HIVE Blockchain Technologies Ltd.: Exhibit 99.2 - Filed by newsfilecorp.com

HIVE Blockchain Technologies Ltd.

Statement of Executive Compensation

Named Executive Officers

For the purposes of this Statement of Executive Compensation, a Named Executive Officer ("NEO") of the Corporation means each of the following individuals:

(a) a chief executive officer ("CEO") of the Corporation;

(b) a chief financial officer ("CFO") of the Corporation;

(c) in respect of the Corporation and its subsidiaries, the most highly compensated executive officer other than the individuals identified in paragraphs (a) and (b) at the end of the most recently completed financial year whose total compensation was more than $150,000; and

(d) each individual who would be an NEO under paragraph (c) above but for the fact that the individual was neither an executive officer of the Corporation, nor acting in a similar capacity, at the end of that financial year.

COMPENSATION DISCUSSION AND ANALYSIS

Compensation provided to the Corporation's NEOs is determined and reviewed by the Corporation's Compensation Committee. In establishing executive compensation policies, the Compensation Committee takes into consideration the recommendations of management and, following discussion and review, reports them to the Corporation's full Board of Directors for final approval. The members of the Compensation Committee are Dave Perrill and Frank Holmes.

Compensation for the Corporation's NEOs consists of:

(a) Base Salary;

(b) Option Based Awards;

(c) Awards under the Corporation's Restricted Share Unit Plan; and

(d) Eligibility to Receive Bonuses in the Form of Cash Payments.

Through its executive compensation practices, the Corporation seeks to provide value to its shareholders. Specifically, the Corporation's executive compensation structure seeks to attract and retain talented and experienced executives necessary to achieve the Corporation's strategic objectives, motivate and reward executives whose knowledge, skills and performance are critical to the Corporation's success, align the interests of the Corporation's executives and shareholders by motivating executives to increase shareholder value.

Within the context of the overall objectives of the Corporation's compensation practices, the Corporation determined the specific amounts of compensation to be paid to its executives during the year ended March 31, 2022 based on a number of factors, including the performance of the Corporation's executives during the fiscal year, the roles and responsibilities of the Corporation's executives, the Corporation's executives' historical compensation and performance, and any contractual commitments the Corporation has made to its executives regarding compensation.

The Board of Directors has not conducted a formal evaluation of the implications of the risks associated with the Corporation's compensation policies. Risk management is a consideration of the Board of Directors when implementing its compensation policies and the Board of Directors do not believe that the Corporation's compensation policies result in unnecessary or inappropriate risk-taking including risks that are likely to have a material adverse effect on the Corporation.

Share Consolidation

On May 24, 2022, the Company underwent a consolidation (the "Consolidation") of the Common Shares (the "Common Shares") on the basis of five pre-consolidation Common Shares for one post-consolidation Common Share. Unless otherwise stated, all references to Common Shares in this Statement of Executive Compensation are to post-Consolidation Common Shares.

Compensation Governance

Base Salary

The Corporation believes that a competitive base salary is a necessary element of any compensation program that is designed to attract and retain talented and experienced executives. The Corporation also believes that attractive base salaries can motivate and reward executives for their overall performance.

To the extent that the Corporation has entered into employment agreements with its executives, the base salaries of such individuals reflect the base salaries that the Corporation negotiated with them. The base salaries that the Corporation negotiated with its executives were based on the individual experience and skills of, and expected contribution from, each executive, the roles and responsibilities of the executive, the base salaries of the Corporation's existing executives and other factors.

Option Based Awards

The Corporation has in effect a stock option plan (the "Option Plan") in order to provide effective incentives to directors, officers, senior management personnel and consultants of the Corporation and to enable the Corporation to attract and retain experienced and qualified individuals in those positions by permitting such individuals to directly participate in an increase in per share value created for the Corporation's Shareholders. In determining option grants to the NEO's, the Compensation Committee together with management takes into consideration factors that include the amount and exercise price of previous option grants, other forms and amounts of compensation, the NEOs experience, level of expertise and responsibilities, and the contributions of each NEO towards the completion of corporate transactions in any given fiscal year.

Under the Option Plan, the maximum number of common shares reserved for issuance pursuant to the exercise of stock options, in combination with all other security based compensation plans, shall not exceed 10% of the issued common shares of the Corporation from time to time. The Option Plan was adopted by the Board on July 20, 2017 and last approved by Shareholders at the Corporation's previous annual general meeting of the Shareholders held on December 21, 2021. Under the policies of the TSX Venture Exchange, a rolling stock option plan must be re- approved by Shareholders on a yearly basis and as such, the Corporation will be asking Shareholders to re-approve the Option Plan at the 2022 annual general meeting of shareholders. The significant terms of the Corporation's Option Plan are set out below, which terms are qualified in their entirety by the full text of the Option Plan which is attached hereto as Schedule "A":

(a) the Option Plan reserves, for issuance pursuant to the exercise of stock options, a maximum number of common shares of the Corporation equal to up to a maximum of 10% of the issued common shares of the Corporation at the time of any stock option grant;

(b) an optionee must either be an Eligible Charitable Organization or a Director, Employee or Consultant of the Corporation at the time the option is granted in order to be eligible for the grant of a stock option to the optionee;

(c) the aggregate number of options granted to any one Person (and companies wholly owned by that Person) in a 12 month period must not exceed 5% of the issued common shares of the Corporation calculated on the date an option is granted to the Person (unless the Corporation has obtained the requisite Disinterested Shareholder Approval);

(d) the aggregate number of options granted to any one Consultant in a 12 month period must not exceed 2% of the issued common shares of the Corporation, calculated at the date an option is granted to the Consultant;

(e) the aggregate number of options granted to all Persons retained to provide Investor Relations Activities must not exceed 2% of the issued shares of the Corporation in any 12 month period, calculated at the date an option is granted to any such Person;

(f) options issued to Persons retained to provide Investor Relations Activities must vest in stages over a period of not less than 12 months with no more than 1/4 of the options vesting in any 3 month period;

(g) the minimum exercise price per common share of a stock option must not be less than the Market Price of the common shares of the Corporation, subject to a minimum exercise price of $0.05;

(h) options can be exercisable for a maximum of 10 years from the date of grant (subject to extension where the expiry date falls within a "blackout period" (see subparagraph (o) below);

(i) stock options (other than options held by a person involved in investor relations activities) will cease to be exercisable 90 days after the optionee ceases to be a Director (which term includes a senior officer), Employee, Consultant, Eligible Charitable Organization or Management Company Employee otherwise than by death, or for a "reasonable period" after the optionee ceases to serve in such capacity, as determined by the Board. Stock options granted to persons involved in Investor Relations Activities will cease to be exercisable 30 days after the optionee ceases to serve in such capacity otherwise than by death, or for a "reasonable period" after the optionee ceases to serve in such capacity, as determined by the Board;

(j) all options are non-assignable and non-transferable;

(k) Disinterested Shareholder Approval will be obtained for any reduction in the exercise price of a stock option if the optionee is an Insider of the Corporation at the time of the proposed amendment;

(l) the Option Plan contains provisions for adjustment in the number of common shares or other property issuable on exercise of a stock option in the event of a share consolidation, split, reclassification or other capital reorganization, or a stock dividend, amalgamation, merger or other relevant corporate transaction, or any other relevant change in or event affecting the common shares;

