HIVE DIGITAL TECHNOLOGIES LTD.

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED MARCH 31, 2024

June 24, 2024

TABLE OF CONTENTS

2

GLOSSARY

| $ or USD$ | United States Dollar. |

| 2021 ATM Equity Program | Means the Company's at-the-market equity program pursuant to the 2021 Equity Distribution Agreement, whereby the Company was entitled to issue Common Shares at prevailing market prices. |

| 2022 ATM Equity Program | Means the Company's at-the-market equity program pursuant to the 2022 Equity Distribution Agreement, whereby the Company was entitled to issue Common Shares at prevailing market prices. |

| 2023 ATM Equity Program | Means the Company's at-the-market equity program pursuant to the 2023 Equity Distribution Agreement, whereby the Company may, from time to time, issue Common Shares at prevailing market prices. |

| 2021 ATM Shares | Means the Common Shares that have been issued pursuant to the 2021 ATM Equity Program. |

| 2022 ATM Shares | Means the Common Shares that have been issued pursuant to the 2022 ATM Equity Program. |

| 2023 ATM Shares | Means the Common Shares that have been issued pursuant to the 2023 ATM Equity Program. |

| 2021 Debentures | Means the unsecured convertible debentures issued pursuant to the Company's non-brokered private placement with U.S. Global, for aggregate gross proceeds of $15,000,000. |

| 2021 Equity Distribution Agreement | Means the equity distribution agreement between the Company and Canaccord Genuity Corp. dated February 2, 2021. |

| 2022 Equity Distribution Agreement | Means the equity distribution agreement between the Company and H.C. Wainwright & Co. dated September 2, 2022. |

| 2023 Equity Distribution Agreement | Means the equity distribution agreement between the Company and Stifel GMP and Canaccord Genuity Corp. dated May 10, 2023. |

| AIF | This annual information form of the Company dated June 24, 2024. |

| Affiliate | A company is an "Affiliate" of another company if |

| (a) one of them is the subsidiary of the other, or | |

| (b) each of them is controlled by the same Person. | |

| A company is "controlled" by a Person if | |

| (a) voting securities of the company are held, other than by way of security only, by or for the benefit of that Person, and | |

| (b) the voting securities, if voted, entitle the Person to elect a majority of the directors of the company. | |

| A Person beneficially owns securities that are beneficially owned by | |

| (a) a company controlled by that Person, or | |

| (b) an Affiliate of that Person or an Affiliate of any company controlled by that Person. | |

| ASIC | Means application-specific integrated circuit, a microchip designed for a special application, such as a particular kind of transmission protocol or a hand-held computer. In the context of digital currency mining, ASICs have been designed to solve specific hashing algorithms efficiently, including for Bitcoin mining. |

3

| Associate | When used to indicate a relationship with a Person, means |

| (a) an issuer of which the Person beneficially owns or controls, directly or indirectly, voting securities entitling him to more than 10% of the voting rights attached to all outstanding voting securities of the issuer, | |

| (b) any partner of the Person, | |

| (c) any trust or estate in which the Person has a substantial beneficial interest or in respect of which the Person serves as trustee or in a similar capacity, and | |

| (d) in the case of a Person who is an individual, (i) that Person's spouse or child, or (ii) any relative of that Person or of his spouse who has the same residence as that Person; but where the Exchange determines that two Persons shall, or shall not, be deemed to be associates with respect to a Member firm, Member corporation or holding company of a Member corporation, then such determination shall be determinative of their relationships in the application of Rule D.1.00 of the Exchange with respect to that Member firm, Member corporation or holding company. | |

| atNorth | Means atNorth ehf. (formerly "Advania Data Centers ehf.") |

| August 2023 ATM Equity Program | Means the Company's at-the-market equity program pursuant to the August 2023 Equity Distribution Agreement, whereby the Company may, from time to time, issue Common Shares at prevailing market prices. |

| August 2023 ATM Shares | Means the Common Shares that have been issued pursuant to the August 2023 ATM Equity Program. |

| August 2023 Equity Distribution Agreement | Means the amended and restated equity distribution agreement between the Company, Stifel GMP, Canaccord Genuity Corp., and Canaccord Genuity LLC dated August 17, 2023. |

| Bank Frick | Means Bank Frick & Co. AG. |

| Barrage | Means Barrage d.o.o. (LLC). |

| BCBCA | The Business Corporations Act (British Columbia), including the regulations made thereunder, in each case as now in effect and as may be amended or replaced from time to time. |

| BCSC | British Columbia Securities Commission. |

| Bikupa | Means Bikupa Datacenter AB. |

| Bikupa 2 or Bikupa Datacenter 2 | Means Bikupa Datacenter 2 AB. |

| Bitcoin or BTC | Bitcoin refers to the native token of the Bitcoin Network which utilizes the SHA-256 algorithm. Bitcoin is a peer-to-peer payment system and the digital currency of the same name which uses open source cryptography to control the creation and transfer of such digital currency. |

| Bitcoin Network | The network of computers running the software protocol underlying Bitcoin and which network maintains the database of Bitcoin ownership and facilitates the transfer of Bitcoin among parties. |

| Bitmain | Bitmain Technologies Ltd., a leading supplier of ASIC hardware (under the brand name Antminer) which designs and manufacturers high performance computing chips and software. |

| Blockbase | Blockbase Consulting GmbH. |

| Blockchain | An immutable, decentralized public transaction ledger which records transactions, such as financial transactions in cryptocurrency, in chronological order. Bitcoin and Ethereum are examples of well-known and widely distributed blockchains. |

4

| Board or Board of Directors | The board of directors of the Company. |

| Boden Tech | Means Boden Technologies AB. |

| Borealis Facility | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - HIVE Iceland Facility Updates". |

| Business Transfer Agreement | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - Bikupa Datacenter AB". |

| BuzzMiner | Means the Bitcoin ASIC Miners built and distributed by the Company. |

| °C | Degrees centigrade. |

| CAD$ | Canadian Dollar. |

| CEO | Chief Executive Officer. |

| CFO | Chief Financial Officer. |

| Coincover | Means Digital Asset Services Ltd. |

| Common Shares or HIVE Shares | The post-consolidation common shares in the capital of the Company. |

| Company or HIVE | HIVE Digital Technologies Ltd. |

| Computershare | Computershare Investor Services Inc. |

| Consolidation | Means the consolidation of the Pre-Consolidation Common Shares on May 24, 2022 on the basis of five Pre-Consolidation Common Shares for one Common Share. |

| Contracted Reserve | Has the meaning given to it under the heading "DESCRIPTION OF THE BUSINESS - Description of the Business - The Hive New Brunswick Facility." |

| COVID-19 | Has the meaning given to it under the heading "RISK FACTORS - Pandemics and COVID-19". |

| CPU | Central processing unit is the component of a computer that provides computing power for execution of operations performed by software installed on that computer. |

| Cryptologic | Cryptologic Corp. |

| Cryptologic SPA | Means the share purchase agreement between the Company and Cryptologic dated as of March 27, 2020 pursuant to which the Company acquired the Lachute Facility. |

| Custodians | Means Fireblocks Ltd. and Bank Frick. |

| DeFi Technologies | Means DeFi Technologies Inc. |

| DDoS | Means distributed denial-of-service, a type of cyber-attack characterized by multiple perpetrators against a single host, with the intention of disrupting or disabling the services of the host. |

| Escrowed Shares | Has the meaning given to it under the heading "ESCROWED SECURITIES". |

| Ether or ETH or Ethereum | Ether or Ethereum refers to the native token of the Ethereum Network which utilizes the ethash algorithm. Ethereum is a global, open-source platform for decentralized applications. |

| Ethereum Network | The network of computers running the software protocol underlying Ethereum and which network maintains the database of Ether ownership and facilitates the transfer of Ether among parties. |

