar amounts and references to "US$" are to U.S. dollars, references to "C$" or "$" are to Canadian dollars.

The following table sets forth for each period indicated: (i) the exchange rates in effect at the end of the periods indicated; (ii) the high and low exchange rates during each period; and (iii) the average exchange rates in effect during each period, in each case, as identified or calculated from the Bank of Canada rate in effect on each trading day during the relevant period. These rates are expressed as Canadian dollars per US$1.00.

| Financial Year Ended December 31 | Four Months Ended | |||||||||||

| 2023 | 2022 | 2021 | April 30, 2024 | |||||||||

| High for period | C$1.3875 | C$1.3856 | C$1.2942 | C$1.3821 | ||||||||

| Low for period | C$1.3128 | C$1.2451 | C$1.2040 | C$1.3316 | ||||||||

| Average for period | C$1.3497 | C$1.3011 | C$1.2535 | C$1.3535 | ||||||||

| Rate at end of period | C$1.3226 | C$1.3544 | C$1.2678 | C$1.3746 | ||||||||

On June 19, 2024, the exchange rate as quoted by the Bank of Canada was C$1.00 = US$0.7294 (US$1.00 = C$1.3709).

COMMODITY PRICE INFORMATION

The following table sets out the high, low and average spot commodity price in US$ of gold for the three calendar and financial years ending December 31, 2023, 2022 and 2021, as well as for the four months ending April 30, 2024.

| Financial Year Ended December 31 | Four Months Ended | |||||||||||

| 2023 | 2022 | 2021 | April 30, 2024 | |||||||||

| High for period | $2115.10 | $2043.30 | $1954.40 | $2386.60 | ||||||||

| Low for period | $1811.27 | $1626.65 | $1678.00 | $1992.06 | ||||||||

| Average for period | $1943.00 | $1801.87 | $1798.89 | $2164.23 | ||||||||

The following table sets out the high, low and average spot commodity price in US$ of silver for the three calendar and financial years ending December 31, 2023, 2022 and 2021, as well as for the four months ending April 30, 2024.

| Financial Year Ended December 31 | Four Months Ended | |||||||||||

| 2023 | 2022 | 2021 | April 30, 2024 | |||||||||

| High for period | $26.06 | $26.90 | $29.42 | $28.89 | ||||||||

| Low for period | $20.01 | $17.83 | $21.49 | $22.09 | ||||||||

| Average for period | $23.40 | $21.76 | $25.14 | $24.44 | ||||||||

The following table sets out the high, low and average spot commodity price in US$ of copper for the three calendar and financial years ending December 31, 2023, 2022 and 2021, as well as for the four months ending April 30, 2024.

| Financial Year Ended December 31 | Four Months Ended | |||||||||||

| 2023 | 2022 | 2021 | April 30, 2024 | |||||||||

| High for period | $4.2864 | $4.9375 | $4.7620 | $4.672 | ||||||||

| Low for period | $3.5728 | $3.2272 | $3.5245 | $3.6864 | ||||||||

| Average for period | $3.8662 | $3.9969 | $4.2445 | $3.9909 | ||||||||

THE COMPANY

Metalla was incorporated on May 11, 1983 pursuant to the Company Act (British Columbia) under the name Cactus West Explorations Ltd. The Company's name was changed to Cimarron Minerals Ltd. and its share capital was consolidated on a five (old) for one (new) basis, on April 29, 1996. On May 1, 2000, the Company's name was changed to DiscFactories Corporation, and its share capital was consolidated on a two (old) for one (new) basis and the Company was continued into the federal jurisdiction under the Canada Business Corporations Act. On February 20, 2007, the Company completed a change of business transaction pursuant to which it changed its name from DiscFactories Corporation to Excalibur Resources Ltd. On January 11, 2010, its share capital was consolidated on an eight (old) for one (new) basis. On December 1, 2016 it changed its name from Excalibur Resources Ltd. to Metalla, and completed a share consolidation on a three (old) for one (new) basis. On November 16, 2017, Metalla continued under the Business Corporations Act (British Columbia) ("BCBCA"). On December 17, 2019, Metalla effected a consolidation of its Common Shares on a four for one basis and all information in this prospectus has been adjusted for the consolidation.

