Exhibit 99.2

nVent Investor Presentation April 2018

Forward Looking Statement CAUTION CONCERNING FORWARD-LOOKING STATEMENTS This presentation contains statements that we believe to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact are forward-looking statements. Without limitation, any statements preceded or followed by or that include the words “targets,” “plans,” “believes,” “expects,” “intends,” “will,” “likely,” “may,” “anticipates,” “estimates,” “projects,” “should,” “would,” “positioned,” “strategy,” “future” or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. All projections in this presentation are also forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, assumptions and other factors, some of which are beyond our control, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include the ability to satisfy the necessary conditions to consummate the planned separation of our Electrical business and the Water business of Pentair plc into two independent, publicly-traded companies (the “Separation”) on a timely basis or at all; the ability to successfully separate our business and realize the anticipated benefits from the Separation; adverse effects on our business operations or financial results as a result of the announcement or consummation of the Separation; unanticipated transaction expenses, such as litigation or legal settlement expenses; changes in tax laws; the impact of the Separation on our employees, customers and suppliers; overall global economic and business conditions impacting our businesses; the ability of our business to operate independently following the Separation; the ability to achieve the benefits of our restructuring plans; the ability to successfully identify, finance, complete and integrate acquisitions; competition and pricing pressures in the markets we serve; the strength of housing and related markets; volatility in currency exchange rates and commodity prices; inability to generate savings from excellence in operations initiatives consisting of lean enterprise, supply management and cash flow practices; increased risks associated with operating foreign businesses; the ability to deliver backlog and win future project work; failure of markets to accept new product introductions and enhancements; the impact of changes in laws and regulations, including those that limit U.S. tax benefits; the outcome of litigation and governmental proceedings; and the ability to achieve our long-term strategic operating goals. Additional information concerning these and other factors is contained in our filings with the SEC, including our Registration Statement on Form 10. All forward-looking statements speak only as of the date of this presentation. nVent Electric plc assumes no obligation, and disclaims any obligation, to update the information contained in this presentation. The officer titles for individual speakers set forth in this presentation are the titles such persons are expected to have at nVent Electric plc after the completion of the Separation. 2

Key Definitions Except as Otherwise Noted, All References to nVent and All Amounts Included Herein Represent the Pentair Electrical Business Excluding the Pentair Water Business, Presented on an Adjusted Basis “Organic Sales” Refers to GAAP Revenue Excluding (1) the Impact of Currency Translation and (2) the Impact of Revenue from Acquired Businesses Recorded Prior to the First Anniversary of the Acquisition Less the Amount of Sales Attributable to Divested Product Lines Not Considered Discontinued Operations Segment Income (Adjusted EBITA) Represents Operating Income Exclusive of Non-Cash Intangible Amortization, Certain Acquisition Related Expenses, Costs of Restructuring Activities, Impairments, and Other Unusual Non-Operating Items Return on Sales (“ROS”) Equals Segment Income Divided by Sales The 2018 Full Year and Q2 Outlook Included Herein Reflects the Anticipated Separation of nVent from Pentair on April 30, 2018 See Appendix for GAAP to Non-GAAP Reconciliations 3

nVent Presenters • Current President of Pentair’s Electrical Segment with over 27 years of experience • Over 12 years of experience as President of various businesses including, President of Pentair’s Flow & Filtration Solutions Beth Wozniak business from 2015 – 2016 Future Chief Executive Officer • President of Honeywell’s Environmental and Combustion Controls from 2011 – 2015; President of Sensing and Control Unit from 2006 – 2011 • Held several other executive and leadership positions at Honeywell and Allied Signal • Previously, CFO of Spectranetics Corporation from 2015 – 2017 • CFO and Treasurer of MSA Safety from 2013 – 2015 Stacy McMahan • 25 years of finance leadership and deep expertise in operations and Future Chief Financial Officer business development at large, publicly held companies • Held several other executive and leadership positions at Johnson & Johnson and Thermo Fisher 4

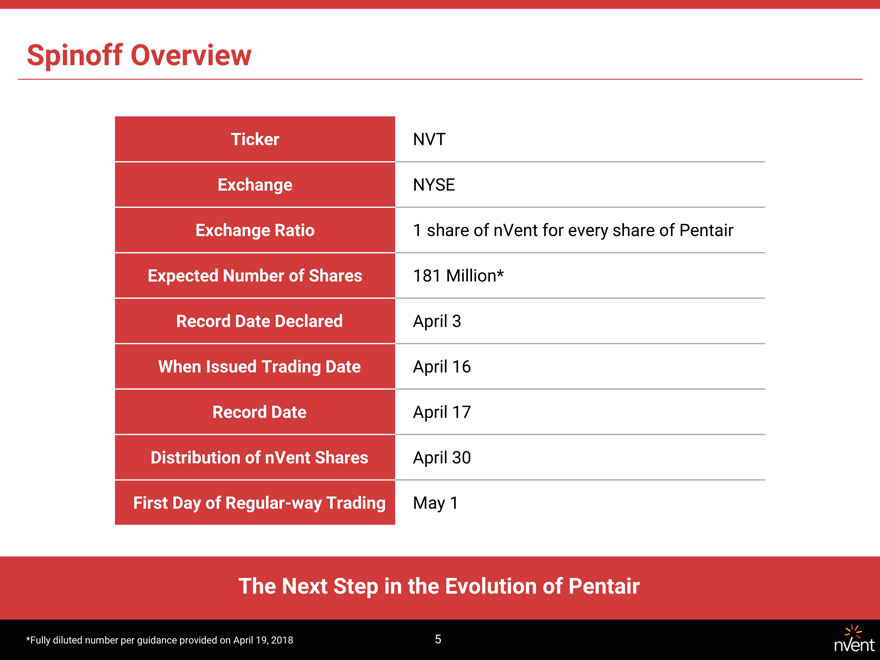

Spinoff Overview Ticker NVT Exchange NYSE Exchange Ratio 1 share of nVent for every share of Pentair Expected Number of Shares 181 Million* Record Date Declared April 3 When Issued Trading Date April 16 Record Date April 17 Distribution of nVent Shares April 30 First Day of Regular-way Trading May 1 The Next Step in the Evolution of Pentair *Fully diluted number per guidance provided on April 19, 2018 5

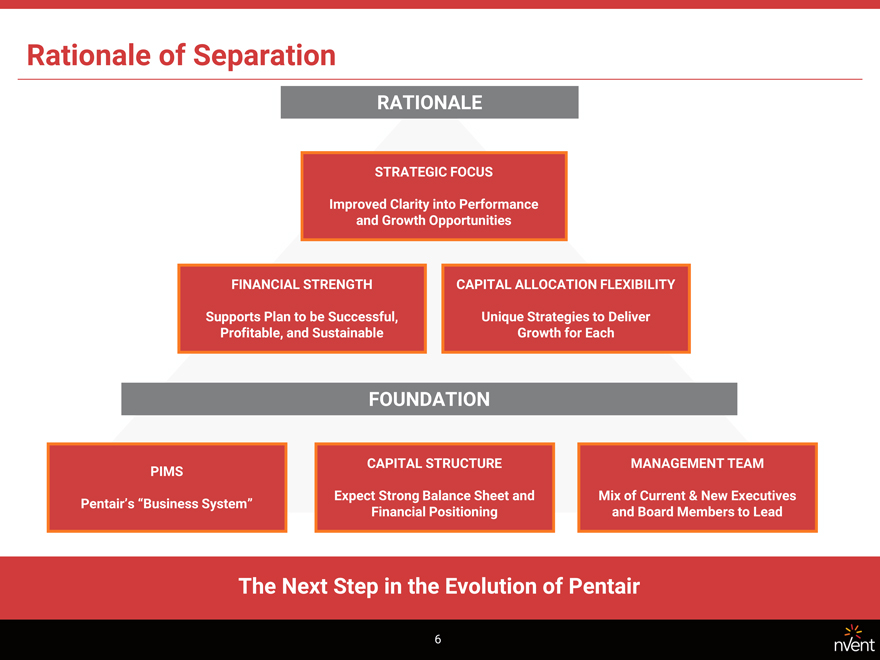

Rationale of Separation RATIONALE STRATEGIC FOCUS Improved Clarity into Performance and Growth Opportunities FINANCIAL STRENGTH CAPITAL ALLOCATION FLEXIBILITY Supports Plan to be Successful, Unique Strategies to Deliver Profitable, and Sustainable Growth for Each FOUNDATION CAPITAL STRUCTURE MANAGEMENT TEAM PIMS Expect Strong Balance Sheet and Mix of Current & New Executives Pentair’s “Business System” Financial Positioning and Board Members to Lead The Next Step in the Evolution of Pentair 6

