HIVE Blockchain Technologies Ltd.

Condensed Interim Consolidated Financial Statements

For the three months ended June 30, 2022 and 2021

(Expressed in US dollars)

(Unaudited)

|

HIVE Blockchain Technologies Ltd. Condensed Interim Consolidated Statements of Financial Position (Unaudited) |

|

| June 30, | March 31, | |||||

| 2022 | 2022 | |||||

| Assets | ||||||

| Current assets | ||||||

| Cash | $ | 4,019,547 | $ | 5,318,922 | ||

| Amounts receivable and prepaids (Note 7) | 7,700,742 | 7,978,327 | ||||

| Investments (Note 6) | 7,914,158 | 17,000,742 | ||||

| Digital currencies (Note 8) | 71,353,907 | 170,000,412 | ||||

| 90,988,354 | 200,298,403 | |||||

| Plant and equipment (Note 9) | 171,197,266 | 177,542,744 | ||||

| Long term receivable (Note 7) | 1,815,964 | 1,815,964 | ||||

| Deposits (Note 10) | 43,660,267 | 59,693,744 | ||||

| Right of use asset (Note 15) | 11,271,806 | 12,587,882 | ||||

| Goodwill and intangible asset | 268,476 | 335,594 | ||||

| Total assets | $ | 319,202,133 | $ | 452,274,331 | ||

| Liabilities and equity | ||||||

| Current liabilities | ||||||

| Accounts payable and accrued liabilities (Note 11) | $ | 16,306,014 | $ | 12,376,825 | ||

| Taxes payable | - | 126,803 | ||||

| Current portion of lease liability (Note 15) | 2,030,810 | 2,164,658 | ||||

| Term loan (Note 14) | 8,791,857 | 9,375,244 | ||||

| Loans payable (Notes 4, 13) | 1,224,102 | 1,224,102 | ||||

| Current income tax liability | 887,000 | 887,000 | ||||

| 29,239,783 | 26,154,632 | |||||

| Convertible loan - liability component (Note 12) | 5,402,258 | 5,599,007 | ||||

| Convertible loan - derivative component (Note 12) | 615,159 | 4,986,354 | ||||

| Loans payable (Notes 4, 13) | 13,101,134 | 14,468,237 | ||||

| Lease liability (Note 15) | 9,346,139 | 10,484,536 | ||||

| Deferred tax liability | 1,529,000 | 1,529,000 | ||||

| Total liabilities | 59,233,473 | 63,221,766 | ||||

| Equity | ||||||

| Share capital (Note 18) | 413,660,484 | 413,660,484 | ||||

| Equity reserve | 13,189,531 | 12,236,169 | ||||

| Accumulated other comprehensive income | 10,843,579 | 23,399,468 | ||||

| Accumulated deficit | (177,724,934 | ) | (60,243,556 | ) | ||

| Total equity | 259,968,660 | 389,052,565 | ||||

| Total liabilities and equity | $ | 319,202,133 | $ | 452,274,331 |

Nature of operations (Note 1)

Commitments and contingencies (Note 16)

Subsequent Event (Note 28)

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements

|

HIVE Blockchain Technologies Ltd. Condensed Interim Consolidated Statements of Comprehensive Income (Unaudited) |

|

| Three months ended June 30, | ||||||

| 2022 | 2021 | |||||

| Restated (Note 26) | ||||||

| Revenue from digital currency mining (Note 8) | $ | 44,178,526 | $ | 37,239,767 | ||

| Hosting revenue | - | 1,742,906 | ||||

| 44,178,526 | 38,982,673 | |||||

| Cost of sales | ||||||

| Operating and maintenance costs | (17,161,751 | ) | (6,220,684 | ) | ||

| Depreciation (Notes 9, 15) | (25,752,181 | ) | (6,899,182 | ) | ||

| 1,264,594 | 25,862,807 | |||||

| Revaluation of digital currencies (Note 8) | (72,154,408 | ) | (1,675,953 | ) | ||

| Gain on sale of digital currencies (Note 8) | (83,585 | ) | 81,469 | |||

| Expenses | ||||||

| General and administrative (Note 21) | (3,365,316 | ) | (1,727,466 | ) | ||

| Foreign exchange gain (loss) | (3,656,510 | ) | 528,868 | |||

| Share-based compensation (Note 18) | (953,362 | ) | (2,322,426 | ) | ||

| (7,975,188 | ) | (3,521,024 | ) | |||

| Unrealized loss on investments (Note 6) | (8,683,081 | ) | (5,808,523 | ) | ||

| Change in fair value of derivative liability (Note 12) | 4,371,195 | 5,433,635 | ||||

| Change in fair value of escrow share liability (Note 5) | - | 837,026 | ||||

| Impairment of miner equipment (Note 9) | (6,336,558 | ) | - | |||

| Impairment of equipment deposits (Note 10) | (4,678,000 | ) | - | |||

| Gain on sale of subsidiary | - | 3,171,275 | ||||

| Finance expense (Note 20) | (989,514 | ) | (907,051 | ) | ||

| Net (loss) income for the period | $ | (95,264,545 | ) | $ | 23,473,661 | |

| Other comprehensive income | ||||||

| Other comprehensive income to be reclassified to | ||||||

| profit or loss in subsequent periods: | ||||||

| Revaluation loss on digital currencies (Note 8) | (13,656,373 | ) | (6,816,774 | ) | ||

| Translation adjustment | 1,100,484 | 323,575 | ||||

| Net (loss) income and comprehensive income | ||||||

| for the period | $ | (107,820,434 | ) | $ | 16,980,462 | |

| Basic (loss) income per share | $ | (1.16 | ) | $ | 0.31 | |

| Diluted (loss) income per share | $ | (1.16 | ) | $ | 0.30 | |

| Weighted average number of common shares outstanding | ||||||

| Basic (Note 20) | 82,241,988 | 75,321,997 | ||||

| Diluted (Note 20) | 82,241,988 | 79,199,669 | ||||

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements

|

HIVE Blockchain Technologies Ltd. Condensed Interim Consolidated Statements of Equity (Unaudited) |

|

| Share capital | Accumulated other | |||||||||

| Equity | comprehensive | Accumulated | Total | |||||||

| Shares issued | Amount | reserve | income | deficit | equity | |||||

| $ | $ | $ | $ | $ | ||||||

| At March 31, 2021 (restated - Note 26) | 73,542,407 | 259,905,407 | 5,095,314 | 10,057,592 | (146,904,547 | ) | 128,153,766 | |||

| Share-based compensation | - | - | 1,816,191 | - | - | 1,816,191 | ||||

| Shares offering | 475,680 | 7,554,266 | - | - | - | 7,554,266 | ||||

| Issuance costs | (279,072) | - | - | - | (279,072 | ) | ||||

| Atlantic acquisition | 1,000,000 | 15,432,865 | - | - | - | 15,432,865 | ||||

| Shares and warrants issued for investment | 800,000 | 12,726,694 | - | - | - | 12,726,694 | ||||

| Exercise of options | 15,885 | 196,730 | (68,903) | - | - | 127,827 | ||||

| Vesting of restricted stock units | 88,100 | 234,091 | 272,143 | - | - | 506,234 | ||||

| Income for the period | - | - | - | - | 23,473,661 | 23,473,661 | ||||

| Translation adjustment | - | - | - | 323,575 | - | 323,575 | ||||

| Revaluation loss on digital currencies | - | - | - | (2,792,186) | - | (2,792,186 | ) | |||

| Realized gain on digital currencies | - | - | - | (4,024,588) | 4,024,588 | - | ||||

| At June 30, 2021 (restated - Note 26) | 75,922,072 | 295,770,981 | 7,114,745 | 3,564,393 | (119,406,298 | ) | 187,043,821 | |||

| At March 31, 2022 | 82,241,988 | 413,660,484 | 12,236,169 | 23,399,468 | (60,243,556 | ) | 389,052,565 | |||

| Share-based compensation | - | - | 886,461 | - | - | 886,461 | ||||

| Vesting of restricted stock units | - | - | 66,901 | - | - | 66,901 | ||||

| Loss for the period | - | - | - | - | (95,264,545 | ) | (95,264,545 | ) | ||

| Translation adjustment | - | - | - | 1,100,484 | - | 1,100,484 | ||||

| Revaluation loss on digital currencies | - | - | - | (35,873,206) | - | (35,873,206 | ) | |||

| Realized loss on digital currencies | - | - | - | 22,216,833 | (22,216,833 | ) | - | |||

| At June 30, 2022 | 82,241,988 | 413,660,484 | 13,189,531 | 10,843,579 | (177,724,934 | ) | 259,968,660 | |||

