| (a) |

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 18 | ||||

| 28 | ||||

| 29 | ||||

| 36 | ||||

1 |

The return shown is based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights, which reflects adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America. |

2 |

Returns presented are without load. Please reference the investments results section of the report for with load returns. |

Annualized Expense Ratios (1) | ||

Institutional Class |

2.31% | |

Class FI |

2.31% | |

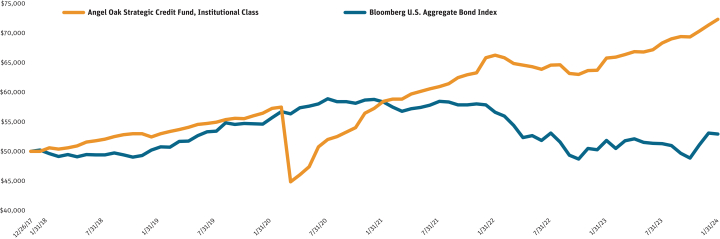

Average Annual Returns | ||||||||

One Year |

Three Year |

Five Year |

Since Inception (2) | |||||

Angel Oak Strategic Credit Fund – Institutional Class |

9.92% (3) |

7.31% | 6.37% | 6.19% | ||||

Angel Oak Strategic Credit Fund – Class FI without load |

9.92% | N/A | N/A | 8.02% | ||||

Angel Oak Strategic Credit Fund – Class FI with load |

6.92% | N/A | N/A | 6.19% | ||||

Bloomberg U.S. Aggregate Bond Index (4) |

2.10% | -3.17% | 0.83% | 0.92% (5) | ||||

Beginning Account Value |

Ending Account Value |

Expenses Paid During Period (1) |

Annualized Expense Ratio | |||||||

Institutional Class |

Actual | $1,000.00 | $1,058.10 | $10.69 | 2.06% | |||||

| Hypothetical (2) |

$1,000.00 | $1,014.82 | $10.46 | 2.06% | ||||||

Class FI |

Actual | $1,000.00 | $1,058.10 | $10.69 | 2.06% | |||||

| Hypothetical (2) |

$1,000.00 | $1,014.82 | $10.46 | 2.06% | ||||||

Assets |

|||||

Investments in securities at fair value* |

$97,239,773 | ||||

Deposit at broker for swaps* |

1,189,005 | ||||

Dividends and interest receivable |

435,190 | ||||

Deposit at broker for futures* |

14,346 | ||||

Receivable for Fund shares sold |

289 | ||||

Prepaid expenses |

28,718 | ||||

Total Assets |

98,907,321 |

||||

Liabilities |

|||||

Payable for reverse repurchase agreements |

1,549,393 | ||||

Net swap premiums received |

514,845 | ||||

Payable for distributions to shareholders |

400,373 | ||||

Payable for investments purchased |

250,000 | ||||

Depreciation on swap agreements |

102,890 | ||||

Payable to Adviser |

100,795 | ||||

Payable to administrator, fund accountant, and transfer agent |

31,176 | ||||

Interest payable for reverse repurchase agreements |

4,329 | ||||

Payable to custodian |

1,150 | ||||

Other accrued expenses |

51,694 | ||||

Total Liabilities |

3,006,645 |

||||

Net Assets |

$95,900,676 |

||||

Net Assets consist of: |

|||||

Paid-in capital |

$99,576,686 | ||||

Total distributable earnings (accumulated deficit) |

(3,676,010 | ) | |||

Net Assets |

$95,900,676 |

||||

Class FI: |

|||||

Net Assets |

$19,462,219 | ||||

Shares outstanding (unlimited number of shares authorized, no par value) |

|||||

Net asset value (“NAV”) and offering price per share |

$ |

||||

Institutional Class: |

|||||

Net Assets |

$76,438,457 | ||||

Shares outstanding (unlimited number of shares authorized, no par value) |

|||||

Net asset value (“NAV”) and offering price per share |

$ |

||||

*Identified Cost: |

|||||

Investments in securities |

$100,126,653 | ||||

Required margin held as collateral for swaps |

478,250 | ||||

Required margin held as collateral for futures contracts |

80 | ||||

Investment Income |

|||||

Interest |

$ | 9,390,713 | |||

Dividends |

4,400 | ||||

Total Investment Income |

9,395,113 |

||||

Expenses |

|||||

Investment Advisory (See Note 5) |

1,105,751 | ||||

Interest expense |

368,176 | ||||

Fund accounting |

87,031 | ||||

Legal |

67,670 | ||||

Transfer agent |

54,253 | ||||

Registration |

43,336 | ||||

Administration |

40,353 | ||||

Trustee |

37,132 | ||||

Audit & tax |

30,249 | ||||

Printing |

13,450 | ||||

Compliance |

11,300 | ||||

Custodian |

6,093 | ||||

Insurance |

5,707 | ||||

Miscellaneous |

20,687 | ||||

Total Expenses |

1,891,188 |

||||

Net Investment Income (Loss) |

7,503,925 |

||||

Realized and Unrealized Gain (Loss) on Investments |

|||||

Net realized gain (loss) on investments |

658,547 | ||||

Net realized gain (loss) on futures contracts |

147 | ||||

Net realized gain (loss) on swaps |

(5,681 | ) | |||

Net change in unrealized appreciation/depreciation on investments |

521,874 | ||||

Net change in unrealized appreciation/depreciation on futures contracts |

614 | ||||

Net change in unrealized appreciation/depreciation on swaps |

(102,890 | ) | |||

Net realized and unrealized gain (loss) on investments |

1,072,611 |

||||

Net increase (decrease) in net assets resulting from operations |

$ |

8,576,536 |

|||

For the Year Ended January 31, 2024 |

For the Year Ended January 31, 2023 (a) | |||||||||

Increase (Decrease) in Net Assets due to: |

||||||||||

Operations |

||||||||||

Net investment income (loss) |

$7,503,925 | $5,136,432 | ||||||||

Net realized gain (loss) on investment transactions, futures contracts, and swaps |

653,013 | (214,652 | ) | |||||||

Net change in unrealized appreciation/depreciation on investments, futures contracts, and swaps |

419,598 | (3,557,022 | ) | |||||||

Net increase (decrease) in net assets resulting from operations |

8,576,536 |

1,364,758 |

||||||||

Distributions to Shareholders |

||||||||||

Distributions, Class FI |

(1,253,571 | ) | (421,986 | ) | ||||||

Distributions, Institutional Class |

(6,139,297 | ) | (4,767,458 | ) | ||||||

Total distributions to shareholders |

(7,392,868 |

) |

(5,189,444 |

) | ||||||

Capital Transactions – Class FI |

||||||||||

Proceeds from shares sold |

8,515,000 | 9,200,000 | ||||||||

Reinvestment of distributions |

1,253,571 | 421,986 | ||||||||

Total Class FI |

9,768,571 |

9,621,986 |

||||||||

Capital Transactions – Institutional Class |

||||||||||

Proceeds from shares sold |

5,745,047 | 68,506,156 | ||||||||

Reinvestment of distributions |

122,230 | 323,098 | ||||||||

Cost of shares repurchased (See Note 7) |

(1,369,686 | ) | (9,123,500 | ) | ||||||

Total Institutional Class |

4,497,591 |

59,705,754 |

||||||||

Net increase (decrease) in net assets resulting from capital transactions |

14,266,162 |

69,327,740 |

||||||||

Total Increase (Decrease) in Net Assets |

15,449,830 |

65,503,054 |

||||||||

Net Assets |

||||||||||

Beginning of year or period |

80,450,846 | 14,947,792 | ||||||||

End of year or period |

$ |

95,900,676 |

$ |

80,450,846 |

||||||

Share Transactions – Class FI |

||||||||||

Shares sold |

414,029 | 437,236 | ||||||||

Shares issued in reinvestment of distributions |

60,897 | 20,609 | ||||||||

Total Class FI |

474,926 |

457,845 |

||||||||

Share Transactions – Institutional Class |

||||||||||

Shares sold |

280,103 | 3,205,714 | ||||||||

Shares issued in reinvestment of distributions |

5,947 | 15,243 | ||||||||

Shares repurchased (See Note 7) |

(66,627 | ) | (432,053 | ) | ||||||

Total Institutional Class |

219,423 |

2,788,904 |

||||||||

Net increase (decrease) in share transactions |

694,349 |

3,246,749 |

||||||||

(a) Class FI commenced operations on July 12, 2022. |

||||||||||

For the Year or Period Ended January 31, | ||||||||||

2024 |

2023 (a) | |||||||||

Selected Per Share Data: |

||||||||||

Net asset value, beginning of year or period |

$20.62 |

$21.13 |

||||||||

Income from investment operations: |

||||||||||

Net investment income (loss) |

1.75 | 0.98 | ||||||||

Net realized and unrealized gain (loss) on investments (b) |

0.20 | (0.46 | ) | |||||||

Total from investment operations |

1.95 | 0.52 | ||||||||

Less distributions to shareholders: |

||||||||||

From net investment income |

(1.71 | ) | (1.03 | ) | ||||||

Total distributions |

(1.71 | ) | (1.03 | ) | ||||||

Net asset value, end of year or period |

$20.86 |

$20.62 |

||||||||

Total return (c) |

9.92 | % | 2.58 | %(d) | ||||||

Ratios and Supplemental Data: |

||||||||||

Net assets, end of year or period (000’s omitted) |

$19,46 | 2 | $9,43 | 9 | ||||||

Interest expense to average net assets (e) |

0.42 | % | 0.13 | % | ||||||

Ratio of expenses to average net assets before waiver and reimbursement/recoupment (e)(f) |

