UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM | ||||||||

(Mark One) | ||||||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended December 31 , 2023

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from to

Commission File No. 001-38387

| (Exact name of registrant as specified in its charter) | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) (Zip code) | ||||||||

( | ||||||||

| (Registrant’s telephone number, including area code) | ||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

The | ||||||||

The | ||||||||

The | ||||||||

| Securities registered pursuant to Section 12(g) of the Act: None | ||||||||

Indicate by a check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ | ||||||||

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ | ||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | ||||||||

| ☐ | Large accelerated filer | ☐ | Accelerated filer | |||||||||||

| ☒ | Smaller reporting company | |||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | ||||||||

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ||||||||

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ||||||||

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b)). ☐ | ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No | ||||||||

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $ | ||||||||

As of March 13, 2024, there were | ||||||||

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2023. | ||||||||

1

HYCROFT MINING HOLDING CORPORATION

Annual Report on Form 10-K

TABLE OF CONTENTS

| Page | |||||||||||

| PART | ITEM | ||||||||||

2

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this Annual Report on Form 10-K for the year ended December 31, 2023, (“2023 Form 10-K”) may constitute “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended ( the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included herein and public statements by our officers or representatives, that address activities, events or developments that our management expects or anticipates will or may occur in the future are forward-looking statements, including but not limited to such things as future business strategy, plans and goals, competitive strengths and expansion and growth of our business. The words “estimate,” “plan,” “anticipate,” “expect,” “intend,” “believe,” “target,” “budget,” “may,” “can,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to” and similar words or expressions, or negatives of these terms or other variations of these terms or comparable language or any discussion of strategy or intention identify forward-looking statements. Forward-looking statements address activities, events or developments that the Company expects or anticipates will or may occur in the future and are based on current expectations and assumptions.

These statements involve known and unknown risks, uncertainties, assumptions and other factors which may cause our actual results, performance or achievements to be materially different from any results, performance or achievements expressed or implied by such forward-looking statements. See our other reports filed with the Securities and Exchange Commission (the “SEC”) for more information about these and other risks. You are cautioned against attributing undue certainty to forward-looking statements. Although we have attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Although these forward-looking statements were based on assumptions that the Company believes are reasonable when made, you are cautioned that forward-looking statements are not guarantees of future performance and that actual results, performance or achievements may differ materially from those made in or suggested by the forward-looking statements contained in this 2023 Form 10-K. In addition, even if our results, performance, or achievements are consistent with the forward-looking statements contained in this 2023 Form 10-K, those results, performance or achievements may not be indicative of results, performance or achievements in subsequent periods. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Any forward-looking statements made in this 2023 Form 10-K speak only as of the date of those statements, and we undertake no obligation to update those statements or to publicly announce the results of any revisions to any of those statements to reflect future events or developments. For information identifying important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, see the Risk Factors and the Summary of Risk Factors in Item 1A. Risk Factors of this 2023 Form 10-K.

4

PART I

ITEM 1. BUSINESS

About the Company

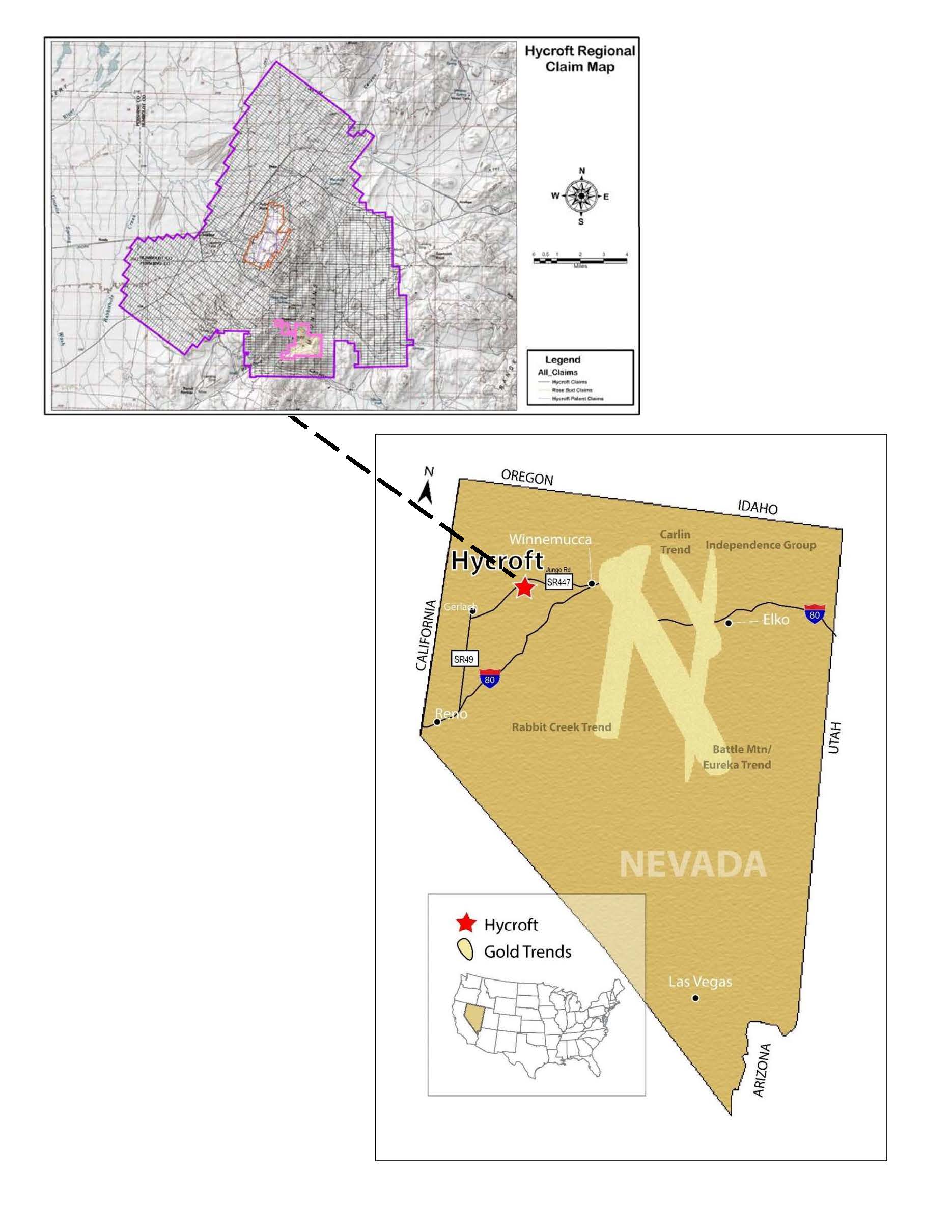

Hycroft Mining Holding Corporation (formerly known as Mudrick Capital Acquisition Corporation) was incorporated under the laws of the state of Delaware on August 28, 2017. In this 2023 Form 10-K, “we,” “us,” “our,” “Company,” “Hycroft,” and “HYMC” refer to Hycroft Mining Holding Corporation and its subsidiaries. We are a U.S.-based gold and silver exploration and development company that owns the Hycroft Mine in the prolific mining region of Northern Nevada. The following discussion should be read in conjunction with the Company’s Consolidated Financial Statements (“Financial Statements”) and Notes to the Financial Statements (“Notes”) included in Part II – Item 8. Financial Statements of this 2023 Form 10-K.