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements

|

HIVE Blockchain Technologies Ltd. Condensed Interim Consolidated Statements of Cash Flows (Unaudited) |

|

| For the three months ended June 30, | ||||||

| 2022 | 2021 | |||||

| Restated - Note 26 | ||||||

| Operating activities | ||||||

| Net (loss) income for the period: | $ | (95,264,545 | ) | $ | 23,473,661 | |

| Adjusted for: | ||||||

| Depreciation and amortization | 25,752,181 | 6,899,182 | ||||

| Gain on sale of subsidiary | - | (3,171,275 | ) | |||

| Unrealized loss on investments | 8,683,081 | 5,808,523 | ||||

| Change in fair value of derivative liability | (4,371,195 | ) | (5,433,635 | ) | ||

| Impairment of miner equipment | 6,336,558 | - | ||||

| Impairment of equipment deposits | 4,678,000 | - | ||||

| Change in fair value of escrow share liability | - | (837,026 | ) | |||

| Accretion and interest on convertible debt | 777,409 | 589,462 | ||||

| Share-based compensation | 953,362 | 2,322,426 | ||||

| Interest expense | 218,770 | 64,995 | ||||

| Foreign exchange loss | 323,830 | - | ||||

| Changes in non-cash working capital items: | ||||||

| Amounts receivable and prepaids | 277,585 | 701,297 | ||||

| Taxes payable | (126,803 | ) | (73,085 | ) | ||

| Digital currencies | 62,773,299 | (22,383,554 | ) | |||

| Accounts payable and accrued liabilities | 3,929,189 | (2,554,959 | ) | |||

| Cash provided by operating activities | 14,940,721 | 5,406,012 | ||||

| Investing activities | ||||||

| Deposits on equipment | 11,355,477 | (13,136,152 | ) | |||

| Investments | - | (499,980 | ) | |||

| Purchase of mining equipment | (25,125,160 | ) | (11,291,587 | ) | ||

| Cash divested from sale of subsidiary | - | (237,254 | ) | |||

| Cash used in investing activities | (13,769,683 | ) | (25,164,973 | ) | ||

| Financing activities | ||||||

| Exercise of options | - | 399,970 | ||||

| Shares offering | - | 7,275,194 | ||||

| Repayment of loan | (583,387 | ) | - | |||

| Repayment of debenture | (974,158 | ) | (750,000 | ) | ||

| Lease payments made, net of lease payments received | (679,570 | ) | (661,459 | ) | ||

| Cash provided by financing activities | (2,237,115 | ) | 6,263,705 | |||

| Effect of exchange rate changes on cash | (233,298 | ) | 116,584 | |||

| Net change in cash during the period | (1,299,375 | ) | (13,378,672 | ) | ||

| Cash, beginning of period | 5,318,922 | 40,290,513 | ||||

| Cash, end of period | $ | 4,019,547 | $ | 26,911,841 | ||

| Supplemental cash flow information | ||||||

| Share consideration issued for Atlantic acquisition | $ | - | $ | 18,559,804 | ||

| Share consideration issued for investments | $ | - | $ | 12,963,804 | ||

| Supplemental disclosures: | ||||||

| Interest paid | $ | 809,599 | $ | 286,047 | ||

| Income taxes paid | $ | - | $ | - | ||

The accompanying notes are an integral part of these unaudited condensed interim consolidated financial statements

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

1. Nature of Operations

HIVE Blockchain Technologies Ltd. (the "Company") was incorporated in the province of British Columbia on June 24, 1987. The Company is a reporting issuer in each of the Provinces and Territories of Canada and is listed for trading on the TSXV, under the symbol "HIVE.V", as well on the Nasdaq's Capital Markets Exchange under "HIVE", and on the Open Market of the Frankfurt Stock Exchange under "HBFA". The Company's head office is located at Suite 855, 789 Pender Street, Vancouver, BC, V6C 1H2, and the Company's registered office is located at Suite 2500, 700 West Georgia Street, Vancouver, BC, V7Y 1B3.

In connection with the Company's change of business filed in September 2017 ("Change of Business"), the

Company acquired digital currency mining data centre equipment in Iceland. Following the initial acquisition, the Company acquired additional data centre equipment in Iceland and Sweden throughout fiscal 2018. Phases one and two of Sweden commenced operations on January 15, 2018 and March 31, 2018 respectively, while phase three commenced operations on April 30, 2018. On April 9, 2020 the Company acquired a data centre in Quebec, Canada, and on April 15, 2021 the Company acquired a data centre in New Brunswick, Canada. The Company is in the business of providing infrastructure solutions, including the provision of computational capacity to distributed networks, in the blockchain industry. The Company's operations are focused on the mining and sale of digital currencies to upgrade, expand and scale up its mining operations. Digital currencies are subject to risks unique to the asset class and different from traditional assets. Additionally, the Company may at times hold assets by third party custodians or exchanges that are limited in oversight by regulatory authorities.

The Company affected the consolidation of its common shares (Note 18) based on one post-consolidation common share for each five pre-consolidated common shares. All common shares and per share amounts have been retroactively restated to reflect the consolidation.

The negative impact on the global supply chain related to the COVID-19 pandemic has presented challenges to the Company including increased shipping costs and delaying obtaining equipment from China on a timely basis. Additionally, the Company continues to face uncertainty in the availability of equipment from suppliers as it relates to the Company's ASIC equipment.

2. Basis of Presentation

(a) Statement of Compliance

These unaudited condensed interim consolidated financial statements have been prepared in accordance with IAS 34, "Interim Financial Reporting of the International Financial Reporting Standards" ("IFRS") as issued by the International Accounting Standards Board ("IASB") and follow the same accounting policies and methods of application as the Company's March 31, 2022 annual audited financial statements, unless otherwise noted. These condensed interim consolidated financial statements do not include all the information required for full annual financial statements and accordingly, they should be read in conjunction with the Company's most recent annual statements.

The condensed interim consolidated financial statements have been prepared on a historical cost basis except for some financial instruments that have been measured at fair value.

The Company is in the business of the mining and sale of digital currencies, many aspects of which are not specifically addressed by current IFRS guidance. The Company is required to make judgements as to the application of IFRS and the selection of accounting policies. The Company has disclosed its presentation, recognition and derecognition, and measurement of digital currencies, and the recognition of revenue as well as significant assumptions and judgements; however, if specific guidance is enacted by the IASB in the future, the impact may result in changes to the Company's earnings and financial position as presented.

These unaudited condensed interim consolidated financial statements were approved and authorized for issuance by the Board of Directors on August 16, 2022.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

3. Significant Judgements

(a) Digital currencies - accounting

There is currently no specific definitive guidance in IFRS or alternative accounting frameworks for accounting for the revenue recognition from digital currency mining as well as subsequent measurement of digital currencies held. Management has determined that revenues should be recognized as the fair value of digital currencies received in exchange for mining services on the date that digital currencies are received and subsequently measured as an intangible asset. Management has exercised significant judgement in determining the appropriate accounting treatment. In the event authoritative guidance is issued by the IASB, the Company may be required to change its accounting policies, which could have a material effect on the Company's financial statements.

4. Norway Acquisition

In May 2018, the Company completed the acquisition of two entities in Norway (the "Norway Acquisition"), Liv Eiendom AS ("Liv Eiendom") and Kolos Norway AS ("Kolos").

As consideration for the acquisition, the Company made cash payments of 55,576,560 Norwegian Kroner

("NOK") (US$6,902,498) to the former shareholders of Kolos, issued 950,000 common shares, issued 250,000 warrants exercisable at C$6.20 for a period of five years and incurred cash transaction costs of $428,127 related to the acquisition.

On May 10, 2021, the Company completed the sale of the net assets of Kolos Norway AS:

| Net liability disposed of | $ | 3,371,275 | ||

| Less: Payment to acquirer | (200,000 | ) | ||

| Gain on disposal | $ | 3,171,275 |

The following are balance sheet items that were derecognized in the sale of the subsidiary:

| May 10, 2021 | ||||

| Assets | ||||

| Current assets | ||||

| Cash and equivalents | $ | 37,254 | ||

| Amounts receivable and prepaids | 878 | |||

| Total assets | $ | 38,132 | ||

| Liabilities and equity | ||||

| Current liabilities | ||||

| Accounts payable and accrued liabilities | $ | 82,540 | ||

| Loans payable | 3,326,867 | |||

| Total liabilities | 3,409,407 | |||

| Net Assets | $ | (3,371,275 | ) |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

5. Atlantic Acquisition

On April 15, 2021, the Company completed the acquisition of 100% of the common shares of GPU Atlantic Inc. ("GPU Atlantic"), in consideration for 100% of GPU Atlantic, the Company paid total consideration of 1,000,000 common shares on closing valued at a total of $18.6 million (C$23.3 million). 200,000 of the common shares were allocated to a holdback and to GPU One earn-out upon delivery of certain earn-out conditions. All 200,000 common shares allocated to the holdback were issued as of March 31, 2022.

