PART II— OFFERING CIRCULAR

Paradyme Equities, LLC

(the “Company”)

Preliminary Offering Circular dated June 28, 2019

The Company is hereby providing the information required by Part I of Form S-11 (17 9 CFR 239.18 and is following the requirements for a smaller reporting company as it meets the definition of that term in Rule 405 (17 CFR 230.405).

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular (“Offering Circular”) is subject to completion or amendment. These securities may not be sold, nor may offers to buy, be accepted before the offering statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before qualification under the laws of any such state. The Company may elect to satisfy its obligation to deliver a Final Offering Circular by sending you a notice within two (2) business days after the completion of our sale that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained.

We are offering 50,000 Class A Interests (“Interests” or “Class A Interests”) at $1,000 per Interest (the “Offering.”) Purchasers shall, upon acceptance by the Manager of their Subscriptions, become Class A Members in the Company. The Class A Interests shall bear a Preferred Return (“Preferred Return”) of eight percent (8%) on invested capital. Funds will be made immediately available to the Company once the Company raises a minimum of $500,000 (“Minimum Offering”) NOTE: THE COMPANY DOES NOT EXPECT TO COMMENCE DISTRIBUTIONS FOR UP TO THREE YEARS AFTER ITS INITIAL INVESTMENT IN PROPERTIES. Funds will be used for acquiring real estate assets throughout the United States as well as for working capital. The Company intends to invest capital from the proceeds of this Offering for the first three (3) years. Thereafter, the Company will hold and, eventually, sell assets purchased or Joint Ventured in funding and developing.

| 1 |

The minimum accepted from any Subscriber is $20,000. To date, the Company has not purchased any assets and all subscription funds remain in a designated escrow account. Subscription funds may remain in the Company’s segregated Subscription account for up to 180 days from the first date of deposit.

Unless terminated by the Manager earlier, this Offering terminates in 365 days after commencement of this Offering. The Manager may extend this Offering in its sole discretion for an additional six-month period at which time the Manager will file the appropriate Offering Circular for qualification with the Commission. There are no provisions for the return of funds once the minimum of 1,000 Interests are sold. No commissions will be paid for the sale of the Interests offered by the Company.

Class A Interests (Unit) |

| Price to Investors |

|

| Sellers’ Commissions |

|

| Proceeds to the Company |

| |||

Per Unit or Interest |

| $ | 1,000 |

|

| $ | 0.00 |

|

| $ | 1,000 |

|

Minimum Dollar Amount |

| $ | 500,000 |

|

| $ | 0.00 |

|

| $ | 500,000 |

|

Maximum Dollar Amount |

| $ | 50,000,000 |

|

| $ | 0.00 |

|

| $ | 50,000,000 |

|

No public market currently exists for our Interests. The Company will be managed by Paradyme Funding, Inc., (the “Manager”) a California limited liability company, of which Ryan Garland is the sole officer. The Company has set a minimum investment requirement of twenty thousand dollars ($20,000.) We do intend to place the funds into a segregated account up to $500,000 that will be in the Company’s name. This will not be an escrow account. Purchasers of our Interests qualified hereunder may be unable to sell their securities, because there may not be a public market for our securities. Any purchaser of our securities should be in a financial position to bear the risks of losing their entire investment.

The transfer of Interests is limited. A Member may assign, his, her or its Interests only if certain conditions set forth in the Company’s Operating Agreement are satisfied. Potential subscribers of the Interests should expect to remain in the Company for six (6) years. At, or around, the fourth or fifth year of operations, the Manager will attempt to sell, refinance, or otherwise dispose of properties in order to return Capital Account Balances (as defined in the Company’s Operating Agreement) to the Members. The Manager may, at its discretion, sell the properties to, among other potential purchasers, a third-party in order to redeem Members within the six-year expected time frame.

The Company has been formed to acquire various real estate assets throughout the United States. Although the Manager intends to initially search for properties located in Arizona, California, Colorado, Florida, Nevada, Tennessee, and Texas with a particular concentration in California, the Company will not limit itself geographically.

| 2 |

The Company’s primary focus is to invest in multifamily, commercial, single family, retail, mini storage, mixed-use commercial, hotels and land. It intends to operate as a diversified income asset equity fund with the intention to Joint Venture with highly qualified sponsors with a proven positive track record. The properties are selected based on criteria that includes value add construction, new construction, and development in good locations.

The Company is considered an “emerging growth company” under Section 101(a) of the Jumpstart Our Business Startups Act (the “JOBS Act”) as it is an issuer that had total annual gross revenues of less than $1.07 billion during its most recently completed fiscal year.

Since the Company is an emerging growth company certain Risk Factors include:

| ¨ | We are an emerging growth company with a limited operating history. |

| ¨ | Subscribers will have no control in the Company and will not have any voting rights. The Manager or its affiliates will manage the day to day operations of the Company. |

| ¨ | We will require additional financing, such as bank loans, outside of this offering in order for the operations to be successful. |

| ¨ | We have not conducted any revenue-generating activities and as such have not generated any revenue since inception. |

| ¨ | Our offering price is arbitrary and does not reflect the book value of our Class A Interests. |

| ¨ | Investments in real estate and real estate related assets are speculative and we will be highly dependent on the performance of the real estate market. |

| ¨ | The Company does not currently own any assets. |

By purchasing Interests, Subscribers are bound by the dispute resolution provisions contained in our Operating Agreement which limits your ability to bring class action lawsuits or seek remedy on a class basis. The dispute resolution process provisions do not apply to claims under the federal securities laws. By agreeing to the dispute resolution process, including mandatory arbitration, investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

See the section entitled “RISK FACTORS” beginning on page 7 for a more comprehensive discussion of risks to consider before purchasing our Class A Interests.

| 3 |

INVESTMENT IN SMALL BUSINESSES INVOLVES A HIGH DEGREE OF RISK, AND INVESTORS SHOULD NOT INVEST ANY FUNDS IN THIS OFFERING UNLESS THEY CAN AFFORD TO LOSE THEIR ENTIRE INVESTMENT. SEE THE SECTION ENTITLED “RISK FACTORS.”

IN MAKING AN INVESTMENT DECISION INVESTORS MUST RELY ON THEIR OWN EXAMINATION OF THE ISSUER AND THE TERMS OF THE OFFERING, INCLUDING THE MERITS AND RISKS INVOLVED. THESE SECURITIES HAVE NOT BEEN RECOMMENDED OR APPROVED BY ANY FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THESE AUTHORITIES HAVE NOT PASSED UPON THE ACCURACY OR ADEQUACY OF THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR SELLING LITERATURE. THESE SECURITIES ARE OFFERED UNDER AN EXEMPTION FROM REGISTRATION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THESE SECURITIES ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

NOTICE REGARDING AGREEMENT TO ARBITRATE

THIS OFFERING MEMORANDUM REQUIRES THAT ALL INVESTORS ARBITRATE ANY DISPUTE, OTHER THAN THOSE RELATED TO CLAIMS UNDER FEDERAL SECURITIES LAWS AND THE RULES AND REGULATIONS PROMULGATED THEREUNDER, ARISING OUT OF THEIR INVESTMENT IN THE COMPANY. ALL INVESTORS FURTHER AGREE THAT THE ARBITRATION WILL BE BINDING AND HELD IN THE STATE OF DELAWARE. EACH INVESTOR ALSO AGREES TO WAIVE ANY RIGHTS TO A JURY TRIAL. OUT OF STATE ARBITRATION MAY FORCE AN INVESTOR TO ACCEPT A LESS FAVORABLE SETTLEMENT FOR DISPUTES. OUT OF STATE ARBITRATION MAY ALSO COST AN INVESTOR MORE TO ARBITRATE A SETTLEMENT OF A DISPUTE.

