As filed with the Securities and Exchange Commission on June 3, 2024

Registration No. 333-__________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Catheter Precision, Inc. |

| (Exact name of registrant as specified in its charter) |

| Delaware |

| 3841 |

| 38-3661826 |

| (State or other jurisdiction of incorporation or organization) |

| (Primary Standard Industrial Classification Code Number) |

| (I.R.S. Employer Identification Number) |

1670 Highway 160 West, Suite 205

Fort Mill, SC 29708

973-691-2000

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

David Jenkins

Executive Chairman of the Board

and Chief Executive Officer

Catheter Precision, Inc.

1670 Highway 160 West, Suite 205

Fort Mill, SC 29708

973-691-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| B. Joseph Alley, Jr., Esq. Arnall Golden Gregory LLP Suite 2100 171 17th Street NW Atlanta, Georgia 30363-1031 (404) 873-8500 |

| Ivan K. Blumenthal, Esq. Daniel Bagliebter, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. 919 Third Avenue New York, New York 10022 (212) 935-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

|

|

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and it is not soliciting offers to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED June 3, 2024

PRELIMINARY PROSPECTUS

______ Shares of Common Stock

Pre-Funded Warrants to Purchase _____ Shares of Common Stock

Up to ________ Shares of Common Stock Issuable Upon Exercise of Pre-Funded Warrants

Underwriter Warrants to Purchase up to ______ Shares of Common Stock

Up to ________ Shares of Common Stock Issuable Upon Exercise of Underwriter Warrants

This is a firm commitment public offering of ____ shares of common stock (the “Shares”), par value $0.0001 per share, of Catheter Precision, Inc., a Delaware corporation (the “Company”), at an assumed public offering price of $____ per share, based on the last sale price of our common stock as reported on NYSE American on _____, 2024. We also are offering warrants (the “Pre-Funded Warrants”) to purchase up to _____ Shares to certain investors, if any, whose purchase of Shares in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, in lieu of Shares that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. The purchase price of each Pre-Funded Warrant is equal to the offering price at which a Share of common stock is sold in this offering, minus $0.0001, and each Pre-Funded Warrant will be exercisable for one share of common stock at an exercise price of $0.0001. This prospectus also relates to the offering of the Shares issuable upon exercise of these Pre-Funded Warrants. For each Pre-Funded Warrant that we sell, the number of Shares of common stock that we are selling will be decreased on a one-for-one basis. The assumed public offering price used throughout this prospectus has been included for illustration purposes only. The actual offering price may differ materially from the assumed price used in the prospectus and will be determined by negotiations between us and the underwriters and may not be indicative of prices of the actual offering price.

Our common stock is listed on NYSE American under the symbol “VTAK.” There is no established public trading market for the Pre-Funded Warrants, and we do not expect a market to develop. We do not intend to list the Pre-Funded Warrants on NYSE American or any other national securities exchange or automated quotation system.

Certain of our existing stockholders have indicated an interest in purchasing an aggregate of up to $[ ] of Common Stock in this offering at the public offering price per Share of common stock and on the same terms as other purchasers in this offering. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, fewer or no Shares of common stock in this offering to any of these stockholders, or any of these stockholders may determine to purchase more, fewer or no Shares of common stock in this offering. The underwriters will receive the same underwriting discount on any Shares of common stock purchased by these stockholders as they will on any other securities sold to the public in this offering.

You should carefully read this prospectus and any amendments or supplements accompanying this prospectus, together with any documents incorporated by reference herein or therein, before you make your investment decision.

Investing in our securities involves a high degree of risk. See “Risk Factors” on page 18 of this prospectus and in the documents incorporated by reference in this prospectus, as updated by any applicable prospectus supplement, and other future filings we make with the Securities and Exchange Commission that are incorporated by reference into this prospectus, for a discussion of the factors you should consider carefully before deciding to purchase our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

| Per Share |

|

| Per Pre-Funded Warrant |

|

| Total |

| |||

| Public offering price |

| $ |

|

| $ |

|

| $ |

| |||

| Underwriting discounts and commissions(1) |

| $ |

|

| $ |

|

| $ |

| |||

| Proceeds, before expenses, to us (2) |

| $ |

|

| $ |

|

| $ |

| |||

| (1) | Represents underwriting discounts equal to ___% per Share or Pre-Funded Warrant, as applicable. |

| (2) | We have also agreed to pay the underwriters a management fee equal to 1% of the aggregate gross proceeds received from the sale of the securities in the transaction. In addition, we have agreed to reimburse the underwriters for certain expenses and issue the underwriters warrants the ("Underwriter Warrants”) to purchase 6% of the total number of Shares sold in this offering, including Shares underlying Pre-Funded Warrants, at an exercise price equal to 155% of the public offering price of the Shares sold in this offering. See “Underwriting” on page [ ] for additional information regarding underwriting compensation. |

We have granted the underwriters a 45-day option to purchase up to additional Shares of our common stock at the public offering price, less underwriting discounts and commissions.

The underwriters expect to deliver the Shares and Pre-Funded Warrants against payment on or about ____________________, 2024.

Ladenburg Thalmann

The date of this prospectus is ____________, 2024.

TABLE OF CONTENTS

|

|

| 1 |

| |

|

|

| 2 |

| |

|

|

| 14 |

| |

|

|

| 18 |

| |

|

|

| 24 |

| |

| MARKET FOR COMMON STOCK |

|

|

| |

|

|

| 25 |

| |

| DESCRIPTION OF PRE-FUNDED WARRANTS |

|

|

| |

|

|

| 26 |

| |

|

|

| 27 |

| |

|

|

| 31 |

| |

|

|

| 35 |

| |

|

|

| 35 |

| |

|

|

| 35 |

| |

|

|

| 36 |

|

We urge you to read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find Additional Information” before buying any of the securities being offered.

You should rely only on the information contained or incorporated by reference in this prospectus or in any free writing prospectus. We and the underwriter have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus may only be used where it is legal to offer and sell Shares of our common stock and other securities. If it is against the law in any jurisdiction to make an offer to sell these Shares and other securities, or to solicit an offer from someone to buy these Shares and/or other securities, then this prospectus does not apply to any person in that jurisdiction, and no offer or solicitation is made by this prospectus to any such person. You should assume that the information appearing in this prospectus or in any applicable free writing prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock or other securities. Our business, financial condition, results of operations and prospects may have changed since such date. Information contained on our website is not a part of this prospectus.

A prospectus supplement may add to, update or change the information contained in this prospectus. You should read both this prospectus and any applicable prospectus supplements together with additional information described below under the heading “Where You Can Find Additional Information.”

This prospectus may contain references to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that the applicable licensor will not assert, to the fullest extent under applicable law, its rights to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

| 1 |

|

This summary highlights important features of this offering and the information contained elsewhere in or incorporated by reference into this prospectus. Because this is only a summary, it does not contain all of the information that you should consider before investing in our securities. You should carefully read this entire prospectus and any applicable prospectus supplement, including the information contained under the heading “Risk Factors” and all other information included or incorporated by reference into this prospectus and any applicable prospectus supplement in their entirety before you invest in our securities.