GPU Atlantic has a 50-megawatt data centre campus located in New Brunswick, Canada.

| Current assets | $ | 671,709 | ||||

| Plant and equipment | 12,898,994 | |||||

| Land | 662,910 | |||||

| Building | 4,576,290 | |||||

| Sales taxes refunds | 75,780 | |||||

| Intangible assets* | 696,192 | |||||

| Goodwill** | 13,154,585 | |||||

| Accounts payable | (3,198,591 | |||||

| Long-term debt | (10,978,065 | |||||

| Net assets acquired | $ | 18,559,804 | ||||

| Consideration paid | Contingent to | Closing to | ||||

| April 15, 2021 | March 31, 2022 | |||||

| Closing common shares - 800,000 | 15,174,278 | 15,174,278 | ||||

| Milestone common shares - 200,000 | 3,385,526 | 2,017,054 | ||||

| Total consideration | $ | 18,559,804 | $ | 17,191,332 | ||

As part of the transaction, the Company also acquired a $10,978,065 (C$13,639,249) term loan (Note 14) included in the long-term debt acquired. As part of the transaction, the Company incurred $83,197 of transaction costs which is included in general and administrative expenses.

* Intangible assets includes an internally generated mining monitoring, tracking and generating software.

** Goodwill represents expected synergies, future income growth potential, and other intangibles that do not qualify for separate recognition. None of the goodwill arising on the acquisition is expected to be deductible for tax purposes.

The purchase price allocation for acquisitions reflects fair value estimates which were finalized during the quarter; with no adjustments to the amounts previously reported.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

6. Investments

The Company's investment holdings that are not traded in active markets by the Company are considered investments. Investments are accounted for as financial assets which are initially recognized at fair value and subsequently measured through fair value through profit or loss.

On April 21, 2021, the Company completed a share swap transaction with Valour Inc. (formerly DeFi Technologies Inc.) pursuant to which HIVE received 10,000,000 common shares of Valour Inc., in exchange for 800,000 common shares of the Company, valued at C$16.0 million.

As at June 30, 2022, in addition to the investment of Valour Inc., the Company holds a number of non- material investments in both private and public companies.

The continuity of investments was as follows:

| Investments | |||

| Balance, March 31, 2021 | $ | 981,736 | |

| Additions | 16,856,828 | ||

| Unrealized loss on investments | (837,822 | ) | |

| Balance, March 31, 2022 | $ | 17,000,742 | |

| Unrealized loss on investments | (8,683,081 | ) | |

| Foreign exchange | (403,503 | ) | |

| Balance, June 30, 2022 | $ | 7,914,158 |

7. Amounts Receivable and Prepaids

| June 30, 2022 | March 31, 2022 | |||||

| Sales tax receivable | $ | 4,881,535 | $ | 4,516,993 | ||

| Prepaid expenses and other receivables | 2,643,055 | 3,021,408 | ||||

| Energy tax receivable | 176,152 | 439,926 | ||||

| Receivable on sale of subsidiary* | 1,815,964 | 1,815,964 | ||||

| Total | $ | 9,516,706 | $ | 9,794,291 | ||

| Less: current portion | (7,700,742 | ) | (7,978,327 | ) | ||

| Long term portion | $ | 1,815,964 | $ | 1,815,964 |

* Receivable is conditional upon ruling by the by the Swedish Tax Authority related to an ongoing value added tax process. If the ruling is favourable then the amounts will be received; otherwise the amounts will not be collectible. Management has assessed the collectability using a probability model under a range of scenarios and this receivable reflects the results of that process.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

8. Digital Currencies

Digital currencies are recorded at their fair value on the date they are received as income from digital currency mining and are revalued to their current market value less costs to sell at each reporting date.

The Company's holdings of digital currencies at their fair value consist of the following:

| June 30, 2022 | March 31, 2022 | |||||

| Bitcoin | $ | 63,269,999 | $ | 117,669,390 | ||

| Ethereum | 8,041,218 | 52,301,707 | ||||

| Ethereum Classic | 42,690 | 29,315 | ||||

| Total | $ | 71,353,907 | $ | 170,000,412 |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

8. Digital Currencies (continued…)

The continuity of digital currencies was as follows:

| Bitcoin | Amount | Number of coins | ||||

| Digital assets, March 31, 2021 | $ | 18,858,987 | 322 | |||

| Digital currency mined | 109,289,154 | 2,368 | ||||

| Digital currency sold | (3,134,857 | ) | (94 | ) | ||

| Revaluation adjustment | (7,343,894 | ) | - | |||

| Digital currencies, March 31, 2022 | 117,669,390 | 2,596 | ||||

| Digital currency mined | 26,826,057 | 821 | ||||

| Digital currency sold | (7,916,704 | ) | (186 | ) | ||

| Revaluation adjustment | (73,308,744 | ) | - | |||

| Digital currencies, June 30, 2022 | $ | 63,269,999 | 3,231 | |||

| Ethereum | Amount | Number of coins | ||||

| Digital assets, March 31, 2021 | $ | 38,640,733 | 20,041 | |||

| Digital currency mined | 97,854,252 | 31,840 | ||||

| Digital currency sold | (103,791,716 | ) | (35,716 | ) | ||

| Revaluation adjustment | 19,598,438 | - | ||||

| Digital currencies, March 31, 2022 | 52,301,707 | 16,165 | ||||

| Digital currency mined | 17,070,043 | 7,675 | ||||

| Digital currency sold | (48,858,093 | ) | (16,230 | ) | ||

| Revaluation adjustment | (12,472,439 | ) | - | |||

| Digital currencies, June 30, 2022 | $ | 8,041,218 | 7,610 | |||

| Ethereum Classic | Amount | Number of coins | ||||

| Digital assets, March 31, 2021 | $ | - | - | |||

| Digital currency mined | 2,465,241 | 50,853 | ||||

| Digital assets received | 751 | - | ||||

| Digital currency sold | (2,461,250 | ) | (50,228 | ) | ||

| Revaluation adjustment | 24,573 | - | ||||

| Digital currencies, March 31, 2022 | 29,315 | 625 | ||||

| Digital currency mined | 88,290 | 3,353 | ||||

| Digital currency sold | (45,317 | ) | (1,087 | ) | ||

| Revaluation adjustment | (29,598 | ) | - | |||

| Digital currencies, June 30, 2022 | $ | 42,690 | 2,891 |

During the period ended June 30, 2022 the Company sold digital currencies for proceeds totalling $34,519,966 (June 30, 2021 - $13,811,319) with a cost of $56,820,114 (June 30, 2021 - $9,705,262), and recorded a loss of $22,300,418 (June 30, 2021 - gain of $4,106,057).

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

9. Plant and Equipment

| Building and | ||||||||||||

| Cost | Equipment | Land | Leaseholds | Total | ||||||||

| Balance, March 31, 2021 | $ | 105,530,948 | $ | - | $ | - | $ | 105,530,948 | ||||

| Atlantic acquisition (Note 5) | 11,872,578 | 662,910 | 5,602,706 | 18,138,194 | ||||||||

| Disposals | (1,244,804 | ) | - | - | (1,244,804 | ) | ||||||

| Additions | 190,643,420 | - | 11,935,014 | 202,578,434 | ||||||||

| Balance, March 31, 2022 | $ | 306,802,142 | $ | 662,910 | $ | 17,537,720 | $ | 325,002,772 | ||||

| Additions | 22,559,170 | - | 2,565,990 | 25,125,160 | ||||||||

| Impairment | (8,300,501 | ) | - | - | (8,300,501 | ) | ||||||

| Balance, June 30, 2022 | $ | 321,060,811 | $ | 662,910 | $ | 20,103,710 | $ | 341,827,431 | ||||

| Building and | ||||||||||||

| Accumulated depreciation and impairment | Equipment | Land | Leaseholds | Total | ||||||||

| Balance, March 31, 2021 | $ | 83,932,145 | $ | - | $ | - | $ | 83,932,145 | ||||

| Disposals | (295,994 | ) | - | - | (295,994 | ) | ||||||

| Depreciation | 63,033,428 | - | 790,449 | 63,823,877 | ||||||||

| Balance, March 31, 2022 | $ | 146,669,579 | $ | - | $ | 790,449 | $ | 147,460,028 | ||||

| Depreciation | 25,091,314 | - | 42,766 | 25,134,080 | ||||||||

| Impairment | (1,963,943 | ) | - | - | (1,963,943 | ) | ||||||

| Balance, June 30, 2022 | $ | 169,796,950 | $ | - | $ | 833,215 | $ | 170,630,165 | ||||

| Carrying amount | ||||||||||||

| Balance, March 31, 2022 | $ | 160,132,563 | $ | 662,910 | $ | 16,747,271 | $ | 177,542,744 | ||||

| Balance, June 30, 2022 | $ | 151,263,861 | $ | 662,910 | $ | 19,270,493 | $ | 171,197,266 | ||||

During the period ended June 30, 2022, the Company recorded an impairment on miner equipment of $6,336,558. The impairment was based on an assessment of the performance of the equipment in relation to prevailing replacement costs.

