HIVE Blockchain Technologies Ltd.: Exhibit 99.4 - Filed by newsfilecorp.com

The following discussion is management's assessment and analysis of the results of operations, cash flows and financial condition of HIVE Blockchain Technologies Ltd. ("HIVE" or the "Company") on a consolidated basis for the three and nine months ended December 31, 2021, and should be read in conjunction with the accompanying unaudited condensed interim consolidated financial statements and related notes for the three and nine months ended December 31, 2021. These documents and additional information regarding the business of the Company are available on the System for Electronic Document Analysis and Retrieval ("SEDAR") at www.sedar.com, and the Company's website at www.hiveblockchain.com. The preparation of financial data is in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and all figures are reported in United States dollars unless otherwise indicated.

This Management's Discussion & Analysis contains information up to and including February 14, 2022.

BUSINESS OVERVIEW

HIVE Blockchain Technologies Ltd. is a growth oriented, TSX Venture Exchange ("TSXV") and Nasdaq's Capital Markets Exchange ("NASDAQ") listed company building a bridge from the blockchain sector to traditional capital markets. HIVE operates state-of-the-art green energy-powered data centre facilities in Canada, Sweden, and Iceland which produce newly minted digital currencies like Bitcoin and Ethereum continuously on the cloud. Our deployments provide shareholders with exposure to the operating margins of digital currency mining as well as a portfolio of crypto-coins. HIVE's cryptocurrency mining operations are all powered by green energy, either renewable hydroelectricity or geothermal, with the major data centres being: 1) A Bitcoin mining operation at a leased facility in Quebec, Canada, currently equipped with approximately 6,500 new generation ASIC mining rigs with an aggregate operating hash rate of approximately 530 petahashes per second (PH/s), utilizing approximately 27 megawatts (MW) power but with available power capacity of 30MW.; 2) A Bitcoin mining operation at an owned facility in New Brunswick, Canada, currently equipped with approximately 13,500 new generation ASIC mining rigs with an aggregate operating hash rate of approximately 1,100 PH/s, utilizing approximately 50MW of power capacity; 3) In Sweden, a leased facility equipped with approximately 14,300 custom and efficient GPU rigs with an aggregate operating hash rate of approximately 3,800 gigahashes per second (GH/s) currently mining Ethereum and utilizing approximately 17MW power; and; 4) In Iceland, a leased facility equipped with approximately 2,600 custom and efficient GPU rigs with an aggregate operating hash rate of approximately 570 GH/s currently mining Ethereum and Ethereum Classic while utilizing approximately 3.5MW of power. In addition to the above major data centers, HIVE has 264 PH/s of Bitcoin mining capacvity from approximately 4,150 ASIC mining rigs utilizing approximately 10MW of power in Iceland and Sweden. All the mining power is being utilized by HIVE for self-mining. These operations provide shareholders with exposure to the operating margins of digital currency mining which the Company believes is currently the most profitable application of the Company's computing power.

The Company recognizes revenue from the provision of transaction verification services, known as 'cryptocurrency mining', for which the Company receives digital currencies and records them at their fair value on the date received.

Q3 Quarterly Highlights- December 31, 2021

- Generated revenue from digital currency mining of $68.2 million, with a gross mining margin1 of $61.6 million

- Mined 697 Bitcoin and over 7,126 Ethereum during the three-month period ended December 31, 2021

- Earned net income of $64.2 million for the period

- Working capital increased by $141.2 million during the three-month period ended December 31, 2021

- Digital currency assets of $168.1 million, as at December 31, 2021

____________________________________

1 Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" below.

The Company is a reporting issuer in each of the Provinces and Territories of Canada and is listed for trading on the TSXV, under the symbol "HIVE.V", as well as on the NASDAQ under "HIVE" and on the Open Market of the Frankfurt Stock Exchange under HBF. The Company's head office is located at Suite 855, 789 West Pender Street, Vancouver, BC, V6C 1H2, and the Company's registered office is located at Suite 2500, 700 West Georgia Street, Vancouver, BC, V7Y 1B3.

DEFINED TERMS

|

ASIC:

|

An ASIC (application-specific integrated circuit) is a microchip designed for a special application, such as a particular kind of transmission protocol or a hand-held computer. In the context of digital currency mining ASICs have been designed to solve specific hashing algorithms efficiently, including for Bitcoin mining.

|

|

Bitcoin or BTC

|

Bitcoin refers to the native token of the Bitcoin network which utilizes the SHA-256 algorithm. Bitcoin is a peer-to-peer payment system and the digital currency of the same name which uses open source cryptography to control the creation and transfer of such digital currency.

|

|

Bitcoin Network

|

The network of computers running the software protocol underlying Bitcoin and which network maintains the database of Bitcoin ownership and facilitates the transfer of Bitcoin among parties.

|

|

Blockchain

|

A Blockchain is an immutable, decentralized public transaction ledger which records transactions, such as financial transactions in cryptocurrency, in chronological order. Bitcoin and Ethereum are the largest examples of a public blockchain.

|

|

Ether or ETH or Ethereum:

|

Ether, ETH or Ethereum refers to the native token of the Ethereum Network which utilizes the ethash algorithm. Ethereum is a global, open-source platform for decentralized applications. Ethereum, ETH and Ether are used interchangeably to refer to the cryptocurrency.

|

|

Ethereum Classic:

|

Ethereum Classic refers to the native token of the Ethereum Classic Network.

|

|

GPU:

|

A GPU or Graphics Processing Unit, is a programmable logic chip (processor) specialized for display functions. GPUs have proven to be efficient at solving digital currency hashing algorithms.

|

|

Hashrate:

|

Hashrate is a measure of mining power whereby the expected revenue from mining is directly proportional to a miner's hashrate normalized by the total hashrate of the network.

|

|

Mining:

|

Mining refers to the provision of computing capacity (or hashing power) to secure a distributed network by creating, verifying, publishing and propagating blocks in the blockchain in exchange for rewards and fees denominated in the native token of that network (i.e. Bitcoin or Ethereum, as applicable) for each block generated.

|

|

Network

Difficulty:

|

Network difficulty is a measure of how difficult it is to find a hash below a given target.

|

|

Proof of Work:

|

Under proof of work consensus miners performing computational work on the network update the ledger; miners are incentivized to protect the network and put forth valid transactions because they must invest in hardware and electricity for the opportunity to mine coins on the network. The success of a miner's business relies on the value of the currency remaining above the cost to create a coin.

|

|

Proof of Stake

|

Under proof of stake consensus stakers who have sufficiently large coin balances 'staked' on the network update the ledger; stakers are incentivized to protect the network and put forth valid transactions because they are heavily invested in the network's currency.

|

|

Revaluation of

Digital

Currencies:

|

Refers to the recognition of fair value adjustments to digital currency holdings based on available market prices at a point in time.

|

|

SHA-256:

|

SHA-256 is a cryptographic Hash Algorithm. A cryptographic hash is a kind of 'signature' for a text or a data file. SHA-256 generates an almost-unique 256-bit (32-byte) signature for a text. The most well-known cryptocurrencies that utilize the SHA-256 algorithm are Bitcoin and Bitcoin Cash.

|

OUTLOOK

Operations

The Company has been continuing to utilize cash flows generated from its Ethereum mining operations to upgrade and expand its Ethereum mining equipment and to support the scaling up of its recently acquired Bitcoin mining operation in Canada.