(m) upon the occurrence of an Accelerated Vesting Event (as defined in the Option Plan), the Board will have the power, at its sole discretion and without being required to obtain the approval of shareholders or the holder of any stock option, to make such changes to the terms of stock options as it considers fair and appropriate in the circumstances, including but not limited to: (a) accelerating the vesting of stock options, conditionally or unconditionally; (b) terminating every stock option if under the transaction giving rise to the Accelerated Vesting Event, options in replacement of the stock options are proposed to be granted to or exchanged with the holders of stock options, which replacement options treat the holders of stock options in a manner which the Board considers fair and appropriate in the circumstances having regard to the treatment of holders of common shares under such transaction; (c) otherwise modifying the terms of any stock option to assist the holder to tender into any take-over bid or other transaction constituting an Accelerated Vesting Event; or (d) following the successful completion of such Accelerated Vesting Event, terminating any stock option to the extent it has not been exercised prior to successful completion of the Accelerated Vesting Event. The determination of the Board in respect of any such Accelerated Vesting Event shall for the purposes of the Option Plan be final, conclusive and binding;

(n) in connection with the exercise of an option, as a condition to such exercise the Corporation shall require the optionee to pay to the Corporation an amount as necessary so as to ensure that the Corporation is in compliance with the applicable provisions of any federal, provincial or local laws relating to the withholding of tax or other required deductions relating to the exercise of such option; and

(o) a stock option will be automatically extended past its expiry date if such expiry date falls within a blackout period during which the Corporation prohibits optionees from exercising their options, subject to the following requirements: (a) the blackout period must (i) be formally imposed by the Corporation pursuant to its internal trading policies; and (ii) must expire upon the general disclosure of undisclosed Material Information; and (b) the automatic extension of an optionee's stock option will not be permitted where the optionee or the Corporation is subject to a cease trade order (or similar order under Securities Laws) in respect of the Corporation's securities.

"Consultant", "Director", "Disinterested Shareholder Approval", "Eligible Charitable Organization", "Employee", "Investor Relations Activities", "Management Company Employee", "Market Price", "Material Information", "Person" and "Securities Laws" all have the same definition as assigned thereto in the policies of the TSX Venture Exchange.

Awards under the Corporation's Restricted Share Unit Plan

The Corporation has in effect a restricted share unit plan (the "RSU Plan") in order to provide effective incentives to directors, officers, senior management personnel and consultants of the Corporation and to enable the Corporation to attract and retain experienced and qualified individuals in those positions by permitting such individuals to directly participate in an increase in per share value created for the Corporation's Shareholders. In determining RSU grants to the Named Executive Officers, the Compensation Committee together with management takes into consideration factors that include the amount of previous RSU grants, other forms and amounts of compensation, the NEOs experience, level of expertise and responsibilities, and the contributions of each NEO towards the completion of corporate transactions in any given fiscal year.

Under the RSU Plan, the maximum number of common shares reserved for issuance is 2,000,000, and in combination with all other security based compensation plans, shall not exceed 10% the issued common shares of the Corporation from time to time. The RSU Plan was adopted by the Board on October 17, 2018 and last approved by Shareholders at the Corporation's previous annual general meeting of the Shareholders held on December 21, 2021. Under the policies of the TSX Venture Exchange, a restricted share unit plan must be re-approved by Shareholders on a yearly basis and as such, the Corporation will be asking Shareholders to re- approve the RSU Plan at the 2022 annual general meeting of shareholders. A summary of the significant terms of the Corporation's RSU Plan is attached hereto as Schedule "B", and is qualified in its entirety by the full text of the RSU Plan.

Eligibility to Receive Bonuses in the Form of Cash Payments

The Compensation Committee, together with recommendations from management, awards bonuses based on both individual performance and corporate success at various times throughout the year. At this time, the Corporation does not have any specific milestone criteria for issuing bonuses.

Pension Plan Benefits

No pension, retirement or deferred compensation plans, including defined contribution plans, have been instituted by the Corporation and none are proposed at this time.

Use of Financial Instruments

The Corporation does not have a policy that would prohibit a Named Executive Officer or director from purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the Named Executive Officer or director. However, management is not aware of any Named Executive or director purchasing such an instrument.

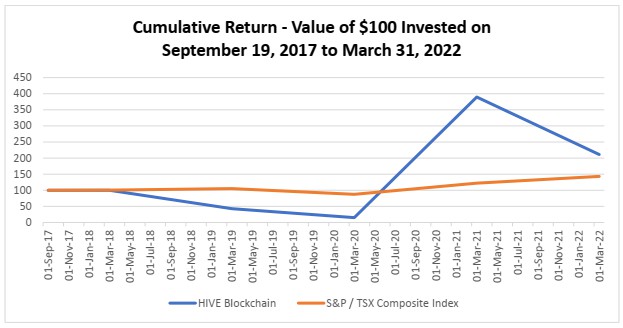

Performance Graph

The following graph compares, from March 31, 2018 to March 31, 2022, the total cumulative return on a CAD$100 investment in the Common Shares with the cumulative total return of the S&P/TSX Composite Index.

Note:

(1) On September 15, 2017, the Company completed a change of business, and changed its name from Leeta Gold Corp. to HIVE Blockchain Technologies Ltd. The data points in the performance graph reflect the investment of $100 on September 19, 2017 to March 31, 2022.

Although an investment in HIVE Common Shares has outperformed the S&P/TSX Composite Index, Management of the Company believes the company's compensation to executive officers is reasonable. The Company does not use benchmarks or comparable companies in determining its executive compensation.

SUMMARY COMPENSATION TABLE

In accordance with applicable legislation, the Corporation had five Named Executive Officers during the financial year ended March 31, 2022, namely Frank Holmes, Darcy Daubaras, Aydin Kilic, Gabriel Ibghy, and William Gray.

The following table sets forth particulars of all compensation paid to the Named Executive Officers during the years ended March 31, 2022, 2021, and 2020, expressed in Canadian dollars.

| |

|

|

|

|

Non-equity incentive |

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

plan compensation

($)

|

|

|

|

| Name and |

Financial |

|

Share- |

|

|

Long- |

|

|

|

| Year |

|

based |

Option- |

Annual |

term |

Pension |

|

Total |

| Principal |

ended |

Salary |

awards |

based |

incentive |

incentive |

value |

All other |

compensation |

| Position |

March 31 |

($) |

($) |

awards ($) |

plans |

plans |

($) |

compensation ($) |

($) |

Frank

Holmes(1)

Executive

Chairman |

2022 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

105,430(1) |

105,430 |

| 2021 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

95,000(1) |

95,000 |

| 2020 |

Nil |

145,000(4) |

137,140(7) |

Nil |

Nil |

Nil |

78,000(1) |

360,140 |

Darcy

Daubaras(2)

CFO |

2022 |

263,750 |

Nil |

Nil |

112,500 |

Nil |

Nil |

23,437(13) |

399,687 |

| 2021 |

180,000 |

Nil |

Nil |

127,775 |

Nil |

Nil |

Nil |

307,775 |

| 2020 |

180,000 |

145,000(4) |

137,140(7) |

100,000 |

Nil |

Nil |

Nil |

562,140 |

Aydin

Kilic(3),

President

and COO |

2022 |

Nil |

148,000(5) |

3,033,361(8) |

61,500 |

Nil |

Nil |

232,258(14) |

3,181,361 |

| 2021 |

Nil |

31,400(6) |

67,578(9)(10) |

Nil |

Nil |

Nil |

40,000(14) |

138,978 |

| 2020 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Gabriel

Ibghy,

Director of

Legal

Affairs and

Secretary |

2022 |

153,846 |

Nil |

335,205(11) |

44,167 |

Nil |

Nil |

Nil |

533,218 |

| 2021 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| 2020 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

William

Gray,

CTO |

2022 |

145,193 |

Nil |

791,428(11)(12) |

42,500 |

Nil |

Nil |

Nil |

979,121 |

| 2021 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| 2020 |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Notes:

(1) Mr. Holmes has served as Executive Chairman since March 25, 2022. Prior to that he served as Interim CEO and Interim Executive Chairman since August 31, 2018., and as Non-Executive Chairman since August 23, 2017. Mr. Holmes earns director's fees of $100,000 per year commencing January 1, 2022 and $2,000 per Board Meeting attended since August 31, 2018. Prior to January 1, 2022 he earned director's fees of $60,000 per year commencing January 1, 2018. Mr. Holmes does not earn a salary as interim CEO, and all compensation is paid pursuant to his capacity as a director.