On May 29, 2020, we consummated a business combination transaction (the “Recapitalization Transaction”) that resulted in Autar Gold Corporation (formerly known as MUDS Acquisition Sub, Inc. (“Acquisition Sub”) acquiring all of the issued and outstanding equity interests of the direct subsidiaries of Hycroft Mining Corporation (“Seller”) and substantially all of the other assets of Seller and assuming substantially all of the liabilities of Seller. In conjunction with the Recapitalization Transaction, Seller’s indebtedness existing prior to the Recapitalization Transaction was either repaid, exchanged for indebtedness of the Company, exchanged for shares of common stock or converted into shares of Seller common stock, and our post-Recapitalization Transaction indebtedness included amounts drawn under the Credit Agreement among Hycroft, AuxAg Mining Corporation (formerly known as MUDS Holdco Inc.), Allied VGH LLC, Hycroft Resources and Development, LLC Sprott Private Resource Lending II (Collector) Inc., and Sprott Resources Lending Corp. (“Sprott Credit Agreement”) and the assumption of the newly issued 10% Senior Secured Notes (“Subordinated Notes”).

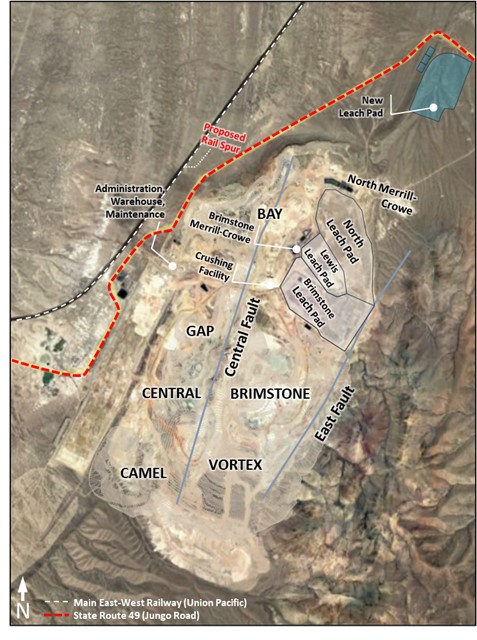

Our property, the Hycroft Mine, historically operated as an open-pit oxide mining and heap leach processing operation and is located approximately 54 miles northwest of Winnemucca, Nevada. Mining operations at the Hycroft Mine were restarted in 2019 on a pre-commercial scale and discontinued in November 2021 as a result of the then-current and expected ongoing cost pressures for many of the reagents and consumables used at the Hycroft Mine and to further determine the most effective processing method for the sulfide ore. In March 2023, Hycroft, along with its third-party consultants, completed and filed the Hycroft Property Initial Assessment Technical Report Summary Humboldt and Pershing Counties, Nevada with an effective date of March 27, 2023 (the “2023 Hycroft TRS”) and prepared in accordance with the SEC’s Modernization of Property Disclosures for Mining Registrants as set forth in subpart 1300 of Regulation S-K (“Modernization Rules”). The 2023 Hycroft TRS provides an initial assessment of the mineral resource estimate utilizing a milling and pressure oxidation (“POX”) process for sulfide and transition mineralization and a heap leaching process for oxide mineralization. The 2023 Hycroft TRS included: (i) additional exploration drilling results from 2021 and 2022; (ii) additional assay information associated with historical drilling that was previously missing; (iii) other updates after additional review of historical assay certificates; and (iv) other adjustments. The 2023 Hycroft TRS supersedes and replaces the Initial Assessment Technical Report Summary for the Hycroft Mine, prepared in accordance with the requirements of the Modernization Rules, with an effective date of February 18, 2022 (“2022 Hycroft TRS”), and the 2022 Hycroft TRS should no longer be relied upon. Our ongoing disclosures and many of management’s estimates and judgments as of and for the periods ended December 31, 2023 and 2022, are based on the 2023 Hycroft TRS. The Company will continue to build on the work to date, incorporate exploration data as it becomes available, and investigate opportunities identified through progressing the technical and data analyses leading up to the 2023 Hycroft TRS and subsequent studies and analyses, and we will provide an updated technical report at an appropriate time.

We ceased mining activities in November 2021, and completed processing of gold and silver ore previously placed on leach pads as of December 31, 2022. We do not expect to generate revenues from gold and silver sales until after further developing the Hycroft Mine and recommencing mining and processing operations. As of December 31, 2023, the Hycroft Mine had measured and indicated mineral resources of 10.6 million ounces of gold and 360.7 million ounces of silver and inferred mineral resources of 3.4 million ounces of gold and 96.1 million ounces of silver, which are contained in oxide, transitional, and sulfide ores.

Segment Information

The Hycroft Mine is our only operating segment and includes operations, exploration, and development activities and accounts for 100% of our Production costs. Corporate and Other includes corporate General and administrative costs. See Note 20 – Segment Information to the Notes to the Consolidated Financial Statements for additional information on our segments.

Principal Products, Revenues, and Market Overview

During the year ended December 31, 2023, the Company generated no Revenues due to the cessation of active mining operations.

5

The principal products produced during 2022 at the Hycroft Mine were unrefined gold and silver bars (doré) and gold and silver-laden carbons and slags, both of which were sent to third party refineries and sold at prevailing spot prices after adjustments for refining and other associated fees, to financial institutions or to precious metals traders. Doré bars and gold and silver laden carbons and slags were sent to refineries to produce bullion that meet the required market standards of 99.95% pure gold and 99.90% pure silver. Under the terms of our refining agreements, doré bars and gold and silver laden carbons and slags were refined for a fee, and our share of the separately recovered refined gold and refined silver were credited to our account or delivered to our buyers.

Product Revenues and Customers

As the Company ceased active mining operations in November 2021 and completed the processing of gold and silver ounces from the leach pads, we do not expect to have Revenues from gold and silver sales until restarting mining operations.

Gold and Silver Uses

Gold and silver have two main categories of use: fabrication and investment. Fabricated gold has a variety of end uses, including jewelry, electronics, dentistry, industrial and decorative applications, medals, medallions and coins. Fabricated silver also has a variety of end uses, including jewelry, mirrors, cameras, electronics, energy production, engines, novelty explosives, and coins. Gold and silver investors buy gold and silver bullion, coins and jewelry.

Gold and Silver Supply and Demand

The supply of gold consists of a combination of current production from mining and metal recycling and the draw-down of existing stocks of gold held by governments, financial institutions, industrial organizations, and private individuals. Based on publicly available information published by the World Gold Council, gold production from mines increased 0.9% in 2023 compared with 2022 totaling approximately 3,644 metric tons (or 117.2 million troy ounces) and represented approximately 74.4% of the 2023 global gold supply of 4,899 metric tons. According to the World Gold Council, gold demand in 2023 was approximately 4,448 metric tons (or 143.0 million troy ounces) and totaled approximately $277.5 billion in value. In 2023, gold demand by sector was comprised of jewelry (49%), investments including bar and coin and ETFs (21%), central bank purchases (23%), and technology (7%).

