UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

_____________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March, 2022

Commission File Number: 001-38376

_____________________

| Central Puerto S.A. |

| (Exact name of registrant as specified in its charter) |

_____________________

Port Central S.A.

(Translation of registrant’s name into English)

_____________________

Avenida Thomas Edison 2701

C1104BAB Buenos Aires

Republic of Argentina

+54 (11) 4317-5000

(Address of principal executive offices)

_____________________

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

CENTRAL PUERTO S.A.

Central Puerto: 4Q2021 and Fiscal Year Results

Buenos Aires, March 9 - Central Puerto S.A (“Central Puerto” or the “Company”) (NYSE: CEPU), one of the largest private sector power generation companies in Argentina, reports its consolidated financial results for the Fiscal Year 2021 and quarter (“Fourth Quarter” or “4Q2021”) ended on December 31, 2021. A conference call to discuss the results of the Fiscal Year 2021 and Fourth Quarter 2021 will be held on March 10, 2022, at 10:00 AM Eastern Time (see details below). All information provided is presented on a consolidated basis, unless otherwise stated. Financial statements as of and for the fiscal year and the quarter ended on December 31, 2021, include the effects of the inflation adjustment, applying IAS 29. Accordingly, the financial statements have been stated in terms of the measuring unit current at the end of the reporting period, including the corresponding financial figures for previous periods informed for comparative purposes. Growth comparisons refer to the same period of the prior year, measured in the current unit at the end of the period, unless otherwise stated. Consequently, the information included in the Financial Statements for the quarter ended on December 31, 2021, are not comparable to the Financial Statements previously published by the company.

Definitions and terms used herein are provided in the Glossary at the end of this document. This release does not contain all the Company’s financial information. As a result, investors should read this release in conjunction with Central Puerto’s consolidated financial statements as of and for the quarter ended on December 31, 2021, and the notes thereto, which will be available on the Company’s website.

A. 4Q2021 Highlights

Resolution No. 1037/2021

On November 2, 2021, Resolution No. 1037/2021 was published in the Official Gazette whereby the Secretariat of Energy, upon verifying a state of high requirement of energy supply from Brazil due to the drought in the area, created an export account where the income margins coming from the electric energy exports will be accumulated. The aim is to finance energy infrastructure projects.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 2 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

Also, it was established an additional and transitory recognition to remuneration included in Resolution 440 for economic transactions between September 1, 2021, and February 28, 2022. An amount of $1,000/MWh exported per month will be assigned proportionally to the energy generated by each agent.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 3 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

B. Market Overview

The table below sets forth key market data for 4Q2021, compared to 3Q2021 and 4Q2020, and 2021, compared to 2020:

| 4Q2021 | 3Q2021 | 4Q2020 | Variation % | 2021 | 2020 | Variation % | |

| Installed capacity (MW; EoP1) | 42,989 | 42,589 | 41,952 | 2% | 42,989 | 41,952 | 2% |

| Thermal (MW) | 25,398 | 25,327 | 25,365 | 0% | 25,398 | 25,365 | 2% |

| Hydro (MW) | 10,834 | 10,834 | 10,834 | 0% | 10,834 | 10,834 | 0% |

| Nuclear (MW) | 1,755 | 1,755 | 1,755 | 0% | 1,755 | 1,755 | 0% |

| Renewable (MW) | 5,001 | 4,673 | 3,998 | 25% | 5,001 | 3,998 | 25% |

| Installed capacity (%) | 100% | 100% | 100% | N/A | 100% | 100% | N/A |

| Thermal | 59% | 59% | 60% | (1 p.p.) | 59% | 60% | (1 p.p.) |

| Hydro | 25% | 25% | 26% | (1 p.p.) | 25% | 26% | (1 p.p.) |

| Nuclear | 4% | 4% | 4% | 0 p.p. | 4 | 4% | 0 p.p. |

| Renewable | 12% | 11% | 10% | 2 p.p. | 12% | 10% | 2 p.p. |

|

|

|

|

|

|

|

|

|

| Energy Generation (GWh) | 35,530 | 37,058 | 35,133 | 1% | 141,793 | 134,177 | 6% |

| Thermal (GWh) | 21,199 | 23,824 | 22,709 | (7%) | 90,073 | 82,336 | 9% |

| Hydro (GWh) | 6,456 | 5,669 | 6,377 | 1% | 24,116 | 29,093 | (17%) |

| Nuclear (GWh) | 2,999 | 2,943 | 2,063 | 45% | 10,170 | 10,011 | 2% |

| Renewable (GWh) | 4,877 | 4,622 | 3,984 | 22% | 17,435 | 12,737 | 37% |

| Energy Generation (%) | 100% | 100% | 100% | N/A | 100% | 100% | N/A |

| Thermal | 60% | 64% | 65% | (5 p.p.) | 64% | 61% | 2 p.p. |

| Hydro | 18% | 15% | 18% | 0 p.p. | 17% | 22% | (5 p.p.) |

| Nuclear | 8% | 8% | 6% | 3 p.p. | 7% | 7% | 0 p.p. |

| Renewable | 14% | 12% | 11% | 2 p.p. | 12% | 9% | 3 p.p. |

|

|

|

|

|

|

|

|

|

| Energy Demand (GWh) | 33,472 | 34,446 | 31,432 | 6% | 133,872 | 127,307 | 5% |

| Residential | 14,828 | 16,304 | 14,018 | 6% | 60,828 | 60,021 | 1% |

| Commercial | 9,530 | 8,961 | 8,903 | 7% | 36,604 | 35,074 | 4% |

| Great Demand Residential/Commercial | 9,114 | 9,180 | 8,511 | 7% | 36,439 | 32,212 | 13% |

| Energy Demand (%) | 100% | 100% | 100% | N/A | 100% | 100% | N/A |

| Residential | 44% | 47% | 45% | 0 p.p. | 45% | 47% | (2 p.p.) |

| Commercial | 28% | 26% | 28% | 0 p.p. | 27% | 28% | 0 p.p. |

| Great Demand Residential/Commercial | 27% | 27% | 27% | 0 p.p. | 27% | 25% | 2 p.p. |

Source: CAMMESA; company data.

1 EoP refers to “End of Period”.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 4 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

Installed Capacity: In 4Q2021, the installed capacity reached 42,989 MW, compared to 41,952 MW in 4Q2020, resulting in a 2% total increase. Renewable´s capacity rise 25% to 5,001 MW in 4Q2021 compared to 3,998 MW of 4Q2020, while the rest of technologies remained stable.

Between 4Q2021 and 4Q2020, almost 1,036 MW commenced operations increasing the system´s capacity. For thermal sources, nearly 383 MW are new combined cycles, partially offset by a decrease of 342 MW from gas turbines. As for renewables, 1,003 MW were added to the system, where the two main sources were wind (668 MW) and solar (301 MW), among others. There were no new projects for hydro or nuclear machines in this period.

