UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number: 001-38318

Odonate Therapeutics, Inc.

(Exact name of Registrant as specified in its charter)

|

Delaware |

|

|

|

82-2493065 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

|

|

(I.R.S. Employer Identification Number) |

4747 Executive Drive, Suite 510

San Diego, CA 92121

(858) 731-8180

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

|

Common Stock, $0.01 par value per share |

ODT |

Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☒ |

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Company as of June 28, 2019 was $457,185,321, based on the closing price on the Nasdaq Global Select Market reported for such date. Shares of common stock held by each officer and director and by each person who is known to own 10% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Company. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 6, 2020, there were 32,063,135 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

|

|

|

|

Page |

|

|

|

|

1 |

|

|

|||

|

|

||||||

|

|

||||||

|

Item 1. |

|

|

2 |

|

|

|

|

Item 1A. |

|

|

34 |

|

|

|

|

Item 1B. |

|

|

54 |

|

|

|

|

Item 2. |

|

|

54 |

|

|

|

|

Item 3. |

|

|

54 |

|

|

|

|

Item 4. |

|

|

54 |

|

|

|

|

|

||||||

|

|

||||||

|

Item 5. |

|

|

55 |

|

|

|

|

Item 6. |

|

|

55 |

|

|

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

56 |

|

|

|

Item 7A. |

|

|

62 |

|

|

|

|

Item 8. |

|

|

62 |

|

|

|

|

Item 9. |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

62 |

|

|

|

Item 9A. |

|

|

62 |

|

|

|

|

Item 9B. |

|

|

63 |

|

|

|

|

|

||||||

|

|

||||||

|

Item 10. |

|

|

64 |

|

|

|

|

Item 11. |

|

|

67 |

|

|

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

72 |

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

74 |

|

|

|

Item 14. |

|

|

75 |

|

|

|

|

|

||||||

|

|

||||||

|

Item 15. |

|

|

76 |

|

|

|

|

Item 16. |

|

|

77 |

|

|

|

|

|

|

|

78 |

|

|

|

i

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the federal securities laws. We make such forward-looking statements pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “will,” “should,” “may,” “plan,” “assume” and other similar expressions that predict or indicate future events and trends that do not relate to historical matters. You should not unduly rely on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, some of which are beyond our control. These risks, uncertainties and other factors may cause our actual results, performance or achievements to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements regarding:

|

|

• |

our plans to develop and commercialize tesetaxel and any other product candidates; |

|

|

• |

our ongoing and planned clinical studies; |

|

|

• |

the relationship between preclinical study results and clinical study results; |

|

|

• |

the timing of and our ability to obtain regulatory approvals for tesetaxel and any other product candidates; |

|

|

• |

our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

|

|

• |

our ability to identify additional products or product candidates with significant commercial potential that are consistent with our commercial objectives; |

|

|

• |

the rate and degree of market acceptance and clinical utility of tesetaxel and any other product candidates, if approved; |

|

|

• |

our commercialization, marketing and manufacturing capabilities and strategy; |

|

|

• |

significant competition in our industry; |

|

|

• |

our intellectual property position; |

|

|

• |

our ability to retain key members of management; |

|

|

• |

our ability to execute our growth strategy; and |

|

|

• |

our ability to maintain effective internal controls. |

These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results to differ materially from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements, including the factors described under the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should evaluate all forward-looking statements made in this Annual Report on Form 10-K, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors.

We caution you that the risks, uncertainties and other factors referred to above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits or developments that we expect or anticipate or, even if substantially realized, that they will affect us or our business in the way expected. All forward-looking statements in this Annual Report on Form 10-K apply only as of the date made and are expressly qualified in their entirety by the cautionary statements included in this Annual Report on Form 10-K. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

1

In this Annual Report on Form 10-K, unless context requires otherwise, references to “we,” “us,” “our,” “Odonate” or the “Company” refer to Odonate Therapeutics, Inc.

Company Overview

We are a pharmaceutical company dedicated to the development of best-in-class therapeutics that improve and extend the lives of patients with cancer. Our initial focus is on the development of tesetaxel, an investigational, orally administered chemotherapy agent that belongs to a class of drugs known as taxanes, which are widely used in the treatment of cancer. Tesetaxel has several pharmacologic properties that make it unique among taxanes, including: oral administration with a low pill burden; a long (~8-day) terminal plasma half-life (“t1/2”) in humans, enabling the maintenance of adequate drug levels with relatively infrequent dosing; no history of hypersensitivity (allergic) reactions; and significant activity against chemotherapy-resistant tumors. In patients with metastatic breast cancer (“MBC”), tesetaxel was shown to have significant, single-agent antitumor activity in two multicenter, Phase 2 studies. We are currently conducting three studies in breast cancer, including a multinational, multicenter, randomized, Phase 3 study in patients with MBC, known as CONTESSA. Enrollment in CONTESSA is complete, and we expect to report top-line results from this study in the third quarter of 2020. Our goal for tesetaxel is to develop an effective chemotherapy choice for patients that provides quality-of-life advantages over current alternatives.

Breast Cancer and Its Treatment

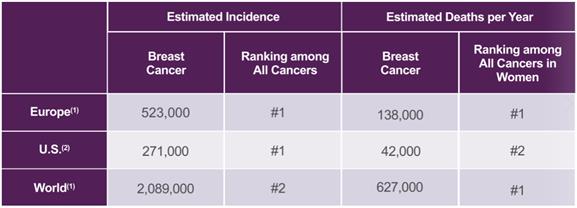

Breast cancer is the second-most common cancer worldwide, with an estimated 2.1 million new cases diagnosed per year (World Health Organization). In Europe, an estimated 523,000 new cases are diagnosed and approximately 138,000 women will die of the disease each year, making it the leading cause of cancer death in women (World Health Organization). In the U.S., an estimated 271,000 new cases are diagnosed and approximately 42,000 women will die of the disease each year, making it the second-leading cause of cancer death in women (American Cancer Society). Estimated breast cancer incidence and deaths per year in Europe, the U.S. and worldwide are shown in the following table.

Estimated Breast Cancer Incidence and Deaths per Year in Europe, the U.S. and Worldwide

|

|

|

(1) World Health Organization (2) American Cancer Society |

2

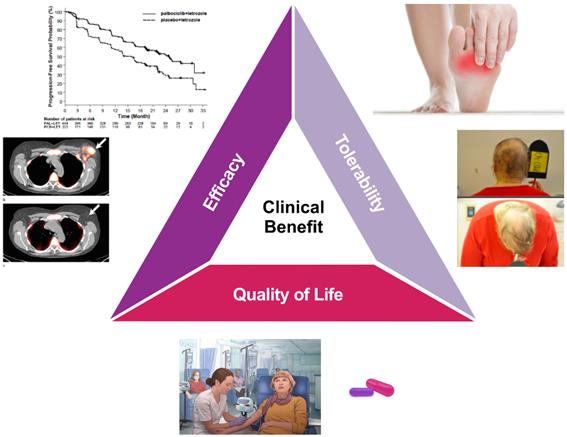

The prognosis for women with MBC remains poor; the 5-year survival rate for metastatic disease is about 22% (American Cancer Society), making this an area of continued, high unmet medical need. Therefore, treatment that balances efficacy, tolerability and quality of life is preferred.

Clinical Benefit Is a Balance of Efficacy, Tolerability and Quality of Life

|

|

3

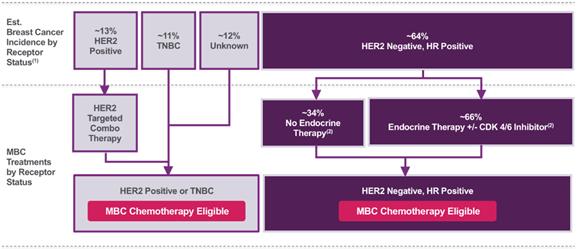

Breast cancer is a heterogeneous disease comprised of several molecular subtypes, which are commonly grouped into clinical subtypes based on receptor status (Perou et al., Nature 2000;406:747-752). Receptors that are assessed in standard clinical practice include the estrogen receptor (“ER”) and progesterone receptor (“PgR”), collectively the hormone receptors (“HRs”), and human epidermal growth factor receptor 2 (“HER2”). Breast cancers generally are categorized by the presence or absence of these receptors. The most common type of breast cancer is HER2 negative and HR positive, accounting for approximately 64% of newly diagnosed cases (Howlader et al., Journal of the National Cancer Institute 2014;106(5):1-8). HER2 positive breast cancer and triple-negative breast cancer (“TNBC”), the latter of which lacks all three receptors, are less common, accounting for approximately 13% and 11% of breast cancers, respectively (Howlader et al., Journal of the National Cancer Institute 2014;106(5):1-8). Estimated U.S. breast cancer incidence by receptor status and MBC treatments by receptor status are shown in the following figure.