2.14 | % | 1.86 | % | ||||||

Ratio of expenses to average net assets after waiver and reimbursement/recoupment (e)(f) |

2.14 | % | 1.03 | %(g) | ||||||

Ratio of net investment income (loss) to average net assets before waiver and reimbursement/recoupment (e)(f) |

8.50 | % | 7.75 | % | ||||||

Ratio of net investment income (loss) to average net assets after waiver and reimbursement/recoupment (e)(f) |

8.50 | % | 8.58 | %(g) | ||||||

Portfolio turnover rate (c) |

49 | % | 29 | %(h) | ||||||

Reverse repurchase agreements, end of year or period (000’s omitted) |

$1,54 | 9 | $6,79 | 6 | ||||||

Asset coverage per $1,000 unit of senior indebtedness (i) |

$62,89 | 6 | $12,83 | 8 | ||||||

| (a) | Class commenced operations on July 12, 2022. |

| (b) | Net realized and unrealized gain (loss) per share may include balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gain/(loss) in the Statement of Operations due to share transactions for the year or period. |

| (c) | Not annualized for periods of less than one year. |

| (d) | Total return would have been lower if no expense waiver was in place. |

| (e) | Annualized for periods less than one year. |

| (f) | Includes interest expense. |

| (g) | Effective January 1, 2023, the expense limitation agreement was terminated. Prior to January 1, 2023, the expense cap was 0.75%. See Note 5. |

| (h) | Figure presented represents turnover for the Fund as a whole for the entire fiscal period. |

| (i) | Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total number of senior indebtedness, where one unit equals $1,000 of senior indebtedness. |

For the Year Ended January 31, | |||||||||||||||||||||||||

2024 |

2023 |

2022 |

2021 |

2020 | |||||||||||||||||||||

Selected Per Share Data: |

|||||||||||||||||||||||||

Net asset value, beginning of year |

$20.61 |

$22.76 |

$23.03 |

$24.73 |

$24.49 |

||||||||||||||||||||

Income from investment operations: |

|||||||||||||||||||||||||

Net investment income (loss) |

1.74 | 1.84 | 3.22 | (a) | 2.01 | 1.69 | |||||||||||||||||||

Net realized and unrealized gain (loss) on investments (b) |

0.22 | (2.06 | ) | (0.32 | ) | (1.72 | ) | 0.22 | |||||||||||||||||

Total from investment operations |

1.96 | (0.22 | ) | 2.90 | 0.29 | 1.91 | |||||||||||||||||||

Less distributions to shareholders: |

|||||||||||||||||||||||||

From net investment income |

(1.71 | ) | (1.93 | ) | (3.17 | ) | (1.99 | ) | (1.67 | ) | |||||||||||||||

Total distributions |

(1.71 | ) | (1.93 | ) | (3.17 | ) | (1.99 | ) | (1.67 | ) | |||||||||||||||

Net asset value, end of year |

$20.86 |

$20.61 |

$22.76 |

$23.03 |

$24.73 |

||||||||||||||||||||

Total return (c) |

9.98 | % | -0.78 | %(d) | 13.31 | % | 2.04 | % | 8.01 | % | |||||||||||||||

Ratios and Supplemental Data: |

|||||||||||||||||||||||||

Net assets, end of year (000’s omitted) |

$76,43 | 8 | $71,01 | 2 | $14,94 | 8 | $14,08 | 6 | $12,34 | 7 | |||||||||||||||

Interest expense to average net assets (e) |

0.42 | % | 0.08 | % | N/A | N/A | N/A | ||||||||||||||||||

Ratio of expenses to average net assets before waiver and reimbursement/recoupment (e) |

2.14 | %(f) | 1.96 | %(f) | 3.36 | % | 5.59 | % | 5.44 | % | |||||||||||||||

Ratio of expenses to average net assets after waiver and reimbursement/recoupment (e) |

2.14 | %(f) | 0.93 | %(f)(g) | 0.75 | % | 0.75 | % | 0.75 | % | |||||||||||||||

Ratio of net investment income (loss) to average net assets before waiver and reimbursement/recoupment (e) |

8.48 | %(f) | 7.56 | %(f) | 11.27 | % | 4.47 | % | 2.25 | % | |||||||||||||||

Ratio of net investment income (loss) to average net assets after waiver and reimbursement/recoupment (e) |

8.48 | %(f) | 8.59 | %(f)(g) | 13.88 | % | 9.31 | % | 6.94 | % | |||||||||||||||

Portfolio turnover rate (c) |

49 | % | 29 | % | 52 | % | 74 | % | 73 | % | |||||||||||||||

Reverse repurchase agreements, end of year or period (000’s omitted) |

$1,54 | 9 | $6,79 | 6 | N/A | N/A | N/A | ||||||||||||||||||

Asset coverage per $1,000 unit of senior indebtedness (h) |

$62,89 | 6 | $12,83 | 8 | N/A | N/A | N/A | ||||||||||||||||||

(a) Calculated using the average shares outstanding method. |

|||||||||||||||||||||||||

(b) Net realized and unrealized gain (loss) per share may include balancing amounts necessary to reconcile the change in net asset value per share for the year, and may not reconcile with the aggregate gain/(loss) in the Statement of Operations due to share transactions for the year. |

|||||||||||||||||||||||||

(c) Not annualized for periods of less than one year. |

|||||||||||||||||||||||||

(d) Total return would have been lower if no expense waiver was in place. |

|||||||||||||||||||||||||

(e) Annualized for periods less than one year. |

|||||||||||||||||||||||||

(f) Includes interest expense. |

|||||||||||||||||||||||||

(g) Effective January 1, 2023, the expense limitation agreement was terminated. Prior to January 1, 2023, the expense cap was 0.75%. See Note 5. |

|||||||||||||||||||||||||

(h) Calculated by subtracting the Fund’s total liabilities (not including borrowings) from the Fund’s total assets and dividing by the total number of senior indebtedness, where one unit equals $1,000 of senior indebtedness. |

|||||||||||||||||||||||||

Principal Amount |

Value |

|||||||

Asset-Backed Securities — 15.98% |

||||||||

Automobile — 5.34% |

||||||||

American Credit Acceptance Receivables Trust, Series 2022-1, Class F,4.870%, 11/13/2028 (a) |

$100,000 | $96,333 | ||||||

Avid Automobile Receivables Trust, Series 2021-1, Class D, 1.990%, 4/17/2028 (a) |

1,000,000 | 967,384 | ||||||

Avis Budget Rental Car Funding LLC, Series 2020-1A, Class D, 3.340%, 8/20/2026 (a) |

700,000 | 660,904 | ||||||

CAL Receivables LLC, Series 2022-1, Class B,9.696% (SOFR30A + 4.350%), 10/15/2026 (a)(b) |

600,000 | 601,123 | ||||||

Carvana Auto Receivables Trust, Series 2022-P3, Class D, 6.490%, 9/10/2029 |

453,000 | 466,492 | ||||||

Hertz Vehicle Financing LLC, Series 2022-4A, Class D, 6.560%, 9/25/2026 (a) |

265,000 | 259,661 | ||||||

Lendbuzz Securitization Trust, Series 2023-3A, Class B, 9.170%, 4/16/2029 (a) |

251,000 | 265,035 | ||||||

Research-Driven Pagaya Motor Asset Trust, Series 2021-2A, Class A, 2.650%, 3/25/2030 (a) |

229,084 | 214,872 | ||||||

Santander Consumer Auto Receivables Trust, Series 2021-AA, Class F, 5.790%, 8/15/2028 (a) |

250,000 | 242,097 | ||||||

Tricolor Auto Securitization Trust, Series 2022-1A, Class F, 9.800%, 7/16/2029 (a) |

100,000 | 99,229 | ||||||

United Auto Credit Securitization Trust, Series 2022-2, Class D, 6.840%, 1/10/2028 (a) |

1,000,000 | 995,336 | ||||||

US Auto Funding Trust, Series 2022-1A, Class A, 3.980%, 4/15/2025 (a) |

51,703 | 50,538 | ||||||

US Auto Funding Trust, Series 2022-1A, Class D, 9.140%, 7/15/2027 (a) |

1,450,000 | 145 | ||||||

Veros Automobile Receivables Trust, Series 2023-1, Class D, 11.460%, 8/15/2030 (a) |

200,000 | 206,951 | ||||||

| 5,126,100 | ||||||||

Consumer — 9.87% |

||||||||

ACHV ABS Trust, Series 2023-3PL, Class D, 8.360%, 8/19/2030 (a) |

250,000 | 259,266 | ||||||

Aqua Finance Trust, Series 2021-A, Class C, 3.140%, 7/17/2046 (a) |

300,000 | 217,297 | ||||||

Conn’s Receivables Funding LLC, Series 2022-A, Class B, 9.520%, 12/15/2026 (a) |

193,952 | 195,158 | ||||||

Foundation Finance Trust, Series 2021-2A, Class D, 5.730%, 1/15/2042 (a) |

100,000 | 94,212 | ||||||

Foundation Finance Trust, Series 2023-1A, Class D, 9.180%, 12/15/2043 (a) |

400,000 | 402,915 | ||||||

LendingClub Receivables Trust, Series 2019-1, Class CERT, 7/17/2045 (a) |

17,660 | 24,672 | ||||||

Lendingpoint Asset Securitization Trust, Series 2022-A, Class E, 7.020%, 6/15/2029 (a) |

100,000 | 21,006 | ||||||

Lendingpoint Asset Securitization Trust, Series 2022-B, Class C, 8.450%, 10/15/2029 (a) |

