As filed with the Securities and Exchange Commission on March 16, 2018

File No. 000-55885

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

PHAROS CAPITAL BDC, INC.

(Exact name of registrant as specified in charter)

| Maryland | 82-3059018 | |

|

(State or other jurisdiction of incorporation or registration) |

(I.R.S. Employer Identification No.) | |

|

3889 Maple Avenue Suite 400 Dallas, TX |

75219 | |

| (Address of principal executive offices) | (Zip Code) | |

(214) 855 0194

(Registrant’s telephone number, including area code)

with copies to:

Steven B. Boehm

Eversheds Sutherland (US) LLP

700 Sixth Street, NW

Washington, DC 20001

(202) 383-0100

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

i

Pharos Capital BDC, Inc. is filing this registration statement on Form 10 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “1934 Act”), on a voluntary basis in order to permit it to file an election to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and to provide current public information to the investment community and to comply with applicable requirements in the event of the future quotation or listing of its securities on a national securities exchange or other public trading market.

In this Registration Statement, except where the context suggests otherwise:

| ● | the terms “we,” “us,” “our,” and “Company,” refer to Pharos Capital BDC, Inc.; | ||

|

● |

the term “Adviser” refers to Pharos Capital Group, LLC, our investment adviser; and | ||

| ● | the term “Administrator” refers to U.S. Bancorp Fund Services, LLC, our administrator. |

The Company is an emerging growth company as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and the Company will take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “1933 Act”).

This Registration Statement registers shares of the Company’s common stock (“Shares,” each a “Share”), par value $0.01 per Share under the 1934 Act; however:

| ● | the Company’s Shares may not be sold without the written consent of the Adviser; |

| ● | the Shares are not currently listed on an exchange, and it is uncertain whether they will be listed or whether a secondary market will develop; |

| ● | repurchases of Shares by the Company, if any, are expected to be limited; and |

| ● | an investment in the Company may not be suitable for investors who may need the money they invest in a specified time frame. |

Once this Registration Statement has been deemed effective, we will be subject to the requirements of Section 13(a) of the 1934 Act, including the rules and regulations promulgated thereunder, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we will be required to comply with all other obligations of the 1934 Act applicable to issuers filing registration statements pursuant to Section 12(g) of the 1934 Act.

We intend to elect to be regulated as a BDC under the 1940 Act and, upon doing so, we will become subject to the 1940 Act requirements applicable to BDCs. We are also subject to the proxy rules in Section 14 of the 1934 Act, and our directors, officers, and principal stockholders are subject to the reporting requirements of Sections 13 and 16 of the 1934 Act. The SEC maintains an Internet web site (http://www.sec.gov) that contains these reports.

ii

This Registration Statement contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, our current and prospective portfolio investments, our industry, our beliefs and opinions, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

| ● | an economic downturn could impair our portfolio companies’ ability to continue to operate, which could lead to the loss of some or all of our investments in such portfolio companies; |

| ● | such an economic downturn could disproportionately impact the companies which we intend to target for investment, potentially causing us to experience a decrease in investment opportunities and diminished demand for capital from these companies; |

| ● | such an economic downturn could also impact availability and pricing of our financing; |

| ● | a contraction of available credit and/or an inability to access the equity markets could impair our lending and investment activities; |

| ● | interest rate volatility could adversely affect our results, particularly if we elect to use leverage as part of our investment strategy; |

| ● | currency fluctuations could adversely affect the results of our investments in foreign companies, particularly to the extent that we receive payments denominated in foreign currency rather than U.S. dollars; |

| ● | our future operating results; |

| ● | our business prospects and the prospects of our portfolio companies; |

| ● | our contractual arrangements and relationships with third parties; |

| ● | the ability of our portfolio companies to achieve their objectives; |

| ● | competition with other entities and our affiliates for investment opportunities; |

| ● | the speculative and illiquid nature of our investments; |

| ● | the use of borrowed money to finance a portion of our investments as well as any estimates regarding potential use of leverage; |

| ● | the adequacy of our financing sources and working capital; |

| ● | the loss of key personnel; |

| ● | the timing of cash flows, if any, from the operations of our portfolio companies; |

| ● | the ability of the Adviser to locate suitable investments for us and to monitor and administer our investments; |

| ● | the ability of the Adviser to attract and retain highly talented professionals; |

| ● | our ability to qualify and maintain our qualification as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), and as a BDC; |

| ● | the effect of legal, tax and regulatory changes; and |

| ● | other risks, uncertainties and other factors we identify under “Item 1A. Risk Factors” and elsewhere in this Registration Statement. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Registration Statement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. These forward-looking statements apply only as of the date of this Registration Statement. Moreover, we assume no duty and do not undertake to update the forward-looking statements. Because we are an investment company, the forward-looking statements and projections contained in this Registration Statement are excluded from the safe harbor protection provided by Section 21E of the 1934 Act.

iii

(a) General Development of Business

We were formed on October 3, 2017 as a corporation under the laws of the State of Maryland. We were organized primarily to generate attractive risk-adjusted returns by investing in select high-growth companies well positioned in underserved communities with limited access to capital. We intend to execute this strategy by being a value-added partner with deep operating expertise in healthcare and seeking companies that improve patient outcomes, lower the total cost of healthcare, and/or expand access to care. We will invest primarily in mezzanine loans and convertible debt securities.

The Private Offering & Liquidity Options

We expect to conduct a private offering (collectively the “Private Offering”) of our Shares through multiple closings to investors in reliance on exemptions from the registration requirements of the 1933 Act. At the closing of any Private Offering, each investor will make a capital commitment (a “Capital Commitment”) to purchase Shares pursuant to a subscription agreement entered into with us. The initial closing (the “Initial Closing”) of the Private Offering is expected to occur in 2018. Investors will be required to fund drawdowns to purchase Shares up to the amount of their respective Capital Commitments on an as-needed basis each time we deliver a notice to the investors. Shares will be issued at the most recent quarterly net asset value per share, subject to adjustment as required by Section 23 of the 1940 Act. Any adjustments would take into account a good faith determination, by the Board or an authorized committee thereof, of changes to net asset value within 48 hours of the sale to assure compliance with Section 23(b) of the 1940 Act. Additionally, the Board is authorized to authorize the Company to issue shares of preferred stock in one or more classes or series without shareholder approval.

We anticipate commencing our loan origination and investment activities as soon as practicable following the initial drawdown from investors in the Private Offering (the “Initial Drawdown”) which is expected to occur in 2018. Prior to an initial public offering (“IPO”) the Adviser may, in its sole discretion, permit one or more additional closings (“Subsequent Closings”) as additional Capital Commitments are obtained (the conclusion of all Subsequent Closings, if any, the “Final Closing” and the Initial Closing, each Subsequent Closing and the Final Closing, each a “Closing”). We do not intend to impose a time limit for holding subsequent closings. See “Item 1(c). Description of Business — The Private Offering.”

