UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report.………………………………

For the transition period from to

Commission file number:

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant’s Name Into English)

(Jurisdiction of Incorporation or Organization)

Huami Global Innovation Center

(Address of Principal Executive Offices)

Huami Global Innovation Center

Phone:

Email:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class |

| Trading Symbol(s) |

| Name of Each Exchange On Which Registered |

Class A ordinary shares, par value US$0.0001 per share* |

|

*Not for trading, but only in connection with the listing of the American depositary shares on the New York Stock Exchange.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2021, there were (i)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

TABLE OF CONTENTS

1 | ||

|

| |

2 | ||

|

| |

3 | ||

|

|

|

3 | ||

3 | ||

3 | ||

60 | ||

90 | ||

90 | ||

106 | ||

119 | ||

122 | ||

123 | ||

124 | ||

136 | ||

136 | ||

|

|

|

138 | ||

|

|

|

138 | ||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 138 | |

138 | ||

139 | ||

139 | ||

140 | ||

140 | ||

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 140 | |

141 | ||

141 | ||

141 | ||

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | 141 | |

|

|

|

141 | ||

|

|

|

141 | ||

142 | ||

142 | ||

i

INTRODUCTION

Unless otherwise indicated and except where the context otherwise requires, in this annual report on Form 20-F:

| ● | “ADSs” refer to our American depositary shares, each of which represents four Class A ordinary shares; |

| ● | “ADRs” refer to the American depositary receipts that evidence our ADSs; |

| ● | “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Hong Kong, Macau and Taiwan; |

| ● | “Class A ordinary shares” refer to our class A ordinary shares, par value US$0.0001 per share; |

| ● | “Class B ordinary shares” refer to our class B ordinary shares, par value US$0.0001 per share; |

| ● | “Memorandum and Articles” refer to the second amended and restated memorandum of association and articles of association adopted by a special resolution passed on January 12, 2018 and effective on February 12, 2018; |

| ● | “Mobile App MAUs” refer to monthly active users of our mobile apps, which are represented by the number of accounts that have been logged into on our mobile apps during a given calendar month. The numbers of our Mobile App MAUs are calculated using internal company data that have not been independently verified. It is possible that some users may have set up more than one account; |

| ● | “ordinary shares” refer to our Class A and Class B ordinary shares, par value US$0.0001 per share; |

| ● | “Our platform” refers to the products and mobile apps that we provide to users and platform partners; |

| ● | “our VIEs” refer to Anhui Huami Information Technology Co., Ltd. and Huami (Beijing) Information Technology Co., Ltd., each of which is a company incorporated in the PRC; |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “Shunyuan Kaihua” or “our WFOE” refers to Beijing Shunyuan Kaihua Technology Co., Ltd., a wholly owned foreign enterprise incorporated with limited liability in the PRC; |

| ● | “US$,” “U.S. dollars,” “$,” or “dollars” refer to the legal currency of the United States; |

| ● | “Xiaomi” refers to Xiaomi Corporation, of which we have been a major partner to design and manufacture Xiaomi Wearable Products; |

| ● | “Xiaomi Wearable Products” refer to Xiaomi-branded smart bands, watches (excluding children watches and quartz watches), scales and associated accessories; and |

| ● | “Zepp,” “we,” “us,” “our company” or “our” refer to Zepp Health Corporation, our Cayman Islands holding company, and its subsidiaries, and, in the context of describing our operations and consolidated financial information, our VIEs in China, including Anhui Huami Information Technology Co., Ltd. and Huami (Beijing) Information Technology Co., Ltd., and their subsidiaries. |

| ● | “U.S. GAAP” refers to generally accepted accounting principles in the United States. |

1

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains forward-looking statements that relate to our current expectations and views of future events. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our goals and strategies; |

| ● | our future business development, financial conditions and results of operations; |

| ● | the expected growth of the smart wearable devices industry; |

| ● | our expectations regarding demand for and market acceptance of our products and services; |

| ● | our expectations regarding our relationships Xiaomi, our other distributors, customers, contract manufacturers, component suppliers, strategic partners and other stakeholders; |

| ● | competition in our industry; and |

| ● | relevant government policies and regulations relating to our industry. |

You should read this annual report and the documents that we refer to in this annual report and have filed as exhibits to this annual report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Unless otherwise noted, all translations from Renminbi to U.S. dollars and from U.S. dollars to Renminbi in this annual report are made at a rate of RMB6.3726 to US$1.00, the exchange rate in effect as of December 30, 2021 as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. We make no representation that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at any particular rate, or at all.