The Company's head office is located at 501-543 Granville Street, Vancouver, British Columbia, V6C 1X8, Canada. The Company's registered and records office is located at Suite 2700, 1133 Melville Street, Vancouver, British Columbia, V6E 4E5, Canada.

As at the date hereof the Common Shares are listed on the on the TSXV under the trading symbol "MTA"; on the NYSE American under the symbol "MTA"; and on the Frankfurt Exchange under the symbol "X9C".

Metalla is a publicly traded precious metals royalty and streaming company listed on the TSX-V, NYSE and Frankfurt Exchange. Metalla's business model is focused on managing and growing its portfolio of Royalties and Streams. Metalla's long-term goal is to provide its shareholders with a model which provides:

• exposure to precious metals price optionality;

• a perpetual discovery option over large areas of geologically prospective lands with no additional cost other than the initial investment;

• limited exposure to many of the risks associated with operating companies;

• a free cash-flow business with limited cash calls;

• a high-margin business that can generate cash through the entire commodity cycle;

• a scalable and diversified business in which a large number of assets can be managed with a small stable overhead; and

• management focus on forward-looking growth opportunities rather than operation or development issues.

Metalla's financial results in the short-term are primarily tied to the price of commodities and the amount of production from its portfolio of producing assets. Financial results have also been supplemented by acquisitions of new producing assets. Over the longer-term, results are impacted by the availability of exploration and development capital applied by other companies to expand or extend Metalla's producing assets. Metalla has a long-term investment outlook and recognizes the cyclical nature of the industry. Metalla has historically operated by maintaining a strong balance sheet so that it can make investments during commodity cycle downturns.

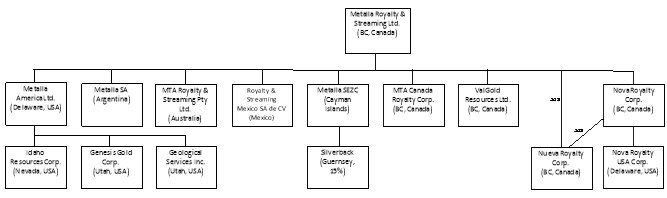

Inter-Corporate Relationship

The chart below illustrates the Company's material inter-corporate relationships as at the date hereof:

On December 1, 2023, Metalla acquired all of the issued and outstanding common shares (the "Nova Shares") in the capital of Nova, by way of a court-approved plan of arrangement (the "Arrangement"). In consideration for the Nova Shares, Metalla issued Common Shares to the former Nova shareholders. Further details about the Arrangement are available in the AIF.

RISK FACTORS

Prospective purchasers of our securities should carefully consider the risk factors described in documents incorporated by reference in this prospectus (including the AIF and subsequently filed documents incorporated by reference) and those described in a prospectus supplement relating to a specific offering of our securities. Discussion of certain risks affecting the Company in connection with its business are provided in the Company's disclosure documents filed with the various securities regulatory authorities which are incorporated by reference into this prospectus.

USE OF PROCEEDS

Unless we otherwise indicate in a prospectus supplement relating to a particular offering, we currently intend to use the net proceeds from the sale of our securities to finance the future purchase of Streams and Royalties and for working capital purposes.

In order to raise additional funds to finance future growth opportunities, we may, from time to time, issue securities. More detailed information regarding the use of proceeds from the sale of securities, including any determinable milestones at the applicable time, will be described in a prospectus supplement. We may also, from time to time, issue securities otherwise than pursuant to a prospectus supplement to this prospectus.

The Company will not receive any proceeds from any sale of securities by any Selling Securityholder.

During the most recent financial year ended December 31, 2023 and for the interim period ended March 31, 2024, the Company had negative cash flow from operating activities. The Company anticipates it will continue to have negative cash flow from operating activities in future periods until such time as the projects underlying its Streams and Royalties or other future interests generate further revenues. Future cash flows from such interests are dependent upon the underlying projects achieving production. If necessary, proceeds from the sale of securities may be used to fund negative cash flow from operating activities in future periods which will be indicated in a prospectus supplement as applicable. All expenses relating to an offering and any compensation paid to underwriters, dealers or agents, as the case may be, will be paid out of the proceeds from the sale of such securities, unless otherwise stated in the applicable prospectus supplement.