Unless otherwise stated, all references in this prospectus to “we,” “us,” “our,” the “Company,” “Catheter Precision” and similar designations refer to Catheter Precision, Inc. (formerly Ra Medical Systems, Inc.) and all entities included in our financial statements.

Company Overview

We (together with our consolidated operating subsidiary, the “Company” or “Catheter”) were incorporated in California on September 4, 2002, and reincorporated in Delaware in July 2018. The Company was initially formed to develop, commercialize and market an excimer laser-based platform for use in the treatment of vascular and dermatological immune-mediated inflammatory diseases, including the DABRA product line.

On January 9, 2023, the Company merged with Catheter Precision, Inc., or “Old Catheter”, a privately-held Delaware corporation (the “Merger”), and the business of Old Catheter became a wholly owned subsidiary of the Company, which today is our only operating subsidiary. Prior to the Merger with Old Catheter, we operated under the name Ra Medical Systems, Inc. Following the Merger, we discontinued the Company’s legacy lines of business and the use of any of its DABRA-related assets. For further information about these historical lines of business, see “Item 1. Business” of the Company’s Form 10-K for the fiscal year ended December 31, 2021. Since the Merger, we have shifted the focus of our operations to Old Catheter’s product lines, and effective August 17, 2023, we changed our name to Catheter Precision, Inc. Accordingly, our current activities primarily relate to Old Catheter’s historical business which comprises the design, manufacture and sale of new and innovative medical technologies focused in the field of cardiac electrophysiology, or “EP.”

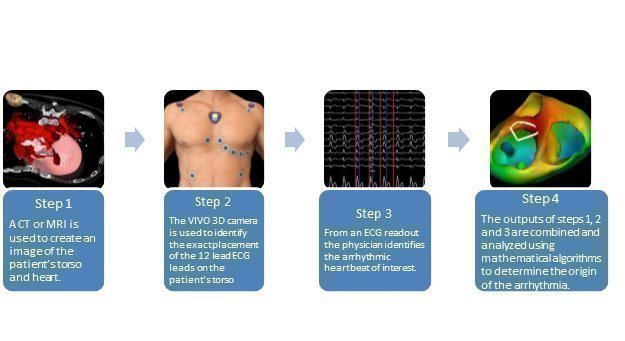

Our two primary products include the VIVO System and LockeT. The VIVO System, which is an acronym for View into Ventricular Onset System (“VIVO” or “VIVO System”), is a non-invasive imaging system that offers 3D cardiac mapping to help with localizing the sites of origin of idiopathic ventricular arrhythmias in patients with structurally normal hearts prior to EP procedures.

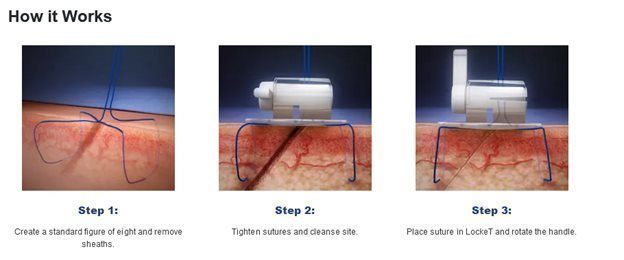

Our newest product, LockeT, is a suture retention device indicated for wound healing by distributing suture tension over a larger area in the patient in conjunction with a figure of eight suture closure. LockeT is intended to temporarily secure sutures and aid clinicians in locating and removing sutures efficiently.

Our product portfolio also includes the Amigo® Remote Catheter System, or Amigo, a robotic arm that serves as a catheter control device. Prior to 2018, Old Catheter marketed Amigo. We own the intellectual property related to Amigo, and this product is under consideration for future research and development of a generation 2 product.

Company Information

Our principal executive offices are located at 1670 Highway 160 West, Suite 205, Fort Mill, SC 29708, and our telephone number is 973-691-2000. Our corporate website address is ir.catheterprecision.com. Our website and the information contained on, or that can be accessed through, the website will not be deemed to be incorporated by reference in, and is not considered part of, this filing. You should not rely on any such information in making your decision whether to purchase our common stock. We make available free of charge through our website, at ir.catheterprecision.com, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information contained in, or that can be accessed through, our website is not part of this prospectus.

|

| 2 |

| Electrophysiology Market Overview

The EP Market is a rapid growing segment in healthcare and includes well known medical devices such as pacemakers, electrocardiogram (ECG) systems, and cardiac catheters and lesser-known products such as intracardiac mapping systems and fluoroscopy systems (similar to x-ray in real time). The EP market includes large medical device companies such as Medtronic, Plc., Abbott Laboratories, Biosense-Webster (J&J) and Boston Scientific Corp. and is estimated to be $15.1 billion by 2028 (CAGR of 13.0%). Population growth, increasing rates of heart disease and the rising cost of healthcare are driving growth in the EP markets.

The catheter ablation market was larger than $3.5 billion in 2022 and is estimated to grow to $14.5 billion by 2032 (13.5% CAGR).

The exact number of ventricular ablations performed each year is not well documented. However, in the last 10 years, ventricular ablation has become a fast-growing treatment option due to updated treatment guidelines, improved technology and raising incidence rates. The ventricular ablation market is expected to grow at a rate of 14.5% CAGR through 2032. Over a ten-year period, one study in Australia demonstrated a growth as high as 18% of ventricular tachycardia. Of note, this surpassed the growth rate of Atrial Fibrillation (12.7%) which has historically been the largest incidence of cardiac arrhythmias.

The Heart Rhythm Society, or HRS, Expert Consensus Statement on Catheter Ablation of Ventricular Arrhythmias, published in May 2019 recommends catheter ablation in preference to anti arrhythmic drugs or in the situation where anti arrhythmic therapy has failed or is not tolerated. The guidelines also recommend ablation for reducing recurrent VT and implantable cardioverter-defibrillator shocks.

Existing Treatments and Methods for Catheter Ablations

Traditionally, the first line of treatment for cardiac arrhythmias is medication. Unfortunately, this is not a permanent fix, and most patients eventually need a catheter ablation.

Catheter Ablation Procedure Overview

An electrophysiologist stands next to the patient’s bed near the patient’s groin. A catheter or catheters are inserted into the femoral vein (located at the groin) and navigated into the right side of the heart. Depending on the type of arrhythmia, the catheter is inserted into the atrium or the ventricle. Once inserted, a diagnostic catheter is used in conjunction with an invasive (traditional) mapping system to create a map/model of the patient’s heart. This allows the physician to see the individual patient’s cardiac structures and size. Once the map is created, the physician begins to “pace map.” This process requires the physician to move the catheter from spot to spot to determine the electrical conduction at different areas to determine if the tissue in that area is responsible for the arrhythmia. Once the area is located, the physician will provide a form of energy (radiofrequency, cryo, etc.) to ablate the tissue in that spot.