Agenda 1. Introduction to nVent 2. Strategic Priorities 3. Financial Overview Appendix: Supplementary Information 7

1. Introduction to nVent

Introduction to nVent $2.1B $334M 2017 Revenues 2017 Free Cash Flow Generation 20% ~8,600 2017 Return on Sales Employees 3 47 Highly Profitable Mfg., Distribution & Business Segments Service Facilities 9

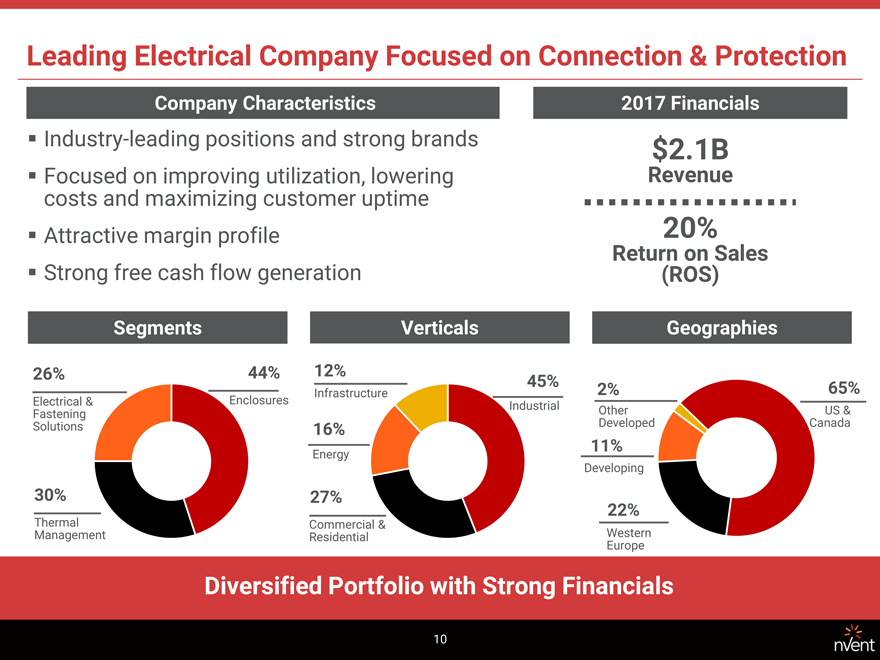

Leading Electrical Company Focused on Connection & Protection Company Characteristics 2017 Financials Industry-leading positions and strong brands $2.1B Focused on improving utilization, lowering Revenue costs and maximizing customer uptime Attractive margin profile 20% Return on Sales Strong free cash flow generation (ROS) Segments Verticals Geographies 26% 44% 12% 45% 65% Infrastructure 2% Electrical & Enclosures Industrial Fastening Other US & Solutions 16% Developed Canada 11% Energy Developing 30% 27% Thermal 22% Commercial & Management Residential Western Europe Diversified Portfolio with Strong Financials 10

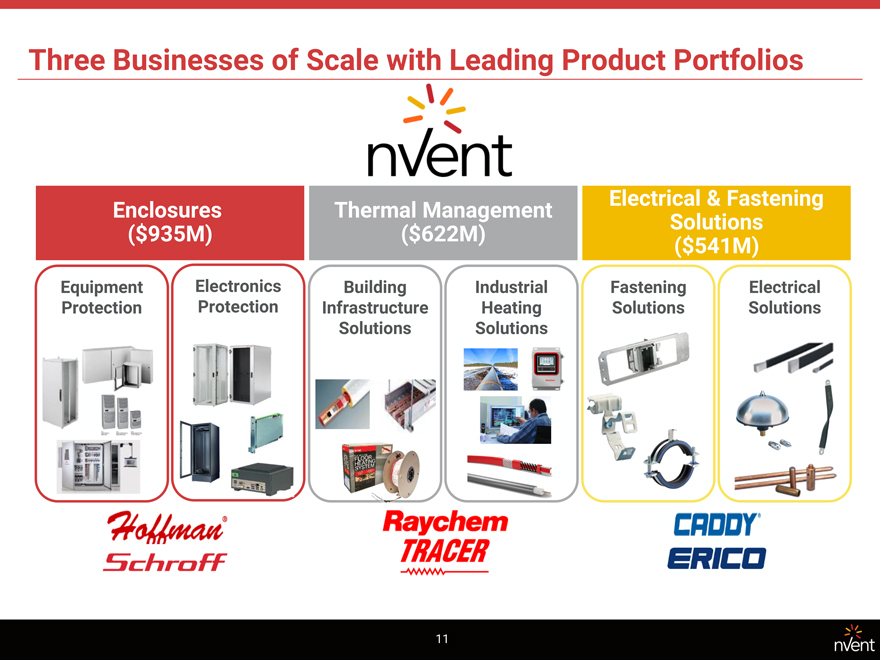

Three Businesses of Scale with Leading Product Portfolios Electrical & Fastening Enclosures Thermal Management Solutions ($935M) ($622M) ($541M) Equipment Electronics Building Industrial Fastening Electrical Protection Protection Infrastructure Heating Solutions Solutions Solutions Solutions 11

Mission-Critical Solutions That Create Value Customer Productivity & Mission-Critical Solutions High Cost of Failure Total Cost of Ownership Our products… Our products… Our products… • Connect and protect • Protect equipment • Reduce labor cost in across broad range of and electronics in installation applications hazardous • Improve utilization • Meet stringent environments • Minimize downtime regulatory standards • Help avoid the high • Reduce total cost of and certifications cost of failure ownership Purge and Stainless Hazardous Rail Surge Pressurization Steel Location Protection Reduced facilities Systems Enclosures Cooling operating costs by ~75% Our Value and Differentiation Drive Customer Loyalty 12

Industry Leading Positions We are a Leader in Connection and Protection • A global leader in electric heat tracing solutions • A global leader in complete heat management systems • A global leader in electrical and fastening solutions • A leader in North American industrial enclosures • A leader in European electronic protection Premier Brands Recognized for Innovation, Quality and Reliability 13