Below is an example that illustrates the calculations for purchase of shares at a drawdown subsequent to the Initial Drawdown:

| ● | On the Initial Closing Date, Investor A makes a capital commitment of $1,000,000. |

| ● | 50% of Investor A’s capital commitment ($500,000) was called in the Initial Drawdown. |

| ● | At the time of the Initial Drawdown, the net asset value per share was $10. |

| ● | The remaining 50% of Investor A’s capital commitment ($500,000) was called in a subsequent drawdown. |

| Initial Drawdown | Purchase Price Per Share | Shares | ||||||||||

| Investor A | $ | 500,000 | $ | 10.00 | 50,000 | |||||||

The following table illustrates the effect of changes in the Company’s net asset value (“NAV”) per shares on the number of shares purchased in a subsequent drawdown, depending on whether the assumed net asset value per share was higher or lower than in the Initial Drawdown.

The calculations in the table below are hypothetical, and actual returns may be higher or lower than those appearing in the table below.

| Initial NAV | Hypothetical NAV at Subsequent Drawdown | |||||||||||||||||||

| $ | 10.00 | $ | 15.00 | $ | 20.00 | $ | 25.00 | $ | 30.00 | |||||||||||

| Shares Purchased | 50,000 | 33,333 | 25,000 | 20,000 | 16,666 | |||||||||||||||

| Total Shares Owned | 100,000 | 83,333 | 75,000 | 70,000 | 66,666 | |||||||||||||||

We may ultimately pursue an IPO or other liquidity option to create an exit option and value opportunity for shareholders. If we have not consummated an IPO or other liquidity option by the six-year anniversary of the Initial Closing, subject to extension for two additional one-year periods, in the sole discretion of our board of directors (the “Board”), the Board may determine to offer a share repurchase plan. Any Share repurchase will include numerous restrictions that limit an Investor’s ability to sell its Shares. Additionally, if we have not consummated an IPO or other liquidity option by the ten-year anniversary of the Initial Closing, subject to extension for two additional one-year periods, in the sole discretion of the Board, we may apply for exemptive relief from the SEC which, if granted, would provide a liquidity option to allow shareholders to exchange their Shares for shares of common stock in a newly formed entity (the “New BDC”) that will elect to be treated as a BDC under the 1940 Act. The New BDC will effectuate an orderly wind down. There can be no assurance that we will be able to obtain such exemptive relief from the SEC. See “Item 1(c). Description of Business – Repurchase Offers” and “Item 1(c). Description of Business – Spin-Off Transaction.” None of the liquidity options described in this paragraph are guaranteed to occur.

| 1 |

BDC Election

We intend to elect to be regulated as a BDC under the 1940 Act. We intend to elect to be treated, and intend to qualify annually thereafter, as a regulated investment company (a “RIC”) under Subchapter M of the Code for U.S. federal income tax purposes. As a BDC and a RIC, we will be required to comply with certain regulatory requirements. See “Item 1(c). Description of Business — Regulation as a Business Development Company” and “Item 1(c). Description of Business — Certain U.S. Federal Income Tax Considerations.”

(b) Financial Information about Industry Segments

Our operations comprise only a single reportable segment.

(c) Description of Business

The Company — Pharos Capital BDC, Inc.

Pharos Capital BDC, Inc. is a newly formed Maryland corporation organized primarily to generate attractive risk-adjusted returns by investing in select high-growth companies well positioned in underserved communities with limited access to capital. The BDC will have a core focus on the healthcare sector and will generally seek to maximize its returns by providing customized financing solutions to growing middle-market companies for internal growth, acquisitions, third party buyouts, and recapitalizations in the healthcare sector. Within the healthcare sector, we plan to target the following sub-groups: (i) healthcare providers; (ii) managed care services; (iii) behavioral health; (iv) hospice, palliative, and post-acute care; (v) wellness, disease, and/or population management; (vi) diagnostic technology and services; (vii) medical device companies with FDA-approved technology; (viii) healthcare data analytics and outcomes measurement; (ix) telemedicine; (x) value-based care; (xi) physical therapy; (xii) primary care; (xiii) oncology; and (xiv) other companies serving the healthcare sector. We will invest primarily in mezzanine loans and convertible debt securities, which are debt obligations convertible at a stated exchange rate or formula into common stock or other equity securities. We expect that the companies in our investment portfolio may be highly leveraged, and, we expect that in many cases, our investments in these companies will not be rated by any rating agency. These investments are highly speculative, and we expect that if these investments were rated, they would likely receive a rating of below investment grade, which is often referred to as “junk”. There are no specific maturity or credit rating parameters with respect to the fixed income securities in which the Company may invest.

Our investment objective is to generate current income, to add value beyond the capital invested, and to pursue investments in partnership with experienced management teams. To seek to achieve our investment objective, we will leverage our Adviser’s investment team’s extensive network of relationships with other sophisticated institutions to source, evaluate and, as appropriate, partner with on transactions (i.e. co-invest with non-affiliates). There are no assurances that we will achieve our investment objective. We seek to make investments in healthcare companies that improve the patient experience of care, reduce the total cost of healthcare, and possess attractive growth prospects either internally through core revenue growth or externally through acquisitions. We tailor the deal structure of each investment to meet the risk and return objectives of the Company while striking the appropriate balance with the needs of the entrepreneur and existing shareholder. We target companies that have defensible market positions, sustainable competitive advantage, and unique attributes of their business models.

We intend to primarily provide customized financing solutions to U.S. middle-market healthcare companies as a part of event-driven transactions such as leveraged buyouts, refinancings, recapitalizations, acquisitions, and growth capital. We define “middle-market companies” to generally mean companies with earnings before interest expense, income tax expense, depreciation and amortization, or “EBITDA,” of $2 million to $20 million and/or annual revenue of $10 million to $100 million at the time of investment. We may on occasion invest in smaller or larger companies if an attractive opportunity presents itself, especially when there are dislocations in the capital markets, including the high yield and large syndicated loan markets. We expect to invest between $5 and $50 million per portfolio company. From time to time, we may make contingent commitments to portfolio companies, but we will at all times have sufficient assets that, in our reasonable belief, will provide cover to allow us to satisfy all such commitments.

We may also invest a portion of our portfolio opportunistically in other types of investments, which will not be our primary focus, but will be intended to enhance our returns to holders of our common stock. These investments may include, but are not limited to, large U.S. companies, foreign companies, structured products or private equity. We will not invest more than 20% of our total assets in companies whose principal place of business is outside the United States, and we will not invest in emerging markets.

We generally intend to distribute, out of assets legally available for distribution, substantially all of our available earnings, on a quarterly basis, as determined by our Board in its discretion.

From time to time, we may be exposed to significant market risk. See “Item 1.A.Risk Factors —Risks Related to our Business and Structure —Risks Related to Changes in Interest Rates.” Our investment portfolio may be concentrated. We are subject to certain investment restrictions with respect to leverage and type of investments. We or our affiliates may engage in certain origination activities and receive attendant structuring or similar fees.