10. Deposits

The deposits relate to required amounts on account with electricity providers in Sweden and deposit for equipment purchases, consisting of:

| Description | June 30, 2022 | March 31, 2022 | ||||

| Vattenfall AB | $ | 1,238,349 | $ | 1,361,422 | ||

| Bodens Energi | 219,478 | 241,291 | ||||

| Skellefteå Kraft | 523,088 | 523,088 | ||||

| Equipment Deposits | 41,679,352 | 57,567,943 | ||||

| Total | $ | 43,660,267 | $ | 59,693,744 |

The Company is exposed to counterparty risk through the significant deposits for the prepaid digital currency mining equipment it places with suppliers of mining hardware to secure orders and delivery dates. The risk of a supplier failing to meet its contractual obligations may result in late deliveries or long-term deposits and equipment prepayments that are not realized. The Company attempts to mitigate this risk by procuring mining hardware from the larger more established suppliers and with whom the company has existing relationships and knowledge of their reputation in the market.

During the period ended June 30, 2022, the Company recorded an impairment on equipment deposits of $4,678,000. The impairment was based on an assessment of deposits made on equipment purchase orders and the expected delivery of the equipment.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

11. Accounts Payable and Accrued Liabilities

| June 30, 2022 | March 31, 2022 | |||||

| Accounts payable and accrued liabilities | $ | 16,306,014 | $ | 12,376,825 | ||

| Total | $ | 16,306,014 | $ | 12,376,825 |

12. Convertible Loan

On January 12, 2021, the Company closed its non-brokered private placement of unsecured debentures (the "Debentures"), for aggregate gross proceeds of $15,000,000 with U.S. Global Investors, Inc. ("U.S. Global"). The Executive Chairman of the Company is a director, officer and controlling shareholder of U.S. Global.

The Debentures mature on the date that is 60 months from the date of issuance, bearing interest at a rate of 8% per annum. The Debentures will be issued at par, with each Debenture being redeemable by the Company at any time, and convertible at the option of the holder into common shares (each, a "Share") in the capital of the Company at a conversion price of CAD$15.00 per Share. Interest will be payable monthly and principal will be payable quarterly. In addition, U.S. Global was issued 5.0 million common share purchase warrants (the "Warrants"). Each five whole Warrant entitles U.S. Global to acquire one common at an exercise price of CAD$15.00 per Share for a period of three years from closing.

The Company determined that the Convertible Loan contained an embedded derivative and that the conversion feature does not qualify as equity as it does not satisfy the "fixed for fixed" requirement as the number of potential common shares to be issued is contingent on a variable carrying amount for the financial liability. The financial liability is variable because the functional currency of Hive Blockchain Technologies Ltd. is Canadian dollars and the Convertible Loan is denominated in US dollars, therefore the amount of common shares to be issued depends on the foreign exchange rate at the date of settlement. Consequently, the conversion feature is classified as a derivative liability.

The Company allocated the proceeds of $15,000,000 first to the derivative component for $8,560,630, with the residual value to the liability component for $6,439,370. The derivative component was valued on initial recognition using the Black-Scholes option pricing model with the following assumptions: a risk-free interest rate of 0.69%; an expected volatility of 105%; an expected weighted average life of 2.71 years; a forfeiture rate of zero; and an expected dividend of zero.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

12. Convertible Loan (continued…)

Liability Component

| Balance, March 31, 2021 | 6,290,741 | |||

| Principal payment | (3,000,000) | |||

| Interest payment | (1,057,336) | |||

| Accretion and interest | 3,365,601 | |||

| Balance, March 31, 2022 | 5,599,006 | |||

| Principal payment | (747,945) | |||

| Interest payment | (226,212) | |||

| Accretion and interest | 777,409 | |||

| Balance, June 30, 2022 | $ | 5,402,258 | ||

| Derivative Component | ||||

| Balance, March 31, 2021 (Restated - Note 29) | 15,737,578 | |||

| Change in fair value of liability | (10,751,224) | |||

| Balance, March 31, 2022 | 4,986,354 | |||

| Change in fair value of liability | (4,371,195) | |||

| Balance, June 30, 2022 | $ | 615,159 | ||

The derivative component is re-valued each reporting period. As at June 30, 2022, the derivative component was revalued at $615,159 (March 31, 2022 - $4,986,354) using the Black-Scholes option pricing model with the following assumptions: share price of C$3.85 (March 31, 2022 - C$2.66) a risk-free interest rate of 1.75% (March 31, 2022 - 1.75%); an expected volatility of 105% (March 31, 2022 - 105%); and an expected weighted average life of 1.99 years (March 31, 2022 - 2.11 years). Accordingly, the Company recorded a change in the fair value of the derivative liability of $4,371,195.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

13. Loans Payable

As part of the Norway Acquisition (Note 4) the Company assumed loans with a principal balance of $2,559,599 (NOK 20,915,000). The loans from the Norway Acquisition are in default as at March 31, 2021. On May 10, 2021, the Company sold the Norway subsidiary which included the loans (Note 4). On March 31, 2021, as part of the sale of the net assets in Boden Technologies AB, the Company incurred a loan payable.

A continuity of the loan balances are as follows:

| Norway | Boden | Total | |||||||

| (Notes 4) | |||||||||

| Balance - March 31, 2021 | $ | 3,172,089 | $ | 18,361,495 | $ | 21,533,584 | |||

| Interest | 25,133 | 172,804 | 197,937 | ||||||

| Repayment | - | (1,259,778 | ) | (1,259,778 | ) | ||||

| Foreign exchange movement | 129,645 | (1,582,182 | ) | (1,452,537 | ) | ||||

| Sale of Norway subsidiary (Note 4) | (3,326,867 | ) | - | (3,326,867 | ) | ||||

| Balance - March 31, 2022 | - | 15,692,339 | 15,692,339 | ||||||

| Interest | - | 47,576 | 47,576 | ||||||

| Foreign exchange movement | - | (1,414,679 | ) | (1,414,679 | ) | ||||

| Balance - June 30, 2022 | - | 14,325,236 | 14,325,236 | ||||||

| Less: Current portion | - | (1,224,102 | ) | (1,224,102 | ) | ||||

| Non-current portion | $ | - | $ | 13,101,134 | $ | 13,101,134 |

14. Term Loan

As part of the Atlantic acquisition (Note 5), the Company acquired a $10,978,065 (C$13,639,249) term loan. The facility bears interest at 3.33% per annum and a maturity date of June 30, 2022. Principal payment of C$189,434 plus interest is payable monthly. During the period ended, the term loan was renewed for another 12 month term.

| Balance, March 31, 2021 | $ | - | |

| Atlantic acquisition (Note 5) | 10,978,065 | ||

| Repayments | (1,602,821 | ) | |

| Balance, March 31, 2022 | $ | 9,375,244 | |

| Repayments | (583,387 | ) | |

| Balance, June 30, 2022 | $ | 8,791,857 |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

15. Right of Use Asset and Lease Liability

During the period ended June 30, 2022, the Company recognized interest expense on the lease liability of $171,194 (June 30, 2021 - $40,881) which was recorded within finance expense.

| Cost | Right of Use Assets | ||

| Balance, March 31, 2021 | $ | 5,753,128 | |

| Additions | 12,458,260 | ||

| Foreign exchange | (452,937 | ) | |

| Balance, March 31, 2022 | $ | 17,758,451 | |

| Foreign exchange | (1,138,766 | ) | |

| Balance, June 30, 2022 | $ | 16,619,685 | |

| Accumulated Depreciation | |||

| Balance, March 31, 2021 | $ | (2,774,844 | ) |

| Depreciation | (2,408,622 | ) | |

| Foreign exchange | 12,897 | ||

| Balance, March 31, 2022 | $ | (5,170,569 | ) |

| Depreciation | (550,983 | ) | |

| Foreign exchange | 373,673 | ||

| Balance, June 30, 2022 | $ | (5,347,879 | ) |

| Carrying Amount | |||

| Balance, March 31, 2022 | $ | 12,587,882 | |

| Balance, June 30, 2022 | $ | 11,271,806 | |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

