Integra Resources Corp.

Management's Discussion and Analysis

For the Three and Six-Month Periods Ended

June 30, 2021 and 2020

Expressed in Canadian Dollars

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

This portion of this quarterly report provides Management's Discussion and Analysis ("MD&A") of the financial condition and results of operations, to enable a reader to assess material changes in financial condition and results of operations as at, and for the three and six-month periods ended June 30, 2021, in comparison to the corresponding prior-year periods. The MD&A is intended to help the reader understand Integra Resources Corp. ("Integra", "we", "our" or the "Company"), our operations, financial performance, and present and future business environment.

This MD&A has been prepared by management as at August 10, 2021 and should be read in conjunction with the unaudited interim condensed consolidated financial statements of Integra for the three and six-month periods ended June 30, 2021 and 2020 and the Company's audited consolidated financial statements of Integra for the years ended December 31, 2020 and 2019 prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board (the "IASB"). Further information on the Company can be found on SEDAR at www.sedar.com and the Company's website, www.integraresources.com.

For the purposes of preparing our MD&A, we consider the materiality of information. Information is considered material if: (i) such information results in, or would reasonably be expected to result in, a significant change in the market price or value of our shares; or (ii) there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision; or (iii) it would significantly alter the total mix of information available to investors. We evaluate materiality with reference to all relevant circumstances, including potential market sensitivity.

CORPORATE SUMMARYIntegra Resources Corp. is a mineral resources company engaged in the acquisition, exploration, and development of mineral properties in the Americas. The primary focus of the Company is advancement of its DeLamar gold and silver project ("DeLamar Project"), consisting of the neighboring DeLamar Deposit and Florida Mountain Deposit ("Florida Mtn" or "Florida Mountain") in the heart of the historic Owyhee County mining district in south western Idaho. The management team comprises the former executive team from Integra Gold Corp. The Company announced in September 2019 a positive Preliminary Economic Assessment ("PEA") and expects completing a Pre-Feasibility Study ("PFS") in late 2021.

As of August 10, 2021, the officers and directors of the Company were:

George Salamis President, Director and CEO

Andrée St-Germain Chief Financial Officer

Max Baker Vice President Exploration

Timothy Arnold Chief Operating Officer

Joshua Serfass Executive VP, Corporate Development and Investor Relations

Leanne Nakashimada Corporate Secretary

Stephen de Jong Chairman and Director

David Awram Director

Timo Jauristo Director

Anna Ladd-Kruger Director

C.L. "Butch" Otter Director

Carolyn Clark Loder Director

The Company is incorporated under the Business Corporations Act (British Columbia) (the "BCBCA").

The Company's head office is located at 1050 - 400 Burrard Street, Vancouver, BC V6C 3A6 and its registered office is located at 2200 HSBC Building, 885 West Georgia Street Vancouver, BC V6C 3E8.

The Company trades on the TSX Venture Exchange ("TSX-V"), under the trading symbol "ITR" and trades in the United States on the NYSE American under the stock symbol "ITRG".

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

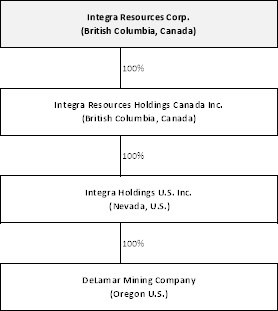

The following diagram illustrates the intercorporate relationships among Integra and its subsidiaries, as well as the jurisdiction of incorporation of each entity.

Q2 2021 IN REVIEW

CORPORATE

For the safety of all employees, the Company closed its corporate office (Vancouver, BC) in mid-March 2020 as a result of the COVID-19 global outbreak. All corporate employees continue to work remotely from home, with some employees now working periodically at the office under safe COVID-19 protection protocols. One of the most impacted activities at the corporate level has been the ability to travel due to travel bans and safety risks. The Company has however remained extremely active on the investor relations and marketing fronts through virtual media forums both with investors and at multiple industry conferences.

The Company held its Annual General Meeting of shareholders ("AGM") on June 29, 2021. A total of 22,225,932 common shares have been voted, representing 40.5% of the Company's outstanding shares. All of the directors were re-elected, and all other resolutions were approved by the Company's shareholders.

DEVELOPMENT

The development activities in Q2 2021 were not materially impacted by the COVID-19 pandemic.

Condemnation Drilling:

The Company commenced its condemnation drilling program in Q2 2021 and drilled at total of 792m this quarter. The Company expects a total of ~3,000m of condemnation drilling to be completed by the end of the year.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Permitting:

The Company announced in August of 2020 a Memorandum of Understanding ("MOU") to facilitate the hiring of a dedicated mineral specialist Project Manager in the Marsing, Idaho U.S. Bureau of Land Management ("BLM") office. That transition began in January 2021 and the BLM Project Manager became full time in April 2021. The Project Manager has been a consistent and efficient point of contact for Integra through Q2 2021 and will become the focal communication point for the BLM moving forward. The BLM project manager will be responsible for all the DeLamar Project permitting work and will help the BLM manage increased workloads from current and anticipated future applications for mineral notices, operations plans/amendment approvals and environmental analyses reviews. This funding effort provided by Integra is intended to increase the capacity of the local BLM office allowing staff to work on DeLamar Project related applications and project requests on a priority basis, while not burdening the BLM with the cost of this increased workload.

The BLM selected SWCA Environmental Consultants ("SWCA") as the third party environmental impact study ("EIS") contractor in support of the DeLamar Project to act as an extension of BLM staff to review and ensure Integra submitted baseline plans of study are deemed adequate and defensible for subsequent inclusion in the draft and final EIS.

Surface water and the newly drilled and installed 2020 groundwater wells were sampled during Q1 and Q2 of 2021. Additional consultants and contractors were brought on board by Integra to support the submittal of aquatic resources, wildlife, wetlands, vegetation, cultural resources, geochemistry and soils plans of study that have been submitted to the agency and the Third-Party Contractor to the BLM (SWCA) for subsequent review and approval.

Metallurgical Engineering and Pre-Feasibility Study:

Column leach tests on Florida Mountain oxide and transitional materials were completed during Q2, with several assays and final results to come in early Q3.

Grind size optimization testing on Florida Mountain unoxidized material yielded a primary grind target of 150µm with sufficient flotation recovery to eliminate the gravity circuit. Column testing composites for DeLamar were selected and sample preparation started, as well as composites for unoxidized mill testing.

Process flow sheets and layouts advanced in Q2. A trade off study was completed to evaluate heap leach feed crush size including an agitated leach mill for higher grade materials. A ½ inch crush has been selected as the most economic feed size for the Florida Mountain heap leach material. Other trade off studies were completed in Q2 for the unoxidized material to evaluate processing options and throughputs, including heap leach throughput and flotation tailing leach. For the PFS, unoxidized material from both Florida Mountain and DeLamar will processed similar to the PEA - regrinding and leaching of the flotation concentrate, but at a significantly higher throughput to account for the addition of DeLamar unoxidized material.

Geotech and condemnation drilling for the flotation tailing storage facility for the PFS was completed in Q2. Evaluation of site access roads progressed as well, and several options are expected for consideration in Q3.

Work progressed during the quarter to determine potential solar pan farm locations for potential on-site solar power generation and microgrid options; studies are aimed at the potential power cost offset for the site.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

EXPLORATION

Impact of COVID-19 on Drilling Activities

Some of Integra's contractors, namely our drilling contractors and assay laboratory, have experienced labour shortage as a result of the COVID-19 pandemic. This impacted our drilling productivity in Q2 and greatly delayed our assay result turn around from the laboratories.

Drilling

The Company completed a total of 10,150 m of core drilling and 2,376 m of reverse circulation ("RC") drilling in Q2 2021 for a total of 12,526 m drilled this quarter, including 8,088 m at Florida Mtn, 1,359 m at DeLamar deposit, and 3,079 m at BlackSheep.

Florida Mountain Drilling

The Company announced in its June 3, 2021 press release drilling results from Florida Mountain. The results continue to demonstrate high-grade gold-silver mineralization continuity in various locations covering a strike length of 1.5 kilometers on the deposit and in some cases 250 m outside of the current NI 43-101 resource model. Including the drill results announced on June 3, the Company has reported a total of 79 high-grade intercepts at Florida Mountain, with grades of over 4 g/t AuEq and a minimum width of 1.52 m. The continued success in intersecting high-grade gold-silver at Florida Mountain has demonstrated the accuracy of the geological model created by Integra's exploration team.