2

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

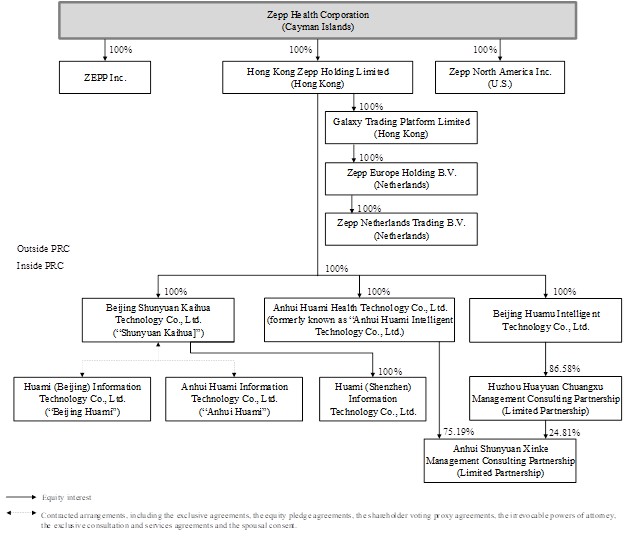

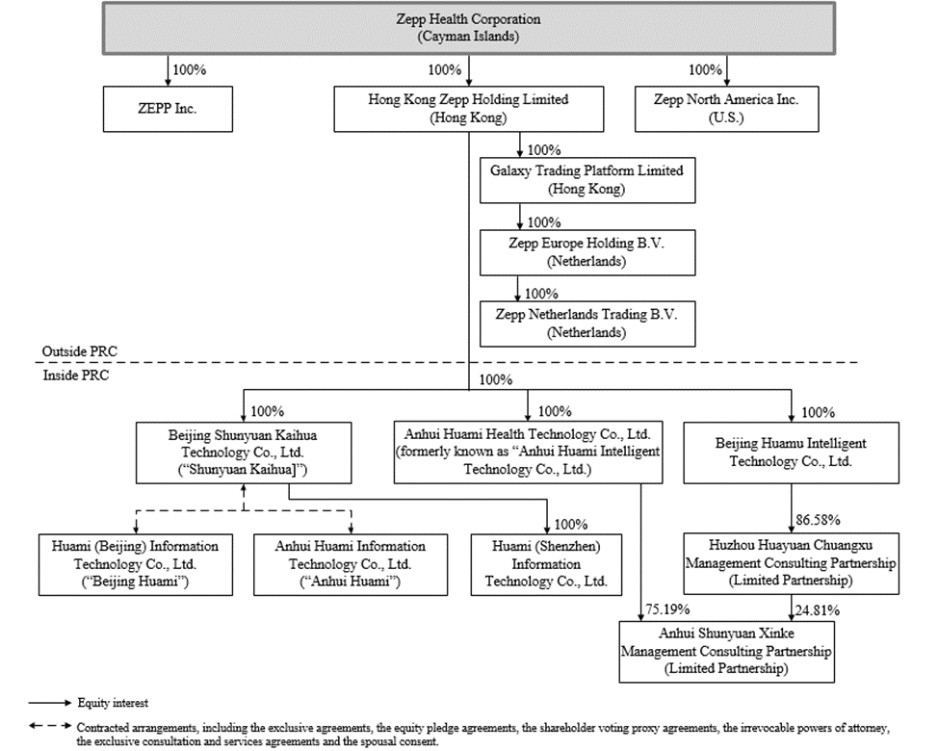

Our Holding Company Structure and Contractual Arrangements with our VIEs

Zepp Health Corporation is not a Chinese operating company but a Cayman Islands holding company with no equity ownership in its consolidated variable interest entities, or VIEs. We conduct our operations in China through (i) our PRC subsidiaries and (ii) our VIEs with which we have maintained contractual arrangements and their subsidiaries in China. PRC laws and regulations impose certain restrictions or prohibitions on foreign ownership of companies that engage in developing substantial proprietary technology to produce consumer health and fitness devices. Accordingly, we operate these businesses in China through our VIEs and their subsidiaries, and rely on contractual arrangements among our PRC subsidiaries, our VIEs and their nominee shareholders to control the business operations of our VIEs. Our VIEs are consolidated for accounting purposes, but are not entities in which our Cayman Islands holding company, or our investors, own equity. Revenues contributed by our VIEs accounted for 99.8%, 97.9% and 83.5% of our total revenues for the years ended December 31, 2019, 2020 and 2021, respectively. As used in this annual report, “we,” “us,” “our company,” “our,” or “Zepp” refers to Zepp Health Corporation, its subsidiaries, and, in the context of describing our operations and consolidated financial information, our VIEs in China, including Anhui Huami Information Technology Co., Ltd. and Huami (Beijing) Information Technology Co., Ltd., and other subsidiaries. Investors in our ADSs are not purchasing equity interest in our operating entities in China but instead are purchasing equity interest in a holding company incorporated in the Cayman Islands.

3

The following chart illustrates our company’s organizational structure, including our principal subsidiaries and consolidated affiliated entities as of the date of this annual report:

Notes:

(1) | Messrs. Wang Huang, Yunfen Lu, Meihui Fan, Bin Fan, Yi Zhang and Xiaojun Zhang are beneficial owners of the shares of our company and hold 90.1%, 2.1285%, 2.1285%, 2.1285%, 2.1285% and 1.386% equity interests in Beijing Huami, respectively. They are either directors or employees of our company. |

(2) | Messrs. Wang Huang and Yunfen Lu are beneficial owners of the shares of our company and hold 99.4% and 0.6% equity interests in Anhui Huami, respectively. They are also directors of our company. |

4

A series of contractual agreements, including loan agreement, equity pledge agreement, exclusive option agreement, exclusive consultation and service agreement, shareholder voting proxy agreement and power of attorney, have been entered into by and among our subsidiaries, our VIEs and their respective shareholders. Terms contained in each set of contractual arrangements with our VIEs and their respective shareholders are substantially similar. Despite the lack of legal majority ownership, our Cayman Island holding company is considered the primary beneficiary of our VIEs and consolidates our VIEs and their subsidiaries as required by Accounting Standards Codification topic 810, Consolidation. Accordingly, we treat our VIEs as our consolidated entities under U.S. GAAP and we consolidate the financial results of our VIEs in our consolidated financial statements in accordance with U.S. GAAP. For more details of these contractual arrangements, see “Item 4. Information on the Company—C. Organizational Structure.”

However, the contractual arrangements may not be as effective as direct ownership in providing us with control over our VIEs and we may incur substantial costs to enforce the terms of the arrangements. Uncertainties in the PRC legal system may limit our ability, as a Cayman Islands holding company, to enforce these contractual arrangements. Meanwhile, there are very few precedents as to whether contractual arrangements would be judged to form effective control over the relevant VIEs through the contractual arrangements, or how contractual arrangements in the context of a VIE should be interpreted or enforced by the PRC courts. Should legal actions become necessary, we cannot guarantee that the court will rule in favor of the enforceability of the VIE contractual arrangements. In the event we are unable to enforce these contractual arrangements, or if we suffer significant delay or other obstacles in the process of enforcing these contractual arrangements, we may not be able to exert effective control over our VIEs, and our ability to conduct our business may be materially adversely affected. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—We rely on contractual arrangements with our VIEs and their shareholders for a large portion of our business operations, which may not be as effective as direct ownership in providing operational control” and “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—The shareholders of our VIEs may have potential conflicts of interest with us, which may materially and adversely affect our business and financial condition.”

There are also substantial uncertainties regarding the interpretation and application of current and future PRC laws, regulations and rules regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with our VIEs and their nominee shareholders. It is uncertain whether any new PRC laws or regulations relating to variable interest entity structures will be adopted or if adopted, what they would provide. If we or any of our VIEs is found to be in violation of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the required permits or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. If the PRC government deems that our contractual arrangements with our VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our Cayman Islands holding company, our PRC subsidiaries and VIEs, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with our VIEs and, consequently, significantly affect the financial performance of our VIEs and our company as a whole. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—If the PRC government finds that the agreements that establish the structure for operating some of our operations in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations” and “—Our current corporate structure and business operations may be affected by the newly enacted Foreign Investment Law.”

We face various risks and uncertainties related to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly regulatory actions, and oversight on cybersecurity and data privacy, as well as the lack of inspection by the Public Company Accounting Oversight Board, or the PCAOB, on our auditors, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States or other foreign exchange. In addition, since our auditor is headquartered in the mainland of China, a jurisdiction where the PCAOB has been unable to conduct inspections without the approval of the Chinese authorities, our auditor is currently not inspected by the PCAOB. As a result, our ADSs may be delisted under the Holding Foreign Companies Accountable Act. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors with the benefits of such inspections. These risks could result in a material adverse change in our operations and the value of our ADSs, significantly limit or completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline or become worthless. For a detailed description of risks related to doing business in China, “Item 3.D. Key Information—Risk Factors—Risks Related to Doing Business in China.”

5

PRC government’s significant authority in regulating our operations and its oversight and control over offerings conducted overseas by, and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors. Implementation of industry-wide regulations in this nature may cause the value of such securities to significantly decline or become worthless. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The PRC government’s significant oversight and discretion over our business operation could result in a material adverse change in our operations and the value of our ADSs.”

Risks and uncertainties arising from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations in China, could result in a material adverse change in our operations and the value of our ADSs. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system and changes in laws and regulations in China could adversely affect us, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations.”

