Exhibit 99.1

Borr Drilling Limited – Investor Presentation

Please find enclosed investor presentation from Borr Drilling Limited.

21 May 2020

Hamilton Bermuda

Borr Drilling LimitedExtending runway with minimum $315m in improved liquidity to 2022May 21, 2020

2 THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN

OFFER TO BUY NOR SHALL THERE BE ANY SALE OF THE SECURITIES REFERRED TO HEREIN IN ANY JURISDICTION IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION, EXEMPTION FROM REGISTRATION OR QUALIFICATION UNDER THE

SECURITIES LAWS OF ANY JURISDICTION. IT IS SOLELY FOR USE AS AN INVESTOR PRESENTATION AND IS PROVIDED FOR INFORMATION PURPOSES ONLY. THIS PRESENTATION DOES NOT CONTAIN ALL OF THE INFORMATION THAT IS MATERIAL TO AN INVESTOR. BY ATTENDING THE

PRESENTATION AND/OR READING THE PRESENTATION SLIDES YOU AGREE TO BE BOUND AS FOLLOWS:The information contained herein does not constitute an offer to subscribe to or a solicitation of an offer to subscribe to securities in any member state

within EEA in which such offer or solicitation is unlawful, unless in reliance upon applicable EEA prospectus exceptions, whereby no EEA prospectus, registration or similar action would be required within EEA. Forward Looking Statements: This

presentation includes forward looking statements. Forward looking statements are, typically, statements that do not reflect historical facts and may be identified by words such as "anticipate", "believe", "continue", "estimate", "expect",

"intends", "may", "should", "will" and similar expressions and include the equity raise, use of proceeds, the waivers and amendments to agreements with stakeholders including the terms thereof, the improvements to liquidity, allocations,

changes to the application period, settlement, offshore activity levels and outlook for oil prices and demand, expected impact of cost savings initiatives including improvements to cashflow and balance sheet strengthening measures, liquidity

expectations, and other non-historical statements. The forward-looking statements in this announcement are based upon various assumptions, many of which are based, in turn, upon further assumptions, which are, by their nature, uncertain and

subject to significant known and unknown risks, contingencies and other factors which are difficult or impossible to predict and which are beyond our control. Such risks, uncertainties, contingencies and other factors could cause actual

events to differ materially from the expectations expressed or implied by the forward-looking statements included herein. In addition to the important factors and matters discussed elsewhere in this report, important factors that, in our view

could cause actual results to differ materially from those discussed in the forward looking statements include the risk that we may not be able to agree such terms with such parties or if we do agree such terms such parties may not obtain

necessary board/credit committee approvals necessary for such amendments, risks relating to executing definitive documentation for such amendments if agreed, risks relating to our debt instruments including risks relating to our ability to

comply with covenants and the risk of cross defaults, risks relating to our liquidity including the risk that we may have insufficient liquidity be able to fund operations, we may be unable to raise necessary funds through issuance of

additional debt or equity and may have to delay or cancel discretionary capital expenditures, we may be unable to obtain extension or additional waivers or unable to meet our obligations under our debt instruments or waiver conditions

resulting in cross defaults and that we may be delisted from the New York Stock Exchange as well as in our most recent annual report and in the section entitled “Risk Factors” in our filings with the Securities and Exchange

Commission. Important information

Key components of the improved liquidity package 3 Provides the Company with a liquidity runway

even without any new contracts or renewals The proposed deal includes the following key elements: + Rescheduling of yard commitments+ Deferral of debt amortization+ Conversion of cash interest to pay-in-kind (PIK) interest+ Amendment of

covenants= Total estimated improvement in liquidity of more than $315m until Q1 2022