15. Right of Use Asset and Lease Liability (continued…)

| Lease Liability | |||

| Balance, March 31, 2021 | $ | 3,063,839 | |

| Lease payments made | (2,807,457 | ) | |

| Additions | 12,458,260 | ||

| Interest expense on lease liabilities | 407,349 | ||

| Foreign exchange | (472,797 | ) | |

| Balance, March 31, 2022 | $ | 12,649,194 | |

| Lease payments made | (679,570 | ) | |

| Interest expense on lease liabilities | 171,194 | ||

| Foreign exchange | (763,869 | ) | |

| 11,376,949 | |||

| Less: current portion | (2,030,810 | ) | |

| Balance, June 30, 2022 | $ | 9,346,139 | |

| Lease Disclosures | |||

| Interest expense on lease liabilities | $ | 171,194 | |

| Total cash outflow for leases | $ | 679,570 | |

| Maturity Analysis - Undiscounted Contractual Payments | |||

| Less than 1 year | $ | 2,570,437 | |

| 1 to 2 years | 2,596,661 | ||

| 2 to 3 years | 2,586,213 | ||

| 3 to 4 years | 2,582,698 | ||

| 4 to 5 years | 1,541,341 | ||

| 5 to 6 years | 1,035,960 | ||

| $ | 12,913,310 |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

16. Commitments and Contingencies

(a) Service agreements

The Company has a service agreement to operate and maintain their data centre computing equipment for the purpose of mining crypto currency on the cloud. As part of the arrangement, proprietary software is installed on the Company's computing equipment to assist in optimizing the use of the equipment.

(b) Power purchase agreement

The Company entered into a supplemental power pricing arrangement that provides a fixed price for up to 12 MW of electricity consumption each month at the Company's Bikupa Datacenter AB location in Sweden. The fixed price agreement was assessed and is being accounted for as an executory contract; electricity costs are expensed as incurred.

(c) Capital and other commitments:

There were no capital or other commitments at the current or prior year end in addition to the commitments disclosed above.

(d) Obligations on Mining equipment

The Company had purchase commitments of $32,136,000 as at June 30, 2022.

(e) Litigation

From time to time, the Company is involved in routine litigation incidental to the Company's business. Management believes that adequate provisions have been made where required and the ultimate resolution with respect to any claim will not have a material adverse effect on the financial position or results of the operations of the Company.

17. Related Party Transactions

The Company had the following related party transactions not otherwise disclosed in these consolidated financial statements:

a) As at June 30, 2022, the Company had $nil (March 31, 2022 - $22,275) due to directors for the reimbursement of expenses included in accounts payable and accrued liabilities.

b) As at June 30, 2022, the Company had $69,424 (March 31, 2022 - $nil) due to a company controlled by a director of the Company included in accounts payable and accrued liabilities. For the period ended June 30, 2022, the Company paid $96,558 (June 30, 2021 - $26,420) to this company for marketing services.

Key Management Compensation

Key management personnel include those persons having authority and responsibility for planning, directing and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of members of the Company's Board of Directors and corporate officers.

For the period ended June 30, 2022, key management compensation includes salaries and wages paid to key management personnel and directors of $225,972 (June 30, 2021 - $140,547) and share-based payments of $312,891 (June 30, 2021 - $1,078,380).

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

18. Equity

(a) Authorized

Unlimited common shares without par value

Unlimited preferred shares without par value

(b) Issued and fully paid common shares

On May 24, 2022, the Company proceeded with the consolidation of its common shares on the basis of five

(5) pre-Consolidation Common Shares for one (1) post-Consolidation Common Shares. The common shares, options, warrants and RSU's have been retroactively adjusted for impact of the share consolidation by the Company.

During the period ended June 30, 2022, the Company did not issue any shares.

(c) Stock options

The Company has established a rolling Stock Option Plan (the "Plan"). Under the Plan, the number of shares reserved for issuance may not exceed 10% of the total number of issued and outstanding shares and, to any one optionee, may not exceed 5% of the issued shares on a yearly basis. The maximum term of each option shall not be greater than 10 years. The exercise price of each option shall not be less than the market price of the Company's shares at the date of grant. Options granted to consultants performing investor relations activities shall vest over a minimum of 12 months with no more than 1/4 of such options vesting in any 3-month period. All other options vest at the discretion of the Board of Directors.

Following is a summary of changes in stock options outstanding for the period ended June 30, 2022:

| Weighted average | |||||||

| Outstanding | exercise price | ||||||

| Balance, March 31, 2021 | 2,830,839 | C$ | 4.33 | ||||

| Granted | 415,000 | 20.05 | |||||

| Cancelled | (12,500 | ) | 1.45 | ||||

| Exercised | (386,823 | ) | 6.74 | ||||

| Balance, March 31, 2022 and June 30, 2022 | 2,846,516 | C$ | 6.31 |

The stock options outstanding and exercisable as at June 30, 2022, are as follows:

| Outstanding | Exercisable | Exercise price | Expiry date | ||||

| 133,301 | 133,301 | C$ | 1.50 | September 14, 2022 | |||

| 2,000 | 2,000 | 15.70 | February 11, 2026 | ||||

| 10,000 | 10,000 | 14.95 | June 4, 2026 | ||||

| 1,000,000 | 1,000,000 | 1.50 | September 14, 2027 | ||||

| 24,615 | 24,615 | 10.00 | October 11, 2027 | ||||

| 50,000 | 50,000 | 10.00 | March 26, 2028 | ||||

| 400,000 | 400,000 | 3.10 | September 18, 2028 | ||||

| 100,000 | 100,000 | 1.35 | December 21, 2028 | ||||

| 500,000 | 500,000 | 1.45 | February 10, 2030 | ||||

| 20,000 | 20,000 | 1.90 | May 29, 2030 | ||||

| 1,600 | 1,600 | 10.80 | December 24, 2030 | ||||

| 200,000 | 125,000 | 25.00 | February 23, 2031 | ||||

| 35,000 | 35,000 | 25.15 | April 6, 2031 | ||||

| 110,000 | 55,000 | 18.35 | April 29, 2031 | ||||

| 180,000 | 27,000 | 18.50 | October 7, 2031 | ||||

| 60,000 | 10,000 | 25.35 | November 10, 2031 | ||||

| 20,000 | 5,000 | 21.00 | December 8, 2031 | ||||

| 2,846,516 | 2,498,516 | ||||||

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

18. Equity (continued…)

(d) Warrants

Following is a summary of changes in warrants outstanding for the period ended June 30, 2022:

| Warrants | Weighted average | |||||

| outstanding | exercise price | |||||

| Balance, March 31, 2021 | 1,250,000 | C$ 13.25 | ||||

| Issued** | 2,323,727 | 28.13 | ||||

| Balance, March 31, 2022 and June 30, 2022 | 3,573,727 | C$ 22.92 |

The warrants outstanding and exercisable as at June 30, 2022, are as follows:

| Outstanding | Exercisable | Exercise price | Expiry date | |||||||

| 250,000 | * | 80,000 | C$ 6.20 | May 22, 2023 | ||||||

| 1,000,000 | 1,000,000 | C$ 15.00 | January 12, 2024 | |||||||

| 300,000 | ** | 300,000 | C$ 15.55 | July 12, 2023 | ||||||

| 1,917,050 | 1,917,050 | C$ 30.00 | May 30, 2024 | |||||||

| 106,677 | *** | 106,677 | C$ 30.00 | September 15, 2024 | ||||||

| 3,573,727 | 3,403,727 |

* Of the 250,000 warrants granted as part of the Norway Acquisition (Note 4), 80,000 vest upon the receipt of all regulatory permits required to commence construction of a digital currency mining data centre in Ballangen, Norway. A further 90,000 warrants vest upon the commencement of the mining of digital currency or other revenue generating activity on the property.

** For the year ended March 31, 2022, the Company issued 300,000 warrants as consideration for mining equipment. Each full warrant entitles the holder to acquire one common share for C$15.55 for a period of 2 years. The warrants were valued at $2,030,045 using the Black-Scholes option pricing model with the following assumptions: a risk-free interest rate of 0.46%; an expected volatility of 105%; an expected life of 2.00 years; a forfeiture rate of zero; and an expected dividend of zero.

*** On December 1, 2021, the Company issued 106,677 warrants as consideration for an investment in Titan.io. Each Warrant is exercisable for one share on or before September 15, 2024, at an exercise price of C$30.00 per Share.

On November 30, 2021, the Company completed an agreement with Stifel GMP as lead underwriter and sole book runner to include a syndicate of underwriters (the "Underwriters"), whereby the Underwriters will purchase, on a bought-deal basis, 3,834,100 special warrants of the Company (the "Special Warrants") at a price of C$30.00 per Special Warrant for aggregate gross proceeds to the Company of C$115,023,000 (the "Offering").