During 4Q2021, 400 MW of renewable projects reached COD, 200 MW of La Puna and Altiplano solar projects under the Renovar 1 and 2 frameworks, located in Salta. In addition to this, there are 123MW from Cañadón León wind farm situated in Santa Cruz.

As of 4Q2021, installed capacity is divided: in 59% thermal (decreasing 1 percentage point from 4Q2020), 25% hydro (decreasing 1 percentage point from 4Q2020), 4% nuclear and 12% renewable (increasing 2 percentage point from 4Q2020).

Generation: In 4Q2021, energy generation increased 1% to 35,530 GWh, compared to 35,133 GWh in the 4Q2020, mainly due to: (i) a 1 % increase in hydro, (ii) a 22 % increase in renewable and (iii) a 45% increase in nuclear, partially offset by a decrease of 7% in thermal.

Thermal´s decrease was due to a lower availability of certain machines, which caused an average system´s availability of 78% in 4Q2021 vs 79% from 4Q2020. In contrast and in case of generation from nuclear´ s source, the increase was based in a greater production from Atucha II, which had maintenance during most of the 4Q2020. Renewable´s generation kept growing due to the new installed capacity.

During 4Q2021, the main sources of energy generation continued to be thermal and hydro, with a share of 60% and 18%, respectively. However, thermal generation decreased 5 percentage points while hydro remained unchanged compared to the same quarter of 2020.Renewables continued to grow, reaching 14%, 2 percentage points more than 4Q2020 and nuclear recovered considerably representing 8%.

During 2021, energy generation increased 6% to 141,793 GWh, compared to 134,177 GWh in the 2020, mainly due to: (i) a 9% increase in thermal, (ii) a 37% increase in renewable and (iii) a 2% increase in nuclear, partially offset by: (i) a decrease of 17% in hydro (related to droughts that the region has experienced in past months and consequently, to the river´s lower flows which impacted the generation)

Demand: In 4Q2021, energy demand increased 6% up to 33,472 GWh, compared to 31,432 GWh in the 4Q2020 where: (i) great demand residential/commercial rise 7%, (ii) commercial grew 7% and (iii) residential increased 6%.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 5 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

The increase in commercial and great demand´s segment in 4Q2021 is attributable to the recovery of the economic activity and lower activity restrictions imposed by the government compared to the same period of the previous year. This same trend can be observed for 2021 full year, where demand grew 5% to 133,872 GWh compared to 127,307 GWh of 2020.

As of 4Q2021, 44% of the demand is represented by residential users, 28% by commercial activity and the remaining 27% is related to great demand residential/commercial. In 2021, the composition remained stable with 45% for residential, 27% for commercial and 27% linked to great demand residential/commercial.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 6 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

C. Central Puerto S.A.: Main operating metrics

The table below sets forth key operating metrics for 4Q2021, compared to 3Q2021 and 4Q2020, and 2021, compared to 2020:

| Key Metrics | 4Q2021 | 3Q2021 | 4Q2020 | Var % (Q/Q) | 2021 | 2020 | Var% (Y/Y) |

| Continuing Operations |

|

|

|

|

|

|

|

| Energy Generation (GWh) | 3,727 | 3,440 | 3,818 | (2%) | 14,392 | 14,331 | 0% |

| -Electric Energy Generation- Thermal | 2,802 | 2,493 | 2,657 | 5% | 10,258 | 9,561 | 7% |

| -Electric Energy Generation - Hydro | 538 | 509 | 762 | (29%) | 2,565 | 3,442 | (25%) |

| -Electric Energy Generation - Wind | 387 | 438 | 399 | (3%) | 1,568 | 1,328 | 18% |

| Installed capacity (MW; EoP1) | 4,809 | 4,709 | 4,689 | 3% | 4,809 | 4,689 | 3% |

| -Installed capacity -Thermal (MW) | 2,995 | 2,895 | 2,874 | 4% | 2,995 | 2,874 | 4% |

| -Installed capacity - Hydro (MW) | 1,441 | 1,441 | 1,441 | 0% | 1,441 | 1,441 | 0% |

| -Installed capacity - Wind (MW) | 374 | 374 | 374 | 0% | 374 | 374 | 0% |

| Availability - Thermal2 | 88% | 90% | 91% | (3 p.p.) | 89% | 89% | 0 p.p. |

| Steam production (thousand Tons) | 360 | 299 | 265 | 36% | 1,209 | 1,082 | 12% |

Source: CAMMESA; company data.

1 EoP refers to “End of Period”.

2 Availability weighted average by power capacity. Off-time due to scheduled maintenance agreed with CAMMESA is not considered in the ratio.

In the 4Q2021, energy generation decreased 2% to 3,727 GWh, compared to 3,818 GWh in the 4Q2020. As a reference, domestic energy generation grew 1% for the 4Q2021, compared to the same period of 2020, according to data from CAMMESA.

Decrease in the energy generated by Central Puerto was due to:

| a) | a 29% or 224 GWh decrease in energy generation form the hydro plant Piedra del Águila due to a significant decrease of water inflow in the Limay and Collón Curá river, caused by the drought in Argentina and the region. |

|

|

|

| b) | 3% or 12 GWh decrease in energy generation from renewable units, mainly due to lower wind in several wind farms. Castellana I, Achiras and Genoveva II were the main affected, partially offset by a great performance of Manque and Genoveva I´s full operation. |

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 7 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

This was partially offset by:

| c) | an increase of 5% or 145 GWh in the electricity generation from thermal units due to Terminal 6´s full production and a great operation of Mendoza´s steam and gas turbines, which was partially offset by lower generation from Puerto´s combined cycle and some of its steam turbines. |

During 4Q2021, machine availability for thermal units decreased to 88%, compared to 91% in the same period of 2020, due to certain small failures in Puerto´s combined cycle and the unavailability for some steam turbines. As a reference, the market average availability for thermal units for the same period was 78%, according to data from CAMMESA.

Steam production increased 36%, totaling 360,411 tons produced during 4Q2021, compared to 264,507 tons during the 4Q2020, due to Lujan de Cuyo´s cogeneration plant and Terminal 6´s full COD.

In 2021, energy generation increased with 14,392 GWh produced, compared to 10,331 GWh for the same period in 2020. As a reference, domestic energy generation increased 6% during 2021, compared to 2020, according to data from CAMMESA.