Estimated U.S. Breast Cancer Incidence by Receptor Status and

MBC Treatments by Receptor Status

|

|

|

CDK=cyclin-dependent kinase; HER2=human epidermal growth factor receptor 2; HR=hormone receptor; MBC=metastatic breast cancer; TNBC=triple-negative breast cancer (1) Howlader et al., Journal of the National Cancer Institute 2014;106(5):1-8 (2) Caldeira et al., Oncology and Therapy 2016;4:189-197 |

Treatment of HER2 Negative, HR Positive MBC

HER2 negative, HR positive disease, which represents the majority of all MBC cases, remains an area of major unmet medical need. Over the past two decades, only modest survival benefits have been achieved in this patient population; hence, treatment goals emphasize controlling disease-related symptoms, minimizing toxicity and maximizing quality-of-life. Patients with HER2 negative, HR positive disease are typically treated with endocrine therapy (with or without a cyclin-dependent kinase [“CDK”] 4/6 inhibitor), chemotherapy or both.

Endocrine Therapy

Endocrine agents, which target certain HRs inside and on the surface of tumor cells with the goal of slowing tumor growth, are preferred as initial treatment prior to chemotherapy for most patients with HER2 negative, HR positive MBC (National Comprehensive Cancer Network 2017). These agents, which typically are used sequentially, include aromatase inhibitors (e.g., anastrozole, exemestane and letrozole), selective ER modulators (e.g., tamoxifen) and ER downregulators (e.g., fulvestrant). As initial therapy in post-menopausal women with HER2 negative, ER positive disease, letrozole plus the recently approved CDK 4/6 inhibitor palbociclib resulted in median progression-free survival (“PFS”) of 24.8 months, compared to 14.5 months with letrozole alone (Finn et al., New England Journal of Medicine

4

2016;375(20):1925-1936). As second-line endocrine therapy in women with HER2 negative, HR positive disease, fulvestrant plus palbociclib resulted in median PFS of 9.5 months, compared to 4.6 months with fulvestrant alone (Cristofanilli et al., The Lancet 2016;17(4):425-439). However, despite these recent advances in endocrine therapy, virtually all patients will eventually progress and require subsequent treatment with chemotherapy.

Chemotherapy

In HER2 negative, HR positive MBC, chemotherapy generally is used following disease progression on endocrine therapy or in women for whom endocrine therapy is not indicated. While endocrine therapy is most often the first-line treatment for women with HER2 negative, HR positive MBC, a significant percentage of women receive chemotherapy as their first treatment for advanced disease. In a recent analysis of a large patient record database (n=1,272-1,640 in Europe and n=2,225-2,760 in the U.S.), chemotherapy-only regimens were given as the first therapy following a diagnosis of advanced disease 33% to 35% of the time in Europe and 34% to 42% of the time in the U.S. (Caldeira et al., Oncology and Therapy 2016;4:189-197). This suggests that a significant percentage of women are not indicated for endocrine therapy in the advanced setting due to: (i) a short relapse-free interval while on adjuvant endocrine therapy (endocrine resistance); (ii) rapidly progressing disease/visceral crisis; or (iii) endocrine intolerance.

There are several approved chemotherapy agents for the treatment of HER2 negative MBC. These include: paclitaxel, nab-paclitaxel and docetaxel (taxanes); capecitabine (a fluoropyrimidine); doxorubicin and epirubicin (anthracyclines); gemcitabine (a nucleoside inhibitor); ixabepilone (an epothilone approved in the U.S.); and eribulin (a non-taxane microtubule dynamics inhibitor). The taxanes and eribulin are approved as monotherapy; capecitabine is approved as both monotherapy and combination therapy (with docetaxel); gemcitabine is approved as combination therapy only (with paclitaxel); and ixabepilone is approved in the U.S. as both monotherapy and combination therapy (with capecitabine).

The choice and sequencing of chemotherapy regimens depend on a number of factors, including physician preference, previous therapies, pre-existing medical conditions, tumor burden and patient symptoms. As shown in the following figure, capecitabine, an oral chemotherapy and taxanes are the preferred first-line chemotherapy agents in HER2 negative, HR positive MBC.

Physician-reported Preferences for First-line Chemotherapy for

Patients with HER2 Negative, HR Positive MBC(1)

|

|

|

Recent survey of 201 U.S. community-based oncologists (1) Lin et al., Cancer Medicine 2016;5(2):209-220 |

5

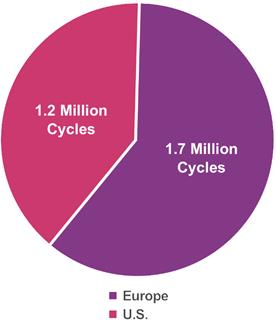

Taxanes are an established class of anticancer agents that are broadly used in various cancers, including breast cancer. Taxanes destroy cancer cells by preventing them from entering mitosis, a process of cell division, and thereby leading to apoptosis, or cell death. As shown in the following figure, taxanes are one of the most widely used classes of chemotherapy agents in both Europe and the U.S., with more than 2.8 million cycles administered in 2016 (Symphony Health Solutions 2016; IMS Health 2016).

>2.8 Million Cycles of Paclitaxel, Nab-paclitaxel and Docetaxel

Administered in 2016 in Europe and the U.S.(1)

|

|

|

(1) Symphony Health Solutions 2016; IMS Health 2016 |

While paclitaxel and docetaxel, the first two taxanes approved for the treatment of breast cancer, possess robust antitumor activity, they have low oral bioavailability and low solubility. Therefore, these pharmaceutical agents must be delivered intravenously, typically at an infusion center, and also are formulated with solubilizing agents that are known to cause hypersensitivity reactions. Nab-paclitaxel, a different formulation of paclitaxel that also is approved for the treatment of breast cancer, has a greatly reduced risk of hypersensitivity reactions, but must still be delivered intravenously.

6

Therapies that must be given intravenously at an infusion center often are associated with(1):

|

• fear of needles and complications associated with venous access; • anxiety, including institutional-triggered side effects such as nausea and vomiting; • heightened awareness of life-threatening disease presence; and • disruption of daily activities. |

|

|

(1) Gornas et al., European Journal of Cancer Care 2010;19(1):131-136; Schott et al., BMC Cancer 2011;11:129 |

|

Tesetaxel: An Orally Administered Taxane with Improved Pharmacologic Properties

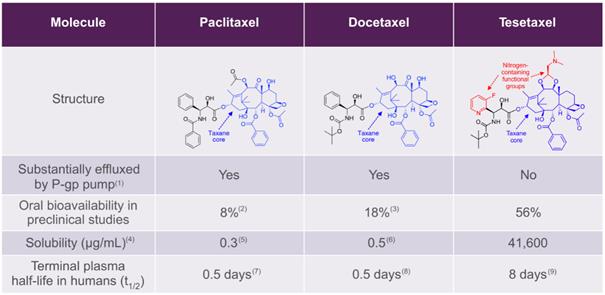

Tesetaxel, which we believe will qualify as a New Chemical Entity (“NCE”) if and when a New Drug Application (“NDA”) is submitted, retains the same taxane core as the approved taxanes, but includes the addition of two novel, nitrogen-containing functional groups. Tesetaxel is chemically designed to: (i) not be substantially effluxed by the P-glycoprotein (“P-gp”) pump, with the intent of retaining activity against chemotherapy-resistant tumor cells; (ii) have high oral bioavailability; (iii) have high solubility; and (iv) have a long (~8 day) t1/2 in humans. The table below includes the chemical and pharmacologic properties of paclitaxel, docetaxel and tesetaxel.

Chemical and Pharmacologic Properties of Paclitaxel, Docetaxel and Tesetaxel

|

|

|

(1) The P-glycoprotein (P-gp) efflux pump mediates gastric absorption as well as chemotherapy resistance (2) Shanmugam et al., Drug Development and Industrial Pharmacy 2015;41(11):1864-1876 (3) McEntee et al., Veterinary and Comparative Oncology 2003;1(2):105-112 (4) At pH conditions similar to gastric fluid (5) Montaseri, Taxol: Solubility, Stability and Bioavailability 1997 (6) Bharate et al., Bioorganic & Medicinal Chemistry Letters 2015;25(7):1561-1567 (7) Tan et al., British Journal of Cancer 2014;110(11):2647-54 (8) Taxotere (docetaxel) prescribing label (9) Lang et al., 2012 American Society of Clinical Oncology (ASCO) Annual Meeting, Journal of Clinical Oncology 2012;20(15 supp):2555 |

7

We believe the improved pharmacologic properties of tesetaxel enable a simple, patient-friendly dosing regimen, as shown in the following table.

