UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

━━━━━━━━━

FORM 10-K

━━━━━━━━━

For the fiscal year ended December 31 , 2021

For the transition period from __________ to __________

Commission file number: 001-38912

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification no.) | ||||

(Address of principal executive offices) (zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol | Exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ☒ Large Accelerated Filer ☐ Accelerated Filer ☐ Non-accelerated Filer ☐ Smaller reporting company ☐ Emerging growth company

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The aggregate market value of common stock held by our non-affiliates at June 30, 2021 was $20,730,129,607 .

On January 28, 2022, 609,968,096 shares of common stock, $0.01 par value per share, were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of our definitive proxy statement for our 2022 annual meeting of stockholders will be filed with the SEC on or before 120 days after our 2021 fiscal year-end and are incorporated by reference into Part III of this report.

Avantor, Inc. and subsidiaries

Form 10-K for the fiscal year ended December 31, 2021

Table of contents

| Page | ||||||||

i

Glossary

| Description | |||||

| we, us, our | Avantor, Inc. and its subsidiaries | ||||

| 2019 Plan | the Avantor, Inc. 2019 Equity Incentive Plan, a stock-based compensation plan | ||||

| Adjusted EBITDA | our earnings or loss before interest, taxes, depreciation, amortization and certain other adjustments | ||||

| AMEA | Asia, Middle-East and Africa | ||||

| AOCI | accumulated other comprehensive income or loss | ||||

| BIS | the Bureau of Industry and Security | ||||

| CERCLA | the Comprehensive Environmental Response Compensation and Liability Act | ||||

| cGMP | Current Good Manufacturing Practice | ||||

COVID-19 | Coronavirus disease of 2019 | ||||

| double-digit | greater than 10% | ||||

| DDTC | Directorate of Defense Trade controls | ||||

| DEA | Drug Enforcement Administration | ||||

| DHHS | Department of Health and Human Service | ||||

| EMA | European Medicines Agency | ||||

| EPA | the U.S. Environmental Protection Agency | ||||

| ERP | enterprise resource planning system | ||||

| EU | European Union | ||||

| EURIBOR | the basic rate of interest used in lending between banks on the European Union interbank market | ||||

| FASB | the Financial Accounting Standards Board of the United States | ||||

| FCPA | the United States Foreign Corrupt Practices Act | ||||

| FDA | United States Food and Drug Administration | ||||

| GAAP | United States generally accepted accounting principles | ||||

| GDPR | the General Data Protection Regulation | ||||

| Goldman Sachs | an investment banking firm and its affiliates | ||||

| high single-digit | 7 - 9% | ||||

| ICH Q7 | the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use - Good Manufacturing Practice Guidance for Active Pharmaceutical Ingredients | ||||

| IPO | initial public offering | ||||

ii

| Description | |||||

| ISO | International Organization for Standardization or international equivalents | ||||

| ITAR | the International Traffic In Arms Regulations | ||||

| JCPS | Junior Convertible Preferred Stock | ||||

| LIBOR | the basic rate of interest used in lending between banks on the London interbank market | ||||

| Long Term | period other than Short Term | ||||

| low single-digit | 1 - 3% | ||||

| M&A | Mergers and Acquisitions | ||||

| MCPS | 6.250% Series A Mandatory Convertible Preferred Stock | ||||

| mid single-digit | 4 - 6% | ||||

| NAV | Net Asset Value | ||||

| New Mountain Capital | a private equity investor and its affiliates | ||||

| NuSil | NuSil Acquisition Corp, NuSil Investments LLC and subsidiaries, a business organization with which we merged in 2016 | ||||

| NuSil Investors | NuSil LLC and NuSil 2.0 LLC, former owners of NuSil that are controlled by its former management | ||||

| NYSE | the New York Stock Exchange | ||||

| OEM | original engineering manufacturers | ||||

| OFAC | the U.S. Department of The Treasury’s Office of Foreign Assets Control | ||||

| OSHA | the U.S. Occupational Safety & Health Administration | ||||

| PPE | personal protective equipment | ||||

| PSP Investments | a pension investment manager and its affiliates | ||||

| RSU | restricted stock unit | ||||

| SAR | stand alone appreciation right | ||||

| SEC | the United States Securities and Exchange Commission | ||||

| SG&A expenses | selling, general and administrative expenses | ||||

| Short Term | period less than a year from the reporting date | ||||

| specialty procurement | product sales related to customer procurement services | ||||

| VWR | VWR Corporation and its subsidiaries, a company we acquired in November 2017 | ||||

iii

Cautionary factors regarding forward-looking statements

This report contains forward-looking statements. All statements other than statements of historical fact included in this report are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “can,” “could,” “may,” “should,” “would,” “will,” the negatives thereof and other words and terms of similar meaning.

Forward-looking statements are inherently subject to risks, uncertainties and assumptions; they are not guarantees of performance. You should not place undue reliance on these statements. We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, we cannot assure you that the assumptions and expectations will prove to be correct.

You should understand that the following important factors, in addition to those discussed under Item 1A, “Risk Factors,” could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements:

•disruptions to our operations;

•competition from other industry providers;

•our ability to implement our growth strategy;

•our ability to anticipate and respond to changing industry trends;

•adverse trends in consumer, business, and government spending;

•our dependence on sole or limited sources for some essential materials and components;

•our ability to successfully value and integrate acquired businesses;

•our products’ satisfaction of applicable quality criteria, specifications and performance standards;

•our ability to maintain our relationships with key customers;

•our ability to maintain our relationships with distributors;

•our ability to maintain consistent purchase volumes under purchase orders;

•our ability to maintain and develop relationships with drug manufacturers and contract manufacturing organizations;

•the impact of new laws, regulations, or other industry standards;

•changes in the interest rate environment that increase interest on our borrowings;

iv

•adverse impacts from currency exchange rates or currency controls imposed by any government in major areas where we operate or otherwise;

•our ability to implement and improve processing systems and prevent a compromise of our information systems;

•our ability to protect our intellectual property and avoid third-party infringement claims;

•exposure to product liability and other claims in the ordinary course of business;

•our ability to develop new products responsive to the markets we serve;

•the availability of raw materials;

•our ability to source certain of our products from certain suppliers;

•our ability to contain costs in an inflationary environment;

•our ability to avoid negative outcomes related to the use of chemicals;

•our ability to maintain highly skilled employees;

•our ability to maintain a competitive workforce;

•adverse impact of impairment charges on our goodwill and other intangible assets;

•fluctuations and uncertainties related to doing business outside the United States;

•our ability to obtain and maintain required regulatory clearances or approvals may constrain the commercialization of submitted products;

•our ability to comply with environmental, health and safety laws and regulations, or the impact of any liability or obligation imposed under such laws or regulations;

•our indebtedness could adversely affect our financial condition and prevent us from fulfilling our debt or contractual obligations;

•our ability to generate sufficient cash flows or access sufficient additional capital to meet our debt obligations or to fund our other liquidity needs; and

•our ability to maintain an adequate system of internal control over financial reporting.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. In addition, all forward-looking statements speak only as of the date of this report. We undertake no obligations to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise other than as required under the federal securities laws.

v

PART I

Item 1. Business

Everything we do is tied to our mission of setting science in motion to create a better world. As a global life sciences leader, we keep life-changing science moving forward.