Energy generated by Central Puerto suffered these variations:

| a) | an increase of 7% or 697 GWh in the electricity generation from thermal units due to Terminal 6´s generation, the recovery to average production of the Siemens branded combined cycle of the Luján de Cuyo plant due to a failure during 2Q2020 and higher generation from the steam and gas turbines, both from Mendoza and Puerto´s plants. This was partially offset by a lower generation from Puerto´s combined cycle. |

|

|

|

| b) | 18% or 240 GWh increase in energy generation from renewable units, which was mainly due to the operation during the full 2021 of La Genoveva I (88.2 MW), Manque (57 MW) and Los Olivos (22.8MW) |

This was partially offset by:

| a) | a 25% or 877 GWh decrease in energy generation form the hydro plant Piedra del Águila due to lower waterflow in the Limay and Collón Curá rivers, as explained above. |

During 2021, machine availability for thermal units remained at 89%, compared to 89% of 2020. As a reference, the market average availability for thermal units for the same period was 81%, according to data from CAMMESA.

Steam production increased 12%, totaling 1,208,923 tons produced during 2021, compared to 1,081,959 tons in 2020, due to Lujan de Cuyo and Terminal 6.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 8 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

D. Financials

Main financial magnitudes of continuing operations

| Million Ps. | 4Q2021 | 3Q2021 | 4Q2020 | Var % (Q/Q) | 2021 | 2020 | Var% (Y/Y) |

|

| Unaudited1 | Unaudited1 | Unaudited1 |

| Audited | Audited |

|

| Revenues | 14,083 | 14,655 | 14,009 | 1% | 57,079 | 57,521 | (1%) |

| Cost of sales | (6,887) | (7,643) | (6,859) | 0% | (29,563) | (25,381) | 16% |

| Gross profit | 7,196 | 7,012 | 7,151 | 1% | 27,517 | 32,140 | (14%) |

| Administrative and selling expenses | (925) | (1,262) | (1,295) | (29%) | (4,152) | (4,487) | (7%) |

| Operating income before other operating results | 6,271 | 5,750 | 5,856 | 7% | 23,365 | 27,653 | (16%) |

| Other operating results, net | (7) | 478 | 1,846 | (100%) | 2,346 | 14,528 | (84%) |

| Operating income | 6,264 | 6,228 | 7,702 | (19%) | 25,712 | 42,181 | (39%) |

| Depreciations and Amortizations | 2,824 | 2,567 | 2,555 | 11% | 10,711 | 8,989 | 19% |

| Adjusted EBITDA | 9,088 | 8,795 | 10,257 | (11%) | 36,423 | 51,170 | (29%) |

| Includes, among others, the following concepts: |

|

|

|

|

|

|

|

| • Foreign Exchange Difference and interests related to FONI trade receivables | 1,070 | 1,639 | 4,818 | (78%) | 8,888 | 17,836 | (50%) |

| • Impairment on property, plant, and equipment | (3,070) | - | (3,798) | (19%) | (7,765) | (6,062) | 28% |

| Adjusted EBITDA excluding FX difference and interests related to FONI trade receivables and Impairment on property, plant, and equipment | 11,087 | 7,155 | 9,237 | 20% | 35,300 | 39,396 | (10%) |

NOTE: Exchange rates quoted by the Banco de la Nación Argentina are provided only as a reference. The average exchange rate refers to the average of the daily exchange rates quoted by the Banco de la Nación Argentina for wire transfers (divisas) for each period.

See “Disclaimer-Adjusted EBITDA” below for further information.

_________________________________

1 4Q2020 and 4Q2019 figures were constructed, as the difference between the 2020 and 2019 financial figures, minus the 9M2020 and 9M2019 financial figures, respectively, informed in the Financial Statements for the quarter and the nine-month period ended on September 30, 2020, in all cases stated in the measuring unit current on December 31, 2020. The 3Q2020 financial figures were also calculated based on the information originally published in the 3Q2020 Financial Statement, stated in terms of the measuring unit current as of December 31, 2020.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 9 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

Adjusted EBITDA Reconciliation

| Million Ps. | 4Q2021 | 3Q2021 | 4Q2020 | Var % (Q/Q) | 2021 | 2020 | Var% (Y/Y) | |

|

| Unaudited2 | Unaudited2 | Unaudited2 |

| Audited | Audited |

| |

| Consolidated net income (Loss) for the year | 849 | 2,963 | 876 | (3%) | (648) | 10,502 | (106%) | |

| (Loss) Gain on net monetary position | 1,686 | 242 | (330) | (610%) | 1,654 | (1,750) | (195%) | |

| Financial expenses | 2,667 | 2,317 | 9,048 | (71%) | 17,815 | 33,656 | (47%) | |

| Financial income | (1,277) | (291) | (3,459) | (63%) | (1,943) | (7,788) | (75%) | |

| Share of the profit of an associate | (97) | (180) | (52) | 89% | 565 | (164) | (444%) | |

| Income tax expenses | 2,436 | 1,177 | 1,619 | 50% | 8,268 | 7,725 | 7% | |

| Depreciation and amortization | 2,824 | 2,567 | 2,555 | 11% | 10,711 | 8,989 | 19% | |

| Adjusted EBITDA | 9,088 | 8,795 | 10,257 | (11%) | 36,423 | 51,170 | (29%) | |

| 1. Includes, among others, the following concepts: |

|

|

|

|

|

|

| |

| • Foreign Exchange Difference and interests related to FONI trade receivables | 1,070 | 1,639 | 4,818 | (78%) | 8,888 | 17,836 | (50%) | |

| • Impairment on property, plant, and equipment | (3,070) | - | (3,798) | (19%) | (7,765) | (6,062) | 28% | |

| Adjusted EBITDA excluding Foreign Exchange Difference and interests related to FONI trade receivables and Impairment on property, plant, and equipment | 11,087 | 7,155 | 9,237 | 20% | 35,300 | 39,396 | (10%) | |

Key Macroeconomic Figures

|

| 4Q2021 | 3Q2021 | 4Q2020 | Var % (Q/Q) | 2021 | 2020 | Var% (Y/Y) |

| Depreciation | 3.98% | 3.11% | 10.36% | (61.60%) | 22.07% | 40.67% | (45.74%) |

| Inflation | 10.12% | 9.27% | 11.41% | (11.29%) | 50.9% | 36.1% | 41% |

_________________________________

2 4Q2020 and 4Q2019 figures were constructed, as the difference between the 2020 and 2019 financial figures, minus the 9M2020 and 9M2019 financial figures, respectively, informed in the Financial Statements for the quarter and the nine-month period ended on September 30, 2020, in all cases stated in the measuring unit current on December 31, 2020. The 3Q2020 financial figures were also calculated based on the information originally published in the 3Q2020 Financial Statement, stated in terms of the measuring unit current as of December 31, 2020.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 10 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