Use of Proceeds from Prior Financings

Metalla raised $4.6 million in each of the years ended December 31, 2023 and 2022 through at-the-market offerings to finance the purchase of streams and royalties by the Company and for general working capital purposes. Metalla also raised $15.0 million through a private placement completed on October 23, 2023, for the acquisition of royalties and streams, Arrangement expenses, and general and administrative expenses of the combined company following completion of the Arrangement. To date, there has been no variance to the use of proceeds previously announced for those financing activities.

CONSOLIDATED CAPITALIZATION

There have been no material changes to the consolidated share or loan capital of the Company on a consolidated basis since March 31, 2024, the date of the Interim Financial Statements.

DESCRIPTION OF MATERIAL INDEBTEDNESS

On April 23, 2019, Metalla announced that it had entered into a convertible loan facility (the "Original Beedie Loan") of up to $12.0 million with Beedie Capital ("Beedie") to fund acquisitions of new Royalties and Streams. The Original Beedie Loan was funded by way of an initial advance of $7.0 million within 90 days from closing of the Original Beedie Loan. The initial drawdown of C$7.0 million occurred on August 7, 2019.

On July 29, 2020, Metalla announced that it had reached an agreement with Beedie to amend and restate the Original Beedie Loan (the "Amended and Restated Beedie Loan" and, collectively with the Original Beedie Loan, the "Beedie Loan Facility") pursuant to which (i) Beedie converted C$6.0 million of the outstanding C$7.0 million principal amount drawn under the Original Beedie Loan (the "Initial Advance") at a conversion price of C$5.56 per Common Share for a total of 1,079,136 Common Shares; (ii) the conversion price of the previously undrawn C$5.0 million tranche of the Original Beedie Loan was increased from C$5.56 to C$9.90 per Common Share; and (iii) the aggregate amount available under the Beedie Loan Facility was increased by an additional C$20 million. The second drawdown of C$5.0 million (the "Second Advance") pursuant to the Amended and Restated Beedie Loan occurred on August 6, 2020 at a conversion price of C$9.90 per Common Share.

The remaining C$1.0 million outstanding under the Initial Advance was converted by Beedie on October 30, 2020 at a conversion price of C$5.56 per Common Share, representing a 25% premium to the 30-day volume-weighted average price ("VWAP") per Common Share as of March 15, 2019, for a total of 179,856 Common Shares

On March 17, 2021, Metalla completed a third drawdown of C$5.0 million under the Beedie Loan Facility (the "Third Advance") and the Second Advance was converted by Beedie at a conversion price of C$9.90, representing a 27% premium to the 30-day VWAP per Common Share as of July 28, 2020, for a total of 505,050 Common Shares. The Third Advance may be converted by Beedie at a price of C$14.30 per Common Share, representing a 20% premium to the 30-day VWAP of the Common Shares on the TSX-V calculated as of March 16, 2021, in accordance with the terms of the Beedie Loan Facility.

On October 1, 2021, Metalla completed a fourth drawdown of an additional C$3 million (the "Fourth Advance") under the Beedie Loan Facility. The Fourth Drawdown may be converted by Beedie at a price of C$11.16 per Common Share, representing a 20% premium to the 30-day VWAP of the Common Shares on the TSX-V calculated as of September 30, 2021, in accordance with the terms of the Beedie Loan Facility.

On August 9, 2022, the Company and Beedie entered into an agreement to extend the maturity date of the Beedie Loan Facility from April 21, 2023, to January 22, 2024 (the "Loan Extension"). In consideration for the Loan Extension the Company incurred a fee of 2.0% of the drawn amount at that time, which was C$8.0 million. The C$160,000 fee will be convertible into Common Shares at a conversion price of C$7.34 per Common Share, calculated based on a 20% premium to the 30-day VWAP of the Common Shares on the trading day immediately prior to the effective date of the Loan Extension.