Cash Flows through Our Organization

We have established stringent controls and procedures for cash flows within our organization. Each transfer of cash between our Cayman Islands holding company and a subsidiary, our VIEs entities or the subsidiaries of our VIEs is subject to internal approval. The cash inflows of the Cayman Islands holding company were primarily generated from the proceeds we received from our public offerings of ordinary shares and other financing activities. The following table sets forth the amount of the transfers for the periods presented.

| Years Ended December 31, | |||||

| 2019 |

| 2020 |

| 2021 | |

(RMB in thousands) | ||||||

Cash transferred from Hong Kong company to PRC subsidiaries, our VIEs and the subsidiary of our VIE | — | 19,575 | 70,099 | |||

Net cash paid by the VIEs to our subsidiaries in operating activities | (245,550) | (605,423) | 374,705 | |||

Net cash received/(paid) by the VIEs (to)/from our subsidiaries in investing activities | — | (597,614) | (290,767) | |||

For details of the financial position, cash flows and results of operations of our VIEs, see “Financial Information Related to the VIEs.” Except the transactions described above, for the years ended December 31, 2019, 2020 and 2021, no assets other than cash were transferred between the Cayman Islands holding company and a subsidiary or a VIE, no subsidiaries or VIE paid dividends or made other distributions to the holding company, and no dividends or distributions were paid or made to U.S. investors. We plan to continue to determine the amount of service fee and payment method with our VIEs and their shareholders through bona fide negotiation, and settle fees under the contractual arrangements accordingly in the future. In April 2022, our Cayman Islands holding company declared and distributed cash dividends with the amount of approximately US$6.3 million to its shareholders and ADS holders, which was funded by surplus cash on our balance sheet. Other than the cash dividends paid in April 2022, we currently intend to retain our available funds and any future earnings to operate and expand our business.

6

As a Cayman Islands holding company, we may receive dividends from our PRC subsidiaries. Under the the Enterprise Income Tax Law of the PRC, or the EIT Law, and its implementation rules, dividends generated after January 1, 2008 and payable by a foreign-invested enterprise in China to its foreign enterprise investors are subject to a 10% withholding tax, unless any such foreign investor’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement. Dividends paid by our wholly foreign-owned subsidiary in China to our intermediate holding company in Hong Kong will be subject to a withholding tax rate of 10%, unless the relevant Hong Kong entity satisfies all the requirements under the China-HK Taxation Arrangement. Effective from January 1, 2020, if our Hong Kong subsidiary satisfies all the requirements under such arrangement, the dividends paid to the Hong Kong subsidiary would be subject to withholding tax at the standard rate of 5%. It could obtain such entitlement by itself at the time of making tax returns, or at the time of making withholding declarations via withholding agents. At the same time, the Hong Kong entity shall collect, gather and retain relevant materials for future reference in accordance with applicable rules, and shall accept the follow-up administration of tax authorities. However, we cannot assure you that we will be able to enjoy the preferential withholding tax rate of 5% under the China-HK Taxation Arrangement. See “Item 3. Key Information—D. Risk Factors—Risks Related to Our Corporate Structure—We may rely on dividends and other distributions on equity paid by our PRC subsidiaries to fund any cash and financing requirements we may have, and any limitation on the ability of our PRC subsidiaries to make payments to us could have a material and adverse effect on our ability to conduct our business” for more details. If our holding company in the Cayman Islands or any of our subsidiaries outside of China were deemed to be a “resident enterprise” under the PRC Enterprise Income Tax Law, it would be subject to enterprise income tax on its worldwide income at a rate of 25%. See “Risk Factors—If we are classified as a PRC resident enterprise for PRC income tax purposes, such classification could result in unfavorable tax consequences to us and our non-PRC shareholders or ADS holders.”

For purposes of illustration, the following discussion reflects the hypothetical taxes that might be required to be paid within China, assuming that: (i) we have taxable earnings, and (ii) we determine to pay dividends in the future.

| Tax calculation(1) |

| |

Hypothetical pre-tax earnings(2) |

| 100 | % |

Tax on earnings at statutory rate of 25%(3) | (25) | % | |

Net earnings available for distribution |

| 75 | % |

Withholding tax at standard rate of 10%(4) | (7.5) | % | |

Net distribution to Parent/Shareholders |

| 67.5 | % |

Notes:

(1) | For purposes of this example, the tax calculation has been simplified. The hypothetical book pre-tax earnings amount, not considering timing differences, is assumed to equal taxable income in China. |

(2) | Under the terms of VIE agreements, our WFOE may charge our VIEs for services provided to VIEs. These service fees shall be recognized as expenses of our VIEs, with a corresponding amount as service income by our WFOE and eliminate in consolidation. For income tax purposes, our WFOE and VIEs file income tax returns on a separate company basis. The service fees paid are recognized as a tax deduction by our VIEs and as income by our WFOE and are tax neutral. |

(3) | Certain of our subsidiaries and VIEs qualify for a 15% preferential income tax rate in China. However, such rate is subject to qualification, is temporary in nature, and may not be available in a future period when distributions are paid. For purposes of this hypothetical example, the table above reflects a maximum tax scenario under which the full statutory rate would be effective. |

(4) | The PRC Enterprise Income Tax Law imposes a withholding income tax of 10% on dividends distributed by a foreign invested enterprise, or FIE, to its immediate holding company outside of China. A lower withholding income tax rate of 5% is applied if the FIE’s immediate holding company is registered in Hong Kong or other jurisdictions that have a tax treaty arrangement with China, subject to a qualification review at the time of the distribution. For purposes of this hypothetical example, the table above assumes a maximum tax scenario under which the full withholding tax would be applied. |

The table above has been prepared under the assumption that all profits of our VIEs will be distributed as fees to our WFOE under tax neutral contractual arrangements. If, in the future, the accumulated earnings of our VIEs exceed the service fees paid to our WFOE (or if the current and contemplated fee structure between the intercompany entities is determined to be non-substantive and disallowed by Chinese tax authorities), our VIEs could make a non-deductible transfer to our WFOE for the amounts of the stranded cash in our VIEs. This would result in such transfer being non-deductible expenses for our VIEs but still taxable income for our WFOE. Such a transfer and the related tax burdens would reduce our after-tax income to approximately 50.6% of the pre-tax income. Our management believes that there is only a remote possibility that this scenario would happen.

7

Under PRC laws and regulations, we are subject to restrictions on foreign exchange and cross-border cash transfers, including to U.S. investors. Our ability to distribute earnings to the holding company and U.S. investors is also limited. We are a Cayman Islands holding company and we may rely on dividends and other distributions on equity paid by our PRC subsidiary, which in turn relies on consulting and other fees paid to us by our VIEs, for our cash and financing requirements, including the funds necessary to pay dividends and other cash distributions to our shareholders and service any debt we may incur. When any of our PRC subsidiary incurs debt on its own behalf, the instruments governing the debt may restrict its ability to pay dividends or make other distributions to us.

Our subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries and our VIEs and their subsidiaries is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of its registered capital. Each of such entities in China is also required to further set aside a portion of its after-tax profits to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of its board of directors. These reserves are not distributable as cash dividends.

In addition, our PRC subsidiaries, our VIEs and their subsidiaries generate their revenue primarily in Renminbi, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our PRC subsidiaries to pay dividends to us. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control of currency conversion may delay or prevent us from using the proceeds of our initial public offering and our ADS offering in April 2019 to make loans or additional capital contributions to our PRC subsidiaries, which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Permissions Required from the PRC Authorities for Our Operations

We conduct our business primarily through our subsidiaries and VIEs in China. Our operations in China are governed by PRC laws and regulations. As of the date of this annual report, our PRC subsidiaries, VIEs and their subsidiaries have obtained the requisite licenses and permits from the PRC government authorities that are material for the business operations of our holding company, our VIEs in China, including, among others, the Business License, the ICP License, the Network Culture Operation License, the Insurance Brokerage License, etc. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required to obtain additional licenses, permits, filings or approvals for the functions and services of our platform in the future. Any failure to obtain or delay in obtaining such permissions or approvals, or a rescission of any such approval if obtained by us, would subject us to sanctions by the applicable PRC regulatory authorities. These regulatory authorities may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operating privileges in China, delay or restrict the repatriation of the proceeds from our offshore offerings into China or take other actions that could materially and adversely affect our business, financial condition, results of operations, and prospects, as well as the trading price of our ADSs. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—Uncertainties with respect to the PRC legal system and changes in laws and regulations in China could adversely affect us, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations.”