We are a leading global provider of mission-critical products and services to customers in the biopharma, healthcare, education & government, and advanced technologies & applied materials industries. Our business model is grounded in supporting our customers from breakthrough discovery to agile delivery and Avantor is embedded in virtually every stage of the most important research, scale-up and manufacturing activities in the industries we serve.

We serve as a one-stop shop, providing scientists all they need to conduct their research: materials & consumables, equipment & instrumentation and services & specialty procurement. Our customer-centric innovation model enables us to provide solutions for some of the most demanding applications, and we leverage our comprehensive offering and access to early-stage research to seek content and solutions that ultimately become specified into our customers’ approved production platforms. Our broad portfolio of products and services, fully integrated business model and world class supply chain enable us to support our customers’ journey every step of the way.

We have a number of distinctive capabilities that set Avantor apart from other companies in our space. For example, our global footprint offers extraordinary customer access, enabling us to serve more than 225,000 customer locations in more than 180 countries around the world.

Our 117-year legacy began in 1904 with the founding of the J.T. Baker Chemical Company. In 2010, we were acquired by New Mountain Capital from Covidien plc. Since then, we have expanded through a series of large acquisitions across the globe. In 2016, we merged with NuSil, a leading supplier of high-purity silicone products for the medical device and aerospace industries that was founded in 1985. In 2017, we acquired VWR, a global manufacturer and distributor of laboratory and production products and services founded in 1852 that now serves as our e-commerce platform for our customers. In June 2021, we acquired RIM Bio, a leading China-based manufacturer of single-use bioprocess bags and assemblies for biopharmaceutical manufacturing applications. That same month, we also acquired Ritter GmbH and its affiliates, a fast growing manufacturer of high-quality robotic and liquid handling consumables used in a variety of molecular screening and diagnostic applications. In November 2021, we acquired the Masterflex bioprocessing business of Antylia Scientific. Masterflex is a leading global manufacturer of peristaltic pumps and aseptic single-use fluid transfer technologies.

Avantor, Inc. was incorporated in Delaware in May 2017 in anticipation of the VWR acquisition. We completed our initial public offering through Avantor, Inc. and listed its shares on the New York Stock Exchange in May 2019.

1

Business segments

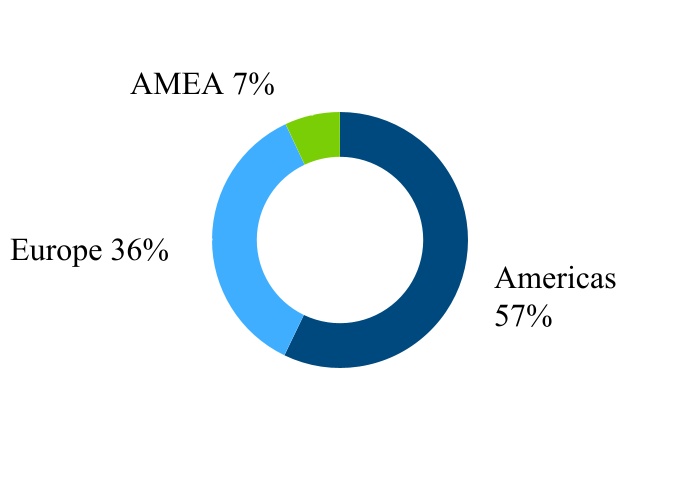

We report financial results in three geographic segments based on customer location: the Americas, Europe and AMEA. The following chart presents the approximate mix of net sales for each of those segments during 2021:

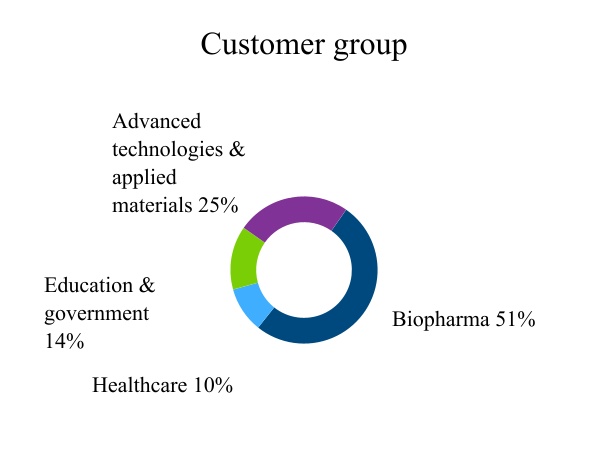

Within each of our geographic segments, we sell materials & consumables, equipment & instrumentation and services & specialty procurement to customers in the biopharma, healthcare, education & government and advanced technologies & applied materials industries. We work with customers across these sophisticated, science-driven industries that require innovation and adherence to the most demanding technical and regulatory requirements. The following charts present the approximate mix of net sales for each of these groups during 2021:

2

Products and services

Our portfolio includes a comprehensive range of products and services that allows us to create customized and integrated solutions for our customers. These products and services enable our customers to achieve precise analytical results in their research, diagnostic, and quality assurance and quality control activities. Approximately 85% of our net sales were from product and service offerings that we consider to be recurring in nature. Our products and services are as follows:

•Materials & consumables include ultra-high purity chemicals and reagents, lab products and supplies, highly specialized formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits and education and microbiology and clinical trial kits, peristaltic pumps and fluid handling tips. Some of these are proprietary products that we make while others are produced by third parties;

•Equipment & instrumentation include filtration systems, virus inactivation systems, incubators, analytical instruments, evaporators, ultra-low-temperature freezers, biological safety cabinets and critical environment supplies; and

•Services & specialty procurement include onsite lab and production, clinical, equipment, procurement and sourcing and biopharmaceutical material scale-up and development services.

In aggregate, we provide approximately six million products and services, including high value specialty products developed to exacting purity and performance specifications. Our proprietary brands have been specified and trusted for decades. Our e-commerce platform makes it easy for customers to do business with us and enables digital marketing efforts that position us to capture new demand. All of our capabilities are underpinned by our Avantor Business System which drives execution and continuous improvement. We manufacture products that meet or exceed the demanding requirements of our customers across a number of highly-regulated industries. Our high-purity and ultra-high purity products, such as our J.T.Baker brand chemicals, are trusted by life sciences and electronic materials customers around the world and can be manufactured at purity levels as stringent as one part-per-trillion. Similarly, our NuSil brand of high-purity, customized silicones has been trusted for more than thirty years by leading medical device manufacturers and aerospace companies.