5

| Ethereum Virtual Machine | Is a virtual state machine that functions as a runtime environment for smart contracts in Ethereum. |

| Exchange or TSXV | TSX Venture Exchange. |

| February SFBS Prospectus | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2023 - Filing of Prospectus and Prospectus Supplement". |

| Financial Statements | Audited consolidated financial statements for the fiscal year ended March 31, 2023. |

| Fireblocks | Means Fireblocks Ltd. |

| Fiscal 2021 | The fiscal year ended March 31, 2021. |

| Fiscal 2022 | The fiscal year ended March 31, 2022. |

| Fiscal 2023 | The fiscal year ended March 31, 2023. |

| Fiscal 2024 | The fiscal year ended March 31, 2024. |

| Fiscal 2024 MD&A | Means the management discussion and analysis of the Company for Fiscal 2024. |

| FSE | Frankfurt Stock Exchange. |

| Genesis | Genesis Mining Ltd. |

| Genesis IRA | The investor rights agreement between the Company and Genesis dated September 13, 2017. See "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - Genesis IRA". |

| GH/s | Gigahashes per second. |

| GPU | Means graphics processing unit, a programmable logic chip (processor) specialized for display functions and effective at solving digital currency hashing algorithms. |

| GPU Acquisition | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - Acquisition of GPU Atlantic Inc.". |

| GPU Atlantic | Means GPU Atlantic Inc. |

| GPU One | Means GPU.One Holding Inc. |

| GPU SPA | Means the share purchase agreement entered into between the Company and GPU One dated February 24, 2021. See "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - 2021 At-The-Market Equity Program". |

| Hash | Means the output of a hash function, i.e. the output of the fundamental mathematical computation of a particular cryptocurrency's computer code which miners execute, and "Gigahash" and "Petahash" mean, respectively, 1x109 Hashes and 1x1015 Hashes. |

| Hashrate: | Hashrate is a measure of mining power whereby the expected income from mining is directly proportional to a miners hashrate normalized by the total hashrate of the network. |

| HIVE or the Company | Means HIVE Digital Technologies Ltd. |

| HIVE Atlantic | Means Hive Atlantic Datacentres Ltd. |

| Hive Atlantic Agreements | Has the meaning given to it under the heading "DESCRIPTION OF THE BUSINESS - Description of the Business - The Hive New Brunswick Facility." |

| HIVE Boden 2 Facility | Means the facility located in Boden, Sweden, acquired on November 29, 2023. |

6

| HIVE Facilities | Means the HIVE Boden 2 Facility, HIVE Iceland Facility, the HIVE Lachute Facility, the New Brunswick Facility, the HIVE Sweden Facilities and other facilities the Company may have operations in from time to time. |

| HIVE Iceland Facility | Means the leased facility located in Iceland, leased from atNorth. |

| HIVE Lachute Facility | Means the leased facility located in Québec, Canada, originally acquired in April 2020 from Cryptologic. |

| HIVE New Brunswick Facility | Means the facility located in New Brunswick, Canada, originally acquired from GPU ONE through the purchase of GPU Atlantic in April 2021. |

| HIVE Sweden Facility | Means the leased facility located in Boden, Sweden. |

| HIVE Sweden Robertsfors Facility | Means the leased facility located in Robertsfors, Sweden. |

| Insider | Insider If used in relation to an issuer, means: |

| (a) a director or senior officer of the issuer; | |

| (b) a director or senior officer of the corporation that is an Insider or subsidiary of the issuer; | |

| (c) a Person that beneficially owns or controls, directly or indirectly, voting shares carrying more than 10% of the voting rights attached to all outstanding voting shares of the issuer; or | |

| (d) the issuer itself if it holds any of its own securities. | |

| IFRS | International Financial Reporting Standards. |

| J/TH | Joules per terahash (a common industry measure of electrical efficiency in an ASIC) |

| January Prospectus Supplement | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - Filing of Prospectus and Prospectus Supplement". |

| January SFBS Prospectus | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - Filing of Prospectus and Prospectus Supplement". |

| Kolos | Means Kolos Norway AS. |

| Lachute Acquisition | Has the meaning given to it under heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - HIVE Lachute Facility Acquisition". |

| Liv Eiendom | Means Liv Eiendom AS. |

| Merge | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2023 - Ethereum "Merge"". |

| MD&A | Management's discussion & analysis of the audited consolidated financial statements for the fiscal year ended March 31, 2024 |

| MicroBT | MicroBT, a leading supplier of ASIC hardware (under the brand name Whatsminer), which specializes in blockchain and artificial intelligence. |

| Mining | Mining refers to the provision of computing capacity to secure a distributed network by creating, verifying, publishing and propagating blocks in the blockchain in exchange for rewards and fees denominated in the native token of that network (i.e. Bitcoin or Ethereum, as applicable). |

| MW | Megawatts. |

7

| NASDAQ | Means the Nasdaq's Capital Markets Exchange. |

| Network Difficulty | Means a measure of how difficult it is to find a Hash below a given target. |

| NEX | Means the NEX board of the TSXV. |

| NI 51-102 | National Instrument 51-102 - Continuous Disclosure Obligations. |

| NI 52-110 | National Instrument 52-110 - Audit Committees. |

| Nord Pool | Means Nord Pool AS, who runs the leading power market in Europe, and offers day-ahead and intraday markets to is customers. |

| November 2021 Private Placement | Means the bought-deal private placement of 19,170,500 special warrants concluded on November 30, 2021. |

| November 2021 Special Warrants | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - Private Placement of Special Warrants". |

| November 2021 Underwriters | Means Stifel GMP, BMO Capital Markets, Canaccord Genuity Corp. and PI Financial Corp. |

| November 2021 Unit | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - Private Placement of Special Warrants". |

| November 2021 Warrant | Has the meaning given to it under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - Private Placement of Special Warrants". |

| Option Share | Common Share issuable upon exercise of a Stock Option in accordance with the Stock Option Plan. |

| OTCQX | OTCQX® Best Market of the OTC Markets Group. |

| Person | Includes any individual, firm, partnership, joint venture, venture capital fund, limited liability company, unlimited liability company, association, trust, trustee, executor, administrator, legal personal representative, estate, group, body corporate, corporation, unincorporated association or organization, governmental entity, syndicate or other entity, whether or not having legal status. |

| PH/s | Petahash per second. |

| Pre-Consolidation Common Shares | The common shares in the capital of the Company, prior to the Consolidation on May 24, 2022. |

| Promoter | The meaning ascribed to it in the Securities Act (British Columbia). |

| Proof of Work | Under proof of work, consensus miners performing computational work on the network update the ledger; miners are incentivized to protect the network and put forth valid transactions because they must invest in hardware and electricity for the opportunity to mine coins on the network. The success of a miner's business relies on the value of the currency remaining above the cost to create a coin. |

| Proof of Stake | Under proof of stake, consensus stakers who have sufficiently large coin balances 'staked' on the network update the ledger; stakers are incentivized to protect the network and put forth valid transactions because they are heavily invested in the network's currency. |

| PSU | Means a computer power supply unit. |

| RSU | Restricted share unit granted under the Company's RSU Plan. |

| RSU Plan | The Company's RSU plan, first approved for adoption by the by the Board of Directors on October 17, 2018 and re-approved by Shareholders at the Company's Annual General and Special Meeting on November 29, 2023, which reserves HIVE Shares for issuance under the RSU Plan equal to a maximum of 10% of the issued and outstanding HIVE Shares from time to time for issue pursuant to the RSU Plan, subject to the combination of all share compensation arrangements of the Company, including the RSU Plan and the Stock Option Plan, will not exceed 10% of the issued and outstanding HIVE Shares. |

8

| SEK | Means the Swedish Krona. |

| SHA -256 | SHA-256 is a cryptographic Hash algorithm. SHA-256 generates an almost-unique 256-bit (32-byte) signature for a text. The most well-known cryptocurrencies that utilize the SHA-256 algorithm are Bitcoin and Bitcoin cash. |

| Shareholders | The holders of HIVE Shares. |

| Stock Option | Option to purchase HIVE Shares granted under the Company's Stock Option Plan. |

| Stock Option Plan | The Company's rolling Stock Option plan, dated July 10, 2017, which reserves options exercisable into HIVE Shares equal to a maximum of 10% of the issued and outstanding HIVE Shares from time to time for issue pursuant to the Stock Option Plan, subject to the combination of all share compensation arrangements of the Company, including the RSU Plan and the Stock Option Plan, will not exceed 10% of the issued and outstanding HIVE Shares. |

| Surplus Energy | Has the meaning given to it under the heading "DESCRIPTION OF THE BUSINESS - Description of the Business - The Hive New Brunswick Facility." |

| Titan Investment | Means the Company's investment in Titan.IO, Inc. on December 1, 2021. |

| UDP | Ultimate designated person. |

| United States: | The United States of America, its territories and possessions, any State of the United States and the District of Columbia. |

| U.S. Global | Means U.S. Global Investors Inc. |

| Valour | Means Valour Inc. |

| Valour Share Swap | Has the meaning given to under the heading "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2021 - Valour Share Swap". |

9

INTRODUCTORY NOTES

Share Consolidation

On May 24, 2022, the Company underwent a consolidation of the Common Shares (the "Consolidation") on the basis of five pre-consolidation Common Shares for one post-consolidation Common Share. Unless otherwise stated, all references to Common Shares in this AIF are to post-Consolidation Common Shares.

Date of Information

In this annual information form ("AIF"), HIVE Digital Technologies Ltd., together with its current subsidiaries, as the context requires, is referred to as the "Company" and "HIVE". All information contained in this AIF is at June 24, 2024, unless otherwise stated.