Tesetaxel Has Simple, Patient-friendly Dosing Regimen

|

|

|

(1) National Comprehensive Cancer Network (NCCN), Clinical Practice Guidelines in Oncology 2017 (2) Corticosteroid plus antihistamine plus H2 antagonist as per prescribing label |

8

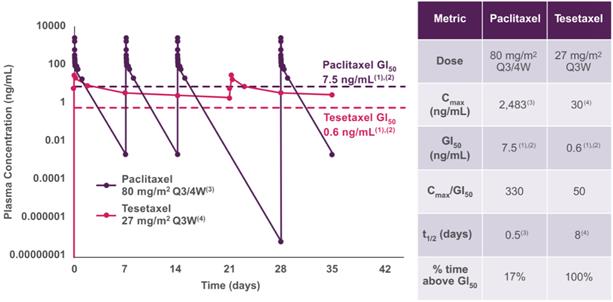

Tesetaxel is chemically designed to have a long (~8 day) t1/2 in humans (see following figure), which may allow adequate drug levels to be maintained with relatively infrequent dosing.

Pharmacokinetic Profiles of Paclitaxel and Tesetaxel

|

|

|

Note: The graph above includes median plasma concentrations through Day 1 and simulated data thereafter for paclitaxel and geometric mean plasma concentrations through Day 21 and simulated data thereafter for tesetaxel. Cmax=maximum (plasma) concentration; GI50=the concentration of drug required to inhibit growth by 50% Q3/4W=once per week for 3 of 4 weeks; Q3W=once every 3 weeks; t1/2=terminal plasma half-life (1) Shionoya et al., Cancer Science 2003;94(5):459-66 (2) Trock et al., Journal of the NCI 1997;89(13):917-31 (3) Tan et al., British Journal of Cancer 2014;110(11):2647-54 (4) Pharmacokinetic data from Studies 927A-PRT001, 927E-PRT003, 927E-PRT005, 927A-PRT006, and 927E-PRT007 |

We believe that tesetaxel’s unique properties may translate into significant benefits for patients. These may include:

|

|

• |

oral administration with a low pill burden; |

|

|

• |

the maintenance of adequate drug levels with relatively infrequent dosing, enabled by a long (~8-day) t1/2 in humans; |

|

|

• |

no history of hypersensitivity reactions; and |

|

|

• |

significant activity against chemotherapy-resistant tumors. |

Nonclinical Studies

Tesetaxel has exhibited potent antitumor activity in both in vitro (in a test tube) and in vivo (in a live organism) nonclinical studies (Shionoya et al., Cancer Science 2003;94(5):459-466). Tesetaxel retains potent antitumor activity against chemotherapy-resistant tumor cells, including tumor cells over-expressing the P-gp efflux pump. A defense mechanism of tumor cells, this efflux pump functions to expel toxins, including many chemotherapy agents.

In Vitro Antitumor Activity

Tesetaxel has exhibited potent antitumor activity in in vitro nonclinical studies, with an overall GI50 (the concentration of drug required to inhibit growth by 50%) of less than 1 nM. GI50 is a commonly used

9

nonclinical measurement of antitumor potency; lower GI50 numbers connote higher potency (1 nM is 1/1,000th of 1 µM). In human tumor cell lines, tesetaxel largely retained antitumor cytotoxic (cell-killing) potency against taxane-resistant (P-gp positive) and other chemotherapy-resistant tumors, while paclitaxel and docetaxel lost considerable antitumor potency (Shionoya et al., Cancer Science 2003;94(5):459-466). Consistent with this finding, the uptake and accumulation of tesetaxel in both P-gp negative and P-gp positive tumor cells were greater than that of either paclitaxel or docetaxel. The relative loss of cytotoxic potency between P-gp negative and P-gp positive tumor cells for paclitaxel, docetaxel and tesetaxel is shown in the following table (low numbers connote high potency, and high numbers connote low potency).

Tesetaxel Retained Activity against Chemotherapy-resistant Tumors In Vitro(1)

|

|

|

(1) Shionoya et al., Cancer Science 2003;94(5):459-466 (2) Concentration of drug required to inhibit growth by 50% (3) The P-glycoprotein (P-gp) efflux pump mediates gastric absorption as well as chemotherapy resistance |

Clinical Studies

More than 800 patients have been treated with tesetaxel across 25 clinical studies. Tesetaxel has been administered as monotherapy in 17 studies and in combination with other agents in 8 studies. Studies have been completed in MBC, gastric cancer, colorectal cancer, non-small cell lung cancer and other cancers as first-line, second-line or salvage therapy.

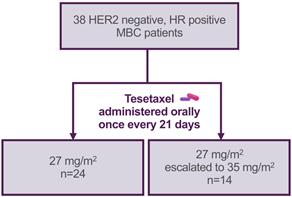

The results from a Phase 2 clinical study of tesetaxel monotherapy in MBC (TOB203) are summarized below.

Study TOB203: A Phase 2 Study of Tesetaxel as First-line Chemotherapy for MBC

In Study TOB203, 38 patients with HER2 negative, HR positive MBC received tesetaxel orally as a single agent once every three weeks at a starting dose of 27 mg/m2. Objective response rate (“ORR”) based on Response Evaluation Criteria in Solid Tumors (RECIST) 1.1 was the primary endpoint (Seidman et al., 2018 ASCO Annual Meeting).

10

Median age was 58 years (range: 36-80 years). Eighty-seven percent (87%) had visceral disease, 74% previously received at least one endocrine therapy, 68% previously received neoadjuvant or adjuvant chemotherapy and 53% previously received a taxane-containing regimen. The figures that follow show the study design and patient characteristics (Seidman et al., 2018 ASCO Annual Meeting).

|

|

|

|

|

ECOG=Eastern Cooperative Oncology Group; HER2=human epidermal growth factor receptor 2; HR=hormone receptor; MBC= metastatic breast cancer |

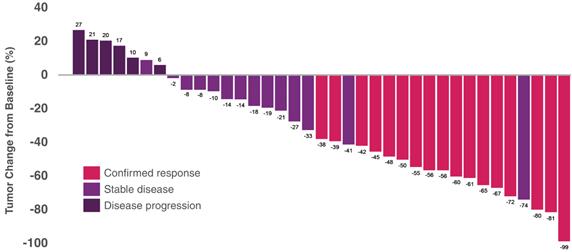

||

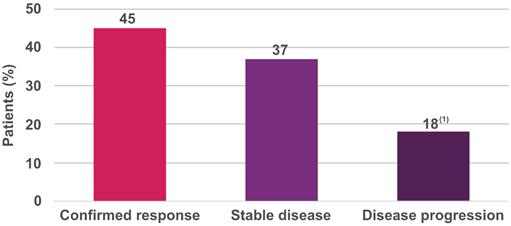

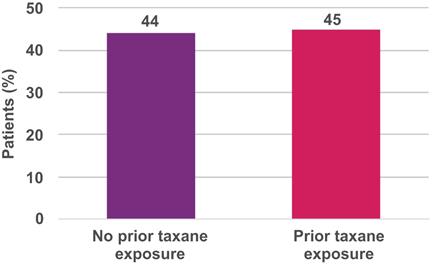

In all 38 patients, the confirmed response rate was 45%. The confirmed response rate was consistent across subgroups. Forty-four percent (44%) of patients who did not previously receive a taxane-containing regimen achieved a confirmed response, compared to 45% of patients who previously received a taxane-containing regimen. Median duration of response (“DoR”) was 10.9 months, and median PFS was 5.4 months (Seidman et al., 2018 ASCO Annual Meeting).

11

Tumor change from baseline in target lesions by individual patient is shown in the following figure.

Tumor Change from Baseline in Target Lesions(1)

|

|

|

(1) Nadir change based on sum of the diameters |

Patient response is shown in the following figure.

Response

|

|

|

(1) Includes one patient who was not evaluated for response |

12

Patient response by prior taxane exposure is shown in the following figure.