COVID-19 and Upgrade Program

As it relates to the continuing impact from the COVID-19 virus, HIVE has enacted various measures to protect its employees and partners and prevent disruption to operations because of COVID-19, in alignment with local governments as well as national and international agency recommendations. These include ceasing non-essential travel and having employees work remotely. The Company has reduced staff on site at its locations through aggressive work at home policies; however, the Company has been able to maintain full uptime of its cryptocurrency mining operations and its data centres and its supply chain continues to operate with only minimal disruption. The Company operates with a lean administrative structure and has few employees, as cryptocurrency mining is not a human capital-intensive industry. The Company's data centres are in sparsely populated areas near the Arctic Circle in Europe, in rural Quebec and New Brunswick. Most operations management can be accomplished remotely, and any necessary equipment maintenance can be achieved by minimal staff utilizing personal protective equipment and maintaining physical distancing. In spite of the preventative measures undertaken, the Company continues to be at risk of operational inefficiencies directly related to COVID-19 because of difficulties in the mobility of the Company's technical employees within Europe. These mobility issues have alleviated somewhat over the past 6 months but continue to be present. The Company continues to caution that current global uncertainty with respect to the spread of the COVID-19 virus and emerging variants and its effect on the broader global economy may have a significant negative effect on the Company. While the precise impact of the COVID-19 virus on the Company remains unknown, the rapid spread of the COVID-19 virus and its variants may have a material adverse effect on global economic activity and can result in volatility and disruption to global supply chains, operations, mobility of people and the financial markets, which could affect interest rates, credit ratings, credit risk, inflation, business, financial conditions, results of operations and other factors relevant to the Company.

HIVE has undertaken a program to upgrade and expand its GPU equipment to maintain its Ethereum mining industry footprint. The negative impact on the global supply chain related to the COVID-19 pandemic has continued to presednt challenges including increased shipping costs and obtaining equipment from China on a timely basis, which has extended this project into calendar 2022. The Company faces uncertainty in the availability of equipment from suppliers as it relates to the Company's ASIC equipment. These continuing challenges are not just impacting our operations but are impacting all industries with one of the most vocal being the auto industry who because of a lack of semiconductors and microchips have had to cut back on car and truck production. In addition, the cost of air and sea freight have surged over 100%. The chip shortage, high shipping costs, and challenging logistical processes are a global effect associated with the COVID-19 pandemic.

Even though the COVID-19 pandemic affects have had a negative impact on HIVE, the company was resilient and successfully completed 2 major acquisitions in April 2020 and April 2021, and even with the global supply chain delays experienced we have been able to expand our footprint in Canada for green and clean coins.

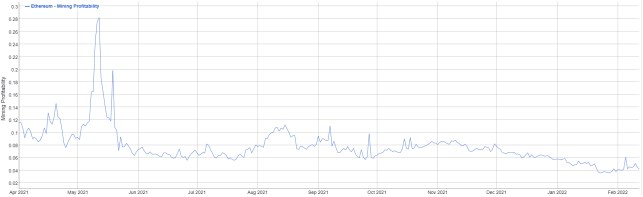

Ethereum Mining Industry Revenues of U.S. dollars per Day for each 1 Megahash per second of computing power;

April 1, 2021 - February 11, 2022

Source: bitinfocharts.com

- Ethereum mining, the economics have remained consistent after the London hardfork in early August. Despite difficulty increases in Winter 2021, strong Ethereum price action has kept Ethereum mining economics in the 6 to 10 US cents per MH/s per day range for the fiscal period from September 2021 to December 2021, consistent with Summer 2021 Ethreum mining economics prior to the London hardfork. There was a lot of speculation that the new fee structure for miners (originally designed to lower transaction fees to make Ethereum an economical blockchain for end users) would have a negative impact on profitability. While the London hardfork in early August 2021 has not correlated to a negative impact on Ethereum mining economics in the months that followed, it was only in January 2022 when we saw an Ethereum price correction to below US$3,000 which yielded mining economics in the 4 to 6 US cents per MH/s range. However in February 2022, signs of recovery emerged as Ethereum price has moved above US$3,000.

- The Company believes the outlook for Ethereum mining is positive, and will continue to be very profitable as there is increased volume and adoption of users on the Ethereum blockchain, with many DeFi and Layer 2 projects keeping strong demand for the Layer 1 Ethereum proof-of-work blockchain. The Company notes that, as a proof-of-work cryptocurrency, being energy intensive and thus an energy-backed cryptocurrency, Ethereum is a form of digital property, whereas Proof-of-Stake tokens which can be issued like securities (equity in a company), may potentially subject to securities laws. Furthermore, the founder of Ethereum (Vitalik Buterin) has recently gone on record acknowledging that the roadmap for proof-of-stake has been pushed out. The Company believes the broader Ethereum ecosystem derives resilience as a digital property, decentralization and high security, by Ethereum remaining as a proof-of-work system, and expects it to remain as such for years to come.

- Ongoing production and delivery delays continue to be experienced at some of the major mining equipment manufacturers, it is likely that network difficulty may rise significantly in the future if prices continue to increase, and the production and delivery delays are solved at the manufacturers and their latest generation of mining equipment is delivered to miners and put into production. If Bitcoin price rises in step with the increase in Difficulty, Bitcoin mining market conditions would be preserved, otherwise the rise in Difficulty will negatively impact Bitcoin mining market conditions. We have seen some stabilization in Bitcoin Difficulty where there was a price correction.

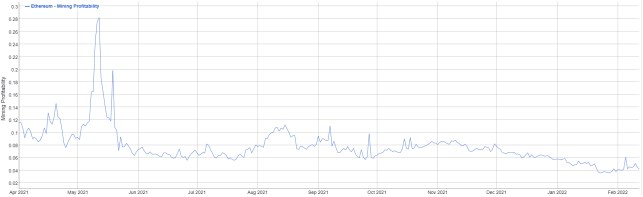

Bitcoin Mining Industry Revenues of U.S. dollars per Day for each 1 Terahash per second of computing power:

April 1, 2021 - February 11, 2022

Source: bitinfocharts.com

- Bitcoin market conditions for miners during Winter 2021 were similar to the strongly favourable conditions from February to May 2021, where $/TH/day revenues were between 25 to 45 US cents. However, following near year-round highs in November 2021, December saw a correction in Bitcoin price which affected mining economics, putting mining economics in the 20 to 30 US cents per $/TH per day range. This downward trend was further continued in January 2022, putting the range from 16 to 25 US cents per $/TH/day revenues, although stabilizing and receiving to approximately 20 US cents per $/TH/day in early February 2022. This is a result of increased in Difficulty, while Bitcoin price went below US$40,000 in January, only to find support and emerge above US$40,000 in February. HIVE has encountered some seasonal high electricity prices in some of its operating jurisdictions (including electrical curtailment at the request of utility providers for load-balancing). Nonetheless, mining economics are still relatively healthy on a historical basis (comparing the last 3 years), and also are still profitable across the board for all of HIVE's Bitcoin operations, despite temporary seasonal electricity high prices due to the extreme cold weather.

Industry subject to evolving regulatory and tax landscape

Both the regulatory and tax landscape for digital companies is constantly evolving. This applies as well to the emerging blockchain, distributed ledger, technology industry and the mining, use, sale and holding of tokens, or digital currencies, related to blockchain technology networks.

Operating in an emerging industry, the Company must constantly adapt to significant changes in regulatory, tax and industry rules and guidelines and obtain regulatory and tax advice from external global experts in this regard. In addition, regulations and the rules, rates, interpretations, and practices related to taxes, including consumption taxes such as value added taxes (VAT), are constantly changing.

The Company's headquarters are in Vancouver, British Columbia, Canada and as such is subject to the jurisdiction of the laws of B.C. and Canada. The Company intends to manage its data centres and trading operations from Bermuda, to simplify tax expectations and extend its eligible trading window for its cryptocurrencies, as Bermuda is under the Atlantic Standard Time zone.

However, the Company also has assets in a variety of other countries and is subject to changes in political conditions and regulations within these markets. Changes, if any, in policies or shifts in political attitude could adversely affect the Company's operations or profitability.

Operations may be affected in varying degrees by government regulations and decisions with respect to, but not limited to, restrictions on price controls, currency remittance, income and consumption taxes, foreign investment, maintenance of claims, environmental legislation, land use, electricity use and safety. Additionally, cryptocurrency prices are highly volatile, can fluctuate substantially and are affected by numerous factors beyond the Company's control, including hacking, demand, inflation, and expectations with respect to the rate of inflation, global or regional political or economic events.

