Hyzon Q2 2024 Earnings August 13, 2024

Forward Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include the Company’s expectations, hopes, beliefs, intentions or strategies for the future. You are cautioned that such statements are not guarantees of future performance and that the Company’s actual results may differ materially from those set forth in the forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time. Factors that could cause the Company’s actual expectations to differ materially from these forward-looking statements include the Company’s ability improve its capital structure; Hyzon’s liquidity needs to operate its business and execute its strategy, and related use of cash; its ability to raise capital through equity issuances, asset sales or the incurrence of debt; the possibility that Hyzon may need to seek bankruptcy protection; Hyzon’s ability to fully execute actions and steps that would be probable of mitigating the existence of substantial doubt regarding its ability to continue as a going concern; our ability to enter into any desired strategic alternative on a timely basis, on acceptable terms; our ability to maintain the listing of our Common Stock on the Nasdaq Capital Market; retail and credit market conditions; higher cost of capital and borrowing costs; impairments; changes in general economic conditions; and the other factors under the heading “Risk Factors” set forth in the Company’s Annual Report on Form 10-K, as supplemented by the Company’s quarterly reports on Form 10-Q and current reports on Form 8- K. Such filings are available on our website or at www.sec.gov. You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof. The Company undertakes no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events, or circumstances, except as may be required under applicable securities laws. 2

Q2 2024 Highlights 3 Key Commercial and Operational Highlights • Focused business on large fleet customers in North American Class 8 and refuse markets with highest immediate commercial potential • Delivered one additional Class 8 Fuel Cell Electric Vehicle (FCEV) to customer Performance Food Group (PFG) for a total of five FCEVs deployed with PFG in California • Completed 16 200kW C-Sample Fuel Cell Systems (FCS) in Q2 for a total of 21 manufactured in 1H 2024, remaining on track for Start of Production (SOP) of 200kW FCS in second half of 2024 • Launched multiple customer trials with 200kW Class 8 FCEV in July, with cross-continental refuse collection vehicle trial program expected to launch this month; 25 large fleet trials across both platforms planned by end of January 2025, with average 4,200+ truck fleet size and 10 fleets of at least 5,000 trucks Key Financial Highlights this Quarter • Cash, cash equivalents and short-term investments of $55.1 million on June 30, 2024 • Net cash burn1 of $27.5 million at lower end of guidance range representing continued cost discipline and operation below $10 million average monthly net cash burn • R&D and SG&A expense below the low-end of Q2 2024 guidance range • Upon shelf effectiveness after quarter end, executed first capital raise since company listing (July 2021) • Significant charges associated with ceasing operations in Europe and Australia providing path to reduced average monthly net cash burn 1. Net cash burn = Ending Cash & Equivalents and ST Investments as of June 30, 2024 - Beginning Cash & Equivalents and ST Investments as of March 31, 2024.

Parker Meeks Chief Executive Officer 4

Hyzon at a Glance Expanding IP Portfolio Foundational to Single Stack 200kW Fuel Cell System’s Economic Advantages 5 Growing IP Portfolio with 176 Patents1 • Doubled the total applied1 / granted patent count since 2021 with over 98 patents applied since 2021, and 10 of those patents granted • Patented areas include Membrane Electrode Assembly (MEA), hybrid bipolar plates (BPP), unit cell, fuel cell (FC) stack, fuel cell system (FCS), and hydrogen storage Benefits of Using 1x 200kW vs. 2x ~110kW Fuel Cells in Heavy Duty Trucks • ~30% lower volume and weight • ~25% lower total FCS cost in truck BOM • ~20% improved miles per kg hydrogen2 Hyzon’s Technology-Led Value Proposition • U.S.-based manufacturing Start of Production (SOP) expected in 2H 2024 • Cash-positive contribution margin fuel cell trucks deployed to large fleet customers in 2023 • Accelerating hydrogen fuel cell truck market powered by customer and government tailwinds • Significant technology option value in several fuel cell- advantaged, future market applications 1. Includes patents awarded and patents pending. Applied patents include both provis ional and non-provis ional patent applications. 2. 200 vs. 120kW at 120kW; Estimated based on early 200kW truck testing at test track in similar s imulated routes on flat road vs. similar use case performance with single 120kW FCS.