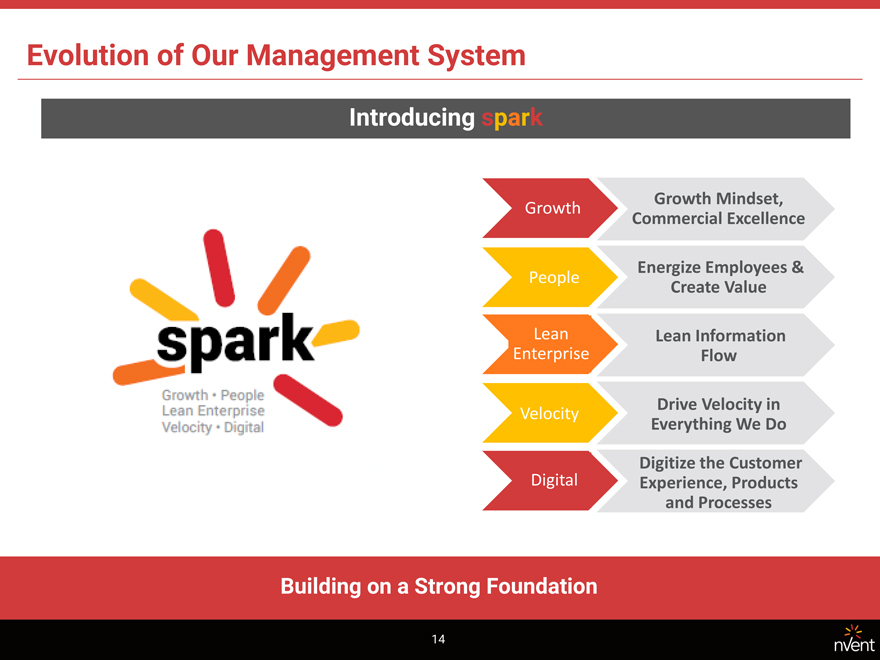

Evolution of Our Management System Introducing spark Growth Mindset, Growth Commercial Excellence Energize Employees & People Create Value Lean Lean Information Enterprise Flow Drive Velocity in Velocity Everything We Do Digitize the Customer Digital Experience, Products and Processes Building on a Strong Foundation 14

2. Strategic Priorities

The nVent Strategy One nVent Focus on Attractive Accelerate Innovation Grow Globally & in Verticals & Connected Solutions Developing Regions Drive Productivity & Velocity Pursue Targeted Bolt-on Acquisitions 16

One nVent Customers Aligned Go to Market Teams for Key Verticals Channels Key Partnerships and Account Management Capability Commercial Excellence Digital Digitizing the Customer Experience Scale Common Processes & Systems 17

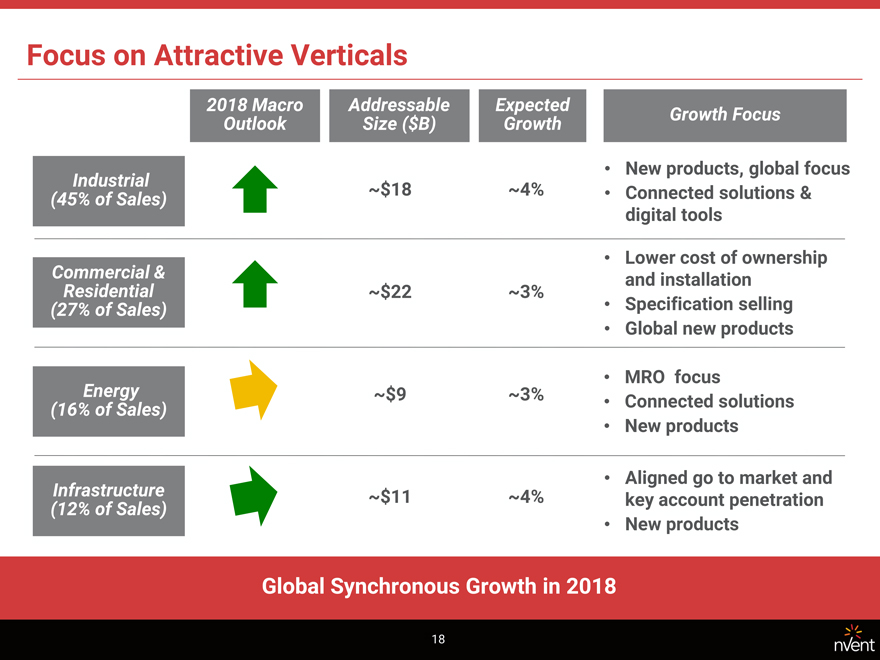

Focus on Attractive Verticals 2018 Macro Addressable Expected Growth Focus Outlook Size ($B) Growth • New products, global focus Industrial ~$18 ~4% • Connected solutions & (45% of Sales) digital tools • Lower cost of ownership Commercial & and installation Residential ~$22 ~3% (27% of Sales) • Specification selling • Global new products • MRO focus Energy ~$9 ~3% (16% of Sales) • Connected solutions • New products • Aligned go to market and Infrastructure ~$11 ~4% key account penetration (12% of Sales) • New products Global Synchronous Growth in 2018 18

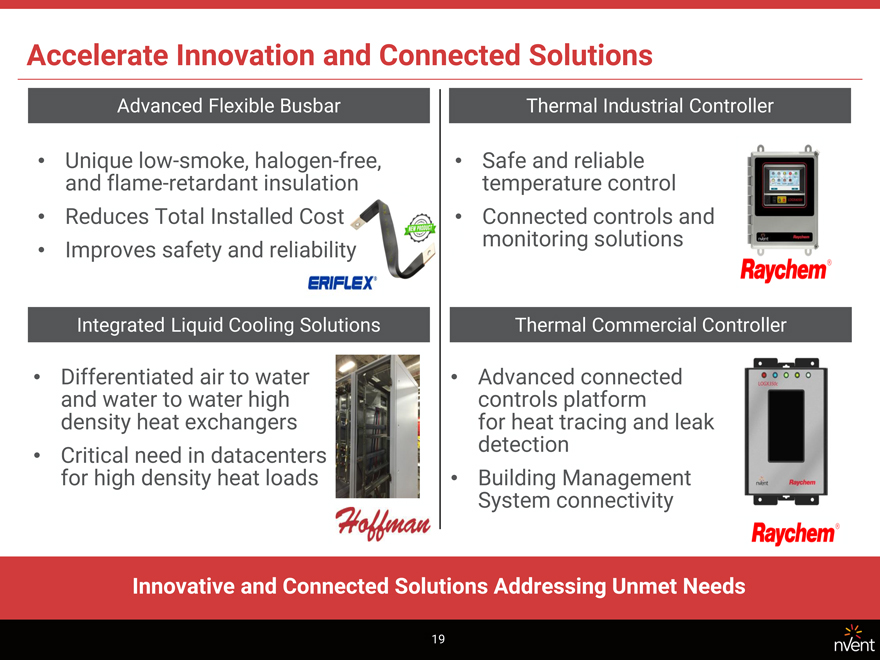

Accelerate Innovation and Connected Solutions Advanced Flexible Busbar Thermal Industrial Controller • Unique low-smoke, halogen-free, • Safe and reliable and flame-retardant insulation temperature control • Reduces Total Installed Cost • Connected controls and monitoring solutions • Improves safety and reliability Integrated Liquid Cooling Solutions Thermal Commercial Controller • Differentiated air to water • Advanced connected and water to water high controls platform density heat exchangers for heat tracing and leak detection • Critical need in datacenters for high density heat loads • Building Management System connectivity Innovative and Connected Solutions Addressing Unmet Needs 19

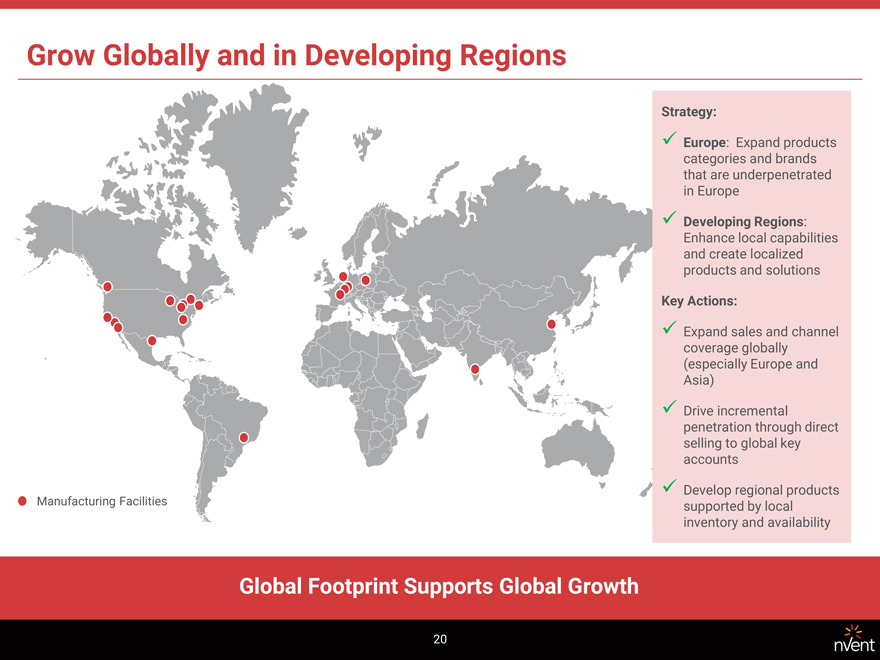

Grow Globally and in Developing Regions Strategy: Europe: Expand products categories and brands that are underpenetrated in Europe Developing Regions: Enhance local capabilities and create localized products and solutions Key Actions: Expand sales and channel coverage globally (especially Europe and Asia) Drive incremental penetration through direct selling to global key accounts Develop regional products Manufacturing Facilities supported by local inventory and availability Global Footprint Supports Global Growth 20