Florida Mountain drill highlights included*:

• Drill hole FME-21-109

o 1.01 g/t Au and 2.34 g/t Ag (1.04 g/t AuEq over 24.39 m, including 7.98 g/t Au and 8.30 g/t Ag (8.09 g/t AuEq) over 1.37 m

• Drill hole FME-21-110

o 2.10 g/t Au and 2.38 g/t Ag (2.13 g/t gold equivalent ("AuEq") over 17.38 m, including 12.94 g/t Au and 3.01 g/t Ag (12.98 g/t AuEq) over 1.52 m

• Drill hole FME-21-111

o 0.82 g/t Au and 23.31 g/t Ag (1.12 g/t AuEq) over 23.47 m

• Drill hole FME-21-116

o 4.28 g/t Au and 1,689 g/t Ag (26.02 g/t AuEq) over 0.92 m

• Drill hole FME-21-118

o 3.20 g/t Au and 790.50 g/t Ag (13.37 g/t AuEq) over 6.71 m, including 27.04 g/t Au and 6,631 g/t Ag (112.38 g/t AuEq) over 0.76 m

The Company announced in its April 8, 2021 press release drilling results from Florida Mountain. The results continued to demonstrate high-grade gold-silver mineralization continuity, in some cases 300 m outside of the resource model.

Florida Mountain drill highlights included*:

• Drill hole FME-21-106

o 12.90 g/t Au and 1,675.00 g/t Ag (34.46 g/t AuEq) over 1.52 m

o 15.17 g/t Au and 250.00 g/t Ag (18.39 g/t AuEq) over 0.92 m

• Drill hole FME-21-107

o 16.86 g/t Au and 2472.00 g/t Ag (48.67 g/t AuEq) over 1.25 m

• Drill hole FME-21-104

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

o 0.49 g/t Au and 125.72 g/t Ag (2.10 g/t AuEq) over 16.92 m

The intercepts reported on April 8, 2021 consist of mineralization with wide-spread low-grade gold-silver values, crosscut and underlain by narrower high-grade, steeply dipping low-sulphidation quartz-adularia veins. Widespread intercepts from both historic shallow oxide and transitional resource definition drilling and recent deeper drilling to vertical depths up to 400 m below surface (and 250 m below the base of the current resource) conducted by Integra over the previous two years has confirmed potentially mineable widths and grades for these high-grade structures.

BlackSheep District Drilling

The Company announced in its April 8, 2021 press release further drill results for the Lucky Days target, including a large, low-grade gold-silver intercept from the recently discovered Lucky Days target*:

• Drill hole LDE-21-002

o 0.50 g/t Au and 41.15 g/t Ag (1.03 g/t AuEq) over 25.15 m, including 2.13 g/t Au and 213.28 g/t Ag (4.87 g/t AuEq) over 2.13 m

Drill hole LDE-21-002, released on April 8, 2021, was designed to intercept a vein structure at a shallow depth (25-30 m), and the high silver intersected at this interval along with the shallow-level vein textures indicate the potential for high-grade mineralization at depth. In addition, this drill hole clipped the southern end of an extensive zone of lower grade stockwork vein mineralization delineated by soil and rock-chip geochemistry and IP geochemistry. The 25.15 m intercept averaging 1.03g/t AuEq at the southern end of this 250 m x 100 m stockwork zone is a very encouraging indication of low-grade open pit potential.

* Downhole thickness; true width varies depending on drill hole dip; most drill holes are aimed at intersecting the vein structures close to perpendicular therefore true widths are close to downhole widths (approximately 60%-70% conversion ratio); Intervals reported are uncapped; Gold equivalent = g Au/t + (g Ag/t ÷ 77.70); For the intervals that were previously mined / stopped and were therefore unrecoverable and unverifiable, a grade of 0 g/t Au was inserted for compositing.

43-101 Resource Update

Due to the successful demonstration of high-grade gold-silver intercepts at Florida Mountain over the past 24-36 months, the Company believes it preferable to incorporate these high-grade results into an updated NI 43-101 resource estimate on Florida Mountain. The previously scheduled Q2 resource estimate update will be deferred and an updated NI 43-101 resource estimate update with a high-grade component will be completed in conjunction with the Pre-feasibility Study ("PFS"), scheduled for completion in Q4, 2021.

SOCIAL AND ENVIRONMENTAL

Stakeholder meetings increased this quarter, as Integra's newly hired Community Affairs Manager commenced in March. Many meetings returned to in-person settings, and COVID-19 safety protocols were strictly adhered to, as appropriate. This quarter the Company engaged with local residents, educators, local non-profits, conservation groups, local city & community councils and chambers of commerce, state government representatives, and specific interest groups. The Company continues to build relationships with surrounding communities that future operations may touch.

Integra continued meeting with Tribal Nations Rightsholders with historic ties to the lands surrounding DeLamar in Q2. Following introductory meetings, Integra is focusing on establishing effective mechanisms for communication, and researching opportunities for respectful involvement. These meetings are in addition to the important inter-governmental agencies meetings held throughout the permitting process.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

In efforts to both strengthen and formalize Integra's approach to certain aspects of the Company's interactions with our stakeholders and employees, several policy and committee outlines were drafted in Q2, including an Employee Volunteerism Policy, a Community Investment Policy, and a Company Culture Committee.

The Company announced on June 29 that it has entered into a Memorandum of Understanding ("MOU") with Trout Unlimited to evaluate and prioritize potential future habitat reclamation projects within the Jordan Creek watershed in Owyhee County, Idaho. This partnership with Trout Unlimited complements Integra's commitment to minimizing unnecessary impacts within the DeLamar Project boundaries and seeking opportunities to offset them with positive habitat impacts in our surrounding areas. This partnership also highlights the importance of collaboration when cleaning up legacy abandoned mine land sites in the west given the complicated mixed land ownership of former mining districts. The overarching goal of this project will be to holistically look at upper Jordan Creek to identify potential projects that will improve the environmental health of the watershed. Some examples of potential future projects could include road crossing improvements, aquatic organism and fish passage barrier identification, reclamation and revegetation of mining impacted lands, source reduction of pollutants from historic mills, and in-stream habitat improvements.

Integra joined the CleanTech Alliance, a Seattle-based group with over 1,100 member organizations that facilitates the generation and growth of cleantech companies and jobs across the Northwest. As a member, Integra will both benefit from collaborations with companies pushing the envelope of responsible environmental practice, and also represent an important voice as a potential future producer of silver and gold, two metals critical to clean technologies including solar energy production and next generation automotive production. Mark Stockton, Integra's Vice President of Corporate Affairs & Sustainability, will serve on the Board of Directors for the CleanTech Alliance.

Water treatment operations followed their regular course at the DeLamar Project. No material environmental or health and safety incidents were reported in Q2 2021.

2021 OUTLOOK

Although management has put in place all necessary measures to protect its employees' safety and to secure essential site activities, should the virus spread, or travel bans get put back into place or should one of the Company's staff members or consultants become infected, the Company's ability to advance the DeLamar Project may be impacted. The Company continues to monitor the situation and the impact the virus may have on the DeLamar Project.

All corporate employees continue to work remotely from home, with some employees now working periodically at the office under safe COVID protection protocols.

The Company will continue its dual track strategy for 2021, consisting of exploration drilling designed to expand the mineral resource base and development study and permitting work designed to de-risk the DeLamar Project.

DEVELOPMENT

A key objective for 2021 will be to complete the PFS in the 4th quarter. To achieve this goal, extensive metallurgical test work will be carried out this year to de-risk and enhance project economics, relative to the 2019 PEA study. There will also be significant condemnation, geotechnical and groundwater drilling programs in 2021. On the permitting front, surface, groundwater, geochemistry, wetlands, wildlife, aquatic, cultural and associated baseline studies, along with the management of these efforts, will extend throughout the year.

Metallurgical test work will continue in Q3, primarily for DeLamar heap leach and mill feed material. Load/permeability and optimization test work will be finalized. Final process throughputs will be determined. Mine design and haul road design, production scheduling, and process design will continue in earnest based on work completed and decisions made in Q2. A final determination of concentrate leach tailing handling from the mill will be made for the PFS.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Processing equipment lists and electrical load requirements will be determined, and engineering on the greater electrification of mining equipment will be advanced. Initial solar and micro grid design will be advanced to the PFS level in Q3. Engineering on the transmission line upgrades will also continue.