On-going and future regulatory or tax changes, actions or decisions may alter the nature of an investment in the Company or restrict the use of cryptocurrencies in a manner that adversely affects the Company's operations. The effect of any future regulatory change on the Company or any cryptocurrency that the Company may mine is impossible to predict, but such change could be substantial and adverse to the Company.

For example, governments may in the future curtail or outlaw, the acquisition, use or redemption of cryptocurrencies. Governments may also take regulatory action that may increase the cost and/or subject cryptocurrency companies to additional regulation or prohibit or severely restrict the right to acquire, own, hold, sell, use or trade cryptocurrencies or to exchange cryptocurrencies for fiat currency. By extension, similar actions by other governments, may result in the restriction of the acquisition, ownership, holding, selling, use or trading in the Company's common shares. Such a restriction could result in the Company liquidating its cryptocurrency inventory at unfavorable prices and may adversely affect the Company's shareholders.

The Company believes the present attitude to blockchain technology, and the digital currency mining industry is increasingly favourable in many countries, but conditions may change. Operations may be affected in varying degrees by government regulation with respect to restrictions on production, price controls, export controls, foreign exchange controls, income and other taxes, and environmental legislation.

GENESIS SETTLEMENT AGREEMENT

On June 28, 2019 the Company announced that they reached a settlement agreement with Genesis (the "Settlement Agreement") which positively resolved prior misunderstandings and disagreements. As part of the settlement the Company assumed responsibility for the operation of the Sweden and Iceland data centres from Genesis.

After the Settlement Agreement, the Company received invoices under the Master Services Agreement from Genesis which the Company is disputing on the basis, inter alia, that the Company believes Genesis is in breach of its obligations of general and preventative maintenance, monitoring, repair, in-warranty repair or replacement of defective equipment and components of the Company's equipment at the Iceland Facility.

Additionally, after the Settlement Agreement, the Company is disputing with Genesis the amounts owed to the Company under the Cloud Mining Agreement.

In May 2018 the Company acquired Liv Eiendom AS ("Liv Eiendom") and Kolos Norway AS ("Kolos") for total consideration of $12.3 million.

The property was expected to provide access to low-cost power in a cold climate, sourced from green and renewable energy sources for future growth opportunities. However, in early December 2018 the Norwegian Parliament approved a legislative bill that cryptocurrency miners will no longer be subject to tax relief on power consumption at the same rate as other power-intensive industries.

Under the Norway agreement, as of March 31, 2021, the Company did not have rights to the land itself, but instead had the right to develop the land until certain provisions are met. These provisions include raising approximately $22 million (200 million Norwegian Krone) before March 2021 which if not done the local Ballangen municipality would have the right to take back the land. As a result, the land rights have been impaired, and the land has been written down to $nil for accounting purposes.

On May 10, 2021, the Company sold its Norwegian subsidiary Kolos to the local community under a share purchase agreement. Under the agreement the Company transferred all the shares to the municipality, along with a $200,000 payment.

BLOCKBASE STRATEGIC PARTNERSHIP

In August 2019, the Company entered into a strategic partnership with Blockbase Group DWC-LLC ("Blockbase") to replace Genesis as the facility operator for the Company's flagship Sweden operation, with an open-ended term. This transition was completed in November 2019. Under the agreement Blockbase will provide all things necessary for the configuration, management, operation, security, maintenance and support for the Company's Sweden facility. Blockbase's highly optimized software monitoring services are expected to enhance the efficiency of the Company's GPU mining operations while reducing costs. Additionally, HIVE has entered into direct agreements with suppliers such as the local electricity providers, which are now providing full transparency of costs at the Company's Swedish operations.

On June 1, 2020, the Company extended its partnership with Blockbase to be the facility operator for the Company's Iceland operation. HIVE will also work with Blockbase to undertake facility improvements and refurbish as necessary its mining rigs to improve mining efficiency

QUEBEC ACQUISITION

On April 8, 2020 the Company completed its acquisition of 9376-9974 Inc. ("9376") a dedicated cryptocurrency mining operation at a leased facility located in Lachute, Quebec from Cryptologic Corp. ("Cryptologic").

In consideration for 100% of the common shares of 9376, the Company paid total consideration of $3,738,809 consisting of:

(i) Issuance of 15,000,000 common shares on closing valued at a price of C$0.23 per common share for a total of $2,458,470 (C$3,450,000); and

(ii) Cash payment of $1,235,873 (C$1,734,315) and holdback of $44,466.

The allocation of the total purchase price to the net assets acquired is as follows:

| |

|

|

|

| Prepaid expenses |

$ |

719,699 |

|

| Data Centre Equipment (Note 11) |

|

2,322,077 |

|

| Right of use asset (Note 16) |

|

2,469,327 |

|

| Intangible asset* |

|

872,545 |

|

| Accounts Payable |

|

(175,512 |

) |

| Lease liability |

|

(2,469,327 |

) |

| Net assets acquired |

$ |

3,738,809 |

|

| Cash paid |

|

1,235,873 |

|

| Shares issued |

|

2,458,470 |

|

| Holdback payable |

|

44,466 |

|

| Total consideration |

$ |

3,738,809 |

|

*Intangible asset relates to favourable supply arrangements acquired as part of the business acquisition and is being amortized over the term of the existing facility lease.

GPU ATLANTIC ACQUISITION

On April 15, 2021, the Company completed the acquisition of 100% of the common shares of GPU Atlantic. In consideration for 100% of GPU Atlantic, the Company paid total consideration of 5,000,000 common shares on closing valued at a total of $18.7 million (C$23.7 million). 1,000,000 of the common shares were allocated to a holdback and to GPU One earn-out upon delivery of certain earn-out conditions.

As part of the acquisition agreement, the Company has agreed ot spend C$6,000,000 on construction and development. The Company is currently on track to fulfill this commitment.

GPU Atlantic has a 50-megawatt data centre campus located in New Brunswick, Canada.

| |

|

|

|

| Current assets |

$ |

671,709 |

|

| Data centre equipment |

|

12,898,994 |

|

| Land |

|

662,910 |

|

| Building |

|

4,576,290 |

|

| Sales taxes refunds |

|

75,780 |

|

| Intangible assets* |

|

3,947,481 |

|

| Goodwill** |

|

10,469,997 |

|

| Accounts payable |

|

(3,198,591 |

) |

| Long-term debt |

|

(11,410,351 |

) |

| Net Assets Acquired |

$ |

18,694,219 |

|

| Consideration paid |

|

18,694,219 |

|

| Total Consideration |

$ |

18,694,219 |

|

As part of the transaction, the Company also acquired a $10,898,353 (C$13,639,249) term loan included in the long-term debt acquired.

* Intangible asset represents an internally generated mining monitoring, tracking and generating software.

** Goodwill represents expected synergies, future income growth potential, and other intangibles that do not qualify for separate recognition. None of the goodwill arising on the acquisition is expected to be deductible for tax purposes.

The purchase price allocation for acquisitions reflects various fair value estimates which are subject to change within the measurement period. The primary areas of purchase price allocation that are subject to change relate to the fair values of certain tangible assets, the valuation of identifiable intangible assets acquired, and residual goodwill. Measurement period adjustments that the Company determines to be material will be applied retrospectively to the period of acquisition in the Company's consolidated financial statements and, depending on the nature of the adjustments, other periods subsequent to the period of acquisition could also be affected. The Company expects to finalize the accounting for the acquisition by March 31, 2022.

INVESTMENT IN DeFi

On April 21, 2021, the Company completed a share swap transaction with DeFi Technologies Inc. ("DeFi Technologies"), pursuant to which HIVE received 10,000,000 common shares of DeFi Technologies, in exchange for 4,000,000 common shares of the Company, valued at C$16.0 million.