4Q 2021 Results Analysis

Revenues increased to Ps. 14.1 billion in the 4Q2021, as compared to Ps. 14 billion in the 4Q2020. This 1% increase was mainly due to:

|

| (i) | 32% increase in sales under contracts which totaled Ps. 9.5 billion in the 4Q2021 as compared to 7.2 billion in the 4Q2020, mainly due to Terminal 6 and Genoveva I´s full COD. |

|

| (ii) | 6% increase in Steam Sales, which totaled Ps. 0.38 billion in the 4Q2021 compared to Ps. 0.36 billion from the same period of 2020, due to a higher inflation´s adjustment over the peso´s depreciation in the period, despite a 36% increase of the production as per Mendoza ´s good performance and Terminal 6´s COD. |

partially offset by:

|

| (iii) | a 36% decrease in Spot Sales/Energia Base which resulted in Ps. 3.9 billon in the 4Q2021 as compared to Ps. 6 billion in the 4Q2020 due to a lower hydro generation and a decrease in production from Puerto´s combined cycle and some of its steam turbines. This was partially offset by the temporary additional income related to Res. 1037. |

|

|

| It is important to highlight that during the 4Q2020, Terminal 6 produced as an open cycle and was remunerated under Energia Base´s resolution. |

Operating income before other operating results, net, was Ps. 6.3 billion, compared to Ps. 5.9 billion in the 4Q2020. This 7% increase was due to:

|

| (i) | costs of sales almost did not change as it totaled Ps. 6.89 billion in the 4Q2021, compared to Ps. 6.86 billion in the 4Q2020, while revenues increased 1%, as explained above. |

|

| (ii) | 29% decrease in administrative and selling expenses that totaled Ps. 0.9 billion in the 4Q2021, as compared to Ps. 1.3 billion in the 4Q2020, mainly due to: (i) a Ps 0.1 billion reduction in maintenance expenses and (ii) a Ps. 0.2 billon drop in taxes |

Adjusted EBITDA was Ps. 9.1 billion in the 4Q2021, compared to Ps. 10.3 billion in the 4Q2020. This 11% decrease was mainly due to (i) the above-mentioned variations and (ii) 85% decrease in foreign exchange difference on operating assets, mainly related to trade receivables, due to a lower depreciation of the Argentine peso in the quarter. Furthermore, Adjusted EBITDA was positively impacted by: (i) a 19% decrease in the impairment charge, (ii) the reverse of Terminal 6 ´s penalty related to delays and (iii) the positive result from Property, plant and equipment´s sale.

This was partially offset by a 11% increase in depreciations and amortizations that totaled Ps. 2.8 billion during the 4Q2021, as compared to Ps. 2.6 billion during the 4Q2020.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 11 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

As a result, Adjusted EBITDA excluding FX difference and interests related to FONI trade receivables and Impairment on property, plant and equipment was Ps. 11.1 billion in the 4Q2021, compared to Ps. 9.2 billion in 4Q2020.

Consolidated net income was Ps. 0.85 billion and net income for shareholder was Ps. 0.82 billion or Ps. 0.55 per share or Ps. 5.47 per ADR, in the 4Q2021, compared to a Consolidated net income of Ps. 0.88 billion and net income for shareholder of Ps. 0.84 billion, respectively, or Ps. 0.56 per share or Ps. 5.56 per ADR, in the 4Q2020.

In addition to the above-mentioned factors, net income was negatively impacted by:

|

| (i) | lower financial income that amounted to Ps. 1.3 billion in the 4Q2021, compared to Ps. 3.5 billion in the 4Q2020, mainly due to the reduction of net gains on financial assets at fair value |

|

| (ii) | higher income tax for the period which grew 50% as totaled Ps. 2.4 billion in the 4Q2021 compared to Ps. 1.6 billion in the 4Q2020, mainly due to the changes in the corporate income ́s tax rate and cancellation of certain deferred tax assets related to operation performed during the 4Q2021. |

and positively impacted by:

|

| (iii) | lower financial expenses which amounted to Ps. 2.7 billion during the 4Q2021, compared to Ps. 9 billion in the 4Q2020 as there were less foreign exchange difference due to a lower depreciation of the argentine peso during the quarter and a lower debt balance denominated in USD. |

Additionally, the share of profit of associates was a Ps. 0.09 billion gain during the 4Q2021 compared to a gain of Ps. 0.05 billion in the 4Q2020.

FONI collections totaled Ps. 1.87 billion in the 4Q2021, including VAT, associated to the FONI trade receivables for Vuelta de Obligado Plant, compared to Ps. 2.3 billion in 4Q2020. The amounts are being collected on time and according to the signed contract.

2021 Results Analysis

Revenues were Ps. 57.1 billion in 2021, as compared to Ps. 57.5 billion in 2020. This 1% decrease was mainly due to:

|

| (i) | 10% decrease in Spot Sales/Energia Base which totaled Ps. 23.8 billion in 2021 as compared to 26.4 billion in 2020, mainly due to the decrease in energy generation form the hydro plant Piedra del Águila. |

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 12 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

partially offset by:

|

| (ii) | 8% rise in sales under contracts, which amounted Ps. 30.1 billon in 2021, compared to Ps. 27.8 billion due to Terminal 6 and full year operation of La Genoveva I, Manque and Los Olivos. |

|

| (iii) | 7% increase in the Steam Sales, which totaled Ps. 1.7 billion in 2021, compared to Ps. 1.6 billion in 2020, due to a higher inflation´s adjustment over the peso´s depreciation in the period, despite a 12% increase of the production as per to Mendoza´s good performance and Terminal 6. |

Operating income before other operating results, net, was Ps. 23.4 billion, compared to Ps. 27.7 billion in 2020. This 16% decrease was due to:

|

| (i) | 16% increase in the costs of sales that totaled Ps. 29.6 billion, compared to Ps. 25.4 billion in 2020, primarily driven by: (i) a 12% or 0,7 billion increase in purchases of fuel and spare parts which totaled Ps. 6.2 billion in 2021 and (ii) a 15% or 3 billion increase in costs of production, mainly due to i) an increase in depreciations ii) a rise in maintenance expenses and (iii) to a lesser extent due to an increase in materials and spare parts. |

|

| (ii) | 7% decrease in administrative and selling expenses that totaled Ps.4.2 billion in 2021, as compared to Ps. 4.5 billion in 2020, mainly because a reduction in taxes. |

Adjusted EBITDA was Ps. 36.4 billion in 2021, compared to Ps. 51.2 billion in 2020. This decrease was mainly due to:

|

| (i) | A Ps. 1.7 billion or 28% increase in the item “Impairment of property, plant and equipment and intangible assets”, related to the Brigadier Lopez, Terminal 6, Puerto´s combined cycle and Lujan de Cuyo´s combined cycle. |

|

| (ii) | a 115% decrease in foreign exchange difference on operating assets, mainly related to trade receivables, due to a lower depreciation of the argentine peso during the period. |

|

| (iii) | a 21% decrease in interest from clients which totaled Ps. 1.8 billion in 2021, compared to Ps. 2.3 billion of 2020. |

This was partially offset by a 19% increase in depreciations and amortizations that totaled Ps. 10.7 billion in 2021, as compared to Ps. 9 billion of 2020.