Each day, our onsite service associates work side-by-side with our customers to support their workflows. Our traditional service offerings focus on the needs of laboratory scientists and include procurement, logistics, chemical and equipment tracking and glassware autoclaving. In addition, we offer more complex and value-added scientific research support services such as DNA extraction, bioreactor servicing, clinical and biorepository services and compound management. We deliver these services in part through over 1,600 associates who are co-located with customers, working side-by-side with their scientists every day.

Customers

We benefit from longstanding customer relationships, and approximately 38% of our 2021 net sales came from customers that have had relationships with us for 15 years or more. We also have a diverse customer base with no single end customer comprising more than 4% of net sales.

3

Suppliers

We sell proprietary products we make and third-party products sourced from a wide variety of product suppliers located across the globe. Our supplier relationships are based on contracts that vary in geographic scope, duration, product and service type, and some include exclusivity provisions. Those relationships may include distribution, sales and marketing support as well as servicing of instruments and equipment. Many of our supplier relationships have been in place for more than twenty years.

Sales channels

We reach our customers throughout the Americas, Europe and AMEA via a well-trained global sales force, comprehensive websites and targeted catalogs. Our sales force is comprised of approximately 3,700 sales and sales support professionals, including over 180 sales specialists selected for their in-depth industry and product knowledge. Our sales professionals include native speakers for each of the countries in which we operate, allowing us to have high impact interactions with our customers across the globe.

Our e-commerce platform plays a vital role in how we conduct business with our customers. In 2021, approximately 73% of our transactions came from our digital channels. Our websites utilize search analytics and feature personalized search tools, customer specific web solutions and enhanced data that optimize our customers’ online purchasing experience and better integrate our customers’ processes with our own. Our websites are designed to integrate acquisitions, drive geographical expansion and serve segmented market needs with ease.

Infrastructure

We have more than 200 facilities strategically located throughout the globe that include manufacturing, distribution, service, research & technology and sales centers.

We operate over 30 global manufacturing facilities, including 16 facilities that are cGMP compliant and 13 facilities that have been registered with the FDA or comparable foreign regulatory authorities. Our facilities are strategically located in North America, Europe and the AMEA region to facilitate supply chain efficiency and proximity to customers. Our manufacturing capabilities include: (i) an ability to quickly change specifications depending on customer needs; (ii) our flexible unit operations, which allow for production scalability, from laboratory pre-clinical development to large-volume commercialization; (iii) proprietary purification technologies designed to ensure lot-to-lot consistency through ultra-low impurity levels; (iv) rigorous analytical quality control testing; and (v) robust regulatory and quality control procedures. Our global network of distribution centers gives our customers security of supply and real-time flexibility, as we can reach the majority of them within 24 hours. We also have 12 innovation centers that enable extensive collaboration and customization, critical elements for serving highly regulated, specification-driven applications.

Information technology

We have a highly automated suite of ERP systems that promote standardization and provide business insight. Our global web infrastructure provides seamless integration with our customers and suppliers. These ERP platforms support rapid development and deployment of enhancements so that we may quickly adapt to meet the technology needs of our customers and seamlessly integrate new acquisitions. We have made significant investments to implement common ERP and online platforms that enhance the customer experience and employ network and data security architecture.

4

Competition

We operate in a highly competitive environment with a diverse and fragmented base of competitors, many of whom focus on specific regions, customers, and/or segments. We focus on service and delivery, breadth of product line, customization capabilities, price, customer support, online capabilities and the ability to meet the special and local needs of our customers.

Competition is driven not only by the product quality and purity across industries we serve, but also by the adaptability of the supplier as a developmental and commercial partner. We rely on our scale, expertise, deep customer access, depth of product and value-added service offerings, marketing strategies and sales force, acquisition strategy, financial profile and management team to deliver superior solutions to our customers and provide extensive market channel access to our suppliers.

Sustainability

Our responsibility to improve the world through science is not one that we take lightly. We are committed to measurable sustainability actions that will create a positive impact on the environment and society. Our Science for Goodness sustainability platform enhances our framework for creating long-term value by embedding sound environmental, social and governance practices into our business strategy. The platform also enables us to continually measure and report progress against four key commitment pillars. We have aligned our pillars with several of the United Nations Sustainable Development Goals where we believe we can have a positive impact for our business and stakeholders.

By providing sustainable products and services as well as transparent information and reporting, we also strive to support our customers in achieving their sustainability goals. Our sustainability is reflected in our people, the products we create, the transformative services we provide, and the integrity with which we serve our shareholders, business partners, suppliers, customers, and communities. We are deeply committed to our global sustainability efforts and keenly aware of the work ahead of us in this area.

Employees and human capital resources

Our success depends on our ability to attract, retain and motivate highly qualified and diverse talent. As of December 31, 2021, we had approximately 13,500 employees located in over 30 different countries in a variety of roles. Approximately 5,850 of our associates were employed in the United States, and the remainder were employed outside of the United States. We believe that our relations with our employees are good. As of December 31, 2021, approximately 6% of our employees in North America were represented by unions, and a majority of our employees in Europe were represented by workers’ councils or unions. We compete in the highly competitive life sciences industry. Attracting, developing and retaining talented people in technical, marketing, sales, research and other positions is crucial to executing our strategy and our ability to compete effectively. Our ability to recruit and retain such talent depends on a number of factors, including a positive work environment and culture, compensation and benefits, talent development and career growth and opportunities, and protecting the health, safety and well-being of our associates. To that end, we invest in our associates in order to be an employer of choice with limitless opportunity.

Avantor 2021 Workforce

Our associates reflect the communities in which we live and work, the customers we serve, and possess a broad range of thought and experiences that have helped Avantor achieve our goal of setting science in motion to create a better world.

5

People & culture

Our values give our associates a foundation for how we want to work together. Innovation, Customer-centricity, Accountability, Respect, and Excellence are the building blocks of our company culture and send a strong message to our associates, customers, suppliers, stockholders and communities: ICARE. In addition, our executive leaders serve as sponsors of our associate-centric teams (ACTs) in support of our diversity and inclusion initiatives. ACTs are employee resource groups that bring associates together and foster inclusion based on common interests, backgrounds and characteristics.

Compensation and benefits

We are committed to rewarding, supporting and developing the associates who make it possible to deliver on our strategy. To that end, we offer a comprehensive total rewards program aimed at the varying health, home-life and financial needs of our diverse and global associates. Our total rewards package includes market-competitive pay, broad-based stock grants and bonuses, healthcare benefits, retirement savings plans, an employee stock purchase plan, paid time off and family leave, flexible work schedules, access to wellness programs, free physicals and flu vaccinations, and an Employee Assistance Program and other mental health services.