CONVERTIBLE DEBENTURE

On January 12, 2021, the Company closed its non-brokered private placement of unsecured debentures (the "Debentures"), for aggregate gross proceeds of $15,000,000 with U.S. Global Investors, Inc. ("U.S. Global"). The Interim Executive Chairman of the Company is a director, officer and controlling shareholder of U.S. Global.

The Debentures will mature on the date that is 60 months from the date of issuance, bearing interest at a rate of 8% per annum. The Debentures will be issued at par, with each Debenture being redeemable by HIVE at any time, and convertible at the option of the holder into common shares (each, a "Share") in the capital of the Company at a conversion price of C$3.00 per Share. Interest will be payable monthly, and principal will be payable quarterly. In addition, U.S. Global will be issued 5.0 million common share purchase warrants (the "Warrants"). Each whole Warrant will entitle U.S. Global to acquire one common at an exercise price of C$3.00 per Share for a period of three years from closing.

AT-THE-MARKET EQUITY PROGRAM

On February 2, 2021, the Company entered into an equity distribution agreement ("Equity Distribution Agreement") with Canaccord Genuity Corp. Under the Equity Distribution Agreement, the Company may, from time to time, sell up to US$100 million of common shares in the capital of the Company (the "ATM Equity Program"). The Company intends to use the net proceeds of the ATM Equity Program, principally for general corporate and working capital requirements, funding ongoing operations, to repay indebtedness outstanding from time to time, to complete future acquisitions, or for other corporate purposes.

For the nine month period ended December 31, 2021, the Company issued 10,872,500 common shares (the "ATM Shares") pursuant to the ATM Equity Program for proceeds of C$42,275,457 ($34,956,137). The ATM Shares were sold at prevailing market prices, for an average price per ATM Share of C$4.01. Pursuant to the Equity Distribution Agreement associated with the Equity Distribution Agreement, a cash commission of $1,048,683 on the aggregate gross proceeds raised was paid to the agent in connection with its services under the Equity Distribution Agreement.

The Company intends to use the net proceeds from the Equity Distrubtion Agreement for the purchase of data centre equipment, strategic investments, and general working capital.

BOUGHT-DEAL PRIVATE PLACEMENT

On November 30, 2021, the Company completed an agreement with Stifel GMP as lead underwriter and sole bookrunner to include a syndicate of underwriters (the "Underwriters"), whereby the Underwriters will purchase, on a bought-deal basis, 19,170,500 special warrants of the Company (the "Special Warrants") at a price of C$6.00 per Special Warrant for aggregate gross proceeds to the Company of C$115,023,000 (the "Offering").

On January 11, 2022 each Special Warrant was deemed to be exercised into one Unit comprised of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant being a "Warrant"). Each Warrant is exercisable for one share on or before May 30, 2024, at an exercise price of C$6.00 per Share.

CONSOLIDATED RESULTS OF OPERATIONS

Below is an analysis of the Company's revenue and gross mining margin:

| |

|

Q3 2022 |

|

|

Q2 2022 |

|

|

Q1 2022 |

|

|

Q4 2021 |

|

|

Q3 2021 |

|

| |

|

|

|

|

|

|

|

Restated |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue from digital currency mining |

$ |

68,183,402 |

|

$ |

52,619,094 |

|

$ |

37,239,767 |

|

$ |

33,420,171 |

|

$ |

13,707,879 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating and maintenance |

|

(6,526,317 |

) |

|

(7,593,349 |

) |

|

(6,220,684 |

) |

|

(5,726,129 |

) |

|

(3,078,934 |

) |

| Depreciation |

|

(14,992,288 |

) |

|

(9,626,529 |

) |

|

(6,899,182 |

) |

|

(5,035,231 |

) |

|

(2,476,592 |

) |

| |

|

46,664,797 |

|

|

35,399,216 |

|

|

24,119,901 |

|

|

22,658,811 |

|

|

8,152,353 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross mining margin |

|

61,657,085 |

|

|

45,025,745 |

|

|

31,019,083 |

|

|

27,694,042 |

|

|

10,628,945 |

|

| Gross mining margin % (1) |

|

90% |

|

|

86% |

|

|

83% |

|

|

83% |

|

|

78% |

|

| Gross margin % |

|

68% |

|

|

67% |

|

|

65% |

|

|

68% |

|

|

59% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revaluation gain of digital currencies (2) |

|

4,052,617 |

|

|

18,017,637 |

|

|

(8,492,727 |

) |

|

16,090,102 |

|

|

6,315,970 |

|

| Gain on sale of digital currencies |

|

7,949,927 |

|

|

4,679,412 |

|

|

4,106,057 |

|

|

3,841,993 |

|

|

1,679,213 |

|

| Hosting revenue |

|

661,387 |

|

|

953,958 |

|

|

1,742,906 |

|

|

410,704 |

|

|

393,518 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share based compensation |

|

(1,672,614 |

) |

|

(1,478,637 |

) |

|

(2,322,426 |

) |

|

(534,193 |

) |

|

(209,726 |

) |

| General expenses |

|

(2,862,011 |

) |

|

(2,633,025 |

) |

|

(2,314,873 |

) |

|

(3,102,849 |

) |

|

(911,076 |

) |

| Foreign exchange gain (loss) |

|

(1,676,763 |

) |

|

(1,888,166 |

) |

|

528,868 |

|

|

(367,219 |

) |

|

1,746,573 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Realized gain on investments |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

6,639 |

|

| Unrealized (loss) gain on investments |

|

11,875,641 |

|

|

6,168,239 |

|

|

(5,808,523 |

) |

|

645,383 |

|

|

148,967 |

|

| Change in fair value of derivative liability |

|

590,837 |

|

|

914,392 |

|

|

(885,612 |

) |

|

(857,702 |

) |

|

- |

|

| Gain (loss) on sale of subsidiary |

|

- |

|

|

- |

|

|

3,171,275 |

|

|

(23,442,219 |

) |

|

- |

|

| Finance expense |

|

(1,338,151 |

) |

|

(305,147 |

) |

|

(319,644 |

) |

|

(871,941 |

) |

|

(111,918 |

) |

| Tax expense |

|

- |

|

|

- |

|

|

- |

|

|

(151,366 |

) |

|

- |

|

| Net income from continuing operations |

$ |

64,245,667 |

|

$ |

59,827,879 |

|

$ |

13,525,202 |

|

$ |

14,319,504 |

|

$ |

17,210,513 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA (1) |

$ |

80,576,106 |

|

$ |

69,759,555 |

|

$ |

20,744,028 |

|

$ |

20,378,042 |

|

$ |

19,799,023 |

|

| Adjusted EBITDA (1) |

$ |

77,605,266 |

|

$ |

52,306,163 |

|

$ |

29,273,518 |

|

$ |

29,122,054 |

|

$ |

13,692,779 |

|

(1) Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" below.

(2) Revaluation is calculated as the change in value (gain or loss) on the coin inventory. When coins are sold, the net difference between the proceeds and the carrying value of the digital currency (including the revaluation), is recorded as a gain (loss) on the sale of digital currencies

Revenue from Digital Currency Mining

For the three months ended December 31, 2021, revenue was $68.2 million, an increase of approximately 397% from the prior year. The increase was primarily due to an increase in cryptocurrency prices, the increased production of Bitcoin as a result of the Quebec and Atlantic facility acquisition from the installation of newly acquired miners for those facilities.

Gross Mining Margin and Gross Mining Margin %

For the three months ended December 31, 2021, HIVE's gross mining margin percentage was 90% against 78% for the prior year.

The Company's gross mining margin from digital currency mining is partially dependent on various external network factors including mining difficulty, the amount of digital currency rewards and fees it receives for mining, and the market price of the digital currencies at the time of mining.