The supply of silver consists of a combination of current production from mining (approximately 82%) and metal recycling and other (approximately 18%). Based on publicly available information, estimated silver production from mines increased approximately 2% in 2023 compared with 2022 totaling approximately 842 million troy ounces and represented approximately 82% of the 2023 global silver supply of 1,025 million troy ounces. Silver demand in 2023 was approximately 1,167 million troy ounces and totaled approximately $24.9 billion in value. In 2023, silver demand by sector was comprised of photovoltaics (14%), other industrial (12%), jewelry (17%), silverware (5%), photography (2%), and investments (26%).

Gold and Silver Prices

The price of gold and silver is volatile and is affected by many factors beyond our control, including geopolitical events, such as conflicts or trade tensions, the sale or purchase of gold by central banks and financial institutions, inflation or deflation and monetary policies, fluctuation in the value of the U.S. dollar and foreign currencies, global and regional demand, and the political and economic conditions of major gold and silver producing countries throughout the world. The following table presents the annual high, low, and average afternoon fix prices for gold and silver over the past three years on the London Bullion Market (in U.S. dollars per ounce).

| GOLD PRICES | SILVER PRICES | |||||||||||||||||||||||||||||||||||||

| Year | High | Low | Average | High | Low | Average | ||||||||||||||||||||||||||||||||

| 2021 | $ | 1,943 | $ | 1,684 | $ | 1,799 | $ | 29.59 | $ | 21.53 | $ | 25.04 | ||||||||||||||||||||||||||

| 2022 | $ | 2,039 | $ | 1,628 | $ | 1,800 | $ | 26.18 | $ | 17.77 | $ | 21.71 | ||||||||||||||||||||||||||

| 2023 | $ | 2,150 | $ | 1,907 | $ | 1,944 | $ | 24.43 | $ | 22.00 | $ | 23.33 | ||||||||||||||||||||||||||

| 2024 (through Mar. 12th) | $ | 2,180 | $ | 1,985 | $ | 2,046 | $ | 24.50 | $ | 22.09 | $ | 22.98 | ||||||||||||||||||||||||||

On March 12, 2024, the afternoon fix price for gold and silver on the London Bullion Market was $2,161 per ounce and $24.38 per ounce, respectively.

Competition

The top ten producers of gold comprise approximately one-quarter of total worldwide mined gold production. We are a gold and silver exploration and development company with a single property, the Hycroft Mine. The Hycroft Mine has a large gold and silver mineral resource as noted in the 2023 Hycroft TRS. We have not completed our engineering studies and we have not fully developed our sulfide ore milling and processing studies and therefore, have not established our long-term

6

production and cost structure. The metals markets are cyclical, and our ability to compete in that market over the long-term will be based on our ability to develop and cost effectively operate the Hycroft Mine in a safe and environmentally responsible manner.

We compete with other mining companies in connection with hiring and retaining qualified employees. There is substantial competition for qualified employees in the mining industry, some of which is with larger companies having greater financial resources than us and a more stable history. As a result, we may have difficulty hiring and retaining qualified employees.

See Item 1A. Risk Factors — Industry Related Risks — The Company faces intense competition in the recruitment and retention of qualified employees and contractors, for additional discussion related to our current and potential competition.

Employees

At December 31, 2023, we had 78 employees, of which 69 were employed at the Hycroft Mine. None of our employees are represented by unions.

We believe safety is a core value and support that belief through our philosophy of safe work performance. Our mandatory mine safety and health programs include employee engagement and ownership of safety performance, accountability, employee and contractor training, risk management, workplace inspection, emergency response, accident investigation, anti-harassment, and program auditing. This integrated approach is essential to ensure that our employees, contractors, and visitors operate safely.

We reported no lost time incidents during the year ended December 31, 2023, and achieved one million workhours without a lost time incident in the second quarter of 2023. The Hycroft Mine’s total recordable injury frequency rate (“TRIFR”) for the trailing 12 months, which includes other reportable incidents, is one of the metrics we use to assess safety performance, and it is well below industry averages and significantly below pre-2021 historical levels experienced at the Hycroft Mine. During the year ended 2023, we continued our critical focus on safety, including allocating personnel, resources, workforce time, and communications to operate safely. These actions contributed to maintaining our TRIFR of Nil (0.00) at December 31, 2023 and December 31, 2022. We remain committed to adapting our safety initiatives as necessary to ensure the well-being of our workforce, contractors, and visitors.

Government Regulation of Mining-Related Activities

Government Regulation

Mining operations and exploration activities are subject to various federal, state and local laws and regulations in the United States, which govern prospecting, exploration, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We have obtained or have pending applications for those licenses, permits or other authorizations currently required to conduct our current mining, exploration and other programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed thereunder in Nevada and at the federal level in the United States. Although we are not aware of any current claims, orders or directions relating to our business with respect to the foregoing laws and regulations, changes to, or more stringent application, interpretation, or enforcement of, such laws and regulations in Nevada, or in jurisdictions where we may operate in the future, could require additional capital expenditures and increased operating and/or reclamation costs, which could adversely impact the profitability levels of our projects.

Environmental Regulation

Our projects are subject to various federal and state laws and regulations governing protection of the environment. These laws and regulations are continually changing and, in general, are becoming more restrictive. The federal laws and regulations, among other things:

•impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites (the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended (“CERCLA”));

•govern the generation, treatment, storage and disposal of solid waste and hazardous waste (the Resource Conservation and Recovery Act of 1976, as amended (“RCRA”));

•restrict the emission of air pollutants from many sources, including mining and processing activities (the Clean Air Act of 1970, as amended (the “Clean Air Act”));

•require federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including the issuance of permits to mining facilities and assessing alternatives to these actions (the National Environmental Policy Act of 1970, as amended (“NEPA”));

7

•regulate the use of federal public lands to prevent undue and unnecessary degradation of the public lands (the Federal Land Policy and Management Act of 1976, as amended (the “FLPMA”));

•restrict and control the discharge of pollutants and dredged and fill materials into waters of the United States (the Clean Water Act of 1972, as amended (the “Clean Water Act”)); and

•regulate the drilling of subsurface injection wells (the Safe Drinking Water Act of 1974, as amended (the “Safe Drinking Water Act”) and the Underground Injection Control Program promulgated thereunder).

We cannot predict at this time what changes, if any, to federal laws or regulations may be adopted or imposed by the current governmental administration. At the state level, mining operations in Nevada are regulated by the Nevada Department of Conservation and Natural Resources, Division of Environmental Protection, which has the authority to implement and enforce many of the federal regulatory programs described above as well as state environmental laws and regulations. Compliance with these and other federal and state laws and regulations could result in delays in obtaining, or failure to obtain, government permits and approvals, delays in beginning or expanding operations, limitations on production levels, incurring additional costs for investigation or cleanup of hazardous substances, payment of fines, penalties or remediation costs for non-compliance, and post-mining closure, reclamation and bonding.

It is our policy to conduct business in a way that safeguards our employees, public health and the environment. We believe that our operations are, and will be, conducted in material compliance with applicable laws and regulations. However, our past and future activities in the United States may cause us to be subject to liability under such laws and regulations. For information about the risks to our business related to environmental regulation, see the following risk factors in Item 1A. Risk Factors – Industry Related Risks:

•The Company relies upon numerous governmental permits that are difficult to obtain, and the Company may not be able to obtain or renew all of the required permits, or such permits may not be timely obtained or renewed;

•Environmental regulations could require the Company to make significant expenditures or expose the Company to potential liability;

•Failure to comply with environmental regulations could result in penalties and costs; and

•Compliance with current and future government regulations may cause the Company to incur significant costs.