Reference is made in this AIF to the Financial Statements and MD&A for HIVE for the year ended March 31, 2024, together with the auditor's report thereon. The Financial Statements and MD&A are available for review, under HIVE's profile on the SEDAR+ website located at www.sedarplus.ca.

All financial information in this AIF for Fiscal 2024 has been prepared in accordance with IFRS.

Cautionary Note Regarding Forward-Looking Information and Statements

This AIF contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian securities legislation. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects", "predicts", "intends", "anticipates" or "believes", or variations of, or the negatives of, such words and phrases, or state that certain actions, events or results "may", "could", "would", "should", "might" or "will" be taken, occur or be achieved. Forward-looking information and statements include, but are not limited to, statements with respect to the Company's ability to meet its working capital needs at the current level for the next twelve-month period; management's outlook regarding future trends; sensitivity analysis on financial instruments, which may vary from amounts disclosed; and general business and economic conditions. For a complete list of the factors that could affect the Company, please make reference to those risk factors further detailed below under the heading "Risk Factors". Readers are cautioned that such risk factors, uncertainties and other factors are not exhaustive.

Forward-looking information and statements are based on the then current expectations, beliefs, assumptions, estimates and forecasts about the Company's business and the industry and markets in which it operates. Forward-looking information and statements are made based upon numerous assumptions. Although the assumptions made by the Company in providing forward looking information or making forward looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

10

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual results, performances and achievements of the Company to differ materially from any projections of results, performances and achievements of the Company expressed or implied by such forward-looking information or statements. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information or statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended.

There can be no assurance that such information or statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information or statements. The forward-looking information and statements contained in this AIF are made as of the date of this AIF and, accordingly, are subject to change after such date. The Company does not undertake to update or reissue forward looking information as a result of new information or events except as required by applicable law.

Currency and Exchange Rates

Unless otherwise specified, all references to $ or USD$ are to United States dollars and all references to CAD$ are to Canadian dollars.

CORPORATE STRUCTURE

Name, Address, and Incorporation

The Company was incorporated in the Province of British Columbia on June 24, 1987 under the Business Corporations Act (British Columbia) under the name "Carmelita Petroleum Limited". The Company changed its name first on September 26, 1996 to "Carmelita Resources Limited", then on July 4, 2000 to "Pierre Enterprises Ltd.", then on February 1, 2011 to "Leeta Gold Corp.", then on September 17, 2017 to "HIVE Blockchain Technologies Ltd.", and finally on July 12, 2023 to "HIVE Digital Technologies Ltd.".

The Company's head office is located at Suite 855, 789 West Pender Street, Vancouver, British Columbia, V6C 1H2, and the Company's registered office is located at Suite 2500, 700 West Georgia Street, Vancouver, BC, V7Y 1B3.

The Company's common shares ("Common Shares" or "Hive Shares") are listed for trading on the TSX Venture Exchange (the "TSXV") under the trading symbol "HIVE" as well as on the NASDAQ Capital Market ("NASDAQ") under the trading symbol "HIVE" and on the Open Market of the Frankfurt Stock Exchange under the symbol "FO0.F".

11

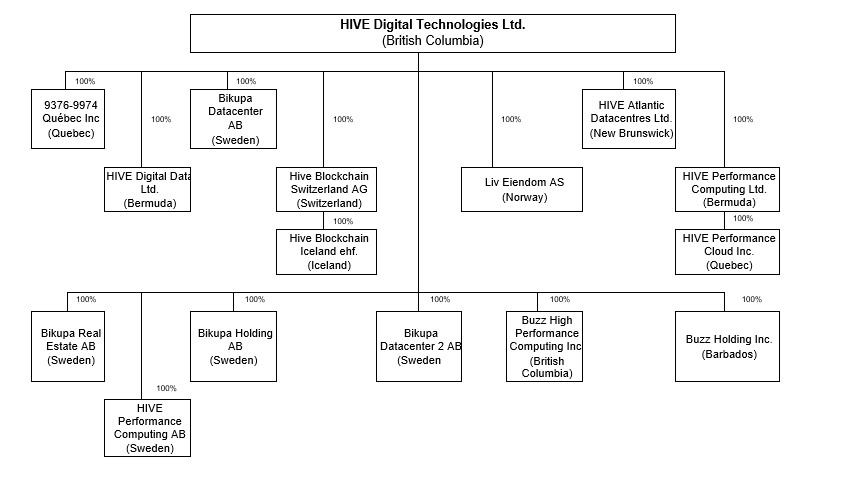

Intercorporate Relationships

The Company has thirteen wholly owned subsidiaries: HIVE Blockchain Switzerland AG (incorporated under the laws of Switzerland), Bikupa Datacenter AB (incorporated under the laws of Sweden), Bikupa Datacenter 2 AB (incorporated under the laws of Sweden), Bikupa Real Estate AB (incorporated under the laws of Sweden), Bikupa Holding AB (incorporated under the laws of Sweden), HIVE Performance Computing AB (incorporated under the laws of Sweden), Buzz High Performance Computing Inc. (incorporated under the laws of the Province of British Columbia), Buzz Holding Inc. (incorporated under the laws of Barbados), HIVE Digital Data Ltd. (incorporated under the laws of Bermuda), HIVE Performance Computing Ltd. (incorporated under the laws of Bermuda), Liv Eiendom AS (incorporated under the laws of Norway), 9376-9974 Québec Inc. (incorporated under the laws of the Province of Québec) and HIVE Atlantic Datacentres Ltd. (incorporated under the laws of the province of New Brunswick). Hive Blockchain Switzerland AG has one wholly owned subsidiary, Hive Blockchain Iceland ehf. (incorporated under the laws of Iceland) and HIVE Performance Computing Ltd. has one wholly owned subsidiary, HIVE Performance Cloud Inc. (incorporated under the laws of the Province of Québec).

12

GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

Fiscal 2022

Bikupa Datacenter AB

Bikupa reached a total of 30 MW of power in October of 2021, when an additional 11 MW of energy was added to the agreement with local grid provider, Bodens Energi AB. 10 MW out of the 11 MW were acquired under a temporary power agreement with an approximate annual renewal timeline. The reason for this type of contract is the expected future power requirement by large corporations such as H2 Green Steel which have reserved 100's of MW of power. 1 MW was added under the permanent power contract and was transferred to Bikupa from an agreement between Guaroo Iceland Swedish Filial and Bodens Energi.

Bikupa Datacenter 2 AB

In May 2021 the Company acquired shell company Bikupa Datacenter 2 AB ("Bikupa 2"), a Swedish registered entity. Bikupa 2 is a 4.6 MW facility located in the town of Robertsfors, Sweden (the "Bikupa 2 Facility"). This facility enabled the Company to continue to expand its footprint in Sweden for mining from stable, low-cost, green, and renewable energy sources.

Previously, on September 24, 2020 the Company acquired Bikupa from Johan Eriksson and Patrik Hild, who each owned 50% of Bikupa at that time. Bikupa remains wholly owned by HIVE as of the date hereof.

Bikupa was acquired in order to operate the GPU data center business located in Boden, Sweden. The data center business was structurally moved from Boden Tech to Bikupa to isolate the ongoing operations into a business entity that was separate from certain value-added tax concerns with the Swedish Tax Authority. Having the data center operated within a new entity allowed the prompt processing of energy tax, assisting greatly in cash flow of operations.

Bikupa 2 was purchased as a shelf company from VPR AB ("VPR") on May 4, 2021 and remains a wholly owned subsidiary of the Company as of the date hereof. The vendors of Bikupa 2 are unrelated to the vendors of Bikupa or the purchaser of Boden Tech. The purpose of the acquisition of Bikupa 2 was the operation of a data center within Sweden, separate from the Boden, Sweden location operated by Bikupa.

Sale of Kolos

On May 10, 2021, the Company sold Kolos Norway AS ("Kolos"), a subsidiary located in Norway, to the local community under a share purchase agreement. Under the agreement the Company transferred all the shares of Kolos to the municipality, along with a $200,000 payment. Without a clear path forward to meet the development conditions by March 2023, the Company decided it was in the best interests of HIVE to sell Kolos to the local municipality. As a result of this transaction, the loans, along with accumulated interest which were assumed as part of the original transaction in May 2018, were transferred along with the shares to the local municipality.

13

HIVE Sweden Facility Updates

On June 18, 2021, the Company announced that it had expanded its operations in Sweden with a 4.6 MW facility in the town of Robertsfors (the "HIVE Sweden Robertsfors Facility"), bringing the total capacity in Sweden to more than 33 MW.