Treatment Challenges for Ventricular Arrhythmias

Ablation locations within the ventricle are very difficult to identify. Often, patients are highly symptomatic (dizzy, breathing difficulties, etc.) but the arrhythmia is infrequent. When this happens, it is hard to predict when the patient will be having an “active” arrhythmia. Because of this, the physician may not be able to identify the location even when using medication to induce the arrhythmia. Without confirmation during invasive mapping, the patient is removed from the electrophysiology lab without the ablation procedure being performed and the patient is required to return at a later date and try again for a successful outcome.

Even when a patient has frequent ventricular arrhythmias, the process of pace-mapping often takes 4 - 5 hours to identify the location for ablation, which can increase the likelihood of patient complications due to the extended time under anesthesia. Lastly, many patients with untreated ventricular arrhythmias cannot tolerate anesthesia well, thus invasive mapping that takes a long time is not an option for them.

|

| 3 |

| Treatment Challenges for Atrial Arrhythmias

Catheter ablation for atrial arrhythmias is more standardized and “advanced” than for ventricular ablations, thus less pace mapping is required. Instead, a procedure called Pulmonary Vein Isolation (“PVI”) is performed for atrial fibrillation, and a single line is ablated for atrial flutter. In pulmonary vein isolation, tiny scars are created in the left upper chamber of the heart in the area where the four lung (pulmonary) veins connect.

Despite steady improvement in the tools available to perform effective procedures, there is clear study evidence that catheter based atrial fibrillation treatment technology can become more effective. According to a study entitled “Long Term Outcomes of Catheter Ablation of Atrial Fibrillation: A Systematic Review and Meta- Analysis” published in the Journal of American Heart Association on March 18, 2013, which looked at multiple individual studies covering over 6,000 patients, “single procedure freedom from atrial fibrillation at long term follow up was 53.1%.” The same study found “with multiple procedures performed, the long-term success rate was 79.8%.” Ineffective treatment may result in patients undergoing two or more EP procedures to achieve relief from atrial fibrillation at an estimated cost in the range of $20,000 or more per procedure.

Specific reasons have not been proven for the lower success rate of initial ablation procedures. However, there is growing evidence that better results occur if the treating EP physician is able to make better lesions by maintaining stable contact force of the catheter against the heart wall, thereby reliably delivering the energy required to eliminate the abnormal rhythms. Variation in catheter contact force occurs as the physician attempts to manually position and hold the catheter tip in a stable position during cases lasting 2 to 3 hours in order to perform typically over 100 ablations of the cardiac anatomy.

Large multi-national medical device companies, such as Medtronic, Inc., Boston Scientific Corp., Abbott Laboratories, St. Jude Medical, Inc. (acquired by Abbott Laboratories in 2017) and the Biosense Webster division of Johnson & Johnson, among others, continue to invest heavily to develop and introduce new devices and technologies to improve patient outcomes. Included among these are force-sensing catheters, including the Biosense SmartTouch TM catheter, which provide a continuous readout of the contact force between the catheter and the heart wall. Our Vivo System is focused on the controlled delivery of these catheter technologies to enhance both the performance of ablation procedures and the ease and safety for the physicians who perform them.

A recent peer-reviewed multicenter study sponsored by Biosense Webster, entitled “Paroxysmal AF Catheter Ablation with a Contact Force Sensing Catheter” published in 2014 found that catheter ablation success rates can be as high as 80% when the physician is able to maintain stable contact force within investigator selected working ranges. “When the CF (contact force) employed was between investigator selected working ranges > 80% of the time during therapy, outcomes were 4.25 times more likely to be successful.” Further, “stable CF during radiofrequency application increases the likelihood of twelve-month success.” However, it should be noted that, using manually controlled methods, the physicians in the study could only maintain optimal tissue contact in less than 30% of the patients studied.

In addition, another study, sponsored by St. Jude Medical, Inc. (acquired by Abbott Laboratories in 2017) and published in 2015 showed similar findings using their recently FDA-approved contact-force sensing catheter, TOCCASTAR. In the TOCCASTAR study, 85.5% of ablation procedure patients were free of atrial fibrillation at one year after the procedure when optimal catheter tip contact force was maintained, versus only 67.7% when non-optimal contact force was achieved.

Our Products

Our products VIVO and LockeT are used in connection with catheter ablation procedures by (in the case of VIVO) providing pre-procedure, non-invasive mapping of arrhythmias and (in the case of LockeT) ensuring efficient hemostasis in conjunction with a figure-of-eight suture, and temporarily securing sutures at the access site. We also believe that LockeT may be useful in connection with other structural heart procedures that require femoral closure, such as procedures for pacemakers, heart valves, heart valve repair, and left atrial appendage devices. |

| 4 |

| VIVO™ System

VIVO is an FDA-cleared and CE marked product that utilizes non-invasive inputs to locate the origin of ventricular arrhythmias. VIVO has been used in more than 1,000 procedures in leading U.S. and European hospitals under a limited commercial launch that commenced in the third quarter of 2021. A full-scale commercial launch commenced in Q1 2023 in conjunction with the expansion of a direct sales force in the US.

VIVO is a non-invasive imaging system that offers 3D cardiac mapping to help with localizing the sites of origin of idiopathic ventricular arrhythmias in patients with structurally normal hearts prior to electrophysiology procedures. The VIVO system has achieved a CE Mark allowing it to be commercialized in the European Union and has been placed at several hospitals in Europe. FDA 510(k) Clearance in the United States was received in June 2019.

The VIVO software is provided on an off the shelf laptop, and the system includes a 3D camera. In addition, the system can only be used with a disposable component, the VIVO Positioning Patches, which are required for each procedure.

| ||||||

|

|

|

|

|

|

|

|

|

The VIVO software contains proprietary algorithms that are based on standard EP principles. However, the accuracy of the algorithms is improved because it does not use generalized assumptions and instead, uses patient specific information. VIVO uses standard clinical inputs such as a CT or MRI and a 12 lead ECG, both of which are routinely gathered for most EP procedures, allowing VIVO to seamlessly integrate into the workflow. A 3D photograph is obtained of the patient’s torso after the ECG leads are in place and all of these clinical inputs are combined to generate a 3D map of the patient’s heart with a location of the earliest onset of the ventricular arrhythmia. | ||||||

| 5 |

| VIVO Workflow

|

| 6 |

| Clinical Use and Studies

To date, VIVO has been used in more than 1,000 procedures, by more than 30 physicians in 10 countries. Initial clinical work was completed with the first-generation software, which resulted in FDA 510(k) Clearance in June 2019.

The U.S. multi-center study enrolled 51 patients from 5 centers. Of note, the Principal Investigator and center to have the highest enrollment was Johns Hopkins University in Baltimore, Maryland. This study was conducted to evaluate the accuracy of VIVO as compared to invasive mapping systems (current prevailing method for determining arrhythmia origins). VIVO met all study endpoints and correctly matched the predicted arrhythmia origin in 44/44 patients (100%; primary endpoint) and correctly matched paced sites in 225/226 locations (99.56%; secondary endpoint). In some instances, this study showed that VIVO has better predictability for arrhythmia origin than a physician’s manual review of a 12 lead ECG.

While conducting the initial clinical study for FDA submission, we developed generation 2 in parallel with a goal to have this version complete and ready to submit upon 510(k) clearance of generation 1. We successfully achieved this goal and received CE Mark and FDA 510(k) Clearance for generation 2 in 2020.