Drive Productivity and Velocity Our Solid Foundation Accelerating Performance Lean Enterprise Lean Enterprise • Standard Work • Lean Information Flow • Creating Flow • Integrated Supply Chain • Strategy Deployment Digital Transformation Digitization • Enterprise-wide platforms • Digital customer experience Standardization • ERP Systems Continue Standardization • Processes • Across all processes Drive Productivity and Velocity 21

Pursue Targeted Bolt-on Acquisitions Appetite for M&A: • Flexible capital structure • Leverage target of 2x – 2.5x over the long-term • Ability to flex to 3x over a short period of time if the appropriate opportunity presents itself M&A Strategy—Key Considerations: • How does the target fit nVent’s strategy? • How compelling are the financials of the deal? • Why are we the right buyer? • What’s our integration plan? • Who’s the integration team? Well Prepared to Execute 22

3. Financial Overview

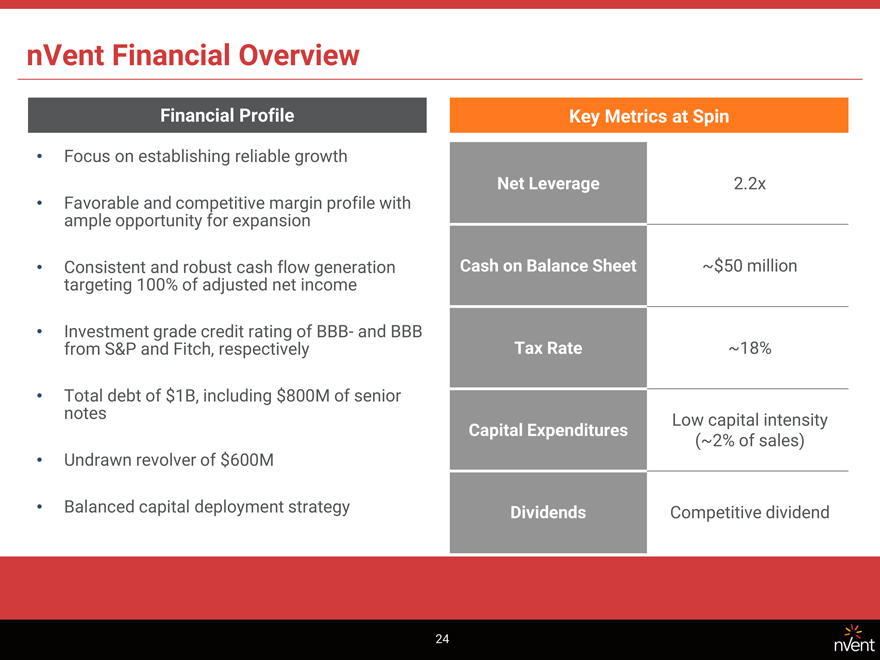

nVent Financial Overview Financial Profile Key Metrics at Spin • Focus on establishing reliable growth Net Leverage 2.2x • Favorable and competitive margin profile with ample opportunity for expansion • Consistent and robust cash flow generation Cash on Balance Sheet ~$50 million targeting 100% of adjusted net income • Investment grade credit rating of BBB- and BBB from S&P and Fitch, respectively Tax Rate ~18% • Total debt of $1B, including $800M of senior notes Low capital intensity Capital Expenditures (~2% of sales) • Undrawn revolver of $600M • Balanced capital deployment strategy Dividends Competitive dividend 24

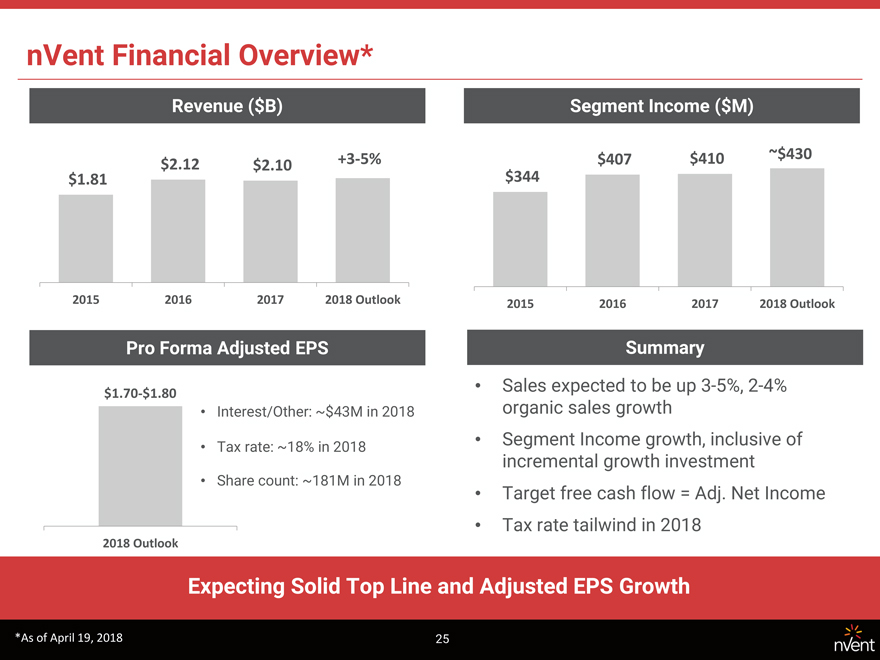

nVent Financial Overview* Revenue ($B) Segment Income ($M) +3-5% $407 $410 ~$430 $2.12 $2.10 $344 $1.81 2015 2016 2017 2018 Outlook 2015 2016 2017 2018 Outlook Pro Forma Adjusted EPS Summary • Sales expected to be up 3-5%, 2-4% $1.70-$1.80 • Interest/Other: ~$43M in 2018 organic sales growth Tax rate: ~18% in 2018 • Segment Income growth, inclusive of • incremental growth investment • Share count: ~181M in 2018 • Target free cash flow = Adj. Net Income • Tax rate tailwind in 2018 2018 Outlook Expecting Solid Top Line and Adjusted EPS Growth *As of April 19, 2018 25

Favorable Margin Profile with Opportunities for Expansion Sales ($ in millions) & ROS Competitive Margin vs Peers1 2018E Adj. EBITA Margin¹ (ROS) of Selected Electrical Peers $2,116 $2,098 $1,809 19% 20% 20% 2015 2016 2017 Sales ROS Current Margin Profile Opportunity to Drive Margin Expansion Established margin performance via: Drive profitable growth • Diversification • Commercial excellence • Growth in new regions and new products • Pricing optimization • Product vitality acceleration • MRO business mix enterprise Expand lean enterprise • Lean • Lean information flow • Integrated supply chain Driving common processes and systems ¹ Selected Electrical Peers include ABB, Acuity, Eaton, Hubbell, Rockwell Automation, Schneider Electric, and Thermon. Peer 2018E EBITA margins based on IBES median estimates as of 13-Apr-2018 and reported amortization projections from 26 latest filings.