During the year ended December 31, 2022, the Company received a notice of non-compliance from the closure branch of the Nevada Division of Environmental Protection (“NDEP”) Bureau of Mining Regulation and Reclamation regarding a historical reclamation matter. As such, the Company has accelerated certain reclamation activities in order to regain compliance. During 2023 and 2022, there were no known material environmental incidents. We did not incur material capital expenditures for environmental control facilities during 2023 and 2022, and we do not expect to incur any material expenditures in 2024 for such environmental control facilities.

Reclamation

We are required to mitigate long-term environmental impacts by amending, backfilling, stabilizing, contouring, re-sloping, and re-vegetating various portions of a site after mining and mineral processing are completed, mitigating potential impacts to surface water and groundwater resources. These reclamation efforts will be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies. Our reclamation obligations at the Hycroft Mine are secured by surface management surety bonds that meet the financial assurance requirements of the State of Nevada and the Bureau of Land Management (“BLM”). Our most recent reclamation cost estimate was approved by the BLM and the State of Nevada in July 2020. As of December 31, 2023, our surface management surety bonds totaled $58.7 million, of which $58.3 million secures the financial assurance requirements for the Hycroft Mine, and $0.4 million secures the financial assurance requirements for the adjacent water supply well field and exploration within the project boundary. The Company began performing reclamation activities on its Crofoot leach pad beginning in 2023 and expects to continue the Crofoot reclamation activities in 2024. The Company also expects to treat and manage solutions in certain ponds beginning in 2024 and continuing through 2026. No additional material reclamation expenditures are expected to be incurred until after mining and mineral processing are completed. If we incur additional long-term environmental impacts from future mining activities, we will likely have additional reclamation obligations, as well as additional financial assurance requirements. For our existing obligations, as well as any future obligations we may incur, we may choose to engage in reclamation activities before mining and mineral processing are completed, but these expenses are not anticipated to be material to the overall reclamation obligation. When we perform reclamation work in the future, the work will be planned to conform to our mining operations and will be required to be documented when completed under our governing permits with the government regulatory agencies. The reclamation obligation would be adjusted accordingly as allowed under current regulations, and the financial assurance requirements would be adjusted to account for the completed reclamation work. If we are required to comply with material unanticipated financial assurance requirements in the future, our financial position could be adversely affected, or our posted financial assurance may

8

be insufficient. For financial information about our estimated future reclamation costs, see Note 8 – Asset Retirement Obligation to the Notes to the Consolidated Financial Statements.

Mine Safety and Health Administration Regulations

Safety and health are core values, which is why we have mandatory mine safety and health programs that include employee and contractor training, risk management, workplace inspection, emergency response, accident investigation, and program auditing. We consider these programs to be essential at all levels within Hycroft to ensure that our employees, contractors, and visitors only operate in a safe and healthy workplace.

Our operations and exploration properties are subject to regulation by the Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and Health Act of 1977, as amended (the “Mine Act”). Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, as amended (the “Dodd-Frank Act”), issuers are required to disclose specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities in periodic reports. MSHA inspects our mines on a regular basis and issues various citations and orders when it believes a violation has occurred under the Mine Act. The number of citations and orders charged against mining operations in the U.S., and the dollar penalties assessed for such citations, have generally increased in recent years. The Dodd-Frank Act requires us to provide certain mine safety disclosure, which we have done in Part I – Item 4. Mine Safety Disclosures of this 2023 Form 10-K.

Property Interests and Mining Claims

Our exploration and development activities are conducted in the State of Nevada. Mineral interests in Nevada may be owned by the United States, the State of Nevada, or private parties. Where prospective mineral properties are held by the United States, mineral rights may be acquired through the location of unpatented mineral claims upon unappropriated federal land. Where prospective mineral properties are owned by the State of Nevada or private parties, some type of property acquisition agreement or access agreement is necessary in order for us to explore or develop such property. Mining claims are subject to the same risk of defective title that is common to all real property interests. Additionally, mining claims are self-initiated and self-maintained and, therefore, possess some unique vulnerabilities not associated with other types of property interests. It is impossible to ascertain the validity of unpatented mining claims solely from an examination of the public real estate records and, therefore, it can be difficult or impossible to confirm that all of the requisite steps have been followed for location and maintenance of a claim. For general information about our mineral properties and mining claims, see Item 2. Properties. For information about the risks to our business related to our property interests and mining claims, see the following risk factors in Item 1A. Risk Factors – Industry Related Risks:

•There are uncertainties as to title matters in the mining industry. Any defects in such title could cause the Company to lose its rights in mineral properties and jeopardize our business operations; and

•Legislation has been proposed periodically that could, if enacted, significantly affect the cost of mine development on the Company’s unpatented mining claims.

Technical Report Summaries (“TRS”) and Qualified Persons

The scientific and technical information concerning our mineral projects in the 2023 Form 10-K have been reviewed and approved by third-party “qualified persons” under the Modernization Rules, including Ausenco Engineering South USA, Inc. (“Ausenco”), Independent Mining Consultants, Inc, (“IMC”), and WestLand Engineering & Environmental Services, Inc. (“WestLand”). For a description of the key assumptions, parameters and methods used to estimate mineral resources included in the 2023 Form 10-K, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the 2023 Hycroft TRS incorporated by reference herein.

Available Information

The Company is a remote first company and does not maintain a corporate headquarters. Our mailing address is PO Box 3030 Winnemucca, Nevada 89446. Our telephone number is (775) 304-0260. Our website is www.hycroftmining.com. We encourage investors to use our website to find information about us. We promptly make available on this website, free of charge, the reports that we file or furnish with the SEC, as well as corporate governance information (including our Code of Business Conduct & Ethics and our Code of Conduct and Ethics for Senior Financial Officers). The SEC maintains a website at www.sec.gov that contains annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements and other information regarding Hycroft and other issuers that file electronically with the SEC. In addition, paper copies of these documents will be furnished to any stockholder, upon request, free of charge.

9

ITEM 1A. RISK FACTORS

You should carefully review and consider the following risk factors and the other information contained in this 2023 Form 10-K. Investing in the Company’s common stock or warrants is speculative and involves a high degree of risk due to the nature of the business and the present stage of exploration and advancement of the Company’s mineral properties. The Company may face additional risks and uncertainties that are not presently known, or that are currently deemed immaterial, which may also impair the Company’s business or financial condition. If any of those risks actually occur, the business, financial condition, and results of operations would suffer. The risks discussed below also include forward-looking statements, and actual results may differ substantially from those discussed in these forward-looking statements. See also Cautionary Statement Regarding Forward-Looking Statements in this 2023 Form 10-K. The following discussion should be read in conjunction with the Financial Statements and Notes.

Summary of Risk Factors:

The following list provides a summary of risk factors discussed in further detail below:

Risks related to changes in the Company’s operations at the Hycroft Mine, including:

•Risks associated with cessation of mining operations at the Hycroft Mine;

•Uncertainties concerning estimates of mineral resources;

•Risks relating to a lack of a completed pre-feasibility or feasibility study; and

•Risks related to the Company’s ability to finance and establish commercially feasible mining operations.