As a BDC, generally at least 70% of our assets must consist of investments in U.S. operating companies, as set forth in Section 55(a) of the 1940 Act, as described herein.

The Adviser — Pharos Capital Group, LLC

Pharos Capital Group, LLC serves as our investment adviser pursuant to an investment advisory agreement (the “Investment Advisory Agreement”) that we entered into with our Adviser prior to the effectiveness of this Registration Statement. Subject to the overall supervision of the Board, the Adviser will be responsible for managing our business and activities, including sourcing investment opportunities, conducting research, performing diligence on potential investments, structuring our investments, and monitoring our portfolio companies on an ongoing basis through a team of investment professionals. The founding partners of the Adviser are Kneeland Youngblood and D. Robert Crants III. The Adviser is also led by Jim Phillips, Joel Goldberg, and Anna Kovalkova. All investment decisions require the unanimous approval of the investment committee, which is currently comprised of Kneeland Youngblood, D. Robert Crants III, Jim Phillips, Joel Goldberg, and Anna Kovalkova (the “Investment Committee”).

| 2 |

The Board of Directors

Overall responsibility for the Company’s operations rests with the Board of Directors (the “Board”). The Board is responsible for overseeing the Adviser and other service providers in our operations in accordance with the provisions of the 1940 Act, applicable provisions of state and other laws and our amended and restated charter, which we refer to as our charter. The Board is currently composed of five members, three of whom are not “interested persons” of the Company or the Adviser as defined in the 1940 Act. Pursuant to our charter, the directors are divided into three classes. Directors of each class will hold office for terms ending at the third annual meeting of our shareholders after their election and when their respective successors are elected and qualify. However, the initial members of the three classes of directors have initial terms ending at the first, second and third annual meeting of our shareholders after the Initial Closing, respectively.

Investment Advisory Agreement

The description below of the Investment Advisory Agreement is only a summary and is not necessarily complete. The description set forth below is qualified in its entirety by reference to the Investment Advisory Agreement attached as an exhibit to this Registration Statement.

The Adviser provides management services to us pursuant to the Investment Advisory Agreement. Under the terms of the Investment Advisory Agreement, the Adviser is responsible for the following:

| ● | managing our assets in accordance with our investment objective, policies and restrictions; |

| ● | determining the composition of our portfolio, the nature and timing of the changes to our portfolio and the manner of implementing such changes; |

| ● | making investment decisions for us, including negotiating the terms of investments in, and dispositions of, portfolio securities and other instruments on our behalf; |

| ● | monitoring our investments; |

| ● | performing due diligence on prospective portfolio companies; |

| ● | exercising voting rights in respect of portfolio securities and other investments for us; |

| ● | serving on, and exercising observer rights for, boards of directors and similar committees of our portfolio companies; and |

| ● | providing us with such other investment advisory and related services as we may, from time to time, reasonably require for the investment of capital. |

The Adviser’s services under the Investment Advisory Agreement are not exclusive, and it is free to furnish similar services to other entities so long as its services to us are not impaired.

Term

The Investment Advisory Agreement was approved by the Board prior to the effectiveness of this Registration Statement. Unless earlier terminated as described below, the Investment Advisory Agreement will remain in effect for a period of two years from the date it first becomes effective and will remain in effect from year-to-year thereafter if approved annually by a majority of the Board or by the holders of a majority of our outstanding voting securities and, in each case, a majority of the independent directors.

The Investment Advisory Agreement will automatically terminate in the event of its “assignment” within the meaning of the 1940 Act and related SEC guidance and interpretations. In accordance with the 1940 Act, without payment of any penalty, we may terminate the Investment Advisory Agreement with the Adviser upon 60 days’ written notice. In addition, without payment of any penalty, the Adviser may generally terminate the Investment Advisory Agreement upon 60 days’ written notice and, in certain circumstances, the Adviser may only be able to terminate the Investment Advisory Agreement upon 120 days’ written notice.

| 3 |

Removal of Adviser

The Adviser may be removed by the Board or by the affirmative vote of a Majority of the Outstanding Shares. “Majority of the Outstanding Shares” means the lesser of (1) 67% or more of the outstanding Shares present at a meeting, if the holders of more than 50% of the outstanding Shares are present or represented by proxy or (2) a majority of outstanding Shares.

Compensation of Adviser

Investment Advisory Agreement

Pursuant to the Investment Advisory Agreement we have entered into with the Adviser, we will pay the Adviser a fee for investment advisory and management services consisting of two components — a base management fee and an incentive fee. The cost of both the base management fee and the incentive fee will ultimately be borne by our shareholders.

Base Management Fee

The base management fee is payable at the beginning of each calendar quarter and calculated at an annual rate of 1.50% of the sum of all assets as of the end of the most recently completed calendar quarter, including those that may be purchased through the use of leverage, and of all uncalled capital committed to us by investors as of the end of the most recently completed calendar quarter. Uninvested cash will be included in gross assets for the purpose of calculating the base management fee. The base management fee for any partial month or quarter will be appropriately prorated.

Incentive Fee

The incentive fee, which provides the Adviser with a share of the income that the Adviser generates for us, will consist of an investment-income component and a capital-gains component, which are largely independent of each other, with the result that one component may be payable even if the other is not.

Investment Income Component: Under the investment income component, we will pay the Adviser each quarter an incentive fee with respect to our pre-incentive fee net investment income. The investment income component will be calculated and payable quarterly in arrears based on the pre-incentive fee net investment income for the immediately preceding fiscal quarter. Payments based on pre-incentive fee net investment income will be based on the pre-incentive fee net investment income earned for the quarter. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence, managerial and consulting fees or other fees we receive from portfolio companies) we accrue during the fiscal quarter, minus our operating expenses for the quarter, including the base management fee, expenses payable under the administration agreement (the “Administration Agreement”) entered into between us and U.S. Bancorp Fund Services, LLC (the “Administrator”), and any interest expense and dividends paid on any issued and outstanding preferred stock, but excluding the incentive fee; provided however, that pre-incentive fee net investment income shall be reduced by multiplying the pre-incentive fee net investment income earned for the quarter by a fraction, the numerator of which is our total assets (as of quarter-end) minus average daily borrowings for the immediately preceding fiscal quarter, and the denominator of which is our total assets (as of quarter-end) for the immediately preceding fiscal quarter. Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with pay in kind interest and zero coupon securities), accrued income that we have not yet received in cash; provided, however, that the portion of the incentive fee attributable to deferred interest features shall be paid, only if and to the extent received in cash, and any accrual thereof shall be reversed if and to the extent such interest is reversed in connection with any write off or similar treatment of the investment giving rise to any deferred interest accrual, applied in each case in the order such interest was accrued. Such subsequent payments in respect of previously accrued income shall not reduce the amounts payable for any quarter pursuant to the calculation of the investment income component described above. Therefore, the Adviser intends only to collect an incentive fee on PIK interest that is in fact received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