NASDAQ Listing

On July 1, 2021, the Company began trading on the NASDAQ's Capital Markets under the trading symbol "HVBT", and on September 14, 2021 the trading symbol of the Company on the NASDAQ was changed to "HIVE".

Management and Board Changes

On August 19, 2021, Aydin Kilic was appointed President & COO of the Company. On November 24, 2021, Mr. Tobias Ebel resigned as a director of the Company. On December 21, 2021, Susan McGee was elected as a director of the Company.

HIVE Iceland Facility Updates

On November 25, 2021, HIVE Blockchain Iceland ehf entered into a service agreement with Borealis Data Park ehf, for the hosting of equipment at a new facility in Iceland (the "Borealis Facility"). The agreement enables the hosting of approximately 1,200 new generation Bitcoin miners, or 4.5 MW of capacity, over a period of 36 months, using geothermal and hydroelectric energy. The completion of the Borealis Facility, and subsequent installation of HIVE ASIC miners, resulted in the hashrate coming online in March 2022.

Private Placement of Special Warrants

On November 30, 2021, the Company closed a bought-deal private placement of 3,334,000 special warrants of the Company (the "November 2021 Special Warrants") at a price of $30.00 per November Special Warrant for aggregate gross proceeds to the Company of $100,020,000 (the "November 2021 Private Placement"). Stifel GMP acted as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters including BMO Capital Markets, Canaccord Genuity Corp. and PI Financial Corp. (collectively, the "November 2021 Underwriters"). The November 2021 Underwriters elected to fully exercise the option granted to them to increase the size of the November 2021 Private Placement by an additional 15% of the November 2021 Special Warrants sold, for an additional 500,100 November 2021 Special Warrants, bringing the aggregate number of November 2021 Special Warrants sold to 3,834,100 for total gross proceeds of $115,023,000.

Subject to adjustment in certain circumstances, each November 2021 Special Warrant entitles the holder to receive one (1) unit of the Company upon exercise (each, a "November 2021 Unit"). Each November 2021 Unit consists of one (1) Common Share and one-half (0.5) of one Common Share purchase warrant (each whole of such Common Share purchase warrant being a "November 2021 Warrant"). Every five (5) November 2021 Warrant entitles the holder thereof to purchase one Common Share at a price of $30.00 per Common Share for a period of 30 months following the closing of the November 2021 Private Placement.

14

Investment in Titan.IO

On December 1, 2021, the Company announced that it had made an investment in Titan.IO, Inc. ("Titan"), a blockchain software company (the "Titan Investment"). The Titan Investment was structured as a share exchange pursuant to which the Company issued Titan 213,354 Common Shares and 106,677 warrants with a total value of $5 million at CAD$30.00 per share, the same terms as the November 2021 Private Placement. Under the Titan Investment, the Company received 5,555,556 Titan common shares representing 10% of the outstanding equity of Titan. Titan operates a next generation mining pool and is creating a market for mining tokens that represent mining capacity. The Titan Investment is anticipated to facilitate a working relationship between the Company and Titan.

Filing of Prospectus and Prospectus Supplement

On January 4, 2022, the Company filed an amended and restated final short form base shelf prospectus with the securities regulatory authorities in each Province of Canada except Quebec (the "January SFBS Prospectus").

On January 7, 2022, the Company filed a prospectus supplement to the January SFBS Prospectus with the securities regulatory authorities in each Province of Canada except Quebec (the "January Prospectus Supplement"). The January Prospectus Supplement qualified for distribution the 3,834,100 Units distributed under the November 2021 Private Placement issuable upon exercise of the November 2021 Special Warrants. In accordance with the terms of a special warrant indenture between the Company and TSX Trust Company, as a result of filing the January Prospectus Supplement on January 11, 2022, each November 2021 Special Warrant was automatically exercised into one November 2021 Unit.

On January 14, 2022, the November 2021 Warrants underlying the 3,834,100 Special Warrants were listed for trading on the TSX Venture Exchange.

Compute North Renewable Energy Deal

On March 7, 2022, the Company announced that it had entered into a non-binding letter of intent with Compute North to host 100 MW of mining capacity at one of Compute North's renewable energy data center facilities in Texas. This proposed transaction did not proceed nor does the Company have any plans to proceed with it in the future.

Conclusion of the 2021 ATM Equity Program

On March 8, 2022, the Company announced the conclusion of the 2021 ATM Equity Program. At the date of termination, the Company had sold 5,447,203 Common Shares at prevailing market rates under the 2021 ATM Equity Program, for aggregate gross proceeds of $99,499,214.

15

Fiscal 2023

Share Consolidation

On May 24, 2022, the Company completed a share consolidation of the Common Shares on the basis of five (5) pre-consolidation Common Shares for one (1) post-consolidation Common Shares (the "Consolidation"). As of the date immediately prior to the Consolidation, there were 411,209,923 Common Shares issued and outstanding and 9,585,250 November 2021 Warrants listed for trading. Effective market open on May 24, 2022, the Consolidation was completed and there were 82,241,984 Common Shares issued and outstanding. The number of listed November 2021 Warrants was not altered, but the exercise terms were adjusted such that post-Consolidation, five (5) November 2021 Warrants are now exercisable for one (1) post-Consolidation Common Share, upon the payment of an adjusted price of CAD$30.00.

RSU and Option Grants

On August 26, 2022, the Company announced the grant of 415,200 incentive stock options to employees, officers and consultants of the Company, exercisable at a price of CAD$5.66 per share for a period of 5 years. The Company also announced the grant of 1,425,280 restricted share units to employees, officers and consultants of the Company, which vest over 24 months.

On December 9, 2022, the Company announced the grant of 16,000 restricted share units to an officer of the Company, which vest over 12 months.

On January 13, 2023, the Company announced the grant of 1,200,000 restricted share units to the Company's directors and an officer, which vest over 12 months.

2022 At-The-Market Equity Program

On September 2, 2022, the Company entered into an equity distribution agreement ("2022 Equity Distribution Agreement") with H.C. Wainwright & Co., pursuant to which the Company was entitled to sell up to $100 million of Common Shares (the "2022 ATM Equity Program"). Under the 2022 ATM Equity Program the Company issued 1,306,474 Common Shares (the "2022 ATM Shares") pursuant to the ATM Equity Program for proceeds of $3,941,736. The 2022 ATM Shares were sold at prevailing market prices, for an average price per 2022 ATM Share of $3.02. Pursuant to the 2022 Equity Distribution Agreement associated with the 2022 ATM Equity Program, a cash commission of $118,252 on the aggregate gross proceeds raised was paid to the agent in connection with its services under the 2022 Equity Distribution Agreement. On February 7, 2023, the Company announced the conclusion of the 2022 ATM Equity Program.

Bikupa Datacenter AB

In June 2022, grid provider Bodens Energi AB, extended an additional 2 MW to Bikupa under a temporary agreement, resulting in a total of 12 MW of temporary and 20 MW of permanent power connected to the facility in Boden. Presently the extension for the 12 MW under temporary contract has been extended through November 30, 2025. The total operating capacity of Bikupa as of the date of this AIF is 32 MW.

16

Ethereum "Merge"

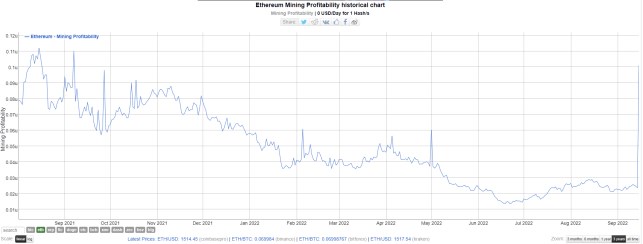

On September 15, 2022, the Ethereum Foundation undertook a planned shift of the Ethereum blockchain from a "proof-of-work" mining protocol to a "proof-of-stake" blockchain (the "Merge"). Prior to the Merge, the Company was earning on average approximately $150,000 per day in revenue from its GPU fleet of miners mining Ethereum. After the Merge, when the GPU fleet was repurposed to mine alternative proof-of-work coins (which were then converted to Bitcoin), the revenue earned was approximately $30,000 per day. This corresponds to a drop in revenue from about $0.35 per unit per kilowatt-hour from mining Ethereum to approximately $0.07 per unit per kilowatt-hour mining alternative coins to earn Bitcoin.

Since the date of the Merge, the Company has ceased mining Ethereum and has sold all of its Ethereum holdings.