Industry-related risks, including:

•Fluctuations in the prices of gold and silver;

•Intense competition within the mining industry for mineral properties, employees, contractors and consultants;

•The commercial success of, and risks relating to, the Company’s exploration and development activities;

•Uncertainties and risks related to reliance on contractors and consultants;

•Availability and cost of equipment, supplies, energy, or commodities;

•The inherently hazardous nature of mining activities, including safety and environmental risks;

•Potential effects of U.S. federal and state governmental regulations, including environmental regulation and permitting requirements;

•Uncertainties relating to obtaining, retaining or renewing approvals and permits from governmental regulatory authorities;

•Cost of compliance with current and future government regulations, including environmental regulations;

•Potential challenges to title in our mineral properties;

•Inadequate insurance to cover all risks associated with our business, or cover the replacement costs of our assets or may not be available for some risks;

•Risks associated with potential legislation in Nevada that could significantly increase the cost of mine development on the Company’s unpatented mining claims;

•Risks associated with regulations and pending legislation involving climate change could result in increased costs, which could have a material adverse effect the Company’s business;

•Changes to the climate and regulations regarding climate change; and

•Continued uncertainties relating to the COVID-19 pandemic or other pandemics.

Business-related risks, including:

•Risks related to the Company’s ability to raise capital on favorable terms or at all;

•The loss of key personnel or the Company’s failure to attract and retain personnel;

•Risks related to the Company’s substantial indebtedness, including operating and financial restrictions under existing indebtedness, cross-acceleration and the Company’s ability to generate sufficient cash to service the indebtedness;

•The costs related to land reclamation requirements;

10

•Future litigation or similar legal proceedings could have a material adverse effect on the Company’s business and results of operations;

•Risks related to information and operational technology systems, new technologies and security breaches; and

•Risks that principal stockholders will be able to exert significant influence over matters submitted to stockholders for approval.

Risks related to the Company’s common stock and warrants, including:

•Volatility in the price of the Company’s common stock and warrants;

•Risks relating to a potential dilution as a result of future equity offerings;

•Risks relating to a short “squeeze” resulting in sudden increases in demand for the Company’s common stock;

•Risks relating to decreased liquidity of the Company’s common stock as a result of the reverse stock split;

•Risks relating to information published by third parties about the Company that may not be reliable or accurate;

•Risks associated with interest rate changes;

•Volatility in the price of the Company’s common stock could subject it to securities litigation;

•Risks associated with the Company’s current plan not to pay dividends;

•Risks associated with future offerings of senior debt or equity securities;

•Risks related to a failure to comply with the Nasdaq Stock Market LLC (“Nasdaq”) listing requirements and a potential delisting by Nasdaq;

•Risks warrants may expire worthless;

•Risks that certain warrants are being accounted for as a liability;

•Anti–takeover provisions could make a third-party acquisition of the Company difficult; and

•Risks related to limited access to the Company’s financial information due to the fact the Company elected to take advantage of the disclosure requirement exemptions granted to smaller reporting companies.

Risks Related to Changes in the Hycroft Mine’s Operations

The Company has mineral resources at the Hycroft Mine, but the mine may not be brought into production.

The Company is not currently conducting commercial mining operations at the Hycroft Mine. There is no certainty that the mineral resources estimated at the Hycroft Mine will be mined or, if mined, processed profitably. The Company has no specific plans and cannot currently predict when the Hycroft Mine may be back in production. The commercial viability of the Hycroft Mine is dependent on many factors, including metal prices, the availability of and ability to raise capital for development, government policy and regulation and environmental protection, which are beyond the Company’s control. The Company may not generate commercial-scale revenues until the Hycroft Mine is back in production.

The figures for the Company’s mineral resources are estimates based on interpretation and assumptions and the Hycroft Mine may yield less mineral production or less profit under actual conditions than is currently estimated.

Unless otherwise indicated, mineral resource figures in the Company’s filings with the SEC, press releases, and other public statements made from time to time are based upon estimates made by the Company’s personnel and independent geologists. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be inaccurate. There can be no assurance that mineral resources or other mineralization figures will be accurate or that this mineralization could be mined or processed profitably.

Because the Company has not completed a feasibility study or recommenced commercial production at the Hycroft Mine, mineral resource estimates may require adjustments or downward revisions based upon further exploration or advancement work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that recovery of minerals in small-scale tests will be duplicated in larger-scale tests under on-site conditions or in production scale.

Until mineral resources are mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral resources may vary depending on metal prices, which largely determine whether mineral resources are classified as ore (economic to mine) or waste (uneconomic to mine). Current mineral resource estimates were calculated using sales prices of $1,900 per ounce of gold price and $24.50 per ounce of silver. A material decline in the current price of gold or silver or material changes in processing methods or cost assumptions could require a reduction in mineral

11

resource estimates. Any material reductions in estimates of mineral resources, or of the Company’s ability to upgrade these mineral resources to mineral reserves and extract these mineral resources, could have a material adverse effect on the Company’s prospects, and restrict its ability to successfully implement strategies for long-term growth. In addition, the Company cannot provide assurances that gold and silver recoveries experienced in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

The Company has not completed a feasibility study for the Hycroft Mine. There are no assurances future advancement activities by the Company, if any, will lead to a favorable feasibility study or profitable mining operations.

The Company completed and issued the 2023 Hycroft TRS, which replaced the 2022 Hycroft TRS. The 2023 Hycroft TRS provides an initial assessment of the mineral resource estimate and is not a feasibility study for the Hycroft Mine. Typically, a company will not make a production decision until it has completed a feasibility study.

There is no certainty that a feasibility study for the Hycroft Mine will be completed or, if completed, that it will result in sufficiently favorable estimates of the economic viability of the Hycroft Mine to justify a construction decision.

The Company may not be able to successfully establish mining operations or profitably produce precious metals.

The Company currently has no commercial mining operations or sustaining revenue from the exploration, development and care and maintenance operations currently conducted at the Hycroft Mine. Mineral exploration and advancement involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. The future advancement of the Hycroft Mine will require obtaining permits and financing and the construction and operation of the mine, processing plants, and related infrastructure. The Company’s ability to establish mining operations or profitably produce precious metals from the Hycroft Mine will be affected by:

•timing and cost, which can be considerable, of the construction of additional mining and processing facilities;

•availability and costs of skilled labor and mining equipment;

•availability and cost of appropriate refining arrangements;

•necessity to obtain additional environmental and other governmental approvals and permits, and the timing of those approvals and permits;

•availability of funds to finance equipment purchases, construction, and advancement activities;

•management of an increased workforce and coordination of contractors;

•potential opposition from non-governmental organizations, environmental groups, or local groups, which may delay or prevent advancement activities; and

•potential increases in construction and operating costs due to changes in the cost of fuel, power, labor, supplies and foreign exchange rates.

It is common in new mining operations to experience unexpected problems and delays during advancement, construction, start-up commissioning, and transition to commercial operations. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that, if the Company decides to initiate construction or mining activities, that it will be able to successfully establish mining operations or profitably produce gold and silver at the Hycroft Mine.