(2) Mr. Daubaras has served as CFO since October 1, 2018.

(3) Mr. Kilic has served as President and COO since August 19, 2021.

(4) On February 10, 2020, the Corporation granted 100,000 restricted shares units ("RSUs") (vesting quarterly over two years) to each of Mr. Holmes and Mr. Daubaras. All share-based awards for the year ended March 31, 2020 reflect a dollar amount of RSUs that were granted to each NEO on February 10, 2020. Fair value of the RSUs was calculated using the closing price of the Corporation's common shares on the TSX Venture Exchange on the trading day before the grant of February 7, 2020, which was $1.45. These values do not represent actual amounts received by the NEOs as the value will depend on the market value of the shares on the date that the RSUs vest. None of these RSUs vested in the year ended March 31, 2020.

(5) On October 7, 2021, the Corporation granted 8,000 restricted shares units ("RSUs") (vesting quarterly over one year) to Akilic Ventures Ltd. ("Akilic") a company controlled by Mr. Kilic. Share-based awards for the year ended March 31, 2022 reflect a dollar amount of RSUs that were granted to Akilic on October 17, 2021. Fair value of the RSUs was calculated using the closing price of the Corporation's common shares on the TSX Venture Exchange on the trading day before the grant of October 17, 2021, which was $18.50. This value does not represent actual amounts received by the NEOs as the value will depend on the market value of the shares on the date that the RSUs vest. 4,000 of these RSUs vested in the year ended March 31, 2022.

(6) On February 11, 2021, the Corporation granted 2,000 restricted shares units ("RSUs") (vesting monthly over ten months) to Unimage Enterprises Ltd. ("Unimage"), a company controlled by Mr. Kilic. Share-based awards for the year ended March 31, 2021 reflect a dollar amount of RSUs that were granted to Unimage on February 11, 2021. Fair value of the RSUs was calculated using the closing price of the Corporation's common shares on the TSX Venture Exchange on the trading day before the grant of February 11, 2021, which was $15.70. This value does not represent actual amounts received by the NEOs as the value will depend on the market value of the shares on the date that the RSUs vest. 4,000 of these RSUs vested in the year ended March 31, 2021.

(7) On February 10, 2020, the Corporation granted 100,000 options (vesting quarterly over two years) to each of Mr. Holmes and Mr. Daubaras exercisable at a price of $1.45 per share until February 10, 2030. A "grant date fair value" has been attributed to these non-cash option-based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by the NEOs as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 120%; ii) expected life: 6.00 years; iii) risk-free interest rate: 1.32%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements.

(8) On October 7, 2021, the Corporation granted 180,000 options (vesting quarterly over five years) to Akilic, a company controlled by Mr. Kilic, at a price of $18.50 per share until October 7, 2031. A "grant date fair value" has been attributed to these non- cash option-based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by Akilic as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 105%; ii) expected life: 10.00 years; iii) risk-free interest rate: 1.44%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements.

(9) On January 20, 2021, the Corporation granted 4,000 options (vesting immediately) to Unimage, a company controlled by Mr. Kilic, at a price of $14.25 per share until January 20, 2026. A "grant date fair value" has been attributed to these non-cash option-based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by Unimage as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 105%; ii) expected life: 5.00 years; iii) risk-free interest rate: 0.69%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements.

(10) On February 11, 2021, the Corporation granted 2,000 options (vesting on December 11, 2021) to Unimage, a company controlled by Mr. Kilic, at a price of $15.70 per share until February 11, 2026. A "grant date fair value" has been attributed to 0these non-cash option-based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by Unimage as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 105%; ii) expected life: 5.00 years; iii) risk-free interest rate: 0.69%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements

(11) On April 29, 2021, the Corporation granted 20,000 options (vesting quarterly over two years) to each of Mr. Ibghy and Mr. Gray exercisable at a price of $18.35 per share until April 29, 2031. A "grant date fair value" has been attributed to these non- cash option-based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by the NEOs as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 105%; ii) expected life: 10.00 years; iii) risk-free interest rate: 1.99%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements.

(12) On November 10, 2021, the Corporation granted 20,000 options (vesting quarterly over two years) to Mr. Gray exercisable at a price of $25.35 per share until November 10, 2031. A "grant date fair value" has been attributed to these non-cash option- based awards. The value of these options has been determined using the Black-Scholes model. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. These values do not represent actual amounts received by the NEOs as the gain, if any, will depend on the market value of the shares on the date that the option is exercised. The Black-Scholes assumptions used by the Corporation were: i) annualized volatility: 105%; ii) expected life: 10.00 years; iii) risk-free interest rate: 1.61%; and iv) dividend yield: 0%; this is consistent with the accounting values used in the Corporation's financial statements.

(13) Mr. Daubaras earns director fees of US $75,000 per year commencing on January 1, 2022, for serving on a number of the Corporation's subsidiary company boards.

(14) The Corporation paid $25,000 per month since August 17, 2021, and prior to that paid $10,000 per month since January 1, 2021, to Unimage, a company controlled by Mr. Kilic,

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth particulars of all outstanding share-based and option-based awards granted to the NEOs and which were outstanding at March 31, 2022, expressed in Canadian dollars:

|

|

|

Option-based Awards

|

|

Share-based Awards(3)

|

|

|

|

|

|

|

Number

|

Market or

|

Market or

|

|

|

|

|

|

|

of

|

payout

|

payout

|

|

|

|

|

|

|

shares

|

value of

|

value of

|

|

|

|

|

|

|

or units

|

share-

|

vested

|

|

|

|

|

|

Value of

|

of

|

based

|

share-

|

|

|

Number of

|

|

|

unexercised

|

shares

|

awards

|

based

|

|

|

securities

|

|

|

in-the-

|

that have

|

that have

|

awards

|

|

|

underlying

|

Option

|

Option

|

money

|

not

|

not

|

not paid

|

|

|

unexercised

|

exercise

|

expiration

|

options

|

vested

|

vested

|

out or

|

|

Name

|

options (#)

|

price ($)

|

date

|

($)(1)

|

(#)

|

($)(2)

|

distributed

|

|

Frank

Holmes

|

500,000

|

1.50

|

Sept 14,

|

5,900,000

|

Nil

|

Nil

|

Nil

|

|

2027

|

|

100,000

|

1.45

|

Feb 10,

2030

|

1,185,000

|

|

Darcy

Daubaras

|

100,000

|

1.35

|

Dec 21,

|

1,195,000

|

Nil |

Nil |

498,750 |

|

2028

|

|

100,000

|

1.45

|

Feb 10,

|

1,185,000

|

|

2030

|

|

Aydin

Kilic

|

2,000(4)

|

15.70

|

Feb 11,

|

Nil

|

4,000

|

53,200

|

Nil

|

|

2031

|

|

180,000(5)

|

18.50

|

Oct 7,

|

Nil

|

|

2031

|

|

Gabriel

|

20,000

|

18.35

|

Apr 29,

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Ibghy

|

2031

|

|

William

Gray

|

20,000

|

18.35

|

Apr 29,

|

Nil

|

Nil

|

Nil

|

Nil

|

|

2031

|

|

20,000

|

25.35

|

Nov 10,

|

Nil

|

|

2031

|

Notes:

(1) The value of unexercised in-the-money Options is calculated by multiplying the difference between the closing price of the Corporation's common shares on the TSX Venture Exchange on March 31, 2022, which was $13.30, and the Option exercise price, by the number of outstanding options (both vested and unvested).