900,000 | 672,822 | ||||||

Marlette Funding Trust, Series 2023-2A, Class D, 7.920%, 6/15/2033 (a) |

250,000 | 256,665 | ||||||

Marlette Funding Trust, Series 2023-4A, Class B, 8.150%, 12/15/2033 (a) |

560,000 | 582,739 | ||||||

Momnt Technologies Trust, Series 2023-1A, Class B, 8.290%, 3/20/2045 (a) |

500,000 | 504,963 | ||||||

Pagaya AI Debt Selection Trust, Series 2021-1, Class C, 4.090%, 11/15/2027 (a) |

249,897 | 228,899 | ||||||

Pagaya AI Debt Selection Trust, Series 2021-3, Class C, 3.270%, 5/15/2029 (a) |

199,989 | 175,303 | ||||||

Pagaya AI Debt Selection Trust, Series 2021-5, Class C, 3.930%, 8/15/2029 (a) |

299,965 | 271,675 | ||||||

Pagaya AI Debt Selection Trust, Series 2022-1, Class C, 4.888%, 10/15/2029 (a) |

99,987 | 86,203 | ||||||

Pagaya AI Debt Selection Trust, Series 2022-3, Class B, 8.050%, 3/15/2030 (a) |

499,951 | 505,635 | ||||||

Pagaya AI Debt Selection Trust, Series 2022-5, Class B, 10.310%, 6/17/2030 (a) |

499,981 | 516,694 | ||||||

Pagaya AI Debt Selection Trust, Series 2023-1, Class B, 9.435%, 7/15/2030 (a) |

399,944 | 409,654 | ||||||

Pagaya AI Debt Selection Trust, Series 2023-3, Class B, 9.570%, 12/16/2030 (a) |

399,920 | 411,190 | ||||||

Prosper Marketplace Issuance Trust, Series 2023-1A, Class D, 11.240%, 7/16/2029 (a) |

300,000 | 306,273 | ||||||

Purchasing Power Funding, Series 2021-A, Class D, 4.370%, 10/15/2025 (a) |

293,462 | 292,177 | ||||||

Republic Finance Issuance Trust, Series 2020-A, Class D, 7.000%, 11/20/2030 (a) |

500,000 | 478,791 | ||||||

Republic Finance Issuance Trust, Series 2021-A, Class D, 5.230%, 12/22/2031 (a) |

200,000 | 182,926 | ||||||

Upgrade Master Pass-Thru Trust, Series 2021-PT2, Class A, 13.886%, 5/15/2027 (a)(c) |

409,060 | 337,142 | ||||||

Upstart Pass-Through Trust, Series 2021-ST9, Class CERT, 11/20/2029 (a) |

200,000 | 57,414 | ||||||

Upstart Pass-Through Trust, Series 2022-ST1, Class CERT, 3/20/2030 (a) |

100,000 | 27,184 | ||||||

Upstart Securitization Trust, Series 2021-1, Class C, 4.060%, 3/20/2031 (a) |

382,668 | 375,300 | ||||||

Upstart Securitization Trust, Series 2022-1, Class C, 5.710%, 3/20/2032 (a) |

200,000 | 115,069 | ||||||

Upstart Securitization Trust, Series 2022-2, Class C, 8.430%, 5/20/2032 (a) |

500,000 | 440,352 | ||||||

Principal Amount |

Value |

|||||||

Upstart Securitization Trust, Series 2023-1, Class C, 11.100%, 2/20/2033 (a) |

$ | 500,000 | $ | 505,738 | ||||

Upstart Securitization Trust, Series 2023-3, Class B, 8.250%, 10/20/2033 (a) |

500,000 | 506,477 | ||||||

| 9,461,811 | ||||||||

Credit Card — 0.19% |

||||||||

Continental Finance Credit Card ABS Master Trust, Series 2020-1A, Class C,5.750%, 12/15/2028 (a) |

200,000 | 178,873 | ||||||

Solar — 0.58% |

||||||||

Goodleap Sustainable Home Solutions Trust, Series 2023-2GS, Class B,7.800%, 5/20/2055 (a) |

500,000 | 501,686 | ||||||

Mosaic Solar Loan Trust, Series 2018-1A, Class C, 0.000%, 6/22/2043 (a)(d) |

45,297 | 41,254 | ||||||

Mosaic Solar Loan Trust, Series 2019-1A, Class B, 0.000%, 12/21/2043 (a)(d) |

21,050 | 16,818 | ||||||

| 559,758 | ||||||||

TOTAL ASSET-BACKED SECURITIES (Cost — $16,817,675) |

$15,326,542 |

|||||||

Collateralized Loan Obligations — 6.09% |

||||||||

AMMC Ltd., Series 2024-30A, Class D, 4.500% (TSFR3M + 4.500%), 1/15/2037 (a)(b) |

250,000 | 250,000 | ||||||

Atlas Senior Loan Fund Ltd., Series 2023-21A, Class D2,12.818% (TSFR3M + 7.500%), 7/20/2035 (a)(b) |

600,000 | 609,115 | ||||||

Blackrock MT Hood CLO LLC, Series 2023-1A, Class VDN, 4/20/2035 (a)(c) |

1,000,000 | 530,000 | ||||||

Carlyle US CLO Ltd., Series 2017-4A, Class C, 8.376% (TSFR3M + 3.062%), 1/15/2030 (a)(b) |

500,000 | 495,103 | ||||||

Ivy Hill Middle Market Credit Fund Ltd., Series 9A, Class DRR, 9.266% (TSFR3M + 3.950%), 4/23/2034 (a)(b) |

500,000 | 468,439 | ||||||

KKR Static CLO Trust, Series 2022-2A, Class D, 10.848%(TSFR3M + 5.530%), 10/20/2031 (a)(b) |

1,000,000 | 1,004,602 | ||||||

LCM LP, Series 40A, Class D2, 12.254% (TSFR3M + 6.940%), 1/15/2036 (a)(b) |

1,000,000 | 1,004,747 | ||||||

Palmer Square Loan Funding Ltd., Series 2022-3A, Class C,10.714% (TSFR3M + 5.400%), 4/15/2031 (a)(b) |

1,000,000 | 1,007,757 | ||||||

THL Credit Wind River CLO Ltd., Series 2018-1A, Class E,11.076% (TSFR3M + 5.762%), 7/15/2030 (a)(b) |

500,000 | 472,317 | ||||||

TOTAL COLLATERALIZED LOAN OBLIGATIONS (Cost — $5,795,289) |

$5,842,080 |

|||||||

Commercial Mortgage-Backed Securities — 1.07% |

||||||||

GS Mortgage Securities Corp. Trust, Series 2018-TWR, Class G,9.556% (TSFR1M + 4.222%), 7/15/2031 (a)(b) |

311,000 | 24,226 | ||||||

Med Trust, Series 2021-MDLN, Class G, 10.697% (TSFR1M + 5.364%), 11/15/2038 (a)(b) |

995,224 | 947,256 | ||||||

X-Caliber Mortgage Trust, Series 2020-1, Class B1,12.967% (TSFR1M + 7.614%), 2/6/2024 (a)(b) |

47,766 | 47,573 | ||||||

X-Caliber Mortgage Trust, Series 2021-9, Class B1,13.473% (TSFR1M + 8.120%), 3/1/2024 (a)(b) |

50,000 | 7,789 | ||||||

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES (Cost — $1,336,070) |

$1,026,844 |

|||||||

Commercial Mortgage-Backed Securities — U.S. Government Agency — 0.13% |

||||||||

Federal Home Loan Mortgage Corp., Series 2017-KF41, Class B, 7.959% (SOFR30A + 2.614%), 11/25/2024 (a)(b) |

129,217 | 125,830 | ||||||

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES — U.S. GOVERNMENT AGENCY (Cost — $128,873) |

$125,830 |

|||||||

Shares |

Value |

|||||||

Common Stocks — 0.42% |

||||||||

Financial — 0.42% |

||||||||

Essent Group Ltd. |

4,400 | $ | 242,704 | |||||

NMI Holdings, Inc. (e) |

5,000 | 159,600 | ||||||

TOTAL COMMON STOCKS (Cost — $299,270) |

$402,304 |

|||||||

Principal Amount |

||||||||

Corporate Obligations — 5.37% |

||||||||

Communications — 0.49% |

||||||||

Gray Television, Inc., 5.375%, 11/15/2031 (a) |

$600,000 | 472,352 | ||||||

Consumer, Cyclical — 0.51% |

||||||||

Carnival Corp., 6.000%, 5/1/2029 (a) |

500,000 | 484,811 | ||||||

Consumer, Non-cyclical — 0.50% |

||||||||

Upbound Group, Inc., 6.375%, 2/15/2029 (a) |

500,000 | 477,105 | ||||||

Energy — 1.25% |

||||||||

Greenfire Resources Ltd., 12.000%, 10/1/2028 (a) |

400,000 | 414,830 | ||||||

New Fortress Energy, Inc., 6.500%, 9/30/2026 (a) |

500,000 | 484,603 | ||||||

Shelf Drilling Holdings Ltd., 9.625%, 4/15/2029 (a) |

300,000 | 291,502 | ||||||

| 1,190,935 | ||||||||

Financial — 2.22% |

||||||||

Freedom Mortgage Corp., 6.625%, 1/15/2027 (a) |

500,000 | 480,687 | ||||||

OneMain Finance Corp., 9.000%, 1/15/2029 |

500,000 | 526,660 | ||||||

PennyMac Financial Services, Inc., 5.750%, 9/15/2031 (a) |

500,000 | 461,931 | ||||||

United Wholesale Mortgage LLC, 5.500%, 4/15/2029 (a) |

700,000 | 661,815 | ||||||

| 2,131,093 | ||||||||

Industrial — 0.40% |

||||||||

Great Lakes Dredge & Dock Corp., 5.250%, 6/1/2029 (a) |

450,000 | 387,958 | ||||||

TOTAL CORPORATE OBLIGATIONS (Cost — $4,739,531) |

$5,144,254 |

|||||||

Residential Mortgage-Backed Securities — 66.76% |

||||||||

A&D Mortgage LLC, Series 2024-NQM1, Class B1, 8.604%, 2/25/2069 (a)(c) |

1,000,000 | 1,003,222 | ||||||

American Home Mortgage Assets Trust, Series 2006-6, Class XP, 0.046%, 12/25/2046 (c)(f) |