Growth and development

We invest significant resources to develop talent with the right capabilities to deliver the growth and innovation needed to support our strategy. We offer associates and their managers a number of tools to help in their personal and professional development, including career development plans, mentoring programs and in-house learning opportunities. These programs are underpinned by the Avantor Business System, which drives excellence in people, processes and problem solving. These consistent lean leadership practices empower associates to continuously improve and add value to our operations and customer solutions. We have aligned our performance management system through which 100% of our associates receive annual performance reviews, to support our culture of feedback to increase the focus on continuous learning and development.

Health, safety and well-being

We are committed to protecting the health, safety and well-being of our associates. Our approach involves environment, health and safety professionals and process engineers who identify risks and implement behavioral solutions to prevent accidents before they occur. A robust auditing program is in place at every facility to ensure that we measure performance and drive continuous improvement. Our core areas of focus include compliance with regulatory and international requirements, active monitoring of regulatory agencies for changing requirements, partnering with operational leaders to meet Environment, Health & Safety (EH&S) requirements, and promoting effective communication throughout the organization.

Impact of COVID-19

The evolving COVID-19 pandemic had a significant impact on our human capital management in 2021, and we continued to be vigilant in our response by following precautionary safety guidance from credible health agencies such as the World Health Organization (WHO), Centers for Disease Control and Prevention (CDC) and European Centre for Disease Prevention and Control (ECDC). A majority of our workforce worked remotely during some portion of the year. In our facilities where essential workers continued to work on-site, we continued or enhanced safety protocols and procedures to mitigate the spread of COVID-19. In addition, we offered associates a number of expanded benefits, including

6

providing up to 10 additional days of paid time off if required to quarantine or otherwise experiencing symptoms of COVID-19, expanding access to no cost individual counseling sessions and virtual support groups under our employee assistance programs, hosting virtual wellness events and waiving telemedicine co-pays for all visits in 2021. Despite the effects of the pandemic, the size of our workforce remained steady in 2021 and we were able to avert employee layoffs related to the pandemic.

Intellectual property

We rely on intellectual property rights, nondisclosure and other contractual provisions and technical measures to protect our offerings, services and intangible assets. Much of our intellectual property is know-how and asset configurations that we treat as trade secrets. These proprietary rights are important to our ongoing operations. In some instances, we may license our technology to third parties or may elect to license intellectual property from others. We have applied in the United States and certain foreign countries for registration of a number of trademarks, service marks and patents, some of which have been registered and issued. We also hold common law rights in various trademarks and service marks. Other than our Avantor, VWR, J.T.Baker, NuSil and Masterflex trademarks, we do not consider any particular patent, trademark, license, franchise or concession to be material to our overall business.

Seasonality

Our business is not seasonal, but some of our proprietary products have exhibited cyclical customer demand in prior periods. We believe that this is caused by factors unique to those particular product markets such as customer manufacturing schedules, inventory levels in the supply chain and government approval processes. As a result, we may see fluctuations across periods as the timing of our customers’ demand for these products may change.

Government contracts

We conduct business with various government agencies and government contractors. As such, we are subject to certain laws and regulations applicable to companies doing business with the government, as well as with those concerning government contracts. Failure to address or comply with these laws and regulations could harm our business by leading to a renegotiation of profits or termination of the contract at the election of the government agency. We believe we are in compliance in all material respects with such laws and regulations, and no government contract is of such a magnitude as to have a material adverse effect on our financial results.

Government regulation

Our facilities that engage in the manufacturing, packaging, distribution and other biopharmaceutical and biomaterials product lines, as well as many of our products themselves, are subject to extensive ongoing regulation by U.S. governmental authorities, the EMA and other global regulatory authorities. Certain of our subsidiaries are required to register with these agencies, or to apply for permits and/or licenses with, and must comply with the operating, cGMP, quality and security standards of applicable domestic and foreign regulators, including the FDA, the DEA, the Bureau of Alcohol, Tobacco, Firearms and Explosives, DHHS, the equivalent agencies of European Union member states, and comparable foreign, state and local agencies, as well as various accrediting bodies, each depending upon the type of operation and the locations of storage or sale of the products manufactured or services provided by those subsidiaries in the event of noncompliance.

7

In order to maintain certain certifications of quality and safety standards for our manufacturing facilities and operations, we must comply with numerous regulatory systems, standards, guidance and other requirements, as appropriate, including, but not limited to, ICH Q7, the guidelines of the International Pharmaceutical Excipients Council, European in vitro diagnostic medical device directives, United States Pharmacopeia / National Formulary, as well as the European, British, Japanese, Indian and Chinese Pharmacopeia, the Food Chemicals Codex and controlled substances regulations.

In addition, our operations, and some of the products we offer, are subject to a number of complex and stringent laws and regulations governing the production, handling, transportation and distribution of chemicals, drugs and other similar products. We are subject to various federal, state, local, foreign and transnational laws, regulations and recommendations, both in the United States and abroad, relating to safe working conditions, good laboratory and distribution practices, and the safe and proper use, transportation and disposal of hazardous or potentially hazardous substances. In addition, U.S. and international import and export laws and regulations, including those enforced by the U.S. Departments of Commerce, State and Treasury, OFAC and BIS, require us to abide by certain standards relating to the cross-border transit of finished goods, raw materials and supplies and the handling of related information. Our logistics activities must comply with the rules and regulations of the Department of Transportation, Department of Homeland Security, Department of Commerce, Department of Defense, and the Federal Aviation Administration and similar foreign agencies. We are also subject to various other laws and regulations concerning the conduct of our foreign operations, including the FCPA and other anti-bribery laws as well as laws pertaining to the accuracy of our internal books and records.

The costs associated with complying with the various applicable federal, state, local, foreign and transnational regulations could be significant, and the failure to comply with such legal requirements could have an adverse effect on our reputation, results of operations and financial condition. See Item 1A, “Risk factors—Risks related to regulation.” We are subject to audits by the FDA and other similar foreign regulatory bodies. To date, we have had no instances of noncompliance that have had a material impact on our operations.

In addition to the regulations described above, as part of our aerospace and military offerings, we are registered with the DDTC as a manufacturer and exporter of goods controlled by ITAR, and we are subject to strict export control and prior approval requirements related to these goods. In connection with our NuSil brand products, we have one ITAR site registration and one ITAR product registration, and we maintain control systems which enable ITAR compliance. With respect to our electronics materials products, we adhere to applicable industry guidelines which set stringent quality criteria for our products, and we are subject to import and export regulations and other restrictions regarding the safe use of these products as well.

Environmental matters

We are subject to various laws and governmental regulations concerning environmental, safety and health matters, including employee safety and health, in the United States and other countries. U.S. federal environmental legislation that affects us includes the Toxic Substances Control Act, the Resource Conservation and Recovery Act, the Clean Air Act, the Clean Water Act, the Safe Drinking Water Act, and CERCLA. These laws and regulations govern, among other things, air emissions, wastewater discharges, the use, handling and disposal of hazardous substances and wastes, soil and groundwater contamination and the general health and safety of our associates and the communities in which we operate. We are also subject to regulation by OSHA concerning employee safety and health matters. The

8

EPA, OSHA, and other federal and foreign or local agencies have the authority to promulgate regulations that may impact our operations.