| 4 |

| 6 |

| ||

| 7 |

| ||

| 11 |

| ||

| 12 |

| ||

| 30 |

| ||

| 31 |

| ||

| 35 |

| ||

| 41 |

| ||

| 44 |

| ||

| 51 |

| ||

| 56 |

| ||

| 62 |

| ||

| 62 |

| ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 63 |

| |

| 63 |

| ||

| 65 |

| ||

| 66 |

| ||

| 67 |

| ||

SELECTION, MANAGEMENT AND CUSTODY OF COMPANY’S INVESTMENTS |

|

|

| |

| 69 |

| ||

| 69 |

| 5 |

This summary contains basic information about us and the Offering. Because it is a summary, it does not contain all the information that you should consider before investing. You should read the entire Offering Circular carefully, including the risk factors and our financial statements and the related notes to those statements included in this Offering Circular. Except as otherwise required by the context, references in this Offering Circular to "we," "our," "us," “the Company,” and "PEF," refer to Paradyme Equities, LLC.

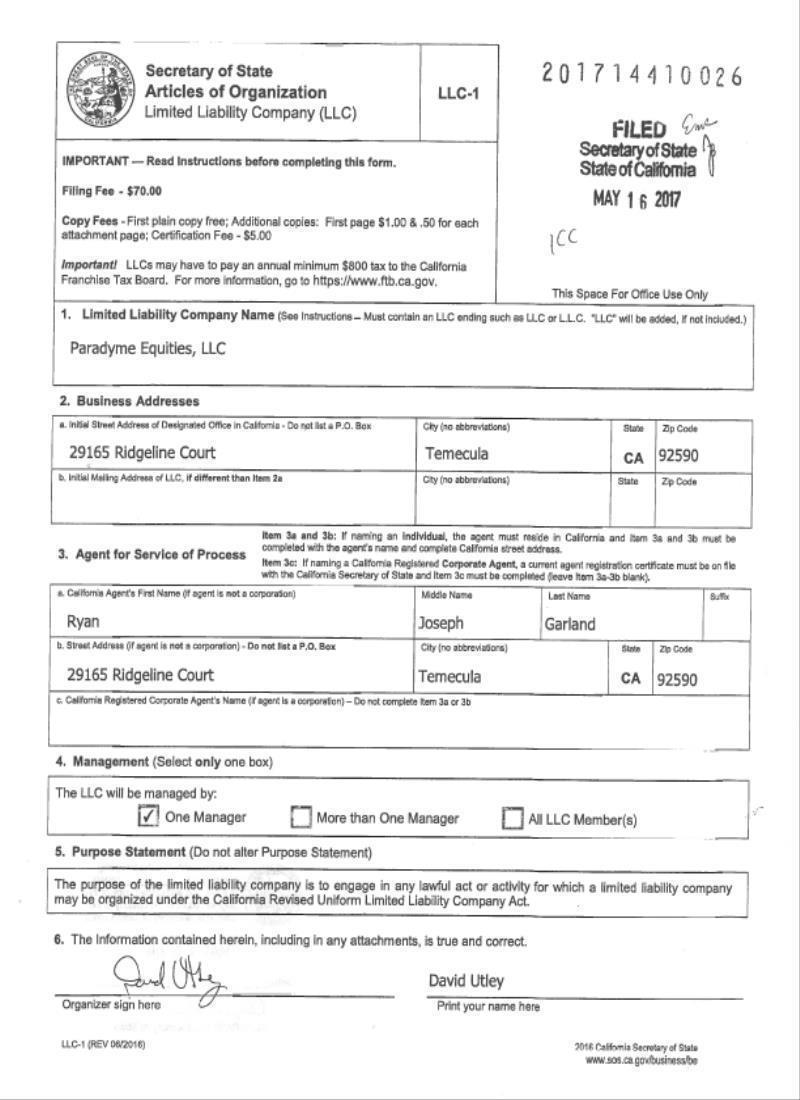

We were formed on May 16, 2017 and have not yet commenced operations.

We are not a blank check company and do not consider ourselves to be a blank check company as we:

| ¨ | Have a specific business plan. We have provided a detailed plan for the next twelve (12) months throughout our Offering Circular. |

| ¨ | Have no intention of entering into a reverse merger with any entity in an unrelated industry in the future. |

Since our inception through May 16, 2017, we have not generated any revenues and have incurred a net loss of $0. We anticipate the commencement of generating revenues in the next twelve months. The capital raised in this Offering has been budgeted to cover the costs associated with beginning to operate our company, marketing expense, and acquisition related costs. We intend on using the majority of the proceeds from this Offering for the acquisition of properties. However, closing and other acquisition related costs such as title insurance, professional fees and taxes will likely require cash. We do not have the ability to quantify any of the expenses as they will all depend on size of deal, price, and place versus procuring new financing, due diligence performed (such as appraisal, environmental, property condition reports), legal and accounting, etc. There is no way to predict or otherwise detail expenses.

We intend on engaging in the following activities:

1. The Company’s primary focus is to invest in multifamily, commercial, single family, retail, mini storage, mixed-use commercial, hotels and land. It is the Company’s intention to operate as a a diversified income asset equity fund with the intention of entering into Joint Ventures with highly qualified sponsors with a proven positive track record whose properties that will appreciate over a three (3) to six (6) year holding period. The properties are selected based on criteria that includes value add construction, new construction, and development in good locations. Upon completion of construction, it is expected that properties will be managed by third-party property management.

2. In some circumstances, the Company may elect to purchase commercial properties that have potential to soon be or are cash flow positive, meaning properties that have a positive monthly income after all expenses (mortgages, operating expenses, taxes) and maintenance reserves are paid. Nonetheless, the potential acquisition should have the likelihood to appreciate over the hold period. In order to determine if an investment or Joint Venture with another sponsor is viable, our Manager will do a significant amount of due diligence to determine the security of the transaction.

| 6 |

| Table of Contents |

3. Invest in any opportunity our Manager sees fit within the confines of the market, marketplace and economy so long as those investments are real estate related and within the investment objectives of the Company. To this end, at some time in the future, the Company may also purchase additional properties or make other real estate investments that relate to varying property types including office, retail, and industrial properties. Such property types will likely be operating properties rather than properties under development.

4. In most circumstances, the Company will elect to enter into a joint venture agreement with another real estate developer or investor who may have certain resources or opportunities not otherwise available to the Company.

In all cases, the debt on any given property must be such that it fits with the Investment Policies of the Company. We intend on leveraging our properties with no more than 80% of their value.

The Company does not currently own any material assets. Please see our “DESCRIPTION OF BUSINESS” on page 24. We believe we will need at least $1,200,000 to provide working capital and $75,000 for professional fees for the next 12 months.

Q: What is Paradyme Equities, LLC?