Additional drilling for metallurgical test work will be completed at Sullivan Gulch. Geotech drilling and condemnation drilling for the heap leach area will continue in Q3. Work will continue to classify potentially problematic mineralogy in the two deposits.

EXPLORATION

The Company increased its 2021 exploration program given the promising drilling results to date from Florida Mountain and BlackSheep. The Company added two core drill rigs and one RC drill rig in early Q2 and had four core drill rigs and one RC drill rig on site for most of the quarter. The Company recently reduced the amount of core rigs to three and returned the RC rig, largely due to slow assay turn-around from the laboratories.

The Company completed a total of 16,186 m of core drilling and 2,376 m of RC drilling this year for a total of 18,562 m drilled, including 11,308 m at Florida Mtn, 3,245 m at DeLamar deposit, and 4,008 m at BlackSheep.

The drilling program will focus on the following areas:

The Florida Mountain Deposit:

Drilling at Florida Mountain will be dual-focused, including follow-up exploration on the high-grade shoots and structures below the existing mineral resource and expanding the existing low-grade mineral resource through drilling geochemical and geophysical anomalies to the east and west of the existing mineral resource.

The Company has identified multiple high-grade gold-silver shoots at Florida Mountain. Integra's exploration team has modeled 7 high-grade vein structures that appear similar in size and orientation to the historically productive high-grade Trade Dollar - Black Jack vein system. Most historic underground production stemmed from the Trade Dollar - Black Jack vein, while the remaining 6 veins saw limited production up until mining operations ceased with the start of World War I. The identified vein zones have an aggregate strike length of over 7,000 m. Within these vein zones are steeply dipping high-grade shoots with strike lengths of up to 200 m and down dip extensions of up to 300 m which are interpreted as having developed at structural intersections. Based on recent drill intercepts, the Company anticipates that the high-grade shoots are likely to have widths of between 1 m and 8 m.

Drilling is also taking place in the Florida Keys area, a large geochemical anomaly located immediately to the east of the mineral resource that has seen limited drilling. The Florida Keys geochemical anomaly is of similar strength and size to the existing mineral resource estimate footprint at the Florida Mountain Deposit. The Company also intends to drill in Rich Gulch, a target located in a large zone of IP chargeability that was identified to the west of Florida Mountain as part of a 2020 geophysical survey. Based on limited historic drilling and the presence of historic underground workings in this area the Company sees potential for both additional low-grade and high-grade underground mineralization.

War Eagle Mountain:

During the 2019 and 2020 drill programs at War Eagle, the Company intersected high-grade gold-silver mineralization within the volcanic unit overlying the entire area. In 2020, the Company identified a second high-grade shoot 400 m to the north of the 2019 drill holes. This second structure is interpreted over a strike length of approximately 550 m south-southeast and is largely untested. The geochemical soil anomaly that led the Company to this new structure is interpreted as being lateral leakage outward along the base of the latite flow, presumably emanating from the eastern most structure identified in the 2020 drill program.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Drilling at War Eagle is expected to commence later this year and will continue to test these parallel structures.

BlackSheep and DeLamar (Henrietta Ridge):

The core drill campaign at BlackSheep will focus on the Georgianna, Milestone and Lucky Days targets. BlackSheep is host to extensive areas of sinter and opaline silica cut by high-level epithermal veining and brecciation. Due to the shallow level of erosion at BlackSheep, very limited exploration drilling completed by previous operators was shown to be too shallow to properly evaluate the potential for high-grade vein style mineralization.

Two shallow drill holes have been completed at the Georgianna target to better define the structures controlling mineralization. Deeper, follow-up drill holes are planned at the Georgianna target for this year to test the productive zone at approximately 200 m below the current surface.

The Company completed the Henrietta Ridge drilling and is awaiting results from BlackSheep. The Company anticipates follow-up drilling at BlackSheep in the last quarter of 2021.

SOCIAL AND ENVIRONMENTAL

Integra intends to publish its first ESG report in Q3 2021. This report will represent an important piece of ESG, which is the strengthening of the public disclosure of the performance surrounding Environment, Social, and Governance factors within a company. Our team has sought to track and measure many facets of our physical operation and Company that have never before been tracked in this manner. The value of this first annual report will both be in the information and data reported, but also equally in the lessons learned across the Company that will help shape future reports and help drive Company performance in ESG.

PROPERTIES

1. DeLamar Project, Idaho

The DeLamar Project consists of the neighboring DeLamar Deposit and Florida Mountain Deposit.

The bulk of the information in this section is derived from the Technical Report and Preliminary Economic Assessment for the DeLamar and Florida Mountain Gold - Silver Project, dated October 22, 2019 (the "Report" or the "PEA"). The DeLamar Report is available for review under the Company's issuer profile on SEDAR at www.sedar.com.

Project Description, Location and Ownership

The DeLamar project consists of 748 unpatented lode, placer, and millsite claims, and 16 tax parcels comprised of patented mining claims, as well as certain leasehold and easement interests, that cover approximately 8,100 hectares in southwestern Idaho, about 80 kilometers southwest of Boise. The property is approximately centered at 43°00′48″N, 116°47′35″W, within portions of the historical Carson (Silver City) mining district, and it includes the formerly producing DeLamar mine last operated by Kinross. The total annual land-holding costs are estimated to be US$321,626.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

All mineral titles and permits are held by the DeLamar Mining Company ("DMC"), an indirect, 100% wholly owned subsidiary of Integra that was acquired from Kinross through a Stock Purchase Agreement in 2017.

A total of 284 of the unpatented claims were acquired from Kinross, 101 of which are subject to a 2.0% net smelter returns royalty ("NSR") payable to a predecessor owner. This royalty is not applicable to the current project mineral resources.

There are also six lease agreements covering 26 patented claims and one unpatented claim that require NSR payments ranging from 2.5% to 5.0%. One of these leases covers a small portion of the DeLamar area resources and one covers a small portion of the Florida Mountain area resources, with 5.0% and 2.5% NSRs applicable to maximums of US$50,000 and US$650,000 in royalty payments, respectively.

The property includes 1,355 hectares under six leases from the State of Idaho, which are subject to a 5.0% production royalty of gross receipts plus annual payments of US$23,252. One of these leases has been issued and five are pending issuance. The State of Idaho leases include very small portions of both the DeLamar and Florida Mountain resources.

Kinross has retained a 2.5% NSR royalty that applies to those portions of the DeLamar area claims that are unencumbered by the royalties outlined above (the "Kinross Royalty"). The Kinross Royalty was subsequently purchased by Maverix Metals Inc ("Maverix") on December 19, 2019. The Maverix royalty applies to more than 90% of the current DeLamar area resources, but this royalty will be reduced to 1.0% upon Maverix receiving total royalty payments of C$10,000,000.

DMC also owns mining claims and leased lands peripheral to the DeLamar project described above. These landholdings are not part of the DeLamar project, although some of the lands are contiguous with those of the DeLamar and Florida Mountain claims and state leases.

The DeLamar project historical open-pit mine areas have been in closure since 2003. Even though a substantial amount of reclamation and closure work has been completed to date at the site, there remain ongoing water-management activities and monitoring and reporting. A reclamation bond of US$2,890,429 remains with the Idaho Department of Lands ("IDL") and a reclamation bond of US$100,000 remains with the Idaho Department of Environmental Quality. A reclamation bond in the amount of US$569,500 has been placed with the U.S. Bureau of Land Management ("BLM") for exploration activities on public lands.

Exploration and Mining History

Total production of gold and silver from the DeLamar - Florida Mountain project area is estimated to be approximately 1.3 million ounces of gold and 70 million ounces of silver from 1891 through 1998, with an unknown quantity produced at the DeLamar mill in 1999, and recorded production may have occurred from 1876 to 1891. This includes an estimated 1.025 million ounces of gold and 51 million ounces of silver produced from the original De Lamar underground mine and the later DeLamar open-pit operations. At Florida Mountain, nearly 260,000 ounces of gold and 18 million ounces of silver were produced from the historical underground mines and late 1990s open-pit mining.