802,637 | 6,154 | ||||||

American Home Mortgage Investment Trust, Series 2006-3, Class 3A2, 6.750%, 12/25/2036 (g) |

310,976 | 88,172 | ||||||

Bellemeade Re Ltd., Series 2023-1, Class B1, 12.045% (SOFR30A + 6.700%), 10/25/2033 (a)(b) |

400,000 | 400,490 | ||||||

BRAVO Residential Funding Trust, Series 2021-NQM2, Class A3, 1.435%, 3/25/2060 (a)(c) |

340,056 | 318,627 | ||||||

BRAVO Residential Funding Trust, Series 2021-A, Class A1, 4.991%, 10/25/2059 (a)(g)(h) |

465,024 | 452,026 | ||||||

CIM Trust, Series 2021-NR3, Class A1, 2.566%, 6/25/2057 (a)(g) |

2,311,316 | 2,265,258 | ||||||

COLT Mortgage Loan Trust, Series 2021-1, Class M1, 2.287%, 6/25/2066 (a)(c) |

1,500,000 | 999,654 | ||||||

Corevest American Finance Trust, Series 2020-4, Class D, 2.712%, 12/15/2052 (a) |

770,000 | 620,531 | ||||||

Countrywide Home Loan Mortgage Pass Through Trust, Series 2007-18, Class 1A1,6.000%, 11/25/2037 |

78,557 | 34,280 | ||||||

CountryWide Home Loan Mortgage Pass-Through Trust, Series 2004-29, Class 1X,0.000%, 2/25/2035 (c)(f) |

1,160,665 | 1,728 | ||||||

Credit Suisse Mortgage Trust, Series 2017-RPL1, Class B4, 2.964%, 7/25/2057 (a)(c) |

1,465,846 | 278,232 | ||||||

Credit Suisse Mortgage Trust, Series 2022-RPL3, Class A1, 3.758%, 3/25/2061 (a)(c) |

2,983,585 | 2,974,306 | ||||||

Principal Amount |

Value |

|||||||

Credit Suisse Mortgage Trust, Series 2021-NQM2, Class M1, 2.282%, 2/25/2066 (a)(c) |

$ | 1,215,000 | $ | 754,227 | ||||

Credit Suisse Mortgage Trust, Series 2022-ATH1, Class B1, 4.651%, 1/25/2067 (a)(c) |

2,000,000 | 1,658,336 | ||||||

Credit Suisse Mortgage Trust, Series 2022-ATH1, Class B2, 4.651%, 1/25/2067 (a)(c) |

2,000,000 | 1,595,798 | ||||||

Credit Suisse Mortgage Trust, Series 2022-NQM5, Class M1, 5.169%, 5/25/2067 (a)(c) |

1,000,000 | 830,829 | ||||||

Credit Suisse Mortgage Trust, Series 2022-NQM4, Class A3, 4.819%, 6/25/2067 (a)(g)(h) |

883,163 | 844,856 | ||||||

DSLA Mortgage Loan Trust, Series 2004-AR2, Class X2, 0.000%, 11/19/2044 (c)(f) |

310,617 | 237 | ||||||

Eagle RE Ltd., Series 2023-1, Class M2, 10.545% (SOFR30A + 5.200%), 9/26/2033 (a)(b) |

500,000 | 519,395 | ||||||

Eagle RE Ltd., Series 2021-2, Class M2, 9.595% (SOFR30A + 4.250%), 4/25/2034 (a)(b) |

2,250,000 | 2,341,575 | ||||||

Ellington Financial Mortgage Trust, Series 2021-2, Class M1, 2.296%, 6/25/2066 (a)(c) |

2,410,000 | 1,595,013 | ||||||

Ellington Financial Mortgage Trust, Series 2021-2, Class B1, 3.202%, 6/25/2066 (a)(c) |

2,000,000 | 1,187,714 | ||||||

FIGRE Trust, Series 2023-HE3, Class A, 6.436%, 1/25/2042 (a) |

1,085,136 | 1,105,049 | ||||||

GCAT Trust, Series 2020-NQM2, Class M1, 3.589%, 4/25/2065 (a)(c)(h) |

1,500,000 | 1,265,229 | ||||||

GSAA Home Equity Trust, Series 2006-15, Class AF6, 6.376%, 9/25/2036 (g) |

39,761 | 10,654 | ||||||

GSAA Home Equity Trust, Series 2006-18, Class AF3A, 5.772%, 11/25/2036 (c) |

122,914 | 37,257 | ||||||

GS Mortgage-Backed Securities Corp. Trust, Series 2020-PJ3, Class B6,3.423%, 10/25/2050 (a)(c) |

1,662,904 | 635,434 | ||||||

GS Mortgage-Backed Securities Corp. Trust, Series 2020-PJ6, Class B6,2.774%, 5/25/2051 (a)(c) |

995,828 | 331,755 | ||||||

GS Mortgage-Backed Securities Trust, Series 2020-NQM1, Class B1, 5.143%, 9/27/2060 (a)(c) |

2,408,000 | 2,042,844 | ||||||

GS Mortgage-Backed Securities Trust, Series 2020-NQM1, Class B2, 6.659%, 9/27/2060 (a)(c) |

2,975,000 | 2,806,630 | ||||||

GS Mortgage-Backed Securities Trust, Series 2021-NQM1, Class B1, 3.207%, 7/25/2061 (a)(c) |

2,000,000 | 1,315,872 | ||||||

Home Partners of America Trust, Series 2021-2, Class F, 3.799%, 12/17/2026 (a) |

384,844 | 341,362 | ||||||

Home RE Ltd., Series 2023-1, Class M2, 11.345% (SOFR30A + 6.000%), 10/25/2033 (a)(b) |

2,000,000 | 2,112,880 | ||||||

Home RE Ltd., Series 2021-2, Class B1, 9.495% (SOFR30A + 4.150%), 1/25/2034 (a)(b) |

760,000 | 728,801 | ||||||

Home RE Ltd., Series 2022-1, Class M1C, 10.845% (SOFR30A + 5.500%), 10/25/2034 (a)(b) |

2,000,000 | 2,093,428 | ||||||

JP Morgan Chase Bank, Series 2021-CL1, Class M5,9.195% (SOFR30A + 3.850%), 3/25/2051 (a)(b) |

45,743 | 41,920 | ||||||

JP Morgan Chase Bank, Series 2021-CL1, Class B,12.245% (SOFR30A + 6.900%), 3/25/2051 (a)(b) |

75,000 | 73,219 | ||||||

JP Morgan Chase Bank, Series 2020-CL1, Class M5,11.050% (TSFR1M + 5.714%), 10/25/2057 (a)(b) |

140,562 | 144,653 | ||||||

JP Morgan Mortgage Trust, Series 2021-11, Class AX1, 0.224%, 1/25/2052 (a)(c)(f) |

81,148,601 | 927,691 | ||||||

JP Morgan Mortgage Trust, Series 2022-6, Class B6, 2.826%, 11/25/2052 (a)(c) |

1,265,736 | 347,583 | ||||||

JP Morgan Mortgage Trust, Series 2022-6, Class B5, 3.304%, 11/25/2052 (a)(c) |

1,265,000 | 441,848 | ||||||

JP Morgan Mortgage Trust, Series 2022-6, Class B4, 3.304%, 11/25/2052 (a)(c) |

3,030,175 | 1,278,322 | ||||||

JP Morgan Mortgage Trust, Series 2023-6, Class B6, 6.260%, 12/26/2053 (a)(c) |

330,000 | 165,364 | ||||||

JP Morgan Mortgage Trust, Series 2023-6, Class B5, 6.260%, 12/26/2053 (a)(c) |

411,000 | 249,803 | ||||||

JP Morgan Mortgage Trust, Series 2023-6, Class B4, 6.260%, 12/26/2053 (a)(c) |

530,927 | 422,761 | ||||||

New Residential Mortgage Loan Trust, Series 2022-SFR2, Class E1, 4.000%, 9/4/2039 (a) |

850,000 | 771,786 | ||||||

New Residential Mortgage Loan Trust, Series 2019-6A, Class B6, 4.394%, 9/25/2059 (a)(c) |

167,057 | 105,194 | ||||||

Oaktown Re Ltd., Series 2021-2, Class M2, 9.045% (SOFR30A + 3.700%), 4/25/2034 (a)(b) |

1,500,000 | 1,442,822 | ||||||

Oaktown Re Ltd., Series 2021-2, Class B1, 9.745% (SOFR30A + 4.400%), 4/25/2034 (a)(b) |