Miner Acquisitions

The Company announced the acquisition of certain Bitmain Antminer S19j Pro, and S19j Pro Plus ASIC miners at opportunistic prices, including:

- The purchase of 2,130 S19j Pro miners in November 2022, at an average hashrate of 98 TH/s, which are expected to produce over 209 PH/s;

- The purchase of 1,540 S19j Pro miners in December 2022, at an average hashrate of 104 TH/s, which are expected to produce over 159 PH/s;

- The purchase of 100 S19j Pro miners in December 2022, at an average hashrate of 98 TH/s, which are expected to produce over 9 PH/s;

- The purchase of 1,169 S19j Pro miners in February 2023, at an average hashrate of 100 TH/s, which are expected to produce over 117 PH/s; and

- The purchase of 3,600 S19j Pro Plus miners in March 2023, at an average hashrate of 122 PH/s which are expected to produce over 439 PH/s.

The following is a summary of the material miner purchases made by the Company since the start of Fiscal 2023:

| Date: | Equipment: |

| November 2022 | Purchased: 2,130 S19j Pro machines, adding 209 PH/s of hashrate |

| December 2022 | Purchased: 1,640 S19j Pro machines, adding 168 PH/s of hashrate |

| February 2023 | Purchased: 1,169 S19j Pro machines, adding 117 PH/s of hashrate |

| March 2023 | Purchased: 3,600 S19j Pro Plus machines, adding 439 PH/s of hashrate |

As at March 31, 2023, the Company had built and shipped 5,743 HIVE BuzzMiners Bitcoin ASIC Miners ("BuzzMiners"), which can operate at an average hashrate between 105-130 TH/s, and produce 605 - 745 PH/s. These BuzzMiners were produced at a cost of approximately $30.5 million which includes deposits made to secure long lead time supply chain components with our original design manufacturer.

Management and Board Changes

On June 16, 2022, Mr. Holmes resigned from the Audit Committee and Ms. McGee was added as a member of the Audit Committee.

On January 17, 2023, Aydin Kilic was appointed President & CEO of the Company.

17

On March 20, 2023, Mr. Mann resigned as a director of the Company.

Fiscal 2024

Filing of Prospectus and Prospectus Supplement

On May 1, 2023, the Company filed a final short form base shelf prospectus with the securities regulatory authorities in each Province of Canada (the "2023 SFBS Prospectus").

2023 At-The-Market Equity Program

On May 10, 2023, the Company entered into an equity distribution agreement ("2023 Equity Distribution Agreement") with Stifel GMP and Canaccord Genuity Corp, pursuant to which the Company may, from time to time, sell up to $100 million of Common Shares (the "2023 ATM Equity Program"). The 2023 Equity Distribution Agreement was terminated as of August 16, 2023.

On August 17, 2023, the Company entered into an amended and restated equity distribution agreement (the "August 2023 Equity Distribution Agreement") with Stifel GMP, Canaccord Genuity Corp, and Canaccord Genuity LLC (collectively, the "Agents"), pursuant to which the Company may, from time to time, sell up to $90 million of Common Shares (the "August 2023 ATM Equity Program"). The August 2023 Equity Distribution Agreement restates and supersedes the previous equity distribution agreement, dated May 10, 2023, between the Company and the Agents expanding the prior Canadian at-the-market program to the United States.

During the year ended March 31, 2024, the Company issued 1,374,700 Common Shares (the "2023 ATM Shares") pursuant to the 2023 ATM Equity Program for proceeds of CAD$9.0 million ($6.8 million). The 2023 ATM Shares were sold at prevailing market prices, for an average price per 2023 ATM Share of CAD$6.55. Pursuant to the 2023 Equity Distribution Agreement associated with the 2023 ATM Equity Program, a cash commission of $0.2 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the 2023 Equity Distribution Agreement.

During the year ended March 31, 2024, the Company issued 13,612,024 common shares (the "August 2023 ATM Shares") pursuant to the August 2023 ATM Equity Program for gross proceeds of CAD$71 million ($52.7 million). The August 2023 ATM shares were sold at prevailing market prices for an average price per August 2023 ATM Share of CAD$5.22. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $1.6 million on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement.

Name Change

On July 12, 2023, the Company changed its name from "HIVE Blockchain Technologies Ltd." to "HIVE Digital Technologies Ltd." (the "Name Change").

18

RSU and Option Grants

On July 6, 2023, the Company announced the grant of 620,000 incentive stock options to employees, officers and consultants of the Company, exercisable at a price of CAD$6.86 per share for a period of 5 years.

On January 12, 2024, the Company announced the grant of 257,976 restricted share units to employees, officers and consultants of the Company, which vest over 12 months.

Miner Acquisitions

The Company announced the acquisition of certain Bitmain S19k Pro miners and Bitmain S21 Antminers at opportunistic prices, including:

- The purchase of 1,000 S19k Pro miners in October 2023, at an average hashrate of 120 TH/s, which are expected to produce over 120 PH/s;

- The purchase of 4,800 S19k Pro miners in November 2023, at an average hashrate of 118 TH/s, which are expected to produce over 568 PH/s;

- The purchase of 5,000 S19k Pro miners in December 2023, at an average hashrate of 118 TH/s, which are expected to produce over 592 PH/s;

- The purchase of 7,000 Bitmain S21 Antminers in December 2023, at an average hashrate of 200 TH/s, which are expected to produce over 1,400 PH/s;

- The purchase of 1,000 Bitmain S21 Antminers in February 2024, at an average hashrate of 200 TH/s, which are expected to produce over 200 PH/s;

- The purchase of 1,000 Bitmain S21 Pro Antminers in June 2024, at an average hashrate of 234 TH/s, which are expected to produce over 234 PH/s.

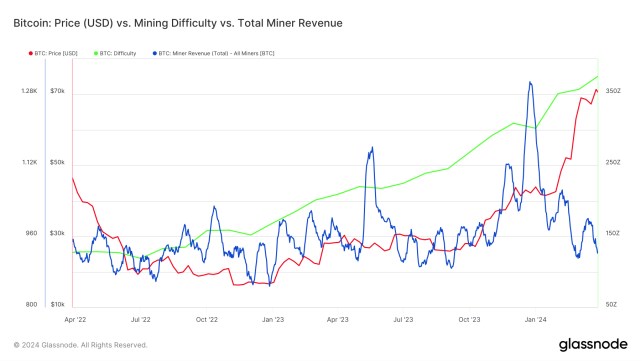

As of May 31, 2024, the Company's daily revenue is approximately $275,000 based on 4.03 BTC mined and using a Bitcoin price of $68,238, generated through 4,960 PH/s of mining capacity, which includes:

| New Brunswick: | 2,595 PH/s active; |

| Quebec: | 1,320 PH/s active; |

| Sweden: | 915 PH/s active; and |

| Iceland: | 130 PH/s active. |

Acquisition of Data Center Facility Located in Sweden

On November 29, 2023, the Company acquired a data center and the real property (the "Turis AB Facility") on which it is situated, located in the city of Boden, Sweden.

HIVE also acquired certain assets located on-site in exchange for a purchase price payable in both cash and common shares of HIVE: (i) up to $750,000 payable in cash; and (ii) up to $1,500,000 payable in HIVE Shares in two installments.

19

The price of the Common Shares issued to the vendor of the Turis AB Facility shall be equal to the lower of: (i) the closing price of the Common Shares on the TSXV on the date ending two (2) business days prior to the closing date of the acquisition (the "Turis Closing Date"); and (ii) the average closing price of the Common Shares on the TSXV on the last five days prior to the Turis Closing Date on which the TSXV is open for trading (the "Turis Issue Price"). Notwithstanding the foregoing, the Turis Issue Price shall not be lower than the minimum acceptable price of the TSXV.

The first installment was composed of 345,566 Common Shares. The second installment shall be paid at the later of: (i) the six month anniversary of the Turis Closing Date; and (ii) the date on which any claims made by HIVE within six months of the Turis Closing Date relating to a breach of warranty under the property transfer agreement have been finally settled, and shall be composed of such number of Common Shares equal to $500,000 less any amount payable by the vendor of the Turis AB Facility to the Company in respect of such claim, divided by the Turis Issue Price.