(2) Market value of the RSUs was calculated by multiplying the number of unvested RSUs, respectively, by the market value of the underlying shares on March 31, 2022, which was $13.30.

(3) This table sets forth all RSUs that have been granted to each NEO and are outstanding as at March 31, 2022.

(4) Issued to Unimage, a company controlled by Mr. Kilic.

(5) Issued to Akilic, a company controlled by Mr. Kilic.

Incentive Plan Awards - Value Vested or Earned During the Year

240,000 stock options were granted to Named Executive Officers during the year ended March 31, 2022, of which 35,500 vested during the year ended March 31, 2022. 102,500 stock options that were previously granted to Named Executive Officers vested during the year ended March 31, 2022.

8,000 restricted share units were granted to Named Executive Officers during the year ended March 31, 2021. 104,000 restricted share units that were previously granted to Named Executive Officers vested during the year ended March 31, 2022.

The following table summarizes, for the Named Executive Officers of the Corporation, the value of incentive plan awards vested or earned during the year ended March 31, 2022, expressed in Canadian dollars:

|

|

|

|

Non-equity incentive

|

|

|

Option-based awards -

|

Share-based awards -

|

compensation - value

|

|

|

Value vested during the

|

Value vested during the

|

earned during the year

|

|

NEO Name

|

year ($)

|

year ($)

|

($)

|

|

Frank Holmes

|

863,125

|

935,625

|

Nil

|

|

Darcy Daubaras

|

863,125

|

935,625

|

112,500

|

|

Aydin Kilic

|

76,650

|

112,300

|

61,500

|

|

Gabriel Ibghy

|

8,750

|

Nil

|

44,167

|

|

William Gray

|

8,750

|

Nil

|

42,500

|

NAMED EXECUTIVE OFFICER EMPLOYMENT AGREEMENTS

The Corporation has entered into written agreements with certain of its NEOs, namely Darcy Daubaras, Gabriel Ibghy, and William Gray which contain terms relating to duties, salaries, compensation, benefits, termination, change of control and severance. The benefits provided to the above mentioned NEOs are standard benefits which include life insurance, short and long- term disability insurance, health and medical insurance programs and plans. The following sets out further details for the above mentioned NEOs relating to their agreement with the Corporation:

Darcy Daubaras

Effective October 1, 2018, the Corporation and Darcy Daubaras entered into an agreement whereby Mr. Daubaras fulfills the role of Chief Financial Officer of the Corporation on a full time basis. Pursuant to this agreement, Mr. Daubaras is entitled to receive an annual salary in the amount of $180,000. On April 1, 2021, Mr. Daubaras' annual salary increased to an amount of $250,000. On December 1, 2021, Mr. Daubaras' annual salary was increased to $300,000.

Gabriel Ibghy

Effective April 19, 2021, the Corporation and Gabriel Ibghy entered into an agreement whereby Mr. Ibghy fulfills the role of Director of Legal Affairs and Secretary of the Corporation on a full- time basis. Pursuant to this agreement, Mr. Ibghy is entitled to receive an annual salary in the amount of $150,000. On November 1, 2021, Mr. Ibghy's annual salary increased to an amount of $175,000.

William Gray

Effective April 19, 2021, the Corporation and William Gray entered into an agreement whereby Mr. Gray fulfills the role of Chief Technology Officer of the Corporation on a full-time basis. Pursuant to this agreement, Mr. Gray is entitled to receive an annual salary in the amount of $150,000. On March 6, 2022, Mr. Gray's annual salary increased to an amount of $175,000.

There are consulting agreements that exist between the Company a corporation of which a NEO is principal. See "Management Contracts" below.

TERMINATION AND CHANGE OF CONTROL BENEFITS

Pursuant to the employment agreement entered into between the Corporation and Mr. Daubaras, Mr. Daubaras is entitled to compensation from the Corporation in the event of termination without cause in the amount equal to one month salary for every full year of employment. Assuming Mr. Daubaras was terminated without cause on March 31, 2022, he would be entitled to receive $75,000. The agreement with Mr. Daubaras also provides that if, within 12 months of a change of control of the Corporation, Mr. Daubaras is terminated without cause or resigns for "good reason", Mr. Daubaras will be entitled to receive a lump sum payment equal to 12 months of his annual salary and all stock options granted to him will immediately accelerate, vest, and become fully exercisable. Assuming Mr. Daubaras was terminated without cause or resigned for "good reason" on March 31, 2022, following a change of control, he would be entitled to receive severance of $300,000.

Pursuant to the employment agreement entered into between the Corporation and Mr. Ibghy, Mr. Ibghy is entitled, in the event of termination without cause, to notice or pay in lieu by the Corporation equal to his residing provincial statutory requirement for notice. Assuming Mr. Ibghy had been terminated without cause on March 31, 2022, he would be entitled to receive 3 weeks' notice or $10,096, minus statutory provincial deductions.

Pursuant to the employment agreement entered into between the Corporation and Mr. Gray, Mr. Gray is entitled, in the event of termination without cause, to notice or pay in lieu by the Corporation equal to his residing provincial statutory requirement for notice. Assuming Mr. Gray had been terminated without cause on March 31, 2022, he would be entitled to receive 3 weeks' notice or $10,096, minus statutory provincial deductions.

DIRECTOR COMPENSATION

During the financial year ended March 31, 2022, there were six individuals who served as a director of the Corporation for either all or a portion of the year, one of which was an NEO - namely Frank Holmes. Compensation for the NEOs has been discussed above. The following table sets forth particulars of all compensation paid to directors who were not NEOs during the year ended March 31, 2022, expressed in Canadian dollars:

|

|

|

|

|

|

Non-equity

|

|

|

|

|

|

|

|

Share-

|

Option-

|

|

|

|

|

|

|

|

Fees

|

based

|

based

|

|

Incentive Plan

|

|

Pension

|

All other

|

Total

|

|

|

Earned

|

Awards

|

Awards

|

|

Compensation

|

|

value

|

compensation

|

compensation

|

|

Name

|

($)

|

($)

|

($)

|

|

($)

|

|

($)

|

($)

|

($)

|

|

Tobias Ebel(1)

|

55,000

|

Nil

|

Nil

|

|

Nil

|

Nil

|

Nil

|

55,000

|

|

Marcus New(2)

|

84,000

|

Nil

|

Nil

|

|

Nil

|

Nil

|

Nil

|

84,000

|

|

Dave Perrill(3)

|

84,000

|

Nil

|

Nil

|

|

Nil

|

Nil

|

Nil

|

84,000

|

|

Ian Mann(4)

|

84,000

|

Nil

|

Nil

|

|

Nil

|

Nil

|

7,810(6)

|

91,810

|

|

|

|

Share-

|

Option-

|

Non-equity

|

|

|

|

|

|

|

|

|

|

|

|

Fees

|

based

|

based

|

Incentive Plan

|

Pension

|

All other

|

Total

|

|

|

Earned

|

Awards

|

Awards

|

Compensation

|

value

|

compensation

|

compensation

|

|

Name

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

($)

|

|

Susan

McGee(5)

|

44,000

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

44,000

|

Notes:

(1) Mr. Ebel served as a Director since August 23, 2017. On November 24. 2021, Mr. Ebel resigned as a Director.