As a result, Adjusted EBITDA excluding FX difference and interests related to FONI trade receivables and Impairment on property, plant and equipment was Ps. 35.3 billion in 2021, compared to Ps. 39.4 billion in 2020.

Consolidated net loss was Ps. 0.65 billion and Net loss for shareholder was Ps. 0.74 billion or (Ps. 0.49) per share or (Ps. 4.93) per ADR, in 2021, compared to a Consolidated net Income of Ps. 10.5 billion and Net income for shareholder of Ps. 10.4 billion, respectively, or Ps. 6.91 per share or Ps. 69.11 per ADR, in 2020. In addition to the above-mentioned factors, net income was negatively impacted by:

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 13 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

|

| (iv) | lower financial income that amounted to Ps. 1.9 billion in 2021, compared to Ps. 7.8 billion in 2020, mainly due to a reduction of net gains on financial assets at fair value. |

|

| (v) | Higher income tax expenses that amounted to Ps. 8.3 billion in 2021, compared to Ps. 7.7 billion in 2020, mainly due to the changes in the corporate income ́s tax rate and cancellation of certain deferred tax assets related to operation performed during the 2021. |

and positively impacted by:

|

| (vi) | lower financial expenses which amounted to Ps. 17.8 billion during 2021, compared to Ps. 33.7 billion in 2020 due to less foreign exchange variation, which decreased from Ps. 26.1 billion in 2020 to Ps. 12.4 billion for 2021, mainly due to a lower debt balance denominated in USD and minor depreciation of the argentine peso. |

Additionally, the share of profit of associates was a Ps. 0,6 billion loss during 2021 compared to a gain of Ps. 0,2 billion in M2020, mainly due to lower results from the operations of Ecogas.

FONI collections totaled Ps. 8.2 billion in 2021, -including VAT, associated to the FONI trade receivables for Vuelta de Obligado Plant, compared to Ps. 10 billion of 2020. The amounts are being collected on time and according to the signed contract.

In the months of January and February 2020, CAMMESA has completed all scheduled payments of principal and interest in accordance with the FONI agreement for Termoeléctrica José de San Martín S.A. (“TJSM”) and Termoeléctrica General Manuel Belgrano S.A. (“TMB”).

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 14 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

Financial Situation

As of December 31, 2021, the Company and its subsidiaries had Cash and Cash Equivalents of Ps. 0.28 billion, and Other Current Financial Assets of Ps. 19.84 billion.

The following chart breaks down the Net Debt position of Central Puerto (on a stand-alone basis) and its subsidiaries:

| Million Ps. |

| As of December 31, 2021 | |

| Cash and cash equivalents (stand-alone) |

| 12 | |

| Other financial assets (stand-alone) |

| 6,783 | |

| Financial Debt (stand-alone) |

| (16,199) | |

|

Composed of: Financial Debt (current) (Central Puerto S.A. stand-alone) | (3,765) |

| |

| Financial Debt (non-current) (Central Puerto S.A. stand-alone) | (12,434) |

| |

| Subtotal Central Puerto stand-alone Net Debt Position |

| (9,403) | |

| Cash and cash equivalents of subsidiaries |

| 269 | |

| Other financial assets of subsidiaries |

| 13,057 | |

| Financial Debt of subsidiaries

Composed of: |

| (26,798) | |

| Financial Debt of subsidiaries (current)4 | (3,050) |

| |

| Financial Debt of subsidiaries (non-current) 4 | (23,748) |

| |

| Subtotal Subsidiaries Net Debt Position |

| (13,472) | |

| Consolidated Net Debt Position |

| (22,875) | |

Cash Flows of 2021

| Million Ps. | 2021 ended on December 31, 2021 |

| Cash and Cash equivalents at the beginning | 421 |

| Net cash flows provided by operating activities | 26,036 |

| Net cash flows used in investing activities | (6,924) |

| Net cash flows used in financing activities | (19,167) |

| Exchange difference and other financial results | 80 |

| Loss on net monetary position by cash and cash equivalents | (164) |

| Cash and Cash equivalents at the end | 282 |

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 15 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

Net cash provided by operating activities was Ps. 26 billion in 2021. This cash flow arises from (i) Ps. 27.5 billion from the gross profit obtained during 2021, (ii) Ps. 3.6 billion due to a decrease in the stock of trade receivables, mainly related to the FONI collections, (iii) Ps. 3.5 billion in collection of interests from clients, including the ones from FONI and (iv) a Ps. 7.8 billion non-cash impairment of property, plant and equipment and intangible assets charge included in the operating income, which was partially offset by (i) a Ps. 6.9 billion non-cash foreign exchange difference on trade receivables, (ii) a Ps. 0.9 billion in net monetary position loss, (iii) a Ps. 4.4 billion from income tax paid, and (iv) a Ps. 6.9 billion reduction in trade and other payables, other non-financial liabilities and liabilities from employee benefits.

Net cash used in investing activities was Ps. 6.9 billion in 2021. This amount was mainly due to (i) Ps. 5.4 billion in payments for the purchase of property, plant, and equipment mainly related to the construction of Terminal 6 thermal project, (ii) Ps. 5.3 billion losses from the sale of short-term financial assets, net, which was partially offset by (iii) Ps. 3.6 billion obtained in the sale of property, plant, and equipment and (iv) Ps. 0,1 billion in dividends collected.

Net cash used in financing activities was Ps. 19.2 billion in 2021. This amount was mainly the result of Ps. 1.6 billion bank and investment accounts overdrafts paid, net, (ii) Ps. 12.9 billion in loans paid, mainly related to the loans received for the expansion projects, and (iii) Ps. 4.2 billion in interest and financial expenses paid, mainly related to those loans.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 16 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

D. Tables

a. Consolidated Statement of Income

|

|

| 4Q 2021 |

|

| 4Q 2020 |

| ||

|

|

| Unaudited3 |

|

| Unaudited3 |

| ||

|

|

| Thousand Ps. |

|

| Thousand Ps. |

| ||

|

|

|

|

|

|

|

| ||

| Revenues |

|

| 14,082,886 |

|

|

| 14,009,376 |

|

| Cost of sales |

|

| (6,887,051 | ) |

|

| (6,858,719 | ) |

| Gross income |

|

| 7,195,835 |

|

|

| 7,150,656 |

|

|

|

|

|

|

|

|

|

|

|

| Administrative and selling expenses |

|

| (924,915 | ) |

|

| (1,294,833 | ) |

| Other operating income |

|

| 1,613,661 |

|

|

| 5,709,088 |

|

| Other operating expenses |

|

| 1,448,938 |

|

|

| (65,361 | ) |

| Property, plant, and equipment impairment |

|

| (3,069,693 | ) |

|

| (3,797,870 | ) |

| Operating income |

|

| 6,263,827 |

|

|

| 7,701,680 |

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Gain on net monetary position |