Effective March 31, 2023, the Company and Beedie entered into a supplemental agreement (the "Second Supplemental Loan Agreement") to amend the Beedie Loan Facility by:

-

extending the maturity date to May 10, 2027;

-

increasing the Beedie Loan Facility by C$5.0 million from C$20.0 million to C$25.0 million;

-

increasing the interest rate from 8.0% to 10.0% per annum;

-

amending the conversion price of the Fourth Advance from C$11.16 to C$8.67 per Common Share, representing a 30% premium to the 30-day VWAP of the Common Shares on the TSXV calculated on the day prior to the announcement of the Second Supplemental Loan Agreement;

-

amending the conversion price of C$4.0 million of the Third Advance from C$14.30 to C$7.33 per Common Share, representing the 5-day VWAP of the Common Shares on the TSXV calculated on the day prior to the announcement of the Second Supplemental Loan Agreement, and converting the C$4.0 million into 545,702 Common Shares at the new conversion price; and

- amending the conversion price of the remaining C$1.0 million of the Third Advance from C$14.30 to C$8.67 per Common Share, representing a 30% premium to the 30-day VWAP of the Common Shares on the TSXV calculated on the day prior to the announcement of the Second Supplemental Loan Agreement.

The Beedie Loan Facility is secured by certain assets of Metalla and can be repaid with no penalty at any time after the 12-month anniversary of each advance.

On October 19, 2023, Metalla and Beedie entered into an amended and restated convertible loan facility agreement (the "Second Amended and Restated Convertible Loan Agreement"), which became effective as at the closing of the Arrangement. Pursuant to the Second Amended and Restated Convertible Loan Agreement, the parties agreed:

-

to increase the Beedie Loan Facility from C$25.0 million to C$50.0 million;

-

to drawdown C$16.4 million (convertible at a conversion price of C$6.00 per Common Share), to refinance the C$4.2 million principal outstanding under the Beedie Loan Facility as at the time of the closing of the Arrangement, and the C$12.2 million principal outstanding under Nova's convertible loan facility with Beedie (the "Nova Convertible Loan"), plus C$2.7 million, being the aggregate accrued and unpaid interest and fees outstanding under the Nova Convertible Loan and the Beedie Loan Facility as at the time of the closing of the Arrangement, with the interest convertible at a conversion price as of the date of conversion and unpaid fees shall not be convertible, plus an amendment fee of approximately C$0.1 million payable to Beedie, plus certain expenses of Beedie (collectively, the "Initial Drawdown");

-

that the interest on the principal will accrue at a rate of 10.0% per annum;

-

for an eighteen-month period from the close of the Arrangement, accrued interest will be capitalized and added to the principal amount, and thereafter, at Metalla's election, 2.0% per annum of the interest accruing on the principal will be capitalized and added to the principal amount;

-

that the standby fee (1.5% per annum), the commitment fee (1.0% on any subsequent advance (not payable on the Initial Drawdown)), the make whole fee (entitling Beedie to earn a minimum of 12 months of interest on each advance made) and the default interest rate (14.0% per annum) remain the same; and

-

to update existing security arrangements to reflect security provided by Nova and its subsidiary for the Beedie Loan Facility, along with updated security arrangements at Metalla to reflect developments in our business.

Concurrent with closing of the Arrangement, Metalla drew down on the Beedie Loan Facility and paid out and discharged all obligations under the Nova Convertible Loan, and the Nova Convertible Loan has been terminated.

On March 19, 2024, Beedie converted C$1,500,002 of the accrued and unpaid interest under the Beedie Loan Facility into 429,800 Common Shares, at a price of C$3.49 per Common Share, being the closing price of the Common Shares on the TSXV on February 20, 2024, the date that Beedie provided notice of their intention to convert.

Any future advances from the remaining C$30.9 million made available by Beedie under the Beedie Loan Facility will require a minimum drawdown of C$2.5 million by Metalla with a conversion price based on a 20% premium to the 30-day VWAP of the Common Shares on the date of such advance.

PRIOR SALES

Information in respect of our Common Shares that we issued within the previous 12-month period, including Common Shares that we issued either upon the exercise of options, or which were granted under our share compensation plan, or any other equity compensation plan, will be provided as required in a prospectus supplement with respect to the issuance of securities pursuant to such prospectus supplement.

TRADING PRICE AND VOLUME

The Company's Common Shares are listed and posted for trading on the TSXV and NYSE American under the symbol "MTA", and on the Frankfurt Exchange under the symbol "X9C". Trading price and volume of the Company's securities will be provided as required for all of our Common Shares, as applicable, in each prospectus supplement to this prospectus.