(2) Mr. New has served as an Independent Director since March 25, 2018.

(3) Mr. Perrill has served as an Independent Director since October 21, 2019.

(4) Mr. Mann has served as an Independent Director since May 29, 2020.

(5) Ms. McGee has served as an Independent Director since December 21, 2021.

(6) Mr. Mann earns director fees of US $25,000 per year commencing on January 1, 2022, for serving on a number of the Corporation's subsidiary company boards

Narrative Discussion

All directors who are not considered permanent management of the Corporation receive a director's fee every quarter in the amount of $25,000. Since August 31, 2018, all directors (including directors who serve as interim management) also receive meeting fees in the amount of $2,000 per meeting for Board Meeting attendance due to the increased participation of the directors during the period of interim management. Stock options and RSUs are granted to the directors of the Corporation as an incentive and compensation for their time and efforts provided to the Corporation.

The Corporation's directors and officers are covered under directors' and officers' liability insurance policies. As at March 31, 2022, the coverage amount applicable to the Corporate Directors and Officers Liability policy was $7,500,000 per claim and aggregate. The Corporate D&O Policy retention is $2,500,000 per claim.

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth particulars of all outstanding share-based and option-based awards granted to the directors who were not NEOs and which were outstanding at March 31, 2022, expressed in Canadian dollars:

|

|

|

Option-based Awards

|

|

|

Share-based Awards(3)

|

|

Name

|

Number of

|

Option

|

Option

|

Value of

|

Number of

|

Market or

|

Market or

|

|

|

securities

|

exercise

|

expiration

|

unexercised

|

shares or

|

payout

|

payout

|

|

|

underlying

|

price ($)

|

date

|

in-the-

|

units of

|

value of

|

value of

|

|

|

unexercise

|

|

|

money

|

shares that

|

share-

|

vested

|

|

|

d options

|

|

|

options

|

have not

|

based

|

share-

|

|

|

(#)

|

|

|

($)(1)

|

vested (#)

|

awards that

|

based

|

|

|

|

|

|

|

|

have not

|

awards not

|

|

|

|

|

|

|

|

vested ($)(2)

|

paid out or

|

|

|

|

|

|

|

|

|

distributed

|

|

Tobias

Ebel

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

|

Marcus

New

|

50,000

|

10.00

|

Mar 26,

|

165,000

|

Nil

|

Nil

|

Nil

|

|

2028

|

|

400,000

|

3.10

|

Sep 18,

|

4,080,000

|

|

2028

|

|

100,000

|

1.45

|

Feb 10,

|

1,185,000

|

|

2030

|

|

Dave

Perrill

|

100,000

|

1.45

|

Feb 10,

2030

|

1,185,000

|

Nil

|

Nil

|

Nil

|

|

Ian Mann

|

200,000

|

25.00

|

Feb 23,

2031

|

Nil

|

20,000

|

266,000

|

Nil

|

|

Susan

McGee

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Nil

|

Notes:

(1) The value of unexercised in-the-money Options is calculated by multiplying the difference between the closing price of the Corporation's common shares on the TSX Venture Exchange on March 31, 2022, which was $13.30, and the Option exercise price, by the number of outstanding options (both vested and unvested).

(2) Market value of the RSUs was calculated by multiplying the number of unvested RSUs, respectively, by the market value of the underlying shares on March 31, 2022, which was $13.30.

(3) This table sets forth all RSUs that have been granted to each director and are outstanding as at March 31, 2022.

Incentive Plan Awards - Value Vested or Earned During the Year

No stock options were granted to a director who was not a NEOs during the year ended March 31, 2022. 243,750 stock options that were previously granted to directors who were not NEOs vested during the year ended March 31, 2022.

No restricted share units were granted to a director who was not a NEOs during the year ended March 31, 2022. 163,750 restricted share units that were previously granted to directors who were not NEOs vested during the year ended March 31, 2022.

MANAGEMENT CONTRACTS

Pursuant to a consulting agreement between the Company, Unimage Enterprises Ltd. ("Unimage"), and Aydin Kilic ("Kilic"), Unimage provides the services of Kilic to the Company, and provides for Kilic to serve as President and COO of the Company at the pleasure of the Board. Unimage is controlled by Kilic. The Company pays Unimage a monthly consulting fee of $25,000 for Kilic's services.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out particulars of the compensation plans under which equity securities of the Corporation are authorized for issuance as of March 31, 2022.

|

|

|

|

C

|

|

|

|

|

Number of securities

|

|

|

A

|

B

|

remaining available for

|

|

|

future issuance under

|

|

|

Number of securities to

|

Weighted average

|

equity compensation

|

|

|

be issued upon exercise

|

exercise price of

|

plans (excluding

|

|

|

of outstanding options,

|

outstanding options,

|

securities reflected in

|

|

Plan Category

|

warrants and rights

|

warrants and rights

|

column A)

|

|

Equity compensation plans

approved by securityholders(1)

|

Options: 2,846,515

|

$6.31

|

|

|

Combined: 5,316,183 (3)

|

|

RSUs: 61,500

|

N/A(2)

|

|

|

Equity compensation

plans not approved by

securityholders |

Nil |

N/A |

Nil |

| TOTALS: |

2,908,015 |

$6.31 |

5,316,183 |

Notes:

(1) Represents the Option Plan and RSU Plan of the Corporation. The maximum number of reserved shares under these plans is a combined 10% of the issued and outstanding common shares of the Corporation from time to time. The RSU Plan also has a fixed limit of 2,000,000. As at March 31, 2022, there were 82,241,988 common shares of the Corporation issued and outstanding.

(2) The common shares issuable upon exercise of vested RSUs are issuable at no additional consideration..

(3) The remaining available under the RSU Plan fixed limit is 5,316,183.

A-1

Schedule A to the Statement of Executive Compensation

The Option Plan

(See following page)

HIVE BLOCKCHAIN TECHNOLOGIES LTD.

(FORMERLY LEETA GOLD CORP.)