1. Manufactured in the U.S. 2. Includes patents awarded and patents pending. Applied patents include both provisional and non -provisional patent applications. 6 Hyzon’s Technology-led Competitive Advantages 200kW Fuel Cell System Underpinned by Growing IP Portfolio • Only 200kW + single stack FCS1 in mobility products • Protected by 176 patents, including over 98 applied since 2021, with 10 granted2 • Technology advantages driven by IP and design at each level of the FCS, including MEA, BPP, stack, and system Vertically Integrated Capital-Light FC Development and U.S. Manufacturing • FC Manufacturing plant on track for 2024 SOP in U.S. o Minimal CapEx left through SOP and 700-unit annual capacity (3 shifts) o Continuous roll-to-roll MEA line installed with the potential to support 4k+ FCS annual production capacity with additional debottlenecking o Low CapEx requirement to debottleneck through Cash Flow breakeven • Vertically integrated from catalyst/electrode and MEA forward Technology Enabled Business Model and Economic Advantages • Single stack 200kW FCS enabling cash-positive contribution margin fuel cell trucks • Vertical integration in IP and manufacturing enables product customization to each major market (e.g., mining, stationary power) • U.S. manufacturing plant & MEA line in place with low CapEx scaling

Large Fleet Focus with Three-Step Ramp-up, Enabling 1,000 Trucks per Year with Just 10 Large Fleet Customers 1. Based on 40kg of hydrogen consumption per day per FCEV Class 8 truck. 7 Example Large Fleet Customer Order Intention Ramp-Up Schedule w/ Hydrogen Fuel Requirements 1 Hyzon’s commercial model collaborates with customers through the FCEV ramp-up, starting with trials attached to confirmed pilots and milestone orders 2 Post-trial fleet ramp-up to 100 trucks per year over 3 to 4-year period 3 10 customers would lead to 1,000 trucks per year over multiple phases 4 Launched first of 25 North America 200kW Class 8 and refuse trials with large fleets in July 2024 Public access or behind the fence based on interest and operational needs Number of Class 8 FCEV trucks Cumulative hydrogen consumption (tons/day)1 Hydrogen Fueling Solutions Cumulative Class 8 FCEV trucks in fleet Mobile refueler or existing public access 15-20 ~0.8 – 1.2 20-30 Implementation 30-50 ~2.0 – 3.2 50-80 Milestone 75-100 ~5.0 – 7.2 125-180 Ramp-up 5-10 ~0.2 – 0.4 5-10 Pilot

8 Significant Global Market Opportunity in Heavy Duty (HD) Trucking Alone, with Multiple Layers of Upside Optionality 1. Statis ta HD Truck Projections (2019). 2030 and 2050 TAM based on extrapolation of 2019 – 2026 CAGR of 2.57%. 2. Mordor Intelligence MD and HD Commercial Vehicles Market Research Report (2022). 2030 and 2050 TAM based on extrapolation of 2018 – 2028 CAGR of 8%. 3. Heavy Duty Mobility Applications consists of Locomotive, Agricultural Machinery, Construction Machinery, ATV markets . 4. Airport: The Business Research Company Commercial Aircraft Market Research Report (2023). 2030 and 2050 TAM based on extrapolation of 2023 – 2027 CAGR of 7.9%. Port: Skyquest Tech Consulting Marine Vessel Market Research Report (2022). 2030 and 2050 TAM based on extrapolation of 2022 – 2028 CAGR of 1.61%. 5. Markets and Markets Hybrid Power Solutions Market Research Report (2015). 2030 and 2050 TAM based on extrapolation of 2016 – 2021 CAGR of 8.13%. Scale = $100Bn Hydrogen Fuel Supply (via partner project investment rights) Core Focus Today: Heavy Duty Trucking1 2 platforms in North America Medium Duty2 Stationary and Mobile Power5 Airport/Port & Other Ecosystems4 Rail/Off-road and other HD3 Option Value End-Markets and Example Entry FC Applications Class 6 Regional Delivery; Vocational Trucks Construction & Mining Equipment w/ 200kW FCS Ground Support Equipment (e.g., aircraft tug) 500kW to 4 MW+ power modules (e.g., data centers, remote operations)