Response by Prior Taxane Exposure

|

|

Adverse Event Profile

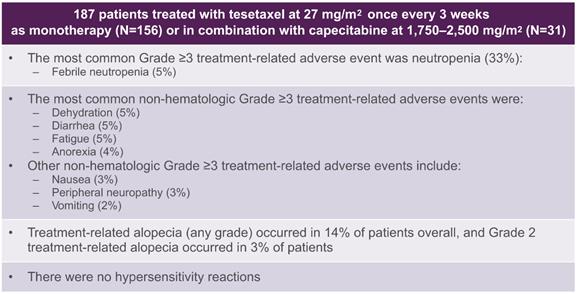

Tesetaxel, administered both alone and in combination with capecitabine, has been generally well tolerated. In 8 studies (927A-PRT001, 927A-PRT004, 927E-PRT003, 927E-PRT005, 927E-PRT007, 927A-PRT006, TOST107 and TOST107XT), a total of 187 patients were treated with tesetaxel at 27 mg/m2 once every three weeks as monotherapy (N=156) or in combination with capecitabine at 1,750-2,500 mg/m2 (N=31).

A summary of tesetaxel’s adverse event (“AE”) profile based on these studies is shown in the following table.

Adverse Event Profile of 187 Patients at Doses Consistent with CONTESSA

|

|

13

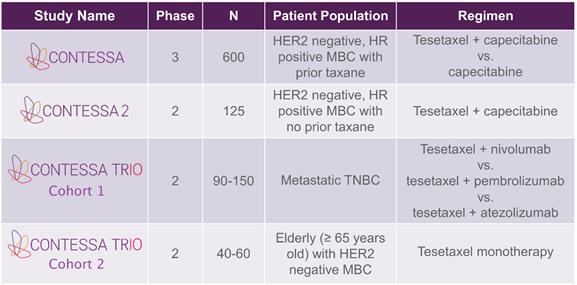

We are currently conducting three clinical studies in breast cancer, including CONTESSA, a multinational, multicenter, randomized Phase 3 study of tesetaxel in patients with MBC, as shown in the following table.

Ongoing Tesetaxel Clinical Studies

|

|

|

HER2=human epidermal growth factor receptor 2; HR=hormone receptor; MBC= metastatic breast cancer; TNBC=triple-negative breast cancer |

CONTESSA

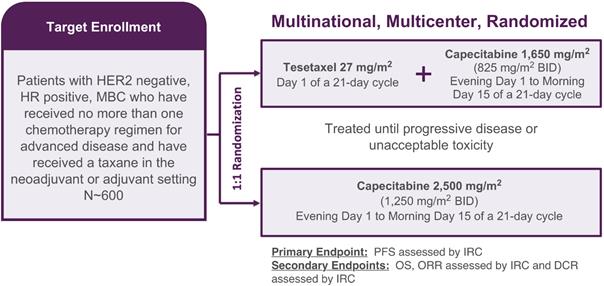

We are conducting a multinational, multicenter, randomized, Phase 3 study, known as CONTESSA, that is comparing tesetaxel dosed orally at 27 mg/m2 on the first day of a 21-day cycle plus a reduced dose of capecitabine (1,650 mg/m2/day on the first 14 days of a 21-day cycle) to the approved dose of capecitabine alone (2,500 mg/m2/day on the first 14 days of a 21-day cycle) in approximately 600 patients with HER2 negative, HR positive MBC previously treated with a taxane in the neoadjuvant (prior to surgery) or adjuvant (immediately following surgery) setting. Where indicated, patients must have received endocrine therapy with or without a CDK 4/6 inhibitor. CONTESSA’s primary endpoint is PFS assessed by an Independent Radiologic Review Committee (“IRC”). CONTESSA’s secondary endpoints are overall survival (“OS”), ORR assessed by IRC and disease control rate (“DCR”) assessed by IRC.

In May 2019, the Independent Data Monitoring Committee (the “IDMC”) for CONTESSA recommended that the study continue with no modifications following a planned interim efficacy futility analysis. The interim efficacy futility analysis was based on a pre-specified analysis of the first approximate 100 PFS events that occurred in the study. The purpose of the interim efficacy futility analysis was to facilitate the early termination of the study if the IDMC determined that achieving a positive outcome on the primary endpoint would be futile.

In October 2019, we announced that enrollment in CONTESSA was complete. We expect to report top-line results from CONTESSA in the third quarter of 2020.

14

|

|

|

BID=twice per day; DCR=disease control rate; HER2=human epidermal growth factor receptor 2; HR=hormone receptor; IRC=Independent Radiologic Review Committee; MBC=metastatic breast cancer; ORR=objective response rate; OS=overall survival; PFS=progression-free survival |

In designing CONTESSA, we received non-binding advice from both the U.S. Food and Drug Administration (“FDA”) and the European Medicines Agency (“EMA”). We believe CONTESSA may serve as a single pivotal study sufficient for product registration, provided that the study demonstrates a statistically significant and clinically meaningful improvement in the primary endpoint, PFS, for tesetaxel plus a reduced dose of capecitabine as compared to the approved dose of capecitabine alone as well as an overall favorable benefit-risk profile for the tesetaxel plus a reduced dose of capecitabine regimen. Generally, a single pivotal study can be sufficient for FDA approval only when the study provides highly reliable and statistically strong evidence of an important clinical benefit and in which confirmation of the result in a second clinical trial would be practically or ethically impossible. There can be no assurance that the outcome of CONTESSA will be sufficient for the approval of tesetaxel by the FDA, European Commission or other regulatory agencies or that tesetaxel will be approved at all.

15

Registration studies of chemotherapy agents FDA-approved for advanced breast cancer are shown in the following table.

Registration Studies of Chemotherapy Agents FDA-Approved for Advanced Breast Cancer(1)

|

|

|

PFS=progression-free survival; TTP=time to progression (1) U.S. Prescribing Information for each drug (2) PFS, or time from randomization until objective tumor progression or death, whichever occurs first (3) TTP, or time from randomization until objective tumor progression |

Reducing the Dose of Capecitabine in Combination with a Taxane

Clinical Studies Evaluating Lower Doses of Capecitabine Combined with a Taxane

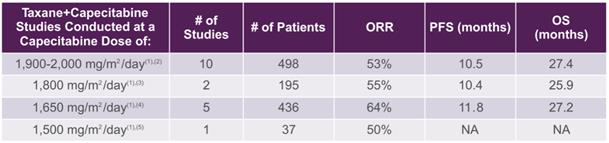

Clinical studies support investigating the combination of a taxane with a reduced dose of capecitabine such as 1,650 mg/m2/day on the first 14 days of a 21-day cycle, the dose of capecitabine chosen for combination with tesetaxel in CONTESSA. In a review of 18 first-line MBC studies of taxane plus capecitabine combinations shown in the following table, there was no apparent loss of efficacy when comparing capecitabine at 1,650 mg/m2/day to capecitabine at 2,000 mg/m2/day (on the first 14 days of a 21-day cycle). Among these studies, the capecitabine 1,650 mg/m2/day dose was the most studied dose less than 2,000 mg/m2/day (5/8 studies). According to Lortholary, the trend toward improved efficacy with lower doses of capecitabine may result from the significantly lower proportion of patients discontinuing study therapy prematurely because of toxicity, and highlights the importance of administering capecitabine using a schedule that optimizes dose intensity and tolerability (Lortholary et al, Breast Cancer Research and Treatment 2012;131:127-135).