Additional clinical work has occurred with generation 2. Until recently, this data has been single center, physician-initiated research and has resulted in peer reviewed clinical science at electrophysiology conferences and in journals.

Three physicians, at different centers, in the UK conducted a feasibility study for Stereotactic Ablative Radiotherapy, or SABR, and published their data on nine patients. SABR is an ablation technique utilizing non-invasive methods akin to proton therapy for cancer treatment. To do a complete non-invasive ablation, accurately predicting the ablation location non-invasively is key to procedural success, and VIVO was utilized for this purpose. Non-invasive ablation is a new technique and requires additional data, but it is showing promise and has generated excitement within the EP community. If accepted for wide-spread treatment, this would allow for previously un-ablatable patients to receive lifesaving treatments.

In February 2023, a study from the Royal Brompton Hospital was published. This study enrolled 15 patients with 24 VTs (ventricular contractions) and PVCs (premature ventricular contractions). VIVO accurately identified VT and PVC origin in 23/24 (96%) and sub-localized in 100% of subjects. Acute success was achieved in 100% of cases. Standard ECG algorithms, conducted by 3 physicians in blind trials, only identified the correct chamber in 50-88% of the patients and sub-localized within the right ventricular outflow tract (septum v free wall) in 37 – 58% of subjects. Of note, six patients had previously attended for nine attempted ablations collectively, which were either unsuccessful or aborted owing to lack of spontaneously occurring clinical PVCs. One patient had previously reported for four separate attempts without PVCs and ablations were aborted, but collection of a single beat allowed VIVO to create an analysis map and provide the physician with information to complete the ablation for all these patients. In addition, this study showed a 27% reduction in procedure time when using VIVO as compared to a historical cohort. This study concluded that VIVO can accurately identify arrhythmia origin with an accuracy that is superior to that of established ECG algorithms.

In April 2022, one physician from the Netherlands presented an abstract at EHRA (European Heart Rhythm Association), focused on using VIVO as a way to screen patients prior to the ablation procedure. This study of 15 patients concludes that using VIVO pre-procedurally may enable the physician to determine procedure success rates and prevent unnecessary ablation procedures. This data will need to be further studied in larger numbers but determining success in advance of the procedure would improve ablation therapy, which has a high failure rate and thus requires additional ablation procedures.

In October 2021 the first patient was enrolled in the VIVO EU Registry. This registry aims to gather data about how VIVO is used in real-world settings, outside of a rigorous clinical study. The registry will enroll 125 patients across Europe and the UK and collect information about different workflows and applications for VIVO. Enrollment of 125 patients was completed in June 2023. The study requires 12-month follow-up and data collection is planned for completion in Q3 2024. This data serves multiple purposes including fulfilling European regulatory requirements for on-going data collection, publication of multi-center data, and future development of studies and improvements to the VIVO technology. |

| 7 |

| Currently, there is an ongoing physician-initiated study at Coventry hospital in the UK. This study will enroll 50 patients with Re-entrant Ventricular Tachycardia. These patients have hearts that are not structurally normal and scarred tissue is present in the ventricle. This data will be used for publication and to support an FDA submission to expand the current labeling of the existing product.

LockeT

As catheters are put into the body, they are put through the skin and into a blood vessel. After the procedure is completed the catheter is removed, and each access site must be closed and bleeding stopped (hemostasis). Ablation for atrial fibrillation (“AFIB”) creates up to four different perforations, each one requiring closure. LockeT is a suture retention device for use as part of the closure process. It is designed to be used in conjunction with a “figure of eight” suture. Each LockeT device can assist with the closure of two perforations, and therefore up to two devices are expected to be used for each AFIB ablation.

We believe LockeT offers a cost-effective solution for access site closure, with multiple features we believe clinicians will find attractive. It is transparent, which allows for easier monitoring of the site, and is designed for a wide range of catheter sizes. It utilizes a crank to provide pressure to the site and provide more efficient hemostasis (i.e., to stop the bleeding from the access site). LockeT simplifies the closure process, making it easy to monitor, adjust and remove as needed.

LockeT is a sterile, Class I product that we registered with the FDA in February 2023, at which time we began initial shipments for product evaluations. In May 2023, Catheter began the process to seek CE Mark approval for LockeT, and we are currently expecting to receive this approval in the second half of 2024. Once we receive CE Mark approval, initial international shipments to distributors may begin. LockeT is indicated for wound healing by distributing suture tension over a larger area in the patient in conjunction with a figure of eight suture closure and is intended to temporarily secure sutures and aid clinicians in locating and removing sutures efficiently. |

| 8 |

| Clinical studies for LockeT began during 2023. The three phases of the current studies are planned to show the product’s effectiveness and benefits, including faster wound closure, earlier ambulation, potentially leading to early hospital discharge, and lower costs for the healthcare provider and/or insurance payor. This data is intended to provide crucial data for marketing and to expand our indications for use with the FDA.

The Phase I - First in Man Feasibility Study was completed in 2023 and showed the device works for its intended purpose, that there were no safety events and gathered initial data to support Phase II submission to Institutional Review Board (IRB). The results were submitted to the Journal of American Academy of Cardiologists in January 2024.

Phase II received IRB approval in late 2023 and is anticipated to be completed by the end of our 2024 third quarter. This phase will compare manual compression (standard of care) to LockeT in a one-to-one randomized study of up to 110 patients and assess improved time to hemostasis and ambulation when using LockeT versus manual compression.

Phase III IRB approval is in process and will compare LockeT to one or more competitive products in a one-to-one randomized study of 100 patients and will include cost comparisons and assess risk of hematoma when using LockeT versus those competitive products. We anticipate this phase to be completed in early 2025.

We are still in the early phases of our roll out for LockeT, which is now under evaluation at several U.S. medical centers. As we build out our sales network, we are focused on placing the product for evaluation at more centers throughout the U.S. During the second quarter of 2024, the product received its first approval for future use by a U.S. medical center, which has submitted several purchase orders to date. Although there are competing devices in the marketplace that assist with vascular closure, we believe that LockeT, which is easy to use, offers unique advantages that will lead to ready adoption in the marketplace.

Our Strategy

Our goal is to become a leading medical imaging and device company in the field of cardiac electrophysiology, and we are dedicated to developing and delivering electrophysiology products to provide patients, hospitals, and physicians with novel technologies and solutions to improve the lives of patients with cardiac arrhythmias. We aim to establish VIVO and LockeT as integral tools used by cardiac electrophysiologists during and following ablation treatment of ventricular arrhythmias, by reducing procedure time and patient complications and increasing procedural efficiencies and success.

Customers

Our primary customers are hospitals providing cardiac electrophysiology lab procedures. We believe there are 2,000 to 3,000 EP labs in the U.S. and a similar number of labs outside of the U.S. performing approximately 600,000 ablation procedures annually. During fiscal 2023, we had two individual customers that represented approximately 32% and 20% of our total revenues, respectively, and four customers (including the two just described) that in the aggregate represented approximately 72% of our total revenues.