On January 12, 2022, each Special Warrant was deemed to be exercised into one Unit comprised of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant being a "Warrant"). Each Warrant is exercisable for one share on or before May 30, 2024, at an exercise price of C$30.00 per Share.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

18. Equity (continued…)

(e) Restricted share-units

The Company has established a Restricted Share Unit Plan (the "RSU Plan"). Under the RSU Plan, together with any other share compensation arrangement, the number of shares reserved for issuance may not exceed 10% of the total number of issued and outstanding shares and, to any one optionee, may not exceed 5% of the issued shares on a yearly basis. Currently, the RSU Plan has a limit of 10 million shares, which is not rolling. The Board may in its own discretion, at any time, and from time to time, grant RSUs to any employee, director or consultant of the Company or its subsidiaries (collectively, "Eligible Persons"), other than persons conducting investor relations activities, from time to time by the Board, subject to the limitations set forth in the RSU Plan. The Board may designate one or more performance periods under the RSU Plan. In respect of each designated performance period and subject to the terms of the RSU Plan, the Board may from time to time establish the grant date and grant to any Eligible Person one or more RSUs as the Board deems appropriate.

Following is a summary of changes in restricted share units outstanding for the period ended June 30, 2022:

| Outstanding | |||

| Balance, March 31, 2021 | 356,800 | ||

| Granted | 8,000 | ||

| Cancelled | (12,500) | ||

| Exercised | (290,800 | ) | |

| Balance, March 31, 2022 and June 30, 2022 | 61,500 |

(f) Share-based compensation

During the period ended June 30, 2022, $886,461 (June 30, 2021 - $1,816,191) of share-based compensation expense was recognized in relation to the vesting of options, and $66,901 (June 30, 2021 - $506,234) of share-based compensation expense was recognized in relation to the vesting of RSU's.

The following weighted average assumptions were used for the valuation of the stock options:

| Fiscal Years | ||||

| 2023 | 2022 | |||

| Risk-free interest rate | - | 1.10% | ||

| Expected life (years) | - | 9.88 | ||

| Annualized volatility | - | 105% | ||

| Dividend rate | - | 0.00% | ||

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

19. Income per Share

Income per common share represents net income for the year divided by the weighted average number of common shares outstanding during the period.

Diluted income per share is calculated by dividing the applicable net income by the sum of the weighted average number of common shares outstanding and all additional common shares that would have been outstanding if potentially dilutive common shares had been issued during the period.

| Three months ended June 30, 2022 |

Three months ended June 30, 2021 |

|||||

| Basic weighted average number of common shares outstanding | 82,241,988 | 75,321,997 | ||||

| Effect of dilutive stock options and warrants | - | 2,651,889 | ||||

| Effect of convertible loan | - | 1,225,783 | ||||

| Diluted weighted average common shares outstanding | 82,241,988 | 79,199,669 |

20. Finance Expense

Finance expenses were comprised of the following for the periods ending:

| June 30, 2022 | June 30, 2021 | |||||

| Interest and accretion on convertible loan | $ | 770,744 | $ | 841,037 | ||

| Interest on loans payable | 47,576 | 25,133 | ||||

| Interest on lease liabilities | 171,194 | 40,881 | ||||

| Total | $ | 989,514 | $ | 907,051 |

21. General and Administrative Expenses

General and administrative expenses were comprised of the following for the periods ending:

| June 30, 2022 | June 30, 2021 | |||||

| Management fees, salaries and wages | $ | 365,222 | $ | 171,660 | ||

| Marketing | 198,471 | 84,749 | ||||

| Office, administration, and regulatory | 1,683,799 | 681,335 | ||||

| Professional fees, advisory, and consulting | 1,117,824 | 789,722 | ||||

| Total | $ | 3,365,316 | $ | 1,727,466 |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management

The fair values of investments were measured using the cost, market or income approaches. The investments measured at fair value are classified into one of the three levels in the fair value hierarchy according to the relative reliability of the inputs used to estimate the fair values, with the designation based upon the lowest level of input that is significant to the fair value measurement. The three levels of the fair value hierarchy are:

Level 1 Inputs: Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date.

Level 2 Inputs: Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities in markets that are not active, or other observable inputs other than quoted prices.

Level 3 Inputs: Unobservable inputs for the asset or liability (Unobservable inputs reflect management's assumptions on how market participants would price the asset or liability based on the information available).

Valuation of Assets that use Level 2 Inputs ("Level 2 Assets"). The fair value of Level 2 Assets would use the quoted price from the exchanges which the Company most frequently uses, with no adjustment.

The Company is exposed, in varying degrees, to a variety of financial related risks. The fair value of the Company's financial instruments, including cash, amounts receivable, investments, and accounts payable and accrued liabilities approximates their carrying value due to their short-term nature. The type of risk exposure and the way in which such exposure is managed is provided as follows:

At the period end the Company classified its financial assets into the following levels:

| As at June 30, 2022 | As at March 31, 2022 | |||||||||||||||||

| Assets | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | ||||||||||||

| Cash | $ | 4,019,547 | $ | 5,318,922 | ||||||||||||||

| Digital currencies | $ | 71,353,907 | $ | 170,000,412 | ||||||||||||||

| Investments | $ | 3,554,960 | $ | - | $ | 4,359,198 | $ | 12,524,161 | $ | - | $ | 4,476,251 | ||||||

| $ | 3,554,960 | $ | 75,373,454 | $ | 4,359,198 | $ | 12,524,161 | $ | 175,319,334 | $ | 4,476,251 | |||||||

| Liabilities | ||||||||||||||||||

| Convertible loan -derivative component (restated) | $ | - | $ | - | $ | 615,159 | $ | - | $ | - | $ | 4,986,354 | ||||||

| $ | - | $ | - | $ | 615,159 | $ | - | $ | - | $ | 4,986,354 | |||||||

Valuation of Assets / Liabilities that use Level 1 Inputs ("Level 1 Assets / Liabilities"). Consists of the Company's investments in common stock, where quoted prices in active markets are available.

Valuation of Assets / Liabilities that use Level 2 Inputs ("Level 2 Assets / Liabilities"). Consists of the Company's digital currencies, where quoted prices in active markets are available. The fair value is determined by the volume-weighted average of prices across principal exchanges as of 12:00 AM UTC, per coinmarketcap.com*.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

* Coinmarketcap.com is a pricing aggregator, as the principal market or most advantageous market is not always known. The Company believes any price difference amongst the principal market and an aggregated price to be immaterial.

Valuation of Assets / Liabilities that use Level 3 Inputs ("Level 3 Assets / Liabilities"). Consists of the Company's investments in preferred stock, convertible notes and common stock. For the Company's common stock investments:

- Various Black Scholes models were utilized; and

- A prior transaction approach was used for others; some adjusted.

A verified prior transaction is initially given 100% weighting in a fair value conclusion (if completed at arm's length), but subsequently such weighting is adjusted based on the merits of newly observed data. As a result, in the absence of disconfirming data, an unadjusted prior transaction price may not be considered "stale" for months or, in some cases, years.

Level 3 Continuity

The following is a reconciliation of Level 3 assets and liabilities for the period ended June 30, 2022:

| Fair value at | Change | Fair Value at, | |||||||||||||

| Level 3 Continuity | March 31, 2022 | Additions | Disposals | in fair value | June 30, 2022 | ||||||||||

| Assets | |||||||||||||||

| Investments | $ | 4,476,251 | $ | - | $ | - | $ | (117,053 | ) | $ | 4,359,198 | ||||

| $ | 4,476,251 | $ | - | $ | - | $ | (117,053 | ) | $ | 4,359,198 | |||||

| Liabilities | |||||||||||||||

| Convertible loan -derivative component | $ | 4,986,354 | $ | - | $ | - | $ | (4,371,195 | ) | $ | 615,159 | ||||

| $ | 4,986,354 | $ | - | $ | - | $ | (4,371,195 | ) | $ | 615,159 |

The carrying values of the Company's cash, amounts receivable, accounts payable and accrued liabilities, term loan and loans payable approximate fair value due to their short maturities. The carrying value of the Company's lease liability is measured as the present value of the discounted future cash flows.

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss. The Company's primary exposure to credit risk is on its cash held in bank accounts as at June 30, 2022. The majority of cash is deposited in bank accounts held primarily with one major bank in Canada so there is a concentration of credit risk. This risk is managed by using a major bank that is a high credit quality financial institution as determined by rating agencies.

For the custody of its digital currencies, the Company uses the services of two institutions through custodial agreements, one located in Liechtenstein and another in the United States.