16

Support for Combining Capecitabine at 1,650 mg/m2/day(1) with a Taxane

|

|

|

ORR=objective response rate; OS=overall survival; PFS=progression-free survival (1) Days 1-14 of a 21-day cycle (2) Bachelot et al., Oncology 2011;80(3-4):262-268; Campone et al., The Breast Journal 2013;19(3):240-249; Chitapanarux et al., Asia-Pacific Journal of Clinical Oncology 2012;8:76-82; Fan et al., Annals of Oncology 2013;24:1219-1225; Liao et al., Chemotherapy 2013;59:207-213; Michalaki et al., Anti-Cancer Drugs 2009;20(3):204-207; Michalaki et al., Anticancer Research 2010;30:3051-3054; Venturini et al., Cancer 2003;97(5):1174-1180; Wang et al., Cancer 2015;121:3412; Wardley et al., Journal of Clinical Oncology 2010;28(6):976-983 (3) Bisagni et al., Cancer Chemotherapy and Pharmacology 2013;71(4):1051-1057; Luck et al., Breast Cancer Research and Treatment 2015;149:141-149 (4) Hatschek et al., Breast Cancer Research and Treatment 2012;131(3):939-947; Lam et al., European Journal of Cancer 2014;50(18):3077-3088; Perez et al., Annals of Oncology 2010;21(2):269-274; Schwartzberg et al., Clinical Breast Cancer 2012;12(2):87-93; Tonyali et al., Journal of Cancer Research and Clinical Oncology 2013;139(6):981-986 (5) Silva et al., Clinical Breast Cancer 2008;8(2):162-167 |

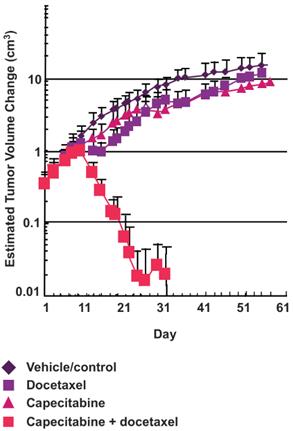

Synergy when Combining a Taxane with Capecitabine in Nonclinical Studies

Nonclinical studies have shown synergy when combining a taxane with capecitabine. Taxanes up-regulate tumor levels of thymidine phosphorylase, the enzyme essential for the activation of capecitabine. These studies suggest the potential to reduce the dose of capecitabine without loss of efficacy. In two in vivo nonclinical studies of breast cancer, the combined administration of capecitabine and docetaxel resulted in antitumor efficacy significantly greater than the sum of the efficacy resulting from either agent administered as monotherapy (see the following figures). Furthermore, the synergy may be tumor-specific, as toxicity as measured by weight loss and effect on peripheral blood cells was minimal.

17

In Vivo Synergy with Taxane-Capecitabine Combinations

|

|

Capecitabine at 1/2 MTD + Docetaxel at 1/8 MTD(1)(2) |

Capecitabine at 2/3 MTD + Docetaxel at 1/15 MTD(3)(4) |

|

|

|

|

|

|

MTD=maximum tolerated dose (1) Sawada et al., Clinical Cancer Research 1998;4:1013-1019 (2) Capecitabine dosed 5 times every 7 days; docetaxel dosed once every 7 days (3) Fujimoto-Ouchi et al., Clinical Cancer Research 2001;7(4):1079-1086 (4) Capecitabine dosed on Days 1-14 and 22-36; docetaxel dosed on Days 8 and 29 |

|

In summary, we believe that the data support the investigation of tesetaxel at 27 mg/m2 on the first day of a 21-day cycle plus capecitabine at 1,650 mg/m2/day on the first 14 days of a 21-day cycle as a novel, all-oral regimen with a potentially favorable benefit-risk profile for the treatment of patients with HER2 negative, HR positive MBC.

CONTESSA 2

CONTESSA 2 is a multinational, multicenter, Phase 2 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC. CONTESSA 2 is investigating tesetaxel dosed orally at 27 mg/m2 on the first day of each 21-day cycle plus a reduced dose of capecitabine (1,650 mg/m2/day dosed orally for 14 days of each 21-day cycle) in approximately 125 patients with HER2 negative, HR positive MBC not previously treated with a taxane. Capecitabine is an oral chemotherapy agent that is considered a standard-of-care treatment in MBC. Where indicated, patients must have received endocrine therapy with or without a CDK 4/6 inhibitor. Patients with central nervous system (“CNS”) metastases are eligible. The primary endpoint is ORR as assessed by an IRC. The secondary efficacy endpoints are DoR as assessed by the IRC, PFS as assessed by the IRC, DCR as assessed by the IRC and OS.

18

|

|

|

BID=twice per day; DCR=disease control rate; DoR=duration of response; HER2=human epidermal growth factor receptor 2; HR=hormone receptor; IRC=Independent Radiologic Review Committee; MBC= metastatic breast cancer; ORR=objective response rate; OS=overall survival; PFS=progression-free survival |

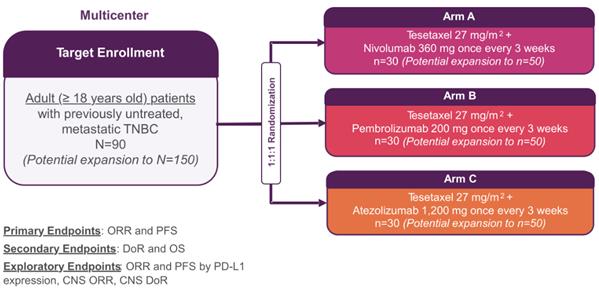

CONTESSA TRIO

CONTESSA TRIO is a multi-cohort, multicenter, Phase 2 study of tesetaxel, an investigational, orally administered taxane, in patients with MBC.

|

|

• |

In Cohort 1, approximately 90 patients (with potential expansion to up to 150 patients) with locally advanced or metastatic TNBC who have not received prior chemotherapy for advanced disease will be randomized 1:1:1 to receive tesetaxel dosed orally at 27 mg/m2 on the first day of each 21-day cycle plus either: (1) nivolumab at 360 mg by intravenous infusion on the first day of each 21-day cycle; (2) pembrolizumab at 200 mg by intravenous infusion on the first day of each 21-day cycle; or (3) atezolizumab at 1,200 mg by intravenous infusion on the first day of each 21-day cycle. Nivolumab and pembrolizumab (PD-1 inhibitors) and atezolizumab (a PD-L1 inhibitor) are immuno-oncology (“IO”) agents approved for the treatment of multiple types of cancer. One of these agents, atezolizumab, in combination with the intravenously delivered taxane, nab-paclitaxel, was recently approved by the FDA as a first-line treatment for patients with metastatic TNBC. Patients with CNS metastases are eligible. The dual primary endpoints for Cohort 1 are ORR and PFS. Secondary endpoints include DoR and OS. Efficacy results for each of the three PD-(L)1 inhibitor combinations will be assessed for correlation with the results of each of the three approved PD-L1 diagnostic assays. |

19

CONTESSA TRIO Study Design: Cohort 1

|

|

|

CNS=central nervous system; DoR=duration of response; ORR=objective response rate; OS=overall survival; PFS=progression-free survival; TNBC=triple-negative breast cancer |

|

|

• |

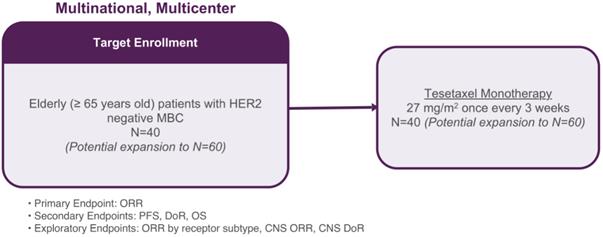

In Cohort 2, approximately 40 elderly patients (with potential expansion to up to 60 patients) with HER2 negative MBC will receive tesetaxel monotherapy dosed orally at 27 mg/m2 on the first day of each 21-day cycle. Patients with CNS metastases are eligible. The primary endpoint for Cohort 2 is ORR. Secondary endpoints include PFS, DoR and OS. |

CONTESSA TRIO Study Design: Cohort 2

|

|

|

CNS=central nervous system; DoR=duration of response; HER2=human epidermal growth factor receptor 2; MBC= metastatic breast cancer; ORR=objective response rate; OS=overall survival; PFS=progression-free survival |

Competition

The biotechnology and pharmaceutical industries are extremely competitive. Our potential competitors in the field are many in number and include major and mid-sized pharmaceutical and biotechnology companies. Many of our potential competitors have significantly more financial, technical and other resources than we do, which may give them a competitive advantage. In addition, they may have

20

substantially more experience in effecting strategic combinations, in-licensing technology, developing drugs, obtaining regulatory approvals and manufacturing and marketing products. We cannot give any assurances that we can compete effectively with these other biotechnology and pharmaceutical companies. Any products that we may develop or discover will compete in highly competitive markets. Our potential competitors in these markets may succeed in developing products that could render our product candidates obsolete or non-competitive.

Tesetaxel faces significant competition. Multiple chemotherapies are currently available to physicians and patients for the treatment of HER2 negative, HR positive MBC. These include: paclitaxel, nab-paclitaxel and docetaxel (taxanes); capecitabine (a fluoropyrimidine); doxorubicin and epirubicin (anthracyclines); gemcitabine (a nucleoside inhibitor); and eribulin (a non-taxane microtubule dynamics inhibitor). The taxanes and eribulin are approved as monotherapy; capecitabine is approved as both monotherapy and combination therapy (with docetaxel); and gemcitabine is approved as combination therapy only (with paclitaxel). In addition, there are novel oral paclitaxel formulations in development, such as Athenex, Inc.’s Oraxol and Daehwa Pharmaceutical Co., Ltd.’s DHP107. We believe that the extent to which tesetaxel is adopted by the marketplace, if it is approved, will depend on factors such as its safety and tolerability, efficacy, convenience, effect on quality-of-life and cost-effectiveness relative to other treatment alternatives.