A: Paradyme Equities, LLC is a newly formed company created for the specific purpose of identifying and purchasing a diverse portfolio of real estate assets. The Company has been formed to acquire and joint venture with highly qualified operators in various real estate assets throughout the United States. Although the Manager intends to initially search for properties located in Arizona, California, Colorado, Florida, Nevada, Tennessee, and Texas with a particular concentration in California. The Company will not limit itself geographically. The Company intends to focus its investment efforts on value add and new construction transactions. It is the intention of the Company to use funds for both acquisition and property development. The Company may use funds for the following asset purchases and developments with Joint Venture partners:

| · | Land for development |

| · | Hotel properties |

| · | Self-storage properties |

| · | Senior and assisted living facilities |

| · | Commercial retail |

| · | Mixed use commercial properties |

| · | Multi-family |

| · | Single Family 1-4 Units |

The Company intends to Joint Venture on properties that will appreciate in value over the expected hold period of five (5) to six (6) years. In some circumstances, the Company may refinance or sell a property to a related entity if the Manager does not feel that it is the optimal time to sell a particular property, but still wants to provide liquidity to Members.

| 7 |

| Table of Contents |

Q: How will Paradyme Funding, LLC (PEF) identify properties?

A: The Manager will search for properties using traditional methods of using brokers in the markets where the Manager believe there are opportunities, third party market studies, appraisals and any/all data sources available to determine if the investment is sound and will turn a profit.

Q: What kind of return may be expected by a Member?

A: The Company does not currently own any assets, therefore, returns are speculative. However, it is the Company’s intent to pay 8% (eight percent) preferred return as well as thirty percent (30%) of the Distributable Cash in accordance with an individual Member’s prorate membership in the Company.. (See the “SUMMARY OF OPERATING AGREEMENT” on page 47 for more information.)

Q: What is the minimum investment amount allowed?

A: $20,000

Q: Who may invest?

A: The Interests will be available to anyone, generally speaking, however, the Manager reserves the right to reject any subscription they wish. Further, investors will not be allowed to invest more than the greater of 10% of their net worth or 10% of their net income, whichever is greater.

Q: Where can I buy Class A Interests?

A: All Interests will be available for purchase at www.paradymefunding.com

Q: Who is the Manager?

A: The Manager is Paradyme Funding, Inc. which is controlled by Ryan Garland. Prior performance of real estate investments may be found in the section entitled “PRIOR PERFORMANCE.” For more info on Mr. Garland, please see “MANAGER, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS”

Q: How can I sell my Interests?

A: Generally speaking, the Interests will not be transferrable. Investors should consider investing for the long-term as disposition of the Interests will be difficult, if not impossible. The Company intends to operate for approximately six (6) years at which time the Manager intends to employ a variety of exit strategies with the intent of then distributing the Capital Account Balances to the Members. Ideally, at or around six years, the Company will begin to sell or refinance properties that have appreciated in value. In some circumstances, the Company may refinance or sell a property to a related entity if the Manager does not feel that it is the optimal time to sell a particular property, but still wants to provide liquidity to Members.

Q: Will I be charged upfront selling commissions?

A: No. Investors will not pay upfront selling commissions as part of the price per Interest purchased in this offering. However, if the Manager finds that selling the Interests is difficult, it may later enlist the services of a licensed broker-dealer to assist with the sales of the Interests, in which case sales commission will be paid by the Company.

| 8 |

| Table of Contents |

Q: Do you have a redemption program?

A: No. We do not currently have a redemption program. An investor should expect to remain in the Company for a period of six (6) years.

Q: May I make an investment through my IRA or other tax-deferred retirement account?

A: Yes. You may make an investment through your IRA or other tax-deferred retirement account. In making these investment decisions, you should consider, at a minimum, (1) whether the investment is in accordance with the documents and instruments governing your IRA, plan or other retirement account, (2) whether the investment would constitute a prohibited transaction under applicable law, (3) whether the investment satisfies the fiduciary requirements associated with your IRA, plan or other retirement account, (4) whether the investment will generate unrelated business taxable income (“UBTI”) to your IRA, plan or other retirement account, and (5) whether there is sufficient liquidity for such investment under your IRA, plan or other retirement account. You should note that an investment in our Class A Interests will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code of 1986, as amended (the “IRS Code”).

It is the Company’s understanding that IRA and Roth IRA investments can be made through self-directed accounts which are not managed by the Company and most likely will be charged fees to manage the self-directed account. These fees will need to be paid by the investor and are not considered an expense of the Company.

Q: Is there any minimum initial offering amount required to be sold?

A: We intend to raise a minimum of $500,000 prior to using funds to purchase properties or for working capital. In some circumstances, the management or some related entity may “pre-fund” a property and funds from this offering will go to replace that “pre-funding” amount as funds are available.

Q: Will I be notified of how my investment is doing?

A: Yes, we will provide you with periodic updates on the performance of your investment in us, including:

| ¨ | an annual report; |

| ¨ | a semi-annual report; |

| ¨ | current event reports for specified material events within ten business days of their occurrence; |

| ¨ | supplements to the offering circular, if we have material information to disclose to you; and |

| ¨ | other reports that we may file or furnish to the SEC from time to time. |

| 9 |

| Table of Contents |

We will provide this information to you by posting such information on the SEC’s website at www.sec.gov, on our website at www. paradymefunding.com, and via e-mail.

Q: When will I get my detailed tax information?

A: Your schedule K-1 tax information, will be provided by March 15th of the year following each taxable year.

Q: Who can help answer my questions about the offering?

Please contact:

Investor Relations

Paradyme Equities, LLC

43620 Ridge Park Drive #200

Temecula, CA 92590

Office: (951)901-5304

Email: Paradymeequitiesinfo@paradymefunding.com

| 10 |

| Table of Contents |

EXEMPTIONS UNDER JUMPSTART OUR BUSINESS STARTUPS ACT

We are an emerging growth company. An emerging growth company is one that had total annual gross revenues of less than $1,070,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) during its most recently completed fiscal year. We would lose our emerging growth status if we were to exceed $1,070,000,000 in gross revenues. We are not sure this will ever take place.

Because we are an emerging growth company, we have the exemption from Section 404(b) of Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934. Under Section 404(b), we are now exempt from the internal control assessment required by subsection (a) that requires each independent auditor that prepares or issues the audit report for the issuer shall attest to, and report on, the assessment made by the management of the issuer. We are also not required to receive a separate resolution regarding either executive compensation or for any golden parachutes for our executives so long as we continue to operate as an emerging growth company.

We hereby elect to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1).

We will lose our status as an emerging growth company in the following circumstances:

| ¨ | The end of the fiscal year in which our annual revenues exceed $1.07 billion. |

| ¨ | The end of the fiscal year in which the fifth anniversary of our IPO occurred. |

| ¨ | The date on which we have, during the previous three-year period, issued more than $1 .07 billion in non-convertible debt. |

| ¨ | The date on which we qualify as a large accelerated filer. |

| 11 |

| Table of Contents |

Investors in the Company should be particularly aware of the inherent risks associated with our business. As of the date of this filing our management is aware of the following material risks.

General Risks Related to Our Business

We are an emerging growth company organized in May 2018 and have not yet commenced operations, which makes an evaluation of us extremely difficult. At this stage of our business operations, even with our good faith efforts, we may never become profitable or generate any significant amount of revenues, thus potential investors have a possibility of losing their investment.

We were organized in May 2017 and have not yet started operations. As a result of our start-up status we (i) have generated no revenues, (ii) will accumulate deficits due to organizational and start-up activities, business plan development, and professional fees since we organized. There is nothing at this time, other than the track record of our Manager, on which to base an assumption that our business operations will prove to be successful or that we will ever be able to operate profitably. However, past results do not guarantee future profitability. Our future operating results will depend on many factors, including our ability to raise adequate working capital, availability of properties for purchase, the level of our competition and our ability to attract and maintain key management and employees.