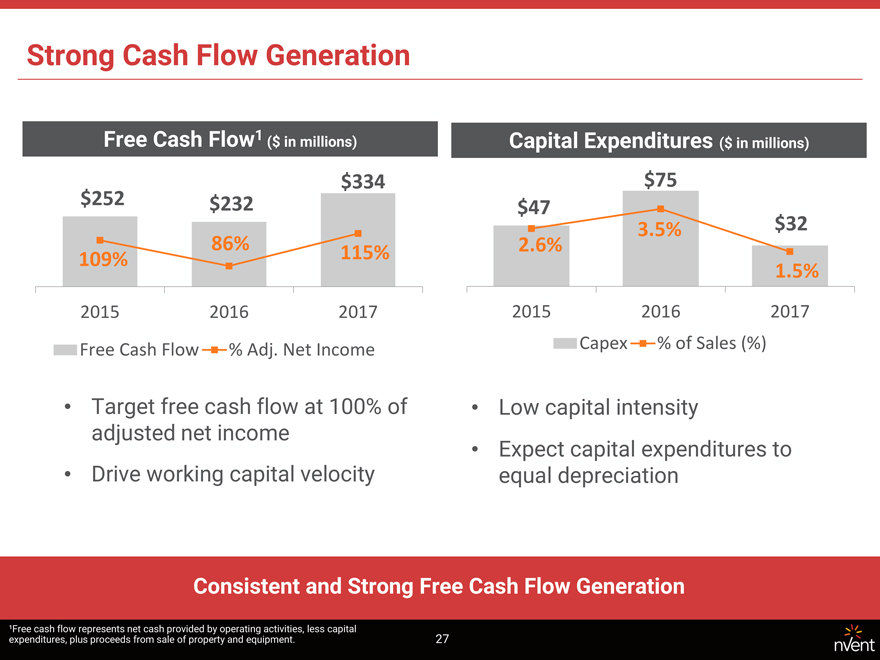

Strong Cash Flow Generation Free Cash Flow1 ($ in millions) Capital Expenditures ($ in millions) $334 $75 $252 $232 $47 $32 3.5% 86% 2.6% 109% 115% 1.5% 2015 2016 2017 2015 2016 2017 Free Cash Flow % Adj. Net Income Capex % of Sales (%) • Target free cash flow at 100% of • Low capital intensity adjusted net income • Expect capital expenditures to • Drive working capital velocity equal depreciation Consistent and Strong Free Cash Flow Generation ¹Free cash flow represents net cash provided by operating activities, less capital expenditures, plus proceeds from sale of property and equipment. 27

Conservative Capital Structure and Allocation Philosophy • Target investment grade metrics • Balanced capital deployment strategy • Competitive dividend policy • Share repurchases to offset dilution at a minimum • Bolt-on acquisitions targeting focused growth areas Committed and Disciplined 28

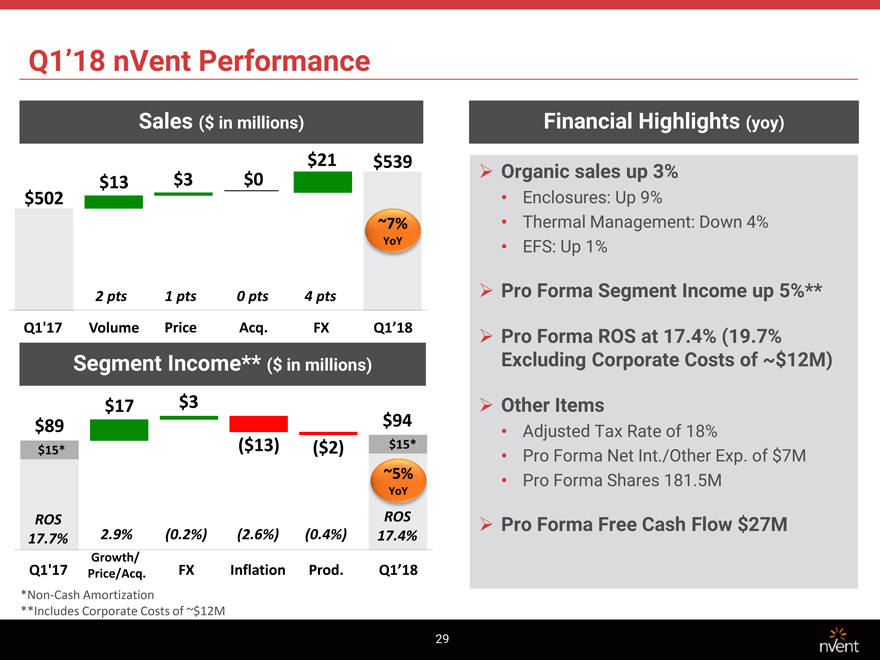

Q1’18 nVent Performance Sales ($ in millions) Financial Highlights (yoy) $21 $539 $0 Organic sales up 3% $13 $3 $502 • Enclosures: Up 9% ~7% • Thermal Management: Down 4% YoY • EFS: Up 1% 2 pts 1 pts 0 pts 4 pts Pro Forma Segment Income up 5%** Q1’17 Volume Price Acq. FX Q1’18 Pro Forma ROS at 17.4% (19.7% Segment Income** ($ in millions) Excluding Corporate Costs of ~$12M) $17 $3 Other Items $89 $94 • Adjusted Tax Rate of 18% ($13) ($2) $15* $15* • Pro Forma Net Int./Other Exp. of $7M ~5% • Pro Forma Shares 181.5M YoY ROS ROS Pro Forma Free Cash Flow $27M 17.7% 2.9% (0.2%) (2.6%) (0.4%) 17.4% Growth/ Q1’17 Price/Acq. FX Inflation Prod. Q1’18 *Non-Cash Amortization **Includes Corporate Costs of ~$12M 29

Q2’18 nVent Pro Forma Outlook* Q2’18 Guidance Q2’17 Organic Sales +2%—4% $513M Segment Income* +1%—3% $106M ROS* 18%—20% 20.6% EPS (reported) $0.33—$0.36 EPS (adjusted) $0.41—$0.44 Summary Other Considerations Continued Sales Strength Tax Rate: ~18% Sequential ROS Improvement Pro Forma Net Interest/Other Expense: ~ 11M Actively Managing Price/Cost Pro Forma Shares: ~181M *Includes corporate costs Executing on Our Plan *As of April 19, 2018 30