DESCRIPTION OF SHARE CAPITAL

The authorized share capital of the Company consists of an unlimited number of Common Shares without par value. As of June 19, 2024, there were 91,491,290 Common Shares issued and outstanding.

In addition, as of June 19, 2024, there were: 4,550,797 Common Shares issuable upon the exercise of outstanding stock options, at a weighted average exercise price of $7.08; and 818,410 Common Shares issuable upon the conversion of outstanding restricted stock units.

Common Shares

Holders of Common Shares are entitled to receive notice of any meetings of shareholders of the Company, to attend and to cast one vote per Common Share at all such meetings. Holders of Common Shares do not have cumulative voting rights with respect to the election of directors and, accordingly, holders of a majority of the Common Shares entitled to vote in any election of directors may elect all directors standing for election. Holders of Common Shares are entitled to receive on a pro rata basis such dividends, if any, as and when declared by the Company's board of directors at its discretion from funds legally available therefor and upon the liquidation, dissolution or winding up of the Company are entitled to receive on a pro rata basis the net assets of the Company after payment of debts and other liabilities. The Common Shares do not carry any pre-emptive, subscription, redemption or conversion rights, nor do they contain any sinking or purchase fund provisions.

DESCRIPTION OF WARRANTS

General

This section describes the general terms that will apply to any warrants for the purchase of Common Shares, or other securities of the Company.

Warrants may be issued independently or together with other securities, and warrants sold with other securities may be attached to or separate from the other securities. Warrants will be issued under one or more warrant indentures or warrant agency agreements to be entered into by the Company and with one or more financial institutions or trust companies acting as warrant agent.

The Company will deliver an undertaking to the securities regulatory authority in each of the provinces of Canada that it will not distribute warrants that, according to the aforementioned terms as described in the applicable prospectus supplement for warrants supplementing this prospectus, are "novel" specified derivatives within the meaning of Canadian securities legislation, separately to any member of the public in Canada, unless the offering is in connection with and forms part of the consideration for an acquisition or merger transaction or unless such prospectus supplement containing the specific terms of the warrants to be distributed separately is first approved by or on behalf of the securities commissions or similar regulatory authorities in each of the provinces of Canada where the warrants will be distributed.

This summary of some of the provisions of the warrants is not complete. The statements made in this prospectus relating to any warrant indenture and warrants to be issued under this prospectus are summaries of certain anticipated provisions thereof and do not purport to be complete and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable warrant indenture. You should refer to the warrant indenture or warrant agency agreement relating to the specific warrants being offered for the complete terms of the warrants. A copy of any warrant indenture or warrant agency agreement relating to an offering or warrants will be filed by the Company with the securities commissions or similar regulatory authorities in applicable Canadian offering jurisdictions and the United States, after it has been entered into, and will be available electronically on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

The applicable prospectus supplement relating to any warrants that we offer will describe the particular terms of those warrants and include specific terms relating to the offering.

Original purchasers of warrants (if offered separately) will have a contractual right of rescission against the Company in respect of the exercise of such warrant. The contractual right of rescission will entitle such original purchasers to receive, upon surrender of the underlying securities acquired upon exercise of the warrant, the total of the amount paid on original purchase of the warrant and the amount paid upon exercise, in the event that this prospectus (as supplemented or amended) contains a misrepresentation, provided that:(i) the exercise takes place within 180 days of the date of the purchase of the warrant under the applicable prospectus supplement; and (ii) the right of rescission is exercised within 180 days of the date of purchase of the warrant under the applicable prospectus supplement. This contractual right of rescission will be consistent with the statutory right of rescission described under section 131 of the Securities Act (British Columbia), and is in addition to any other right or remedy available to original purchasers under section 131 of the Securities Act (British Columbia) or otherwise at law.

In an offering of warrants, or other convertible securities, original purchasers are cautioned that the statutory right of action for damages for a misrepresentation contained in the prospectus is limited, in certain provincial securities legislation, to the price at which the warrants, or other convertible securities, are offered to the public under the prospectus offering. This means that, under the securities legislation of certain provinces, if the purchaser pays additional amounts upon conversion, exchange or exercise of such securities, those amounts may not be recoverable under the statutory right of action for damages that applies in those provinces. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser's province for the particulars of these rights, or consult with a legal advisor.