Daiichi Sankyo License Agreement

In 2013, we licensed rights to tesetaxel in all major markets from Daiichi Sankyo Company, Limited (“Daiichi Sankyo”), the original inventor of the product. Tesetaxel had previously been licensed to Genta Incorporated.

Under the Daiichi Sankyo license agreement, we currently hold exclusive rights to 15 issued patents covering our tesetaxel program. See “Business—Patents and Proprietary Rights.” We are obligated under the license agreement to use commercially reasonable efforts to develop and commercialize tesetaxel in the following countries: France, Germany, Italy, Spain, the United Kingdom and the U.S. We are required to make aggregate future milestone payments of up to $31.0 million, contingent on attainment of certain regulatory milestones, none of which have yet been achieved. Additionally, we are obligated to pay Daiichi Sankyo a tiered royalty that ranges from the low to high single digits, depending on annual net sales of tesetaxel. To date, no payments have been made to Daiichi Sankyo under the license agreement. The license agreement and accompanying royalty obligation terminate on a country-by-country basis on the last-to-expire patent in each such country, which we expect will be between 2026 and 2031 in the U.S., 2025 and 2030 in European countries and 2025 and 2030 in Japan, depending on the availability and application of patent term extensions.

NCE Exclusivity

We believe that tesetaxel will qualify as an NCE if and when an NDA is submitted. If tesetaxel qualifies as an NCE, we believe that NCE regulatory exclusivity, combined with our intellectual property, assuming the availability of 5 years of patent term restoration under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly referred to as the Hatch-Waxman Act, will provide exclusivity for tesetaxel in all major markets into 2031. Separate from patent protection, exclusivity refers to certain delays and prohibitions on approval of competitor drugs available under the statute that attach on approval of a drug.

Exclusivity in the U.S.

In the U.S., NCEs approved by the FDA are eligible for market exclusivity under the Federal Food, Drug, and Cosmetic Act (“FDCA”), which can delay the approval of generic versions of the NCE by up to 7.5 years from the date of the initial approval of the NCE. Specifically, the FDCA provides a 5-year period of non-patent marketing exclusivity within the U.S. to the first applicant to gain approval of an NDA for an NCE. A drug is an NCE if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the

21

exclusivity period, the FDA may not accept for review an ANDA or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all of the data required for approval. However, an application may be submitted after 4 years if it contains a certification of patent invalidity or non-infringement. This certification will trigger an automatic 30-month stay in the approval of any generic competition, effectively extending the regulatory exclusivity period to 7.5 years.

NCE market exclusivity will not delay the submission or approval of a full NDA. However, an applicant submitting a full NDA would be required to conduct or obtain a right of reference to all of the nonclinical studies and adequate and well-controlled clinical studies necessary to demonstrate safety and effectiveness.

Exclusivity in Europe

In Europe, NCEs, sometimes referred to as new active substances, qualify for 8 years of data exclusivity upon marketing authorization and an additional two years of market exclusivity, for a total of 10 years of regulatory exclusivity. This exclusivity, if granted, prevents regulatory authorities in the EU from referring to the innovator’s data to assess a generic application for 8 years, after which generic marketing authorization can be submitted, and the innovator’s data may be referenced, but the generic product may not be approved for two years. This 10-year period can be extended to a maximum of 11 years if, during the first 8 years of those 10 years, the marketing authorization holder obtains an authorization for one or more new therapeutic indications that, during the scientific evaluation prior to their authorization, are held to bring a significant clinical benefit in comparison with existing therapies.

However, even if a compound is considered to be an NCE and the sponsor is able to gain the prescribed period of data exclusivity, another company nevertheless could also market another version of the drug if such company can complete a full Marketing Authorization Application with a complete database of pharmaceutical tests, nonclinical studies and clinical studies and obtain marketing approval of its product.

Exclusivity in Japan

In Japan, an NCE is eligible for at least 8 years of regulatory exclusivity. Specifically, under the Pharmaceutical Affairs Law, the regulatory authority re-examines the safety and efficacy of drugs after drug approval. The data submitted to the regulatory authority is not available to generic drug companies during the re-examination period. This effectively makes the re-examination system a regulatory exclusivity system in Japan. The re-examination period is 10 years following approval for an orphan drug and 8 years for an NCE. Innovators may also benefit from an additional 4- to 10-month waiting period for generic pricing approval. There may be an additional 4 years of market protection granted if a new indication for a drug is registered in the first 8 years of the re-examination period.

Patents and Proprietary Rights

The proprietary nature of, and protection for, our product candidates, processes and know-how are important to our business. Our success depends in part on our ability to protect the proprietary nature of our product candidates, processes and know-how, to operate without infringing the proprietary rights of others and to prevent others from infringing our proprietary rights. We seek and maintain patent protection in the U.S. and internationally for our product candidates and other technology. We endeavor to patent or in-license technology, inventions and improvements that we consider important to the development of our business. In addition to patent protection, we intend to use other means to protect our proprietary rights, including pursuing periods of marketing or data exclusivity, orphan drug status (if applicable) and similar rights that are available under regulatory provisions in certain jurisdictions, including the U.S., Europe and Japan. We also rely on trade secrets, know-how and continuing innovation to develop and maintain our competitive position.

22

The intellectual property portfolio protecting our tesetaxel program includes 9 U.S., 5 European and 7 Japanese patents, as well as one pending U.S. patent application, two pending international patent applications, one pending European patent application and one pending Japanese patent application. Of these, 5 U.S., 4 European and 6 Japanese patents are exclusively licensed to us by Daiichi Sankyo. The 21 issued patents consist of the following:

|

|

• |

Nine (9) U.S. patents, including: (i) two composition-of-matter patents expiring in October 2020 and in 2026, without taking into account any potential patent term restoration; (ii) 5 patents with claims to manufacturing methods and/or manufacturing intermediates expiring between 2023 and 2032, without taking into account any potential patent term restoration; and (iii) two patents with composition-of-matter, method of manufacture and/or method of use claims relating to alternate salt forms of tesetaxel expiring in 2031, without taking into account any potential patent term restoration. |

|

|

• |

Five (5) European patents, including: (i) two composition-of-matter patents expiring in October 2020 and in 2022, without taking into account any potential patent term restoration; and (ii) three patents with claims to manufacturing methods and/or manufacturing intermediates expiring in 2022, 2025 and 2031, without taking into account any potential patent term restoration. |

|

|

• |

Seven (7) Japanese patents, including: (i) three composition-of-matter patents expiring between October 2020 and 2022, without taking into account any potential patent term restoration; and (ii) 4 patents with claims to manufacturing methods and/or manufacturing intermediates expiring in 2022, 2025, 2025 and 2031, without taking into account any potential patent term restoration. |

Among these patents, one issued U.S. composition-of-matter patent (U.S. Patent No. 7,410,980) covers the crystal form of tesetaxel used in our clinical formulation and will expire in 2026. If tesetaxel is approved by the FDA, we will be entitled to request patent term restoration that could extend the protection of this patent into 2031. The exact duration of the extension depends on the time we spend in clinical studies as well as the time the FDA spends reviewing our NDA. See “Business—Government Regulation—U.S. Patent Term Restoration.”

Our success depends on an intellectual property portfolio that will support our future revenue streams. We intend to maintain and build our patent portfolio through filing new patent applications and prosecuting existing applications. We cannot be certain that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications that we may file in the future, nor can we be sure that any of our existing patents or any patents granted to us in the future will be commercially useful in protecting our technology. Any of our intellectual property and proprietary rights could be challenged, invalidated, circumvented, infringed or misappropriated, or such intellectual property and proprietary rights may not be sufficient to permit us to take advantage of current market trends or otherwise to provide competitive advantages. For more information, see “Risk Factors—Risks Relating to Intellectual Property.”

Manufacturing

We currently contract with third-party contract development and manufacturing organizations (“CDMOs”) for the manufacture of tesetaxel and intend to do so in the future. We do not own or operate manufacturing facilities and currently have no plans to build our own clinical- or commercial-scale manufacturing capabilities. Although we rely on CDMOs, we have personnel with extensive manufacturing experience to oversee these contract service providers.