1,500,000 | 1,399,448 | ||||||

Progress Residential Trust, Series 2021-SFR1, Class F, 2.757%, 4/17/2038 (a) |

1,400,000 | 1,272,573 | ||||||

Progress Residential Trust, Series 2021-SFR9, Class F, 4.053%, 11/17/2040 (a) |

500,000 | 430,090 | ||||||

PRPM LLC, Series 2024-RCF1, Class M2, 4.000%, 1/25/2054 (a)(g) |

550,000 | 434,311 | ||||||

PRPM LLC, Series 2022-5, Class A1, 6.900%, 9/27/2027 (a)(g) |

1,807,863 | 1,821,272 | ||||||

Radnor RE Ltd., Series 2021-2, Class B1, 11.345% (SOFR30A + 6.000%), 11/25/2031 (a)(b) |

1,000,000 | 1,044,391 | ||||||

Radnor RE Ltd., Series 2022-1, Class M1B, 12.095% (SOFR30A + 6.750%), 9/25/2032 (a)(b) |

1,000,000 | 1,069,439 | ||||||

Radnor RE Ltd., Series 2023-1, Class M2, 11.195% (SOFR30A + 5.850%), 7/25/2033 (a)(b) |

1,000,000 | 1,051,596 | ||||||

Radnor RE Ltd., Series 2023-1, Class B1, 12.595% (SOFR30A + 7.250%), 7/25/2033 (a)(b) |

1,125,000 | 1,134,551 | ||||||

Radnor RE Ltd., Series 2021-1, Class M1C, 8.045% (SOFR30A + 2.700%), 12/27/2033 (a)(b) |

2,000,000 | 2,015,444 | ||||||

Principal Amount |

Value |

|||||||

Saluda Grade Mortgage LLC, Series 2022-INV1, Class A3, 4.637%, 4/25/2067 (a)(c) |

$ | 943,005 | $ | 866,638 | ||||

Saluda Grade Mortgage Funding LLC, Series 2023-FIG4, Class A, 6.718%, 11/25/2053 (a)(c) |

1,962,003 | 2,021,194 | ||||||

Saluda Grade Mortgage Funding LLC, Series 2023-FIG3, Class B, 7.712%, 8/25/2053 (a) |

934,193 | 959,643 | ||||||

Seasoned Credit Risk Transfer Trust, Series 2019-3, Class M, 4.750%, 10/25/2058 (c) |

1,800,000 | 1,702,483 | ||||||

Triangle Re Ltd., Series 2021-3, Class M2, 9.095% (SOFR30A + 3.750%), 2/25/2034 (a)(b) |

1,600,000 | 1,600,062 | ||||||

Verus Securitization Trust, Series 2021-5, Class M1, 2.331%, 9/25/2066 (a)(c) |

450,000 | 266,639 | ||||||

Verus Securitization Trust, Series 2022-7, Class M1, 5.365%, 7/25/2067 (a)(c) |

750,000 | 656,617 | ||||||

Wells Fargo Credit Risk Transfer Securities Trust, Series 2015-WF1, Class 1M2, 10.709% (SOFR30A + 5.364%), 11/25/2025 (a)(b) |

10,657 | 7,690 | ||||||

Western Mortgage Reference Notes, Series 2021-CL2, Class M3,9.445% (SOFR30A + 4.100%), 7/25/2059 (a)(b) |

1,443,219 | 1,451,128 | ||||||

Western Mortgage Reference Notes, Series 2021-CL2, Class M5,11.845% (SOFR30A + 6.500%), 7/25/2059 (a)(b) |

420,796 | 410,332 | ||||||

Western Mortgage Reference Notes, Series 2021-CL2, Class B,13.845% (SOFR30A + 8.500%), 7/25/2059 (a)(b) |

400,000 | 397,378 | ||||||

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES (Cost — $65,918,112) |

$64,023,740 |

|||||||

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer — 2.35% |

||||||||

Federal Home Loan Mortgage Corp., Series 2022-HQA1, Class M2, 10.595% (SOFR30A + 5.250%), 3/25/2042 (a)(b) |

1,000,000 | 1,078,221 | ||||||

Federal Home Loan Mortgage Corp., Series 2022-HQA1, Class B2, 16.345% (SOFR30A + 11.000%), 3/25/2042 (a)(b) |

1,000,000 | 1,145,000 | ||||||

Federal Home Loan Mortgage Corp., Series 2018-SPI3, Class B, 4.156%, 8/25/2048 (a)(c) |

30,989 | 22,767 | ||||||

TOTAL RESIDENTIAL MORTGAGE-BACKED SECURITIES - U.S. GOVERNMENT AGENCY CREDIT RISK TRANSFER (Cost — $1,989,642) |

$2,245,988 |

|||||||

Shares |

||||||||

Short-Term Investments — 3.23% |

||||||||

Money Market Funds — 3.23% |

||||||||

First American Government Obligations Fund, Class U, 5.271% (i) |

3,102,191 | 3,102,191 | ||||||

TOTAL SHORT-TERM INVESTMENTS (Cost — $3,102,191) |

$3,102,191 |

|||||||

TOTAL INVESTMENTS — 101.40% (Cost — $100,126,653) |

$97,239,773 |

|||||||

Liabilities in Excess of Other Assets — (1.40%) |

(1,339,097 | ) | ||||||

NET ASSETS — 100.00% |

$95,900,676 |

|||||||

| (a) | Security exempt from registration under Rule 144A or Section 4(a)(2) of the Securities Act of 1933. The security may be resold in transactions exempt from registration, normally to qualified institutional buyers. These securities are determined to be liquid by the Adviser, under the procedures established by the Fund’s Board of Trustees, unless otherwise denoted. At January 31, 2024, the value of these securities amounted to $90,861,160 or 94.75% of net assets. |

| (b) | Variable or floating rate security based on a reference index and spread. Certain securities are fixed to variable and currently in the fixed phase. Securities that reference SOFR may have been subject to a credit spread adjustment, particularly legacy holdings that previously referenced LIBOR and have transitioned to SOFR as the base lending rate. Rate disclosed is the rate in effect as of January 31, 2024. |

| (c) | Variable rate security. The coupon is based on an underlying pool of assets. Rate disclosed is the rate in effect as of January 31, 2024. |

| (d) | Principal only security. |

| (e) | Non-income producing security. |

| (f) | Interest only security. |

| (g) | Step-up bond that pays an initial coupon rate for the first period and then a higher coupon rate for the following periods. Rate disclosed is the rate in effect as of January 31, 2024. |

| (h) | All or a portion of the security has been pledged as collateral in connection with open reverse repurchase agreements. At January 31, 2024, the value of securities pledged amounted to $2,562,111. |

| (i) | Rate disclosed is the seven day yield as of January 31, 2024. |

Short Futures Contracts |

Expiration Month |

Number of Contracts |

Notional Value |

Value & Unrealized Appreciation (Depreciation) | ||||||||||

5 Year ERIS Aged Standard Swap Future |

June 2024 | (1 | ) | ($ | 96,554 | ) | $94 | |||||||

Counterparty |

Interest Rate |

Trade Date |

Maturity Date |

Net Closing Amount |

Face Value | ||||||||||||||||||||

Goldman Sachs & Co. |

7.282% | 1/18/2024 | 2/20/2024 | $1,257,718 | $1,249,379 | ||||||||||||||||||||

Goldman Sachs & Co. |

6.782% | 1/18/2024 | 2/20/2024 | 301,879 | 300,014 | ||||||||||||||||||||

Total |

$1,549,393 |

||||||||||||||||||||||||

Reference Obligation |

Implied Credit Spread at 1/31/2024 (b) |

Pay (Receive) Fixed Rate |

Payment Frequency |

Maturity Date |

Counterparty |

Notional Amount (c) |

Value |

Premium Paid (Received) |

Unrealized Appreciation (Depreciation) | |||||||||||||||||||||||||||||||||||||

Markit. CDX.NA.HY (d) |

3.587% |

5.000 | % | Quarterly | 12/20/2028 | Wells Fargo Securities, LLC |

$ | 10,000,000 | ($ | 617,735 | ) | ($ | 514,845 | ) | ($ | 102,890 | ) | |||||||||||||||||||||||||||||

| (a) | If the Fund is a buyer of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) receive from the seller of protection an amount equal to the notional amount of the swap and take delivery of the referenced obligation or underlying securities comprising the referenced index or (ii) receive a net settlement amount in the form of cash or securities equal to the notional amount of the swap less the recovery value of the referenced obligation or underlying securities comprising the referenced index. |

| (b) | Implied credit spreads, represented in absolute terms, utilized in determining the fair value of credit default swap agreements on U.S. municipal issues, corporate issues or sovereign issues of an emerging country as of year end serve as an indicator of the current status of the payment/performance risk and represent the likelihood or risk of default for the credit |

| derivative. The implied credit spread of a particular referenced entity reflects the cost of buying/selling protection and may include upfront payments required to be made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit soundness and a greater likelihood or risk of default or other credit event occurring as defined under the terms of the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced entity or obligation. |

| (c) | The maximum potential amount the Fund could be required to pay as seller of credit protection or receive as a buyer of credit protection if a credit event occurs as defined under the terms of that particular swap agreement. |

| (d) | Centrally cleared swap, clearing agent: Intercontinental Exchange. |

Ticker |

Investment Strategy |

Commencement of Operations |

Front-End Sales Charge |

Back-End Sales Charge |

12b-1 Fees |

|||||||||||||||||

Strategic Credit Fund |

||||||||||||||||||||||

Class A |

ASCAX | Total Return | N/A | 2.25 | % | N/A | 0.25 | % | ||||||||||||||

Class U |

ASCUX | N/A | N/A | 1.50 | % | N/A | ||||||||||||||||

Class FI |

ASCNX | 07/12/2022 | N/A | 3.00 | % | N/A | ||||||||||||||||

Institutional Class |

ASCIX | 12/26/2017 | N/A | N/A | N/A | |||||||||||||||||

| • | Level 1: quoted prices in active markets for identical securities |

| • | Level 2: other significant observable inputs (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| • | Level 3: significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