Industry-Related Risks

The market prices of gold and silver are volatile. A decline in gold or silver prices could result in decreased revenues, decreased net income, increased losses, and decreased cash inflows which may negatively affect the business.

Gold and silver are commodities. Commodity prices fluctuate and are affected by many factors beyond the Company’s control, including interest rates, expectations regarding inflation, speculation, currency values, central bank activities, governmental decisions regarding the disposal of precious metals stockpiles, global and regional demand and production, political and economic conditions and other factors. The prices of gold and silver, as quoted by The London Bullion Market Association on December 31, 2023 and December 31, 2022, were $2,062.40 and $1,813.75 per ounce for gold, respectively, and $23.79 and $23.945 per ounce for silver, respectively. The prices of gold and silver may decline in the future. A substantial or extended decline in gold or silver prices would adversely impact the Company’s financial position. In addition, sustained lower gold or silver prices may materially adversely affect the Company’s business, including:

•halting, delaying, modifying, or canceling plans for the mining of oxide, transitional, and sulfide ores or the development of new and existing projects;

12

•reducing existing mineral resources by removing ore from mineral resources that can no longer be economically processed at prevailing prices; and

•causing the Company to recognize an impairment to the carrying values of its long-lived assets.

The Company faces intense competition in the recruitment and retention of qualified employees and contractors.

The mining industry is intensely competitive for employees and contractors and includes several large established mining companies with substantial mining capabilities and with greater financial and technical resources than the Company’s. The Company competes with other mining companies in the recruitment and retention of qualified managerial and technical employees as well as contractors. If unable to successfully attract and retain qualified employees and contractors, the Company’s exploration and development programs and/or operations may be slowed or suspended, which may materially adversely impact the Company’s financial condition and results of operations.

The Company cannot be certain that future exploration and development activities will be commercially successful.

Substantial expenditures are required to construct and operate the Hycroft Mine, including additional equipment and infrastructure that is typically seen in milling and processing operations to allow for extraction of gold and silver from the sulfide mineral resource, to further develop the Hycroft Mine to establish mineral reserves and identify new mineral resources through exploration drilling and analysis. In 2024, the Company expects to continue to advance its evaluation reflected in the 2023 Hycroft TRS. In conjunction with the 2023 Hycroft TRS, the Company intends to complete additional exploration drilling, focusing on higher grade opportunities, conducting trade-off studies using the results from the 2022-2023 drill program and variability test work program and conduct alternatives analyses. The Company cannot provide any assurance that an economic process can be developed for the sulfide mineral resource using POX or other similar sulfide extraction processes, that any mineral resources discovered will be in sufficient quantities and grades to justify commercial operations or that the funds required for development can be obtained on a timely or economic basis.

Several factors, including costs, actual mineralization, consistency and reliability of ore grades, and commodity and reagent quantities and prices, affect successful project development. The efficient operation of processing facilities, the existence of competent operational management, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development. The Company can provide no assurance that the exploration, development and advancement of the Hycroft Mine sulfide processing operations will result in economically viable mining operations.

The Company’s reliance on third-party contractors and consultants to conduct exploration and development projects exposes the Company to risks.

In connection with the exploration and development of the Hycroft Mine, the Company contracts and engages third-party contractors and consultants to assist with aspects of the project. As a result, the Company is subject to a number of risks, some of which are outside its control, including:

•negotiating agreements with contractors and consultants on acceptable terms;

•the inability to replace a contractor or consultant and their operating equipment in the event that either party terminates the agreement;

•reduced control over those aspects of exploration or development operations that are the responsibility of the contractor or consultant;

•failure of a contractor or consultant to perform under their agreement or disputes relative to their performance;

•interruption of exploration or development operations or increased costs in the event that a contractor or consultant ceases their business due to insolvency or other unforeseen events;

•failure of a contractor or consultant to comply with applicable legal and regulatory requirements, to the extent they are responsible for such compliance; and

•problems of a contractor or consultant with managing their workforce, labor unrest or other employment issues.

In addition, the Company may incur liability to third parties as a result of the actions of contractors or consultants. The occurrence of one or more of these risks could increase the Company’s costs, interrupt or delay exploration or development activities or the ability to access its mineral resources, and materially adversely affect the Company’s liquidity, results of operations and financial position.

A shortage of equipment and supplies and/or the time it takes such items to arrive at the Hycroft Mine could adversely affect the Company’s ability to operate.

13

The Company is dependent on various supplies and equipment to engage in exploration and development activities. The shortage of supplies, equipment, and parts and/or the time it takes such items to arrive at the Hycroft Mine could have a material adverse effect on the Company’s ability to explore and develop the Hycroft Mine. Such shortages could also result in increased costs and cause delays in exploration and development projects.

Mining, exploration, development and processing operations pose inherent risks and costs that may negatively impact the Company’s business.

Mining, exploration, development and processing operations involve many hazards and uncertainties, including, among others:

•metallurgical or other processing problems;

•ground or slope failures;

•industrial accidents;

•unusual and unexpected rock formations or water conditions;

•environmental contamination or leakage;

•flooding and periodic interruptions due to inclement or hazardous weather conditions or other acts of nature;

•fires;

•seismic activity;

•supply and transportation interruptions;

•pandemics adversely affecting the availability of workforces and supplies;

•mechanical equipment failure and facility performance problems; and

•availability of skilled labor, critical materials, equipment, reagents, and consumable items.

These occurrences could result in damage to, or destruction of, the Company’s properties or production facilities, personal injury or death, environmental damage, delays in future mining or processing, increased future production costs, long-lived asset impairments, monetary losses and legal liability, any of which could have a material adverse effect on future exploration and development plans, the Company’s ability to raise additional capital, and/or the Company’s financial condition, results of operations and liquidity.

Environmental regulations could require the Company to make significant expenditures or expose the Company to potential liability.

To the extent the Company becomes subject to environmental liabilities, the payment of such liabilities, or the costs that may be incurred, including costs to remedy environmental pollution, would reduce funds otherwise available to the Company and could have a material adverse effect on the Company’s financial condition, results of operations, and liquidity. If unable to fully remedy an environmental violation or release of hazardous substances, the Company might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy or corrective action. The environmental standards that may ultimately be imposed at a mine site can vary and may impact the remediation costs. Actual remediation costs may exceed the financial accruals made for such remediation. Additionally, the timing of the remedial costs may be materially different from the current remediation plan. The potential exposure may be significant and could have a material adverse effect on the Company’s financial condition and results of operations.

Moreover, governmental authorities and private parties may bring lawsuits based upon damage to property or natural resources and injury to persons resulting from the environmental, health and safety impacts of the Company’s past and current operations, which could lead to the imposition of substantial fines, remediation costs, penalties, injunctive relief and other civil and criminal sanctions. Substantial costs and liabilities, including those required to restore the environment after the closure of mines, are inherent in mining operations. The Company cannot provide any assurance that any such law, regulation, enforcement or private claim will not have a material negative effect on the Company’s business, financial condition or results of operations.

The Company relies upon numerous governmental permits that are difficult to obtain, and the Company may not be able to obtain or renew all of the required permits, or such permits may not be timely obtained or renewed.