Growth of HPC Business using GPU compute for AI revenues

The Company previously expressed its intent to expand its HPC line of operations by a factor of , which meant the approximately 450 GPUs which were operating in the Company’s beta test in early calendar year 2023 would be expanded to 4,800 GPUs operating in the HPC business unit. The Company for the three month period ended March 31, 2024, achieved a run rate revenue of $7.2 million per year from its HPC business with GPUs. In order to achieve the Company’s goal of reaching 10x growth of HPC revenue (from the Company’s original beta-test benchmark of $1 million annualized run rate revenue), the Company continues to invest in data grade servers, networking equipment and storage to utilize its existing inventory of Nvidia GPUs. Therefore the Company is working towards and interim goal of $10 million of annualized run-rate revenue. The Company notes that it has 4800 Nvidia A-series GPUs installed in Tier 3 data centers (comprised of A40, A6000, A5000 and A4000 cards) operating in SuperMicro servers, additionally the Company has 96 Nvidia H100 GPUs operating in Dell servers. The Company notes that it did successfully reach a peak of over $10 million of annual run—rate revenue for a short period of time. During the Q4 2023 fiscal period, the Company’s average weekly revenue for the week of February 24th was $9.3 million annualized run-rate revenue. Currently, if the 4800 A-series GPUs and the 96 H100 GPUs were all rented at prevailing market rates with 70% uptime, the Company would realize $20 million of annualized run-rate revenue. Since the Company uses a business-to-business model, it does not control the customer engagement and marketing of the marketplace platforms where the GPUs are rented, therefore the Company notes that while this is a high-margin business, there can be fluctuations in the demand outside of the Company’s control. The Company believes that HPC has the potential to be the most profitable and highest revenue generating use of its access to power.

While the Company previously purchased 38,000 data-center grade Nvidia GPUs which are capable of HPC, the Company must procure data center grade servers in order to operate them. Each data-center grade server can operate 10 GPUs, therefore the Company purchased 480 SuperMicro servers, capable of operating 4,800 Nvidia A-series GPUs to enable them to have HPC capability, in order to have the infrastructure in place to realize the Company’s goal of 10x growth of $1 million to $10 million annualized run-rate revenue from the HPC business.

Purchase of 96 High-Performing GPUs and GH200 SuperChip

On December 15, 2023, the Company announced the purchase of 96 Nvidia H100 GPUs as part of its high-performance computing (HPC) and artificial intelligence (AI) strategy. These chips will operate in 12 HGX servers, each with 8xH100 GPUs with SXM connectivity. The Company received eight of these GPUs in January 2024 and 88 of them in March 2024.

Private Placement of Special Warrants

On December 28, 2023, the Company announced that it had completed a private placement offering of 5,750,000 special warrants of the Company (the "December 2023 Special Warrants") at a price of $5.00 per December 2023 Special Warrant for aggregate gross proceeds to the Company of $28,750,000 (the "December 2023 Private Placement"). Stifel Canada and Canaccord acted as co-lead underwriters and joint bookrunners (collectively, the "December 2023 Underwriters").

Subject to adjustment in certain circumstances, each December 2023 Special Warrant entitled the holder to receive one (1) unit of the Company upon exercise (each, a "December 2023 Unit"). Each December 2023 Unit consisted of one (1) Common Share and one-half (0.5) of one (1) Common Share purchase warrant (each whole of such Common Share purchase warrant being a "December 2023 Warrant"). Each December 2023 Warrant entitles the holder thereof to purchase one (1) Common Share of the Company at a price of $6.00 per Common Share until December 28, 2026.

On January 30, 2024, the Company filed a final short form prospectus in connection with the December 2023 Private Placement, qualifying the distribution of the 5,750,000 December 2023 Units issuable upon the automatic exercise of the December 2023 Special Warrants for no additional consideration.

Officer's Appointment

On January 4, 2024, the Company announced the appointment of Luke Rossy to Chief Operating Officer ("COO") and Mario Sergi to Chief Information Officer ("CIO").

20

Subsequent to Fiscal 2024

Subsequent to March 31, 2024, the Company issued 10,965,793 common shares (the "August 2023 ATM Shares") pursuant to the August 2023 ATM Equity Program for gross proceeds of CAD$44.1 million ($32.2 million). The August 2023 ATM shares were sold at prevailing market prices, for an average price per August 2023 ATM Share of CAD$4.02. Pursuant to the August 2023 Equity Distribution Agreement, a cash commission of $967,000 on the aggregate gross proceeds raised was paid to the agent in connection with its services under the August 2023 Equity Distribution Agreement.

DESCRIPTION OF THE BUSINESS

Description of the Business

HIVE is a growth oriented, publicly listed company building a bridge from the blockchain sector to traditional capital markets. The Company operates in one segment, the mining and sale of digital currencies. The Company owns and leases green energy-powered data center facilities in Canada, Sweden, and Iceland which mine newly minted Bitcoin continuously on the cloud. These operations provide shareholders with exposure to the operating margins of digital currency mining which the Company believes is currently the most profitable application of the Company's computing power. The Company will diversify its business by utilizing its approximately 31,500 GPU-based cards to build systems that can provide computational power on a massive scale. In addition, the Company will branch out into the rental of GPU server clusters via marketplaces and is exploring the development of a new service to be known as HIVE Cloud. This cloud service will offer to users a selection of options to access computing resources ranging from a virtual instance of a single GPU to a bare-metal server equipped with up to 10 GPUs to clusters of multiple servers.

For a further description of HIVE's current cryptocurrency mining business and its general development, see "GENERAL DEVELOPMENT OF THE BUSINESS" above. HIVE believes that these strategic transactions, along with certain related financings and capital markets initiatives, corporate initiatives, and other transactions, each as further detailed above or elsewhere in this AIF and the Fiscal 2024 MD&A, have been the primary influence on the general development of HIVE's business during the last three completed financial years and subsequently.

Production and Services

HIVE currently maintains seven cryptocurrency mining operations as set forth below. The Company's operating and maintenance expenses are composed primarily of electricity to power its computing equipment as well as cooling and lighting, etc. The facilities are strategically located where electricity costs are low due to an abundance of hydro power and geothermal energy. Other site expenses include leasing costs for the facilities, internet access, equipment maintenance and software optimization, and facility security, maintenance and management.

The HIVE Lachute Facility

The HIVE Lachute Facility is a leased facility and is located in Québec, Canada and as of March 31, 2024 is equipped with approximately 10,500 Bitcoin miners, with an aggregate operating hashrate of approximately 1,300 PH/s. The HIVE Lachute Facility utilizes approximately 34 MW of power, with available power capacity of 36 MW. 100% of the Bitcoin mining power is being utilized by HIVE for self-mining.

21

In April 2020 HIVE acquired this leased facility located in Lachute, Quebec from Cryptologic, which has access to low cost, renewable electricity, available capacity of 36 MW of HVAC and electrical infrastructure that is unique to cryptocurrency mining, systems for power and internet connectivity and operational staff. HIVE has subsequently been investing in next generation mining equipment that can provide positive gross mining margins of Bitcoin rewards.

In the first quarter of fiscal 2021, HIVE invested more than $2 million in approximately 2,000 next generation SHA-256 Bitmain-manufactured miners with an aggregate operating hashrate of 124 PH/s to scale up mining power and increase the operating efficiency of the facility. In July 2020, HIVE ordered 200 additional new generation Bitmain miners, with an aggregate operating hashpower of 12 PH/s, from an equipment broker. In August 2020, the Company installed an additional 1,000 new generation miners from manufacturer MicroBT, having a cost of approximately $2 million, with an aggregate operating hashrate of 93 PH/s. The equipment was initially hosted by HIVE on behalf of an institutional client, and on July 12, 2021 these machines were purchased from this institutional client.

As part of the Company's strategy to enhance mining efficiency ahead of the 2024 halving event, over 8,500 new-generation ASICs have been deployed to the Lachute facility since April 1st, 2023. These ASICs were intended to replace older models, leading to a significant increase in hashrate from approximately 670 PH/s to 1,300 PH/s. Additionally, as of March 31st, 2024, the average efficiency at the Lachute facility stands at approximately 24 J/TH.

The HIVE Sweden Facility

The Company's operations in Sweden as of March 31, 2024 are comprised of the following facilities:

a) The HIVE Sweden Facility, leased facility in Boden, equipped with approximately 7,800 Bitcoin miners, with an aggregate operating hashrate of approximately 845 PH/s. The HIVE Sweden Facility is equipped with power capacity of 32 MW, of which 26 MW are ASICs which produce approximately 845 PH/s of Bitcoin mining capacity.

b) The HIVE Sweden Robertsfors Facility, leased facility in Robertsfors, equipped with approximately 1,000 Bitcoin miners, generating approximately 82 PH/s. The HIVE Sweden Robertsfors Facility utilizes approximately 4 MW of power.

c) The HIVE Notviken Facility, a modular unit near near Lulea, Sweden, equipped with 430 Bitcoin miners, generating approximately 45 PH/s. The HIVE Sweden Notviken Facility utilizes approximately 1.5 MW of power.

d) The Hive Boden 2 Facility, an owned facility in Boden, equipped with approximately 110 Bitcoin miners, with an average operating hashrate of approximately 10 PH/s. The HIVE Sweden Boden 2 Facility utilizes approximately 0.3 MW of power.