We are significantly dependent on Ryan Garland. The loss or unavailability of his services would have an adverse effect on our business, operations and prospects in that we may not be able to obtain new management under the same financial arrangements, which could result in a partial loss or return of your investment.

The acquisition of properties and the attainment of new investors is significantly dependent on Ryan Garland. We expect that our investor base will be largely drawn from Mr. Garland’s exposure on social media and on media content delivered over the Company’s website. Mr. Garland implemented the Company’s strategy to identify and acquire multifamily, commercial, single family, mini storage and ultimately being diversified in real estate investment. And properties which has resulted in the success of his prior real estate investments. It would be difficult to replace Ryan Garland at such an early stage of development of the Company. Mr. Garland has built a qualified team of individuals that manage the marketing, business operations, property management, acquisitions and dispositions of assets while maintaining Mr. Garland’s investment strategy. In the event of Mr. Garland’s departure from the Company, it may be difficult to attain new investors or purchase properties, but the current management team would be able to manage the Company’s assets until a such time as an exit would occur. Should the Company be unable to replace Ryan Garland it may be required to cease pursuing business opportunities, which may result in a partial loss or return of your investment.

| 12 |

| Table of Contents |

This offering is a blind pool offering, and therefore, Members will not have the opportunity to evaluate some of our investments before we make them, which makes investments more speculative.

We will seek to invest substantially all of the net offering proceeds from this Offering, after the payment of fees and expenses, in the acquisition of or investment in interests in assets. However, because, as of the date of this Offering Circular, we have not identified the assets we expect to acquire and because our Members will be unable to evaluate the economic merit of assets before we invest in them, they will have to rely on the ability of our Manager to select suitable and successful investment opportunities. These factors increase the risk that our Members’ investment may not generate returns comparable to the Company’s competitors.

Our Manager will have complete control over the Company and will therefore make all decisions over which Members will have no control.

Paradyme Funding, Inc., our Manager, will make all decisions relating to the business, operations, and strategy, without input by the Members. Such decisions may include purchase and sale decisions regarding the assets, the appointment of other officers, managers, vendors and whether to enter into material transactions with related parties.

An investment in the Interests is highly illiquid. You may never be able to sell or otherwise dispose of your Interests.

Since there is no public trading market for our Interests, you may never be able to liquidate your investment or otherwise dispose of your Interests. The Company intends to operate for a period of six (6) years. Therefore, you should expect to keep your investment in Class A Interests for a period of six (6) years.

Risks Related to the Real Estate Business in General

The profitability of attempted acquisitions is uncertain.

We intend to acquire and joint venture in desirable real estate properties selectively. Real estate investments entail risk that investments may fail to perform in accordance with expectations. In undertaking these acquisitions, we will incur certain risks, including the expenditure of funds on, and the devotion of management’s time to, transactions that may not come to fruition. Additional risks inherent in acquisitions include risks that the properties will not achieve anticipated sales price, rents, or occupancy levels and that estimated operating expenses and costs of improvements to bring an acquired property up to standards established for the market position intended for that property may prove inaccurate.

| 13 |

| Table of Contents |

Rising expenses could reduce cash flow and funds available for future acquisitions.

Our properties will be subject to increases in real estate tax rates, utility costs, operating expenses, insurance costs, repairs and maintenance, administrative and other expenses. If we are unable to increase rents at an equal or higher rate or lease properties on a basis requiring the tenants to pay all or some of the expenses, we would be required to pay those costs, which could adversely affect funds available for future cash distributions.

If we purchase assets at a time when the multifamily or commercial real estate market is experiencing substantial influxes of capital investment and competition for properties, the real estate we purchase may not appreciate or may decrease in value.

The multifamily real estate markets along with our chosen asset classes are currently experiencing a substantial influx of capital from investors worldwide. This substantial flow of capital, combined with significant competition for real estate and the strength in the economy, may result in inflated purchase prices for such assets. To the extent we purchase real estate in such an environment, we are subject to the risk that if the real estate market ceases to attract the same level of capital investment in the future as it is currently attracting, or if the number of companies seeking to acquire such assets decreases, our returns will be lower and the value of our assets may not appreciate or may decrease significantly below the amount we paid for such assets.

A multifamily or commercial property's income and value may be adversely affected by national and regional economic conditions, local real estate conditions such as an oversupply of properties or a reduction in demand for properties, availability of "for sale" properties, competition from other similar properties, our ability to provide adequate maintenance, insurance and management services, increased operating costs (including real estate taxes), the attractiveness and location of the property and changes in market rental rates. Our income will be adversely affected if a significant number of tenants are unable to pay rent or if our properties cannot be rented on favorable terms. Our performance is linked to economic conditions in the regions where our properties will be located and in the market for multifamily space generally. Therefore, to the extent that there are adverse economic conditions in those regions, and in these markets generally, that impact the applicable market rents, such conditions could result in a reduction of our income and cash available for distributions and thus affect the amount of distributions we can make to you.

| 14 |

| Table of Contents |

We will depend on commercial real estate tenants for our revenue and therefore our revenue may depend on the economic viability of our tenants.

We will be highly dependent on income from tenants. Our financial results will depend in part on leasing space in the properties or the full properties we acquire to tenants on economically favorable terms.

In the event of a tenant default prior to stabilization, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and re-letting our property. A default, of a substantial tenant or number of tenants at any one time, on lease payments to us would cause us to lose the revenue associated with such lease(s) and cause us to have to find an alternative source of revenue to meet mortgage payments and prevent a foreclosure if the property is subject to a mortgage. Therefore, substantial lease payment defaults by tenant(s) could cause us to lose our investment or reduce the amount of distributions to Members.

Competition and any increased affordability of single-family homes could limit our ability to lease our apartments or maintain or increase rents, which may materially and adversely affect us, including our financial condition, cash flows, results of operations and growth prospects. However, having investments also in the single-family sector could offset the level of risk.

The commercial real estate investment industry is highly competitive, and we face competition from many sources, including from other multifamily apartment communities both in the immediate vicinity and the geographic market where our properties are and will be located. If so, this would increase the number of apartments units available and may decrease occupancy and unit rental rates. Furthermore, multifamily apartment communities we acquired compete, or will compete, with numerous housing alternative in attracting residents, including owner occupied single and multifamily homes available to rent or purchase. The number of competitive properties and/or condominiums in a particular area, or any increased affordability of owner occupied single and multifamily homes caused by declining housing prices, mortgage interest rates and government programs to promote home ownership, could adversely affect our ability to retain our residents, lease apartment units and maintain or increase rental rates. These factors could materially and adversely affect us.

We may not make a profit if we sell a property.

The prices that we can obtain when we determine to sell a property will depend on many factors that are presently unknown, including the operating history, tax treatment of real estate investments, demographic trends in the area and available financing. There is a risk that we will not realize any significant appreciation on our investment in a property. Accordingly, your ability to recover all or any portion of your investment under such circumstances will depend on the amount of funds so realized and claims to be satisfied therefrom.

| 15 |

| Table of Contents |

Our Properties may not be diversified.

Our potential profitability and our ability to diversify our investments may be limited, both geographically and by type of properties purchased. We will be able to purchase additional properties only as additional funds are raised. Given the limited number of assets we are targeting, our properties will not be well diversified, and their economic performance could be affected by changes in local economic conditions or changes uniquely affecting one or more particular asset classes.