|

| (1,685,842 | ) |

|

| 330,480 |

|

| Finance income |

|

| 1,277,264 |

|

|

| 3,459,376 |

|

| Finance expenses |

|

| (2,667,176 | ) |

|

| (9,048,332 | ) |

| Share of the profit of associates |

|

| 97,435 |

|

|

| 51,558 |

|

| Income before income tax |

|

| 3,285,508 |

|

|

| 2,494,792 |

|

| Income tax for the year |

|

| (2,436,200 | ) |

|

| (1,618,830 | ) |

| Net income for the year |

|

| 849,308 |

|

|

| 875,962 |

|

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

| -Equity holders of the parent |

|

| 823,767 |

|

|

| 837,076 |

|

| -Non-controlling interests |

|

| 25,541 |

|

|

| 38,886 |

|

|

|

|

| 849,308 |

|

|

| 875,962 |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

| Basic and diluted (Ps.) |

|

| 0.55 |

|

|

| 0.56 |

|

_________________________________

3 4Q2021 and 4Q2020 figures were constructed, as the difference between the 2021 and 2020 financial figures, minus the 9M2021 and 9M2020 financial figures, respectively, informed in the Financial Statements for the quarter and the nine-month period ended on September 30, 2021, in all cases stated in the measuring unit current on December 31, 2021.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 17 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

|

|

| 2021 |

|

| 2020 |

| ||

|

|

| Audited |

|

| Audited |

| ||

|

|

| Thousand Ps. |

|

| Thousand Ps. |

| ||

|

|

|

|

|

|

|

| ||

| Revenues |

|

| 57,079,339 |

|

|

| 57,521,079 |

|

| Cost of sales |

|

| (29,562,588 | ) |

|

| (25,381,445 | ) |

| Gross income |

|

| 27,516,751 |

|

|

| 31,139,634 |

|

|

|

|

|

|

|

|

|

|

|

| Administrative and selling expenses |

|

| (4,151,623 | ) |

|

| (4,486,896 | ) |

| Other operating income |

|

| 10,919,061 |

|

|

| 21,280,499 |

|

| Other operating expenses |

|

| (807,635 | ) |

|

| (689,930 | ) |

| Property plant and equipment and intangible assets impairment |

|

| (7,765,017 | ) |

|

| (6,062,276 | ) |

| Operating income |

|

| 25,711,537 |

|

|

| 42,181,031 |

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Gain on net monetary position |

|

| (1,653,978 | ) |

|

| 1,749,785 |

|

| Finance income |

|

| 1,942,647 |

|

|

| 7,788,279 |

|

| Finance expenses |

|

| (17,815,205 | ) |

|

| (33,655,663 | ) |

| Share of the profit of associates |

|

| (564,502 | ) |

|

| 164,149 |

|

| Income before income tax |

|

| 7,620,499 |

|

|

| 18,227,581 |

|

| Income tax for the year |

|

| (8,268,362 | ) |

|

| (7,725,155 | ) |

| Net (loss) income for the year |

|

| (647,863 | ) |

|

| 10,502,426 |

|

|

|

|

|

|

|

|

|

|

|

| Attributable to: |

|

|

|

|

|

|

|

|

| -Equity holders of the parent |

|

| (742,076 | ) |

|

| 10,402,779 |

|

| -Non-controlling interests |

|

| 94,213 |

|

|

| 99,647 |

|

|

|

|

| (647,863 | ) |

|

| 10,502,426 |

|

|

|

|

|

|

|

|

|

|

|

| (Loss) Earnings per share: |

|

|

|

|

|

|

|

|

| Basic and diluted (Ps.) |

|

| (0.49 | ) |

|

| 6,91 |

|

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 18 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

b. Consolidated Statement of Financial Position

|

|

| As of December 31, 2021 |

|

| As of December 31, 2020 |

| ||

|

|

| Audited |

|

| Audited |

| ||

|

|

| Thousand Ps. |

|

| Thousand Ps. |

| ||

| Assets |

|

|

|

|

|

| ||

| Non-current assets |

|

|

|

|

|

| ||

| Property, plant, and equipment |

|

| 110,623,326 |

|

|

| 119,525,703 |

|

| Intangible assets |

|

| 6,039,588 |

|

|

| 10,179,651 |

|

| Investment in associates |

|

| 6,300,371 |

|

|

| 7,039,925 |

|

| Other financial assets |

|

| 34,877 |

|

|

| - |

|

| Trade and other receivables |

|

| 30,427,894 |

|

|

| 44,376,921 |

|

| Other non-financial assets |

|

| 344,226 |

|

|

| 730,724 |

|

| Inventories |

|

| 381,710 |

|

|

| 993,388 |

|

| Deferred tax asset |

|

| 131,556 |

|

|

| 148,496 |

|

|

|

|

| 154,283,548 |

|

|

| 182,994,808 |

|

| Current assets |

|

|

|

|

|

|

|

|

| Inventories |

|

| 1,447,182 |

|

|

| 1,213,912 |

|

| Other non-financial assets |

|

| 2,353,292 |

|

|

| 1,359,017 |

|

| Trade and other receivables |

|

| 22,753,339 |

|

|

| 28,279,049 |

|

| Other financial assets |

|

| 19,839,795 |

|

|

| 21,247,011 |

|

| Cash and cash equivalents |

|

| 281,728 |

|

|

| 420,671 |

|

|

|

|

| 46,675,336 |

|

|

| 52,519,660 |

|

| Property, plant, and equipment available for sale |

|

| - |

|

|

| 3,561,394 |

|

| Total assets |

|

| 200,958,884 |

|

|

| 239,075,862 |

|

|

|

|

|

|

|

|

|

|

|

| Equity and liabilities |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Capital stock |