| 4 |

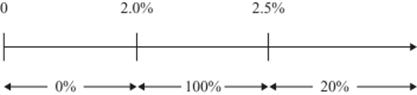

Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets (defined as the amount of funded capital commitments from investors) at the end of the immediately preceding fiscal quarter, will be compared to a “hurdle rate” of 2.0% per quarter (8.0% annualized). The Company shall pay the Adviser an incentive fee with respect to the Company’s pre-incentive fee net investment income in each calendar quarter as follows: (1) no incentive fee in any calendar quarter in which the Company’s pre-incentive fee net investment income does not exceed the hurdle rate of 2.0%; (2) 100% of the Company’s pre-incentive fee net investment income with respect to that portion of such pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 2.5% in any calendar quarter (10.0% annualized) (the portion of the Company’s pre-incentive fee net investment income that exceeds the hurdle but is less than 2.5% is referred to as the “catch-up”; the “catch-up” is meant to provide the Adviser with 20.0% of the Company’s pre-incentive fee net investment income as if a hurdle did not apply if the Company’s pre-incentive fee net investment income exceeds 2.5% in any calendar quarter); and (3) 20.0% of the amount of the Company’s pre-incentive fee net investment income, if any, that exceeds 2.5% in any calendar quarter (10.0% annualized) payable to the Adviser (once the hurdle is reached and the catch-up is achieved, 20.0% of all pre-incentive fee net investment income thereafter is allocated to the Adviser). These calculations shall be appropriately pro-rated for any period of less than three months.

The following is a graphical representation of the calculation of the income-related portion of the incentive fee:

Pre-incentive fee net investment income (expressed as a percentage of the value of net assets)

Capital Gains Component: Under the capital gains component of the incentive fee, we will pay the Adviser at the end of each calendar year 20.0% of our aggregate cumulative realized capital gains from the date of our election to be regulated as a business development company through the end of that year, computed net of all aggregate cumulative realized capital losses and aggregate cumulative unrealized depreciation through the end of such year, less the aggregate amount of any previously paid capital gain incentive fees. For the foregoing purpose, our “aggregate cumulative realized capital gains” will not include any unrealized appreciation. We will accrue an incentive fee for accounting purposes taking into account any unrealized appreciation in accordance with GAAP. The capital gains component of the incentive fee is not subject to any minimum return to shareholders. If that amount is negative, then no capital gains incentive fee will be payable for such year. If the Investment Advisory Agreement is terminated as of a date that is not a calendar year end, the termination date will be treated as though it were a calendar year end for purposes of calculating and paying the capital gains incentive fee.

Limitations of Liability and Indemnification

The Adviser and its affiliates (each, an “Indemnitee”) will not be liable to us for (i) mistakes of judgment or for action or inaction that such person reasonably believed to be in our best interests absent such Indemnitee’s gross negligence, knowing and willful misconduct, or fraud or (ii) losses or expenses due to mistakes of judgment, action or inaction, or the negligence, dishonesty or bad faith of any broker or other agent of the Company who is not an affiliate of such Indemnitee, provided that such person was selected, engaged or retained without gross negligence, willful misconduct, or fraud.

We will indemnify each Indemnitee against any liabilities relating to our offering of our common stock or our business, operation, administration or termination, if the Indemnitee acted in good faith and in a manner it believed to be in, or not opposed to, our interest and except to the extent arising out of the Indemnitee’s gross negligence, fraud or knowing and willful misconduct. We may pay the expenses incurred by the Indemnitee in defending an actual or threatened civil or criminal action in advance of the final disposition of such action, provided the Indemnitee agrees to repay those expenses if found by adjudication not to be entitled to indemnification.

| 5 |

Board Approval of the Investment Advisory Agreement

The Board will hold an in-person meeting to consider and approve the Investment Advisory Agreement and related matters. The Board will be provided the information it requires to consider the Investment Advisory Agreement, including: (a) the nature, quality and extent of the advisory and other services to be provided to us by the Adviser; (b) comparative data with respect to advisory fees or similar expenses paid by other BDCs with similar investment objectives; (c) our projected operating expenses and expense ratio compared to BDCs with similar investment objectives; (d) any existing and potential sources of indirect income to the Adviser from its relationship with us and the profitability of that relationship; (e) information about the services to be performed and the personnel performing such services under the Investment Advisory Agreement; (f) the organizational capability and financial condition of the Adviser and its affiliates; (g) the Adviser’s practices regarding the selection and compensation of brokers that may execute our portfolio transactions and the brokers’ provision of brokerage and research services to the Adviser; and (h) the possibility of obtaining similar services from other third-party service providers or through an internally managed structure.

The Board, including a majority of independent directors, will oversee and monitor the investment performance and, beginning with the second anniversary of the effective date of the Investment Advisory Agreement, will annually review the compensation we pay to the Adviser to determine that the provisions of the Investment Advisory Agreement are carried out.

Administration Agreement

The description below of the Administration Agreement is only a summary and is not necessarily complete. The description set forth below is qualified in its entirety by reference to the Administration Agreement attached as an exhibit to this Registration Statement.

Under the terms of the Administration Agreement, the Administrator will perform, or oversee the performance of, required administrative services, which includes maintaining financial records, preparing reports to shareholders and reports filed with the SEC, and managing the payment of expenses and the performance of administrative and professional services rendered by others. We will reimburse the Administrator for services performed for us pursuant to the terms of the Administration Agreement. In addition, pursuant to the terms of the Administration Agreement, the Administrator may delegate its obligations under the Administration Agreement to an affiliate or to a third party and we will reimburse the Administrator for any services performed for us by such affiliate or third party.

Our Board approves the Administration Agreement on an annual basis. In connection with such approval the Board, including a majority of independent directors, reviews the compensation we pay to the Administrator to determine that the provisions of the Administration Agreement are carried out satisfactorily and to determine, among other things, whether the expenses payable under the Administration Agreement are reasonable in light of the services provided. The Board also reviews the methodology employed in determining how the expenses are allocated to us and the proposed allocation of administrative expenses among us and our affiliates. The Board then assesses the reasonableness of such reimbursements for expenses allocated to us based on the breadth, depth and quality of such services. The Board also considers the possibility of obtaining such services from a different third-party and whether any other third-party service provider would be capable of providing all such services at comparable cost and quality. Finally, the Board compares the total amount paid to the Administrator for such services as a percentage of our net assets to the same ratio as reported by other comparable BDCs.

The Administration Agreement has been approved by the Board. Unless earlier terminated as described below, the Administration Agreement will remain in effect for a period of two years from the date it becomes first effective and will remain in effect from year to year thereafter if approved annually by a majority of the Board or by the holders of a majority of our outstanding voting securities and, in each case, a majority of the independent directors.

We may terminate the Administration Agreement, without payment of any penalty, upon 60 days’ written notice. The decision to terminate the agreement may be made by a majority of the Board or shareholders holding a majority of the outstanding Shares. In addition, the Administrator may terminate the Administration Agreement, without payment of any penalty, upon 60 days’ written notice.