Mining activity began in the area of the DeLamar project when placer gold deposits were discovered in 1863 in Jordan Creek, just upstream from what later became the town site of De Lamar. During the summer of 1863, the first silver-gold lodes were discovered in quartz veins at War Eagle Mountain, to the east of Florida Mountain, resulting in the initial settlement of Silver City. Between 1876 and 1888, significant silver-gold veins were discovered and developed in the district, including underground mines at De Lamar Mountain and Florida Mountain. A total of 553,000 ounces of gold and 21.3 million ounces of silver were reportedly produced from the De Lamar and Florida Mountain underground mines from the late 1800s to early 1900s.

The mines in the district were closed in 1914 and very little production took place until the gold and silver prices increased in the1930s. Placer gold was again recovered from Jordan Creek from 1934 to 1940, and in 1938 a 181 tonne-per-day flotation mill was constructed to process waste dumps from the De Lamar underground mine. The flotation mill reportedly operated until the end of 1942. Including Florida Mountain, the De Lamar - Silver City area is believed to have produced about 1 million ounces of gold and 25 million ounces of silver from 1863 through 1942.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

During the late 1960s, the district began to undergo exploration for near-surface bulk-mineable gold-silver deposits, and in 1977 a joint venture operated by Earth Resources Company ("Earth Resources") began production from an open-pit milling and cyanide tank-leach operation at De Lamar Mountain, known as the DeLamar mine. In 1981, Earth Resources was acquired by the Mid Atlantic Petroleum Company ("MAPCO"), and in 1984 and 1985 the NERCO Mineral Company ("NERCO") successively acquired the MAPCO interest and the entire joint venture to operate the DeLamar mine with 100% ownership. NERCO was purchased by the Kennecott Copper Company ("Kennecott") in 1993. Two months later in 1993, Kennecott sold its 100% interest in the DeLamar mine and property to Kinross, and Kinross operated the mine, which expanded to the Florida Mountain area in 1994. Mining ceased in 1998, milling ceased in 1999, and mine closure activities commenced in 2003. Closure and reclamation were nearly completed by 2014, as the mill and other mine buildings were removed and drainage and cover of the tailings facility were developed.

Total open-pit production from the DeLamar project from 1977 through 1998, including the Florida Mountain operation, is estimated at approximately 750,000 ounces of gold and 47.6 million ounces of silver, with an unknown quantity produced at the DeLamar mill in 1999. From start-up in 1977 through to the end of 1998, open-pit production in the DeLamar area totaled 625,000 ounces of gold and about 45 million ounces of silver. This production came from pits developed at the Glen Silver, Sommercamp - Regan (including North and South Wahl), and North DeLamar areas. In 1993, the DeLamar mine was operating at a mining rate of 27,216 tonnes per day, with a milling capacity of about 3,629 tonnes per day. In 1994, Kinross commenced open-pit mining at Florida Mountain while continuing production from the DeLamar mine. The ore from Florida Mountain, which was mined through 1998, was processed at the DeLamar facilities. Florida Mountain production in 1994 through 1998 totaled 124,500 ounces of gold and 2.6 million ounces of silver.

Geological and Mineralization

The DeLamar project is situated in the Owyhee Mountains near the east margin of the mid-Miocene Columbia River - Steens flood-basalt province and the west margin of the Snake River Plain. The Owyhee Mountains comprise a major mid-Miocene eruptive center, generally composed of mid-Miocene basalt flows intruded and overlain by mid-Miocene rhyolite dikes, domes, flows and tuffs, developed on an eroded surface of Late Cretaceous granitic rocks.

The DeLamar mine area and mineralized zones are situated within an arcuate, nearly circular array of overlapping porphyritic and flow-banded rhyolite flows and domes that overlie cogenetic, precursor pyroclastic deposits erupted as local tuff rings. Integra interprets the porphyritic and banded rhyolite flows and latites as composite flow domes and dikes emplaced along regional-scale northwest-trending structures. At Florida Mountain, flow-banded rhyolite flows and domes cut through and overlie a tuff breccia unit that overlies basaltic lava flows and Late Cretaceous granitic rocks.

Gold-silver mineralization occurred as two distinct but related types: (i) relatively continuous, quartz-filled fissure veins that were the focus of late 19th and early 20th century underground mining, hosted mainly in the basalt and granodiorite and to a lesser degree in the overlying felsic volcanic units; and (ii) broader, bulk-mineable zones of closely-spaced quartz veinlets and quartz-cemented hydrothermal breccia veins that are individually continuous for only a few feet laterally and vertically, and of mainly less than 1.3 centimeters in width - predominantly hosted in the rhyolites and latites peripheral to and above the quartz-filled fissures. This second style of mineralization was mined in the open pits of the late 20th century DeLamar and Florida Mountain operations, hosted primarily by the felsic volcanic units.

The fissure veins mainly strike north to northwest and are filled with quartz accompanied by variable amounts of adularia, sericite or clay, ± minor calcite. Vein widths vary from a few centimeters to several meters, but the veins persist laterally and vertically for as much as several hundreds of meters. Principal silver and gold minerals are naumannite, aguilarite, argentite, ruby silver, native gold and electrum, native silver, cerargyrite, and acanthite. Variable amounts of pyrite and marcasite with very minor chalcopyrite, sphalerite, and galena occur in some veins. Gold- and silver-bearing minerals are generally very fine grained.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

The gold and silver mineralization at the DeLamar project is best interpreted in the context of the volcanic-hosted, low-sulfidation type of epithermal model. Various vein textures, mineralization, alteration features, and the low contents of base metals in the district are typical of shallow low-sulfidation epithermal deposits worldwide.

Drilling, Database and Data Verification

As of the effective date of this report, the resource database includes data from 2,718 holes, for a total of 306,078 meters, that were drilled by Integra and various historical operators at the DeLamar and Florida Mountain areas. The historical drilling was completed from 1966 to 1998 and includes 2,625 holes for a total of 275,790 meters of drilling. Most of the historical drilling was done using reverse-circulation ("RC") and conventional rotary methods; a total of 106 historical holes were drilled using diamond-core ("core") methods for a total of 10,845 meters. Approximately 74% of the historical drilling was vertical, including all historical conventional rotary holes.

Integra commenced drilling in 2018. As of the end of April 2019, Integra had drilled a total of 55 RC holes, 36 core holes, and 11 holes commenced with RC and finished with core tails, for a total of 33,573 meters in the DeLamar and Florida Mountain areas combined. All but one of the Integra holes were angled.

The historical portions of the current resource drill-hole databases for the DeLamar and Florida Mountain deposit areas were originally created by MDA using original DeLamar mine digital database files, and this information was subjected to various verification measures by both MDA and Integra. The Integra portion of the drill-hole databases was directly created by MDA using original digital analytical certificates in the case of the assay tables, or it was checked against original digital records in the case of the collar and down-hole deviation tables. Through these and other verification procedures summarized herein, the authors have verified that the DeLamar data as a whole are acceptable as used in this report.

Metallurgical Testing

Available results from ongoing metallurgical testing by Integra, at McClelland Laboratories (2018-2019) have been used to select preferred processing methods and estimate recoveries for oxide and transitional material types from both the DeLamar and Florida Mountain deposits, as well as unoxidized (sulfide) material type from the Florida Mountain deposit. Metallurgical testing has also been conducted on unoxidized (sulfide) material from the DeLamar deposit, but that testing has not yet progressed to the level required for processing of that material to be included in the PEA.

Samples used for this 2018-2019 testing, primarily composites of 2018 and 2019 drill core, were selected to represent the various material types contained in the current resources from both the DeLamar and Florida Mountain deposits. Composites were selected to evaluate effects of area, depth, grade, oxidation, lithology, and alteration on metallurgical response. In general, test results indicate that materials from each of the DeLamar and Florida Mountain deposits can most usefully be evaluated by considering the oxidation state (oxidized, transitional, or unoxidized).

Bottle-roll and column-leach cyanidation testing on drill core composites from both the DeLamar and Florida Mountain deposits and on bulk samples from the DeLamar deposit have shown that the oxide and transitional material types from both deposits can be processed by heap-leach cyanidation. Testing on drill core composites from the Florida Mountain deposit has shown that the unoxidized material from that deposit is not amenable to heap leach cyanidation but can be leached using cyanide after grinding. The Florida Mountain unoxidized material also responds well to bulk sulfide flotation treatment, and the resulting flotation concentrate is amenable to agitated cyanide leaching. Highest recoveries from the Florida Mountain unoxidized material were obtained by grinding, followed by gravity concentration and flotation of the gravity tailings, with regrind and agitated cyanidation of the flotation concentrate.