Level 1 |

Level 2 |

Level 3 |

Total | |||||

Assets |

||||||||

Asset-Backed Securities |

$– | $15,326,542 | $– | $15,326,542 | ||||

Collateralized Loan Obligations |

– | 5,842,080 | – | 5,842,080 | ||||

Commercial Mortgage-Backed Securities |

– | 1,026,844 | – | 1,026,844 | ||||

Commercial Mortgage-Backed Securities – U.S. Government Agency |

– | 125,830 | – | 125,830 | ||||

Common Stocks |

402,304 | – | – | 402,304 | ||||

Corporate Obligations |

– | 5,144,254 | – | 5,144,254 | ||||

Residential Mortgage-Backed Securities |

– | 64,023,740 | – | 64,023,740 | ||||

Residential Mortgage-Backed Securities – U.S. Government Agency Credit Risk Transfer |

– | 2,245,988 | – | 2,245,988 | ||||

Short-Term Investments |

3,102,191 | – | – | 3,102,191 | ||||

Total |

$3,504,495 | $93,735,278 | $– | $97,239,773 | ||||

Other Financial Instruments |

||||||||

Assets |

||||||||

Futures Contracts* |

$94 | $– | $– | $94 | ||||

Liabilities |

||||||||

Swaps* |

– | (102,890) | – | (102,890) | ||||

Reverse Repurchase Agreements |

– | (1,549,393) | – | (1,549,393) | ||||

Total |

$94 | ($1,652,283) | $– | ($1,652,189) |

| * | Futures and swaps are reflected at the unrealized appreciation (depreciation) on the instrument as presented in the Schedule of Open Futures Contracts and Schedule of Centrally Cleared Credit Default Swaps. |

Reverse Repurchase Agreements |

Overnight and Continuous |

Up to 30 Days |

30-90 Days |

Greater than 90 Days |

Total | |||||

| Residential Mortgage-Backed Securities | $– | $1,549,393 | $– | $– | $1,549,393 | |||||

Total |

$– | $1,549,393 | $– | $– | $1,549,393 | |||||

| Gross amount of reverse repurchase agreements in Balance Sheet Offsetting Information Table | $1,549,393 | |||||||||

| Amounts related to agreements not included in offsetting disclosure in Balance Sheet Offsetting Information Table | $– | |||||||||

Derivatives |

Type of Derivative Risk |

Statement of Assets and Liabilities Location |

Fair Value of Deposit at Broker for Futures and Swaps |

Value of Unrealized Appreciation (Depreciation)* | ||||

Futures Contracts |

Interest Rate | Deposit at broker for futures | $14,346 | $94 | ||||

Swaps |

Credit | Deposit at broker for swaps | $1,189,005 | ($102,890) |

| * | Represents the value of unrealized appreciation (depreciation) as presented in the Schedule of Open Futures Contracts and Schedule of Centrally Cleared Credit Default Swaps. |

Derivatives |

Type of Derivative Risk |

Location of Gain (Loss) on Derivatives in Income |

Realized Gain (Loss) on Derivatives | |||

Futures Contracts |

Interest Rate | Net realized gain (loss) on futures contracts |

$147 | |||

Swaps |

Credit | Net realized gain (loss) on swaps | ($5,681) |

Derivatives |

Type of Derivative Risk |

Location of Gain (Loss) on Derivatives in Income |

Change in Unrealized Appreciation/Depreciation on Derivatives | |||

Futures Contracts |

Interest Rate | Net change in unrealized appreciation/depreciation on futures contracts |

$614 | |||

Swaps |

Credit | Net change in unrealized appreciation/depreciation on swaps | ($102,890) |

Gross Amounts Not Offset in Statement of Assets and Liabilities | ||||||||||||

Gross Amounts of Recognized Assets/Liabilities |

Gross Amounts Offset in Statement of Assets and Liabilities |

Net Amounts of Assets/Liabilities Presented in Statement of Assets and Liabilities |

Financial Instruments* |

Cash Collateral Pledged* |

Net Amount | |||||||

Assets: |

||||||||||||

Futures Contracts |

$94 | $– | $94** | $– | $– | $94 | ||||||

Liabilities: |

||||||||||||

Swaps |

$102,890 | $– | $102,890*** | $– | $102,890 | $– | ||||||

Reverse Repurchase Agreements |

$1,549,393 | $– | $1,549,393 | $1,549,393 | $– | $– | ||||||

| * | The amount is limited to the net amounts of financial assets and liabilities and accordingly does not include excess collateral pledged. |

| ** Represents | the value of unrealized appreciation (depreciation) as presented in the Schedule of Open Futures Contracts, which is included in deposit at broker for futures on the Statement of Assets and Liabilities. |

| *** | Represents the value of unrealized appreciation (depreciation) as presented in the Schedule of Centrally Cleared Credit Default Swaps, which is included in deposit at broker for swaps on the Statement of Assets and Liabilities. |

Total Waived Expenses Recoverable by the Adviser as of 01/31/24 |

Recoverable Expenses Subject to 36 Month Limit During the Year Ended 01/31/25 |

Recoverable Expenses Subject to 36 Month Limit During the Year Ended 01/31/26 | ||

$972,655 |

$366,867 | $605,788 |

Purchases |

Sales | |

$49,214,736 |

$44,155,344 |

Repurchase Offer Date |

Repurchase Request Deadline |

NAV on Repurchase Pricing Date |

Percentage of Outstanding Shares the Fund Offered to Repurchase |

Number of Shares the Fund Offered to Repurchase |

Percentage of Shares Repurchased to Outstanding Shares |

Number of Shares Repurchased | ||||||

February 24, 2023 |

March 17, 2023 | $20.59 | 5.0% | 200,293 | 0.4% | 17,720 | ||||||

May 26, 2023 |

June 16, 2023 | $20.35 | 5.0% | 209,447 | 0.3% | 14,328 | ||||||

August 25, 2023 |

September 15, 2023 | $20.61 | 5.0% | 228,319 | 0.5% | 24,873 | ||||||

November 24, 2023 |

December 15, 2023 | $20.67 | 5.0% | 228,840 | 0.2% | 9,706 |

2024 |

2023 |

|||||||

Distributions paid from: |

||||||||

Ordinary Income |

$ | 7,392,868 | $ | 5,189,444 | ||||

Net Long-Term Capital Gain |

– | – | ||||||

Tax Cost of Investments |

$100,126,653 | |||

Unrealized Appreciation* |

2,907,648 | |||

Unrealized Depreciation* |

(5,794,528) | |||

Net Unrealized Appreciation (Depreciation |

($2,886,880) | |||

Undistributed Ordinary Income |

424,096 | |||

Undistributed Long-Term Gain (Loss) |

– | |||

Accumulated Gain (Loss) |

$424,096 | |||

Other Accumulated Gain (Loss) |

(1,213,226) | |||

Total Distributable Earnings (Accumulated Deficit) |

($3,676,010) | |||

| * | Represents aggregated amounts of Fund’s investments, reverse repurchase agreements, futures, and swaps. |

No expiration short-term |

$– | |

No expiration long-term |

$812,853 | |

Total |

$812,853 |

Repurchase Offer Date |

Repurchase Request Deadline |

NAV on Repurchase Pricing Date |

Percentage of Outstanding Shares the Fund Offered to Repurchase |

Number of Shares the Fund Offered to Repurchase |

Percentage of Shares Repurchased to Outstanding Shares |

Number of Shares Repurchased | ||||||

February 23, 2024 |

March 15, 2024 | $20.93 | 5.0% | 232,428 | 0.4% | 17,198 |

Name and Year of Birth |

Position with the Trust |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex (1) Overseen by Trustee |

Other Directorships Held During the Past 5 Years | |||||

Independent Trustees (2) | ||||||||||

Ira P. Cohen 1959 |

Independent Trustee, Chair | Trustee since 2017, Chair since 2017; indefinite term |

Executive Vice President, Recognos Financial (investment industry data analysis provider) (2015-2021); Independent financial services consultant (since 2005). |

10 | Trustee, Valued Advisers Trust (since 2010); Trustee, Apollo Diversified Real Estate Fund (formerly, Griffin Institutional Access Real Estate Fund) (since 2014); Trustee, Angel Oak Funds Trust (since 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2018); Trustee, U.S. Fixed Income Trust (since 2019); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022); Trustee, Apollo Credit Fund (formerly, Griffin Institutional Access Credit Fund) (2017-2022). | |||||

Alvin R. Albe, Jr. 1953 |

Independent Trustee | Since 2017; indefinite term | Retired. | 10 | Trustee, Angel Oak Funds Trust (since 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2018); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022). | |||||

Name and Year of Birth |

Position with the Trust |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex (1) Overseen by Trustee |

Other Directorships Held During the Past 5 Years | |||||

Keith M. Schappert 1951 |

Independent Trustee |

Since 2017; indefinite term |

President, Schappert Consulting LLC (investment industry consulting) (since 2008); Retired, President and CEO of JP Morgan Investment Management. |

10 |

Trustee, Angel Oak Funds Trust (since 2014); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2018); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022); Director, Commonfund Capital, Inc. (2015-2022); Trustee, Mirae Asset Discovery Funds (2010-2023). | |||||