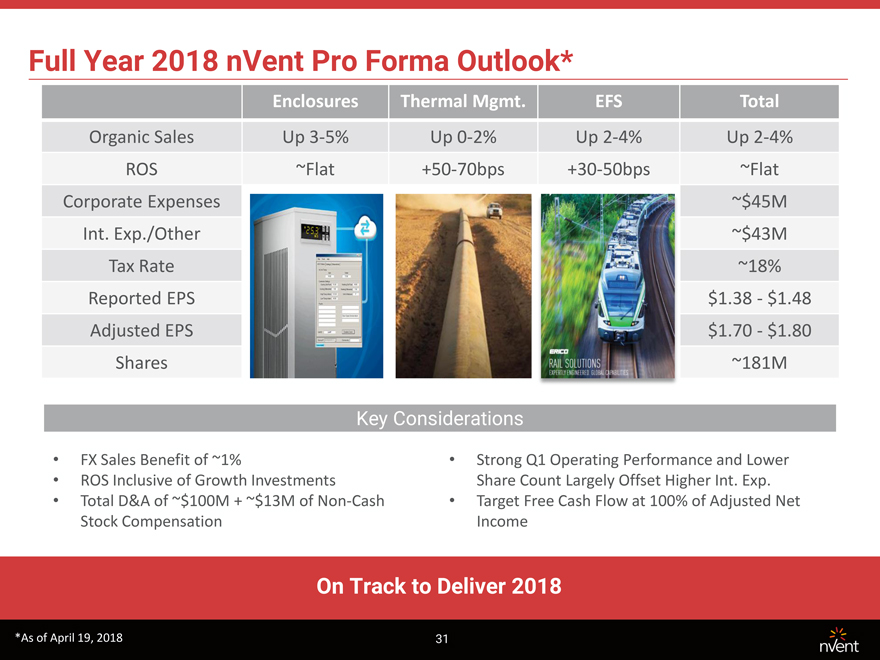

Full Year 2018 nVent Pro Forma Outlook* Enclosures Thermal Mgmt. EFS Total Organic Sales Up 3-5% Up 0-2% Up 2-4% Up 2-4% ROS ~Flat +50-70bps +30-50bps ~Flat Corporate Expenses ~$45M Int. Exp./Other ~$43M Tax Rate ~18% Reported EPS $1.38—$1.48 Adjusted EPS $1.70—$1.80 Shares ~181M Key Considerations • FX Sales Benefit of ~1% • Strong Q1 Operating Performance and Lower • ROS Inclusive of Growth Investments Share Count Largely Offset Higher Int. Exp. • Total D&A of ~$100M + ~$13M of Non-Cash • Target Free Cash Flow at 100% of Adjusted Net Stock Compensation Income On Track to Deliver 2018 *As of April 19, 2018 31

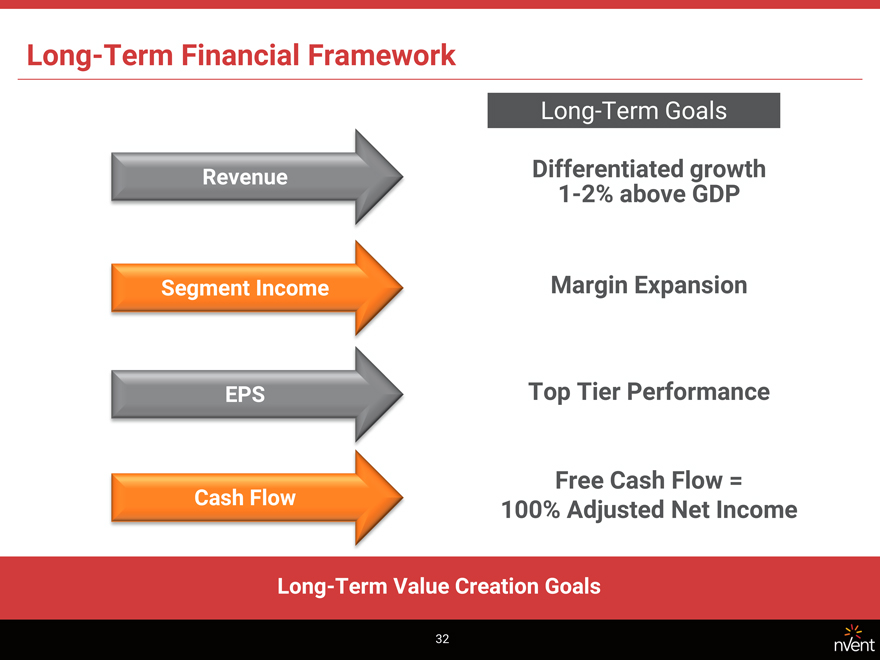

Long-Term Financial Framework Long-Term Goals Revenue Differentiated growth 1-2% above GDP Segment Income Margin Expansion EPS Top Tier Performance Free Cash Flow = Cash Flow 100% Adjusted Net Income Long-Term Value Creation Goals 32

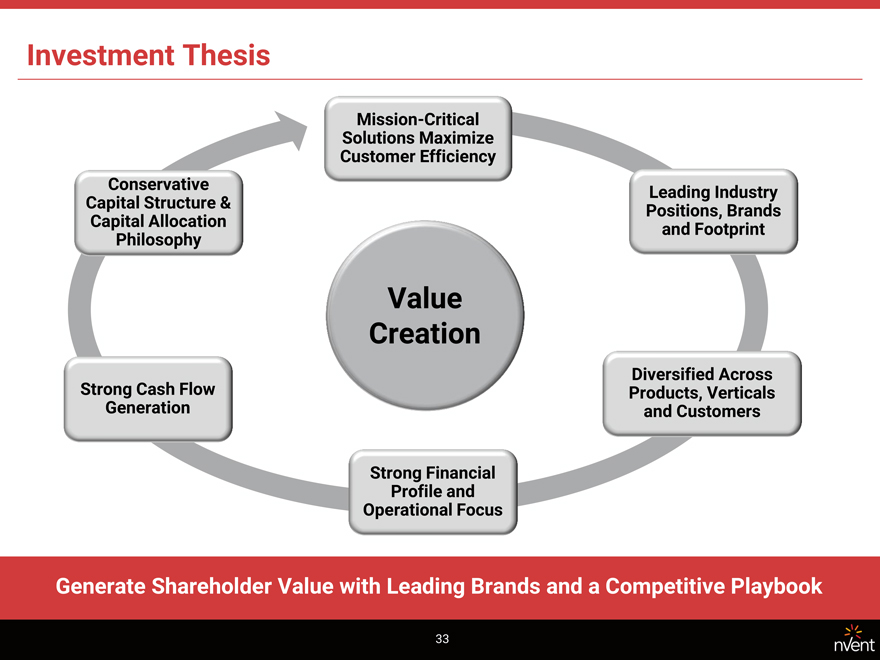

Investment Thesis Mission-Critical Solutions Maximize Customer Efficiency Conservative Leading Industry Capital Structure & Positions, Brands Capital Allocation and Footprint Philosophy Value Creation Diversified Across Strong Cash Flow Products, Verticals Generation and Customers Strong Financial Profile and Operational Focus Generate Shareholder Value with Leading Brands and a Competitive Playbook 33

Appendix

nVent Leadership Team STACY McMAHAN EVP LYNNETTE & Chief HEATH Human JON LAMMERS BEN SOMMERNESS Financial EVP & Chief Officer Resources Officer EVP, & General Secretary Counsel EVP, Strategy Chief Growth Officer & Chief BETH Executive WOZNIAK Officer EVP & TOM Chief PETTIT Integrated JOE President RUZYNSKI BRAD President FAULCONER ROBERT President Van der KOLK Supply Chain Officer Enclosures Thermal Management EFS New Leadership Team in Place 35