Our performance is therefore linked to economic conditions in the regions in which we will acquire properties and in the market for real estate properties generally. Therefore, to the extent that there are adverse economic conditions in the regions in which our properties are located and in the market for real estate properties, such conditions could result in a reduction of our income and cash to return capital and thus affect the amount of distributions we can make to you.

Competition with third parties in acquiring and operating properties may reduce our profitability and the return on your investment.

We compete with many other entities engaged in real estate investment activities, many of which have greater resources than we do. Specifically, there are numerous commercial developers, real estate companies, foreign investors and investment funds that operate in the markets in which we may operate, that will compete with us in acquiring residential, commercial, and other properties that will be seeking investments and tenants for these properties.

Many of these entities have significant financial and other resources, including operating experience, allowing them to compete effectively with us. Competitors with substantially greater financial resources than us may generally be able to accept more risk than we can prudently manage, including risks with respect to the creditworthiness of entities in which investments may be made or risks attendant to a geographic concentration of investments. Demand from third parties for properties that meet our investment objectives could result in an increase of the price of such properties. If we pay higher prices for properties, our profitability may be reduced, and you may experience a lower return on your investment. In addition, our properties may be located in a close proximity to other properties that will compete against our properties for tenants. Many of these competing properties may be better located and/or appointed than the properties that we will acquire, giving these properties a competitive advantage over our properties, and we may, in the future, face additional competition from properties not yet constructed or even planned. This competition could adversely affect our business. The number of competitive properties could have a material effect on our ability to rent space at our properties and the amount of rents charged. We could be adversely affected if additional competitive properties are built in locations competitive with our properties, causing increased competition for residential renters. In addition, our ability to charge premium rental rates to tenants may be negatively impacted. This increased competition may increase our costs of acquisitions or lower the occupancies and the rent we may charge tenants. This could result in decreased cash flow from tenants and may require us to make capital improvements to properties which we would not have otherwise made, thus affecting cash available for distributions to you.

| 16 |

| Table of Contents |

We may not have control over costs arising from rehabilitation of properties.

We may elect to acquire properties which may require rehabilitation, although we do not intend on acquiring properties that require extensive rehabilitation. Nonetheless, we may acquire affordable properties that we will rehabilitate and convert to market rate properties. Consequently, we may retain independent general contractors to perform the actual physical rehabilitation and/or construction work and will be subject to risks in connection with a contractor's ability to control rehabilitation and/or construction costs, the timing of completion of rehabilitation and/or construction, and a contractor's ability to build in conformity with plans and specification.

Inventory or available properties might not be sufficient to realize our investment goals.

We may not be successful in identifying suitable real estate properties or other assets that meet our acquisition criteria, or consummating acquisitions or investments on satisfactory terms. Failures in identifying or consummating acquisitions would impair the pursuit of our business plan. Moreover, our acquisition strategy could involve significant risks that could inhibit our growth and negatively impact our operating results, including the following: increases in asking prices by acquisition candidates to levels beyond our financial capability or to levels that would not result in the returns required by our acquisition criteria; diversion of management’s attention to expansion efforts; unanticipated costs and contingent or undisclosed liabilities associated with acquisitions; failure of acquired businesses to achieve expected results; and difficulties entering markets in which we have no or limited experience.

The consideration paid for our target acquisition may exceed fair market value, which may harm our financial condition and operating results.

The consideration that we pay will be based upon numerous factors, and the target acquisition may be purchased in a negotiated transaction rather than through a competitive bidding process. We cannot assure anyone that the purchase price that we pay for a target acquisition or its appraised value will be a fair price, that we will be able to generate an acceptable return on such target acquisition, or that the location, lease terms or other relevant economic and financial data of any properties that we acquire will meet acceptable risk profiles. We may also be unable to lease vacant space or renegotiate existing leases at market rates, which would adversely affect our returns on a target acquisition. As a result, our investments in our target acquisition may fail to perform in accordance with our expectations, which may substantially harm our operating results and financial condition.

| 17 |

| Table of Contents |

The failure of our properties to generate positive cash flow or to sufficiently appreciate in value would most likely preclude our Members from realizing an attractive return on their Interest ownership.

There is no assurance that our real estate investments will appreciate in value or will ever be sold at a profit. The marketability and value of the properties will depend upon many factors beyond the control of our management. There is no assurance that there will be a ready market for the properties, since investments in real property are generally non-liquid. The real estate market is affected by many factors, such as general economic conditions, availability of financing, interest rates and other factors, including supply and demand, that are beyond our control. We cannot predict whether we will be able to sell any property for the price or on the terms set by it, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property. Moreover, we may be required to expend funds to correct defects or to make improvements before a property can be sold. We cannot assure any person that we will have funds available to correct those defects or to make those improvements. In acquiring a property, we may agree to lockout provisions that materially restrict us from selling that property for a period of time or impose other restrictions, such as a limitation on the amount of debt that can be placed or repaid on that property. These lockout provisions would restrict our ability to sell a property. These factors and any others that would impede our ability to respond to adverse changes in the performance of our properties could significantly harm our financial condition and operating results.

Illiquidity of real estate investments could significantly impede our ability to respond to adverse changes in the performance of our properties and harm our financial condition.

Because real estate investments are relatively illiquid, our ability to promptly sell one or more properties or investments in our portfolio in response to changing economic, financial and investment conditions may be limited. In particular, these risks could arise from weakness in or even the lack of an established market for a property, changes in the financial condition or prospects of prospective purchasers, changes in national or international economic conditions, and changes in laws, regulations or fiscal policies of jurisdictions in which the property is located. We may be unable to realize our investment objectives by sale, other disposition or refinance at attractive prices within any given period of time or may otherwise be unable to complete any exit strategy. An exit event is not guaranteed and is subject to the Manager’s discretion.

| 18 |

| Table of Contents |

Risks Specific to Hotel Properties

We plan to invest in the select service hotels segment of the lodging market which is highly competitive.

The select service segment of the hotel business is highly competitive. Our hotel properties will most likely compete on the basis of location, room rates, quality, service levels, reputation and franchise, among many factors. There are many competitors in the select service segment, and many of these competitors may have substantially greater marketing and financial resources than we have. This competition could reduce occupancy levels and room revenue at our hotels. Over-building in the lodging industry may increase the number of rooms available and may decrease occupancy and room rates. In addition, in periods of weak demand, as may occur during a general economic recession, profitability is negatively affected by the relatively high fixed costs of operating hotels.

Our returns could be negatively impacted if we hire third-party management companies and those management companies do not manage our hotel properties effectively.

We currently do not own any hotels and thus, we do not have any management agreements in place. We may hire third-party managers to manage our hotels while we are attempting to dispose of or renovate the properties. Our cash flow from the hotels may be adversely affected if our managers fail to provide quality services and amenities or if they or their affiliates fail to maintain a quality brand name. In addition, our managers or their affiliates may manage, and in some cases may own, invest in or provide credit support or operating guarantees to hotels that compete with our hotel properties, which may result in conflicts of interest and decisions regarding the operation of our hotels that are not in our best interests.

We generally will attempt to resolve issues with our managers through discussions and negotiations. However, if we are unable to reach satisfactory results through discussions and negotiations, we may choose to litigate the dispute or submit the matter to third-party dispute resolution.