|

| 1,514,022 |

|

|

| 1,514,022 |

|

| Adjustment to capital stock |

|

| 39,442,309 |

|

|

| 39,442,309 |

|

| Legal reserve |

|

| 6,313,345 |

|

|

| 5,793,206 |

|

| Voluntary reserve |

|

| 83,058,876 |

|

|

| 73,176,237 |

|

| Other equity accounts |

|

| (2,967,736 | ) |

|

| (2,967,736 | ) |

| Retained earnings |

|

| (733,517 | ) |

|

| 10,411,085 |

|

| Equity attributable to shareholders of the parent |

|

| 126,627,299 |

|

|

| 127,369,123 |

|

| Non-controlling interests |

|

| 170,113 |

|

|

| 193,686 |

|

| Total Equity |

|

| 126,797,412 |

|

|

| 127,562,809 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

| Other non-financial liabilities |

|

| 5,416,996 |

|

|

| 7,930,929 |

|

| Other loans and borrowings |

|

| 36,182,243 |

|

|

| 46,557,746 |

|

| Compensation and employee benefits liabilities |

|

| 341,835 |

|

|

| 474,880 |

|

| Provisions |

|

| 48,179 |

|

|

| 68,532 |

|

| Deferred income tax liabilities |

|

| 15,174,872 |

|

|

| 13,584,596 |

|

|

|

|

| 57,163,925 |

|

|

| 68,616,683 |

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Trade and other payables |

|

| 2,721,562 |

|

|

| 3,842,213 |

|

| Other non-financial liabilities |

|

| 3,357,632 |

|

|

| 3,397,995 |

|

| Other loans and borrowings |

|

| 6,814,403 |

|

|

| 30,376,190 |

|

| Compensation and employee benefits liabilities |

|

| 1,632,182 |

|

|

| 1,537,973 |

|

| Income tax payable |

|

| 2,382,082 |

|

|

| 3,689,390 |

|

| Provisions |

|

| 89,686 |

|

|

| 52,609 |

|

|

|

|

| 16,997,547 |

|

|

| 42,896,370 |

|

| Total liabilities |

|

| 74,161,472 |

|

|

| 111,513,053 |

|

| Total equity and liabilities |

|

| 200,958,884 |

|

|

| 239,075,862 |

|

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 19 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

c. Consolidated Statement of Cash Flow

|

|

| 2021 |

|

| 2020 |

| ||

|

|

| Audited |

|

| Audited |

| ||

|

|

| Thousand Ps. |

|

| Thousand Ps. |

| ||

| Operating activities |

|

|

|

|

|

| ||

| Income for the year before income tax |

|

| 7,620,499 |

|

|

| 18,227,581 |

|

|

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile income for the year before income tax to net cash flows: |

|

|

|

|

|

|

|

|

| Depreciation of property, plant, and equipment |

|

| 7,637,642 |

|

|

| 5,465,104 |

|

| Amortization of intangible assets |

|

| 3,073,753 |

|

|

| 3,523,429 |

|

| Property, plant and equipment and intangible assets impairment |

|

| 7,765,017 |

|

|

| 6,062,276 |

|

| Sale of Property, plant and equipment result |

|

| (105,174 | ) |

|

| - |

|

| (Recovery) Discount of tax credits |

|

| (236,729 | ) |

|

| 45,575 |

|

| Interest earned from customers |

|

| (3,610,639 | ) |

|

| (4,690,603 | ) |

| Commercial and fiscal interests lost |

|

| 624,433 |

|

|

| 563,199 |

|

| Financial income |

|

| (1,942,647 | ) |

|

| (7,788,279 | ) |

| Financial expenses |

|

| 17,815,205 |

|

|

| 33,655,663 |

|

| Share of the profit of associates |

|

| 564,502 |

|

|

| (164,149 | ) |

| Provision for material´s impairment |

|

| 41,355 |

|

|

| 64,807 |

|

| Stock-based payments |

|

| - |

|

|

| 2,525 |

|

| Movements in provisions and long-term employee benefit plan expenses |

|

| 306,174 |

|

|

| 204,159 |

|

| Foreign exchange difference for trade receivables |

|

| (6,879,987 | ) |

|

| (16,531,502 | ) |

| Loss on net monetary position |

|

| (897,938 | ) |

|

| (18,647,607 | ) |

|

|

|

|

|

|

|

|

|

|

| Working capital adjustments: |

|

|

|

|

|

|

|

|

| Decrease in trade and other receivables |

|

| 3,649,803 |

|

|

| 21,894,898 |

|

| (Increase) Decrease in other non-financial assets and inventories |

|

| (989,538 | ) |

|

| 515,037 |

|

| Decrease in trade and other payables, other non-financial liabilities, and liabilities from employee benefits |

|

| (6,891,718 | ) |

|

| (12,334,541 | ) |

|

|

|

| 27,544,014 |

|

|

| 30,067,572 |

|

| Commercial and fiscal interests paid |

|

| (624,433 | ) |

|

| (563,199 | ) |

| Interest received from customers |

|

| 3,522,898 |

|

|

| 4,696,821 |

|

| Income tax paid |

|

| (4,406,562 | ) |

|

| (5,079,094 | ) |

| Net cash flows provided by operating activities |

|

| 26,035,917 |

|

|

| 29,122,100 |

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchase of property, plant, and equipment |

|

| (5,372,000 | ) |

|

| (18,068,364 | ) |

| Sale of property, plant, and equipment |

|

| 3,644,979 |

|

|

| - |

|

| Dividends received |

|

| 140,168 |

|

|

| 212,804 |

|

| Acquisition of other financial assets, net |

|

| (5,337,330 | ) |

|

| (8,239,468 | ) |

| Net cash flows used in investing activities |

|

| (6,924,183 | ) |

|

| (26,095,028 | ) |

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Banks and investment accounts overdrafts received (paid), net |

|

| (1,610,020 | ) |

|

| (1,061,263 | ) |

| Loans paid |

|

| (12,892,771 | ) |

|

| (4,874,369 | ) |

| Loans received |

|

| - |

|

|

| 6,236,913 |

|

| Direct expenses of indebtedness and loan refinancing |

|

| (348,314 | ) |

|

| (488,263 | ) |

| Interests and other loan costs paid |

|

| (4,197,999 | ) |

|

| (5,276,205 | ) |

| Dividends paid |

|

| (117,786 | ) |

|

| (96,540 | ) |

| Net cash flows used in financing activities |

|

| (19,166,890 | ) |

|

| (5,559,727 | ) |

|

|

|

|

|

|

|

|

|

|

| (Decrease) in cash and cash equivalents |

|

| (55,156 | ) |

|

| (2,532,655 | ) |

| Exchange difference and other financial results |

|

| 80,379 |

|

|

| 417,650 |

|

| Monetary results effect on cash and cash equivalents |

|

| (164,163 | ) |

|

| (534,116 | ) |

| Cash and cash equivalents as of January 1 |

|

| 420,671 |

|

|

| 3,069,792 |

|

| Cash and cash equivalents as of December 31, 2021 |

|

| 281,728 |

|

|

| 420,671 |

|

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 20 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

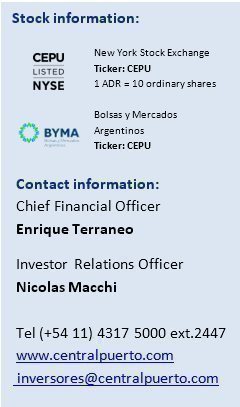

E. Information about the Conference Call

There will be a conference call to discuss Central Puerto’s Fiscal Year 2021 and Fourth Quarter results on March 10, 2022, at 10.00 AM Eastern Time.