Payment of Our Expenses under the Investment Advisory and Administration Agreements

Except as specifically provided below, we anticipate that all investment professionals and staff of the Adviser, when and to the extent engaged in providing investment advisory and management services to us, and the base compensation, bonus and benefits, and the routine overhead expenses, of such personnel allocable to such services, will be provided and paid for by the Adviser. We will bear our allocable portion of the compensation paid by the Adviser (or its affiliates) to our chief compliance officer and chief financial officer and their respective staffs (based on a percentage of time such individuals devote, on an estimated basis, to our business affairs). We will also bear all other costs and expenses of our operations, administration and transactions, including, but not limited to (i) investment advisory fees, including management fees and incentive fees, to the Adviser, pursuant to the Investment Advisory Agreement; (ii) our allocable portion of overhead and other expenses incurred by the Adviser in performing its administrative obligations under the Investment Advisory Agreement and by the Administrator in performing its administrative obligations under the Administration Agreement, and (iii) all other expenses of our operations and transactions including, without limitation, those relating to:

| ● | the cost of our organization and this offering; |

| ● | the cost of calculating our net asset value, including the cost of any third-party valuation services; |

| 6 |

| ● | the cost of effecting any sales and repurchases of our common stock and other securities; |

| ● | fees and expenses payable under any dealer manager agreements, if any; |

| ● | debt service and other costs of borrowings or other financing arrangements; |

| ● | costs of hedging; |

| ● | expenses, including travel expense, incurred by the Adviser and related personnel, or payable to third parties, performing due diligence on prospective portfolio companies and, if necessary, enforcing our rights; |

| ● | transfer agent and custodial fees; |

| ● | fees and expenses associated with marketing efforts; |

| ● | federal and state registration fees, any stock exchange listing fees and fees payable to rating agencies; |

| ● | federal, state and local taxes; |

| ● | independent directors’ fees and expenses including certain travel expenses; |

| ● | costs of preparing financial statements and maintaining books and records and filing reports or other documents with the SEC (or other regulatory bodies) and other reporting and compliance costs, including registration and listing fees, and the compensation of professionals responsible for the preparation of the foregoing; |

| ● | the costs of any reports, proxy statements or other notices to shareholders (including printing and mailing costs), the costs of any shareholder or director meetings and the compensation of investor relations personnel responsible for the preparation of the foregoing and related matters; |

| ● | commissions and other compensation payable to brokers or dealers; |

| ● | research and market data; |

| ● | fidelity bond, directors and officers errors and omissions liability insurance and other insurance premiums; |

| ● | direct costs and expenses of administration, including printing, mailing, long distance telephone and staff; |

| ● | fees and expenses associated with independent audits, outside legal and consulting costs; |

| ● | costs of winding up; |

| ● | costs incurred in connection with the formation or maintenance of entities or vehicles to hold our assets for tax or other purposes; |

| ● | extraordinary expenses (such as litigation or indemnification); and |

| ● | costs associated with reporting and compliance obligations under the 1940 Act and applicable federal and state securities laws. |

Fees and Expenses

The table below provides information about the Company’s estimated annual operating expenses during a typical twelve month period, expressed as a percentage of average net assets attributable to common stock. The percentages indicated in the table below are estimates and may vary.

| Base Management Fee (1) | 2.25 | % | ||

| Incentive Fee (2) | — | |||

| Interest Payments on Borrowed Funds (3) | 2.00 | % | ||

| Other Expenses (4) | 0.86 | % | ||

| Total Annual Expenses | 5.11 | % |

| (1) | Amount assumes that we have average net assets of $300 million during the following twelve months and that we borrow funds equal to 50% of our average net assets during such period. The base management fee will be payable quarterly in arrears and calculated at an annual rate of 1.50% based on a percentage of the sum of all assets as of the end of the most recently completed calendar quarter and of all uncalled capital committed to us by investors as of the end of the most recently completed calendar quarter. The percentage indicated in this fee table is higher than the contractual rate because the base management fee included in the table is shown as a percentage of net assets. |

| (2) | For purposes of this chart, we have assumed that no incentive fee will be paid in the twelve-month period. |

| (3) | We intend to borrow funds to make investments. To the extent that we determine it is appropriate to borrow funds to make investments, the costs associated with such borrowing will be indirectly borne by our investors. The figure in the table assumes we borrow for investment purposes an amount equal to 50% of our average net assets (including such borrowed funds) during the twelve month period and that the annual interest rate on the amount borrowed is 4.0%. We may borrow additional funds from time to time to make investments to the extent we determine that the economic situation is conducive to doing so. |

| 7 |

| (4) | Other expenses include, but are not limited to, accounting, legal and auditing fees, as well as the reimbursement of the compensation of administrative personnel and fees payable to our directors who do not also serve in an executive officer capacity for us or the Adviser. The amount presented in the table reflects estimated amounts we expect to pay during a typical twelve month period. |

Finder’s Agreements

We have retained certain third parties to find potential investors (each a “Finder”). If an investor purchases through a Finder, we and/or such investor may be subject to finder-related fees, the arrangements of which are set forth in detail in our Private Placement Memorandum.

License Agreement

We entered into a license agreement (the “License Agreement”) with Pharos Capital Group, LLC, pursuant to which Pharos Capital Group, LLC granted us a non-exclusive license to use the name “Pharos.” Under the License Agreement, we have a right to use the Pharos name for so long as the Adviser or one of its affiliates remains our investment adviser. Other than with respect to this limited license, we have no legal right to the “Pharos” name or logo.

Market Opportunity

We believe that there is a substantial opportunity for a BDC focused on providing growth capital and other equity financing to middle-market healthcare companies in underserved areas and investing with entrepreneurs who traditionally have had less access to institutional investors. The middle-market lending environment will allow us to meet our goal of making investments that generate above market risk-adjusted returns as a result of a combination of the following factors:

Limited Availability of Capital for Middle-Market Companies. We believe that regulatory and structural changes in the market have reduced the amount of capital available to middle-market companies. Specifically, the Basel III accord, the adoption of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and recent leveraged lending guidelines and regulations implemented by the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation are expected to significantly increase capital and liquidity requirements for banks, decreasing their capacity and appetite to originate and/or hold non-investment grade loans on their balance sheets. In addition, the number of lenders serving the middle-market has declined as traditional participants, such as commercial banks and specialty finance companies, have consolidated and are pursuing larger opportunities and as many non-traditional lenders, often referred to as the “shadow banking sector” (e.g., hedge funds, private equity funds, mezzanine funds and structured vehicles) have struggled with illiquidity, been unable to satisfy investor expectations, or otherwise exited the market. Finally, while the institutional leveraged loan and high-yield bond markets have enjoyed significant investor interest in the past several years, middle-market companies are unable to access those markets as they fail to meet the size and liquidity requirements imposed by the institutional investor community.