Available metallurgical test results indicate that gold recoveries in the range of 75% to 80%, and silver recoveries of about 30%, can be expected from the DeLamar oxide and transitional material types, by heap leaching at a crush size of 80% -13mm. Agglomeration pretreatment of this material is currently planned, because of the potential for processing of some materials with elevated clay content. Heap leach cyanide consumptions are expected to be reasonably low (about 0.3 - 0.4 kg NaCN/tonne).

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

In the case of the Florida Mountain oxide and transitional material types, gold recoveries of 85% to 90%, and silver recoveries of about 40%, are expected for heap leaching at an 80% -38mm feed size. Agglomeration pretreatment is not considered to be necessary for these material types. Heap leach cyanide consumptions are expected to be reasonably low (about 0.4 kg NaCN/tonne).

Planned processing of the Florida Mountain unoxidized material type includes grinding, followed by gravity concentration and flotation of the gravity tailings, with regrind and agitated cyanidation of the flotation concentrate. Expected recoveries are about 90% gold and 80% silver. Cyanide consumption for the concentrate leaching is expected to be equivalent to about 0.2 kg NaCN/tonne, on a mill feed basis.

In the case of the unoxidized material from the DeLamar deposit, 2018-2019 testing has shown that this material type is not amenable to heap-leach cyanidation and is highly variable with respect to response to grinding followed by agitated cyanidation. Reasons for the generally poor and highly variable grind-leach recoveries from this material type are poorly understood at present. Additional testing and mineralogy studies are in progress to gain a better understanding of the observed variability in recoveries. Further testing is also planned to better define what portion of the DeLamar unoxidized material type might be economically processed by simple grind-leach processing. Metallurgical testing has also shown that the DeLamar unoxidized material generally responds well to upgrading by gravity and flotation processing. Testing to evaluate subsequent processing of the resulting concentrate is in progress, but has not been completed as of the effective date of this report. It is expected that flotation concentrate produced from a significant portion of the DeLamar unoxidized materials will not be amenable to agitated leach (cyanidation). It is expected that for these flotation concentrates, some form of oxidative pre-treatment (such as pressure oxidation or roasting) will be required to maximize gold recovery by cyanidation. Alternatively, these concentrates could be shipped off site for toll processing.

Mineral Resources

Mineral resources have been estimated for both the Florida Mountain and DeLamar areas of the DeLamar project. The gold and silver resources were modeled and estimated by:

- evaluating the drill data statistically;

- creating low- (domain 100), medium- (domain 200) and high-grade (domain 300) mineral-domain polygons for both gold and silver on sets of cross sections spaced at 30-meter intervals;

- projecting the sectional mineral-domain polygons three-dimensionally to the drill data within each sectional window;

- slicing the three-dimensional mineral-domain polygons along 6-meter-spaced horizontal and vertical planes and using these slices to recreate the gold and silver mineral-domain polygons on level plans and long sections, respectively;

- coding a block model to the gold and silver domains for each of the two deposit areas using the level-plan and long-section mineral-domain polygons;

- analyzing the modeled mineralization geostatistically to aid in the establishment of estimation and classification parameters; and

- using inverse-distance to the third power to interpolate grades into models comprised of 6x6x6-meter blocks using the gold and silver mineral domains to explicitly constrain the grade estimations.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Parameters used in the estimation of gold and silver grades are summarized in Table 1.

Table 1 - Summary of DeLamar Area Grade Estimation Parameters

|

Estimation Pass - Au + Ag Domain |

Search Ranges (meters) |

Composite Constraints |

||||

|

Major |

Semi-Major |

Minor |

Min |

Max |

Max/Hole |

|

|

Pass 1 + 2 - Doman 100 |

60 |

60 |

30 |

2 |

12 |

4 |

|

Pass 1 + 2 - Doman 200 + 300 + 0 |

60 |

60 |

30 |

2 |

20 |

4 |

|

Pass 3 - Doman 0 + 100 + 200 +300 |

170 |

170 |

170 |

1 |

20 |

4 |

|

|

|||

|

Restrictions on Search Ranges |

|||

|

Domain |

Search Restriction Threshold |

Search Restriction Distance |

Estimation Pass |

|

Au 100 |

>0.7 g Au/t |

40 meters |

1, 2 |

|

Au 300 |

>20 g Au/t |

35 meters |

1, 2, 3 |

|

Ag 300 |

>400 g Ag/t |

35 meters |

1, 2, 3 |

|

Au 0 |

>0.5 g Au/t |

6 meters |

1, 2, 3 |

|

Ag 0 |

>34.29 g Ag/t |

9 meters |

1, 2, 3 |

The estimation passes were performed independently for each of the mineral domains, so that only composites coded to a particular domain were used to estimate grade into blocks coded by that domain. The estimated grades for each gold and silver domain coded to a block were then coupled with the partial percentages of those mineral domains in the block, as well as the outside, dilutionary, domain 0 grades and volumes, to enable the calculation of a single volume-averaged gold and a single volume-averaged silver grade for each block. These single resource block grades, and their associated resource tonnages, are therefore fully block-diluted using this methodology.

The search restrictions place limits on the maximum distances from a block that high-grade population composites can be 'found' and used in the interpolation of gold and/or silver grades into a block. To further avoid the smearing of outlier high grades that are sporadically present in the low-grade gold and silver domains, the maximum number of composites allowed for the estimation in Pass 1 and Pass 2 are less than that used for the higher-grade interpolations.

The gold and silver mineralization commonly exhibits multiple orientations, which led to the use of a number of search orientations to control both the DeLamar and Florida Mountain estimations.

Grade interpolation was completed using length-weighted 3.05-meter (10-foot) composites. The estimation passes were performed independently for each of the mineral domains, so that only composites coded to a particular domain were used to estimate grade into blocks coded to that domain. Blocks coded as having partial percentages of more than one gold and/or silver domain had multiple grade interpolations, one for each domain coded into the block for each metal. The estimated grades for each gold and silver domain coded to a block were coupled with the partial percentages of those mineral domains in the block, as well as any outside, dilutionary, domain 0 grades and volumes, to enable the calculation of a single volume-averaged gold and a single volume-averaged silver grade for each block. These single final resource block grades, and their associated resource tonnages, are therefore fully block-diluted using this methodology.

The DeLamar project mineral resources have been estimated to reflect potential open-pit extraction and processing by a combination of heap leaching, milling / agitated leaching, and flotation. To meet the requirement of the in-pit resources having reasonable prospects for eventual economic extraction, pit optimizations for the DeLamar and Florida Mountain deposit areas were run using the parameters summarized in Table 2 and Table 3.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

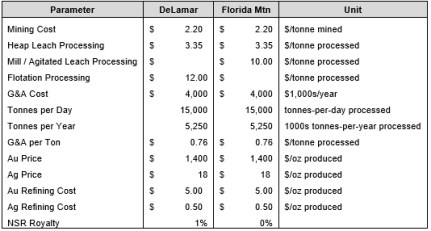

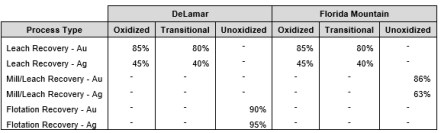

Table 2 - Pit Optimization Cost Parameters (US$)

Table 3 - Pit-Optimization Metal Recoveries by Deposit and Oxidation State

The pit shells created using these optimization parameters were applied to constrain the project resources of both the DeLamar and Florida Mountain deposit areas. The in-pit resources were further constrained by the application of a gold-equivalent cutoff of 0.2 g/t to all model blocks lying within the optimized pits that are coded as oxidized or transitional, and 0.3 g/t for blocks coded as unoxidized. Gold equivalency, as used in the application of the resource cutoffs, is a function of metal prices (Table 2) and metal recoveries, with the recoveries varying by deposit and oxidation state (Table 3).