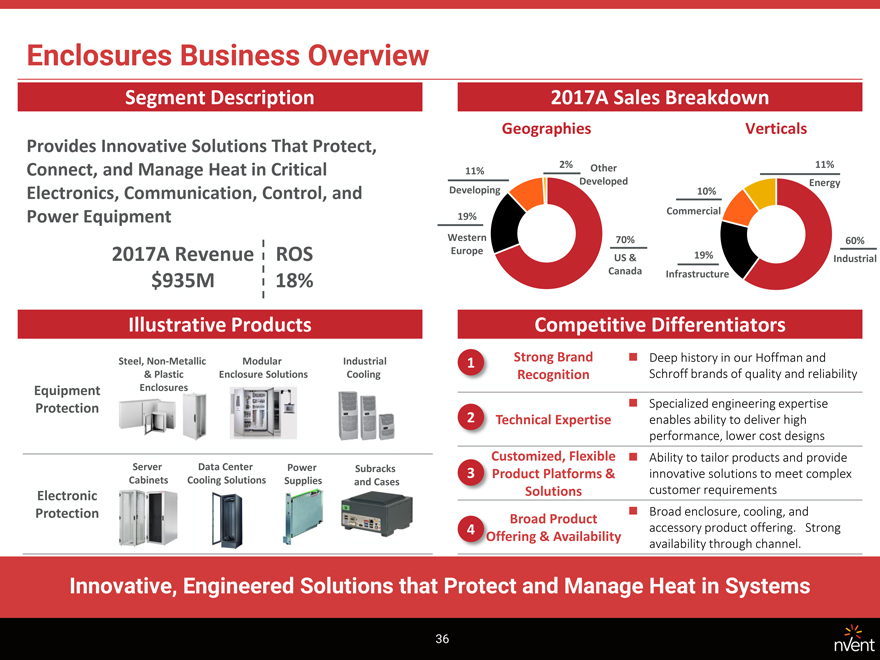

Enclosures Business Overview Segment Description 2017A Sales Breakdown Geographies Verticals Provides Innovative Solutions That Protect, 2% Other 11% Connect, and Manage Heat in Critical 11% Developing Developed Energy Electronics, Communication, Control, and 10% Commercial Power Equipment 19% Western 70% 60% Europe 2017A Revenue ROS US & 19% Industrial Canada Infrastructure $935M 18% Illustrative Products Competitive Differentiators Steel, Non-Metallic Modular Industrial 1 Strong Brand Deep history in our Hoffman and & Plastic Enclosure Solutions Cooling Recognition Schroff brands of quality and reliability Equipment Enclosures Protection Specialized engineering expertise 2 Technical Expertise enables ability to deliver high performance, lower cost designs Customized, Flexible Ability to tailor products and provide Server Data Center Power Subracks 3 Product Platforms & innovative solutions to meet complex Cabinets Cooling Solutions Supplies and Cases customer requirements Electronic Solutions Protection Broad enclosure, cooling, and Broad Product 4 accessory product offering. Strong ffering & Availability availability through channel. Innovative, Engineered Solutions that Protect and Manage Heat in Systems 36

Thermal Management Business Overview Segment Description 2017A Sales Breakdown Geographies Verticals Provides Electric Thermal Solutions that 2% Other Connect and Protect Critical Buildings, 14% Developed Infrastructure, Industrial Processes 43% Developing Industrial 26% and People Commercial & Residential 55% 29% 2017A Revenue ROS US & Western Canada $622M 24% Europe 31% Energy Illustrative Products Competitive Differentiators Deep and rich Raychem and Tracer Pipe Freeze Advanced Control Pipeline Heat Strong Brand 1 history of innovative and high-quality Protection and Process and Monitoring Heating Management Recognition Maintenance 3D Design products Industrial Heating Specialized engineering expertise Solutions 2 Technical Expertise enables delivery of high performance, lower cost & inventive designs Ease of Highly Reliable and easy to install Floor Heating Fire Rated Wiring Snow Melting & Pipe Heating 3 Installation & solutions that lower total cost of Building & Cables De-Icing Reduced Total Cost ownership Infrastructure Solutions Offer one-stop shop and access to large 4 Complete Solutions portfolio with multi-tier offerings Complete and Connected Solutions for Optimal, Reliable Systems 37

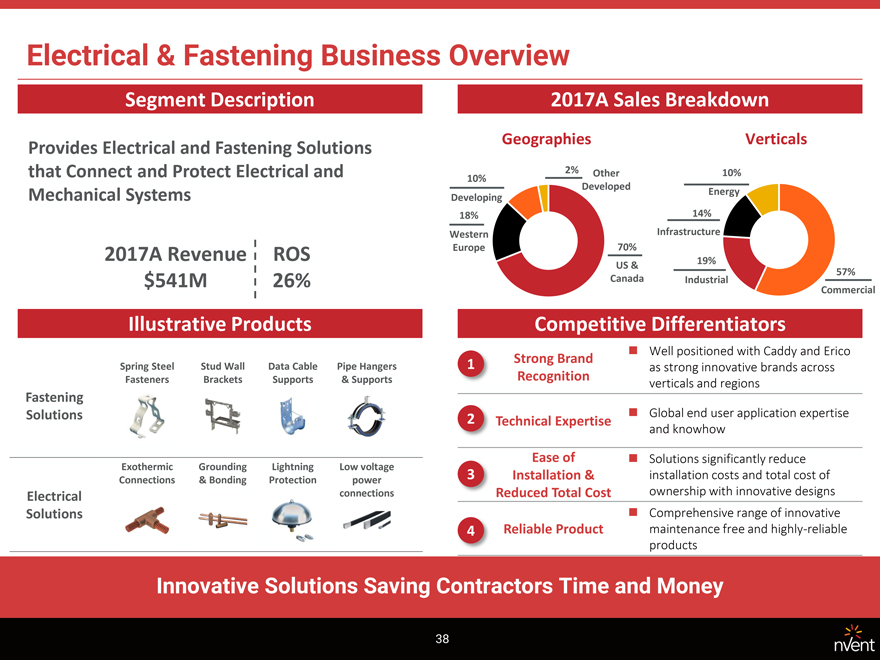

Electrical & Fastening Business Overview Segment Description 2017A Sales Breakdown Geographies Verticals Provides Electrical and Fastening Solutions that Connect and Protect Electrical and 10% 2% Other 10% Developed Mechanical Systems Energy Developing 18% 14% Western Infrastructure 2017A Revenue ROS Europe 70% 19% US & 57% $541M 26% Canada Industrial Commercial Illustrative Products Competitive Differentiators Well positioned with Caddy and Erico 1 Strong Brand Spring Steel Stud Wall Data Cable Pipe Hangers Recognition as strong innovative brands across Fasteners Brackets Supports & Supports verticals and regions Fastening Solutions 2 Global end user application expertise Technical Expertise and knowhow Exothermic Grounding Lightning Low voltage Ease of Solutions significantly reduce 3 Installation & installation costs and total cost of Connections & Bonding Protection power Electrical connections Reduced Total Cost ownership with innovative designs Solutions Comprehensive range of innovative 4 Reliable Product maintenance free and highly-reliable products Innovative Solutions Saving Contractors Time and Money 38

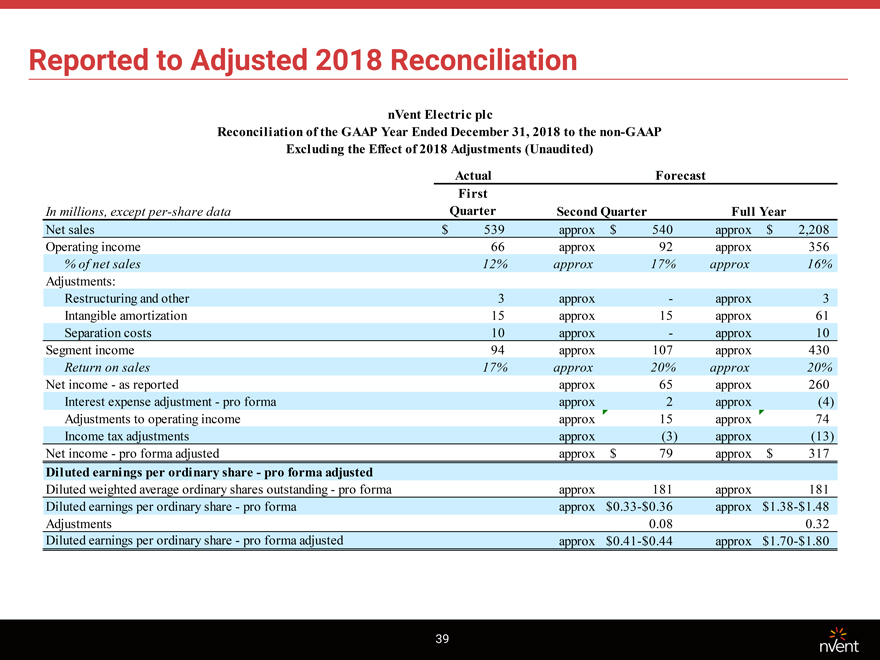

Reported to Adjusted 2018 Reconciliation nVent Electric plc Reconciliation of the GAAP Year Ended December 31, 2018 to the non-GAAP Excluding the Effect of 2018 Adjustments (Unaudited) Actual Forecast First In millions, except per-share data Quarter Second Quarter Full Year Net sales $ 539 approx $ 540 approx $ 2,208 Operating income 66 approx 92 approx 356 % of net sales 12% approx 17% approx 16% Adjustments: Restructuring and other 3 approx —approx 3 Intangible amortization 15 approx 15 approx 61 Separation costs 10 approx —approx 10 Segment income 94 approx 107 approx 430 Return on sales 17% approx 20% approx 20% Net income—as reported approx 65 approx 260 Interest expense adjustment—pro forma approx 2 approx (4) Adjustments to operating income approx 15 approx 74 Income tax adjustments approx (3) approx (13) Net income—pro forma adjusted approx $ 79 approx $ 317 Diluted earnings per ordinary share—pro forma adjusted Diluted weighted average ordinary shares outstanding—pro forma approx 181 approx 181 Diluted earnings per ordinary share—pro forma approx $0.33-$0.36 approx $1.38-$1.48 Adjustments 0.08 0.32 Diluted earnings per ordinary share—pro forma adjusted approx $0.41-$0.44 approx $1.70-$1.80 39