8

Furthermore, in connection with offering and listing in an overseas market, we, our PRC subsidiaries and our VIEs, under the Discussion Draft of the Administrative Measures for the Filings of Overseas Offering and Listing by Domestic Enterprises for Public Comments, issued by the China Securities Regulatory Commission, or the CSRC on December 24, 2021, as well as its relevant regulations and regulatory rules, may be required to fulfill filing procedures and obtain approval from the CSRC, and under the Measures for Cybersecurity Review, which is effective on February 15, 2022, as well as its relevant laws, regulations and regulatory rules, may be required to go through cybersecurity review by the Cyberspace Administration of China, or the CAC. As of the date of this annual report, we have not received or were denied such requisite approval by the CSRC, nor have we been subject to any cybersecurity review made by the CAC. If we fail to obtain the relevant approval or complete other filing procedures, we may face sanctions by the CSRC or other PRC regulatory authorities, which may include fines and penalties on our operations in China, limitations on our operating privileges in China, restrictions on or prohibition of the payments or remittance of dividends by our subsidiaries in China, or other actions that could have a material and adverse effect on our business, financial condition, results of operations, reputation and prospects, as well as the trading price of our ADSs. For more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China—The approval of the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval” and “—We collect, store, process and use personal information and other user data, which subjects us to laws, governmental regulations and other legal obligations related to privacy, information security and data protection, and any actual or perceived failure to comply with such legal obligations could harm our brand and business.”

Selected Financial Data

Our Selected Consolidated Financial Data

The following selected consolidated statements of operating data for the years ended December 31, 2019, 2020 and 2021, selected consolidated balance sheet data as of December 31, 2020 and 2021 and selected consolidated cash flow data for the years ended December 31, 2019, 2020 and 2021 have been derived from our audited consolidated financial statements included elsewhere in this annual report. The selected consolidated statements of operating data for the years ended December 31, 2017 and 2018, the selected consolidated balance sheet data as of December 31, 2017, 2018 and 2019 and selected consolidated cash flow data for the years ended December 31, 2017 and 2018 have been derived from our audited consolidated financial statements that are not included in this annual report. Our consolidated financial statements are prepared and presented in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP.

9

You should read the selected consolidated financial information in conjunction with our consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results are not necessarily indicative of our results expected for future periods.

| Years Ended December 31, | |||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | |||||||

|

| RMB |

| RMB |

| RMB |

| RMB |

| RMB |

| US$ |

| (in thousands, except for per share data) | |||||||||||

Selected Consolidated Statements of Operating Data: |

|

|

|

|

|

| ||||||

Revenues(1) |

| 2,048,896 |

| 3,645,335 |

| 5,812,255 |

| 6,433,363 |

| 6,250,109 |

| 980,778 |

Cost of revenues(2) |

| 1,554,194 |

| 2,705,885 |

| 4,344,512 |

| 5,100,698 |

| 4,944,467 |

| 775,895 |

Gross profit |

| 494,702 |

| 939,450 |

| 1,467,743 |

| 1,332,665 |

| 1,305,642 |

| 204,883 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

| |

Research and development(3) |

| 153,827 |

| 263,220 |

| 430,822 |

| 538,009 |

| 515,081 |

| 80,827 |

General and administrative(3) |

| 114,880 |

| 213,973 |

| 248,462 |

| 261,805 |

| 258,346 |

| 40,540 |

Selling and marketing(3) |

| 44,026 |

| 96,538 |

| 181,975 |

| 358,655 |

| 438,273 |

| 68,775 |

Total operating expenses |

| 312,733 |

| 573,731 |

| 861,259 |

| 1,158,469 |

| 1,211,700 |

| 190,142 |

Operating income |

| 181,969 |

| 365,719 |

| 606,484 |

| 174,196 |

| 93,942 |

| 14,741 |

Other income and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Realized gain from investments |

| 2,373 |

| 261 |

| 1,822 |

| — |

| 13,507 |

| 2,120 |

Gain from deconsolidation of a subsidiary | — | — | — | 56,522 | — | — | ||||||

Interest income |

| 3,003 |

| 11,595 |

| 33,478 |

| 46,118 |

| 16,686 |

| 2,618 |

Interest expense | — | — | — | (22,623) | (44,884) | (7,043) | ||||||

Gain from fair value change of long-term investments |

| — |

| 7,860 |

| — |

| 12,325 |

| — |

| — |

Impairment loss from long-term investments |

| — |

| (7,590) |

| (2,600) |

| — |

| — |

| — |

Other income/(loss), net |

| 4,555 |

| 8,768 |

| 13,186 |

| (929) |

| 27,418 |

| 4,302 |

Income before income tax |

| 191,900 |

| 386,613 |

| 652,370 |

| 265,609 |

| 106,669 |

| 16,738 |

Provision for income taxes |

| (27,611) |

| (52,036) |

| (77,887) |

| (31,154) |

| (10,745) |

| (1,686) |

Income before income/(loss) from equity method investments |

| 164,289 |

| 334,577 |

| 574,483 |

| 234,455 |

| 95,924 |

| 15,052 |

Income/(loss) from equity method investments |

| 2,806 |

| 1,743 |

| (1,112) |

| (4,749) |

| 41,028 |

| 6,438 |

Net income |

| 167,095 |

| 336,320 |

| 573,371 |

| 229,706 |

| 136,952 |

| 21,490 |

Less: net (loss)/income attributable to non-controlling interest |

| (587) |

| (3,726) |

| (1,825) |

| 953 |

| (851) |

| (134) |

Net income attributable to Zepp Health Corporation |

| 167,682 |

| 340,046 |

| 575,196 |

| 228,753 |

| 137,803 |

| 21,624 |

Net income per share attributable to ordinary shareholders of Zepp Health Corporation: |

|

|

|

|

|

|

|

|

| |||

Basic income per ordinary share |

| 0.68 |

| 0.54 |

| 2.35 |

| 0.92 |

| 0.55 |

| 0.09 |

Diluted income per ordinary share |

| 0.65 |

| 0.51 |

| 2.24 |

| 0.88 |

| 0.52 |

| 0.08 |

Notes:

| (1) | Includes RMB1,778.6 million, RMB2,817.0 million, RMB4,281.0 million, RMB4,449.8 million and RMB3,350.0 million (US$525.7 million) with related parties for the years ended December 31, 2017, 2018, 2019, 2020 and 2021, respectively. |

| (2) | Includes RMB1,355.5 million, RMB2,141.1 million, RMB3,342.1 million, RMB3,713.5 million RMB2,760.0 million (US$433.1 million) resulting from related parties sales for the years ended December 31, 2017, 2018, 2019, 2020 and 2021, respectively. |

10

(3)Share-based compensation expenses were included in operating expenses. Our share-based compensation expenses were the result of (i) our grants of options, restricted shares and restricted share units under our share incentive plans to our employees, and (ii) the share restriction agreements entered into among our founders and our preferred shareholders in relation to our private financing transactions in January 2014 and April 2015. For the years ended December 31, 2017, 2018, 2019, 2020 and 2021, we recorded share-based compensation expenses of RMB51.5 million, RMB55.3 million, RMB17.8 million, nil and nil, respectively, in relation to the vesting of the restricted shares of our founders under the share restriction agreements.