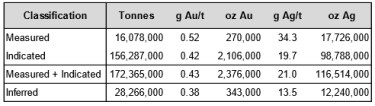

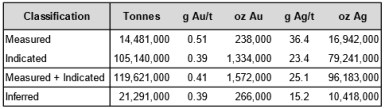

The total DeLamar project resources, which include the resources for both the DeLamar and Florida Mountain areas, are summarized in Table 4. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 4 - Total DeLamar Project Gold and Silver Resources

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

1. Mineral Resources are comprised of all oxidized and transitional model blocks at a 0.2 g AuEq/t cutoff and all unoxidized blocks at a 0.3 g AuEq/t that lie within optimized pits

2. The effective date of the resource estimations is May 1, 2019

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability

4. Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content

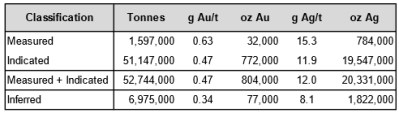

The gold and silver resources for the DeLamar and Florida Mountain areas are reported separately in Table 5 and Table 6, respectively.

Table 5 - DeLamar Deposit Gold and Silver Resources

1. Mineral Resources are comprised of all oxidized and transitional model blocks at a 0.2 g AuEq/t cutoff and all unoxidized blocks at a 0.3 g AuEq/t that lie within optimized pits

2. The effective date of the resource estimations is May 1, 2019

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability

4. Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content

Table 6 - Florida Mountain Deposit Gold and Silver Resources

1. Mineral Resources are comprised of all oxidized and transitional model blocks at a 0.2 g AuEq/t cutoff and all unoxidized blocks at a 0.3 g AuEq/t that lie within optimized pits

2. The effective date of the resource estimations is May 1, 2019

3. Mineral resources that are not mineral reserves do not have demonstrated economic viability

4. Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content

Mining Methods

The PEA considers open-pit mining of the DeLamar and Florida Mountain gold-silver deposits. Note that a PEA is preliminary in nature and includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied that would enable them to be classified as mineral reserves. There is no certainty that the economic results of the PEA will be realized.

The methodology used for mine planning to define the economics for the PEA includes definition of economic parameters, pit optimization, creation of pit and waste rock facility designs, creation of production schedules, definition of personnel and equipment requirements, estimation of capital and operating costs, and performance of an economic analysis.

Pit optimization assumed processing of Florida Mountain and DeLamar oxide and transition resources as heap leach, and unoxidized Florida Mountain resources as milled using floatation followed by cyanidation of the concentrates on site. Leach material would be processed at 27,000 tonnes per day and mill material would be processed at 2,000 tonnes per day. Processing of the DeLamar material will require crushing and agglomeration prior to heap leaching.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

The resulting pit optimizations were used as the basis for pit designs. The designs used an inner-ramp slope of 45°. DeLamar pit designs utilized five pit phases to establish a mining sequence and Florida Mountain pit designs were completed using three pit phases.

Waste management facility designs were created for the PEA to contain the waste material mined from both the DeLamar and Florida Mountain areas. Some waste material may also be stored in the form of backfill where and when space is available, although this has not been assumed for the PEA and therefore this is a potential opportunity for the project.

Production scheduling was completed with leaching starting with Florida Mountain material and DeLamar leach material being processed starting in year 5 at the same rate as Florida Mountain leach material. Florida Mountain unoxidized material will be stockpiled until the flotation mill is constructed. The start of the 2,000 tonne per day mill will be in year 3 and it will operate at a rate of 720,000 tonnes per year until unoxidized material is exhausted.

The total project mining rate is given a reasonable ramp-up that starts at 2,000 tonnes per day and increases to a life-of-mine maximum of 90,000 tonnes per day in later years.

The PEA has assumed owner mining in order to keep operating costs lower than it would be with contract mining. The production schedule was used along with additional efficiency factors, cycle times, and productivity rates to develop the first-principle hours required for primary mining equipment to achieve the production schedule. Mining anticipates 136-tonne capacity haul trucks loaded by hydraulic shovels. Personnel requirements have been estimated based on the number of people required to operate, supervise, maintain, and plan for operations to achieve the production schedule.

Processing and Recovery Methods

The PEA envisions the use of two process methods for the recovery of gold and silver:

1) Lower-grade oxide and transition materials from both DeLamar and Florida Mountain will be processed by crushed-ore cyanide heap leaching with stacking on a central heap leach by conveyor, followed by Merrill-Crowe zinc precipitation.

2) Higher-grade unoxidized material from Florida Mountain will be processed using grinding followed by gravity and flotation concentration, with the concentrates processed by regrinding, agitated-cyanide leaching, counter-current decantation ("CCD"), and Merrill-Crowe zinc precipitation. Flotation tailings will be thickened, filtered, and dry stacked at the tailings storage facility. Concentrate-leach tailings will be added to the heap-leach circuit for further recovery of gold and silver.

Both Florida Mountain and DeLamar oxide and transition ore types have been shown to be amenable to heap-leach processing following crushing. Material will be crushed in two stages to a nominal 100 millimeter size at a rate of 27,000 tonnes per day. Initially, for the Florida Mountain materials, the product of the secondary circuit will be a nominal size of 38 millimeters. Transitioning to DeLamar ore types will require the addition of a tertiary crushing circuit with tertiary screens and cone crushers operating in closed circuit to produce a nominal 13-millimeter product followed by cement agglomeration. Lime will be added to the crushed ore for pH control at a dosage of 1 kilogram/tonne. Cement will be added at 3 kilograms/tonne for agglomeration as required.

Crushed and prepared ore will be transferred to the heap-leach pad using overland conveyors and stacked on the heap using portable or grasshopper conveyors and a radial stacking system. Leach solution will be collected at the base on the heap leach and transferred to the Merrill-Crowe processing plant for recovery of precious metals by zinc precipitation. The zinc precipitate will be filtered, dried, and smelted to produce a precious metal doré product for shipment off site.

Gold and silver recoveries are expected to be 90% and 40%, respectively, for the Florida Mountain oxide heap-leach material. The DeLamar oxide recoveries used in this study are 80% for gold and 30% for silver. Cyanide consumptions for the oxide ore types are 0.4 kilograms/tonne and 0.3 kilograms/tonne for Florida Mountain and DeLamar, respectively.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Transition material gold recoveries are projected to be 85% for Florida Mountain and 75% for DeLamar. Silver recoveries for the transition material are projected to be 40% and 30% for Florida Mountain and DeLamar, respectively. Projected cyanide consumption is 0.4 kilograms per tonne for both the Florida Mountain and DeLamar transition material types.

Higher-grade Florida Mountain unoxidized material will be processed by crushing, grinding, gravity, and flotation concentration, followed by cyanide leaching of the concentrates using CCD and Merrill-Crowe precipitation. This circuit is scheduled to operate at a nominal production rate of 2,000 tonnes per day. For this process, the final crusher product will have a nominal particle size of 6 millimeters and will be fed to the ball mill via two belt feeders at a nominal ore production rate of 88 tonnes per hour. The ball mill discharge will be pumped to a set of two hydrocyclones, one operating and one standby, with the cyclone overflow reporting to the flotation conditioning tank. The cyclone underflow will report to a centrifugal gravity concentrator. Concentrator rejects then reports back to the ball mill for additional grinding. The gravity concentrate will report to the concentrate regrind mill for subsequent processing in the leach circuit.

The flotation feed from the conditioning tank will report to the flotation circuit for sulfide concentration. The flotation concentrate will report to a regrind circuit where it will be ground to a nominal 37 µm before being leached in a conventional leach tank and CCD circuit. The flotation tailings are to be thickened and filtered with the filter cake reporting to the dry stacked tailings storage facility.

Leach solid residue and the pregnant leach solution are separated in the CCD circuit. The pregnant leach solution will report to the heap leach Merrill-Crowe circuit where it will be processed using zinc precipitation for the recovery of gold and silver. The leached residue will be thickened to 60% solids and added to the heap leach material before it is stacked on the heap, thus allowing for additional processing and mitigating the need for a cyanide-rated tailings storage facility.

Recoveries from the Florida Mountain milling/concentrator circuit are expected to be 90% for gold and 80% for silver. Sodium cyanide and lime consumptions are both expected at 0.2 kilograms per tonne of material feed.

Capital and Operating Costs

Table 7 summarizes the estimated life-of-mine ("LOM") capital costs for the project. The LOM total capital costs are estimated at US$270.3 million, including US$161.0 million in preproduction capital (including working capital) and US$109.3 million for sustaining capital (which includes US$20.0 million in reclamation costs).