In the ordinary course of business, the Company is required to obtain and renew governmental permits for the current limited operations at the Hycroft Mine. Additional governmental permits are needed to accomplish the long-term plans to mine sulfide ores under plans yet to be developed. Obtaining or renewing the necessary governmental permits is a complex and time-consuming process involving costly undertakings by the Company. The duration and success of efforts to obtain and renew

14

permits are contingent upon many variables not within the Company’s control, including the interpretation of applicable requirements implemented by the permitting authority and intervention by third parties in any required environmental review. The Company may be unable to obtain or renew necessary permits on a timely basis or at all, and the cost to obtain or renew permits may exceed the Company’s estimates. Failure to comply with permit terms may result in injunctions, fines, suspension or revocation of permits and other penalties. The Company can provide no assurance that it has been, or will at all times be, in full compliance with all of the terms of its permits or that the Company has all required permits. The costs and delays associated with compliance with these permits and with the permitting process could alter all or a portion of any mine plan proposed in the future, delay or stop the Company from proceeding with the development of the Hycroft Mine or increase the costs of development or production, any or all of which may materially adversely affect the Company’s business, prospects, results of operations, financial condition and liquidity.

Failure to comply with environmental regulations could result in penalties and costs.

While the Company is not conducting active mining operations at the Hycroft Mine, the facilities and prior operations have been and are, and the Company’s future development plans may continue to be, subject to extensive federal and state environmental regulation, including those enacted under the following laws:

•CERCLA;

•RCRA;

•Clean Air Act;

•NEPA;

•Clean Water Act;

•Safe Drinking Water Act;

•FLPMA; and

•Bald and Golden Eagle Protection Act of 1940, as amended.

Additional regulatory authorities may also have or have had jurisdiction over some of the Company’s operations and mining projects including the Environmental Protection Agency, NDEP, the U.S. Fish and Wildlife Service, BLM, and the Nevada Department of Wildlife (“NDOW”).

These environmental regulations require the Company to obtain various permits, approvals and licenses and also impose standards and controls relating to development and production activities. For instance, the Company is required to hold a Nevada Reclamation Permit with respect to the Hycroft Mine. This permit mandates concurrent and post-mining reclamation of mines and requires the posting of reclamation bonds sufficient to guarantee the cost of mine reclamation. Changes to the amount required to be posted for reclamation bonds could materially affect the Company’s financial position, results of operations, cash flows and liquidity. Also, the U.S. Fish and Wildlife Service may designate critical habitat and suitable habitat areas it believes are necessary for the survival of a threatened or endangered species. A critical habitat or suitable habitat designation could result in further material land-use restrictions and may materially delay or prohibit land access for development. For example, the Company had to obtain certain permits associated with mining in the area of an eagle habitat. Failure to obtain such required permits or failure to comply with federal and state regulations could also result in delays in beginning or expanding exploration, future operations, incurring additional costs for investigation or cleanup of hazardous substances, payment of penalties for non-compliance or discharge of pollutants, and post-mining closure, reclamation, and bonding, all of which could have a material adverse impact on the Company’s financial performance, results of operations, and liquidity.

Compliance with current and future government regulations may cause the Company to incur significant costs.

Mining operations are subject to extensive federal and state legislation governing matters such as mine safety, occupational health, labor standards, prospecting, exploration, production, exports, toxic and hazardous substances, explosives, management of natural resources, land use, water use, air emissions, waste disposal, environmental review, and taxes. While the Company has ceased mining operations at the Hycroft Mine, continued compliance with these regulations and other legislation relating to regulation obligations concerning the Hycroft Mine and its future exploration and development could require significant financial outlays to comply with these laws. The enactment of new legislation or more stringent enforcement of current legislation may also increase these costs, which could materially and negatively affect the Company’s financial position, results of operations, and liquidity. The Company can provide no assurances that it will be able to adapt to these regulatory developments on a timely or cost-effective basis. Violations of these laws, regulations, and other regulatory requirements could lead to substantial fines, penalties or other sanctions, including possible shutdown of future operations.

15

There are uncertainties as to title matters in the mining industry. Any defects in such title could cause the Company to lose its rights in mineral properties and jeopardize the business.

The Hycroft Mine consists of private mineral rights, leases covering private lands, patented mining claims, and unpatented mining claims. Areas of the Hycroft Mine are unpatented mining claims located on lands administered by the BLM Nevada State office to which the Company has only possessory title. Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper location and posting and marking of boundaries, and possible conflicts with other claims not determinable from descriptions of record. The Company believes a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, and this uncertainty is inherent in the mining industry.

The present status of the Company’s unpatented mining claims located on public lands allows the Company the right to mine and remove valuable minerals, such as precious and base metals, from the claims conditioned upon applicable environmental reviews and permitting programs. The Company is generally allowed to use the surface of the land solely for purposes related to mining and processing the mineral-bearing ores. However, legal ownership of the land remains with the United States. The Company remains at risk of the mining claims being forfeited either to the United States or to rival private claimants due to failure to comply with statutory requirements. Before 1994, a mining claim locator who was able to prove the discovery of valuable, locatable minerals on a mining claim and to meet all other applicable federal and state requirements and procedures pertaining to the location and maintenance of federal unpatented mining claims had the right to prosecute a patent application to secure fee title to the mining claim from the Federal government. However, the right to pursue a patent has been subject to a moratorium since October 1994 through federal legislation restricting the BLM from accepting any new mineral patent applications. If the Company does not obtain fee title to its unpatented mining claims, the Company cannot assure that it will be able to obtain compensation in connection with the forfeiture of such claims.

There may be challenges to title to the mineral properties in which the Company holds a material interest. If there are title defects concerning any properties, the Company may be required to compensate other persons or reduce its interest in the affected property. Also, in any such case, the investigation and resolution of title issues would divert management’s time from ongoing business operations.

The Company’s insurance may not cover all of the risks associated with the business.

The mining industry is subject to risks and hazards, including, but not limited to, environmental hazards, industrial accidents, the encountering of unusual or unexpected geological formations, slide-ins, flooding, earthquakes and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, mineral properties, equipment or facilities, personal injury or death, environmental damage, long-lived asset impairments, monetary losses, and possible legal liability. Insurance fully covering many of these risks is not generally available to the Company and if it is, the Company may elect not to obtain it because of the high premium costs or commercial impracticality. Any liabilities incurred for these risks and hazards could be significant and could materially and adversely affect the Company’s results of operations, cash flows, and financial condition.

Legislation has been proposed periodically that could, if enacted, significantly affect the cost of mine development on the Company’s unpatented mining claims.

Members of the U.S. Congress have periodically introduced bills that would supplant or alter the provisions of the Mining Law of 1872. Such bills have proposed, among other things, to either eliminate or greatly limit the right to a mineral patent and to impose a federal royalty on production from unpatented mining claims. Such proposed legislation could change the cost of holding unpatented mining claims and could significantly impact the Company’s ability to develop mineralized material on unpatented mining claims. A majority of the Company’s mining claims at the Hycroft Mine are unpatented claims. Although the Company is unable to predict what legislated royalties might be, the enactment of these proposed bills could adversely affect the potential for development of the Company’s unpatented mining claims and the economics of any future mine operations on federal unpatented mining claims. Passage of such legislation could materially adversely affect the Company’s financial performance and results of operations.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on the Company’s business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could materially increase the Company’s costs, and the costs of its suppliers, for further exploration and development of the Hycroft Mine, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact the Company’s ability to compete with companies situated in areas not subject to such

16

regulations. Given the political significance and uncertainty around the impact of climate change and how it should be dealt with, the Company cannot predict how legislation and regulation will affect its financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness, and any adverse publicity in the global marketplace about potential impacts on climate change by the Company or other companies in the mining industry could cause reputational harm.