The following table presents our selected consolidated balance sheet data as of the dates indicated.

As of December, 31 | ||||||||||||

2017 | 2018 | 2019 | 2020 | 2021 | ||||||||

| RMB |

| RMB |

| RMB |

| RMB |

| RMB |

| US$ | |

(in thousands) | ||||||||||||

Selected Consolidated Balance Sheet Data: |

|

|

|

|

|

| ||||||

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

| 366,336 |

| 1,441,802 |

| 1,803,117 |

| 2,273,349 |

| 1,468,499 |

| 230,440 |

Restricted cash | 3,185 | 10,010 | 874 | 2,401 | 41,040 | 6,440 | ||||||

Accounts receivable (net of allowance of nil, nil and 814 as of December 31, 2019, 2020 and 2021, respectively) |

| 32,867 |

| 58,925 |

| 188,940 |

| 298,038 |

| 537,084 |

| 84,280 |

Amount due from related parties (net of allowance of nil, nil and nil as of December 31, 2019, 2020 and 2021, respectively) |

| 578,454 |

| 656,399 |

| 1,421,170 |

| 860,213 |

| 295,614 |

| 46,388 |

Inventories |

| 249,735 |

| 484,622 |

| 893,806 |

| 1,217,537 |

| 1,249,327 |

| 196,047 |

Total current assets | 1,295,360 | 2,857,456 | 4,392,452 | 4,827,866 | 3,930,953 | 616,852 | ||||||

Non-current assets: |

|

|

|

|

|

|

|

|

| |||

Property, plant and equipment, net |

| 28,755 |

| 40,042 |

| 64,350 |

| 124,619 |

| 133,873 |

| 21,008 |

Total assets |

| 1,465,517 |

| 3,258,481 |

| 5,174,743 |

| 5,903,719 |

| 6,085,501 |

| 954,950 |

Current liabilities: |

|

|

|

|

|

|

|

|

| |||

Accounts payable |

| 707,782 |

| 1,064,106 |

| 1,999,951 |

| 1,951,335 |

| 1,317,306 |

| 206,714 |

Short-term bank borrowings |

| 30,000 |

| 20,000 |

| — |

| 504,671 |

| 358,000 |

| 56,178 |

Total liabilities |

| 887,735 |

| 1,448,903 |

| 2,677,155 |

| 3,173,461 |

| 3,152,062 |

| 494,628 |

Total liabilities and equity |

| 1,465,517 |

| 3,258,481 |

| 5,174,743 |

| 5,903,719 |

| 6,085,501 |

| 954,950 |

The following table presents our selected cash flows for the years indicated.

| Years Ended December 31, | |||||||||||

| 2017 | 2018 | 2019 | 2020 | 2021 | |||||||

|

| RMB |

| RMB |

| RMB |

| RMB |

| RMB |

| US$ |

| (in thousands) | |||||||||||

Selected Consolidated Cash Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by/(used in) operating activities |

| 238,336 |

| 707,605 |

| 427,999 |

| 157,302 |

| (232,435) |

| (36,474) |

Net cash used in investing activities |

| (38,881) |

| (324,841) |

| (112,703) |

| (206,880) |

| (1,069.289) |

| (167,796) |

Net cash provided by financing activities |

| 20,089 |

| 639,170 |

| 25,609 |

| 564,671 |

| 551,077 |

| 86,477 |

Net increase/(decrease) in cash and cash equivalents and restricted cash |

| 219,544 |

| 1,021,934 |

| 340,905 |

| 515,093 |

| (750,647) |

| (117,793) |

Exchange rate effect on cash and cash equivalents and restricted cash |

| (3,175) |

| 60,357 |

| 11,274 |

| (43,334) |

| (15,564) |

| (2,442) |

Cash and cash equivalents and restricted cash at the beginning of the year |

| 153,152 |

| 369,521 |

| 1,451,812 |

| 1,803,991 |

| 2,275,750 |

| 357,115 |

Cash and cash equivalents and restricted cash at end of the year |

| 369,521 |

| 1,451,812 |

| 1,803,991 |

| 2,275,750 |

| 1,509,539 |

| 236,880 |

11

Financial Information Related to the VIEs

The following table presents the condensed consolidating schedule of financial position for our VIEs and other entities as of the dates presented. In the following tables, “Primary Beneficiary of VIEs” refers to Beijing Shunyuan Kaihua Technology Co., Ltd., our WFOE who entered into contractual arrangements with our VIEs and their respective shareholders and acts as the primary beneficiary under the contractual arrangements. “Other Subsidiaries” refer to the subsidiaries of Zepp Health Corporation, our Cayman holding company, other than Beijing Shunyuan Kaihua Technology Co., Ltd., the VIEs and the subsidiaries of the VIEs,

Selected Condensed Consolidated Statements of Operations Data

For the Year Ended December 31, 2021 | ||||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Third-party revenues |

| — |

| 1,030,549 |

| — |

| 5,219,560 |

| — |

| 6,250,109 |

Inter-company revenues |

| — |

| 533,943 |

| 240,103 |

| 1,202,152 |

| (1,976,198) |

| — |

Total revenues |

| — |

| 1,564,492 |

| 240,103 |

| 6,421,712 |

| (1,976,198) |

| 6,250,109 |

Total costs and expenses |

| (94,824) |

| (1,561,349) |

| (240,920) |

| (6,063,153) |

| 1,804,079 |

| (6,156,167) |

Income/(loss) from subsidiaries and VIEs | 232,566 |

| 378,511 |

| 384,365 |

| — |

| (995,442) |

| — | |

Income/(loss) from non-operations |

| 61 |

| 1,174 |

| (10) |

| 34,728 |

| (23,226) |

| 12,727 |

Income/(loss) before income tax expenses |

| 137,803 |

| 382,828 |

| 383,538 |

| 393,287 |

| (1,190,787) |

| 106,669 |

Less: income tax expenses |

| — |

| 8,501 |

| (5,027) |

| (42,509) |

| 28,290 |

| (10,745) |

Income/(loss) before loss from equity method investments |

| 137,803 |

| 391,329 |

| 378,511 |

| 350,778 |

| (1,162,497) |

| 95,924 |

Income from equity method investments |

| — |

| 7,441 |

| — |

| 33,587 |

| — |

| 41,028 |

Net income/(loss)(1) |

| 137,803 |

| 398,770 |

| 378,511 |

| 384,365 |

| (1,162,497) |

| 136,952 |

Less: net income attributable to non-controlling interests |

| — |

| 851 |

| — |

| — |

| — |

| 851 |

Net income/(loss) attributable to Zepp Health Corporation's shareholders |

| 137,803 |

| 399,621 |

| 378,511 |

| 384,365 |

| (1,162,497) |

| 137,803 |

Note:

(1) | The net income includes gain from inter-company transactions where the VIEs sold out products through our other subsidiaries functioning as international distributors of the group. |

12

For the Year Ended December 31, 2020 | ||||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Third-party revenues | — | 132,682 | 3,147 | 6,297,534 | — | 6,433,363 | ||||||