Andrea N. Mullins 1967 |

Independent Trustee |

Since 2019; indefinite term |

Private Investor; Independent Contractor, SWM Advisors (since 2014). |

10 |

Trustee and Audit Committee Chair, Valued Advisers Trust (since 2013, Chair since 2017); Trustee, Angel Oak Funds Trust (since 2019); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2019); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021); Trustee and Audit Committee Chair, NXG Cushing Midstream Energy Fund (formerly, Cushing MLP & Infrastructure Fund) (since 2021); Trustee and Audit Committee Chair, NXG NextGen Infrastructure Income Fund (formerly, Cushing NextGen Infrastructure Income Fund) (since 2021); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022); Trustee and Audit Committee Chair, Cushing Mutual Funds Trust (2021-2023). |

Name and Year of Birth |

Position with the Trust |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years |

Number of Portfolios in Fund Complex (1) Overseen by Trustee |

Other Directorships Held During the Past 5 Years | |||||

Interested Trustees | ||||||||||

Samuel R. Dunlap, III 1979 |

Interested Trustee | Since 2019; indefinite term | Chief Investment Officer-Public Strategies, Angel Oak Capital Advisors, LLC (investment management) (since 2009). | 10 | Trustee, Angel Oak Funds Trust (since 2019); Trustee, Angel Oak Credit Opportunities Term Trust (since 2021): Trustee, Angel Oak Financial Strategies Income Term Trust (since 2022); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022). | |||||

Cheryl M. Pate 1976 |

Interested Trustee | Since 2022; indefinite term | Senior Portfolio Manager, Angel Oak Capital Advisors, LLC (investment management) (since 2017). | 10 | Trustee, Angel Oak Funds Trust (since 2022); Trustee, Angel Oak Credit Opportunities Term Trust (since 2022); Trustee, Angel Oak Financial Strategies Income Term Trust (since 2023); Trustee, Angel Oak Dynamic Financial Strategies Income Term Trust (2022-2022). | |||||

| (1) | The Fund Complex includes the Fund, each series of Angel Oak Funds Trust, Angel Oak Financial Strategies Income Term Trust, and Angel Oak Credit Opportunities Term Trust. |

| (2) | The Trustees of the Trust who are not “interested persons” of the Trust as defined in the 1940 Act (“Independent Trustees”). |

Name and Year of Birth |

Position with the Trust |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past 5 Years | |||

Officers | ||||||

Adam Langley 1967 |

President | Since 2022; indefinite term (other offices held 2015-2022) | Chief Operating Officer, Angel Oak Capital Advisors, LLC (since 2021); Chief Compliance Officer, Angel Oak Capital Advisors, LLC (2015-2022); Chief Compliance Officer of Falcons I, LLC (2018-2022); Chief Compliance Officer, Angel Oak Funds Trust (2015-2022); Chief Compliance Officer, Angel Oak Financial Strategies Income Term Trust (2018-2022); Chief Compliance Officer, Angel Oak Dynamic Financial Strategies Income Term Trust (2019-2022); Chief Compliance Officer, Angel Oak Credit Opportunities Term Trust (2021-2022); Chief Compliance Officer, Angel Oak Commercial Real Estate Solutions (2021-2022); Chief Compliance Officer, Buckhead One Financial Opportunities, LLC (2015-2022); Chief Compliance Officer, Angel Oak Capital Partners II, LLC (2016-2022); Chief Compliance Officer, Hawks I, LLC (2018-2022). | |||

Michael Colombo 1984 |

Secretary | Since 2023; indefinite term | Chief Risk Officer, Angel Oak Capital Advisors, LLC (since 2023); Director of Valuation, Angel Oak Capital Advisors, LLC (2022-2023); Director of Trade Operations, Intercontinental Exchange, Inc. (2022); Manager of Trade Operations, Intercontinental Exchange, Inc. (2019-2022); Lead Analyst, Trade Operations, Intercontinental Exchange, Inc. (2018-2019). | |||

Daniel Fazioli 1981 |

Treasurer | Since 2015; indefinite term | Chief Accounting Officer, Angel Oak Capital Advisors, LLC (since 2015). | |||

Chase Eldredge 1989 |

Chief Compliance Officer | Since 2022; indefinite term | Chief Compliance Officer, Angel Oak Capital Advisors, LLC (since 2022); Chief Compliance Officer of Falcons I, LLC (since 2022); Chief Compliance Officer, Angel Oak Funds Trust (since 2022); Chief Compliance Officer, Angel Oak Financial Strategies Income Term Trust (since 2022); Chief Compliance Officer, Angel Oak Credit Opportunities Term Trust (since 2022); Senior Compliance Officer, Angel Oak Capital Advisors, LLC (2020-2022); Compliance Officer, Angel Oak Capital Advisors, LLC (2017-2020). | |||

| • | Information we receive from you on or in applications or other forms, correspondence, or conversations, including, but not limited to, your name, address, phone number, social security number, assets, income and date of birth; and |

| • | Information about your transactions with us, our affiliates, or others, including, but not limited to, your account number and balance, payments history, parties to transactions, cost basis information, and other financial information. |

| (b) | Not applicable. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s Principal Executive Officer and Principal Financial Officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Mr. Alvin R. Albe, Jr. is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| FYE 01/31/2024 | FYE 01/31/2023 | |||||||

| (a) Audit Fees |

$ | 26,000 | $ | 25,000 | ||||

| (b) Audit-Related Fees |

$ | 0 | $ | 0 | ||||

| (c) Tax Fees |

$ | 4,000 | $ | 4,000 | ||||

| (d) All Other Fees |

$ | 0 | $ | 0 | ||||

The Audit, Financial and Administrative Oversight Committee has not adopted written pre-approval policies and procedures. Instead, the Committee has the duty and responsibility to pre-approve all auditing services and permissible non-auditing services to be provided to the Fund in accordance with its Charter and the 1940 Act. In addition, the Committee considers matters with respect to the principal accountant’s independence each year. The Committee did not approve any of the audit-related, tax or other non-audit fees described above pursuant to the “de minimis exceptions” set forth in Rule 2-01(c)(7)(i)(C) and Rule 2-01(c)(7)(ii) of Regulation S-X.

1

The Audit, Financial and Administrative Oversight Committee also has the duty and responsibility to pre-approve those non-audit services provided to the Fund’s investment adviser (and entities controlling, controlled by or under common control with the investment adviser that provide ongoing services to the Fund) where the engagement relates directly to the operations or financial reporting of the Fund in accordance with the Charter of the Committee and the 1940 Act. The Committee considered whether the provision of any non-audit services rendered to the Adviser and any entity controlling, controlled by, or under common control with the Adviser that provides ongoing services to the Fund that were not pre-approved by the Committee because the engagement did not relate directly to the operations and financial reporting of the Fund is compatible with maintaining the principal accountant’s independence.

The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| FYE 01/31/2024 | FYE 01/31/2023 | |||||||

| Audit-Related Fees |

0 | % | 0 | % | ||||

| Tax Fees |

0 | % | 0 | % | ||||

| All Other Fees |

0 | % | 0 | % | ||||

All of the principal accountant’s hours spent on auditing the registrant’s financial statements for the most recent fiscal year were attributed to work performed by full-time permanent employees of the principal accountant.

The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity) for the last two years.

| Non-Audit Related Fees |

FYE 01/31/2024 | FYE 01/31/2023 | ||||||

| Registrant |

$ | 4,000 | $ | 4,000 | ||||

| Registrant’s Investment Adviser |

$ | 0 | $ | 0 | ||||

The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

The registrant is not a foreign issuer.

2

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

3

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

ANGEL OAK FUNDS TRUST

ANGEL OAK STRATEGIC CREDIT FUND

ANGEL OAK FINANCIAL STRATEGIES INCOME TERM TRUST

PROXY VOTING

The Boards of Trustees (the “Board”) of Angel Oak Funds Trust, Angel Oak Strategic Credit Fund, and Angel Oak Financial Strategies Income Term Trust (each, a “Trust” and together, the “Trusts”) and the Trusts’ respective series, if any, (each, a “Fund” and together with the Trusts, the “Funds”) recognizes that the Board’s right to vote proxies for Trust holdings is an important responsibility and a significant Trust asset. Consistent with its fiduciary duties and duty to report each Funds’ proxy voting record pursuant to Rule 30b1-4 under the Investment Company Act of 1940, the Board has adopted this proxy voting policy on behalf of the Funds to reflect its commitment to ensure that proxies are voted in a manner consistent with the best interests of the Funds’ shareholders.

Delegation

The Board recognizes that the investment adviser of the Funds, Angel Oak Capital Advisors, LLC (the “Adviser”), as the entity that selects the individual securities that comprise each Fund’s portfolio, is the most knowledgeable and best suited to monitor corporate actions, analyze proxy proposals, make voting decisions, and ensure that proxies are submitted in a timely fashion. The Board therefore delegates the authority to vote proxies to the Adviser, subject to the supervision of the Board.

The Board must approve the Adviser’s proxy voting policies and procedures. The Board will monitor the implementation of these policies to ensure that the Adviser’s voting decisions:

| • | are consistent with the Adviser’s fiduciary duty to the Funds and their shareholders; |

| • | seek to maximize shareholder return and the value of Fund investments; |

| • | promote sound corporate governance; and |

| • | are consistent with each Fund’s investment objective and policies. |

Consistent with its duties under this Policy, the Adviser shall monitor and review corporate actions of companies in which a Fund has invested, obtain all information sufficient to allow an informed vote on all proxy solicitations, ensure that all proxy votes are cast in a timely fashion, and maintain all records required to be maintained by the Fund under Rule 30b1-4 and other provisions of the 1940 Act. The Adviser will perform these duties in accordance with the Adviser’s proxy voting policy, a copy of which has been presented to the Board for its review. The Adviser will promptly provide to the Board any updates to its proxy voting policy where such updates are both material and are not solely operational in nature.