Robust Demand for Debt Capital. We believe nearly 200,000 middle-market companies will continue to require access to debt capital to refinance existing debt, support growth and finance acquisitions. In addition, we believe the large amount of uninvested capital held by private equity funds will continue to drive deal activity. We expect that private equity firms will continue to pursue acquisitions and to seek to leverage their equity investments with debt provided by companies such as us.

Compelling Investment Dynamics. We believe that the imbalance between the supply of, and demand for, middle-market debt capital creates transaction dynamics that offer opportunities to make investments with attractive risk-adjusted rates of return. In addition to commanding higher pricing, principally due to illiquidity, the directly negotiated nature of middle-market financings generally provides for more favorable terms to the lender, including more conservative leverage, stronger covenants and reporting packages, better call protection, and more restrictive change-of-control provisions. In addition, middle-market companies often have simpler capital structures than those of larger borrowers, which we believe facilitates a streamlined underwriting process and improves returns to lenders during a restructuring process.

Disparate Financing Needs. Middle-market borrowers’ needs vary considerably based on company- or industry-specific circumstances. We believe that the number of capital providers with the capabilities and flexibility of mandate to deliver tailored “one-stop” solutions addressing the idiosyncratic needs of the market remains limited. We believe that the Adviser’s experience in designing and investing in custom solutions across the capital structure, positions us as a desirable lending partner to middle-market companies and their sponsors.

| 8 |

Distinctive Lender Capabilities. Lending to middle-market companies requires specialized due diligence and underwriting capabilities, as well as extensive ongoing monitoring. Middle-market lending also is generally more labor-intensive than lending to larger companies due to smaller investment sizes and the lack of publicly available information on these companies. We believe the Adviser’s experience positions us more strongly to lend to middle-market companies than many other capital providers.

Competitive Strengths

We believe that the Adviser’s disciplined approach to origination, fundamental credit analysis, portfolio construction and risk management should allow us to achieve attractive risk-adjusted returns while preserving our capital. We believe that it represents an attractive investment opportunity for the following reasons:

Experienced Investment Team. The five most senior investment professionals at the Adviser have worked together as a team for over 20 years. Over that period, the Adviser has developed a proven, proprietary strategy to (i) generate preferential deal flow in its target markets, (ii) effectively review and process investment opportunities, (iii) monitor and add value to its portfolio holdings, and (iv) execute the appropriate exit option to maximize return for investors. We believe this experience provides the Adviser with an in-depth understanding of the strategic, financial and operational challenges and opportunities of middle-market companies. Further, we believe this positions the Adviser to effectively identify, assess and select quality investments while also enabling it to monitor and provide managerial assistance to our portfolio companies.

Distinctive Origination Platform. We anticipate that a majority of our investments will not be intermediated and will be originated without the assistance of investment banks or other traditional Wall Street sources. The Adviser is responsible for originating, underwriting, executing and managing the assets of our direct lending transactions and for sourcing and executing opportunities directly. The Adviser’s investment professionals have significant experience as transaction originators and executing direct calling campaigns on companies based on the Adviser’s sector and macroeconomic views.

The Adviser also maintains direct contact with financial sponsors, banks, corporate advisory firms, industry consultants, attorneys, investment banks, “club” investors and other potential sources of lending opportunities. By sourcing through multiple channels, we believe we are able to generate investment opportunities that have more attractive risk-adjusted return characteristics than by relying solely on origination flow from investment banks or other intermediaries.

Disciplined, Income-Orientated Investment Philosophy. The Adviser will employ a defensive investment approach focused on long-term credit performance and principal protection. This investment approach will involve a multi-stage selection process for each investment opportunity as well as ongoing monitoring of each investment made, with particular emphasis on early detection of credit deterioration. This strategy is designed to achieve optimized risk adjusted returns.

Active Portfolio Monitoring. The Adviser intends to closely monitor the investments in the portfolio and take a proactive approach to identifying and addressing sector or company risks, as well as to monitor the financial information of each portfolio company through monthly and/or weekly reporting. The Adviser will receive and review detailed financial information from portfolio companies no less than quarterly in addition to maintaining regular dialogue with company management teams regarding current and forecasted performance.

Expertise Across All Levels of the Corporate Capital Structure. We believe that the Adviser’s broad expertise and experience at all levels of a company’s capital structure will afford it numerous tools to manage risk while preserving the opportunity for attractive returns on our investments. The Adviser will attempt to capitalize on this expertise in an effort to produce and maintain an investment portfolio that will perform in a broad range of economic conditions.

Investment Selection

The Adviser has identified the following investment criteria and guidelines that it believes are important in evaluating prospective portfolio companies. However, not all of these criteria and guidelines, either individually or collectively, will be met in connection with each of our investments.

| 9 |

Established Companies with Positive Cash Flow and Profitability. For management buyouts and recapitalizations, the Adviser will generally seek out profitable, middle-market companies with rapid top-line growth independent of leverage. For growth and expansion investments, the Adviser expects to target companies that are EBITDA-positive, such that the company will not be dependent upon additional outside capital going forward. The Adviser believes that it is essential to have a clear understanding of the funding needs required for internal growth, capital spending, potential acquisitions, and eventual liquidity scenarios. As the portfolio companies grow, the Adviser will seek to ensure that each company has sufficient capital to execute its plan for value creation.

Strong Competitive Position in Industry. The Adviser will analyze the strengths and weaknesses of target companies relative to their competitors in the healthcare industry, and seeks to select investments in healthcare companies that improve the patient experience of care (including quality and satisfaction), reduce the total cost of healthcare, and possess attractive growth prospects either internally through core revenue growth or externally through acquisitions. The Adviser seeks to select investments in companies that have defensible market positions, sustainable competitive advantage, and unique attributes to their business model.

Experienced Management Team. We seek to invest in companies that have strong management teams with significant industry experience and a proven track record of executing strategic business plans. We strongly believe in having an alignment of interests with management teams and expect to see management hold a significant level of ownership.

Exit Strategy. The Adviser prefers to select investments in portfolio companies that have several viable exit strategies. These exits may involve a financial buyer, an IPO, a recapitalization, or a sale to a strategic purchaser. In the experience of the Adviser, the most successful exits are typically the direct result of growth in enterprise sales, sustained increases in profitability, and enhanced competitive position.

Investments in Different Portfolio Companies. We will seek to invest broadly among portfolio companies in the healthcare industry, thereby potentially reducing the risk of any one company having a disproportionate impact on the value of our portfolio, however there can be no assurances in this regard. Within the healthcare sector, we plan to target the following sub-groups: (i) healthcare providers; (ii) managed care services; (iii) behavioral health; (iv) hospice, palliative, and post-acute care; (v) wellness, disease, and/or population management; (vi) diagnostic technology and services; (vii) medical device companies with FDA-approved technology; (viii) healthcare data analytics and outcomes measurement; (ix) telemedicine; (x) value-based care; (xi) physical therapy; (xii) primary care; (xiii) oncology; and (xiv) other companies serving the healthcare sector.