Table 8 shows the estimated LOM operating costs for the project, which are estimated to be US$7.82 per tonne processed. This includes mining costs which are estimated to be US$2.00 per tonne mined. The total cash cost is estimated to be US$619 per ounce of gold equivalent and all-in sustaining costs are estimated to be US$742 per ounce of gold equivalent. See "Non-GAAP Measures" disclosure at the end of this MD&A.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Table 7 Capital Cost Summary (US$)

| Sustaining | Total | ||||||||

| Mine | Pre-Production (1) | Yr 1 to Yr 10 (1) | LOM (1) | ||||||

| Mining Equipment | $ | 32,980 | $ | 52,014 | $ | 84,994 | |||

| Pre-Stripping | $ | 7,514 | $ | - | $ | 7,514 | |||

| Other Mine Capital | $ | 6,027 | $ | 746 | $ | 6,773 | |||

| Sub-Total Mine | $ | 46,521 | $ | 52,760 | $ | 99,281 | |||

| Processing | |||||||||

| Heap Leach Pad | $ | 14,130 | $ | 19,178 | $ | 33,308 | |||

| Heap leach Plant (Incl Crushing and Stacking) | $ | 48,449 | $ | - | $ | 48,449 | |||

| Heap leach: Agglomeration / Crushing (DeLamar Ore) | $ | - | $ | 20,518 | $ | 20,518 | |||

| Florida Mill: Plant | $ | - | $ | 34,354 | $ | 34,354 | |||

| Florida Mill: Dry Stack Tailings | $ | - | $ | 6,990 | $ | 6,990 | |||

| Sub-Total Processing | $ | 62,579 | $ | 81,039 | $ | 143,618 | |||

| Infrastructure | |||||||||

| Power | $ | 21,714 | $ | - | $ | 21,714 | |||

| Assay Lab | $ | 2,804 | $ | - | $ | 2,804 | |||

| Other | $ | 2,552 | $ | 974 | $ | 3,526 | |||

| Sub-Total Infrastructure | $ | 27,070 | $ | 974 | $ | 28,044 | |||

| Owner's Costs | $ | 5,819 | $ | - | $ | 5,819 | |||

| SUB-TOTAL | $ | 141,989 | $ | 134,773 | $ | 276,761 | |||

| Other | |||||||||

| Working Capital(2) | $ | 13,024 | $ | (13,024 | ) | $ | - | ||

| Cash Deposit for Reclamation Bonding(3) | $ | 6,000 | $ | (6,000 | ) | $ | - | ||

| Salvage Value(4) | $ | - | $ | (26,426 | ) | $ | (26,426 | ) | |

| TOTAL | $ | 161,013 | $ | 89,323 | $ | 250,336 | |||

| Reclamation | $ | - | $ | 20,000 | $ | 20,000 | |||

| Total Including Reclamation Costs | $ | 161,013 | $ | 109,323 | $ | 270,336 |

(1) Capital costs include contingency and EPCM costs;

(2) Working capital is returned in year 11;

(3) Cash deposit = 30% of bonding requirement. Released once reclamation is completed;

(4) Salvage value for mining equipment and plant; and

(5) Reclamation costs listed here are treated as operating costs in the economic evaluation.

Table 8 Operating and Total Cost Summary (US$)

| USD / Tonne | |||||||

| LOM Operating Costs | Mined | Processed | |||||

| Mining | $ | 2.00 | $ | 4.18 | |||

| Processing | $ | 3.08 | |||||

| G&A | $ | 0.55 | |||||

| Total Site Costs | $ | 7.82 | |||||

| LOM Cash Costs and All-in Sustaining Costs | By-Product (1) | Co-Product (2) | ||||||

| Mining | $ | 380 | $ | 317 | ||||

| Processing | $ | 280 | $ | 233 | ||||

| G&A | $ | 50 | $ | 42 | ||||

| Total Site Costs | $ | 711 | $ | 592 | ||||

| Transport & Refining | $ | 13 | $ | 11 | ||||

| Royalties | $ | 17 | $ | 14 | ||||

| Total Cash Costs | $ | 741 | $ | 617 | ||||

| Silver By-Product Credits | $ | (272 | ) | $ | - | |||

| Total Cash Costs Net of Silver by-Product | $ | 469 | $ | 617 | ||||

| Sustaining Capital | $ | 131 | $ | 109 | ||||

| Reclamation | $ | 19 | $ | 16 | ||||

| All-in Sustaining Costs | $ | 619 | $ | 742 | ||||

(1) By-Product costs are shown as US dollars per gold ounces sold with silver as a credit; and

(2) Co-Product costs are shown as US dollars per gold equivalent ounce.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Preliminary Economic Analysis

MDA has prepared this PEA for the DeLamar mining project, which includes operations at both the DeLamar and Florida Mountain deposits. A summary of the PEA results is shown in Table 9.

Table 9 Preliminary Economic Analysis Summary

|

After-tax NPV (5%) |

K USD |

$357,572 |

|

After-tax NPV (8%) |

K USD |

$284,448 |

|

After-tax NPV (10%) |

K USD |

$244,454 |

|

After-tax IRR |

% |

43% |

|

After-Tax Payback Period |

Years |

2.35 |

Note that a preliminary economic assessment is preliminary in nature and it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied that would enable them to be classified as mineral reserves. There is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Some economic highlights include:

- Initial construction period is anticipated to be 18 months;

- After-tax net present value ("NPV") (5%) of US$358 million with a 43% after-tax internal rate of return ("IRR") using US$1,350 and US$16.90 per ounce gold and silver prices, respectively;

- After-tax payback period of 2.35 years;

- Year 2 to 6 gold equivalent production of 148,000 ounces (126,000 oz Au and 1,796,000 oz Ag); and

- Year 1 to 10 gold equivalent average production of 124,000 ounces (103,000 oz Au and 1,660,000 oz Ag);

- After-tax LOM cumulative cash flows of US$528 million; and

- Average annual after-tax free cash flow of US$61 million once in production.

2. BlackSheep District, Idaho

On February 14, 2019, Integra announced the acquisition of a highly prospective trend of multiple epithermal centers 6 km to the northwest of the DeLamar Project, a trend now referred to as the BlackSheep District ("BlackSheep" or the "District"). The District was identified in part during site visits and research by renowned epithermal geologists Dr. Jeff Hedenquist and Dr. Richard Sillitoe. Dr. Sillitoe and Dr. Hedenquist, along with Integra's exploration team led by Dr. Max Baker, mapped the area and interpreted the District to have undergone very limited erosion since the mid-Miocene mineralization event, suggesting the productive zone of mineralization is potentially located approximately 200 m beneath the surface. Minimal historical exploration did encounter gold-silver in BlackSheep; however, historic drilling was shallow, less than 100 m vertical on average, and did not enter the theorized productive zone.

The BlackSheep District to the northwest of DeLamar is comparable in geographical size to both the DeLamar and Florida Mountain Deposits combined. The nature of the mineralization and alteration in BlackSheep includes extensive sinter deposits surrounding centers of hydrothermal eruption breccia vents associated with high-level coliform banded amorphous to chalcedonic silica with highly anomalous gold, silver arsenic, mercury, antimony and selenium values. In addition to some preliminary rock chip sampling, Integra completed an extensive soil geochemistry grid over the BlackSheep District showing highly anomalous gold and silver trends over significant lengths.

The Company commenced an extensive regional exploration program at BlackSheep in 2019. This regional exploration program included:

- Additional rock-chip sampling and prospect scale mapping

- A regional airborne magnetic and radiometric survey

- Commissioning of the Idaho Geology Department to undertake 1:24,000 scale geological mapping of the DeLamar, Florida Mountain and BlackSheep Districts

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

- Induced polarization ("IP") survey currently underway

See "Q2 2021 in Review" and "2021 Outlook" sections above for further details on recent exploration work.

3. War Eagle Property, Idaho

On January 21, 2019, Integra announced that, through its wholly owned subsidiary, DeLamar Mining Company, it entered into an option agreement with Nevada Select Royalty, Inc. ("Nevada Select"), a wholly owned subsidiary of Ely Gold Royalties, Inc ("Ely Gold") to acquire Nevada Select's interest in a State of Idaho Mineral Lease encompassing the War Eagle gold-silver Deposit ("War Eagle") situated 3 km east of Integra's Florida Mountain Deposit. On June 21, 2021, Gold Royalty Corp. ("GRC") and Ely Gold announced that they have entered into a definitive agreement pursuant to which GRC will acquire all of the issued and outstanding common shares of Ely Gold by way of a statutory plan of arrangement under the Business Corporations Act (British Columbia). The companies are working towards closing the transaction in the third quarter of 2021.