Under CERCLA, and analogous statutes in local and foreign jurisdictions, current and former owners and operators of contaminated land are strictly liable for the investigation and remediation of the land and for natural resource damages that may result from releases of hazardous substances at or from the property. Liability under CERCLA and analogous laws is strict, unlimited, joint, several, retroactive, may be imposed regardless of fault and may relate to historical activities or contamination not caused by the current owner or operator. It is possible that facilities that we acquire or have acquired may expose us to environmental liabilities associated with historical site conditions that have not yet been discovered.

In addition to the federal environmental laws that govern our operations, various states have been delegated certain authority under the aforementioned federal statutes as well as having authority over these matters under state laws. Many state and local governments have adopted environmental and employee safety and health laws and regulations, some of which are similar to federal requirements.

A number of our operations involve, in varying degrees, the handling, manufacturing, use or sale of substances that are or could be classified as toxic or hazardous materials within the meaning of applicable laws. Consequently, some risk of environmental harm is inherent in our operations and products, as it is with other companies engaged in similar businesses. For additional information about environmental matters, see note 13 to our audited financial statements beginning on page F-1 of this report.

Available information

We file or furnish annual, quarterly and current reports, proxy statements and other documents with or to the SEC. The public can obtain any documents that we file with or furnish to the SEC at www.sec.gov.

You may also access our press releases, financial information and reports filed with or furnished to the SEC through our own website at www.avantorsciences.com. Copies of any documents on our website may be obtained free of charge, and reports filed with or furnished to the SEC will be available as soon as reasonably practicable after they are filed with or furnished to the SEC. The information found on our website is not part of this or any other report filed with or furnished to the SEC.

Item 1A. Risk factors

Risks related to our business and our industry

The COVID-19 pandemic has adversely impacted, and continues to pose risks to, our business, operating results, cash flows and/or financial condition, the nature and extent of which could be material.

The COVID-19 pandemic has adversely affected global economies, financial markets and the overall environment in which we do business, and the extent to which it may impact our future results of operations and overall financial performance remains uncertain. Many countries including the United States implemented measures such as quarantine, shelter-in-place, curfew, travel and activity restrictions and similar isolation measures, including government orders and other restrictions on the conduct of business operations. These measures resulted in significant and unpredictable reductions or increases in demand for certain of our offerings. We experienced, and may again experience, a decline in sales activities and customer orders in certain elements of our businesses, including our education & government and healthcare customer groups. The COVID-19 pandemic has also impacted our supply

9

chain as we experienced disruptions or delays in shipments of certain raw materials used in the products we manufacture and in the finished goods that we sell globally. It is uncertain how materially COVID-19 will affect our global operations generally if these impacts persist, worsen or re-emerge over an extended period of time. Moreover, any actions we take in response to any improvements in conditions may also vary widely by geography and by business and will likely be made with incomplete information; pose the risk that such actions may prove to be premature, incorrect or insufficient; and could have a material, adverse impact on our business, operating results, cash flows and/or financial condition.

Further, in connection with the global outbreak and spread of COVID-19 and in an effort to increase the wider availability of needed medical and other supplies and products, we have been required to allocate certain products (for example pursuant to the U.S. Defense Production Act) in a way that adversely affects our regular operations and financial results, results in differential treatment of customers and/or adversely affects our reputation and customer relationships.

Due to changes in COVID-19 infection rates regionally, nationally and globally, rapidly changing governmental directives, public health challenges and economic disruption and the duration of the foregoing, the potential impact that COVID-19 could have on the other Risk Factors described in this “Risk Factors” section remains unclear.

We refer you to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” for a more detailed discussion of the potential impact of the COVID-19 pandemic and associated economic disruptions, and the actual operational and financial impacts that we have experienced to date.

Significant interruptions in our operations could harm our business, financial condition and results of operations.

Manufacturing, distribution, service and logistics problems can and do arise, and any such problems could have a significant impact on our operating results. Accordingly, any significant disruptions to the operations of our manufacturing or distribution centers or logistics providers for any reason, including labor relations issues, power interruptions, severe weather, fire or other circumstances beyond our control could cause our operating expenses to increase without coverage or compensation or seriously harm our ability to fulfill our customers’ orders or deliver products on a timely basis, or both. We must also maintain sufficient production capacity in order to meet anticipated customer demand, which carries fixed costs that we may not be able to offset if orders slow, which would adversely affect our operating margins. If we are unable to manufacture our products consistently, in sufficient quantities, and on a timely basis, our net sales, gross margins and our other operating results will be materially and adversely affected. Prompt shipment of our products is also very important to our business. We have experienced problems, both as a result of the COVID-19 pandemic and otherwise with or delays in, our production, shipping and logistics capabilities that resulted in delays in our ability to ship finished products, and there can be no assurance that we will not encounter such problems in the future. If we experience significant delays in our manufacturing, shipping or logistics processes, we could damage our customer relationships, cause disruption to our customers and adversely affect our business, financial condition and operating results.

10

We compete in highly competitive markets. Failure to compete successfully could adversely affect our business, financial condition and results of operations.

We face competition across our products and the markets in which we operate. We compete on several fronts, both domestically and internationally, including competing with other companies that provide similar offerings. Competition is driven by proprietary technologies and know-how, capabilities, consistency of operational performance, quality, supply chain control, price, value and speed. Our competitors range from regional companies, which may be able to more quickly respond to customers’ needs because of geographic proximity, to large multinational companies, which may have greater financial, marketing, operational and research and development resources than we do. Such greater resources may allow our competitors to respond more quickly with new, alternative or emerging technologies.

In addition, consolidation trends in the biopharma and healthcare industries have served to create fewer customer accounts and to concentrate purchasing decisions for some customers, resulting in increased pricing pressures. The entry into the market by manufacturers in low-cost manufacturing locations also creates increased pricing and competitive pressures, particularly in developing markets, which may impede our goal to grow in those markets. Failure to anticipate and respond to competitors’ actions may adversely affect our results of operations and financial condition.

It may be difficult for us to implement our strategies for improving growth.

We plan to continue expanding our commercial sales operations and scope and complexity of our business both domestically and internationally, while maintaining our commercial operations and administrative activities. For example, we intend to pursue the following growth strategies: (i) increase integration of our products and services into customers’ workflows; (ii) develop new products and services; (iii) expand in geographies expected to have outsized growth; (iv) continue to enhance our global online platform; (v) increase commercial excellence and operational efficiency to drive margin expansion; and (vi) pursue strategic acquisitions to expand our platform. However, our ability to manage our business and conduct our global operations while also pursuing the aforementioned growth strategies requires considerable management attention and resources and is subject to the challenges of supporting a rapidly growing business in an environment of multiple languages, cultures and customs, legal and regulatory systems, alternative dispute systems and commercial markets.