Sales and Marketing

Today, we use a mix of distribution partners (Europe), independent sales agents (U.S.) specializing in EP products, and direct employees providing clinical support and product specialization. In the U.S., LockeT and VIVO, including the VIVO System and patches, are currently sold by direct employees who call on electrophysiologists, lab staff and hospital administrators. This sales team qualifies appropriate prospective customers, and with support from our direct clinical specialists they conduct product demonstrations, and support customer training and case usage. In Europe, our products are sold through distributors, supported by two full-time contracted employees. |

| 9 |

| We also have co-marketing and spot distribution agreements with Stereotaxis, Inc., that allow for the promotion of VIVO by Stereotaxis to customers who may benefit from VIVO at certain hospitals using a Stereotaxis Robotic Magnetic Navigation System, in exchange for a commission of 45% of any revenue generated from VIVO at these robotic hospitals; the 45% payments will continue beyond the initial sale, if any.

We continue to hire additional clinical support and direct sales representation as we continue the buildout of our sales network for both VIVO and LockeT. We focus on sales staff who are experienced in the electrophysiology field and are able to identify and target prospective customers to educate, and demonstrate our products, leading to adoption and purchase of our technology. We will continue to use direct clinical specialists to provide training and ongoing clinical support.

In the future, we intend to market our products in the U.S. and certain international markets using a combination of a direct sales force and independent distributors. This requires us to make a significant investment building our U.S. commercial infrastructure and sales force and in recruiting and training our sales representatives and clinical specialists for U.S. commercialization of VIVO. This is a lengthy process that requires recruiting appropriate sales representatives, establishing a commercial infrastructure in the United States, and training our sales representatives, and will require significant ongoing investment by us. Following initial training, our sales representatives typically require lead time in the field to grow their network of accounts, coordinate their sales efforts with each hospital’s capital budgeting and acquisition cycle and produce sales results. Successfully recruiting and training a sufficient number of productive sales representatives is required to achieve growth at the rate we desire.

Outside the U.S., we will continue to foster additional key partner relationships with distributors who will market, sell and support its products.

In addition, we believe there are opportunities to offer additional complementary products through our sales and marketing channels that would enhance the productivity of our sales force and provide additional scale to revenue, better covering fixed operating costs.

Manufacturing and Availability of Raw Materials

VIVO manufacturing, inventory and product fulfillment is housed in our approximate 2,000 square feet facility in Fort Mill, South Carolina. This facility currently has one full-time employee who oversees manufacturing, quality objectives, and order fulfillment. The VIVO system includes VIVO software, loaded onto an off-the-shelf laptop, which we equip with a 3D camera. We purchase laptops and cameras that have been manufactured by third parties. Disposable VIVO Positioning Patches are also required for use of the system, and the manufacture of the patches is outsourced. We also outsource updating and troubleshooting of the software, as needed, to a third-party software engineering company from time to time. LockeT manufacturing, inventory and product fulfillment has been subcontracted to the company that is also providing research and development of the product.

LockeT is manufactured by a third party, Zien Medical Technologies, located in Salt Lake City, Utah. Zien is responsible for procuring product, packaging, assembly and sterilization of LockeT. Once sterilization is complete Catheter Precision reviews the Device History Report (DHR) and approves the product before it is placed into inventory.

Competition

The medical device industry is highly competitive, subject to rapid change and significantly affected by new product introductions and other activities of industry participants. We face potential competition from major medical device companies worldwide, many of which have longer, more established operating histories, and significantly greater financial, technical, marketing, sales, distribution, and other resources. Our overall competitive position is dependent upon a number of factors, including product performance and reliability, manufacturing cost, and customer support. Our primary competitors in the cardiac electrophysiology space include known medical devices such as pacemakers, electrocardiogram, or ECG, systems and cardiac catheters, but also laboratory equipment such as intracardiac mapping systems and fluoroscopy systems (similar to x-ray in real time). The EP market includes large medical device companies such as Medtronic, Plc., Abbott Laboratories, Biosense-Webster (J&J) and Boston Scientific Corp. LockeT’s direct competitors include Abbott’s Perclose device, Haemonetic’s VASCADE device and Inari Medical’s FlowStasis device. |

| 10 |

| Reimbursement

At this time, there is no reimbursement for VIVO or LockeT. Ablation procedures are reimbursed using one current procedural technology, or CPT, code, which varies depending on the type and complexity of the procedure. The range of reimbursement for ablations varies within regions but can be as much as $20,000 or more.

We currently intend, in the future, to hire a reimbursement specialist to guide us through the process of obtaining a CPT code specifically for VIVO. Although a new Category III CPT codes is approved and available starting July 1, 2024, Category III codes, which are temporary, do not have a payment rate established, and payment is at the discretion of payors; further, payors generally require a high level of clinical data through long-term patient studies to demonstrate that a treatment produces favorable results in a cost-effective manner relative to other treatments, in order to be willing to provide reimbursement based on Category III codes. Successful execution of our current commercialization and build out for VIVO will be needed in order to move Category III codes to permanent Category I codes.

Research and Development

The major focus of our research and development team is to leverage our existing technology platform for new applications and improvements to our existing applications, including multiple engineering efforts to improve our current products. Future research and development efforts will involve continued enhancements to and cost reductions for VIVO and LockeT. We will also explore the development of other products that can be derived from our core technology platform and intellectual property. Our research and development team works together with our commercial team to set development priorities based on communicated customer needs. The feedback received from our customers is reviewed and evaluated for incorporation into new products. Our research and development function has been outsourced to a third-party provider.

In the future we intend to develop a generation 3 of VIVO. This version would have expanded indications to include ischemic heart disease and improve usability by the hospital staff. It would also contain more automaticity, potentially reducing our need for clinical support.

Resources Material to Our Business

Patents and Proprietary Technology

Patents

We have a number of patents covering our intellectual property, both in the U.S., as well in a number of international countries. We consider the U.S. to be the most important market for our products, and hence, the most important country for the filing of patents. Any foreign filings are merely replicates of the U.S. filings. For the U.S., we have the following patent positions for the different product areas: | ||

|

|

|

|

|

| · | VIVO – We have two U.S. patents granted on the original VIVO concept, which have been licensed from a third party. We consider the primary component to be the ideas around utilizing a 3D camera to identify the exact location of the body surface electrodes. These two patents expire in 2038. An additional two applications have been granted, which disclosed ideas around merging of the heart models to other heart images and expire in 2038 and 2040. An additional three applications were published, all filed in 2021, covering the idea of determining the thickness of the wall of the ventricle, covering the concept of the rendering of a heart model and likely outcomes of an EP procedure. An additional application was filed in September 2023 and is not yet published. |

|

|

|

|

|

| · | LockeT – Suture Retention Device - We have four published U.S. patent applications. These cover the basic concept, methods of use and the design of the conceived device. |