Liquidity risk

Liquidity risk is the risk that the Company will not be able to meet its financial obligations as they fall due. The Company manages liquidity risk by maintaining cash balances to ensure that it is able to meet its short term and long-term obligations as and when they fall due. The Company manages company-wide cash projections centrally and regularly updates projections for changes in business and fluctuations caused by digital currency prices and exchange rates.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

As at June 30, 2022, the contractual maturities of financial and other liabilities, including estimated interest payments, are as follows:

| Contractual cash flows |

within 1 year | 1 to 3 years | 3 to 5 years | 5+ years | |||||||||||

| Accounts payable and accrued liabilities | $ | 15,849,859 | $ | 15,849,859 | $ | - | $ | - | $ | - | |||||

| Term loan | 8,791,857 | 8,791,857 | - | - | - | ||||||||||

| Convertible loan | 12,195,604 | 3,757,500 | 6,803,731 | 1,634,372 | - | ||||||||||

| Lease commitments | 12,913,310 | 2,570,437 | 5,182,874 | 4,124,039 | 1,035,960 | ||||||||||

| Loans payable and interest | 15,596,513 | 1,198,613 | 2,358,191 | 2,306,145 | 9,733,564 | ||||||||||

| Total | $ | 65,347,143 | $ | 32,168,266 | $ | 14,344,796 | $ | 8,064,557 | $ | 10,769,524 |

Foreign currency risk

Currency risk relates to the risk that the fair values or future cash flows of the Company's financial instruments will fluctuate because of changes in foreign exchange rates. Exchange rate fluctuations affect the costs that the Company incurs in its operations as well as the currency in which the Company has historically raised capital.

The Company's presentation currency is the US dollar, major purchases are transacted in US dollars, while financing to date has been completed in Canadian and US dollars. As the Company operates in an international environment, some of the Company's financial instruments and transactions are denominated in currencies other than an entity's functional currency. A portion of the Company's general and administrative costs are incurred mainly in currencies separate from each entity's functional currency, such as Swiss Francs, the Euro, the Swedish Krona, and Icelandic Krona. The fluctuation of these currencies in relation to the US dollar will consequently impact the profitability of the Company and may also affect the value of the Company's assets and liabilities and the amount of shareholders' equity.

The Company's net monetary position in the significant foreign currencies as of June 30, 2022 is summarized below with the effect on earnings before tax of a 10% fluctuation of each currency relative to the functional currency of the entity holding it to the US dollar:

| Net Monetary Position June 30, 2022 (USD$ equivalent) |

Impact of 10% variance in foreign exchange rate (in foreign currency) |

|||||

| US Dollars | 265,153 | 24,105 | ||||

| Canadian Dollars | 414,336 | 29,199 | ||||

| Swiss Francs | (370,537 | ) | 35,089 | |||

| Swedish Krona | 1,756,261 | 15,607 | ||||

| Icelandic Krona | 2,404,207 | 1,651 |

Interest rate risk

Interest rate risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market interest rates. The Company's exposure to interest rate risk is limited and only relates to its ability to earn interest income on cash balances at variable rates. Changes in short term interest rates will not have a significant effect on the fair value of the Company's cash account. The interest rate on the Company's loans are fixed in nature and have limited exposure to changes in interest rates.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

Price Risk

Price risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate due to changes in market prices, other than those arising from interest rate risk or foreign currency risk. The Company is not exposed to any significant price risks with respect to its financial instruments.

Loss of access risk

The loss of access to the private keys associated with the Company's digital currency holdings may be irreversible and could adversely affect an investment. Digital currencies are controllable only by an individual that possesses both the unique public key and private key or keys relating to the "digital wallet" in which the digital currency is held. To the extent a private key is lost, destroyed or otherwise compromised and no backup is accessible the Company may be unable to access the digital currencies.

Irrevocability of transactions

Digital currency transactions are irrevocable and stolen or incorrectly transferred digital currencies may be irretrievable. Once a transaction has been verified and recorded in a block that is added to the blockchain, an incorrect transfer or theft generally will not be reversible, and the Company may not be capable of seeking compensation.

Regulatory oversight risk

Regulatory changes or actions may restrict the use of digital currencies or the operation of digital currency networks or exchanges in a manner that adversely affects investments held by the Company.

Digital Asset Risk

Digital currencies are measured at fair value less cost to sell. Digital currency prices are affected by various forces including global supply and demand, interest rates, exchanges rates, inflation or deflation and the political and economic conditions. Further, digital currencies have no underlying backing or contracts to enforce recovery of invested amounts. The profitability of the Company is related to the current and future market price of digital currencies; in addition, the Company may not be able to liquidate its holdings of digital currencies at its desired price if necessary. Investing in digital currencies is speculative, prices are volatile and market movements are difficult to predict. Supply and demand for such currencies change rapidly and are affected by a variety of factors, including regulation and general economic trends. Digital currencies have a limited history, their fair values have historically been volatile and the value of digital currencies held by the Company could decline rapidly. A decline in the market prices of digital currencies could negatively impact the Company's future operations. Historical performance of digital currencies is not indicative of their future performance.

Many digital currency networks are online end-user-to-end-user networks that host a public transaction ledger (blockchain) and the source code that comprises the basis for the cryptographic and algorithmic protocols governing such networks. In many digital currency transactions, the recipient or the buyer must provide its public key, which serves as an address for a digital wallet, to the seller. In the data packets distributed from digital currency software programs to confirm transaction activity, each party to the transaction user must sign transactions with a data code derived from entering the private key into a hashing algorithm, which signature serves as validation that the transaction has been authorized by the owner of the digital currency. This process is vulnerable to hacking and malware and could lead to theft of the Company's digital wallets and the loss of the Company's digital currency.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

Digital currencies are loosely regulated and there is no central marketplace for exchange. Supply is determined by a computer code, not a central bank. Additionally, exchanges may suffer from operational issues, such as delayed execution, that could have an adverse effect on the Company.

Additionally, to the extent that the digital asset exchanges representing a substantial portion of the volume in digital asset trading are involved in fraud or experience security failures or other operational issues, such digital asset exchanges' failures may result in loss or less favorable prices of digital currencies, or may adversely affect the Company, its operations and its investments.

Safeguarding of Digital Assets

The Company utilizes the Fireblocks platform to maintain custody, transfer, and secure a material portion of its digital currencies associated with its operations. Fireblocks, with locations in New York and Tel Aviv, utilizes a secure hot vault and secure transfer environment to help establish connections between the Company's wallets and exchanges. Fireblocks utilizes multi-party computation ("MPC") protection layers to distribute private key secrets across multiple locations to ensure there is no single point of failure associated with the private keys. The use of MPC ensures private key shards are never concentrated to a single device at any point in time. The Company utilizes the Fireblocks Policy Engine to designate transaction approval policies for digital assets held within the Fireblocks portal. As such, administrators configure automated rules to ensure all transactions are disbursed based on the asset sent, total value of the transaction, source and destination of funds and signor requirements. All transactions initiated from Fireblocks that fail to meet the Company's predefined criteria per the engine policy are automatically rejected. All internal wallets owned by the Company and external wallets for addresses of the Company's counterparties require multiple approvals in accordance with our whitelisting policy. As such, the Company settles with counterparties or entities without the risk of losing funds due to deposit address attacks or errors. Fireblocks is SOC 2 Type II certified for the defined period and undergoes a SOC 2 review on an annual basis. The Company reviews the Fireblocks SOC 2 report to ensure they maintain a secure technology infrastructure and that their systems are designed and operating effectively. Additionally, the Company reviews its own complementary user entity controls in conjunction with the Fireblocks controls to ensure that applicable trust services criteria can be met. Fireblocks maintains an insurance policy which has coverage for technology, cyber, and professional liability and is rated "A" by A.M. Best based on the strength of the policy and has had no known security breaches or incidents reported to date.

Digital asset mining risk

The digital asset mining industry has seen rapid growth and innovation, and the Company may be unable to compete effectively. The Company's expenses may be greater than we anticipate, and our investments to make the Company more efficient or to gain digital asset mining market share may not outpace monetization efforts. ASIC and GPU miners and other necessary hardware are also subject to malfunction, technological obsolescence, the global supply chain and difficulty and cost in obtaining new hardware. Any major malfunction out of the typical range of downtime for normal maintenance and repair could cause a significant disruption in our ability to continue mining, which could result in lower yields and harm our digital asset mining market share. New miners can be costly and may be in short supply. There can be no assurances that the most efficient mining hardware will be readily available when we identify the need for it. We face competition in acquiring mining machines from major manufacturers and, at a given time, mining machines may only be available for pre-order months in advance. As a result of competition for the latest generation mining machines, or if we unexpectedly need to replace our mining machines due to a faulty shipment or other failure, we may not be able to secure replacement machines at reasonable costs on a timely basis.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

Digital currency mining operations can consume significant amounts of electricity, and recently, there has been increased focus on, and public debate surrounding, the negative environmental, social and governance considerations associated with such operations. Regulatory changes or actions in foreign jurisdictions may affect the Company's business or restrict the use of one or more digital assets, mining activity or the operation of their networks or the digital asset exchange market in a manner that adversely affects the Company's business and if regulators or public utilities take actions that restrict or otherwise impact mining activities, there may be a significant decline in such activities, which could adversely affect digital asset networks, the Company's business and the market price of the Company's common shares.