In August 2019, the Company assumed full control of operations at the HIVE Sweden Facility from Genesis Mining Ltd. and entered into direct agreements with local suppliers, including a strategic partnership with Blockbase to be the facility operator. Blockbase manages Barrage d.o.o. (LLC) ("Barrage"), which has a team of data center technicians with technical training unique to operating GPUs. This is critical as GPUs require more attention and specialized skill sets to ensure proper maintenance and operation than a data center filled with ASIC chips. The transition of facility operations from Genesis to Blockbase was completed in November 2019.

22

In 2020, the Company restructured its strategy in Boden to shift towards becoming more of a data center operation in order to broaden the range of services the Company offers. The Company believes the demand for GPU high performance chips will generate new sources of revenue including revenue derived from gaming, artificial intelligence, movie rendering, and support for smart cities, and this shift in strategy will position the Company to capitalize on these opportunities.

In the fall of 2020, the Company announced that it had entered into energy hedging agreements related to its electricity costs in Sweden through the calendar year 2021, and these agreements have been extended to continue until December 2023. This has resulted in the Company locking in attractive energy prices that are lower than industry averages. The Company estimates that the combination of its new, direct agreements with local suppliers for its Sweden operation combined with the electricity hedging agreements has resulted in a 40% reduction in its operating and maintenance costs at the HIVE Sweden Facility, compared to what such costs would have been under its previous service provider agreement with Genesis which ended in November 2019. Additionally, the refurbishment of HIVE's mining rigs carried out by Blockbase and Barrage has resulted in an increase in mining output.

In March 2020, HIVE announced the initiation of an expansion at the HIVE Sweden Facility. The expansion, then anticipated to cost approximately $750,000 and be financed with cash flows from operations, was expected to occur in two phases and be completed within six months. However, the Company put the expansion on temporary hold due to lack of clarity on whether the Company would have access to long term hydro electricity, due to new green energy requirements for the steel industry in the Boden region. The expansion was reinitiated at a larger scale and completed during Fiscal 2022.

In June of 2021 HIVE announced the expansion of its Sweden Operations with the addition of the HIVE Sweden Robertsfors Facility, a 4 MW facility in the town of Robertsfors, Sweden. This facility is managed by Bikupa Datacenter 2 AB and is referred to internally as the Old Diamond Factory or "ODF" which hosts approximately 1,000 new generation miners mining digital assets in the cloud. See "GENERAL DEVELOPMENT OF THE BUSINESS - Fiscal 2022 - HIVE Sweden Facility Updates".

In the spring budget of 2023, the Swedish Parliament abolished the reduced energy tax for data centers, effective as of July 1, 2023. As a result of this decision, the Company's cost of energy at its HIVE Sweden Facility will increase by approximately 0.30 Swedish Krona ("SEK") per kWh. Prior to the effective date of the abolishment of the energy tax reduction, HIVE's cost of energy at the HIVE Sweden Facility was approximately 0.30 to 0.50 SEK per kWh. Revenues from HIVE's operations at these facilities typically ranges from 0.80 to 1.00 SEK per kWh. The HIVE Sweden Facility currently represents approximately 18% of the Company's global production of Bitcoin per day. See "RISK FACTORS - Changes to Tax Laws".

The HIVE Boden 2 Facility

On November 29, 2023, the Company acquired a data center and the real property on which it is situated, located in the city of Boden, Sweden. This facility has 1.5 MW operational and is being expanded to 7.0 MW, and internally referred to as Boden 2 which hosts approximately 110 new generation miners mining digital assets in the cloud, with an operational hashrate of approximately 10 PH/s. The facility will be ready for new generation ASICs expected to arrive in July 2025.

23

The Boden 2 facility consists of an office building, a storage building and four data halls: A1, A2, A3, which are interconnected, and A5. Building A4 has yet to be built and remains a cement foundation. Power contracts for a total of 7.0 MW belong to the property. At the time of the acquisition, 5 x 1.5 MW transformers also formed part of the transaction. Another transformer with a subscription of 0.5 MW is owned by the local grid provider, Bodens Energi. On November 29 the facility had approx. 1.5 MW of available power.

The HIVE Iceland Facility

The HIVE Iceland Facility is a leased facility with atNorth and is currently equipped with approximately 2,400 new generation Bitcoin miners, with an aggregate operating hashrate of approximately 250 PH/s. This facility has a combined capacity of approximately 8.0 MW of power. Iceland tends to be cool year-round, with summer daytime temperature seldom rising above 25°C. Consequently, the Company does not have to incur costs associated with substantial cooling of mining equipment at this facility.

We received notification from the Icelandic power company on November 29, 2023, mandating a 50% reduction in energy consumption until further notice, attributable to diminished water levels in hydroelectric reservoirs. No specific end date has been provided; however, they will inform us when operations can resume normal energy usage once reservoir levels recover sufficiently. Do to the curtailment, we have an aggregate operating hashrate of approximately 130 PH/s utilizing 4.0 MW of power.

HIVE Blockchain Iceland ehf also entered into a service agreement with Borealis Data Park ehf on November 25, 2021, for the hosting of equipment at the Borealis Facility. The agreement enables the hosting of approximately 1,200 new generation Bitcoin miners, or 4.5 MW of capacity, over a period of 36 months, using geothermal and hydroelectric energy. On January 2, 2024, the Company mutually agreed to the early termination of its service agreement for the Borealis Facility. The 1,200 Bitcoin miners were moved to storage and most of the miners were subsequently disposed for a nominal amount.

The HIVE New Brunswick Facility

The HIVE New Brunswick Facility was acquired from GPU ONE through the purchase of GPU Atlantic, which has undergone a name change, and is now known as HIVE Atlantic Datacentres Ltd. ("HIVE Atlantic"). HIVE Atlantic is a wholly owned subsidiary of the Company and is the owner of the HIVE New Brunswick Facility. As of the date of this AIF, this facility has a capacity of 80 MW of power. As of March 31, 2024, this facility operates approximately 20,000 new generation ASIC miners, with an aggregate operating hashrate of approximately 2,250 PH/s, utilizing approximately 60 MW of power. At full capacity, the campus can utilize approximately 75 MW of power.

On October 23, 2019, HIVE Atlantic entered into an agreement for the supply of power and energy (the "NB Agreement") with New Brunswick Power Corporation ("NB Power"). The NB Agreement has a term of ten (10) years.

The NB Agreement stipulates that NB Power will supply a total of 15,000kW of power to HIVE Atlantic, 2,250kW of which NB Power has a contractual obligation to deliver on a continued basis from October 23, 2019 until October 23, 2029, while the 12,750kW of interruptible surplus power can be consumed at HIVE's discretion at the daily spot prices during this same ten (10) year term.

24

"Total Usable Power" is not defined in the NB Agreement; it is the sum of the Contracted Reserve and the Surplus Energy. The NB Agreement defines "Contracted Reserve" and "Surplus Energy" as follows:

-

"Contracted Reserve" means the amount of power which NB Power shall reserve for the Customer as specified in Article 3.1 hereof.

-

"Surplus Energy" means energy which may be interrupted by NB Power at any time and is supplied to the Customer provided NB Power has energy available to it surplus to the requirements of other firm commitments of NB Power and its affiliated companies.

The Total Usable Power is thus the amount of kW that HIVE can elect to consume on a daily basis throughout the term of the NB Agreement.

At the time of execution of the NB Agreement, the understanding with NB Power was that the Company would have a right to consume a total amount of 50 MW on a continuous basis. Pursuant to the foregoing, on August 11, 2020, NB Power issued a facilities study which, in effect, authorized HIVE Atlantic to increase total consumption to the level of 50 MW on a continuous basis.

On April 5, 2022, the NB Agreement was updated to reflect that NB Power will supply a total power supply of 80,000kW to HIVE Atlantic, with 37,500kW of which NB Power has a contractual obligation to deliver on a continued basis until October 23, 2029 with the available Surplus Energy at 42,500kW, bringing the Total Usable Power to 80,000kW throughout the duration of the term.

Curtailable power, or Surplus Energy, which is available to HIVE Atlantic varies daily with on-peak and off-peak hours. Each week, HIVE Atlantic obtains the anticipated pricing forecast for the week's available Surplus Energy and can elect when it wishes to operate and at what capacity (over and above its fixed Contracted Reserve).

NB Power has the right to withhold and suspend the supply of power and energy from HIVE Atlantic for the purpose of safeguarding life or property, for making repairs, changes, renewals, improvements or replacements to NB Power facilities that it deems necessary, but such interruptions are to be for the shortest period reasonably possible and in accordance with their Good Utility Practice, and when possible, arranged for a time least objectionable to HIVE Atlantic.

As part of the HIVE New Brunswick Facility acquisition, the Company acquired 740 Innosilicon miners and 40 Bitmain S9 Antminers, as well as data center equipment including racking, cabling, electrical infrastructure, and fixtures.