Additionally, in the event that we need to replace any management company, we may be required by the terms of the management contract to pay substantial termination fees and may experience significant disruptions at the affected hotels.

| 19 |

| Table of Contents |

Restrictive covenants in our management contracts could preclude us from taking actions with respect to the sale or refinancing of a hotel property that would otherwise be in our best interest.

We may enter into management contracts that contain some restrictive covenants or acquire properties subject to existing management contracts that do not allow the flexibility we seek, including management contracts that restrict our ability to terminate the contract or require us to pay large termination fees. Any such management contract may preclude us from taking actions that would otherwise be in our best interest or could cause us to incur substantial expense.

We may acquire hotels that may be operated under franchise agreements are subject to risks arising from adverse developments with respect to the franchise brand and to costs associated with maintaining the franchise license.

We expect that we may purchase hotel properties that will operate under franchise agreements and we anticipate that some of the hotels we acquire in the future will operate under franchise agreements. We are therefore subject to the risks associated with concentrating hotel investments in several franchise brands, including reductions in business following negative publicity related to one of the brands or the general decline of a brand.

The maintenance of the franchise licenses for branded hotel properties are subject to the franchisors’ operating standards and other terms and conditions. Franchisors periodically inspect hotel properties to ensure that we and our management companies follow their standards. Failure by us or one of our third-party management companies to maintain these standards or other terms and conditions could result in a franchise license being canceled. If a franchise license is cancelled due to our failure to make required improvements or to otherwise comply with its terms, we also may be liable to the franchisor for a termination payment, which varies by franchisor and by hotel property. As a condition of maintaining a franchise license, a franchisor could require us to make capital expenditures, even if we do not believe the capital improvements are necessary or desirable or will result in an acceptable return on our investment. We may risk losing a franchise license if we do not make franchisor-required capital expenditures.

If a franchisor terminates the franchise license or the license expires, we may try either to obtain a suitable replacement franchise or to operate the hotel without a franchise license. The loss of a franchise license could materially and adversely affect the operations and the underlying value of the hotel property because of the loss of associated name recognition, marketing support and centralized reservation system provided by the franchisor and adversely affect our revenues. This loss of revenue could in turn adversely affect our financial condition, results of operations, the market price of our common shares and our ability to make distributions to our limited partners.

| 20 |

| Table of Contents |

Risks Related to Financing

We might obtain lines of credit and other borrowings, which increases our risk of loss due to potential foreclosure.

We may obtain lines of credit and long-term financing that may be secured by our assets. As with any liability, there is a risk that we may be unable to repay our obligations from the cash flow of our assets. Therefore, when borrowing and securing such borrowing with our assets, we risk losing such assets in the event we are unable to repay such obligations or meet such demands.

We have broad authority to incur debt and high debt levels could hinder our ability to make distributions and decrease the value of our investors’ investments.

Our policies do not limit us from incurring debt until our total liabilities would be at 80% of the value of the assets of the Company. Although we intend to borrow typically no more than 70% of a property’s value, we may borrow as much as 80% of the value of our properties. We do not currently own any properties. High debt levels would cause us to incur higher interest charges and higher debt service payments and may also be accompanied by restrictive covenants. These factors could limit the amount of cash we have available to distribute and could result in a decline in the value of our investors’ investments.

Risks Related to Conflicts of Interest

There are conflicts of interest between us, our Manager and its affiliates.

We have not identified who might provide asset management and other services to our Manager and the Company. Prevailing market rates are determined by Management based on industry standards and expectations of what Management would be able to negotiate with a third-party on an arm’s length basis. All of the agreements and arrangements between such parties, including those relating to compensation, are not the result of arm’s length negotiations. Some of the conflicts inherent in our Company’s transactions with the Manager and its affiliates, and the limitations on such parties adopted to address these conflicts, are described below. Our Company, Manager and their affiliates will try to balance our interests with their own. However, to the extent that such parties take actions that are more favorable to other entities than the Company, these actions could have negative impact on our financial performance and, consequently, on distributions to Members and the value of our Interests. See “Conflicts of Interest”.

| 21 |

| Table of Contents |

The interests of the Manager, our principals and their other affiliates may conflict with your interests.

The operating agreement provides our Manager with broad powers and authority which may result in one or more conflicts of interest between your interests and those of the Manager, the principals and its other affiliates. Potential conflicts of interest include, but are not limited to, the following:

| ¨ | the Manager, the principals and/or its other affiliates are offering, and may continue to originate and offer, other real estate investment opportunities, including additional blind pool equity and debt offerings similar to this offering and may make investments in real estate assets for their own respective accounts, whether or not competitive with our business; |

| ¨ | the Manager, the principals and/or its other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separately from us, and you will not be entitled to receive or share in any of the profits return fees or compensation from any other business owned and operated by the Manager, the principals and/or its other affiliates for their own benefit; |

| ¨ | we may engage the Manager or affiliates of the Manager to perform services at prevailing market rates. Prevailing market rates are determined by the Manager based on industry standards and expectations of what the Manager would be able to negotiate with a third-party on an arm’s length basis; and |

| ¨ | the Manager, the principals and/or its other affiliates are not required to devote all of their time and efforts to our affairs. |

Risks Associated with Joint Ventures/Co-Investors

The terms of joint venture agreements or other joint ownership/co-investor arrangements into which the Manager may enter could impair operating flexibility and results of operations.

In connection with the purchase of real estate or making real estate-related investments, the Manager may enter into joint ventures with affiliated or unaffiliated partners. In addition, the Company may also purchase or develop properties in arrangements with affiliates of the Manager, the sellers of the properties, developers and/or similar persons. These structures involve participation in the investment by outsiders whose interests and rights may not be the same as the Company’s. These joint venture partners or co-tenants may have rights to take some actions over which the Manager has no control and may take actions contrary to the interests of the Company. For example, joint ownership of an investment, under certain circumstances, may involve risks not associated with direct ownership of such investment, including the following:

| 22 |

| Table of Contents |

| ¨ | a partner or co-investor might have economic and/or other business interests or goals which are unlike or incompatible with the business interests or goals of the Company, including inconsistent goals relating to the sale of properties held in a joint venture and/or the timing of the termination and liquidation of the venture; |

| ¨ | such partners or co-investors may become bankrupt and such proceedings could have an adverse impact on the operation of the Company or joint venture; |

| ¨ | the Company may incur liabilities as the result of actions taken by joint venture partners in which there was no direct involvement; and |

| ¨ | such partners or co-investors may be in a position to take action contrary to instructions from the Manager or requests or contrary to the Company’s policies and objectives or fail to take actions as instructed. |

If the Company has a right of first refusal or buy/sell right to buy out a co-investor/venturer or partner, we may be unable to finance such a buy-out if it becomes exercisable or we may be forced to exercise those rights at a time when it would not otherwise be in our best interest to do so. If the Company’s interest is subject to a buy/sell right, we may not have sufficient cash, available borrowing capacity or other capital resources to allow the purchase of such an interest of a co-investor/venturer subject to the buy/sell right, in which case we may be forced to sell the interest when otherwise we would have preferred to retain such interest. The Manager may not be able to sell a Company’s interest in a joint venture on a timely basis or on acceptable terms if an exit from the venture is desired for any reason, particularly if the interest is subject to a right of first refusal of the co-investor/venturer or partner.

The Manager may structure a joint venture/co-invest relationships in a manner which could limit the amount the Company participates in the cash flow or appreciation of an investment.