Inter-company revenues |

| — |

| 285,645 |

| 147,237 |

| 184,619 |

| (617,501) |

| — |

Total revenues |

| — |

| 418,327 |

| 150,384 |

| 6,482,153 |

| (617,501) |

| 6,433,363 |

Total cost and expenses |

| (81,162) |

| (530,557) |

| (215,859) |

| (6,007,145) |

| 575,556 |

| (6,259,167) |

Income/(loss) from subsidiaries and VIEs |

| 308,578 |

| 427,093 |

| 490,493 |

| — |

| (1,226,164) |

| — |

Income from non-operations |

| 1,337 |

| 13,060 |

| 492 |

| 53,351 |

| 23,173 |

| 91,413 |

Income/(loss) before income tax expenses |

| 228,753 |

| 327,923 |

| 425,510 |

| 528,359 |

| (1,244,936) |

| 265,609 |

Less: income tax expenses/(benefits) |

| — |

| 6,739 |

| 1,583 |

| (39,476) |

| — |

| (31,154) |

Income/(loss) before loss from equity method investments |

| 228,753 |

| 334,662 |

| 427,093 |

| 488,883 |

| (1,244,936) |

| 234,455 |

(Loss)/income from equity method investments |

| — |

| (7,312) |

| — |

| 2,563 |

| — |

| (4,749) |

Net income /(loss) |

| 228,753 |

| 327,350 |

| 427,093 |

| 491,446 |

| (1,244,936) |

| 229,706 |

Less: net loss attributable to non-controlling interests |

| — |

| — |

| — |

| (953) |

| — |

| (953) |

Net income/(loss) attributable to Zepp Health Corporation’s shareholders |

| 228,753 |

| 327,350 |

| 427,093 |

| 490,493 |

| (1,244,936) |

| 228,753 |

For the Year Ended December 31, 2019 | ||||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Third-party revenues | — | 7,797 | 3,053 | 5,801,405 | — | 5,812,255 | ||||||

Inter-company revenues |

| — |

| 204,718 |

| 186,243 |

| 24,698 |

| (415,659) |

| — |

Total revenues | — |

| 212,515 |

| 189,296 |

| 5,826,103 |

| (415,659) |

| 5,812,255 | |

Total cost and expenses | (65,016) |

| (232,785) |

| (169,594) |

| (5,154,290) |

| 415,914 |

| (5,205,771) | |

Income from subsidiaries and VIEs | 634,043 |

| 648,341 |

| 630,299 |

| — |

| (1,912,683) |

| — | |

Income from non-operations | 6,169 |

| 1,689 |

| 598 |

| 37,429 |

| — |

| 45,885 | |

Income/(loss) before income tax expenses | 575,196 |

| 629,760 |

| 650,599 |

| 709,242 |

| (1,912,428) |

| 652,370 | |

Less: income tax expenses/(benefits) | — |

| 4,089 |

| (2,258) |

| (79,718) |

| — |

| (77,887) | |

Income/(loss) before loss from equity method investments | 575,196 |

| 633,849 |

| 648,341 |

| 629,524 |

| (1,912,428) |

| 574,483 | |

Loss from equity method investments | — |

| (62) |

| — |

| (1,050) |

| — |

| (1,112) | |

Net income/(loss) | 575,196 |

| 633,787 |

| 648,341 |

| 628,474 |

| (1,912,428) |

| 573,371 | |

Less: net income attributable to non-controlling interests | — |

| — |

| — |

| 1,825 |

| — |

| 1,825 | |

Net income/(loss) attributable to Zepp Health Corporation's shareholders | 575,196 |

| 633,787 |

| 648,341 |

| 630,299 |

| (1,912,428) |

| 575,196 | |

13

Selected Condensed Consolidated Balance Sheets Data

As of December 31, 2021 | ||||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Assets |

|

|

|

|

|

| ||||||

Cash and cash equivalents | 19,634 | 464,638 | 30,809 | 953,418 | — | 1,468,499 | ||||||

Restricted cash | — |

| 572 |

| — |

| 40,468 |

| — |

| 41,040 | |

Term deposit | — |

| — |

| — |

| 5,000 |

| — |

| 5,000 | |

Accounts receivable, net | — |

| 185,699 |

| 4,360 |

| 347,025 |

| — |

| 537,084 | |

Amount due from related parties | — |

| — |

| 322 |

| 295,292 |

| — |

| 295,614 | |

Inventories, net | — | 242,441 | — | 1,036,617 | (29,731) | 1,249,327 | ||||||

Short-term investments | — |

| — |

| — |

| 19,351 |

| — |

| 19,351 | |

Prepaid expenses and other current assets | 3,010 |

| 16,804 |

| 2,921 |

| 292,303 |

| — |

| 315,038 | |

Intra-group receivable due from Zepp Health Corporation's subsidiaries | 801,856 |

| 886,839 |

| 233,540 |

| 1,779,374 |

| (3,701,609) |

| — | |

Total current assets | 824,500 |

| 1,796,993 |

| 271,952 |

| 4,768,848 |

| (3,731,340) |

| 3,930,953 | |

Property, plant and equipment, net | — |

| 16,592 |

| 11,021 |

| 106,260 |

| — |

| 133,873 | |

Intangible assets, net | — |

| 183,580 |

| 73,251 |

| 67,353 |

| (188,602) |

| 135,582 | |

Long-term investments | — |

| 1,380,141 |

| 20,000 |

| 386,635 |

| (234,185) |

| 1,552,591 | |

Investment in subsidiaries and VIEs | 2,128,912 |

| 378,512 |

| 384,365 |

| — |

| (2,891,789) |

| — | |

Deferred tax assets | — |

| 36,017 |

| 18,847 |

| 60,265 |

| 28,290 |

| 143,419 | |

Operating lease right-of-use assets | — |

| 50,593 |

| 15,904 |

| 41,938 |

| — |

| 108,435 | |

Goodwill | — |

| 61,055 |

| — |

| — |

| — |

| 61,055 | |

Other non-current assets | — |

| 5,882 |

| 4,294 |

| 17,066 |

| (7,649) |

| 19,593 | |

Total non-current assets | 2,128,912 | 2,112,372 | 527,682 | 679,517 | (3,293,935) | 2,154,548 | ||||||

Total assets |

| 2,953,412 |

| 3,909,365 |

| 799,634 |

| 5,448,365 |

| (7,025,275) |

| 6,085,501 |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable | — |

| 3,175 |

| 40 |

| 1,314,091 |

| — |

| 1,317,306 | |

Advance from customers | — |

| 1,683 |

| 285 |

| 2,262 |

| — |

| 4,230 | |

Amount due to related parties | — |

| — |

| 1,562 |

| 48,561 |

| — |

| 50,123 | |

Accrued expenses and other current liabilities | 8,914 |

| 112,128 |

| 29,860 |

| 165,181 |

| — |

| 316,083 | |

Intra-group payable due to Zepp Health Corporation's subsidiaries | 24,150 |

| 2,707,043 |

| 325,052 |

| 641,675 |

| (3,697,920) |

| — | |

Income tax payables | — |

| 2,184 |

| — |

| 411 |

| — |

| 2,595 | |

Notes payable | — |

| — |

| — |

| 103,795 |

| — |

| 103,795 | |

Short-term bank borrowings | — |

| 55,000 |

| — |

| 303,000 |

| — |

| 358,000 | |

Total current liabilities | 33,064 |

| 2,881,213 |

| 356,799 |

| 2,578,976 |

| (3,697,920) |

| 2,152,132 | |

Deferred tax liabilities | — | 3,903 | — | 23,006 | — | 26,909 | ||||||

Long-term borrowings | — |

| 480,000 |

| — |

| 254,500 |

| (7,649) |

| 726,851 | |

Other non-current liabilities | — |

| 2,318 |

| — |

| 172,735 |

| — |

| 175,053 | |

Non-current operating lease liabilities | — |

| 37,254 |

| 4,428 |

| 29,435 |

| — |

| 71,117 | |

Total non-current liabilities | — | 523,475 | 4,428 | 479,676 | (7,649) | 999,930 | ||||||