Conflicts of Interest

In the event of a conflict between the interests of the Adviser and the Trusts, the Adviser’s policies provide that the conflict may be disclosed to the Board or its delegate, who shall provide direction to vote the proxies. The Board has delegated this authority to the disinterested directors, and the proxy voting direction in such a case shall be determined by a majority of the disinterested directors.

| Proxy Voting Policies and Procedures | Page 1 |

Fund of Funds Arrangements

When voting proxies related to Acquired Funds, as defined in the Trusts’ Fund of Funds Investments Policy, ensure any voting remains compliant with the proxy voting requirements within the Fund of Funds Investments Policy.

Shareholder Reporting

Each Trust will disclose in its annual and semi-annual reports to shareholders that a description (or copy) of the Trust’s proxy voting policies and procedures is available without charge, upon request, by calling toll-free (855) 751-4324 (or another number which connects to the transfer agent) or by accessing the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov. The Trust’s transfer agent will notify the Adviser of any such request of proxy voting procedures. The Adviser will send a description or copy of its proxy voting policies and procedures within three business days of receipt of a request.

Each Trust will file its complete proxy voting record with the SEC on Form N-PX on an annual basis, for the prior 12 months ended June 30, by no later than August 31 of each year. Each Trust also will disclose in its SAI and annual and semi-annual reports to shareholders that its proxy voting record is available without charge, upon request, by calling toll-free (855) 751-4324 (or another number which connects to the transfer agent) or by accessing the SEC’s website. The Trust’s transfer agent will notify the Adviser of any such request of proxy voting records. The Adviser must send the information disclosed in the Trust’s most recently filed Form N-PX within three business days of receipt of a request.

| Proxy Voting Policies and Procedures | Page 2 |

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a)(1) The following provides biographical information about the individuals who are primarily responsible for the day-to-day management of the registrant’s portfolio (“Portfolio Managers”) as of the date of this filing:

Sreeniwas (Sreeni) V. Prabhu is Managing Partner, Co-CEO, and Chief Investment Officer of the Adviser and a Portfolio Manager of the Fund. Prior to co-founding the Adviser in 2009, Mr. Prabhu was the Chief Investment Officer of the $25 billion investment portfolio at Washington Mutual Bank for three years and was also part of the macro asset strategy team at the bank. Prior to joining Washington Mutual Bank, Mr. Prabhu worked for six years at SunTrust Bank in Atlanta, where he was responsible for investment strategies and served as head portfolio manager for the $3 billion commercial mortgage-backed securities portfolio. He began his career at SunTrust in 1998 as a bank analyst focused on asset/liability management and liquidity strategies. Mr. Prabhu holds a B.B.A. in Economics from Georgia College and State University and an M.B.A. in Finance from Georgia State University.

Sam Dunlap is Chief Investment Officer, Public Strategies at the Advisor and a Portfolio Manager of the Fund. Mr. Dunlap is also responsible for managing some of the separately managed accounts for the Advisor’s clients. Mr. Dunlap began his capital markets career in 2002 and has investment experience across multiple sectors of the fixed income market. Prior to joining the Advisor in 2009, Mr. Dunlap spent six years marketing and structuring interest rate derivatives with SunTrust Robinson Humphrey where he focused on both interest rate hedging products and interest rate linked structured notes. Mr. Dunlap’s previous experience included two years at Wachovia in Charlotte, North Carolina supporting the agency mortgage pass-through trading desk. Mr. Dunlap received a B.A. in Economics from the University of Georgia.

Berkin Kologlu is a Senior Portfolio Manager of the Adviser and a Portfolio Manager of the Fund. Mr. Kologlu has over 20 years’ experience in fixed income products and focuses on building and managing strategies within the Collateralized Loan Obligation (CLO) market. He spent the previous six years as an Executive Director at UBS, covering structured products and client solutions. Prior to UBS, Mr. Kologlu worked at Bank of America, where he focused on the structuring and marketing of CLOs and synthetic CDOs backed by corporate credit. Before Bank of America, Mr. Kologlu worked in Turkey as a commercial banker, where he was responsible for lending to large cap corporations. He received his MBA from Duke University’s Fuqua School of Business and his B.S. in Civil Engineering from Bogazici University in Istanbul, Turkey.

6

Matthew R. Kennedy, CFA, is a Head of Corporate Credit and Senior Portfolio Manager of the Adviser and a Portfolio Manager of the Fund. Mr. Kennedy has over 20 years of capital markets and asset management experience. Prior to joining the Adviser in 2016, Mr. Kennedy spent seven years as a portfolio manager with Rainier Investment Management, LLC, where he served as Director of Fixed Income Management and was responsible for managing the Predecessor High Yield Fund among other clients. Mr. Kennedy began his investment career in 1995 at GE Financial Assurance, where he served as a Senior Analyst and made investment recommendations for investment grade, high yield, and private placement portfolios. From 1991 through 1994, he was a CPA and Auditor at Deloitte & Touche. Mr. Kennedy is a member of the CFA Institute and the Seattle Society of Financial Analysts. He holds the Chartered Financial Analyst designation. Mr. Kennedy received his Bachelor of Arts degree in Business Administration, with specializations in Finance and Accounting, from Washington State University.

Colin McBurnette is a Senior Portfolio Manager of the Adviser and a Portfolio Manager of the Fund. Mr. McBurnette focuses on security and portfolio analytics. Prior to joining the Adviser in 2012, Mr. McBurnette worked for Prodigus Capital Management, where he served on the investment committee and ran the analytics group. He was responsible for acquisition and management of their distressed debt portfolio, as well as the development of their proprietary financial technology platform. Previously, Mr. McBurnette worked in the Real Estate Capital Markets group for Wachovia Bank and Wells Fargo where he focused on risk management for their commercial real estate REPO lines. Mr. McBurnette holds a B.B.A. in Finance and in Real Estate from the University of Georgia.

Clayton Triick, CFA, is a Senior Portfolio Manager of the Adviser and a Portfolio Manager of the Fund. Mr. Triick is a portfolio manager within the non-agency and agency RMBS markets and focuses on asset allocation and interest rate risk management of the Financials Income Fund, other Angel Oak funds, and the institutional separately managed accounts. Mr. Triick has 8 years of investment experience across multiple sectors of fixed income. Prior to joining Angel Oak in 2011, Mr. Triick worked for YieldQuest Advisors, where he was a member of the investment committee focusing on interest rate risk, currency risk, and commodity of the portfolios alongside directly managing he closed-end fund allocations within YieldQuest portfolios and individual accounts. Mr. Triick holds a B.B.A. in Finance from the Farmer School of Business at Miami University. He also holds the Chartered Financial Analyst (CFA) designation.

(a)(2) The following provides information on other accounts managed on a day-to-day basis by the Portfolio Managers listed above as of January 31, 2024:

Sreeniwas (Sreeni) V. Prabhu

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 5 | 15 | 0 | 0 | 13 | 0 | |||||

| $3,523,305,327 | $2,537,800,341 | $0 | $0 | $2,127,688,015 | $0 | |||||

7

Sam Dunlap

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 8 | 0 | 16 | 0 | 0 | 0 | |||||

| $3,063,272,252 | $0 | $547,688,909 | $0 | $0 | $0 | |||||

Berkin Kologlu

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 4 | 1 | 5 | 0 | 1 | 0 | |||||

| $2,882,556,912 | $112,496,477 | $467,847,243 | $0 | $112,496,477 | $0 | |||||

Matthew R. Kennedy

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 4 | 1 | 0 | 0 | 1 | 0 | |||||

| $331,650,312 | $112,496,477 | $0 | $0 | $112,496,477 | $0 | |||||

Colin McBurnette

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 9 | 1 | 12 | 0 | 1 | 0 | |||||

| $3,513,214,232 | $112,496,477 | $373,547,564 | $0 | $112,496,477 | $0 | |||||

Clayton Triick

| Number and Assets of Other Accounts |

Number and Assets of Accounts for which Advisory Fee is Performance Based | |||||||||

| Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts |

Registered Investment Companies |

Other Pooled Investment Vehicles |

Other Accounts | |||||

| 9 | 1 | 4 | 0 | 1 | 0 | |||||

| $3,513,214,232 | $112,496,477 | $276,788,424 | $0 | $112,496,477 | $0 | |||||

8

Potential Conflicts of Interest: Actual or apparent conflicts of interest may arise when a portfolio manager has day-to-day management responsibilities with respect to more than one fund or other account. More specifically, portfolio managers who manage multiple funds and/or other accounts may experience the following potential conflicts: The management of multiple accounts may result in a portfolio manager devoting unequal time and attention to the management of each account. Investment decisions for client accounts are also made consistent with a client’s individual investment objective and needs. Accordingly, there may be circumstances when purchases or sales of securities for one or more client accounts will have an adverse effect on other clients. The Adviser may seek to manage such competing interests by: (1) having a portfolio manager focus on a particular investment discipline; (2) utilizing a quantitative model in managing accounts; and/or (3) reviewing performance differences between similarly managed accounts on a periodic basis to ensure that any such differences are attributable by differences in investment guidelines and timing of cash flows. The Adviser also maintains a Code of Ethics to establish standards and procedures for the detection and prevention of activities by which persons having knowledge of the investments and investment intentions of the Fund may abuse their fiduciary duties to the Fund.