We conduct our manufacturing activities under individual purchase orders with multiple CDMOs. To date, our third-party manufacturers have met our manufacturing requirements. We expect third-party manufacturers to be capable of providing sufficient quantities of tesetaxel to meet anticipated full-scale commercial demands. To meet our projected needs for commercial manufacturing, third parties with whom we currently work with might need to increase their scale of production, or we will need to secure alternate suppliers. We believe that there are alternate sources of supply that can satisfy our anticipated clinical and commercial requirements, although we cannot be certain that identifying and establishing

23

relationships with such sources, if necessary, would not result in significant delay or material additional costs.

Sales and Marketing

In order to commercialize tesetaxel, if approved, or any other product candidates that we may develop, we must build marketing, sales and distribution capabilities or make arrangements with third parties to perform these services. The commercial infrastructure for oncology products typically consists of a sales force that calls on oncologists, supported by sales management, medical liaisons, internal sales and marketing support and distribution support.

Additional capabilities important to the oncology marketplace include the management of key accounts such as managed care organizations, integrated delivery networks, group-purchasing organizations, specialty pharmacies and government accounts. To develop the appropriate commercial infrastructure, we will have to invest significant amounts of financial and management resources, some of which will be committed prior to any confirmation that any of our product candidates will be approved.

Where appropriate, we may elect in the future to utilize marketing partners, distributors or contract sales forces to assist in the commercialization of tesetaxel.

Government Regulation

Governmental authorities in the U.S., Europe, Japan and other countries where we may seek approval to commercialize tesetaxel extensively regulate the research, development, testing, manufacture, approval and marketing of pharmaceutical products. Our product candidates must be approved by these regulatory authorities before they may be legally marketed in the applicable jurisdictions. The process of obtaining regulatory approvals and the subsequent compliance with applicable federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Below is a general summary of applicable government regulations affecting our current and planned business activities in the U.S., Europe and Japan.

U.S. Government Regulation

In the U.S., the FDA regulates drugs under the FDCA and its implementing regulations. Failure to comply with the applicable U.S. requirements at any time during the product development or approval process, or after approval, may subject an applicant to administrative or judicial sanctions, any of which could have a material adverse effect on us. These sanctions could include:

|

|

• |

refusal to approve pending applications; |

|

|

• |

withdrawal of an approval; |

|

|

• |

imposition of a clinical hold; |

|

|

• |

warning or untitled letters; |

|

|

• |

seizures or administrative detention of product; |

|

|

• |

total or partial suspension of production or distribution; |

|

|

• |

injunctions, fines, restitution, disgorgement, refusal of government contracts or civil or criminal penalties; or |

|

|

• |

criminal prosecution. |

U.S. Drug Approval Process

The process required by the FDA before a pharmaceutical product may be marketed in the U.S. generally involves the following:

24

|

|

• |

completion of extensive nonclinical laboratory tests, in vivo nonclinical studies and formulation studies conducted according to Good Laboratory Practices and other applicable regulations; |

|

|

• |

submission to the FDA of an investigational new drug (“IND”) application, which must become effective before human clinical studies may begin; |

|

|

• |

performance of adequate and well-controlled human clinical studies according to Good Clinical Practices (“GCPs”) and other applicable regulations to establish the safety and efficacy of the product candidate for its intended use; |

|

|

• |

submission to the FDA of a NDA or other applications for approval; |

|

|

• |

satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities to assess compliance with current Good Manufacturing Practices (“cGMPs”) and conformance with the manufacturing-related elements of the application to assure consistent production of the product within required specifications; |

|

|

• |

potential FDA audit of the study sites that generated the data in support of the NDA; |

|

|

• |

FDA review and approval of the NDA; and |

|

|

• |

compliance with any post-approval requirements, such as post-approval studies required by the FDA. |

Once a pharmaceutical candidate is identified for development, it enters the nonclinical testing stage. Nonclinical tests include laboratory evaluations of product chemistry, toxicity and formulation, as well as animal studies. An IND sponsor must submit the results of the nonclinical tests, together with manufacturing information and analytical data, to the FDA as part of the IND. The IND will also include a protocol detailing the objectives of the clinical study, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated.

All clinical studies must be conducted under the supervision of one or more qualified investigators in accordance with FDA requirements. An institutional review board (“IRB”) must review and approve the protocol and will monitor the study until completion. Clinical studies must be conducted under protocols detailing the objectives of the study, dosing procedures, research subject selection, inclusion and exclusion criteria and the safety and effectiveness criteria to be evaluated. Each protocol, and any material amendments to the protocol, must be submitted to the FDA as part of the IND, and sponsors must report to the FDA serious and unexpected adverse reactions in a timely manner. Sponsors also must make certain financial disclosures to the FDA regarding any financial relationships with study investigators.

Human clinical studies are typically conducted in three sequential phases that may overlap or be combined.

|

|

• |

Phase 1—The product candidate is initially introduced into healthy human subjects and tested for safety, dosage tolerance, absorption, metabolism, distribution and elimination. Initial human testing is often conducted in patients for product candidates intended to treat severe or life-threatening diseases, such as cancer, especially when the product candidate may be inherently too toxic to ethically administer to healthy volunteers. |

|

|

• |

Phase 2—Clinical studies are performed on a limited patient population intended to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage. |

25

|

|

completion of post-approval studies, sometimes referred to as Phase 4 studies, which are conducted after initial regulatory approval to collect additional information from the treatment of patients for the intended indication or to meet other regulatory requirements. |

Human clinical studies are inherently uncertain, and Phase 1, Phase 2, Phase 3 or post-approval studies may not be successfully completed or may not be completed at all. The FDA or the sponsor may suspend a clinical study at any time for a variety of reasons, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical study if the clinical study is not being conducted in accordance with the IRB’s requirements or if the product candidate has been associated with unexpected serious harm to patients.

The results of product development, nonclinical studies and clinical studies, along with descriptions of the manufacturing process, analytical tests and other control mechanisms, direction for use, proposed labeling, patent information and other relevant information, are submitted to the FDA as part of an NDA requesting approval to market the product. Within 60 days following submission of the application, the FDA reviews the NDA to determine if it is substantially complete before the agency accepts it for filing. The FDA may refuse to accept any NDA that it deems incomplete or not properly reviewable at the time of submission and may request additional information. Once the submission is accepted for filing, the FDA begins an in-depth, substantive review of the NDA, which includes an assessment of the nonclinical and clinical data, the product’s formulation and manufacturing and whether the product is safe and effective for the proposed intended use. The FDA’s review goal for NDAs for new molecular entities is 10 months from the date the application is accepted for filing for a standard review and 6 months from the date the application is accepted for filing for a priority review. The FDA does not always meet these goal dates for standard and priority review NDAs, and the review process can be significantly extended by requests from the FDA for additional information or clarification.

Under the Prescription Drug User Fee Act, each NDA must be accompanied by a user fee, which for Fiscal Year 2020 runs at approximately $2.95 million for NDAs requiring clinical trials, as well as a program fee for prescription human drugs of approximately $325,000. Fee waivers or reductions are available, such as for the first application by a small business or for certain products designated as Orphan Drugs under the Orphan Drug Act.

FDA Expedited Review and Approval

The FDA has various programs, including fast-track designation, breakthrough therapy designation, accelerated approval and priority review, each of which are intended to facilitate and expedite the development and review of new drugs to address unmet medical needs in the treatment of serious or life-threatening conditions. Different qualifying criteria apply to each program, and each program offers different mechanisms to expedite the development or approval process, such as additional opportunities to meet with the FDA regarding the product candidate’s clinical development program, the opportunity for rolling review of a marketing application, approval based on a surrogate endpoint or, in the case of priority review, a shorter timeline for reviewing a marketing application. We may seek to take advantage of one or more of these expedited programs for tesetaxel or other product candidates in the future. However, even if a product candidate qualifies for one or more of these programs, the development or approval of the product candidate may not be shortened. The FDA may also later determine that a product candidate no longer meets the criteria for designation, and designation does not guarantee that the FDA will ultimately approve the product.

U.S. Patent Term Restoration

Depending on the timing, duration and specifics of FDA approval of the use of our product candidates, one of our U.S. patents may be eligible for limited patent term extension under the Hatch-Waxman Act. The Hatch-Waxman Act permits a patent restoration term of up to 5 years as compensation for patent term lost during product development and the FDA regulatory review process, provided the patent term restoration does not extend the remaining term of a patent beyond a total of 14 years from the product’s approval date. In the future, if available, we intend to apply for an extension of patent term for one of our

26

currently owned patents beyond its current expiration date; however, there can be no assurance that any such extension will be granted to us.