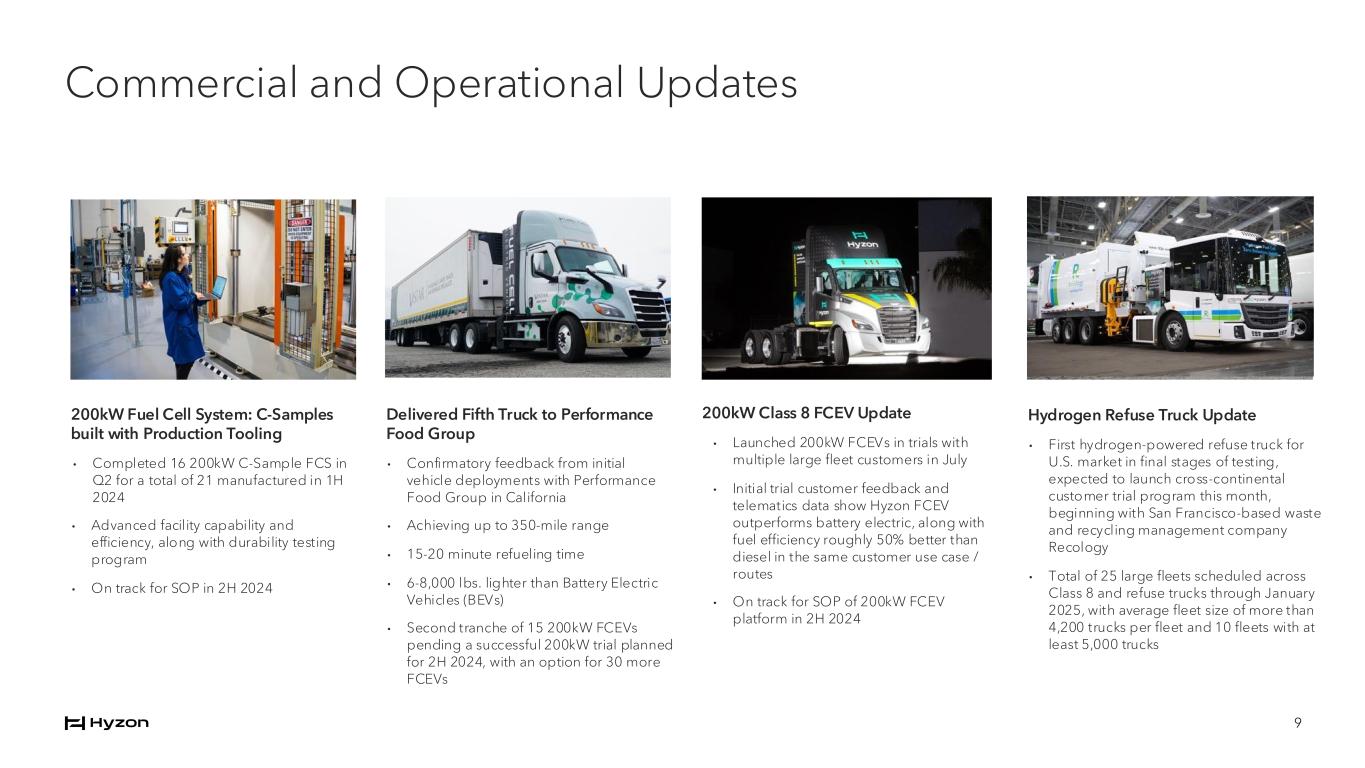

200kW Class 8 FCEV Update • Launched 200kW FCEVs in trials with multiple large fleet customers in July • Initial trial customer feedback and telematics data show Hyzon FCEV outperforms battery electric, along with fuel efficiency roughly 50% better than diesel in the same customer use case / routes • On track for SOP of 200kW FCEV platform in 2H 2024 Commercial and Operational Updates 9 200kW Fuel Cell System: C-Samples built with Production Tooling • Completed 16 200kW C-Sample FCS in Q2 for a total of 21 manufactured in 1H 2024 • Advanced facility capability and efficiency, along with durability testing program • On track for SOP in 2H 2024 Delivered Fifth Truck to Performance Food Group • Confirmatory feedback from initial vehicle deployments with Performance Food Group in California • Achieving up to 350-mile range • 15-20 minute refueling time • 6-8,000 lbs. lighter than Battery Electric Vehicles (BEVs) • Second tranche of 15 200kW FCEVs pending a successful 200kW trial planned for 2H 2024, with an option for 30 more FCEVs Hydrogen Refuse Truck Update • First hydrogen-powered refuse truck for U.S. market in final stages of testing, expected to launch cross-continental customer trial program this month, beginning with San Francisco-based waste and recycling management company Recology • Total of 25 large fleets scheduled across Class 8 and refuse trucks through January 2025, with average fleet size of more than 4,200 trucks per fleet and 10 fleets with at least 5,000 trucks

Initial 200kW Customer Trial Results Demonstrate Strong Performance + Route covered hilly terrain with multiple elevation gains of over 1,300 feet and up to 6% sustained grades + With 32 kg of hydrogen used, our FCEV averaged over 6 mpg equivalent vs. 4 mpg for diesel trucks in the same use case, roughly 50% better than diesel Altitude Profile in meters According to the customer, four other Battery Electric Vehicles trialed were unable to complete the route due to range and elevation. + Deployed in Southern California, the Hyzon 200kW Class 8 FCEV ran back-to-back routes in a single shift, covering 234 miles with heavy-haul loads Example Daily Performance:

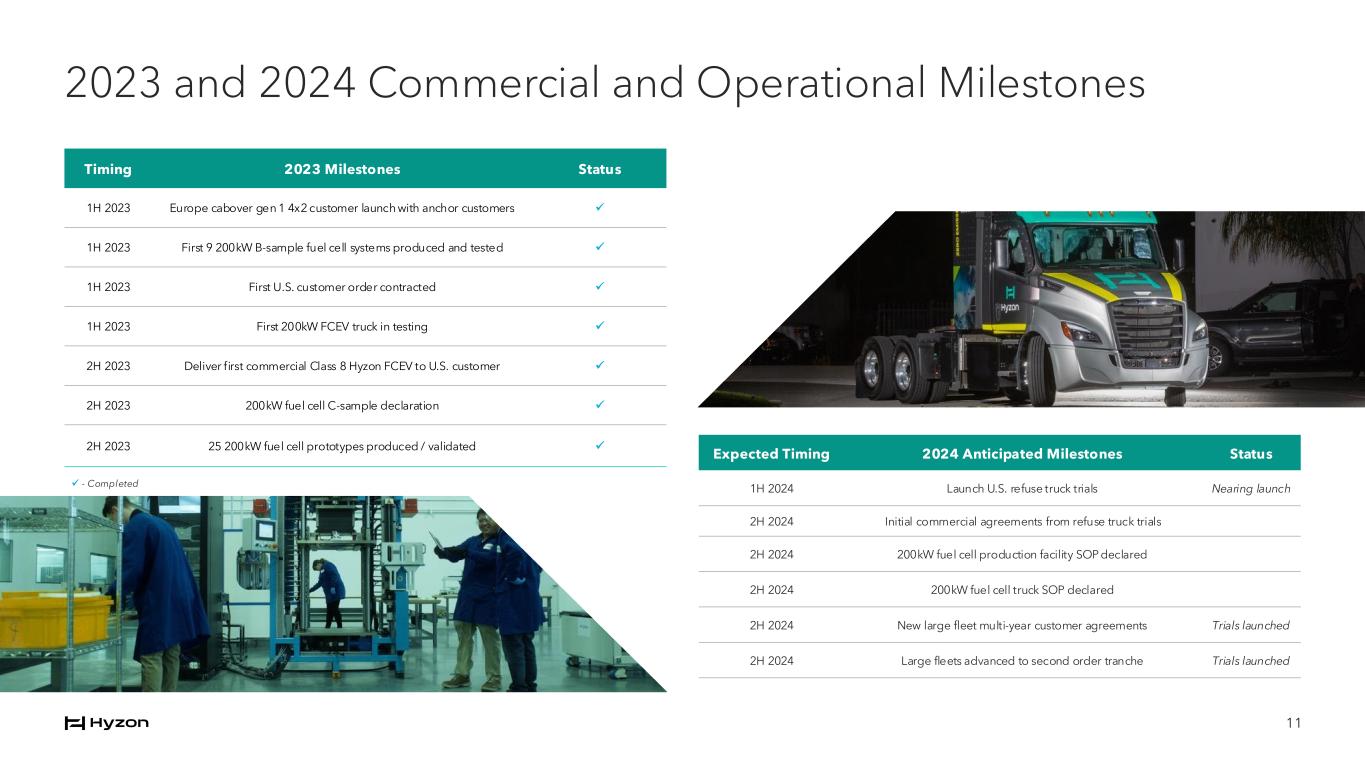

2023 and 2024 Commercial and Operational Milestones 11 Timing 2023 Milestones Status 1H 2023 Europe cabover gen 1 4x2 customer launch with anchor customers ✓ 1H 2023 First 9 200kW B-sample fuel cell systems produced and tested ✓ 1H 2023 First U.S. customer order contracted ✓ 1H 2023 First 200kW FCEV truck in testing ✓ 2H 2023 Deliver first commercial Class 8 Hyzon FCEV to U.S. customer ✓ 2H 2023 200kW fuel cell C-sample declaration ✓ 2H 2023 25 200kW fuel cell prototypes produced / validated ✓ ✓ - Completed Expected Timing 2024 Anticipated Milestones Status 1H 2024 Launch U.S. refuse truck trials Nearing launch 2H 2024 Initial commercial agreements from refuse truck trials 2H 2024 200kW fuel cell production facility SOP declared 2H 2024 200kW fuel cell truck SOP declared 2H 2024 New large fleet multi-year customer agreements Trials launched 2H 2024 Large fleets advanced to second order tranche Trials launched