The Manager may enter into joint venture agreements, the economic terms of which may provide for the distribution of income to the Company otherwise than in direct proportion to ownership interest in the joint venture. For example, while a co-investor/venturer may invest an equal amount of capital in an investment, the investment may be structured such that the Company has a right to priority distributions of cash flow up to a certain target return while the co-investor/venturer may receive a disproportionately greater share of cash flow than the Company is to receive once such target return has been achieved. This type of investment structure may result in the co-investor/venturer receiving more of the cash flow, including appreciation, of an investment than the Company would receive. If the Manager does not accurately judge the appreciation prospects of a particular investment or structure the agreement appropriately, the Company may incur losses on joint venture/co-invest investments and/or have limited participation in the profits of a joint venture/co-invest investment, either of which could reduce the ability to make cash distributions to the Members.

| 23 |

| Table of Contents |

Co-investments with other parties will result in additional risks.

The Company may co-invest in various investments with other investors obtained by an affiliate of the Manager. It is possible that a co-investor would be unable to pay its share of costs, which could be detrimental to the Company’s investment in a project unless an alternative source of capital could be obtained. In the event a third-party co-investor was to become bankrupt; third party creditors could become involved in the project affairs. In addition, the co-investors could have economic or business interests or goals which are, or which may become inconsistent with the Company’s business interests or goals.

If the Manager enters into joint ventures with affiliates, the Company may face conflicts of interest or disagreements with the joint venture partners that will not be resolved as quickly or on terms as advantageous to the Company as would be the case if the joint venture had been negotiated at arm’s-length with an independent joint venture partner. As a result, Member returns may be decreased by entering into such joint ventures with affiliates of the Manager.

In the event that the Company enters into a joint venture with any other program sponsored or advised by the Manager or one of its affiliates, the Company may face certain additional risks and potential conflicts of interest. Joint venture partners may not desire to sell properties at the time the Company desires. Joint ventures between the Company and other Manager programs will not have the benefit of arm’s-length negotiation of the type normally conducted between unrelated co-venturers. Under these joint venture agreements, none of the co-venturers may have the power to control the venture, and an impasse could be reached regarding matters pertaining to the joint venture, including the timing of a liquidation, which might have a negative impact on the joint venture and decrease returns to the Members. Joint ventures with other Manager programs would also be subject to the risks associated with joint ventures with unaffiliated third parties.

Risks Related to Our Corporate Structure

We do not set aside funds in a sinking fund to pay distributions, so you must rely on our revenues from operations and other sources of funding for distributions. These sources may not be sufficient to meet these obligations.

We do not contribute funds on a regular basis to a separate account, commonly known as a sinking fund, to pay distributions on the Interests. Accordingly, you will have to rely on our cash from operations and other sources of liquidity, such as borrowed funds and proceeds from sale of the assets, for distribution payments. Our ability to generate revenues from operations in the future is subject to general economic, financial, competitive, legislative, statutory and other factors that are beyond our control. Moreover, we cannot assure you that we will have access to additional sources of liquidity if our cash from operations are not sufficient to fund distributions to you. Our need for such additional sources may come at undesirable times, such as during poor market or credit conditions when the costs of funds are high and/or other terms are not as favorable as they would be during good market or credit conditions. The cost of financing will directly impact our results of operations, and financing on less than favorable terms may hinder our ability to make a profit. Your right to receive distributions on your Interests is junior to the right of our general creditors to receive payments from us. If we do not have sufficient funds to meet our anticipated future operating expenditures and debt repayment obligations as they become due, then you could lose all or part of your investment. We currently do not have any revenues.

| 24 |

| Table of Contents |

You will have limited control over changes in our policies and operations, which increases the uncertainty and risks you face as a Member.

Our Manager determines our major policies, including our policies regarding financing, growth and debt capitalization. Our Manager may amend or revise these and other policies without a vote of the Members. Our Manager’s broad discretion in setting policies and our Members’ inability to exert control over those policies increases the uncertainty and risks you face as a Member. In addition, our Manager may change our investment objectives without seeking Member approval.

Our ability to make distributions to our Members is subject to fluctuations in our financial performance, operating results and capital improvement requirements.

Currently, our strategy includes paying a preferred return to investors under this Offering that would result in a return of approximately 8.0% annualized return on investment, of which there is no guarantee. In the event of downturns in our operating results, unanticipated capital improvements to our properties, or other factors, we may be unable to declare or pay distributions to our Members. The timing and amount of distributions are the sole discretion of our Manager who will consider, among other factors, our financial performance, any debt service obligations, any debt covenants, our taxable income and capital expenditure requirements. We cannot assure you that we will generate sufficient cash in order to fund distributions. NOTE: THE COMPANY DOES NOT EXPECT TO COMMENCE DISTRIBUTIONS FOR UP TO THREE YEARS AFTER ITS INITIAL INVESTMENT IN PROPERTIES.

Investors will not receive the benefit of the regulations provided to real estate investment trusts or investment companies.

We are not a real estate investment trust and enjoy a broader range of permissible activities. Under the Investment Company Act of 1940, an “investment company” is defined as an issuer which is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business of investing, reinvesting, or trading in securities; is engaged or proposes to engage in the business of issuing face-amount certificates of the installment type, or has been engaged in such business and has any such certificate outstanding; or is engaged or proposes to engage in the business of investing, reinvesting, owning, holding, or trading in securities, and owns or proposes to acquire investment securities having a value exceeding 40 per centum of the value of such issuer’s total assets (exclusive of Government securities and cash items) on an unconsolidated basis.

We intend to operate in such manner as not to be classified as an "investment company" within the meaning of the Investment Company Act of 1940 as we intend on primarily holding real estate. The management and the investment practices and policies of ours are not supervised or regulated by any federal or state authority. As a result, investors will be exposed to certain risks that would not be present if we were subjected to a more restrictive regulatory situation.

| 25 |

| Table of Contents |

If we are deemed to be an investment company, we may be required to institute burdensome compliance requirements and our activities may be restricted

If we are ever deemed to be an investment company under the Investment Company Act of 1940, we may be subject to certain restrictions including:

| ¨ | restrictions on the nature of our investments; and |

| ¨ | restrictions on the issuance of securities. |

In addition, we may have imposed upon us certain burdensome requirements, including:

| ¨ | registration as an investment company; |

| ¨ | adoption of a specific form of corporate structure; and |

| ¨ | reporting, record keeping, voting, proxy, compliance policies and procedures and disclosure requirements and other rules and regulations. |

The exemption from the Investment Company Act of 1940 may restrict our operating flexibility. Failure to maintain this exemption may adversely affect our profitability.