Total liabilities |

| 33,064 |

| 3,404,688 |

| 361,227 |

| 3,058,652 |

| (3,705,569) |

| 3,152,062 |

Total equity |

| 2,920,348 |

| 504,677 |

| 438,407 |

| 2,389,713 |

| (3,319,706) |

| 2,933,439 |

Total liabilities and equity |

| 2,953,412 |

| 3,909,365 |

| 799,634 |

| 5,448,365 |

| (7,025,275) |

| 6,085,501 |

14

As of December 31, 2020 | ||||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Assets |

|

|

|

|

|

| ||||||

Cash and cash equivalents | 204,637 | 795,908 | 14,641 | 1,258,163 | — | 2,273,349 | ||||||

Restricted cash |

| — |

| 401 |

| — |

| 2,000 |

| — |

| 2,401 |

Term deposit |

| — |

| — |

| — |

| 5,000 |

| — |

| 5,000 |

Accounts receivable, net |

| — |

| 61,854 |

| 8,536 |

| 227,648 |

| — |

| 298,038 |

Amount due from related parties |

| — |

| — |

| — |

| 860,213 |

| — |

| 860,213 |

Inventories, net |

| — |

| 91,059 |

| — | 1,166,996 | (40,518) |

| 1,217,537 | ||

Short-term investments |

| — |

| — |

| — |

| 18,430 |

| — |

| 18,430 |

Prepaid expenses and other current assets |

| 335 |

| 10,890 |

| 4,729 |

| 136,944 |

| — |

| 152,898 |

Intra-group receivable due from Zepp Health Corporation's subsidiaries | 656,579 | 105,157 | 89,076 | 943,227 | (1,785,039) | — | ||||||

Total current assets |

| 861,551 |

| 1,065,269 |

| 116,982 |

| 4,609,621 |

| (1,825,557) |

| 4,827,866 |

Property, plant and equipment, net |

| — |

| 17,250 |

| 11,701 |

| 95,668 |

| — |

| 124,619 |

Intangible assets, net |

| — |

| 34,685 |

| 46,858 |

| 63,670 |

| — |

| 145,213 |

Long-term investments |

| — |

| 354,934 |

| 20,000 |

| 286,584 |

| (217,532) |

| 443,986 |

Investment in subsidiaries and VIEs |

| 1,895,011 |

| 427,093 |

| 490,493 |

| — |

| (2,812,597) |

| — |

Deferred tax assets |

| — |

| 26,952 |

| 23,873 |

| 69,365 |

| — |

| 120,190 |

Operating lease right-of-use assets |

| — |

| 64,687 |

| 25,890 |

| 60,588 |

| — |

| 151,165 |

Goodwill |

| — |

| 62,515 |

| — |

| — |

| — |

| 62,515 |

Other non-current assets |

| — |

| 5,660 |

| 4,777 |

| 17,728 |

| — |

| 28,165 |

Total non-current assets | 1,895,011 | 993,776 | 623,592 | 593,603 | (3,030,129) | 1,075,853 | ||||||

Total assets |

| 2,756,562 |

| 2,059,045 | 740,574 | 5,203,245 |

| (4,855,686) |

| 5,903,719 | ||

Liabilities |

|

|

|

|

|

|

|

|

|

|

| |

Accounts payable |

| — |

| 5,077 |

| 527 |

| 1,945,731 |

| — |

| 1,951,335 |

Advance from customers |

| — |

| 913 |

| 278 |

| 41,311 |

| — |

| 42,502 |

Amount due to related parties |

| — |

| — |

| 10,293 |

| 892 |

| — |

| 11,185 |

Accrued expenses and other current liabilities |

| 688 |

| 52,096 |

| 23,743 |

| 175,748 |

| — |

| 252,275 |

Intra-group payable due to Zepp Health Corporation's subsidiaries | 24,727 | 1,481,240 | 219,974 | 59,079 | (1,785,020) | — | ||||||

Income tax payables |

| — |

| — |

| — |

| 27,706 |

| — |

| 27,706 |

Short-term bank borrowings |

| — |

| — |

| — |

| 504,671 |

| — |

| 504,671 |

Total current liabilities |

| 25,415 |

| 1,539,326 |

| 254,815 |

| 2,755,138 |

| (1,785,020) |

| 2,789,674 |

Deferred tax liabilities |

| — |

| 5,203 |

| — |

| 17,171 |

| — |

| 22,374 |

Long-term borrowings | — | — | — | 60,000 | — | 60,000 | ||||||

Other non-current liabilities |

| 889 |

| 359 |

| — |

| 183,920 |

| — |

| 185,168 |

Non-current operating lease liabilities |

| - |

| 53,307 |

| 14,288 |

| 48,650 |

| — |

| 116,245 |

Total non-current liabilities | 889 | 58,869 | 14,288 | 309,741 | — | 383,787 | ||||||

Total liabilities |

| 26,304 |

| 1,598,195 |

| 269,103 |

| 3,064,879 |

| (1,785,020) |

| 3,173,461 |

Total equity |

| 2,730,258 |

| 460,850 |

| 471,471 |

| 2,138,345 |

| (3,070,666) |

| 2,730,258 |

Total liabilities and equity |

| 2,756,562 |

| 2,059,045 |

| 740,574 |

| 5,203,224 |

| (4,855,686) |

| 5,903,719 |

15

Selected Condensed Consolidated Cash Flows Data

| For the Year Ended December 31, 2021 | |||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Net cash (used in)/provided by transactions with external parties | (14,164) | 277,212 | (199,623) | (295,860) | — | (232,435) | ||||||

Net cash (used in)/provided by transactions with intra-group entities | (489) |

| (520,369) |

| 146,153 |

| 374,705 |

| — |

| — | |

Cash flows from operating activities: | (14,653) |

| (243,157) |

| (53,470) |

| 78,845 |

| — |

| (232,435) | |

Net cash (used in)/provided by transactions with external parties | — |

| (987,276) |

| (10,097) |

| (71,916) |

| — |

| (1,069,289) | |

Net cash (used in)/provided by transactions with intra-group entities | (146,699) |

| (15,751) |

| 79,735 |

| (290,767) |

| 373,482 |

| — | |

Cash flows from investing activities: | (146,699) |

| (1,003,027) |

| 69,638 |

| (362,683) |

| 373,482 |

| (1,069,289) | |

Net cash (used in)/provided by transactions with external parties | (8,298) | 527,351 | — | 32,024 | — | 551,077 | ||||||

Net cash provided by/(used in) transactions with intra-group entities | — | 386,704 | — | — | (386,704) | — | ||||||

Cash flows from financing activities: | (8,298) |

| 914,055 |

| — |

| 32,024 |

| (386,704) |

| 551,077 | |

| For the Year Ended December 31, 2020 | |||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Net cash provided by/(used in) transactions with external parties | 1,880 | (389,473) | (226,040) | 770,935 | — | 157,302 | ||||||