Stephen Weiland Chief Financial Officer 12

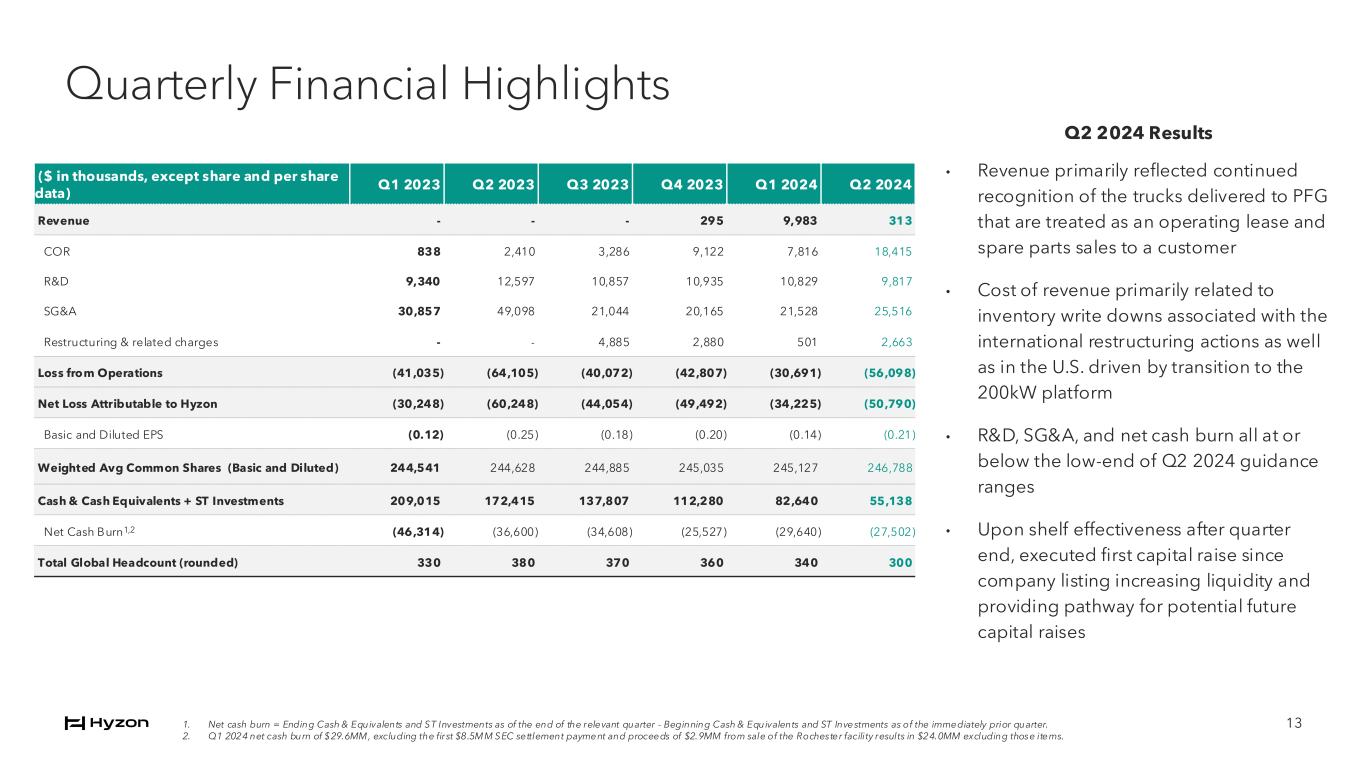

Quarterly Financial Highlights Q2 2024 Results • Revenue primarily reflected continued recognition of the trucks delivered to PFG that are treated as an operating lease and spare parts sales to a customer • Cost of revenue primarily related to inventory write downs associated with the international restructuring actions as well as in the U.S. driven by transition to the 200kW platform • R&D, SG&A, and net cash burn all at or below the low-end of Q2 2024 guidance ranges • Upon shelf effectiveness after quarter end, executed first capital raise since company listing increasing liquidity and providing pathway for potential future capital raises ($ in thousands, except share and per share data) Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Revenue - - - 295 9,983 313 COR 838 2,410 3,286 9,122 7,816 18,415 R&D 9,340 12,597 10,857 10,935 10,829 9,817 SG&A 30,857 49,098 21,044 20,165 21,528 25,516 Restructuring & related charges - - 4,885 2,880 501 2,663 Loss from Operations (41,035) (64,105) (40,072) (42,807) (30,691) (56,098) Net Loss Attributable to Hyzon (30,248) (60,248) (44,054) (49,492) (34,225) (50,790) Basic and Diluted EPS (0.12) (0.25) (0.18) (0.20) (0.14) (0.21) Weighted Avg Common Shares (Basic and Diluted) 244,541 244,628 244,885 245,035 245,127 246,788 Cash & Cash Equivalents + ST Investments 209,015 172,415 137,807 112,280 82,640 55,138 Net Cash Burn1,2 (46,314) (36,600) (34,608) (25,527) (29,640) (27,502) Total Global Headcount (rounded) 330 380 370 360 340 300 1. Net cash burn = Ending Cash & Equivalents and ST Investments as of the end of the relevant quarter - Beginning Cash & Equivalents and ST Investments as of the immediately prior quarter. 2. Q1 2024 net cash burn of $29.6MM, excluding the first $8.5MM SEC settlement payment and proceeds of $2.9MM from sale of the Rochester facility results in $24.0MM excluding those items. 13