Amended financing creates very low cash-breakeven rates for 2020e and 2021e 4 Required 2021e bareboat

contribution per jack-up and # of jack-ups in operation to cover direct cash costs Cash interest for 2021 estimated to $40m, $6k/day in stacking cost per rig. 25 jack-ups deliveredBareboat contribution, current market, based on $80k/day, 97%

utilisation, $50k/day opexBareboat contribution, 15 year average, based on $140k/day, 97% utilisation, $50k/day opexExcludes any tax on revenueSource: Borr Drilling, IHS Petrodata, DNB Markets # of jack-ups in operation Needed bareboat per

jack-up $k/day Bareboat contribution, 15 year average, jack-ups Bareboat contribution, current market, jack-ups # of jack-ups in operation 0 12 18 25 SG&A ($m) -20 -20 -25 -30 Stacking cost ($m) -55 -28 -15 0 Cash

interest ($m) -40 -40 -40 -40 Total costs ($m) -115 -88 -80 -70 Bareboat needed to cover direct cash costs $20.2k/day $12.2k/day $7.7k/day

Mexico integrated contracts – learning curve has improved operations 5 First wells behind schedule –

recovery for geologic event Last wells significantly ahead of schedule Source: Borr Drilling Planned time: 58 daysActual time: 50 days Planned time: 44 daysActual time: 34 days Planned time: 58 daysActual time: 78

days Planned time: 80 daysActual time: 180 days Geological eventloss reversed in Q1 2020 Core sampleson client request

Attractive entry point – solid upside 6 The value case The cash-flow case Implied value of EV per

rig of $98m, based on ~$2.6bn net debt. Share price of $1.2. Assumes $50k/day in operating costs including SG&AIllustrative EBITDA per jack up given various dayrate levelsSource: Borr Drilling Borr implied value $m per

jack-up Dayrate per jack-up $k/day EV/EBITDA $m in EBITDA per jack-up Depreciated value of a jack-up

Historic dayrates give support to debt service 7 Estimated historic bareboat contribution per premium

jack-ups vs required rate for debt service Assumes Q1 2020 net debt + remaining capex estimated to ~$2.6bnBareboat calculated as TC-rate less applicable opex1) Average age based on 28 modern jack-up built after 2010.Source: Borr Drilling,

DNB Markets Contribution required for debt service with 28 rigs in operation – $29k/day Fully invested net debt $2,600m # units 28 Average net debt per rig $92.9m Average age of fleet1 3 Age when debt is 0 20 years Amort per

rig (17y) $14k/day Interest per rig (6%) $15k/day Debt service per rig $29k/day Contribution required to cover direct cash costs 2021e – $20k/day $k/day

Shallow water oil production - quick payback – driven by NOCs 8 Jack-up demand is mainly brownfield –

75% NOCs Core NOCs are drilling significantly more today Source: IHS Petrodata, DNB Markets, Borr Drilling # jack-ups contracted Brownfield Greenfield Exploration Greenfielddevelopment Infill drilling Workover P&A 3% 2% 6

months 3 months 2 years 3 years 7 years 3-4 years 1 year 6 months Time to first oil Global demand by type of OilCo Jack-up Floater NOC % 74.7% 34.6% IOC % 25.3% 65.4%

The global jack-up fleet is old – modern rigs will likely get utilisation 9 Modern jack-ups

gaining market share Historic jack-up demand vs age of supply >35% of the fleet is > 20 years old 1) Assumed scrapping of 10 owner operated rigs. Borr Drilling assumptionSource: IHS Petrodata, Rystad, Borr

Drilling 1985 1971 1973 1975 1977 2015 1979 1981 2005 1983 1987 1989 2003 1991 1993 1996 1999 2001 2007 2009 2013 2011 2017 2019 2010 – 2022259 rigs 2000 – 201096 rigs 1968 – 2000167 rigs 355 “modern”

rigs Premium jack-up rig count Standard jack-up rig count 114 254 193 225 Premium jack-up rig count 114 254 193 225 # jack-ups Total fleet 522 Stacked standard units -55 Standard with <12 months contract

left -39 Standard owner operated exp scrapped1) -10 Expected total fleet mid-21 418 Under construction (not marketed) -45 2000-2010 cold stacked (not marketed) -13 Expected marketed supply mid-2021 360 Average demand 342

rigs “Legacy” fleet Delivered jack-ups pr year Modern jack-up rig count Standard jack-up rig count