INCENTIVE STOCK OPTION PLAN

Dated: July 20, 2017

ARTICLE 1

DEFINITIONS AND INTERPRETATION

1.1 Defined Terms

For the purposes of this Plan, the following terms shall have the following meanings:

(a) "Accelerated Vesting Event" means the occurrence of any one of the following events:

(i) a take-over bid (as defined under applicable securities Laws) is made for Common Shares or Convertible Securities which, if successful would result (assuming the conversion, exchange or exercise of the Convertible Securities, if any, that are the subject of the take-over bid) in any Person or Persons acting jointly or in concert (as determined under applicable securities Laws) or Persons associated or affiliated with such Person or Persons (as determined under applicable securities Laws) beneficially, directly or indirectly, owning shares that would, notwithstanding any agreement to the contrary, entitle the holders thereof for the first time to cast at least 50% of the votes attaching to all shares in the capital of the Corporation that may be cast to elect Directors;

(ii) the acquisition or continuing ownership by any Person or Persons acting jointly or in concert (as determined under applicable securities Laws), directly or indirectly, of Common Shares or of Convertible Securities, which, when added to all other securities of the Corporation at the time held by such Person or Persons, Persons associated with such person or persons, or persons affiliated with such Person or Persons (as determined under applicable securities Laws) (collectively, the "Acquirors"), and assuming the conversion, exchange or exercise of Convertible Securities beneficially owned by the Acquirors, results in the Acquirors beneficially owning shares that would, notwithstanding any agreement to the contrary, entitle the holders thereof for the first time to cast at least 50% of the votes attaching to all shares in the capital of the Corporation that may be cast to elect Directors;

(iii) an amalgamation, merger, arrangement or other business combination (a "Business Combination") involving the Corporation receives the approval of, or is accepted by, the securityholders of the Corporation (or all classes of securityholders whose approval or acceptance is required) or, if their approval or acceptance is not required in the circumstances, is approved or accepted by the Corporation and as a result of that Business Combination, parties to the Business Combination or securityholders of the parties to the Business Combination, other than the securityholders of the Corporation, own, directly or indirectly, shares of the continuing entity that entitle the holders thereof to cast at least 50% of the votes attaching to all shares in the capital of the continuing entity that may be cast to elect Directors;

(b) "Affiliate" shall have the meaning ascribed thereto by the TSX Venture Exchange in Policy

1.1 - Interpretation;

(c) "Associate" shall have the meaning ascribed thereto by the TSX Venture Exchange in Policy 1.1 - Interpretation;

(d) "Board" means the board of directors of the Corporation or, as applicable, a committee consisting of not less than 3 directors of the Corporation duly appointed to administer this Plan;

(e) "Charitable Option" means a stock option or equivalent security granted by the Corporation to an Eligible Charitable Organization;

(f) "Charitable Organization" means "charitable organization" as defined in the Income Tax Act (Canada) from time to time;

(g) "Common Shares" means the common shares in the capital of the Corporation;

(h) "Consultant" means, in relation to the Corporation, an individual (other than an Employee or a Director of the Corporation) or company that:

(i) is engaged to provide on an ongoing bona fide basis, consulting, technical, management or other services to the Corporation or to an Affiliate of the Corporation, other than services provided in relation to a Distribution;

(ii) provides the services under a written contract between the Corporation or the Affiliate and the individual or the company, as the case may be;

(iii) in the reasonable opinion of the Corporation, spends or will spend a significant amount of time and attention on the affairs and business of the Corporation or an Affiliate of the Corporation; and

(iv) has a relationship with the Corporation or an Affiliate of the Corporation that enables the individual to be knowledgeable about the business and affairs of the Corporation;

(i) "Consultant Company" means a Consultant that is a company;

(j) "Convertible Securities" means any security of the Corporation which is convertible into Common Shares;

(k) "Corporation" means HIVE BLOCKCHAIN TECHNOLOGIES LTD. (FORMERLY LEETA GOLD CORP.) and its successor entities;

(l) "Director" means a director, senior officer or Management Company Employee of the Corporation, or a director, senior officer or Management Company Employee of the Corporation's subsidiaries;

(m) "Disinterested Shareholder Approval" means approval by a majority of the votes cast by all shareholders entitled to vote at a meeting of shareholders of the Corporation excluding votes attached to shares beneficially owned by insiders to whom options may be granted under this Plan and their Associates;

(n) "Distribution" has the meaning ascribed thereto by the Exchange;

(o) "Eligible Charitable Organization" means:

(i) any Charitable Organization or Public Foundation which is a Registered Charity, but is not a Private Foundation; or

(ii) a Registered National Arts Service Organization;

(p) "Eligible Person" means

(i) a Director, Officer, Employee or Consultant of the Corporation or its subsidiaries, if any, at the time the option is granted, and includes companies that are wholly owned by Eligible Persons; or

(ii) an Eligible Charitable Organization at the time the Option is granted;

(q) "Employee" means:

(i) an individual who is considered an employee of the Corporation or its subsidiary under the Income Tax Act (Canada) (and for whom income tax, employment insurance and Canada Pension Plan deductions must be made at source);

(ii) an individual who works full-time for the Corporation or its subsidiary providing services normally provided by an employee and who is subject to the same control and direction by the Corporation over the details and methods of work as an employee of the Corporation, but for whom income tax deductions are not made at source; or

(iii) an individual who works for the Corporation or its subsidiary on a continuing and regular basis for a minimum amount of time per week providing services normally provided by an employee and who is subject to the same control and direction by the Corporation over the details and methods of work as an employee of the Corporation, but for whom income tax deductions are not made at source.

(r) "Exchange" means the TSX Venture Exchange or the NEX board of the TSX Venture Exchange, as the context requires, and any successor entity or the Toronto Stock Exchange if the Corporation is listed thereon;

(s) "Expiry Date" means the last day of the term for an Option, as set by the Board at the time of grant in accordance with Section 5.2 and, if applicable, as amended from time to time;

(t) "Governmental Authorities" means governments, regulatory authorities, governmental departments, agencies, commissions, bureaus, officials, ministers, Crown corporations, courts, bodies, boards, tribunals or dispute settlement panels or other law, rule or regulation-making organizations or entities:

(i) having or purporting to have jurisdiction on behalf of any nation, province, territory or state or any other geographic or political subdivision of any of them; or

(ii) exercising, or entitled or purporting to exercise any administrative, executive, judicial, legislative, policy, regulatory or taxing authority or power;

(u) "Insider" means a director or senior officer of the Corporation, a Person that beneficially owns or controls directly or indirectly, voting shares carrying more than 10% of the voting rights attached to all outstanding voting shares of the Corporation, a director or senior officer of a company that is an insider or a subsidiary of the Corporation, and the Corporation itself if it holds any of its own securities;

(v) "Investor Relations Activities" has the meaning ascribed thereto in the TSX Venture Exchange's Corporate Finance Manual;

(w) "Laws" means currently existing applicable statutes, by-laws, rules, regulations, orders, ordinances or judgments, in each case of any Governmental Authority having the force of the law;

(x) "Management Company Employee" means an individual who is employed by a Person providing management services to the Corporation which are required for the ongoing successful operation of the business enterprise of the Corporation, but excluding a Person engaged in Investor Relations Activities;

(y) "Material Information" has the meaning ascribed thereto in the TSX Venture Exchange's Corporate Finance Manual;

(z) "Officer" means an officer of the Corporation or its subsidiaries, if any;

(aa) "Option" means a non-transferable and non-assignable option to purchase Common Shares granted to an Eligible Person pursuant to the terms of this Plan;

(bb) "Optionee" means an Eligible Person of an Option granted by the Corporation;

(cc) "Other Share Compensation Arrangement" means, other than this Plan and any Options, any stock option plan, stock options, employee stock purchase plan or other compensation or incentive mechanism involving the issuance or potential issuance of Common Shares, including but not limited to a purchase of Common Shares from treasury which is financially assisted by the Corporation by way of loan, guarantee or otherwise;

(dd) "Person" means any individual, sole proprietorship, partnership, firm, entity, unincorporated association, unincorporated syndicate, unincorporated organization, trust, body corporate, Governmental Authority, and where the context requires any of the foregoing when they are acting as trustee, executor, administrator or other legal representative;

(ee) "Plan" means this incentive stock option plan;

(ff) "Private Foundation" means "private foundation" as defined in the Income Tax Act (Canada) as amended from time to time;

(gg) "Public Foundation" means "public foundation" as defined in the Income Tax Act (Canada) as amended from time to time;

(hh) "Registered Charity" means "registered charity" as defined in the Income Tax Act (Canada) as amended from time to time;

(ii) "Registered National Arts Service Organization" means "registered national arts service organization" as defined in the Income Tax Act (Canada) as amended from time to time; and

(jj) "Termination Date" means the date on which an Optionee ceases to be an Eligible Person.