U.S. Post-Approval Requirements

Once an approval is granted, the FDA may withdraw the approval for various reasons, such as non-compliance with regulatory requirements or significant safety and performance problems with the product. Later discovery of previously unknown problems with a product may result in recalls or restrictions on the product or even complete withdrawal of the product from the market. Holders of an approved NDA are required to report certain adverse reactions to the FDA and maintain pharmacovigilance programs to proactively look for these adverse events. Manufacturers are also required to comply with restrictions on the advertising and promotion of their products, including restrictions on “off-label” promotion for uses outside those described in the approved product labeling.

In addition, after a product candidate has been approved, the FDA may require that certain additional post-approval requirements be satisfied, including the conduct of additional clinical studies. Certain changes to an approved product, such as adding new indications, making certain manufacturing changes or making certain additional labeling claims are subject to further FDA review and approval. Before a company can market products for additional indications, it must obtain approval from the FDA of a new NDA or NDA supplement, which generally requires that additional clinical studies be conducted. A company cannot be sure that any additional approval for new indications for any product candidate will be approved on a timely basis, or at all.

Changes to the manufacturing process for a given drug are strictly regulated and, depending on the significance of the change, may require FDA approval before being implemented. FDA regulations also require investigation and correction of any deviations from cGMP and impose reporting and documentation requirements on us and any third-party manufacturers we use. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with cGMP and other aspects of regulatory compliance and are subject to periodic or for-cause inspection by the FDA and other regulatory authorities to ensure such compliance.

U.S. Reimbursement and Pricing

Significant uncertainty exists as to the coverage and reimbursement status of tesetaxel and any other products for which we may seek regulatory approval. Sales in the U.S. will depend in part on the availability of adequate financial coverage and reimbursement from third-party payors, which include government health programs such as Medicare, Medicaid, TRICARE and the Veterans Administration, as well as managed care organizations and private health insurers. Prices at which we or our customers seek reimbursement for our product candidates can be subject to challenge, reduction or denial by payors.

The process for determining whether a payor will provide coverage for a product is typically separate from the process for setting the reimbursement rate that the payor will pay for the product. Third-party payors may limit coverage to specific products on an approved list or formulary, which might not include all of the FDA-approved products for a particular indication. Also, third-party payors may refuse to include a particular branded drug on their formularies or otherwise restrict patient access to a branded drug when a less costly generic equivalent or other alternative is available. Medicare Part D, Medicare’s outpatient prescription drug benefit, contains protections to ensure coverage and reimbursement for oral oncology products, and all Part D prescription drug plans are required to cover substantially all oral anti-cancer agents. However, a payor’s decision to provide coverage for a product does not imply that an adequate reimbursement rate will be available.

Private payors often rely on the lead of the governmental payors in rendering coverage and reimbursement determinations. Sales of our product candidates will therefore depend substantially on the extent to which the costs of our products will be paid by third-party payors. Achieving favorable coverage and reimbursement from the Centers for Medicare and Medicaid Services (“CMS”) and/or the Medicare

27

Administrative Contractors is typically a significant gating issue for successful introduction of a new product.

Third-party payors are increasingly challenging the price and examining the medical necessity and cost-effectiveness of medical products and services, in addition to their safety and efficacy. In order to obtain coverage and reimbursement for any product that might be approved for marketing, we may need to conduct expensive pharmacoeconomic studies in order to demonstrate the medical necessity and cost-effectiveness of any products, which would be in addition to the costs expended to obtain regulatory approvals. Third-party payors may not consider our product candidates to be medically necessary or cost-effective compared to other available therapies, or the rebate percentages required to secure favorable coverage may not yield an adequate margin over cost or may not enable us to maintain price levels sufficient to realize an appropriate return on our investment in drug development.

U.S. Healthcare Fraud and Abuse Laws and Compliance Requirements

We are subject to various federal and state laws targeting fraud and abuse in the healthcare industry. These laws may impact, among other things, our proposed sales and marketing programs. In addition, we may be subject to patient privacy regulation by both the federal government and the states in which we conduct our business. The laws that may affect our ability to operate include:

|

|

• |

The federal Anti-Kickback Statute, which prohibits, among other things, persons from soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order or recommendation of, an item or service reimbursable under a federal healthcare program, such as the Medicare and Medicaid programs. The term “remuneration” has been broadly interpreted to include anything of value, including for example gifts, cash payments, donations, the furnishing of supplies or equipment, waivers of payment, ownership interests, and providing any item, service or compensation for something other than fair market value. Federal false claims and civil monetary penalties laws, including the federal civil False Claims Act, which prohibits anyone from, among other things, knowingly presenting, or causing to be presented, for payment to federal programs (including Medicare and Medicaid) claims for items or services that are false or fraudulent. Although we may not submit claims directly to payors, manufacturers can be held liable under these laws in a variety of ways. These include: providing inaccurate billing or coding information to customers, improperly promoting a product’s off-label use, violating the Anti-Kickback Statute or misreporting pricing information to government programs. |

|

|

• |

Provisions of the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which created new federal criminal statutes that prohibit, among other things, knowingly and willfully executing a scheme to defraud any healthcare benefit program or making false statements in connection with the delivery of or payment for healthcare benefits, items or services. |

|

|

• |

The federal Physician Payment Sunshine Act requirements, under the Patient Protection and Affordable Care Act, which require manufacturers of certain drugs and biologics to track and report to CMS payments and other transfers of value they make to U.S. physicians and teaching hospitals as well as physician ownership and investment interests in the manufacturer. |

|

|

• |

Provisions of HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations, which impose certain requirements relating to the privacy, security and transmission of individually identifiable health information. |

28

|

|

information in certain circumstances, many of which differ from each other in significant ways and which may not have the same effect, thus complicating compliance efforts. |

European Government Regulation

In Europe, tesetaxel and any future products we may seek to develop and commercialize will also be subject to extensive regulatory requirements. As in the U.S., medicinal products can only be marketed if a marketing authorization from the competent regulatory authorities has been obtained.

Similar to the U.S., the various phases of nonclinical and clinical research in Europe are subject to significant regulatory controls. Although the EU Clinical Trials Directive 2001/20/EC (the “Directive”) has sought to harmonize the EU clinical trials regulatory framework, setting out common rules for the control and authorization of clinical trials in the EU, the EU Member States have transposed and applied the provisions of the Directive differently. This has led to significant variations in the member state regimes. Under the current regime, before a clinical study can be initiated, it must be approved in each of the EU countries where the study is to be conducted by two distinct bodies: The National Competent Authority (“NCA”) and one or more Ethics Committees (“EC”). Under the current regime, all suspected unexpected serious adverse reactions to the investigated drug that occur during the clinical study have to be reported to the NCA and ECs of the Member State where they occurred.

In 2014, a new Clinical Trials Regulation 536/2014 (the “Regulation”), which will replace the current Directive, was adopted. The new Regulation will become directly applicable in all EU Member States (without national implementation) once the EU Portal and Database are fully functional. Until that time, the Directive remains in force and continues to apply to clinical studies in the EU. It is expected that the Regulation will apply in 2020, although this timing may be further delayed. The new Regulation seeks to simplify and streamline the approval of clinical studies in the EU. For example, the sponsor shall submit a single application for approval of a clinical study via the EU Portal. As part of the application process, the sponsor shall propose a reporting Member State, which will coordinate the validation and evaluation of the application. The reporting Member State shall consult and coordinate with the other concerned Member States. If an application is rejected, it can be amended and resubmitted through the EU Portal. If an approval is issued, the sponsor can start the clinical study in all concerned Member States. However, a concerned Member State can, in limited circumstances, declare an “opt-out” from an approval. In such a case, the clinical study cannot be conducted in that Member State. The Regulation also aims to streamline and simplify the rules on safety reporting, and introduces enhanced transparency requirements such as mandatory submission of a summary of the clinical study results to the EU Database.

European Drug Approval Process

In the European Economic Area (“EEA”), which is comprised of the 27 Member States of the EU plus Norway, Iceland and Liechtenstein, medicinal products can only be commercialized after obtaining a Marketing Authorization (“MA”). There are two types of marketing authorizations:

29

|

|

of a major public health interest, defined by three cumulative criteria: the seriousness of the disease (e.g., disabling or life-threatening diseases) to be treated; the absence or insufficiency of an appropriate alternative therapeutic approach; and anticipation of high therapeutic benefit. In this circumstance, EMA ensures that the opinion of the CHMP is given within 150 days, excluding clock stops. |

|

|

• |