|

|

|

|

|

| · | AMIGO – We have twenty issued U.S. patents. The first patent, filed in 2006 and expiring in 2031, covers the basic idea, with a three way motor, a remote control, a sled device, and a docking station for a catheter. The more detailed ideas behind the original concept were covered in three patents filed between 2011 and 2013 and expiring in 2026. Additional concepts and methods were filed with six patents between 2010 and 2013, with expirations between 2029 and 2031. We consider the most relevant of the intellectual property to be the guiding track with opposing flexible guides to hold the catheter stable as it is advanced, the form and function of the controller handle, and the introducer interface of the arm to the introducer. An additional ten patents, filed between 2013 and 2017, and expiring in 2034 to 2037, are patents covering ideas not used in the original commercial device, but potential ideas for future embodiments. |

| 11 |

| License and Other Agreements

PEACS, NV Software and Technology License Agreement

On May 1, 2016, we entered into a certain Software and Technology License Agreement with PEACS, NV, a Netherlands company, or the License Agreement, for the exclusive worldwide license of the underlying technology to its VIVO product, including intellectual property rights and patent applications pertaining thereto. The license was for use of the technology for the field of use defined as “the localization of the origin of cardiac activation for the electrophysiology treatment and/or detection of cardiac arrhythmias.” The License Agreement called for us to pay for the prosecution and maintenance of patents to protect the technology.

In May 2021, the License Agreement was modified to modify the field of use to specifically exclude the use of clinical applications for the implanting of atrial or ventricular pacemakers, including bi-ventricular pacemakers.

LockeT Royalty Agreements

We have acquired the rights to Locket pursuant to certain assignment agreements, including an assignment and royalty agreement (the “Assignment and Royalty Agreement”) with one of the co-inventors. Pursuant to the Assignment and Royalty Agreement, we agreed to pay a royalty fee of 5% on net sales up to $1 million. Thereafter, if a patent for the LockeT device is obtained from the U.S. Patent and Trademark Office, we will pay a royalty fee of 2% of net sales up to a total of $10 million in royalties. However, no further royalty payments will be due after December 31, 2033, or after the expiration, cancelation or abandonment of the patents that are the subject of the agreement, whichever is earlier. In addition, at the time of the Merger, additional royalty rights with respect to the LockeT device were granted to certain holders, or the Noteholders, of Old Catheter’s outstanding convertible promissory notes in exchange for forgiveness of the interest that had accrued under those notes but remained unpaid, pursuant to the terms of certain Debt Settlement Agreements. The Debt Settlement Agreements provided for the Noteholders to receive, in the aggregate, approximately 12% of the net sales, if any, of the LockeT device, commencing upon the first commercial sale through December 31, 2035.

Trademarks

We own or have rights to trademarks that we use in connection with the operation of our business. We own or have rights to trademarks for Ra Medical Systems and Catheter Precision and their logos, as well as other trademarks such as AMIGO. In February 2024 we filed a trademark for LockeT.

Trade Secrets

We also have relied upon trade secrets, know-how and technological innovation, and may in the future rely upon licensing opportunities, to develop and maintain its competitive position. We have protected our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to proprietary information.

Government Regulations

Governmental authorities in the U.S. (at the federal, state, and local levels) and abroad extensively regulate, among other things, the research and development, testing, manufacture, quality control, clinical research, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing, and export and import of products such as those we market and are developing. See our Form 10-K for the fiscal year ended December 31, 2023, for more information about the impact on our business from these and other pertinent regulations. |

| 12 |

| Segment Information

We operate our business as one segment which includes all activities related to the marketing, sales and development of medical technologies focused in the field of cardiac EP. The chief operating decision-maker reviews the operating results on an aggregate basis and manages the operations as a single operating segment.

Employees

As of May 28, 2024, we had a total of 19 employees, including 19 full-time employees, which includes finance and administrative, sales and marketing and clinical professionals. We also have retained a total of four persons as independent contractors. We are planning to increase our sales force in support of product launches but currently have no other plans to increase our staff.

Recent Developments

Interim Financing

On May 30, 2024, we borrowed $500,000 from David Jenkins, our Chairman of the Board and Chief Executive Officer, pursuant to a promissory note dated May 30, 2024 in order to fund our short-term liquidity needs. The borrowed amount bears interest at the rate of 8% per annum, and all outstanding principal and interest under the note will be due and payable on August 30, 2024. We expect to repay this loan using proceeds from this offering. See “Use of Proceeds.”

Proposed Reverse Stock Split

Our stockholders will vote on a proposed reverse stock split at our July 3, 2024 annual meeting of stockholders. If approved by our stockholders, the reverse stock split proposal would permit, but would not require, the Board to effect a reverse stock split of our Common Stock issued and outstanding or held in treasury by a ratio of not less than 1-for-5 and not more than 1-for-15, with the exact ratio to be set at a whole number within this range as determined by the Board, or a duly authorized committee thereof, in its sole discretion. The reverse stock split, if effected, would affect all of our holders of common stock uniformly, including Shares issued in this offering. See our definitive proxy statement on Schedule 14A filed with the Securities and Exchange Commission on May 16, 2024, which has been incorporated by reference herein, for additional information.

Proposed Reduction in Authorized Shares

Our Amended and Restated Certificate of Incorporation, as amended to date, currently authorizes the issuance of 310 million shares of capital stock, consisting of 300 million shares of common stock and 10 million shares of preferred stock. At our July 3, 2024 annual meeting of stockholders, our stockholders will vote on a proposal to reduce our authorized common stock, either (i) in the event the reverse stock split is approved and effected, from 300 million shares to 30 million shares, with authorized preferred stock remaining at 10 million shares; or (ii) in the event the reverse stock split is not approved and effected, from 300 million shares to 100 million shares, with authorized preferred stock remaining at 10 million shares.

Corporate Information

Our principal executive offices are located at 1670 Highway 160 West, Suite 205, Fort Mill, South Carolina 29708. Our telephone number is (973) 691-2000. Our corporate website address is www.catheterprecision.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this document, and you should not consider information on our website to be part of this document. |

| 13 |

|

|

|

| Common stock offered | _____ Shares of common stock. |

|

|

|

| Common stock outstanding prior to this Offering | 7,573,403 Shares of common stock. |

|

|

|

| Common stock to be outstanding immediately after this Offering (assuming all offered Shares are sold) | _____ Shares of common stock (____ shares if the underwriter exercises its option to cover over-allotments, if any), excluding Pre-Funded Warrants, if any. |

|

|

|

| Pre-Funded Warrants offered | We are also offering to those purchasers, if any, whose purchase of Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if such purchasers so choose, [ ] Pre-Funded Warrants, in lieu of Shares that would otherwise result in any such purchaser’s beneficial ownership exceeding 4.99% (at an exercise price of $0.0001 per Pre-Funded Warrant) of our outstanding shares of common stock. The purchase price of each Pre-Funded Warrant will equal the public offering price at which Warrants are being sold to the public in this offering, minus $0.0001. See “Description of Securities We Are Offering—Pre-Funded Warrants.” This prospectus also relates to the offering of the Shares issuable upon exercise of the Pre-Funded Warrants. |

|

|

|

| Over-allotment option

| We have granted the underwriter an option for a period of 45 days from the date of this prospectus to purchase up to an additional __ Shares of common stock, at a purchase price per additional Share equal to the public offering price per Share, less the underwriting discount. |