In the War Eagle Mountain District, Integra had previously acquired the Carton Claim group comprising of six patented mining claims covering 45 acres and located 750 m north of the State Lease.

War Eagle Mountain has a rich history of high-grade gold-silver production dating back to the late 1800's. The War Eagle-Florida-DeLamar geological settings, all hosting low sulphidation epithermal gold-silver are genetically related to the same mineralization forming event that occurred roughly 16 million years ago. The local geology and ore mineralogy found within the low sulphidation epithermal veins on War Eagle Mountain are similar to the regimes found at DeLamar and Florida Mountain to the west. The key difference is the host rock. Historically mined gold and silver in high grade veins at War Eagle was predominately mined and hosted by late Cretaceous age granitic rock. It should be noted that historically, the veins of War Eagle Mountain were of far higher grade compared to any other mining operations in the district, including DeLamar and Florida Mountain. Past production on these high-grade vein systems has outlined strike lengths in excess of 1 km and depth extents of up to 750 meters or more.

The following table highlights several of the best intercepts drilled by previous explorers of War Eagle Mountain, as described in historic drill data tabulations.

|

Drill Hole ID |

From (m) |

To |

Interval |

g/t AuEq(2) |

|

W14 incl |

131.06 131.06 |

213.36 134.11 |

82.30 3.05 |

4.07 32.04 |

|

W02 |

56.39 |

62.48 |

6.09 |

9.49 |

|

W03 |

175.26 |

182.88 |

7.62 |

9.28 |

|

W06 |

146.30 |

147.83 |

1.52 |

55.03 |

|

W40 |

68.58 |

92.96 |

24.38 |

8.45 |

|

W40 incl |

152.40 166.12 |

195.07 176.78 |

42.67 10.67 |

8.83 19.19 |

|

W51 |

124.97 |

132.59 |

7.62 |

8.04 |

1. The historic drill data reported in this release was developed by previous operators of the War Eagle Project prior to the introduction of NI43-101. Historic drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals are estimated to be less than 75% of the reported widths. The historic drill data was sourced from historic reports by various operators' exploration and production data and reports. Integra Resources is providing this historic data for informational purposes only, and gives no assurance as to its reliability or relevance. Integra Resources has not completed any quality assurance program or applied quality control measures to the historic data. Accordingly, the historic data should not be relied upon.

2. Gold equivalent = g Au/t + (g Ag/t ÷ 85)

See "Q2 2021 in Review" and "2021 Outlook" sections above for further details on recent exploration work.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

SELECTED CONSOLIDATED FINANCIAL INFORMATION

The following table sets forth selected consolidation information of the Company as of June 30, 2021, December 31, 2020, and December 31, 2019, prepared in accordance with IFRS. The selected consolidated financial information should be read in conjunction with the Company's audited annual consolidated financial statements and unaudited interim condensed consolidated financial statements for the three and six-month periods ended June 30, 2021.

|

|

Six-Months Ended June 30, 2021 $ |

Year Ended $ |

Year Ended December 31, 2019 $ |

|

Exploration and evaluation expenses |

(14,549,470) |

(17,135,991) |

(13,433,489) |

|

Operating loss |

(18,936,512) |

(25,674,240) |

(20,281,662) |

|

Other income (expense) |

(1,257,474) |

(1,489,377) |

(1,371,387) |

|

Net loss |

(20,193,986) |

(27,163,617) |

(21,653,049) |

|

Net loss per share |

(0.37) |

(0.54) |

(0.64) |

|

Other comprehensive income (loss) |

(448,115) |

(170,070) |

(861,523) |

|

Comprehensive loss |

(20,642,101) |

(27,333,687) |

(22,514,572) |

|

Cash and cash equivalents |

19,628,906 |

37,000,648 |

31,323,346 |

|

Restricted cash, long-term |

23,001 |

23,100 |

1,928,641 |

|

Exploration and evaluation assets |

63,881,665 |

72,330,024 |

61,348,921 |

|

Total assets |

89,434,089 |

113,584,204 |

97,714,711 |

|

Total current liabilities |

9,103,327 |

7,246,586 |

4,445,062 |

|

Total non-current liabilities |

44,900,906 |

53,084,571 |

42,710,061 |

|

Working capital |

12,445,668 |

30,630,454 |

27,587,579 |

The operating losses for the six-months ended June 30, 2021, and the years ended December 31, 2020 and December 31, 2019 were mostly driven by exploration and evaluation expenses, as well as head office and site G&A expenses such as compensation, office, professional fees, regulatory fees, and stock-based compensation (non-cash) expenses.

Other expenses for the six-months ended June 30, 2021, and the years ended December 31, 2020 and December 31, 2019 were mostly due to foreign exchange loss/income and reclamation accretion expenses, partly offset by interest and rent income.

Other comprehensive income (loss) amounts are related to the foreign exchange translation adjustment.

Total assets in the current six-month period ended June 30, 2021 decreased compared to the year ended December 31, 2020, mostly due to cash decrease (mostly as a result of exploration and development activities) and a decrease in exploration and evaluation assets (resulting from a reclamation adjustment). Total assets in the year ended December 31, 2020 increased compared to the year ended December 31, 2019, mostly due to cash increase (as a result of the Company's September 2020 financing), and an increase in exploration and evaluation assets (resulting from a reclamation adjustment), and property, plant and equipment additions.

Working capital in the current six-month period decreased compared to the year ended December 31, 2020 due to a decrease in cash and an increase in payables in the current period. Working capital in the year ended December 31, 2020 increased compared to the year ended December 31, 2019, mostly due to an increase in cash, partially off-set by greater payables.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

Total current liabilities increased in the current six-month period compared to the year ended December 31, 2020 mostly due to increased payables. Total current liabilities increased in the year ended December 31, 2020 comparing to the year ended December 31, 2019, due to increased payables, leases liabilities, and equipment financing liability. Total non-current liabilities decreased in the current six-month period compared to the year ended December 31, 2020 due to a change in reclamation liability (resulting from a change in discount rate). Total non-current liabilities increased in the year ended December 31, 2020 compared to the year ended December 31, 2019, mostly due to a change in reclamation liability (resulting from a change in discount rate and exchange rate) and equipment financing liability incurred in fiscal 2020.

The following table outlines the exploration and evaluation assets break-down:

Exploration and Evaluation Assets Summary:

| Total | |||

| Balance at December 31, 2019 | $ | 61,348,921 | |

| Land acquisitions/option payments | 45,835 | ||

| Claim Staking | 69,550 | ||

| Legal expenses | 5,559 | ||

| Title review and environment | 8,678 | ||

| Reclamation adjustment* | 12,000,190 | ||

| Depreciation** | (9,453 | ) | |

| Translation difference*** | (1,209,218 | ) | |

| Total | 72,260,062 | ||

| Advance minimum royalty | 69,962 | ||

| Balance at December 31, 2020 | 72,330,024 | ||

| Land acquisitions/option payments | 18,591 | ||

| Reclamation adjustment* | (6,585,428 | ) | |

| Depreciation** | (4,550 | ) | |

| Translation difference*** | (1,920,165 | ) | |

| Total | 63,838,472 | ||

| Advance minimum royalty | 43,193 | ||

| Balance at June 30, 2021 | $ | 63,881,665 |

*Reclamation adjustment is the change in present value of the reclamation liability, mainly due to changes to inflation rate and discount rate.

**A staff house building with a carrying value of US$187,150 (C$231,954) has been included in the DeLamar property. This building is being depreciated.

***December 31, 2019 closing balance of US$47,235,080 (C$61,348,921), translated to C$ with the December 31, 2020 exchange rate equals to $60,139,703, resulting in a $1,209,218 translation difference; December 31, 2020 closing balance of US$56,809,633 (C$72,330,024), translated to C$ with the June 30, 2021 exchange rate equals to $70,409,859, resulting in a $1,920,165 translation difference.

MANAGEMENT’S DISCUSSION & ANALYSIS For the Three and Six-Month Periods Ended June 30, 2021 and 2020 |

The following tables outline the Company's exploration and evaluation expense summary for the six-month period ended June 30, 2021 and 2020:

Exploration and Evaluation Expense Summary:

| June 30, 2021 | DeLamar deposit |

Florida Mountain deposit |

War Eagle deposit |

Other deposits |