1.2 Interpretation

(a) References to the outstanding Common Shares at any point in time shall be computed on a non-diluted basis.

(b) If the Corporation is listed on the Toronto Stock Exchange, the provisions of this Plan as they relate to companies listed on Tier 1 of the TSX Venture Exchange shall apply.

ARTICLE 2

ESTABLISHMENT OF PLAN

2.1 Purpose

The purpose of this Plan is to advance the interests of the Corporation, through the grant of Options, by:

(a) providing an incentive mechanism to foster the interest of Eligible Persons in the success of the Corporation, its Affiliates and its subsidiaries, if any;

(b) encouraging Eligible Persons to remain with the Corporation, its Affiliates or its subsidiaries, if any; and

(c) attracting new Directors, Officers, Employees and Consultants.

2.2 Shares Reserved

(a) The aggregate number of Common Shares that may be reserved for issuance pursuant to Options shall not exceed 10% of the issued and outstanding Common Shares at the time of the granting of an Option, LESS the aggregate number of Common Shares then reserved for issuance pursuant to any Other Share Compensation Arrangement. For greater certainty, if an Option is surrendered, terminated or expires without being exercised, the Common Shares reserved for issuance pursuant to such Option shall be available for new Options granted under this Plan. If the Corporation is listed on the NEX board of the TSX Venture Exchange, the maximum number of Options that may be reserved for issuance or issued in any 12 month period shall not exceed 10% of the issued and outstanding Common Shares of the Corporation.

(b) If there is a change in the issued and outstanding Common Shares by reason of any share consolidation or split, reclassification or other capital reorganization, or a stock dividend, arrangement, amalgamation, merger or combination, or any other change to, event affecting, exchange of or corporate change or transaction affecting the Common Shares, the Board shall make, as it shall deem advisable and subject to the requisite approval of the relevant regulatory authorities, appropriate substitution and/or adjustment in:

(i) the number and kind of shares or other securities or property reserved or to be allotted for issuance pursuant to this Plan;

(ii) the number and kind of shares or other securities or property reserved or to be allotted for issuance pursuant to any outstanding unexercised Options, and in the exercise price for such shares or other securities or property; and

(iii) the vesting of any Options, including the accelerated vesting thereof on conditions the Board deems advisable and, if it relates to Investor Relations vesting provisions, then subject to the approval of the Exchange,

and if the Corporation undertakes an arrangement or is amalgamated, merged or combined with another corporation, the Board shall make such provision for the protection of the rights of Optionees as it shall deem advisable.

(c) No fractional Common Shares shall be reserved for issuance under this Plan and the Board may determine the manner in which an Option, insofar as it relates to the acquisition of a fractional Common Share, shall be treated.

(d) The Corporation shall, at all times while this Plan is in effect, reserve and keep available such number of Common Shares as will be sufficient to satisfy the requirements of this Plan.

2.3 Non-Exclusivity

Nothing contained herein shall prevent the Board from adopting such other incentive or compensation arrangements as it shall deem advisable.

2.4 Effective Date

This Plan shall be subject to the approval of any regulatory authority whose approval is required. Any Options granted under this Plan prior to such approvals being given shall be conditional upon such approvals being given, and no such Options may be exercised unless and until such approvals are given.

ARTICLE 3

ADMINISTRATION OF PLAN

3.1 Administration

(a) This Plan shall be administered by the Board or any committee established by the Board for the purpose of administering this Plan. Subject to the provisions of this Plan, the Board shall have the authority:

(i) to determine the Eligible Persons to whom Options are granted, to grant such Options, and to determine any terms and conditions, limitations and restrictions in respect of any particular Option grant, including but not limited to the nature and duration of the restrictions, if any, to be imposed upon the acquisition, sale or other disposition of Common Shares acquired upon exercise of the Option, and the nature of the events and the duration of the period, if any, in which any Optionee's rights in respect of an Option or Common Shares acquired upon exercise of an Option may be forfeited; and

(ii) to interpret the terms of this Plan, to make all such determinations and take all such other actions in connection with the implementation, operation and administration of this Plan, and to adopt, amend and rescind such administrative guidelines and other rules and regulations relating to this Plan, as it shall from time to time deem advisable, including without limitation for the purpose of ensuring compliance with Section 3.3 and 3.4 hereof.

(b) The Board's interpretations, determinations, guidelines, rules and regulations shall be conclusive and binding upon the Corporation, Eligible Persons, Optionees and all other Persons.

(c) For stock options granted to Employees, Consultants or Management Company Employees, the Corporation and the Optionee are responsible for ensuring and confirming that the Optionee is a bona fide Employee, Consultant or Management Company Employee, as the case may be.

3.2 Amendment, Suspension and Termination

The Board may amend, subject to the approval of any regulatory authority whose approval is required, suspend or terminate this Plan or any provision herein. No such amendment, suspension or termination shall alter or impair any outstanding unexercised Options or any rights without the consent of such Optionee. If this Plan is suspended or terminated, the provisions of this Plan and any administrative guidelines, rules and regulations relating to this Plan shall continue in effect for the duration of such time as any Option remains outstanding.

3.3 Compliance with Laws

(a) This Plan, the grant and exercise of Options hereunder and the Corporation's obligation to sell, issue and deliver any Common Shares upon exercise of Options shall be subject to all applicable federal, provincial and foreign Laws, policies, rules and regulations, to the policies, rules and regulations of any stock exchanges or other markets on which the Common Shares are listed or quoted for trading and to such approvals by any Governmental Authority as may, in the opinion of counsel to the Corporation, be required. The Corporation shall not be obligated by the existence of this Plan or any provision of this Plan or the grant or exercise of Options hereunder to sell, issue or deliver Common Shares upon exercise of Options in violation of such Laws, policies, rules and regulations or any condition or requirement of such approvals.

(b) No Option shall be granted and no Common Shares sold, issued or delivered hereunder where such grant, sale, issue or delivery would require registration or other qualification of this Plan or of the Common Shares under the applicable securities Laws of any foreign jurisdiction, and any purported grant of any Option or any sale, issue and delivery of Common Shares hereunder in violation of this provision shall be void. In addition, the Corporation shall have no obligation to sell, issue or deliver any Common Shares hereunder unless such Common Shares shall have been duly listed, upon official notice of issuance, with all stock exchanges on which the Common Shares are listed for trading.

(c) Common Shares sold, issued and delivered to Optionees pursuant to the exercise of Options shall be subject to restrictions on resale and transfer under applicable securities Laws and the requirements of any stock exchanges or other markets on which the Common Shares are listed or quoted for trading, and any certificates representing such Common Shares shall bear, as required, a restrictive legend in respect thereof.