The particular terms of each issue of warrants will be described in the applicable prospectus supplement. This description will include, where applicable:

• the designation and aggregate number of warrants;

• the price at which the warrants will be offered;

• the currency or currencies in which the warrants will be offered;

• the date on which the right to exercise the warrants will commence and the date on which the right will expire;

• the number of Common Shares or other securities, as applicable, that may be purchased upon exercise of each warrant and the price at which and currency or currencies in which the Common Shares or other securities, as applicable, may be purchased upon exercise of each warrant;

• the terms of any provisions allowing or providing for adjustments in (i) the number and/or class of Common Shares or other securities, as applicable, that may be purchased, (ii) the exercise price per Common Share, or other securities, as applicable, or (iii) the expiry of the warrants;

• whether the Company will issue fractional shares;

• whether the Company has applied to list the warrants or the underlying shares on a securities exchange or automated interdealer quotation system;

• the designation and terms of any securities with which the warrants will be offered, if any, and the number of the warrants that will be offered with each security;

• the date or dates, if any, on or after which the warrants and the related securities will be transferable separately;

• whether the warrants will be subject to redemption or call and, if so, the terms of such redemption or call provisions;

• material U.S. and Canadian federal income tax consequences of owning the warrants; and

• any other material terms or conditions of the warrants.

Prior to the exercise of their warrants, holders of warrants will not have any of the rights of holders of the securities subject to the warrants.

DESCRIPTION OF UNITS

Metalla may issue units, which may consist of one or more Common Shares, warrants or any combination of securities, including fractions of such securities, as is specified in the relevant prospectus supplement. In addition, the relevant prospectus supplement relating to an offering of units will describe all material terms of any units offered, including, as applicable:

• the designation and aggregate number of units being offered;

• the price at which the units will be offered;

• the designation, number and terms of the securities comprising the units and any agreement governing the units;

• the date or dates, if any, on or after which the securities comprising the units will be transferable separately;

• whether the Company will apply to list the units on a securities exchange or automated interdealer quotation system;

• material U.S. and Canadian federal income tax consequences of owning the units, including how the purchase price paid for the units will be allocated among the securities comprising the units; and

• any other material terms or conditions of the units.

DESCRIPTION OF SUBSCRIPTION RECEIPTS

Metalla may issue subscription receipts separately or in combination with one or more other securities. The subscription receipts will entitle holders thereof to receive, upon satisfaction of certain Release Conditions (as defined herein) and for no additional consideration, Common Shares, warrants or any combination thereof. Subscription receipts will be issued pursuant to one or more subscription receipt agreements (each, a "Subscription Receipt Agreement"), each to be entered into between the Company and an escrow agent (the "Escrow Agent") that will be named in the relevant prospectus supplement. Each Escrow Agent will be: (i) a financial institution organized under the laws of Canada or a province thereof and authorized to carry on business as a trustee; or (ii) otherwise authorized to act as a trustee. If underwriters or agents are used in the sale of any subscription receipts, one or more of such underwriters or agents may also be a party to the Subscription Receipt Agreement governing the subscription receipts sold to or through such underwriter or agent.

The following description sets forth certain general terms and provisions of subscription receipts that may be issued hereunder and is not intended to be complete. The statements made in this prospectus relating to any Subscription Receipt Agreement and subscription receipts to be issued thereunder are summaries of certain anticipated provisions thereof and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable Subscription Receipt Agreement. Prospective investors should refer to the Subscription Receipt Agreement relating to the specific subscription receipts being offered for the complete terms of the subscription receipts. Metalla will file a copy of any Subscription Receipt Agreement relating to an offering of subscription receipts with the securities commissions or similar regulatory authorities in applicable Canadian offering jurisdictions and the United States, after it has been entered into, and such Subscription Receipt Agreement will be available electronically on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

General

The prospectus supplement and the Subscription Receipt Agreement for any subscription receipts that the Company may offer will describe the specific terms of the subscription receipts offered. This description may include, but may not be limited to, any of the following, if applicable:

• the designation and aggregate number of subscription receipts being offered;