Our failure to implement these strategies in a cost-effective and timely manner could have an adverse effect on our business, results of operations and financial condition.

Part of our growth strategy is to pursue strategic acquisitions, which will subject us to a variety of risks that could harm our business.

As part of our business strategy, we intend to continue to review, pursue and complete selective acquisition opportunities. There can be no assurances that we will be able to complete suitable acquisitions for a variety of reasons, including the identification of, and competition for, acquisition targets, the need for regulatory approvals, the inability of the parties to agree to the structure or purchase price of the transaction and the inability to finance the transaction on commercially acceptable terms. In addition, any completed acquisition will subject us to a variety of other risks, including:

•acquisitions may have an adverse effect on our business relationships with existing or future suppliers and other business partners, in particular, to the extent we consummate acquisitions that vertically integrate portions of our business;

11

•we may assume substantial actual or contingent liabilities, known and unknown, including environmental liabilities;

•acquisitions may not meet our expectations of future financial performance;

•we may experience delays or reductions in realizing expected synergies;

•we may incur substantial unanticipated costs or encounter other problems associated with acquired businesses or devote time and capital investigating a potential acquisition and not complete the transaction;

•we may be unable to achieve our intended objectives for the transaction; and

•we may not be able to retain the key personnel, customers and suppliers of the acquired business.

These factors related to our acquisition strategy, among others, could have an adverse effect on our business, financial condition and results of operations.

The customers we serve have and will continue to experience significant industry-related changes that could adversely affect our business.

Many of the customers we serve have experienced significant industry-related changes in the last several years and are expected to continue to experience significant changes, including reductions in governmental payments for biopharmaceutical products, expirations of significant patents, adverse changes in legislation or regulations regarding the delivery or pricing of general healthcare services or mandated benefits, and increased requirements on quality. General industry changes include:

•development of large and sophisticated group purchasing organizations and on-line auction sites that increase competition for, and reduce spending on, laboratory products;

•consolidation of biopharmaceutical companies resulting in a rationalization of research expenditures;

•increased regulatory scrutiny over drug production requiring safer raw materials;

•customers’ purchasing the products that we supply directly from our suppliers; and

•significant reductions in development and production activities.

Some of our customers have implemented, or may in the future implement, certain measures described above in an effort to control and reduce costs. The ability of our customers to develop new products to replace sales decreases attributable to expirations of significant patents, along with the impact of other past or potential future changes in the industries we serve, may result in our customers significantly reducing their purchases of products from us or the prices they are willing to pay for those products. While we believe we are able to adapt our business to maintain existing customer relationships and develop new customer relationships, if we are unsuccessful or untimely in these efforts, our results of operations may suffer.

12

Our offerings are highly complex, and, if our products do not satisfy applicable quality criteria, specifications and performance standards, we could experience lost sales, delayed or reduced market acceptance of our products, increased costs and damage to our reputation.

The high-purity materials and customized solutions we offer are highly exacting and complex due to demanding customer specifications and stringent regulatory and industry requirements. Our operating results depend on our ability to execute and, when necessary, improve our global quality control systems, including our ability to effectively train and maintain our employees with respect to quality control. A failure of our global quality control systems could result in problems with facility operations or preparation or provision of defective or non-compliant products. Nearly all of our products are subsequently incorporated into products sold to end users by our customers, and we have no control over the manufacture and production of such products.

Our success depends on our customers’ confidence that we can provide reliable, high-quality products. We believe that customers in our target markets are likely to be particularly sensitive to product defects and errors. Our reputation and the public image of our products and technologies may be impaired if our products fail to perform as expected or fail to meet applicable quality criteria, specifications or performance standards. If our products experience, or are perceived to experience, a material defect or error, this could result in loss or delay of net sales, damaged reputation, diversion of development resources, and increased insurance or warranty costs, any of which could harm our business.

The loss of a significant number of customers or a reduction in orders from a significant number of customers could reduce our net sales and harm our operating results.

Our operating results could be negatively affected by the loss of revenue from a significant number of our customers, including direct distributors and end users. Though we often include pricing and volume incentives in our contracts, our customers are generally not obligated to purchase any fixed quantities of products, and they may stop placing orders with us at any time. If a significant number of customers purchase fewer of our products, defer orders or fail to place additional orders with us, our sales could decline, and our operating results may not meet our expectations. In addition, if those customers order our products, but fail to pay on time or at all, our liquidity and operating results could be adversely affected.

Our contracts generally do not contain minimum purchase requirements, and we sell primarily on a purchase order basis. Therefore, our sales are subject to changes in demand from our customers, and these changes have been material in the past. The level and timing of orders placed by our customers vary for a number of reasons, including individual customer strategies, the introduction of new technologies, the desire of our clients to reduce their exposure to any single supplier and general economic conditions. If we are unable to anticipate and respond to the demands of our clients, we may lose clients because we have an inadequate supply of raw materials with which to manufacture our products or insufficient capacity in our sites. Alternatively, we may have excess inventory or excess capacity. Either of these factors may have a material adverse effect on our business, financial position and operating results.

We are subject to risks associated with doing business globally, which may harm our business.

We have global operations and derive a portion of our net sales from customers outside of the United States. Accordingly, our international operations or those of our international customers could be substantially affected by a number of risks arising from operating an international business, including:

•limitations on repatriation of earnings;

13

•taxes on imports;

•the possibility that unfriendly nations or groups could boycott our products;

•general economic and political conditions in the markets where we operate;

•foreign currency exchange rate fluctuations;

•potential changes in diplomatic and trade relationships, such as the United Kingdom’s exit from the European Union;

•potential increased costs associated with overlapping tax structures;

•potential increased reliance on third parties within less developed markets;

•potential trade restrictions, tariffs and exchange controls;

•more limited protection for intellectual property rights in some countries;

•difficulties and costs associated with staffing and managing foreign operations;

•unexpected changes in regulatory requirements;

•difficulties in complying with a wide variety of foreign laws and regulations;

•the risk that certain governments may adopt regulations or take other actions that would have a direct adverse impact on our business and market opportunities, including nationalization of private enterprise;

•violations of anti-bribery and anti-corruption laws, such as the FCPA;

•violations of economic sanctions laws, such as the regulations enforced by OFAC;

•longer accounts receivable cycles in certain foreign countries, whether due to cultural differences, exchange rate fluctuation or other factors;

•the credit risk of local customers and distributors;

•limitations on our ability to enforce legal rights and remedies with third parties or partners outside of the United States;

•import and export licensing requirements and other restrictions, such as those imposed by OFAC, BIS, DDTC and comparable regulatory agencies and policies of foreign governments; and

•changes to our distribution networks.

Changes in exchange rates can adversely affect our net sales, profits and cash flows.