Digital asset mining risk

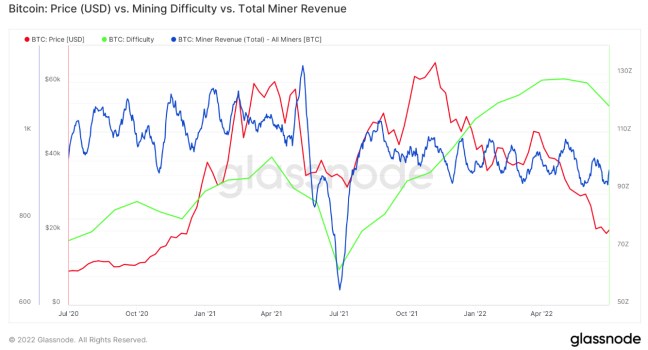

The Company's business strategy currently focuses on mining Bitcoin and Ethereum, and our hardware is limited to mining using current "proof-of-work" protocols. There could be developments in proof of work protocols, or other competing validation methods or processes that render such business strategy obsolete. Proof-of-stake is an alternative method of validating digital asset transactions. Proof-of-stake methodology does not rely on resource intensive calculations to validate transactions and create new blocks in a blockchain; instead, the validator of the next block is determined, sometimes randomly, based on a methodology in the blockchain software. Rewards, and sometimes penalties, are issued based on the amount of digital assets a user has "staked" in order to become a validator. Should Bitcoin or Ethereum shift from a proof-of-work validation method to a proof-of-stake or other method, the transaction verification process (i.e., "mining" or "validating") may render our mining business less competitive or less profitable.

In addition, the aggregate computing power of the global Bitcoin and Ethereum networks have generally grown over time and we expect it to continue to grow in the future. The barriers to entry for new Bitcoin and Ethereum miners are relatively low, which can give rise to additional capacity from competing miners. As the hash rate in the Bitcoin and Ethereum networks increase, the amount of Bitcoin and Ethereum earned per unit of hash rate decreases. The Bitcoin and Ethereum protocols respond to increasing total hash rate by increasing the "difficulty" of Bitcoin and Ethereum mining respectively. If this "difficulty" increases at a significantly higher rate, we would need to increase our hash rate at the same rate in order to maintain market share and generate equivalent block rewards. Therefore, in order to maintain or increase our market share, we may be required to make significant capital expenditures.

Any decrease in the Company's effective market share would result in a reduction in our share of block rewards and transaction fees, which could adversely affect our financial performance and financial position.

Uncertain tax position

Various foreign jurisdictions have, and may continue to adopt laws, regulations or directives that affect a digital asset network, the digital asset markets, and their users, particularly digital asset exchanges and service providers that fall within such jurisdictions' regulatory scope. For example, if China or other foreign jurisdictions were to ban or continue to otherwise restrict mining activity, including by regulating or limiting manufacturers' ability to produce or sell semiconductors or hard drives in connection with mining, it would have a material adverse effect on digital asset networks, the digital asset market, and as a result, impact our business.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

22. Financial Instruments and Risk Management (continued…)

A number of foreign jurisdictions have recently taken regulatory action aimed at digital asset activities. China has made transacting in digital currencies illegal for Chinese citizens in mainland China, and additional restrictions may follow. As recently as September 2021, China's central bank has further restricted digital asset-related activities, stating that activity by overseas digital asset exchanges, and services offering trading, order matching, and token issuance and derivatives, constitute illegal activity. Both China and South Korea have banned initial coin offerings entirely and regulators in other jurisdictions, including Canada, Singapore, and Hong Kong, have opined that initial coin offerings may constitute securities offerings subject to local securities regulations. In May 2021, the Chinese government announced renewed efforts to restrict digital currencies trading and mining activities, citing concerns about high energy consumption and its desire to promote financial stability. Regulators in the Inner Mongolia and other regions of China have proposed regulations that would create penalties for companies engaged in digital currency mining activities and introduce heightened energy saving requirements on industrial parks, data centers and power plants providing electricity to digital currency miners. The United Kingdom's Financial Conduct Authority published final rules in October 2020 banning the sale of derivatives and exchange traded notes that reference certain types of digital currencies, contending that they are "ill-suited" to retail investors citing extreme volatility, valuation challenges and association with financial crime.

Foreign laws, regulations or directives may conflict with those of the jurisdiction we operate in and may negatively impact the acceptance of one or more digital assets by users, merchants and service providers and may therefore impede the growth or sustainability of the digital asset economy in the European Union, China, Japan, Russia and the United States and globally, or otherwise negatively affect the value of digital assets that we invest in. The effect of any future regulatory change on our business or the digital assets that we invest in is impossible to predict, but such change could be substantial and adverse to our investment and trading strategies, the value of our assets and our investment value.

23. Digital Currency and Risk Management

Digital currencies are measured using Level 2 inputs (Note 22).

Digital currency prices are affected by various forces including global supply and demand, interest rates, exchange rates, inflation or deflation and the global political and economic conditions. The profitability of the Company is directly related to the current and future market price of coins; in addition, the Company may not be able liquidate its inventory of digital currency at its desired price if required. A decline in the market prices for coins could negatively impact the Company's future operations. The Company has not hedged the conversion of any of its coin sales or future mining of digital currencies.

Digital currencies have a limited history and the fair value historically has been very volatile. Historical performance of digital currencies are not indicative of their future price performance. The Company's digital currencies currently consist of Bitcoin, Ethereum, and Ethereum Classic. The table below shows the impact for every 10% variance in the price of each of these digital currencies on the Company's earnings before tax, based on their closing prices at June 30, 2022.

| Impact of 10% variance in price | |||

| Bitcoin | $ | 6,327,000 | |

| Ethereum | 804,122 | ||

| Ethereum Classic | 4,269 |

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

24. Capital Management

The Company manages its capital to maintain its ability to continue as a going concern and to provide returns to shareholders and benefits to other stakeholders. The capital structure of the Company consists of equity comprised of issued share capital and reserves.

The Company manages its capital structure and makes adjustments to it in light of economic conditions. The Company, upon approval from its Board of Directors, will balance its overall capital structure through new share issues or by undertaking other activities as deemed appropriate under the specific circumstances.

The Company is subject to externally imposed capital requirements due to its term loan (Note 14). The Company's overall strategy with respect to capital risk management remains unchanged from the year ended March 31, 2022.

|

HIVE Blockchain Technologies Ltd. Notes to the Condensed Interim Consolidated Financial Statements (Unaudited) |

|

25. Segmented Information

The Company operates in one segment, the mining and sale of digital currencies. External revenues are attributed by geographical location, based on the country from which services are provided.

| June 30, 2022 | Canada | Sweden | Iceland | Switzerland | Bermuda | Total | ||||||||||||

| Revenue from digital currency mining | $ | - | $ | - | $ | - | $ | - | $ | 44,178,526 | $ | 44,178,526 | ||||||

| June 30, 2021 | Canada | Sweden | Iceland | Switzerland | Bermuda | Total | ||||||||||||

| Revenue from digital currency mining | $ | - | $ | - | $ | - | $ | - | $ | 37,239,767 | $ | 37,239,767 |

The Company's plant and equipment are located in the following jurisdictions:

| June 30, 2022 | Canada | Sweden | Iceland | Switzerland | Bermuda | Total | ||||||||||||

| Plant and equipment | $ | 81,946,294 | $ | 86,028,051 | $ | 3,222,921 | $ | - | $ | - | $ | 171,197,266 | ||||||

| ROU asset | 5,045,930 | 6,056,860 | - | - | 169,016 | 11,271,806 | ||||||||||||

| $ | 86,992,224 | $ | 92,084,911 | $ | 3,222,921 | $ | - | $ | 169,016 | $ | 182,469,072 | |||||||

| March 31, 2022 | Canada | Sweden | Iceland | Switzerland | Bermuda | Total | ||||||||||||

| Plant and equipment | $ | 89,480,975 | $ | 84,501,305 | $ | 3,560,464 | $ | - | $ | - | $ | 177,542,744 | ||||||