Predictable Risk Exposure. From its considerable investment experience, the Adviser has developed a keen understanding of the various regulatory, market, and technology risks prevalent in the healthcare sector. These risks include government healthcare reimbursement rate changes, patient demographic shifts, market consolidation trends, and various other factors that the Adviser has navigated successfully throughout its history.

Investment Process Overview

Deal Log. When a new investment opportunity (“Deal”) is sourced by an Adviser professional (the “Deal Lead”), the Deal Lead will record the Deal into the Adviser Deal Log. Upon review of the available materials provided on the Deal, the Deal Lead elects to either pass or move forward to the next stage.

Deal Sheet. The Deal Lead completes our proprietary Deal Sheet, which summarizes the Deal in a standardized form and asks initial questions covering management, strategy, source, risk management, and structure. This produces a score based on the question responses. The Deal Lead then presents at the internal weekly meeting (which includes all investment professionals.) A majority approval vote of the investment professionals is required to move the Deal forward to the next stage.

Management Meeting. The Deal Lead gathers three to five investment professionals (the “Deal Team”) who will have primary responsibility for completing the due diligence. The Deal Team meets with the company’s management (typically at the company’s headquarters), collects additional company information, and completes an initial background check on the managers. If the Deal Lead is still interested in pursuing the Deal following the site visit with the management team and initial gathering of information, the Deal advances to the next stage.

Financial Due Diligence. The company management is presented with the Adviser’s Financial Due Diligence request that encompasses both historical and projected financial results, including the company’s detailed financial model in a fully dynamic format. The Deal Team completes the bulk of the due diligence process, including market analysis, review of competition, financial analysis, and sensitivity analysis, and develops a detailed report based on variable projected company results as well as proposed deal structures. Once this work is completed, the Deal moves to the next stage.

| 10 |

Term Sheet. The Deal Lead commits to proceeding and composes a draft Term Sheet, distributes it to the Adviser’s investment professionals, and places it on the agenda for discussion at the Adviser’s weekly meeting. The Deal Team presents the results of the due diligence and financial analysis and makes a recommendation to move forward with a Term Sheet. A majority vote from the attendees at the meeting is required to approve the Term Sheet and move forward with the Deal.

Completion of Due Diligence/Negotiation of Terms. The Deal Lead presents the approved Term Sheet to the company management and then leads the negotiations that follow. The Deal Team completes the due diligence process, including executing detailed management background checks, collecting any outstanding items requested from the company, gathering information on any items from the Due Diligence Questionnaire that have not yet been addressed and completing any third-party due diligence that has not yet been finalized. Once the due diligence process and the Term Sheet negotiations have been satisfactorily completed, the Deal advances to the next step.

Investment Committee. The Deal Team distributes the final, negotiated Term Sheet to the Adviser’s investment professionals and places it on the agenda for discussion at the weekly meeting. At the meeting, the final results of the Team’s due diligence are discussed, final negotiated terms and conditions are reviewed, and the Deal Lead makes a recommendation on whether to close the Deal. A unanimous vote from the Adviser’s Investment Committee is required to move forward with the closing.

Closing. Upon approval of the Investment Committee, the Deal Team prepares closing documents and closes the deal.

Structure of Investments

Our investment objective is to generate current income, to add value beyond the capital invested, and to pursue investments in partnership with experienced management teams.

Debt Investments. The terms of our debt investments are tailored to the facts and circumstances of each transaction. The

Adviser will negotiate the structure of each investment to protect our rights and manage our risk. We intend to invest in the following types of debt:

|

● |

Convertible debt. The Company will invest in convertible securities, including bonds, debentures, corporate notes, preferred stock or other securities which may be exchanged or converted into a predetermined number of the issuer’s underlying equity securities during a specified time period. Prior to their conversion, convertible securities have the same overall characteristics as non-convertible debt securities insofar as they generally provide a stable stream of income with generally higher yields than those of equity securities of the same or similar issuers. Convertible debt securities are debt obligations convertible at a stated exchange rate or formula into common stock or other equity securities. Convertible securities rank senior to equity securities in an issuer’s capital structure. They are of a higher credit quality and entail less risk than an issuer’s equity securities, although the extent to which such risk is reduced depends in large measure upon the degree to which the convertible security sells above its value as a fixed income security.

The market value of a convertible security may be viewed as comprised of two components: its “investment value,” which is its value based on its yield without regard to its conversion feature; and its “conversion value,” which is its value attributable to the underlying equity security obtainable on conversion. The investment value of a convertible security is influenced by changes in interest rates and the yield of similar non-convertible securities, with investment value declining as interest rates increase and increasing as interest rates decrease. The conversion value of a convertible security is influenced by changes in the market price of the underlying common stock. If, because of a low price of the underlying equity security, the conversion value is low relative to the investment value, the price of the convertible security is governed principally by its investment value. To the extent the market price of the underlying equity security approaches or exceeds the conversion price, the convertible security will be increasingly influenced by its conversion value, and the convertible security may sell at a premium over its conversion value to the extent investors place value on the right to acquire the underlying equity security while holding a fixed income security.

A convertible security entitles the holder to receive interest that is generally paid or accrued until the convertible security matures, or is redeemed, converted, or exchanged. Convertible securities have unique investment characteristics, in that they generally (i) have higher yields than equity securities, but lower yields that comparable non-convertible securities, (ii) are less subject to fluctuation in value than the underlying equity securities due to their fixed income characteristics, and (iii) provide the potential for capital appreciation if the market price of the underlying equity securities increases. A convertible security may be subject to redemption at the option of the issuer at a price established in the convertible security’s governing documents. If a convertible security held by the Company is called for redemption, the Company will be required to permit the issuer to redeem the security, convert it into the underlying equity security, or sell it to a third party. Any of these actions could result in losses to the Company. |

| 11 |

| ● | Mezzanine debt. Structurally, mezzanine debt usually ranks subordinate in priority of payment to first-lien and second-lien debt, is often unsecured, and may not have the benefit of financial covenants common in first-lien and second-lien debt. However, mezzanine debt ranks senior to common and preferred equity in an issuer’s capital structure. Mezzanine debt investments generally offer lenders fixed returns in the form of interest payments and will often provide lenders an opportunity to participate in the capital appreciation, if any, of an issuer through an equity interest. This equity interest typically takes the form of an equity co-investment or warrants. Due to its higher risk profile and often less restrictive covenants compared to senior secured loans, mezzanine debt generally bears a higher stated interest rate than first-lien and second-lien debt. |

Our debt investments will typically be structured with the maximum seniority and collateral that we can reasonably obtain while seeking to achieve our total return target. The Adviser seeks to limit the downside potential of our investments by:

| ● | requiring a total return on our investments (including both interest and potential equity appreciation) that compensates us for credit risk; |

| ● | negotiating covenants in connection with our investments consistent with preservation of our capital, including restrictions such as affirmative covenants (including reporting requirements), negative covenants, change of control provisions and board rights (including either observation or rights to a seat on the board under some circumstances), close monitoring of the financial information of each portfolio company through monthly and/or weekly reporting; and |

| ● |

including debt amortization requirements, where appropriate, to require the timely repayment of principal of the loan, as well as appropriate maturity dates. |