| 14 |

| Underwriter Warrants | We have agreed to issue to the underwriters warrants, or the Underwriter Warrants, to purchase up to 6% of the total number of Shares sold in this offering, including Shares underlying Pre-Funded Warrants, or [ ] Shares of common stock, assuming the exercise of the over-allotment option in full, as a portion of the compensation payable to the underwriters in connection with this offering. The Underwriter Warrants will be immediately exercisable upon issuance at an exercise price equal to 155% of the public offering price of the Shares sold in this offering, expire on the fifth anniversary of the commencement of sales in this offering, and are otherwise in substantially similar form to the Pre-Funded Warrants issued in the offering. The Underwriter Warrants and the Shares of common stock underlying the Underwriter Warrants are being registered on the registration statement of which this prospectus is a part. See “Underwriting” on page [ ] of this prospectus. |

|

|

|

| Lock-up Agreements | We have agreed with the underwriters not to sell additional equity securities for a period of 90 days after the effective date of this Offering. Our directors and officers have agreed with the underwriters not to offer for sale, sell, contract to sell, pledge or otherwise dispose of any of their Shares of our common stock or securities convertible into our common stock, subject to certain exceptions, for a period of 90 days after the date of this prospectus, which restriction may be waived in the discretion of the underwriter. |

|

|

|

| Use of proceeds | Assuming all offered Shares are sold, either in the form of Shares or Pre-Funded Warrants, we estimate that the net proceeds from this offering will be approximately $ million, assuming a public offering price of $_______, based on the last sale price of our common stock as reported on NYSE American on , 2024 or approximately $ million if the underwriter exercises its over-allotment option in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, together with other available funds, to support our operations, including for clinical trials, for working capital and for other general corporate purposes, including the payment of accrued liabilities and the repayment of interim financing from our Chairman of the Board and Chief Executive Officer. See “Prospectus Summary—Recent Developments—Interim Financing” and “Use of Proceeds.” |

| 15 |

| Risk factors | Investing in our securities involves a high degree of risk. You should read the “Risk Factors” section included in this prospectus, on page 18, and the risk factors incorporated by reference in this prospectus for a discussion of factors to consider carefully before deciding to invest in Shares of our common stock or Pre-Funded Warrants.

|

| Indications of Interest | Certain of our existing stockholders have indicated an interest in purchasing an aggregate of up to $[ ] of Common Stock in this offering at the public offering price per Share of common stock and on the same terms as other purchasers in this offering. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters may determine to sell more, fewer or no Shares of common stock in this offering to any of these stockholders, or any of these stockholders may determine to purchase more, fewer or no Shares of common stock in this offering. The underwriters will receive the same underwriting discount on any Shares of common stock purchased by these stockholders as they will on any other securities sold to the public in this offering.

|

| 16 |

| NYSE American symbol | “VTAK”. | |

| The information above is based on 7,573,403 Shares of our common stock outstanding as of June 3, 2024, assumes no exercise of the underwriter’s over-allotment option and no exercise of the Pre-Funded Warrants issued pursuant to this offering, and also does not include as of such date, the following: | ||

|

|

|

|

|

| · | 989,593 Shares of common stock issuable upon the exercise of outstanding options to purchase shares of common stock issued to directors, employees and consultants at a weighted average exercise price of $1.7589 per share, 210,842 shares of which are currently exercisable; |

|

|

|

|

|

| · | 11,042,137 shares of common stock issuable upon the exercise of outstanding warrants to purchase Shares of common stock at a weighted average exercise price of $5.31 per share, all of which are currently exercisable, subject to applicable beneficial ownership blockers; |

|

|

|

|

|

| · | 2,313,956 shares of common stock issuable upon conversion of outstanding Series A Convertible Preferred Stock, all of which are currently convertible; and |

|

|

|

|

|

| · | 12,656,011 Shares of common stock issuable upon conversion of outstanding Shares of convertible Series X Preferred Stock, none of which are currently convertible. |

|

|

|

|

| Except as otherwise indicated herein, all information in this prospectus reflects or assumes no exercise of the underwriter’s option to purchase up to an additional [ ] Shares of our common stock to cover over-allotments, if any. | ||

| 17 |

Investing in our securities involves a high degree of risk. Before deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this prospectus is a part, you should carefully consider the Risk Factors described below as well as the risks and uncertainties discussed under “Special Note Regarding Forward-Looking Statements” below and elsewhere in this prospectus, and the risk factors set forth under “Risk Factors” in our previous SEC filings, all of which are incorporated by reference into this prospectus:

|

| · | our most recent Annual Report on Form 10-K, |

|

|

|

|

|

| · | our most recent Quarterly Report on Form 10-Q filed subsequent to such filing, and |

|

|

|

|

|

| · | discussions of potential risks, uncertainties, and other important factors in our subsequent filings with the SEC. |

The Risk Factors set forth in this Prospectus and in the filings described above may be amended, supplemented or superseded from time to time by other reports and/or prospectus supplements we file with the SEC in the future, and you should carefully consider any such additional or modified risk factors and other information provided in any such future filings that may be available after the date of this prospectus before making your investment decision.

If any of the risks set forth in this Prospectus and/or in the filings described above actually occur, it may materially harm our business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and/or the available secondary market for our securities may diminish or become non-existent, and you could lose all or part of your investment or lose liquidity in the Shares. The risks and uncertainties we describe in this prospectus and in the documents incorporated by reference herein are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial could materially adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to lose all or part of your investment.

Risks Relating to This Offering

We have broad discretion to determine how to use the proceeds raised in this offering, and we may not use the proceeds effectively.

Our management will have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways with which you may not agree or that do not yield a favorable return. We intend to use the net proceeds from this offering to support our operations, including for clinical trials, for working capital and for other general corporate purposes, including the payment of accrued expenses, including repayment of interim financing from our Chairman of the Board and Chief Executive Officer. See “Prospectus Summary—Recent Developments—Interim Financing.” If we do not invest or apply the proceeds of this offering in ways that improve our operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

You will experience immediate and substantial dilution when you purchase securities in this offering.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the assumed sale by us of ______ Shares of our common stock in this offering at the public offering price of $____ per share of common stock, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, investors in this offering will suffer an immediate dilution of $____ per share. Furthermore, if the underwriters exercise their option to purchase additional Shares of common stock and/or warrants to purchase Shares of common stock, you will experience further dilution.

If we issue additional common stock, or securities convertible into or exchangeable or exercisable for common stock, our stockholders, including investors who purchase Shares of common stock in this offering, may experience additional dilution, and any such issuances may result in downward pressure on the price of our common stock. We may not be able to sell Shares or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing Shares or other securities in the future could have rights superior to existing stockholders. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

| 18 |

The issuance of additional equity securities may negatively impact the trading price of our common stock.

We have issued equity securities in the past, will issue equity securities in this offering and expect to continue to issue equity securities to finance our activities in the future. In addition, outstanding options and warrants to purchase our common stock may be exercised and additional options and warrants may be issued, resulting in the issuance of additional Shares of common stock. The issuance by us of additional equity securities would result in dilution to our stockholders, and even the perception that such an issuance may occur could have a negative impact on the trading price of our common stock.