The average monthly Ethereum market data from April 2021 to December 2021 was as follows:

| |

|

April |

|

|

May |

|

|

June |

|

|

July |

|

|

August |

|

|

September |

|

| Ethereum |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

| Average price |

$ |

2,298 |

|

$ |

3,141 |

|

$ |

2,336 |

|

$ |

2,131 |

|

$ |

3,098 |

|

$ |

3,337 |

|

| Average daily total miner revenue in ETH, i.e. fees plus newly minted coins |

|

24,047 |

|

|

23,012 |

|

|

15,813 |

|

|

16,334 |

|

|

20,527 |

|

|

24,039 |

|

| Average daily hashrate |

|

529,139 |

|

|

604,692 |

|

|

559,149 |

|

|

521,910 |

|

|

615,597 |

|

|

699,841 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

October |

|

|

November |

|

|

December |

|

|

Average |

|

|

|

|

|

|

|

| Ethereum |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

YTD F2022 |

|

|

|

|

|

|

|

| Average price |

$ |

3,819 |

|

$ |

4,434 |

|

$ |

4,045 |

|

$ |

3,183 |

|

|

|

|

|

|

|

| Average daily total miner revenue in ETH, i.e. fees plus newly minted coins |

|

24,286 |

|

|

26,985 |

|

|

22,575 |

|

|

21,947 |

|

|

|

|

|

|

|

| Average daily hashrate |

|

755,796 |

|

|

841,066 |

|

|

914,570 |

|

|

671,510 |

|

|

|

|

|

|

|

Sources: Coinmarketcap.com, Etherscan.io

The average monthly Ethereum market data from April 2020 to March 2021 was as follows:

| |

|

April |

|

|

May |

|

|

June |

|

|

July |

|

|

August |

|

|

September |

|

|

|

|

| Ethereum |

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

|

|

| Average price |

$ |

172 |

|

$ |

208 |

|

$ |

236 |

|

$ |

259 |

|

$ |

402 |

|

$ |

368 |

|

|

|

|

| Average daily total miner revenue in ETH, i.e. fees plus newly minted coins |

|

14,221 |

|

|

15,179 |

|

|

16,728 |

|

|

17,704 |

|

|

22,774 |

|

|

28,559 |

|

|

|

|

| Average daily hashrate |

|

176,715 |

|

|

181,900 |

|

|

185,854 |

|

|

191,035 |

|

|

208,026 |

|

|

244,137 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

October |

|

|

November |

|

|

December |

|

|

January |

|

|

February |

|

|

March |

|

|

Average |

|

| Ethereum |

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

F2021 |

|

| Average price |

$ |

376 |

|

$ |

486 |

|

$ |

622 |

|

$ |

1,203 |

|

$ |

1,700 |

|

$ |

1,737 |

|

$ |

648 |

|

| Average daily total miner revenue in ETH, i.e. fees plus newly minted coins |

|

18,430 |

|

|

17,843 |

|

|

19,130 |

|

|

22,350 |

|

|

28,672 |

|

|

25,570 |

|

|

20,597 |

|

| Average daily hashrate |

|

261,013 |

|

|

271,021 |

|

|

286,378 |

|

|

327,932 |

|

|

392,202 |

|

|

447,510 |

|

|

264,477 |

|

Sources: Coinmarketcap.com, Glassnode.com, Etherscan.io

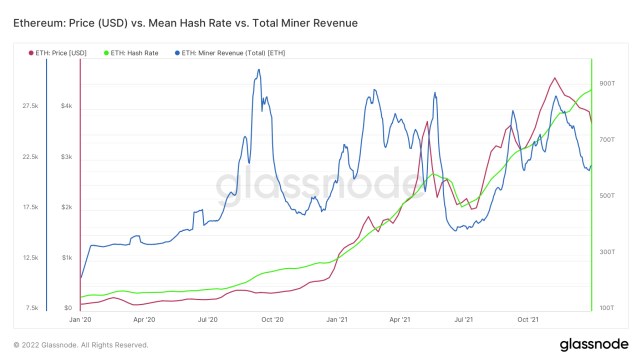

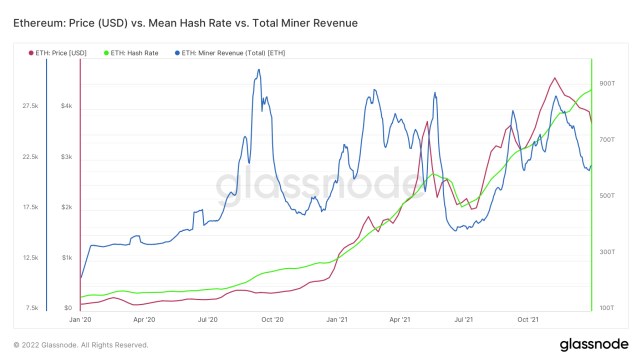

For your reference is an Ethereum price vs Ethereum miners' revenues in Ether block rewards and transaction fees vs network hash rate* chart for the 24-month period from January 2020 to December 2021:

Source: Glassnode.com

* Network Hash rate - The historical measure of the processing power of the Ethereum network.

The average monthly Bitcoin market data from April 2021 to December 2021 was as follows:

| |

|

April |

|

|

May |

|

|

June |

|

|

July |

|

|

August |

|

|

September |

|

| Bitcoin |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

| Average price |

$ |

57,207 |

|

$ |

46,443 |

|

$ |

35,845 |

|

$ |

34,445 |

|

$ |

45,709 |

|

$ |

45,940 |

|

| Average daily total miner revenue in BTC, i.e. fees plus newly minted coins |

|

994 |

|

|

978 |

|

|

776 |

|

|

907 |

|

|

990 |

|

|

947 |

|

| Average daily difficulty (in millions) |

|

23,317,563 |

|

|

23,162,908 |

|

|

20,408,893 |

|

|

14,471,974 |

|

|

15,565,176 |

|

|

18,410,092 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

October |

|

|

November |

|

|

December |

|

|

Average |

|

|

|

|

|

|

|

| Bitcoin |

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

YTD F2022 |

|

|

|

|

|

|

|

| Average price |

$ |

57,912 |

|

$ |

60,621 |

|

$ |

49,263 |

|

$ |

48,129 |

|

|

|

|

|

|

|

| Average daily total miner revenue in BTC, i.e. fees plus newly minted coins |

|

959 |

|

|

925 |

|

|

938 |

|

|

935 |

|

|

|

|

|

|

|

| Average daily difficulty (in millions) |

|

19,864,683 |

|

|

22,196,881 |

|

|

23,588,402 |

|

|

20,087,764 |

|

|

|

|

|

|

|

Sources: Coinmarketcap.com, Glassnode.com, Blockchain.com

The average monthly Bitcoin market data from April 2020 to March 2021 was as follows:

| |

|

April |

|

|

May |

|

|

June |

|

|

July |

|

|

August |

|

|

September |

|

|

|

|

| Bitcoin |

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

|

|

| Average price |

$ |

7,224 |

|

$ |

9,263 |

|

$ |

9,489 |

|

$ |

9,590 |

|

$ |

11,652 |

|

$ |

10,660 |

|

|

|

|

| Average daily total miner revenue in BTC, i.e. fees plus newly minted coins |

|

1,908 |

|

|

1,283 |

|

|

990 |

|

|

1,007 |

|

|

1,020 |

|

|

1,026 |

|

|

|

|

| Average daily difficulty (in millions) |

|

14,920,681 |

|

|

15,713,352 |

|

|

14,873,312 |

|

|

16,650,895 |

|

|

17,066,713 |

|

|

18,108,004 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

October |

|

|

November |

|

|

December |

|

|

January |

|

|

February |

|

|

March |

|

|

Average |

|

| Bitcoin |

|

2020 |

|

|

2020 |

|

|

2020 |

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

F2021 |

|

| Average price |

$ |

11,887 |

|

$ |

16,646 |

|

$ |

21,983 |

|

$ |

34,762 |

|

$ |

46,307 |

|

$ |

54,998 |

|

$ |

20,372 |

|

| Average daily total miner revenue in BTC, i.e. fees plus newly minted coins |

|

959 |

|

|

1,045 |

|

|

1,009 |

|

|

1,041 |

|

|

1,054 |

|

|

1,025 |

|

|

1,114 |

|

| Average daily difficulty (in millions) |

|

19,623,036 |

|

|

17,494,373 |

|

|

18,864,893 |

|

|

20,180,891 |

|

|

21,449,568 |

|

|

21,655,355 |

|

|

18,050,089 |

|

Sources: Coinmarketcap.com, Glassnode.com, Blockchain.com

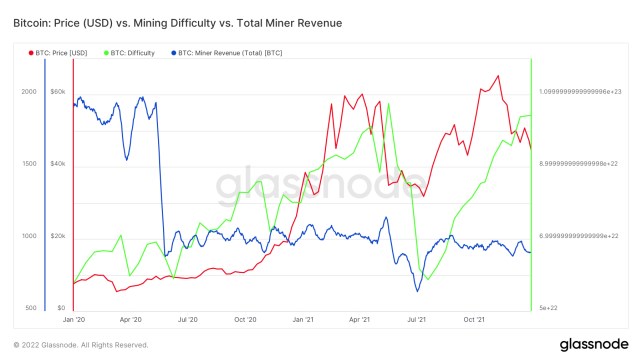

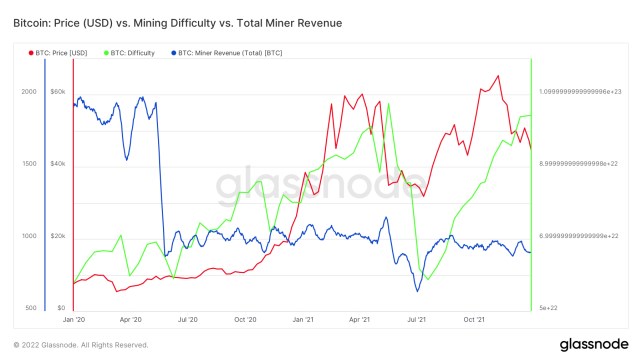

For your reference is a Bitcoin price vs Bitcoin miners' revenues (in Bitcoin block rewards and transaction fees) vs block difficulty* chart for the 24-month period from October 2019 to September 2021:

Source: Glassnode.com

* Block Difficulty - A relative measure of how difficult it is to find a new block. The difficulty is adjusted periodically as a function of how much hashing power has been deployed by the network of miners.

The block reward is how new bitcoin is "minted" or brought into the economy. These rewards, which started at 50 Bitcoin at inception of the network in 2009, halve every 210,000 blocks, with the halving that occurred on May 11, 2020 resulting in a reward of 6.25 Bitcoin per block vs 12.5 immediately prior to the halving.

Total Assets

Total assets increased to $487.2 million as at December 31, 2021 from $178.3 million at March 31, 2021, primarily due to the increase in data centre equipment by $85.5 million, increase in digital currencies by $110.6 million, increase in long term deposits by $50.1 million, increase in intangible asset by $14.0 million, an increase in investments by $25.7 million and an increase in cash and equivalents by $23.4 million.

The significant assets consisted of cash of $63.7 million, amounts receivable and prepaids of $10.0 million, investments of $26.7 million, digital currencies of $168.1 million, data centre equipment of $107.1 million, long term deposits of $95.6 million and right of use assets of $1.3 million.

Total Liabilities

Total liabilities increased to $55.1 million as at December 31, 2021 from $43.9 million as of March 31, 2021, primarily due to an additional mortgage balance of $7.6 million associated with the GPU Atlantic acquisition.

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED DECEMBER 31, 2021

During the three-month period ended December 31, 2021, the Company recorded net income before tax of $64.2 million (Q3 F2021 - $17.2 million).

Revenue:

- Revenue of $68.2 million from the mining of digital currencies, including 7,126 Ethereum and 697 Bitcoin; and

- Hosting revenue of $0.7 million earned from the hosting of ASIC miners for clients.

Operating expenses:

- Operating and maintenance costs were $6.5 million consisting of fees paid to suppliers including local electricity providers, as well as service provider Blockbase, and includes electricity, daily monitoring and maintenance and all other costs directly related to the maintenance and operation of the data centre equipment; and

- Depreciation for the quarter of $15.0 million related to the Company's data centre equipment and right of use assets.

Gain on sale of digital currencies:

- The Company sold digital currencies and received proceeds of $35.2 million during the three-month period ended December 31, 2021; the Company recognized a gain on sale of $7.9 million in relation to the sale of digital currencies with a cost base of $27.3 million.

Revaluation of digital currencies:

- The Company recorded a gain of $4.1 million related to the quarterly revaluation of its portfolio of digital currencies.

Other items:

- Share based compensation expense of $1.7 million in relation to the options and restricted share units vested in the period;

- Foreign exchange loss of $1.7 million; and

- Finance expense of $1.3 million.

RESULTS OF OPERATIONS FOR THE NINE MONTHS ENDED DECEMBER 31, 2021

During the nine-month period ended December 31, 2021, the Company recorded net income before tax of $137.6 million (F2021 - $28.5 million).

Revenue:

- Revenue of $158.0 million from the mining of digital currencies, including 25,516 Ethereum and 1,573 Bitcoin; and

- Hosting revenue of $3.4 million earned from the hosting of ASIC miners for clients.

Operating expenses:

- Operating and maintenance costs were $20.3 million consisting of fees paid to suppliers including local electricity providers, as well as service provider Blockbase, and includes electricity, daily monitoring and maintenance and all other costs directly related to the maintenance and operation of the data centre equipment; and

- Depreciation for the period of $31.5 million related to the Company's data centre equipment and right of use assets.

Gain on sale of digital currencies:

- The Company sold digital currencies and received proceeds of $78.3 million during the nine-month period ended December 31, 2021; the Company recognized a gain on sale of $16.7 million in relation to the sale of digital currencies with a cost base of $61.6 million.

Revaluation of digital currencies:

- The Company recorded a gain of $13.6 million related to the quarterly revaluation of its portfolio of digital currencies.

Other items:

- Share based compensation expense of $5.5 million in relation to the options and restricted share units vested in the period;

- Foreign exchange loss of $3.0 million; and

- Finance expense of $3.1 million.

RESULTS OF OPERATIONS FOR THE THREE MONTHS ENDED DECEMBER 31, 2020

During the three-month period ended December 31, 2020, the Company recorded net income before tax of $17.2 million (Q3 F2020 - $3.4 million).

Revenue:

- Revenue of $13.7 million from the mining of digital currencies, including 21,506 Ethereum and 165 Bitcoin.

Operating Expenses:

- Operating and maintenance costs were $3.1 million consisting of fees paid to suppliers including local electricity providers, as well as service provider Blockbase, and includes electricity, daily monitoring and maintenance and all other costs directly related to the maintenance and operation of the data centre equipment; and

- Depreciation for the quarter of $2.5 million related to the Company's data centre equipment and right of use assets.

Gain on sale of digital currencies:

- The Company continued to sell digital currencies and received proceeds of $16.5 million during the three-month period ended December 31, 2020; the Company recognized a gain on sale of $1.7 million in relation to the sale of digital currencies with a cost base of $14.8 million.

Revaluation of digital currencies:

- The Company recorded a gain of $6.3 million related to the quarterly revaluation of its portfolio of digital currencies.

Other items:

- Share based compensation expense of $209,726 in relation to the options and restricted share units vested in the period;

- Foreign exchange gain of $1.7 million; and

- Finance expense of $111,918.

RESULTS OF OPERATIONS FOR THE NINE MONTHS ENDED DECEMBER 31, 2020

During the nine-month period ended December 31, 2020, the Company recorded net income before tax of $28.5 million (F2020 loss - $2.6 million).