A substantial amount of our revenues are derived from international operations, and we anticipate that a significant portion of our sales will continue to come from outside of the United States. in the future. The

14

revenues we report with respect to our operations outside of the United States may be adversely affected by fluctuations in foreign currency exchange rates.

Further, we have a substantial amount of Euro denominated indebtedness. Fluctuations in the exchange rate between U.S. dollars and Euros may have a material adverse effect on our ability to repay such indebtedness. See Item 7A. “Quantitative and qualitative disclosures about market risk.”

Our business depends on our ability to use and access information systems, and any failure to successfully maintain these systems or implement new systems to handle our changing needs could materially harm our operations.

We depend on standardized procedures and multiple information systems, including our online customer portal and distribution and enterprise resource systems, for our operations, customer service and quality and safety procedures. Furthermore, we rely on information technology systems to process, transmit, store and protect electronic information, including confidential customer, supplier, employee or other business information. Through our online customer portal, we collect and store confidential information that customers provide in order to, among other things, purchase products and services and register on our website.

We utilize commercially available third-party technology solutions, software and software systems with some proprietary configurations. We also store data using third-party cloud services. Our information systems are subject to damage or interruption from power outages, computer and telecommunications failures, computer viruses, security breaches, vandalism, catastrophic events, natural disasters, terrorist attacks, hackers and other security issues as well as human error. If our information systems are damaged, fail to work properly or otherwise become unavailable, we may incur substantial costs to repair or replace them, and we may experience a loss of critical information, customer disruption and interruptions or delays in our ability to perform essential functions and implement new and innovative services. A compromise of our information systems or those with which we interact could harm our reputation and expose us to regulatory actions and claims from customers and other persons, any of which could adversely affect our business, financial position and results of operations.

The GDPR, which went into effect in the EU on May 25, 2018, applies to the collection, use, retention, security, processing, and transfer of personally identifiable information of residents of countries in the European Economic Area. The GDPR created a range of new compliance obligations and imposes significant fines and sanctions for violations.

Any failure, or perceived failure, by us to comply with the GDPR, or with any applicable regulatory requirements or orders, including but not limited to privacy, data protection, information security, or consumer protection-related privacy laws and regulations, in one or more jurisdictions within the EU or elsewhere, could: result in proceedings or actions against us by governmental entities or individuals; subject us to significant fines, penalties, and/or judgments; require us to change our business practices; limit access to our products and services in certain countries, incur substantial costs (even if we ultimately prevail) or otherwise adversely affect our business.

Our inability to protect our intellectual property could adversely affect our business. In addition, third parties may claim that we infringe their intellectual property, and we could suffer significant litigation or licensing expenses as a result.

We rely on a variety of intellectual property rights, including patents, trademarks, copyrights and trade secrets, to protect our proprietary technology and products. We place considerable emphasis on obtaining

15

patent or maintaining trade secret protection for significant new technologies, products and processes because of the length of time and expense associated with bringing new products and processes through development and to the market.

We may need to spend significant resources monitoring and enforcing our intellectual property rights and we may not be able to prove infringement by third parties. Our competitive position may be harmed if we cannot enforce our intellectual property rights. In some circumstances, we may choose to not pursue enforcement for business reasons. In addition, competitors might avoid infringement by designing around our intellectual property rights or by developing non-infringing competing technologies. Intellectual property rights and our ability to enforce them may be unavailable or limited in some countries, which could make it easier for competitors to capture market share and could result in lost revenues.

Our trademarks are valuable assets and if we are unable to protect them from infringement, our business prospects may be harmed.

Our brands, particularly our J.T.Baker, NuSil, VWR and Masterflex brands, are valuable assets. Therefore, we actively manage our trademark portfolio, including by maintaining registrations for long-standing trademarks and applying to obtain trademark registrations for new brands. We also police our trademark portfolio against infringement. Our efforts to protect and defend our trademarks may fall short or be unsuccessful against competitors or other third parties for a variety of reasons. To the extent that third parties or distributors sell products that are counterfeit versions of our branded products, our customers could inadvertently purchase products that are inferior. This could cause our customers to refrain from purchasing our brands in the future and in turn could impair our brand equity and adversely affect our sales.

We are subject to product liability and other claims in the ordinary course of business.

Our business involves risk of product liability, intellectual property claims and other claims in the ordinary course of business arising from the products that we source from various manufacturers or produce ourselves. Furthermore, there may be product liability risks that are unknown or which become known in the future. Substantial, complex or extended litigation on any claim could cause us to incur significant costs and distract our management. We maintain insurance policies and in some cases, our suppliers, customers and predecessors of acquired companies have indemnified us against certain claims. We cannot assure you that our insurance coverage or indemnification agreements will be available in all pending or any future cases brought against us. Accordingly, we could be subject to uninsured and unindemnified future liabilities requiring us to provide additional reserves to address such liabilities. An unfavorable result in a case for which adequate insurance or indemnification is not available could adversely affect our business, financial condition and results of operations.

We must develop new products, adapt to rapid and significant technological change and respond to introductions of new products by competitors to remain competitive.

We sell our products in industries that are characterized by significant technological changes, frequent new product and technology introductions and enhancements and evolving industry standards. As a result, our customers’ needs are rapidly evolving. If we do not appropriately innovate and invest in new technologies, our offerings may become less desirable in the markets we serve, and our customers could move to new technologies offered by our competitors or make products themselves. Without the timely introduction of new products, services and enhancements, our offerings will likely become less competitive over time, in which case, our competitive position, net sales and operating results could

16

suffer. Accordingly, we focus significant efforts and resources on the development and identification of new technologies, products and services that are attractive to, and gain acceptance, in the markets we serve and further broaden our offerings. To the extent we fail to timely introduce new and innovative products or services, adequately predict our customers’ needs or fail to obtain desired levels of market acceptance, our business may suffer.

Our business, financial condition and results of operations depend upon the availability of raw materials.

Our operations depend upon our ability to obtain high-quality raw materials meeting our specifications and other requirements at reasonable prices, including various active pharmaceutical ingredients, components, compounds, excipients and other raw materials, many of which are sole-sourced due to market or customer demands. Our ability to maintain an adequate supply of such materials and components could be impacted by the availability and price of those raw materials and maintaining relationships with key suppliers.

Moreover, we are dependent upon the ability of our suppliers to provide materials and components that meet our specifications, quality standards, other applicable criteria, and delivery schedules. Our suppliers’ failure to provide expected raw materials or components that meet such criteria could adversely affect production schedules and contract profitability.

Our business, financial condition and results of operations depend upon maintaining our relationships with suppliers.

We offer products from a wide range of suppliers. While there is generally more than one source of supply for most of the categories of third-party materials & consumables and equipment & instrumentation that we sell, we currently do not manufacture the majority of our products and are dependent on these suppliers for access to those products.