• the price at which the subscription receipts will be offered;

• the designation, number and terms of the Common Shares, warrants or a combination thereof to be received by the holders of subscription receipts upon satisfaction of the Release Conditions (as defined herein), and any procedures that will result in the adjustment of those numbers;

• the conditions that must be met in order for holders of subscription receipts to receive, for no additional consideration, the Common Shares, warrants or a combination thereof (the "Release Conditions");

• the procedures for the issuance and delivery of the Common Shares, warrants or a combination thereof to holders of subscription receipts upon satisfaction of the Release Conditions;

• whether any payments will be made to holders of subscription receipts upon delivery of the Common Shares, warrants or a combination thereof upon satisfaction of the Release Conditions;

• the identity of the Escrow Agent;

• the terms and conditions under which the Escrow Agent will hold all or a portion of the gross proceeds from the sale of subscription receipts, together with interest and income earned thereon (collectively, the "Escrowed Funds"), pending satisfaction of the Release Conditions;

• the terms and conditions pursuant to which the Escrow Agent will hold Common Shares, warrants or a combination thereof pending satisfaction of the Release Conditions;

• the terms and conditions under which the Escrow Agent will release all or a portion of the Escrowed Funds to the Company upon satisfaction of the Release Conditions;

• if the subscription receipts are sold to or through underwriters or agents, the terms and conditions under which the Escrow Agent will release a portion of the Escrowed Funds to such underwriters or agents in payment of all or a portion of their fees or commissions in connection with the sale of the subscription receipts;

• procedures for the refund by the Escrow Agent to holders of subscription receipts of all or a portion of the subscription price of their subscription receipts, plus any pro rata entitlement to interest earned or income generated on such amount, if the Release Conditions are not satisfied;

• any contractual right of rescission to be granted to initial purchasers of subscription receipts in the event that this prospectus, the prospectus supplement under which subscription receipts are issued or any amendment hereto or thereto contains a misrepresentation;

• any entitlement of Metalla to purchase the subscription receipts in the open market by private agreement or otherwise;

• whether the Company will issue the subscription receipts as global securities and, if so, the identity of the depository for the global securities;

• whether the Company will issue the subscription receipts as bearer securities, as registered securities or both;

• provisions as to modification, amendment or variation of the Subscription Receipt Agreement or any rights or terms of the subscription receipts, including upon any subdivision, consolidation, reclassification or other material change of the Common Shares, warrants or other Metalla securities, any other reorganization, amalgamation, merger or sale of all or substantially all of the Company's assets or any distribution of property or rights to all or substantially all of the holders of Common Shares;

• whether the Company will apply to list the subscription receipts on a securities exchange or automated interdealer quotation system;

• material U.S. and Canadian federal income tax consequences of owning the subscription receipts; and

• any other material terms or conditions of the subscription receipts.

Original purchasers of subscription receipts will have a contractual right of rescission against the Company in respect of the conversion of the subscription receipt. The contractual right of rescission will entitle such original purchasers to receive the amount paid on original purchase of the subscription receipt upon surrender of the underlying securities gained thereby, in the event that this prospectus (as supplemented or amended) contains a misrepresentation, provided that: (i) the conversion takes place within 180 days of the date of the purchase of the subscription receipt under this prospectus; and (ii) the right of rescission is exercised within 180 days of the date of purchase of the subscription receipt under this prospectus. This contractual right of rescission will be consistent with the statutory right of rescission described under section 131 of the Securities Act (British Columbia), and is in addition to any other right or remedy available to original purchasers under section 131 of the Securities Act (British Columbia) or otherwise at law.

Rights of Holders of Subscription Receipts Prior to Satisfaction of Release Conditions

The holders of subscription receipts will not be, and will not have the rights of, shareholders of Metalla. Holders of subscription receipts are entitled only to receive Common Shares, warrants or a combination thereof on exchange of their subscription receipts, plus any cash payments, all as provided for under the Subscription Receipt Agreement and only once the Release Conditions have been satisfied. If the Release Conditions are not satisfied, holders of subscription receipts shall be entitled to a refund of all or a portion of the subscription price thereof and all or a portion of the pro rata share of interest earned or income generated thereon, as provided in the Subscription Receipt Agreement.

Escrow