Revenue:

- Revenue of $33.3 million from the mining of digital currencies, including 79,882 Ethereum, 88,689 Ethereum Classic and 408 Bitcoin.

Operating Expenses:

- Operating and maintenance costs were $10.8 million consisting of fees paid to suppliers including local electricity providers, as well as service provider Blockbase, and includes electricity, daily monitoring and maintenance and all other costs directly related to the maintenance and operation of the data centre equipment; and

- Depreciation for the period of $5.9 million related to the Company's data centre equipment and right of use assets.

Gain on sale of digital currencies:

- The Company continued to sell digital currencies and received proceeds of $33.7 million during the nine-month period ended December 31, 2020; the Company recognized a gain on sale of $4.2 million in relation to the sale of digital currencies with a cost base of $29.6 million.

Revaluation of digital currencies:

- The Company recorded a gain of $8.6 million related to the quarterly revaluation of its portfolio of digital currencies.

Other items:

- Share based compensation expense of $868,947 in relation to the options and restricted share units vested in the period;

- Foreign Exchange gain of $1.7 million; and

- Finance expense of $342,283.

SUMMARY OF QUARTERLY RESULTS

The following tables summarize the Company's financial information for the last eight quarters in accordance with IFRS:

| |

|

|

|

|

|

|

|

Restated |

|

|

|

|

| |

|

Q3 2022 |

|

|

Q2 2022 |

|

|

Q1 2022 |

|

|

Q4 2021 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

68,183,402 |

|

|

52,619,094 |

|

|

37,239,767 |

|

|

33,420,171 |

|

| Net income |

|

64,245,667 |

|

|

59,827,879 |

|

|

13,525,202 |

|

|

14,319,504 |

|

| Basic income per share |

|

0.17 |

|

|

0.16 |

|

|

0.04 |

|

|

0.04 |

|

| Diluted income per share |

|

0.16 |

|

|

0.15 |

|

|

0.04 |

|

|

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q3 2021 |

|

|

Q2 2021 |

|

|

Q1 2021 |

|

|

Q4 2020 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Revenue |

|

13,707,879 |

|

|

12,989,592 |

|

|

6,580,282 |

|

|

5,251,311 |

|

| Net income |

|

17,210,513 |

|

|

9,210,973 |

|

|

1,798,694 |

|

|

921,201 |

|

| Basic and diluted income per share |

|

0.05 |

|

|

0.03 |

|

|

0.00 |

|

|

0.00 |

|

LIQUIDITY AND CAPITAL RESOURCES

The Company commenced earning revenue from digital currency mining in mid-September 2017, however it has limited history and no assurances that historical performance will be indicative of future performance. The Company is reliant on external financing to take advantage of growth opportunities and its ability to continue as a going concern is dependent on the Company's ability to efficiently mine and liquidate digital currencies.

As at December 31, 2021, the Company had a working capital balance of $253.1 million (March 31, 2021 - $97.7 million) and currently has sufficient cash to fund its current operating and administrative costs.

The net change in the Company's cash position as at December 31, 2021 as compared to March 31, 2021 was an increase of $23.4 million as a result of the following cash flows:

- Cash provided by operating activities of $52.6 million;

- Cash used in investing activities of $145.1 million related to the purchase of mining equipment, and deposits on mining equipment; and

- Cash provided by financing activities of $114.9 million due share offerings and the exercise of stock options, offset by lease and debt payments.

At December 31, 2021 and at the date of this report, the following securities were outstanding:

| Total Outstanding as of: |

December 31,

2021 |

Date of this

report: |

Exercise price

range: |

| Shares outstanding |

390,628,999 |

409,845,653 |

|

| Restricted Share Units |

667,500 |

667,500 |

|

| Stock options |

14,341,233 |

14,295,079 |

C$0.27 - C$5.07 |

| Warrants |

7,750,000 |

17,335,250 |

C$1.24 - C$6.00 |

RECONCILIATIONS OF NON-IFRS FINANCIAL PERFORMANCE MEASURES

The Company has presented certain non-IFRS measures in this document. The Company believes that these measures, while not a substitute for measures of performance prepared in accordance with IFRS, provide investors an improved ability to evaluate the underlying performance of the Company. These measures do not have any standardized meaning prescribed under IFRS, and therefore may not be comparable to other issuers.

Gross Mining Margin:

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, it is helpful to investors to use the gross mining margin to evaluate the Company's performance and ability to generate cash flows and service debt. The Gross mining margin is defined as the revenue from the mining of digital currencies less direct cash costs, being operating and maintenance costs. Accordingly, this measure does not have a standard meaning and is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

The following table provides illustration of the calculation of the gross mining margin for the last four quarters:

| Calculation of Gross Mining Margin: |

|

Q3 2022 |

|

|

Q2 2022 |

|

|

Q1 2022 |

|

|

Q4 2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue (1) |

$ |

68,183,402 |

|

$ |

52,619,094 |

|

$ |

37,239,767 |

|

$ |

33,420,171 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating and maintenance costs: |

|

(6,526,317 |

) |

|

(7,593,349 |

) |

|

(6,220,684 |

) |

|

(5,726,129 |

) |

| Gross Mining Margin |

$ |

61,657,085 |

|

$ |

45,025,745 |

|

$ |

31,019,083 |

|

$ |

27,694,042 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Mining Margin % |

|

90% |

|

|

86% |

|

|

83% |

|

|

83% |

|

(1) As presented on the statements of income (loss) and comprehensive income (loss).

EBITDA & Adjusted EBITDA

The Company uses EBITDA and Adjusted EBITDA as a metric that is useful for assessing its operating performance on a cash basis before the impact of non-cash items and acquisition related activities.

EBITDA is net income or loss from operations, as reported in profit and loss, before finance income and expense, tax and depreciation and amortization.

Adjusted EBITDA is EBITDA adjusted for removing other non-cash items, including share-based compensation, non-cash effect of the revaluation of digital currencies and one-time transactions.

The following table provides illustration of the calculation of EBITDA and Adjusted EBITDA for the last four quarters:

Calculation of EBITDA & Adjusted

EBITDA: |

|

Q3 F2022 |

|

|

Q2 F2022 |

|

|

Restated

Q1 F2022 |

|

|

Q4 F2021 |

|

|

Q3 F2021 |

|

| Net income |

|

64,245,667 |

|

|

59,827,879 |

|

|

13,525,202 |

|

|

14,319,504 |

|

|

17,210,513 |

|

| Add the impact of the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance expense |

|

1,338,151 |

|

|

305,147 |

|

|

319,644 |

|

|

871,941 |

|

|

111,918 |

|

| Depreciation |

|

14,992,288 |

|

|

9,626,529 |

|

|

6,899,182 |

|

|

5,035,231 |

|

|

2,476,592 |

|

| Tax expense |

|

- |

|

|

- |

|

|

- |

|

|

151,366 |

|

|

- |

|

| EBITDA |

|

80,576,106 |

|

|

69,759,556 |

|

|

20,744,028 |

|

|

20,378,042 |

|

|

19,799,023 |

|

| Revaluation of digital currencies |

|

(4,052,617 |

) |

|

(18,018,637 |

) |

|

8,492,727 |

|

|

(16,090,102 |

) |

|

(6,315,970 |

) |

| Revaluation of derivative liability |

|

(590,837 |

) |

|

(914,392 |

) |

|

885,612 |

|

|

857,702 |

|

|

- |

|

| Loss (gain) on sale of subsidiary |

|

- |

|

|

- |

|

|

(3,171,275 |

) |

|

23,442,219 |

|

|

- |

|

| Share-based compensation |

|

1,672,614 |

|

|

1,478,637 |

|

|

2,322,426 |

|

|

534,193 |

|

|

209,726 |

|

| Adjusted EBITDA |

|

77,605,266 |

|

|

52,305,164 |

|

|

29,273,518 |

|

|

29,122,054 |

|

|

13,692,779 |

|

(1) As presented on the statements of income (loss) and comprehensive income (loss).