A substantial number of Shares of our common stock and/or Pre-Funded Warrants may be sold in this offering, which could cause the price of our common stock to decline.

In this offering, we seek to sell _____ Shares of common stock, representing approximately ____% of our outstanding common stock as of June 3, 2024, or _____ Pre-Funded Warrants in lieu of Shares that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. This sale and any future sales of a substantial number of Shares of our common stock in the public market, or the perception that such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of those Shares of common stock or the availability of those Shares of common stock for sale will have on the market price of our common stock.

A significant number of additional Shares of our common stock may be issued upon the conversion of existing securities, including the Series A and Series X Preferred Stock and outstanding options and warrants, which issuances would substantially dilute existing stockholders and may depress the market price of our common stock.

As of June 3, 2024, there were 7,573,403 Shares of common stock outstanding, plus 27,001,697 Shares underlying preferred stock, warrants, and options. See “Description of Capital Stock,” filed as Exhibit 4.2 to our Form 10-K for fiscal year ended December 31, 2023. The issuance of such Shares of common stock would substantially dilute the proportionate ownership and voting power of existing security holders, and their issuance, or the possibility of their issuance, may depress the market price of our common stock.

Future issuances of preferred stock may adversely affect the market price for our common stock.

Additional issuances and sales of preferred stock, or the perception that such issuances and sales could occur, may cause prevailing market prices for our common stock to decline and may adversely affect our ability to raise additional capital in the financial markets at times and prices favorable to us.

There is no public market for the Pre-Funded Warrants being offered in this offering.

There is no public trading market for the Pre-Funded Warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply to list the Pre-Funded Warrants on any securities exchange or nationally recognized trading system, including NYSE American. Without an active market, the liquidity of the Pre-Funded Warrants will be limited.

Holders of Pre-Funded Warrants purchased in this offering will have no rights as holders of our common stock with respect to the Shares underlying such Pre-Funded Warrants until such holders exercise their Pre-Funded Warrants and acquire our common stock.

Until holders of Pre-Funded Warrants acquire Shares of our common stock upon exercise of the Pre-Funded Warrants, holders of Pre-Funded Warrants will have no rights with respect to the Shares of our common stock underlying such Pre-Funded Warrants including with respect to dividends and voting rights. Upon exercise of the Pre-Funded Warrants, the holders will be entitled to exercise the rights of a holder of our common stock only as to matters for which the record date occurs after the exercise date.

| 19 |

Significant holders or beneficial holders of our common stock may not be permitted to exercise Pre-Funded Warrants that they hold.

A holder of a Pre-Funded Warrant will not be entitled to exercise any portion of any Pre-Funded Warrant which, upon giving effect to such exercise, would cause (i) the aggregate number of Shares of our common stock beneficially owned by the holder (together with its affiliates) to exceed 4.99% (or, at the election of the holder, 9.99%) of the number of Shares of our common stock outstanding immediately after giving effect to the exercise, or (ii) the combined voting power of our securities beneficially owned by the holder (together with its affiliates) to exceed 4.99% (or, at the election of the holder, 9.99%) of the combined voting power of all of our securities then outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Pre-Funded Warrants. As a result, you may not be able to exercise your Pre-Funded Warrants for Shares of our common stock at a time when it would be financially beneficial for you to do so. In such circumstance you could seek to sell your Pre-Funded Warrants to realize value, but you may be unable to do so in the absence of an established trading market for the Pre-Funded Warrants.

As noted above, you are urged to review, in addition to the foregoing, important risk factors contained in our periodic reports filed with the SEC and incorporated herein by reference, which describe in more detail risk factors pertaining to our business and our common stock including but not limited to the following:

Risks Related to Our Financial Position and Need for Additional Capital

|

| · | We will be required to raise additional funds to finance our operations and continue as a going concern; We may not be able to do so when necessary, and/or the terms of any financings may not be advantageous to us. |

|

|

|

|

|

| · | Our business has a history of losses, will incur additional losses, and may never achieve profitability. |

Risks Related to Our Internal Controls

|

| · | We have identified material weaknesses in our internal control over financial reporting. These material weaknesses could adversely affect our ability to report our results of operations and financial condition accurately and in a timely manner. |

|

|

|

|

|

| · | Compliance with Sarbanes-Oxley Act Section 404 could have a material adverse impact on our business. |

Risks Related to Our Business and Products

Product Liability Risks Related to our Vivo and LockeT Products

We may incur material losses and costs as a result of product liability claims that may be brought against us and recalls, which may adversely affect our results of operations and financial condition. Furthermore, as a medical device company, we face an inherent risk of damage to our reputation if one or more of our products are, or are alleged to be, defective.

Our business exposes us to potential product liability risks that are inherent in the design, manufacture and marketing of our products. In particular, our medical device products are often used in connection with or subsequent to surgical and intensive care settings with seriously ill patients. For example, our LockeT product is designed to be applied to a sutured wound on the human body for varying periods of time, and component failures, lack of appropriate sterility, manufacturing flaws, design defects or inadequate disclosure of product-related risks with respect to these or other products we manufacture or sell could result in an unsafe condition or injury to, or death of, the patient. Further, with respect to our LockeT product, we have outsourced manufacturing to a third-party and therefore face additional risk regarding the quality of that manufacturing. As a result, we face an inherent risk of monetary liability and damage to our reputation if one or more of our products are, or are alleged to be, defective. Although we carry product liability insurance, we may be exposed to product liability claims in the event that our products actually or allegedly fail to perform as expected or the use of our products results, or is alleged to result, in bodily injury and/or property damage. The outcome of litigation, particularly any class-action lawsuits, is difficult to quantify. Plaintiffs often seek recovery of very large or indeterminate amounts, including punitive damages. The magnitude of the potential losses relating to these lawsuits may remain unknown for substantial periods of time and the cost to defend against any such litigation may be significant. Accordingly, we could experience material product liability losses in the future and incur significant costs to defend these claims.

| 20 |

In addition, if any of our products are, or are alleged to be, defective, we may voluntarily participate, or be required by applicable regulators, to participate in a recall of that product if the defect or the alleged defect relates to safety. In the event of a recall, we may experience lost sales and be exposed to individual or class-action litigation claims and reputational risk. Product liability and recall costs may have a material adverse effect on our business, financial condition and results of operations.

Additional Business and Product Risks

|

| · | We will not be able to reach profitability unless we are able to achieve our product expansion and growth goals; our VIVO launch plans require significant investment in infrastructure and sales representatives. |

|

|

|

|

|

| · | Our research and development and commercialization efforts may depend on entering into agreements with corporate collaborators. |

|

|

|

|

|

| · | We have entered into joint marketing agreements with respect to our products, and may enter into additional joint marketing agreements, that will reduce our revenues from product sales. |

|

|

|

|

|

| · | Royalty agreements with respect to LockeT, the surgical vessel closing pressure device, will reduce any future profits from this product. |

|

|

|

|

|

| · | If we experience significant disruptions in our information technology systems, our business may be adversely affected. |

|

|

|

|

|