The conference will be hosted by Mr. Fernando Bonnet, Chief Executive Officer, and Enrique Terraneo, Chief Operating Officer. To access the conference call, please dial:

Participants (Toll Free): +1-888-506-0062

International Participants: +1-973-528-0011

Access Code: 645855

The Company will also host a live audio webcast of the conference call on the Investor Relations section of the Company’s website at www.centralpuerto.com Please allow extra time prior to the call to visit the website and download any streaming media software that might be required to listen to the webcast. The call will be available for replay on the Company website under the Investor Relations section.

You may find additional information on the Company at:

|

| · | http://investors.centralpuerto.com/ |

|

| · | www.sec.gov |

|

| · | www.cnv.gob.ar |

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 21 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

Glossary

In this release, except where otherwise indicated or where the context otherwise requires:

|

| · | “BCRA” refers to Banco Central de la República Argentina, Argentina’s Central Bank, |

|

|

|

|

|

| · | “CAMMESA” refers to Compañía Administradora del Mercado Mayorista Eléctrico Sociedad Anónima; |

|

|

|

|

|

| · | “COD” refers to Commercial Operation Date, the day in which a generation unit is authorized by CAMMESA (in Spanish, “Habilitación Comercial”) to sell electric energy through the grid under the applicable commercial conditions; |

|

|

|

|

|

| · | “Ecogas” refers collectively to Distribuidora de Gas Cuyana (“DGCU”), Distribuidora de Gas del Centro (“DGCE”), and their controlling company Inversora de Gas del Centro (“IGCE”); |

|

|

|

|

|

| · | “Energía Base” (legacy energy) refers to the regulatory framework established under Resolution SE No. 95/13, as amended, currently regulated by Resolution SE No. 440; |

|

|

|

|

|

| · | “FONINVEMEM” or “FONI”, refers to the Fondo para Inversiones Necesarias que Permitan Incrementar la Oferta de Energía Eléctrica en el Mercado Eléctrico Mayorista (the Fund for Investments Required to Increase the Electric Power Supply) and Similar Programs, including Central Vuelta de Obligado (CVO) Agreement; |

|

|

|

|

|

| · | “p.p.”, refers to percentage points; |

|

|

|

|

|

| · | “PPA” refers to power purchase agreements. |

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 22 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

Results for the quarter and twelve-month period ended on December 31, 2021

Disclaimer

Rounding amounts and percentages: Certain amounts and percentages included in this release have been rounded for ease of presentation. Percentage figures included in this release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding. For this reason, certain percentage amounts in this release may vary from those obtained by performing the same calculations using the figures in the financial statements. In addition, certain other amounts that appear in this release may not sum due to rounding.

This release contains certain metrics, including information per share, operating information, and others, which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar measures used by other companies. Such metrics have been included herein to provide readers with additional measures to evaluate the Company’s performance; however, such measures are not reliable indicators of the future performance of the Company and future performance may not compare to the performance in previous periods.

OTHER INFORMATION

Central Puerto routinely posts important information for investors in the Investor Relations support section on its website, www.centralpuerto.com. From time to time, Central Puerto may use its website as a channel of distribution of material Company information. Accordingly, investors should monitor Central Puerto’s Investor Support website, in addition to following the Company’s press releases, SEC filings, public conference calls and webcasts. The information contained on, or that may be accessed through, the Company’s website is not incorporated by reference into, and is not a part of, this release.

CAUTIONARY STATEMENTS RELEVANT TO FORWARD-LOOKING INFORMATION

This release contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to in this Earnings Release as “forward-looking statements”) that constitute forward-looking statements. All statements other than statements of historical fact are forward-looking statements. The words ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘expect’’, ‘‘should’’, ‘‘plan’’, ‘‘intend’’, ‘‘will’’, ‘‘estimate’’ and ‘‘potential’’, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements.

Statements regarding possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition, expected power generation and capital expenditures plan, are examples of forward-looking statements. Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies, which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 23 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

The Company assumes no obligation to update forward-looking statements except as required under securities laws. Further information concerning risks and uncertainties associated with these forward-looking statements and the Company’s business can be found in the Company’s public disclosures filed on EDGAR (www.sec.gov )

Adjusted EBITDA

In this release, Adjusted EBITDA, a non-IFRS financial measure, is defined as net income for the year, plus finance expenses, minus finance income, minus share of the profit of associates, minus depreciation, and amortization, plus income tax expense, plus depreciation and amortization, minus net results of discontinued operations.

Adjusted EBITDA is believed to provide useful supplemental information to investors about the Company and its results. Adjusted EBITDA is among the measures used by the Company’s management team to evaluate the financial and operating performance and make day-to-day financial and operating decisions. In addition, Adjusted EBITDA is frequently used by securities analysts, investors, and other parties to evaluate companies in the industry. Adjusted EBITDA is believed to be helpful to investors because it provides additional information about trends in the core operating performance prior to considering the impact of capital structure, depreciation, amortization, and taxation on the results.

Adjusted EBITDA should not be considered in isolation or as a substitute for other measures of financial performance reported in accordance with IFRS. Adjusted EBITDA has limitations as an analytical tool, including:

|

| · | Adjusted EBITDA does not reflect changes in, including cash requirements for, working capital needs or contractual commitments; |

|

|

|

|

|

| · | Adjusted EBITDA does not reflect the finance expenses, or the cash requirements to service interest or principal payments on indebtedness, or interest income or other finance income; |

|

|

|

|

|

| · | Adjusted EBITDA does not reflect income tax expense or the cash requirements to pay income taxes; |

|

|

|

|

|

| · | although depreciation and amortization are non-cash charges, the assets being depreciated or amortized often will need to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for these replacements; |

|

|

|

|

|

| · | although share of the profit of associates is a non-cash charge, Adjusted EBITDA does not consider the potential collection of dividends; and |

|

|

|

|

|

| · | other companies may calculate Adjusted EBITDA differently, limiting its usefulness as a comparative measure. |

The Company compensates for the inherent limitations associated with using Adjusted EBITDA through disclosure of these limitations, presentation of the Company’s consolidated financial statements in accordance with IFRS and reconciliation of Adjusted EBITDA to the most directly comparable IFRS measure, net income. For a reconciliation of the net income to Adjusted EBITDA, see the tables included in this release.

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 24 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|

|

| Results for the quarter and twelve-month period |

| ended on December 31, 2021 | |

|

| |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| Central Puerto S.A. |

| |

|

|

| ||

| Date: March 9, 2022 | By: | /s/ ENRIQUE TERRANEO |

|

|

| Name: | Enrique Terraneo |

|

|

| Title: | Attorney-in-Fact |

|

|

|

|

|

|

|

|

| Av. Thomas Edison 2701 |

| Tel (+54 11) 4317 5000 ext. 2447 | 25 |

|

| C1104BAB - City of Buenos Aires |

| inversores@centralpuerto.com |

|

|

| Republic of Argentina |

| www.centralpuerto.com |

|