3.4 Tax Withholdings

(a) Notwithstanding any other provision contained herein, in connection with the exercise of an Option by an Optionee from time to time, as a condition to such exercise the Corporation shall require such Optionee to pay to the Corporation or the relevant Affiliate an amount as necessary so as to ensure that the Corporation or such Affiliate, as applicable, is in compliance with the applicable provisions of any federal, provincial or local Laws relating to the withholding of tax or other required deductions relating to the exercise of such Options. In addition, the Corporation or the relevant Affiliate, as applicable shall be entitled to withhold from any amount payable to an Optionee, either under this Plan or otherwise, such amount as may be necessary so as to ensure that the Corporation or the relevant Affiliate is in compliance with the applicable provisions of any federal, provincial, local or foreign Laws relating to the withholding of tax or other required deductions relating to the exercise of such Options. The Corporation may also satisfy any liability for any such withholding obligations, on such terms and conditions as the Corporation may determine in its discretion, by (a) requiring an Optionee, as a condition to the exercise of any Options, to make such arrangements as the Corporation may require so that the Corporation can satisfy such withholding obligations including, without limitation, requiring the Optionee to remit to the Corporation in advance, or reimburse the Corporation for, any such withholding obligations or (b) selling on the Optionee's behalf, or requiring the Optionee to sell, any Shares acquired by the Optionee under the Plan, or retaining any amount which would otherwise be payable to the Optionee in connection with any such sale.

ARTICLE 4

OPTION GRANTS

4.1 Eligibility and Multiple Grants

Options shall only be granted to Eligible Persons. An Eligible Person may receive Options on more than one occasion and may receive separate Options, with differing terms, on any one or more occasions.

4.2 Option Agreement

Every Option shall be evidenced by an option agreement executed by the Corporation and the Optionee In the event of any discrepancy between this Plan and an option agreement, the provisions of this Plan shall govern.

4.3 Limitation on Grants and Exercises

(a) To any one Person. The aggregate number of Options granted to any one Person (and companies wholly owned by that Person) pursuant to this Plan and any other Share Compensation Arrangement in a 12 month period must not exceed 5% of the issued shares of the Corporation, calculated on the date an Option is granted to the Person (unless the Corporation has obtained the requisite Disinterested Shareholder Approval).

(b) To Consultants. The aggregate number of Options granted to any one Consultant in a 12 month period pursuant to this Plan and any other Share Compensation Arrangement must not exceed 2% of the issued shares of the Corporation, calculated at the date an Option is granted to the Consultant.

(c) To Persons conducting Investor Relations Activities. The aggregate number of Options granted to all Persons retained to provide Investor Relations Activities pursuant to this Plan and any other Share Compensation Arrangement must not exceed 2% of the issued shares of the Corporation in any 12 month period, calculated at the date an Option is granted to any such Person. If the Corporation is listed on the NEX board of the TSX Venture Exchange, no Options are permitted to be granted to Persons who provide Investor Relations Activities.

(d) To Eligible Charitable Organizations. The aggregate number of Options granted and outstanding to Eligible Charitable Organizations pursuant to this Plan and any other Share Compensation Arrangement must not at any time exceed 1% of the issued shares of the Corporation, as calculated immediately subsequent to the grant of any Options to Eligible Charitable Organizations.

ARTICLE 5

OPTION TERMS

5.1 Exercise Price

(a) Subject to a minimum exercise price of $0.05 per Common Share, the exercise price per Common Share for an Option shall be determined by the Directors or their delegates if any, but will in no event be less than the Market Price for the Common Shares (as defined by the policies of the Exchange) at the date of grant.

(b) If Options are granted within ninety days of a Distribution by the Corporation by prospectus, then the exercise price per Common Share for such Option shall not be less than the greater of the minimum exercise price calculated pursuant to subsection 5.1(a) herein and the price per Common Share paid by the public investors for Common Shares acquired pursuant to such Distribution. Such ninety day period shall begin:

(i) on the date the final receipt is issued for the final prospectus in respect of such Distribution; or

(ii) in the case of an initial public offering, on the date of listing.

5.2 Expiry Date

Every Option granted shall, unless sooner terminated, have a term not exceeding and shall therefore expire no later than 10 years after the date of grant (subject to extension where the expiry date falls within a "blackout period", as discussed in subsection 5.7) hereof.

5.3 Vesting

(a) Subject to subsection 5.3(b) herein and otherwise in compliance with the policies of the Exchange, the Board shall determine the manner in which an Option shall vest and become exercisable.

(b) Options granted to Consultants performing Investor Relations Activities shall vest over a minimum of 12 months with no more than 1/4 of such Options vesting in any 3 month period.

5.4 Accelerated Vesting Event

Subject to subsection 5.3(b) and in compliance with the policies of the Exchange, upon the occurrence of an Accelerated Vesting Event, the Board will have the power, at its sole discretion and without being required to obtain the approval of shareholders or the holder of any Option, except pertaining to options granted to Consultants performing Investor Relations activities which will be subject to prior written Exchange approval, to make such changes to the terms of Options as it considers fair and appropriate in the circumstances, including but not limited to: (a) accelerating the vesting of Options, conditionally or unconditionally; (b) terminating every Option if under the transaction giving rise to the Accelerated Vesting Event, options in replacement of the Options are proposed to be granted to or exchanged with the holders of Options, which replacement options treat the holders of Options in a manner which the Board considers fair and appropriate in the circumstances having regard to the treatment of holders of Shares under such transaction; (c) otherwise modifying the terms of any Option to assist the holder to tender into any take- over bid or other transaction constituting an Accelerated Vesting Event; or (d) following the successful completion of such Accelerated Vesting Event, terminating any Option to the extent it has not been exercised prior to successful completion of the Accelerated Vesting Event. The determination of the Board in respect of any such Accelerated Vesting Event shall for the purposes of this Plan be final, conclusive and binding.

5.5 Non-Assignability

Options may not be assigned or transferred.

5.6 Ceasing to be Eligible Person

(a) If an Optionee who is a Director, Officer, Employee or Consultant is terminated for cause, each Option held by such Optionee shall terminate and therefore cease to be exercisable upon such termination for cause.

(b) If an Optionee dies prior to otherwise ceasing to be an Eligible Person, each Option held by such Optionee shall be exercisable by the heirs or administrators of such Optionee and shall terminate and therefore cease to be exercisable no later than the earlier of the Expiry Date and the date which is twelve months from the date of the Optionee's death.

(c) Unless an option agreement specifies otherwise, if an Optionee ceases to be an Eligible Person for any reason other than death or termination for cause, each Option held by the Optionee other than an Optionee who is involved in investor relations activities will cease to be exercisable 90 days after the Termination Date or for a "reasonable period" after the Optionee ceases to serve in such capacity, as determined by the Board. For Optionees involved in investor relations activities, Options shall cease to be exercisable 30 days after the Termination Date or for a "reasonable period" after the Optionee ceases to serve in such capacity, as determined by the Board.

(d) If any portion of an Option is not vested at the time an Optionee ceases, for any reason whatsoever, to be an Eligible Person, such unvested portion of the Option may not be thereafter exercised by the Optionee or its legal representative, as the case may be, provided that the Board may, in its discretion, thereafter permit the Optionee or its legal representative, as the case may be, to exercise all or any part of such unvested portion of the Option that would have vested prior to the time such Option otherwise terminates.

(e) A Charitable Option must expire after the earlier of a date that is not more than 10 years from the grant date of the Charitable Option and the 90th day following the date that the holder of the Charitable Option ceases to be an Eligible Charitable Organization.

5.7 Blackout Periods

An Option will be automatically extended past the expiry date of an Option governed by the Plan if such expiry date falls within a period (a "blackout period") during which the Corporation prohibits Optionees from exercising their Options provided that the following requirements are satisfied:

(a) The blackout period must be formally imposed by the Corporation pursuant to its internal trading policies. For greater certainty, in the absence of the Corporation formally imposing a blackout period, the expiry date of any Options will not be automatically extended in any circumstances.