Budget

The Company's revenue and future capital raises will be used to finance ongoing and future construction. As of the date of this AIF, the Company's daily revenue is approximately $252,000 generated through an average of 3.5 bitcoin mined per day using 5,000 PH/s of Bitcoin mining capacity from ASICs and, additionally, $20,000 generated from high-performance computing.

25

Security

HIVE's facilities are located in relatively remote locations and surrounded by a chain-link fence with barbed wire and staffed with security on a 24x7x365 basis. The sites have a physical security policy and staff are trained to be aware of any unauthorized personnel. There are closed-circuit televisions on site and the mining rigs are located within locked data center warehouses. At the HIVE Sweden Facility, HIVE's strategic partner Barrage arranges for security for HIVE's facility. At the HIVE Iceland Facility and HIVE Lachute Facility, the property owners provide security for these facilities. At the HIVE New Brunswick Facility a local service provider is responsible for providing IT and security services and has a 24/7 on-site presence with live camera feeds covering the interior buildings site and private substation.

Network Connectivity

The sites are equipped with the following mediums of connectivity: (a) two satellite internet connections; and (b) two long-term evolution connections. Each medium is provided by a different vendor, which increases redundancy and resiliency.

Monitoring and Repair

All key components of the sites are monitored including the intake air temperature, hash board temperature, voltage, hashrate, data center air temperature, exhaust air temperature and humidity of each facility. All parameters are monitored and can be changed remotely on a twenty-four hour basis throughout each day of the year, by: (i) Blockbase for the HIVE Sweden Facility; (ii) atNorth for the HIVE Iceland Facility; (iii) the Company directly for the HIVE Lachute Facility; and (iv) for the HIVE New Brunswick Facility, a local service provider facilitates the maintenance and upkeep of the key components and provides their readings to the Company directly. Parallel monitoring is performed by local on-site staff who are responsible for implementing any necessary repairs to mining infrastructure. In the event that the Company's remote monitoring or any parallel monitoring identifies any malfunction or technical issue, personnel are dispatched to physically inspect and, if necessary, repair defective components. HIVE intends to maintain an inventory of all necessary components for repair, which is kept at the same facility as operations.

26

Custodial services for digital currencies

The Company utilizes a platform provided by Fireblocks Inc. ("Fireblocks"), which is headquartered in New York, to maintain custody1 and secure its digital currencies. The Company also holds its digital currencies in secure storage wallets at Bank Frick ("Bank Frick" and together with Fireblocks, the "Custodians"), which is headquartered in Liechtenstein. The Custodians are responsible only for safeguarding the cryptocurrency assets of the Company. Neither the Company nor the Custodians process cryptocurrency asset payments for the Company or for others. Neither of the Custodians uses a sub-custodian and neither is a related party of the Company. Bank Frick is regulated by the Liechtenstein financial market authority and is the foreign equivalent of a Canadian financial institution (as that term is defined in National Instrument 45-106 - Prospectus Exemption). The Company is not aware of anything with regards to the Custodians' operations that would adversely affect the issuer's ability to obtain an unqualified audit opinion on its audited financial statements. As at The date hereof, the percentages of the Company's cryptocurrency assets held by Fireblocks and Bank Frick were approximately 99% and 1%, respectively. As at the date of this AIF, the quantity and dollar value of the Company's cryptocurrency assets were 2,483 Bitcoin, with a market value of approximately USD$161 million.

The Company has conducted due diligence on its Custodians and has not identified any material concerns. It routinely reviews and verifies its asset balances on public blockchain explorers. In order to monitor Fireblocks, the Custodian at which the large majority of the Company's assets are held, the Company relies on system and organization controls provided by a SOC 2 Type II report, undertaken by an independent audit firm. Management of the Company is not aware of any security breaches or other similar incidents involving either of the Custodians which resulted in lost or stolen cryptocurrency assets. In the event of an insolvency or bankruptcy of the Custodians, the Company would write off as losses any unrecoverable cryptocurrency assets.

The Company has chosen to continue to use Bank Frick as custodian due to its track record in the industry. Bank Frick has acted as custodian for the Company since its early stages and was one of the few institutions that readily accepted cryptocurrency companies in Europe after changes in Switzerland greatly limited banks from operating in the cryptocurrency industry. In addition, Bank Frick permits the Company to maintain accounts in both fiat currency as well as cryptocurrency, and consequently, upon sales of cryptocurrency, the proceeds can be deposited into the Company's account with Bank Frick that is denominated in US dollars.

Fireblocks was chosen as the Company's second and primary custodian after they had announced in December 2019 that they had completed an examination and received a SOC 2 Type II certification. In general, a SOC 2 Type II certification is issued by an outside auditor and evaluates the extent to which a vendor complies with five trust principles based on the systems and processes in place. These five principles include the following (collectively, the "Trust Services Criteria"):

- "Security", which addresses the safeguarding of system resources and assets against unauthorized access;

1HIVE owns all of the wallets in which its cryptocurrency assets deposited with Fireblocks are held. Fireblocks does not directly hold any of the Company's cryptocurrency inventory. Fireblocks stores two of the Company's three key shares on servers located in the United States and operated by Microsoft Azure, a cloud computing service operated by Microsoft Corporation, and International Business Machines Corporation; the Company maintains the third key share in the secure enclave of authorized user's mobile devices. All three key shares are required in order to execute a transfer of cryptocurrency from the secure storage wallet.

27

-

"Availability", which addresses the accessibility of the system as stipulated by the applicable service agreement between vendor and customer;

-

"Processing Integrity", which addresses whether or not a system achieves its purpose;

-

"Confidentiality", which addresses whether access and disclosure of data is restricted to a specified set of persons or organizations; and

-

"Privacy", which addresses the system's collection, use, retention, disclosure and disposal of personal information in conformity with an organization's privacy notice.

The most recent SOC 2 Type II certification received by Fireblocks was based on an examination of its platform for the period from September 1, 2022 to August 31, 2023 (the "2023 SOC 2 Report"). The 2023 SOC 2 Report concluded that the controls implemented by Fireblocks were suitably designed to meet Fireblocks' service commitments and system requirements based on the applicable Trust Services Criteria. As a result of their nature however, the controls implemented by a service organization such as Fireblocks may not always operate effectively or continue to meet the applicable Trust Services Criteria. It is impossible to predict the future applicability of any evaluation regarding the suitability of design or operating effectiveness of the controls used by Fireblocks, as these are subject to the risk that the systems or controls used may change or become ineffective. Additionally, the conclusion of the 2023 SOC 2 Report is based on the assumption that the controls in place were effectively applied by user entities and any subservice organizations engaged by Fireblocks, which may not always be the case.

As of the date hereof, the Company's only material custodian is Fireblocks. The Company relies primarily on Fireblocks as it compiles documented controls that can be provided to the Company, such as the SOC 2 Type II certification, which are viewed as instrumental in providing verification to third parties that appropriate controls have been put in place.

Fireblocks is a wallet infrastructure provider and a digital asset security firm which was backed in its early stages by the investment arm of Fidelity International Ltd. Fireblocks utilizes multi-party computation technology to secure private keys to assist its customers to securely self-custody and transfer cryptocurrency assets among counterparties, and consequently, does not directly hold the Company's cryptocurrency inventory. Fireblocks stores two of the Company's three key shares on servers located in the United States and operated by Microsoft Azure, a cloud computing service operated by Microsoft Corporation, and International Business Machines Corporation; the Company maintains the third key share in the secure enclave of authorized user's mobile devices. All three key shares are required in order to execute a transfer of cryptocurrency from the secure storage wallet.

As at the date hereof, the Company had elected to maintain 99% of its cryptocurrency with Fireblocks primarily due to the comfort provided by the SOC 2 Type II certification, undertaken by an independent audit firm, and for which Fireblocks undergoes a review on an annual basis. Such reports are not applicable to Bank Frick or other large cryptocurrency custodians at this time. The Company reviews the SOC 2 Type II report to ensure it maintains a secure technology infrastructure and the security systems designed to safeguard cryptocurrency assets are operating effectively. To date, the Company has not identified any material concerns based on its review of the SOC 2 Type II report.

28

Fireblocks also maintains an insurance policy which covers technology, cyber, and professional liability, and has received an "A" rating by A.M. Best based on the strength of the policy. The Company is not aware of any security breaches or incidents involving Fireblocks, or of any other limitations on Fireblocks's insurance.

The Company further believes that the SOC 2 Type II certification better addresses the commentary of the Canadian Public Accountancy Board and the Canadian Securities Administrators continuing review and guidance in respect of custodial controls and security of cryptocurrency assets.