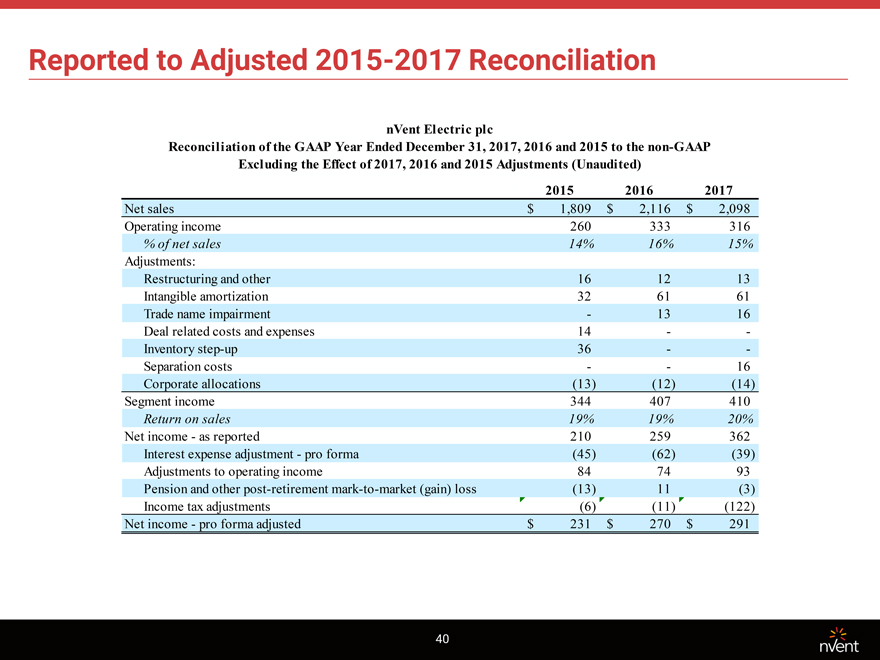

Reported to Adjusted 2015-2017 Reconciliation nVent Electric plc Reconciliation of the GAAP Year Ended December 31, 2017, 2016 and 2015 to the non-GAAP Excluding the Effect of 2017, 2016 and 2015 Adjustments (Unaudited) 2015 2016 2017 Net sales $ 1,809 $ 2,116 $ 2,098 Operating income 260 333 316 % of net sales 14% 16% 15% Adjustments: Restructuring and other 16 12 13 Intangible amortization 32 61 61 Trade name impairment — 13 16 Deal related costs and expenses 14 — -Inventory step-up 36 — -Separation costs — — 16 Corporate allocations (13) (12) (14) Segment income 344 407 410 Return on sales 19% 19% 20% Net income—as reported 210 259 362 Interest expense adjustment—pro forma (45) (62) (39) Adjustments to operating income 84 74 93 Pension and other post-retirement mark-to-market (gain) loss (13) 11 (3) Income tax adjustments (6) (11) (122) Net income—pro forma adjusted $ 231 $ 270 $ 291 40

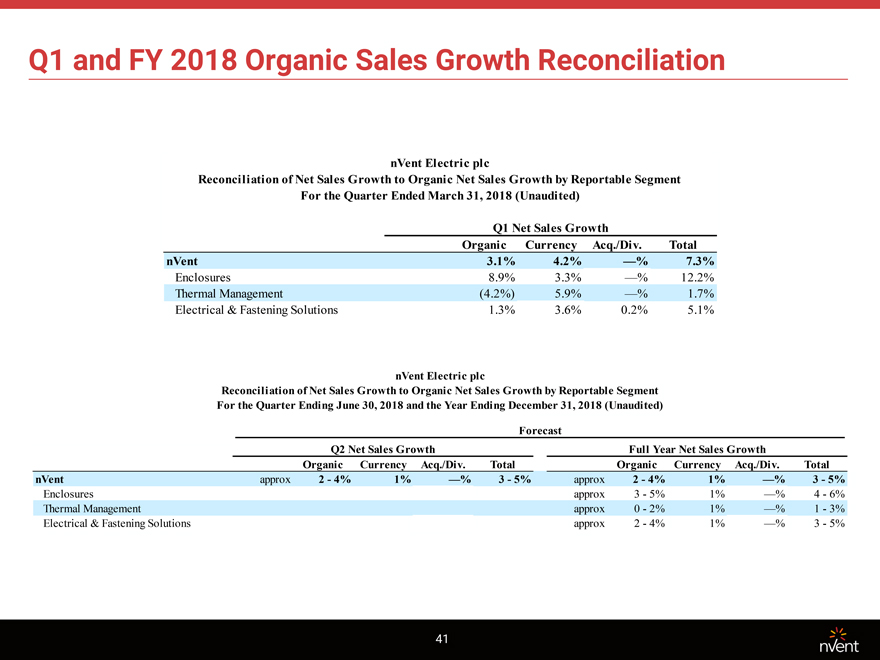

Q1 and FY 2018 Organic Sales Growth Reconciliation nVent Electric plc Reconciliation of Net Sales Growth to Organic Net Sales Growth by Reportable Segment For the Quarter Ended March 31, 2018 (Unaudited) Q1 Net Sales Growth Organic Currency Acq./Div. Total nVent 3.1% 4.2% —% 7.3% Enclosures 8.9% 3.3% —% 12.2% Thermal Management (4.2%) 5.9% —% 1.7% Electrical & Fastening Solutions 1.3% 3.6% 0.2% 5.1% nVent Electric plc Reconciliation of Net Sales Growth to Organic Net Sales Growth by Reportable Segment For the Quarter Ending June 30, 2018 and the Year Ending December 31, 2018 (Unaudited) Forecast Q2 Net Sales Growth Full Year Net Sales Growth Organic Currency Acq./Div. Total Organic Currency Acq./Div. Total nVent approx 2—4% 1% —% 3—5% approx 2—4% 1% —% 3—5% Enclosures approx 3—5% 1% —% 4—6% Thermal Management approx 0—2% 1% —% 1—3% Electrical & Fastening Solutions approx 2—4% 1% —% 3—5% 41

Cash Flow Reconciliation nVent Electric plc Reconciliation of the GAAP Operating Activities Cash Flow to the non-GAAP Free Cash Flow (Unaudited) Three months ended In millions March 31, 2018 March 31, 2017 Free cash flow Net cash provided by (used for) operating activities—as reported $ 36 $ 87 Interest expense—pro forma 6 16 Net cash provided by (used for) operating activities—pro forma 30 71 Capital expenditures (5) (11) Proceeds from sale of property and equipment 2 -Free cash flow—pro forma $ 27 $ 60 Twelve months ended In millions December 31, 2015 December 31, 2016 December 31, 2017 Free cash flow Net cash provided by (used for) operating activities—as reported $ 344 $ 364 $ 402 Interest expense—pro forma 46 63 40 Net cash provided by (used for) operating activities—pro forma 298 301 362 Capital expenditures (47) (75) (32) Proceeds from sale of property and equipment 1 6 4 Free cash flow—pro forma $ 252 $ 232 $ 334 42