Our ability to sustain our gross margins has been, and will continue to be, dependent in part upon our ability to obtain favorable terms from our suppliers. These terms may change from time to time, and such changes could adversely affect our gross margins over time. In addition, our results of operations and cash flows could be adversely impacted by the acceleration of payment terms to our suppliers and/or the imposition of more restrictive credit terms and other contractual requirements.

Our use of chemicals and chemical processes is subject to inherent risk.

We use chemical ingredients in the manufacture of certain of our products. Due to the nature of the manufacturing process itself, there is a risk of incurring liability for damages caused by or during the storage or manufacture of both the chemical ingredients and the finished products. The processes used in certain of our facilities typically involve large volumes of solvents and chemicals, creating the potential for fires, spills and other safety or environmental impacts. If any of these risks materialize, it could result in significant remediation and other costs, potential adverse regulatory actions and liabilities, any of which could have an adverse effect on our business, results of operations and financial condition.

In addition, the manufacturing, use, storage, and distribution of chemicals are subject to threats including terrorism. We have several high-risk chemical facilities that possess materials that could be stolen and used to make weapons. We could also be subject to an attack on our high-risk facilities that could cause a significant number of deaths and injuries. As a result, many people, including our employees, could be harmed. Such an occurrence could also harm the environment, our reputation and disrupt our operations.

17

We are highly dependent on our senior management and key employees.

Our success depends on our ability to attract, motivate and retain highly qualified individuals. Competition for senior management and other key personnel in our industry is intense, and the pool of suitable candidates is limited. The failure to attract, retain and properly motivate members of our senior management team and other key employees, or to find suitable replacements for them in the event of death, illness or their desire to pursue other professional opportunities, could have a negative effect on our operating results.

Changes in tax law relating to multinational corporations could adversely affect our tax position.

The U.S. Congress, government agencies in non-U.S. jurisdictions where we and our affiliates do business, and the Organisation for Economic Cooperation and Development, or OECD, continue to focus on issues related to the taxation of multinational corporations. One example is in the area of “base erosion and profit shifting,” where profits are claimed to be earned for tax purposes in low-tax jurisdictions, or payments are made between affiliates from a jurisdiction with high tax rates to a jurisdiction with lower tax rates. The OECD has released several components of its comprehensive plan to create an agreed set of international rules for addressing base erosion and profit shifting.

Due to the potential for changes to tax laws and regulations or changes to the interpretation thereof, the ambiguity of tax laws and regulations, the subjectivity of factual interpretations, the complexity of our intercompany arrangements, uncertainties regarding the geographic mix of earnings in any particular period, and other factors, our estimates of effective tax rate and income tax assets and liabilities may be incorrect and our financial statements could be adversely affected. The impact of the factors referenced in the first sentence of this paragraph may be substantially different from period-to-period.

Certain of our businesses rely on relationships with collaborative partners and other third parties for development, supply and marketing of certain products and potential products, and such collaborative partners or other third parties could fail to perform sufficiently.

We believe that for certain of our businesses, success in penetrating target markets depends in part on their ability to develop and maintain collaborative relationships with other companies. Relying on collaborative relationships is risky because, among other things, our collaborative partners may (i) not devote sufficient resources to the success of our collaborations; (ii) fail to obtain regulatory approvals necessary to continue the collaborations in a timely manner; (iii) be acquired by other companies and terminate our collaborative partnership or become insolvent; (iv) compete with us; (v) disagree with us on key details of the collaborative relationship; (vi) have insufficient capital resources; and (vii) decline to renew existing collaborations on acceptable terms. Because these and other factors may be beyond our control, the development or commercialization of our products involved in collaborative partnerships may be delayed or otherwise adversely affected. If we or any of our collaborative partners terminate a collaborative arrangement, we may be required to devote additional resources to product development and commercialization or we may need to cancel some development programs, which could adversely affect our business and financial statements.

18

Risks related to regulation

We are required to comply with a wide variety of laws and regulations, and are subject to regulation by various federal, state and foreign agencies, and our failure to comply with existing and future regulatory requirements could adversely affect our results of operations and financial condition.

We compete in markets in which we and our customers are subject to federal, state, local, international and transnational laws and regulations, including the operating, quality and security standards of the FDA, various state health departments, the DHHS, similar bodies of the EU and its member states and other comparable agencies around the world, and, in the future, any changes to such laws and regulations could adversely affect us. We develop, configure and market our products to meet customer needs driven by those regulations. Among other rules affecting us, we are subject to laws and regulations concerning cGMP and product safety. Our subsidiaries may be required to register for permits and/or licenses with, and may be required to comply with, the laws and regulations of the FDA, the DHHS, the DEA, foreign agencies including the EMA, and other various state health departments and/or comparable state and foreign agencies as well as certain accrediting bodies depending upon the types of operations and locations of distribution and sale of the products manufactured or services provided by those subsidiaries. Any significant change in regulations could reduce demand for our products or increase our expenses. For example, many of our products are marketed to the biopharma industry for use in discovering, developing and manufacturing drugs, or are sold as raw materials or components to drug device manufacturers or for use in the manufacture of implantable devices. Changes in the domestic or foreign regulation of drug discovery, development or manufacturing processes or medical device manufacturing processes, or adverse findings concerning any health effects associated with these products, could have an adverse effect on the demand for these products and could also result in legal liability and claims.

We are also registered with the DDTC, as a manufacturer and exporter of goods controlled by ITAR, and we are subject to strict export control and prior approval requirements related to these goods. Our failure to comply with ITAR and other export control laws and regulations, as well as economic sanctions, could result in penalties, loss, or suspension of contracts or other consequences. Any of these could adversely affect our operations and financial condition. Failure by us or by our customers to meet one or more of these various regulatory obligations could have adverse consequences in the event of material non-compliance. Compliance with relevant sanctions and export control laws could restrict our access to, and increase the cost of obtaining, certain products and at times could interrupt our supply of imported inventory or our ability to service certain customers. Conversely, compliance with these regulatory obligations may require us to incur significant expenses.

In addition, certain of our facilities are certified to ISO, including ISO 13485, ISO 9001, AS9100, ISO 22000 and/or ISO 14001. These standards are voluntary quality management system standards, the maintenance of which indicates to customers certain quality and operational norms. Customers may rely on contractual assurances that we make with respect to ISO certificates to transact business. Failure to comply with these ISO standards can lead to observations of non-compliance or even suspension of ISO or Aerospace Standard (AS) certifications or European Community (EC) Declarations of Conformity Certificates by the registrar. If we were to lose ISO or AS certifications or EC Declarations of Conformity, we could lose sales and customers to competitors or other suppliers. We are also subject to periodic inspections or audits by our customers. If these audits or inspections identify issues or the customer perceives there are issues, the customer may decide to cease purchasing products from us which could adversely affect our business.

19

We are subject to environmental, health and safety laws and regulations, and costs to comply with such laws and regulations, or any liability or obligation imposed under such laws or regulations, could negatively impact our business, financial condition and results of operations.