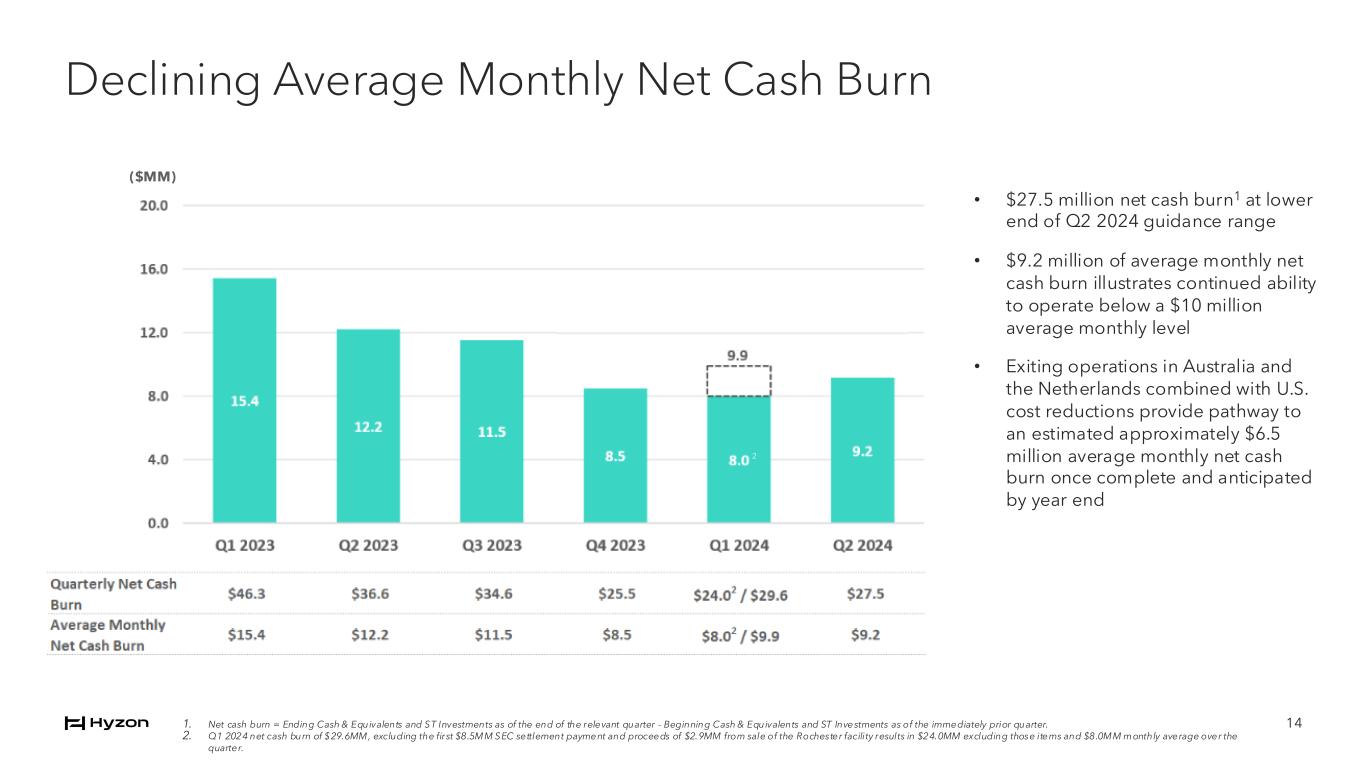

Declining Average Monthly Net Cash Burn • $27.5 million net cash burn1 at lower end of Q2 2024 guidance range • $9.2 million of average monthly net cash burn illustrates continued ability to operate below a $10 million average monthly level • Exiting operations in Australia and the Netherlands combined with U.S. cost reductions provide pathway to an estimated approximately $6.5 million average monthly net cash burn once complete and anticipated by year end 141. Net cash burn = Ending Cash & Equivalents and ST Investments as of the end of the relevant quarter - Beginning Cash & Equivalents and ST Investments as of the immediately prior quarter. 2. Q1 2024 net cash burn of $29.6MM, excluding the first $8.5MM SEC settlement payment and proceeds of $2.9MM from sale of the Rochester facility results in $24.0MM excluding those items and $8.0MM monthly average over the quarter. ($MM) 2