Within our portfolio, the Adviser aims to maintain the appropriate proportion among the various types of first-lien loans, as well as second-lien debt and mezzanine debt, to allow us to achieve our target returns while maintaining our targeted amount of credit risk. We may also invest in original issue discount or “payment-in-kind” (“PIK”) interest. We expect that the companies in our investment portfolio may be highly leveraged, and, we expect that in many cases, our investments in these companies will not be rated by any rating agency. These investments are highly speculative, and we expect that if these investments were rated, they would likely receive a rating of below investment grade, which is often referred to as “junk”. Additionally, we may seek to hedge against interest rate and currency exchange rate fluctuations and credit risk by using structured financial instruments such as futures, options, swaps and forward contracts, subject to the requirements of the 1940 Act.

Direct Equity Investments. Our investment in a portfolio company may secondarily include equity-related securities such as warrants, preferred stock and similar forms of senior equity, which may or may not be converted into a portfolio company’s common equity. Our equity investments typically will be completed in conjunction with a debt investment in a portfolio company. We expect that market capitalization of these investments to range from $10 to $200 million. We may seek direct investments in private companies. There is a large market among emerging private companies for equity capital investments. Many of these companies lack the necessary cash flow to sustain substantial amounts of debt, and therefore have viewed equity capital as a more attractive long-term financing tool. We seek to be a source of such equity capital as a means of investing in these companies and look for opportunities to invest alongside other venture capital and private equity investors with whom we have established relationships.

| 12 |

Competition

Our primary competitors in providing financing to middle-market companies include public and private funds, other BDCs, commercial finance companies and, to the extent they provide an alternative form of financing, private equity and hedge funds. Many of our competitors are substantially larger and have considerably greater financial, technical, and marketing resources than we do. Some competitors may have access to funding sources that are not available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more relationships than us. Further, many of our competitors are not subject to the regulatory restrictions that the 1940 Act imposes on us as a business development company, or to the distribution and other requirements we must satisfy to maintain our RIC status. See “Item 1A. Risk Factors — Risk Relating to Our Business and Structure — Competition for Investments.”

Term

Prior to an IPO, if the Board determines that there has been a significant adverse change in the regulatory or tax treatment of the Company or our shareholders that in its judgment makes it inadvisable for the Company to continue in its present form, then the Board will endeavor to restructure or change the form of the Company to preserve (insofar as possible) the overall benefits previously enjoyed by our shareholders as a whole or, if the Board determines it appropriate (and subject to any necessary shareholder approvals and applicable requirements of the 1940 Act), (i) cause the Company to change its form and/or jurisdiction of organization or (ii) liquidate and dissolve the Company.

If we have not consummated an IPO or other liquidity option by the six-year anniversary of the Initial Closing, subject to extension for two additional one-year periods, in the sole discretion of the Board, the Board (subject to any necessary shareholder approvals and applicable requirements of the 1940 Act) may determine to offer repurchases of capital accounts on a quarterly basis or on some other basis. The repurchases may be limited to 2% of the total value of the fund. To the extent greater than 2% is sought to be repurchased, repurchases will be prorated. See “Repurchase Offers.”

Additionally, if we have not consummated an IPO or other liquidity option by the ten-year anniversary of the Initial Closing, subject to extension for two additional one-year periods, in the sole discretion of the Board, we may apply for exemptive relief from the SEC which, if granted, would provide a liquidity option to allow shareholders to exchange their common Shares for shares of common stock in a newly formed entity (the “New BDC”) that will elect to be treated as a BDC under the 1940 Act, and that will effectuate an orderly wind down. See “Spin-Off Transaction.”

In the event of our liquidation, dissolution or winding up, each Share would be entitled to share ratably in all of our assets that are legally available for distribution after we paid or otherwise provide for all debts and other liabilities and subject to any preferential rights of holders of our preferred stock, if any preferred stock is outstanding at such time. For the purposes of this paragraph, a merger or consolidation of the Company with or into any other corporation or other entity, or a sale or conveyance of all or any part of our property or assets will not be deemed to be a dissolution, liquidation or winding up, voluntary or involuntary.

Emerging Growth Company

We are an emerging growth company as defined in the JOBS Act and we are eligible to take advantage of certain specified reduced disclosure and other requirements that are otherwise generally applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). Although we have not made a determination whether to take advantage of any or all of these exemptions, we expect to remain an emerging growth company for up to five years following the completion of our IPO or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.0 billion, (ii) December 31 of the fiscal year that we become a “large accelerated filer” as defined in Rule 12b-2 under the 1934 Act which would occur if the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter and we have been publicly reporting for at least 12 months or (iii) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the preceding three-year period. In addition, we will take advantage of the extended transition period provided in Section 7(a)(2)(B) of the 1933 Act for complying with new or revised accounting standards.

| 13 |

Dividend Reinvestment Plan

We have adopted a dividend reinvestment plan, pursuant to which we will reinvest all cash dividends declared by the Board on behalf of our shareholders who elect to have their dividends reinvested. As a result, if the Board authorizes, and we declare, a cash dividend or other distribution, then our shareholders who have opted in to our dividend reinvestment plan will have their cash distributions automatically reinvested in additional Shares as described below, rather than receiving the cash dividend or other distribution. Any fractional Share otherwise issuable to a participant in the dividend reinvestment plan will instead be paid in cash.

The number of Shares to be issued to a shareholder under the dividend reinvestment plan will be determined by dividing the total dollar amount of the distribution payable to such shareholder by the net asset value per Share, as of the last day of our calendar quarter immediately preceding the date such distribution was declared. We intend to use newly issued Shares to implement the plan.

No action is required on the part of a registered shareholder to have his, her, or its dividend or other distribution issued in cash. A registered shareholder is able to elect to have his, her, or its dividend reinvested pursuant to the plan by notifying the Adviser in writing so that such notice is received by the Adviser no later than ten days prior to the record date for distributions to the shareholders.

There are no brokerage charges or other charges to shareholders who participate in the plan.

The plan is terminable by us upon notice in writing mailed to each shareholder of record at least 30 days prior to any record date for the payment of any distribution by us.

Repurchase Offers

If we have not consummated an IPO or other liquidity option by the six-year anniversary of the Initial Closing, subject to extension for two additional one-year periods, in the sole discretion of the Board, the Board (subject to any necessary shareholder approvals and applicable requirements of the 1940 Act) may determine to commence a share repurchase program on a quarterly basis to allow shareholders to tender their Shares at a price equal to the current net offering price per Share in effect on each date of repurchase. Any Share repurchase will include numerous restrictions that limit an Investor’s ability to sell its Shares.