We do not believe that at any time we will be deemed an “investment company” under the Investment Company Act of 1940 as we do not intend on trading or selling securities. Rather, we intend to hold and manage real estate. However, if at any time we may be deemed an “investment company,” we believe we will be afforded an exemption under Section 3(c)(5)(C) of the Investment Company Act of 1940, as amended (referred to in this Offering as the “1940 Act”). Section 3(c)(5)(C) of the 1940 Act excludes from regulation as an “investment company” any entity that is primarily engaged in the business of purchasing or otherwise acquiring “mortgages and other liens on and interests in real estate”. To qualify for this exemption, we must ensure our asset composition meets certain criteria. Generally, 55% of our assets must consist of qualifying mortgages and other liens on and interests in real estate and the remaining 45% must consist of other qualifying real estate-type interests. Maintaining this exemption may adversely impact our ability to acquire or hold investments, to engage in future business activities that we believe could be profitable or could require us to dispose of investments that we might prefer to retain. If we are required to register as an “investment company” under the 1940 Act, then the additional expenses and operational requirements associated with such registration may materially and adversely impact our financial condition and results of operations in future periods.

| 26 |

| Table of Contents |

NOTICE REGARDING AGREEMENT TO ARBITRATE

THIS OFFERING MEMORANDUM REQUIRES THAT ALL INVESTORS ARBITRATE ANY DISPUTE, OTHER THAN THOSE CLAIMS UNDER FEDERAL SECURITIES LAWS AND THE RULES AND REGULATIONS PROMULGATED THEREUNDER, ARISING OUT OF THEIR INVESTMENT IN THE COMPANY. ALL INVESTORS FURTHER AGREE THAT THE ARBITRATION WILL BE BINDING AND HELD IN THE STATE OF DELAWARE. EACH INVESTOR ALSO AGREES TO WAIVE ANY RIGHTS TO A JURY TRIAL. OUT OF STATE ARBITRATION MAY FORCE AN INVESTOR TO ACCEPT A LESS FAVORABLE SETTLEMENT FOR DISPUTES. OUT OF STATE ARBITRATION MAY ALSO COST AN INVESTOR MORE TO ARBITRATE A SETTLEMENT OF A DISPUTE.

ADDITIONAL RISK FACTOR ARBITRATION:

The Operating Agreement contains a mandatory dispute resolution process which may limit the rights of investors to some legal remedies and forums otherwise available. This Agreement contains a provision which requires that all claims arising from Member's investment in the Company be resolved through arbitration.

For Members’ information:

(a) Arbitration is final and binding on the parties;

(b) The parties are waiving their right to seek remedies in court, including the right to jury trial;

(c) Pre-arbitration discovery is generally more limited than and potentially different in form and scope from court proceedings.

(d) The Arbitration Award is not required to include factual findings or legal reasoning and any party's right to appeal or to seek modification of a ruling by the arbitrators is strictly limited;

(e) The panel of arbitrators may include a minority of persons engaged in the securities industry. Such arbitration provision limits the rights of an investor to some legal remedies and rights otherwise available.

The dispute resolution process provisions do not apply to claims under the federal securities laws. By agreeing to the dispute resolution process, including mandatory arbitration, investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

Insurance Risks

We may suffer significant losses that are not covered by insurance.

The geographic areas in which we invest in properties may be at risk for damage to property due to certain weather-related and environmental events, including such things as severe thunderstorms, flooding, sinkholes, and hurricanes. To the extent possible, the Manager may but is not required to attempt to acquire insurance against some of these risks. However, such insurance may not be available (or may only be available at cost-prohibitive costs) in all areas, nor are all hazards insurable as some may be deemed acts of God or be subject to other policy exclusions.

| 27 |

| Table of Contents |

Furthermore, an insurance company may deny coverage for certain claims, and/or determine that the value of the claim is less than the cost to restore the property, and a lawsuit could have to be initiated to force them to provide coverage, resulting in further losses in income to the Company. Additionally, properties may now contain or come to contain mold, which may not be covered by insurance and has been linked to health issues.

Federal Income Tax Risks

The Internal Revenue Service may challenge our characterization of material tax aspects of your investment in the Interests.

An investment in Interests involves material income tax risks which are discussed in detail in the section of this offering entitled “TAX TREATMENT OF COMPANY AND ITS SUBSIDIARIES” starting on page 31. You are urged to consult with your own tax advisor with respect to the federal, state, local and foreign tax considerations of an investment in our Interests. We may or may not seek any rulings from the Internal Revenue Service regarding any of the tax issues discussed herein. Accordingly, we cannot assure you that the tax conclusions discussed in this offering, if contested, would be sustained by the IRS or any court. In addition, our legal counsel is unable to form an opinion as to the probable outcome of the contest of certain material tax aspects of the transactions described in this offering, including whether we will be characterized as a “dealer” so that sales of our assets would give rise to ordinary income rather than capital gain. Our counsel also gives no opinion as to the tax considerations to you of tax issues that have an impact at the individual or partner level.

You may realize taxable income without cash distributions, and you may have to use funds from other sources to fund tax liabilities.

As a Member of the Company, you will be required to report your allocable share of the Company’s taxable income on your personal income tax return regardless of whether you have received any cash distributions from us. It is possible that your Interests will be allocated taxable income in excess of your cash distributions. We cannot assure you that cash flow will be available for distribution in any year. As a result, you may have to use funds from other sources to pay your tax liability.

| 28 |

| Table of Contents |

You may not be able to benefit from any tax losses that are allocated to your Interests.

Interests may be allocated their share of tax losses should any arise. Section 469 of the Internal Revenue Code limits the allowance of deductions for losses attributable to passive activities, which are defined generally as activities in which the taxpayer does not materially participate. Any tax losses allocated to investors will be characterized as passive losses, and, accordingly, the deductibility of such losses will be subject to these limitations. Losses from passive activities are generally deductible only to the extent of a taxpayer’s income or gains from passive activities and will not be allowed as an offset against other income, including salary or other compensation for personal services, active business income or “portfolio income”, which includes non-business income derived from dividends, interest, royalties, annuities and gains from the sale of property held for investment. Accordingly, you may receive no benefit from your share of tax losses unless you are concurrently being allocated passive income from other sources.

We may be audited which could subject you to additional tax, interest and penalties.

Our federal income tax returns may be audited by the Internal Revenue Service. Any audit of the Company could result in an audit of your tax return. The results of any such audit may require adjustments of items unrelated to your investment, in addition to adjustments to various Company items. In the event of any such audit or adjustments, you might incur attorneys’ fees, court costs and other expenses in contesting deficiencies asserted by the Internal Revenue Service. You may also be liable for interest on any underpayment and penalties from the date your tax was originally due. The tax treatment of all Company items will generally be determined at the Company level in a single proceeding rather than in separate proceedings with each Member, and our Manager is primarily responsible for contesting federal income tax adjustments proposed by the Internal Revenue Service. In such a contest, our Manger may choose to extend the statute of limitations as to all Members and, in certain circumstances, may bind the Members to a settlement with the Internal Revenue Service. Adjustments to Company items would continue to be determined at the Company level however, and any such adjustments would be accounted for in the year they take effect, rather than in the year to which such adjustments relate. Our Manager will have the discretion in such circumstances either to pass along any such adjustments to the Members or to bear such adjustments at the Company level.

State and local taxes and a requirement to withhold state taxes may apply, and if so, the amount of net cash from open payable to you would be reduced.

The state in which you reside may impose an income tax upon your share of our taxable income. Further, states in which we will own properties may impose income taxes upon your share of our taxable income allocable to any Company property located in that state. Many states have implemented or are implementing programs to require companies to withhold and pay state income taxes owed by non-resident Members relating to income-producing properties located in their states, and we may be required to withhold state taxes from cash distributions otherwise payable to you. You may also be required to file income tax returns in some states and report your share of income attributable to ownership and operation by the Company of properties in those states. In the event we are required to withhold state taxes from your cash distributions, the amount of the net cash from operations otherwise payable to you would be reduced. In addition, such collection and filing requirements at the state level may result in increases in our administrative expenses that would have the effect of reducing cash available for distribution to you. You are urged to consult with your own tax advisors with respect to the impact of applicable state and local taxes and state tax withholding requirements on an investment in our Interests.

| 29 |

| Table of Contents |

Legislative or regulatory action could adversely affect investors.