Climate change could have an adverse impact on the Company’s cost of operations.

The potential physical impacts of climate change on the Company’s development activities or future operations are highly uncertain and would be particular to the areas in which the Company operates. These climate changes may include changes in rainfall and storm patterns and intensities, water shortages, and changing temperatures. These changes in climate could materially adversely affect mining operations, including by affecting the moisture levels and pH of ore on leach pads, could materially and adversely affect the cost to construct and operate the Hycroft Mine, and materially and adversely affect the Company’s financial performance and operations.

The ongoing effects of the coronavirus pandemic or other pandemics may adversely impact our business and financial condition.

The effects of the COVID-19 pandemic have largely abated. However, the remaining ongoing effects are uncertain. The pandemic could begin worsening again in the U.S. and elsewhere, creating renewed uncertainty. The worsening of the COVID-19 pandemic could continue to, and possible future similar epidemics or other possible pandemics could also, materially and negatively impact the Company’s business, including without limitation, employee health, workforce productivity, insurance premiums, ability to travel, the availability of industry experts and personnel, restrictions or delays to current and future drill and work programs and/or the timing to process drilling and other metallurgical testing, and other factors that will depend on future developments beyond the Company’s control, which may have a material and adverse effect on its business, financial condition and results of operations. Additionally, the Company’s financial condition and results could be adversely and materially impacted due to pandemic closures or restrictions requested or mandated by governmental authorities, disruption to supply chains, and credit losses when vendors or counterparties fail to satisfy their obligations to the Company.

Business-Related Risks

The Company will need to raise additional capital, but such capital may not be available on favorable terms or at all.

The exploration and development of the Hycroft Mine for mining and processing mineral resources will require significant investment. Failure to obtain sufficient financing may result in the delay or indefinite postponement of exploration, development, or production at the Hycroft Mine. The covenants in the Sprott Credit Agreement could significantly limit the Company’s ability to secure new or additional credit facilities, increase the cost of borrowing, and make it difficult or impossible to raise additional capital on favorable terms or at all.

The Company’s primary future cash requirements for 2024 will be to fund working capital needs, capital and project expenditures, satisfying debt service required under the Sprott Credit Agreement, and other corporate expenses so the Company can continue to develop the Hycroft Mine by conducting targeted exploration drilling and completing the necessary technical studies to determine the likely timeline to bring the sulfide mineral resources into commercial-scale operation. As of December 31, 2023, the Company had unrestricted cash of $106.2 million. Stockholders are cautioned that expectations regarding the Company’s liquidity and capital resources are based on a number of assumptions that are believed to be reasonable but could prove to be incorrect. For example, the Company’s expectations are based on assumptions regarding commodity prices, anticipated costs and other factors that are subject to risks, many of which are beyond the Company’s control. If the Company’s assumptions prove to be incorrect, it may require additional financing sooner than expected to continue to operate the business, which may not be available on favorable terms or at all and which could have a material adverse effect on the Company’s results of operations, financial condition, and liquidity.

If the Company loses key personnel or cannot attract and retain additional personnel, the Company may be unable to explore and develop the business.

The Company’s development in the future will be highly dependent on the efforts of key management employees, specifically Diane Garrett, its President and Chief Executive Officer; Stanton Rideout, its Executive Vice President and Chief Financial Officer; and other key employees the Company may hire in the future. The Company will need to recruit and retain other qualified managerial and technical employees to build and maintain its operations. If the Company is unable to successfully recruit and retain such persons, the Company’s exploration, development and growth plans could be significantly curtailed.

The Sprott Credit Agreement imposes significant operating and financial restrictions that may limit the Company’s ability to operate its business.

17

The Sprott Credit Agreement imposes significant operating and financial restrictions on the Company and its restricted subsidiaries. These restrictions limit the Company’s ability and the ability of restricted subsidiaries to, among other things, as applicable:

•incur additional debt;

•pay dividends or make other restricted payments, including certain investments;

•create or permit certain liens;

•sell assets;

•engage in certain transactions with affiliates; and

•consolidate or merge with or into other companies, or transfer all or substantially all of the Company’s assets or the assets of its restricted subsidiaries.

These restrictions could limit the Company’s ability to finance future operations or capital needs, make acquisitions or pursue available business opportunities.

In addition, the Sprott Credit Agreement requires the Company to comply with a number of customary covenants, as well as cross acceleration defaults. The customary covenants include:

•delivery of monthly, quarterly and annual consolidated financial statements, and semi-annual budgets or projections;

•maintaining required insurance;

•compliance with laws (including environmental);

•compliance with Employee Retirement Income Security Act of 1974, as amended (“ERISA”);

•maintenance of ownership of 100% of the Hycroft Mine;

•restrictions on consolidations, mergers or sales of assets;

•limitations on liens;

•limitations on issuance of certain equity interests;

•limitations on issuance of additional indebtedness;

•limitations on transactions with affiliates; and

•other customary covenants.

The Company has received several waivers to date from covenant obligations under the Sprott Credit Agreement. The Company can make no assurances that it will satisfy these covenants or that its lenders will continue to waive any future failure to do so. A breach of any of the covenants under the Sprott Credit Agreement could result in a default. See Note 9 – Debt, Net to the Notes to the Financial Statements for further information. If a default occurs under the Sprott Credit Agreement and/or the Royalty Agreement among the Company, Hycroft Resources and Development, LLC, a wholly owned subsidiary of the Company, and Sprott Private Resource Lending II (Co) Inc. (the “Sprott Royalty Agreement”), the lenders could elect to declare the debt, together with accrued interest and other fees, to be immediately due and payable and proceed against the collateral securing that debt, which, in the case of the Sprott Credit Agreement and the Sprott Royalty Agreement, constitutes all or substantially all of the Company’s assets.

The Company’s substantial indebtedness could adversely affect its financial condition.

As of December 31, 2023, the Company had substantial outstanding indebtedness under the Sprott Credit Agreement and the Subordinated Notes. Subject to the limits and terms contained in the Sprott Credit Agreement, if the Company is unable to incur additional debt or grant additional security interests from time to time to finance working capital, capital expenditures, investments or acquisitions, or for other purposes, then the risks related to the Company’s high level of debt could intensify. This high level of debt and royalty payment obligations could:

•make it more difficult for the Company to satisfy obligations with respect to its outstanding debt;

•require a substantial portion of the Company’s cash flows to be dedicated to debt service and/or royalty payments instead of other purposes, thereby reducing the amount of cash flows available for working capital, capital expenditures, acquisitions and other general corporate purposes;

•limit the Company’s ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements;

18

•increase vulnerability to commodity price volatility, including increases in prices of commodities the Company purchases and decreases in prices of gold and silver that the Company sells, each as part of operations, general adverse economic and industry conditions;

•limit flexibility in planning for and reacting to changes in the industry in which the Company competes;

•place the Company at a disadvantage compared to other, less leveraged competitors; and