Net cash (used in)/provided by transactions with intra-group entities | (14,671) |

| 370,827 |

| 249,267 |

| (605,423) |

| — |

| — | |

Cash flows from operating activities: | (12,791) |

| (18,646) |

| 23,227 |

| 165,512 |

| — |

| 157,302 | |

Net cash (used in)/provided by transactions with external parties | — |

| (66,079) |

| (9,618) |

| (131,183) |

| — |

| (206,880) | |

Net cash (used in)/provided by transactions with intra-group entities | (114,719) |

| — |

| — |

| (597,614) |

| 712,333 |

| — | |

Cash flows from investing activities: | (114,719) |

| (66,079) |

| (9,618) |

| (728,797) |

| 712,333 |

| (206,880) | |

Net cash provided by/(used in) transactions with external parties | — |

| — |

| — |

| 564,671 |

| — |

| 564,671 | |

Net cash provided by/(used in) transactions with intra-group entities | — |

| 712,333 |

| — |

| — |

| (712,333) |

| — | |

Cash flows from financing activities: | — |

| 712,333 |

| — | 564,671 |

| (712,333) |

| 564,671 | ||

16

| For the Year Ended December 31, 2019 | |||||||||||

Primary | VIEs and | |||||||||||

Zepp Health | Other | Beneficiary of | VIEs’ | Eliminating | Consolidated | |||||||

| Corporation |

| Subsidiaries |

| VIEs |

| Subsidiaries |

| adjustments |

| Totals | |

(RMB, in thousands) | ||||||||||||

Net cash (used in)/provided by transactions with external parties | (5,781) | (175,313) | (115,263) | 724,356 | — | 427,999 | ||||||

Net cash provided by/(used in) transactions with intra-group entities | 5,017 |

| 131,307 |

| 109,226 |

| (245,550) |

| — |

| — | |

Cash flows from operating activities: | (764) |

| (44,006) |

| (6,037) |

| 478,806 |

| — |

| 427,999 | |

Net cash provided by/(used in) transactions with external parties | 97,976 |

| (83,586) |

| (206) |

| (126,887) |

| — |

| (112,703) | |

Net cash (used in)/provided by transactions with intra-group entities | (216,528) |

| — |

| — |

| — |

| 216,528 |

| — | |

Cash flows from investing activities: | (118,552) |

| (83,586) |

| (206) |

| (126,887) |

| 216,528 |

| (112,703) | |

Net cash provided by/(used in) transactions with external parties | 45,609 |

| — |

| — |

| (20,000) |

| — |

| 25,609 | |

Net cash provided by/(used in) transactions with intra-group entities | — |

| 216,528 |

| — |

| — |

| (216,528) |

| — | |

Cash flows from financing activities: | 45,609 |

| 216,528 |

| — |

| (20,000) |

| (216,528) |

| 25,609 | |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of Risk Factors

An investment in our ADSs or Class A ordinary shares involves significant risks. Below is a summary of material risks we face, organized under relevant headings. These risks are discussed more fully in the following Item 3. Key Information—D. Risk Factors.

Risks Related to Our Business

| ● | Xiaomi is our most important customer and distribution channel. Any deterioration of our relationship with Xiaomi or reduction of sales of Xiaomi Wearable Products could have a material adverse effect on our operating results; |

| ● | If we fail to successfully and timely develop and commercialize new products, services and technologies, our operating results may be materially and adversely affected; |

| ● | Our future success depends on our ability to promote our own brands and protect our reputation. The failure to establish and promote our brands, including Amazfit and Zepp, and any damage to our reputation will hinder our growth; |

| ● | We are susceptible to supply shortages, long lead time for raw materials and components, and supply changes, any of which could disrupt our supply chain and have a material adverse impact on our results of operation because some of the key components of our products, such as Bluetooth Low Energy (BLE) system-on-chip and sensors, come from a limited number or a single source of supply; |

17

| ● | We operate in highly competitive markets and the scale and resources of some of our competitors may allow them to compete more effectively than we can, which could result in a loss of our market share and a decrease in our revenue and profitability; |

| ● | If we are unable to anticipate and satisfy consumer preferences in a timely manner or if technological innovation renders existing smart wearable technology non-competitive or obsolete, our business may be materially and adversely affected; |

| ● | We do not have internal manufacturing capabilities and rely on several contract manufacturers to produce our products. If we encounter issues with these contract manufacturers, our business, brand and results of operations could be harmed; |

| ● | Our operating results could be materially harmed if we or Xiaomi is unable to accurately forecast consumer demand for our products and services or manage our inventory; |

| ● | We collect, store, process and use personal information and other user data, which subjects us to laws, governmental regulations and other legal obligations related to privacy, information security and data protection, and any actual or perceived failure to comply with such legal obligations could harm our brand and business; and |

| ● | Any significant cybersecurity incident or disruption of our information technology systems or those of third-party partners could materially damage user relationships and subject us to significant reputational, financial, legal and operation consequences. |

Risks Related to Our Corporate Structure

| ● | We are a Cayman Islands holding company with no equity ownership in our VIEs and we conduct our operations in China through (i) our PRC subsidiaries and (ii) our VIEs with which we have maintained contractual arrangements and their subsidiaries. Investors in our Class A ordinary shares or the ADSs thus are not purchasing equity interest in our VIEs in China but instead are purchasing equity interest in a Cayman Islands holding company. If the PRC government finds that the agreements that establish the structure for operating some of our operations in China do not comply with PRC regulations relating to the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company in the Cayman Islands, our VIEs and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with our VIEs and, consequently, significantly affect the financial performance of our VIEs and our company as a group; |

| ● | We rely on contractual arrangements with our VIEs and their shareholders for a large portion of our business operations, which may not be as effective as direct ownership in providing operational control; and |

| ● | Any failure by our VIEs or their shareholders to perform their obligations under our contractual arrangements with them would have a material and adverse effect on our business. |

Risks Related to Doing Business in China

| ● | The PCAOB is currently unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor deprives our investors with the benefits of such inspections; |

| ● | Our ADSs will be prohibited from trading in the United States under the Holding Foreign Companies Accountable Act, or the HFCAA, in 2024 if the PCAOB is unable to inspect or fully investigate auditors located in China, or in 2023 if proposed changes to the law are enacted. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment; |

| ● | The approval of the CSRC or other PRC government authorities may be required in connection with our offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval; |

18

| ● | Changes in China’s economic, political or social conditions or government policies could have a material adverse effect on our business and operations; |

| ● | Uncertainties with respect to the PRC legal system and changes in laws and regulations in China could adversely affect us, and any lack of requisite approvals, licenses or permits applicable to our business may have a material adverse effect on our business and results of operations; and |

| ● | The PRC government’s significant oversight and discretion over our business operation could result in a material adverse change in our operations and the value of our ADSs. |

Risks Related to our ADSs

| ● | Recent disruptions in the financial markets and economic conditions could affect our ability to raise capital; |

| ● | The trading price of our ADSs has fluctuated and is likely to be volatile, which could result in substantial losses to investors; and |

| ● | If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding our ADSs, the market price for our ADSs and trading volume could decline. |

Risks Related to Our Business

Xiaomi is our most important customer and distribution channel. Any deterioration of our relationship with Xiaomi or reduction of sales of Xiaomi Wearable Products could have a material adverse effect on our operating results.