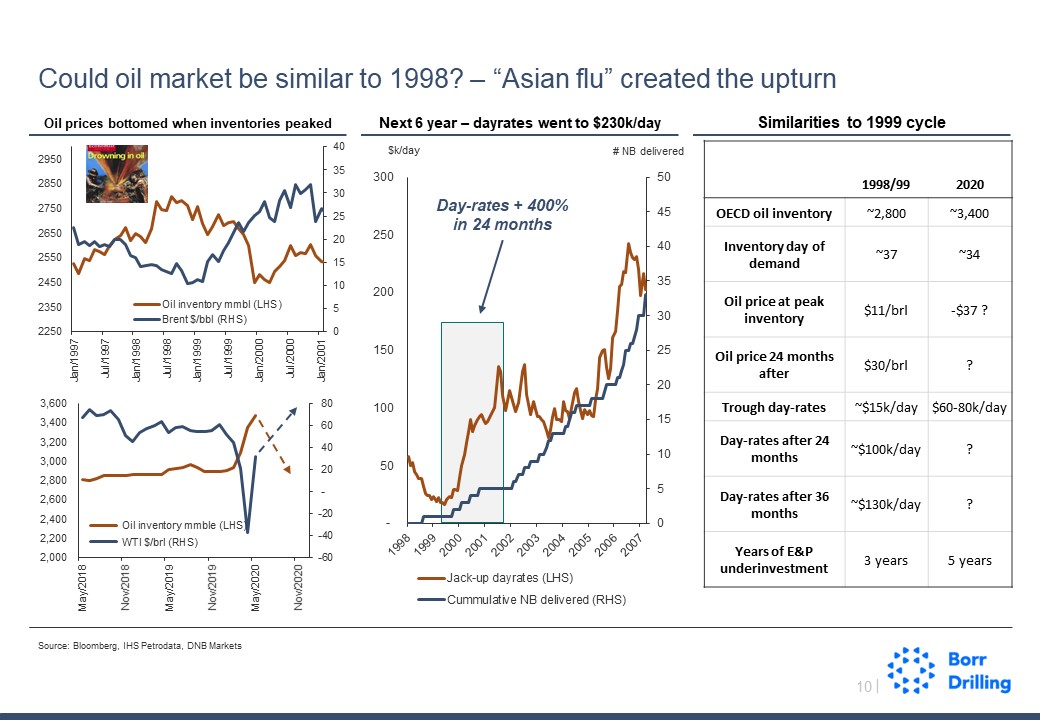

Could oil market be similar to 1998? – “Asian flu” created the upturn 10 Oil prices bottomed when

inventories peaked Next 6 year – dayrates went to $230k/day Similarities to 1999 cycle Source: Bloomberg, IHS Petrodata, DNB Markets $k/day # NB delivered Day-rates + 400% in 24 months 1998/99 2020 OECD oil

inventory ~2,800 ~3,400 Inventory day of demand ~37 ~34 Oil price at peak inventory $11/brl -$37 ? Oil price 24 months after $30/brl ? Trough day-rates ~$15k/day $60-80k/day Day-rates after 24 months ~$100k/day ? Day-rates

after 36 months ~$130k/day ? Years of E&P underinvestment 3 years 5 years

Oil the best performing sector last month – turning point? 11 Oil services in context1) Lessons from

the last cycle2) Energy weighting in % of technology3) 1) 100m brl/day at $35/brl. Market cap all listed oil services. Market cap all listed offshore drillers2) Assumes average date-rate of $140k/day from 2002 to 2020 at 90% utilisation.

Opex of $50k/day3) Energy weighting % of the S&P 500 divided by technology % of the S&P 500. Higher ratio means relative size of energy vs technologySource: Bloomberg, DNB Markets $bn $m