RELATED PARTY TRANSACTIONS

The Company had the following related party transactions not otherwise disclosed in these consolidated financial statements:

(a) As at December 31, 2021, the Company had $12,634 (March 31, 2021 - $49,288) due to directors for the reimbursement of expenses included in accounts payable and accrued liabilities.

(b) As at December 31, 2021, the Company had $68,585 (March 31, 2021 - $2,938) due to a company controlled by a director of the Company included in accounts payable and accrued liabilities. For the period ended December 31, 2021, the Company paid $175,272 (December 31, 2020 - $nil) to this company for marketing services.

Key Management Compensation

Key management personnel include those persons having authority and responsibility for planning, directing and controlling the activities of the Company as a whole. The Company has determined that key management personnel consist of members of the Company's Board of Directors and corporate officers.

For the period ended December 31, 2021, key management compensation includes salaries and wages paid to key management personnel and directors of $471,757 (December 31, 2020 - $577,728) and share-based payments of $2,827,181 (December 31, 2020 - $786,545).

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The Company has prepared the consolidated financial statements in accordance with IFRS. Significant accounting policies are described in Note 5 of the Company's financial statements as at and for the year ended March 31, 2021.

The preparation of financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. Actual outcomes could differ from these estimates.

The Company's significant judgements are detailed in Note 3 to the condensed interim consolidated financial statements for the period ended December 31, 2021, and include: functional currency, classification of digital currencies as current assets, asset acquisitions, and revenue from digital currency mining.

The Company's significant estimates are detailed in Note 4 to the condensed interim consolidated financial statements for the period ended December 31, 2021 and include: determination of asset fair values and allocation of purchase consideration, carrying value of assets, depreciation, deferred taxes, digital currency valuation and share-based compensation.

FINANCIAL INSTRUMENTS AND FINANCIAL RISK MANAGEMENT

The Company is exposed, in varying degrees, to a variety of financial related risks. The fair value of the Company's financial instruments, including cash, amounts receivable and accounts payable and accrued liabilities approximates their carrying value due to their short-term nature. The type of risk exposure and the way in which such exposure is managed is provided in Note 22 to the condensed interim consolidated financial statements for the period ended December 31, 2021.

DIGITAL CURRENCY AND RISK MANAGEMENT

Digital currencies are measured using level two fair values, determined by taking the rate from quoted price from the exchanges which the Company most frequently uses, with no adjustment.

Digital currency prices are affected by various forces including global supply and demand, interest rates, exchange rates, inflation or deflation and the global political and economic conditions. The profitability of the Company is directly related to the current and future market price of coins; in addition, the Company may not be able liquidate its inventory of digital currency at its desired price if required. A decline in the market prices for coins could negatively impact the Company's future operations. The Company has not hedged the conversion of any of its coin sales or future mining of digital currencies.

Digital currencies have a limited history and the fair value historically has been very volatile. Historical performance of digital currencies is not indicative of their future price performance. The Company's digital currencies currently consist of Ethereum, Ethereum Classic, and Bitcoin. The table below shows the impact of the 25% variance in the price of each of these digital currencies on the Company's earnings before tax, based on their closing prices at December 31, 2021.

| |

|

Impact of 25% variance in price |

|

| Ethereum |

$ |

21,228,049 |

|

| Ethereum Classic |

|

8,054 |

|

| Bitcoin |

|

20,786,754 |

|

RISKS AND UNCERTAINTIES

The Company faces several risks that are related to both the general cryptocurrency business as well as the Company's business model. The risk factors described below summarize and supplement the risk factors contained in the Company's continuous disclosure filings, and this MD&A, all of which are available on SEDAR at www.sedar.com, and should be read in conjunction with the more detailed risk factors outlined therein.

The Company is at risk due to the volatility/momentum pricing of any underlying digital currency mined by the Company and held in inventory - wide fluctuations in price, speculation, negative media coverage (highlighting for example, regulatory actions and lawsuits against industry participants) and downward pricing may adversely affect investor confidence, and ultimately, the value of the Company's digital currency inventory which may have a material adverse affect on the Company, including an adverse effect on the Company's profitability from current operations. The Company is also at risk due to the volatility of network hashrates (and lag between network hashrate and underlying cryptocurrency pricing), which may have an adverse effect on the Company's costs of mining. The Company is also at risk due to volatility in energy (electricity) pricing, a key factor in the Company's profitability of its mining operations, which is subject to, among other things, government regulation and natural occurrences which affect pricing.

The Company holds it digital currencies in cold storage solutions not connected to the internet. The Company may not be able to liquidate its digital currency inventory at economic values, or at all. Due to the infancy of the cryptocurrency industry, the Company may have restricted access to services available to more mainstream businesses (for example, banking services). The general acceptance and use of digital currencies may never gain widespread or significant acceptance, which may materially adversely affect the value of the Company's digital currency inventory and long-term prospects of current operations.

An additional risk to the Company arises because of the potential shift from the use of a proof of work validation model by the Ethereum network to a proof of stake model. The current proposal for Ethereum's shift to proof of stake has several unknown variables, including uncertainty over timing, execution and ultimate adoption; and there is not yet a definitive plan that is established and approved. As a result of these uncertainties, the Company cannot estimate the impact of a potential change to proof of stake on operations but may see its competitive advantages decrease over time; this may have a material adverse effect on the Company.

The Company also faces risk relating to the impact of the timing and exchange rate fluctuations resulting from the remittance and receipt back of value added taxes where due, as well as risks related to the imposition and quantum of value added taxes in jurisdictions where the Company operates. Due to the newness of the industry, there exists the possibility that the tax treatment of digital currencies becomes less favourable, which could have a material adverse effect on the Company.

The Company may be required to sell its digital currency inventory in order to pay for its ongoing expenses (and in particular, expenses to maintain the Company's facilities), and such sales may not be available at economic values.

Given the novelty of digital currency mining and associated businesses, insurance over crypto assets is generally not available, or uneconomical for the Company to obtain which leads to the risk of inadequate insurance coverage. The occurrence of an event may have a material adverse affect on the Company. Additionally, while the Company takes measure to mitigate against losses of this nature, the Company's mined digital currency may be subject to loss, theft or restriction on access, including loss due to cybercrime (hacking).

In terms of regulatory risks, governments may take action in the future that prohibit or restrict the right to acquire, own, hold, sell, use or trade digital currencies or exchange digital currencies for fiat currency. Such restrictions, while impossible to predict, could result in the Company liquidating its digital currencies inventory at unfavorable prices which may have a material adverse affect on the Company. The Company has liquidated a portion of coins, partially to mitigate against the aforementioned risk.

The Company also has risks associated with the continually evolving tax and regulatory environments in the countries we operate, as described more fully under the heading "Industry subject to evolving regulatory and tax landscape" in the Outlook section above. Any final decisions by tax or regulatory agencies with jurisdiction over the Company may have a material adverse impact on the Company's financial position and operations

The Company cautions that current global uncertainty with respect to the spread of the COVID-19 virus and its effect on the broader global economy may have a significant negative effect on the Company. In particular, as a result of the uncertainty surrounding the impact of COVID-19 on global supply chains, including increased shipping costs and delays in obtaining equipment from China, the Company faces risks that the Company's program to update and expand the Company's GPU equipment will not complete as currently anticipated, which may cause material adverse effects on the Company's operations and results. Further, while the precise impact of the COVID-19 virus on the Company remain unknown, rapid spread of the COVID-19 virus may have a material adverse effect on global economic activity and can result in volatility and disruption to global supply chains, operations, mobility of people and the financial markets, which could affect interest rates, credit ratings, credit risk, inflation, business, financial conditions, results of operations and other factors relevant to the Company.